Tag: Oil Trading Room

OIL TRADING ROOM – EPIC V3.1.1 Oil Trade Alerts Live Broadcast Day Trading Example (Video, Charts, Commentary)

Oil Trading Newsletter – Live Oil Trading Room Example of Day Trading Alerts with Video, Charts, Commentary.

#oiltradingroom #oiltradealerts #oildaytrading

After five years of development, our oil trading software most recent version (EPIC V3.1.1) has not lost a trade since deployed June 1, 2020. Below is an example of how our oil trade alerts are broadcast live in the oil trading room. Screen shots of the trade alert feed and oil chat room are also included in the article.

The video below is 4 hours long, to find the trades as alerted by voice by our lead trader simply look at the time on the alerts or charts and go to that time on the video. Between trades there is no discussion on the video.

Oil trading room alerts shown on the charting for day trades for the win. #OOTT $CL_F $USOIL $USO

Below is the guidance and trade alerts as it happened live (screen shots of live oil chat room):

Curt MelonopolyToday at 7:23 AM

Good morning traders,

We’re hunting for structure in markets, for now watching. We’re loaded to the gills in $VIX long as you know. As we’ve been discussing on Study videos for weeks.Take profits as you go.

When the markets bounce we’ll have the structure pinned down and start trading it. For now we’re deep in data.

Mail server should be up and running tonight.

Long list of WIP but we’re getting there.

Emails will come from [email protected] when done.

The fall reporting we wanted done at latest last Sunday I am hoping will be done through out the week (all models updates etc).

For now we’ll alert as opportunities arise.

Curt

Curt MelonopolyToday at 8:26 AM

Symmetrical extension, so we see what the bulls got now

and if 30 min is dominant

the sell off was a perfect symmetrical move on 30 Min

this is a good sign – symmetry, means we may get in to a pocket of exceptional trading here this week

I will be active in live trading room when EPIC starts firing. Lots of symmetry on models, machines are in control, so I would expect an exceptional week.

Curt MelonopolyToday at 8:44 AM

bulls took it a couple ticks early on bounce

nice structure

JeremyToday at 8:57 AM

progressive order flow

JeremyToday at 8:57 AM

progressive order flow

Curt MelonopolyToday at 8:58 AM

retail bulls could get wrecked here we’ll see

watching 36.909 for possible bounce

if area doesnt hold 36.15 FX USOIL WTI 30 min support

gray is at 36.15 thats intra week range support

Curt MelonopolyToday at 9:53 AM

3/40 long 36.69 not expected to hold, position trade only, only on intra day.

There is 1 secondary on IDENT on order flow to long side in here now so EPIC so following intra day. But 36.16 – 36.60 is expected so prepare for pressure.

Curt MelonopolyToday at 10:05 AM

If it does bounce in this range we’re looking for 37.80 to upside today.

secondary came in again 36.37 on long side on IDENT

would be nice to see the other 2 come in here

Curt MelonopolyToday at 10:30 AM

Sell 1 36.88 hold 2/40 long

Curt MelonopolyToday at 11:01 AM

Buy 2 hold 4/40 long 36.17

prepare for more pressure

Curt MelonopolyToday at 11:10 AM

Sell 1 36.46 hold 3

correction: here’s the right sequence thus far

Curt MelonopolyToday at 12:02 PM

Sell 1 36.60 holds 2

symmetrical on 1

Today’s sequence. Nice and smooth.

+1340.00

So now the software will look for the bulls to get too positive and when order flow changes it will likely start shorting.

Did bounce at swing range support BTW, that’s very structured trading.

I’m on break for a bit.

Below is the guidance and trade alerts as it happened live (screen shots of live oil trade alert subscriber feed)::

EPIC V3.1.1 did some day trading today

Oil trade alert screen shots from sub feed below. Green arrows buy & red sell.

EPIC V3.1.1 version software has still not lost a trade sequence since launch June 1, 20.

#OilTradeAlerts #MachineLearning #OOTT $CL_F $USOIL $USO

https://twitter.com/EPICtheAlgo/status/1303406969823399937

Our goal is to develop the best oil trading room and alerts service available with the highest win rate % and the most repeatable strategies for consistent wins.

“In pursuit of this goal we are providing our oil traders with articles like this series to help our oil traders with mastery of trading set-ups. Once a trader masters these strategies their win rate goes way up, their returns explode and their lives are changed.”

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

Article Topics; oil trading room, oil trade alerts, oil day trading

Lessons from Oil Trading Room (Part 1). Positioning 250 Tick Swing Trade Short Oil EIA & Day Trade Reversal.

How to Position Oil Trade Intra Week Swing Trading and Day Trading Strategies with Crude Oil Futures (Part 1 of 3)

#oiltradingroom #oiltradealerts #tradingstrategies

This three part article series deals with strategies for position trading crude oil intra-week. Positioning your size for events such as the EIA report Wednesday, API Tuesday, the Federal Reserve decision and more.

The live oil trading room video is an excellent supplement to the article as it provides a live raw feed insider’s look in to how our oil trading experts were trading crude oil this week both on swing trading and day trading time frames. Charting is reviewed along with key levels of support and resistance.

As the swing trade short starts to play out and oil sells off intra day 250 ticks the lead trader explains all strategies involved for the big win.

The automated software was also trading short and revered perfectly for an excellent intra week swing trade and day trade in this oil trading room video.

First the video below and then the charting and screen shots of alerts from oil trade alerts live feed.

Oil Trading Room Video (raw feed):

Video is live raw video feed from our oil trading room of a live positioning strategy short crude oil in to the EIA report 10:30 Wednesday and the reversal trade after a 250 tick CL_F crude oil sell off for a rally trade long.

‘Incredible day in our oil trading room on Thursday July 30, 2020.

Both our lead trader and EPIC V3.1.1 machine trading software were executing trades in this trading strategy master class. One of the best videos in our library for learning how to swing trade and day trade crude oil and how to position events such as EIA reporting.”

The oil trading strategy started with an alert to short oil 10% size 41.27 900 AM Wednesday morning in advance of EIA report.

And then alerts went out to buy and sell small positions in size in advance of the EIA report, in to EIA 1 futures contract was held.

At 1214 PM I started a personal swing trade short alerting it as 10% size at 41.35 on FX USOIL WTI traded on CL futures.

Image of guidance provided to oil trading room and alerts feed and overnight in to Thurs oil was selling off, strategy was working

Another screen shot of guidance I provided oil traders in oil trading room of strategy and what signals to watch for.

Screen capture image of oil trade room alerts my swing trade and software closing oil swing trade positions for nice win.

Image of oil trade alert feed for new position long crude oil intraday in oil trading room to 20% size.

Image capture of oil trading room alert feed alerts for a win as price reversal strategy intraday works selling contracts.

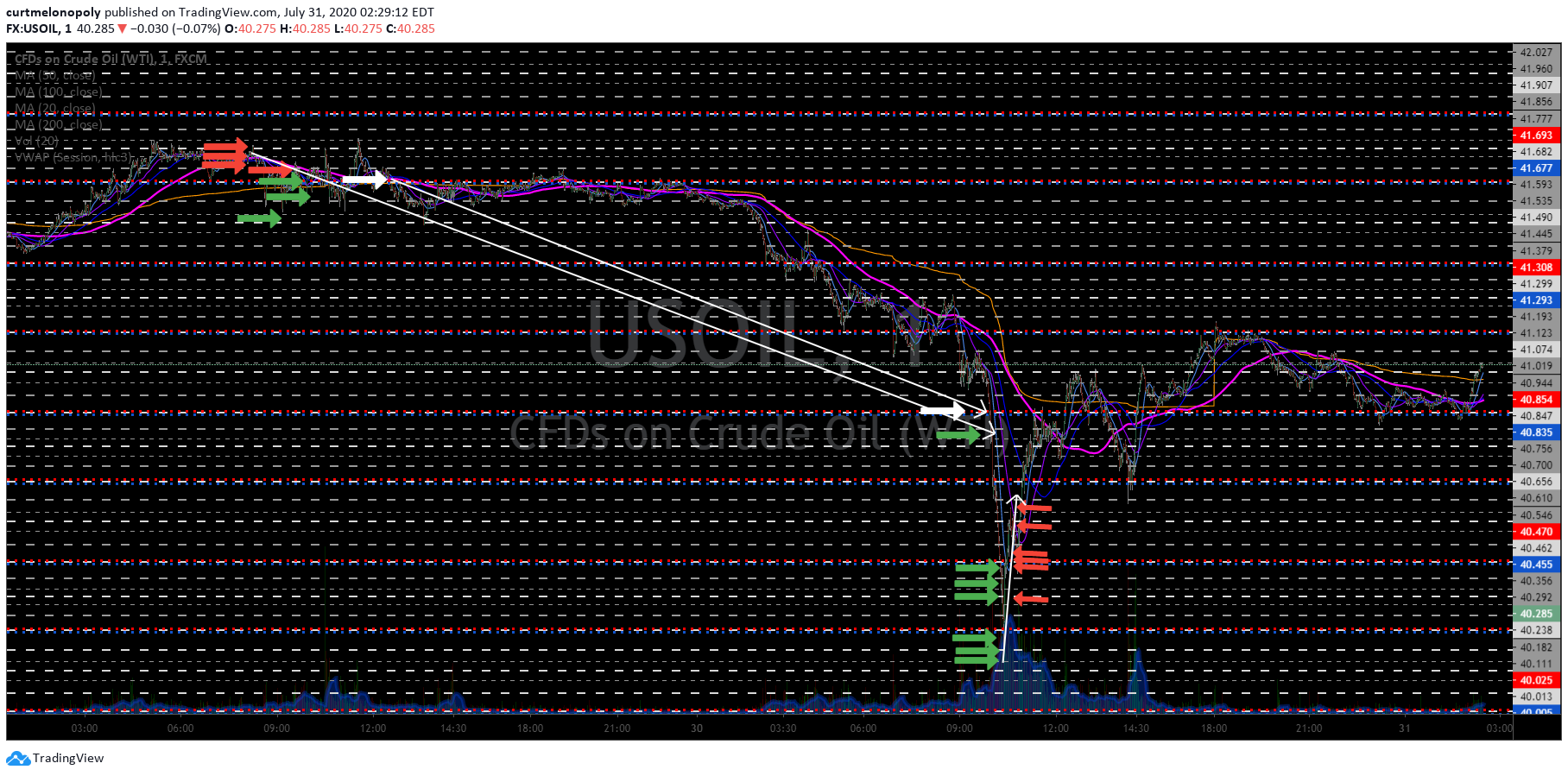

The chart below shows all the trade alerts – entries and exits of positions traded in oil trading room live, green arrows are buys and red arrows are sell CL contracts.

The red arrows are EPIC V3 selling futures contracts, green arrows are the buy alerts and the white arrows are my personal positions. You can see the start of the trade was an intra week short swing trade position in oil in advance of the Wed EIA report by the software and I entered my swing trade after EIA. Then the next series of trades on the chart below are the intra day trades the oil trading software took for a long position snap back trade as oil reversed.

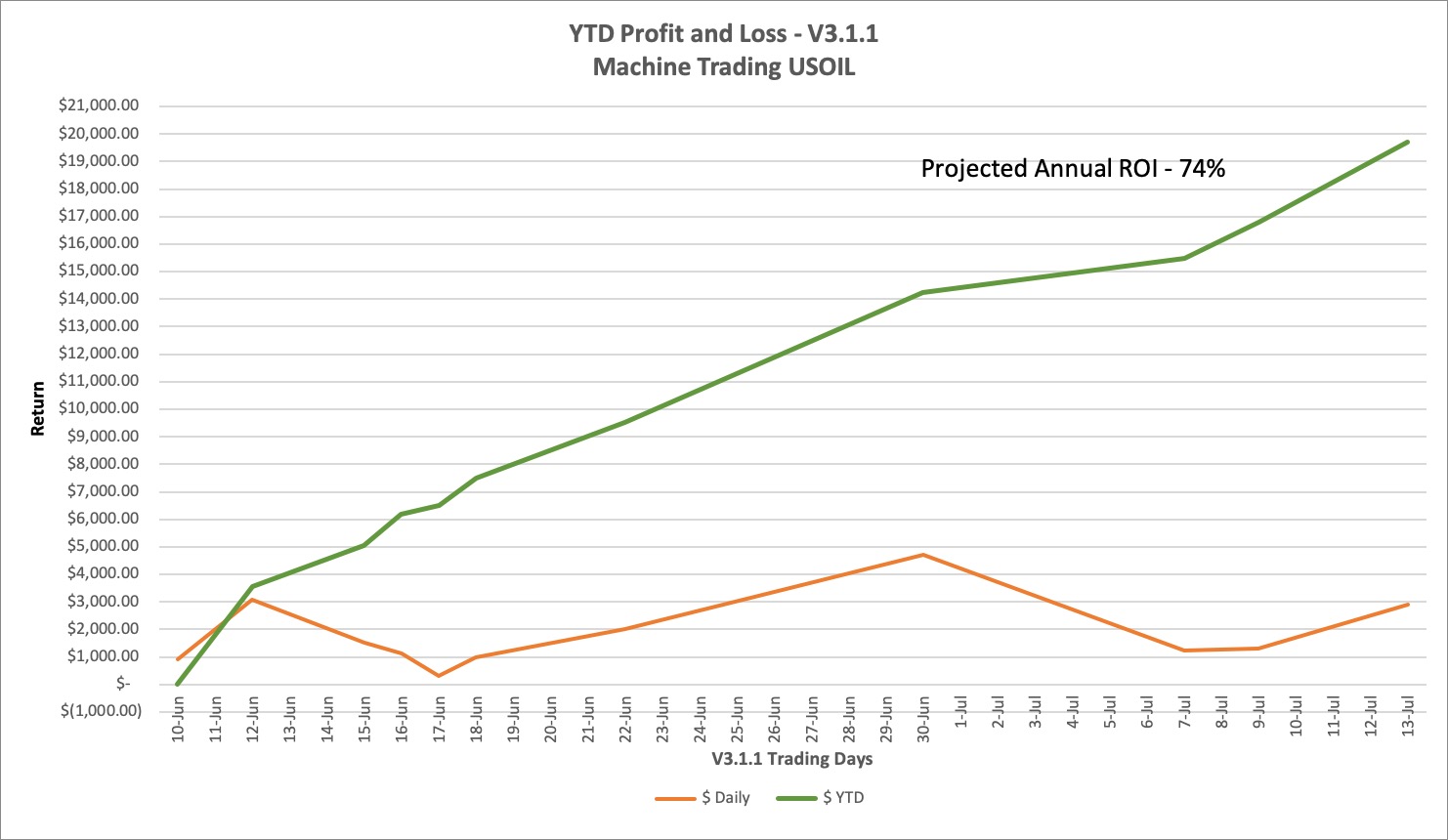

Black Swan Update, June 1-July 30 Profit & Loss YTD +$28,105 or $222,064 74% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 300k Account

In Part 1 above we show you exactly what happened in the oil trade (trading room video, chart that shows the trade execution positions, screen shots of the actual alerts) for the nice win.

In Part 2 I include charting for our Swing Trading subscribers and strategies used to position for the sell off in crude oil intra week. You can find the article here: Protected: Lessons from Oil Trading Room. Part 2 – Swing Trader Premium “5 Key Strategies”. How to Position Swing Trade Short Oil.

In Part 3 I explain in detail what strategies were used for such precise trade executions for day trading crude oil for our Oil Trading Service Subscribers. You can find the article here: Protected: Lessons from Oil Trading Room. Day Trading Strategies – Part 3 Premium. Positioning 250 Tick Trade Short Oil EIA & Day Trade Reversal.

Our goal is to develop the best oil trading room and alerts service available with the highest win rate % and the most repeatable strategies for consistent wins.

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

Article Topics: Oil Trade Alerts, Oil Trading Room, Crude Oil, Trading, Trading Strategies, Swing Trading, Day Trading

Oil Trading Room Live Trade Alerts Video, Alerts Screen Shots, Charts Etc. Crude Oil Trading Strategy Short in to Settlement.

Oil Trading Room Live Trade Alerts Video.

Monday crude oil trade sequence. Short in to settlement at 2:30 EST.

This oil day trading strategy is one of the best. In to settlement at 2:30 watch trade for over bought or over sold conditions on the day (VWAP helps for this as does having crude oil charting models, you will see examples in the video below).

In the example below crude oil had sold off early in the day and then a rally occurred. The day rally in crude oil had intra day trade sitting well over VWAP in to settlement at 2:30 EST.

When the order flow shifted just prior to settlement EPIC V3.1.1 kicked in to a short trade sequence intra day 6/30 size and the trade was caught live in the oil trading room on video.

The video below is a live broadcast as the trades are executed and the charting we use is also shown.

The chart below from the oil trading room shows the oil trade executed short for a win.

The next two images are from the oil trading alerts live feed on Twitter that show each trade alert as is it occurred.

Live oil trade alerts sequence image.

Oil trading room on Discord of discussion and alerts as they occurred for the short win in to settlement at 2:30 on Monday.

Black Swan Update, June 1-July 27 Profit & Loss YTD +$26,507 or $220,947 74% ROI Per Annum. #oiltradealerts #oiltradingroom

Black Swan Update, June 1-July 27 Profit & Loss YTD +$26,507 or $220,947 74% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 300k Account (time stamped alerts, audited P&L) #OOTT $CL_F $USOIL $USO #oiltradealerts #oiltradingroom

https://twitter.com/EPICtheAlgo/status/1287993958677831683

The bottom line is that having a solid repeatable trading strategy is important for any trader.

The EPIC V3.1.1 software is coded with our best oil trading strategies and the video in this report shows the results of trading with a plan.

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

https://twitter.com/

Article Topics: Oil trade alerts, Oil Trading Room, Crude Oil, Trading

Premarket Trader Market Note: Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting and more.

Morning Traders,

RE: Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting and more.

After fighting through Sunday night Study download issues with Click Meeting server capacity and WordPress Black Listing me keeping me from updating it looks like we’re good to go to get Swing Set Ups and the new Oil Report out tonight. Wow, technology makes your life easier.

Yesterday seen negative order flow in crude oil and in equities later in the day, it sure looked like de risking, not so much large machine sweeper programs – YET.

As I thought from yesterday we did get the negative side yesterday, we’ll see if they can run up in to EOD Tuesday (API) and then we have EIA Wed 10:30.

Watch these two crude oil chart levels for directional trading in crude oil and as a signal for the broader market swings:

**** private member link sent to your email

**** private member link sent to your email

EPIC V3.1.1 continues to win, post Black Swan updates:

https://twitter.com/EPICtheAlgo/status/1283014880111493121

https://twitter.com/EPICtheAlgo/status/1283014880111493121

Simple Oil Swing Trading Signals – Part 2 and 3 Schedule for Release Tonight:

#OOTT $CL_F $USO $USOIL $UCO $SCO

April Swing Trade Alert P&L is published. May & June to be published soon.

Swing Trade Alerts Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC … #swingtradealerts https://t.co/ChgjHxmOE0

— Swing Trading (@swingtrading_ct) July 12, 2020

ROKU, my miss of the week, don’t miss these TL break out set-ups when they’re alerted, this is a prime set-up for your swing trading returns.

ROKU, the one I missed. Had it lined up, alerted, alarmed and missed it.

No excuse, nice gains on that beauty TL break set-up.

Congrats longs!

#swingtrading $ROKU #tradingsetups

ROKU, the one I missed. Had it lined up, alerted, alarmed and missed it.

No excuse, nice gains on that beauty TL break set-up.

Congrats longs! #swingtrading $ROKU #tradingsetups pic.twitter.com/L44kuGq7Ag

— Melonopoly (@curtmelonopoly) July 13, 2020

For students of market instrument time cycles, this is a great starter $STUDY.

#timecycles

Previously alerted this Time Cycle trade set up in $FUV as a possible 3x hit and it got that and more!

Time cycles are powerful set-ups🎯🏹🔥#swingtrading #timecycleshttps://t.co/6p8tW12WX0https://t.co/z9lsyra9N5 pic.twitter.com/PRSxcGGTDO

— Swing Trading (@swingtrading_ct) July 12, 2020

Here’s a rundown of your top economic news today https://www.bloomberg.com/news/articles/2020-07-14/economic-lifeline-u-k-growth-struggle-china-nerves-eco-day

https://twitter.com/CompoundTrading/status/1283022759971495938

Articles this morning on our $RCUS and $TSCO swing trades:

$TSCO – Smashing quarter expected out of Tractor Supply https://t.co/miFa9r8d9I

— Swing Trading (@swingtrading_ct) July 14, 2020

$RCUS – Arcus Biosciences, Inc.: An Oncology Stock With Newfound Prominence. https://t.co/gbKXE79Owm

— Swing Trading (@swingtrading_ct) July 14, 2020

More as the day unfolds and look to alert feeds for set-ups.

Have a great day!

Thanks

Curt

Article Topics: premarket, traders, trading, crude oil, swing trading, oil trading room, Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting

Day Trading Crude Oil Intra Day Price Reversal Strategies w/Oil Trading Room Video, “How To” Instructional.

Short Instructional Oil Trading Strategy Article and Video.

Exactly How We Executed Day Trade for Price Reversal Intra day Oil Trade.

This strategy works for us over and over again and is alerted to our premium oil trade alert feed and in the oil trading room.

The video and article highlight the algorithmic model charting but the disciplines of trade can also be applied to conventional or classical charting when day trading crude oil.

VIDEO: Day Trading Crude Oil Intra Day Price Reversals – Oil Trading Room, “How To” Instructional.

We start below with a screen capture of the oil trading room, with a trade alert at 10:59 AM EST on watch for the support coming at the 1 hour oil charting support area of 35.37.

Intra-day oil price actually hit exactly that price and then oil price reversed for the trade to trigger. You can see clearly the signal price target perfect hit if you look 3 images down you can see it clearly on the 15 second day trading chart (1 minute trading model brought down to 15 second time frame).

The one hour algorithmic oil chart below is the chart that was referenced in the oil trading alert to be on watch for the price reversal expected at 35.37.

We are intent on building the best oil trading room and alert service in the world, this proprietary modeling is one example of the edge our oil traders have.

You can read more about the 8700 rules our oil trading software uses to execute trades here.

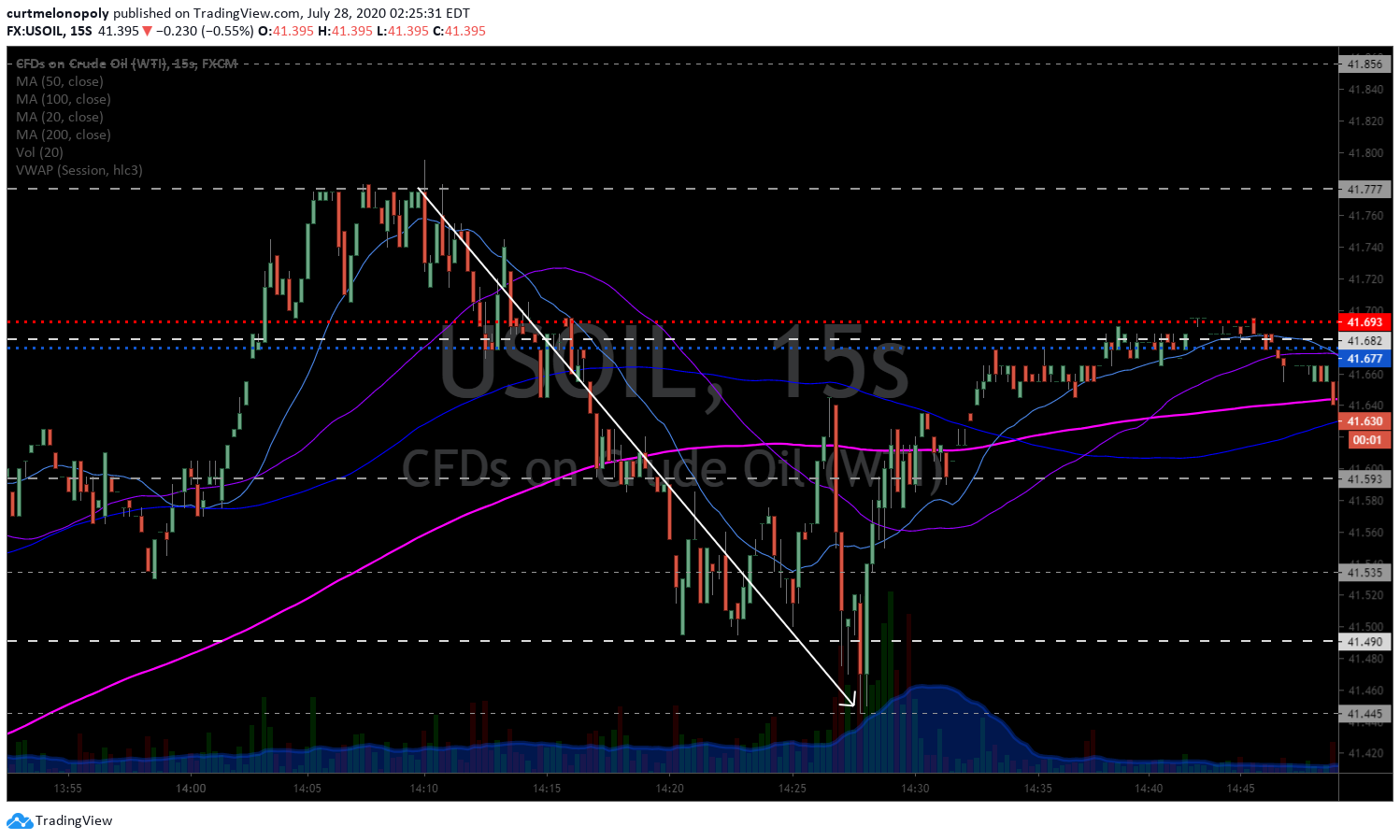

The chart below is the 1 minute oil daytrading model our traders use.

It is a machine grid and in the image below it is brought down to a 15 second time frame to show our traders how the software executes to the signal of progressive volume on the chart volume bars on the 15 second timeframe.

If you look at specifically where the trade long was started you will see the increased volume on 3 x 15 second time frames for the software to alert the trade to our subscribers.

Additionally, not shown, the software also requires progressive machine liquidity order flow buying identified on the EPIC IDENT system (also proprietary that you can read more about in the white paper link above).

Also you will notice that the set-up included a double bottom in oil trading price intra-day.

And finally on this chart you will see that price was using the one minute chart model support (see blue and red horizontal lines on chart).

Those four signals (progressive volume, progressive machine buying, double bottom, one minute support on chart model) created a strong enough signal to alert and execute the trade in the trading room and alert to the various feeds. The one hour support as show above also was considered in the probability analysis for execution of the trade.

For additional signals I recently wrote another oil day trading article you can find if you click here.

The five minute chart model includes time cycles for daytrading crude oil.

In this trading strategy the mid cycle point was hit perfectly on the chart at 11:00 AM. You can see that the price of oil hit the mid cycle perfectly and bounced to VWAP area and then double bottomed for the alert to be sent out to members for the trade.

Time cycles are critical in crude oil trading strategies because most of the oil trading liquidity in world markets is now traded by machines and knowing how the machines are executing trades is key. One the primary methods machines use to trade is time cycles. The video provides more in depth discussion.

The EPIC ALGORTHM 30 minute chart model is shown below and the key support discussed in the video is marked with a white arrow below.

As described in the video, another key trigger for this oil trading strategy intra-day was the key support on the 30 minute chart time frame.

Also, in the video I discuss how trade had bounced progressively “up the stairs” of each support on the chart model, this is a strong signal for the trading strategy.

And on the one hour chart below you can see the result of a well executed oil trading strategy, the trade went flawlessly and with ease. Intra-day oil trading without a lot of stress.

Other Links:

There is also a live raw video link of the Oil Trading Room live alerted trade as it happened – click here.

Link to screen shot of Oil Trade Alerts for this trade of Premium User Twitter feed click here.

Click here to Subscribe to Live Oil Trading Alerts: Use Code “TRIAL50” for 50% off.

Click here to Subscribe to Oil Trading Room: Use Code “TRIAL50” for 50% off.

Link to Free Articles on “How To” Day Trade Crude Oil here.

Any questions about the oil trading strategies reviewed in this article send me an email anytime at [email protected].

Thanks

Curt

Article Topics; oil trading strategies, daytrading, crude oil, oil trading room, signals, trade alerts.

Oil Trading Room 200 Tick Intra Day Trading Strategy – How It Was Traded and Alerted (Video) Part 1 #OOTT $CL_F $USO $USOIL

Part 1 – Crude Oil Day Trade Strategy For 200 Ticks Win From Our Oil Trading Room – Step by Step Tips on How We Traded It and Alerted it Live

The main question for oil traders reading this and /or watching the instructional video should be, “How did we know that oil intra-day would most likely reverse where it did on the chart?”

The oil trading alert went out at 6:37 AM EST and the one prior to that was at 4:09 PM the day prior (Monday June 8, 2020), so it isn’t that we send out many alerts every day, we send our alerts only out when it is the most highly probable area of intra day trade for a win.

So why then at that time of day? What was happening with intra-day trade, the charting, time of day and with other signals that caused us to trade in size long at 6:37 AM EST today?

In short it was the only trade entry alert of the day, the trade was in size and it happened to be at the low price of trade on the day also.

Below are the secrets of this time tested oil trading strategy.

Important Tips for this Simple Intra-Day Crude Oil Trading Strategy

- Time of Day is Important – Today’s 200 tick oil day trade was started in the morning prior to US regular market open and after many traders around the world in different time zones (and overnight Futures traders) have finished their trading day.

- Chart Trend Lines – I teach students to always have classical charting trend lines for support and resistance ready at all times on all time-frames.

- Key Algorithmic Charting Levels – Not all oil traders have this at their disposal, but this was one key reason for our trade success today..

Time of Day.

Time of day when day trading crude oil is very important. In this trade example it was the time of day where overnight futures traders (as far as USA traders are concerned) usually finish their day as well as some traders from around the world also (depending on time zone) and day traders in the U.S. start their day.

When traders start and stop their trading day is not the only time of day consideration.

There are other time of day considerations such as regular U.S. open premarket, regular U.S. market open at 9:30 AM EST, daily settlement at 2:30 PM EST, weekly inventory statistics from the American Petroleum Institute at 4:30 PM EST Tuesday’s and U.S. Energy Information Administration (EIA) at 10:30 AM EST on Wednesdays.

Specifically as it applies to this intra-day oil trading strategy, this trade was taken when the overnight futures traders were typically finished “taking profits or losses” on their day trade sessions and the new batch of day trader liquidity was entering the market. VERY KEY. Again, today’s oil trade was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture image from our Oil Trading Room with the day trade execution at 6:37 AM for 6 contracts entered – adding to existing 6 contracts in the long position sequence of trade.

Also in the image are some of the alerts in the trading room as the trade progressed (this is the private member oil trade chat room in Discord, there is a live charting and mic broadcast room also).

You can also see in the image the lead trader discussing another time of day coming at 9:00 AM and to be prepared to watch the possible signals of oil trade at that specific time. Time of day in oil trading is one of the best signals oil day traders can use in their strategies.

Oil trading alerts screen capture of today’s oil trade that was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture of the actual oil trading alerts feed showing the lead tech alerting the buy in crude oil.

The broker platform trade executions by our oil machine trading algorithm are shown (screen shots) in this tweet:

Crude oil trading alert feed today, deep dive early in premarket for a great 200 point rally through the day.

#OOTT $CL_F $USO $USOIL

#oiltradingalerts #machinetrading

https://twitter.com/EPICtheAlgo/status/1270435771615510531

Trading Trend Line Support and Break Outs.

In today’s trading action there was a trend line support signal on the charting for the long position at 6:37 AM and the a trend line break later in the day for a break out to continue the rally.

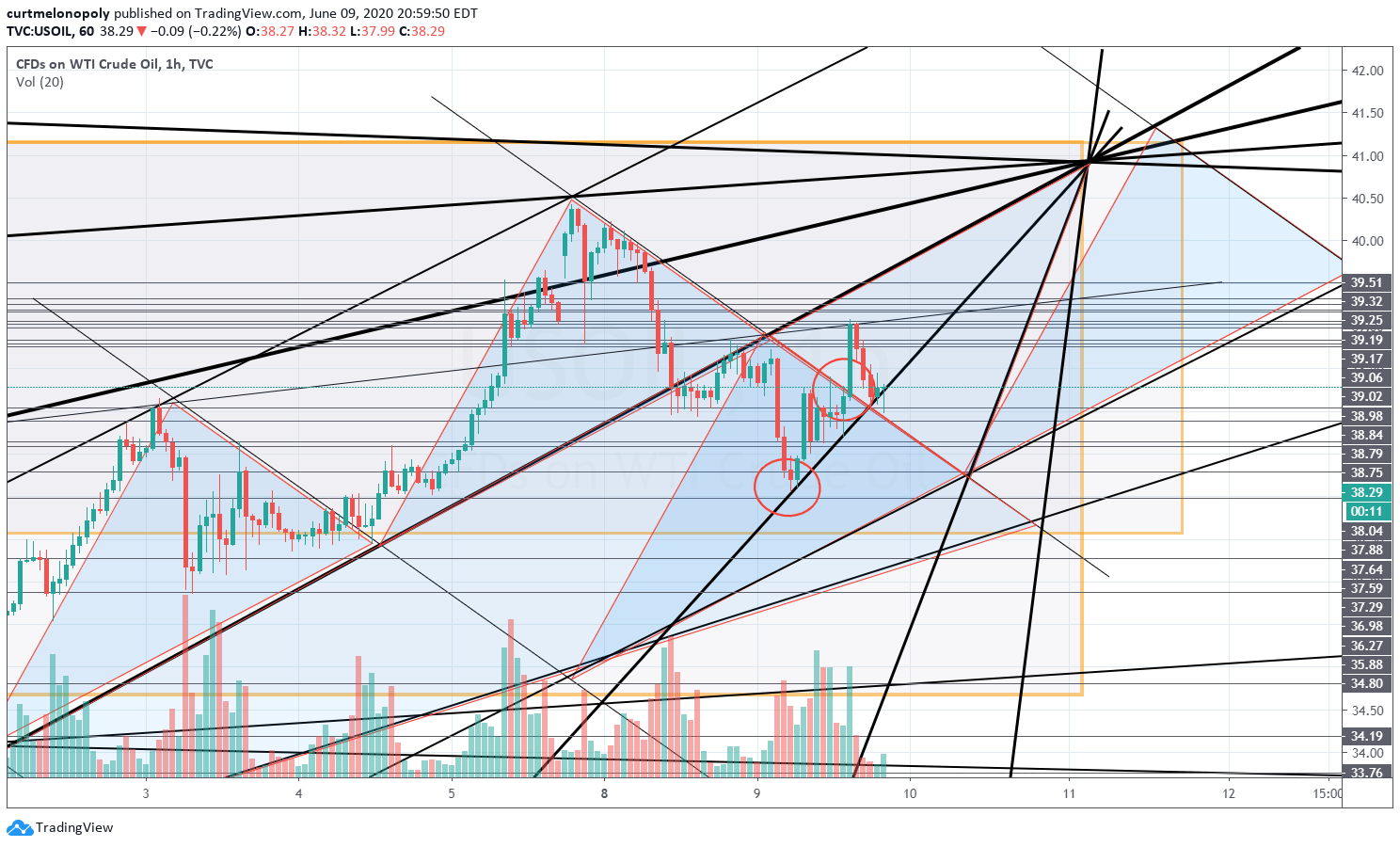

First, below see the initial support area of the trend line chart for the long trade entry. This signal is from a classical 1 hour oil chart with trend lines that included the mirrored fractal trading trend lines. This “mirrored fractal trend line” is where the signal was to enter the trade.

The one hour trading time frame is a significant oil trading signal because it is a larger than say a 1 minute, 5 minute, 15 or 30 minute chart timeline for daytrading. The one hour timing can be used also for intra-week trading signals.

The mirrored trend line fractal is a bit more than basic oil charting 101 in that it takes some technical analysis experience to learn, but not much and if you are an oil day trader it is a good skill to learn because the machine liquidity in the markets use mirrored fractals greatly.

You can see this technical charting skill helped garner a 200 point rally oil trade win today.

Crude Oil Trend line Chart, oil hit key support on the chart and this was one key signal for taking and alerting the trade.

And then later in the day came the trend Line resistance break out.

I marked the intra day oil trend line resistance break out area on the chart below with a second red circle.

I recently did a video instructional on oil trend line resistance break outs that explains the rules and tips for how to trade intraday break outs above a trend line resistance. It was identical to today’s set up and signals that produced this excellent win.

Here is an excerpt from that article:

Three Possible Trade Scenarios When Price Breaks Out;

1. The break out fails. This is possible so be sure to use stops or reverse your trade if the break out of resistance fails.

2. The break out succeeds and price keeps running without a retest of previous resistance (now support). If price does not come back to test support of the trend line then you have to be prepared to take the trade long and go with price action.

3. And finally, price breaks out of resistance and then comes back to retest the new support (which was previously the resistance of the trendline structure).

You can find Part 1 to the article with video tutorial here:

and

Part 2 for our premium members is here:

Trend line break outs, especially on larger time frame charting such as the one hour like with today’s trading are very powerful signals.

I even publicly gave my Twitter followers a bit of a heads up intra-day because I could see the trend line breach set up coming. My tweet went out at 11:30 AM and shortly after noon oil was in break out mode above the trend line resistance.

oil shorties could get wrecked here

oil shorties could get wrecked here

— Melonopoly (@curtmelonopoly) June 9, 2020

In Part 2 of this article we will take a look at how the swing trading strategies played in to this set up for our Swing Trade Alert service members.

In Part 3 for our Pro Oil Day Traders (Oil Trade Subscribers) we will look at the algorithmic charting structures that enabled this successful trade.

The video tutorial for this specific article (Part 1) is below.

As always, any questions please send me a note via email [email protected].

Thank you.

Curt

< Updated June 10 7:41 AM EST >

There is another classical charting reason possible for crude oil’s 200 Point reversal rally intra-day, Fibonacci level 50% was hit perfectly.

Nonetheless, there were strong algorithmic charting reasons for the reversal rally intra-day that I will go in to in more detail for our oil trader members in Part 3. Considering the machine trading liquidity in the oil trading markets I would weigh those indicators / signals much more greatly than the chart below.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Oil, Trading, Alerts, Oil Trading Room, Strategies, Day Trading, Intra Day, Trend Lines, Break – Outs, Support, Time of Day