Blogs

PreMarket Trading Plan Fri Aug 10: Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $TSLA, $FB, $GOOGL, OIL more.

Compound Trading Premarket Trading Plan & Watch List Friday Aug 10, 2018.

In this edition: Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Friday Aug 10 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 14 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- Before Sept 1 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14 (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

In Play: $HAIR, $TUR, $RDFN, $AWX, $NEO, $DB, $TVIX, $DGAZ High Uncertainty: $INTC, $BRK.B, $AMZN

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 96.07, Oil FX $USOIL ($WTI) trading 67.26, Gold $GLD trading 1212.90, Silver $SLV trading 15.35, $SPY 283.84, Bitcoin $BTC.X $BTCUSD $XBTUSD 6518.00 and $VIX trading 12.1.

Momentum Stocks / GAPS to Watch:

Overstock and The Trade Desk are both trading higher by more than 20% in Friday’s pre-market session. https://benzinga.com/z/12182530 $MDLY $AWX $TTD $OSTK $PBYI $OLED $RDFN $CORT $ELGX $RUN $DBX $XON $MCHP

News:

Your Friday morning Speed Read:

– Stock futures ⬇ on concerns over Turkey’s economic woes $SPY $TUR

– #Trump task force 2day advises on changing Postal Service rates, watch $FDX $UPS $STMP $AMZN

– Citigroup cuts Booking Holdings (formerly Priceline) to Neutral $BKNG

Your Friday morning Speed Read:

– Stock futures ⬇️ on concerns over Turkey's economic woes $SPY $TUR

– #Trump task force 2day advises on changing Postal Service rates, watch $FDX $UPS $STMP $AMZN

– Citigroup cuts Booking Holdings (formerly Priceline) to Neutral $BKNG— Benzinga (@Benzinga) August 10, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/RHWh9I0Pd4

— Melonopoly (@curtmelonopoly) August 10, 2018

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/mfmhip2r0r

— Melonopoly (@curtmelonopoly) August 9, 2018

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

— Melonopoly (@curtmelonopoly) August 9, 2018

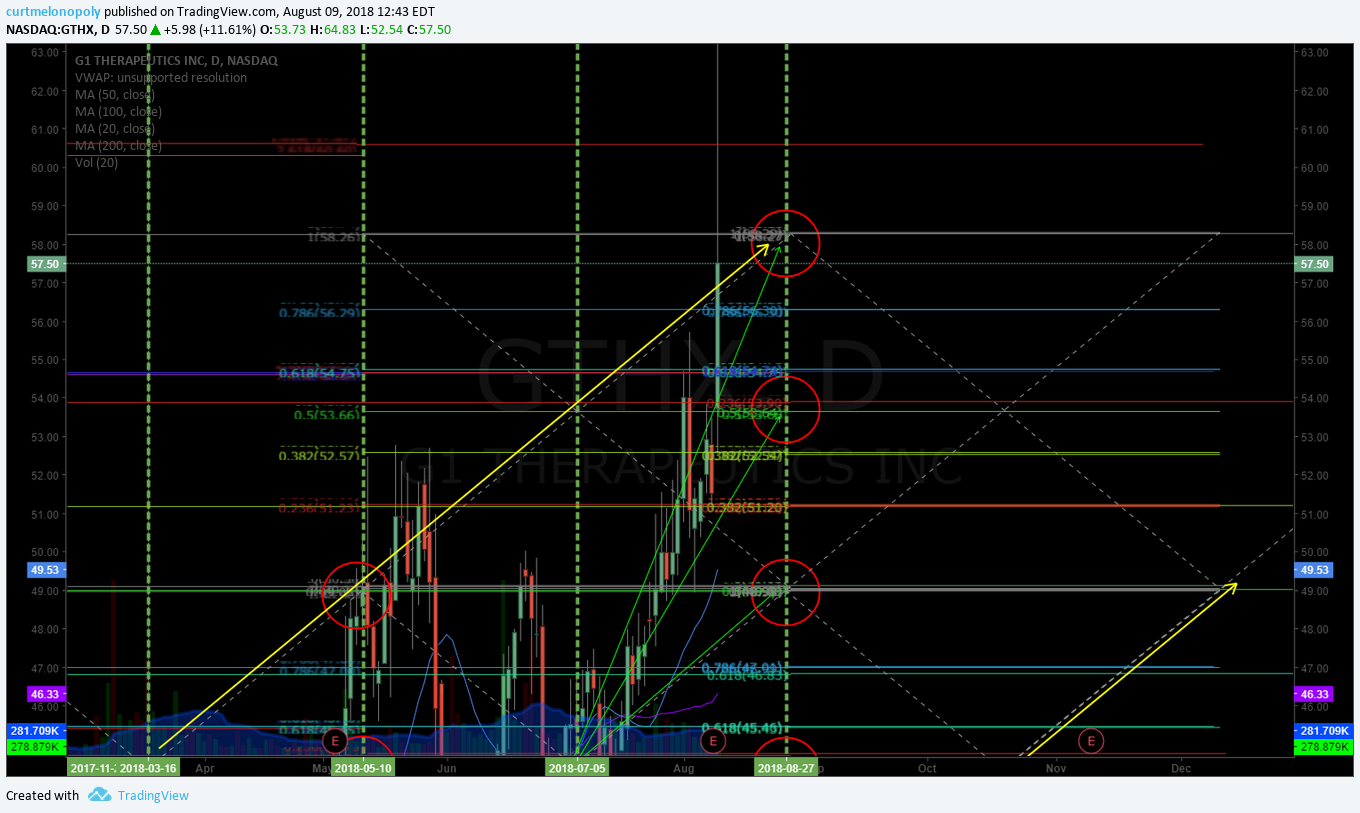

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading pic.twitter.com/Y9MBk0hE7F

— Melonopoly (@curtmelonopoly) August 9, 2018

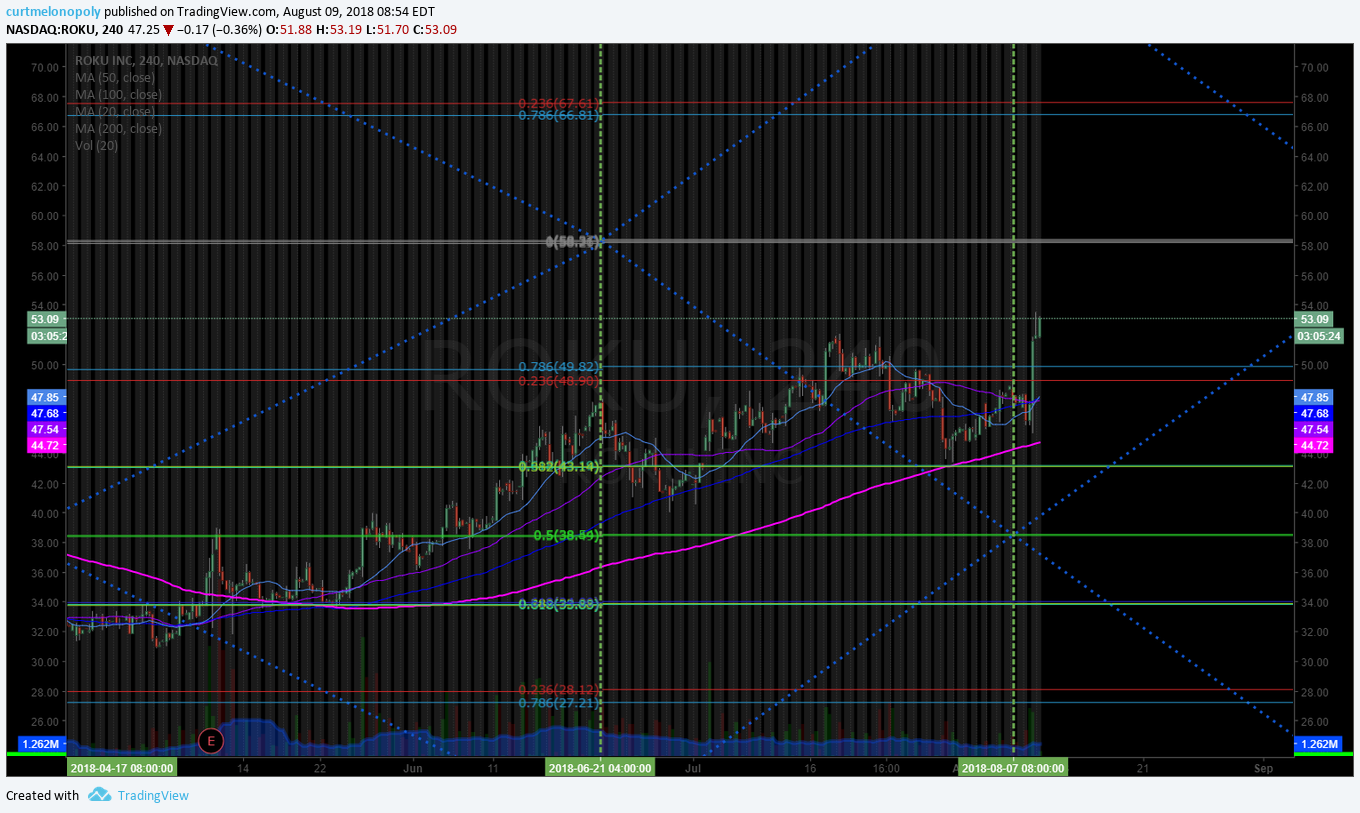

ROKU (ROKU) hit the chart model resistance perfect and came off today $ROKU #daytrading

G1 THERAPEUTICS (GTHX) What a fantastic swing trade. Blew through our most bullish price target today. $GTHX #swingtrade #chart

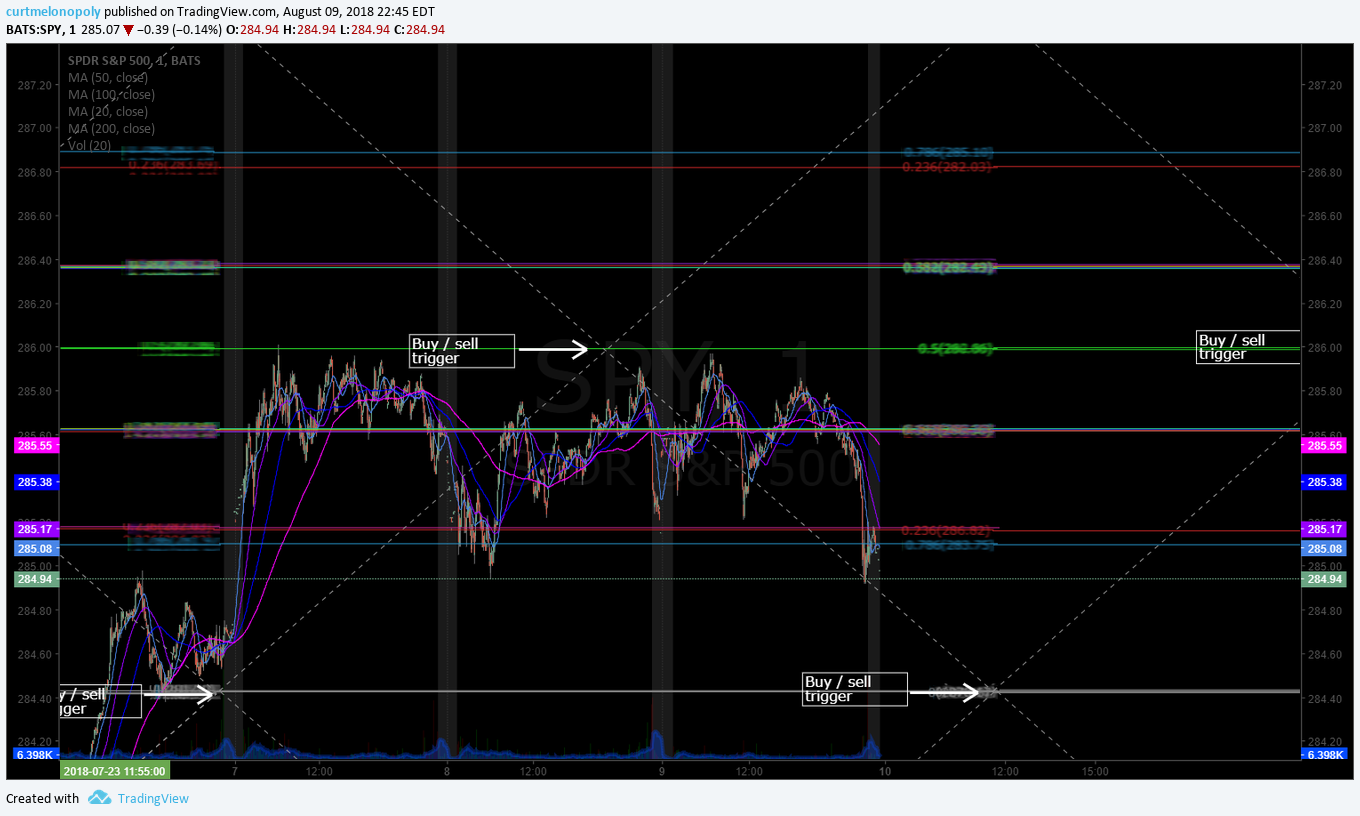

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

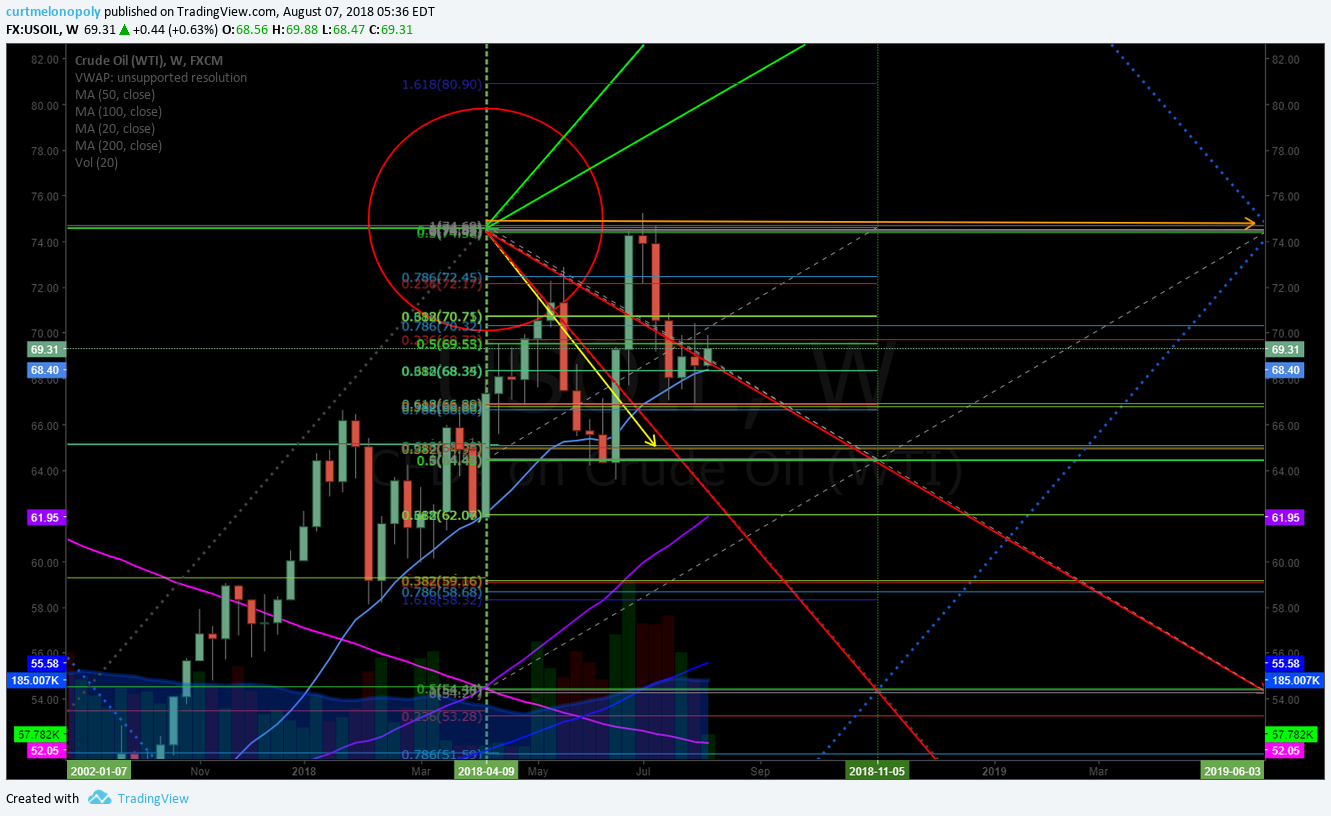

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

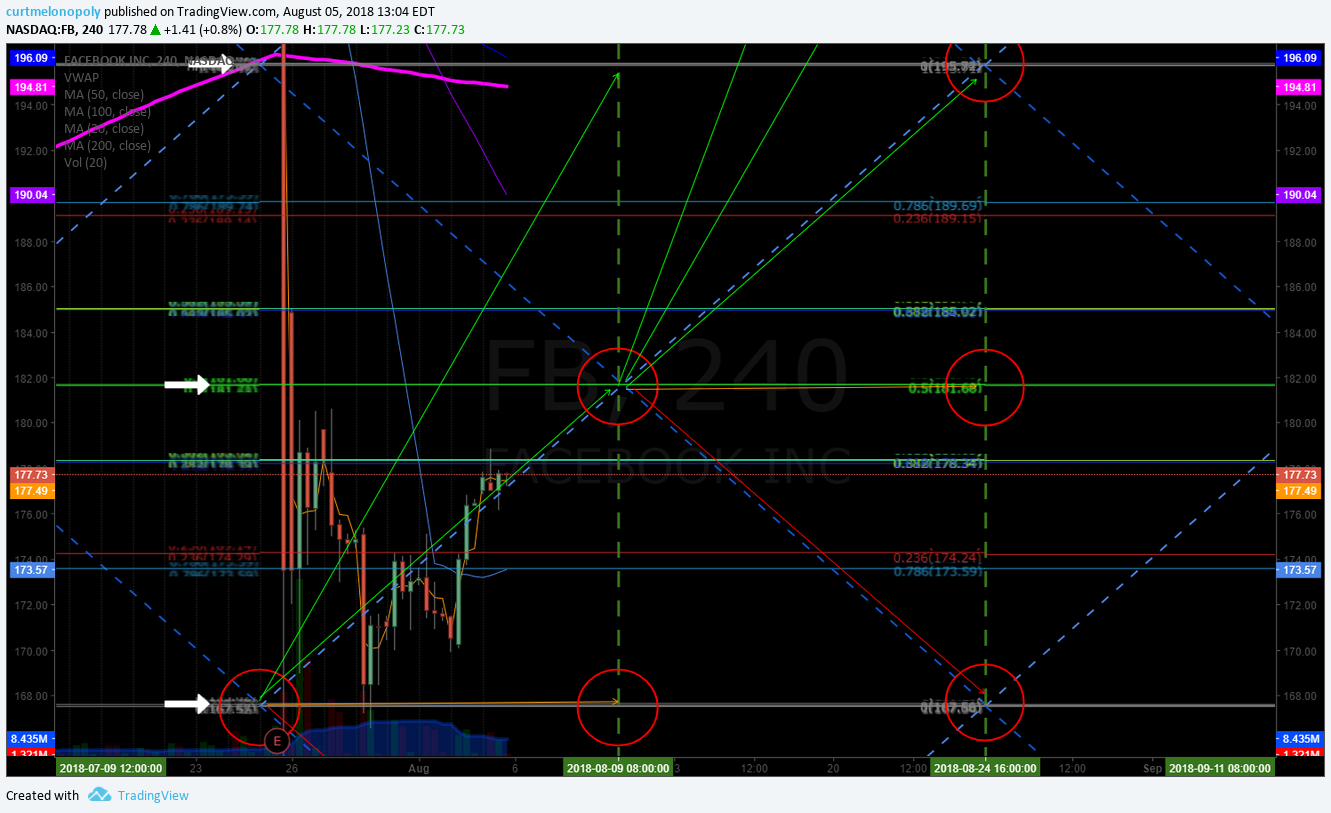

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

Stock Futures Lower, Chips Hit Again As Goldman Downgrades Intel http://dlvr.it/QfRXhs

Stock Futures Lower, Chips Hit Again As Goldman Downgrades Intel https://t.co/AxsCefCtzc pic.twitter.com/FDDUJEePFO

— Investors.com (@IBDinvestors) August 10, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AWX $MDLY $TTD $OSTK $PVG $PBYI $OLED $MCC $MNGA $TVIX $UVXY $PLNT $WPRT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD

SP500 Algorithm (SPY). Thurs Aug 9 Report. $SPY $ES_F $SPXL, $SPXS #SPY #Algorithm

S&P 500 SPY Trading Algorithm Update Thursday August 9, 2018.

$SPY $ES_F ($SPXL, $SPXS) Chart Observations

My name is Freedom the SPY Algo ($SPY). Welcome to my S&P 500 trade report for Compound Trading Group.

Below you will find algorithmic model charting based on Fibonacci extensions, timing and various other principles. This is a very early stage development model (generation 2 – 5 modeling rolls out in 2018 and as a result the reporting frequency increase significantly – our more advanced algorithm chart models are 4th and 5th generation, such as EPIC the Oil Algo that is graduating to #IA coding).

Notices:

NA

How to use this charting model:

This S&P 500 (SPY) algorithm report includes a 1 minute model and a 60 minute model with buy sell triggers and reports in near future will include other time-frames for different styles / time-frames of trade.

The simplest way to use the charting is to consider all lines support and resistance decisions with the horizontal grey lines (marked with grey arrows) to be significant trading ranges in the model. The thicker the line the more important. And please consider that all support and resistance lines are approximate as this is a working chart model (a work-sheet). Horizontal and diagonal dotted lines are consider support and resistance.

This chart model is best weighed against conventional charting and used in conjunction with a conventional chart.

If you have questions about the best use of the chart model or private coaching options email our developers anytime at [email protected].

SP500 Algorithm (SPY). 1 Min Chart (Intra-Day Trading) $SPY.

Current Buy / Sell Triggers for $SPY SP500:

292.29

290.70

289.15

287.58

286.00

284.45

282.88

281.30

279.74

278.17

276.61

275.02

273.46

271.89

270.33

268.75

267.20

265.62

264.04

262.47

260.92

When you open the live chart below in “viewer” mode you can then click on the share button at bottom right and then click on “make it mine” to open real-time chart. Double click the body of the chart to remove or institute indicators at bottom of chart (MACD, Stoch RSI, SQZMOM).

SP500 Algorithm (SPY). 1 Min chart. Current trade. Buy sell triggers, fibs, quads, MA’s. Aug 9 1046 PM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 1 Min chart. Current trade. Buy sell triggers, fibs, quads, MA’s. July 26 137 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 60 Minute Chart (Swing Trading) $SPY:

SP500 Algorithm (SPY). 60 Min chart. Current trade above mid quad support. Aug 9 1100 PM $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 Algorithm (SPY). 60 Min Gen 1. Current trade above pivot. Buy sell triggers, fibs, quads, MA’s. July 26 148 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 (SPY) Conventional Charting Considerations $SPY:

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

July 26, 2018 – Structure from previous still intact.

SP500 (SPY) Chart – MACD still turned down, messy structure. $SPY $ES_F $SPXL $SPXS #SPY #Chart

SPY chart with bearish (or at best indecisive) overtones in its structure.

Recent Real-Time Alerts, Trading, Model Price Target hits etc.

Aug 9 – Alert and price target examples will be updated soon.

Per recent;

9:56 AM – 19 Apr 2018 $SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts.

$SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts. pic.twitter.com/3vo4sgNXKH

— Melonopoly (@curtmelonopoly) April 19, 2018

5:18 AM – 18 Apr 2018 That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that’s the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain’t much room available above that short term. Rest on deck.

That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that's the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain't much room available above that short term. Rest on deck. pic.twitter.com/wKfBQ9njDc

— Melonopoly (@curtmelonopoly) April 18, 2018

4:48 AM – 18 Apr 2018 $SPY long side trade cleared mid quad and quad wall. Closed 270.19, next res trims 270.22, 270.45, 271.99, 273.25

https://twitter.com/SwingAlerts_CT/status/986526884790927360

3:37 PM – 13 Apr 2018 The resistance dump after the alert and the 50 MA support may become your buy area Mon morning. $SPY #swingtrading https://www.tradingview.com/chart/SPY/H375XWXb-The-resistance-dump-after-the-alert-and-the-50-MA-support-may-be/ …

https://twitter.com/SwingAlerts_CT/status/984878380284858369

11:05 AM – 13 Apr 2018 $SPY trim quad resistance alert worked well.

https://twitter.com/SwingAlerts_CT/status/984809783768346624

9:31 AM – 13 Apr 2018 $SPY upside resistance trim alert to long side as it approaches 268.00 mid quad res

https://twitter.com/SwingAlerts_CT/status/984786277189988352

$SPY at upside resistance pivot and structured trade worked out. Trim longs add above.

$SPY building structure near the buy trigger and channel bottom we expected. It’s long while it holds area. Trading 261.23 intra day.

https://twitter.com/SwingAlerts_CT/status/981571557771350018

$SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet.

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1pic.twitter.com/50zcoPctuv

Best with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: SP500, Algorithm, SPY, $SPY, Chart, Model, $ES_F, $SPXL, $SPXS

PreMarket Trading Plan Thurs Aug 9: Semiconductors, Earnings, Tariffs, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD more.

Compound Trading Premarket Trading Plan & Watch List Thursday Aug 9, 2018.

In this edition: Semiconductors, Earnings, Tariffs, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Thursday Aug 9 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 10 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- July 31-Aug 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14! (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

ROKU Inc (ROKU) Premarket up 12.38% trading 53.10 on better than expected earnings. $ROKU #premarket #earnings https://www.marketwatch.com/story/rocku-stock-jumps-8-after-second-quarter-profits-new-streaming-web-channel-2018-08-08?siteid=yhoof2&yptr=yahoo

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 95.22, Oil FX $USOIL ($WTI) trading 68.80, Gold $GLD trading 1215.90, Silver $SLV trading 15.49, $SPY 285.36, Bitcoin $BTC.X $BTCUSD $XBTUSD 6318.00 and $VIX trading 10.9.

Your Thursday morning Speed Read:

– U.S. initial jobless claims due @ 8:30am ET $SPY

– IPOs due today from Amalgamated Bank $AMAL, Mesa Air Group $MESA, & Vaccinex $VCNX

– Rite-Aid shares ⬇ 6% premarket after news Wed. evening its planned Albertsons merger has been axed $RAD

Your Thursday morning Speed Read:

– U.S. initial jobless claims due @ 8:30am ET $SPY

– IPOs due today from Amalgamated Bank $AMAL, Mesa Air Group $MESA, & Vaccinex $VCNX

– Rite-Aid shares ⬇️ 6% premarket after news Wed. evening its planned Albertsons merger has been axed $RAD— Benzinga (@Benzinga) August 9, 2018

Momentum Stocks / GAPS to Watch: $KBSF $BEL $CLDC $DNB $UPLD $YELP $SAIL $END $SESN $NETE

Roku and Yelp are among the biggest gainers in Thursday’s pre-market session. Meanwhile, e.l.f. Beauty and Gevo are down more than 15%. https://benzinga.com/z/12173256 $YELP $ROKU $HJLI $SAIL $CVNA $RIGL $JACK $ZUMZ $IAC $IPAS $GEVO $ABIL $PRGO $ACAD $FLO

Stocks – Rite Aid, ELF Beauty Plummet in Pre-market; #DunBradstreet, Yelp Soar – https://invst.ly/88uo2

News:

Morgan Stanley downgrades semiconductor industry view to Cautious $NVDA $XLNX $AMBA $APH $TEL $ADI $CY $ON $INTC $QCOM $MCHP $QRVO $MU $AVGO http://dlvr.it/QfKNFH

$KRYS KB105 Granted Orphan Drug Designation to Treat Patients With TGM-1 Deficient Autosomal Recessive Congenital Ichthyosis

Stocks making the biggest moves after hours: Yelp, Roku and more –

Stocks making the biggest moves after hours: Yelp, Roku and more – https://t.co/CTGFQ1VWiK

— Melonopoly (@curtmelonopoly) August 8, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

Yelp’s second-quarter profit tops expectations as ad revenue jumps https://cnb.cx/2KKtPQI

L Brands’ stock surges after sales rise above expectations and upbeat earnings outlook

Norwegian Cruise’s stock driven higher by profit and revenue beat, raised outlook

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

ROKU (ROKU) Premarket up 12.38% trading 53.10 on better than expected earnings. $ROKU #premarket #earnings

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

APPLIED OPTOELECTRONICS (AAOI) premarket trading 46.05 on earnings +23% $AAOI #daytrading #swingtrading #premarket

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

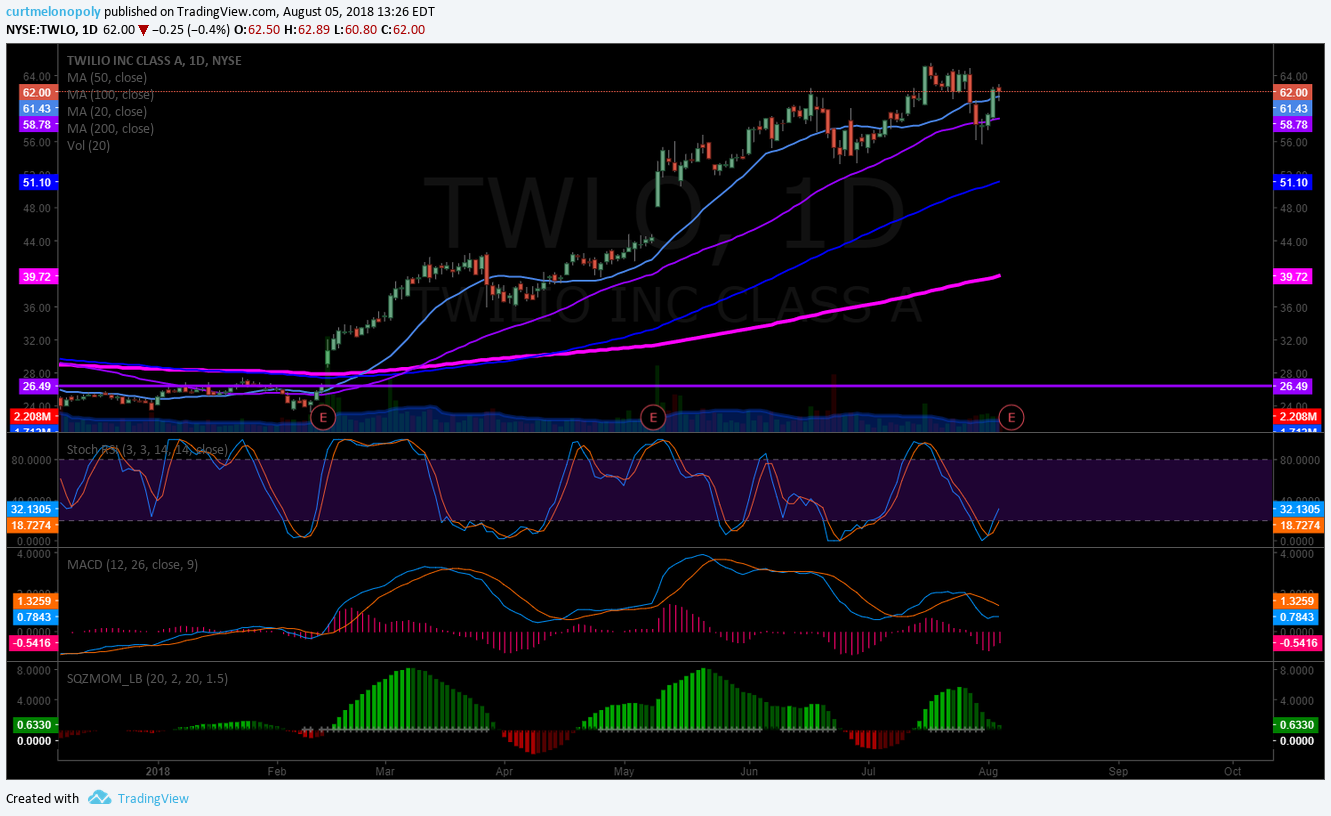

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSi turned up, watching trend structure in to eanrings in one day. $TWLO #chart #earnings

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading pic.twitter.com/b71F3ArbsC

— Melonopoly (@curtmelonopoly) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

U.S. oil vanishing from Chinese tariffs reveals America’s clout https://bloom.bg/2AUN2iD

#5things

-Russian sanctions

-Musk’s money mystery

-Lira falls again

-Markets quiet

-Data due

https://bloom.bg/2vTFdnJ

#5things

-Russian sanctions

-Musk's money mystery

-Lira falls again

-Markets quiet

-Data duehttps://t.co/ctwcvTktHs pic.twitter.com/iIUyfAOJj8— Bloomberg Markets (@markets) August 9, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $KBSF $BEL $CLDC $HJLI $DNB $SAIL $SND $YELP $CUR $AYX $SESN $ROKU $GOOS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MNK, $AM, $CVNA, $RARX, $BMRN, $YELP, $ORCL, $KORS, $MTCH

Antero Midstream Partners LP $AM PT Raised to $38 at Wells Fargo

$BMRN PT raised to $120 at Citi

(6) Recent Downgrades:

$EGLT PT lowered to $1.50 from $4 at JMP

Morgan Stanley downgrades high flying chip sector to sell as ‘indicators are flashing red’ https://cnb.cx/2M8ceXF

Stock Futures Mixed; 3 Chip Stocks Dive On Downgrades http://dlvr.it/QfKHQl

DepoMed Inc $DEPO PT Lowered to $8 at RBC Capital

$AFMD PT lowered to $4 from $6 at BMO

ProPetro Holding $PUMP PT Lowered to $19 at RBC Capital

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Semiconductors, Earnings, Tariffs, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD

PreMarket Trading Plan Wed Aug 8: EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC more.

Compound Trading Premarket Trading Plan & Watch List Wednesday Aug 8, 2018.

In this edition: EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Wednesday Aug 8 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 10:30 EIA Petroleum Report Live Oil Trading with EPIC the Oil Algorithm in live trading room (EPIC members welcome).

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 10 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- July 31-Aug 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14! (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

$AAOI $LITE $MTCH $BOOT $DDD $ALRM $SFLY $PLT $LUV $PTCT $NVTA

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 95.31, Oil FX $USOIL ($WTI) trading 68.28, Gold $GLD trading 1207.90, Silver $SLV trading 15.29, $SPY 285.36, Bitcoin $BTC.X $BTCUSD $XBTUSD 6488.00 and $VIX trading 11.0.

Momentum Stocks / GAPS to Watch: $AAOI $LITE $MTCH $BOOT $DDD $ALRM $SFLY $PLT $LUV $PTCT $NVTA

Stocks making the biggest moves premarket: KORS, CVS, DIS, PZZA & more –

Stocks making the biggest moves premarket: KORS, CVS, DIS, PZZA & more – https://t.co/dFORu5F33P

— Melonopoly (@curtmelonopoly) August 8, 2018

News:

Lumentum’s stock shoots up over 7% after earnings beat by wide margin https://on.mktw.net/2vtHTJz

Your Wednesday Morning Speed Read:

– U.S. to hit Chinese imports w/$16B more tariffs Aug. 23rd $SPY $FXI

– Financial media freak-out continues over @elonmusk’s Tuesday tweet he’s “considering” taking Tesla private $TSLA

– @axios to create @HBO series centered on tech & politics

Your Wednesday Morning Speed Read:

– U.S. to hit Chinese imports w/$16B more tariffs Aug. 23rd $SPY $FXI

– Financial media freak-out continues over @elonmusk's Tuesday tweet he's "considering" taking Tesla private $TSLA

– @axios to create @HBO series centered on tech & politics— Benzinga (@Benzinga) August 8, 2018

CHINA GOVT SAYS IMPORT TARIFFS ON $16 BLN WORTH OF U.S. GOODS TO TAKE EFFECT AT 1201 LOCAL TIME ON AUG 23

Elon Musk’s Tesla scenario would mean funding biggest buyout ever. $TSLA #swingtrading

Elon Musk's Tesla scenario would mean funding biggest buyout ever. $TSLA #swingtrading

Read: https://t.co/UEbmDKkzQ5

— Swing Trading (@swingtrading_ct) August 8, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

Applied Opto stock spikes higher after earnings beat https://on.mktw.net/2AOeZbX

Tomorrow morning’s #earnings

$CVS $WB $KORS $MYL $SINA $LITE $ENDP $DLPH $SUP $CARS $MGA $SO $MTBC $RGNX $GOGO $FI $MGIC $NYT $VSI $ETM $ATHM $EXTR $CRK $EGLT $CNK $BBSI $JLL $KERX $GVA $HXNP $KDP $NEOS $WWW $NXST $STWD $TRI $GEL $ARCO $CMRX $STE $CRL

https://twitter.com/CompoundTrading/status/1027031168993173504

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

APPLIED OPTOELCTRONICS (AAOI) premarket trading 46.05 on earnings +23% $AAOI #daytrading #swingtrading #premarket

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSi turned up, watching trend structure in to eanrings in one day. $TWLO #chart #earnings

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading pic.twitter.com/b71F3ArbsC

— Melonopoly (@curtmelonopoly) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ABIL, $SBBP, $AAOI $MTCH $DDD $HDP $ENDP $YTEN $CYBR $MTBC $RKDA $GOGO $LITE $VSLR $AQXP $OPK $WB $FOSL $SGYP $ETM $DWT $CVS $KORS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC

Swing Trading Earnings Special Report (Members) Tues Aug 7 $DIS, $AMD, $AAPL, $WMT, $FB, $JKS, $EXP, $LTBR, $SPY, $DXY more.

Swing Trading Report. In this Special Earnings Season (Member Edition) Tuesday Aug 7, 2018: $DIS, $AMD, $AAPL, $WMT, $FB, $JKS, $EXP, $LTBR, $SPY, $DXY and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 6 mid day review, published August 7, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

June 12 Swing Trading Regular Report is referenced in this special earnings report. Members can reference that report for charts you may need (or review the video) as some charting is not included in the report below due to weekly reporting time constraints. Also, please be sure to check date on the chart as the date may not reflect publish date depending on the scenario.

Earnings Season Stocks Covered in This Report; $DIS, $AMD, $AAPL, $WMT, $FB, $JKS, $EXP, $LTBR, $SPY, $DXY

Report published Aug 7 and recorded Aug 6, 2018 Mid Day Swing Trading Review.

July 12 Swing Trading Regular Member Report is referenced in this special earnings report. Members can reference those two reports for charts you may need.

Tickers:

SP500 $SPY – 283.74 by trigger hit, 284.93 resistance, bullish price target 299.00 on same day.

US Dollar $DXY – Watching the range resistance / support test area now for possible long trade. On a sell-off will not short.

Eagle Materials $EXP – Post earnings, positive earnings, trading 100.00, quad wall (Fibonacci trend line) support bounce 98.87. 179.92 resistance. Looking for a long side trade over upside resistance on chart.

DISNEY $DIS – Earnings Tuesday, price target 124.19 in a post earnings squeeze, downside 110.50 (yet to be seen),

FACEBOOK $FB – Facebook has been paying the bills this year. Traded last wash-out snap-back and now trading this one. Trading intra-day at quad wall resistance (down trending Fibonacci trend-line). Has 50 MA coming down over hear on 4 HR chart with 200 MA above that. Resistance 195.71, trading intra-day 183.69, support 181.70. Trading range reviewed on video. 195.71 price target Aug 9 in bullish trade scenario.

APPLE $AAPL – Chart structure clean, resistance 205.30 and launched upside 209.80 next resistance 212.63. The buy sell triggers are explained on video for our charts (the white arrows). Main 200.58 support, 212.61 resistance, intraday resistance 209.80, intraday sup 205.77. Trading intraday 208.78 on other side of earnings. Trade alert sent out to members to trim longs in to the upside resistance area on chart. #swingtrading #earrnings

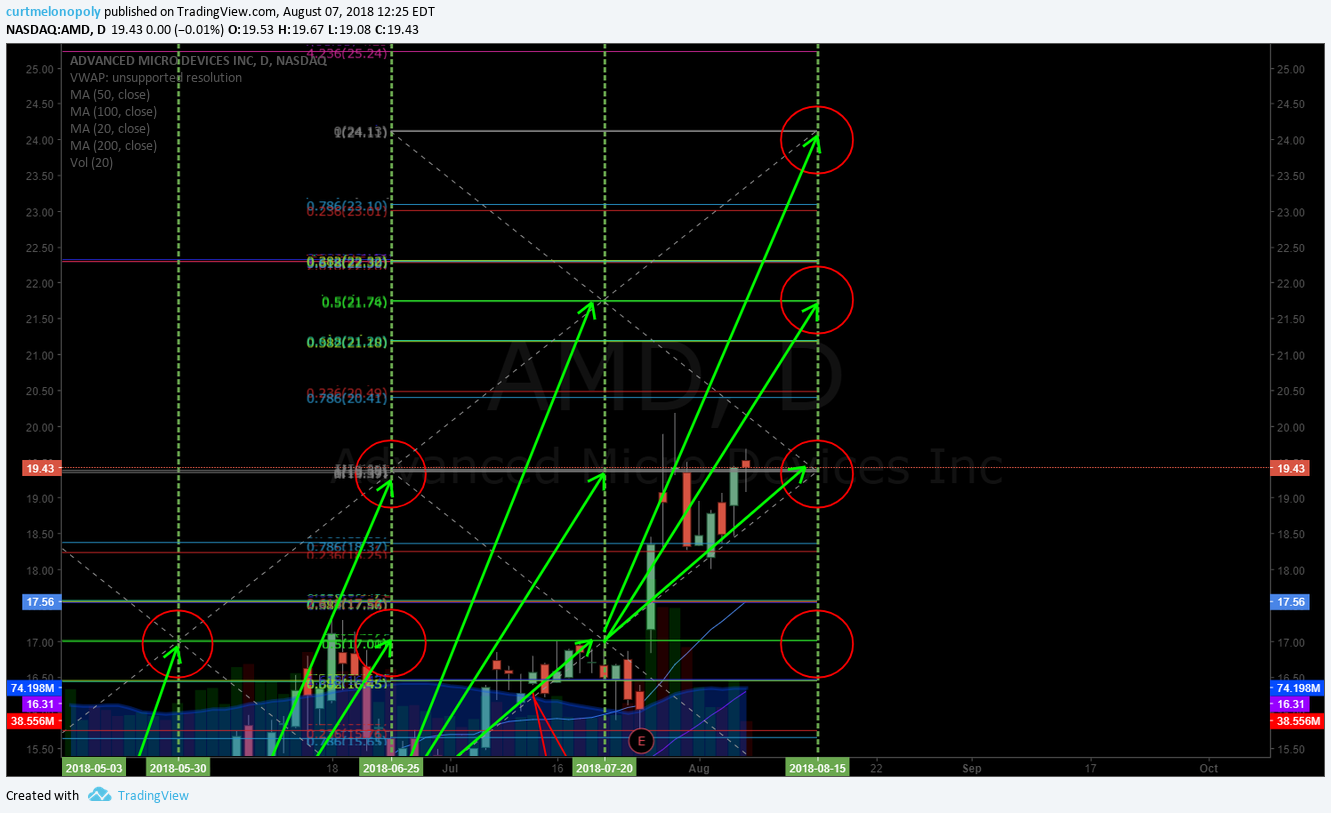

Advanced Micro $AMD – Against main pivot resistance 19.35 trading intra day, hit target July 20, trending for upside if over resistance the target is 21.75 Aug 15 with 24.50 most bullish, 17.04 in a sell-off is price target intra-day.

WALLMART $WMT has earnings in ten days and is still struggling with 200 MA. Looks like a 200 MA upside resistance test in play. 91.10 main pivot resistance, 82.83 structural support. Intra day 87.17 support / resistance.

LightBridge Corp $LTBR – still under 200 MA running along support .896. Can’t trade it until over 200 MA for a long and short I’m not interested in for risk / reward.

Jinko Solar $JKS – Earnings in 7 days, 50 MA has made its way down with 20 MA and price, this is a good area to watch for a possible pop.

Not on video, included in editing below:

EDITAS MEDICINE (EDIT) Hit downside channel support #, over 27.96 adds for longs under channel support broken trade. $EDIT #swingtrade

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:https://twitter.com/swingtrading_ct

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

Oil Algorithm Trading Report (EPIC) Tues Aug 7 FX: $USOIL $WTI $CL_F $USO #Oil #Trading #Algorithm

Crude Oil Trading Algorithm Chart Report (EPIC) Tuesday Aug 7, 2018.

FX: $USOIL $WTI $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to the oil trading algorithm report. My name is EPIC the Oil Algorithm and I am one of seven primary Algorithmic Chart Models in development at Compound Trading Group (there are near 300 in total in development at various stages for all markets).

NOTICES:

New members to our oil algorithm charting model are encouraged to on-board in a way that equips you as an oil trader for profit.

Visit my Twitter feed EPIC Oil Algorithm Twitter (@EPICtheAlgo) and review tweets over the last few months, visit our blog and review the recent oil algorithm blog posts, our You Tube channel “how my oil algorithm works”, “how to use my charting”, weekly EIA oil report videos and our website (it explains how the oil algorithm was developed). Reviewing those important points of reference will increase your probability of success considerably. This report includes links to some recent example “how-to” videos.

Oil Trade Coaching – Users of this algorithmic oil charting model may opt for private one-on-one coaching with our lead trader and / or an experienced trader that has worked under our lead trader. On our website standard one-on-one online coaching packages are made available (coaching via Skype) or you can request a customized package (reflecting the time you wish to invest in learning). To request a custom package suited to your needs email [email protected] or click here for standard private trade coaching packages. Other options for coaching include online webinars and private on location (in person) coaching sessions.

Oil Trading – How to Use the Oil Algorithm

Oil Trading – How to Trade Intra-day with my Algorithmic Charting

Oil Trading Alerts. Live Lead Trader Video Trading w EPIC Oil Algorithm

A recent article from our blog about how to trade crude oil with our oil trading algorithm, “The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

MULTI-USERS: Institutional / commercial platform now available.

SOFTWARE: My algorithmic charting is planned to go to developer coding phase for our trader’s dashboard program. Please review my algorithm development process, about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on my Twitter feed and/or this blog.

HOW MY ALGORITHM WORKS: I am an oil algorithm model in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am not a high frequency robot type algorithm – I am presented on (and used on) a traditional trading chart as one would normally use as a probability indicator. The goal is to provide our trader’s with an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil.

Below you will find simplified levels represented on a traditional chart (both intra-day and as a swing trader or investor). This work (and associated trade) should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on. Questions to; [email protected], message our lead trader on Twitter, or message a lead trader in the private Discord oil trade room server.

Visit this link for more information about my oil algorithm development, this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE SIGNAL (ON EVERY VENUE) IS VIDEO RECORDED, ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Oil Algorithm Observations:

Below is a link for the live chart version of EPIC the Oil Algorithm. The charting is a real-time trading chart represented on FX $USOIL $WTI published Aug 7, 2018.

Click on share button (bottom right beside flag) and when that screen opens click on “make it mine” to view real-time, make edits etc:

Oil Algorithm (EPIC). Current trade. Aug 7 430 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Aug 7, 2018

The first most predictable trade are the resistance and support cluster areas formed by long term chart trend lines (see charts that have trend-lines represented in red as made available below).

The second most predictable trade (wide trading range primary resistance and support that become predictable buy and sell triggers). Current algorithmic model wide trading range resistance (grey arrow – grey horizontal line) at approximately 72.54 in the current trading range. Current algorithmic model wide trading range support (grey arrow – grey horizontal line) at approximately 68.93 in the current trading range – these areas are general range support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades). Trading between the resistance / support horizontal grey lines is extremely profitable risk – reward if one is disciplined to the patience required and follows the trend of trade.

The lower trading range is 65.32 to 68.92. The upper trading range 72.54 to 76.15.

Trading Bias / Forward Guidance: As with previous report, range bound. Slightly bullish based on MACD pinch and cross up possible on daily, but very slight.

Current (as of Aug 7, 2018) MACD is starting to pinch up on the daily oil chart.

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and a downward option (channel support and resistance / trading range is represented as diagonal dotted orange lines and purple arrows – as made available, assist in displaying directional trade decision areas).

Fourth most predictable trade (support and resistance of 30 min quadrants). The diagonal lines make up quadrants (in this instance on a 30 min chart) and are represented as orange diagonal lines that make up geometric diamond shapes. These lines also assist in intra-day trade.

Fifth most predictable trade (support and resistance of most applicable Fibonacci) the Fib support and resistance lines are the horizontal lines in various colors with the exception of purple and yellow (see below). These horizontal lines become support and resistance for intra-day trade.