Tag: Trading

Swing Trading Special Report Series (Part D) Sun Nov 18 NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ …

Compound Trading Swing Trade Report Sunday November 18, 2018 (Part D).

Swing Trading Signals and Stock Picks In this Issue: NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ … .

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part D of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were covered at the last Trade Coaching Boot Camp. Part A of this swing trading special series can be found here, Part B of the swing trade report here and Part C of the swing trading report here.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports..

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSIS, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 14 – Swing Trading Special Report Sun Oct 14 (Part A) FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Current Swing Trading Signals and Stock Charts.

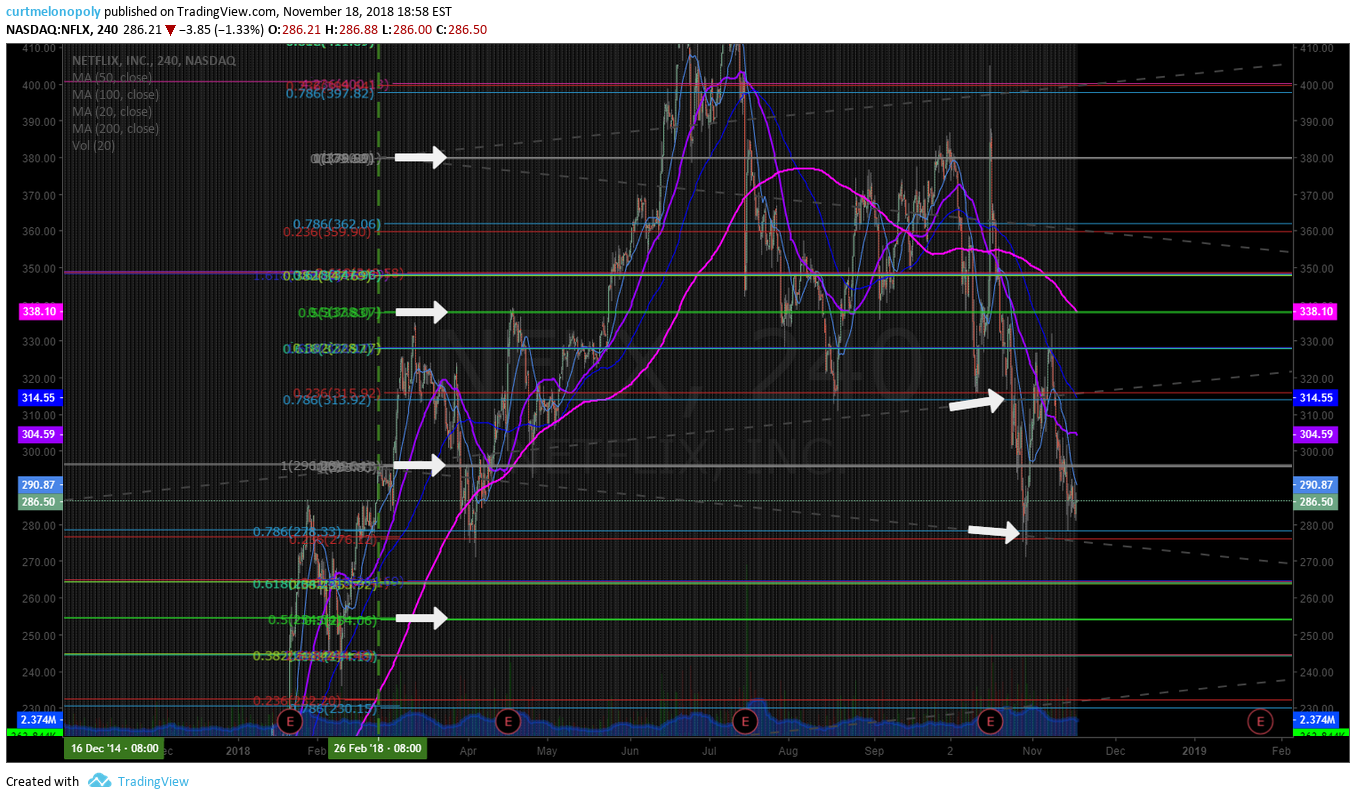

NETFLIX (NFLX) stock under pressure trading near Fibonacci Trend line support.

How to trade the Netflix stock move:

- Under trend line support (trending down) 275.00 targets 232.68 (trending up).

- Current area holds (closed 286.21 Friday) targets 315’s (upper trend line).

- Current bias is down to 232’s, on watch for Monday.

It’s time to stop lumping Netflix in with the other FAANG stocks, says analyst. #swingtrading $NFLX https://www.marketwatch.com/story/its-time-to-stop-lumping-netflix-in-with-the-other-faang-stocks-says-analyst-2018-11-16?siteid=yhoof2&yptr=yahoo

MOLECULAR TEMPLATES INC (MTEM) Bounced off previous support, over 5.50 targets 7.00 or 9.79 Mar 4, 2019.

Barron’s calculates that has been a total of nearly $46 million in recent stock purchases in Acadia Pharmaceuticals (ACAD), Molecular Templates (MTEM), Foamix Pharmaceuticals (FOMX), and Amicus Therapeutics (FOLD). https://www.barrons.com/articles/biotech-stocks-1538083965?siteid=yhoof2&yptr=yahoo

PYXUS $PYX bounced off previous low, last trade was near 3x return, targets for next swing on chart. Now on watch.

Pyxus Stock Dives On Tariffs, Marijuana Stocks Also Retreat https://www.investors.com/news/pyxus-stock-marijuana-stocks/

22nd CENTURY GROUP (XXII) over 2.85 targets 3.09, 3.53 then 4.39. On high watch. $XXII.

Analyzing 22nd Century Group’s Year-to-Date Performance. https://marketrealist.com/2018/11/analyzing-22nd-century-groups-year-to-date-performance?utm_source=yahoo&utm_medium=feed&yptr=yahoo

PROQR THERAPEUTICS (PRQR) Over 20.70 targets 22.65, 24.85, 27.55 Dec 10 time cycle $PRQR

ProQR (PRQR) Reports Q3 Loss, Misses Revenue Estimates https://finance.yahoo.com/news/proqr-prqr-reports-q3-loss-134501815.html?soc_src=social-sh&soc_trk=tw

BOX INC (BOX) Trading 17.90 forming bottom, upside targets 19.30, 23.85 July 2019 $BOX. Watching for the interim bottom to continue and a possible turn up in price.

G1 THERAPEUTICS (GTHX) could have bottomed, above trading box possibly sees price targets on chart $GTHX.

Seaspan (SSW) If this area holds price targets 10.20 perhaps 10.61 Nov 26 time cycle with symmetry $SSW.

Health Innovations (HIIQ) Watching for 200 MA test to hold and bounce with price targets on chart $HIIQ.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ

Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Compound Trading Swing Trade Report Wednesday November 7, 2018 (Part C).

Swing Trading Signals and Stock Picks In this Issue: $AAPL, $BABA, $AMD, $EDIT, $CARA, $OSIS, $BZUN, $NIHD … .

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part C of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Part A of this swing trading special series can be found here and Part B of the swing trade report here.

Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSIS, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Current Swing Trading Signals and Stock Charts.

NII Holdings (NIHD) swing trade alert over trade box 7.79 targets 9.31, 10.89, 12.31.

Why NII Holdings Stock Just Popped 19%

Rich Smith, The Motley Fool

Motley Fool November 2, 2018

https://finance.yahoo.com/news/why-nii-holdings-stock-just-204100872.html?.tsrc=rss

BAOZAN (BZUN) ER 15 days. Trading 44.58 over 46.75 targets 50.00, under 43.24 targets 37.08.

3 Top Small-Cap Stocks to Buy in November https://finance.yahoo.com/news/3-top-small-cap-stocks-195600069.html?soc_src=social-sh&soc_trk=tw

ADVANCED MICRO (AMD) MACD turning up, bullish signal. Over 20.55 targets 24.15. Under 18.28 targets 14.67.

OSI SYSTEMS (OSIS) MACD turn up on daily with symmetrical chart in play, bullish bias to upper target.

Edited Transcript of OSIS earnings conference call or presentation 25-Oct-18 8:30pm GMT

https://finance.yahoo.com/news/edited-transcript-osis-earnings-conference-041011066.html?.tsrc=rss

CARA THERAPEUTICS (CARA) Structured chart. Watching the 21.80 pivot area for next trade.

3 Top Small-Cap Stocks to Buy Right Now $CARA #swingtrading https://finance.yahoo.com/news/3-top-small-cap-stocks-135300031.html?soc_src=social-sh&soc_trk=tw

ALIBABA (BABA) trading at primary pivot on chart. On watch for a trade.

Alibaba (BABA) Outpaces Stock Market Gains: What You Should Know.

https://finance.yahoo.com/news/alibaba-baba-outpaces-stock-market-224510428.html?.tsrc=rss

EDITAS MEDICINE (EDIT) on watch with earning. Symmetry likely continues.

5 Drug/Biotech Stocks Set to Trump Estimates in Q3 Earnings $EDIT https://finance.yahoo.com/news/5-drug-biotech-stocks-set-125512591.html?soc_src=social-sh&soc_trk=tw

APPLE (AAPL) premarket trading 206.70 with resistance 209.80 212.63 next. More on chart.

Cramer: Charts suggest Apple’s stock could bottom this week and then soar to new highs $AAPL #swingtrading https://cnb.cx/2Per0OB

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD

Swing Trading Special Report Series (Part B) Mon Oct 29 SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

Compound Trading Swing Trade Report Monday October 29, 2018 (Part B).

Swing Trading Signals and Stock Picks In this Issue: SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Part A of this swing trading special series can be found here.

Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSI, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Current Swing Trading Signals and Stock Charts.

SQUARE (SQ) Near key support on watch for a bounce. $SQ #swingtrade #tradealerts

ALLERGAN (AGN) Near support on watch for adds to swing trade. $AGN #swingtrading

BOX INC (BOX) Short PT hit – short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #tradealerts

PROQR THERAPEUTICS (PRQR) Hit price target from previous alert, on watch for support bounce – over 22.70 targets 24.85 fast $PRQR #swingtrading #tradealerts

DISNEY (DIS) Holding its structure in market downturn, looking for long 112 area $DIS #swingtrading

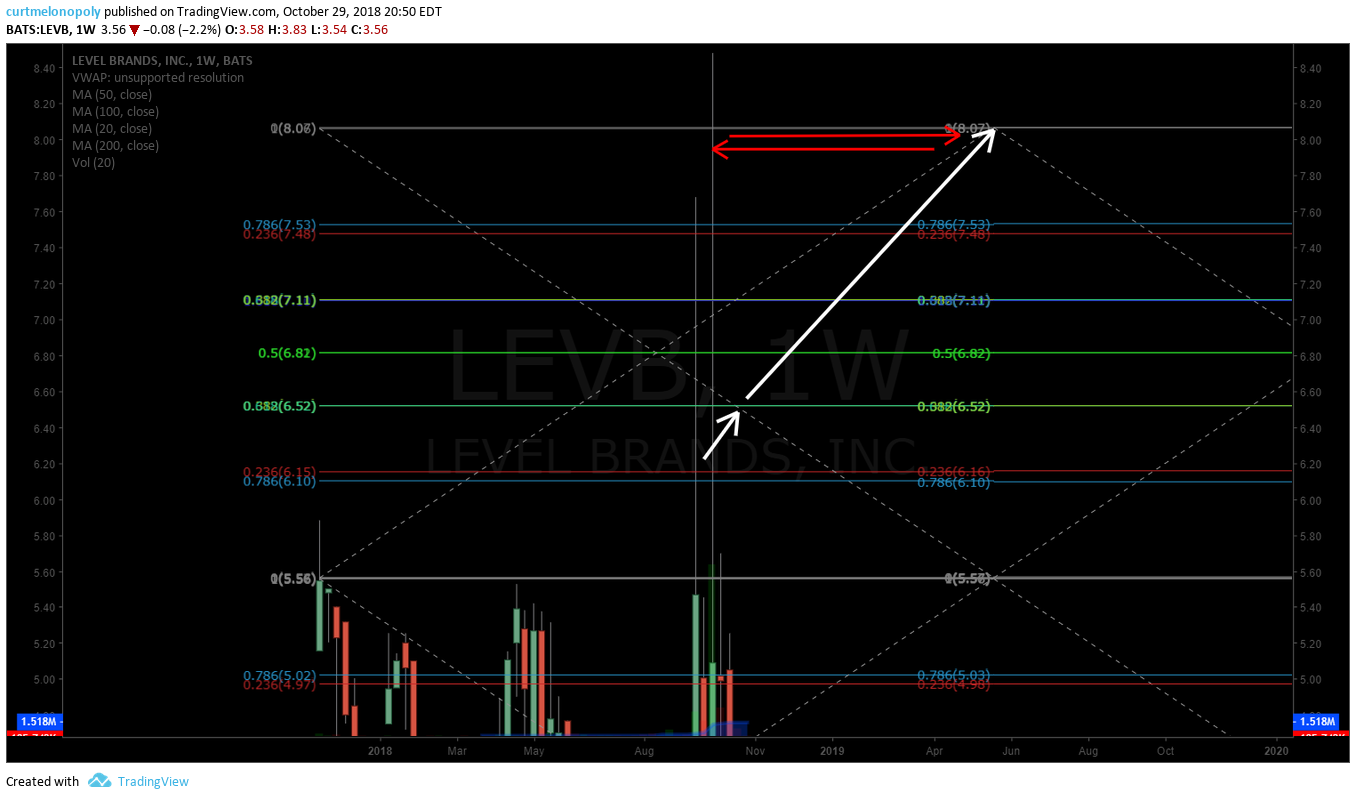

LEVEL BRANDS (LEVB) hit the 8.09 price target and then some, now nearing support watch again $LEVB #swingtrade

BALLARD POWER (BLDP) Turned down perfectly on time per alert, now it is a matter of where it turns. $BLDP #swingtrading #tradealerts

NEW AGE BEVERAGES (NBEV) Near support again on watch after near 4 x gains on last alert – above 2.80, targets 3.27, 4.17, 4.89 $NBEV #tradealerts #swingtrading

PYXUS $PYX near triple x since last alerted now nearing support and on watch for another run #swingtrade #tradealert

NETFLIX (NFLX) on watch for bounce at diagonal trendline support and possible MACD turn on 240 min chart. $NFLX #swingtrading

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, FSQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

Crude Oil Trading Strategy | Technical Analysis & Guidance

A Quick Article With Charting for my Oil Trading Strategies for the Week.

Continued sell-off last week seen oil trade below the multi – week uptrend and trade dropped below support on the weekly wedge chart that I have been sharing.

I wouldn’t be surprised at this point to see a bounce in price, however, the weekly wedge support now becomes resistance. If price breaches the previous support (now resistance) then trades should be ready for a retest of previous support before possible higher.

On the monthly oil chart, price ended the week near the 200 MA support within range of recent monthly candles. Watch the support area.

On the one minute crude oil chart in late trade Friday there were wild price swings (some reporting sweepers, specifically in $XOP). This could be an attempt to a floor in price by a hedge fund or other large money pool.

On the daily chart price ended the week right above the 200 MA and above the primary pivot marked on the chart. The MACD is nearing a bottom to FYI.

On the 4 hour crude oil chart we are using as a test model for trimming and adding to positions trade ended near resistance. This is an untested non back tested chart.

On the weekly pivot charting trade was working near support as with other charts.

Bottom line, the EPIC Crude Oil Algorithm continues to reward those that take long positions at support (channel support and quad support) and short at resistance areas of the algorithmic trading model. This will be my focus and I know the machine trading tech(s) will be focused primarily to those areas of trade also.

Until there is a bounce, retrace and confirmed reversal the bias is short at resistance. The opposite will be true when a reversal is confirmed.

“Bottom line, the EPIC Crude Oil Algorithm continues to reward…”

The machine trade crude oil alert from last week was perfect to the penny at an intra-day top – I would expect the machine trading alerts to increase in intensity this week.

I’ll be in the oil trading room most of the week as I expect a big week in oil trade with the test areas in play.

Follow this link for a detailed description of my longer term crude oil trading strategy review at this post.

Increase Your Crude Oil Trading With These Tools.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing [email protected]. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading to Help You Trade Oil:

Find more posts like this one on our Oil Trading Academy Page – links to numerous oil trade strategy reports.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Crude, Oil, Trading, Strategy, Technical, Analysis, Alerts, Trading Room, USOIL, WTI, CL_F, USO

Follow:

Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video

A Career Trade In Crude Oil Is Setting Up. My Personal Oil Trading Strategy Near Term.

This article reviews the oil trade technical set-ups reviewed Monday in the Oil Trading Room for the near term, intra-day (daytrading), swing trading and my thesis (strategy) for a career trade setting up.

With mid-term elections near, President Trump wanting the price of oil lower (economy related), the recent Saudi geopolitical problems and other geopolitical pressure it seems a perfect storm for oil shorts is brewing.

It is my thesis that there is a very real possibility that shorts will get caught (as mid term elections near or shortly thereafter) and the price of crude oil could rebound out of the pressure and run in to early 2019 in a bullish fashion.

If that doesn’t happen I’ll follow the trend down and provide our members with the technical analysis for the scenario, but I think shorts are going to get caught on wrong side of the trade in to 2019.

#Crude #Oil #Trading #Strategy FX: $USOIL $WTI $CL_F $USO

Oil Trading Room Video – Technical Analysis of Oil Trade Strategies Near Term and in to Next Six Months.

Voice broadcast starts at 2:30 on video.

Summary of Video Transcript – Lead Trader Technical Analysis for Strategy:

The video is very detailed, the summary below doesn’t cover a lot of what was discussed on the video so if you are trading oil be sure to watch the video as it is a very in depth look at the charting and more.

Oil trading 69.05 at noon Monday during review.

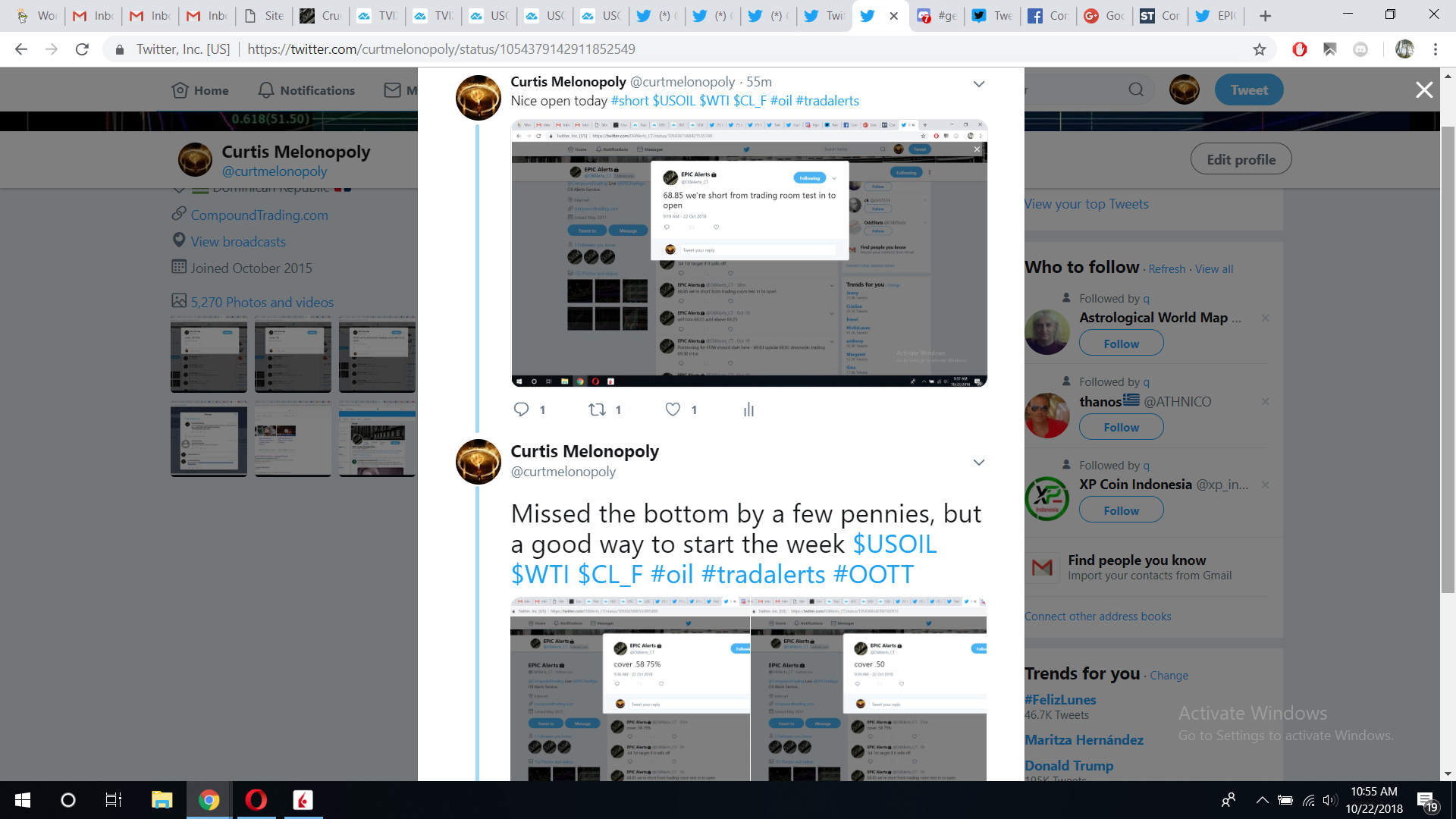

Review of our crude oil trade and trade alerts in to the regular market open:

We were short crude oil 68.85 in to open. We covered 68.58 75% of the position and then the final 25% we covered the trade at 68.50.

Below are the screen shots of the Oil Trade Alerts from private member Oil Twitter Alert Feed.

Below is a screen shot of EPIC Oil Algorithm charting that shows the short oil trade entry (green arrow) and the areas of the chart where we covered the trade.

Below the chart from the oil trading room shows the obvious short and long positions that could be traded on the algorithm model (also what the machine trading is programmed to execute oil trades with).

At 4:00 on video I discuss the machine coding progress and the obvious trades on the oil algorithm charting and how clean that trading has been in the trading range on the model.

At 4:45 in the the Oil Trading Room there was a member comment pointed out that is very true for trading the model with success.

“Trade the model until it breaks, take you lumps when it does.”

I have been looking for an area to re-short in to the week and I just haven’t executed but there was an excellent area of the charting to do that.

At 6:00 on the video a question in the private oil trading room on Discord is answered with reference to the wide swing trading ranges on the model.

ifitworksYesterday at 10:29 AM

@Curt Melonopoly do you are you able to back test any data for how the market reacts(probability) stays around the grey line before it makes a decision to change trend. if that makes any sense?

At that point in the video I explain how we are coding the oil algorithm for machine trading and more specifically the swing trading range at the grey horizontal main pivots on the charting.

At 8:00 areas to short oil and the down channel in oil trade is reviewed on the algorithmic model and charting.

A member call for intra-day oil trade from the oil trading room is also discussed;

RichYesterday at 12:12 PM

If it holds here at 68.95 should be a good opportunity to go long to 69.30

At 10:44 hidden pivots on the charting are discussed and trend lines for trade.

At 11:00 the Trend Line charting is discussed. A very good chart to watch. Support and resistance is strong.

At 11:20 the Symmetry charting is reviewed. It looks like oil trade is going to return to its natural order. What to expect going forward in trade is reviewed and historical advantages.

At 12:30 the trading box on the daily oil charting is reviewed. Down trend waves are reviewed. 70.85 is very likely intra-day on the chart. The 200 MA test is likely.

At 13:00 on the video is the weekly wedge charting reviewed and how trade in oil is playing out almost perfect to the time cycle and price. 68.38 (approximate) is the area near the bottom of the quad to watch. The upside thesis is reviewed here for trade between now and early 2019. AND YES I know they aren’t the “primaries” haha – lots going on in the brain while in a trading day.

At 15:00 200 MA 67.05 on monthly chart is reviewed. This is in large part why I don’t think we will sell off heavy.

Either way I want a big move in crude oil trade in to Christmas, I want a career trade and that is what I will be watching for.

In to the end of the video the 4 hour chart for crude oil is reviewed showing the trend line support areas of the charting and I review some possible “tells” on the oil chart.

It’s important to watch the video to get the support areas in a sell-off – if 68.50 is lost in trade it’s 67.00’s and so on.

Trading Strategy in Summary

This is how I think the shorts are going to get caught. The decision area (support in trade) is similar on all the charts. The technical set-up and thesis that shorts will get caught off-side is reviewed here. I think there is going to be a sell-ff that will freak out the long positions and the shorts will be caught in a compressed situation after mid terms.

Increase Your Crude Oil Trading With These Tools.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing [email protected]. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading to Help You Trade Oil:

Find more posts like this one on our Oil Trading Academy Page – links to numerous oil trade strategy reports.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Crude, Oil, Trading, Trading Room, Strategy, Technical, Analysis, Alerts, USOIL, WTI, CL_F, USO

Follow: