Tag: $TGTX

PreMarket Trading Report Tues Jan 22: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday January 22, 2019.

In this premarket trading edition: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 22 – Per email sent to members in premarket.

- Main Trading Room

- Jan 22 – Per email sent to members in premarket.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 20 – Protected: Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 15 – Protected: Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Tuesday Jan 22 –

Voice Broadcast Starts at 2:50 on video.

This is mid day review from Friday Jan 18, 2019.

This video explains the upcoming pull back I was looking for in oil and the general markets.

I explain how I will time my Swing entries around that, trading Indices, algorithm models SPY VIX WTI BTC GLD SLV DXY etc.

It’s a much watch for trading this time period.

All the reports will be out over next 48 hours, most before market open tomorrow.

Today I am in trading room for market open, mid day and futures.

Have a great day!

Curt

Friday Jan 18 – Mid day review will be looking at Swing Trade entry points. Crude oil has been a great week, don’t miss the post from last night – important details for daytrading crude oil. Same guidance per below from recent.

Market Observation:

Markets as of 8:07 AM: US Dollar $DXY trading 96.32, Oil FX $USOIL ($WTI) trading 53.21, Gold $GLD trading 1282.04, Silver $SLV trading 15.26, $SPY 264.96 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3548.00, $VIX 18.5 and NatGas 3.25.

Momentum Stocks / Gaps to Watch:

$TSLA (+1.0% pre) Tesla is reportedly in talks with China’s Lishen over Shanghai battery contract – CNBC.

$EBAY (+12.3% pre) Elliott Sends Letter to Board of Directors of eBay; Seeks Separation of StubHub and Classifieds.

$NVCN up 55% at $1.27 – Neovasc announces dismissal of claim brought by Edwards Lifesciences.

$UQM (+45.1% pre) UQM Technologies Signs Definitive Agreement to be Acquired by Danfoss – SI.

$TGTX – TG Therapeutics up 11% on receiving Breakthrough Therapy Designation for umbralisib.

$AAPL WOES SHOULD BENEFIT TELECOMS $TMUS $T $VZ – MACQUARIE.

24 Stocks Moving In Tuesday’s Pre-Market Session http://benzinga.com/z/13015207 $MDWD $APHA $EDU $AABA $URI $LULU $AUPH $TI $UBS $GPS

News:

Stocks making the biggest moves premarket: Johnson & Johnson, Nike, FedEx & more –

https://twitter.com/CompoundTrading/status/1087694423557849088

PG&E secures $5.5 billion in DIP financing to fund operations through bankruptcy https://on.mktw.net/2FR7Qsg

ARCONIC TO NO LONGER PURSUE SALE OF THE COMPANY.

$NVCN just out: Neovasc Announces Dismissal of Claim brought by Edwards Lifesciences.

$LCI Lannett (LCI) Announces Distribution Agreement For Trientine Hydrochloride Capsules.

$TSLA: NEEDHAM CUTS MODEL 3 DELIVERIES ESTIMATES BY 15,000 IN 2019 TO 243,000.

UBS Tumbles On “Very Poor” Results As Clients Pull $13 Billion.

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Offerings, Mergers:

$TOPS Announces Completion of Senior Secured Post-Delivery Financing for M/T Eco California.

Tilray to buy Natura Naturals for about $26.3 billion in cash and stock.

$CHFS – CHF Solutions files for equity offering.

Earnings:

Travelers beats earnings estimates despite higher catastrophe losses.

Halliburton tops profit and revenue expectations, shares slip.

Johnson & Johnson tops estimates for fourth quarter.

Stanley Black & Decker shares fall nearly 7% after weak 2019 guidance.

#earnings for the week

$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNP

#earnings for the week$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNPhttps://t.co/lObOE0dgsr pic.twitter.com/ROwchUMNvx

— Earnings Whispers (@eWhispers) January 19, 2019

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

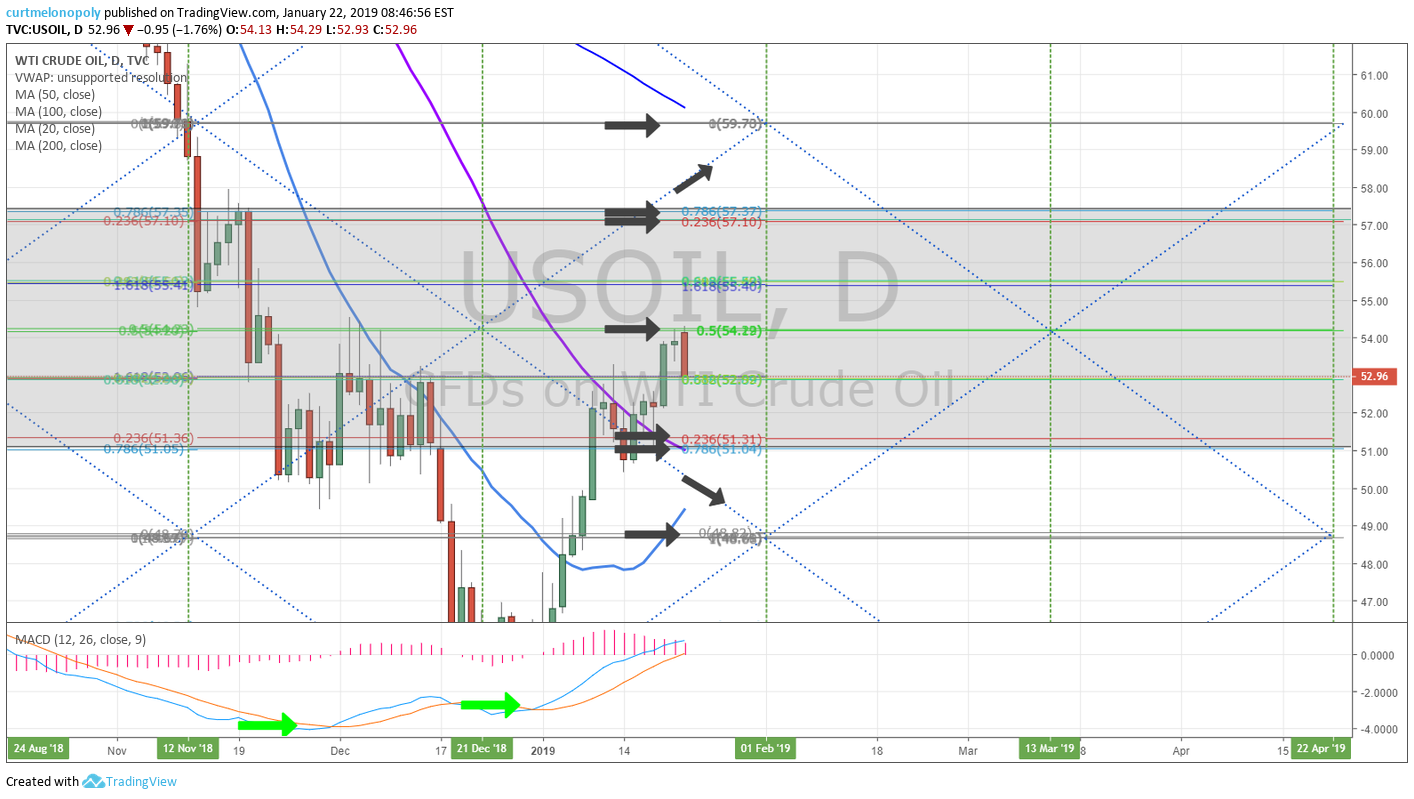

Crude oil perfect hit to mid quad on daily algorithmic model and backed off FX USOIL WTI $CL_F $USO #CrudeOil #Chart

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT pic.twitter.com/iqcDOtr7ri

— Melonopoly (@curtmelonopoly) January 21, 2019

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO pic.twitter.com/Fib1n1iMLG

— Melonopoly (@curtmelonopoly) January 18, 2019

Oil Trading Alerts Yesterday – Man vs. Machine, Both Winning.

Overnight futures crude oil trading alert Selling 51.07 will advise #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Overnight futures crude oil trading alert Covering 50.74 #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

It’s A “Sea Of Red” As Global Stocks, S&P Futures Tumble

It's A "Sea Of Red" As Global Stocks, S&P Futures Tumble https://t.co/KavAmDyE9N

— zerohedge (@zerohedge) January 22, 2019

#5things

-No end in sight for shutdown

-Chances of second Brexit referendum rise

-Davos begins

-Markets slip

-Data, earnings due

https://bloom.bg/2AYQTcm

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://www.ft.com/content/49c9df22-19aa-11e9-9e64-d150b3105d21 …

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://t.co/a20LwlwF6k pic.twitter.com/JL6rAYR37X

— Lisa Abramowicz (@lisaabramowicz1) January 22, 2019

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $UAA $ICE $PANW $HIW $CABO $FTI $MIDD $BJ $CARS $SNV $NKE $CHU $TGP $BUD $IAG $AUY $FISV $AINV $DRNA

(6) Recent Downgrades: $BMTC $D $GPS $STT $PSEC $X $FTNT $BL $MO $ERJ $HTHT $FHN $PVH $REVG $GLOG $TIF $TOO $IMMU $LXFT $GPS $CRSP $LFC $WB $BTE $HBM

SCHLUMBERGER $SLB: SUSQUEHANNA CUTS TARGET PRICE TO $54 FROM $55

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY

Swing Trading Report (Earnings Season Special Report) July 19: $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

Swing Trading Report and Video for July 19, 2018.

In this Edition: $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

Mid Day Chart Swing Trading Set-ups July 19, 2018 Summary:

Note: Voice broadcast on this video starts at 1:47.

Swing Trading Review of charts from July 19 Mid Day Review. Between Monday July 23 and Friday 27 we will be reviewing the charting for all one hundred equities we follow on our swing trading platform (it’s earnings season so it is important to be on top of the charting and buy sell trigger alarms). Each report from mid day will be sent to swing trading members daily.

Tickers covered; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT and more.

$VIX – Volatility time cycle on large weekly structure is coming to conclusion near mid next week. Watch for a possible trend reversal in the $VIX as we complete the time cycle. $VIX is currently in downtrend pinch on chart.

US Dollar $DXY – Algorithm model summary review (review dollar algorithm reports for complete detail or review mid day chart review videos from recent months). Intra day at resistance and if it trades above the resistance look to next structure above. Very bullish and 97.00 upside is very possible. Detail on video.

$SPY – Over 281.04 is a long side trade trigger 283.89. Support at 278.66. How to trade the algorithmic model (60 min) is discussed some on video. Other main support and resistance areas discussed.

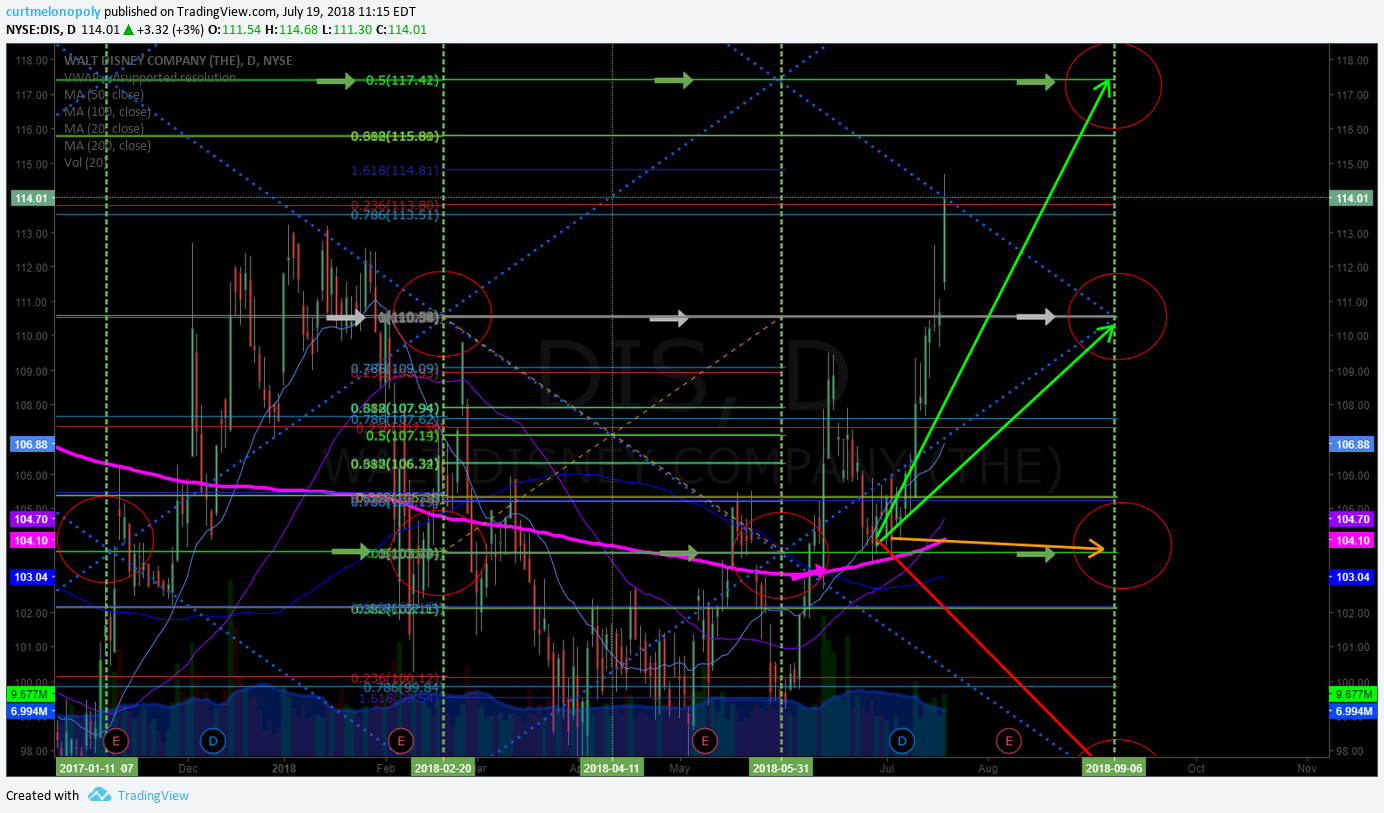

$DIS – Disney has been a great trade. The algorithmic charting has been good. Hit resistance today at a Fibonacci horizontal. Price Targets: Bullish 117.53 early Sept, 110.60 if it comes off, 103.68 is the bearish target, trade each support and resistance on way to each target. Up over today’s resistance is a long to price target on video.

$RCL – Royal Caribbean, short warning was good and it popped and got in to price target early so this is a trim 115.00 resistance, 98.50 is bearish scenario. 131.00 is bullish price target scenario above 115.00. On an upside trajectory watch the 200 MA (pink line) overhead.

$RKDA – Conventional charting reviewed for Arcadia Biosciences, This chart has lots of room to move. 50 MA is getting close to price on daily chart and that puts this on watch for a huge potential move up. We have alarmed the chart for when / if price crosses 50 MA and we’re looking for a run to the 100 MA (14.00 possible from 8’s). Watch the 200 MA overhead on way to 100 MA if that scenario occurs.

$SQ – Square, chart seems over extended and a revisit to 20 MA should occur soon. Longs should be cautious.

$HEAR – What a move, missed the major part of the move and only got daytrade snipes. Longs should trim in advance of a retrace.

$SMIT – daytraders chart and that’s it. Careful trying to trade it. Buy sell triggers discussed and how to daytrade it.

$TGTX – may be setting up for a move.

Watch for the same on Friday and next week watch for the 100 chart reviews of our regular charting in preparation for trading through earnings season.

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible (public). $DXY $UUP #USD #swingtrading #dollar

ARCADIA BIOSCIENCES (RKDA) Premarket up 22% trading 8.41 on milestone news. $RKDA #premarket

DISNEY (DIS) Trading 113.95 testing quad TL, 113.80 and 113.51 support. Above 115.80 res targets 117.42 Sept 6. $DIS #swingtrading

ROYAL CARIBBEAN (RCL) hit 113.00 near PT resistance for trims. Above 115.00 has 118.67 res next and under 111.24 support and so on $RCL #charting

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

PreMarket Trading Plan Mon June 5 $LOXO, $DVAX, $TGTX, $LTBR, $JUNO, $GLD, GOLD

Compound Trading Chat Room Stock Trading Plan and Watch list for Monday June 5, 2017; $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Post Market Reports:

Sorry we’re running behind on them – we’ll get them caught up this week. Getting the 24 hour oil room ready took a bit more manpower than we expected. But we’re on for June 12 launch!

Most recent lead trader blog posts:

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series. https://t.co/7XFIQ68CoY

— Melonopoly (@curtmelonopoly) May 29, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watchlists:

Morning momentum stocks on watch so far: $LOXO, $DVAX, $TGTX

Bias toward / on watch: Watching to possibly close some longer term swings I have done well with such as $GOOGL, $AMZN and others. Watching Gold with a possible chart set up and looking for a bounce in oil (trading at 47.33 7:51 ET).

Markets: $SPY $ES_F $SPX I continue to be cautiously optimistic grinding up, $GLD, $GDX, $SLV continue in indecision but the charts say it could be up soon. $USOIL, $WTI ran up and tanked again overnight so we’re watching for a bounce. $DXY and $VIX no significant news.

OTC on watch: Randoms I am still watching.. $PGPM, $BRNE, $ELED, $PVCT, $LIGA (I hold),$AMLH, $BLDV $UPZS $OPMZ $MMEX $ACOL $BVTK $USRM $ORRV $JAMN $PFSD

Gaps to Watch:

Recent Momentum Stocks to Watch:

Stocks with News: $LOXO, $SRRA, $TGTX, $PBMD

Recent SEC Filings to Watch: $LACDF Lithium Americas Corp Director Acquires C$266,750.00 in Stock

Short Term Trader’s Edge: $LTBR, $JUNO

Some Earnings Today: $ASNA $CASY $COUP $THO

Holds: All holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA, $PVCT

Various Recent Chart Set-ups on Watch: $LTBR, $RCL, $JKS, $CALA, $LITE, $JUNO, $PCRX, $CTSH, $FEYE, $TSLA, $NVO, $FSLR, $AAOI, $HIIQ, $JASO, $VIPS – We are working on these and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Midday Chart and Trade Setup Review June 1, 2017:

Midday Chart and #SwingTrading Setup Review, June 1, 2017: $JUNO $USOIL $WTI $GOOGL $VIPS $AGN $SNAP and more.

https://twitter.com/CompoundTrading/status/869275423879958530

Market Outlook :

Watch those large and mega caps – when they stall things could change. And don’t forget our $SPY algo warned about recent highs.

Market News and Social Bits From Around the Internet:

8:30am

-Productivity/ Costs

-US Consumer Spending

9:45am

PMI Services Index

10am

-Factory Orders

-Non-Mfg Index

-Market Conditions Index

$LOXO premarket up 40.77 % trading 68.95 on positive cancer drug trial news.

$SRRA Sierra Oncology Reports Encouraging Initial Progress from Ongoing Phase 1 Clinical Trials of Chk1 Inhibitor SRA737

$TGTX Announces Positive Data from Phase 3 GENUINE Trial of TG-1101 in Combination with Ibrutinib

$PBMD LAG-3Ig (IMP321) DEMONSTRATES POSITIVE SAFETY AND EFFICACY QUALITIES IN BREAST CANCER CLINICAL TRIAL

$XAUUSD 100 MA breaching 200 MA on Daily. SQZMOM green and MACD trending up. #GOLD $GLD pic.twitter.com/VThOIKY12j

— Melonopoly (@curtmelonopoly) June 5, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List :$LOXO, $DVAX, $NAKD $CLSN $HMNY $PBYI $TGTX $FOR $GIMO $PERI $RNN $MBVX $HAL $AEHR $MNKD $ARRY $HTGM $P I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $UWT $SPY $XIV $LABD $JDST $DUST $JKS $SNAP $CHK I will update before market open or refer to chat room notices.

(3) Other Watch-List: $LABU $LOXO $DVAX $PBYI $TGTX $HMNY

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $WEX $LOXO $STT $OUT $EC $OMAM $PB $PBCT $FOE $UFS $RFP $GPS $NAV $STI $IVZ $EBAY $EV $INCR $MDP $CW $SKX $YELP as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $PRGO $VEEV $AAPL $AMG $FII as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

Post-Market Tues Mar 14 $DRWI, $ETRM, $DRYS, $TGTX, $OAKS, $JNUG, $DUST, $GOOGL

Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Tuesday March 14, 2017; $MGI, $DRWI, $ETRM, $DRYS, $TGTX, $OAKS, $JNUG, $DUST, $GOOGL, $COKE – $NE, $XOM, $BSTG, $ONTX, $DUST, $MGTI, $TRCH, $LGCY, $DRYS, $SSH, $ASM etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Trade Room attendance – I will be traveling Wednesday so in trading room for an hour in the morning and then intermittently as I have service through the day.

Posts to Members sent direct vs. posting to blog – One of the most common DM questions I am getting is from folks asking questions surrounding member algo our post unlocks (the one’s members get and we unlock after some time)…. We do not post all member updates to the blog, in other words many of the posts are direct email updates that never get to the blog. Theses can be daily updates or intra-day updates of various types. The only reason we post to the blog at all is for transparency and a public historical record of our work (if it’s good work it should show and if not we should go do something else). So if you are a member to a specific algo charting service or our swing trading service you will receive intra updates and memos etc relating to that service that nonpaying public will never see. Hope that helps.

Gotta say thanks to the traders in the community coming out to share your insights in the room – really appreciate it! And the kind notes!

— Melonopoly (@curtmelonopoly) March 14, 2017

Per recent;

Trading Room Open House: We continue running open house – which will end soon (we just want to get this new platform settled first).

Trading Room Attendance: With our commercial multi-user algorithm chart modeling client platform launch, upcoming 24 hour oil trading room and coding for our algorithm models for our trader’s cockpit (you’d have to read our story on our website to understand our build-out plans)… I won’t be in the trading room as much starting Tuesday March 14, 2017. I expect to be in the room most days the first hour or two and then I have to turn my attention to the platform development daily and assistance our software developers require of me. I will still have my monitors on and will likely comment and/or run intra-day review broadcasts etc – I just won’t be in the room minute by minute.

We’re in middle of creating and editing a swath of educational videos – out soon.

The ability for members to access transcripts on demand we are working on – should have that done soon.

The Compound Trading YouTube Channel now has the daily trading chat room full length video uploaded daily with all stock trades for the day.

Members are reporting that they like the mobile service ability of YouTube Live better than Webinato but members need to know that they need to have a Google+ / Gmail account and sign in to YouTube and activate a channel to use the service. We have had many not understand that so if you aren’t sure about procedure let us know and we will assist.

The live charts we share, to make them live you need to open the chart and click on the share button at bottom right of any of the charts and then click “make it mine”. This will enable the live chart in your browser in TradingView whether a member or or not of TradingView.

Overview Perspective & Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

In play today in chat room; $DRWI, $ETRM, $DRYS, $TGTX, $OAKS, $JNUG, $DUST, $GOOGL, $COKE

$ETRM was traded by Market Maven in morning momo for a small loss, I got out of last 25% of $DRYS position and that was a nice swing that started last Thursday with adds along the way, Flash got out of a nice $COKE swing and a big $OAKS swing exit (which was his largest play from our January swings), Mathew and Flash continued in $JNUG I believe, I held on $DUST, my $GOOGL swing is rocking and the $TGTX play was big – that was alerted in the premarket chatroom newsletter as one of my watches. Also watching $NKE $X among others you can find on premarket newsletter or swing newsletters (depending on your sub).

The premarket trading plan from Tuesday;

Protected: PreMarket Trading Plan Tues Mar 14 $MGI, $ETRM, $TNXP, $ONCS, $ISIG, $UGAZ https://t.co/ZLcwlqJlr8 https://t.co/OGImAMJ83c

— Melonopoly (@curtmelonopoly) March 14, 2017

Premarket was all about watching; $DRWI $MGI $ETRM $GALT $RT $BIOC $EDIT $RLJE

Twitter post that included some of the daily trading action (click on);

Open House Today – Live Broadcast Trading 9:30 AM https://t.co/7H84KcZXgh $MGI $ETM $TNXP $ONCS $DWT $UGAZ #chatroom #stocks #premarket

— Melonopoly (@curtmelonopoly) March 14, 2017

Swing Trading:

Here’s the latest public edition of keep it simple swing charting – this one has a MACD focus;

https://twitter.com/CompoundTrading/status/840839909573349376

The Swing Trading Twitter feed can be found here: https://twitter.com/swingtrading_ct.

Algorithmic Chart Models:

I see that @EpictheAlgo nailed the bottom trading range of the current downdraft in oil trade. Nice to see the math works in that scenario. Our $SPY algo has been hitting extensions for weeks so that’s awesome and our Gold and Silver algos have big updates on deck (big in terms of maybe two or three of that significance would go out a year).

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderate small size to micro sizing) – $DUST, $ONTX, $XOM, $NE, $BLKG, $DRYS, $USRM, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| DRWI | 1.90 | 65.22% | 10326717 | Top Gainers | |

| NVCN | 1.78 | 27.14% | 7103877 | Top Gainers | |

| MGI | 15.77 | 24.57% | 10304400 | Top Gainers | |

| RT | 2.16 | 24.14% | 8120500 | Top Gainers | |

| NAKD | 2.60 | 21.50% | 2929700 | Top Gainers | |

| CVRS | 1.41 | 19.49% | 6952605 | Top Gainers | |

| MGI | 15.77 | 24.57% | 10304400 | New High | |

| KMG | 43.88 | 14.06% | 214900 | New High | |

| GDOT | 33.18 | 10.01% | 900100 | New High | |

| TGTX | 13.15 | 7.79% | 4865959 | New High | |

| MGI | 15.77 | 24.57% | 10304400 | Overbought | |

| FIZZ | 73.79 | 1.47% | 276104 | Overbought | |

| ICVT | 51.05 | 0.03% | 1001600 | Unusual Volume | |

| DRWI | 1.90 | 65.22% | 10326717 | Unusual Volume | |

| HYLB | 50.11 | -0.23% | 376771 | Unusual Volume | |

| GMAN | 0.09 | 12.50% | 12126700 | Unusual Volume | |

| ARRS | 26.11 | 4.52% | 2785700 | Upgrades | |

| ADES | 10.77 | -1.37% | 127091 | Earnings Before | |

| CWT | 34.45 | -0.29% | 129200 | Insider Buying |

The Markets Looking Forward:

It’s FOMC day Wednesday so everything’s a tad stalled. If I had to guess, and this is completely a guess, Gold and Silver will tank a but more, the dollar will get a lift, $SPY will get a lift, Oil will get lift and things will go back to normal. Could be wrong of course but I’m wondering. Banks may come off too. But that’s all a wild guess. That’s not what the algos say necessarily and not what the charts say necessarily either.

#FOMC cometh https://t.co/7NVSaN7F8R

— Melonopoly (@curtmelonopoly) March 15, 2017

Terrified talk in US national security circles that WikiLeaks is going to publish many CIA or NSA intercepts of Merkel tonight or tomorrow.

— WikiLeaks (@wikileaks) March 13, 2017

Per previous;

The markets are looking a little toppy – we’ll see. As you will see below, with our new Swing Trading KISS post – I am paying close attention to the MACD on main charting I follow – at time of possible turn I find it simple.

Per recent, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

Results are in for Gold trading vote:

Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 13, 2017

https://twitter.com/CompoundTrading/status/840809172421632000

Silver $SLV:

https://twitter.com/CompoundTrading/status/840812731791892486

Crude Oil $USOIL $WTI:

Good read 👌 $CL_F $WTI $USOIL #OIL https://t.co/m99UNDBARM

— Melonopoly (@curtmelonopoly) March 15, 2017

Volatility $VIX:

Pre previous’ $VIX has been flat for some time, however, our algorithmic modeling suggests a possible time / price cycle coming due soon. It is possible the oil sell off was the time-price cycle of note. Here again will await weekend algo charting updates before I do much.

Live Trading Chat Room Transcript: (on YouTube Live):

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times. Also, most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

6:52 AM Flash G Curt’s on mic at 9:30 correct?

6:53 AM MarketMaven MY epp. Morning @Flash G

6:53 AM MarketMaven M $ETRM is up +21.5% in premarket

6:58 AM MarketMaven M $WOR $ZEUS $RS $DGX $GDOT $DIS $TXRH $OXY $CTB $LADR $ETH $MAA $ARRS $TDG

6:58 AM MarketMaven M Upgrades

6:59 AM MarketMaven M Premarket Leaderboard: $DRWI $MGI $ETRM $GALT $RT $BIOC $EDIT $RLJE $GOGL $BCEI $DWT $ONCS

7:05 AM MarketMaven M So $RNN and $RXII have been FANTASTIC Flash! Babies.

7:05 AM Flash G yeah thanks for the poke on em

7:06 AM Curtis Melonopoly Grabbing a coffee… back for open broadcast ?

7:06 AM MarketMaven M kk

7:08 AM MarketMaven M congrats on $GOOGL Curt!

7:09 AM Curtis Melonopoly thanks catcha in 15

7:10 AM MarketMaven M Ouch! #Oil plunges as Saudis tell #OPEC Kingdom reverses one-third of cuts made at outset of OPEC deal.

7:14 AM Curtis Melonopoly quite the storm rolling in to NY

7:14 AM Curtis Melonopoly?

7:25 AM Flash G $CBR gonna get run today

7:26 AM MarketMaven M In Play: $AUPH, $MGI, $LNTH, $VRX, $DWT, $DSW, $UWT, $SCO

7:26 AM MarketMaven M $CALA on close watch again for me

7:27 AM Mathew w Morning all. Likely in wait and see mode today but I don’t hate the action so far in CAT lol

7:27 AM MarketMaven M $LIGA on news also

7:27 AM MarketMaven M Hey Mathew!

7:27 AM Flash G hey mat mornin

7:28 AM Curtis Melonopoly on mic

7:29 AM Curtis Melonopoly $DRWI $ETRM $MGI

7:30 AM MarketMaven M Long $MGI small

7:31 AM Flash G oil lol wow

7:31 AM MarketMaven M nice

7:32 AM MarketMaven M Nibbling on $VRX too very small

7:34 AM Curtis Melonopoly $DRYS stop 1.69 on 26% held was a good play

7:34 AM MarketMaven M argh shit stupid open

7:34 AM MarketMaven M sorry

7:35 AM Flash G haha sassy

7:35 AM Mathew w GLA mentioned yesterday nice open. Still long and strong that guy.

7:35 AM MarketMaven M in $ETRM heavy dyty

7:35 AM MarketMaven M 7.04 3000

7:36 AM Curtis Melonopoly careful

7:36 AM Flash G in with ya hre small $ETRM

7:36 AM MarketMaven M $VRX 52 week lows so a good place to try too

7:37 AM Curtis Melonopoly good calls

7:38 AM Curtis Melonopoly watching 5 min candle $ETRM

7:38 AM MarketMaven M it will go Curt

7:39 AM MarketMaven M In $DIS on the break

7:39 AM Flash G ya my swing has been great gong back weeks now

7:40 AM Flash G $WYNN off your watchlist CUrt jig

7:40 AM MarketMaven M Stop on $ETRM at 200 MA 3 min just south

7:41 AM MarketMaven M will add there for a snap

7:41 AM MarketMaven M love $WYNN here but too much to early to manage

7:42 AM Curtis Melonopoly long $DRWI 1.62

7:45 AM Curtis Melonopoly stop 1.54

7:47 AM MarketMaven Madd $ETRM 6.77 tight now

7:48 AM Curtis Melonopoly add $DRWI 2.01 another 5000

7:49 AM Eric Lunianga Good morning to all, what a time to be alive!

7:49 AM Curtis Melonopoly expiring 5 min candle test on deck

7:49 AM MarketMaven M hey eric!

7:49 AM Flash G peace eic

7:49 AM Flash G eric

7:50 AM Curtis Melonopoly stop 2.01

7:52 AM MarketMaven M nice trade curt

7:53 AM Curtis Melonopoly trailing out 10000 shares $DRWI

7:54 AM wintonresearch hey all

7:54 AM MarketMaven M fantastic trade

7:54 AM MarketMaven M hey nich

7:54 AM MarketMaven M school in session with curt’s $DRWI trade wow

7:54 AM Curtis Melonopoly out $DRWI 2.14 average decent win

7:55 AM Flash G ?

7:55 AM Curtis Melonopoly ugh too early

7:55 AM Curtis Melonopoly hey Nicholas

7:56 AM MarketMaven M $ETRM riding 200MA 3 min

7:57 AM wintonresearch fyi- FNMA moving up

7:57 AM wintonresearch great swing fanny imo

7:58 AM Flash G profit is profit

7:58 AM wintonresearch amen Flash

7:58 AM MarketMaven M stopped on $ETRM btw

7:59 AM Flash G holding small $ETRM will play wash out snap with 3x

7:59 AM MarketMaven M not a bad exit point curt

7:59 AM Curtis Melonopoly ya

8:00 AM Curtis Melonopol y✌

8:00 AM wintonresearch $MJTK chart continues to look like it will rip

8:00 AM wintonresearch quietly setting up for weeks

8:01 AM Curtis Melonopolystopped $DRYS 1.69 last 25%

8:01 AM MarketMaven M luv $MJTK chart

8:02 AM wintonresearch agree MM

8:02 AM wintonresearch i think it could multibag given chart and mkt cap of 1M

8:02 AM MarketMaven M $VRTU jiggy

8:03 AM MarketMaven M Out $MGI loss

8:03 AM Curtis Melonopoly unusual for u maven

8:03 AM Curtis Melonopoly usually watching your school session

8:04 AM MarketMaven M ya smaller losses

8:04 AM MarketMaven M happy way up this month

8:05 AM MarketMaven M really glad I followed Curt in to $GOOGL and $AMZN when I did they have helped muchly

8:05 AM MarketMaven M $AMDA I thought they would run today

8:06 AM Flash G $NKE on watch with me also here – was there any news? cant find it

8:06 AM MarketMaven M $WAC popping

8:08 AM MarketMaven M Mathew…. what do you think of $UGAZ entry today long?

8:08 AM Flash G i thnk ur late MM

8:09 AM Mathew w I was actually just thinking of adding a bit after trimming some yesterday. I like it if it can reclaim 3 in short order

8:09 AM Curtis Melonopoly $SINO interesting

8:11 AM Curtis Melonopoly I think Nicholas u were alerting $SINO

8:11 AM MarketMaven M ummm $UGAZ on watch I will wait

8:11 AM MarketMaven M thanks guys for opinions

8:12 AM Mathew w /NG 9 day down a 2.921 FYI and 200 at 2.959

8:13 AM Flash G $HYG phew

8:13 AM Flash G Trailing out my $COKE swing for decent roi

8:14 AM Flash G Trailing out of $OAKS – THANKS CURT! Fantastic win on that one! Swing

8:14 AM MarketMaven M $OAKS such a great swing holy congrats guys really nice

8:15 AM Curtis Melonopoly np flash welcome

8:15 AM MarketMaven M thanks Mathew

8:17 AM MarketMaven M u know curt… i should have taken all your January swings haha

8:17 AM Curtis Melonopoly hindsight

8:17 AM Flash Gs oooo GoldCorp… wathcing very close now $GC

8:26 AM MarketMaven M got quiet quick

8:26 AM Curtis Melonopoly watching $CATB over 2

8:27 AM MarketMaven M $GENE action

8:28 AM Flash G $CATB clears that 200 day there and it could be gone for a while

8:28 AM wintonresearch yes Curt, SINO is interesting- all the shippers going forward

8:28 AM Curtis Melonopoly $SINO chart especially IMO

8:28 AM wintonresearch but SINO has a nice curl on MACD and has that look- plus it had that crazy move months ago

8:29 AM wintonresearch i think we are going back to the glory days

8:29 AM Curtis Melonopoly yup

8:29 AM wintonresearch i love me some Springsteen

8:29 AM Curtis Melonopoly yup

8:30 AM Flash G I guess Natty may be decent MM I just looked through it again

8:31 AM wintonresearch Curt what do you think of MJTK

8:31 AM wintonresearch fwiw- my signals are suggesting a really powerful move is coming over the next month in that one

8:32 AM Mathew w JNUG small starter after quick scalp off of the open lows. Will give this one more leash

8:32 AM Curtis Melonopoly I don’t know neigh about it

8:33 AM Curtis Melonopoly I’ll research tonight but my guess if you’re catching the right energy it’s a watch!

8:33 AM Flash G $JNUG is my main play right now Mathew

8:38 AM wintonresearch also I’m getting – do not forget about $DRYS

8:39 AM wintonresearch i still think it’s going to turn up and run

8:39 AM wintonresearch over the next few weeks

8:40 AM wintonresearch most of this is from some proprietary forecasts i’ve completed in the last day or two

8:41 AM Curtis Melonopoly looking at $TGTX for swing here

8:41 AM MarketMaven M $DRYS can be really aggressive lol

8:43 AM Curtis Melonopoly would like to see OA at bottom there turn green on 15 min and stich RSI turn up and chart bot buy signal all on 15 min $TGTX for a large swing play

8:44 AM Curtis Melonopol yso I’ll watch it

8:45 AM MarketMaven M $CATB likely rocket yet today

8:46 AM Flash G $WLL blocks

8:46 AM Flash G $WG pops

8:51 AM MarketMaven MBTD on $SPY?

8:52 AM Flash G yolo

8:53 AM Curtis Melonopoly going on early lunch catchya in a bit

8:53 AM Flash G k

8:55 AM Flash G $NYMO crush

8:57 AMMarketMaven M$NYMO suggests your $JNUG might be offside?

8:57 AM Flash G iffy

9:02 AM Mathew w JNUG is a swing for me from here off of GDX levels. GDX needs to clear and close above 22.2 to let me know that we should be moving up from here

9:02 AM Mathew w I went super small and gave it a wide margin but won’t be afraid to close it if things look crappy

9:02 AM MarketMaven M Starting to $BTD here

9:03 AM MarketMaven M Thanks Mat I may follow you guys soon

9:04 AM Mathew w I really don’t want to take any new large positions right before FOMC tomorrow so if you’re on the fence keep that in mind

9:04 AM MarketMaven M Thats my thoughts too and the markets I think

9:10 AM MarketMaven M $AVGO serious pressure here – watching wash-out now for a possible play

9:13 AM MarketMaven M $CLRB jiggy

9:19 AM Curtis Melonopoly. crude on watch

9:20 AM Curtis Melonopoly3 0 min candle bullish

9:20 AM Curtis Melonopoly serious volume

9:22 AM Curtis Melonopoly FX $USOIL $WTI Needs to hold 47.70 market though and if it loses 47.30 then down another leg. 47.30 to 47.70 the test for this leg.

9:29 AM Curtis Melonopoly last 4 1 min candles sitting right on 47.70 lol

9:44 AM MarketMaven M that grey line is the magic line curt?

9:44 AM Curtis Melonopoly lol yup

9:45 AM Curtis Melonopoly math

9:45 AM MarketMaven M magic math

9:45 AM Curtis Melonopoly ok

9:53 AM MarketMaven M Looks like crude chart may repair at least intra

9:54 AM Curtis Melonopoly so much pressure on it but that’s the mark as you say at least intra

9:55 AM Flash G wactching $FATE $CUR $GOOGL here

9:57 AM MarketMaven M zzz

10:37 AM Mathew w Bumping stops on UEC and HL swings. Fairly tight on both.

10:41 AM Curtis Melonopoly $SBUX down again today?

10:47 AM Curtis Melonopoly $MGM NHOD $WYNN watching resistance for break or fail

10:48 AM wintonresearch watch $TGB here

10:48 AM wintonresearch at 50 dma

10:56 AM Mathew w APVO making a nice move here

11:01 AM Mathew w $PLG a mathew most hated pain trade showing up on the scanners. Im back in from the 1.4’s, this thing can run then kick you in the face all in the same day so careful if diving in

11:01 AM Mathew w that said, I like it for a run into the 2’s

11:12 AM Curtis Melonopoly a number of plays waking up here let’s hope for some follow through

11:21 AM Curtis Melonopoly Gold may start popping soon here

11:24 AM Mathew w Im really expecting some dollar weakness tomorrow after the fed releases their statement. I expect a hike with language that they will raise when appropriate but delayed and not in June

11:35 AM MarketMaven M ?

11:36 AM Curtis Melonopoly $TGXT at its extension ratchet if long

11:39 AMCurtis Melonopoly wow $TGXT may go for a double extension ??

11:42 AM Mathew w Nice play on that

11:44 AM MarketMaven M how’d you call that one?

11:45 AM Curtis Melonopoly just a feeling

11:47 AM MarketMaven M ?

11:52 AM MarketMaven M $RAD popping on rumours

12:05 PM MarketMaven M $TSLA bullish signals

12:13 PM MarketMaven M $XGTI

12:16 PM Flash G quiet

12:24 PM Mathew w fed lock up in progress I guess.

12:29 PM MarketMaven M yepp

12:33 PM Curtis Melonopoly watching $X $TGXT and the others from watch list on premarket report

12:33 PM MarketMaven M $NVCN on scanner

12:41 PM MarketMaven M $TSRO kicked hard

12:48 PM Curtis Melonopoly $MGTI up

1:18 PM MarketMaven M?

1:19 PM Curtis Melonopoly.bear is getting emotional in twitter ????

1:23 PM Curtis Melonopoly they might run crude up tonight for a gap fill

1:24 PM Curtis Melonopoly If Gild failed I will add to $DUST swing

1:24 PM Curtis Melonopoly If $GOOGL holds may add to swing.

1:26 PM Curtis Melonopoly $X divergent to bull side… over 200 on 15 min is a long

1:30 PM Mathew w gold looks horrible here with rest of the metals

1:35 PM MarketMaven M $RTK bounce

1:58 PM Curtis Melonopoly WELL THAT’S ALL. have a great night!

1:59 PM MarketMaven M see ya curt n all

1:59 PM Flash G,bye guys

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $DRWI, $ETRM, $DRYS, $TGTX, $OAKS, $JNUG, $DUST, $GOOGL, $COKE – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM, $DRYS, $BLTG – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

Post-Market Mon Mar 6 $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX

Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Monday March 6, 2017; $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX – $NE, $XOM, $BSTG, $ONTX, $DUST, $MGTI, $TRCH, $LGCY, $SSH, $ASM etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

The YouTube live trading we now have transcripts (which you will see below) – sorry about the delay, we thought transition would be easier. So the post market trading result reports recently missed may never get done FYI (we’ll see). Also, transcripts are Central Mountain time so you will have to add two hours for Eastern Time (New York).

The remaining algo reports will be out tonight, then swing reports and we’re in middle of editing and uploading a swath of educational videos (may take a few days on that).

Also, the ability for members to access transcripts on demand we are working on – should have that done soon. As well soon you will be able to visit our YouTube channel soon and replay the trading day video on demand.

Members are reporting that they like the mobile service ability of YouTube Live better than Webinato but members need to know that they need to have a Google+ / Gmail account and sign in to YouTube and activate a channel to use the service. We have had many not understand that so if you aren’t sure about procedure let us know and we will assist.

And lastly, the live charts we share, to make them live you need to open the chart and click on the share button at bottom right of any of the charts and then click “make it mine”. This will enable the live chart in your browser in TradingView whether a member or or not of TradingView.

Overview Perspective & Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

In play today in chat room; $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX

Today was a big day! It was a classic schooling scenario of some senior traders putting on a class in our trading room to say the least – almost everything went 100% as planned and execution was professional. A definite learning experience for any traders on a learning curve.

In summary, Mathew is testing a $NFLX short that I wanted to enter but didn’t and he nailed the $PIRS break-out. Market Maven and Flash nailed the turn on Natural Gas like pros. Flash exited $UGAZ at the intra-day top and flipped to $DGAZ and Market Maven was in it too and kaboom almost to the minute Natural Gas turned. They both exited perfectly too. They also nailed the turn on $XIV with precision, and if you look in to why $XIV took flight the way it did today you’ll understand the experience behind that trade – wow. And $TGTX they both nailed the momentum on it and in $CNCE perfect execution.

I was basically flat on $CNCE and some of my swings were up and some slightly down so it was a moderate day for me. I added $CELG, $LITE, $CALA, $SBUX, and bitcoin stocks to my swing watch list.

Most professional trading day I have seen in a long time. Perfectly executed.

Trading $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG in room today for gains. $VIX, $CELG, $LITE, $CALA, $SBUX and more on swing watch.

— Melonopoly (@curtmelonopoly) March 6, 2017

Momentum / Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| TGTX | 10.20 | 90.65% | 33753654 | Top Gainers | |

| CNCE | 15.64 | 62.07% | 10630533 | Top Gainers | |

| ICLD | 0.02 | 34.34% | 126346679 | Top Gainers | |

| DXTR | 1.49 | 30.70% | 6808552 | Top Gainers | |

| GBSN | 0.00 | 28.57% | 173318219 | Top Gainers | |

| BLPH | 1.77 | 26.43% | 7319152 | Top Gainers | |

| CNCE | 15.64 | 62.07% | 10630533 | New High | |

| OIBR-C | 8.47 | 13.84% | 198492 | New High | |

| VBIV | 6.10 | 13.59% | 960460 | New High | |

| MRUS | 32.23 | 9.44% | 114980 | New High | |

| CLUB | 4.10 | 4.59% | 171072 | Overbought | |

| MASI | 93.57 | 0.32% | 897260 | Overbought | |

| FLQG | 26.99 | -0.20% | 166111 | Unusual Volume | |

| CNCE | 15.64 | 62.07% | 10630533 | Unusual Volume | |

| TGTX | 10.20 | 90.65% | 33753654 | Unusual Volume | |

| DEMG | 26.67 | -0.73% | 256402 | Unusual Volume | |

| AA | 36.93 | 1.51% | 5764024 | Upgrades | |

| AFI | 19.44 | -11.44% | 369442 | Earnings Before | |

| HBCP | 35.62 | -0.86% | 2821 | Insider Buying |

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small to micro sizing) – $ONTX, $DUST, $USRM, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio):

Trading and The Markets Looking Forward:

#earnings $THO $MOMO $ULTA $FNSR $MEET $MVIS $DKS $CLNE $CIEN $CARA $URBN $MIK $DXYN $LGIH $SCMP $BIOC $BTE $CASY https://t.co/rsllzs6MVb

— Melonopoly (@curtmelonopoly) March 5, 2017

Recent notes in post market reports that still apply,

“Our standard plays that reflect the six algorithm charting we do are all at decisions at either support or resistance so this should get really interesting soon.”

Per recent, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

The US Dollar is threatening important upside levels on the algorithmic model charting – we’ll see.

YEN Yup https://t.co/y53em8X2ki

— Melonopoly (@curtmelonopoly) March 6, 2017

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Excellent review of #Gold trade 💯. $GC_F $GLD $NUGT $DUST https://t.co/lyzT88NgWV

— Melonopoly (@curtmelonopoly) March 5, 2017

Will the next leg in #Gold trading be up or down? Round 2. $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 5, 2017

Silver $SLV:

Silver recently failed at exactly where our algorithm had a symmetry price target extension. What does this mean? Silver needs to repair the chart soon or it’s down.

Crude Oil $USOIL $WTI:

Crude oil continues in its sideways trade and our EPIC the Oil algo members have been killing the range.

$CL_F $WTIC $USOIL Chart range bound with higher lows and horizontal top at resistance. Will have to break soon higher or lower? #Oil #OOTT

— Melonopoly (@curtmelonopoly) March 6, 2017

Here's a decent review of the oil trade. $WTIC $CL_F $USOIL https://t.co/0jwfSKv6AT

— Melonopoly (@curtmelonopoly) March 6, 2017

Crude oil twenty year monthly performance. $CL_F $WTI https://t.co/HgxmIyVkax

— Melonopoly (@curtmelonopoly) March 6, 2017

Volatility $VIX:

$VIX has been flat for some time, however, our algorithmic modeling suggests a possible time / price cycle coming due soon.

— Melonopoly (@curtmelonopoly) March 6, 2017

Oh yes, finally a possible sign of life in the algo signals.🔥 @VexatiousVIX https://t.co/mC5a0eDzMV

— Melonopoly (@curtmelonopoly) March 6, 2017

$SPY S&P 500:

$SPY has been trading perfectly within our model and see no divergence yet, however, we are watching the time /price cycle in our $VIX model very close here now.

$SPY S&P 500 Seasonality https://t.co/tGqZ7UksFo

— Melonopoly (@curtmelonopoly) March 6, 2017

$SPY A perspective on yearly pivot resistance point. https://t.co/QAWwdVPOk0

— Melonopoly (@curtmelonopoly) March 6, 2017

Natural Gas:

Natural Gas we do not have an algorithmic model for yet (testing). Our traders have been nailing it however.

Momentum Trades:

$TGXT and $CNCE were strong momo trades today (as were others such as $PIRS). Follow – through seemed better today. It has been lacking for a number of weeks now.

Swing Trading:

$CELG, $LITE, $CALA, $SBUX are the new swing trades added to my swing trading watch list.

$LITE Agree. Great set-up for decent RR. https://t.co/DD6SstUajn

— Melonopoly (@curtmelonopoly) March 6, 2017

Per recent; As noted above, our Swing Trading service has sent one out of the park after another. Continues to look good forward.

The Swing Trading Twitter feed can be found here: https://twitter.com/swingtrading_ct.

Algorithmic Chart Models:

As noted above, these are doing exceptionally well also. Building, building, building.

Epic the Oil Algo continues to nail targets, SuperNova Silver recently nailed a price target extension that was critical, Rosie the Gold algo has been nailing price target extensions, our US Dollar algo has been spot on and even our $SPY algo has been nailing targets the last few weeks so it is coming along. Soon we will see if our $VIX algo is dialed in with this time / price cycle potentially ending soon.

https://twitter.com/EPICtheAlgo/status/837717042182545408

Where has @EPICtheAlgo been all my life? I’m just sitting back and watching this print money….

— NardoCrypto (@nardocrypto) March 3, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Compound Trading Stock Chat-room Transcript:

Miscellaneous chatter may be removed.

Live Trading Chat Room Transcript: (on YouTube Live)

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times.

5:55 AM Flash G mornin

5:56 AM MarketMaven M hey

6:10 AM Curtis Melonopoly morning

6:49 AM MarketMaven M $TGTX gonna fly at open

6:51 AM Flash G So glad I took that $UGAZ trade Fri

7:07 AM MarketMaven M $NFLX got their upgrade lol FIXED!

7:09 AM

Compound Trading Protected: PreMarket Trading Plan Mon Mar 6 $TGTX, $CNCE, $UGAZ LINK: https://compoundtrading.com/premarket… PASSWORD: PREMARKET030617

7:12 AM Mathew w Started $NFLX short using swing high as stop

7:13 AM Mathew w Will add under the 50 day

7:13 AM MarketMaven M $POLA on the move PM

7:15 AM MarketMaven M $TGTX taking off before bell… makes that tough

7:19 AM Curtis Melonopoly $MGTI swing from Friday up a little premarket

7:20 AM Curtis Melonopoly good luck with $NFLX! I chickened on it

7:20 AM Mathew w Small starter vs 146 stop of new highs. We’ll see nice r/r if Im right

7:21 AM Curtis Melonopoly Quick before the bell… we’re uploading the new educational vids now, swing report and rest of ago reports out today / tonight.

7:22 AM Curtis Melonopoly For the record… I want to be in that $NFLX short lol

7:23 AM MarketMaven M Citi raises Apple to $160 target, reiterates Buy

7:24 AM MarketMaven M jeez $UVXY down again PM

7:25 AM Curtis Melonopoly I won’t be on mic today… we have our hands full with video uploads and ago reports here. I will alert trades tho in here and SMS email.

7:28 AM Curtis Melonopoly $TGTX near 100% use caution imo

7:29 AM MarketMaven M I’m long $TGTX here

7:29 AM Flash G lol

7:30 AM Flash G $RNVA looks good too

7:31 AM MarketMaven M Add at 10.52

7:31 AM MarketMaven M Closed 10.94

7:31 AM MarketMaven M YES

7:31 AM Flash G lol

7:31 AM Flash G funny

7:31 AM Flash G congrats

7:32 AM Curtis Melonopoly holding $MGTI

7:33 AM Flash G $MYOS jiggy

7:33 AM MarketMaven M Back in 11.10

7:33 AM MarketMaven M $TGTX

7:34 AM Flash G wow great action on $TGTX

7:34 AM MarketMaven M Out 2000 shares 11.44

7:34 AM MarketMaven M YESSSSS

7:34 AM Curtis Melonopoly nice play MM

7:35 AM Flash G scalper!

7:37 AM Flash G $MELY $RMTN $MGTI on watch Bitcoin

7:37 AM Flash G Long $DGAZ for daytrade

7:38 AM Flash G $HSHS $CCTL $MELY $RMTN $MGTI on watch

7:38 AM Flash G$ RNVA on the move

7:38 AM Curtis Melonopoly $MGTI tank

7:39 AM Curtis Melonopoly long $CNCE 14.01

7:42 AM Flash G $RNVA low float could be big

7:42 AM MarketMaven M SHort $TGTX now? hmmm

7:44 AM Curtis Melonopoly $CNCE stop triggered 13.99

7:45 AM Mathew w Completed my first leg short right here on $NFLX. Will let it play out and see where it goes from here

7:46 AM Mathew w $NFLX chart

7:47 AM Mathew w tos

7:47 AM Mathew w. mx/saND28

7:52 AM MarketMaven M close $CNCE 15.00 – yup Curt took the trade alert

7:53 AM Curtis Melonopoly nice

7:56 AM Flash G Long $XIV

8:00 AM Flash G $CCIH 28%

8:00 AM Mathew w $PIRS nice lok

8:00 AM Mathew w Through res. Im long against the rising wedge

8:01 AM Mathew w tos

8:01 AM Mathew w .mx/XQ2epV

8:02 AM Flash G $PIRS looks good mat

8:04 AM Mathew w Simple look but easy play to manage. Stop set so I’ll let it keep trucking

8:07 AM Flash G $SNAP in trouble now

8:08 AM MarketMaven M Curt, got to admit $CNCE was the right choice of the bunch. Appreciate the call.

8:08 AM Curtis Melonopoly no problem MM

8:09 AM Curtis Melonopoly glad you banked!

8:10 AM MarketMaven M I’m with ya long $XIV Flash

8:13 AM Curtis Melonopoly nice work on $XIV guys

8:14 AM Flash G Still holding $DGAZ with defined risk / stops in place

8:15 AM Mathew w fins look horrible

8:15 AM Mathew w breaking below 3 day range from last week

8:15 AM Curtis Melonopoly $CNCE brute

8:21 AM Curtis Melonopoly if your in $CNCE off my alert time to tlratchet stops near 100% now

8:23 AM MarketMaven M $SNAP snapped

8:28 AM MarketMaven M That looks like it for the morning lol – great start to the week!

8:36 AM MarketMaven M yup got really quiet quick

8:37 AM Flash G yeah

8:42 AM Mathew w $NFLX flush baby flush. I expect this play will take a while to materialize

8:43 AM Curtis Melonopoly $NFLX looks like sh@t lol

8:44 AM Mathew wY epp couldn’t even get going very hard on that late cycle upgrade

8:47 AM Curtis Melonopoly surprised santelli on cnbc hasn’t had a heart attack yet… he’s a wired dude lol

8:49 AM Curtis Melonopoly Airlines took a hit

8:58 AM Curtis Melonopoly some general divergence here… $AAPL not looking great…. $VIX turn…. $NFLX looking bad …. interesting imo

9:33 AM Mathew w Metals looks horrible. I’m all out of $SLW small loss after big win to start the year. Still in small miners plays but things don’t look great at all

9:35 AM Curtis Melonopoly gonna watch this immigration announcement

10:33 AM Mathew w $PIRS stop bumped, no loser here but the action is great

10:37 AM Mathew w $NFLX on lows, went inside and down on 15,30,hour

10:59 AM Flash G $SBUX sweepers today Curt…. seen your tweet on it last night #swng

11:00 AM Curtis Melonopoly ya

11:26 AM Curtis Melonopoly $CELL, $LITE, $SBUX, $CARA bit coin stocks are on my swing radar.

11:28 AM Curtis Melonopolyu still holding $UGAZ flash?

11:29 AM Flash G yes

11:29 AM Flash G $DGAZ

11:29 AM Flash G lol but yes

11:29 AM Curtis Melonopoly right

11:30 AM Curtis Melonopoly and $XIV?

11:30 AM Flash G yes

11:30 AM MarketMaven M mee too on the $VIX

11:31 AM Curtis Melonopoly nice

11:46 AM Curtis Melonopoly That $XAUUSD chart really interesting point… failed 200 MA under 20 MA with 50 MA cross up thru 100 MA on deck and Stoch RSI near bottom…. hmmmmm….

11:46 AM Curtis Melonopoly and Jan 27 look at how it bounced off the 50 MA

11:47 AM MarketMaven M it did bounce there

11:47 AM Curtis Melonopoly yup

11:50 AMFlash Gsimilar set up to Jan 27

11:50 AM Curtis Melonopoly similar yup

11:56 AM Flash G If t doesn’t bounce at 50 MA this time likely done lol

11:56 AM Curtis Melonopoly likely

11:57 AM Curtis Melonopoly but likely will bounce

12:02 PM Curtis Melonopoly killing $NFLX might require something nuclear lolol jeeps

12:06 PM Curtis Melonopoly oooo sweet call on $DGAZ Flash!!!

12:06 PM Flash G why thank ya

12:07 PM Curtis Melonopoly I was wondering about that call all day lol

12:07 PM Curtis Melonopoly u pinned that

12:08 PM Flash G thanks

12:09 PM Curtis Melonopoly wow did u nail it lol

12:09 PM Curtis Melonopoly awesome reversal

12:11 PM Curtis Melonopoly credit where credit due… I knew I should have followed that one… my gut was saying go

12:16 PM Curtis Melonopoly $BSTG Swing doing well… holding.

12:31 PM MarketMaven M $PIRS 52 week high – nice trade Mathew

12:34 PM Mathew w Thanks. Blue sky breakout and can keep roasting those shorts.

12:36 PM MarketMaven M roast baby roast!

12:38 PM Flash G man I missed $PIRS

12:40 PM MarketMaven M great trade

12:40 PM MarketMaven M $BTSG sizing up to be a big runner potentially tomorrow imo

12:41 PM MarketMaven M $XIV a money machine today

12:41 PM Flash G we’re banking on that girlfriend:)

12:41 PM MarketMaven M haha

12:42 PM Curtis Melonopoly ya that’s a great call too

12:48 PM Curtis Melonopoly lol OPEC might cut again

12:48 PM Curtis Melonopoly what I see in the chart they need to lol

12:49 PM Flash G lunatics

12:49 PM Flash G mad science the oil trade

12:50 PM MarketMaven M $CRTN on scanner – lotsa buys

12:52 PM Flash G $CRTN actually got bull MM

12:53 PM Flash G Possibly looking at closing $DGAZ

12:58 PM Chat disconnected. Please wait while we try to reconnect you.

12:58 PM Successfully connected.

1:01 PM Curtis Melonopoly when $CARA Stoch RSI hits bottom on 1 day chart. … that’s an entry for me for sure…

1:03 PM Curtis Melonopoly Hoping $MGTI has another leg up

1:08 PM Flash G I think its time to look at selling bits of $DGAZ here

1:08 PM MarketMaven M 10-4

1:08 PM Flash G closing 25%

1:11 PM Flash G time to start closing $XIV bits …. 25% here – thanks for the reminder with the chart Curt!

1:11 PM MarketMaven M yup on it lol thanks

1:12 PM Curtis Melonopoly way to go guys gals take your profits

1:12 PM Flash G out another 25% in $DGAZ and $XIV holding 50% in both

1:14 PM Curtis Melonopoly same thing on $CELG swing looking for stoch rsi to cool on 1 day if possible

1:19 PM Curtis Melonopoly $LITE I’m looking for 20MA to hold on 1 day for entry long

1:21 PM Curtis Melonopoly $SBUX I’m looking for upper trend line resistance to break and hold or possibly stoch rsi at bottom on 1 day for long entry. .. I like how 20MA crossed 100 MA

1:21 PM Flash G thanks Curt

1:22 PM Curtis Melonopoly of course with each swing there are various other indicators I’m watching but you get the idea

1:22 PM Flash G ys

1:23 PM Curtis Melonopoly wow $NATGAS continues down wow wow what a trade

1:24 PM Flash G still holding 50%

1:30 PM Flash G closing $XIV and $DGAZ trades for AWESOME WINS!

1:30 PM MarketMaven M yippy! thanks flash!

1:31 PM Curtis Melonopoly nice

1:33 PM MarketMaven M $PIRS!

1:33 PM MarketMaven M looks like a decent place for our $DGAZ close

1:34 PM MarketMaven M and $XIV…. good calls Flash

1:36 PM Curtis Melonopoly Bama losing his sh@t lol gotta live him

1:37 PM Curtis Melonopoly chart bot on buy signal on $NFLX? ??

1:42 PM Mathew w Look how poorly it called that last sell signal

1:44 PM Curtis Melonopoly yup

1:44 PM Curtis Melonopoly that’s a perfect example of checking it’s calls to each stock

1:57 PM Flash G i suppose i should get my chores done… building a shed for my new ride on mower

1:57 PM Flash G that was a great day – i think we hammered every call

1:57 PM Flash G back tomorrow

1:58 PM Curtis Melonopoly peace

1:58 PM MarketMaven M ya thanks Flash! awesome day!

1:58 PM MarketMaven M lets do it again Tues!

1:58 PM MarketMaven M paid my bills today:)

1:59 PM Curtis Melonopoly have a great night y all!

2:00 PM MarketMaven M bye curt

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX – $BSTG, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Mon Mar 6 $TGTX, $CNCE, $UGAZ

Stock Trading Plan for Monday Mar 6, 2017 in Compound Trading Chat room. $TGTX, $CNCE, $UGAZ – $ONTX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGIT – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

The educational videos were completed last night and still need to be uploaded – this may take a day or two – a very slow process on You Tube to say the least.

Most of the algo updates are out, the ones that are not out yet are being processed right now and will be out over next 24 hours (including Swing Newsletter).