Tag: China

PreMarket Trading Report Wed Jan 9: China US Trade, Time Cycles, EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday Jan 9, 2019.

In this premarket trading edition: China US Trade, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 9 – All the reporting for the new time cycle extending six months starts tonight.

- Main Trading Room

- Jan 9 – I am in session in main trading room today for market open, EIA, mid day review, during active trading and overnight futures.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 8 – A number of trading strategy posts were sent to members recently. Please review.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Wednesday Jan 9 – EIA day, this will be interesting to see if the move in overnight oil futures is supported post EIA. We want a pull back to add to DWT short swing and establish structure for the daytrading of this possible reversal in trend. If you haven’t read the related reports for a possible reversal please do so. If you need access codes for historical posts on blog please email Jen a list that you require.

Would like to see small short term pull back in markets and then go in to May 2019 per my reporting in to end of December.

The reporting for this new time cycle will start tonight. Dig deep, you will thank yourself on the other side of this 6 months later.

https://twitter.com/CompoundTrading/status/1082994414459473920

Tuesday Jan 8 – Today in to EIA is the final watch on market structure that we need and we’ll start producing the structured trading range reports for the next 6 months. 24 hours of patience. Then its go time. I think we have it nailed down. Please watch those mid day review videos so you are in the know before we go. Really really important.

Monday Jan 7 – Two days to let market structure settle and the report flow for the next six month time cycles starts. #patience #caution.

Fri Jan 4 – If Fed pauses hikes and US-China trade relations improve oil should run in to May targets oil bundle members have (especially if OPEC cuts remain in play), the markets should run up in to May. Gold, Silver, VIX, DXY and Bitcoin may (are likely) to get soft and equities will be a stock pickers environment (traded properly within instrument structure) during that period (Q1 2019). Generally this is how it looks currently. But yet to be seen in to next week forward – this is one scenario. Reporting and alerts (either way) will become very active as next week rolls out and in to next 6 months. We will have the structure of trade for our coverage (the algorithm models and swing platform) so that we can trade either scenarios (up or down in each, including swing trading).

Market Observation:

Markets as of 7:48 AM: US Dollar $DXY trading 95.90, Oil FX $USOIL ($WTI) trading 50.73, Gold $GLD trading 1281.35, Silver $SLV trading 15.61, $SPY 257.17 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4008.00, $VIX 20.3 and NatGas 3.019.

Momentum Stocks / Gaps to Watch:

22 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12957524 $GMED $SWKS $URGN $VSTM $CLVS $CGC $SGH $TLND $GBX $NBR $AXSM

Stocks making the biggest moves premarket: AAPL, MS, BAC, TLRY, FL & more –

https://twitter.com/CompoundTrading/status/1082983829214777344

News:

Oil rises 2 percent on U.S.-China trade talk optimism – SI

$AAPL: WEDBUSH SAYS SERVICES BUSINESS, POISED TO EXCEED $50 BILLION IN FY20, WILL BE ULTIMATE DRIVER FOR NEXT PHASE OF APPLE GROWTH STORY

LATEST: U.S.-listed shares of Fiat Chrysler up about 3.2 percent premarket after @Reuters report says company nearing U.S. diesel emissions settlement. Read more:0 https://reut.rs/2CWntg8

$NEO (+7.5% pre) NeoGenomics (NEO) Set to Join S&P SmallCap 600 – SI

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

Don’t forget the pump- steins ala no secondaries

U.S. Government Shutdown Freezes IPO Market, Imperiling Expectations for 2019

Don't forget the pump- steins ala no secondaries

U.S. Government Shutdown Freezes IPO Market, Imperiling Expectations for 2019https://t.co/PiArRGejwI

— Marc Lehman (@markflowchatter) January 9, 2019

Earnings:

$GOGO (+12.9% pre) Gogo Announces Strong Year-end De-icing Results, Raises Adjusted EBITDA Guidance to High End of Previously Range – SI

Illumina sees Q4 revenue above expectations, provides a mixed outlook.

Lennar beats profit expectations, but revenue and deliveries come up short.

#earnings scheduled for the week

$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAA

#earnings scheduled for the week$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAAhttps://t.co/r57QUKKDXL https://t.co/CdQw0J0oUi

— Melonopoly (@curtmelonopoly) January 7, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

http://eps.sh/cal

A look at Jan #earnings calendar.$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN https://t.co/r57QUKKDXL https://t.co/rBfBzOCeAu

— Melonopoly (@curtmelonopoly) January 2, 2019

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

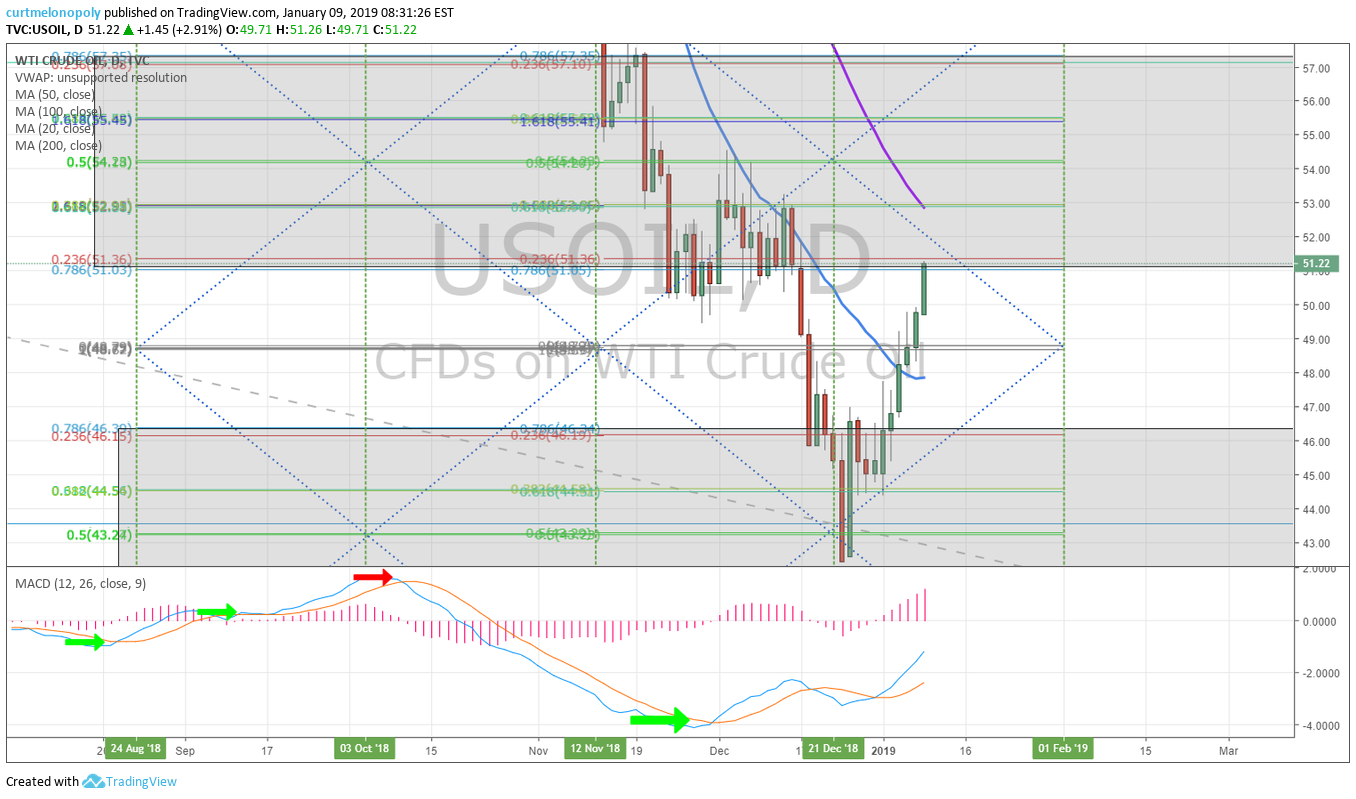

Possible reversal in oil trend on the daily chart. What a move. #Oil #Trading

Test chart for machine sizing – in a turn up red more important support and resistance $CL_F $WTI $USOIL #Oil

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Crude oil resistance points, trade technically should come under pressure in to the 10th and then possibly bounce to target.

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

-China and the U.S. coordinate messaging as trade talks end on optimism

-Bullard warns of a U.S. recession if the Fed keeps raising rates

-Fed minutes for December’s unanimous rate hike are due today

Here’s a rundown of your top economic news

-China and the U.S. coordinate messaging as trade talks end on optimism

-Bullard warns of a U.S. recession if the Fed keeps raising rates

-Fed minutes for December's unanimous rate hike are due today

Here's a rundown of your top economic newshttps://t.co/57MhiWdSJQ— Bloomberg Economics (@economics) January 9, 2019

#5Things

-Trade optimism

-Shutdown rattles on

-Oil over $50

-Markets rise

-Central bank news

https://bloom.bg/2FiAmTA

Here comes the reversal of last year’s flight to cash. Investors pulled $745 million yesterday from Vanguard’s $27.2 billion short-term bond ETF, the fund’s biggest one-day withdrawal in its history. $BSV

Here comes the reversal of last year's flight to cash. Investors pulled $745 million yesterday from Vanguard's $27.2 billion short-term bond ETF, the fund's biggest one-day withdrawal in its history. $BSV pic.twitter.com/tx8ewqFXDk

— Lisa Abramowicz (@lisaabramowicz1) January 9, 2019

PS Markets won’t crash for real until everything…. and I mean everything goes up at the same time. And yes, it will be a first. Mark it.

PS Markets won't crash for real until everything…. and I mean everything goes up at the same time. And yes, it will be a first. Mark it.

— Melonopoly (@curtmelonopoly) November 22, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $OILU $UWT $VSTM $SFET $CLVS $DBD $CGC $STM $AMRH $NEPT $FCAU $YINN $MT $ASML $USO $APHA $MU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $BAC $CNO $PUK $PBF $CTRE $DRE $HCP $RF $CIT $E $MA $AKAM $WEN $NBL $CXO $URBN $MTB $TRGP $RIG $TVPT $HLI $CARB $IGT $MGP $AAP $GPC $FL $TRV $ACGL $PGR $AMP $CPLG $BXP $RL $LULU $FITB $MS

$MS: CITIGROUP RAISES TO BUY FROM NEUTRAL

$AMZN PT RAISED TO $2,100 FROM $2,000.00 AT BOFA/MERRILL LYNCH

(6) Recent Downgrades: $UAL $DAL $FIVE $RDFN $BKNG $PFG $DK $HTA $CUBE $EXPE $PKG $IP $MB $ORCL $LOW $DUK $NKE $PHI $X $RNR $CNHI $RDFN $RES $OAS $LPI

$BAC: CITIGROUP CUTS TARGET PRICE TO $28 FROM $31

$WFC: CITIGROUP CUTS TARGET PRICE TO $56 FROM $60

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Oil, SPY, VIX, BTC, Gold, Silver, DXY, China US Trade, Time Cycles

PreMarket Trading Plan Mon Oct 22: Market Chop, Oil Pressure, Silver, China, $BABA, $SLS, $JTPY, $TOPS, $NETE, $SLS, $NDRA …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday October 22, 2018.

In this premarket trading edition: Market Chop, Oil Pressure, Silver, China, $BABA, $SLS, $JTPY, $TOPS, $NETE, $SLS, $NDRA and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 22 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- https://twitter.com/curtmelonopoly/status/1054318666878238720

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Sept 17 – Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 12 – XENETIC BIOSCIENCES INC How to Trade XBIO Snap-back Swing Trade. $XBIO #swingtrading #tradealert

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 22: I have a new position in Silver in 14.63’s long that may get some pressure but there is a plan to add at support below. Earnings season may help equities some here near term – but it is dubious.

General outlook remains unchanged from running comments from previous posts below.

Notes per recent remain:

I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Notes per recent…. this remains.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 8:23 AM: US Dollar $DXY trading 95.64, Oil FX $USOIL ($WTI) trading 69.34, Gold $GLD trading 1223.90, Silver $SLV trading 14.62, $SPY 277.17 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6397.00 and $VIX trading 19.

Momentum Stocks / Gaps to Watch: $TOPS $NETE $SLS $NDRA

30 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12540486 $TOPS $GLBS $ARII $LCGN $DVAX $SEED $MRTX $AVEO $YECO $PHG $CZR

News:

Bristol-Myers Squibb stock drops 3% premarket after FDA delays approval deadline for cancer drug

$JTPY JetPay to be Acquired by NCR for $5.05/Share Cash #Benzinga

$BABA Alibaba’s stock surges as part of broad rally in China-based companies

Mirati Therapeutics stock drops 30% premarket after cancer trial results

American Railcar to be bought in a $1.75 billion deal by ITE, giving Icahn a $757 million profit

$SLS Announces Positive Final Data in Triple Negative Breast Cancer Patients from Phase 2b Clinical Trial of Nelipepimut-S in Combination with Trastuzumab Presented at #ESMO18.

Intec Pharma completes enrollment in Phase 3 trial of AP-CD/LD for the treatment of advanced PD https://seekingalpha.com/news/3399216-intec-pharma-completes-enrollment-phase-3-trial-ap-cd-ld-treatment-advanced-pd?source=feed_f … #premarket $NTEC.

Recent SEC Filings / Insiders:

Recent IPO’s:

$AXNX Axonics to offer 6.7 million shares in IPO, priced at $14 to $16 each. #premarket https://www.marketwatch.com/story/axonics-to-offer-67-million-shares-in-ipo-priced-at-14-to-16-each-2018-10-22?mod=BreakingNewsSecondary

Analyst IPO quiet periods expiring this week for:

– Survey Money $SVMK

– Capital Bancorp $CBNK

– Arco Platform $ARCE

Earnings:

Kimberly-Clark rise after earnings and revenue beat expectations.

Halliburton tops profit and revenue estimates for third quarter.

Hasbro’s stock set for selloff after profit and revenue fall, miss expectations.

#earnings for the week

$AMD $AMZN $MSFT $GE $SNAP $TWTR $GOOGL $T $INTC $BA $CAT $V $HAL $SHOP $F $MCD $LMT $HAS $CELG $VZ $AAL $UPS $MMM $NOK $KMB $LAGN $CMG $PETS $FCX $CY $GRUB $GILD $WDC $BIIB $PII $STM $RTN $NOW $IRBT $AMTD $SALT $TXN $UTX $SIRI

#earnings for the week$AMD $AMZN $MSFT $GE $SNAP $TWTR $GOOGL $T $INTC $BA $CAT $V $HAL $SHOP $F $MCD $LMT $HAS $CELG $VZ $AAL $UPS $MMM $NOK $KMB $LAGN $CMG $PETS $FCX $CY $GRUB $GILD $WDC $BIIB $PII $STM $RTN $NOW $IRBT $AMTD $SALT $TXN $UTX $SIRI https://t.co/r57QUKKDXL https://t.co/4ZnvQ7L3g5

— Melonopoly (@curtmelonopoly) October 20, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

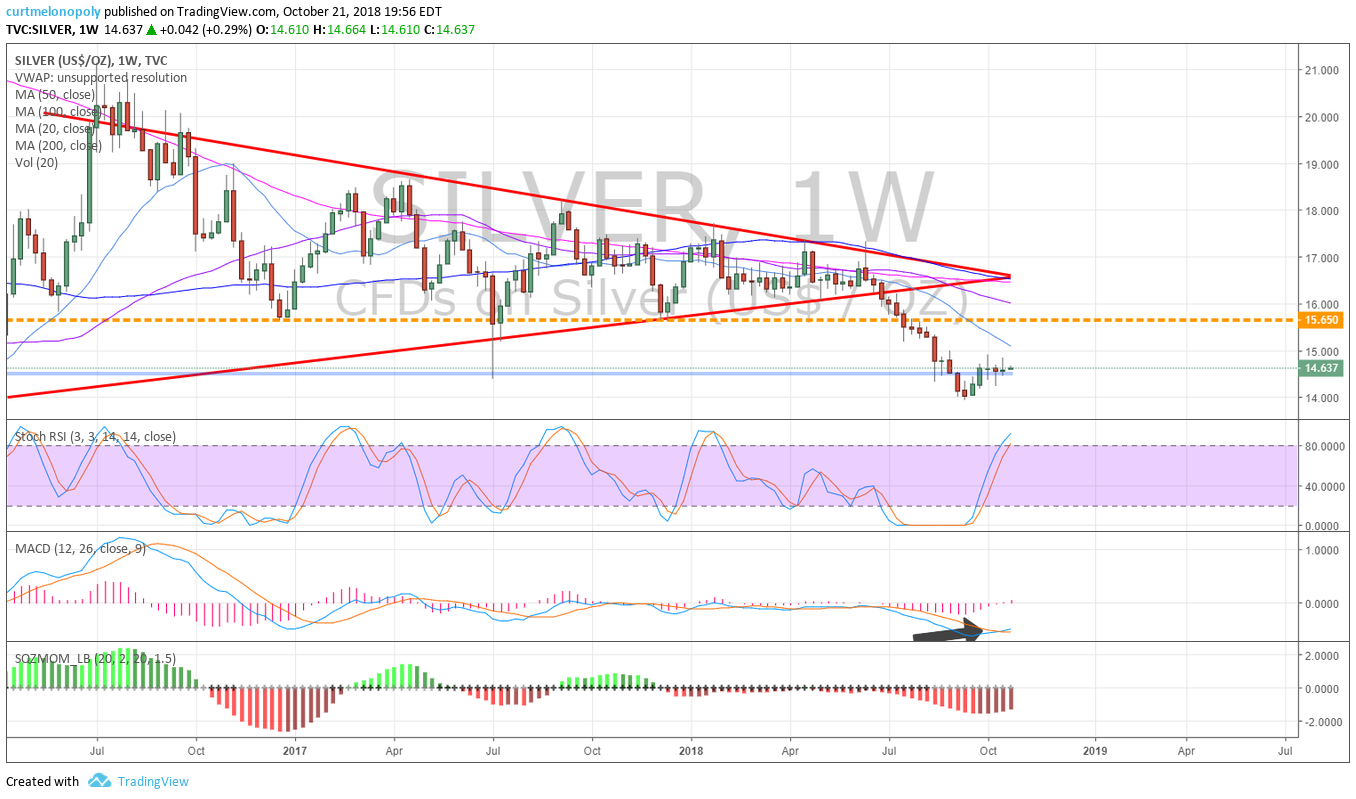

Silver Weekly Chart has a MACD turn up possible, watching for a possible run up Oct 21 756 PM #Silver #Algorithm $SLV $USLV $DSLV

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD pic.twitter.com/JNfF5U9u7L

— Rosie the Gold Algo (@ROSIEtheAlgo) October 21, 2018

Crude oil lines on 4 hour chart $CL_F $USO $UWTI $DWTI $UCO $SCO $UWT $DWT#Oil #OOTT

https://twitter.com/EPICtheAlgo/status/1052900369003622401

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

Our swing trade that started in premarket yesterday couldn’t have been better timing with SEC mins after then this… $TSLA Tesla’s stock jumps after Elon Musk discloses plan to buy $20 million worth of shares

Our swing trade that started in premarket yesterday couldn't have been better timing with SEC mins after then this… $TSLA Tesla's stock jumps after Elon Musk discloses plan to buy $20 million worth of shares https://t.co/lvBf2QhYTm

— Melonopoly (@curtmelonopoly) October 17, 2018

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

NETFLIX (NFLX) up premarket on earnings, key resistance points to watch if trading this move $NFLX #swingtrading #earnings #upgrades

SQUARE (SQ) blowing through resistance points in move, over 81.40 targets 83.40 85.40. $SQ #swingtrade #tradealerts

FIREEYE (FEYE) long bounce working toward upper price targets in to earnings, watch resistance points for trims #swingtrade $FEYE

SHOPIFY (SHOP) bounced at top of trading box, resistance 154.00 earnings 8 days, over 156 long targets 166 then 177 $SHOP #swingtrading #earnings

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Crude Oil Daily Chart, MACD crossed down with trade testing mid pivot Oct 15 1244 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

TESLA (TSLA) At trading box range support EOD Friday, in a bounce it targets 280.34 Nov 20, 2018 $TSLA #swingtrading

ARROWHEAD PHARMA (ARWR) MACD turned down but over 200 MA and channel support. On watch for adds to trade. $ARWR #swingtrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

Crude oil trade alert entry and exit shown on an oil chart.

SP500 (SPY) Under pressure, careful with trajectory inflection lines (red) when trading long $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-China shares surge

-Italian asset rise

-Trump’s tax-cut promise

-May faces lawmakers

-Coming up…

https://bloom.bg/2PcQXxo

Here is that same chart, with the SP500 overlaid, to reveal how this low reading is a bottoming condition, and not a sign of impending doom.

Here is that same chart, with the SP500 overlaid, to reveal how this low reading is a bottoming condition, and not a sign of impending doom. pic.twitter.com/5brnpsRV2A

— Tom McClellan (@McClellanOsc) October 19, 2018

Net speculative futures positioning behind the $VIX has swung by over 100,000 contracts in the favor of bulls the past two weeks:

Net speculative futures positioning behind the $VIX has swung by over 100,000 contracts in the favor of bulls the past two weeks: pic.twitter.com/DbkEYTbing

— John Kicklighter (@JohnKicklighter) October 20, 2018

Net speculative gold futures positioning posted its biggest swing away from a net short position since March 1999

Net speculative gold futures positioning posted its biggest swing away from a net short position since March 1999 pic.twitter.com/jeF5pzLIpi

— John Kicklighter (@JohnKicklighter) October 20, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TOPS $CLGN $ARII $DCIX $SINO $AYTU $SEED $NDRA $PXS $GLBS $SLS $FTFT $ESEA $DVAX $YINN $IGC $CHAU $NVIV $YNDX $MOMO $PDD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Chipotle upgraded on same-store sales growth potential though earnings expected to be ‘lackluster’.

$AYTU – initiated with a Outperform and $10 price tgt at Northland.

Aetna $AET PT Raised to $207 at Credit Suisse.

Jefferies Upgrades Ophir Energy Plc. (OPHR:LN) $OPHRY to Buy.

(6) Recent Downgrades:

Accor SA (AC:FP) $ACCYY PT Lowered to EUR49 at UBS.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Market Chop, Oil Pressure, Silver, China, $BABA, $SLS, $JTPY, $TOPS, $NETE, $SLS, $NDRA

PreMarket Trading Plan Tues Apr 10: China, Trump, $NFLX, $SPY, $AMD, $CHFS, $CUR, $MYOS, $PAY, $SPPI…

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday April 10, 2018: – SP500, $SPY, $BTC, Bitcoin, Gold, $GLD, $GDX, OIL, $WTI, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Details to our next Trading Boot Camp in May! We’re over 70% booked so don’t wait. 30% off on this session! And what a location! #tradecoaching #learntotrade

https://twitter.com/CompoundTrading/status/982706326454358017

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Today will be all about watching the models and structure of the charts and possible alerting some significant positions. I won’t detail them all here because we have over 100 equity models now all alarmed and ready. It will be a big day I am sure.

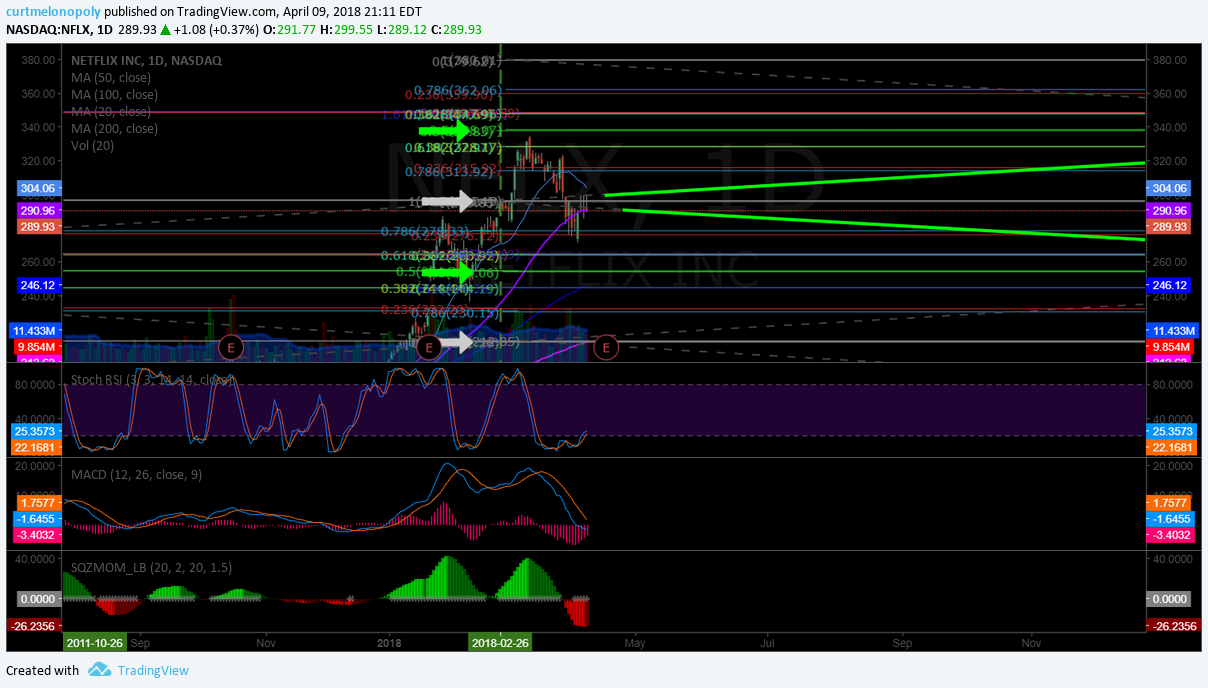

$NFLX Netflix’s stock surges after J.P. Morgan boosts price target

$NFLX Algorithm modelling tells you what the needle movers are doing (insiders) before the retail markets know. We alerted this move in detail last night. #tradingedge #premarket #charting

$NFLX Algorithm modelling tells you what the needle movers are doing (insiders) before the retail markets know. We alerted this move in detail last night. #tradingedge #premarket #charting

— Melonopoly (@curtmelonopoly) April 10, 2018

$NFLX Screen shots from our private Swing Trading member Discord screen last night #trading #algorithm #chart #models #premarket

$NFLX Screen shots from our private Swing Trading member Discord screen last night #trading #algorithm #chart #models #premarket pic.twitter.com/YvfQJdni0w

— Melonopoly (@curtmelonopoly) April 10, 2018

Stocks making the biggest moves premarket: GS, NVDA, PM, TEN, IEP, NKE, UAL & more

Stocks making the biggest moves premarket: GS, NVDA, PM, TEN, IEP, NKE, UAL & more https://t.co/TJ0HYnpV82

— Melonopoly (@curtmelonopoly) April 10, 2018

Market Observation:

As of 7:59 AM: US Dollar $DXY trading 89.90, Oil FX $USOIL ($WTI) trading 64.76, Gold $GLD trading 1336.50, Silver $SLV trading 16.51, $SPY trading 264.5, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 6741.00, and $VIX trading 20.5.

Recent Momentum Stocks to Watch:

News:

Netflix tracks higher after Morgan Stanley confidence https://seekingalpha.com/news/3344593-netflix-tracks-higher-morgan-stanley-confidence.

$SELB Presents Positive New Data from Ongoing Phase 2 Trial of SEL-212, in Development for Chronic Severe Gout, at PANLAR 2018 Congress

$AMD, $CHFS, $CUR, $LEVB, $MYOS, $PAY, $SPPI, $VBLT, $VTVT

Recent SEC Filings:

Recent IPO’s:

Pivotal Software to offer 37 million shares in IPO at $14 to $16 a pop

Earnings:

#earnings scheduled for the week

$JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY

http://eps.sh/cal

#earnings scheduled for the week $JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY https://t.co/r57QUKKDXL https://t.co/BcGzJRjTUB

— Melonopoly (@curtmelonopoly) April 7, 2018

Trade Set-up Alerts – Recent / Current Holds, Open and Closed Trades:

Swing Trading in Review. $DIS, $C, $TSLA, $FB, $SPY, $GDX, $CELG https://compoundtrading.com/swing-trading-review-dis-c-tsla-fb-spy-gdx-celg/ …

https://twitter.com/CompoundTrading/status/983045524839452672

Charts and Chart Set-ups on Watch:

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://www.tradingview.com/chart/GOLD/IcE7fVql-Historical-resistance-hit-again-Predictable-short-Chart-Notes/ …

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://t.co/1ic9v7LhsP pic.twitter.com/hZlfN8gjV9

— Rosie the Gold Algo (@ROSIEtheAlgo) April 9, 2018

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://t.co/5AWSJCxqA5 pic.twitter.com/9SaQX01K5U

— Swing Trading (@swingtrading_ct) April 8, 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

Oil Resistance One of Most Predictable Trades in Markets. See chart notes. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/LFoaIZEq-Oil-Resistance-One-of-Most-Predictable-Trades-See-chart-notes/ …

https://twitter.com/EPICtheAlgo/status/982760354815053824

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://www.tradingview.com/chart/MXIM/l2JjyH3X-MXIM-under-55-94-short-side-looks-great-MACD-turn-Chart-notes/ …

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://t.co/nNQfOV6rMr pic.twitter.com/4241zYTpX0

— Swing Trading (@swingtrading_ct) April 8, 2018

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

https://www.tradingview.com/chart/LTCUSD/NAsEtGUs-Litecoin-likely-bounce-near-here-for-chart-structure-Chart-notes/ …

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

$TSLA also blasting here from yesterday’s alert🔥 In it to win it. #swingtrading

$TSLA also blasting here from yesterday's alert🔥 In it to win it. #swingtrading pic.twitter.com/JEefAyUROL

— Melonopoly (@curtmelonopoly) April 5, 2018

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://twitter.com/SwingAlerts_CT/status/981914928528416768/photo/1pic.twitter.com/muDQaThxP2

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://t.co/muDQaThxP2 pic.twitter.com/UXpvTgLpuo

— Melonopoly (@curtmelonopoly) April 5, 2018

Trade in $C Citi on fire🔥In it to win it. #swingtrading

Trade in $C Citi on fire🔥In it to win it. #swingtrading pic.twitter.com/0HKG0jH9sb

— Melonopoly (@curtmelonopoly) April 5, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

:#5things

-Xi speech

-Russia selloff

-Trump v Mueller

-Markets rise

-Zuckerberg in Washington

https://bloom.bg/2H9HtPr

#5things

-Xi speech

-Russia selloff

-Trump v Mueller

-Markets rise

-Zuckerberg in Washington https://t.co/kniHNEhFfc pic.twitter.com/YPTU3KgBT3— Bloomberg Markets (@markets) April 10, 2018

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/RgRRr2NNib

— Benzinga (@Benzinga) April 10, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PAY, $WATT, $CUR $SPPI $KPTI $UWT $VEON $GUSH $TQQQ $SCYX $MT $UCO $STM $SPXL $PTN $BHP $NVDA $GM $OAS $TSLA $ROKU $BA $NFLX $MU $AMD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ULTA $IOVA $ETN $PFPT $LYV $FRAC $PNFP $PACW $CBSH $LYV $BDX $VRTU $AUY $TGB $CFMS $ITW

Bernstein Starts E*TRADE $ETFC at Outperform, ‘Standalone Story Works’

$NFLX PT raised to $350 from $275 at $MS – keeps Overweight rated

Bernstein Starts TD Ameritrade $AMTD at Outperform, Likes The Attractive Valuation

Bernstein Starts IntercontinentalExchange $ICE at Outperform

(6) Recent Downgrades: $VTVT $CGNX $KGC $TV $CFR $MTG $RDN $LGIH $MTB $HSY

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, China, Trump, $NFLX, $SPY, $AMD, $CHFS, $CUR, $MYOS, $PAY, $SPPI

Post Market Thur Nov 17 Low Float Shippers China, $USOIL, #OIL, $UWTI and more.

Review of my Chat Room Stock Day Trades / Alerts for Thursday Nov 17, 2016. Low Float Shippers China, $SCON $BNSO, $DHRM, $ISNS, $UWTI, OIL, and more.

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive (we start sharing videos soon – just one more thing on the to-do list).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

Overview Perspective of Chart Room, Trades and Alerts:

Today for me was a scalping day… worked moderately well. With a goal of 1% minimum per day (preferably 3%) I’m easily on track since the beta start of our trading room a couple weeks back (1% per day 10k to 1.14MM in 26 mos compounded).

Primary lessons I learned that may help your trades…

Today wasn’t exciting… it was a process of me chewing around the edges of crude trades with $UWTI (which by the way is being delisted soon – see premarket report coming up). I was likely up 1% or better – haven’t had the time to see yet.

The reason I chew around the edges is that I am looking for a break-out entry scalping with my small account looking to build it at 1% a day compound and if a break-out occurs then I start hammering down with my larger swing account on every pull-back. Pretty simple strategy that works well. With oil, the break-out I’m looking for is due to not only the current OPEC meetings but also in the charting.

But soon, very soon we’re looking at Gold and Silver because the are getting really close to our algorithm’s projected lows. So I will start chewing around the edges of $GOLD $SILVER and miners $GDX. Right now $DXY is in break-out mode so I may trade $UUP on pull-backs for a bit (however we see it trailing off soon) – it’s an inflection point in markets – so it is about being cautious during inflection prior to next trends. Japan is also in break-out so I may start chewing around edges of $DBJP also and of course the S & P 500 $XIV same thing. $VIX is getting stomped as expected but inflection will come there too.

What I did miss was the shippers (was all over them before they started but elected not to play) and China low float stocks have started (was also all over that ahead of curve and I’m thinking on it) and semi conductors I didn’t play.

Stock Chatroom Trading Transcript

08:54 am Curtis M : Premarket Top % Gainers: $SINO 76%, $RLOG 70%, $GSL 36%, $DCIX 27%, $ESEA 27%, $TOPS, $NM $GLBS $IMNP $NMM $SB $SHIP $NTAP $PLUG $BBY $EGLE

08:55 am Curtis M : Upgrades $MSFT $NOA $RRC $TCK $KBR $FSLR $QVCA $T $MUSA $NTAP

09:05 am Curtis M : No morning newsletter… same as yesterday with premarket gainers and upgrades listed here.

09:20 am Curtis M : $RLOG 113%, $GSL 105%, $SINO 99%, $PSID 36%, $DCIX 29%, $NMM 28%, $NWBO $TOPS $WNR $NM $SB $ANW $GLBS $NTAP $HAIN

09:23 am Curtis M : “Risk control is the most important thing in trading.”

09:24 am GSCT . : /CL surge here

09:26 am Curtis M : Morning … back in a minute for open

09:32 am GSCT . : DRYS offering

09:49 am mathew w : Getting out of my ON UWTI position

09:49 am mathew w : Huge moves all over the board

09:52 am Curtis M : Looking for $UWTI long as oil settles through morning, oil companies starting to squeeze so Im running scans, expected entry long $UWTI at arrow gives me 46.20 – 47.28 width on crude for 3-6% in $UWTI potential

09:53 am GSCT . : Thanks for the detailed strategy

09:58 am Curtis M : RUnning screeners on oil companies and waiting for $UWTI entry on oil price target

10:00 am mathew w : WLL and NE working nicely here

10:00 am Curtis M : For those wondering why I will stalk an oil trade for hours …. https://compoundtrading.com/100000-turns-1-million-24-mths-1-per-day-compound-stock-trading/

10:00 am mathew w : Looking and JONE and EPE

10:04 am mathew w : LE? No NE. Noble energy

10:04 am mathew w : I’m in these calls from friday

10:04 am mathew w : haha close. Cows. Oil. whatever

10:13 am GSCT . : U or DWTI?

10:27 am Curtis M : http://finance.yahoo.com/news/janet-yellen-testifies-on-capitol-hill-150717531.html

10:53 am Curtis M : https://twitter.com/curtmelonopoly/status/799278889566662656 finally got some sun after 4 days of rain

10:57 am Curtis M : Long $UWTI 19.60 800 shares small account – may have to sit through some pain… a little early but ya

11:13 am Curtis M : Out for now at 19.70 looking to renter $UWTI

11:22 am Curtis M : Lomg $UWTI 19.535 small account 1000 shares

11:24 am Curtis M : Out $UWTI flat

11:25 am Curtis M : chewing around edges trying to get lift

11:49 am Curtis M : Long $UWTI small account 1000 share 19.536

11:59 am Curtis M : OUt $UWTI 19.74

12:00 pm Curtis M : ugh

12:02 pm Mathew Waterfall : Nice Kill Curtis. Well done

12:03 pm Curtis M : thanks

12:06 pm Curtis M : So going to get ready for EOD oil squeezes catcha in a few

12:06 pm Mathew Waterfall : AMD and MU going crazy today if you’re looking for other momo plays

12:06 pm Curtis M : thanks

12:07 pm Mathew Waterfall : Repeated calls being bought in size in both this AM

12:07 pm Mathew Waterfall : Might be a little tired but still seeing flows coming across

12:09 pm Curtis M : ok thanks

12:10 pm Curtis M : going to be out of hotel for 20 mins

12:10 pm Curtis M : if it says im out of room or whatver no prob cya in 20

12:11 pm Curtis M : specifically im mainly looking at oil squueze small caps but will look at anything EOD

12:56 pm Mathew Waterfall : invernse h&s on /cl 1′ chart

01:20 pm Curtis M : $DHRM china loa float

01:21 pm Curtis M : Yup theyre gonna run the Chinas now for a while lol

01:27 pm Curtis M : $SCON $BNSO, $DHRM then likely $ISNS

01:32 pm Mathew Waterfall : In and out of /cl and UWTI for small wins. That price action is agrivating.

01:40 pm Mathew Waterfall : Back in FH for a swing trade. Hit this for a win about a month ago. Back on the radar today so hoping to get back into the 3s shortly

01:42 pm Curtis M : crude has snipers in there till bots get it and go

01:45 pm Curtis M : Watching $BNSO $NFEC $ DHRM $ISNS and other China low float mania

01:51 pm Curtis M : Long $UWTI 19.26 1000 shares small acct

01:51 pm Mathew Waterfall : Im short FYI

01:51 pm Mathew Waterfall : once it broke .21 I went short

01:52 pm Mathew Waterfall : I was wrong on that one lol. Quick out

01:57 pm Curtis M : $UWTI small win beers and hotdogs

01:57 pm Curtis M : $CCCL

01:57 pm Mathew Waterfall : I’m back short. This is going lower with the $DXY strength

01:58 pm GSCT . : When you talk about a ticker can you please say its name as I can’t always have your screen up and also can you make the ticker symbol more readable on your chart as it’s very hard to discern.

02:00 pm GSCT . : I mean the symbol name in light grey. Please make it more white.

02:01 pm Mathew Waterfall : The dollar moves make me very nervous right here RE oil

02:05 pm Mathew Waterfall : Im playing against last weeks high here

02:05 pm Mathew Waterfall : might go long /cl

02:08 pm Mathew Waterfall : long and wrong new LOD

02:13 pm Curtis M : Long $UWTI 1000 shares small account 19.05

02:19 pm Curtis M : $UWTI 18.88 loss 1000 shares

02:22 pm Mathew Waterfall : Damn that price action is all over the place

02:22 pm Mathew Waterfall : I was trying to get out of my /cl contracts and it was jumping so bad I lost $$$ trying to chase it down

02:24 pm Curtis M : Long $UWTI 18.93 1000 shares small acct

02:25 pm Curtis M : out flat $UWTI no mojo

02:27 pm Curtis M : Long $UWTI 19.06 1000 shares small act

02:29 pm Mathew Waterfall : Dude tough day for sure. I have 8 round trips in UWTI in one account and have probably half as many round trips for /cl contracts

02:29 pm Mathew Waterfall : Broker making as much as I am today

02:30 pm Curtis M : Out $UWTI 19.07 flat

02:30 pm Curtis M : 3 w 1 L 1 F choppy cant get a trend easily

02:35 pm Mathew Waterfall : Might hit silver shortly for a swing. USLV looks appealing

02:52 pm Curtis M : looks like a lot of gold and silver trading coming up soon here

02:54 pm Curtis M : $DXY should back off… $GOLD and $SILVER gonna run… until then low float mania? And remember what happened last year same time…

03:02 pm Mathew Waterfall : I’m still in TKAI for a low float pick lol. Things kind of a turd but I bought low enough it doesnt matter

03:15 pm Curtis M : Gonna call it a night guys. Were going to try and get all algo charts for all 6 up by Monday. Looks like Gold and Silver are near so lotsa work to do.

03:15 pm Curtis M : Room will stay open till 4 see ya n morning

03:18 pm GSCT . : Thanks CM

Topics: Wall Street, Stocks, Stock Market, Day Trading, Chat Room, Trading Results, Low Float Stocks, Shippers, China, $UWTI, OIL, $SCON $BNSO, $DHRM, $ISNS, $GOLD, $SILVER, $DXY