Compound Trading Premarket Trading Plan & Watch List Wednesday September 5, 2018.

In this edition: NAFTA, Emerging Markets, $PRQR, $CRON, $MNKD, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information is of value to existing members, those asking about our services and new on-boarding members.

- Thur Sept 6-

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Plan on a calm day at my trading desk, many inflections in markets and getting ready for Sept Trading Challenge that starts tomorrow.

#Stocks – Facebook, Twitter Drop in Pre-market; SecureWorks, Coupa Surge –

#Stocks – Facebook, Twitter Drop in Pre-market; SecureWorks, Coupa Surge – https://t.co/gLo8icZSAs

— Investing.com News (@newsinvesting) September 5, 2018

Market Observation:

Markets as of 8:23 AM: US Dollar $DXY trading 95.41, Oil FX $USOIL ($WTI) trading 68.88, Gold $GLD trading 1194.51, Silver $SLV trading 14.14, $SPY 289.12 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 7015.00 and $VIX trading 13.7.

Momentum Stocks / Gaps to Watch: $PRQR $CRON $MNKD

26 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12305633 $PRQR $COUP $WATT $SMAR $HDS $TSRO $CGC $CRON $TLRY $CAL $RH $ADC $JD

26 Stocks Moving In Wednesday's Pre-Market Session https://t.co/5ab8NxWWRr $PRQR $COUP $WATT $SMAR $HDS $TSRO $CGC $CRON $TLRY $CAL $RH $ADC $JD

— Benzinga (@Benzinga) September 5, 2018

News:

$PFE $CHEK $YTEN $FCSC $WATT $CHFS $CRON $SBOT $XSPL $MNKD $PRQR

$YTEN (low float) Reports Promising Seed Yield Results for Novel Yield Trait C3004 in Growth Chamber Studies in Camelina

$FCSC Fibrocell Announces FDA Fast Track Designation of FCX-013 for Treatment of Moderate to Severe Localized Scleroderma

Blackstone’s EagleClaw to buy Caprock Midstream for $950 million in cash

Energous Reaches Milestone As It Secures Regulatory Approval For Its WattUp Wireless Charging Technology In 100 Countries Worldwide $WATT https://pro.benzinga.com @benzinga

$PFE Receives Breakthrough Therapy Designation From FDA For PF-06651600, An Oral JAK3 Inhibitor, For The Treatment Of Patients With Alopecia Areata

Your Wednesday morning Speed Read:

– Stock futures ⬇️ as specter of emerging-market concerns reaapears $SPY $VWO

– Morgan Stanley ups Anthem to Overweight, $368 price target $ANTM

– Blood-testing startup turned dumpster fire sh*t-show Theranos will officially dissolve itself

Your Wednesday morning Speed Read:

– Stock futures ⬇️ as specter of emerging-market concerns reaapears $SPY $VWO

– Morgan Stanley ups Anthem to Overweight, $368 price target $ANTM

– Blood-testing startup turned dumpster fire sh*t-show Theranos will officially dissolve itself— Benzinga (@Benzinga) September 5, 2018

LATEST: Bitcoin drops 3% in 10 minutes, Ethereum plunges 12%

LATEST: Bitcoin drops 3% in 10 minutes, Ethereum plunges 12% https://t.co/ufqwB3YBEA

— Bloomberg Crypto (@crypto) September 5, 2018

$GS reportedly ditches its bitcoin plans, and hodlers are left wondering…

$GS reportedly ditches its bitcoin plans, and hodlers are left wondering… pic.twitter.com/8DmJxVV5xO

— CNBC's Fast Money (@CNBCFastMoney) September 5, 2018

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Earnings:

#earnings for the week

$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI

#earnings for the week$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI https://t.co/r57QUKKDXL https://t.co/oiZ3V5Hc7S

— Melonopoly (@curtmelonopoly) September 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

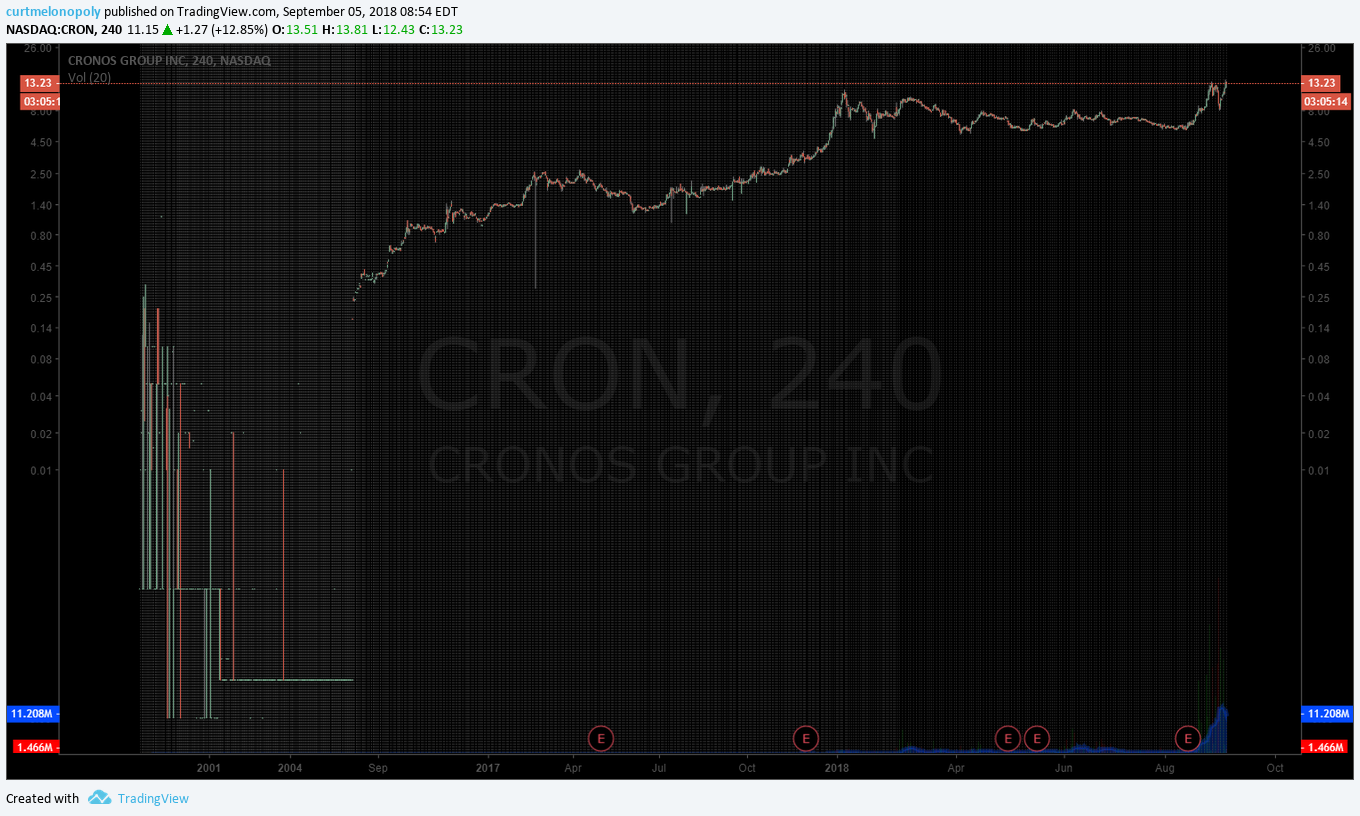

CRONOS (CRON) trading 13.23 up premarket and looks to be one of the few momos that may fly at open. $CRON #premarket

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they’ll get you.

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they'll get you.

— Melonopoly (@curtmelonopoly) September 4, 2018

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/RvSwFejYxm

— Melonopoly (@curtmelonopoly) September 3, 2018

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/hpvrwLjWwx

— Melonopoly (@curtmelonopoly) September 4, 2018

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/JWCGQisxxU

— Melonopoly (@curtmelonopoly) September 4, 2018

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket pic.twitter.com/FAiPnf3tIK

— Melonopoly (@curtmelonopoly) September 4, 2018

Oil Daily Chart. MACD still crossed up with price thru 50 MA and resting on it now. Sept 2 1108 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Emerging market selloff

-Natfa talks resume

-Trump mulls shutdown

-Markets drop

-Coming up…

https://bloom.bg/2NnQWpC

Markets accustomed to buying the dips keep asking when can this EM sell-off end? But in reality until it gets big enough to impact the US, the pain will continue. In the 1997-98 EM crisis it took 15mths from the THB devaluation until LTCM's failure forced the Fed to act. pic.twitter.com/bwPYrpOogi

— Julian Brigden (@JulianMI2) September 5, 2018

Contagion or not, these emerging markets hold key to selloff

Contagion or not, these emerging markets hold key to selloff https://t.co/rynFQK8sKo

— Bloomberg Markets (@markets) September 5, 2018

Oil drops below $69 on U.S. supply concern as storm threat eases.

Read: https://goo.gl/eTjyrs

Oil drops below $69 on U.S. supply concern as storm threat eases.

Read: https://t.co/0mtNeDnxFy pic.twitter.com/ohIUKqHPWa

— NDTV Profit (@NDTVProfitIndia) September 5, 2018

We’ve got our first 2019 stock market forecast from Wall Street and it’s very bullish https://cnb.cx/2wGqNrC

https://twitter.com/CompoundTrading/status/1036952393441792000

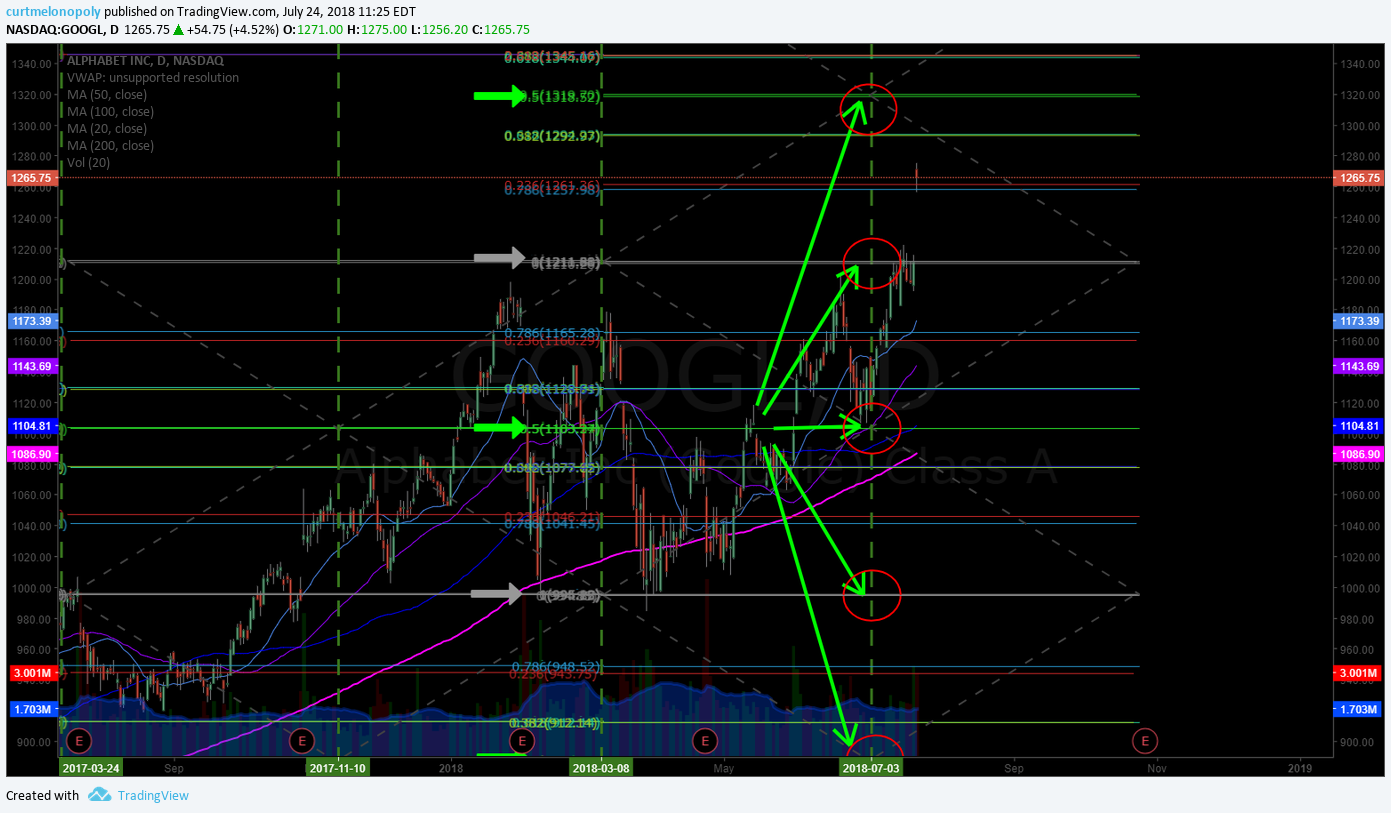

Google will be broken up, warns ‘Cable Cowboy’ John Malone $GOOGL #swingtrading https://www.telegraph.co.uk/business/2018/09/01/google-will-broken-warns-industry-veteran/

Google will be broken up, warns 'Cable Cowboy' John Malone $GOOGL #swingtrading https://t.co/YFslnOvBFC

— Swing Trading (@swingtrading_ct) September 4, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PRQR $CRON $SBOT $NSU $IGC $VCEL $WATT $COUP $MNKD $TLRY $CGC $NEPT $HMY $AMD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $GKOS $UNH $COST $COUP $GE $RH $GKOS $SYBX, $TNDM $PKI $BP $ANTM $CNP

$AMZN D.A. DAVIDSON RAISES AMZN PRICE TARGET TO $2,450 FROM $2,200

$RH Citi analyst Geoffrey Small raised the price target on Restoration Hardware (NYSE: RH) to $181.00 (from $176.00) while maintaining a Buy rating.

Exact Sciences (EXAS) PT Raised to $100 from $65 at Cowen Following Pfizer Deal Deep-Dive @Street_Insider

(6) Recent Downgrades: $RHI $HOLX $MYGN $CSX $MTN $CNI $HOLX $PDS $TSN

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Nafta, Emerging Markets, $PRQR, $CRON, $MNKD, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.