Compound Trading Premarket Trading Plan & Watch List Friday September 14, 2018.

In this edition: $BABA, $NIO, $SHOP, $BOX, $DIS, $AAPL, $TSLA, $FB, $PRQR, $ARWR and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members.

- Friday Sept 14 – Trading Boot Camp Day 1

-

- The main trading room is reserved for Boot Camp Training attendees Fri, Sat, Sun. I’ll be live on mic live broadcast trading in main trading room #premarket 9:25 #daytrade momos, trading until approximately 11:00 AM, and at noon mid-day #swingtrading chart set-up reviews at 12:00. From 1:00 – 5:00 we start charting basics and any trading left for week and then Saturday and Sunday are intensive classroom days. If room is full message me so I can make room. GL today! Trading room link.

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

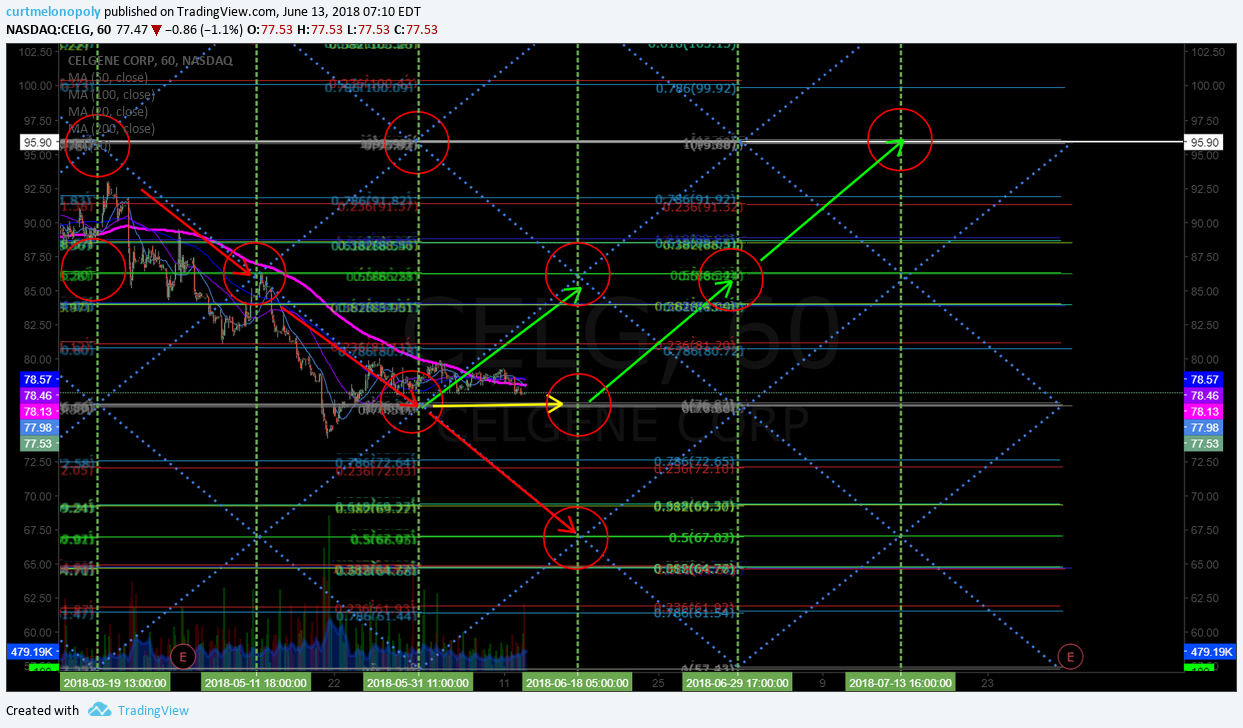

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

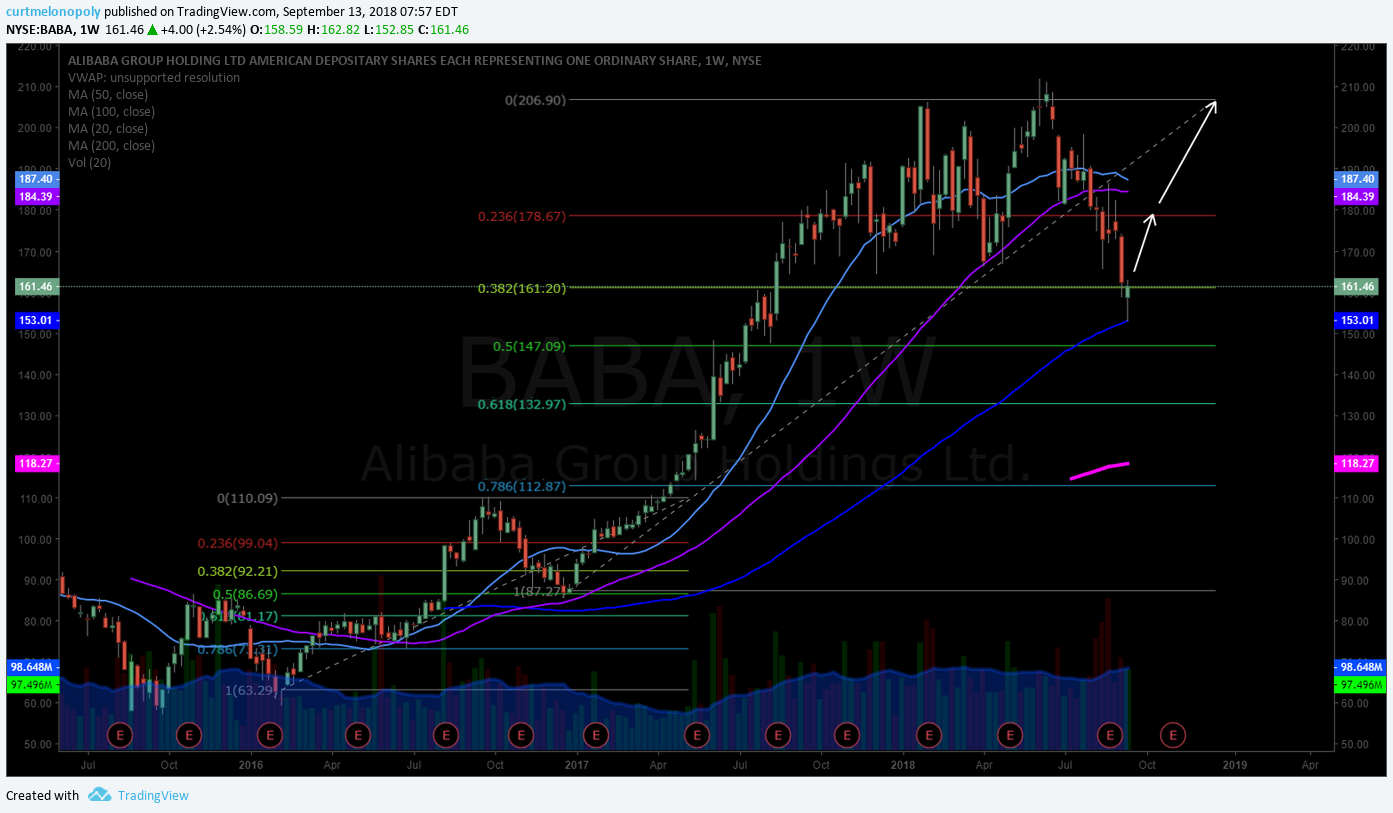

ALIBABA (BABA) swing trade alert is going well trading 167s premarket up from 165s start of swing.

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

Set ups in $BOX and $SHOP below are on watch.

$NIO premarket trading near yesterday highs (IPO).

Currently have oil on watch in premarket. Favor 69.83 for end of Friday at this point on FX $USOIL $WTI, currently trading at mid quad waiting on decision.

Per my suggestion yesterday there is continued reason for a possible inflection in Gold and Silver to bullish side. There are still some hurdles but it seems near. $GLD $SLV

Also per my suggestion yesterday… Bitcoin has been recovering, so BTC is also watch that at this point. As noted previous I am trying to position for a run in to December. $BTC $XBT. Morgan Stanley’s Bitcoin swaps launch has me intrigued.

If you missed premarket reports over last few days there were a number of swing trade set ups in there that could inflect and become decent trades.

Market Observation:

Markets as of 7:38 AM: US Dollar $DXY trading 94.54, Oil FX $USOIL ($WTI) trading 68.81, Gold $GLD trading 1205.66, Silver $SLV trading 14.18, $SPY 291.38 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6461.00 and $VIX trading 12.2.

#Futures tick higher on hopes of U.S.-China trade talks –

#Futures tick higher on hopes of U.S.-China trade talks – https://t.co/O6C4StNTVM

— Investing.com News (@newsinvesting) September 14, 2018

Momentum Stocks / Gaps to Watch:

Nio’s shares zoomed up 76 percent in the second day of trading after its IPO on the New York Stock Exchange. @KatrinaHamlin explains this unexpected, and implausible, U-turn:

https://www.breakingviews.com/considered-view/nio-zooms-from-carmaker-to-tech-star/

Nio's shares zoomed up 76 percent in the second day of trading after its IPO on the New York Stock Exchange. @KatrinaHamlin explains this unexpected, and implausible, U-turn: https://t.co/WFRJQHx10E

— Reuters Breakingviews (@Breakingviews) September 14, 2018

News:

Your Friday morning Speed Read:

– Amazon says it’ll decide on 2nd HQ location by year-end $AMZN

– Futures point to another spike for recently IPO’d electric vehicle co. $NIO, which rose as much as 95% Thursday

– Tomorrow’s the 10th anniversary of the collapse of #Lehman Bros.

Your Friday morning Speed Read:

– Amazon says it'll decide on 2nd HQ location by year-end $AMZN

– Futures point to another spike for recently IPO'd electric vehicle co. $NIO, which rose as much as 95% Thursday

– Tomorrow's the 10th anniversary of the collapse of #Lehman Bros. pic.twitter.com/ExM2Y3b5B7— Benzinga (@Benzinga) September 14, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Navios ceases plan for IPO on Nasdaq

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

Dave & Buster’s shares rise after earnings beat, guidance lifted

#earnings for the week

$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)

http://eps.sh/cal

#earnings for the week$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)https://t.co/r57QUKKDXL https://t.co/wHU5AlivAx

— Melonopoly (@curtmelonopoly) September 8, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

SHOPIFY (SHOP) Per Sean alert in live daytrading room yesterday $SHOP got over resistance today targeting 166s next #tradealerts #daytrade

BOX INC (BOX) Swing trading plan well in play with nice bounce off 50 MA on way to symmetrical price target. $BOX #Swingtrading #TradeAlerts

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

ALIBABA (BABA) from recent trade alert for weekly 100 MA bounce watch, up premarket trading 164.76. $BABA #tradealerts #premarket

NEMAURA (NMRD) Premarket trading 2.98 up 4.2%, up 32.7% yesterday hit daily 200 MA area and backed off in previous trade.$NMRD #daytrading.

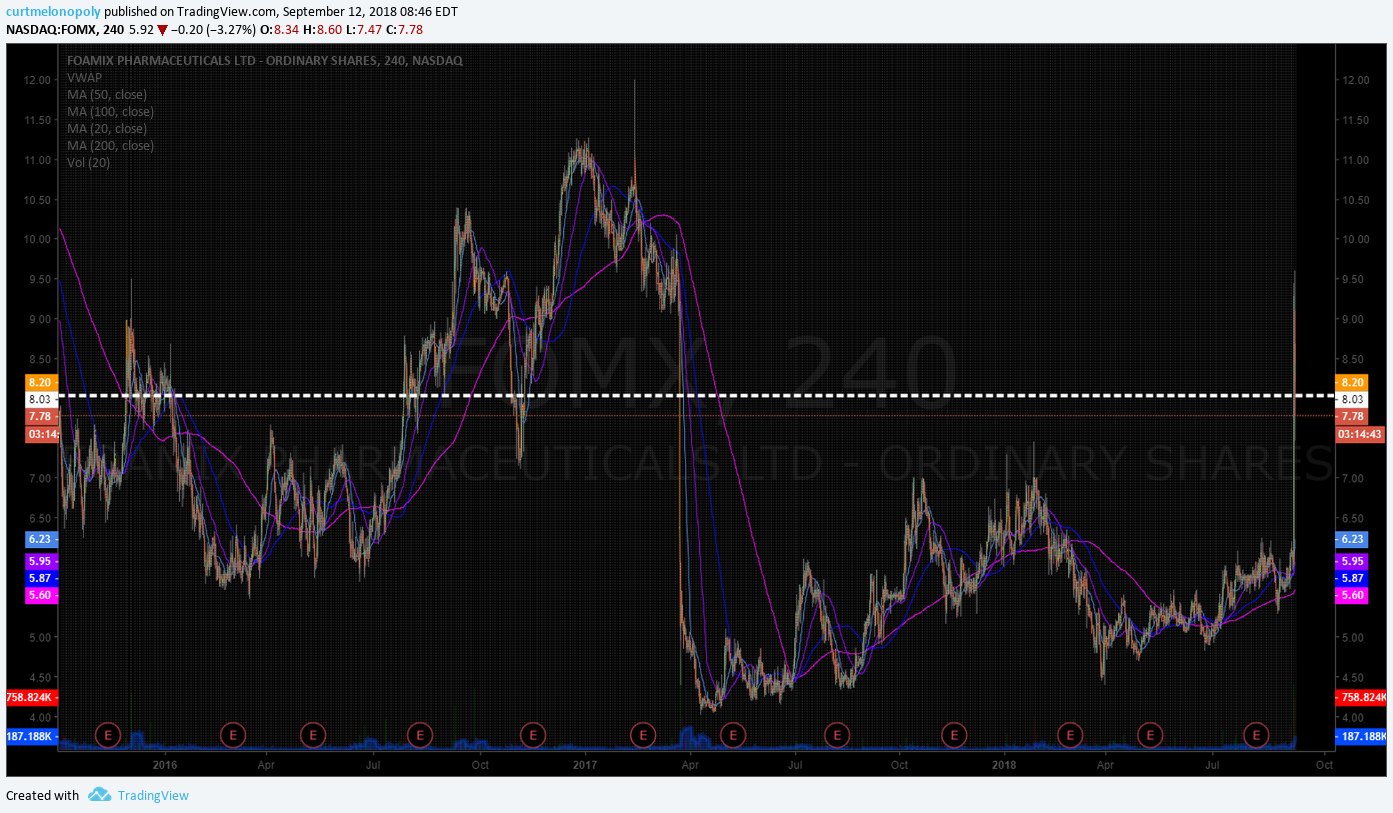

FOMIX PHARMA (FOMX) premarket up 31.4% trading 7.78 on positive results, resistance 8.00 range $FOMX #daytrading #stocks

XENETIC BIOSCIENCES INC Premarket near 200 MA support test after sel;-off, near time cycle peak Sept 14, possible turn $XBIO #swingtrade #daytrade #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up scenario Number 2. $XBIO #swingtrading #tradealert

FREDS INC (FRED) On day two of gap and go continued to struggle with 200 MA wall. $FRED #daytrading #swingtrade #premarket

PROQ THERAPEUTICS (PRQR) ran another 15% yesterday near a buy sell trigger resistance, trim in to it add above. $PRQR #swingtrading #daytrade

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

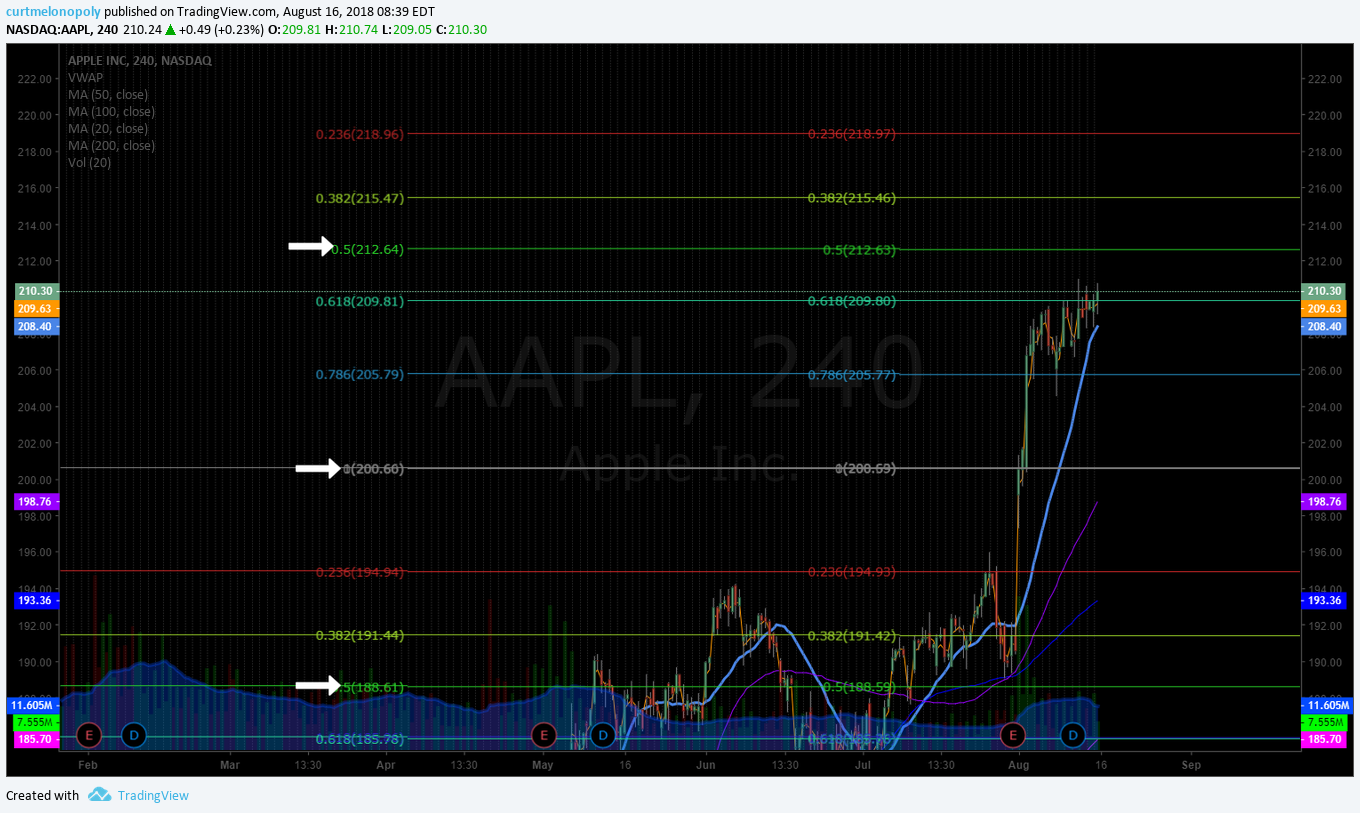

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ALIBABA (BABA) If no bounce at 100 MA that is near it is most probable to bounce in 147 range. $BABA #swingtrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

PROQ THERAPEUTICS (PRQR) premarket resistance watch at diagonal Fib line overhead and 22.75, above sees 27.55 implied $PRQR #swingtrading #daytrade

FREDS INC (FRED) Cleared 200 MA on daily, premarket next major resistance 50 MA on weekly. $FRED #daytrading #swingtrade #premarket

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

CLOUDERA INC (CLDR) Premarket up 6.5% trading 18.75 with 22.00 target. $CLDR #daytrading #swingtrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Florence hits Carolina

-Low trade talk hopes

-Carney’s Brexit warning

-Markets rise

-Data due

https://bloom.bg/2CU6pJF

#5things

-Florence hits Carolina

-Low trade talk hopes

-Carney's Brexit warning

-Markets rise

-Data duehttps://t.co/rh7ZNF2sQt pic.twitter.com/WGa5Dn4uKs— Bloomberg Markets (@markets) September 14, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

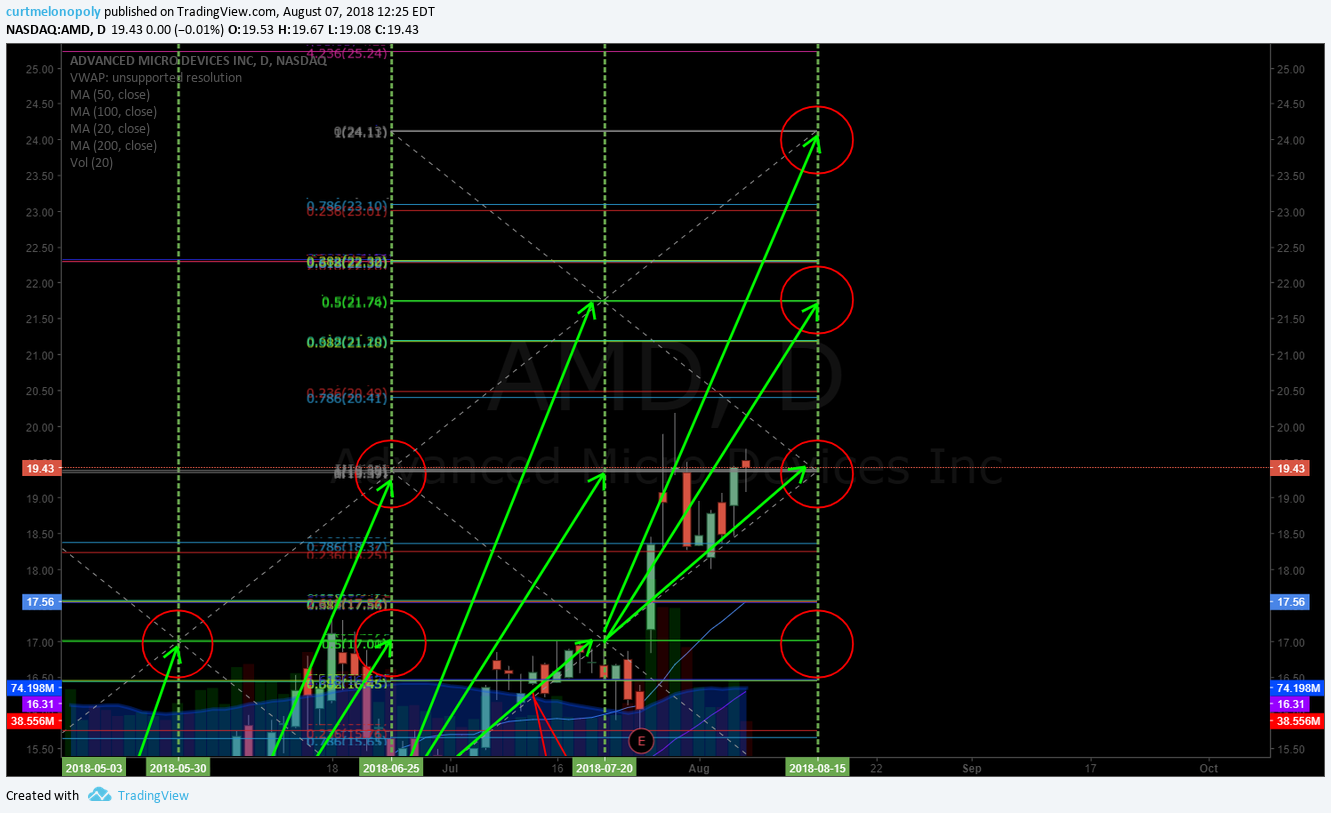

(1) Pre-Market Gainers Watch-List: $SHLD $NIO $RLGT $LPL $KNDI $YI $PIR $AMD $PLAY $MYSZ $TEUM $SHPG $WYNN $CLF $MHLD $MU $LVS $HUYA

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$ADBE $CMI $ZGNX $DISCA $GLW $YELP $SQ

$AMD (AMD) PT Raised to $40 at Argus; Shares Not Overvalued @Street_Insider

NVIDIA $NVDA PT Raised to ‘Street High’ $350 at Needham & Company; Fast Becoming the ‘Wintel’ for AI

Nvidia shares rise after analyst says ‘dominance’ in machine learning spells even more upside

Nvidia shares rise after analyst says 'dominance' in machine learning spells even more upside https://t.co/8M4vFFPrDc

— CNBC (@CNBC) September 14, 2018

(6) Recent Downgrades:

$LEN

$CTRP

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Alerts, $BABA, $NIO, $SHOP, $BOX, $DIS, $AAPL, $TSLA, $FB, $PRQR, $ARWR