Year: 2019

Oil Webinar Itinerary & Format | Everything I Know About Trading Crude Oil | March 24: 10 AM – 6 PM

Trading Crude Oil Webinar Format and Itinerary

Welcome to our newest webinar series. In this series of webinars I will be covering everything I know about various instruments of trade that we focus in at Compound Trading Group.

This series is an attempt to consolidate what we have learned over the last few years in to a neat condensed package that will be recorded for our clients.

The primary goal is to provide simple structured trade coaching to our most probable actionable set-ups.

Our webinar series includes and will be presented in this order; Crude Oil, Swing Trading (April 8), SP500 SPY (Apr 15), Gold (Apr 15), Silver (Apr 22), Volatility VIX (Apr 22), US Dollar DXY (Apr 22), Bitcoin (Apr 29) and Day Trading Momentum Equities (Apr 29). All the webinars will be presented prior to the end of April 2018 (so yes, April will be a busy month for me).

The first in this webinar series is for Crude Oil Trade, the topic of today’s webinar session. The crude oil session is scheduled for 8 hours and the others listed above will be 2 – 8 hours depending on the specific webinar.

If you cannot attend, or if you are in attendance and miss part of the webinar don’t worry, the webinars are recorded. Attendees will receive a free video report after the webinar.

Today’s webinar will cover my strategies for conventional and algorithmic oil trade and charting, intra-day trading, short term swing trading, longer term swing trading, trade sizing, time cycles, key set-ups and much more.

I will explain in detail how I maintain a win rate of better than 90% in crude oil trade (live recorded in our oil trading room and live alerted to our members).

Limited attendance of 25 persons to allow me to take questions and converse as needed to be sure we cover the trading concepts in detail.

Itinerary / Format:

Access webinar in main trading room. If you do not have the link and password please email us.

Questions are encouraged. Please ask questions, this helps our lead trader structure the webinar discussion and flow.

Please use the chat box to list questions in point form. If you can, please list questions during each break (if you are afraid of forgetting your questions then go ahead and put in the chat box during the regular session).

The lead trader will answer questions upon return from each break.

Breaks will be short and regular through-out the day. Average break time 10 – 15 mins and we expect to take 3 – 6 breaks. There is no specific scheduled time for breaks to allow for breaks at each critical point of discussion (per below).

10:00 AM Webinar Start.

The format is a live voice broadcast with live charting in our main trading room.

- Review question and answer format, breaks etc.

- Review other study resources; Discord private server, Oil Trading Blog, Crude Oil Trading Academy Web Page (the articles on this list are a must), You Tube, Previous Webinars, Trade Coaching (private and events).

- Review Mar 23, 2019 Client Memo – Crude Oil Trading Strategies With Highest Returns | Important Introduction | Private Client Series.

- Deconstruct the Trading Process Required to Achieve at Least an 80% Win Rate and a 2% Per Day Account Build in Crude Oil Trade.

- Use the Oil Algorithm Structured Models.

- Before you trade at all on any given day review the key support and resistance (trading range) of the Monthly, Weekly, Daily and 4 Hour Crude oil charting models. Define the ranges, review the trend and note the ranges or set alarms for the ranges. These are key for using the 30 minute and 1 minute models reviewed below.

- Lets get ready for this weeks trade. A run through of each chart model. Simplifying our levels and set ups for predictable trades. How to chart each time frame.

- Most probable trade set-ups (structures).

- See this previous post (and others) for examples Protected: Strategies for Day Trading and Swing Trading Crude Oil | Premium Member Newsletter

- Quad walls / channel support and resistance, mid channel lines, primary Fibonacci support and resistance.

- 1/4, 1/2 and full timing structures.

- Secondary set-ups such as end of week price targets, price targets for API and EIA.

- Price target locations on the model for intra-day indications of trade trajectory.

- Swing trading weekly range on model.

- Short term swing trading intra-day range on model.

- Day swing trading current intra-day structure.

- 30 Minute Candles.

- Trading range within body of candles.

- The 30 minute candle turn.

- Using the One Minute Model and other time frames.

- Order entries, sizing, closing trades.

- Specifically when to enter, when to size, when to trim and close each trade.

- Primary support and resistance on other time frames.

- Symmetry on chart models.

- Timing and Fibonacci on the one minute model.

- Order entries, sizing, closing trades.

- Time Cycles / Timing.

- API, EIA, regular market openings, lunch hour, 30 min quad and channel range, one minute time cycles.

- Intra-Day Trade Action to Signal Set-Ups.

- Intra day trend / momentum.

- Recognizing the intra-day structure of trade and when the momentum changes.

- Recognizing the key areas of intra-day trade action for highest probability trades and largest range of trade.

- Sell-Off Structure / Snap-Back Structure.

- Waterfall (Bearish) Structure / Trade Action and Bullish Trade Structure and Action on 1 minute time frame.

- Other set ups as time allows.

- Use the Oil Algorithm Structured Models.

6:00 PM Webinar Completion

Post webinar follow-up: the goal is to provide a plan for our attendees to execute the highest probability set-ups in crude oil for the coming week. Please send our lead trader an email approximately one week following the webinar with your trading success, failures and observations (thoughts) from the previous week. This will help you stay on track for the next week and will assist us in helping you with your trading journey.

Crude Oil Trading Strategies With Highest Returns | Important Introduction | Private Client Series

Welcome to the Compound Trading Group Private Client Series: Crude Oil Trading Strategies With The Highest Returns.

Introduction:

This document series will cover the best oil trading strategies we have garnered in our intensive research and application in real world trading (both mechanical human executed day trading and machine driven trading).

It will encompass what I have learned in my thirty year personal journey as a trader as well as the intensive deep research we have done at Compound Trading Group over the last two and a half years. The latter being more in depth than my own personal thirty year trading journey.

But first, bear with me in this introductory document as I provide important perspective for those new to our trading group, those to come in the future and of course for clients and stakeholders that have been with us for some time.

I will then share in great detail much of the best oil trading strategies we know.

The Release Process of Our Data.

This (the Crude Oil Trading Strategies with the Highest Returns Document Series) will be released in parts as data is consolidated and documented over the next month prior to our going private at the end of April 2019. “Going Private” meaning that just anyone off the street will not gain access to our crude oil trading data services simply because they paid and subscribed (more on that later). “Consolidated” because we have lived in a petri dish of oil trading data discovery for the last 2.5 years, and let me tell you, there is a need for consolidation of the data. “To be released in parts” because we have to author the series, and fast (before the end of April) – yes, this is a grass roots, organic, transparent upstart.

What Will be Made Public and What Will Remain Private. Our Edge.

Some of the documents in this trade knowledge consolidation series (or portions thereof) will be made public for various reasons, but most key data will not be made public.

Not all we have learned about the nature of crude oil trade will be released to even our key commercial clientele. Some knowledge must remain proprietary to our clients and some other proprietary for the benefit of our clients. In other words, we have an interest in maintaining a certain trading edge to our benefit and on behalf of our clients.

It is an interesting balance. For example, another goal within this series is to release enough data (or better described as the most pertinent data) needed for our client traders that are manually executing trades to use as the most actionable strategies for trading crude oil day to day (intraday crude oil trade and swing trading).

Another noted benefit of this series is that our stakeholders and commercial clients will gain an understanding of our growth processes (the discovery processes) and our rules based trading systems. This will facilitate understanding and provide for better communication with all involved.

Below I summarize our journey to date and then the first article in this series will be released before our oil trading webinar tomorrow. We expect new document posts in this series to be delivered to our clients at a rate on average of about one every two days between now and end of April, 2019.

An Important Time for our Oil Traders, Trading Team / Staff Developers, Client / Members and Stakeholders of Compound Trading Group.

Why? As I pointed out, tomorrow is our first (and very important) Oil Trading Webinar (an important focused opportunity to share in detail the best oil trading strategies we have learned), we recently started providing oil trade data to the SOVORON machine trading service, we are taking our oil trading alert / subscription service private soon and most importantly we recently finished our two and a half year systematic exploration of all crude oil technical trading methods we had set out to test, trade, code and re-test over and over again.

In other words, we are at an inflection in our growth process – at certain junctures in growth you have to trim off what doesn’t work and build roots in what does.

We are going private to take our current clients with us and cease spending time with on-boarding “new” clients. Not because we don’t want new clients, we simply don’t have the time for new clients and I want more time with our core clients.

But every business wants new clients! Not really – not the typical retail type client. We’re best suited to commercial trading groups. We want partners in our journey, traders in a core group, friends, comrades, those that are on a quest to be better and do better – be the best they can be in the markets…. those type of people and up and coming enterprises… but not your average retail trader that isn’t serious about a life long journey in the markets. Those folks are better managed by other groups.

And hey, if we’re as good as we think we are (or should be by now) then we should just be able to trade it up without a subscription service right? Exactly. One way to look at it.

We’re just built for a different type of client. Our commercial trading group clients, retail traders that are very serious and other specialized type of clients are our thing.

Truth be told, we are a privately financed operation with significant overhead (team staff etc to develop our machine trading related platforms) so we need to focus on profit, profit derived from our trading and in turn providing that data to commercial groups that also aspire to a greater than typical trading profit.

And to be perfectly frank, we want to build something exceptional, lasting and moderately revolutionary. Our goal is to build the best trading group in the markets and provide our success knowledge to others that are as serious as we are.

So we want to complete our development process in crude oil trade and soon get on to our swing trading platform (next) and the other algorithmic trading models such as SPY, Gold, Silver, Bitcoin, VIX, DXY and more.

Information Released to Date and Going Forward.

I know over time I / we have talked about moving toward solidifying / reconciling all we have discovered thus far as it relates to the historical nature of oil trade, but to be honest we didn’t know how far that journey of discovery would go so releasing specific data (the rule-set) was difficult – we didn’t know how deep the rabbit hole was.

We still haven’t rolled every rock, we know there are more but we don’t have time, so we have prioritized the rocks to roll over and we did that as publicly and transparently as we knew how. Although more recently I have to admit there are some things we just haven’t shared (special nuggets of data that obviously will provide a significant proprietary edge for us and our stake-holders / clients at various levels).

The point being, we have released some articles and we have promised more. This is the start of the more.

You can find previously released oil trading strategy articles here.

What We Set Out To Do and What We Plan Next. The Big.

In our journey we prioritized structured trading as it applies to thirteen time frames on conventional charting (one minute trading through to monthly time frames) and how various time cycles, order flow, liquidity, events and such determine crude oil trade within the specific structured time-frames.

I would think as a result of this deep dive in to the data that we are now one the worlds most knowledgeable groups as it applies to the trading structure of crude oil. Not just because of the data historically, but the data as it relates to the living moment to moment tick by tick trade of crude oil.

Looking at historical data is one thing, but relating that to real-time trade (by the tick living in the trade), applying that to real world trade and coding it is a completely different level of data analysis and trade platform development.

Our next is to be one the worlds most profitable oil trading groups and most sought after data providers. That is our goal.

How We Intend to Accomplish Our Goal. The World’s Best Oil Trade ROI.

As I noted above, “at certain junctures in growth you have to trim off what doesn’t work and build roots in what does.”

The only way to do that is to drill down and focus on (only trade) what we now know about how crude oil trades – the natural structure of oil trade. Sure there are anomalies on every time frame, but every financial instrument has a natural trading structure (the DNA of the instrument).

You can see this (what doesn’t work) in our own oil trading returns and alerts – in January we traded oil accounts up over 60% then in February 30% and in March some accounts are red and some green (referring to specifically only what we publicly alerted). The worst of our accounts are down about 3% in March thus far.

This example is a reflection of us in a real life setting executing real-time trades and applying that which we have learned (the rabbit hole of historical data), how to trade the data, can it be coded and executed like the data suggests? What works best? Why? And more.

Quite literally we grew our monthly returns month over month the last few years until we peaked in January and then our returns started to come off on a month over month basis. This is no random occurrence.

How does that happen?

As we got further and further down the rabbit hole we went to lower and lower time frames of trade, we learned more and more. We found order flow details, structural trade details and time cycle events that most would not know about. We found all kinds of details that we had no idea were there.

But what makes sense on paper (what mathematically works based on historical back testing) and what can be applied in real-life practice are two different things as you get down the rabbit hole (lower time frames), in other words in High Frequency Trading (HFT).

What makes sense on paper (what mathematically works based on historical back testing) and what can be applied in real-life practice are two different things

The easiest way to visualize this is to imagine it all (the financial instruments in markets on various time frames) as structures. We have learned that there are structures of trade (charting, geometric patterns and such), there are structures of liquidity and various other structures that assist in understanding the nature of crude oil trade.

This video will give you some insight “The mathematician who cracked Wall Street | Jim Simons” as will these rudimentary oil trading room videos from our day to day trade Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart and Oil Trading Room – How to trade intra day w EPIC the Algo Charting.

What Does Not Work.

Specifically and more recently, we have found what doesn’t work for us, it may work for others but it definitely does not work for us.

What is that? High frequency machine trade (HFT) on the lowest time frames. I am referring to high frequency machine trading on the one minute, half minute and quarter minute time frames – yes, we went that far down the rabbit hole.

How and why did we chase oil trade down to the lowest time frames?

Why? To gain competitive advantage we specifically chased liquidity in oil markets that move the price of oil. We wanted to know when specific entities are in trade so we can choose to be with them or not.

We not only want the structure of trade on all time-frames, we don’t only want the time cycles of trade on all chart time frames, we want to know WHO IS AFFECTING THE PRICE OF OIL and how we gain advantage with that. This is our IDENT program. We want the structure of trade, the timing of trade and what entities are trading.

How? We chased the order flow, the order book, the liquidity in the oil trade in markets using every data provider we could find. We chased the order flow tick by tick and back tested the order flow under the exact same methods we back test charting or trading structures. On every time frame sixty months back tick by tick and then bringing all that data back up to real-time and testing it tick by tick for months.

The structure or pattern of liquidity provides an ID.

You can’t imagine the affect that process has on your mind haha.

Anyway, we discovered that the high frequency machine trading specifically on the lowest time frames with what we refer to as the micro players works on paper (the back tested math works) BUT IT DOES NOT WORK IN PRACTICE.

This is why some of our account P/Ls are moderately red and some moderately green in March of 2019. This is how we went from over 60% returns per month in January to near 0% in March.

And we still believe our goal is 100% + per month (50% being minimum on average). Yes, this is true. In fact, our software techs spoke of 500%, but that was only possible in HFT as it related to what I describe above as what works on paper but does not work in practice.

Why Does High Frequency Machine Crude Oil Trading on the Lowest Time Frames Not Work?

High frequency machine trade on the lowest time frames in crude oil does not return nearly as well as the return that structured larger time frame machine (or even mechanically execute human trade) can provide.

Our optimum returns are in the thirty minute structure referencing the one minute time frame for specific entries and exits taking in account the key resistance and support of the various other time frames.

I can’t reveal everything because we are still going to uncover some rocks to confirm our conclusions, we still hold some hope that some day we will crack the code to successful HFT on lower time frames, but we don’t have much hope. We only have hope in theory because of the potential returns (as back tested on paper) but in practice we don’t see it being possible.

Our interest is specifically in being the best at executing the highest probability oil trades within well defined historically back tested structures (oil trading strategies) that have a clear risk reward control mechanism with the highest ROI possible in that frame work.

Anyway, here are some reasons why HFT on the lowest time frames does not work in practice;

- Risk – Reward Controls. The range of trade that the micro entities are competing in are 5 – 10 ticks. A 5 – 10 tick range is not bad on paper if you can win 80% and control risk, but when you factor in what actually occurs in practice with liquidity, order execution fills, stops, volatility within that specific range at specific timing you then get a poor result. There are various methods to “game” the system such as faster computers, location of computers to exchanges, faster connections and such, but we aren’t interested in competing in that space. Our interest is specifically in being the best at executing the highest probability oil trades within well defined historically back tested structures (oil trading strategies) that have a clear risk reward control mechanism with the highest ROI possible in that frame work.

- Range. As I said above, a 5 – 10 cent trading range in oil is okay, but range isn’t everything. What you see on your screen (or what your computer software sees) is not necessarily what your order fill will see.

- Stops. Stops have to be used to limit risk. We use sophisticated dynamic stops that work extremely well if we are not trading in the lowest time frames with the micro HF competitors. They are competing in a ranges that sees volatility flash 5 – 10 ticks in a micro second. It’s a race to execution by the fast machines with the fastest internet connections etc. This is not an ideal environment for stops that are vital to protecting equity.

- Order Fills. Order fills (given the above control issues) are not realistic to your expected result because trading ranges on the lowest time frames change in a blink of an eye, which isn’t a big deal until you are competing machine to machine in a micro environment. Order fill control is not reality in this realm. Not in the way we expect anyway. We can achieve a much higher control in an exceptional ROI environment in a 30 minute structured time frame.

- Liquidity. Liquidity on the tightest time frames changes fast, too fast for our risk threshold. This is an issue for us on many levels.

So in short, what happened with our development the last month or so is that we went after the pure math (and not structured set-ups and strategies) as it related to tight time frames and high frequency because it made sense on paper. On paper if the trades executed as the back tested math revealed then returns of up to 500% per month would be possible. But in practice trade set-ups with defined structured set-ups that have controlled down side with 5 or even 10 to 1 risk reward work much better in practice. This is a much better oil trading strategy for machine trading and for mechanically executed human oil trade.

I won’t go in to every detail as I said but HFT on the lowest time frames is ridden with hidden problems and you can’t know until you develop it, code it and put it in to practice, which we did. It is far too difficult to control outcome and we want highly controlled trading environments only. For us, HFT on low time frames is not the best ROI by far.

So What Oil Trading Strategies Are The Best That Provide Highest Return and Lowest Risk?

In our development process we identified the 20 – 40 largest machine liquidity entities in oil trade (we call the primaries) and 200 or so secondaries and a host of what we refer to as micro machine trading entities (HFTs).

Our highest predictable return is trading crude oil with the secondaries and taking in to consideration the primaries. The primaries are not using our methodologies of trade and as such we are still working on this specific area. The micros are competing for small returns many times a day but this is ridden with all kinds of problems as described above.

Our best tested (real world test) results have been with the broad market liquidity (the secondaries and obviously broad market liquidity) and this is traded primarily on the thirty minute time frame. The EPIC Oil Algorithm Model specifically is what I am referring to. This model provides a working structure for mechanically executed trades and our machine trading.

Our software uses the one minute model structure for specific entry, exit and sizing on the lowest time frames but is using the 30 minute model as the basis or structure of trade. This allows for sizing progression in the trade as it proves out. More specifically it allows for a test size and then progressive sizing and releasing of size through the structured trade.

This is critical to return and defined minimal risk.

And lastly, all the other time frames (up to the monthly charting structure) are considered in an order of probability for support and resistance decisions.

This works, it provided for over 60% account build / returns in January and we expect that to increase to 100% if our team is right. We believe that as we further perfect this process that 100% or more is attainable and 50% is our minimum bar at this point. This is yet to be seen and we start Sunday night in futures trade specifically to this process.

Starting Sunday night our software will only trade the highest probability crude oil trading set-ups / strategies as it relates to the above noted 30 minute model referencing the one minute model for specific entry, exit and sizing points.

The frequency of trade will be 20 – 40 trades per week or about 6 trades per day. 20 – 60 ticks per day at an average of 5/10 sizing 20 days a month. The rate of return math on that scenario assuming a 10 contract account size (100 K account approximately) is as follows;

Average trade size = 5 contracts (sizing from 1 to 10 progressive).

Average winning range per day = 40 ticks (on 6 trades) at 80% win side. On surface this looks like only 7 – 10 ticks or so per trade, but this is actually the 7 – 10 tick core (or meat of the trade) that averages 5 contract size, the actual average trade range is larger.

Average daily wins = 2000.00 per day x 20 days per month.

Average monthly gain = 40%+ (we assume 50%+)

Remember, this is average, some days it will be none and some days 200 ticks. Structured trading is boring until it isn’t. Then it is anything but.

This methodology of oil trade provides for the highest probability to being on the win side of the trade (tested in practice), with the highest ROI because the trades are 10 – 100 ticks in range, with controlled stops (larger range structure provides for more predictable stops), with manageable order fills because a 3 – 6 tick divergence is not an issue when you are looking for an average 30 tick move and more.

Note: above I note a 40 tick per day average win rate and yet that we are looking for a 30 tick move in each trade, you have to consider that the trade sizing is from 1 to 10 and progressive on either side of the move.

Example Trade Sizing Progressively.

Below is a simple example, our software in a much more dynamic manner, but the example below provides a frame-work for discussion. The example below is also a real life typical example of a range from the even dollar to the half dollar (60.00 – 60.50) within the key area or core of liquidity and volatility on the day (typical going in to or at regular US market open, events such as EIA, and at key inflection points of intra-day trade).

Trade long 60.00 2 contract size based on structure support, timing, order flow.

Wait for retest of support and progressive order flow and price action.

Long 60.04 4 contract size. Hits next resistance, trade retests next support, price action moves to next leg.

Long 60.14 4 contract size. Hits next resistance.

Trim long 60.24 4 contracts.

Trim long 60.36 4 contracts.

Trim long 60.48 2 contracts.

In the above perfect intra day range trade example you have profit as follows;

2 contracts 24 ticks

2 contracts 20 ticks

2 contracts 32 ticks

2 contracts 22 ticks

2 contracts 34 ticks

Average contract win 35 ticks less volatility in fill slippage (market order) is lets say 30 ticks. That’s an excellent trade and these trade set-ups do occur most days in crude oil, however, not every set up will be executed to the set up because oil trade is not always perfect.

Above is a perfect scenario, below are reasons for the real – world average scenario to be less than a 30 tick winning range.

- Win Rate – If the win rate is 80% then one in five trades will not work, this has to be factored. Our win rate with the 30 minute structure is over 90% (documented, traded live, alerted, recorded), but lets assume 80% for argument. Lets assume your average stop loss is 12 or so ticks. That is a loss of 12 ticks every 5 trades and adds quick if your win rate is not 80% (hence the importance of only trading the most probable set-ups).

- Range of Average Trade – Not every trade has the 50 tick range assumed in the example above. A 50 tick move from 60.00 – 60.50 as in the example above does happen most days (in fact we often see 100 ticks or more), but you have to execute on those specific moves to see that.

- Failed Moves – Many of the trade set-ups will not work according to plan. It usually takes two or three attempts at a move before the market moves price through the whole move.

- Order Fills – There are many reasons for issues here, especially for manually executed market orders, you can assume 5 ticks per trade series (or more depending on your method).

To successfully trade crude oil intraday to a 2% account gain daily (the example we use above) requires that you catch the moves when they occur, that you trade within the most probable / defined structure and setups. And lets not forget that it also requires that you execute stops when the setup fails (fast).

Understanding the structure of intraday trade on the 30 minute model is key to catching the moves and knowing the most probable size of the move (support and resistance). The one minute model is key to your trade entry, sizing and exit.

Summary

So in short we went all the way down the rabbit hole, we tested every oil trading strategy we could find and we believe we’ve come out the other side with the most predictable, lowest risk, highest ROI oil trading structures available in the markets.

The next article will detail the oil trading strategies that are most predictable with the highest ROI as described above.

If you have any questions please feel free to email us at compoundtradingofficial@gmail.com anytime.

To access our services you will find our oil trade alerts are here, oil trading room here (bundled with alerts and newsletters) and oil trade reporting service here.

Thank you.

Curtis, Lead Trader Compound Trading Group

3 Spots Left “Everything I Know About Trading Crude Oil” Webinar Event March 24: 10 AM – 6 PM

Even if you are not attending the webinar, you should read this if you are a client of Compound Trading Group or affiliates.

As of 2:00 PM Saturday We Have 3 Spots Left for the Sunday Crude Oil Trade Training Webinar!

10:00 AM – 6 PM EST Sunday March 24, 2019 we are hosting a special crude oil trading webinar.

This special series webinar will cover everything our trading team has learned about crude oil trade.

Content will include conventional and algorithmic crude oil trading. Conventional and algorithmic charting, technical set-ups, time cycles, sizing, swing trading and day-trading oil and much more.

In summary this will be a detailed insiders look at everything our lead trader and team have learned as investors, swing traders, day traders and algorithmic traders of crude oil.

The timing of this event is no accident and is specific to our lead trader / team finishing a full cycle learning process spanning decades (an organic, transparent systematic process of discovery) – investing to swing trading to day trading to high frequency machine trading and now AI on the horizon.

We know very specifically what works, what does not, why and how to execute on this knowledge.

The reality of return for each type of oil trading process may surprise you. We traded oil to over 60% return in January, 30% in February and in March some accounts are even negative (some are not) – there is a reason for the returns in each of those 3 months. We tried, tested, traded, back-tested every method of oil trade.

We will be uncovering it all for our attendees in a one-time 8 hour special webinar event.

To be clear, our discovery process is over, after this webinar is over we will only be trading specifically what we know to be the highest probability set-ups. We won’t be testing here forward.

Shortly after this webinar we go private, so now is the time.

Below is important information for attendees (from a previous post):

The webinar will cover my strategies for conventional and algorithmic oil trade and charting, intra-day trading, short term swing trading, longer term swing trading, trade sizing, time cycles, key set-ups and much more.

I will explain in detail how I maintain a win rate of better than 90% in crude oil trade (live recorded in our oil trading room and live alerted to our members).

Limited attendance of 25 persons to allow me to take questions and converse as needed to be sure we cover the trading concepts in detail.

Current member clients of Compound Trading Group receive 50% off. Use promo code: member

Early bird registrants prior to March 11, 2019 receive 30% off (cannot be used in conjunction with other offers). Use promo code: early.

To Register for the Crude Oil Trading Webinar Click Here.

The 8 hour special webinar event cost : 499.00.

Attendees receive a free video report of the webinar after we’re done so that you can study the in depth knowledge long in to the future. The video will also be available online at our store (for non attendees).

Can’t attend? The post webinar cost for non-attendees for the video is 799.00 at our online shop. Pre-orders (prior to March 24) receive a 30% discount. Use promo code: earlybird. To pre-order the video click here VIDEO: Everything I Know About Trading Crude Oil | Special Webinar Event Series

For complimentary trade articles, click this link: Crude Oil Trading Academy : Learn to Trade Oil.

For our Oil Trading Services use the links below:

Crude Oil Trade Alerts – alerts via Discord Server and Twitter Feed.

Crude Oil Trading Bundle with Newsletters, Charting, Live Trading Room and Alerts – Recommended bundle for the active oil trader.

Post topics; oil trading, crude oil, webinar, learn to trade

Premarket Note | Grand Slam Q1 2019

Premarket Note

Morning,

In trading room at open, mid day, during active trade and in evening session.

Swing Members: If you haven’t reviewed the swing trade report from last night (or at all this quarter) you missed out because near if not all the trade alerts were winners (Q1 2019). Next round in the works now.

Have a great day.

Curt

Stock Swing Trades On-Watch & Current Trades | AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT more …

Trade Set Ups / Current Swing Trade Positions March 19, 2019.

Stocks Covered in this Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, the first leg of the move from Dec 24, 2018 to now has been great and the next COULD BE better in to mid May 2019. Don’t miss out.

Trade Set Ups and Current Swing Trade Positions March 19, 2019.

Anadarko Petroleum (APC) –

Per March 5 Report “this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target”.

ALSO, the is a link to a special report below (at bottom of this post) that explains exactly how to trade Anadarko Petroleum.

ANADARKO PETROLEUM CORP (APC) MACD turning up on Weekly Chart, should be ready to go soon. #swingtrade $APC

TerraForm (TERP) –

Per March 5 report “trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year”.

THERE IS ALSO A LINK TO A SPECIAL REPORT BELOW FOR TERP AT BOTTOM OF THIS POST.

TerraForm Power Caps a Transformational Year With Solid Q4 Results #swingtrading $TERP https://finance.yahoo.com/news/terraform-power-caps-transformational-solid-173600840.html?soc_src=social-sh&soc_trk=tw

TERRAFORM POWER (TERP) This is about to test 200 MA on Weekly Chart, you will want to watch close now. #swingtrade $TERP

Home Depot (HD) –

Per March 5 Report, “240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video”.

Home Depot’s Solid 2018 in 3 Charts https://finance.yahoo.com/news/home-depot-solid-2018-3-210500199.html?soc_src=social-sh&soc_trk=tw #swingtrading $HD

HOME DEPOT (HD) holding top of trading box with indicators turning up, looking for a pop here $HD #swingtrading

Gold (XAUUSD, GLD, GC_F) –

Per March 5 report, “Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far”.

GOLD remains in structure on monthly chart. Watching. $GC_F $XAUUSD $GLD

EXXON (XOM) –

Per March 5 report, “this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM)”.

EXXON (XOM) This swing trade just keeps giving $XOM #swingtrade #energy

I will be trimming this position in to the red trading box (underside) resistance tomorrow and considering re-entering above the blue line when price is in trading box.

Nike (NKE) –

Per March 5 Report, “this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight”.

Breaking Down Nike’s Q3 Earnings Outlook Ahead of March Madness https://finance.yahoo.com/news/breaking-down-nikes-q3-earnings-192407481.html?soc_src=social-sh&soc_trk=tw #swingtrading $NKE #earnings

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

Alphabet / Google (GOOGL) –

Per March 5 Report, “algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video”.

Tech giants will have to be regulated in future – EU’s Timmermans https://finance.yahoo.com/news/tech-giants-regulated-future-eus-145838975.html?soc_src=social-sh&soc_trk=tw #swingtrading $GOOGL

Google (GOOGL) Exceptional trajectory (upper scenario) on this swing trade, no reason to liquidate any time soon. $GOOGL

This is another fantastic swing trade. If anything just remember to take profit along the way.

Advanced Micro (AMD) –

Per March 5 Report, “when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019”.

AI Stocks to Watch, Including One Under-The-Radar Gem https://finance.yahoo.com/news/ai-stocks-watch-including-one-120000581.html?soc_src=social-sh&soc_trk=tw Gopher Protocol Inc. (GOPH), Five9, Inc. (FIVN), Fortinet, Inc. (FTNT), Advanced Micro Systems (AMD), and Tesla, Inc. (TSLA) #swingtrading #AI

ADVANCED MICRO (AMD) does have symmetry in price targets hit with a channel, upper target may hit #swingtrade $AMD

I don’t like the way this stock trades, however, it has held the channel structure and the price targets are hitting on the model. The upper price target on the chart below could be in play.

https://www.tradingview.com/chart/AMD/w5sN14u2-ADVANCED-MICRO-AMD-does-have-symmetry-in-price-targets-hit-wit/

Twitter (TWTR) –

Per March 5 Report, “didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review”.

TWITTER (TWTR) continues to struggle in the cluster of support and resistance areas, no trade for me. #swingtrade $TWTR

Facebook (FB) –

Per March 5 Report, “the model has done really well, we will be updatnig the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past”.

For now I will leave this one alone considering the mosque attacks. A structured trade just isn’t possible at this point, I will re-look at it the near future.

BP –

Per March 5 Report, “bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best”.

BP I didn’t execute on this but it does look like a decent trade setting up. #swingtrading $BP #chart

FireEye (FEYE) –

Per March 5 Report, “tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it”.

FIREEYE (FEYE) Fireeye stuck in a range, watching for now. #swingtrade $FEYE

Arrowhead Pharma ARWR –

Per March 5 Report, “This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video”.

ARROWHEAD PHARMA (ARWR) Looking for top of trading box resistance to break for a move to next, great swing trade. $ARWR

TESLA (TSLA) –

Per March 5 Report, “I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video”.

TESLA (TSLA) hasn’t hit my 231.00 price target yet but it has come off really hard so far. $TSLA #stock

Alibaba (BABA) – the bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

ALIBABA (BABA) This couldn’t be a better swing trade, hasn’t hit 206.00 price target yet but it is in play $BABA #swingtrade

Microsoft (MSFT) –

Per March 5 Report, “per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch”.

This stock has done really well, but I missed taking the trade, so I won’t review the chart at this time.

Eagle Materials (EXP) –

Per March 5 Report, “was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

I missed my execution on this one so I won’t review the chart set-up at this time.

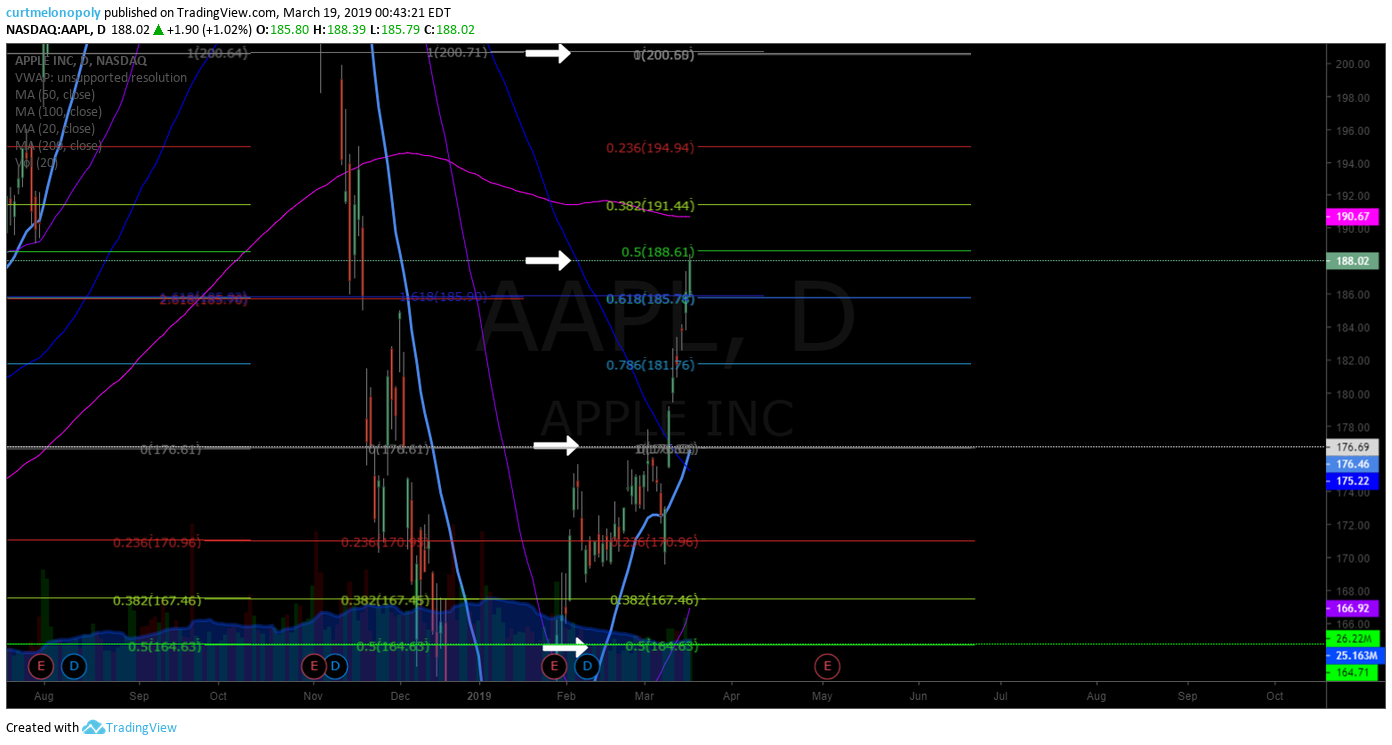

APPLE (AAPL) –

Per March 5 Report, “direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video”.

APPLE (AAPL) The gift that keeps giving, take profit at each gray and green and add above. Simple. $AAPL #swingtrading

Allergan (AGN) –

Per March 5 Report, “has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now”.

ALLERGAN (AGN) Bounce off key support after sell-off, working its way up channel. $AGN #swingtrade #chart

AK Steel (AKS) –

March 5 Report, “potential trajectory on video and it isn’t my favorite type of set-up. Just on watch”.

AKS isn’t doing much of anything, not trading it anytime soon.

Netflix (NFLX) –

March 5 Report, “very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video”.

NETFLIX (NFLX) Continues to trend towared price target for late May. Take profit along the way. $NFLX #stock #chart

American Express (AXP) –

Per March 5 Report, “great trade alert set up from swing trade service, hit price targets early, really strong trade structure”,

AMERICAN EXPRESS (AXP) great trade set-up and above current resistance it has lots of room to run $AXP

The 3 below I am not interested in trading any time soon.

Morgan Stanley (MS) – trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines – hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC) – really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Other Recent Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below (that may be locked) please email us at compoundtradingofficial@gmail.com for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT

Premarket Note

Good morning traders,

Last night we spent the majority of our session trouble shooting the load issues with the 1 min oil model, it’s fixed, loads fast.

The EPIC 30 Min model was also revised and sent to bundle members.

The next on our list is getting the hours of trading vid / blog posts done AND yes, the oil machine trade protocols (review recent premarket notes if you’re not sure what I’m on about).

Swing trade updates are in the pipeline next also.

To the oil trading (which also affects other areas of markets)…. the machine trade in markets is becoming increasingly sophisticated (we have a post coming soon on that, some articles I have posted to my Twitter feed in last week also reference this), anyway…. the time frames the machine trade is operating on is frequently moving to a half and a quarter of the regular time frame traders are used to using on any given chart (they are flipping down and up time frames so it becomes important to know when and what time frame the machines are in so that our software triggers to the right time frame and human traders can trigger to the current time frame also). I mention this to say 1) We’ve back tested this now and we’ve got it nailed down (this will affect frequency of alerts) 2) We will provide more detail soon in special posts to explain how to trade the 1/2 and 1/4 time frames 3) This of course affects the protocol documents, hence the delay. Bottom line, we’ve got it nailed down and now we can start moving along again.

So the WIP will start flowing out to clients as a result.

Have a great day.

Thanks

Curt

Premarket Note & Important Updates: Current Trades, Schedule, Oil Machine Trade Protocols, Trade Alerts, P/L’s, Events

Premarket Note and Important Client Updates March 8, 2019.

Good morning traders!

Our Schedule.

Last night we were in coding / trade protocol publication conference all night so there was no live trading for me in the overnight session.

I am scheduled in main live trading room (voice / chart broadcast room) at US regular market open (9:30 EST) and during active trade today. Mid day trade setups review in live trading room will be set off until Monday as we are working on completion of the oil trade protocols (yes, still grinding through it).

Sunday we will return to active trade attendance in overnight trade (12:00 midnight EST).

For those unaware, our trading team is on a daily scheduled break from 2:30 PM to 12:00 midnight EST. We are in attendance from 12:00 midnight to 2:30 PM EST. I am typically in the main live broadcast trading room at regular US market open (9:30 AM EST), mid day review (12:00 PM – 1:00 PM EST), during any active trading and for special events (weekly EIA, webinars, etc).

Link to live broadcast trading room: https://compoundtrading1.clickmeeting.com/livetrading

The team will also be in the Discord chat rooms today as usual. If you need a link to access Discord please email us.

Current Work In Progress.

Crude Oil Machine Trade Protocol Document Set:

For those unaware (and for the sake of updating everyone), as noted above we were at it again last night working through the code detail and oil trade protocol publications.

Again, my apologies for being behind on our schedule with this task, unfortunately it happens. The coding work and associated protocols are VERY detailed. With over 8000 instructions in the code it is taking some time to condense those instructions to an easy to reference set of protocol documents for our clients.

We’re close now, while I write this Jeremy has advised me that his final edits are done so I’ll do my last review and send the protocols out to clients this weekend.

The written protocols (rule-set) are a document series intended to assist our clients with being able to reference the trading rule-set (instructions / protocol) our machine trading software is executing trades to.

In other words, when oil trade alerts are sent to alert feeds (private client Twitter feed & client private Discord server chat) marked with an “M” for machine trade, our member will then be able to reference the trade rule-set / set-up specific to that alert. The goal is for our member to know what the trading plan is for each type of alert.

One protocol document (rule-set) for each type of trade set-up alerted to the feeds.

This is another step toward our goal of an intelligent assisted trading platform for our traders / clients. The broadcast trading rooms, Discord chat, newsletter publications, live alerts etc are a start toward that and the protocol documents are the next step. Moving forward near future our developers will be automating the machine trade alerts to the alert feeds, trading rooms etc.

Current Trades.

Oil Trading:

In January we posted over 60% account gains in crude oil trade, February profit and loss statement is above 30% (depending on the account – some less some more, yet to be released – Jen has that on her WIP) and we’re shooting for 100% in March. To get 100% in this environment (see below) is a challenge, but we’re in it to win it. Read on.

Personal Oil Trades – Choppy week for me (personal oil trades) and the machine trading. Yesterday was my first red day in a while.

I AM RETURNING to ONLY THE HIGHEST PROBABLE TRADE SET-UPS after the chop I was in yesterday. You will see less trades from me over the coming days, but the oil trades I do alert will be the highest probable wins and they will be trades I will want to be able to execute in SIZE.

The smaller the account the more chop I experienced yesterday. The larger the account the easier it was to navigate the chop.

Crude Oil Machine Trading – Specific to the machine trading, the protocol document flow due out soon will help our clients understand this better, but for now I will say that the machine trade liquidity in the markets has become extremely advanced, very quickly. And I wouldn’t doubt sophisticated AI manifesting near term.

Machine trade in crude oil liquidity is becoming more advanced literally by the day (we have noticed a substantial recent increase in change). Our timing in this endeavor is really interesting in my opinion.

What am I saying? Well, for example most recently we have noticed the machine traded liquidity in the markets has moved down one and sometimes two time-frames. This means that the machine driven liquidity in crude oil trade is executing trade on half or a quarter minute charting time-frames. Imagine that.

If you can imagine having coded the software (with over 8000 instructions) and written the protocol document rule – sets for over forty set-ups only to find that in sideways consolidated oil trade action that the machine liquidity is now moving from a one minute time-frame in executions to a half or even a quarter minute time-frame. Human traders don’t even have charting for that!

Anyway, that’s what we have found the last ten days in the sideways trade in crude oil (look at a daily crude oil chart).

This has caused us to re-code appropriately, trim our throttle down and down and down again the time-frame that our software will fire trades at and re-do and re-do and re-do the trading protocol documents that our clients will use to reference the trade set-up at each oil trade alert.

I have spoken to our most experienced oil traders (we have some serious veterans in our midst) and all of them had a tough week – and these folks rarely are challenged with trading green.

It was a tough week, but we responded and re-coded, and we’re throttling down the software appropriately so it fires on lower time frames and I am personally adjusting my personal trades to only take the best set-ups with a preference to those that I will be able to size in to.

Swing / Day Trading:

Review all current / swing trades thus far in 2019 and current here (if you need an access code email us):

In addition to the trades in the document above I am also now in a starter swing trade position in $HIIQ (per yesterday’s alert).

2019 has been really positive in our swing trading platform, the returns have been great and I expect the next time cycle to continue as such. We should see near 100% return on the year if things continue as they are. The first quarter P/L will be out end of month for review.

Just remember to take profits along the way with the winning swing trades and use stops to protect your account equity.

We expect to start the next round of swing trades between now and Tuesday morning of next week.

New Client On-boarding.

Legacy Members:

The only outstanding new client on-boarding are our newest Legacy Members. All new Legacy All Access Members should have received a conference time with myself for this Sunday afternoon or evening. Look forward to connecting with each of you.

New Members:

Before you start executing trades as a client of Compound Trading Group I highly recommend you study and even take a few hours of private trade coaching to be sure you are best set for success in your trading. Too many newer clients to our group start trading way to early in the process.

Study the historical blog posts specific to your trading focus. Examples are the oil algorithm historical posts on the blog, the crude oil trading special articles listed on the Oil Trading Academy page on our website or the Swing Trading historical posts on the blog. Many posts are unlocked over time for public view and if you are a member that needs an access code to a specific post please email us.

You can also study the videos on our YouTube channel. They are raw video feed (so they aren’t packaged for quick consumption sound bites) but if you’re willing to put in the time they will be of great benefit to your trading.

Also of great benefit are the private Discord servers, especially the crude oil server. You can review historical chat and trade set-ups – many new clients have told me this has been of great benefit.

Attendance to the live trading room when I am broadcasting my live trades (or reviewing historical raw video on You Tube) also helps.

And lastly, if you want to take your technical analysis / charting etc to the next level, there is a 20 hour video series available (the Master Class Series recorded last year) for 1499.00. Email Jen at compoundtradingofficial@gmail.com if interested. We cover much of the content at each trading boot camp, but only about 20% of the Master Class Series for Technical Analysis, Charting and Trade Set-Ups.

Upcoming Events.

Special Trade Coaching Webinar Series:

Oil Traders Special Webinar Everything I Know About Trading Crude Oil | Special Webinar Event Series | March 24: 10 AM – 6 PM.

Swing Traders Special Webinar: Stay tuned, to be announced. It will be held in April 2019.

Trade Coaching Boot Camp (in-person or online):

Take your trading to the next level with our lead trader at our next Trade Coaching Boot Camp at Cabarete Beach, Dominican Republic April 19 – 21, 2019.

- If you can’t attend in person you can attend the class online virtually and take part in question and answer as if you were in the boot camp live.

- Register Here: Trade Coaching Boot Camp April 19, 20, 21 2019.

Recent Press:

News Release: SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release.

Be sure to reach out if you need any help with your trading.

Have a great day!

Curtis

Premarket Note March 6, 2019

Premarket Note

Good morning traders,

I will be in main trading room at open, for EIA, mid day review, during active trade and then overnight at midnight.

Jeremy and Kate completed the oil alert trade protocols last evening and I will review and distribute them today. Thanks for your patience.

For those not aware, the protocols include the specific crude oil trade signals (set-up) for each type of alert members receive on the alert feed so that you can understand the trade structure (support, resistance etc).

Overnight session crude oil was very quiet in advance of EIA (price had very little movement overnight) and likely to be so until the report is released at 10:30 AM today. The oil trade alert feed has been quiet as a result, but that will change post EIA also.

Extended until midnight tonight for last minute parties that have asked:

“Price Increase Mar 4: Oil Trade Services (Bundle, Newsletter, Alerts, Trading Room) w/ Promo Codes”

Be sure to catch the review of all swing trades thus far in 2019 here:

We expect to start the next round of swing trades between post EIA and Tuesday morning of next week.

Be sure to reach out if you need any help with your trading.

Have a great day!

Curtis

Stock Swing Trades On Watch and Current Trade Positions (w/video) | AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and many more…

Trade Set Ups and Current Swing Trade Positions March 5, 2019.

Stocks Covered in this Special Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, this report reviews how great this time-cycle has been and is going to get better around the next corner. These trades have gone extremely well so please do study the video, go in to the previous reports, study the charts and time cycle price targets and BE READY FOR THE NEXT TRADE SET-UPS on deck!

Swing Trading Set-Up VIDEO:

#Swingtrading

Voice broadcast starts at 4:25 on video.

Trade Set Ups and Current Swing Trade Positions March 5, 2019.

The beginning of this video discusses the team work in progress, trade alert protocols, coding, alerts, machine trading developments, changes in my personal trading schedule etc.

This is an important trade set-up video for all stocks we have been swing trading in 2019 so far, so it is an important review for our clients prior to the next round of swing trade entries coming.

Crude Oil ($WTI, $USOIL, $USO) – Tonight the protocols for the alerts will be distributed to members so that our clients know which set up is in play when we send out alerts. The EIA down channel target 55.23 and top uptrend channel 57.25 – the mid pivot (mid quad) for indecisive trade is at 56.25 on FX USOIL WTI. Our bias is toward up channel and we are hoping to get up in to 58.07 range this week to top of swing area of the EPIC Algorithm model (30 minute). The video outlines a scenario for between API Tuesday afternoon at 4:30 and EIA report Wednesday at 10:30.

Anadarko Petroleum (APC) – this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target.

TerraForm (TERP) – trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year.

Home Depot (HOM) – 240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video.

Gold (XAUUSD, GLD, GC_F) – Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far.

EXXON (XOM) – this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM).

Nike (NKE) – this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight.

Alphabet / Google (GOOGL) – algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video.

Advanced Micro (AMD) – when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019.

Twitter (TWTR) – didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review.

Facebook (FB) – the model has done really well, we will be updated the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past.

BP – bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best.

FireEye (FEYE) – tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it.

Arrowhead Pharma ARWR – This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video.

TESLA (TSLA) – I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video.

Alibaba (BABA) – the bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

Microsoft (MSFT) – per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch.

Eagle Materials (EXP) – was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

APPLE (AAPL) – direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video.

Allergan (AGN) – has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now.

AK Steel (AKS) – potential trajectory on video and it isn’t my favorite type of set-up. Just on watch.

Netflix (NFLX) – very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video.

American Express (AXP) – great trade alert set up from swing trade service, hit price targets early, really strong trade structure,

Morgan Stanley (MS) – trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines – hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC) – really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Other Recent Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below (that may be locked) please email us at compoundtradingofficial@gmail.com for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT