Tag: symmetry

One of The Best Crude Oil Day Trading Strategies – 200 MA One Minute Chart Time Frame #OOTT $CL_F $USO $USOIL

How to Day Trade the 1 Minute Oil Chart Using the 200 MA for Support and Symmetry for Resistance.

A Simple Step by Step Intra Day Trading Guide from our Oil Trading Room and Alerts Service.

Below are my top trading rules (steps I take in my strategy) when daytrading crude oil on the one minute time-frame. It has worked for me over the years and I am sure you will find it a highly profitable way to day-trade oil.

1. The Price Trend of Trade is Your Friend.

- If you are going to day trade oil long be sure oil is in a rally. In this case oil has been rallying for a number of days and today oil price continued to rally. In this instance, the trend is on your side so it is obvious that your highest probability day trades scalping crude oil futures will be long buy entries.

- Today’s News – Stock market live updates: Dow up 400, oil rallies 18%, Norwegian dives 18% https://www.cnbc.com/2020/05/05/stock-market-today-live.html

2. Price Dropping in to The 200 MA on One Minute Oil Chart.

- Chart from the Oil Trading Room and Alerts feed shows the set-up intra day for the 200 MA scalp, “On the 1 minute time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts” The white arrow on the chart points to the 200 MA on the 1 minute time-frame (200 MA in pink).

On the 1 min time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts

3. Execute Your Long Trade when Price Hits the 200 MA (Moving Average).

- The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play.

- “Nice 40 point move on that crude oil daytrade set up on the 1 minute time frame, I didn’t take it, first extension resistance here. #oiltradealerts”

The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play. #oiltradingalerts

4. Take Profit as You – Go Based on Your Trading Plan.

- Oil trading room live image below shows first price target hit, symmetrical price extensions, and a point to trim profits in your long trade scalping crude oil #oiltradingroom

Oil trading room live image shows first price target hit, symmetrical extensions, and a point to trim long scalp #oiltradingroom

5. Technical Analysis Helps Plan Your Oil Trading Strategies.

- Below is a one minute oil chart with symmetrical price extension price targets so our oil traders know where to trim profits along the way while daytrading oil.

Your 3 steps of symmetrical extension resistance points for this day trade in oil #oiltradealerts

6. Use an Oil Trading Strategy – A Plan.

- The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

- At point of writing this article, the move on this oil trade alert intra-day is now 80 points, this is a fantastic day trade strategy for oil traders. Knowing where your price targets are and knowing how to measure the symmetry for price extension price targets will really help your strategy.

The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

Technical indicators or signals really help retrieve more profit in each trade and also help with your winning percentage of trades.

There are many other signals that you can use for any oil day trade, including the trade outlined in this article. Some of the other indicators or trade signals include order flow, time of day, resistance and support on larger time frames such as the 5 minute, 15 minute or 30 minute chart time-frames and many more.

The price extensions in this article are part of a proprietary one minute oil trading grid model that our machine trading uses. There are many ways to set your price targets, some use conventional charting methods and some algorithmic (or proprietary models as in this instance).

Hopefully this tutorial on using the one minute oil chart 200 MA as a signal for day trading (scalping) trades has helped. It is an intra-day strategy that has worked for me in my trading time and time again.

You should find implementing this simple crude oil intra day trading strategy that your win rate and returns will excel.

If you liked this article there is another day trading oil strategy article I wrote here.

Oh, and by the way, while I am finishing up writing this article oil is getting near the upper price target for this day trade and I just alerted the oil trading room and our alert subscribers to take profits. Nice Trade!

My goal is to build the best oil trading room and oil trading alerts service in the world for oil traders – obviously a tall order, but we’re getting there one step at a time.

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; day trading, crude oil, 200 MA, 1 minute time frame, strategy, chart, symmetry, oil trading room, oil trading alerts, simple, intraday, trading strategy

Feature Post: 12 of Last 13 Oil Chart Time-Cycles Have Trend Reversal. $USOIL $WTI $CL_F $USO $UCO $UWT $DWT #OIL #OOTT

Going Back to 2002, Twelve of last Thirteen Major Time Cycle completions on Weekly Oil Chart (a significant structure) have a Trend Reversal to one extent or another.

This structural set-up should not be ignored by oil traders as the weekly chart is a significant structural consideration for long / short bias in trade planning and positioning.

Consideration toward indicators or chart set-ups / patterns in your oil trade planning is good (technical), as is fundamental research.

However, relying on limited individual charting indicators or set-up patterns (such as moving averages, MACD, head and shoulder pattern, etc) to form a bias can be problematic as it doesn’t provide a complete “structural” perspective to effectively form trade bias / positioning.

In our work, we rely heavily on chart structure on various time frames (1 min, 3, 5, 15, 30, 1 hour, 2, 4, Daily, Weekly and Monthly).

Above all else, the structure of the trading instrument (in our work and trade) is trump consideration. We know that all financial instruments have a structure and it is this structure that allows our trade positioning and our machine coding to operate at a significant advantage to the broad market.

If you wish to confirm our call record, contact me anytime for a personal tour of time stamped alert feeds, private user feeds and more.

January 2019 Update:

It happened again… today I posted an updated chart that brings the count to 13 out of last 14 time cycles, see below.

Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT

The Technical Significance of the Weekly Oil Chart and Structure Presented:

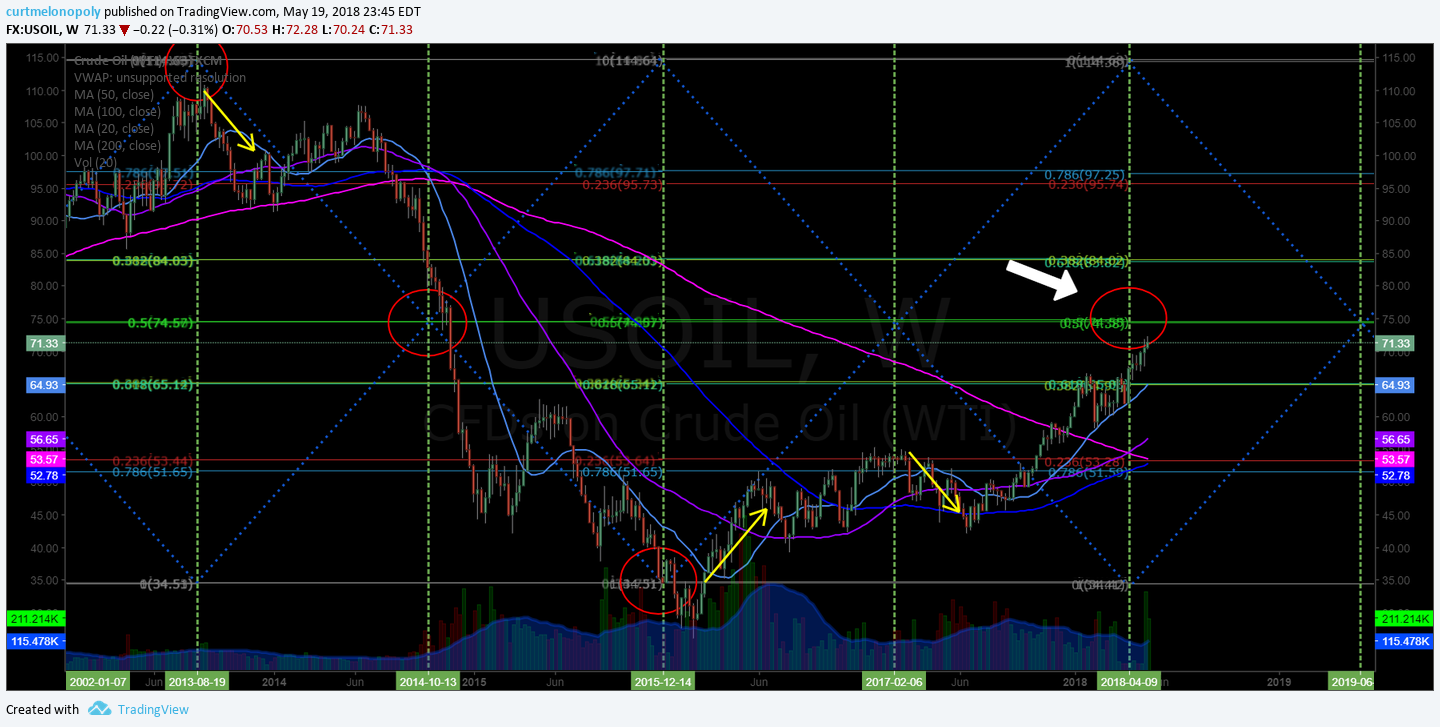

Specific to the point of this post, below is the oil chart I published to Trading View that shows the time cycle peak areas of oil on the weekly chart. The weekly oil chart is a significant structure because it is one of the broadest time frames the market uses to chart the trade of oil.

Dating back to 2002, 12 of 13 major time cycles on weekly oil chart have seen trend reversal to some extent or another #OILChart

Real-time oil chart link:

12 of last 13 time cycles in Oil trade had trend reversal. #OIL by curtmelonopoly on TradingView.com

How to Read this Oil Chart:

- The vertical green lines show the date(s) of the peak time cycle area. You will notice that oil trade has reversed trend 12 of the last 13 time cycle peak areas. In some instances immediately and in some instances a few weeks later. You will also notice that the trend reversal is at times considerable and at other times not so much. The only time cycle peak that did not see a trend reversal was during the price plunge in October of 2014.

- The yellow arrows on the oil chart denote area of trend reversal (in some instances a simple retrace and in others the reversal in oil trade is much more significant).

- The diagonal blue lines are simple Fibonacci related trendlines that form what we call Trading Quadrants (the term comes from the lab work we do in preparation for machine coding of our algorithm models).

- The horizontal lines are Fibonacci related support and resistance (retracement) lines. Our Fibonacci work is formed specific to chart structure and not conventional Fibonacci retracement work you may usually see from market chartists.

- The red circles are targeted areas of precise trade that we note for our reference and purpose as it relates to our work. Not a significant indication on this chart for the point of this post.

- The moving averages 20 MA, 50, 100, 200 are also on the chart and also not significant to the point of this post.

Below are Oil Chart Snap Shots From 2002 to Present (Note the Symmetry):

Symmetry and patterns in trade are important, especially if symmetry can be established within time cycles with some regularity. The chart images for oil trade from 2002 to 2018 (present) display the importance of this type of work.

Oil Charting Jan 2002 to Jan 2009 shows a consistent pattern / symmetry of oil trade trend reversals at time cycle peaks. $USOIL $WTI $CL_F #OIL

Oil Charting Jan 2008 to December 2014 also shows the trend reversal pattern with one exception in Oct 2014. $USOIL $WTI $CL_F #OIL

Oil Charting from Aug 2013 to present day in May 2018 also displays the trend reversals post time cycle peaks. $USOIL $WTI $CL_F #OIL

Where are We Now?

Oil trade is now on the other side of an important time cycle completion / peak, as with the last thirteen time cycles highlighted in this post.

There is a very high probability of a reversal in trend, whether it be a simple retrace or a completely new trend develops.

How to Trade The Next Move in Oil:

For a detailed swing trading plan for the next move in oil register to our free mailing list and you will receive a copy. Unsubscribe anytime.

If you are already on our mailing list, you will automatically receive a copy of the oil trading report when released shortly.

Crude Oil Trading Academy : Learn to Trade Oil:

Learning to Trade Crude Oil Futures Contracts is Like No Other Trading – Having a Rules Based Process Will Help You.

Visit our complimentary study links here for real articles from our oil traders day to day experience in our oil trading room, click here – Crude Oil Trading Academy : Learn to Trade Oil.

Learning to Trade? Here are some links that reflect topics in this post:

Trend Reversal https://www.investopedia.com/terms/r/reversal.asp

Charting Time Cycles http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:cycle_lines

Fibonacci for Charting https://www.investopedia.com/terms/f/fibonacciretracement.asp

Symmetry in Mathematics https://en.wikipedia.org/wiki/Symmetry_in_mathematics

Subscribe:

Temporary Discount Offers:

30% Off Oil Newsletter: Use Promo Coupon Code “epic30” When Subscribing to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/ (cancel anytime, for new members only to trial the service).

30% Off Oil Alerts: Use Promo Coupon Code “oilalerts30” for Real-Time Oil Trade Alerts via Private Twitter Feed @OilAlerts_CT Here: https://compoundtrading.com/product/live-oil-trading-alerts/?attribute_plan=One+Month (cancel anytime, for new members only to trial the service).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: compoundtradingofficial@gmail.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.