Tag: DGAZ

Part2 – Natural Gas (NATGAS) Trade Alert 2.08 Long Rallied to 2.50s Fast – What’s Next? $NG_F $UGAZ $DGAZ $UNG

The Natural Gas Trade is Heating Up – What a Sweet Trade Set-Up.

Trading natural gas futures or ETN’s / ETF’s like $UGAZ $DGAZ or $UNG can provide excellent returns if you get your trade set-up right. Below we demonstrate what precision trading in natural gas can do for your returns. Our members have enjoyed a series of recent swing trade alerts that have worked well for us. See below.

In our Oct 5, 2020 Natural Gas Swing Trading Newsletter (unlocked) we provided a video from our Weekly Swing Trading Study Webinar and charting for a Natural Gas trade set-up long in the channel.

The Oct 7, 2020 Swing Trade Alert:

NATURAL GAS (NATGAS) 30 min levels, greens and grays are your key levels, will be watching close post oil EIA today #swingtrading $NATGAS

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

The trade alert worked out great and the buy trigger 2.08s hit for long entries and Natural Gas rallied to 2.50s fast.

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

Prior to this, our swing trading platform had traded the Natural Gas falling wedge pattern break-out for excellent returns. See the previous member natural gas newsletter link above.

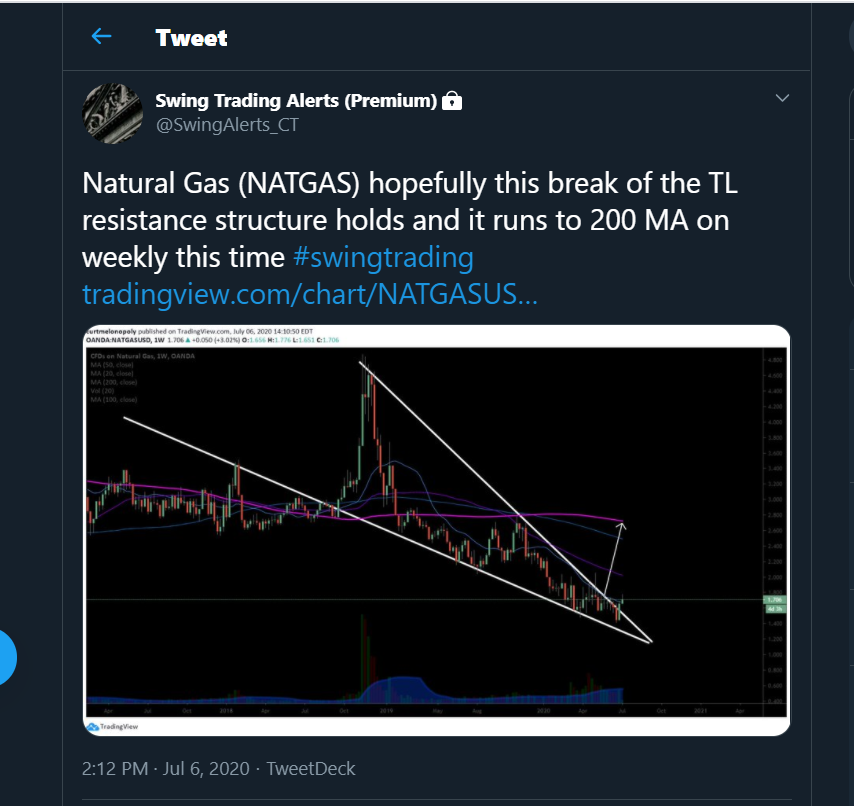

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading

Swing trade alert feed:

The question now is, what’s next?

Swing trade members can review the next set-up in Natural Gas trade in newsletter:

Protected: Natural Gas Trading Newsletter (Premium Swing Trading Post) Part 3

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 300.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, $NG_F, $UGAZ, $DGAZ, $UNG

PreMarket Trading Report Wed Nov 21: EIA, Oil, $WTI, NatGas, $DGAZ, Equities Bounce, Low Float, Penny Momo …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday November 21, 2018.

In this premarket trading edition: EIA, Oil, $WTI, Natgas, $DGAZ, Equities Bounce, Low Float, Penny Momo and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Nov 21 – Lead trader in attendance to live trading room at open, EIA, mid day review and as required through the day.

- Nov 12 Member Update (click) Trade Service Updates: Machine Trade, Trade Alerts, Live Trading, Reporting, Coaching etc.

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- Live Trading Room (as lead trader is available) is a 24 hour trading room (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- Team Work in Progress:

- Machine trading signals to be fed in to main trading room.

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November / December 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Watching time-cycle expiry / inflection for a direction in to next late Dec and then late Dec in to first quarter time cycle 2019.

Nov 21 – Looking at possible retrace to .5 on oil (per last move), possible short in Natural Gas (DGAZ) and watching equities very close for supports to bounce and hold.

Per previous;

If you’re a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You’ll learn a lot and you’ll possibly catch a turn and change your financial life soon. You won’t get many opportunities like this. #premarket

If you're a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You'll learn a lot and you'll possibly catch a turn and change your financial life soon. You won't get many opportunities like this. #premarket

— Melonopoly (@curtmelonopoly) November 20, 2018

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 6:55 AM: US Dollar $DXY trading 96.81, Oil FX $USOIL ($WTI) trading 54.37, Gold $GLD trading 1223.40, Silver $SLV trading 14.41, $SPY 265.53 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4518.00 and $VIX trading 21.7.

Momentum Stocks / Gaps to Watch:

FAANG STOCKS EXTEND GAINS, NOW UP BETWEEN 1.2 PCT AND 3 PCT PREMARKET

FAANG STOCKS EXTEND GAINS, NOW UP BETWEEN 1.2 PCT AND 3 PCT PREMARKET

— *Walter Bloomberg (@DeItaone) November 21, 2018

Low float on watch $ANY $INPX $GLBS $PXS

Momos on watch $ICTY $MDIN $NHPI $KRFG $PGUS $LCLP $WWIO $INKW

20 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12737960 $FL $ABIL $BZUN $ADSK $BJ $LTM $HTBX $XRF $ANY $DE $CAL $BILI

News:

Equity contagion spreads to credit, deepening worries on growth. GE woes, rising Fed rates are weighing on bonds. Spreads probably haven’t widened enough, Goldman says. https://www.bloomberg.com/news/articles/2018-11-21/equity-contagion-spreads-to-credit-deepening-worries-on-growth …

Equity contagion spreads to credit, deepening worries on growth. GE woes, rising Fed rates are weighing on bonds. Spreads probably haven’t widened enough, Goldman says. https://t.co/HU22R0Ivfz pic.twitter.com/xvYFskWv9W

— Holger Zschaepitz (@Schuldensuehner) November 21, 2018

iPhone $AAPL Assembler Foxconn Warns of Difficult and Competitive Year, to Eliminate 10% of Non-Technical Staff – Bloomberg

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

Deere’s stock drops after earnings and revenue rose less than expected

#earnings for the week

$JD $TGT $BBY $LOW $KSS $TJX $BZUN $LB $GWGH $DE $INTU $URBN $$ROST $MDT $SPB $ADSK $CPB $PSTG $JT $A $ADI $LEJU $JEC $SOL $JACK $HRL $BILI $FL $GPS $GHG $BJ $BECN $QD $KEYS $DY $BRKS $NUAN $VBLT $SSI $NM $SFL $NJR $MMS $KLIC

#earnings for the week $JD $TGT $BBY $LOW $KSS $TJX $BZUN $LB $GWGH $DE $INTU $URBN $$ROST $MDT $SPB $ADSK $CPB $PSTG $JT $A $ADI $LEJU $JEC $SOL $JACK $HRL $BILI $FL $GPS $GHG $BJ $BECN $QD $KEYS $DY $BRKS $NUAN $VBLT $SSI $NM $SFL $NJR $MMS $KLIC https://t.co/r57QUKKDXL https://t.co/Cb4X0ukwMC

— Melonopoly (@curtmelonopoly) November 19, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

There have been a few paper cuts executed on machine trading side in oil trade last few days – report will detail when released.

VIX MACD on close watch today, could cross up and we could see escalation quick $VIX $TVIX $UVXY

SP500 (SPY) Daily Chart MACD turned up but structure under pressure. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again

if crude lets go here watch out…. yet again

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5Things

-U.S. accuses China of IP theft

-OPEC’s Texas headache

-Markets rise

-Calls for fiscal coordination

-Data due…

https://bloom.bg/2DCiCBP

Morgan Stanley says bear market starting. GS says economy won’t go into a recession, but its research says bear market risks highest in decades. Wells Fargo says if you got cash use it.

“…the only place that people with Rolls Royce get advice from those who take the subway.”

https://twitter.com/TihoBrkan/status/1065229468166434816

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SYN $ABIL $FL $QD $UGAZ $BRZU $BZUN $MBT $FIVE $UWT $YINN $UCO $VIPS $DB $NVDA $SNAP $AMD $SQ

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$FL Raised to $63 at Citi

(6) Recent Downgrades:

Jacobs Engineering $JEC PT Lowered to $90 Credit Suisse

Kohl’s $KSS PT Lowered to $67 Credit Suisse

$TGT Lowered to $79 Credit Suisse

$LOW Lowered to $101 Deutsche Bank

$JACK Lowered to $103 SunTrust Robinson

$CRM Lowered to $160 Piper Jaffray

$TJX Lowered to $58 Citi

$KSS Lowered to $67 Credit Suisse

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, EIA, Oil, $WTI, Natgas, $DGAZ, Equities Bounce, Low Float, Penny Momo

Post-Market Mon Mar 6 $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX

Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Monday March 6, 2017; $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX – $NE, $XOM, $BSTG, $ONTX, $DUST, $MGTI, $TRCH, $LGCY, $SSH, $ASM etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

The YouTube live trading we now have transcripts (which you will see below) – sorry about the delay, we thought transition would be easier. So the post market trading result reports recently missed may never get done FYI (we’ll see). Also, transcripts are Central Mountain time so you will have to add two hours for Eastern Time (New York).

The remaining algo reports will be out tonight, then swing reports and we’re in middle of editing and uploading a swath of educational videos (may take a few days on that).

Also, the ability for members to access transcripts on demand we are working on – should have that done soon. As well soon you will be able to visit our YouTube channel soon and replay the trading day video on demand.

Members are reporting that they like the mobile service ability of YouTube Live better than Webinato but members need to know that they need to have a Google+ / Gmail account and sign in to YouTube and activate a channel to use the service. We have had many not understand that so if you aren’t sure about procedure let us know and we will assist.

And lastly, the live charts we share, to make them live you need to open the chart and click on the share button at bottom right of any of the charts and then click “make it mine”. This will enable the live chart in your browser in TradingView whether a member or or not of TradingView.

Overview Perspective & Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

In play today in chat room; $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX

Today was a big day! It was a classic schooling scenario of some senior traders putting on a class in our trading room to say the least – almost everything went 100% as planned and execution was professional. A definite learning experience for any traders on a learning curve.

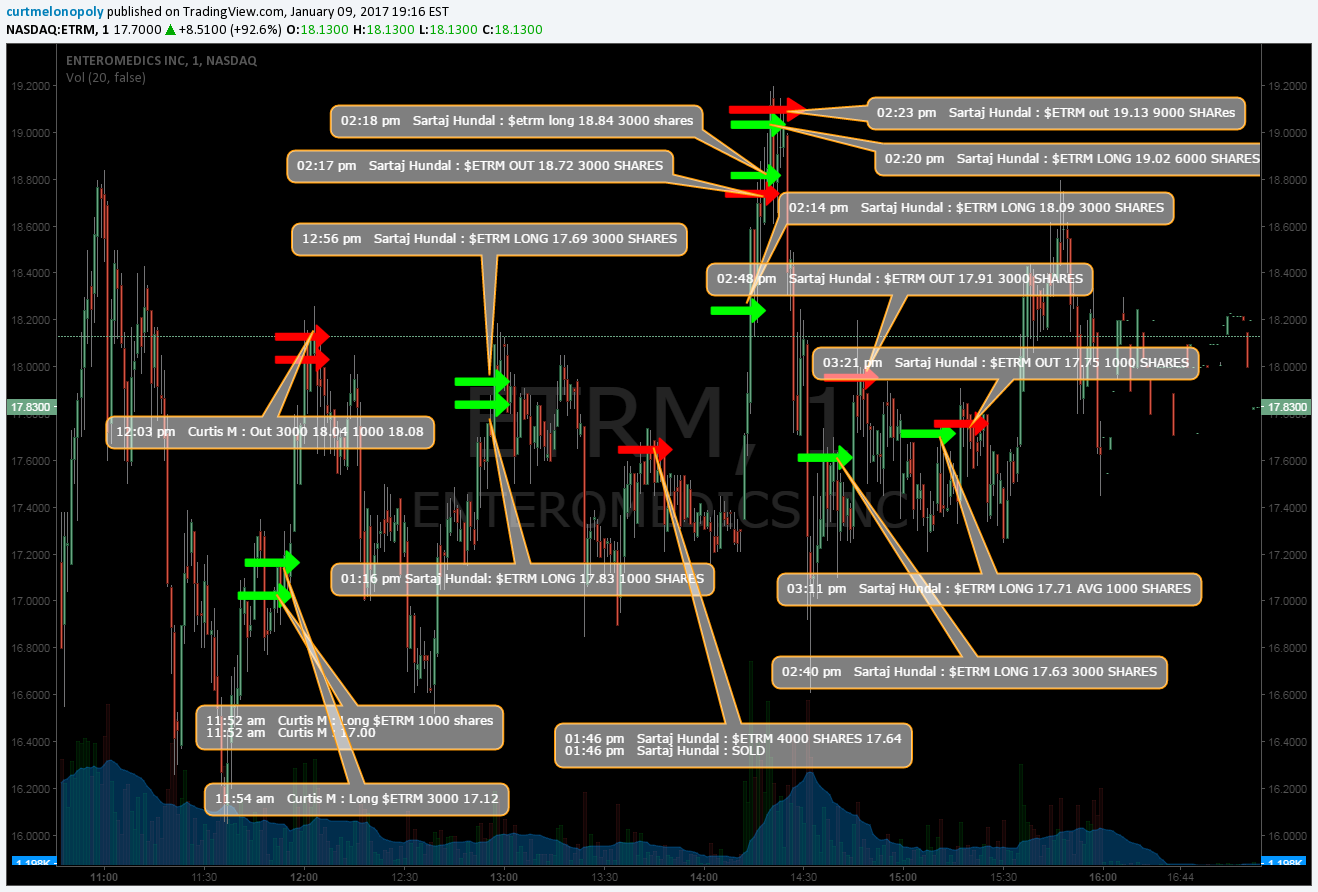

In summary, Mathew is testing a $NFLX short that I wanted to enter but didn’t and he nailed the $PIRS break-out. Market Maven and Flash nailed the turn on Natural Gas like pros. Flash exited $UGAZ at the intra-day top and flipped to $DGAZ and Market Maven was in it too and kaboom almost to the minute Natural Gas turned. They both exited perfectly too. They also nailed the turn on $XIV with precision, and if you look in to why $XIV took flight the way it did today you’ll understand the experience behind that trade – wow. And $TGTX they both nailed the momentum on it and in $CNCE perfect execution.

I was basically flat on $CNCE and some of my swings were up and some slightly down so it was a moderate day for me. I added $CELG, $LITE, $CALA, $SBUX, and bitcoin stocks to my swing watch list.

Most professional trading day I have seen in a long time. Perfectly executed.

Trading $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG in room today for gains. $VIX, $CELG, $LITE, $CALA, $SBUX and more on swing watch.

— Melonopoly (@curtmelonopoly) March 6, 2017

Momentum / Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| TGTX | 10.20 | 90.65% | 33753654 | Top Gainers | |

| CNCE | 15.64 | 62.07% | 10630533 | Top Gainers | |

| ICLD | 0.02 | 34.34% | 126346679 | Top Gainers | |

| DXTR | 1.49 | 30.70% | 6808552 | Top Gainers | |

| GBSN | 0.00 | 28.57% | 173318219 | Top Gainers | |

| BLPH | 1.77 | 26.43% | 7319152 | Top Gainers | |

| CNCE | 15.64 | 62.07% | 10630533 | New High | |

| OIBR-C | 8.47 | 13.84% | 198492 | New High | |

| VBIV | 6.10 | 13.59% | 960460 | New High | |

| MRUS | 32.23 | 9.44% | 114980 | New High | |

| CLUB | 4.10 | 4.59% | 171072 | Overbought | |

| MASI | 93.57 | 0.32% | 897260 | Overbought | |

| FLQG | 26.99 | -0.20% | 166111 | Unusual Volume | |

| CNCE | 15.64 | 62.07% | 10630533 | Unusual Volume | |

| TGTX | 10.20 | 90.65% | 33753654 | Unusual Volume | |

| DEMG | 26.67 | -0.73% | 256402 | Unusual Volume | |

| AA | 36.93 | 1.51% | 5764024 | Upgrades | |

| AFI | 19.44 | -11.44% | 369442 | Earnings Before | |

| HBCP | 35.62 | -0.86% | 2821 | Insider Buying |

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small to micro sizing) – $ONTX, $DUST, $USRM, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio):

Trading and The Markets Looking Forward:

#earnings $THO $MOMO $ULTA $FNSR $MEET $MVIS $DKS $CLNE $CIEN $CARA $URBN $MIK $DXYN $LGIH $SCMP $BIOC $BTE $CASY https://t.co/rsllzs6MVb

— Melonopoly (@curtmelonopoly) March 5, 2017

Recent notes in post market reports that still apply,

“Our standard plays that reflect the six algorithm charting we do are all at decisions at either support or resistance so this should get really interesting soon.”

Per recent, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

The US Dollar is threatening important upside levels on the algorithmic model charting – we’ll see.

YEN Yup https://t.co/y53em8X2ki

— Melonopoly (@curtmelonopoly) March 6, 2017

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Excellent review of #Gold trade 💯. $GC_F $GLD $NUGT $DUST https://t.co/lyzT88NgWV

— Melonopoly (@curtmelonopoly) March 5, 2017

Will the next leg in #Gold trading be up or down? Round 2. $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 5, 2017

Silver $SLV:

Silver recently failed at exactly where our algorithm had a symmetry price target extension. What does this mean? Silver needs to repair the chart soon or it’s down.

Crude Oil $USOIL $WTI:

Crude oil continues in its sideways trade and our EPIC the Oil algo members have been killing the range.

$CL_F $WTIC $USOIL Chart range bound with higher lows and horizontal top at resistance. Will have to break soon higher or lower? #Oil #OOTT

— Melonopoly (@curtmelonopoly) March 6, 2017

Here's a decent review of the oil trade. $WTIC $CL_F $USOIL https://t.co/0jwfSKv6AT

— Melonopoly (@curtmelonopoly) March 6, 2017

Crude oil twenty year monthly performance. $CL_F $WTI https://t.co/HgxmIyVkax

— Melonopoly (@curtmelonopoly) March 6, 2017

Volatility $VIX:

$VIX has been flat for some time, however, our algorithmic modeling suggests a possible time / price cycle coming due soon.

— Melonopoly (@curtmelonopoly) March 6, 2017

Oh yes, finally a possible sign of life in the algo signals.🔥 @VexatiousVIX https://t.co/mC5a0eDzMV

— Melonopoly (@curtmelonopoly) March 6, 2017

$SPY S&P 500:

$SPY has been trading perfectly within our model and see no divergence yet, however, we are watching the time /price cycle in our $VIX model very close here now.

$SPY S&P 500 Seasonality https://t.co/tGqZ7UksFo

— Melonopoly (@curtmelonopoly) March 6, 2017

$SPY A perspective on yearly pivot resistance point. https://t.co/QAWwdVPOk0

— Melonopoly (@curtmelonopoly) March 6, 2017

Natural Gas:

Natural Gas we do not have an algorithmic model for yet (testing). Our traders have been nailing it however.

Momentum Trades:

$TGXT and $CNCE were strong momo trades today (as were others such as $PIRS). Follow – through seemed better today. It has been lacking for a number of weeks now.

Swing Trading:

$CELG, $LITE, $CALA, $SBUX are the new swing trades added to my swing trading watch list.

$LITE Agree. Great set-up for decent RR. https://t.co/DD6SstUajn

— Melonopoly (@curtmelonopoly) March 6, 2017

Per recent; As noted above, our Swing Trading service has sent one out of the park after another. Continues to look good forward.

The Swing Trading Twitter feed can be found here: https://twitter.com/swingtrading_ct.

Algorithmic Chart Models:

As noted above, these are doing exceptionally well also. Building, building, building.

Epic the Oil Algo continues to nail targets, SuperNova Silver recently nailed a price target extension that was critical, Rosie the Gold algo has been nailing price target extensions, our US Dollar algo has been spot on and even our $SPY algo has been nailing targets the last few weeks so it is coming along. Soon we will see if our $VIX algo is dialed in with this time / price cycle potentially ending soon.

https://twitter.com/EPICtheAlgo/status/837717042182545408

Where has @EPICtheAlgo been all my life? I’m just sitting back and watching this print money….

— NardoCrypto (@nardocrypto) March 3, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Compound Trading Stock Chat-room Transcript:

Miscellaneous chatter may be removed.

Live Trading Chat Room Transcript: (on YouTube Live)

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times.

5:55 AM Flash G mornin

5:56 AM MarketMaven M hey

6:10 AM Curtis Melonopoly morning

6:49 AM MarketMaven M $TGTX gonna fly at open

6:51 AM Flash G So glad I took that $UGAZ trade Fri

7:07 AM MarketMaven M $NFLX got their upgrade lol FIXED!

7:09 AM

Compound Trading Protected: PreMarket Trading Plan Mon Mar 6 $TGTX, $CNCE, $UGAZ LINK: https://compoundtrading.com/premarket… PASSWORD: PREMARKET030617

7:12 AM Mathew w Started $NFLX short using swing high as stop

7:13 AM Mathew w Will add under the 50 day

7:13 AM MarketMaven M $POLA on the move PM

7:15 AM MarketMaven M $TGTX taking off before bell… makes that tough

7:19 AM Curtis Melonopoly $MGTI swing from Friday up a little premarket

7:20 AM Curtis Melonopoly good luck with $NFLX! I chickened on it

7:20 AM Mathew w Small starter vs 146 stop of new highs. We’ll see nice r/r if Im right

7:21 AM Curtis Melonopoly Quick before the bell… we’re uploading the new educational vids now, swing report and rest of ago reports out today / tonight.

7:22 AM Curtis Melonopoly For the record… I want to be in that $NFLX short lol

7:23 AM MarketMaven M Citi raises Apple to $160 target, reiterates Buy

7:24 AM MarketMaven M jeez $UVXY down again PM

7:25 AM Curtis Melonopoly I won’t be on mic today… we have our hands full with video uploads and ago reports here. I will alert trades tho in here and SMS email.

7:28 AM Curtis Melonopoly $TGTX near 100% use caution imo

7:29 AM MarketMaven M I’m long $TGTX here

7:29 AM Flash G lol

7:30 AM Flash G $RNVA looks good too

7:31 AM MarketMaven M Add at 10.52

7:31 AM MarketMaven M Closed 10.94

7:31 AM MarketMaven M YES

7:31 AM Flash G lol

7:31 AM Flash G funny

7:31 AM Flash G congrats

7:32 AM Curtis Melonopoly holding $MGTI

7:33 AM Flash G $MYOS jiggy

7:33 AM MarketMaven M Back in 11.10

7:33 AM MarketMaven M $TGTX

7:34 AM Flash G wow great action on $TGTX

7:34 AM MarketMaven M Out 2000 shares 11.44

7:34 AM MarketMaven M YESSSSS

7:34 AM Curtis Melonopoly nice play MM

7:35 AM Flash G scalper!

7:37 AM Flash G $MELY $RMTN $MGTI on watch Bitcoin

7:37 AM Flash G Long $DGAZ for daytrade

7:38 AM Flash G $HSHS $CCTL $MELY $RMTN $MGTI on watch

7:38 AM Flash G$ RNVA on the move

7:38 AM Curtis Melonopoly $MGTI tank

7:39 AM Curtis Melonopoly long $CNCE 14.01

7:42 AM Flash G $RNVA low float could be big

7:42 AM MarketMaven M SHort $TGTX now? hmmm

7:44 AM Curtis Melonopoly $CNCE stop triggered 13.99

7:45 AM Mathew w Completed my first leg short right here on $NFLX. Will let it play out and see where it goes from here

7:46 AM Mathew w $NFLX chart

7:47 AM Mathew w tos

7:47 AM Mathew w. mx/saND28

7:52 AM MarketMaven M close $CNCE 15.00 – yup Curt took the trade alert

7:53 AM Curtis Melonopoly nice

7:56 AM Flash G Long $XIV

8:00 AM Flash G $CCIH 28%

8:00 AM Mathew w $PIRS nice lok

8:00 AM Mathew w Through res. Im long against the rising wedge

8:01 AM Mathew w tos

8:01 AM Mathew w .mx/XQ2epV

8:02 AM Flash G $PIRS looks good mat

8:04 AM Mathew w Simple look but easy play to manage. Stop set so I’ll let it keep trucking

8:07 AM Flash G $SNAP in trouble now

8:08 AM MarketMaven M Curt, got to admit $CNCE was the right choice of the bunch. Appreciate the call.

8:08 AM Curtis Melonopoly no problem MM

8:09 AM Curtis Melonopoly glad you banked!

8:10 AM MarketMaven M I’m with ya long $XIV Flash

8:13 AM Curtis Melonopoly nice work on $XIV guys

8:14 AM Flash G Still holding $DGAZ with defined risk / stops in place

8:15 AM Mathew w fins look horrible

8:15 AM Mathew w breaking below 3 day range from last week

8:15 AM Curtis Melonopoly $CNCE brute

8:21 AM Curtis Melonopoly if your in $CNCE off my alert time to tlratchet stops near 100% now

8:23 AM MarketMaven M $SNAP snapped

8:28 AM MarketMaven M That looks like it for the morning lol – great start to the week!

8:36 AM MarketMaven M yup got really quiet quick

8:37 AM Flash G yeah

8:42 AM Mathew w $NFLX flush baby flush. I expect this play will take a while to materialize

8:43 AM Curtis Melonopoly $NFLX looks like sh@t lol

8:44 AM Mathew wY epp couldn’t even get going very hard on that late cycle upgrade

8:47 AM Curtis Melonopoly surprised santelli on cnbc hasn’t had a heart attack yet… he’s a wired dude lol

8:49 AM Curtis Melonopoly Airlines took a hit

8:58 AM Curtis Melonopoly some general divergence here… $AAPL not looking great…. $VIX turn…. $NFLX looking bad …. interesting imo

9:33 AM Mathew w Metals looks horrible. I’m all out of $SLW small loss after big win to start the year. Still in small miners plays but things don’t look great at all

9:35 AM Curtis Melonopoly gonna watch this immigration announcement

10:33 AM Mathew w $PIRS stop bumped, no loser here but the action is great

10:37 AM Mathew w $NFLX on lows, went inside and down on 15,30,hour

10:59 AM Flash G $SBUX sweepers today Curt…. seen your tweet on it last night #swng

11:00 AM Curtis Melonopoly ya

11:26 AM Curtis Melonopoly $CELL, $LITE, $SBUX, $CARA bit coin stocks are on my swing radar.

11:28 AM Curtis Melonopolyu still holding $UGAZ flash?

11:29 AM Flash G yes

11:29 AM Flash G $DGAZ

11:29 AM Flash G lol but yes

11:29 AM Curtis Melonopoly right

11:30 AM Curtis Melonopoly and $XIV?

11:30 AM Flash G yes

11:30 AM MarketMaven M mee too on the $VIX

11:31 AM Curtis Melonopoly nice

11:46 AM Curtis Melonopoly That $XAUUSD chart really interesting point… failed 200 MA under 20 MA with 50 MA cross up thru 100 MA on deck and Stoch RSI near bottom…. hmmmmm….

11:46 AM Curtis Melonopoly and Jan 27 look at how it bounced off the 50 MA

11:47 AM MarketMaven M it did bounce there

11:47 AM Curtis Melonopoly yup

11:50 AMFlash Gsimilar set up to Jan 27

11:50 AM Curtis Melonopoly similar yup

11:56 AM Flash G If t doesn’t bounce at 50 MA this time likely done lol

11:56 AM Curtis Melonopoly likely

11:57 AM Curtis Melonopoly but likely will bounce

12:02 PM Curtis Melonopoly killing $NFLX might require something nuclear lolol jeeps

12:06 PM Curtis Melonopoly oooo sweet call on $DGAZ Flash!!!

12:06 PM Flash G why thank ya

12:07 PM Curtis Melonopoly I was wondering about that call all day lol

12:07 PM Curtis Melonopoly u pinned that

12:08 PM Flash G thanks

12:09 PM Curtis Melonopoly wow did u nail it lol

12:09 PM Curtis Melonopoly awesome reversal

12:11 PM Curtis Melonopoly credit where credit due… I knew I should have followed that one… my gut was saying go

12:16 PM Curtis Melonopoly $BSTG Swing doing well… holding.

12:31 PM MarketMaven M $PIRS 52 week high – nice trade Mathew

12:34 PM Mathew w Thanks. Blue sky breakout and can keep roasting those shorts.

12:36 PM MarketMaven M roast baby roast!

12:38 PM Flash G man I missed $PIRS

12:40 PM MarketMaven M great trade

12:40 PM MarketMaven M $BTSG sizing up to be a big runner potentially tomorrow imo

12:41 PM MarketMaven M $XIV a money machine today

12:41 PM Flash G we’re banking on that girlfriend:)

12:41 PM MarketMaven M haha

12:42 PM Curtis Melonopoly ya that’s a great call too

12:48 PM Curtis Melonopoly lol OPEC might cut again

12:48 PM Curtis Melonopoly what I see in the chart they need to lol

12:49 PM Flash G lunatics

12:49 PM Flash G mad science the oil trade

12:50 PM MarketMaven M $CRTN on scanner – lotsa buys

12:52 PM Flash G $CRTN actually got bull MM

12:53 PM Flash G Possibly looking at closing $DGAZ

12:58 PM Chat disconnected. Please wait while we try to reconnect you.

12:58 PM Successfully connected.

1:01 PM Curtis Melonopoly when $CARA Stoch RSI hits bottom on 1 day chart. … that’s an entry for me for sure…

1:03 PM Curtis Melonopoly Hoping $MGTI has another leg up

1:08 PM Flash G I think its time to look at selling bits of $DGAZ here

1:08 PM MarketMaven M 10-4

1:08 PM Flash G closing 25%

1:11 PM Flash G time to start closing $XIV bits …. 25% here – thanks for the reminder with the chart Curt!

1:11 PM MarketMaven M yup on it lol thanks

1:12 PM Curtis Melonopoly way to go guys gals take your profits

1:12 PM Flash G out another 25% in $DGAZ and $XIV holding 50% in both

1:14 PM Curtis Melonopoly same thing on $CELG swing looking for stoch rsi to cool on 1 day if possible

1:19 PM Curtis Melonopoly $LITE I’m looking for 20MA to hold on 1 day for entry long

1:21 PM Curtis Melonopoly $SBUX I’m looking for upper trend line resistance to break and hold or possibly stoch rsi at bottom on 1 day for long entry. .. I like how 20MA crossed 100 MA

1:21 PM Flash G thanks Curt

1:22 PM Curtis Melonopoly of course with each swing there are various other indicators I’m watching but you get the idea

1:22 PM Flash G ys

1:23 PM Curtis Melonopoly wow $NATGAS continues down wow wow what a trade

1:24 PM Flash G still holding 50%

1:30 PM Flash G closing $XIV and $DGAZ trades for AWESOME WINS!

1:30 PM MarketMaven M yippy! thanks flash!

1:31 PM Curtis Melonopoly nice

1:33 PM MarketMaven M $PIRS!

1:33 PM MarketMaven M looks like a decent place for our $DGAZ close

1:34 PM MarketMaven M and $XIV…. good calls Flash

1:36 PM Curtis Melonopoly Bama losing his sh@t lol gotta live him

1:37 PM Curtis Melonopoly chart bot on buy signal on $NFLX? ??

1:42 PM Mathew w Look how poorly it called that last sell signal

1:44 PM Curtis Melonopoly yup

1:44 PM Curtis Melonopoly that’s a perfect example of checking it’s calls to each stock

1:57 PM Flash G i suppose i should get my chores done… building a shed for my new ride on mower

1:57 PM Flash G that was a great day – i think we hammered every call

1:57 PM Flash G back tomorrow

1:58 PM Curtis Melonopoly peace

1:58 PM MarketMaven M ya thanks Flash! awesome day!

1:58 PM MarketMaven M lets do it again Tues!

1:58 PM MarketMaven M paid my bills today:)

1:59 PM Curtis Melonopoly have a great night y all!

2:00 PM MarketMaven M bye curt

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $CNCE, $TGTX, $PIRS, $XIV, $DGAZ, $PIRS, $BSTG, $NFLX, $VIX, $CELG, $LITE, $CALA, $SBUX – $BSTG, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Fri Feb 17 $HTBX, $RGSE, $TOPS $DRYS, $LMIA, $TRUE, $UGAZ, $DGAZ

Stock Trading Plan for Friday Feb 17, 2017 in Compound Trading Chat room. $HTBX, $RGSE, $TOPS $DRYS, $LMIA, $TRUE, $UGAZ, $DGAZ – $UWT, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Trade Results: Click review trade results post market report from yesterday.

Weekend Webinar Videos: The webinars from weekend that explain how our algorithmic chart models work for each of six ($SPY, $DXY, $USOIL, $GOLD, $SILVER, $VIX), our Swing Trading and our Live Trading Room are now posted on our You Tube Channel.

Current Holds / Trading Plan:

All small size – $UWT, $BSTG, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Most of my outlook is similar to yesterday.

As expected, we did get a bit of $SPY pull-back and now I am watching the $VIX a little closer.

Got $VIX? pic.twitter.com/7hMHEuONOI

— Melonopoly (@curtmelonopoly) February 17, 2017

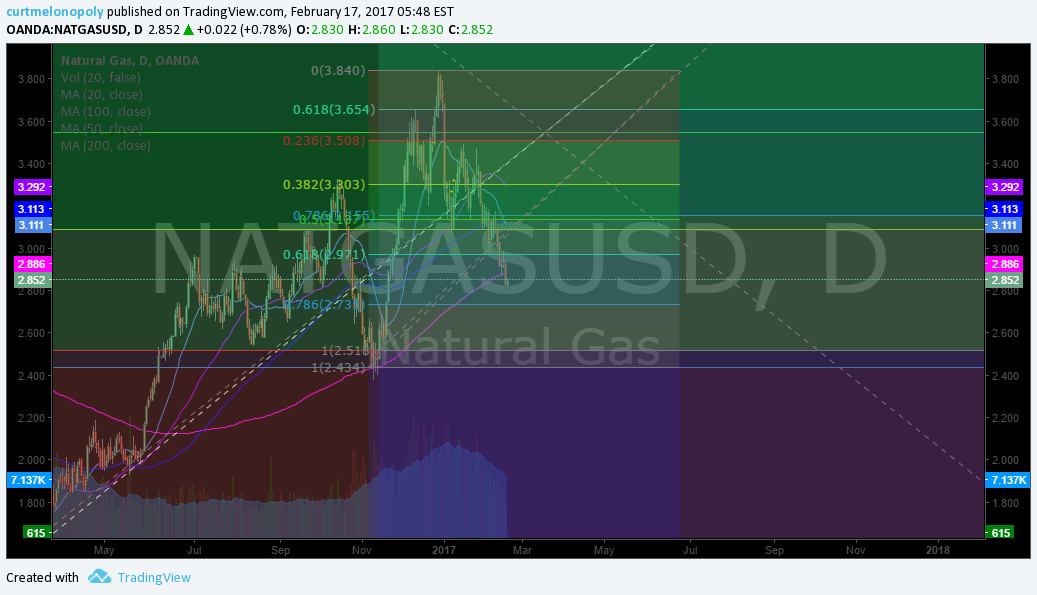

$OIL in multi-week range and has resistance coming, $GOLD and $SILVER are struggling with resistance (Rosie the Algo pointed out at the bottom turn weeks back) and have been struggling with that resistance going back ten calendar days, $USDJPY $DXY are at support threatening break-outs or break-downs and natural gas $NG_F looks like it is near an interim bottom BUT it did lose its 200 day yesterday intra-day and as of this morning it has not recovered. $NATGASUSD chart https://www.tradingview.com/chart/9SENGc51/.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $HTBX, $RGSE, $TOPS $DRYS, $LMIA, $TRUE, $UGAZ, $DGAZ

10am

Retail Sales

10am

Leading Indicators

1pm

Baker-Hughes #’s

DineEquity’s stock drops 2.2% premarket after CEO resignation, profit miss

Kraft Heinz shares rose 4.6% premarket and Unilever shares were trading 12% higher

AstraZeneca’s Lynparza beats chemo in late-stage breast cancer study; shares up 2% premarket

Freeport gets Indonesian OK to resume copper exports for a year http://seekingalpha.com/news/3244406-freeport-gets-indonesian-ok-resume-copper-exports-year?source=feed_f … #premarket $FCX $JJC $CPER $CUPM

ImmunoGen revenues off 23% in FQ2; updates guidance http://seekingalpha.com/news/3244404-immunogen-revenues-23-percent-fq2-updates-guidance?source=twitter_sa_factset … #premarket $IMGN

6:22 AM Gainers $TOPS 56%, $RGSE 29%, $DRYS 13%, $TRUE 13%, $SCON 10%, $SHIP $ANET $ESEA

$VRX receives FDA approval

$CSBR PR !! Announces New Collection of Patient-Derived Xenograft (PDX) Models Available for Translational Research

ReWalK revenues up 60% in FY16 http://seekingalpha.com/news/3244411-rewalk-revenues-60-percent-fy16?source=twitter_sa_factset … #premarket $RWLK

#Raytheon, Germany’s Rheinmetall to cooperate in defense technology. http://twitthat.com/ffzsR

$RTN +1.85% at 155.21 premarket

#stocks

Celgene’s ozanimod successful in late-stage MS study; shares up a fraction premarket http://seekingalpha.com/news/3244410-celgenes-ozanimod-successful-late-stage-ms-study-shares-fraction-premarket?source=feed_f … #premarket $CELG $BIIB

$NAK believes claims made against it are unfounded and filled with errors. Trading up 3.5% in premarket

XTL Bio inks $2.5M capital raise via direct offering of ADSs at $2.50; shares slump 29% premarket http://seekingalpha.com/news/3244414-xtl-bio-inks-2_5m-capital-raise-via-direct-offering-adss-2_50-shares-slump-29-percent?source=twitter_sa_factset … #premarket $XTLB

General Mills shares decline in premarket after lowering of sales outlook http://on.mktw.net/2lVmi67

DENTSPLY revenues up 49%; earnings up 83% in Q4 http://seekingalpha.com/news/3244418-dentsply-revenues-49-percent-earnings-83-percent-q4?source=twitter_sa_factset … #premarket $XRAY

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $TOPS $SKLN $RGSE $TRUE $DCIX $DRYS

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $FNSR, $OREX, $MDLZ, $SAGE, $ERIC, $JD, $XIV, $OCLR, $OPK, $VOD I will update before market open or refer to chat room notices.

(3) Other Watch-List: $TOPS $DRYS $SINO $GLBS $DCIX $ESEA

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $M $POOL $CS $MDCA $CPA $COF $TPX $ANET $CC $CIG $Q $WDAY $OC $CRY as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $HTZ $CAR $GEL $SLF $SPN $CIR $ABCO $ITW $TTMI $CHTR $AIV $RAI $BBW $ITW $GNCA as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $HTBX, $RGSE, $TOPS $DRYS, $LMIA, $TRUE, $UGAZ, $DGAZ – $UWT, $BSTG, $ONTX, $VRX, $SSH, $ASM, $CBMX, $JUNO, $DUST, $TRCH, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Newsletter Thurs Jan 12 – $HSGX $RNVA $BSPM $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ

My Stock Trading Plan for Thursday Jan 12, 2017 in Trading Chat room. $HSGX, $RNVA, $JNUG, $NUGT, $BSPM – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

Notices:

A quick rabbit trail… Terms of Use: Be sure to review the rules of the chatroom and our disclosure statement. We take these seriously. If you are following our trades (entering when we do and exiting when we do) then you are NOT in keeping with the spirit of our relationship. For example, I don’t follow Mathew in and out of every trade. I share with and learn from him and other considerable traders in our room. But I never follow in and out of trades. That is not the purpose, spirit, mission, etc… I am not a “stick a quarter in and out pops success bot”. If you are looking for that go to a different trading room. I cannot recommend you buy a stock, I am not a registered investment professional and you need your own trading plan. You are given the opportunity to watch how systematic traders execute a process. That is it. You can learn and share and develop your own trading plan. The algorithmic modeling / charts should be more than enough to assist a trader with a trading plan for that specific instrument. Many trading rooms don’t even share a chart let alone sophisticated modeling and reports. On the first occasion we likely won’t ban misuse, but we will ban misuse very quickly. We choose to do this because we love what we do and would like to share what we know and further democratize algorithmic modeling that would otherwise not be available to the public. This is about developing something of use, supporting each other and sharing in that process. Fall down as often as you like, and I’ll help you up, ask for help and I will help and I will never stop doing that, but you better be ready to get back in there. No diapers changed here – no crying – this isn’t grade school. Fair? Okay, now on to winning.

Goal: Double accounts between now and when Trump sworn in. Range opening in our focus areas for scalps that will add quick.

Day 2 of two week double account challenge video recap:

https://twitter.com/CompoundTrading/status/819339460907270144

Per previous;

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

$URRE, $TCCO, $CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Per previous;

Lots of width in what we are trading between now and Jan 20, 2017 (and likely at least short-term thereafter) IMO. Should be really active. My focus will be toward morning momentum plays and scalping range in $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ $TVIX $UVXY $XIV.

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Generally speaking I am looking for some volatility between now and late January. My instinct tells me that even if there is some downdraft in the markets that the Trump train will sweep them up in positive momentum at some point.

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

Per previous;

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo: $HSGX, $RNVA, $JNUG, $NUGT, $BSPM

Twitter lowered to Hold at Pivotal http://seekingalpha.com/news/3234884-twitter-lowered-hold-pivotal?source=feed_f … #premarket $TWTR

Callaway Golf acquires lifestyle brand OGIO http://seekingalpha.com/news/3234872-callaway-golf-acquires-lifestyle-brand-ogio?source=feed_f … #premarket $ELY

KB Home turns lower post-earnings; Evercore downgrades http://seekingalpha.com/news/3234871-kb-home-turns-lower-post-earnings-evercore-downgrades?source=feed_f … #premarket $KBH

BioLife Solutions sees 2016 top line up 24%; shares ahead 4% premarket http://seekingalpha.com/news/3234858-biolife-solutions-sees-2016-top-line-24-percent-shares-ahead-4-percent-premarket?source=feed_f … #premarket $BLFS

Canaccord cools on V.F. Corp http://seekingalpha.com/news/3234867-canaccord-cools-v-f-corp?source=feed_f … #premarket $VFC

FDA rejects TESARO’s marketing application for rolapitant IV; shares ease 3% premarket http://seekingalpha.com/news/3234875-fda-rejects-tesaros-marketing-application-rolapitant-iv-shares-ease-3-percent-premarket?source=feed_f … #premarket $TSRO

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $HSGX 37%, $RNVA 25%, $JNUG 9%, $NUGT 8%, $KGC $NJR $MPEL $AU $URRE $GOLD $GFI $SHIP $HMY $UGAZ $ABX $UWT $GDXJ

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: Losers: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $TYPE $TRGP $ENLK $NGL $ETE $HEP $PII $MRK $GLOB $TEL $FAST $HII $CNI $CCJ $ABC $CAFD $RHT $BKD $FLR $VVC $CHH $KN $HII as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $NMRX $KBH $GATX $NSIT $ESL $NOC $AKS $STLD $X $DIS $TWTR $CRM $IPG $DISCA $ADBE $CBS $KALU $SC $VEEV $THG $ACM $AIV $HOV $WLH $VFC $GATX $MIXT $SWKS $OKE $SWX $ENLC $VLO $OGS as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $HSGX, $RNVA, $JNUG, $NUGT, $BSPM, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $CBMX, $JUNO, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Newsletter Tues Jan 10 $GNVC, $DFFN, $XGTI, $ROKA, $ETRM – $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ

My Stock Trading Plan for Tuesday Jan 10, 2017 in Trading Chat room. $GNVC, $DFFN, $XGTI, $ROKA, $ETRM – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

A super quick premarket newsletter..

Notices:

Goal: Double accounts between now and when Trump sworn in. Range opening in our focus areas for scalps that will add quick.

Goal: Double accounts between now and when Trump sworn in. Range opening in our focus areas for scalps that will add quick. Start tomorrow.

— Melonopoly (@curtmelonopoly) January 5, 2017

https://twitter.com/CompoundTrading/status/818629447498792961

Per previous;

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

Per previous;

$CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Lots of width in what we are trading between now and Jan 20, 2017 (and likely at least short-term thereafter) IMO. Should be really active. My focus will be toward morning momentum plays and scalping range in $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ $TVIX $UVXY $XIV.

Per previous;

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Generally speaking I am looking for some volatility between now and late January. My instinct tells me that even if there is some downdraft in the markets that the Trump train will sweep them up in positive momentum at some point.

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

Per previous;

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo: $GNVC, $DFFN, $XGTI, $ROKA, $ETRM

Pluristem gains premarket as FDA OKs trial for critical limb ischemia therapy.

Ascena Retail’s stock plunges 19% premarket after earnings outlook slashed.

DexCom sees 2016 top line up 42% to $570M.

If you are new to our trading service you should review recent blog posts and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $GNVC 41%, $DFFN 21%, $XGTI 21%, $ROKA 18%, $ETRM 15%, $NSPR $ILMN $MSTX $VRX $UGAZ $CUDA $VICL $ARRY $VALE $RIO

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: Losers: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $GNVC, $DFFN, $XGTI, $ROKA, $ETRM, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $CBMX, $JUNO, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F

PreMarket Trading Plan Newsletter Mon Jan 9 – $MSTX $MACK $ARWR $BIOC $EXAS $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ

My Stock Trading Plan for Monday Jan 9, 2017 in Trading Chat room. $MSTX $MACK $ARWR $BIOC $EXAS Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

A super quick premarket newsletter below! You all have charting for regular trades I follow (sent overnight on email and/or on Compound Trading Twitter feed) so I won’t include below for Oil, Gold, Silver, VIX, SPY, etc.

Notices:

Big week coming. Official Launch @CompoundTrading Monday. All algorithms published for launch. Two week double account challenge live.

Big week coming🔥 Official Launch @CompoundTrading Monday🎉 All algorithms published for launch🚀 2 week double account challenge live🎥 #stocks pic.twitter.com/MGPCTAdDsx

— Melonopoly (@curtmelonopoly) January 7, 2017

Monday is free room access first Monday each month. Join us for official launch?. https://compoundtrading.com #stockmarket #stocks #wallstreet

https://twitter.com/CompoundTrading/status/817847904337432576

Goal: Double accounts between now and when Trump sworn in. Range opening in our focus areas for scalps that will add quick.

Goal: Double accounts between now and when Trump sworn in. Range opening in our focus areas for scalps that will add quick. Start tomorrow.

— Melonopoly (@curtmelonopoly) January 5, 2017

Per previous;

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

Per previous;

$CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Lots of width in what we are trading between now and Jan 20, 2017 (and likely at least short-term thereafter) IMO. Should be really active. My focus will be toward morning momentum plays and scalping range in $NUGT $DUST $JNUG $JDST $USLV $DSLV $UWT $DWT $UGAZ $DGAZ $TVIX $UVXY $XIV.

Per previous;

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Generally speaking I am looking for some volatility between now and late January. My instinct tells me that even if there is some downdraft in the markets that the Trump train will sweep them up in positive momentum at some point.

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

Per previous;

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo Stocks: $MSTX $MACK $ARWR $BIOC $EXAS

$DNAI changes its corporate name to Sierra Oncology.

New ticker $SRRA

ER’s

$JPM $BAC $WFC $BLK $KBH $DAL

—

#JPM17

$CELG $AMGN $VRX $JUNO

$BLUE $KITE $ONCE $CLVS

$GILD $REGN $SGEN $BIIB

$BMRN $JAZZ $RDUS $HALO

ARIA aquired by Takeda for $24/sh. 5.2 billion deal

Mars to Acquire VCA Inc $WOOF for $9.1B

If you are new to our trading service you should review recent blog posts and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups: