Tag: Swing Trade

How to Swing Trade Crude Oil: The Next Leg Has Started, Will it Last? Our Oil Trading Strategy (Part 1 of 3)

Swing Trading Crude Oil – Next Leg of the Rally Has Started. A Review of Our Strategy.

Since crude oil traded to negative prices, we have been writing a series of articles for our subscribers (some are unlocked for the public) – they are below. This is a continuation of the article series for the current price rally.

Trading crude oil is difficult enough, the technical analysis we will review here (including price resistance, support, retracement levels, time cycles, symmetry) and various other topics such as; Surprise Jobs Numbers, Fed stimulus, Corona Virus, OPEC and more.

The technical analysis for the legs of the rally have been spot on (as of time of writing the public can refer to the first 3 unlocked articles below on Apr 29, Apr 30 and May 2 – eventually they will be all unlocked), the trick is trading it.

- May 29 – Protected: How to Trade Crude Oil – Recent Rally, Time Cycle, My Current Oil Swing Trade (Premium) $CL_F $USO $USOIL

- May 20 – Protected: How to Trade Current Price Decisions in Crude Oil (Premium) $CL_F $USO $USOIL

- May 19 – Protected: Oil Trading Newsletter (Premium): Charting, Alerts, Price Targets, Trading Strategies, Time Cycles. $CL_F $USO $USOIL

- May 15 – Protected: What’s Next? Crude Oil Trading Strategy – Trading Trend Line Resistance Break-Outs (PREMIUM) #CrudeOil #OOTT $CL_F $USO

- May 4 – Protected: The Symmetry and Time Cycle Price Targets of Next Move in Oil Trade | Part 4 (Premium) How We Daytrade Crude Oil.

- May 2 – BOOOM! Price and Time Exactly as Predicted Days in Advance | Part 3 – How We Daytrade Crude Oil #OOTT $CL_F $USOIL $WTI $USO

- April 30 – “Excuse Me, While I Kiss The Sky”. Part 2 Insider’s Look at How We Daytrade Crude Oil (w/ real-time alert screen shots from oil trading room).

- April 29 – What They Won’t Tell You – How We DayTrade Crude Oil Against The AI’s in the Markets, A Sneak Peak.

In the most recent article on May 29 I was clear that I was starting to short the rally in advance of the key resistance in the 38.57 area on FX USOIL WTI and that doing so was not an easy trade and that if the rally continued in to the next leg that I would reverse the trade – this happened Friday morning.

From May 29:

The big challenge with this oil trade strategy is that I am trading against the wider trend, the trend is up and I am trying to position ahead of the turn down in oil, this is not a simple strategy to execute.

In the oil trading room and on the oil trade alerts feed Thursday / Friday I also had said that I was going to trade the rest of the decisions along with EPIC because I could see the decision coming.

Commentary from Oil Trading Chat Room and Oil Trade Alerts (there is also a live trading room with voice alerts and charting separate of this).

As the price of oil was nearing the key resistance area of the charting in this leg of trade EPIC software (as was I) was shorting the resistance. I was noting that a reversal trade was likely imminent.

Curt MelonopolyYesterday at 8:16 AM

EPIC is shorting 38.56 and will likely reverse above, booting up trading room.

And then when price breached the resistance area we reversed our short trade 3/30 size to 12/30 size long for the next leg of trade. Oil rallied on the day from there more than 100 points.

Reversal trades are tough, this morning I (and various EPIC V3 programs) reversed at 38.50-.70 an oil short 3/30 size for 12/30 size longs for a rocket ride🚀 Hit 39.65 on FX USOIL WTI trading 39.44. Wild day. We'll see what next brings.#OOTT $CL_F $USO #swingtrading #crudeoil pic.twitter.com/L9VpJkyQAG

— Melonopoly (@curtmelonopoly) June 5, 2020

Curt MelonopolyYesterday at 8:40 AM

On the oil swing EPIC did reverse 12 contracts from 3 short released 4 so far trading 39.19, we’re in live room. Will release P&L as we go here so you can see what it is doing. 38.56 is the mark for sure for reversals.

Oil Trading Room Chat Screen Capture.

Strategy, Time Cycles, The Fed, The Virus.

The image below provides an idea of what our oil trading alerts feed looks like as trade progresses.

The strategy for swing trading the oil price rally was long until key resistance areas are near as with what occurred on Friday. The other important part of this current area of the rally is that there was a mid time cycle for volatility occurring around the week of June 3 so we were being extra cautious with our long bias.

The mid time cycle would be an opportune time for oil to reverse in the rally, however, the Fed has once again brought in stimulus, continues to signal all kinds of magic money and signals the possibility of more, the world is re-opening after the initial COVID scare, a surprise jobs number was posted Friday and Trump is talking up virus vaccines ready which is almost guaranteed to have the rally continue.

This will all be on close watch however this week because quite often Fed stimulus, magic money talk, news flow in general is timed perfectly within market cycles (they are not stupid) and this can unwind fast, so we will be vigilant being long in this current leg of the rally – to say the least.

So What is the Plan for the Next Part of the Trading Strategy?

Some of the questions an oil trader needs to consider in planning for the week coming;:

- Where is key resistance and support?

- How to size at key resistance and support?

- When to reverse the trade if it support is broken or resistance is breached?

- When to add to the trade or trim the trade?

- Key areas to trim size within each structure or range – position trading.

Lets Start With The Primary Simple Structure of the Oil Chart Trend Lines (for Part 1 public facing article).

Then in Part 2 for our Swing Trading and Oil Trade Subscribers we will go in to Swing Trading the Time Cycle Charts and Models (helps swing trade and position key areas of support and resistance, time and symmetry decisions which is key for sizing adds and trimming positions).

Then in Part 3 for our Pro Oil Day Traders (Oil Trade Subscribers) we will review the various EPIC Oil Algorithm Chart Models for Day Trading and Swing Trading decisions on a variety of time frames.

Part 1 – Simple Oil Charts for Swing Trade Strategies

The oil chart below is from 11:14:37 AM Thursday, crude oil was just holding on to the support of both the trading box of the “gap” on the one hour chart and the lower uptrending support.

And then Friday morning the surprise jobs number came out and oil rallied again to the top of the resistance on the simple trend line crude oil swing trading chart.

Shown below is the Simple Crude Oil Chart for the Gap and Trend lines.

So what is the Plan for a Simple Swing Trading Strategy for Crude Oil here?

You should be long at the key support areas of the chart, the horizontal trend lines that make up the “gaps” historically on the 60 minute chart and more importantly at the up trending trend lines which oil traders are obviously using to size their trades.

At end of week trade on Friday oil price was left at the resistance area of the upper trend line with another possible upper uptrend trend line and trading box “gap” resistance above.

If oil fails to hold support or breaches the resistance areas of this chart you will need a plan – this we will cover in Part 2 and Part 3 of this article.

Below are some simple tips;

If oil breaches resistance look to the next resistance in your strategy and be sure that you are aware of how break-outs work paying close attention to previous resistance now support levels.

If oil fails support be sure you don’t get chopped up by death of a thousand cuts around the key support (in and out of trade taking small losses that add up) and you will need a plan for this also.

Knowing the order flow of intra day trade helps a lot (along with various other more technical indications which increase probability that you are on the right side of a move) which is why we have the oil machine trading software side of our business that our oil trading room and alert clients are alerted to. You can find the most recent EPIC white paper here: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL.

In Part Two, “Protected: Part 2 of 3 – Swing Trading Crude Oil: Key Chart Considerations (Time Cycles, Symmetry, Support and Resistance Levels for Sizing)” we will look at more charting and strategies for our Swing Trading and Oil Trade Subscribers including time cycles, other chart time-frames, symmetry, support and resistance, sizing and more.

In Part Three, “Protected: Part 3 – Algorithmic Crude Oil Trading Strategies (Day Trading, Swing Trading, Position Trading, Time Frames, Models)” for our Pro Oil Day Traders (Oil Trade Subscribers) we will review the various EPIC Oil Algorithm Chart Models for Day Trading and Swing Trading decisions on a variety of time frames.

As always, any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; How to, Swing Trade, Crude Oil, Oil Trading Strategy

How to Trade US Dollar Index (DXY) Large Time Cycle in to Week of August 5 #USD $DXY $UUP #tradealerts #swingtrading

Trading Strategy for US Dollar Trade Alert Issued This Morning in Premarket for the Swing Trade Positioning in to Week of August 5, 2019 Time Cycle.

This a very important trading opportunity not just for the US Dollar, but many other instruments of trade on the equity, commodity and currency markets are affected by the price of the US Dollar. Below is your complete trading strategy for the time cycle peak coming in the Dollar.

On public facing Twitter feeds the alert reads;

“Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today’s premarket. #timecycles $DXY $UUP #USD #SwingTrading”

Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today's premarket. #timecycles $DXY $UUP #USD #SwingTrading

— Melonopoly (@curtmelonopoly) August 1, 2019

On the private member alert feed the alert reads;

“US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD”

https://twitter.com/SwingAlerts_CT/status/1156872463273402369

Below is the chart and link for the US Dollar (DXY) time cycle alert;

US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD

How to Trade the US Dollar (DXY) Time Cycle Peak.

The trading strategy for the US Dollar Index is simple if you use the model chart provided above.

In early 2018 we had alerted that the US Dollar was divergent to the downside and that a run in the dollar was imminent. The US Dollar traded up since that time from sub 90.00 to currently trading at 99.91.

When the US Dollar traded higher (after our alerts) it then reached the area of the main pivot (shown on chart above with horizontal red dotted line). The Dollar then traded around that pivot for some time. The trading pivot is important in your trading plan.

Simple Chart Symmetry and Price Targeting (price extensions) for this time cycle says to measure from the recent lows (trading just under 90.00) to the pivot area of 96.64 (about 7.00) and add the 7.00 approximately to 96.64 and you get about 103.50 ish. There are different ways to measure this – you can take the hard and fast support and resistance lines on the chart and measure from there or use exactly what price action said. In other words, the chart says support was 90.00, but the Dollar traded under 90.00 before it turned back up and got bullish. Depending on how you use those numbers this then determines your extension to the top. Lets call it 103.50 and use that for this example for your trading strategy.

The charting says the time cycle peak is the weak of Aug 5, 2019. This is a large time cycle so you have to allow for a week or so either side of the weak of the peak. Coming out of the other side of that peak the trade action (trading trajectory) will be key. You will either see a continuation of the current bullish trend or a turn to the bearish trade side. Probability says the price of the US Dollar will turn down. However, this is not always the case.

The chart says that 102.92 is your peak resistance price, but this can be extended up some for two reasons. One reason is the price extension you may measure from the previous lows, in this instance you would see the Dollar trade in to the 103s or 104s before turning. The other reason for a price higher than 102.92 is a simple over trade extension that happens at large time cycle tops and bottoms in trade – an over exaggerated move.

If the trade trajectory continues bullish then you simply extend the price up one structure above the current area of trade (see chart below). This is an unlikely scenario but it may occur. This bullish run would then peak in to the week of March 30, 2020 (this can change as we come near to the date, watch for charting updates). The price target in this scenario is 109.30 for March 30, 2020.

US Dollar Index (DXY) Bullish trading strategy for 109s in to Mar 30 2020 $DXY $UUP #swingtrade #USD

The Bear scenario to short the US Dollar is more likely, below is your trading strategy.

As noted above, simply wait for the week of August 5, 2019 and watch trade the week on the other side. Watch the key resistance areas on the chart. Early on in to the time cycle start to size your trade and continue sizing the trade (in my case it will be short $UUP likely) and then start to take profit at each support on the way back down as the US Dollar trades lower in to March 30 of 2020.

It is important to get your full size in early enough but not too early so you get caught on the wrong side.

If you need help with the trade let me know.

Watch the chart resistance close as we trade the markets over the coming few weeks, watch the apex of the quad the US Dollar is trading in currently on the chart. Watch for the inflection points. You can also bring your time down to a daily or 4 hour chart to get a better feel for what trade is doing.

Also, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Other Reading:

US Dollar Index on Market Watch https://www.marketwatch.com/investing/index/dxy

Dollar hits two-year high after Federal Reserve cuts interest rates by a quarter point as expected https://cnb.cx/2MsfQn1

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: US Dollar, USD, Trading, Strategy, Charts, Algorithm, Currencies, Alerts, $DXY, Swing Trade, $UUP, time cycles

Swing Trading AngloGold Ashanti Limited (AU) – Part 2 | Premium Report

There are two primary reasons to consider a swing trade / investment (hedge) in AngloGold Ashanti (AU) (or similar companies).

This is Part Two of the Swing Trading AngloGold Ashanti Limited (AU) Report.

The first reason is that a global market time cycle is near or at peak and the other is in preparation for a coming scenario we see very possible – a revamp of our global economic structure.

Both reasons (market time cycles and a possible revamp in our global economic structure) will be topics I will cover in great detail in client reports in near future.

I won’t be explaining either of the two scenarios in this report, but I will for now point out the following;

- Portfolio Protection (Hedge). If I am correct about the near term time cycle completion in global markets, AngloGold is a decent portfolio protection trade should increased volatility come to the markets, and

- Economic Structure Revamp (Two Scenarios). If I am correct (further out in terms of years and not decades) that a significant global economic structural revamp is in fact in play, there is a high probability that corporations such as AngloGold will be fantastic trades / investments / portfolio hedging instruments of trade. I will be reporting on two scenarios for the economic structural revamp I see coming, one in which companies like AngloGold will do well and another scenario in which companies such as AngloGold will not do so well. It will be up to the trader / investor to watch as one of two scenarios play out – both I will present so we are prepared in advance.

In this report I present a weekly structural chart of AngloGold. It is a noisy chart but if you take the time to work with it you will find that the signals you most need to plan a successful swing trade and / or investment in AngloGold are very likely detailed on the charting below.

The AngloGold Ashanti (AU) chart below details the following scenarios / indicators for your swing trade and or investment (hedge) strategy (timing of entries etc);

- Bullish Scenarios – There are three white arrows that predict three possible uptrend scenarios, you can consider these possible price trajectories should AngloGold start to trend up. I won’t explain in detail how they are derived other than to say that symmetry plays a large part as does time cycle theory and Fibonacci levels. Simply put, if price starts to trend with one of the arrows, follow the trajectory for a trade and consider all other lines on the chart as possible support and retrace considerations for entries, exits, adding to or trimming your trade size.

- Gann Waves – The other scenario is not as bullish, but takes in to consideration an uptrend, slower and not as bullish in trajectory. The Gann Waves on the chart are the diagonal lines with multi-colors. Follow the wave in which price is trading and it is that simple. Long considerations at the bottom of each support area and trimming longs near the top of each.

- Fibonacci Levels – And the third indicator on the charting are the Fibonacci levels, the most important of which are marked with white arrows. You can ebb and flow a long trade taking in to consideration those support and resistance levels. The diagonal Fib trendlines are also included but are of less importance (grey dotted diagonal). And finally the horizontal Fibonacci lines are included. The Fibonacci lines are structurally motivated to the instrument and not conventional. In other words, the Fibonacci structure (overlay) on this chart is for mid to long term thinking / trade planning.

Other reasons for considering this trade;

- Price is above the 200 MA on the weekly. This is a significant signal for a long position.

- The MACD is crossed up on the daily time-frame. Another significant bullish indication.

- There are three distinct areas of symmetry on this chart, if correct, I see a fourth starting soon. This would be a return to the second time cycle within the symmetry of the life of this specific financial instrument. In other words, the most bullish area of the chart structure (on the weekly). This could very well repeat. This however relates back to the economic restructure that is coming and which of two scenarios I see possible playing out.

Below is the Chart for AngloGold Ashanti. The signals to plan your trading strategy are include on the chart.

The price targets and signals are much different than in Part One of this report, but that is intentional. Part one provides a simple trading strategy for hands off swing trading and / or investment and / or hedging. The trading plan included in this report is for more hands on trading and / or for more serious long term hedging or investing.

A Final Note:

This trade has to be considered one step at a time.

Specific to time cycles, there is no way to know what the markets will do at inflections in time cycles. In other words, we know that a large time cycle is coming due between the end of May 2019 and mid June 2019.

We also know it is large and will run for some time (see near future report for more detail). Within the time frame that the next time cycle(s) occur the markets will have waves of bullish and bearish trade trajectory.

We will be reporting in great detail about this specific time cycle, we see it lasting for up to six years (to peak) and we plan to day trade, swing trade, trend trade and invest / hedge with clear discipline through-out its peaks and valleys.

The other important final note is that we see two possible scenarios playing out in the large time cycle of the “next” (the commencement of the post carbon world economic restructure). In this, some companies (equities), some resources / commodities, currencies, sectors etc will do well and others will not do well. We see the separation (divergence) of bullish and bearish inflections to very likely be the largest in a generation, historical in fact. In one scenario companies such as AngloGold will do very well but in the other not so well.

The upcoming time cycle reporting and the upcoming reporting that will detail the “next” we see as being very plausible (an economic structural revamp) will be our focus reporting. The trade set-ups we will report on will be motivated around what we see as the next.

As I noted on my Twitter feed today, we see the next six years as a significant (historical) time in global financial markets.

Part One of the AngloGold trading strategy is available at link click here.

For More Study:

Visit our website blog link specific to swing trading and scroll down to posts that have been historically unlocked to the public. You will have to scroll down and scroll to historical pages.

Special Pricing (expires June 16, 2019):

Swing Trade Alerts Only Discount for our Followers – One Month Reg 99.00 Special 69.30 w/ 30% Off. Use Code: SWING30. Expires June 16, 2019. Discount code can be used for 3, 6, 12 mos terms also for greater savings. #swingtrading #tradealerts https://compoundtrading.com/product/swing-trading-alerts/?attribute_plan=One+Month

Swing Trading Bundle Discount (Newsletters, Trade Alerts, Chat) for our Followers – One Month Reg 149.00 Special 104.30 with 30% Off. Use Code: SWING30. Expires June 16, 2019. Discount code can be used for 3, 6, 12 mos terms also for greater savings. https://compoundtrading.com/product/swing-trading-bundle/

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; AngloGold Ashanti, AU, Swing Trade, Trading Strategy, Time Cycles, Price Targets, Hedge, Investment, Signals

How to Trade TerraForm Power Earnings and Swing Trade Time Cycle. #swingtrading $TERP #earnings

TERRAFORM POWER (TERP) How to trade TerraForm Power earnings and swing trade it to next time cycle. #swingtrading $TERP #earnings

The trade set-up in TerraForm is hard to ignore. For a structured swing trade / investment, this one is hard to beat (on other side of earnings) in my opinion. Sure, it may not be the return some traders are looking for, but if it plays like the chart structure is indicating, there’s a 50% or better upside over the next two years and much of that move could be on the other side of this coming earnings or the next.

To trade it, I will wait for earnings. I won’t wait long however. The move is likely to see a decent return in the early time-frame and then play out over the next 12 – 24 months. If it doesn’t transpire this earnings season then I will watch each earnings season forward because a bullish run should occur in this stock based on the time cycle structure of the weekly TerraForm chart.

The move is likely to see a decent return in the early time-frame and then play out over the next 12 – 24 months.

The most likely scenario I have charted below. The two yellow lines are the expected bullish swing trade channel and the red circle is the price target and date that the price target comes in. If the channel does not transpire then simply move the channel over to the next earnings period reporting and watch if the trend transpires at that juncture.

TerraForm reports earnings in just over a week – it’s on high watch for me here.

TERP Earnings Date

Earnings announcement* for TERP: Mar 14, 2019

https://www.nasdaq.com/earnings/report/terp

TerraForm Website: http://www.terraform.com/phoenix.zhtml?c=253464&p=irol-home

3 Top Energy Stocks to Buy Right Now

Energy stocks can be painfully cyclical and subject to big commodity price swings, but here are three we really like right now — including one great “buy on the dip” opportunity.

Jason Hall, Travis Hoium, And Matthew DiLallo (TMFVelvetHammer)

Feb 5, 2019 at 6:02AM

https://www.fool.com/investing/2019/02/05/3-top-energy-stocks-to-buy-right-now.aspx

TerraForm Power uses 80% to 85% of its cash flow to pay a dividend, which has a current yield of 6.7%, with the additional funds going to pay down debt or fund growth projects. Long term, management aims to grow the dividend by 5% to 8% annually, which is a conservative target, and could be done with organic growth for the foreseeable future.

Investors who don’t know where to turn in energy today should consider yieldcos like TerraForm Power. The company is stable, pays a great dividend, and avoids a lot of the commodity risks that will make the energy industry a volatile sector in 2019.

TerraForm Earnings Chart Swing Trade Set-Up.

Below is the weekly chart for TerraForm going in to earnings in a week. The structure of this stock chart implies a significant move up in to May 20, 2020 (next year). If the move does not occur as the channel below is drawn then simply move the channel over to the next time TerrForm reports earnings.

The structure of this stock chart implies a significant move up in to May 20, 2020 (next year).

Each horizontal Fibonacci resistance is an area to possibly trim and add above (or you can use the channel support to add and channel resistance to trim your position).

The key horizontal support and resistance marks are at 12.37, 16.76, 21.17 and 25.41 areas.

The key moving average is the 200 MA over head near term on the chart (pink).

It traded last at 12.59 during the regular session on Friday and was up .64% on the day.

The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Home Depot Trade: Swing Trade and Day Trade.

Home Depot is trading 185.36 pre-market down 2.43% on earnings guidance.

The News Story Link:

Home Depot Misses Q4 Earnings on Interline Charge; Sees Softer 2019 Profit #swingtrading $HD #earnings https://www.thestreet.com/investing/earnings/home-depot-misses-q4-earnings-on-interline-charge-sees-softer-2019-profit-14877506

The Chart:

How to Trade It:

Key Support 174.30 area trading 185’s in premarket so 174’s is quite a ways down, however, I think it is possible.

Key Resistance 191.00 area. Anything under 191 seems short bias to 174 s.

Watch the 182 s on way down (trading box support) and the 200 MA on the 4 hour.

On the day trade side of things, use the horizontal support and resistance levels on the chart for the trade. I will alert as I trade it also.

Thanks

Curt

Swing Trading. How to Swing Trade Using Technical Analysis. Our SQUARE $SQ Trade As Example #swingtrading

Learning How to Swing Trade with Structured Technical Analysis Provides Better Win Rate, More Confidence in Your Trading and Delivers Higher Rate of Return.

Many financial social media traders comment to our charting as having too many lines or being too complicated (especially on Stock Twits). This is not only a flawed perspective but also why few traders win over time. It is also why we make a living (we being the traders on the winning side of the ledger).

In today’s stock market the number one thing a trader can do to increase their win rate and return in each swing trade (or even intra-day trading) is to first accept the reality that machine liquidity is growing exponentially and then learn how the machines are programmed to trade.

In today’s stock market the number one thing a trader can do to increase their win rate and return in each swing trade (or even intra-day trading) is to first accept the reality that machine liquidity is growing exponentially and then learn how the machines are programmed to trade.

Read: Machines now dominate stock trading and it’s having unexpected consequences https://www.businessinsider.com/machines-dominate-stock-trading-and-its-having-unexpected-consequences-2017-6

And truthfully, it isn’t hard to learn how to swing trade (or day trade) along with the best in the stock market – those that are increasingly controlling how a stock trades (or commodity, currency, etc).

The structure of the trading instrument (in the example below with $SQ – a stock) is the key to success in swing trading.

When you know the structure of the stock (represented on a chart) you then know more than 90% of your competitors (the other traders that are competing against you). Why? Because they are simply too lazy, ignorant of how it works or just don’t treat their trading as a business.

When you learn how to trade with a structured chart this can also be used to leverage returns otherwise not possible for options traders and fundamental trading. Options traders can take advantage of time cycles for example. Fundamental traders can use the charting structures to better time their initial trade entries, closing trades with better precision and it will also help traders with sizing and adding to or trimming trade positions.

It doesn’t matter what your trading style is, every single trader can use structured swing trading to increase their win rate, increase trading confidence and increase returns on each trade. Even traders that use very specific trade set-ups for day trading can benefit from structured trading knowledge.

Below I will use my recent swing trade entry in Square (SQ) as a study example. I publicly traded Square in our trading room and recorded the trade. This is a good example because the stock broke out hard the day I entered my swing trade and there were very specific reasons for my entry point. I explain that below and also explain what my swing trading plan is going forward.

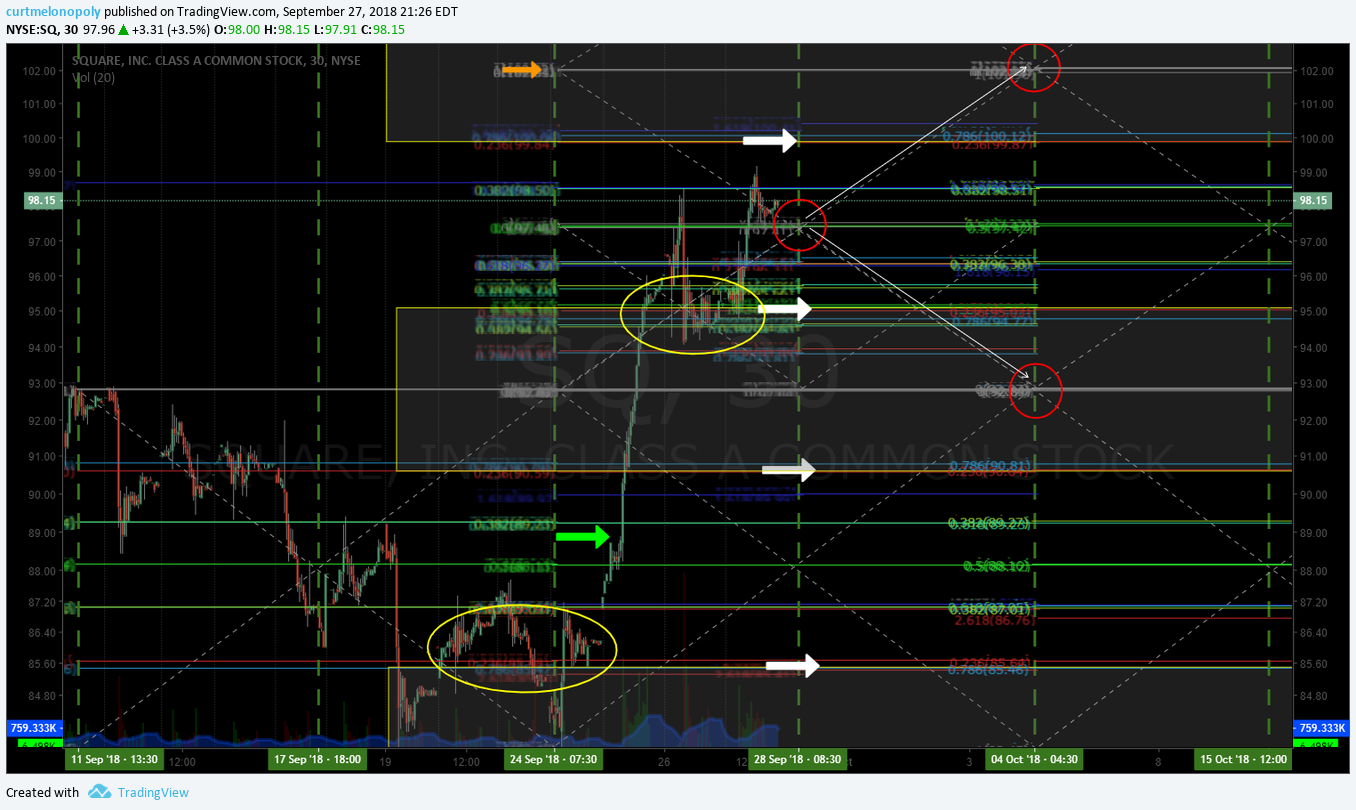

Below is the chart for Square (SQ) and the link to the live chart on Trading View.

Below the chart I explain the technical indicators that determined my entry point in Square for my swing trade, where I will consider adding and trimming my position, where the important support and resistance points are and more.

Swing Trading. How to Swing Trade Using Technical Analysis. $SQ Trade Example #swingtrading

Below is a list of important technical analysis specific to this swing trade and charting:

- The Initial Long Entry.

- The initial reason Square (SQ) was on watch this morning that I entered the swing trade is because there was an upgrade to 125.00 by a well known analyst: Why Instinet Analyst Dan Dolev Is So Bullish on Square https://www.bloomberg.com/news/videos/2018-09-25/why-instinet-analyst-dan-dolev-is-so-bullish-on-square-video

- The entry at 89.00 was not by random (shown with a green arrow), when price was higher on the 30 minute candle than the previous candle high in a bullish intra-day momentum – this is the primary reason for my entry in this swing trade.

- My entry to the trade was above a key support at the mid quad support (I noted an example with an orange arrow on the chart).

- As mentioned above, trade was bullish intra-day. Long in strength is smart, in an up market trading long in strength is a high probability win.

- I had to take the initial trade three times before price stuck. The live video from the day trading room shows this.

- My entry was taken above a trading box area on the chart (shown in yellow boxes on chart). The top of the box will provide decent support.

- Here is a screen shot image of the actual swing trading alert issued to members:

-

Screen shot of Swing Trading Alerts feed on Twitter alerting the Square swing trade entry at 89.00

-

- Price Consolidation.

- The price consolidation areas are marked on the chart with yellow circles. In both instances marked on the chart, trade in Square (SQ) was consolidating above the trading box (which is bullish because support held). I didn’t add to the trade at the second consolidation area because I was hoping for a larger retracement in stock price.

- Charting Support and Resistance.

- The important support and resistance areas on the Square (SQ) chart are identified with white arrows – they correspond with the top and bottom of each trading box area on the chart. Consolidation at the top support is a key area to add to your swing trade.

- The mid area of the trading box is where the mid quad charting pivot is, this is the half way point in trade on the chart in the trading box. This is at times used as key support in trade for continuation of the trend in price.

- The various horizontal lines on the charting are Fibonacci related. These are to be used for intra-day support and resistance considerations of trade.

- The various diagonal trend lines (gray dotted) are Fibonacci trend lines. These are also support and resistance areas of the chart specific to the trend in trade.

- Price Targets. Time cycles.

- The red circles are the most likely price targets that correspond with time cycle peaks in the time-frame of the chart that are represented with vertical dotted green lines on the chart.

- Trading Plan Forward.

- I am currently awaiting an intra-day wash-out or retracement (also called a pullback trade set-up) that is larger than would be normal – an anomaly (an entry in a wash is ideal because you get the benefit of a snap back in price to secure your add to the trade). This typically occurs in profit taking scenarios. If there is no other reason then time of day or time of week is the best scenario. Typically over the lunch hour trade is soft and tends to come off or end of week late Friday afternoon. However, if trade is really strong in to end of day on Friday this is a strong indication that Monday the following week the stock is likely to run up again.

- I will trim the trade each time price approaches the next resistance level at the bottom of the next trading box.

This article’s focus was to how to swing trade the actual chart, but doesn’t explain how to chart the structure on your own.

To learn how to chart technical analysis for structured trading see the links below that provide options for further learning.

The swing trade charting in this article – so that you can swing trade with confidence, can be learned in a number of ways:

- There are many videos on our You Tube Channel, they are raw video and not packaged as clean presentations, but if you have the patience to sort through raw video from our trading room there is a lot of learning material for free there https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w

- We have a master class series of about 20 hours of video that you can purchase for 1499.00 (at this point available only by emailing us info@compoundtrading.com) and you can request the 30% discount code at the time you email.

- The other way is that we recorded the last Trade Coaching Boot Camp – this video series is about 20 hours and retails for the same price 1499.00 (also available only at this point in time by emailing) and has a 30% discount code also.

- You can also attend one of trading boot camps, the next ones will be announced soon on our website, there is a one day online boot camp planned for early November specifically for learning how to swing trade also by the way.

- Our private trade coaching is available (done online via Skype). The starter package is 399.00 for 3 hours.

- Or join our day trading room for 999.00 per month (a serious trading room for the serious trader only).

You can take advantage of our swing trading set-ups the following ways:

- Our swing trading alerts service is here: Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

- Our swing trading newsletter service is here: use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

- Or the bundled swing trading alert and newsletter service is here at 149.00 per month.

Further Reading and Videos:

Investopedia: Introduction to Swing Trading.

Compound Trading Group: How to Swing Trade Like the Pros and Win Most Trades.

Click here for the mid day swing trading review that has the Square trading plan review https://www.youtube.com/watch?v=DMFHJ8ki9nY&list=PLTeUfxpy0iabJdqXpy5aBVa3dd1DdGLLz

Anything else I can do to help you swing trade better please let me know.

Thanks,

Curtis