Tag: #EIA

PreMarket Trading Report Fri Jan 4: Trade Talks, China RRR,Tesla, Intel, GameStop, Flex Pharma, LUV, TSLA, NFLX, INTC, #EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Friday Jan 4, 2019.

In this premarket trading edition: Trade Talks, China RRR,Tesla, Intel, GameStop, Flex Pharma, LUV, TSLA, NFLX, INTC, #EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Remaining Discount Codes to be released to Public Today:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading.

- December Special 40% Discounts (limited promo discounts per):

- Lead Trader Premarket Note:

- Jan 4 – I will be in attendance in main trading room at market open, EIA at 11:00, mid day review, and futures overnight Sunday. The markets have been a mess over holiday season with completion of this massive time cycle and it was a short week. Early in our first full week of regular trade next week the reporting will be significant and trade alerts will ramp up. We expect an epic six months of trading here forward. Stay on top of it and lets catch the turns in to 2019!

- #EIA for week ending December 28, 2018 alternate release day January 4, 2019 Friday 11:00 a.m. due to New Year’s holiday. #OOTT $CLF $USOIL $USO #Oil #OOTT https://www.eia.gov/petroleum/supply/weekly/schedule.php …

- https://twitter.com/EPICtheAlgo/status/1080419058573631488

- Jan 4 – I will be in attendance in main trading room at market open, EIA at 11:00, mid day review, and futures overnight Sunday. The markets have been a mess over holiday season with completion of this massive time cycle and it was a short week. Early in our first full week of regular trade next week the reporting will be significant and trade alerts will ramp up. We expect an epic six months of trading here forward. Stay on top of it and lets catch the turns in to 2019!

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when API integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December/ January for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- 3 day Cabarete trading boot camp to be announced for early Feb 2019.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

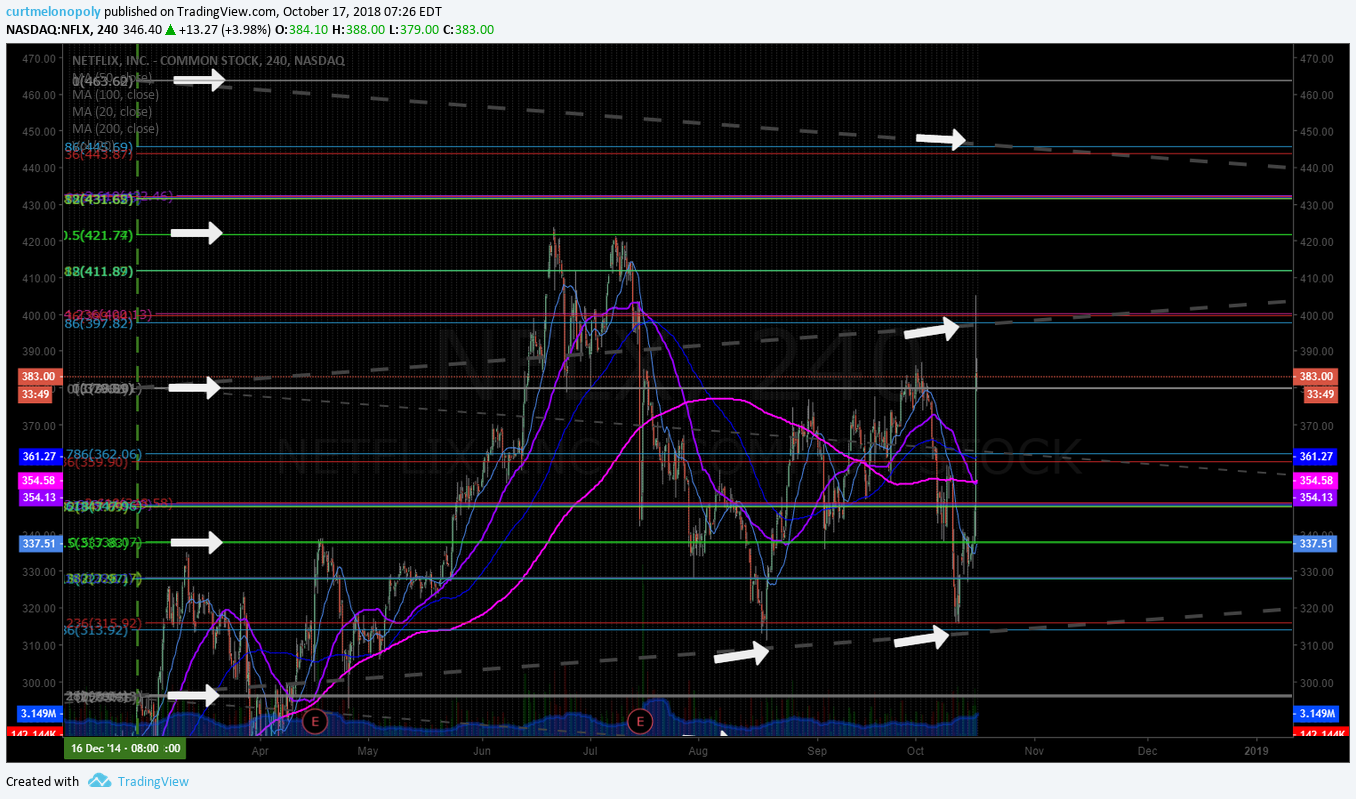

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Fri Jan 4 – If Fed pauses hikes and US-China trade relations improve oil should run in to May targets oil bundle members have (especially if OPEC cuts remain in play), the markets should run up in to May. Gold, Silver, VIX, DXY and Bitcoin may (are likely) to get soft and equities will be a stock pickers environment (traded properly within instrument structure) during that period (Q1 2019). Generally this is how it looks currently. But yet to be seen in to next week forward – this is one scenario. Reporting and alerts (either way) will become very active as next week rolls out and in to next 6 months. We will have the structure of trade for our coverage (the algorithm models and swing platform) so that we can trade either scenarios (up or down in each, including swing trading).

Thurs Jan 3 – Stay calm, only today and Friday left in this holiday / time cycle completion phase. Our trading alerts will be very active in to next week.

A note from Jeremy yesterday posted to oil server in Discord;

I have received a few questions about why our machine trade is quiet. Trade through holidays was not structured at all and not within our rule set. When structured trade returns (it always does), we will be higher frequency than last month (about 5 – 10 x). At latest we expect structure next week but it could be earlier.

Wed Jan 2 – Remaining cautious and patient, short week, post holiday in to first full trading week of year next week.

#EIA for week ending December 28, 2018 alternate release day January 4, 2019 Friday 11:00 a.m. due to New Year’s holiday. #OOTT $CLF $USOIL $USO #Oil #OOTT https://www.eia.gov/petroleum/supply/weekly/schedule.php …

Friday Dec 28 –

Closed DGAZ trade in premarket long 86.79 (NatGas short) from 52.30. Nice trade.

Per premarket note above: Still recovering from brutal food poisoning last 36 hours, trading room open today but likely trade will be really light until we are past Jan 1. Markets are not structured last number of days. Last Friday was completion of large time cycle in markets with a week either way as caution. Next week the new time cycles will be in play and our reporting and trading will reflect that (beyond Jan 1, 2019). Team is in session this weekend processing WIP completion for 2018 in to 2019.

Last trading session in crude oil trade alerts screen shot is below in trades section. Will be more active now that I’m recovering from sick and Jan 1 near.

Near end of June we signaled to lighten up on equity longs and we brought our long trades in for a landing over the next 90 days (check our feeds). Since then we’ve consistently signaled caution in to end of time cycle in to end of Dec 2018. First two quarters 2019 we expect to be extremely active. Watch all reporting closely from recent forward.

Wednesday Dec 19 –

Still holding DGAZ (Natgas short) and will add to it if oil gets a leg up post EIA and FOMC.

Still holding the others per recent reports.

Time cycle completing and with FOMC and EIA today it makes sense.

Some of our favorite daytrading and swing trading equities are bullish premarket so that is a good sign and many market leaders have a jump in their step this morning, FB is an exception – it isn’t looking great at time of writing.

Machine trade in oil yesterday worked, small but it worked fine. Per dms, the reason it didn’t trade in to 230 EST when it was an obvious trade after giving guidance of price pressure in to the close is that the software is programmed not to trade between 210 – 230 EST in to close with oil. Same with post close until futures open, right before regular market open and around EIA or other special events. We will shorten this duration next updates and have a goal to completely eliminate the black out period for events and low volume periods – will advise.

Patience, we’re almost done this cycle.

Per Recent:

Tuesday Dec 18 –

DO NOT MISS the lead trader premarket note at start of this report.

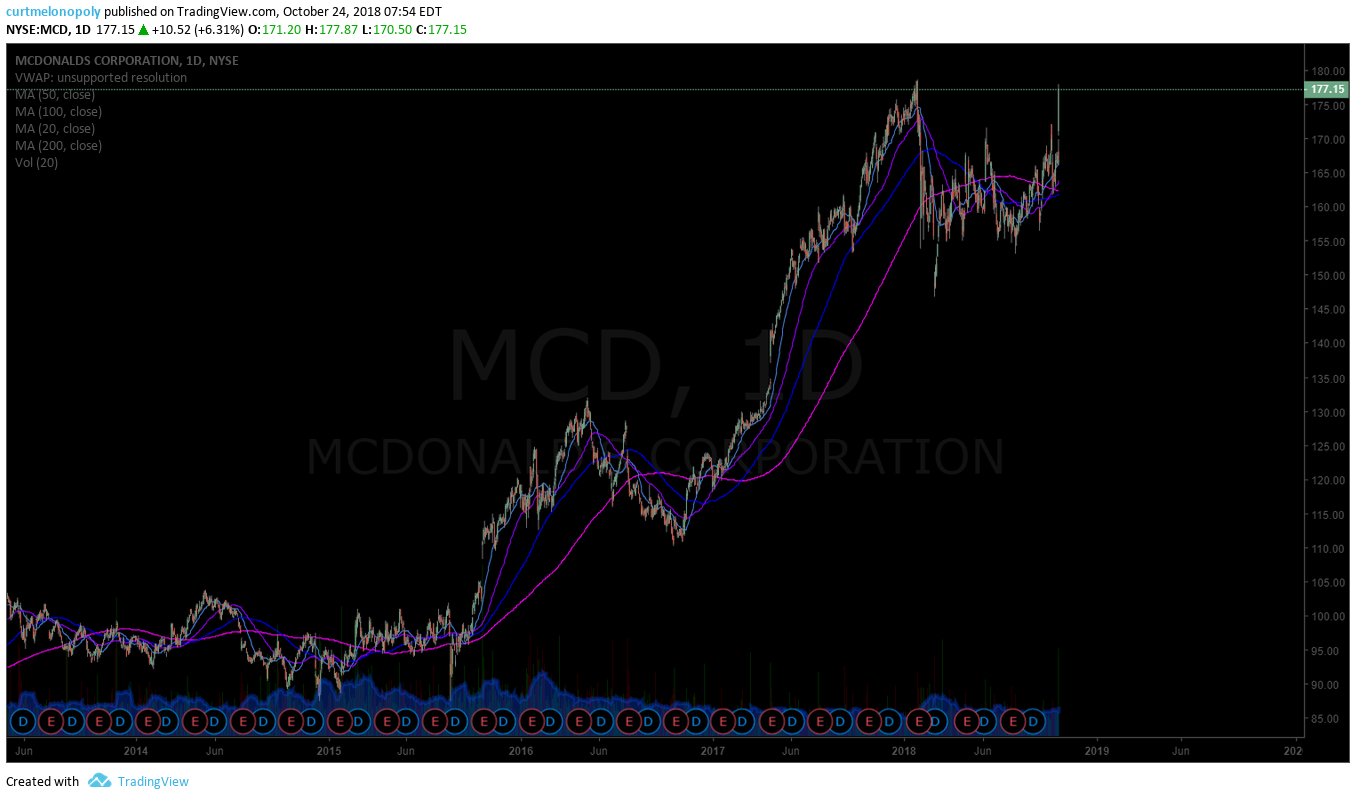

I am watching GS, MCD, SBUX and SPY today, as well as Oil and obviously VIX with the two day Fed meetings. The other watches are in recent lists in premarket (equities etc). Also, Trump after Googl, FB, and TWTR again – watch your long bias.

If oil doesn’t regain yesterday’s price drop I will close my DGAZ long position soon.

Everything in recent reports remains in to time cycle peak. Use extreme caution.

We’re close to the other side of this cycle now. Lots of reporting on deck.

In to and out of this massive time cycle peak $STUDY and you’ll never regret it. Forget trading for a week.

Monday Dec 17 –

Global markets are calmer. Out of the VIX short trade last week but still in the others.

Equities on watch listed below all remain on my list.

Dec 13 – Markets are mixed (not surprising considering time cycle completion on 20 th ish). Extreme caution between here and 20th ish.

Current Trades:

Looking for a pull back on DGAZ to size next leg above starter.

Holding VIX starter short in TVIX – HIGH RISK TRADE, extreme caution. Likely reverse bias after Dec 20 ish.

Holding SPY long starter. Likely reverse to short after Dec 20 ish.

Holding DWT short starter (however, it looks like oil may take another leg down here, it will either hold here or down another floor). Will size in next leg after a pull back in oil.

Holding ARWR swing starter long (missed my next leg size).

Looking for a possible BTC long swing other side of Dec 20 ish.

Looking for a possible Silver and Gold long other side of Dec 20 ish.

Looking for a possible DXY short other side of Dec 20 ish.

Expect next 6 months to be trading career huge. Massive range. Equity swings will increase as we come out of this time cycle peak – it will be a stock pickers year in 2019 with technical analysis rooting the trade action. My goal is to retire off front lines in 6 months (still here, but off the front lines), to do that my personal trading and machine trading has to be massive to win side.

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. W

I will be in trading room for open, mid day and at other times when we are trading.

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas.

Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

Market Observation:

Markets as of 7:01 AM: US Dollar $DXY trading 96.27, Oil FX $USOIL ($WTI) trading 48.16, Gold $GLD trading 1290.90, Silver $SLV trading 15.70, $SPY 247.61 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3783.00 and $VIX trading 23.9.

Momentum Stocks / Gaps to Watch:

Esperion to receive $300 million in upfront payments in deal with Daiichi Sankyo #swingtrading $ESPR https://on.mktw.net/2GScYyB

Stocks – Tesla, Intel Gain in Premarket, GameStop, Flex Pharma Soar – https://invst.ly/9ox9g

Stocks making the biggest moves premarket: LUV, TSLA, NFLX, INTC & more –

Stocks making the biggest moves premarket: LUV, TSLA, NFLX, INTC & more – https://t.co/bjSequmXIs

— Melonopoly (@curtmelonopoly) January 4, 2019

News:

Flex Pharma to merge with Salarius to accelerate development of cancer treatments.

$MBVX and Oncotelic Enter into Merger Discussions.

Dow is set to rise more than 300 points on US-China trade talks –

https://twitter.com/CompoundTrading/status/1081155432587104259

China Cuts Bank’s Reserve Require Ratios $ES_F $USDCNY

-Cuts Reserve Ratio By Overall 100Bps

– Cuts Reserve Ratio By 50 Bps Jan 15

– Cuts Reserve Ratio By 50 Bps Jan 25

China Cuts Bank's Reserve Require Ratios $ES_F $USDCNY

-Cuts Reserve Ratio By Overall 100Bps

– Cuts Reserve Ratio By 50 Bps Jan 15

– Cuts Reserve Ratio By 50 Bps Jan 25— LiveSquawk (@LiveSquawk) January 4, 2019

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

Earnings:

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

http://eps.sh/cal

A look at Jan #earnings calendar.$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN https://t.co/r57QUKKDXL https://t.co/rBfBzOCeAu

— Melonopoly (@curtmelonopoly) January 2, 2019

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

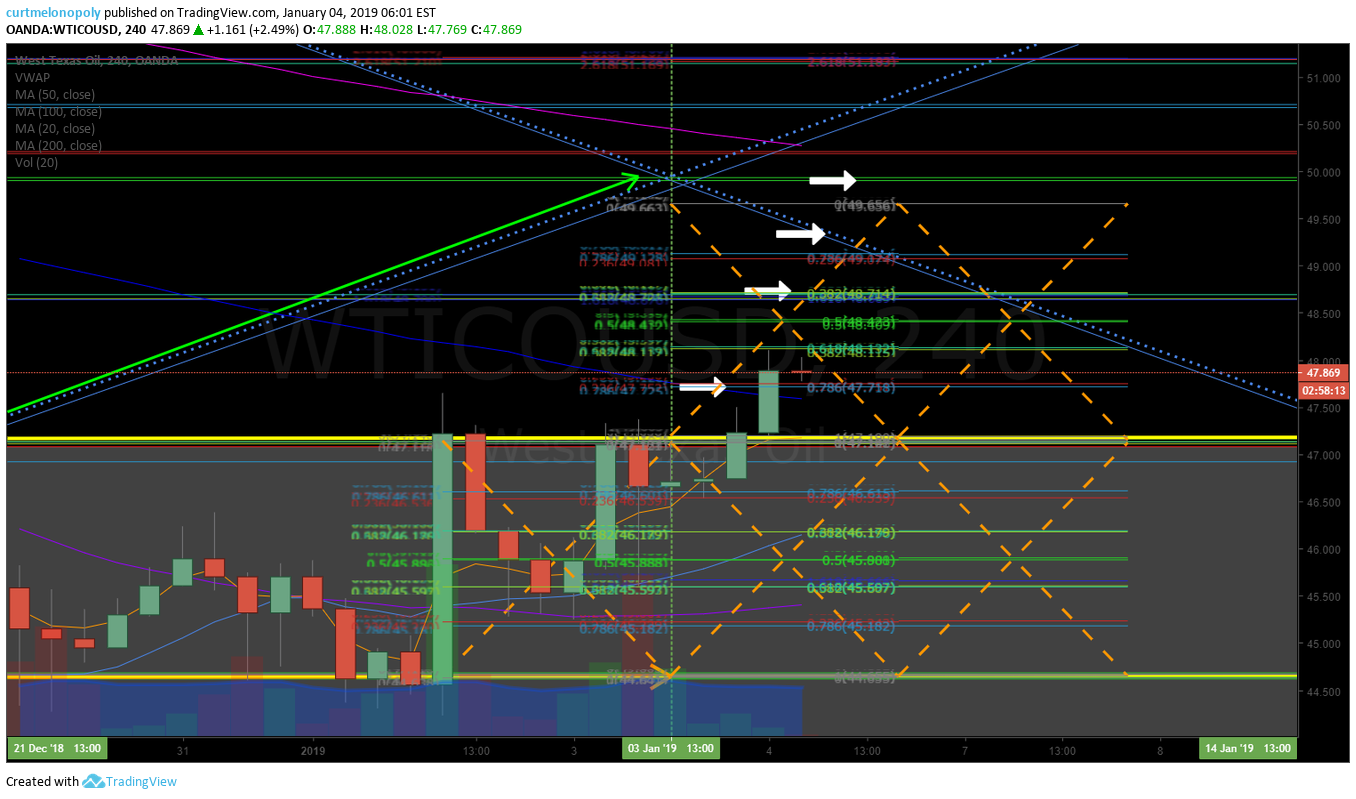

Crude Oil. 240 Min Chart – we got the move up over trading box overnight. Jan 4 602 AM FX USOIL WTI $USO $CL_F #OIL #trading

If oil breaches top of this trading box today on simple model it should hit topside white arrow in today’s trade.

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Gold (Daily) Trade testing TL resistance intra. Other noteable resistance marked (gray arrows). #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtradealerts

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Short Natural Gas trade in DGAZ – looking for add today post EIA if oil jumps. #NaturalGas #trading #alerts

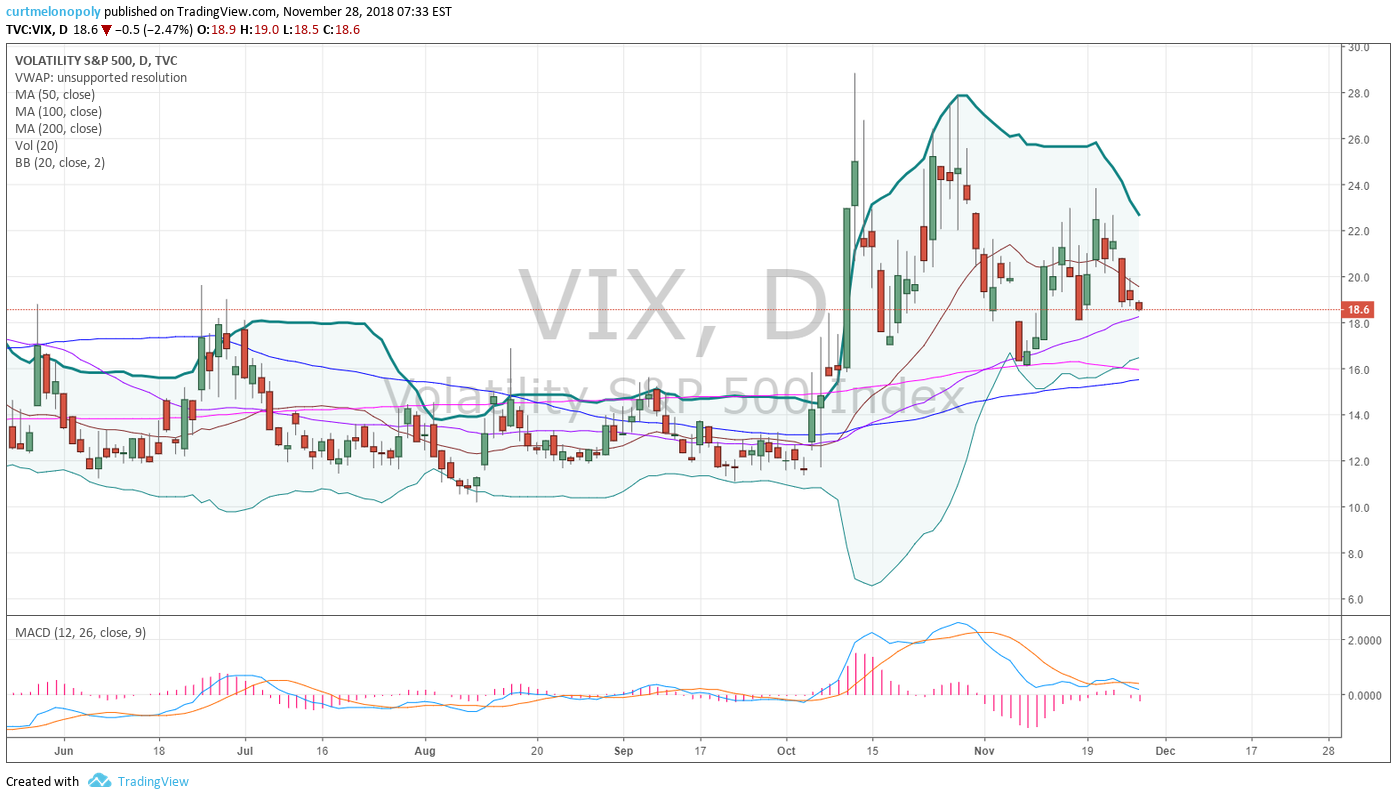

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

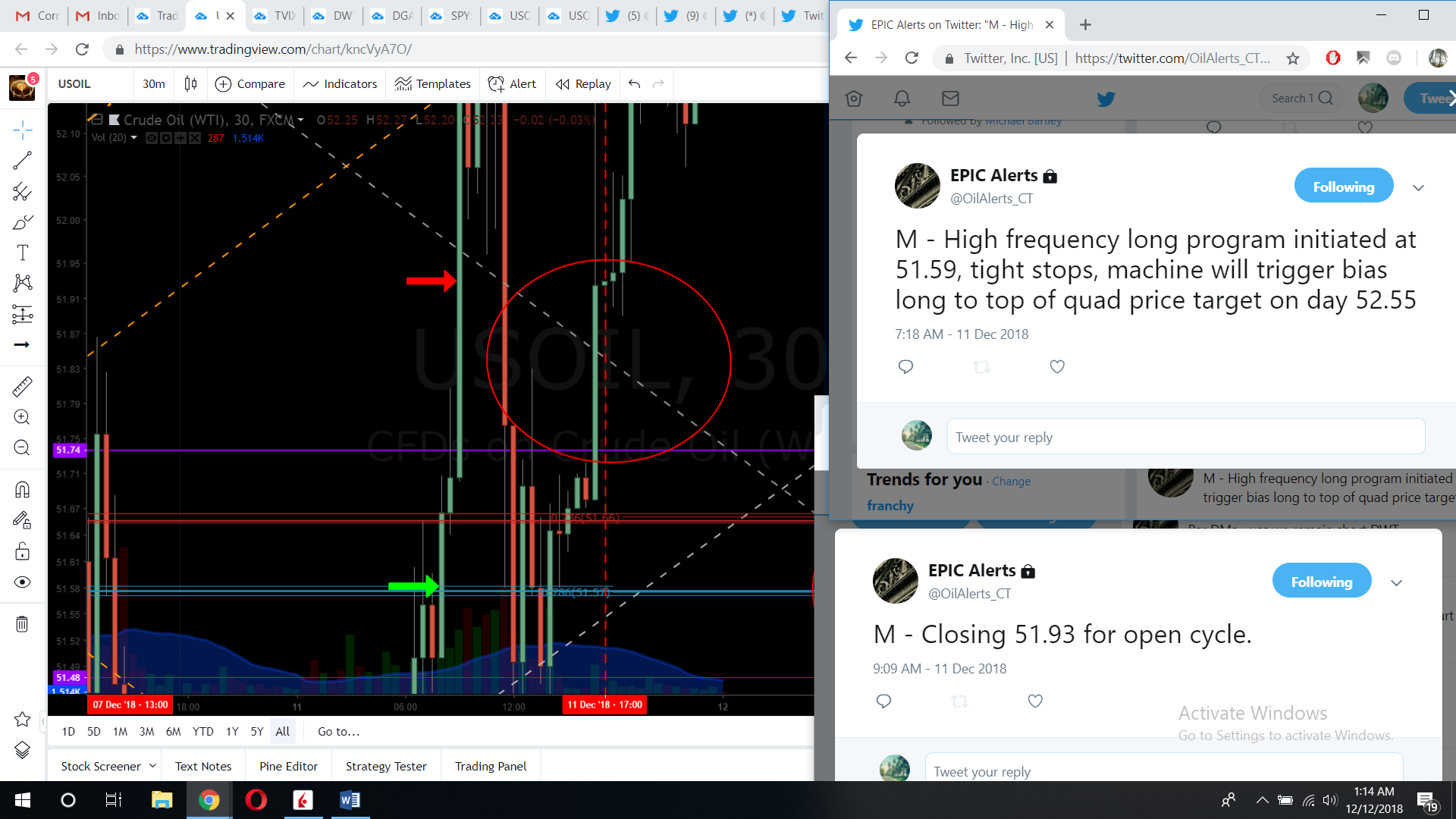

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

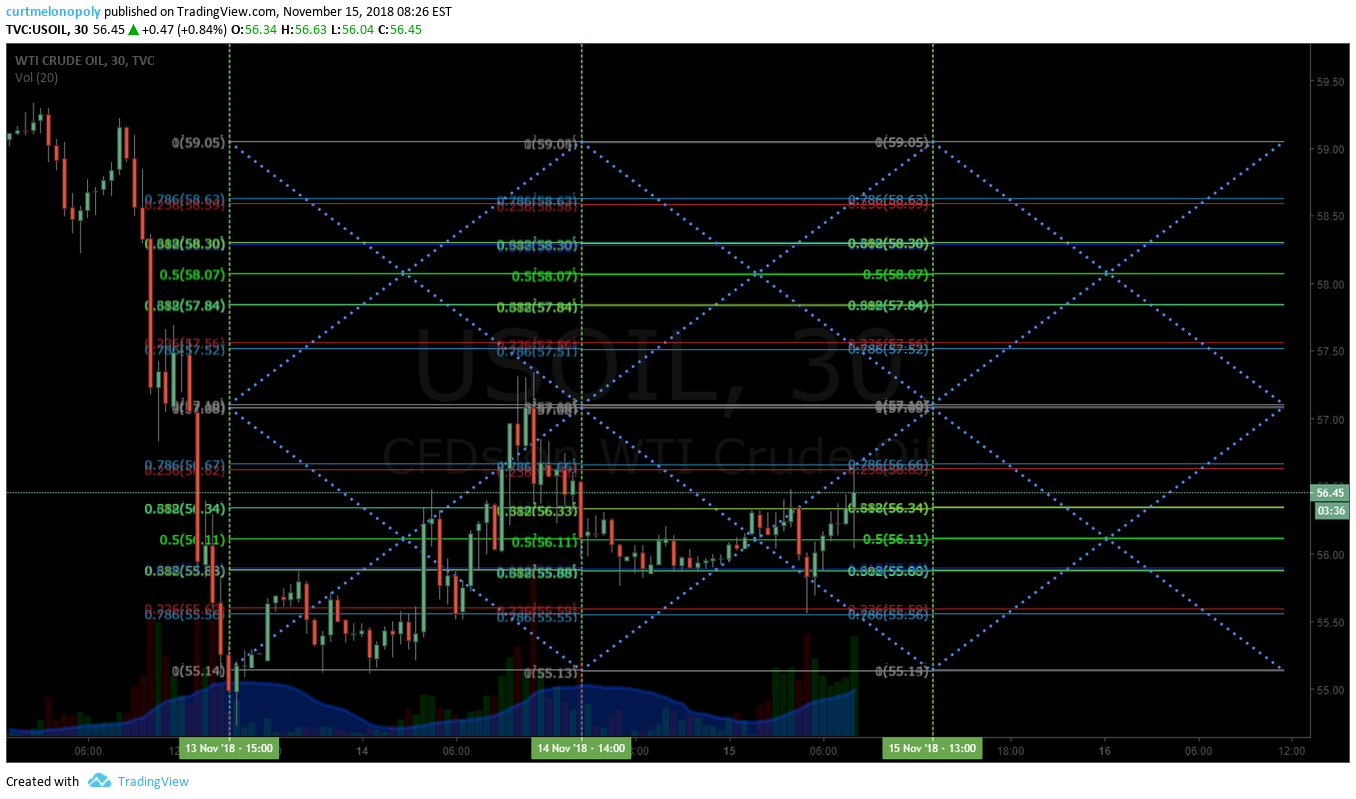

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

China’s central bank moves to support growth with a 1 percentage point reserve ratio cut https://www.bloomberg.com/news/articles/2019-01-04/pboc-cuts-banks-reserve-ratio-to-ratchet-up-support-for-2019 …

Here’s what will lead the new growth cycle after correction according to Alchemy’s Hiren Ved. #swingtrading #timecycles https://www.bloombergquint.com/business/alpha-moguls-alchemys-hiren-ved-predicts-the-winners-of-next-growth-cycle

Here’s what will lead the new growth cycle after correction according to Alchemy’s Hiren Ved. #swingtrading #timecycles https://t.co/s68ZPvTyaX

— Swing Trading (@swingtrading_ct) January 4, 2019

Dallas Fed Energy Survey

https://twitter.com/EPICtheAlgo/status/1081168296861487104

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $FLKS $HSGX $PTN $INFI $NVAX $ASNS $NBRV $DPW $DBVT $GME $YINN $UGAZ $GLPG $UXIN $UWT $KTOV

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $COTY $IEX $OFC $GDOT $HON $NOK $CPT $OHI $INTC $IMO $REGN $VAR $SFLY $IEX $KOS $CELG $QLYS $MYGN $SNDR $MAS $AWI $FBHS $NFLX $ETSY$EXPE $CBOE $AERS $VIRT $CG $AZPN $LEA $DAN $AZPN $SHW $CC $KOS

$NFLX upgraded to Conviction Buy from Buy at $GS (Malaysia division) w/ $400 PT.

BofA/Merrill prefers cloud and 5G exposure in semis, upgrades Intel to Buy $INTC $AMD http://dlvr.it/Qvy59y

(6) Recent Downgrades: $SWKS $AVNS $EMR $UTX $FLOW $COO $DEO $ADI $CYBR $VC $FTNT $ALV $VNE $ADNT $TXN $FTSI $EVRG $RES $PACB $EXC $HOLX $EBAY $CRTO $SNAP $TROW $FLXN $KKR $ICE $MRT $SESN

BofA downgrades TI, Analog Devices, Maxim Integrated in semi ratings shake-up $TXN $ADI $MXIM $INTC http://dlvr.it/Qvy5B6

BofA/Merrill Lynch Downgrades California Resources $CRC to Neutral

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Trade Talks, China RRR,Tesla, Intel, GameStop, Flex Pharma, LUV, TSLA, NFLX, INTC, #EIA,

PreMarket Trading Report Wed Dec 12 : Firsts Far From Over, EIA, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, NatGas …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday December 12, 2018.

In this premarket trading edition: Firsts Far From Over, EIA, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, NatGas and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Scheduled Events / Platform Development / Team Work in Progress:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading. - Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December / January 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

the firsts are far from over . careful with bias

— Melonopoly (@curtmelonopoly) December 12, 2018

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. We have majority of weekly reporting due out Mon – Wed evening.

I will be in trading room for open, mid day and at other times when we are trading.

Reminder: The live trading room is partitioned in to 25 attendees per room each viewing the same charting. If you are moved room to room you will be down for at most 20 secs at a time.

Reminder: The live trading room is attended by mostly full time traders and funds. We appreciate interaction to be as actionable as possible for attendees. Chatter can be directed to Discord server specific to instrument. If you need a link to private discord server for chat let us know compoundtradingofficial@gmail.com.

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas. Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

I may be off on Friday for a vet hospital operation (bulldog) YTBD.

Market Observation:

Markets as of 8:00 AM: US Dollar $DXY trading 97.45, Oil FX $USOIL ($WTI) trading 52.61, Gold $GLD trading 1244.75, Silver $SLV trading 14.63, $SPY 266.77 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3394.00 and $VIX trading 21.1.

Momentum Stocks / Gaps to Watch:$ABIL $LX $WPP $DBVT

Stocks – Nvidia, Apple, Amazon, Aphria Gain in Premarket; American Eagle Plunges – https://twitter.com/newsinvesting/status/1072847307484348416

News:

Dow set to jump 250 points as Wall Street’s wild swings in reaction to the trade battle continue https://www.cnbc.com/2018/12/12/stock-markets-dow-cheered-by-trumps-upbeat-trade-war-comments.html?__source=iosappshare%7Ccom.apple.UIKit.activity.PostToTwitter

Recent SEC Filings / Insiders:

Recent IPO’s:

Ride-hailing startup Lyft files confidentially for U.S. IPO.

Read: https://goo.gl/jxpnxi

Earnings:

#earnings for the week

$ADBE $AEO $SFIX $COST $DSW $PLAY $CIEN $PVTL $ASNA $INSE $FRAN $GTIM $CDMO $ASPU $ARWR $DLHC $CASY $PLAB $VRA $NCS $NX $TLRD $SEAC $ROAD $CHKE $IRET $OXM $NDSN $FTI $VERU $PHX $CIVI $SKIS $SMMT $PURE $STRM $MMMB $AXNX

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

USOIL MACD turned up on daily testing 20 MA resistance area. Holding after recent sell-off. #oil #Chart #crude

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility lower but we’re watching in to Dec 5 and lower supports near bollinger for possible bounce $VIX #volatility

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

TVIX premarket trading down. We are short Volatility from last Wednesday in 49s #premarket #volatility $VIX

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

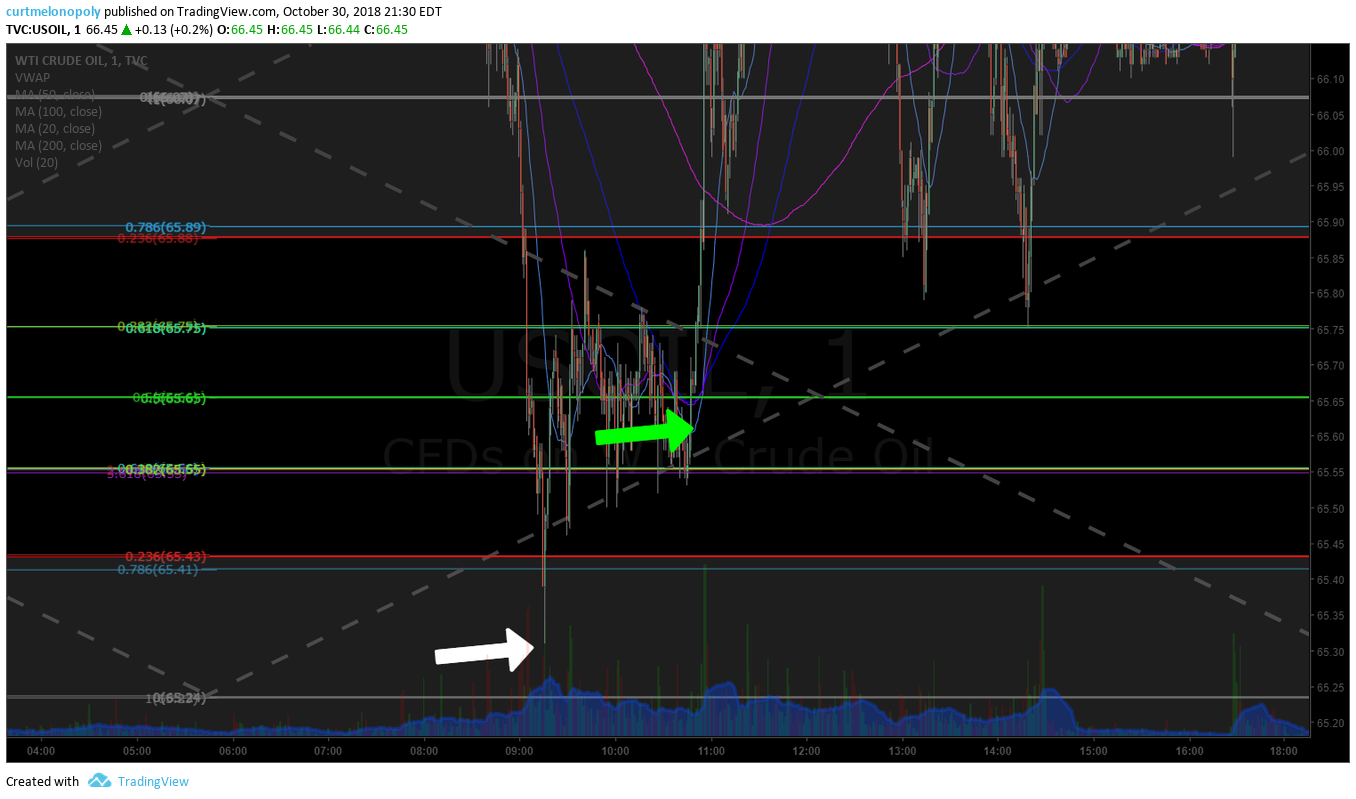

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

$ROKU #daytrading #tradealerts

Market Outlook, Market News and Social Bits From Around the Internet:

A Peek Into The Markets: US Stock Futures Higher Ahead Of Consumer Price Index https://benzinga.com/z/12836854 $AEO$BAC$PLAY$MRNS$SPY$DJIA$USO

Yields on 3-month Treasury bills match those on global bonds for the first time since the financial crisis. https://www.ft.com/content/2a6a0ccc-fd2d-11e8-aebf-99e208d3e521 …

Trump admin seeks to severely limit all biotech interactions with China involving joint ventures, investments into US companies, and manufacturing. Public comments are due by Dec 18 2018! Universities are already planning to curtail graduate programs/students. This is HUGE 🤯

Nice one: A flatter yield curve tends to boost volatility as we move into the later phase of the economic cycle.

Kremlin tells Russian banks to prepare for disconnection from international payment systems #Russia

The market’s biggest problem: Everyone Is Bearish But No-One Is Short

Don’t get too scared by flattening yield curve: S&P 500 didn’t peak for >19mths, on avg, after yield curve inverted. On avg, it gained >22% before reaching its high point. Time between inversion & recession arriving can be as long as 765 days.

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, EIA, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, NatGas

PreMarket Trading Report Wed Nov 28: #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRM …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday November 28, 2018.

In this premarket trading edition: #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRMand more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Nov 28 – Lead trader in attendance to live trading room at market open, EIA, mid day review and as required through the day and in futures trading.

- Jen (office)Yesterday at 6:08 PM

This week: Curtis, Jeremy (Sr. machine tech) and Katie (new machine tech) will be monitoring machine trades in oil on rotation near 24 hours a day (and going fwd). When trades are active the live trading room will be opened for EPIC and trading room members. During low liquidity hours trades will be nominal and more frequent in higher liquidity hours through each week. The first generation of the software is complete. There will be continuous updates. A rules based machine trade protocol will be published soon for members. The next to be coded is Bitcoin then SPY. Member reports are being processed now for the week also. Thank you — Jen. - Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November / December 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Watching time-cycle expiry / inflection for a direction in to next late Dec and then late Dec in to first quarter time cycle 2019.

There is a volatility time-cyle (monthly) coming in at Dec 5 so we are looking for a possible bounce in to that date and shortly thereafter.

Watching EIA closely today for structure in the current trading quad, it has been constructive of late.

Possible short $DWT on the day based on rise in premarket.

Per previous;

Nov 21 – Looking at possible retrace to .5 on oil (per last move), possible short in Natural Gas (DGAZ) and watching equities very close for supports to bounce and hold.

If you’re a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You’ll learn a lot and you’ll possibly catch a turn and change your financial life soon. You won’t get many opportunities like this. #premarket

If you're a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You'll learn a lot and you'll possibly catch a turn and change your financial life soon. You won't get many opportunities like this. #premarket

— Melonopoly (@curtmelonopoly) November 20, 2018

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 7:51 AM: US Dollar $DXY trading 97.36, Oil FX $USOIL ($WTI) trading 51.45, Gold $GLD trading 1214.15, Silver $SLV trading 14.15, $SPY 269.70 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4017.00 and $VIX trading 18.6.

Momentum Stocks / Gaps to Watch:

22 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12763192 $GPIC $NTNX $CRM $BURL $SWPH $JILL $SINA $WB $CHS $SMRT $TIF $SJM $GWPH $GNL

News:

Wayfair shares soar premarket after company says direct retail sales rose 58% over holiday weekend.

AMD, Nvidia stocks rise after Mizuho says GPU prices are rebounding #swingtrading $AMD $NVDA

AMD, Nvidia stocks rise after Mizuho says GPU prices are rebounding #swingtrading $AMD $NVDA https://t.co/w5opqHarb8

— Swing Trading (@swingtrading_ct) November 28, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

$DKS Dick’s Sporting Goods’ stock surges after earnings beat, raised outlook https://on.mktw.net/2AuTNEz

Chico’s stock plummets toward 9 1/2-year low after earnings and sales miss, lowered outlook

#earnings for the week

$CRM $WB $SPLK $NTNX $DLTR $DKS $TIF $BURL $PANW $BOX $DSX $ZUO $BNS $JKS $SINA $GWPH $VEEV $ANF $CBRL $HIBB $KSHB $VMW $AMBA $HMLP $WDAY $DAVA $RY $SJM $GME $JILL $VJET $AMWD $ITRN $TD $PAGS $KNOP $TLYS $BKE $GSM $HPQ $TECD

#earnings for the week $CRM $WB $SPLK $NTNX $DLTR $DKS $TIF $BURL $PANW $BOX $DSX $ZUO $BNS $JKS $SINA $GWPH $VEEV $ANF $CBRL $HIBB $KSHB $VMW $AMBA $HMLP $WDAY $DAVA $RY $SJM $GME $JILL $VJET $AMWD $ITRN $TD $PAGS $KNOP $TLYS $BKE $GSM $HPQ $TECD https://t.co/r57QUKKDXL https://t.co/jLnh9OtyI6

— Melonopoly (@curtmelonopoly) November 26, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

There have been a few paper cuts executed on machine trading side in oil trade last few days – report will detail when released.

Volatility lower but we’re watching in to Dec 5 and lower supports near bollinger for possible bounce $VIX #volatility

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

TVIX premarket trading down. We are short Volatility from last Wednesday in 49s #premarket #volatility $VIX

SP500 (SPY) Daily Chart MACD turned up but structure under pressure. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again

if crude lets go here watch out…. yet again

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

Futures higher on hopes of trade breakthrough; Powell speech in focus

Futures higher on hopes of trade breakthrough; Powell speech in focus https://t.co/IPZPh7IrIf

— Reuters (@Reuters) November 28, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $GPIC $IPCI $CMCM $MBRX $UGAZ $CRMD $NTNX $PXS $CRM $GSM $BURL $ANY $AFSI $WB $INFY $BITA $UNG

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DVA $SWKS $AZPN $SIVB $ZAYO $SAVE $OOMA $IMO $ONDK $ALK $AMX $TGP $SIVB $AZPN

Stifel upgrades $TGP from Hold to Buy

$AMZN: EVERCORE ISI RAISES PRICE TARGET TO $1990 FROM $1970

(6) Recent Downgrades: $BECN $WHR $EV $ECA $CME $TLP $TI $CBRL $CRNT $WHR

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRM

PreMarket Trading Report Wed Nov 21: EIA, Oil, $WTI, NatGas, $DGAZ, Equities Bounce, Low Float, Penny Momo …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday November 21, 2018.

In this premarket trading edition: EIA, Oil, $WTI, Natgas, $DGAZ, Equities Bounce, Low Float, Penny Momo and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Nov 21 – Lead trader in attendance to live trading room at open, EIA, mid day review and as required through the day.

- Nov 12 Member Update (click) Trade Service Updates: Machine Trade, Trade Alerts, Live Trading, Reporting, Coaching etc.

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- Live Trading Room (as lead trader is available) is a 24 hour trading room (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- Team Work in Progress:

- Machine trading signals to be fed in to main trading room.

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November / December 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Watching time-cycle expiry / inflection for a direction in to next late Dec and then late Dec in to first quarter time cycle 2019.

Nov 21 – Looking at possible retrace to .5 on oil (per last move), possible short in Natural Gas (DGAZ) and watching equities very close for supports to bounce and hold.

Per previous;

If you’re a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You’ll learn a lot and you’ll possibly catch a turn and change your financial life soon. You won’t get many opportunities like this. #premarket

If you're a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You'll learn a lot and you'll possibly catch a turn and change your financial life soon. You won't get many opportunities like this. #premarket

— Melonopoly (@curtmelonopoly) November 20, 2018

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 6:55 AM: US Dollar $DXY trading 96.81, Oil FX $USOIL ($WTI) trading 54.37, Gold $GLD trading 1223.40, Silver $SLV trading 14.41, $SPY 265.53 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4518.00 and $VIX trading 21.7.

Momentum Stocks / Gaps to Watch:

FAANG STOCKS EXTEND GAINS, NOW UP BETWEEN 1.2 PCT AND 3 PCT PREMARKET

FAANG STOCKS EXTEND GAINS, NOW UP BETWEEN 1.2 PCT AND 3 PCT PREMARKET

— *Walter Bloomberg (@DeItaone) November 21, 2018

Low float on watch $ANY $INPX $GLBS $PXS

Momos on watch $ICTY $MDIN $NHPI $KRFG $PGUS $LCLP $WWIO $INKW

20 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12737960 $FL $ABIL $BZUN $ADSK $BJ $LTM $HTBX $XRF $ANY $DE $CAL $BILI

News:

Equity contagion spreads to credit, deepening worries on growth. GE woes, rising Fed rates are weighing on bonds. Spreads probably haven’t widened enough, Goldman says. https://www.bloomberg.com/news/articles/2018-11-21/equity-contagion-spreads-to-credit-deepening-worries-on-growth …

Equity contagion spreads to credit, deepening worries on growth. GE woes, rising Fed rates are weighing on bonds. Spreads probably haven’t widened enough, Goldman says. https://t.co/HU22R0Ivfz pic.twitter.com/xvYFskWv9W

— Holger Zschaepitz (@Schuldensuehner) November 21, 2018

iPhone $AAPL Assembler Foxconn Warns of Difficult and Competitive Year, to Eliminate 10% of Non-Technical Staff – Bloomberg

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

Deere’s stock drops after earnings and revenue rose less than expected

#earnings for the week

$JD $TGT $BBY $LOW $KSS $TJX $BZUN $LB $GWGH $DE $INTU $URBN $$ROST $MDT $SPB $ADSK $CPB $PSTG $JT $A $ADI $LEJU $JEC $SOL $JACK $HRL $BILI $FL $GPS $GHG $BJ $BECN $QD $KEYS $DY $BRKS $NUAN $VBLT $SSI $NM $SFL $NJR $MMS $KLIC

#earnings for the week $JD $TGT $BBY $LOW $KSS $TJX $BZUN $LB $GWGH $DE $INTU $URBN $$ROST $MDT $SPB $ADSK $CPB $PSTG $JT $A $ADI $LEJU $JEC $SOL $JACK $HRL $BILI $FL $GPS $GHG $BJ $BECN $QD $KEYS $DY $BRKS $NUAN $VBLT $SSI $NM $SFL $NJR $MMS $KLIC https://t.co/r57QUKKDXL https://t.co/Cb4X0ukwMC

— Melonopoly (@curtmelonopoly) November 19, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

There have been a few paper cuts executed on machine trading side in oil trade last few days – report will detail when released.

VIX MACD on close watch today, could cross up and we could see escalation quick $VIX $TVIX $UVXY

SP500 (SPY) Daily Chart MACD turned up but structure under pressure. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again

if crude lets go here watch out…. yet again

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018