Trading Strategy Webinar Hosted Nov 28, 2018 with Trade Alerts and Charting

Audio starts at 3:58 on video.

Quick trade strategy review for crude oil, Bitcoin, SP500, Volatility and ARWR trades.

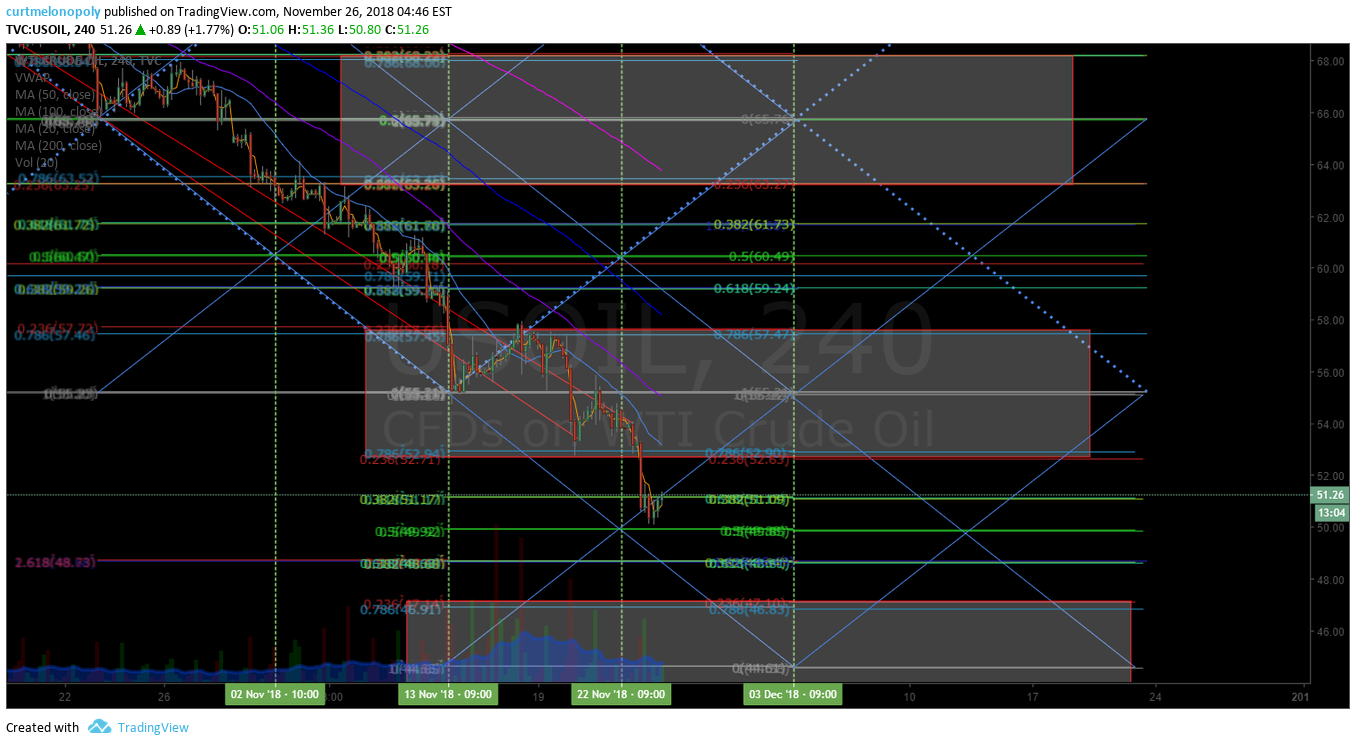

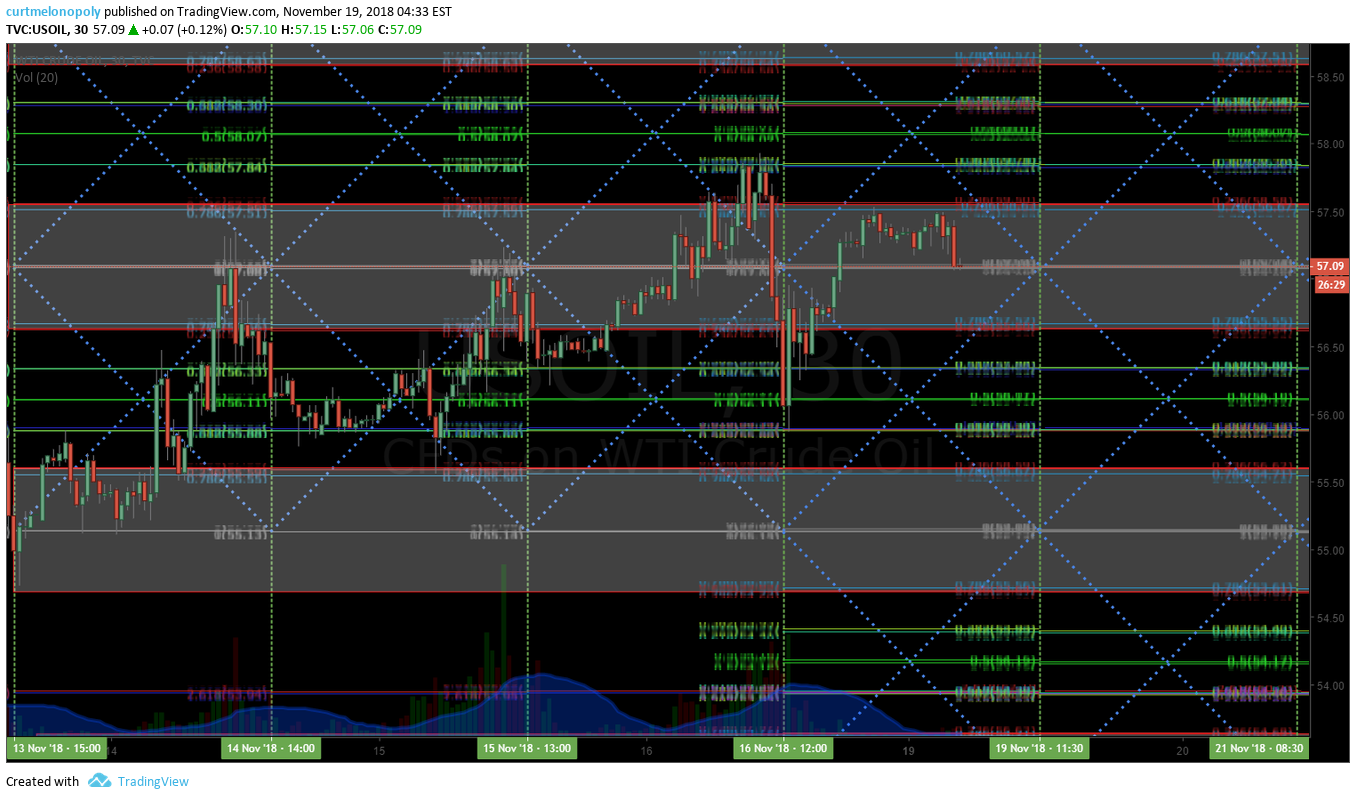

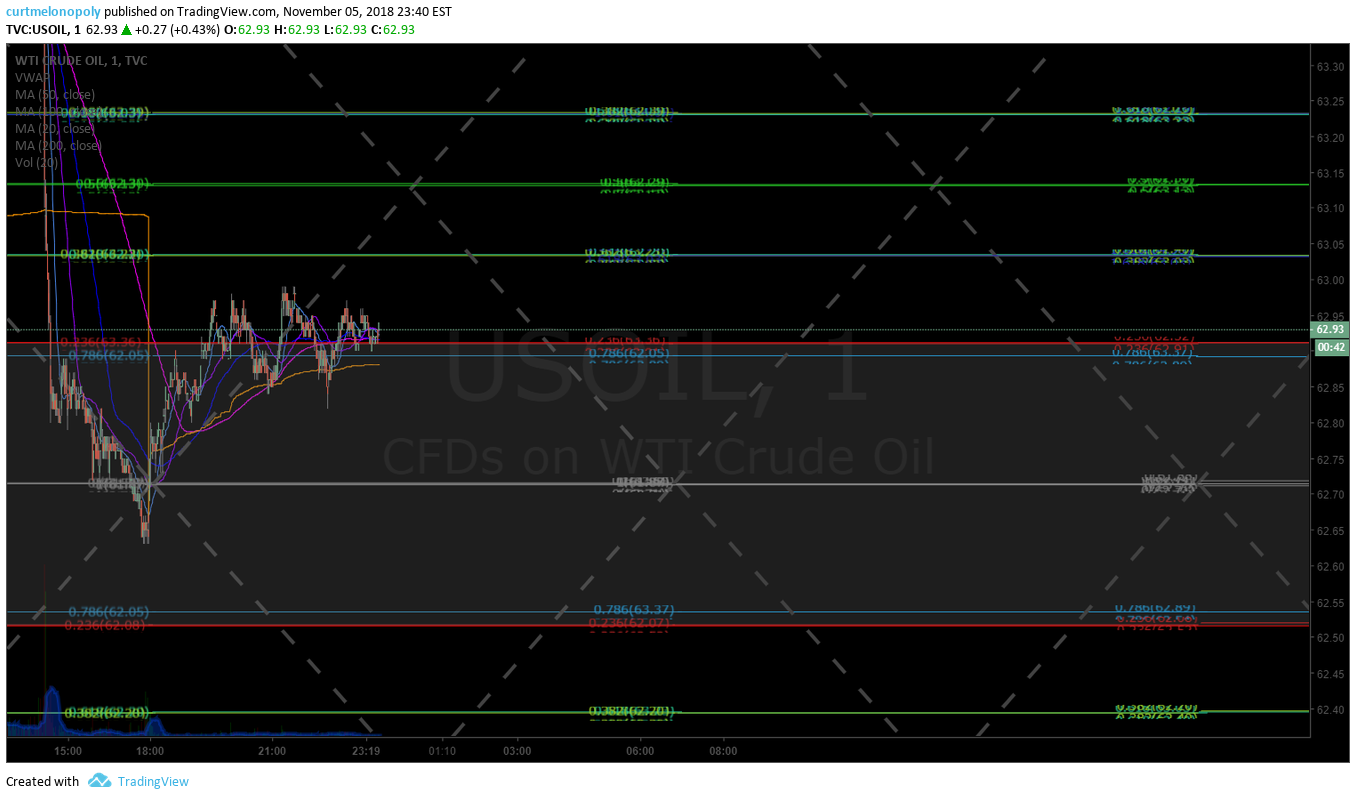

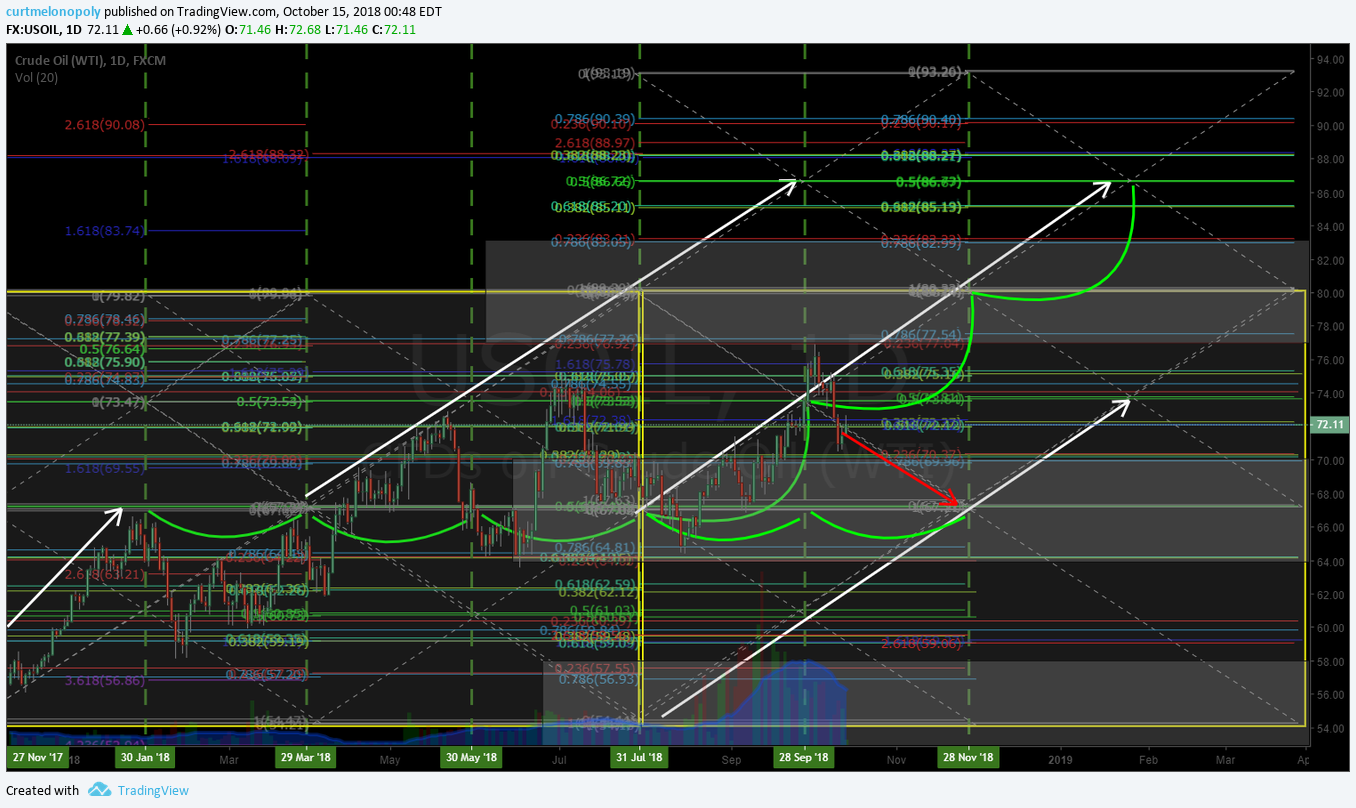

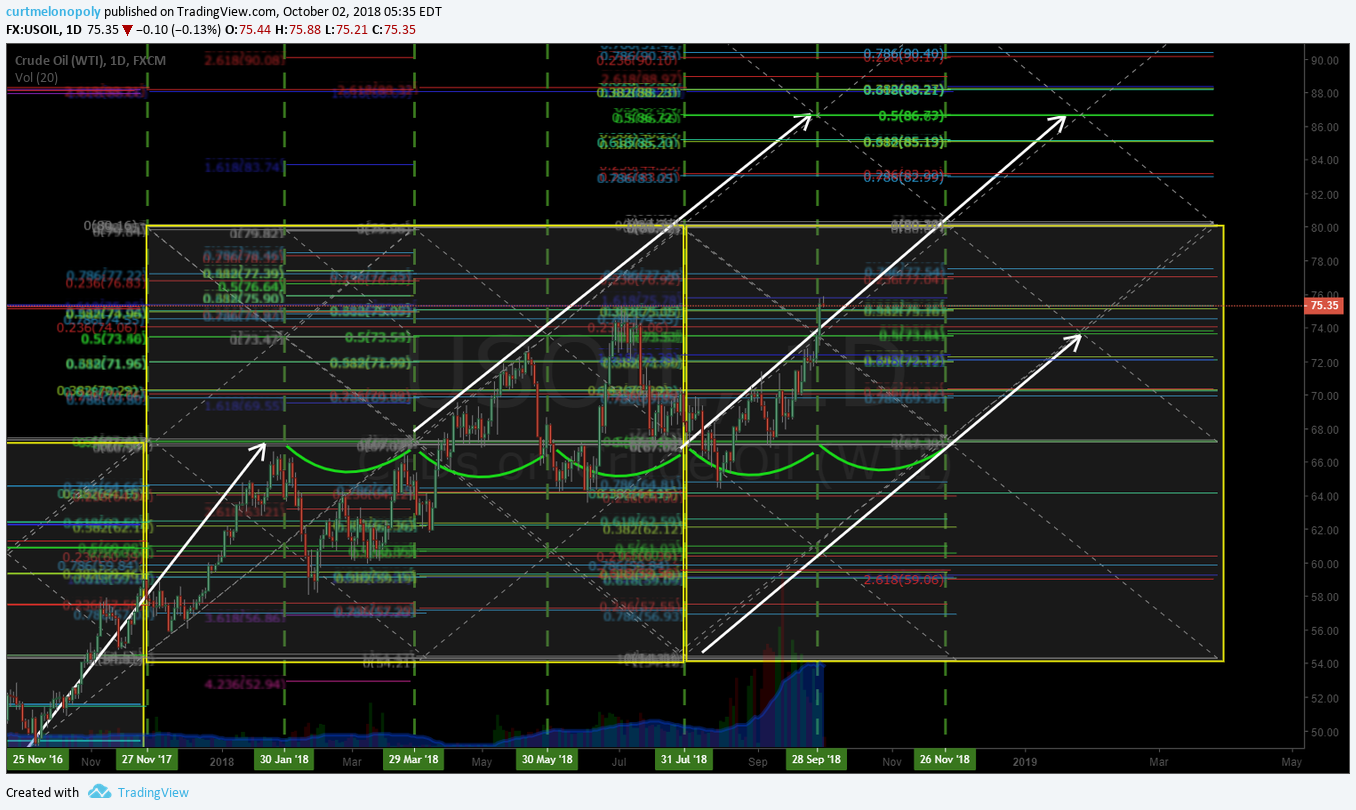

Short $DWT starter position 13.59 trading intra day 13.05 with price target 8.62. We will see how it goes. Trading 13.03 intra-day. Looking for a snap back trade to upside in crude to 50% of recent sell-off.

Daily chart resistance 52.15 area.

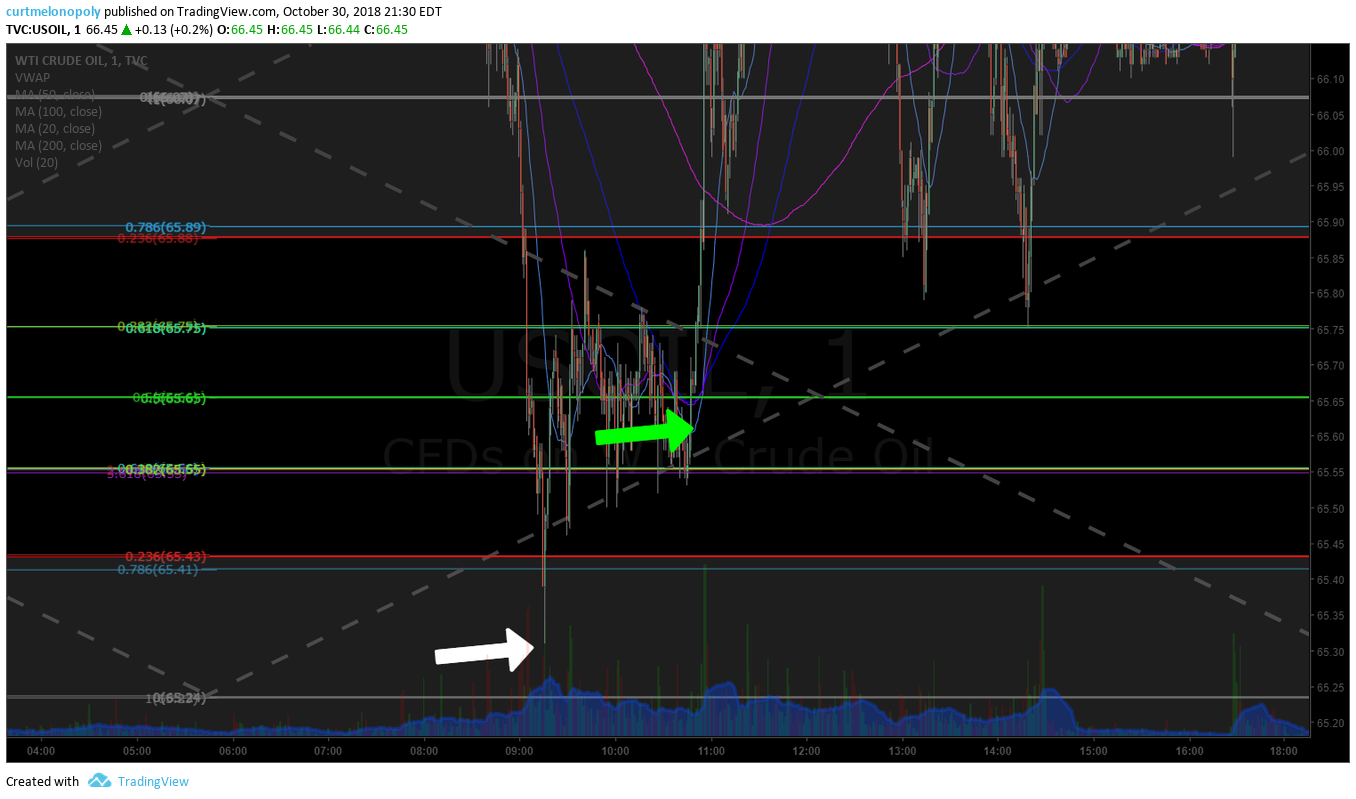

In overnight trade now oil is off trading 49.77 on USOIL WTI at 4:50 AM Eastern. The small bounce so far in overnight after the sell off was at trend-line support on the spigot chart our coders are using for legging in to trade sizing.

As for this starter position short $DWT, holding for now, it is a small position so far. Putin is supportive of Saudi Arabia and if there is a cut in production oil will turn up fast. I’m not marrying the trade either way.

Intra day you could short at top of quad area with 52.40 – .50 resistance.

8:25 Bitcoin BTC – we are looking for a turn in to Christmas being aware of the road bump in market time cycles that has a volatility time cycle (monthly) coming due Dec 5. On Bitcoin we are watching the trend-line chart resistance.

9:23 SP500 $SPY – looking for a possible long SPY in to Dec 20 time cycle peak, however, there is a smaller time cycle peak in VIX on Dec 5 we have to avoid, if that wasn’t there we’d already be long SPY. At this point we are watching.

10:43 Volatility $VIX $UVXY $TVIX We covered our volatility short. Went short TVIX 49.35 covered 50% 45.22 and the remaining at 43.28. Watching support near on VIX at 50 MA (20, 100, 200 also under price) and lower Bollinger bands. Will likely be long in to Dec 5 time VIX specific cycle and short thereafter in to Dec 20 SPY time cycle peak.

11:10 ARROWHEAD $ARWR Last number of days has seen a bounce off the 200 MA, we are monitoring our initial position long.

There is a swing trading report due out today.

Thursday Mid day I will review many swing trades (pending market conditions). We expect to enter most swing trades between now and Tuesday next week. End of day Friday and pre-market is typical for me.

Thanks.