Tag: $DIS

Swing Trading Special Report Series (Part B) Mon Oct 29 SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

Compound Trading Swing Trade Report Monday October 29, 2018 (Part B).

Swing Trading Signals and Stock Picks In this Issue: SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS.

Email us at compoundtradingofficial@gmail.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Part A of this swing trading special series can be found here.

Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSI, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Current Swing Trading Signals and Stock Charts.

SQUARE (SQ) Near key support on watch for a bounce. $SQ #swingtrade #tradealerts

ALLERGAN (AGN) Near support on watch for adds to swing trade. $AGN #swingtrading

BOX INC (BOX) Short PT hit – short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #tradealerts

PROQR THERAPEUTICS (PRQR) Hit price target from previous alert, on watch for support bounce – over 22.70 targets 24.85 fast $PRQR #swingtrading #tradealerts

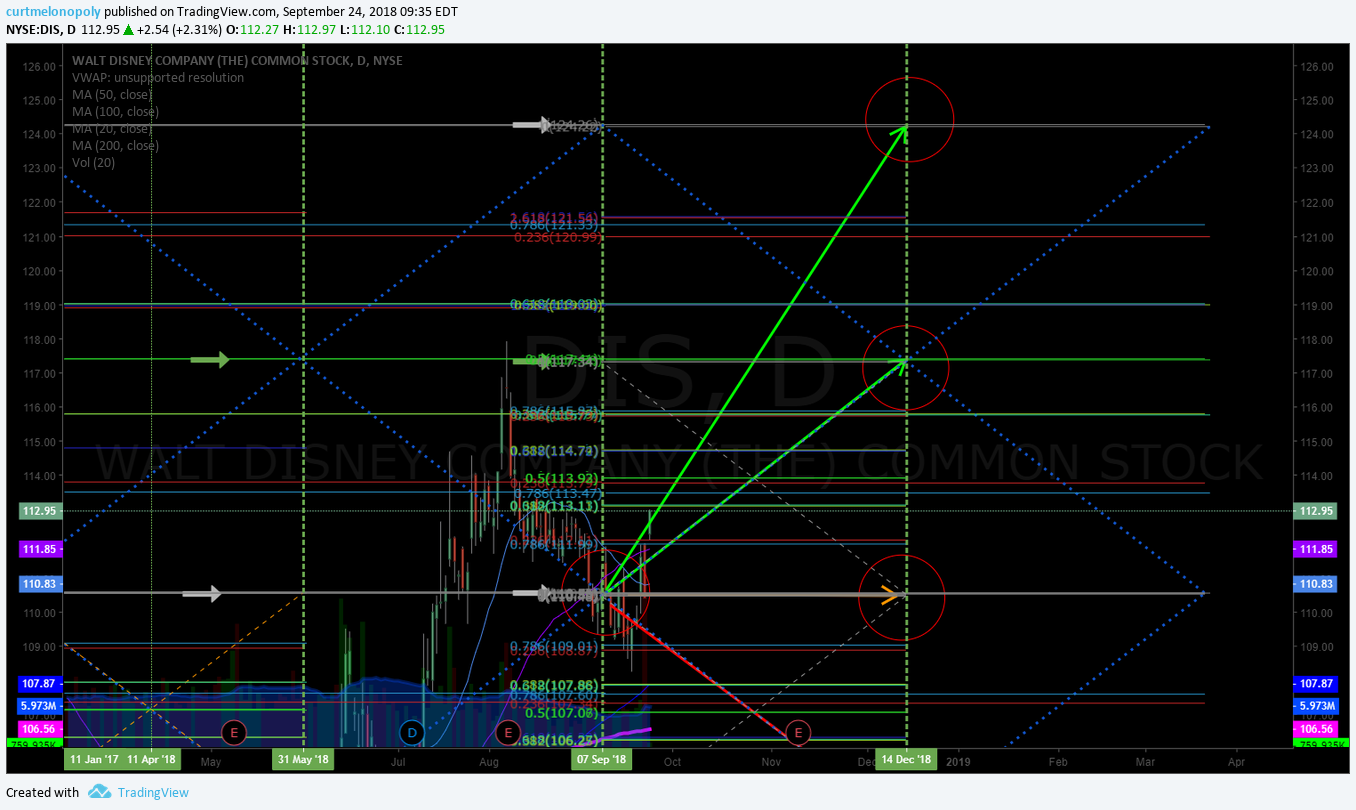

DISNEY (DIS) Holding its structure in market downturn, looking for long 112 area $DIS #swingtrading

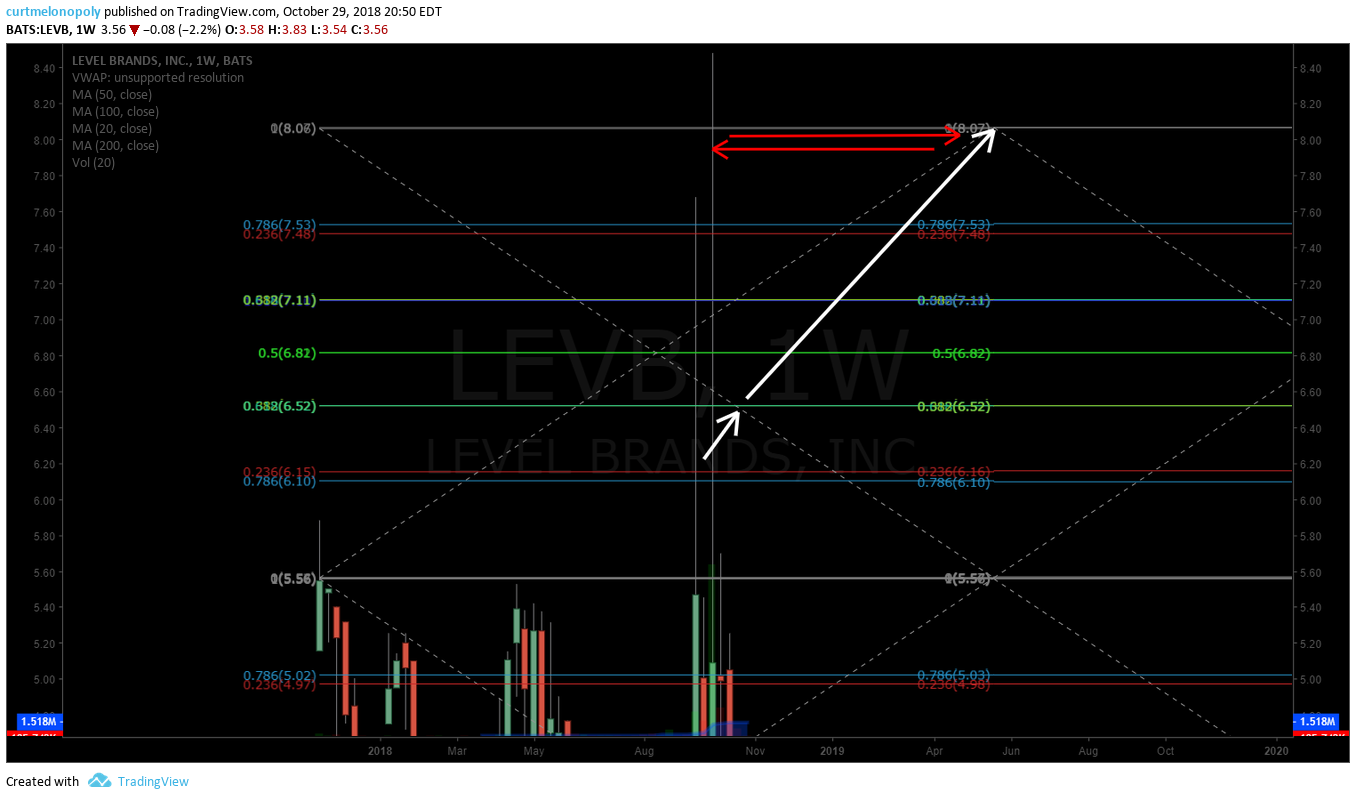

LEVEL BRANDS (LEVB) hit the 8.09 price target and then some, now nearing support watch again $LEVB #swingtrade

BALLARD POWER (BLDP) Turned down perfectly on time per alert, now it is a matter of where it turns. $BLDP #swingtrading #tradealerts

NEW AGE BEVERAGES (NBEV) Near support again on watch after near 4 x gains on last alert – above 2.80, targets 3.27, 4.17, 4.89 $NBEV #tradealerts #swingtrading

PYXUS $PYX near triple x since last alerted now nearing support and on watch for another run #swingtrade #tradealert

NETFLIX (NFLX) on watch for bounce at diagonal trendline support and possible MACD turn on 240 min chart. $NFLX #swingtrading

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, FSQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

PreMarket Trading Plan Mon Oct 1: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday October 1, 2018.

In this premarket trading edition: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 1 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

SQUARE (SQ) swing trade is performing well in continuation of trajectory on chart – premarket trading 101.20 near 102.00 resistance from our 89.00 entry. Trim in to resistance add to trade above (if you are trimming at each resistance). The updated chart is below.

Per last week: The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Oil trading plan is similar to last week, I am looking for a trade at / near bottom channel support. Last week it did hit near lower channel support at 71.85 FX USOIL WTI at around 8:30 AM Sept 28 and then took off (no execution), currently trading near upper channel resistance. I will do more day trading again also with oil.

Per last week: Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

DISNEY (DIS) swing trade doing well, in to resistance area pre-market 117.17, trim in to add above $DIS. Good timing on this trade.

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO. Will only consider a smaller size but will consider another trade. This could be a bottoming pattern setting up. Yet to be seen though.

Bitcoin, the bottoming pattern continues, convinced that 5800 area is most probable bottom (alerted numerous times prior to it trading anywhere near there). Bottom line is that we’re expecting to trade it actively soon going in to Dec 24 time cycle peak and in to 1st Q 2019 aggressive.

Below are some trade position notes from recent weeks if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.13, Oil FX $USOIL ($WTI) trading 73.42, Gold $GLD trading 1186.12, Silver $SLV trading 14.53, $SPY 292.48 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6573.00 and $VIX trading 11.8.

Momentum Stocks / Gaps to Watch:

New Ages Beverages bid up 17% https://seekingalpha.com/news/3393975-new-ages-beverages-bid-17-percent?source=feed_f … #premarket $NBEV

Your Monday morning Wake Up Call:

#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company’s update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

Your Monday morning Wake Up Call:#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company's update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

— Benzinga (@Benzinga) October 1, 2018

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://bloom.bg/2DIinGQ $TSLA #premarket #swingtrading

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://t.co/dHZ2HFe5KU pic.twitter.com/4PyqE8FG8c

— Bloomberg Markets (@markets) October 1, 2018

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://bloom.bg/2DISeYz

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://t.co/evehvFP8a8 pic.twitter.com/1iTdE24dGH

— Bloomberg Markets (@markets) October 1, 2018

News:

Viking Therapeutics stock jumps 4.8% premarket on news of positive trial results

$AGLE FDA Grants Rare Pediatric Disease Designation to Pegzilarginase for Arginase 1 Deficiency

$CORT Receives Orphan Drug Designation for Relacorilant as Treatment for Pancreatic Cancer.

Recent SEC Filings / Insiders:

Recent IPO’s:

$SVMK SurveyMonkey IPO is bigger than expected https://www.marketwatch.com/story/surveymonkey-ipo-is-bigger-than-expected-2018-09-25?mod=mw_share_twitter

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Earnings:

Cal-Maine misses profit and sales expectations, dividend drops from previous quarter

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis https://t.co/SEASQ0kFJW

— Swing Trading (@swingtrading_ct) October 1, 2018

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://finance.yahoo.com/news/3-highest-growth-stocks-market-190200998.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://t.co/6OaZlugwOd via @YahooFinance

— Swing Trading (@swingtrading_ct) October 1, 2018

SQUARE (SQ) premarket trading 101.20 near 102.00 resistance. Trim in to resistance add to trade above. Updated chart. $SQ #tradealerts

DISNEY (DIS) swing trade doing well, in to resistance premarket 117.17, trim in to add above $DIS #swingtrading #tradealerts

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO #swingtrading #tradealerts

CRONOS (CRON) MACD cross up on 240 Min Chart with decision near on chart timing, on watch $CRON #tradealert #swingtrading

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

– Tesla’s faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.

– Tesla's faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.https://t.co/42zskaCK7W— NDTV Profit (@NDTVProfitIndia) October 1, 2018

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PROQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

our Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA

Your Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA— Benzinga (@Benzinga) October 1, 2018

#5things

-North America trade deal

-Musk settles

-Italian risk

-Markets rise

-Coming up…

https://bloom.bg/2DSHs26

U.S. and Canada forge a last-gasp deal to salvage NAFTA as a trilateral pact with Mexico https://reut.rs/2N9Q1os

https://twitter.com/Reuters/status/1046727441354563584

Gerald Celente – Economic Meltdown Worse Than Great Depression Coming

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ACST $SYN $MTNB $TSLA $LEVB $NBEV $OGEN $IRDM $GE $IGC $CRMD $MTSL $ALT $AMRN $TLRY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $VIAV $BCS $ICPT $STOR $ALVR $BIIB $EWBC $MTB $UPS $LOGM $APO $TEVA $ENTG

BMO Capital Downgrades The Chefs’ Warehouse, Inc $CHEF to Market Perform

J.B. Hunt Transport Services $JBHT PT Raised to $151 at Credit Suisse

(6) Recent Downgrades: $INTC $TI $BUD $AMD $CIEN $ALV $MEI $TEL $CHEF $FFIV $REVG $WDC $LRCX $INFN $CMG $AMAT $SHLO $DLPH $VEEV $PAYC

RBC Capital Downgrades CAPREIT (CAR-U:CN) to Sector Perform

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO

PreMarket Trading Plan Wed Sept 26: EIA, Crude Oil, Fed, $ALDX, $SQ, $NKE, $SVMK, $GPRO, $DIS, $AMD more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday September 26, 2018.

In this premarket trading edition: $ALDX, $SQ, $NKE, $SVMK, $DIS, $OSIS, $BLDP, $LEBV, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $ROKU, $CVM, $XXII, $MOMO, $SPY, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 26 – Lead trader booked for main trading room for market open, #EIA report crude oil trading at 10:30, mid day review and futures trading this evening (as available and as market demands).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or when the lead trader is not available.

- In final edits for release this week;

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

Stocks making the biggest move premarket: NKE, IBM, MRK, KBH, SVMK & more https://www.cnbc.com/2018/09/26/stocks-making-the-biggest-move-premarket-nke-ibm-mrk-kbh-svmk–more.html

$SVMK Per CNBC;

SVMK – SVMK priced its initial public offering at $12 per share, above the expected range of $9 to $11 per share. The parent of SurveyMonkey also increased the size of its offering to 15 million shares from the original 13.5 million, and the IPO’s pricing gives the company a market value of $1.46 billion.

$NKE Per CNBC;

Nike – Nike reported quarterly profit of 67 cents per share, 4 cents a share above estimates. The athletic footwear and apparel maker’s revenue was just barely above Street forecasts. Nike benefited from strong consumer spending in the U.S. market, among other factors, but some analysts are concerned about what they consider weaker than expected profit margins.

$GRPO per CNBC;

GoPro – The stock was upgraded to “outperform” from “perform” at Oppenheimer, based on the high definition camera maker’s new product offerings and what the firm calls appropriate pricing.

Below are some trade position notes from the last week or so if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on. I don’t see any reason why we won’t be able to push these set-ups out this evening after the markets close. There is so much going on right now in the markets (the ground is moving) that we have to start pushing this stuff out and get ready.

Doing some charting in premarket for $CLRB and $APDN – both very interesting set-ups IMO.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 8:10 AM: US Dollar $DXY trading 94.14, Oil FX $USOIL ($WTI) trading 71.75, Gold $GLD trading 1198.21, Silver $SLV trading 14.43, $SPY 291.14 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6378.00 and $VIX trading 11.9.

Momentum Stocks / Gaps to Watch:

$ALDX Alderya’s stock rockets after positive trial results of mesothelioma treatment https://www.marketwatch.com/story/alderyas-stock-rockets-after-positive-trial-results-of-mesothelioma-treatment-2018-09-26?mod=BreakingNewsSecondary

28 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12409271 $ALDX $IGC $VSTM $EGY $KBH $GPRO $VNDA $DGLY $CONE $TEN $NKE $CTAS

28 Stocks Moving In Wednesday's Pre-Market Session https://t.co/OO2rmEC8Mv $ALDX $IGC $VSTM $EGY $KBH $GPRO $VNDA $DGLY $CONE $TEN $NKE $CTAS

— Benzinga (@Benzinga) September 26, 2018

News:

$TLRY Supreme Cannabis Signs $12M Guaranteed Supply Agreement with Tilray®Supreme Cannabis (SPRWF) and Tilray® enter into a twelve-month guaranteed supply agreement Supreme Cannabis (SPRWF) to supply 7ACRES premium dried cannabis to Tilray®

Recent SEC Filings / Insiders:

Recent IPO’s:

$SVMK SurveyMonkey IPO is bigger than expected https://www.marketwatch.com/story/surveymonkey-ipo-is-bigger-than-expected-2018-09-25?mod=mw_share_twitter

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Actuant’s stock tumbles after earnings and sales beat but profit outlook falls short

#earnings for the week

$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL

#earnings for the week$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL https://t.co/r57QUKKDXL https://t.co/pVka1Ud3QD

— Melonopoly (@curtmelonopoly) September 24, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

$ALDX Premarket trading 12.60 up 27 percent Alderya’s stock rockets after positive trial results of mesothelioma treatment #premarket

DISNEY (DIS) swing trade trading HOD 114.70 with intra resistance, serious resistance at quad wall (dotted gray) next $DIS #swingtrading #tradealerts

SQUARE (SQ) swing trade alert going well. As trade nears previous highs on candles on 240 expect resistance until break-out. $SQ #tradealerts

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

Screen shot of crude oil trading room, lead trader discussing oil trading signals and strategy in chat. #oiltradingroom

Screen Shot of Crude Oil Trading Room and the oil trading signals discussed by lead trader.

Swing trade alert at 89.00 on Square $SQ today at market open. Chart shows the incredible trading in Square today. #swingtrade #tradealerts

$SQ opened strong today on upgrade, long 89.00 and we’ll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts

$SQ opened strong today on upgrade, long 89.00 and we'll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts pic.twitter.com/sYOmmRJ27s

— Melonopoly (@curtmelonopoly) September 26, 2018

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading https://t.co/KiWbcjO7PO

— Swing Trading (@swingtrading_ct) September 25, 2018

Best Oil Stocks to Buy Now https://finance.yahoo.com/news/best-oil-stocks-buy-now-012433429.html?soc_src=social-sh&soc_trk=tw …

Best Oil Stocks to Buy Now https://t.co/mh3568k1o0 via @YahooFinance

— Melonopoly (@curtmelonopoly) September 24, 2018

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

Risk appetite keeps climbing…

Risk appetite keeps climbing… pic.twitter.com/QhRj5H21zn

— David Schrottenbaum (@David_Schro) September 26, 2018

America avoided an apocalyptic ‘economic catastrophe’: Hank Paulson https://www.foxbusiness.com//economy/america-avoided-an-apocalyptic-economic-catastrophe-hank-paulson #FoxBusiness

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ANY $IGC $ALDX $INPX $JONE $EGY $VSTM $OASM $NBEV $MNKD $AMDA $KBH $MICT $AKER $TLRY $GPRO $NIO $NVAX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $KBH $GOLD $LNG $SONC $MTB $GPRO $STM $VIAB $MTB $IBM

$SQ Square (SQ) PT Raised to $105 at Buckingham Research; ‘Story Keeps Getting Better’

Amazon.com (AMZN) PT Raised to $2,350 at Jefferies, Could Reach $3,000 By 2020

Activision stock rises after Piper Jaffray raises target due to new ‘Call of Duty’ battle royale mode

(6) Recent Downgrades: $KOS $DWDP $CHEF $XOXO $COG $SYF $PAYC $LRCX $CIEN $MANH

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, EIA, Crude Oil, Fed, $ALDX, $SQ, $NKE, $SVMK, $GPRO, $DIS, $AMD

Trade Alerts | Day Trade & Swing Trades (w / video) Trading Square $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL and more.

Trade Alerts. #tradealerts #daytrading #swingtrading

Swing Trading and Day Trading Alerts with raw video footage from our Live Trading Room premarket and market open on Sept 26, 2018.

Stocks Alerted for Trade: $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL and more.

At 1:20 in the video the Square $SQ trade alert is discussed and the chart set-up, specifically the sidewinder trade set-up with the 20 MA under 50 MA with price above and reason for Square to run on the upgrade in premarket. The video explains the Square trading set-up in detail.

Why Instinet Analyst Dan Dolev Is So Bullish on Square $SQ (video) https://www.bloomberg.com/news/videos/2018-09-25/why-instinet-analyst-dan-dolev-is-so-bullish-on-square-video

Square CFO Friar Says Financial System Not Serving Consumers Properly $SQ (video) https://www.bloomberg.com/news/videos/2018-09-25/square-cfo-friar-says-financial-system-not-serving-consumers-properly-video

Square Belongs in the Same Class as Apple and Facebook, Analyst Says $SQ https://www.barrons.com/articles/square-belongs-in-the-same-class-as-apple-and-facebook-analyst-says-1537886007?siteid=yhoof2&yptr=yahoo

Then in pre-market I review the Disney $DIS chart and swing trade we are in, Advanced Micro $AMD trade set-up, Oil trading strategy for the week and in to the EIA report, Netflix $NFLX looking for ads to position, Facebook $FB and Google $GOOGL looking for a short position, Ballard Power $BLDP trade set-up in to time cycle, Bitcoin $BTC on high watch, and Volatility $VIX on watch.

After a quick break I reviewed the massive opportunities we are seeing in the markets over the next two quarters.

At 6:30 I move $SQ to 5 min chart and consider an entry before open. Reviewed stochastic RSI, MACD and squeeze momentum indicators on the Square chart for members.

At 9:30 in video is near the market open and I review my trading plan for it and move to 1 minute chart.

At 10:40 I discuss the next market inflection we see.

At 11:00 the buy side trade starts coming in to Square and I take my first entry in Square at 89.00 for a 1/10 size with a stop at 89.00.

I explain that I’m looking for a base entry that holds in the Square trade and that I will leg in once I get a base trade in.

A copy of the swing trading alert on our private member’s Twitter feed is here;

$SQ opened strong today on upgrade, long 89.00 and we’ll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts

$SQ opened strong today on upgrade, long 89.00 and we'll be looking for more size / legs in this one. Closed the day at 95.95. #swingtrading #daytrading #tradealerts pic.twitter.com/sYOmmRJ27s

— Melonopoly (@curtmelonopoly) September 26, 2018

At 14:40 on the video I start explaining the 5 min candle positioning I am looking for and the times through the week that I will look at adds to the swing trade as “pockets” for optimum timing on adds to the $SQ trade (lunch time, end of day, early in premarket and end of day Friday).

On the swing trading alerts private member feed the trading plan for adds for sizing in to this trade is explained per below;

General idea for legging in to $SQ – when 5 min held previous top of 5 i hit a 1/10 entry long 89 again, i’ll keep chewing till an area holds – for first leg

https://twitter.com/SwingAlerts_CT/status/1044587344584597506

the next $SQ leg entry long will be on 30 min body holding the previous 30 min but i won’t do that until lunch, late day, premarket (early) or end of day Friday, then next 1 hour same process then 4 hour same process.

https://twitter.com/SwingAlerts_CT/status/1044587418353975296

Swing trade alert at 89.00 on Square $SQ today at market open. Chart shows the incredible trading in Square today. #swingtrade #tradealerts

At around 53:00 in the video I am explaining my entry, sizing opportunities, retrace support areas, how to trade 5 min candles and how to trade other time-frames for sizing in to the trade.

TRADE ALERTS VIDEO – TRADING ROOM: #daytrading #swingtrading

Trade Alerts | Day Trade & Swing Trades. Square $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL and more.

DAY TRADING ALERTS CHAT ROOM LOG

Below are chat entries specific to actionable alerts from the trading room today. Add 2 hours to the chat log times shown for Eastern Standard Time.

CURT M_1 September 25, 2018 06:55:06 AM

Protected: PreMarket Trading Plan Tues Sept 25: Market Screams Epic Opportunity Near, $DIS, $APDN, $CLRB, $KORS, $NFLX, $BLDP, OIL, Bitcoin, more.rrrrPassword: CLRBrrrrLink: https://compoundtrading.com/premarket-trading-plan-tues-sept-25-market-screams-epic-opportunity-near-dis-apdn-clrb-kors-nflx-bldp-oil-bitcoin-more/

CURT M_1 September 25, 2018 06:55:09 AM

Mornin!

CURT M_1 September 25, 2018 06:55:27 AM

Running scans and chart set ups now. We may get some opportunity here at open today.

CURT M_1 September 25, 2018 06:55:30 AM

brb

OILK September 25, 2018 07:00:33 AM

AMD held key support pivot on chart yesterday, trading up near 2% this morning. I’m long here.

SANDEEP September 25, 2018 07:01:47 AM

Caught that, seems upside target(s) in play if 32.47 is used as support

CURT M_1 September 25, 2018 07:04:15 AM

Mobile Mini $MINI PT Raised to $61 at Sidoti

SHAF September 25, 2018 07:06:18 AM

GOOGl short in play per curt – today best IMO

LENNY September 25, 2018 07:07:15 AM

Momo Watch: JAGX, JONE, CEI, APDN

LENNY September 25, 2018 07:07:44 AM

Short term only – all charts on momo watch are broken garbage.

LENNY September 25, 2018 07:08:11 AM

SQ interesting also on the UG

LENNY September 25, 2018 07:08:28 AM

the GOOGL TWTR FB money could rool some in there

PAUL M September 25, 2018 07:08:39 AM

seems logical len

CURT M_1 September 25, 2018 07:09:04 AM

Advanced Micro Devices $AMD Seen As A Near Term Semi Trend Beneficiary At Northland

CURT M_1 September 25, 2018 07:09:42 AM

Canopy Growth initiated with a Buy at Benchmark $CGC $STZ $STZ.B http://dlvr.it/QlK351

CURT M_1 September 25, 2018 07:11:03 AM

BREAKING: Qualcomm unveils explosive charges against Apple for stealing “vast swaths” of its confidential information and trade secrets for the purpose of improving the performance of chip sets provided by Qualcomm’s competitor Intel

CURT M_1 September 25, 2018 07:11:21 AM

https://twitter.com/CNBCnow/status/1044573719899906050

OILK September 25, 2018 07:12:31 AM

They will run oil after EIA

OILK September 25, 2018 07:12:47 AM

significant run imo then

CURT M_1 September 25, 2018 07:14:58 AM

thats a swidewinder setting up on 240 $SQ

CURT M_1 September 25, 2018 07:17:13 AM

On Watch: Oil long (likely not until post EIA or maybe an intr day prior), SQ long on sidewinder set-up, short GOOGL FB, DIS, NFLX adds long, BTC set up nearing, BLDP short is nearing time frame, and VIX near.

CURT M_1 September 25, 2018 07:17:35 AM

I may take an entry in SQ at open.

CURT M_1 September 25, 2018 07:17:37 AM

will see

CURT M_1 September 25, 2018 07:20:32 AM

on mic in 1

CURT M_1 September 25, 2018 07:56:49 AM

when the 5 min held the previous top of 5 i hit a 1/10 entry long SQ 89 again, i’ll keep chewing till an area holds – for the first leg

CURT M_1 September 25, 2018 07:57:00 AM

looks like this may hold

CURT M_1 September 25, 2018 07:58:13 AM

the next leg entry long will be on 30 min body holding the previous 30 min but i won’t do that until lunch, late day, premarket (early) or end of day Friday, then next 1 hour same process then 4 hour same process.

CURT M_1 September 25, 2018 08:03:00 AM

on mic 10:10 ish re: SQ trade

CURT M_1 September 25, 2018 08:10:05 AM

i will be a few mins here

CURT M_1 September 25, 2018 08:12:55 AM

on mic 9:13

CURT M_1 September 25, 2018 08:12:59 AM

10:13

CURT M_1 September 25, 2018 09:05:09 AM

it seems pressure in to weekly reporting has started looking for bottom of EPIC uptrend channel on chart for long positioning other side of reporting EIA

CURT M_1 September 25, 2018 09:58:28 AM

on mic 12:05

CURT M_1 September 25, 2018 11:07:08 AM

$NKE earnings on high watch for me later today (when I return from some exercise). Cya later, GL! #freedivetime 9 videos scheduled for members to do tonight, we’ll see if I can get em all done. peace https://twitter.com/curtmelonopoly/status/1044633980493008896

Subscribe:

Click here for Day Trading Alerts.

Click here for Swing Trading Alerts.

Click here for a menu of Trading Alerts, Newsletters, Trading Rooms and Trade Coaching prices and options.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Swing Trading Alerts, Day Trading Alerts, Trading Room, $SQ, $DIS, $NFLX, $AMD, OIL, $FB, $GOOGL

PreMarket Trading Plan Tues Sept 25: Market Screams Epic Opportunity Near, $DIS, $APDN, $CLRB, $KORS, $NFLX, $BLDP, OIL, Bitcoin, more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday September 25, 2018.

In this premarket trading edition: $DIS, $APDN, $CLRB, $ARMN, $ACST, $XON, $OSIS, $BLDP, $LEBV, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $ROKU, $CVM, $XXII, $MOMO, $SPY, $SSW, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 25 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or when the lead trader is not available.

- In final edits for release this week;

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced in part (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

See the general market news near bottom of this report – the are epic market trading opportunities on the near horizon.

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on. I don’t see any reason why we won’t be able to push these set-ups out this evening after the markets close. There is so much going on right now in the markets (the ground is moving) that we have to start pushing this stuff out and get ready.

Doing some charting in premarket for $CLRB and $APDN – both very interesting set-ups IMO.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Below are some trade position notes from late last week if you didn’t catch them;

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 7:43 AM: US Dollar $DXY trading 94.25, Oil FX $USOIL ($WTI) trading 72.40, Gold $GLD trading 1201.21, Silver $SLV trading 14.30, $SPY 291.83 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6378.00 and $VIX trading 11.9.

Momentum Stocks / Gaps to Watch: $JAGX $CEI $JONE $ASNA $TLRY $APDN $GNCA $HMNY

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12401306 $JAGX $ASNA $TLRY $MTNB $INFO $TGTX $OPNT $AINC $FDS $PETQ $KORS $CNP

https://twitter.com/CompoundTrading/status/1044562223388127232

News:

$APDN Applied DNA Expands Cannabis Tagging Portfolio to Address Large Growers https://finance.yahoo.com/news/applied-dna-expands-cannabis-tagging-090000755.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$CLRB: Cellectar’s CLR 131 Receives FDA Orphan Drug Designation for the Treatment of Pediatric Osteosarcoma

Michael Kors takes over fashion icon Versace in $2 billion deal

The Knot parent XO Group’s stock soars after $933 million buyout deal

$FCSC Awarded $1.4M FDA Orphan Grant for FCX-007 for Treatment of Recessive Dystrophic Epidermolysis Bullosa

Fiserv to buy U.S. Bancorp unit’s debt-card processing, ATM services and MoneyPass for $690 million

Aleafia to receive $10 million investment as part of deal to take majority stake in Serruya-led One Plant

$PSTI here is PR: FDA Orphan Drug Designation for PLX cell therapy for the Treatment of Graft Failure

Recent SEC Filings / Insiders:

Recent IPO’s:

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Jabil’s stock jumps after profit, revenue beat expectations

#earnings for the week

$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL

#earnings for the week$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL https://t.co/r57QUKKDXL https://t.co/pVka1Ud3QD

— Melonopoly (@curtmelonopoly) September 24, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

DISNEY (DIS) trade alert long 112.30, over 112.10 targets 117.38 or 124.27 Dec 14 pending trajectory of trade $DIS #swingtrading #tradealerts

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading https://t.co/KiWbcjO7PO

— Swing Trading (@swingtrading_ct) September 25, 2018

Best Oil Stocks to Buy Now https://finance.yahoo.com/news/best-oil-stocks-buy-now-012433429.html?soc_src=social-sh&soc_trk=tw …

Best Oil Stocks to Buy Now https://t.co/mh3568k1o0 via @YahooFinance

— Melonopoly (@curtmelonopoly) September 24, 2018

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

ADVANCED MICRO (AMD) hit key support and bounced, targets 33.62 Oct 2 or sell off 28.87, watch structure uoutlined on chart #swingtrading #tradealerts

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading