Tag: $XLE

Swing Trading Earnings Special Report (Members) Sun Aug 5 $GPRO, $NFLX, $TAN, $TWLO, $WYNN, $XLE, $XLF, $X, $RIG…

Swing Trading Report. In this Special Earnings Season (Member Edition) Sunday Aug 5, 2018: OIL $WTI $USOIL, SP500 $SPY, US Dollar $DXY, $SWIR, $GPRO, $NFLX, $GSIT, $AXP, $ABX, $TAN, $TWLO, $WYNN, $XLE, $XLF, $X, $RIG, $SLX and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 3 mid day, published August 5, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

Published Aug 5, recorded Aug 3, 2018 Mid Day Swing Trading Review.

July 3 and July 10 Swing Trading Regular Reports are referenced in this special earnings report. Members can reference those two reports for charts you may need (or review the video) as all the charting is not included in the report below due to weekly reporting time constraints.

Tickers covered;

OIL $WTI $USOIL – expecting oil to settle in cradle at end of week. Video has quick review of model.

$DXY US Dollar – Up against resistance threatening to move in to its next bullish structure – long over 95.62, PT 96.70.

SP 500 $SPY – over 200 ma on 60 mi, support 278.60, resistance 283.77, that’s your range for Monday.

$SWIR Sierra Wireless – Momentum stock on the day reviewed on video (moving averages). Nearing 50 MA resistance on weekly chart.

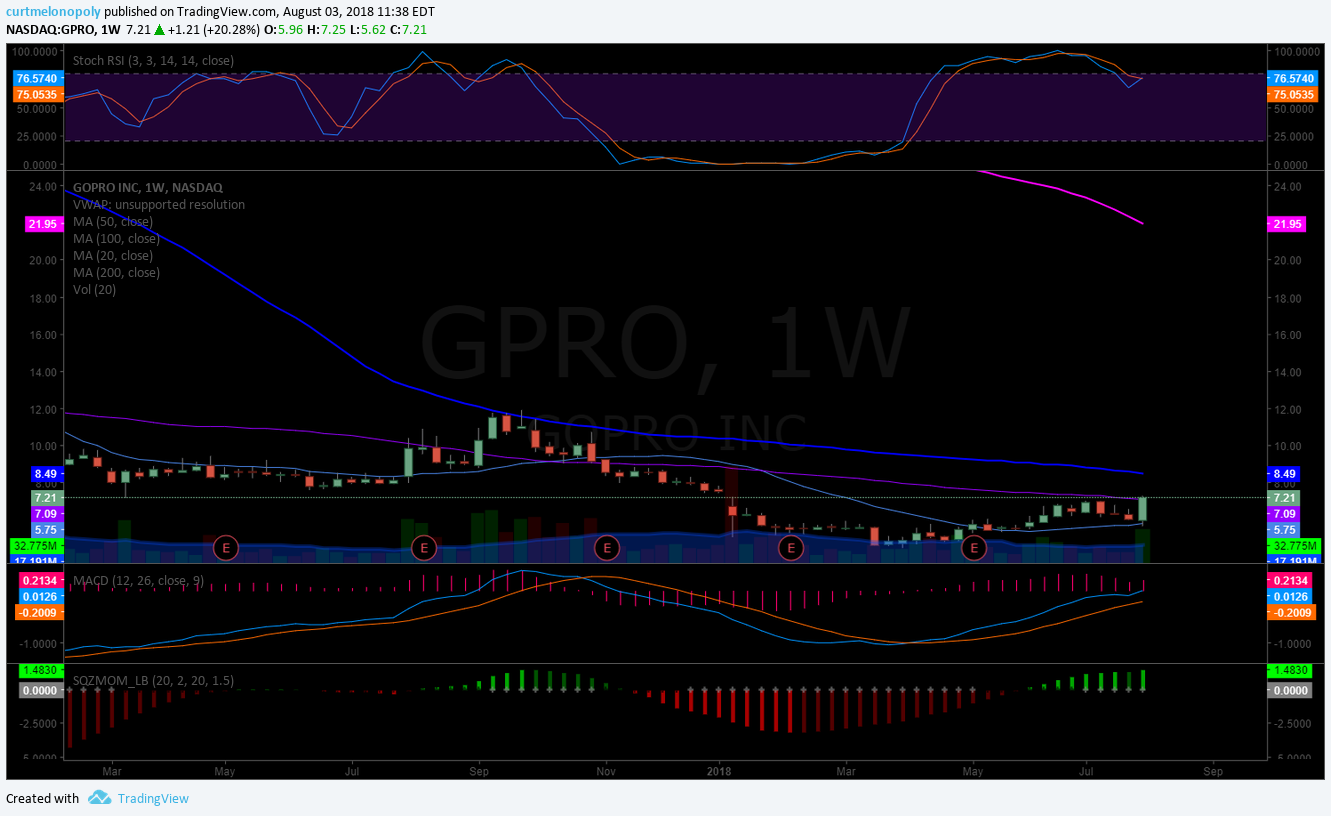

$GPRO GoPro – Testing 50 MA on weekly, up 20% on day, last time it used 100 MA for resistance.

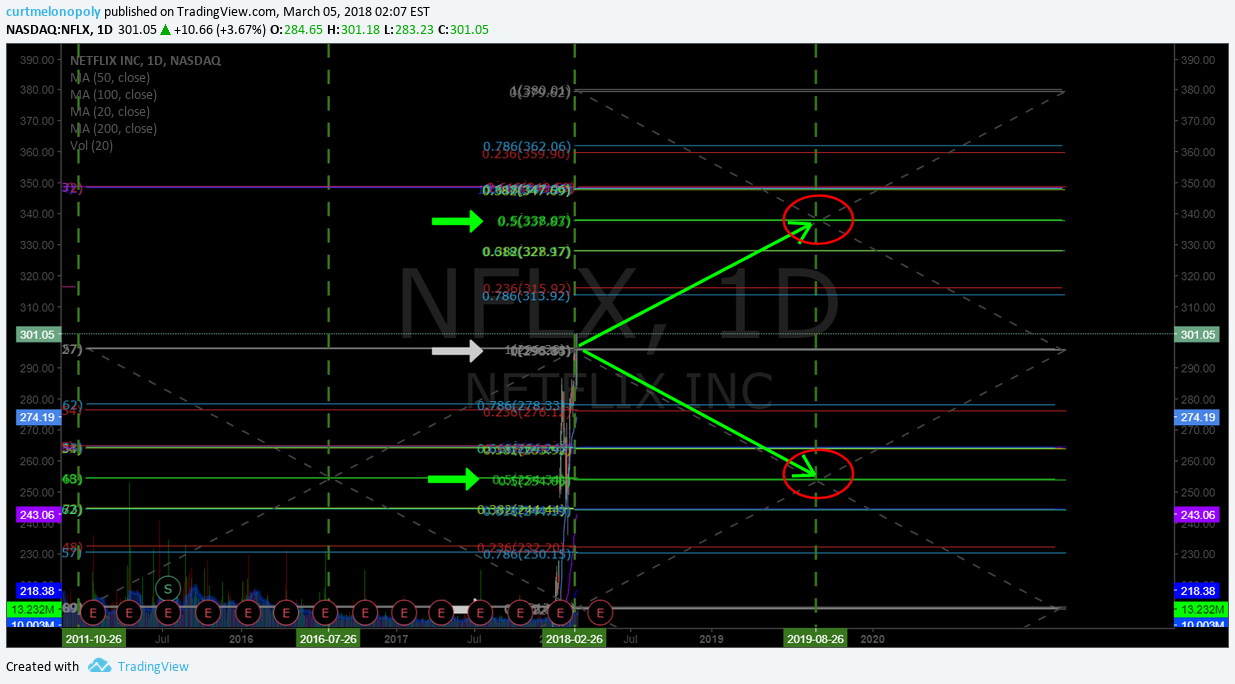

Netflix $NFLX – 337.64 is main structural support. 421.70 is key resistance area. When it got the 200 MA on the hour previously is where we traded the buy sell triggers to the bullish side. 307.44 296.19 283.80 are supports and we’re looking for a long at end of retrace. At 309.70 I am interested in a long would prefer 284.18 could even sell in to 254.91 structural support. Detailed trendlines are discussed in video. Levels quoted will change on trend lines. 368.61 quad wall 377.20 200 MA 380.24 resistance area intra day. If I’m right we’ll get a bounce to the 379 area around 200 MA. Trading plan scenarios are discussed on video with various technical levels to watch.

GSI Technology $GSIT – Other side of earnings, has held previous lows, last report had indicators indecisive and it still is. Trade alert alarm set at 50 MA for a watch.

American Express $AXP – Was going to daytrade it and start sending out trade alerts on AXP but it keeps failing the break out I’m watching on the weekly chart. Indicators are flat and that’s a problem.

Barrick Gold $ABX – Main pivot has worked on charting alerted to members in the swing report. Likely sees the 8s before it bounces. Trading 11s.

Solar ETF $TAN – Same with this chart, the pivot has worked but there isn’t enough to make a bias decision.

TWILIO $TWLO – Daily chart, trending stock. Have to wait for earnings this week to make a decision.

$WYNN – Wash out territory on the daily. Sent out trade alerts on the $WYNN trade and we did okay but it is difficult to leg in to this trade. Set alarm to be alerted when Stochastic RSI turns.

Metals and Mining ETF $XME – Red line is a large structure weekly chart major pivot on the chart. Over 39.50 is a watch for a long side trade. Slight bullish bias.

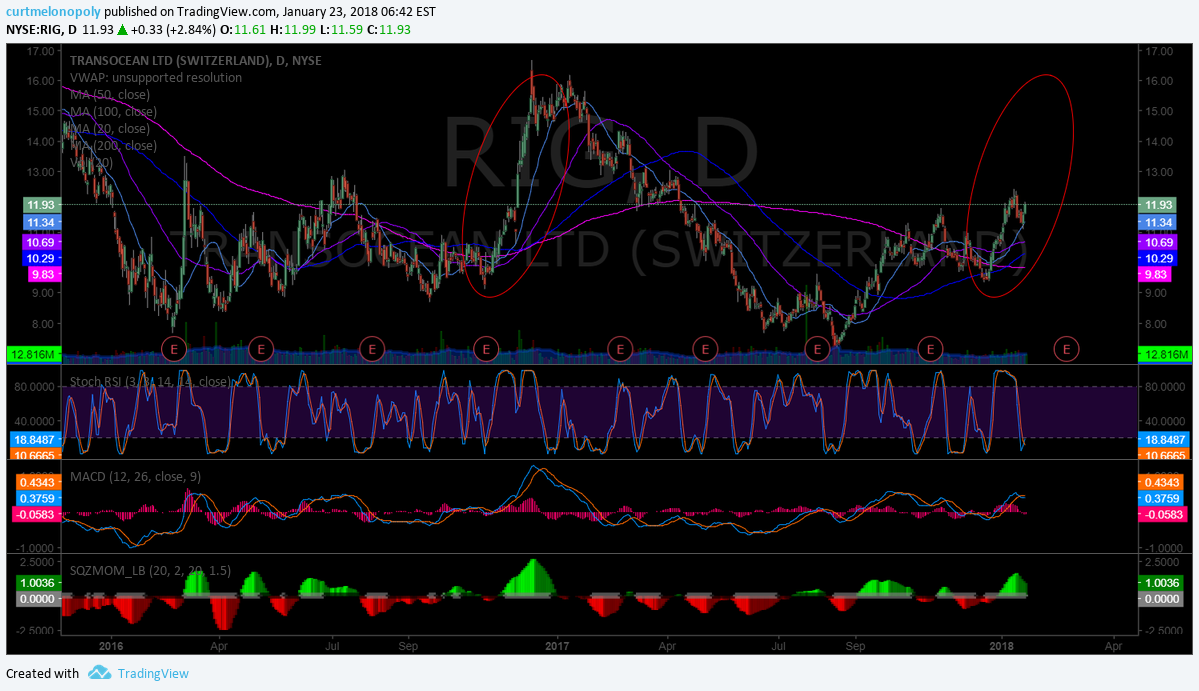

Transocean $RIG – Not a clean set-up at this point. Support 11.76, 15.65 is resistance. 10.84, 9.71, 11.50, 7.84 in a sell-off.

Energy Sector Fund $XLE – Trading 75.05 Stochastic coming down on daily, over its previous highs it’s a long but it is really indecisive at this point.

Steel ETF $XLF – Daily SQZMOM on its way down but there is a pinch and coil on the 200 ma, slight edge to the bulls. The weekly chart looks better but it’s coiled around main pivot. It’s a decision area.

$SLX – MACD is coming down on weekly and indicators are indecisive at this point.

United States Steel Corp $X – Bear advantage. MACD on way down on weekly chart and has lost its 50 MA.

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

Swing Trading Stock Update Tues July 10 (Part B) Swing, Trading, Stock, Picks, Alerts, $XLE, $X, $SLX, $RIG, $NFLX, $AXP, $TAN more.

Welcome to the Compound Trading Swing Trade Report Tuesday July 10, 2018 (Part B).

In this edition: Swing, Trading, Stock, Picks, Alerts, $XLE, $X, $SLX, $RIG, $NFLX, $AXP, $TAN, $TWLO, $WYNN, $VRX, $ABX, $XME, $GSIT

Notices:

Good day!

This swing trading report is Part B of one of five in rotation.

The five reports include approximately one hundred equities that we cover. The equities covered in the reports are divided in to five publications (that may be partitioned in to Part A and Part B) and the reports are then rotated on cycle approximately every five weeks to members of our service. In addition to the regular reports our members receive feature set-up and educational reports as available.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading room broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators at bottom of chart screen (MACD, Stochastic RSI, Squeeze Momentum) double click on chart body to remove indicators from chart – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue provided to you.

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos and/ or Feature Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage:

$NFLX – Netflix.

July 3, 2018 – NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

May 25 – Netflix swing trade going well. Stochastic RSI is high watch that, more importantly watch MACD and resistance levels charted. $NFLX #swingtrade

$NFLX in to resistance 348.00 area. Trim in to add above to 360.00 area resistance. #swingtrading

https://twitter.com/SwingAlerts_CT/status/999663951192436736

Netflix Is Now Worth More Than Comcast And Is Almost Beating Disney

http://fortune.com/2018/05/23/netflix-worth-more-comcast-record-stock/

Per previous;

April 9 – $NFLX testing 50 MA support, upside quad wall resistance and trading near main chart pivot decision.

Below is an updated and blown up version of the previous chart posted.

With earnings in seven days… the Netflix chart is on the top of my personal watchlist now, and here’s why;

The really interesting thing here is the bull bear fight in play. If you look close you will see the top of the candles the last 3 days hitting the quad wall resistance (gray dotted) and sitting on 50 MA support on this daily chart (50 MA is an important indicator in swing trading) and most interesting is that trade is near the mid quad main pivot area of the chart (gray horizontal line with gray arrow).

What does this mean?

My Netflix trading plan in bull scenario…. Trade above 300.00 and 20 MA (blue) is a long to 313.92 then 315.92 then 328 area.

And for bearish trade scenario… Trade below 285.00 / 290.00 and 50 MA targets 278.33 then 275.50 then 263.29.

More notes on this trade set-up at next chart below also.

Further to my Netflix swing trading plan… it would be ideal to time a turn up in the MACD. The chart below shows that the Stochastic RSI has already curled up and was near bottom (leading indicator typically and the fact it got so close to the bottom is perfect) and the MACD is near the bottom and so is the Squeeze Momentum Indicator (I would expect this to turn next and then the MACD)

I really like this set-up for a long side trade. Hoping price actions proves this trade set-up out here.

$NFLX Stochastic RSI has turned (leading indicator) with MACD near bottom and SQZMOM near bottom.

Netflix News: Tech Stocks Shine As Nasdaq Jumps 2%; Netflix, Alphabet Lead FANG Stocks

$GSIT – GSI Technology.

July 3 – GSI TECH (GSIT) All indicators have gone silent, trading in range of historical gap – indecisive. $GSIT #chart

May 25 – $GSIT trading 7.43 with all indicators and price indecisive. Watching.

GSI Technology Announces Participation in 8th Annual LD Micro Invitational

https://finance.yahoo.com/news/gsi-technology-announces-participation-8th-163239398.html?.tsrc=rss

Per recent;

April 9 – $GSIT at this point is screaming indecisive on all charting indicators reviewed. Wait.

$AXP – American Express

Jul 3 – AMERICAN EXPRESS (AXP) With the 50 MA coming to meet price on the weekly stock chart, will price retrace like it did previous or break out. $AXP. We’re watching.

May 25 – $AXP working on a break of all time highs. I will likely daytrade over 104.00 and wait for a retrace to swing it. MACD is turned up on weekly chart but price is extended above MA’s. It will likely run but how far before a retrace now is at issue in a swing.

How Mastercard’s Second Quarter Could Shake Out

https://marketrealist.com/2018/05/how-mastercards-second-quarter-could-shake-out

April 9 – $AXP riding 200 MA with indecisive indicators and earnings in nine days. Wait.

$ABX – Barrick Gold

July 2 – BARRICK GOLD (ABX) Looks like it will coil under the key pivot until a decision is made. Watching. $ABX #stock #chart

May 25 – Barrick looks like it could turn here with MACD starting to turn and Stoch RSI curled up. On watch over pivot and 50 MA. $ABX #swingtrading

Barrick (ABX) Up 2.2% Since Earnings Report: Can It Continue?

https://finance.yahoo.com/news/barrick-abx-2-2-since-125312749.html?.tsrc=rss

$TAN – INVESCO SOLAR ETF

July 3 – INVESCO SOLAR ETF (TAN) Could turn here for at least a bounce. All indicators turning after sell off. $TAN #trade

May 25 – $TAN over pivot but on a turn down, watch pivot if it fails the 200 MA test is in play. MACD about to turn down. Stoch RSI turned.

Solar-company ETFs gain after California requires new homes to have solar panels

$TAN News: Top 5 Alternative Energy ETFs for 2018 https://www.investopedia.com/etfs/top-alternative-energy-etfs/?partner=YahooSA&yptr=yahoo

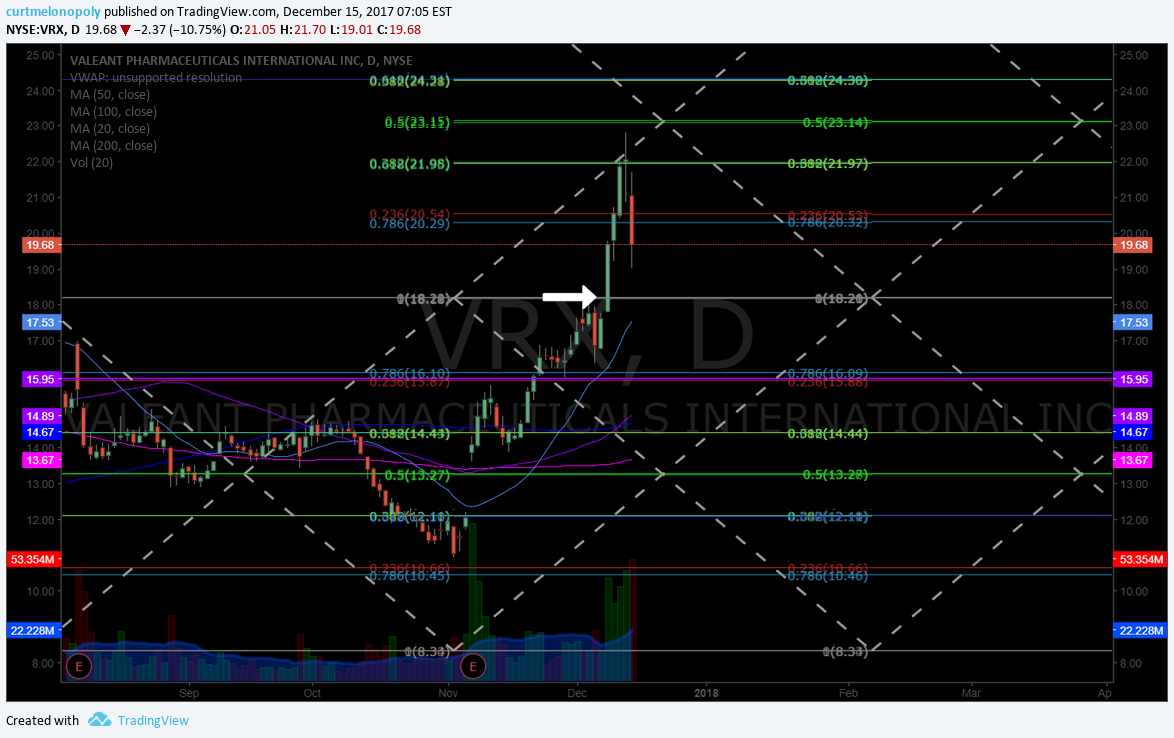

$VRX – VALEANT

July 3 – VALEANT (VRX) Time cycle concludes July 9, time to have next trajectory on watch and trade it. $VRX #swingtrading #daytrading

Will trade the new time cycle levels as / when the trajectory takes shape. On high watch now.

May 25 – $VRX trade over 23.17 targets 24.30 and over targets 28.00 July 6 as bullish scenario. But a retrace likely first if up plays out.

I like this one a lot now so it is on high watch. Most probable scenario is a test of mid quad fib at 23.17 and possibly 24.30 and a retrace to near diagonal trendline (quad wall) below and then bounce. But I will be watching close for the mid quad fib resistance test around 23.17.

Cantor Fitzgerald: 18 Drug Companies With Catalysts Worth Watching https://finance.yahoo.com/news/cantor-fitzgerald-18-drug-companies-201029170.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

https://www.tradingview.com/chart/VRX/4n3vc9EW-VRX-trade-over-23-17-targets-24-30-and-over-targets-28-00-July/

April 9 – $VRX is very indecisive here. No trade alert here.

$TWLO – TWILIO

July 3 – TWILIO (TWLO) Pinched between 20 and 50 MA on daily. Will wait for conclusion before forming a trade. $TWLO #chart

May 25 – $TWLO weekly chart structure very aggressive to bull side with Stochastic RSI turn down but it looks like there’s upside yet. Daily chart below the weekly.

When the Stoch RSI and MACD turn back up on daily it is likely a decent long. On watch. #swingtrading $TWLO

Twilio to Present at the 2018 Bank of America Merrill Lynch Global Technology Conference

https://finance.yahoo.com/news/twilio-present-2018-bank-america-201500267.html?.tsrc=rss

$WYNN – WYNN RESORTS

July 3 – WYNN RESORTS (WYNN) MACD still turned down on daily chart, waiting for a turn at this point. $WYNN #chart

May 25 – $WYNN weekly chart says a retrace is soon, this is an opinion however, as there are no clear indications. On watch.

On the daily chart (not show) I will be watching for a pull back to 50 MA and 100 MA for a possible bounce.

Trump, China Trade, Target and Las Vegas Casinos – 5 Things You Must Know

https://www.thestreet.com/markets/5-things-you-must-know-14596890?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

Per recent;

April 9 – $WYNN trade action has turned indecisive also with earnings in sixteen days I will be watching close.

$XME – SPDR S&P Metals and Mining ETF

July 3 – XME is still coiling under that pivot in chart below. Watching.

May 25 – $XME over 38.41 with built up structure is an interesting long possible swing trade. On watch.

$WWR – Westwater Resources (Previously known as $URRE)

Jul 10 – Trading .40 in downtrend. No action. Likely to remove from our coverage in near term.

May 29 – Trading .40 in downtrend. No action.

April 12 – Trading down trend long term. No action.

Mar 5 – $WWR Trading .79 with indecisive trade action and indicators. Caution.

$RIG

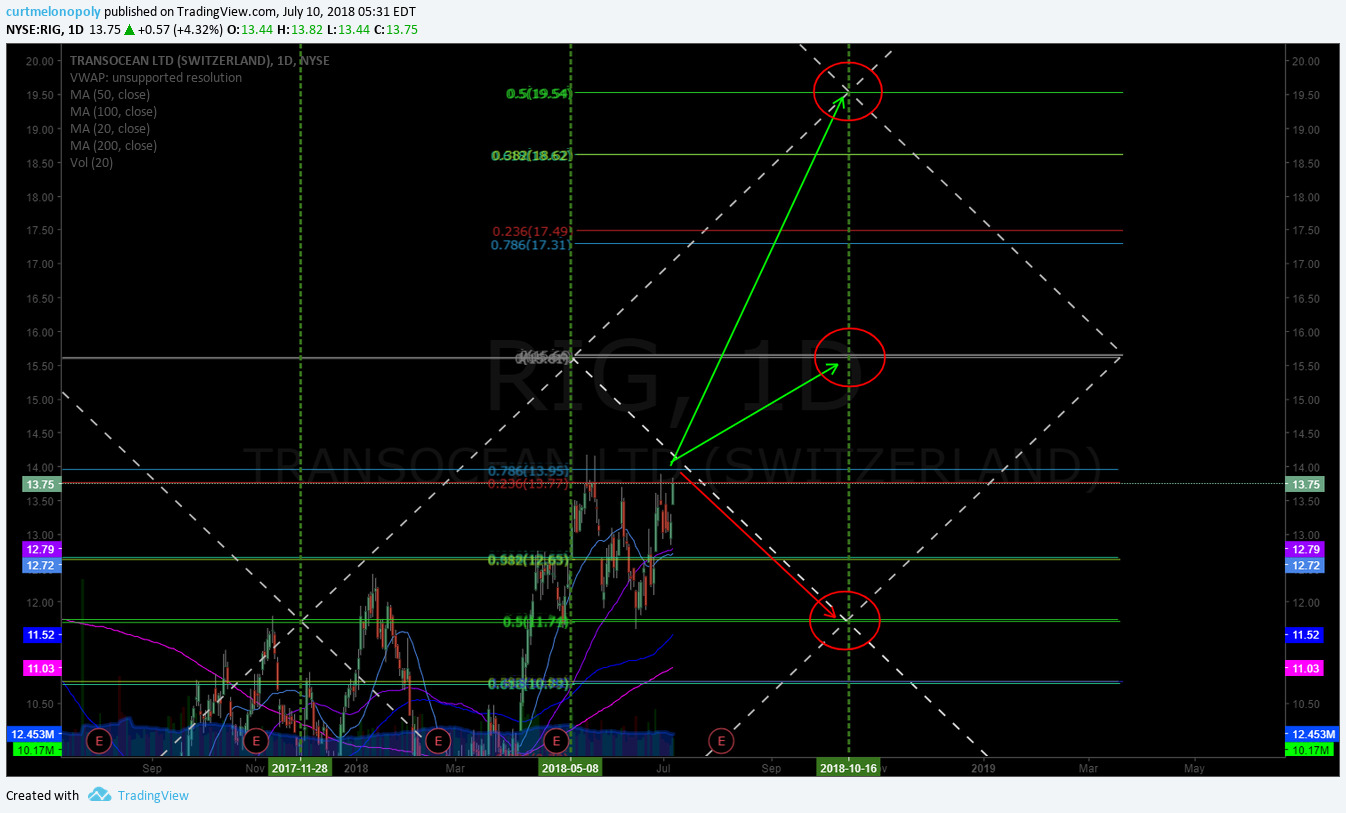

July 10 – TRANSOCEAN (RIG) Trading 13.74 with upside targets 15.63 19.54 with earnings in 27 days. $RIG #swingtrading #chart

Stochastic RSI, MACD, SQZMOM all turned up on the daily chart for RIG. High probability the first target of 15.63 is hit early and depending on earnings action the upper 19.54 target could be in play. On watch now for earnings play.

Energy: Marathon Oil and Transocean Look Like Buys

ByTeresa Rivas July 9, 2018 10:23 a.m. ET

May 29 – $RIG has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Earnings : Transocean Ltd. Announces First Quarter 2018 Earnings Release Date

GlobeNewswire https://finance.yahoo.com/news/transocean-ltd-announces-first-quarter-210053348.html?.tsrc=rss

$XLE

July 10 – SPDR SELECT SECTOR FUND – ENERGY SECTOR (XLE) On watch close in to earnings season. $XLE #energy #swingtrading

$XLE Energy ETFs May Strike it Big This Earnings Season https://finance.yahoo.com/news/energy-etfs-may-strike-big-190937451.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

May 25 – $XLE has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Energy ETFs Plunge as OPEC Looks to Higher Production

https://finance.yahoo.com/news/energy-etfs-plunge-opec-looks-180340726.html?.tsrc=rss

Per recent;

April 12 – $XLE a very tough trade because it has been range bound. Weekly chart about to test 200 MA.

Over the 200 MA on weekly chart with indicators set up right – with also the daily chart set-up and a trade may trigger.

Related news: These energy stocks stand to benefit from U.S. shale’s best—and worst—days. Occidental, EOG, Andeavor among the Goldman picks helped by improved returns and free cash flow https://www.marketwatch.com/Story/these-energy-stocks-stand-to-benefit-from-us-shales-bestand-worstdays-2018-04-12?&siteid=yhoof2&yptr=yahoo

$SLX – Vaneck Vectors Steel

July 10 – VANECK VECTORS STEEL ETF (SLX) MACD on daily has turned up with price over 200 MA. Bullish. $SLX #swingtrading #chart

Looking good going in to earnings. Hope to get a long side win here. On watch.

May 25 – $SLX also has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Related News: Why It’s Time to Be Cautious on Steel, Steel ETFs https://finance.yahoo.com/news/why-time-cautious-steel-steel-160723425.html?.tsrc=rss

$X – United States Steel Corp.

July 10 – UNITED STATES STEEL CORP (X) MACD is turning up and on high watch in to earnings. $X #swingtrading

May 29 – $X on a MACD turn up looks interesting as possible long. On watch for a turn.

US Steel Companies Keep Fingers Crossed, Key Deadline Looms

https://marketrealist.com/2018/05/us-steel-companies-keep-fingers-crossed-key-deadline-looms

Recent Trade Alerts / Chart Set-Up Posts:

July 10 – I will update this section soon.

$GDX Gold Miners (public alert, not on private Swing Trading Twitter Feed)

1:08 PM – 1 Apr 2018

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart https://t.co/tbZte7ikx8

— Melonopoly (@curtmelonopoly) April 1, 2018

11:51 AM – 8 Apr 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

$C Citi

2:33 PM – 4 Apr 2018

Citi quad wall & historical support near. 74.46 PT Chart notes. – #C chart

http://www.tradingview.com/chart/C/qRDWOlvu-Citi-quad-wall-historical-support-near-74-46-PT-Chart-notes/ … …

$C Citi at a quad wall and historical support test here. 74.46 June 15 time cycle price target in play. #swingtrading

https://twitter.com/SwingAlerts_CT/status/981600758792642562

11:31 AM – 5 Apr 2018

$C Citi 70.75 HOD puts it up on day 2% from yesterday alert. Watch the 200 MA resistance overhead.

https://twitter.com/SwingAlerts_CT/status/981917242467213313

$SPY SP500

9:40 AM – 28 Mar 2018 (originally on daytrading alert feed copied to Swing Trading alert feed also)

Trading 260.41 intra. $SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet. https://www.tradingview.com/chart/SPY/IDiDMAVs-SPY-Time-cycle-peak-on-this-simple-model-is-now-If-its-going-t/ …

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1

11:28 AM – 5 Apr 2018

$SPY strong trade set-up from recent alerts intra 266.42 with 268.00 resistance on deck.

https://twitter.com/SwingAlerts_CT/status/981916489212100608

$TSLA Tesla

3:11 PM – 4 Apr 2018

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

11:23 AM – 5 Apr 2018

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$DIS Disney

3:24 PM – 4 Apr 2018

$DIS trading 100.57 has MACD on daily targeting 103.89 110.64 May 30. #swingtrading Other targets noted. https://www.tradingview.com/chart/DIS/241M4TSO-DIS-trading-100-57-has-MACD-on-daily-targeting-103-89-110-64-Ma/ …

https://twitter.com/SwingAlerts_CT/status/981613492896755713

11:22 AM – 5 Apr 2018

$DIS swing trade set-up from swing trading report yesterday blasting here. Nice set-up. Trading 101.81 intra-day.

https://twitter.com/SwingAlerts_CT/status/981914928528416768

$CELG Celgene

5:56 PM – 26 Mar 2018

$CELG hit last price target – targets 95.90 Apr 3. Chart notes. https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/ …

https://twitter.com/SwingAlerts_CT/status/978390139201302529

1:21 PM – 8 Apr 2018

$CELG 86s to 91s off alert, buy sell trigger now. Waiting for trade direction triggers. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/

https://twitter.com/SwingAlerts_CT/status/983031984753692672

$FB Facebook

Buy side of $FB has started again in 164 range now… in a snap back long watch 167.50 mid quad resistance very closely.

12:17 PM – 20 Mar 2018

https://twitter.com/SwingAlerts_CT/status/976130671176450051

4:43 PM – 20 Mar 2018

$FB bounced off buy side alert earlier in 164s now trading 168.15 above mid quad support. #snapback #trading #alert

https://twitter.com/SwingAlerts_CT/status/976197473030037504

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Alerts, $XLE, $X, $SLX, $RIG, $NFLX, $AXP, $TAN, $TWLO, $WYNN, $VRX, $ABX, $XME, $GSIT

Swing Trading Stock Update Tues May 29 (Part B) $X, $XLE, $WWR, $XLS, $RIG, $XME …

Welcome to the Compound Trading Swing Trade Report Tuesday May 29, 2018 (Part B).

In this edition: $X, $XLE, $WWR, $XLS, $RIG, $XME.

Notices:

Good day!

This swing trading report is Part B of one of five in rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators at bottom of chart screen (MACD, Stochastic RSI, Squeeze Momentum) double click on chart body to remove indicators from chart – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue provided to you.

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage:

$NFLX – Netflix

May 25 – Netflix swing trade going well. Stochastic RSI is high watch that, more importantly watch MACD and resistance levels charted. $NFLX #swingtrade

$NFLX in to resistance 348.00 area. Trim in to add above to 360.00 area resistance. #swingtrading

https://twitter.com/SwingAlerts_CT/status/999663951192436736

Netflix Is Now Worth More Than Comcast And Is Almost Beating Disney

http://fortune.com/2018/05/23/netflix-worth-more-comcast-record-stock/

Per previous;

April 9 – $NFLX testing 50 MA support, upside quad wall resistance and trading near main chart pivot decision.

Below is an updated and blown up version of the previous chart posted.

With earnings in seven days… the Netflix chart is on the top of my personal watchlist now, and here’s why;

The really interesting thing here is the bull bear fight in play. If you look close you will see the top of the candles the last 3 days hitting the quad wall resistance (gray dotted) and sitting on 50 MA support on this daily chart (50 MA is an important indicator in swing trading) and most interesting is that trade is near the mid quad main pivot area of the chart (gray horizontal line with gray arrow).

What does this mean?

My Netflix trading plan in bull scenario…. Trade above 300.00 and 20 MA (blue) is a long to 313.92 then 315.92 then 328 area.

And for bearish trade scenario… Trade below 285.00 / 290.00 and 50 MA targets 278.33 then 275.50 then 263.29.

More notes on this trade set-up at next chart below also.

Further to my Netflix swing trading plan… it would be ideal to time a turn up in the MACD. The chart below shows that the Stochastic RSI has already curled up and was near bottom (leading indicator typically and the fact it got so close to the bottom is perfect) and the MACD is near the bottom and so is the Squeeze Momentum Indicator (I would expect this to turn next and then the MACD)

I really like this set-up for a long side trade. Hoping price actions proves this trade set-up out here.

$NFLX Stochastic RSI has turned (leading indicator) with MACD near bottom and SQZMOM near bottom.

Netflix News: Tech Stocks Shine As Nasdaq Jumps 2%; Netflix, Alphabet Lead FANG Stocks

Mar 5 – $NFLX How to trade the move with price targets #swingtrading – see feature post link below for complete trade set-up details.

Feb 26 – Feature Post https://compoundtrading.com/trade-momo-move-2/

$GSIT

May 25 – $GSIT trading 7.43 with all indicators and price indecisive. Watching.

GSI Technology Announces Participation in 8th Annual LD Micro Invitational

https://finance.yahoo.com/news/gsi-technology-announces-participation-8th-163239398.html?.tsrc=rss

Per recent;

April 9 – $GSIT at this point is screaming indecisive on all charting indicators reviewed. Wait.

Mar 5 – $GSIT Trading 7.91 with indecisive indicators.

$AXP – American Express

May 25 – $AXP working on a break of all time highs. I will likely daytrade over 104.00 and wait for a retrace to swing it. MACD is turned up on weekly chart but price is extended above MA’s. It will likely run but how far before a retrace now is at issue in a swing.

How Mastercard’s Second Quarter Could Shake Out

https://marketrealist.com/2018/05/how-mastercards-second-quarter-could-shake-out

April 9 – $AXP riding 200 MA with indecisive indicators and earnings in nine days. Wait.

Mar 5 – $AXP Trading 95.74 with indications trending down. Looking for 200 MA test.

Jan 23 – $AXP 50 MA support test with Stoch RSI near bottom and MACD trending down. Watching.

$ABX – Barrick Gold

May 25 – Barrick looks like it could turn here with MACD starting to turn and Stoch RSI curled up. On watch over pivot and 50 MA. $ABX #swingtrading

Barrick (ABX) Up 2.2% Since Earnings Report: Can It Continue?

https://finance.yahoo.com/news/barrick-abx-2-2-since-125312749.html?.tsrc=rss

April 9 – $ABX with earnings in 14 days and trade under 50 MA 200 MA and main pivot it is indecisive. Wait.

Mar 5 – $ABX Trading 11.54 with poor indicators. Watching.

$TAN

May 25 – $TAN over pivot but on a turn down, watch pivot if it fails the 200 MA test is in play. MACD about to turn down. Stoch RSI turned.

Solar-company ETFs gain after California requires new homes to have solar panels

Per recent;

April 9 – $TAN swing trade set-up here for long side risk reward with price pinched between 200 MA and main pivot.

The secret to this long side bias trade is to let price prove itself over pivot and the indicators all turned up.

High on my watch list also now. I like this set-up.

$TAN News: Top 5 Alternative Energy ETFs for 2018 https://www.investopedia.com/etfs/top-alternative-energy-etfs/?partner=YahooSA&yptr=yahoo

$VRX

May 25 – $VRX trade over 23.17 targets 24.30 and over targets 28.00 July 6 as bullish scenario. But a retrace likely first if up plays out.

I like this one a lot now so it is on high watch. Most probable scenario is a test of mid quad fib at 23.17 and possibly 24.30 and a retrace to near diagonal trendline (quad wall) below and then bounce. But I will be watching close for the mid quad fib resistance test around 23.17.

Cantor Fitzgerald: 18 Drug Companies With Catalysts Worth Watching https://finance.yahoo.com/news/cantor-fitzgerald-18-drug-companies-201029170.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

https://www.tradingview.com/chart/VRX/4n3vc9EW-VRX-trade-over-23-17-targets-24-30-and-over-targets-28-00-July/

April 9 – $VRX is very indecisive here. No trade alert here.

Mar 5 – $VRX Trading 14.88 under 200 MA with all indicators trending down. Bearish.

$TWLO

May 25 – $TWLO weekly chart structure very aggressive to bull side with Stochastic RSI turn down but it looks like there’s upside yet. Daily chart below the weekly.

When the Stoch RSI and MACD turn back up on daily it is likely a decent long. On watch. #swingtrading $TWLO

Twilio to Present at the 2018 Bank of America Merrill Lynch Global Technology Conference

https://finance.yahoo.com/news/twilio-present-2018-bank-america-201500267.html?.tsrc=rss

Per recent;

April 9 – $TWLO indicators on weekly are over extended and downside trade limited imo. No trade yet.

Mar 5 – $TWLO Trading 36.84 very bullish on weekly chart – waiting for pull back. Last report bullish bias was spot on.

$WYNN

May 25 – $WYNN weekly chart says a retrace is soon, this is an opinion however, as there are no clear indications. On watch.

On the daily chart (not show) I will be watching for a pull back to 50 MA and 100 MA for a possible bounce.

Trump, China Trade, Target and Las Vegas Casinos – 5 Things You Must Know

https://www.thestreet.com/markets/5-things-you-must-know-14596890?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

Per recent;

April 9 – $WYNN trade action has turned indecisive also with earnings in sixteen days I will be watching close.

Mar 5 – $WYNN Weekly chart says caution long as MACD is turned down even though Stoch RSI says short term pop.

$XME – SPDR S&P Metals and Mining ETF

May 25 – $XME over 38.41 with built up structure is an interesting long possible swing trade. On watch.

Per recent;

April 12 – $XME not far from upside resistance test of 50 MA. Stochastic RSI high but MACD trending up. 50 MA on watch.

$WWR – Westwater Resources (Previously known as $URRE)

May 29 – Trading .40 in downtrend. No action.

April 12 – Trading down trend long term. No action.

Mar 5 – $WWR Trading .79 with indecisive trade action and indicators. Caution.

$RIG

May 29 – $RIG has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Per recent;

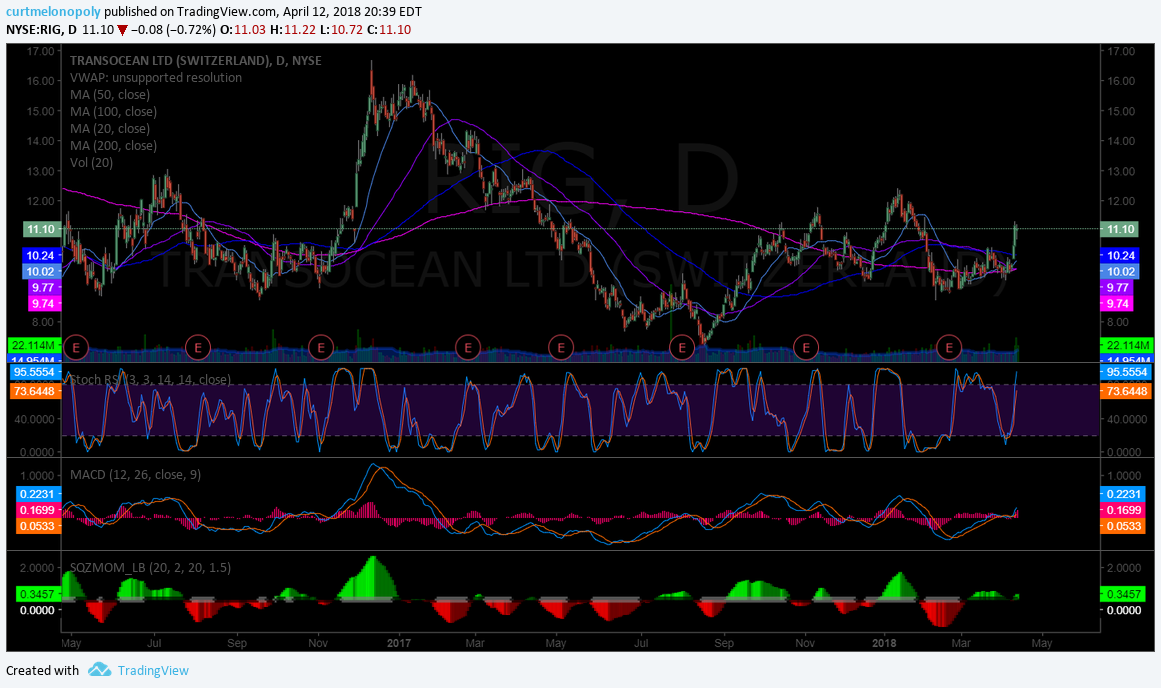

April 12 – $RIG This could be $RIG upside run setting up with price above MA’s and MACD trending up. On Watch.

Earnings : Transocean Ltd. Announces First Quarter 2018 Earnings Release Date

GlobeNewswire https://finance.yahoo.com/news/transocean-ltd-announces-first-quarter-210053348.html?.tsrc=rss

$XLE

May 25 – $XLE has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Energy ETFs Plunge as OPEC Looks to Higher Production

https://finance.yahoo.com/news/energy-etfs-plunge-opec-looks-180340726.html?.tsrc=rss

Per recent;

April 12 – $XLE a very tough trade because it has been range bound. Weekly chart about to test 200 MA.

Over the 200 MA on weekly chart with indicators set up right – with also the daily chart set-up and a trade may trigger.

Related news: These energy stocks stand to benefit from U.S. shale’s best—and worst—days. Occidental, EOG, Andeavor among the Goldman picks helped by improved returns and free cash flow https://www.marketwatch.com/Story/these-energy-stocks-stand-to-benefit-from-us-shales-bestand-worstdays-2018-04-12?&siteid=yhoof2&yptr=yahoo

Mar 5 – $XLE trading 66.44 with indecisive to bearish indicators under 200 MA. Caution.

$SLX – Vaneck Vectors Steel

May 25 – $SLX also has been selling off on daily and MACD trending down. Will consider on a MACD turn.

Per recent:

April 12 – $SLX at a historical primary pivot area indicators indecisive and under 20 MA. Range bound slight uptrend. No trade at this time, however, if fundamentals lined up and technical did I would consider.

Related News: Why It’s Time to Be Cautious on Steel, Steel ETFs https://finance.yahoo.com/news/why-time-cautious-steel-steel-160723425.html?.tsrc=rss

$X – United States Steel Corp.

May 29 – $X on a MACD turn up looks interesting as possible long. On watch for a turn.

US Steel Companies Keep Fingers Crossed, Key Deadline Looms

https://marketrealist.com/2018/05/us-steel-companies-keep-fingers-crossed-key-deadline-looms

Per recent;

April 12 – $X MACD trending down on weekly chart. Squeeze momentum trending down also. No trade.

Recent Trade Alerts / Chart Set-Up Posts:

May 29 – I will update this section soon.

$GDX Gold Miners (public alert, not on private Swing Trading Twitter Feed)

1:08 PM – 1 Apr 2018

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart https://t.co/tbZte7ikx8

— Melonopoly (@curtmelonopoly) April 1, 2018

11:51 AM – 8 Apr 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

$C Citi

2:33 PM – 4 Apr 2018

Citi quad wall & historical support near. 74.46 PT Chart notes. – #C chart

http://www.tradingview.com/chart/C/qRDWOlvu-Citi-quad-wall-historical-support-near-74-46-PT-Chart-notes/ … …

$C Citi at a quad wall and historical support test here. 74.46 June 15 time cycle price target in play. #swingtrading

https://twitter.com/SwingAlerts_CT/status/981600758792642562

11:31 AM – 5 Apr 2018

$C Citi 70.75 HOD puts it up on day 2% from yesterday alert. Watch the 200 MA resistance overhead.

https://twitter.com/SwingAlerts_CT/status/981917242467213313

$SPY SP500

9:40 AM – 28 Mar 2018 (originally on daytrading alert feed copied to Swing Trading alert feed also)

Trading 260.41 intra. $SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet. https://www.tradingview.com/chart/SPY/IDiDMAVs-SPY-Time-cycle-peak-on-this-simple-model-is-now-If-its-going-t/ …

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1

11:28 AM – 5 Apr 2018

$SPY strong trade set-up from recent alerts intra 266.42 with 268.00 resistance on deck.

https://twitter.com/SwingAlerts_CT/status/981916489212100608

$TSLA Tesla

3:11 PM – 4 Apr 2018

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

11:23 AM – 5 Apr 2018

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$DIS Disney

3:24 PM – 4 Apr 2018

$DIS trading 100.57 has MACD on daily targeting 103.89 110.64 May 30. #swingtrading Other targets noted. https://www.tradingview.com/chart/DIS/241M4TSO-DIS-trading-100-57-has-MACD-on-daily-targeting-103-89-110-64-Ma/ …

https://twitter.com/SwingAlerts_CT/status/981613492896755713

11:22 AM – 5 Apr 2018

$DIS swing trade set-up from swing trading report yesterday blasting here. Nice set-up. Trading 101.81 intra-day.

https://twitter.com/SwingAlerts_CT/status/981914928528416768

$CELG Celgene

5:56 PM – 26 Mar 2018

$CELG hit last price target – targets 95.90 Apr 3. Chart notes. https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/ …

https://twitter.com/SwingAlerts_CT/status/978390139201302529

1:21 PM – 8 Apr 2018

$CELG 86s to 91s off alert, buy sell trigger now. Waiting for trade direction triggers. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/

https://twitter.com/SwingAlerts_CT/status/983031984753692672

$FB Facebook

Buy side of $FB has started again in 164 range now… in a snap back long watch 167.50 mid quad resistance very closely.

12:17 PM – 20 Mar 2018

https://twitter.com/SwingAlerts_CT/status/976130671176450051

4:43 PM – 20 Mar 2018

$FB bounced off buy side alert earlier in 164s now trading 168.15 above mid quad support. #snapback #trading #alert

https://twitter.com/SwingAlerts_CT/status/976197473030037504

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Alerts, $X, $XLE, $WWR, $XLS, $RIG, $XME

Swing Trading Stock Update Thurs Apr 12 (Part B) $XLE, $XME, $RIG, $SLX, $X …

Welcome to the Compound Trading Swing Trade Report Thursday April 12, 2017 (Part B). $NFLX, $TAN, $WYNN, $AXP, $TWLO, $VRX, $GSIT, $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X.

Notices:

Good day!

This swing trading report is Part B of one of five in rotation. Part A went was processed on April 9 and is included in the first part of this report also.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators at bottom of chart screen (MACD, Stochastic RSI, Squeeze Momentum) double click on chart body to remove indicators from chart – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue provided to you.

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage:

$NFLX – Netflix

April 9 – $NFLX testing 50 MA support, upside quad wall resistance and trading near main chart pivot decision.

Below is an updated and blown up version of the previous chart posted.

With earnings in seven days… the Netflix chart is on the top of my personal watchlist now, and here’s why;

The really interesting thing here is the bull bear fight in play. If you look close you will see the top of the candles the last 3 days hitting the quad wall resistance (gray dotted) and sitting on 50 MA support on this daily chart (50 MA is an important indicator in swing trading) and most interesting is that trade is near the mid quad main pivot area of the chart (gray horizontal line with gray arrow).

What does this mean?

My Netflix trading plan in bull scenario…. Trade above 300.00 and 20 MA (blue) is a long to 313.92 then 315.92 then 328 area.

And for bearish trade scenario… Trade below 285.00 / 290.00 and 50 MA targets 278.33 then 275.50 then 263.29.

More notes on this trade set-up at next chart below also.

Further to my Netflix swing trading plan… it would be ideal to time a turn up in the MACD. The chart below shows that the Stochastic RSI has already curled up and was near bottom (leading indicator typically and the fact it got so close to the bottom is perfect) and the MACD is near the bottom and so is the Squeeze Momentum Indicator (I would expect this to turn next and then the MACD)

I really like this set-up for a long side trade. Hoping price actions proves this trade set-up out here.

$NFLX Stochastic RSI has turned (leading indicator) with MACD near bottom and SQZMOM near bottom.

Netflix News: Tech Stocks Shine As Nasdaq Jumps 2%; Netflix, Alphabet Lead FANG Stocks https://finance.yahoo.com/m/958e733b-9932-3701-9448-0357fbf249f1/tech-stocks-shine-as-nasdaq.html?.tsrc=rss

Mar 5 – $NFLX How to trade the move with price targets #swingtrading – see feature post link below for complete trade set-up details.

Feb 26 – Feature Post https://compoundtrading.com/trade-momo-move-2/

Jan 23 – $NFLX trading 248.07 in premarket post ER trade extended way above MA’s on daily. Wait for MA bounce structure to setup.

Dec 15 – $NFLX trading 188.30 premarket under 20 and 50 MA with MACD that could turn up.

When price above 20 and 50 MA’s and MACD turns up this likely becomes a long trade. Will post buy/sell triggers as a trade nears. On high watch here.

$GSIT

April 9 – $GSIT at this point is screaming indecisive on all charting indicators reviewed. Wait.

Mar 5 – $GSIT Trading 7.91 with indecisive indicators.

Jan 23 – $GSIT Trading 8.38 with indecisive indicators up decent from mid Aug 2017 lows. Watching.

$AXP – American Express

April 9 – $AXP riding 200 MA with indecisive indicators and earnings in nine days. Wait.

Mar 5 – $AXP Trading 95.74 with indications trending down. Looking for 200 MA test.

Jan 23 – $AXP 50 MA support test with Stoch RSI near bottom and MACD trending down. Watching.

Dec 15 – $AXP trading 97.10 with indicators pointing down – watching for test and bounce of MA’s.

$ABX – Barrick Gold

April 9 – $ABX with earnings in 14 days and trade under 50 MA 200 MA and main pivot it is indecisive. Wait.

Mar 5 – $ABX Trading 11.54 with poor indicators. Watching.

Jan 23 – $ABX trading 14.51 over 50 MA under 20 100 200 MAs. Stoch RSI near bottom. Watching.

$TAN

April 9 – $TAN swing trade set-up here for long side risk reward with price pinched between 200 MA and main pivot.

The secret to this long side bias trade is to let price prove itself over pivot and the indicators all turned up.

High on my watch list also now. I like this set-up.

$TAN News: Top 5 Alternative Energy ETFs for 2018 https://www.investopedia.com/etfs/top-alternative-energy-etfs/?partner=YahooSA&yptr=yahoo

Mar 5 – $TAN trading 24.31 with indecisive indicators on the daily chart. Watching.

$VRX

April 9 – $VRX is very indecisive here. No trade alert here.

Mar 5 – $VRX Trading 14.88 under 200 MA with all indicators trending down. Bearish.

Jan 23 – $VRX trading 22.03 with Stoch RSI near bottom but MACD is turned down. Will wait for MACD to curl up. #swingtrading

$TWLO

April 9 – $TWLO indicators on weekly are over extended and downside trade limited imo. No trade yet.

Mar 5 – $TWLO Trading 36.84 very bullish on weekly chart – waiting for pull back. Last report bullish bias was spot on.

Jan 23 – $TWLO Trading 26.24 with Stoch RSI turned back up, MACD trend up, SQSMOM up and price over 20 50 MAs under 100 200 MAs.

This is actually not a bad set-up…. so I will watch.

$WYNN

April 9 – $WYNN trade action has turned indecisive also with earnings in sixteen days I will be watching close.

Mar 5 – $WYNN Weekly chart says caution long as MACD is turned down even though Stoch RSI says short term pop.

Jan 23 – $WYNN trading 195.23 on weekly chart Stoch RSI turned back up with earnings in 2 days.

$XME – SPDR S&P Metals and Mining ETF

April 12 – $XME not far from upside resistance test of 50 MA. Stochastic RSI high but MACD trending up. 50 MA on watch.

Mar 5 – $XME weekly chart says wait for confirmation on Stoch RSI for long bias.

$WWR – Westwater Resources (Previously known as $URRE)

April 12 – Trading down trend long term. No action.

Mar 5 – $WWR Trading .79 with indecisive trade action and indicators. Caution.

$RIG

April 12 – $RIG This could be $RIG upside run setting up with price above MA’s and MACD trending up. On Watch.

Earnings : Transocean Ltd. Announces First Quarter 2018 Earnings Release Date

GlobeNewswire https://finance.yahoo.com/news/transocean-ltd-announces-first-quarter-210053348.html?.tsrc=rss

Mar 5 – $RIG Trading 9.45 with indecisive indicators under 200 MA.

$XLE

April 12 – $XLE a very tough trade because it has been range bound. Weekly chart about to test 200 MA.

Over the 200 MA on weekly chart with indicators set up right – with also the daily chart set-up and a trade may trigger.

Related news: These energy stocks stand to benefit from U.S. shale’s best—and worst—days. Occidental, EOG, Andeavor among the Goldman picks helped by improved returns and free cash flow https://www.marketwatch.com/Story/these-energy-stocks-stand-to-benefit-from-us-shales-bestand-worstdays-2018-04-12?&siteid=yhoof2&yptr=yahoo

Mar 5 – $XLE trading 66.44 with indecisive to bearish indicators under 200 MA. Caution.

Jan 23 – $XLE trading 78.03 near previous high break-out. On close watch now. #swingtrading

$SLX – Vaneck Vectors Steel

April 12 – $SLX at a historical primary pivot area indicators indecisive and under 20 MA. Range bound slight uptrend. No trade at this time, however, if fundamentals lined up and technical did I would consider.

Related News: Why It’s Time to Be Cautious on Steel, Steel ETFs https://finance.yahoo.com/news/why-time-cautious-steel-steel-160723425.html?.tsrc=rss

Mar 5 – $SLX trending on daily with indicators indecisive – waiting for a 200 MA test

$X – United States Steel Corp.

April 12 – $X MACD trending down on weekly chart. Squeeze momentum trending down also. No trade.

Mar 5 – Trading 45.39 and exactly the same set-up / indicator scenario as $SLX. Watching.

Sept 23 – $X near historical resistance and previous high break out. On watch now.

Recent Trade Alerts / Chart Set-Up Posts:

$GDX Gold Miners (public alert, not on private Swing Trading Twitter Feed)

1:08 PM – 1 Apr 2018

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart

This, one of the cleanest easiest trades in market. Chart notes. – #GDX chart https://t.co/tbZte7ikx8

— Melonopoly (@curtmelonopoly) April 1, 2018

11:51 AM – 8 Apr 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

$C Citi

2:33 PM – 4 Apr 2018

Citi quad wall & historical support near. 74.46 PT Chart notes. – #C chart

http://www.tradingview.com/chart/C/qRDWOlvu-Citi-quad-wall-historical-support-near-74-46-PT-Chart-notes/ … …

$C Citi at a quad wall and historical support test here. 74.46 June 15 time cycle price target in play. #swingtrading

https://twitter.com/SwingAlerts_CT/status/981600758792642562

11:31 AM – 5 Apr 2018

$C Citi 70.75 HOD puts it up on day 2% from yesterday alert. Watch the 200 MA resistance overhead.

https://twitter.com/SwingAlerts_CT/status/981917242467213313

$SPY SP500

9:40 AM – 28 Mar 2018 (originally on daytrading alert feed copied to Swing Trading alert feed also)

Trading 260.41 intra. $SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet. https://www.tradingview.com/chart/SPY/IDiDMAVs-SPY-Time-cycle-peak-on-this-simple-model-is-now-If-its-going-t/ …

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1

11:28 AM – 5 Apr 2018

$SPY strong trade set-up from recent alerts intra 266.42 with 268.00 resistance on deck.

https://twitter.com/SwingAlerts_CT/status/981916489212100608

$TSLA Tesla

3:11 PM – 4 Apr 2018

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

11:23 AM – 5 Apr 2018

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$DIS Disney

3:24 PM – 4 Apr 2018

$DIS trading 100.57 has MACD on daily targeting 103.89 110.64 May 30. #swingtrading Other targets noted. https://www.tradingview.com/chart/DIS/241M4TSO-DIS-trading-100-57-has-MACD-on-daily-targeting-103-89-110-64-Ma/ …

https://twitter.com/SwingAlerts_CT/status/981613492896755713

11:22 AM – 5 Apr 2018

$DIS swing trade set-up from swing trading report yesterday blasting here. Nice set-up. Trading 101.81 intra-day.

https://twitter.com/SwingAlerts_CT/status/981914928528416768

$CELG Celgene

5:56 PM – 26 Mar 2018

$CELG hit last price target – targets 95.90 Apr 3. Chart notes. https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/ …

https://twitter.com/SwingAlerts_CT/status/978390139201302529

1:21 PM – 8 Apr 2018

$CELG 86s to 91s off alert, buy sell trigger now. Waiting for trade direction triggers. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/

https://twitter.com/SwingAlerts_CT/status/983031984753692672

$FB Facebook

Buy side of $FB has started again in 164 range now… in a snap back long watch 167.50 mid quad resistance very closely.

12:17 PM – 20 Mar 2018

https://twitter.com/SwingAlerts_CT/status/976130671176450051

4:43 PM – 20 Mar 2018

$FB bounced off buy side alert earlier in 164s now trading 168.15 above mid quad support. #snapback #trading #alert

https://twitter.com/SwingAlerts_CT/status/976197473030037504

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Article Topics; $NFLX, $TAN, $WYNN, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XLE,$XME, $RIG, $SLX, $X, Compound Trading, Swing, Trading, Stock, Picks, Alerts

Swing Trading Stock Update Mon Mar 5 $RIG, $X, $XME, $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT…

Welcome to the Compound Trading Swing Trade Report Monday Mar 5, 2017. $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X.

Notices:

Good morning!

This swing trading report is one of five in rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators at bottom of chart screen (MACD, Stochastic RSI, Squeeze Momentum) double click on chart body to remove indicators from chart – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue provided to you.

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage:

$NFLX – Netflix

Mar 5 – $NFLX How to trade the move with price targets #swingtrading – see feature post link below for complete trade set-up details.

Feb 26 – Feature Post https://compoundtrading.com/trade-momo-move-2/

Jan 23 – $NFLX trading 248.07 in premarket post ER trade extended way above MA’s on daily. Wait for MA bounce structure to setup.

Dec 15 – $NFLX trading 188.30 premarket under 20 and 50 MA with MACD that could turn up.

When price above 20 and 50 MA’s and MACD turns up this likely becomes a long trade. Will post buy/sell triggers as a trade nears. On high watch here.

Nov 21 – $NFLX trading 194.70 with MACD Stochastic RSI and SQZMOM trending down. Waiting for MACD turn to assess long.

Oct 31 – Trading 198.10 with MACD turned down above all MA’s on daily. On watch for MACD turn up and decision.

Sept 13 – Trading 185.40 bounced off 50 MA on daily since last report. MACD is now up, SQZMOM up but Stoch RSI peaking. Will assess when Stoch RSI bottoms and turns again.

Aug 18 – Trading 166.10. Indicators all pointing down and sitting on natural support. Waiting for indicators to turn.

Aug 7 – Trading 180.46 after its post earning’s break out. MACD turned down and will wait for it and other indicators to turn up before considering an entry.

July 24 – Closed premarket 188.40 from 158.20. Will watch for a re-enter pending some ER considerations early this week. Sentiment is pensive imo. Could go either way in market – generally speaking.

July 12 – Trading 158.20. Will watch here over its 50 ma and if 20 ma is about to breach 50 with price above and other indicators line up I will alert an add.

July 5 – Trading 146.17. Long from 159.35 200 shares on the 26th of June. Unfortunately thats where it turned down and now MACD is near bottom. 200 MA however is at 135.35 and that is possible. Understand that when I take an entry it is normally no more than 1/5 sizing until a trade proves itself out so I can usually take the down draft if required.

June 26 – Trading 158.33.

$NFLX pull back may be over MACD could cross up with SQZMOM and Stoch RSI trend up.On watch and I may take a long entry in premarket today.

$GSIT

Mar 5 – $GSIT Trading 7.91 with indecisive indicators.

Jan 23 – $GSIT Trading 8.38 with indecisive indicators up decent from mid Aug 2017 lows. Watching.

Dec 15 – $GSIT Trading 7.18 with MACD trending down. Will wait for a MACD turn for swing trade. Last report I stated that although the technical indicators appeared bullish that caution was warranted – the warning proved to be important as price did come under pressure. Now it’s a matter of allowing the chart to set-up for a long.

$AXP – American Express

Mar 5 – $AXP Trading 95.74 with indications trending down. Looking for 200 MA test.

Jan 23 – $AXP 50 MA support test with Stoch RSI near bottom and MACD trending down. Watching.

Dec 15 – $AXP trading 97.10 with indicators pointing down – watching for test and bounce of MA’s.

Nov 21 – $AXP American Express trading 93.95 Stoch RSI at bottom turn up MACD turned down SQZMOM turned down under 20 MA trending.

Wait for the MACD to curl back up and assess indicators for a long at that time.

$ABX – Barrick Gold

Mar 5 – $ABX Trading 11.54 with poor indicators. Watching.

Jan 23 – $ABX trading 14.51 over 50 MA under 20 100 200 MAs. Stoch RSI near bottom. Watching.

Dec 15 – $ABX trading 14.20 with indecisive indicators on daily chart but this could be close to bottom (IMO).

$TAN

Mar 5 – $TAN trading 24.31 with indecisive indicators on the daily chart. Watching.

Jan 23 – $TAN Solar ETF trending 20 MA test with Stoch RSI near bottom and MACD turned down. Watching.

Dec 15 – $TAN trading 24.48 with MACD about to turn up. Likely swing trade this one soon long. On high watch here.

$VRX

Mar 5 – $VRX Trading 14.88 under 200 MA with all indicators trending down. Bearish.

Jan 23 – $VRX trading 22.03 with Stoch RSI near bottom but MACD is turned down. Will wait for MACD to curl up. #swingtrading

Dec 15 – $VRX is on the turn and the mid quad horizontal lines are excellent entries and trim profits as you go. #swingtrading

Quad wall resistance recently hit and price came off – so pay attention to the quads (diagonal Fib trend lines)

18.20, 23.15 and so on.

$TWLO

Mar 5 – $TWLO Trading 36.84 very bullish on weekly chart – waiting for pull back. Last report bullish bias was spot on.

Jan 23 – $TWLO Trading 26.24 with Stoch RSI turned back up, MACD trend up, SQSMOM up and price over 20 50 MAs under 100 200 MAs.

This is actually not a bad set-up…. so I will watch.

$WYNN

Mar 5 – $WYNN Weekly chart says caution long as MACD is turned down even though Stoch RSI says short term pop.

Jan 23 – $WYNN trading 195.23 on weekly chart Stoch RSI turned back up with earnings in 2 days.

Oct 31 – Trading 141.21 under 20 and 50 MA and about to retest 100 MA. It bounced at 100 MA previous so this is on high watch now also for a bounce. Post earnings with surprise upside.

$XME

Mar 5 – $XME weekly chart says wait for confirmation on Stoch RSI for long bias.

Jan 23 – $XME Weekly chart with price above 200 MA challenging historical resistance. Above the resistance area a possible long trade is possible pending set-up at that time. On watch here.

$WWR – Westwater Resources (Previously known as $URRE)

Mar 5 – $WWR Trading .79 with indecisive trade action and indicators. Caution.

Jan 23 – Trading 1.51 with flat indicators. Watching.

Oct 31 – Trading .81 and all indicators tanking.

$RIG

Mar 5 – $RIG Trading 9.45 with indecisive indicators under 200 MA.

Jan 23 – $RIG trading 12.02 premarket with historical symmetry setting up intra-day that may be a good trade. #swingtrading

$XLE

Mar 5 – $XLE trading 66.44 with indecisive to bearish indicators under 200 MA. Caution.

Jan 23 – $XLE trading 78.03 near previous high break-out. On close watch now. #swingtrading

Oct 31 – $XLE Trading 67.69 and like $RIG and testing underside of 200 ma and it may get going again. Watching for MACD turn up.

$SLX – Vaneck Vectors Steel

Mar 5 – $SLX trending on dailing with indicators indecisive – waiting for a 200 MA test

Jan 23 – $SLX Steel ETF testing previous highs. On watch here now.

$X – United States Steel Corp.

Mar 5 – Trading 45.39 and exactly the same set-up / indicator scenario as $SLX. Watching.

Sept 23 – $X near historical resistance and previous high break out. On watch now.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X, Compound Trading, Swing, Trading, Stock, Picks

Swing Trading Stock Update Tues Jan 23 $RIG, $X, $XME, $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT…

Welcome to the Compound Trading Swing Trade Report Tuesday Jan 23, 2017. $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X.

Notices:

Good morning!

This swing trading report is one of five in rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.