Tag: $AAOI

PreMarket Trading Plan Wed Aug 8: EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC more.

Compound Trading Premarket Trading Plan & Watch List Wednesday Aug 8, 2018.

In this edition: EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Wednesday Aug 8 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 10:30 EIA Petroleum Report Live Oil Trading with EPIC the Oil Algorithm in live trading room (EPIC members welcome).

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 10 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- July 31-Aug 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14! (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

$AAOI $LITE $MTCH $BOOT $DDD $ALRM $SFLY $PLT $LUV $PTCT $NVTA

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 95.31, Oil FX $USOIL ($WTI) trading 68.28, Gold $GLD trading 1207.90, Silver $SLV trading 15.29, $SPY 285.36, Bitcoin $BTC.X $BTCUSD $XBTUSD 6488.00 and $VIX trading 11.0.

Momentum Stocks / GAPS to Watch: $AAOI $LITE $MTCH $BOOT $DDD $ALRM $SFLY $PLT $LUV $PTCT $NVTA

Stocks making the biggest moves premarket: KORS, CVS, DIS, PZZA & more –

Stocks making the biggest moves premarket: KORS, CVS, DIS, PZZA & more – https://t.co/dFORu5F33P

— Melonopoly (@curtmelonopoly) August 8, 2018

News:

Lumentum’s stock shoots up over 7% after earnings beat by wide margin https://on.mktw.net/2vtHTJz

Your Wednesday Morning Speed Read:

– U.S. to hit Chinese imports w/$16B more tariffs Aug. 23rd $SPY $FXI

– Financial media freak-out continues over @elonmusk’s Tuesday tweet he’s “considering” taking Tesla private $TSLA

– @axios to create @HBO series centered on tech & politics

Your Wednesday Morning Speed Read:

– U.S. to hit Chinese imports w/$16B more tariffs Aug. 23rd $SPY $FXI

– Financial media freak-out continues over @elonmusk's Tuesday tweet he's "considering" taking Tesla private $TSLA

– @axios to create @HBO series centered on tech & politics— Benzinga (@Benzinga) August 8, 2018

CHINA GOVT SAYS IMPORT TARIFFS ON $16 BLN WORTH OF U.S. GOODS TO TAKE EFFECT AT 1201 LOCAL TIME ON AUG 23

Elon Musk’s Tesla scenario would mean funding biggest buyout ever. $TSLA #swingtrading

Elon Musk's Tesla scenario would mean funding biggest buyout ever. $TSLA #swingtrading

Read: https://t.co/UEbmDKkzQ5

— Swing Trading (@swingtrading_ct) August 8, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

Applied Opto stock spikes higher after earnings beat https://on.mktw.net/2AOeZbX

Tomorrow morning’s #earnings

$CVS $WB $KORS $MYL $SINA $LITE $ENDP $DLPH $SUP $CARS $MGA $SO $MTBC $RGNX $GOGO $FI $MGIC $NYT $VSI $ETM $ATHM $EXTR $CRK $EGLT $CNK $BBSI $JLL $KERX $GVA $HXNP $KDP $NEOS $WWW $NXST $STWD $TRI $GEL $ARCO $CMRX $STE $CRL

https://twitter.com/CompoundTrading/status/1027031168993173504

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

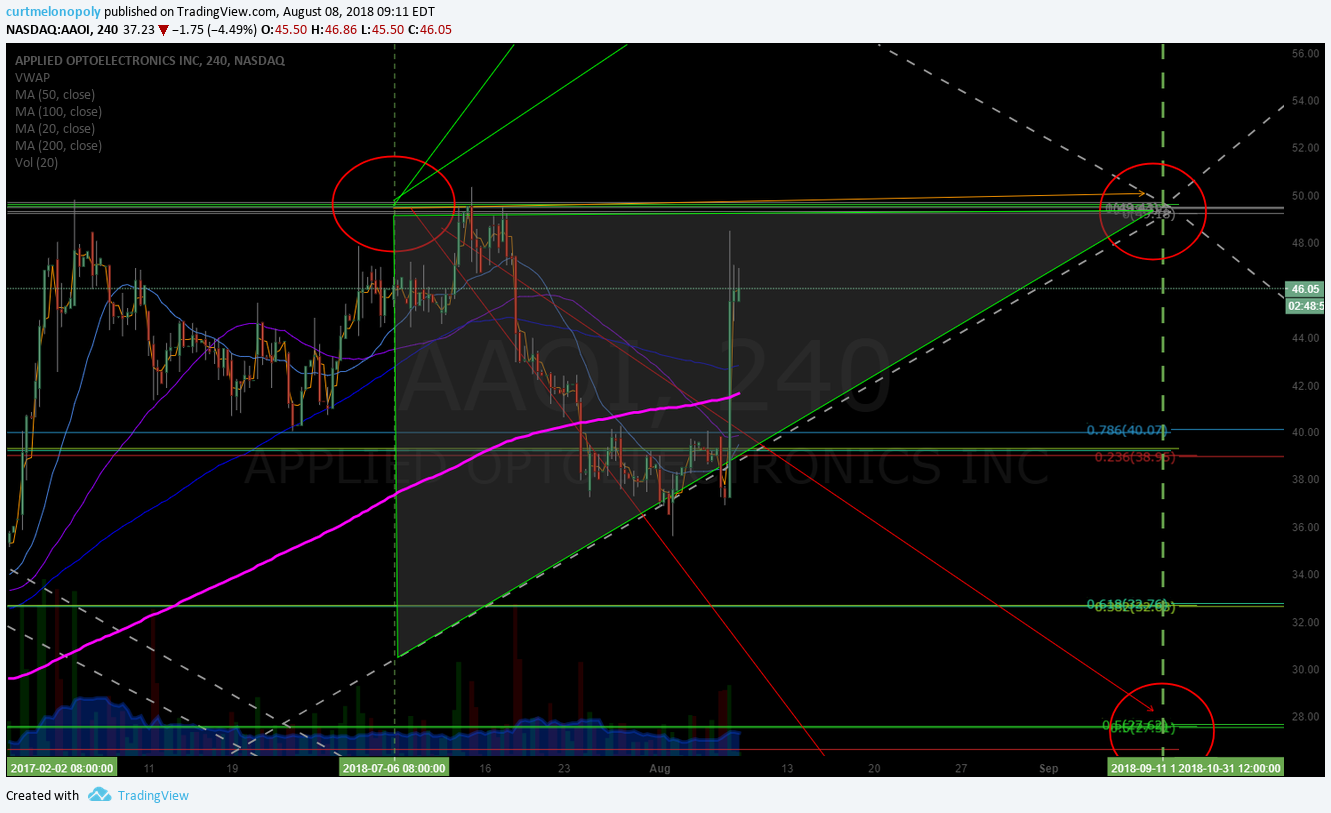

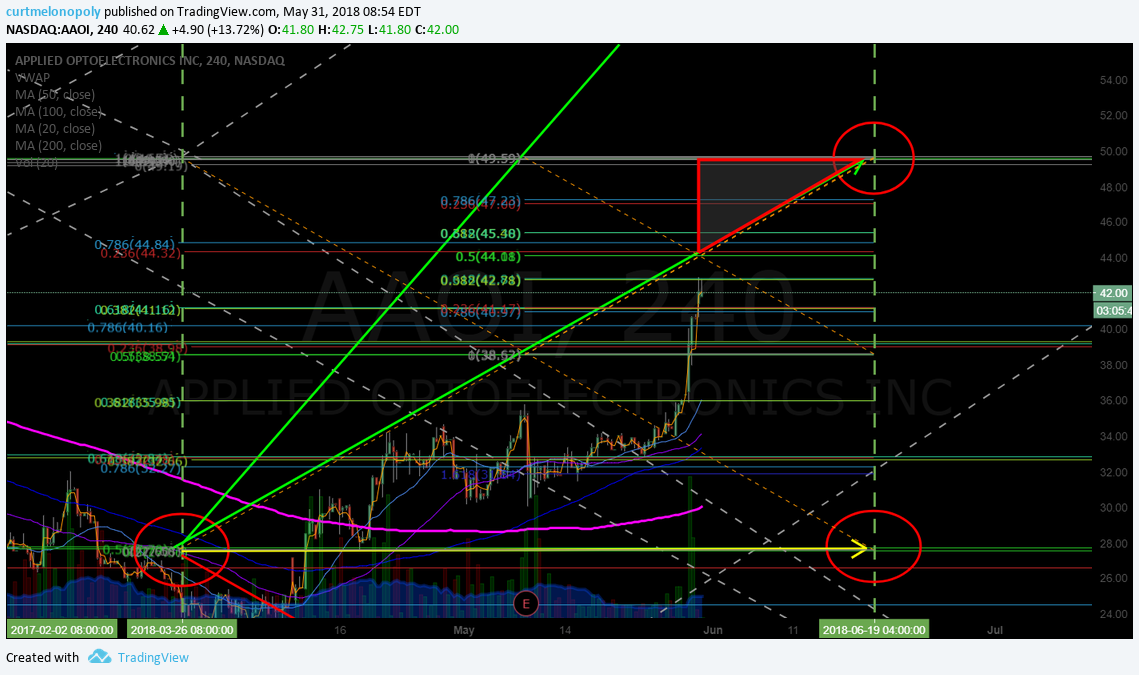

APPLIED OPTOELCTRONICS (AAOI) premarket trading 46.05 on earnings +23% $AAOI #daytrading #swingtrading #premarket

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSi turned up, watching trend structure in to eanrings in one day. $TWLO #chart #earnings

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading

$SWIR has held the 200 MA on daily, will be one to watch for Monday #daytrading pic.twitter.com/b71F3ArbsC

— Melonopoly (@curtmelonopoly) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ABIL, $SBBP, $AAOI $MTCH $DDD $HDP $ENDP $YTEN $CYBR $MTBC $RKDA $GOGO $LITE $VSLR $AQXP $OPK $WB $FOSL $SGYP $ETM $DWT $CVS $KORS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, EIA, OIL, Earnings, Tariffs, $AAOI, $FIT, $TSLA, $FB, $GOOGL, $LITE, $HIIQ, $AGN, $TWLO, OIL, $SPY, $DXY, $BTC

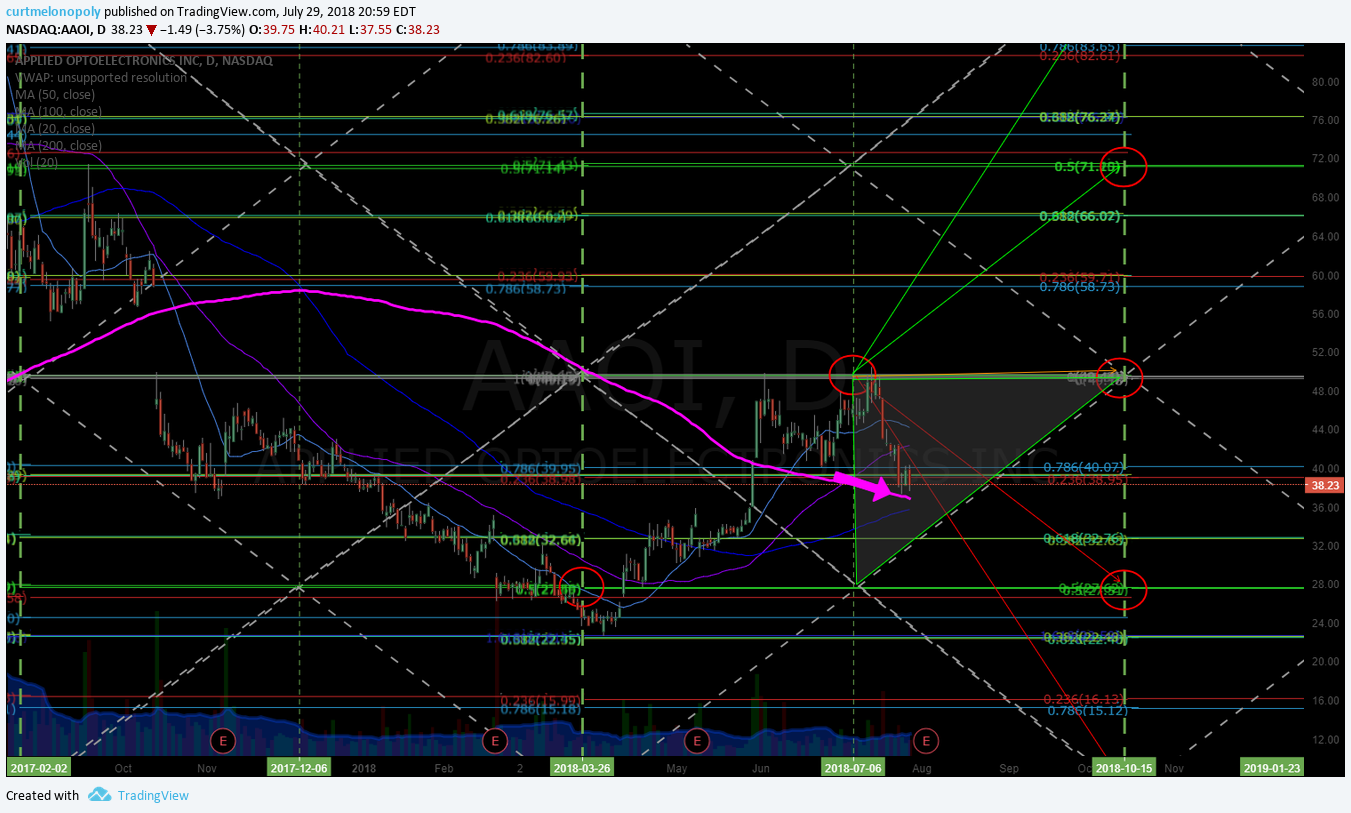

Special Swing Trading Report (Members) #earnings Sun July 29 OIL, $RIOT, $SPY, $PSTG, $AMBA, $FSLR, $AAOI, $LITE, $CALA …

In this Special Earnings Season Swing Trading Report: OIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: Do not miss listening to the actual video for earnings trade levels on these charts. Reviewing just the notes below is not sufficient. Many of these set-ups will be traded and as was so the last earnings and times before significant ROI for the year is gained setting up positions during earnings season. Also, even if the video was recorded days earlier the trading structure of the charts is still in play for the earnings trade set-up.

Mid Day Member Webinar Chart Swing Trading Set-ups Summary (from July 25 mid day, published July 29):

Swing Trading Special Earnings Season Report (member version) that will become the premise for our next major entries.

Reviewed: Crude OIL, $WTI, $USOIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA.

This is the mid day review video from Wednesday July 25, 2018 of last week. The charting updates apply today as they are focused toward the swing trading platform. We didn’t have time to post the video and report until now.

We continue in this series to review the 100 equities on our swing trading platform in about ten days in lieu of the one regular weekly swing trading report (covering about 1/5 per week). The objective is to cover all the charting trade set-ups during earnings season. This doesn’t mean we can include new charting for each as each are reviewed on the video.

The equities on this report are in reference to our regular Swing Trading report that was last published June 20, 2018 on regular rotation (for referencing charts as you need).

Not reviewing the video details (trading plans) is not advised because there is detailed trading plan information in this video.

FX $USOIL $WTI #CL #OILTrading – A quick look at the oil algorithm charting. I had about ten trades today, our machine trading side had 30 – 40 oil trades. My personal monthly month oil trading win streak continues. See special report to follow, the report will also have an intra day chart for members (charting our machine trading thesis is formed via).

$RIOT – See special report (to follow) on the daytrade and how we did it.

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

US Dollar $DXY – Dollar is at main pivot in structure of chart.

$SPY – SPY is at pivot also. Review recent videos. Near buy trigger trim near 284.94.

$TORC – was the the premarket momo, we didn’t take a trade, it did nothing at open.

$TORC Premarket up 142% trading 21.79 on lock up exp, results, short interest. $TORC #daytrading

$EDIT – I am in 33.43 1/3 sizing. 34.86 resistance on model. Will add on pull backs at supports or channel. I think it will get near bottom of channel and then I’ll add. Earnings in 18 days. Video shows trading plan on EDIT chart.

EDITAS MEDICINE (EDIT) Sell-off nears key support 27.95 for an add to swing, trading 29.70 Friday $EDIT #swingtrade #alerts

$GTHX – Long swing trade entry 49.63 1/3 sizing. Total sizing is never more than 3% of account sizing. So at 1/3 there is no stress. Set a trim 50.99 alerted it and trade missed trim trigger by 2 cents. Details of GTHX trading plan shown on video.

G1 THERAPEUTICS (GTHX) Over mid quad key support in swing trade long here. Targets on chart. $GTHX #swingtrade

$ARWR – Long swing trade from yesterday 17.24 entry, over mid quad support, Resistance at 19.50 quad wall and Fib line, pivot 16.42, main support 12.84. Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

$PSTG Pure Storage – trading 23.84 earnings 32 days, in the pinch in the quad, looking for 25.90 in to Oct 1 in trading plan – looking for trade. 29.13 would be ideal price target Oct 1 top of algorithmic channel on chart.

PURE STORAGE (PSTG) Closed Friday just above key support. Below targets 19.25 Oct 1 above 25.92. $PSTG #swingtrading

$AMBA – there was a special report published previously. Video shows users how to clone a simple trading model. Sitting on quad wall, price targets Aug 1 40.00, 30.63, 31.61. Looking for a pop around 36.09 and the possible long thereafter. Support 36.15 resistance 40.16 over 44.00 resistance. Time cycle Aug 1 termination. Earnings 39 days. 49.30 upside target in a long scenario. Video details the trading plan in AMBA.

Ambarella (AMBA) Above the mid quad just above is a long in to earnings and under a short – trade in direction of price targets on chart. $AMBA #earnings #swingtrading

Ambarella (AMBA) Note the chart symmetry in last sell off hitting mid quad each rotation in structure. $AMBA #chart #symmetry

$COTY – has been in our coverage for about a year, hasn’t been great and not looking at trading it.

$FSLR First Solar – trading on 200 MA weekly chart structure, Stochastic RSI is up, indicators are week, if price gets above the 20 and 50 MA and 20 MA breaches 50 then it is a long. Sidewinder setup possible and on watch. Video explains the trading plan. Resistance 86.42 if it gets bullish. Earnings in a day.

FIRST SOLAR (FSLR) Looking for a trade either side of 200 MA on the weekly chart. Testing now. $FSLR #swingtrading

$AAOI – was my nemesis from last year, AAOI over it’s 200 MA earnings in 8 days, history reviewed on video on company over last year, if this earnings hits 49.37 is the first price target, 71.48 is my personal target (aggressive hope), most bullish (not likely) 92.77 all Oct 16, 2018. Trading 38.83 intra day, in a sell-off support 27.59, 200 MA support and 100 MA support in play 35.35, horizontal FIB support 32.86, 33.01 quad wall support, range support 27.59 (major range support). Double bottom 22.90 area – would hit that very hard if it occurs.

APPLIED OPTOELCTRONICS (AAOI). It’s all about earnings in 3 days now. Looking for a sizeable trade on other side of ER. $AAOI #trading #earnings

September 7th Options Now Available For Applied Optoelectronics (AAOI) https://www.thestreet.com/partner/september-7th-options-now-available-for-applied-optoelectronics-aaoi–14663833

$HIIQ – mid quad main pivot for structure is where trade is and earnings are coming in 11 days, trading 31.90 intra day, moving from buy sell trigger to buy sell trigger, if it holds that 31.05 it’s a long side trade with a target 35.70 Aug 13 right after earnings, downside 31.10 price target in sell-off and 26.65 for same time frame mid Aug. Trading plan discussed on video.

Health Innovations (HIIQ) Testing key support with earnings in four days, will be looking for a trade post earnings $HIIQ chart. #swingtrade #earnings

$LITE – I’m watching this one close for a sizeable trade in Q3 and Q4. MACD cross down Stoch RSI near bottom. trading 53.75 at mid quad pivot, earnings 16 days, would be surprised if it doesn’t gap up, Recent downtrend was over done in my opinion. 51.25 support, 53.85 pivot, 56.55 resistance then 200 MA, then 60.00 ish range. 65.05 price target in upside trade scenario.

LUMENTUM HOLDINGS INC (NASDAQ LITE) Coming in to earnings at key mid quad, looking for trade other side of ER $LITE #swingtrade #earnings

$CALA – on other side of July 9 time cycle expiry, trading 4.40, nailed the price target on the short side alerted, 10.75 is a price target May 23, 2019 on upside move if it happens. This is a possible double ROI trade. 2.76 support. Main resistance 8.55. Fib resistance 6.20. Quad wall support. This is a long for sure if it turns bullish. I don’t hold through earnings typically.

CALITHERA BIOSCIENCES (CALA) Time cycle switch here should see some upside. Price targets on chart. $CALA #swingtrade

#swingtrading #charting #tradecoaching

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Swing Trading Report Wed June 13 Part A: $CELG, $AMBA, $COTY, $FSLR, $AAOI more …

Welcome to Compound Trading Swing Trading Report Wednesday June 13, 2018 Part A.

In this issue; $CELG, $AMBA, $COTY, $FSLR, $AAOI and more …

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good day!

This swing trading report is one in five in rotation. This is part A.

The reports are in the process of upgrades to included buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators (MACD, Stochastic RSI, Squeeze Momentum Indicator represented at bottom of chart) double click on chart body – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue..

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

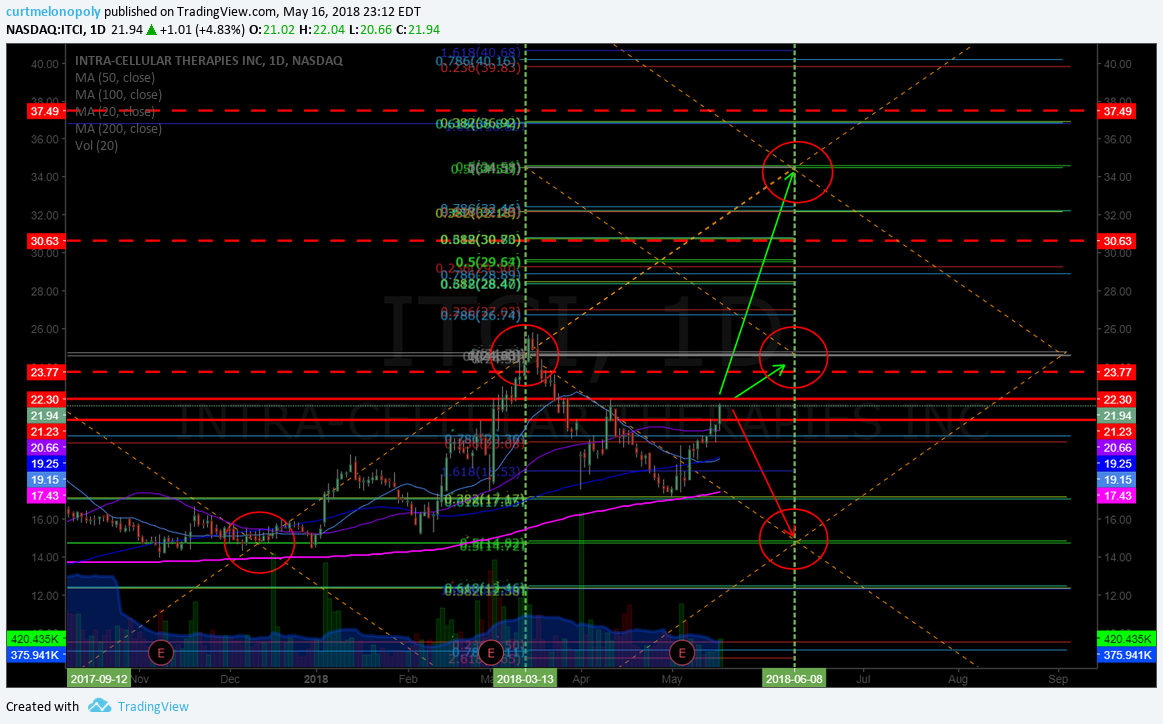

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

$AMBA – Ambarella Inc.

June 13 – Ambarella (AMBA) If this holds 40.10 in to June 21 time cycle it will bounce on other side of that. $AMBA #snapback #washout #swingtrading

April 29 – I published a two part special report on the $AMBA swing trade, you can find them below. As the trade proves out I will post member exclusive set-ups and alerts. Could be a good one here.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Part 2 – The Battle Plan | How to Trade the $AMBA Move

Summary of the trade set-up on AMBA:

$AMBA closed April 27 at 46.75.

Trend Change: This set-up is a long over 49.50 (if 49.50 area is held) for a major trend change to the upside. Resistance is at 51.50 area in this scenario (trim in advance and add over).

or for Active Trading: This is a long over 47.25 in to resistance near 49.40 (trim in advance and add over).

Be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points.

On the short side for a day trade… Friday’s close was 46.75 and the next support is in the 44.55 range… so if there is pressure on the stock in premarket or at open Monday then a short in to the 44.55 support may work out. But be cautious, this thing has science all over it saying that a snap-back is very possible and it should be vicious when it starts.

Support and Resistance Levels – I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers.

Note also the “trading quad walls”. These are Fibonacci based diagonal trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for June 10, 2018 time cycle peak are 58.60 (bullish), 49.40 (moderate), 40.13 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

The MOST INTERESTING THING about this set-up is the possibility for a trend reversal based on a simple wash-out down trend with a snap-back that could see a significant three to six month trend to the upside.

In Part 3 (for our Swing Trading Members) I will cover that scenario for significant gains should that transpire.

Also… pay attention to the downside bearish scenario playing out here. If that occurs I will do a Part 3 specific to that and include a detailed trading plan.

My Personal Earnings Rule: 95% of the time I will not hold in to earnings. Trade your plan however you wish.

Mar 21 – $AMBA swing trade technically perfect 54.72 targets 58.66 Mar 30 . Chart Notes.

https://www.tradingview.com/chart/AMBA/rOpynBS5-AMBA-swing-trade-technically-perfect-54-72-targets-58-66-Mar-30/ #swingtrading #pricetargets

Feb 20 – $AMBA over 49.40 is a buy and below a sell – currently testing support resistance area.

Feb 20 – $AMBA Not a great risk reward chart set up here with MACD and SQZMOM up and Stochastic near top. #trading

AMBA buy sell triggers.

40.10 Primary

49.45 Primary

51.70

54.66

57.57

58.56 Primary

63.00

65.68

67.53 Primary

$COTY

June 12 – COTY. Double historical bottom with MACD turn on the Daily Chart. $COTY #swingtrading

Even though I don’t like the stock and I don’t think it will bounce far I think it will, and I may the setup seriously here and o for a near term swing trade if it firms.

April 29 – This $COTY chart is a nightmare, will likely bounce to 200 MA soon. But I may discontinue coverage soon also. Watching.

$FSLR – First Solar

FIRST SOLAR (FSLR) Weekly under key historical resistance. Not enough ROI yet to engage. $FSLR #swingtrading

If this dumps in to an area of acceptable return – goes on a wash-out, then I’ll look at a long side trade on a wash-out snap-back scenario.

First Solar a Steal, SunPower Less Sunny: Analysts By Shoshanna Delventhal | June 12, 2018 — 10:36 AM EDT

April 29 – $FSLR trading closed Friday 77.90 and is in break-out on the daily. We’ll look at the weekly and find resistance to watch for.

April 29 – $FSLR on the weekly chart – between here and 86.00 imo is pensive… however, it seems to have the indications to do it. Over 86 long. If I had to predict what’s next… the pull back is near and at each turn up after a pull-back it’s a long. And then if and when it gets up over 86.00 it’s a structured trade to the upside. At that point (over 86.00 held) I will chart the trade structure with specific lower time frame support and resistance and price targets along with time-cycles etc.

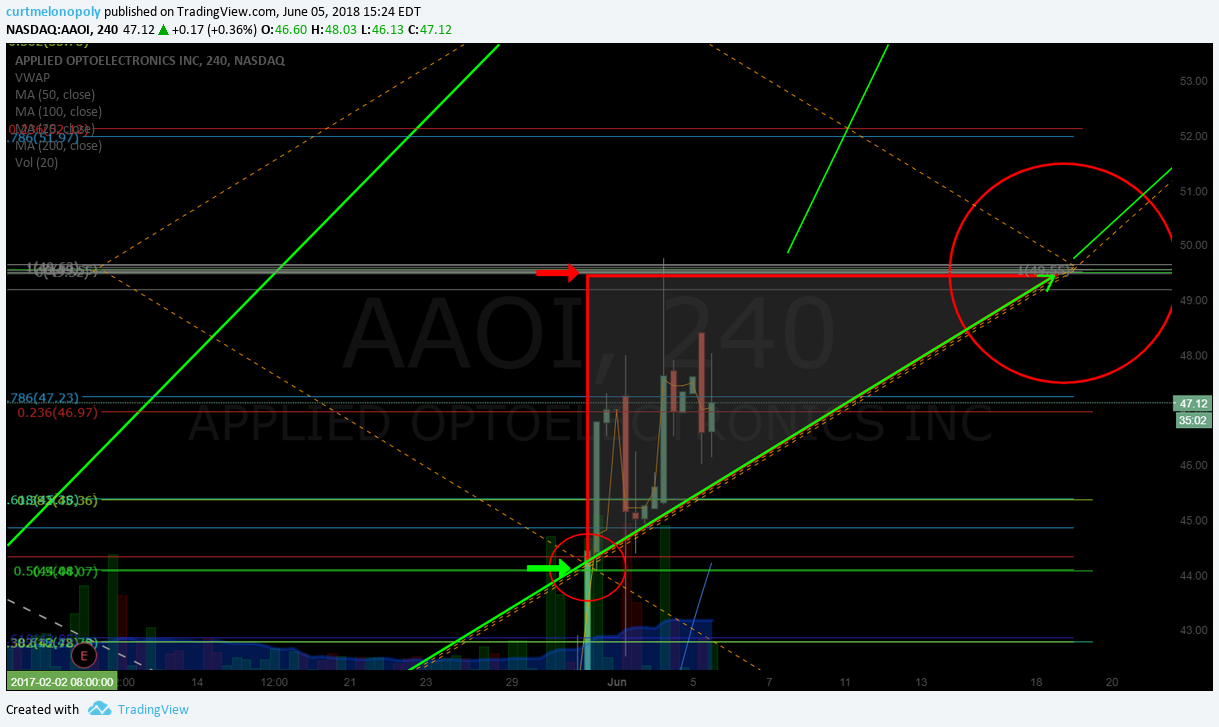

$AAOI – Applied Opto Electronics Inc

June 13 – APPLIED OPTOELCTRONICS (AAOI). 49.50 July 5 target in play trading 43.52 intra. Trim in to that key resistance and add above. $AAOI #swingtrading

How Applied Optoelectronics Inc. Stock Rose 46% Last Month

Motley Fool

Anders Bylund, The Motley Fool

Motley Fool June 12, 2018

https://finance.yahoo.com/news/applied-optoelectronics-inc-stock-rose-165800531.html?.tsrc=rss

April 29 – $AAOI closed the session Friday 33.76 above main trading area support around 27.50

This $AAOI chart went out to the private server on April 23, 2018;

$AAOI over 32.90 targets 39.18 then 40.66. Watch for 50 MA overhead. (purple)

$AAOI over 20 50 100 MA, indicators trending (MACD, Stochastic RSI, SQZMOM, above mid quad Fibonacci diagonal support are all bullish. Watch quad Fib downtrending trendline, FIB horizontal resistance lines and especially 200 MA on way to July targets.

I prefer the upper target as long as trade can breach the 200 MA.

$AAOI News: SUGAR LAND, Texas, April 18, 2018 (GLOBE NEWSWIRE) — Applied Optoelectronics, Inc. (AAOI), a leading provider of fiber-optic access network products for the internet datacenter, cable broadband, telecom and fiber-to-the-home (FTTH) markets, today announced that it will release financial results for its first quarter ended March 31, 2018 on Tuesday, May 8, 2018.

$AAOI News: Applied Optoelectronics, Fiber-optic network provider Applied Optoelectronics Inc (NASDAQ: AAOI) has been a regular on the FIS Astec list for months. Utilization jumped 23 percent last week, pushing short interest up to 92 percent of available shares.

Mar 21 – $AAOI Sitting on 200 MA on weekly chart. If it bounces watch for 20 MA upside resistance. #watchlist #swingtrading

This is my nemesis from 2017 and now in to 2018. I am absolutely convinced this will run to at least the mid 45s this year, if not more. Earnings will be the turn imo (at latest) in about 45 days ish.

At least I admit the conviction trade struggles 🙂

$HIIQ – Health Ins Innovations

June 12 – Health Innovations (HIIQ) What a great trading structure in channel hitting mid targets. Watching. $HIIQ chart. #swingtrade

I really have no excuse for missing the long side trade on the most recent run. I’ve caught it earlier in its bullish trend but this last run I missed all together.

April 29 – $HIIQ under pressure with ER in 3 days. Bias to a downside dump in to earnings and upside targets 31.15 maybe 35.70 Aug 10 – but post earnings price action will tell the story.

Mar 21 – $HIIQ What a sweet trade for our swing trading members…. hit first and second targets near perfect boom town. #swingtrading #tradingtowin

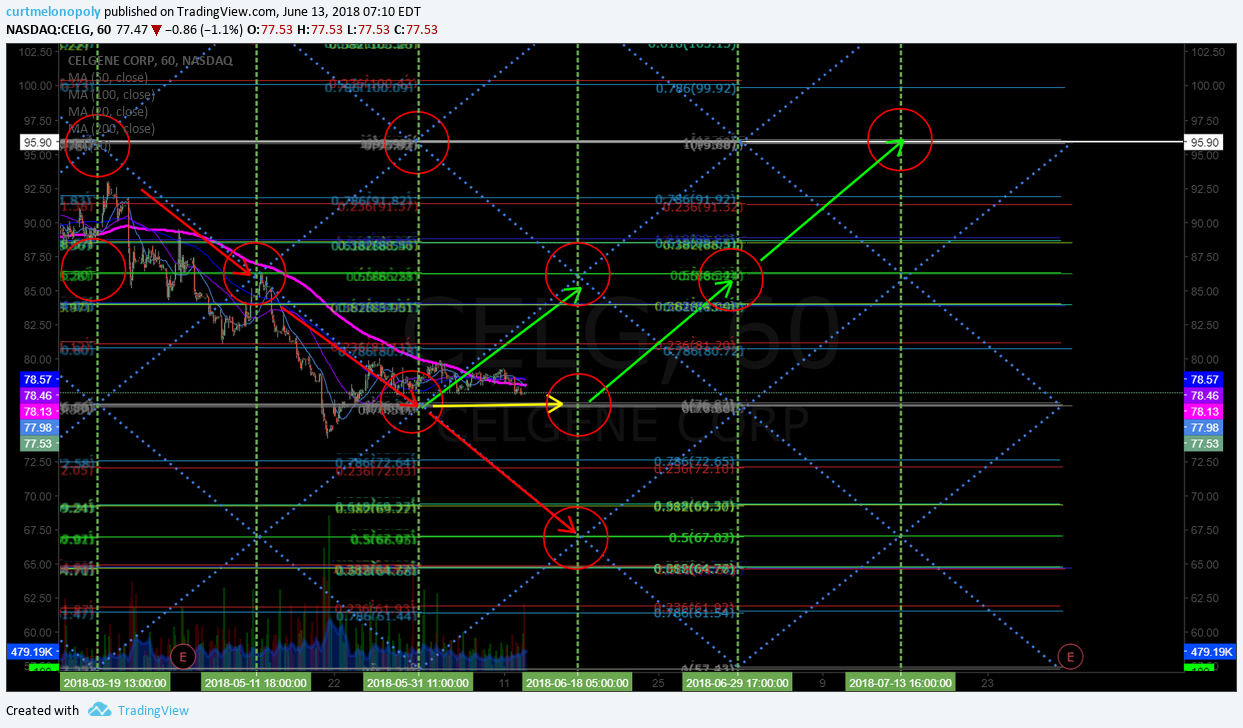

$CELG – Celgene

June 12 – CELGENE (CELG) It is very possible we get a reversal here. Needs to hold that mid quad suppot. #swingtrading

June 12 – CELGENE (CELG) If you do get a reversal here, this is your likely up channel with price targets. #swingtrading

April 29 – $CELG with earnings in 4 days. Upside bias 105.41 downside 86.09 June 9 time cycle pending earnings price action.

Of special note with this set-up is where trade closed Friday (91.18). This specific area of the chart is a volatile area (see yellow circles to left). There are large gaps between Fib support and resistance areas. Prepare for volatility in to earnings.

I think it’s likely we see lift in to earnings. But as always trade price direction in to most logical target between support and resistance as noted on chart.

April 8 – $CELG 86s to 91s off real-time alert, buy sell trigger now. Looking for next price target in time cycle. #swingtrading

Trade wasn’t bullish enough to get to last price target BUT nonetheless it was a decent buy side trade alert in to the most recent time cycle.

Refer to my last real-time swing trading alert post on $CELG here: https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/

Now trade is sitting right on top of a mid quad price support (signalling a decision area). When price exits a time cycle and is at the mid quad this signifies the bull bear fight at the buy sell trigger. If it was trading / trending under I could confidently alert a short side trade in to the next time cycle. The same works above the quad support to the next upside bullish price target in to the next time cycle. In this instance, trade is not signalling yet which way we are going.

I will real-time alert the set-up as it concludes over the coming days.

My personal trader bias is short in to next downside price target in to next time cycle peak (see vertical dotted green lines for time cycle conclusions).

1:21 PM – 8 Apr 2018 $CELG 86s to 91s off alert, buy sell trigger now. Waiting for trade direction triggers. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

https://twitter.com/SwingAlerts_CT/status/983031984753692672

5:56 PM – 26 Mar 2018 $CELG hit last price target – targets 95.90 Apr 3. Chart notes. https://www.tradingview.com/chart/CELG/RwZItPb8-CELG-hit-last-price-target-targets-95-90-Apr-3-Chart-notes/ …

https://twitter.com/SwingAlerts_CT/status/978390139201302529

Mar 26 –

$CELG Celgene 2.58% hit our last price target and now $CELG targets 95.90 April 3 peak time cycle on 60 minute chart as most probable with MACD turned up on daily. Trading 87.03 intra. If it fails trade in direction of the possible targets. #swingtrading

Use the chart model to trim and add at horizontal Fibonacci support and resistance and watch the blue diagonal trend-lines for support and resistance also.

$CELG targets 95.90 April 3 as most probable with MACD turned up on daily. Trading 87.03 intra.

Feb 20 – $CELG under 96.00 resistance is bearish to 86.00 support Feb 28 cycle peak. 60 Min stock chart.

Jan 7 – $CELG So far in this washout very indecisive trade – watching for 60 min time cycle peaks for trade lift to bring time frame out for swing trade.

In other words, as soon as trade gets bullish on the 60 minute time-frame then I can chart the daily time frame for a proper swing trade. So I am watching the mid quad time cycle peaks for possible lift for a clue to begin trading it and move to a daily time-frame chart for a swing trade post wash-out.

$LITE – LUMENTUM

April 29 – Per last report “From here $LITE targets 64.95 April 6 with MACD turned down” and … yes it hit that target near perfect.

$LITE With earnings in 2 days it seems oversold. Expect a bounce at quad wall. Bias to 105.41 June 4. Bearish 86.09.

March 26 – Doesn’t get much better than this. Great trade set-up for our swing trading platform, hit upper target and more (early), was alerted on report Feb 20 for Apr 9 PT. $LITE #swingtrading

From here $LITE targets 64.95 April 6 with MACD turned down, but IMO doesn’t get the whole way.

$CALA – Calithera Biosciences

May 13 – $CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

This is quite amazing actually. With so much pressure to downside it is remaining structural. Great short trade but risk reward is diminishing as it nears it’s previous lows from Dec 2016. Watching for a bounce now.

News: Calithera Biosciences Inc (NASDAQ:CALA): Is Breakeven Near? https://finance.yahoo.com/news/calithera-biosciences-inc-nasdaq-cala-003530591.html?.tsrc=rss

Mar 26 – $CALA trending toward lower target and indecisive, but MACD may turn up here. Needs at least 8.30 for upside.

Feb 20 – $CALA Continues under pressure targeting lower targets on price cycle termination. Buy sell triggers on chart.

$XRT – SPDR S&P Retail ETF

May 13 – $XRT Under 45.00 is a short bias and over 46.00 is long bias. Retail ETF.

March 26 – $XRT short set up at 44.90 area if price gets there. Under significant structural pressure now. #swingtrading

Jan 7 – $XRT Nice clean mid quad price time target hit on this daily swing trading chart model. #swingtrading

$XRT Symmetry suggests 41.36 ish May 2019 but be sure to trade with price action. As trade leaves this target area I will chart lower time frames as the trade gives indication to up or downside. Chart link below FYI (from previous reports).

Dec 7 – Stoch RSI on $XRT daily has turned down so there is a chance that the lower target for Jan 8 2018 hits at 41.00 FYI on watch

$EXP Building Materials

May 13 – With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

Also of note; when it recently bottomed it was technically perfect to the buy trigger noted on the chart (white arrow) and now trade is above the 200 MA on daily chart. It is set to rocket if earnings are received well by the street.

Mar 26 – $EXP 118.00 or 140.00 Oct 30 2018 with MACD turned up and above 200 MA with volume.

Main Buy Sell Triggers:

140.00

118.00

95.60

73.37

$FIT – FITBIT

May 13 – Trading 5.21 with flat indicators and bottom ish pattern that doesn’t look healthy. Alarmed and ready if it moves.

Mar 26 – $FIT near its previous lows, may get a bottom bounce soon. Watching Stoch RSI for a trade.

$VFC

May 13 – Trading 77.94 with MACD on daily trending down. Won’t look at it until MACD crosses up.

Mar 26 – $VFC on weekly looks like it has some chop left. No trade.

Alphabet (Google) $GOOGL, $GOOG

May 13 – $GOOGL bounced perfectly early April at the buy sell trigger, now at the next buy sell trigger. Above long and below short.

Mar 26 – $GOOGL interesting how it hit that quad wall support and bounced back over 200 MA. Price targets on chart. #swingtrading

As long as it holds that 200 MA it should be either 1218.00 or 1319.00 for July 11 time price cycle peak on Google chart.

Amazon $AMZN

May 13 – $AMZN near all time highs. Watching for structure on break-out. To be determined.

Mar 26 – $AMZN Keep it easy on this and assess when Stoch RSI on daily turns. Very easy trade for decent RR.

OakTree Capital $OAK

May 13 – Trading 40.05 indicators are flat – on watch for a trade.

Mar 26 – $OAK Risk reward near long side now, watching for Stoch RSI to turn on weekly. #swingtrading

VanEck Vectors Russia ETF $RSX

May 13 – Keenly watching $RSX trade for a breach through 200 MA with structure. On watch.

BOFI Holdings $BOFI

May 13 – $BOFI chart has the ingredients for a structured break-out of previous highs here. Watching very close now.

Mar 26 – $BOFI Great trading set-up from earlier this year. Indicators extended and long side RR is limited. No new trade. Weekly chart shown.

Jan 9 – $BOFI Very near upside break out in to earnings. On high watch now. I will alert and chart if trade starts.

US Silica Holdings $SLCA

May 13 – $SLCA is still indecisive relative to risk reward IMO. Watching.

Mar 26 – $SLCA trading 25.08 with indecisive indicators on all time-frames

Jan 9 – $SLCA Will likely start a long position today on this set up. Will alert and chart the trade if so.

$EOG EOG Resources

May 13 – $EOG Yet another great trade set up from this year, on watch for structured upside break also.

Mar 26 – $EOG watching resistance on weekly just under 109 for upside or downside trade. #swingtrading Upside targets 134.00 area and downside 83.00 area.

$GREK Global Greece ETF

May 10 – $GREK Watching for strength in a move over 200 MA on weekly chart.

Mar 26 – $GREK on weekly is a short when Stoch RSI peaks and turns down if price under 200 MA. Watching.

$TRCH Torchlight Energy

May 13 – Trading 1.20 indecisive.

Mar 26 – Trading 1.36 indecisive.

Jan 9 – Trading 1.26 indecisive but that could change soon.

$NG Nova Gold

May 13 – Trading 4.90. As with previous report… it is moderately bullish but RR isn’t the best.

March 26 – Trading 4.68 has some bullside indications for follow-through but I’m not convinced at this point. Watching only.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

To register as a swing trading member click here.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $CELG, $AMBA, $COTY, $FSLR, $AAOI

PreMarket Trading Plan Wed June 6: #EIA, OIL, $TSLA, $AXON, $LAC, $AAPL, $FIT, $WYNN, $AAOI, $MXIM more

Compound Trading Premarket Trading Plan & Watch List Wednesday June 6, 2018.

In this edition: #EIA, OIL, $TSLA, $AXON, $LAC, $AAPL, $FIT, $WYNN, $AAOI, $MXIM and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

June 6 – How to Swing Trade Like the Pros and Win Over 90% of Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Next sessions recommence week of Monday June 4, 2018 as coding team is preparing new environment. Applicable members will begin to receive notice as sessions commence.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: HPQ, SIG, CI, TWTR, AMBA & more

Stocks making the biggest moves premarket: HPQ, SIG, CI, TWTR, AMBA & more https://t.co/ZvM31Mb05S

— Melonopoly (@curtmelonopoly) June 6, 2018

24 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/11837258 $AXON $VBLT $NCS $EXAS $SIG $FIVE $AMBA $IMGN $OLLI $YELP $TWTR

24 Stocks Moving In Wednesday's Pre-Market Session https://t.co/ihk2ALO9ZB $AXON $VBLT $NCS $EXAS $SIG $FIVE $AMBA $IMGN $OLLI $YELP $TWTR

— Benzinga (@Benzinga) June 6, 2018

$TSLA getting a boost in pre-market trading on the back of its annual shareholder meeting

$TSLA getting a boost in pre-market trading on the back of its annual shareholder meeting pic.twitter.com/IcPzm9h2Jf

— Trading Nation (@TradingNation) June 6, 2018

Market Observation:

As of 8:35 AM: US Dollar $DXY trading 93.57, Oil FX $USOIL ($WTI) trading 65.10, Gold $GLD trading 1299.00, Silver $SLV trading 16.66, $SPY 275.70, Bitcoin $BTC.X $BTCUSD $XBTUSD 7631.00 and $VIX trading 12.2.

Momentum Stocks to Watch:

News:

Athenahealth CEO Jonathan Bush to exit, company in search for new leader, exploring strategic alternatives –

Athenahealth CEO Jonathan Bush to exit, company in search for new leader, exploring strategic alternatives – https://t.co/i3QRvczJTI

— Melonopoly (@curtmelonopoly) June 6, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$YY $PANW $AVGO $DVMT $SIG $THO $OKTA $FIVE $DLTH $CLDR $HDS $AMBA $NAV $HQY $SJM $KNOP $COUP $FCEL $MTN $GWRE $HOME $OLLI $FRAN $GIIi $CPST $GCO $CSWC $VRA $FGP $ASNA $HLNE $NX $ROAD $MDB $SFIX $COO $SCWX $UNFI $SEAC $NCS $ZUMZ

#earnings for the week$YY $PANW $AVGO $DVMT $SIG $THO $OKTA $FIVE $DLTH $CLDR $HDS $AMBA $NAV $HQY $SJM $KNOP $COUP $FCEL $MTN $GWRE $HOME $OLLI $FRAN $GIIi $CPST $GCO $CSWC $VRA $FGP $ASNA $HLNE $NX $ROAD $MDB $SFIX $COO $SCWX $UNFI $SEAC $NCS $ZUMZhttps://t.co/r57QUKKDXL https://t.co/hSEAqcOvwb

— Melonopoly (@curtmelonopoly) June 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart.

If AQMS gets over 50 MA (purple) on Weekly chart targets 9.38 Aug 13, 2018. Bullish scenario.

Volatility Index (VIX). Weekly chart suggests mid July time cycle peak could bring long side RR adv soon. $VIX #chart #symmetry

Markets are so machine controlled now 15 of 19 of these symmetrical targets $SLV $USLV $DSLV #Silver #Chart #Symmetry

US Dollar Index (DXY). Algorithm structure in play on daily chart. Trade inside geometric structure (red). #algorithm $DXY #Chart

LITHIUM AMERICAS CORP (LAC). Primary range support today, bounce, test 20 MA res, targets 7.80 Jan1 trading 5.54 intra. $LAC #swingtrading

APPLIED OPTOELECTRONICS (AAOI). Flexing structured move again today. Charting in advance of move – not after. Think GPS. $AAOI #daytrading #swingtrading #towin

MAXIM INTEGRATED PRODUCTS (MXIM) Short side trade went. Bulls in it bounced b4 50 MA weekly. $MXIM #swingtrading

WYNN RESORTS (WYNN) On watch for washout snapback day and swing trade long as it nears 200 MA on daily. Model to follow. $WYNN #chart

Oil Algorithm (EPIC). Thanks for coming out. Perfect price target hit. Boom. June 5 1145 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

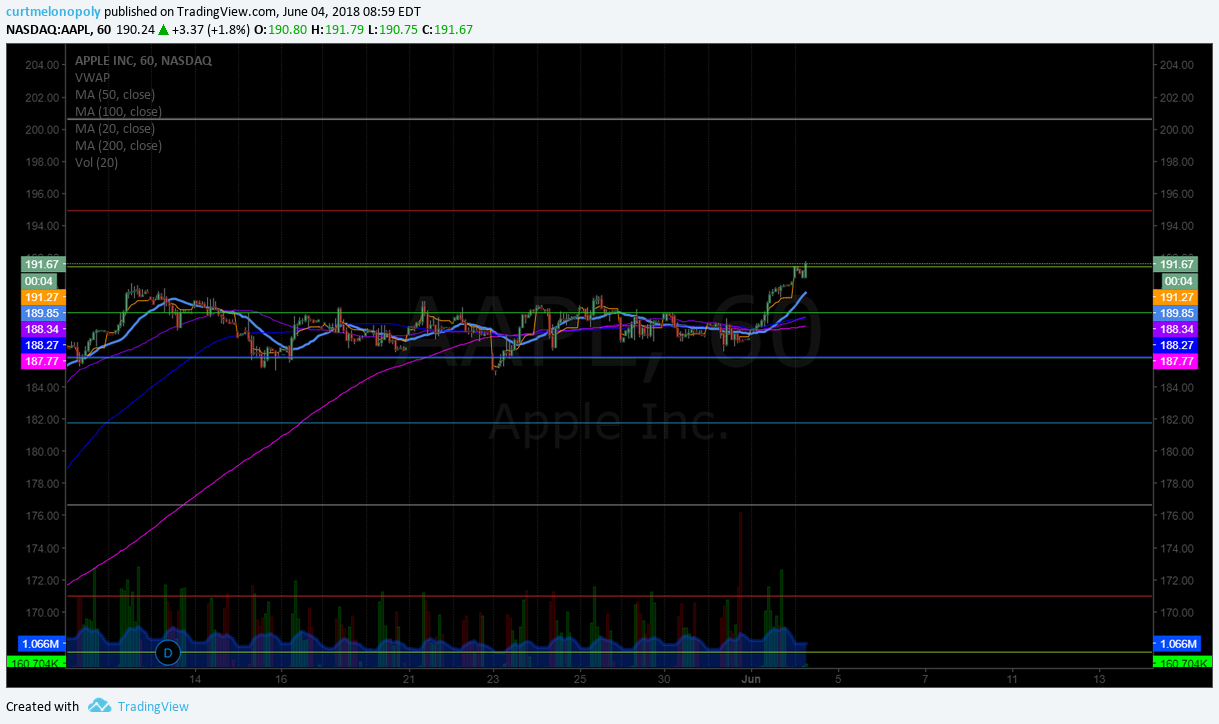

$AAPL premarket over 191.44 intra resistance trading 191.67 premarket. Next resistance near 195.00 #daytrading #swingtrading #chart

SP500 (SPY) Chart – Trade above moving averages but MACD is turned down on daily. $SPY $ES_F $SPXL $SPXS #SPY #Chart

Oil Chart (Weekly). The validity of this trendline work is ambiguous, but something to watch. June 4 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Monthly). Trade struggling with pivot. Trade rest on 200 MA under pivot. June 3 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Algorithm Model (Weekly Gen 1). 20 MA and Fibonacci support test in progress. June 3 1014 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Anyone remember this tweet from last September. Last time oil had 200 MA w 20 MA breach, price ripped 39.80s to 51.50s fast (6 weeks). $USOIL $WTI $CL_F #OIL #OOTT $UWT $DWT

Oil Chart (Daily). K.I.S.S. charting says short bias since MACD turned May 22, 2018. FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Facebook trade – longs should be trimming in to resistance, add above 189.75 for 195.88 June 5 most bullish target. #swingtrading $FB

$IBB on the move trading 108.93 with 112.80 Fib and quad wall resistance. #swingtrading

Trading $AAOI – over 49.55 and holds a close has two upside bullish scenarios. Closed at intra res today. #swingtrading

$GOOGL right up against key resistance – trim in and add above to next. #swingtrading #daytrading

$IBB daytrading levels 112.38 une 29 likely target on upside move. 109.04 intra resistance. #daytrading

$ATHM swing traders need to trim heavy into 114.64 quad wall and Fib test. July 30 mid quad PT 110’s on retrace #swingtrading

Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. #swingtrading #setups

With MACD turn up and testing under 200 MA this is the test. Above 200 MA add to long #GOLD #CHART $GC_F $XAUUSD $GLD

Gold monthly chart saga continues. Wow. $XAUUSD $GLD $GC_F $GLD $UGLD $DGLD #Gold #Chart

Apple support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

US Dollar Index Weekly chart 200 MA resistance is long side swing trade trim area. $DXY $UUP #USD

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/O5d7rnLERb

— Benzinga (@Benzinga) June 6, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AXON $CLRB $VBLT $IFON $SNES $MBRX $SIG $MEIP $DVN $BVSN $MYO $SCYX $VRA $EXAS $HUYA $USLV $TSLA $CGC $OCUL $TRXC $SBGL $X $SNAP $IQ

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, #EIA, OIL, $TSLA, $AXON, $AAPL, $FIT, $WYNN, $AAOI, $MXIM

PreMarket Trading Plan Mon June 4: $AAPL, $TSLA, $SPY, OIL, $FB, $IBB, $GOOGL, $AAOI more.

Compound Trading Premarket Trading Plan & Watch List Monday June 4, 2018.

In this edition: $AAPL, $TSLA, $SPY, OIL, $FB, $IBB, $GOOGL, $AAOI and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Next sessions recommence week of Monday June 4, 2018 as coding team is preparing new environment. Applicable members will begin to receive notice as sessions commence.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: MSFT, FB, DAL, BA, MGM, WHR & more https://cnb.cx/2JrDpLn

Stocks making the biggest moves premarket: MSFT, FB, DAL, BA, MGM, WHR & more https://t.co/b4FFIDRSjT

— Melonopoly (@curtmelonopoly) June 4, 2018

5 Stocks To Watch For June 4, 2018 https://benzinga.com/z/11820021 $ASNA $BIG $DVMT $PANW $NX

5 Stocks To Watch For June 4, 2018 https://t.co/ZzzNhP4wBC $ASNA $BIG $DVMT $PANW $NX

— Benzinga (@Benzinga) June 4, 2018

Market Observation:

As of 8:35 AM: US Dollar $DXY trading 93.71, Oil FX $USOIL ($WTI) trading 65.51, Gold $GLD trading 1296.76, Silver $SLV trading 16.49, $SPY 274.60, Bitcoin $BTC.X $BTCUSD $XBTUSD 7375.00 and $VIX trading 13.6.

Momentum Stocks to Watch:

News:

Palatin shares surge 9% premarket after FDA accepts for review treatment for HSDD

$VSAR Versartis Enters into Merger Agreement with Aravive Biologics to Form a Clinical-Stage Biopharmaceutical Company Advancing Innovative Oncology Therapeutics

$INFI Reports IPI-549 Clinical and Translational Data from Ongoing Phase 1/1b Study #ASCO18

$CUR Announces Publication of Data From First-In-Human Study of Human Neural Stem Cell Transplantation for Chronic Spinal Cord Injury

$VXRT Vaxart Reports Topline Results from Phase 2 Trial of Teslexivir™ for the Treatment of Condyloma

$EIGR Announces HDV Phase 2 Program Oral Presentation and Investigator / Key Opinion Leader Reception for Planned HDV Phase 3 D-LIVR Study at Global Hepatitis Summit 2018™

$CALA Results from Phase 1 Study of CB-839 in Combination with Capecitabine in Advanced Solid Tumors to be Presented at #ASCO18

WEX reaches agreement with Shell for new commercial fleet cards portfolio https://seekingalpha.com/news/3361325-wex-reaches-agreement-shell-new-commercial-fleet-cards-portfolio?source=feed_f … #premarket $WEX

$MYSZ My Size Launches BoxSizeID™ Measurement Technology for Rugged Hand Held Devices to Serve $343 Billion Shipping/Parcel Industry

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$YY $PANW $AVGO $DVMT $SIG $THO $OKTA $FIVE $DLTH $CLDR $HDS $AMBA $NAV $HQY $SJM $KNOP $COUP $FCEL $MTN $GWRE $HOME $OLLI $FRAN $GIIi $CPST $GCO $CSWC $VRA $FGP $ASNA $HLNE $NX $ROAD $MDB $SFIX $COO $SCWX $UNFI $SEAC $NCS $ZUMZ

#earnings for the week$YY $PANW $AVGO $DVMT $SIG $THO $OKTA $FIVE $DLTH $CLDR $HDS $AMBA $NAV $HQY $SJM $KNOP $COUP $FCEL $MTN $GWRE $HOME $OLLI $FRAN $GIIi $CPST $GCO $CSWC $VRA $FGP $ASNA $HLNE $NX $ROAD $MDB $SFIX $COO $SCWX $UNFI $SEAC $NCS $ZUMZhttps://t.co/r57QUKKDXL https://t.co/hSEAqcOvwb

— Melonopoly (@curtmelonopoly) June 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart.

$AAPL premarket over 191.44 intra resistance trading 191.67 premarket. Next resistance near 195.00 #daytrading #swingtrading #chart

SP500 (SPY) Chart – Trade above moving averages but MACD is turned down on daily. $SPY $ES_F $SPXL $SPXS #SPY #Chart

Oil Chart (Weekly). The validity of this trendline work is ambiguous, but something to watch. June 4 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Monthly). Trade struggling with pivot. Trade rest on 200 MA under pivot. June 3 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Algorithm Model (Weekly Gen 1). 20 MA and Fibonacci support test in progress. June 3 1014 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

Oil Chart (Weekly). SImple Fibonacci work suggests 64.50 support and 69.53 resistance are key . June 3 1037 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Anyone remember this tweet from last September. Last time oil had 200 MA w 20 MA breach, price ripped 39.80s to 51.50s fast (6 weeks). $USOIL $WTI $CL_F #OIL #OOTT $UWT $DWT

Oil Chart (Daily). K.I.S.S. charting says short bias since MACD turned May 22, 2018. FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Facebook trade – longs should be trimming in to resistance, add above 189.75 for 195.88 June 5 most bullish target. #swingtrading $FB

$IBB on the move trading 108.93 with 112.80 Fib and quad wall resistance. #swingtrading

Trading $AAOI – over 49.55 and holds a close has two upside bullish scenarios. Closed at intra res today. #swingtrading

$GOOGL right up against key resistance – trim in and add above to next. #swingtrading #daytrading

$IBB daytrading levels 112.38 une 29 likely target on upside move. 109.04 intra resistance. #daytrading

$ATHM swing traders need to trim heavy into 114.64 quad wall and Fib test. July 30 mid quad PT 110’s on retrace #swingtrading

Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. #swingtrading #setups

With MACD turn up and testing under 200 MA this is the test. Above 200 MA add to long #GOLD #CHART $GC_F $XAUUSD $GLD

Gold monthly chart saga continues. Wow. $XAUUSD $GLD $GC_F $GLD $UGLD $DGLD #Gold #Chart

Apple support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

$SPY using 100 MA on Daily as Support for Now. MACD looks to be turning down here. SP500

Oil trade in sell-off bounced off 200 MA on Monthly Chart as support for now. $USOIL $WTI $USO #OIL #OilTrading

64.91 Fibonacci level support and 20 MA should be watched on weekly charting. $USOIL $WTI $USO #OIL #OilTrading

US Dollar Index Weekly chart 200 MA resistance is long side swing trade trim area. $DXY $UUP #USD

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

New on http://bloomberg.com/deals this morning

– Microsoft set to announce deal for GitHub

– Nomad Foods buys Aunt Bessie’s

– GE picks Cummins, Kohler, KKR to bid for gas-engine business

New on https://t.co/z8xhAP5pFd this morning

– Microsoft set to announce deal for GitHub

– Nomad Foods buys Aunt Bessie's

– GE picks Cummins, Kohler, KKR to bid for gas-engine business pic.twitter.com/VFseat4wJN— Bloomberg Deals (@BloombergDeals) June 4, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).