Tag: $XBIO

PreMarket Trading Plan Mon Oct 1: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday October 1, 2018.

In this premarket trading edition: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 1 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

SQUARE (SQ) swing trade is performing well in continuation of trajectory on chart – premarket trading 101.20 near 102.00 resistance from our 89.00 entry. Trim in to resistance add to trade above (if you are trimming at each resistance). The updated chart is below.

Per last week: The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Oil trading plan is similar to last week, I am looking for a trade at / near bottom channel support. Last week it did hit near lower channel support at 71.85 FX USOIL WTI at around 8:30 AM Sept 28 and then took off (no execution), currently trading near upper channel resistance. I will do more day trading again also with oil.

Per last week: Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

DISNEY (DIS) swing trade doing well, in to resistance area pre-market 117.17, trim in to add above $DIS. Good timing on this trade.

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO. Will only consider a smaller size but will consider another trade. This could be a bottoming pattern setting up. Yet to be seen though.

Bitcoin, the bottoming pattern continues, convinced that 5800 area is most probable bottom (alerted numerous times prior to it trading anywhere near there). Bottom line is that we’re expecting to trade it actively soon going in to Dec 24 time cycle peak and in to 1st Q 2019 aggressive.

Below are some trade position notes from recent weeks if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.13, Oil FX $USOIL ($WTI) trading 73.42, Gold $GLD trading 1186.12, Silver $SLV trading 14.53, $SPY 292.48 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6573.00 and $VIX trading 11.8.

Momentum Stocks / Gaps to Watch:

New Ages Beverages bid up 17% https://seekingalpha.com/news/3393975-new-ages-beverages-bid-17-percent?source=feed_f … #premarket $NBEV

Your Monday morning Wake Up Call:

#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company’s update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

Your Monday morning Wake Up Call:#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company's update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

— Benzinga (@Benzinga) October 1, 2018

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://bloom.bg/2DIinGQ $TSLA #premarket #swingtrading

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://t.co/dHZ2HFe5KU pic.twitter.com/4PyqE8FG8c

— Bloomberg Markets (@markets) October 1, 2018

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://bloom.bg/2DISeYz

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://t.co/evehvFP8a8 pic.twitter.com/1iTdE24dGH

— Bloomberg Markets (@markets) October 1, 2018

News:

Viking Therapeutics stock jumps 4.8% premarket on news of positive trial results

$AGLE FDA Grants Rare Pediatric Disease Designation to Pegzilarginase for Arginase 1 Deficiency

$CORT Receives Orphan Drug Designation for Relacorilant as Treatment for Pancreatic Cancer.

Recent SEC Filings / Insiders:

Recent IPO’s:

$SVMK SurveyMonkey IPO is bigger than expected https://www.marketwatch.com/story/surveymonkey-ipo-is-bigger-than-expected-2018-09-25?mod=mw_share_twitter

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Earnings:

Cal-Maine misses profit and sales expectations, dividend drops from previous quarter

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis https://t.co/SEASQ0kFJW

— Swing Trading (@swingtrading_ct) October 1, 2018

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://finance.yahoo.com/news/3-highest-growth-stocks-market-190200998.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://t.co/6OaZlugwOd via @YahooFinance

— Swing Trading (@swingtrading_ct) October 1, 2018

SQUARE (SQ) premarket trading 101.20 near 102.00 resistance. Trim in to resistance add to trade above. Updated chart. $SQ #tradealerts

DISNEY (DIS) swing trade doing well, in to resistance premarket 117.17, trim in to add above $DIS #swingtrading #tradealerts

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO #swingtrading #tradealerts

CRONOS (CRON) MACD cross up on 240 Min Chart with decision near on chart timing, on watch $CRON #tradealert #swingtrading

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

– Tesla’s faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.

– Tesla's faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.https://t.co/42zskaCK7W— NDTV Profit (@NDTVProfitIndia) October 1, 2018

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PROQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

our Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA

Your Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA— Benzinga (@Benzinga) October 1, 2018

#5things

-North America trade deal

-Musk settles

-Italian risk

-Markets rise

-Coming up…

https://bloom.bg/2DSHs26

U.S. and Canada forge a last-gasp deal to salvage NAFTA as a trilateral pact with Mexico https://reut.rs/2N9Q1os

https://twitter.com/Reuters/status/1046727441354563584

Gerald Celente – Economic Meltdown Worse Than Great Depression Coming

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ACST $SYN $MTNB $TSLA $LEVB $NBEV $OGEN $IRDM $GE $IGC $CRMD $MTSL $ALT $AMRN $TLRY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $VIAV $BCS $ICPT $STOR $ALVR $BIIB $EWBC $MTB $UPS $LOGM $APO $TEVA $ENTG

BMO Capital Downgrades The Chefs’ Warehouse, Inc $CHEF to Market Perform

J.B. Hunt Transport Services $JBHT PT Raised to $151 at Credit Suisse

(6) Recent Downgrades: $INTC $TI $BUD $AMD $CIEN $ALV $MEI $TEL $CHEF $FFIV $REVG $WDC $LRCX $INFN $CMG $AMAT $SHLO $DLPH $VEEV $PAYC

RBC Capital Downgrades CAPREIT (CAR-U:CN) to Sector Perform

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO

PreMarket Trading Plan Tues Sept 18: Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $FB, $AAPL, $TSLA, $WTI, $SPY, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday September 18, 2018.

In this edition: Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $BOX, $FB, $AGN, $AAPL, $DIS, $XBIO, $ARWR, $TSLA, $VIX, $WTI, $SPY, $DXY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 18 – Lead trader is in the main trading room for market open, mid day review and futures trading today.

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- The main live trading room going forward is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with our Lead Trader.The exceptions are; Trade Coaching Boot Camps, special Trading Webinars or if the lead trader is not available.

- Week of Sept 17 – New pricing published representing next generation algorithm models (existing members no change).

- Week of Sept 17 – Next generation algorithm models roll out (machine trading Gen 1).

- Week of Sept 17 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Week of Sept 17 – Trading Boot Camp Event videos become available on our website.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Week of Sept 17 – The previously recorded Master Class Videos will become available on our website.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

As I wrote yesterday, many of the set ups that we charted and alerted during coaching boot camp are likely to alarm early week, so I’m expecting trades for those, we are also updating the complete platform equity list charting in the same way (re-charting them all and alarming them etc) – so this week and going forward should become very active in the trading room and on alert feeds.

Stocks – Oracle, FedEx Slide in Pre-market, Netflix, Apple Gain, Avon Surges –

Stocks – Oracle, FedEx Slide in Pre-market, Netflix, Apple Gain, Avon Surges – https://t.co/ssMbjoDBnP

— Investing.com Stocks (@InvestingStockz) September 18, 2018

Market Observation:

Markets as of 7:04 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 69.72, Gold $GLD trading 1200.48, Silver $SLV trading 14.22, $SPY 290.05 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6239.00 and $VIX trading 13.2.

Momentum Stocks / Gaps to Watch:

News:

Tilray receives approval from U.S. to import a medical cannabis study drug for a clinical trial … https://seekingalpha.com/news/3390989-tilray-receives-approval-u-s-import-medical-cannabis-study-drug-clinical-trial-uc-san-diego?source=feed_f … #premarket $TLRY

$VKTX Viking Therapeutics announces positive results in trial of non-alcoholic fatty liver treatment

Sempra Energy announces agreement with Elliott Management, Bluescape Energy $SRE http://dlvr.it/QkZ8b9

EMA accepts Bristol-Myers’ marketing application for expanded use of Empliciti https://seekingalpha.com/news/3390991-ema-accepts-bristol-myers-marketing-application-expanded-use-empliciti?source=feed_f … #premarket $BMY $CELG $ABBV

$FB Facebook Sought Access to Financial Firms’ Customer Data

https://www.wsj.com/articles/facebook-sought-access-to-financial-firms-customer-data-1537263000

Oil market safe despite trade tensions, Iran sanctions: Al-Falih http://bit.ly/2xoyaUI #OOTT $USOIL $WTI $CL_F $USO

https://twitter.com/EPICtheAlgo/status/1041980749736554498

Recent SEC Filings / Insiders:

Recent IPO’s:

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Navios ceases plan for IPO on Nasdaq

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

#earnings for the week

$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK

#earnings for the week$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK https://t.co/r57QUKKDXL https://t.co/cAnHRobuy5

— Melonopoly (@curtmelonopoly) September 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

VIKING THERAPEUTICS (VKTX) premarket up 140% on liver trial news. $VKTX #premarket #daytrading

$MYND needs that 50 MA on the weekly to get going above where it is IMO

Seaspan (SSW) over 9.50 intra should see lower 10s fast, trading 9.34 intraday. $SSW #daytrade #swingtrade #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

SHOPIFY (SHOP) is working the area between main pivot (red line) and upper price target $SHOP #tradealerts #swingtrading

SP500 (SPY) Chart – Came off at test area around pivot on 60 min chart, above box long below short $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

ALIBABA (BABA) got a bounce at 100 MA under rane support, watching close here now $BABA #tradealerts #swingtrading

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

CARA THERAPEUTICS (CARA) Testing break-out area intra-day. On watch. $CARA #tradingsetups #tradealert

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

Crude Oil Daily Chart, MACD turning back up with price above 50 MA Sept 17 623 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

SHOPIFY (SHOP) Per Sean alert in live daytrading room yesterday $SHOP got over resistance today targeting 166s next #tradealerts #daytrade

BOX INC (BOX) Swing trading plan well in play with nice bounce off 50 MA on way to symmetrical price target. $BOX #Swingtrading #TradeAlerts

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump tariffs

-China vows retaliation

-Markets rally

-Saudi happy with $80 Brent

-Confirmation delay

https://bloom.bg/2D8kjbh

Investors are going all in on the global divergence trade https://bloom.bg/2D7uKvU

Investors are going all in on the global divergence trade https://t.co/0n9qenMdbn

— Melonopoly (@curtmelonopoly) September 18, 2018

OPEC is warning of threats to #oil supply from large producers like Iran

https://bloom.bg/2NkagVj via @business #OOTT

OPEC is warning of threats to #oil supply from large producers like Iranhttps://t.co/9LQR0Dvh5I via @business #OOTT

— Bloomberg Energy (@BloombergNRG) September 18, 2018

Confidence in the global economy over the next 12 months has declined to the weakest in near 7 years, shows #MerrilLynch Global Fund Manager Survey.

Confidence in the global economy over the next 12 months has declined to the weakest in near 7 years, shows #MerrilLynch Global Fund Manager Survey. pic.twitter.com/EUALLJ2638

— YUAN TALKS (@YuanTalks) September 18, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $VKTX $APHB $TLRY $AVP $RDCM $EYES $NTNX $NBEV $QTT $OILU $UWT $UNP $ACBFF $ATRS $FTI $PDD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Providence Service $PRSC PT Raised to $107 at CJS Securities

Buy Nutanix $NTNX on ‘Unfounded Media Rumors’ – Needham & Company

$TRGP $VALE $UHS $SGRY $MD $LB $GFI $UNP

AMD, Nvidia stocks gain after Mizuho hikes target

(6) Recent Downgrades: $UAL $WK $BKU $FTNT $PLYA $DISCA $PRI $RHT $AU

Citi Downgrades Primerica $PRI to Sell

$FB-Facebook stock price target cut to $195 from $205 at J.P. Morgan

UBS downgrades Fortinet on “priced in” momentum https://seekingalpha.com/news/3391006-ubs-downgrades-fortinet-priced-momentum?source=feed_f … #premarket $FTNT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $BOX, $FB, $AGN, $AAPL, $DIS, $XBIO, $ARWR, $TSLA, $VIX, $WTI, $SPY, $DXY, $BTC

PreMarket Trading Plan Wed Sept 12: #EIA, OIL, $WTI, Hurricane Florence. $FOMX, $AAPL, $XBIO, $PROQR, $FRED, $TSLA, $ARWR, $CLDR, $FB, $BABA, $DIS, $AGN, $SPY, $BTC, $VIX more.

Compound Trading Premarket Trading Plan & Watch List Wednesday September 12, 2018.

In this edition: #EIA, OIL, $WTI, Hurricane Florence. $FOMX, $AAPL, $XBIO, $PRQR, $FRED, $TSLA, $ARWR, $CLDR, $FB, $BABA, $APPL, $DIS, $AGN, $SPY, $BTC, $VIX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members.

- Wednesday Sept 12 –

-

- I’ll be live on mic live broadcast trading in main trading room #premarket 9:15 #daytrade momos, #EIA #Oil $WTI $USOIL $USO 10:20 and mid-day #swingtrading chart set-up reviews at 12:00 noon. If room is full message me so I can make room. GL today! Trading room link.

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Per above:

I’ll be live on mic live broadcast trading in main trading room #premarket 9:15 #daytrade momos, #EIA #Oil $WTI $USOIL $USO 10:20 and mid-day #swingtrading chart set-up reviews at 12:00 noon. If room is full message me so I can make room. GL today! Trading room link.

https://twitter.com/curtmelonopoly/status/1039833850308911104

Market Observation:

Markets as of 7:23 AM: US Dollar $DXY trading 95.10, Oil FX $USOIL ($WTI) trading 69.85, Gold $GLD trading 1194.56, Silver $SLV trading 14.11, $SPY 289.18 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6220.00 and $VIX trading 13.2.

Momentum Stocks / Gaps to Watch:

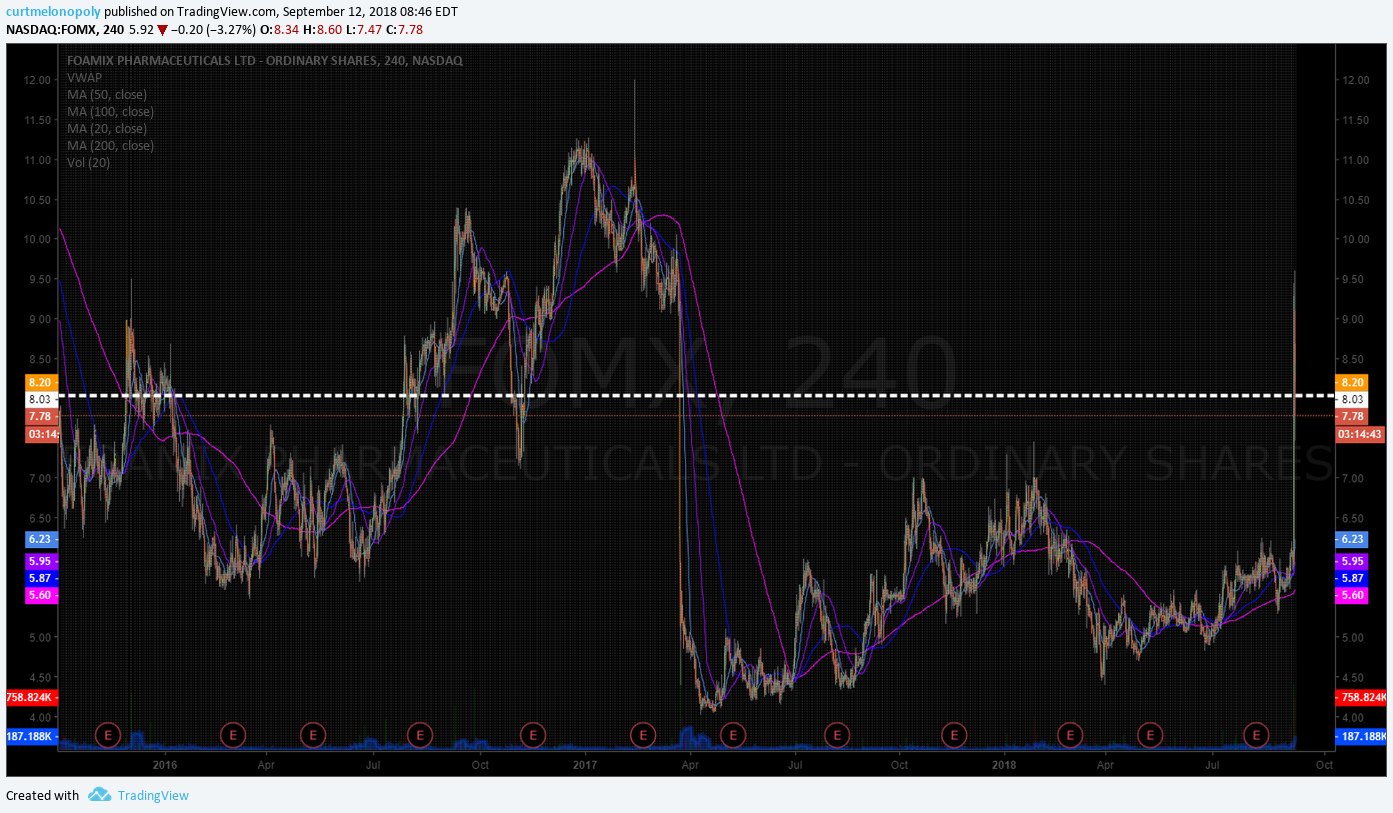

Foamix stock surges 30% on positive late-stage results for acne medication

FOMIX PHARMA (FOMX) premarket up 31.4% trading 7.78 on positive results, resistance 8.00 range $FOMX #daytrading #stocks

News:

Hurricane #Florence Advisory 52: Dangerous Florence Heading Toward the U. S. East Coast. http://go.usa.gov/W3H

PayPal fills a void in sports betting payment processing https://seekingalpha.com/news/3389596-paypal-fills-void-sports-betting-payment-processing?source=feed_f … #premarket $DRAFT $PYPL

Vital Therapies shares slide 86% after biotech says it will scrap treatment for liver failure

Bausch Health stock soars 8.6% premarket on news of patent settlement

$ATOS to Host Conference Call to Announce Preliminary Results from Male Phase 1 Study of Topical Endoxifen Thursday, September 13, 2018 at 10 am EDT

‘Monster’ Hurricane Florence takes aim at U.S. Southeast

'Monster' Hurricane Florence takes aim at U.S. Southeast https://t.co/6TbrSsb32f

— Reuters (@Reuters) September 12, 2018

Your Wednesday morning Speed Read:

– The 2018 Mobile World Congress begins 2day in LA $SSNLF $SMTC $INSG

– The Fed Beige Book report, full of anecdotal economic info, to be released at 2pm ET $SPY

One more thing…

– The 2018 Apple iPhone event is today, 1pm ET $AAPL

Canadian weed stocks might be too high $TLRY #swingtrading https://www.bloomberg.com/news/articles/2018-09-12/at-90-times-earnings-weed-stock-valuations-are-sparking-jitters … via @markets

Canadian weed stocks might be too high $TLRY #swingtrading https://t.co/GChUfZCWzi via @markets

— Swing Trading (@swingtrading_ct) September 12, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

Wabco sees 2018 earnings at lower half of guidance as ‘geopolitical dynamics’ intensify

#earnings for the week

$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)

http://eps.sh/cal

#earnings for the week$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)https://t.co/r57QUKKDXL https://t.co/wHU5AlivAx

— Melonopoly (@curtmelonopoly) September 8, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

FOMIX PHARMA (FOMX) premarket up 31.4% trading 7.78 on positive results, resistance 8.00 range $FOMX #daytrading #stocks

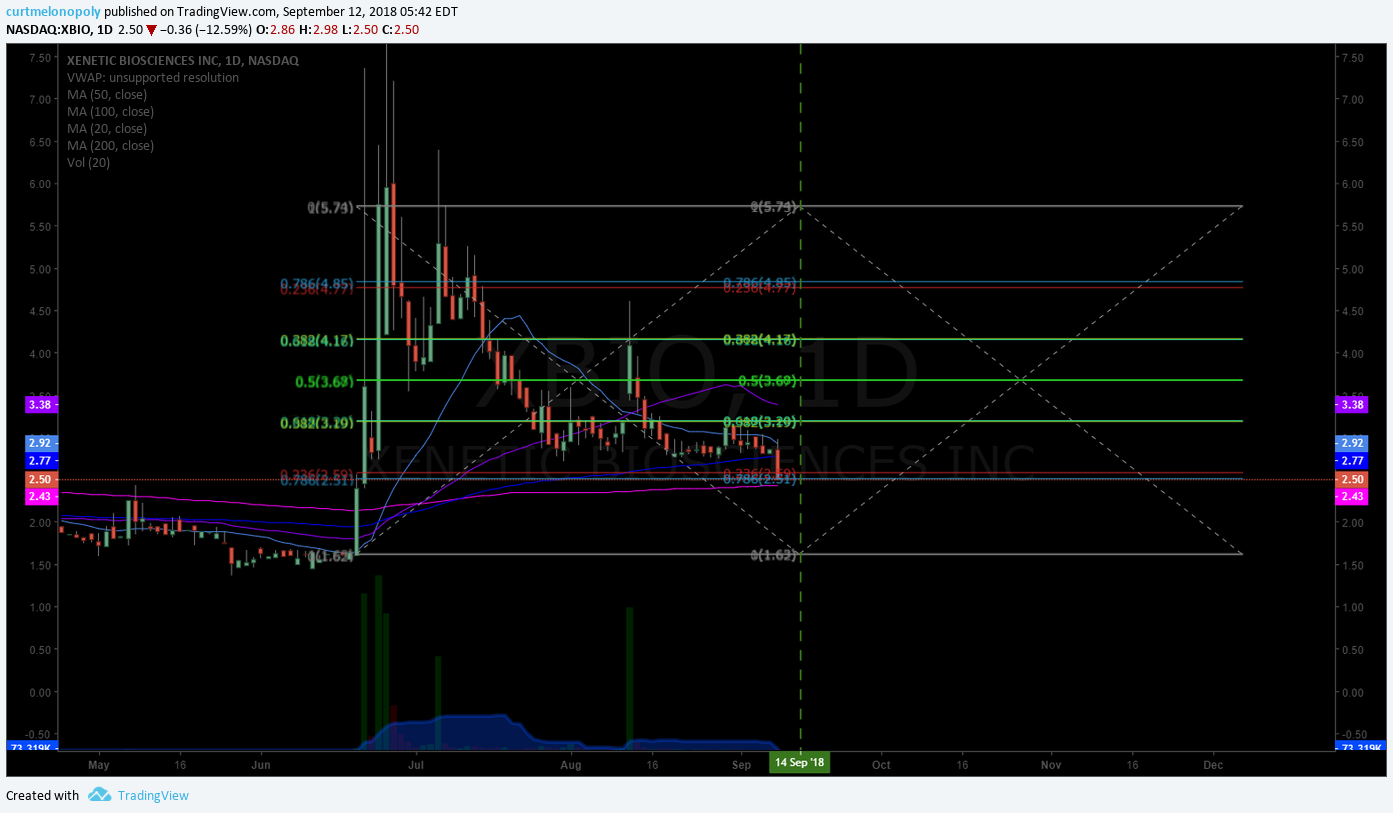

XENETIC BIOSCIENCES INC Premarket near 200 MA support test after sel;-off, near time cycle peak Sept 14, possible turn $XBIO #swingtrade #daytrade #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up scenario Number 2. $XBIO #swingtrading #tradealert

FREDS INC (FRED) On day two of gap and go continued to struggle with 200 MA wall. $FRED #daytrading #swingtrade #premarket

PROQ THERAPEUTICS (PRQR) ran another 15% yesterday near a buy sell trigger resistance, trim in to it add above. $PRQR #swingtrading #daytrade

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ALIBABA (BABA) If no bounce at 100 MA that is near it is most probable to bounce in 147 range. $BABA #swingtrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

Tesla stock gets a rare analyst boost as two brokerages say they believe the electric car maker will meet its targets and turn a profit in the second half of the year via @ReutersTV. We will delete our incorrect tweet.

CORRECTS MISSPELLING: Tesla stock gets a rare analyst boost as two brokerages say they believe the electric car maker will meet its targets and turn a profit in the second half of the year via @ReutersTV. We will delete our incorrect tweet. pic.twitter.com/JubrVD0CIP

— Reuters (@Reuters) September 10, 2018

Retracement on this wedge on weekly oil chart is likely 51.80, bulls are likely panicked here, selling any pops now very likely.

PROQ THERAPEUTICS (PRQR) premarket resistance watch at diagonal Fib line overhead and 22.75, above sees 27.55 implied $PRQR #swingtrading #daytrade

FREDS INC (FRED) Cleared 200 MA on daily, premarket next major resistance 50 MA on weekly. $FRED #daytrading #swingtrade #premarket

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

CLOUDERA INC (CLDR) Premarket up 6.5% trading 18.75 with 22.00 target. $CLDR #daytrading #swingtrading

TESLA (TSLA) Premarket watching for a snap back wash out trade here, CFO steps down, ELON smokes weed $TSLA #daytrading #swingtrading

ARROWHEAD PHARMA (ARWR) Two options for swing trading channels. $ARWR #swingtrading #chart

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts pic.twitter.com/J3ku1UKdVa

— Melonopoly (@curtmelonopoly) September 7, 2018

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-U.S. and Hong Kong weather warnings

-Tech scrutiny

-Fed, ECB outlook

-Markets mixed

-Oil’s future

https://bloom.bg/2NA2vde

#5things

-U.S. and Hong Kong weather warnings

-Tech scrutiny

-Fed, ECB outlook

-Markets mixed

-Oil's futurehttps://t.co/BBXkB7h3St pic.twitter.com/gefUtOF3AJ— Bloomberg Markets (@markets) September 12, 2018

Oil nears $80 a barrel as concern grows over global supply https://reut.rs/2x7NuoV $USOIL $WTI $USO #OIL #OOTT

https://twitter.com/EPICtheAlgo/status/1039843221550112768

U.S. Judge Says Initial Coin Offering Covered by Securities Law

U.S. Judge Says Initial Coin Offering Covered by Securities Law https://t.co/vpcyr0XsjY

— Melonopoly (@curtmelonopoly) September 11, 2018

New York Regulator Approves Two New Stablecoins, Gemini Dollar and Paxos Standard https://news.bitcoin.com/new-york-regulator-approves-two-new-stablecoins-gemini-dollar-and-paxos-standard/ … via @BTCTN

New York Regulator Approves Two New Stablecoins, Gemini Dollar and Paxos Standard https://t.co/C7vXipFVes via @BTCTN

— Crypto the BTC Algo (@CryptotheAlgo) September 11, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $RHE $FOMX $GLPG $NSPR $ATOS $BPMX $BHC $TLRY $PYX $AKTX $NOG $BRZU $CCE $GILD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ZNH $BSTI $TIF $CVX $AA $RBS $CPA $WP $IMMR

Goldman Sachs Raises McDonald’s Price Target To $190 From $179

Casey’s General Stores $CASY PT Raised to $130 at RBC Capital

CoStar Group $CSGP PT Raised to $500 at Needham & Company

BofA/Merrill Lynch Upgrades China Southern Airlines $ZNH to Buy

Buckingham Research Starts Huntington Ingalls $HII at Buy

Northland Capital Markets Upgrades DexCom $DXCM to Market Perform

(6) Recent Downgrades: $MU $LRCX $ENTG $IVTY $DFRG $DENN $CHUY $TXRH $MTSI $MXIM $NXPI $POWI $AYI $SNAP

Snap stock falls after BTIG cuts to sell

NXP stock falls after Stifel downgrades to sell

An analyst just came out with a sell rating and $5 price target for Snap https://bloom.bg/2CPy9PU

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Alerts, #EIA, OIL, $WTI, Hurricane Florence. $FOMX, $AAPL, $XBIO, $PRQR, $FRED, $TSLA, $ARWR, $CLDR, $FB, $BABA, $APPL, $DIS, $AGN, $SPY, $BTC, $VIX

XENETIC BIOSCIENCES INC How to Trade XBIO Snap-back Swing Trade. $XBIO #swingtrading #tradealert

Swing trading alert for a possible wash-out snap-back trade setup developing in XENETIC BIOSCIENCES INC (XBIO)

How to Trade XBIO Wash-out Snap-back trade set-up. $XBIO #swingtrading #tradealert

XBIO has been in a wash-out sell-off since its late June 2018 run up in to a 52 week high of 8.95.

XBIO premarket is trading 2.50 today after a 12.5% sell-off (continued) yesterday.

The 200 MA on the daily XBIO chart is at 2.33. Near term the 200 MA is the obvious support test.

The peak timing in the time-cycle on the daily chart is approximately on this Friday Sept 14, 2018.

The peak timing in the time-cycle on the daily chart is approximately on this Friday Sept 14, 2018. There is a high probability of a turn up on the other side of that time cycle if XBIO can hold the 200 MA support on the daily chart.

Click here for the XBIO stock financial page on Yahoo Finance.

October 5, 2018 is a near term time cycle peak that sees a potential 4.69 upside bullish price target and alternatively in a continued sell-off the most likely target on October 5 is 1.66 – but very unlikely considering the 200 MA and the time cycle completion this Friday.

I have provided two short term scenarios for trade between now and Friday and from there the two charting scenarios provided below offer the potential targets.

How to trade the move in XBIO after Sept 14?

For your trading plan simply select the chart that most resembles where trade is at Sept 14.

Then if trade is above the buy sell trigger (noted with white arrows) then this would be a long in to the trending price target on the chart.

The opposite is true if price is below the buy sell trigger. In a short scenario be very cautious of buy-side volume approaching on any given day as this is a common theme in trading wash-outs. The 200 MA support is likely to fail and then bulls could very well step in as stops are triggered and buy side momentum ensues, especially if short side panics.

XENETIC BIOSCIENCES INC Premarket near 200 MA support test after sel;-off, near time cycle peak Sept 14, possible turn $XBIO #swingtrade #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up scenario Number 2. $XBIO #swingtrading #tradealert

If you have any questions about the trade alert detailed in this article reach out! You can get me on email info@compoundtrading.com or private message me on any of my social media accounts.

Trade safe and cut losers fast!

Curt

Need help learning to trade set-ups like the one included in this post? Visit our trade coaching page.

Interested in our live trading room, swing trading newsletters or trade alerts? Visit our menu of trading services.

Click here for the XENETIC BIOSCIENCES website to learn more about the company.

Article Topics; trade, alerts, XBIO, snap-back trade, set-up, swing trading, trading plan, price targets, buy sell triggers.

PreMarket Trading Plan Mon Aug 13: Turkey Lira, Elliott Stake Boosts Nielsen, $VIX, OIL, $TSLA, $HOG, $NLSN, $WMT, $ABIL, $DBD, $RSLS, $XBIO more.

Compound Trading Premarket Trading Plan & Watch List Monday August 13, 2018.

In this edition: Turkey Lira, Elliott Stake Boosts Nielsen, $VIX MACD, OIL, $TSLA, $HOG, $NLSN, $WMT, $ABIL, $DBD, $RSLS, $XBIO and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Monday Aug 13 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 17 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Before Sept 1 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 1 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 1 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14 (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: VFC, HGV, WMT, HOG & more –

Stocks making the biggest moves premarket: VFC, HGV, WMT, HOG & more – https://t.co/wkAoBtDONV

— Melonopoly (@curtmelonopoly) August 13, 2018

#Stocks – Harley Davidson Drops in Pre-market; Tesla Gains; Nielsen Soars –

#Stocks – Harley Davidson Drops in Pre-market; Tesla Gains; Nielsen Soars – https://t.co/ZK6jAWvk43

— Investing.com News (@newsinvesting) August 13, 2018

Market Observation:

Markets as of 8:08 AM: US Dollar $DXY trading 96.35, Oil FX $USOIL ($WTI) trading 67.39, Gold $GLD trading 1199.90, Silver $SLV trading 15.16, $SPY 283.16, Bitcoin $BTC.X $BTCUSD $XBTUSD 6453.00 and $VIX trading 14.1.

Momentum Stocks / GAPS to Watch: $ABIL $DBD $CLRB $CLDC

Nielsen is up 11.5% in pre-market trading after WSJ reported Elliott Management has taken an 8% stake in the company and wants it to sell itself. https://www.benzinga.com/news/18/08/12190488/26-stocks-moving-in-mondays-pre-market-session … $SSC $NLSN $IMMY $DY $SECO $RYB $TAL $STG $BEDU $REDU $ALNY

Nielsen is up 11.5% in pre-market trading after WSJ reported Elliott Management has taken an 8% stake in the company and wants it to sell itself. https://t.co/F4LUQCjTw8 $SSC $NLSN $IMMY $DY $SECO $RYB $TAL $STG $BEDU $REDU $ALNY

— Benzinga (@Benzinga) August 13, 2018

News:

OPEC lifted crude production in July https://bloom.bg/2B6AFjN

OPEC lifted crude production in July https://t.co/gLe2YH7LM2 pic.twitter.com/DRfSHnn202

— Bloomberg Markets (@markets) August 13, 2018

Saudi cuts oil output as OPEC points to 2019 surplus.

https://twitter.com/EPICtheAlgo/status/1028979288257818624

Recent SEC Filings / Insiders:

Satya Nadella unloads 30% of his Microsoft common stock in his biggest sale as CEO

$MSFT https://cnb.cx/2OvfBFB

Recent IPO’s:

Earnings:

Sysco’s stock rallies after earnings, revenue top expectations.

Dycom’s stock plunges after profit, sales warning.

#earnings for the week

$NVDA $JD $HD $AMAT $WMT $CSCO $JCP $M $YY $SYY $BZUN $DE $TSG $CGC $GWGH $SPCB $CRON $AAP $VIPS $JKS $NTAP $NINE $SWCH $CSIQ $HQCL $AG $BLRX $TPR $JWN $A $CREE $EAT $CNNE $ESES $ARRY $TGEN $CAE $GDS $ROSE $SNES $SORL $EAST $AVGR

#earnings for the week$NVDA $JD $HD $AMAT $WMT $CSCO $JCP $M $YY $SYY $BZUN $DE $TSG $CGC $GWGH $SPCB $CRON $AAP $VIPS $JKS $NTAP $NINE $SWCH $CSIQ $HQCL $AG $BLRX $TPR $JWN $A $CREE $EAT $CNNE $ESES $ARRY $TGEN $CAE $GDS $ROSE $SNES $SORL $EAST $AVGRhttps://t.co/r57QUKKDXL https://t.co/PfPzmWSmLy

— Melonopoly (@curtmelonopoly) August 12, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

$ABIL premarket trading 7.27 up 58% #premarket #daytrading

Oil Daily Chart. MACD cross up failed, trade under 50 MA. Bearish trend continues. Aug 12 947 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/RHWh9I0Pd4

— Melonopoly (@curtmelonopoly) August 10, 2018

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/mfmhip2r0r

— Melonopoly (@curtmelonopoly) August 9, 2018

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

— Melonopoly (@curtmelonopoly) August 9, 2018

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading pic.twitter.com/Y9MBk0hE7F

— Melonopoly (@curtmelonopoly) August 9, 2018

ROKU (ROKU) hit the chart model resistance perfect and came off today $ROKU #daytrading

G1 THERAPEUTICS (GTHX) What a fantastic swing trade. Blew through our most bullish price target today. $GTHX #swingtrade #chart

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

Market Outlook, Market News and Social Bits From Around the Internet:

Stock Futures Lower On Turkey, Lira; Elliott Stake Boosts Nielsen http://dlvr.it/QfkS8w

Stock Futures Lower On Turkey, Lira; Elliott Stake Boosts Nielsen https://t.co/QH9jxLhPOL pic.twitter.com/xerf0Bjkuq

— Investors.com (@IBDinvestors) August 13, 2018

#5things

-Lira rout continues

-Risk spreads beyond Turkey

-Saudis eye Tesla investment

-Markets drop

-Quiet data week

https://bloom.bg/2B87eOo

Despite the recent raw-material rally, hedge funds that trade commodities just keep closing down https://www.wsj.com/articles/how-the-last-commodity-funds-will-survive-the-algo-age-adapt-or-die-1529919003 … via @WSJ

https://twitter.com/EPICtheAlgo/status/1028697150639747075

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ABIL $RSLS $XBIO $CLDC $NLSN $CLRB $DBD $MDGS $TLRY $SYY $FOLD $TVIX $DUST $YANG $CWH $NVFY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$CRNX Leerink Partners analyst Joseph Schwartz initiates coverage on Crinetics (NASDAQ: CRNX) with a Outperform rating and a price target of $43.00.