Tag: $CGC

PreMarket Trading Plan Wed Oct 3: #EIA, Oil, WTI, USOIL, $BABA, $AAPL, $CGC, Gold more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday October 3, 2018.

In this premarket trading edition: #EIA, Oil, WTI, USOIL, $BABA, $AAPL, $CGC, Gold and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 3 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 3 – Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

$AAPL $BABA on watch with me.

Today is #EIA petroleum report at 10:30 looking for a large trade.

Gold, Silver and other reports out tonight likely trading them in to next week for a possible turn.

Per recent;

The $ROKU daytrade yesterday at market open went well.

Looking for a large long side oil entry at support on algorithm model.

That Square alert from yesterday went well. Nice trim area. I have it on watch with upgrade.

Volatility in to end of week on watch.

Other trading plan notes below.

SQUARE (SQ) swing trade is performing well in continuation of trajectory on chart – premarket trading 101.20 near 102.00 resistance from our 89.00 entry. Trim in to resistance add to trade above (if you are trimming at each resistance). The updated chart is below.

The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Oil trading plan is similar to last week, I am looking for a trade at / near bottom channel support. Last week it did hit near lower channel support at 71.85 FX USOIL WTI at around 8:30 AM Sept 28 and then took off (no execution), currently trading near upper channel resistance. I will do more day trading again also with oil.

Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

DISNEY (DIS) swing trade doing well, in to resistance area pre-market 117.17, trim in to add above $DIS. Good timing on this trade.

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO. Will only consider a smaller size but will consider another trade. This could be a bottoming pattern setting up. Yet to be seen though.

Bitcoin, the bottoming pattern continues, convinced that 5800 area is most probable bottom (alerted numerous times prior to it trading anywhere near there). Bottom line is that we’re expecting to trade it actively soon going in to Dec 24 time cycle peak and in to 1st Q 2019 aggressive.

Below are some trade position notes from recent weeks if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.48, Oil FX $USOIL ($WTI) trading 75.25, Gold $GLD trading 1203.12, Silver $SLV trading 14.72, $SPY 292.59 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6453.00 and $VIX trading 11.5.

Momentum Stocks / Gaps to Watch: $INTC

Top Gainers in #Premarket Hours $TRI $AA $PBR $PRTK $TLRY $EWZ $CGC $WP $LEN $BUD $STM $BIDU $BABA $TEVA $TNA https://marketchameleon.com/Reports/PremarketTrading/ …

News:

USA ADP Employment Change for Sep 230.0K vs 187.0K Est; Prior 163.0K.

$GM shares up 5.1 percent premarket after Honda joins with Cruise and GM to build new autonomous vehicle.

Paratek announces FDA approval of NUZYRA https://seekingalpha.com/news/3394702-paratek-announces-fda-approval-nuzyra?source=feed_f … #premarket $PRTK.

$NVCN Reports Positive 12-Wk Follow-up Data from First U.S. Patient Implanted with Neovasc Reducer.

$CVNA-Carvana Co(CVNA) said pre-market Wednesday that it has expanded into Myrtle Beach, South Carolina with the launch of its as-soon-as-next-day vehicle delivery service.The company said that the service will enable customers to shop more than 10,000 vehicles next day service

J.C. Penney spikes after naming former Joann Stores chief as new CEO $JCP $LOW $AMZN $JWN $M http://dlvr.it/Qm8yvm.

VistaGen shares surge 13% after FDA grants fast track status to non-opioid pain treatment.

IGC’s stock tumbles after near 6-fold run up in 5 day as share offering completed.

Canopy Growth unit in pilot to test medical marijuana in treating senior pain, cognitive function #swingtraading $CGC.

Canopy Growth unit in pilot to test medical marijuana in treating senior pain, cognitive function #swingtraading $CGC https://t.co/l4RlraM921

— Swing Trading (@swingtrading_ct) October 3, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

Lennar’s stock jumps after profit, deliveries rise above expectations

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

APPLE (AAPL) premarket testing highs, leading the charge. $AAPL #premarket #trading

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Crude Oil Monthly Chart testing 100 MA resistance. Oct 2 517 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

ALLERGAN (AGN) Looks like it may not be ready to retrace to bottom of channel in forecast, testing new highs.

SQUARE (SQ) premarket trading 101.20 near 102.00 resistance. Trim in to resistance add to trade above. Updated chart. $SQ #tradealerts

DISNEY (DIS) swing trade doing well, in to resistance premarket 117.17, trim in to add above $DIS #swingtrading #tradealerts

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO #swingtrading #tradealerts

CRONOS (CRON) MACD cross up on 240 Min Chart with decision near on chart timing, on watch $CRON #tradealert #swingtrading

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PROQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump tax probe

-Italian asset rebound

-May speech

-Markets mixed

-More Fed speeches

https://bloom.bg/2zO2WZz

#5things

-Trump tax probe

-Italian asset rebound

-May speech

-Markets mixed

-More Fed speeches https://t.co/RRuQLNkxzl pic.twitter.com/NMErwTzKc1— Bloomberg Markets (@markets) October 3, 2018

This bull market run has echoes of the late 1920s, Nobel Prize-winning economist Shiller says

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MNGA 76%, $VTVT 40%, $ELGX $NVCN $TRVN $PTIE $JCP $TRI $AA $PBR $PRTK $NIO $EWZ $TLRY

(2) Pre-market Decliners Watch-List :

DavidsTea -19% after issuing statement https://seekingalpha.com/news/3394695-davidstea-minus-19-percent-issuing-statement?source=feed_f … #premarket $DTEA.

Kala Pharmaceuticals down 12% on pricing 7.5M-share stock offering https://seekingalpha.com/news/3394737-kala-pharmaceuticals-12-percent-pricing-7_5m-share-stock-offering?source=feed_f … #premarket $KALA.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $WING $AMNB $AX $SF $WP $CHRA $TPX $WBS $FULT $TRGP $PSX $CI $SF $KORS $INTU

Eli Lilly $LLY PT Raised to $107 at BMO Capital.

Xilinx $XLNX PT Raised to $90 at BMO Capital.

21Vianet +1% as Jefferies starts at Buy https://seekingalpha.com/news/3394705-21vianet-plus-1-percent-jefferies-starts-buy?source=feed_f … #premarket $VNET.

Rosenblatt raises Ciena target, lowers Infinera’s on expected CenturyLink shift $CIEN $INFN $CTL http://dlvr.it/Qm97ZG.

Southwest Gas $SWX PT Raised to $80 at Citi Following Analyst Day

(6) Recent Downgrades: $CVIA $ORCL $HCLP $CVRR $HMC $VGR

Applied Materials $AMAT PT Lowered to $60 at Susquehanna

Amneal Pharmaceuticals $AMRX PT Lowered to $24 at Morgan Stanley

MercadoLibre $MELI PT Lowered to $340 at Susquehanna

Delta Air Lines $DAL PT Lowered to $67 at BofA/Merrill Lynch

Analog Devices $ADI PT Lowered to $108 at Morgan Stanley

Amphenol $APH PT Lowered to $100 at Morgan Stanley

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, #EIA, Oil, WTI, USOIL, $BABA, $AAPL, $CGC, Gold

PreMarket Trading Plan Wed Sept 19: #EIA, Oil, $NBEV, $TLRY, $CRON, $CGC, $TSLA, $SHOP, $MOMO, $XXII, $ROKU, $CARA more.

Compound Trading Premarket Trading Plan & Watch List Wednesday September 19, 2018.

In this edition: #EIA, Oil, $NBEV, $TLRY, $CRON, $CGC, $TSLA, $SHOP, $MOMO, $XXII, $ROKU, $CARA and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 19 – Lead trader is in the main trading room for market open, EIA oil inventory, mid day review and futures trading today.

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- The main live trading room going forward is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with our Lead Trader.The exceptions are; Trade Coaching Boot Camps, special Trading Webinars or if the lead trader is not available.

- Week of Sept 17 – New pricing published representing next generation algorithm models (existing members no change).

- Week of Sept 17 – Next generation algorithm models roll out (machine trading Gen 1).

- Week of Sept 17 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Week of Sept 17 – Trading Boot Camp Event videos become available on our website.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Week of Sept 17 – The previously recorded Master Class Videos will become available on our website.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

As I wrote the last few days I expected the trade set-ups from Trading Boot Camp to start alarming and they have, the markets have some really decent setups (see video reports the last few days).

Also, today is oil inventory #EIA day, so the oil trades are on high alert.

Have a trade in $CRON premarket per yesterday’s trade alert that is going well and there will likely be adds to that swing trade here at open today.

$BRKS has a triple support watch for me on chart structure.

Market Observation:

Markets as of 7:04 AM: US Dollar $DXY trading 94.61, Oil FX $USOIL ($WTI) trading 69.85, Gold $GLD trading 1201.48, Silver $SLV trading 14.17, $SPY 290.91 (previous close), Bitcoin $BTC.X $BTCUSD $XBTUSD 6267.00 and $VIX trading 12.7.

Momentum Stocks / Gaps to Watch:

$NBEV $TLRY $CRON $CGC $PYX $MJ

Molecular Templates’ stock soars after development deal with Takeda

Command Security’s stock rockets 44% after buyout deal to pace premarket gainers

Considering a marijuana-related investment? Some tips: http://ow.ly/FkgR30lJoqn

Considering a marijuana-related investment? Some tips: https://t.co/xmZNKk5aUu

— U.S. Securities and Exchange Commission (@SECGov) September 18, 2018

At $21 billion, Tilray’s market cap is now higher than 48% of the companies in the S&P 500.

At $21 billion, Tilray's market cap is now higher than 48% of the companies in the S&P 500. pic.twitter.com/COCz0Jn5Dt

— Charlie Bilello (@charliebilello) September 19, 2018

News:

The Finance 202: The stock market is shrugging off Trump’s trade war. That may not last.

Analysis | The Finance 202: The stock market is shrugging off Trump's trade war. That may not last. https://t.co/0ATdp4GB4X

— Melonopoly (@curtmelonopoly) September 19, 2018

DANSKE BANK, DEUTSCHE BANK, CITIBANK alleged conspired to launder billions of Russian and post-Soviet money 🔥🔥🔥 h/t @pdacosta

DANSKE BANK, DEUTSCHE BANK, CITIBANK alleged conspired to launder billions of Russian and post-Soviet money 🔥🔥🔥 h/t @pdacosta https://t.co/F09AmYLABm

— Eric Garland (@ericgarland) September 19, 2018

Tesla Criminal Probe Into Musk Tweet Seen Opening Pandora’s Box https://www.bloomberg.com/news/articles/2018-09-19/tesla-criminal-probe-into-musk-tweet-seen-opening-pandora-s-box?cmpid=socialflow-twitter-business&utm_campaign=socialflow-organic&utm_source=twitter&utm_content=business&utm_medium=social

Tesla Criminal Probe Into Musk Tweet Seen Opening Pandora’s Box https://t.co/sCSu985xbc

— Melonopoly (@curtmelonopoly) September 19, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Navios ceases plan for IPO on Nasdaq

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

#earnings for the week

$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK

#earnings for the week$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK https://t.co/r57QUKKDXL https://t.co/cAnHRobuy5

— Melonopoly (@curtmelonopoly) September 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

OIL 1 Min Chart $USOIL $WTI $USO $CL_F

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

NEW AGE BEVERAGES (NBEV) Above 2.80, targets 3.27, 4.17, 4.89 $NBEV #tradealerts #swingtrading #daytrade

CRONOS (CRON) trading 11.93 testing diag TL over targets 13.04 14.62 14.80 15.88 16.75 Sept 27 $CRON #tradealert #swingtrading

Seaspan (SSW) over 9.50 intra should see lower 10s fast, trading 9.34 intraday. $SSW #daytrade #swingtrade #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

ALIBABA (BABA) got a bounce at 100 MA under rane support, watching close here now $BABA #tradealerts #swingtrading

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

CARA THERAPEUTICS (CARA) Testing break-out area intra-day. On watch. $CARA #tradingsetups #tradealert

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

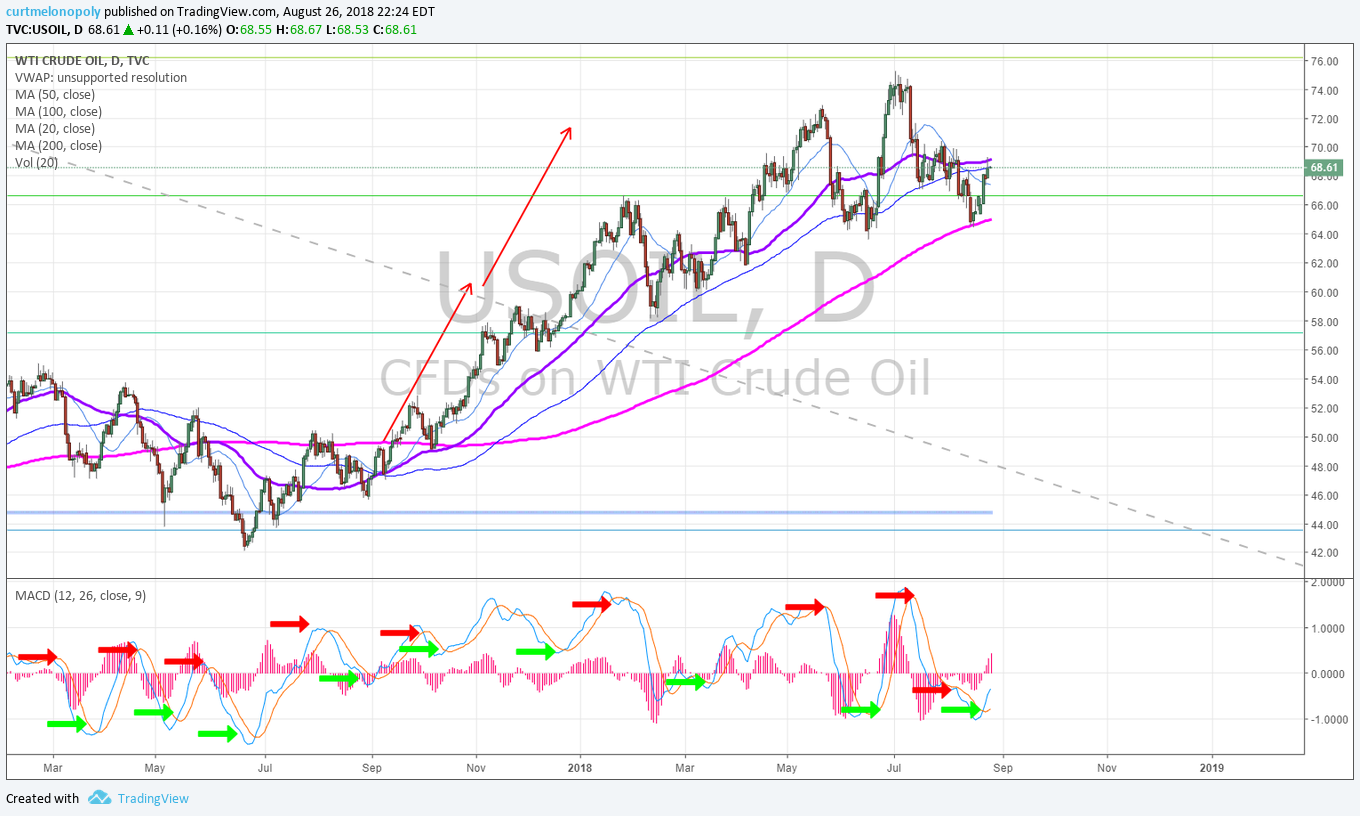

Crude Oil Daily Chart, MACD turning back up with price above 50 MA Sept 17 623 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Nafta talks

-Brexit summit

-Kavanaugh hearing

-Markets rise

-Banks look at EM investments

https://bloom.bg/2DdeSYS

There’s no stopping king dollar, robo traders and compliance https://bloom.bg/2DnkL5V

There's no stopping king dollar, robo traders and compliance https://t.co/v7AekIYKd9 pic.twitter.com/EcFvWrsY3z

— Bloomberg Markets (@markets) September 19, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MOC $TLRY $NBEV $NAVB $CRON $PYX $IGC $CGC $PYX $VKTX $SPWR $YINN $PX $JNUG $PDD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, #EIA, Oil, $NBEV, $TLRY, $CRON, $CGC, $TSLA, $SHOP, $MOMO, $XXII, $ROKU, $CARA

Trade Alerts (w/ video): $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room: $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 18, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Stocks Reviewed: $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY and more.

Sept 18, 2018 Mid Day Trading Room Review.

Again, the sound upload quality struggled, today we’ll test the hardwired set-up and see if it’s better.

Reviewed the PL for 2017 and 2018 along with goals for Q4 2018 and Q1 2019 – gearing up for a big Q4 this year and Q1 2019 (getting back to basics of trading vs software development because development funds come from trading of course).

BE SURE TO LOOK AT THE CHART DATE AND TIME IN TOP LEFT HAND CORNER OF EACH CHART.

Crude Oil $WTI $CL_F $USO – review of crude oil algorithm and crude oil trading alert at channel support that I should have held, anyway I cut and missed it. Also the top channel resistance crude oil trade set-up was good (missed it, but some of the members reporting they nailed it). Opportunities this week with trading range and EIA reviewed. Crude oil machine trading price targets reviewed also (for last week’s trade). Only 1 minute chart below showing intra day resistance on second trade attempt on day (algorithm models not below).

VIKING THERAPEUTICS $VKTX – we had this lined up in premarket, retraced intra-day.

TILRAY $TLRY – trading at only 420 x earnings or something like that. Weekly chart gap on gap on weekly body of candles. Only way I would long this is on short time frames, and I likely will when the pot stocks settle a bit – working on the charting for all the pot stocks right now (hopefully released this weekend in prep for a sector pull back when it happens).

SP500 $SPY $SPXS $SPXL – 60 minute chart reviewed, over 291.70 is the upside break resistance, above the box price targets for Sept 27 reviewed on video, various support and resistance areas reviewed.

MOMO $MOMO – signalling a long or add long over 48.50 (if it holds, you always trim in to resistance areas and then add above or wait for a pull back and add to your long trade), expected trading trajectory reviewed on video, price targets for between now and Feb 5, 2019 large time cycle peak conclusion reviewed on video. This is a very structured chart.

https://www.tradingview.com/chart/MOMO/zkLs91ot-MOMO/

22nd Century Group $XXII – price targets reviewed on video. Very structured equity that has excellent ROI ROE. Not a chart or trade set-up to ignore IMO.

SHOPIFY $SHOP – bulls pressing the upside diagonal Fibonacci resistance, price targets reviewed. Great alert from Sean for an excellent swing trade. Could see previous highs in 177.00s really fast.

CEL SCI Corp $CVM – targets at 5.00 and 6.00 reviewed on chart on video and more is possible, liquidity is my issue. A double upside extension move is possible with this bullish scenario, bottom bounce structure coming out of bowl.

ROKU $ROKU – was at resistance 73.55 and price targets reviewed on video. As price nears the peak of the time cycle on the chart prepare for possible double extension blow-through on this one.

https://www.tradingview.com/chart/ROKU/7dzcNyBE-ROKU/

Note: CARA, BOX, BABA, POQR, SSW, VIX, OIL, SPY and others reviewed on yesterday’s video BTW.

CARA THERAPEUTICS $CARA – price targets etc reviewed on yesterday’s video.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

US Dollar $DXY – decision October 3, 2018 that is important on the US Dollar DXY charting (parallel to many other peak time cycles in broad markets). Probability is up at or prior to time cycle completion.

$RLM – no.

$OASM – if you’re a risk taking trader this is a real aggressive chart structure, top of bowl is where it is trading now but it has a nature of coming off hard and it is thinly traded.

$NBEV NEW AGE BEVERAGES – weekly chart over 50 MA targeting 100 MA not a great ROI there in that set-up, chart is hard read. On daily up over 200 MA, does respect the 200 MA on daily, Showing bullish initial signals of a return. This one should go. Volume is good, Initial view I was not too interested but as I looked closer at the NBEV chart I realized this on should be on high watch. I went in to great detail of the pivots on the chart, buy sell triggers and price targets for NBEV.

NEW AGE BEVERAGES (NBEV) Above 2.80, targets 3.27, 4.17, 4.89.

$BHTG – no.

$RDCM – sitting on previous trading range support. 16.00 is reasonable, decent chart.

CRONOS GROUP (CRON) $CRON – reviewed on video, on the fly chart structure model reviewed. On high watch, expect a possible upside trading scenario with CRONOS. A trendline resistance was reviewed and important support and resistance and price targets reviewed on video (while we are processing this report the morning of Sept 19 it is moving in premarket trading up 8.39% at 12.53 in premarket this morning nearing its upside trading test area, the trendline resistance was broke to upside and the 13.00 area resistance in next). Over trendline sees the next test fast and the other price targets reviewed on video.

Updated set-up and trade alert for $CRON in premarket today while we process this video report.

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket https://www.tradingview.com/chart/CRON/klRhec02-CRONOS-per-yesterday-s-trade-alert-and-review-video-over-trend/

AVON – Daily chart for AVON reviewed, likes the 200 MA with some room, testing resistance right now, I can’t touch it until it’s up for 3.00, needs to see recent highs first and then still some challenges.

$PYX – weekly chart reviewed, no structure I can work with.

$NVTA – aggressive structure, 18.90 alarmed on chart, has potential for a rip upside.

$EPM – not enough there. Doesn’t have margin, widths.

$CL – bad structure on chart.

YELP $YELP – technical bounce off 200 MA on the weekly chart in to resistance area on chart, if you’re long go to previous steps shown on chart in video, not taking the trade but it may work, not my thing – not enough range for ROI ROE for me.

$SRT – no.

$JONE – no.

$DEQ – no.

CANOPY GROWTH $CGC – had the opportunity to be in ground floor of this industry in Canada and turned it down jeez, getting close to previous candle high on weekly chart, could see a large a move there. Chart for Canopy Growth reviewed on the video. Can’t chase it here where it is on the chart and I’ll watch. Working on the structure of all the charts on our equities covered in our swing trading platform and when we’re done I’ll get more day trade aggressive.

CALIFORNIA RESOURCES $CRC – Aggressive chart and trade set-ups, coming out of bowl, 39.32 an 39.86 pivots on chart reviewed on video. Start watching it at 40.00 and see how it does.

THOR INDUSTRIES $THO – resting on the 200 MA trading about half way between it and 100 MA, it will likely turn here, price above moving averages on chart with 20MA breaching the 50 MA is a good entry long on this chart. The sidewinder set-up will be key on this one (reviewed on video) – that’s where the good returns are.

$MRSN – no chart structure, junk.

DIGITAL ALLEY $DGLY – trading 4.05, daily chart, getting in to diagonal trendline resistance at 12.20 right now, over 12.31 is a nice confirmation to the long side of this trade. Nice chart.

$CCXI – swing traders service type of trending stock that has way to many steps and not enough ROI, the step type that chop up a trader I’m not interested in.

$MHLD – no.

$BRID – no.

$NXIO – chart structure can get aggressive, gapping through chart structure makes me nervous.

There were many more of the momentum stocks for the day reviewed and the stocks selling-off on the day were also reviewed.

TRADING ROOM VIDEO Trade Alerts: #daytrading #swingtrading

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, SwingTrading, DayTrading, Chart, Trade, Set-Ups, Signals, Price Targets, $NBEV, $TLRY, $CGC, $CRON, $VKTX, $MOMO, $ROKU, $NVTA, $CRC, $THO, $DGLY, $YELP, $XXII, $CVM, $SHOP, OIL, $DXY, $SPY

PreMarket Trading Plan Mon Sept 10: $CLDR, $TSLA, $CGC, $CRON, $TLRY, $FRED, $ECYT, $VBIV, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX Volatility more.

Compound Trading Premarket Trading Plan & Watch List Monday September 10, 2018.

In this edition: $CLDR, $TSLA, $CGC, $CRON, $TLRY, $FRED, $ECYT, $VBIV, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX Volatility and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members.

- Monday Sept 10 –

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 6 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

I’m still working an oil trade long, also watching the stocks below. Hoping after last weeks soft week that we get some momentum in to Tuesday. If we do I’ll get aggressive in to that pocket.

I’m thinking $CGC, $CRON, $TLRY will rest soon, yet to be seen this week.

$CLDR, $CGC $CRON $TLRY

Tesla shares jumping pre-market after Baird reiterates its “buy” rating and $411 price target on the stock saying that investors should buy $TSLA despite the recent management drama.

We’re running all of our swing and day trade charting set-ups tonight so there will be many updates coming early week.

Market Observation:

Markets as of 7:17 AM: US Dollar $DXY trading 95.34, Oil FX $USOIL ($WTI) trading 68/19, Gold $GLD trading 1193.95, Silver $SLV trading 14.18, $SPY 288.75 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6276.00 and $VIX trading 14.5.

Momentum Stocks / Gaps to Watch: $FRED $ECYT $VBIV $TLRY

News:

SAIC to buy Engility in a stock deal valued at $2.5 billion, including debt.

$ECYT Announces FDA Acceptance of Radiographic Progression Free Survival as Alternative Primary Endpoint of VISION Trial in Addition to Overall Survival

$PIXY: ShiftPixy Sees Opportunity in IRS Notices of ACA Non-Compliance

Your Monday morning Speed Read:

– CBS settles dispute w/National Amusements, CEO Les Moonves resigns amid harassment claims $CBS

– China promises retaliation as U.S. threatens new tariffs on virtually all Chinese imports $SPY $FXI

– Snap’s Chief Strategy Officer steps ⬇️ $SNAP

Your Monday morning Speed Read:

– CBS settles dispute w/National Amusements, CEO Les Moonves resigns amid harassment claims $CBS

– China promises retaliation as U.S. threatens new tariffs on virtually all Chinese imports $SPY $FXI

– Snap's Chief Strategy Officer steps ⬇️ $SNAP— Benzinga (@Benzinga) September 10, 2018

Coinbase reportedly in #talks with BlackRock to explore #crypto ETF. More in “The Intersection,” weekly from @theflynews $BTC $BITCOIN $GS $BLK $SSC $RIOT $SRAX $AMD $NVDA $OSTK $DPW $KODK $TEUM http://dlvr.it/QjRW1d

Coinbase reportedly in #talks with BlackRock to explore #crypto ETF. More in "The Intersection," weekly from @theflynews $BTC $BITCOIN $GS $BLK $SSC $RIOT $SRAX $AMD $NVDA $OSTK $DPW $KODK $TEUM https://t.co/bAoxlS4ss5

— Crypto the BTC Algo (@CryptotheAlgo) September 9, 2018

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

#earnings for the week

$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)

http://eps.sh/cal

#earnings for the week$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)https://t.co/r57QUKKDXL https://t.co/wHU5AlivAx

— Melonopoly (@curtmelonopoly) September 8, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

CLOUDERA INC (CLDR) Premarket up 6.5% trading 18.75 with 22.00 target. $CLDR #daytrading #swingtrading

TESLA (TSLA) Premarket watching for a snap back wash out trade here, CFO steps down, ELON smokes weed $TSLA #daytrading #swingtrading

ARROWHEAD PHARMA (ARWR) Two options for swing trading channels. $ARWR #swingtrading #chart

Thurday Premarket – ARROWHEAD PHARMA (ARWR) premarket at top of swing structure, take some profit here at resistance $ARWR #swingtrading #chart

CLOUDERA INC (CLDR) Thursday played out precisely to trade alert, above 18.17 long below short. $CLDR #daytrading #swingtrading

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts pic.twitter.com/J3ku1UKdVa

— Melonopoly (@curtmelonopoly) September 7, 2018

CRONOS GROUP (CRON) Holding the support area of swing trading – day trade structure. $CRONO #swingtrading #daytrading

CRONOS GROUP (CRON) Seems to me the buy side at green arrows is a great risk reward swing trade. Daytrade the levles. $CRONO #swingtrading #daytrading

TESLA (TSLA) At previous support, on watch for bounce in to 293s then 300s possible $TSLA #daytrading #swingtrading

On the back of excellent August sales estimates, $TSLA gapping-up in pre-market. Anticipating this, UBS issue a strategic downgrade on the stock.

What @UBS don’t tell anyone, is that have a massive short position with $TSLA and need the SP to fall to $185 or they loose $zillions

https://twitter.com/AskDrStupid/status/1037642153743278081

CLOUDERA INC (CLDR) Premarket up on earnings trading 16.51 looking for possible 18.17. $CLDR #daytrading #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-China trade

-U.K. growth

-Crypto crash

-Markets mixed

-Moonves out

https://www.bloomberg.com/news/articles/2018-09-10/five-things-you-need-to-know-to-start-your-day …

#5things

-China trade

-U.K. growth

-Crypto crash

-Markets mixed

-Moonves outhttps://t.co/ZgP01UEcyB pic.twitter.com/NyXLQVqJJA— Bloomberg Markets (@markets) September 10, 2018

Across-The-Board Losses For The Major Asset Classes Last Week –

Across-The-Board Losses For The Major Asset Classes Last Week – https://t.co/ukliOJOrl9

— Investing.com Stocks (@InvestingStockz) September 10, 2018

U.S. energy chief to meet Russian, Saudi counterparts ahead of Iran sanctions

U.S. energy chief to meet Russian, Saudi counterparts ahead of Iran sanctions https://t.co/y1zj9Fg6VX

— Melonopoly (@curtmelonopoly) September 10, 2018

Trade war, Iran sanctions and EM worries remained some of the key drivers behind the changes in speculative positions held by hedge funds in the week to September 4. Overall the net-long was cut by 5% to 880k lots, an 18-month low

Trade war, Iran sanctions and EM worries remained some of the key drivers behind the changes in speculative positions held by hedge funds in the week to September 4. Overall the net-long was cut by 5% to 880k lots, an 18-month low pic.twitter.com/BhQiJJWnSc

— Ole S Hansen (@Ole_S_Hansen) September 9, 2018

Funds bought crude #oil for a second week as the Iranian sanctions threat to supplies helped override EM risk to demand. Interestingly enough both long and short positions were added with the latter being rewarded following Brent’s failure to break above $80/b. #OOTT

Funds bought crude #oil for a second week as the Iranian sanctions threat to supplies helped override EM risk to demand. Interestingly enough both long and short positions were added with the latter being rewarded following Brent’s failure to break above $80/b. #OOTT pic.twitter.com/W7xFTRFjIu

— Ole S Hansen (@Ole_S_Hansen) September 9, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List : $COOL $CVM $GEMP $JCP

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $LNC $PRU $CVE $CS $AKAM $NVS $SNE $SNY $RH $KMT $FL $STT $HCP $SLG $CUBE $AEP $TFX $SSNC $RIO $SJW

$AAPL Pt raised to $256 from $225 @ Loop

Genesco $GCO PT Raised to $55 at Pivotal Research

Nike stock price target hiked at Wedbush as analyst cheers ‘resurgent iconic American, global brand’

Maxim init w/ Buy & $75PT

ULTA Salon $ULTA PT Raised to $340 at Oppenheimer

DA Davidson Upgrades Akamai Technologies $AKAM to Buy

(6) Recent Downgrades: $TMK $INGN $DIN $TXRH $DRI $TCO $NJR $NI $TXRH $AHL $STZ $HTHT $ZS $ANTM $UNH

Zscaler -1.3% on analyst downgrade https://seekingalpha.com/news/3388976-zscaler-minus-1_3-percent-analyst-downgrade?source=feed_f … #premarket $ZS

DCP Midstream LP $DCP PT Lowered to $48 at UBS

Micron price target lowered at Susquehanna on DRAM pricing concerns

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CLDR, $TSLA, $CGC, $CRON, $TLRY, $FRED, $ECYT, $VBIV, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX Volatility

PreMarket Trading Plan Thurs Sept 6: $CRON, $CLDR, $TLRY, $CGC, $TSLA, #EIA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday September 6, 2018.

In this edition: $CRON, $CLDR, $TLRY, $CGC, $TSLA, #EIA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information is of value to existing members, those asking about our services and new on-boarding members.

- Thur Sept 6-

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

First day of month’s trading challenge. Thurs through Sunday will be getting my set-ups in order so it will likely be fairly quiet for me. There are some set-ups now, but it is end of week but I wanted to start live today to get set for Monday (so really I’ll be running a 30 day challenge starting Monday), anyway… you get the idea.

It is #EIA report day at 11:00 and I’ve got an oil position a tad under water so that is on high watch today.

Also watching $CLDR range to targets sent out, $TSLA possible bounce to targets sent out, $CRON trading range and others of course that I’ll alert as we go.

Bitcoin $BTC has been hammered with manipulation lately so I’m sitting tight, trading small ranges.

Pot stocks $TLRY $CGC $CRON I am working on set-ups for pull backs in to next week.

And of course eyes on $VIX time-cycle smoldering now (see previous posts).

When u step in to arena for battle today remember it ain't ur regular job or biz… here u compete w best in world real-time, instant, w less tools. Top tier waiting to take ur $. Make sure you have the tools, training & emotional discipline to compete #premarket #wallstreet

— Melonopoly (@curtmelonopoly) September 6, 2018

Market Observation:

Markets as of 8:23 AM: US Dollar $DXY trading 95.10, Oil FX $USOIL ($WTI) trading 68.78, Gold $GLD trading 1205.91, Silver $SLV trading 14.27, $SPY 289.29 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6400.00 and $VIX trading 13.8.

Momentum Stocks / Gaps to Watch:

21 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12313623 $CLDR $VRNT $INSG $AVAV $CTRP $SECO $GIII $PRQR $DOCU $KALV $CGC $CRON

21 Stocks Moving In Thursday's Pre-Market Session https://t.co/ZPl8Z6a2ss $CLDR $VRNT $INSG $AVAV $CTRP $SECO $GIII $PRQR $DOCU $KALV $CGC $CRON

— Benzinga (@Benzinga) September 6, 2018

Stocks making the biggest move premarket: CBS, XOM, FB, DAL, NAV & more

https://twitter.com/CompoundTrading/status/1037670890857799680

News:

USA Continuing Claims for Aug 24 1.71M vs 1.71M Est; Prior 1.71M

USA Initial Jobless Claims for Aug 31 203.0K vs 214.0K Est; Prior 213.0K

BioCryst stock surges 6% premarket after winning $35 million CDC contract for flu therapy.

Hot pot stock Tilray presents at Barclays conference 7:30am ET $TLRY

Kapstone & Westrock shareholders vote on their proposed merger $KS $WRK

$CFRX completes enrollment in Phase 2 tiral Of CF-301 as a potential treatment for Staphylococcus aureus (Staph aureus) Top-Line data Q4

$ZSAN Zosano Pharma to Present Phase 3 Safety Study Update for ADAM™ Technology in the Delivery of Zolm… https://finance.yahoo.com/news/zosano-pharma-present-phase-3-123000859.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$CFRX ContraFect Completes Enrollment in Phase 2 Clinical Trial Evaluating CF-301 (exebacase) in Patien… https://finance.yahoo.com/news/contrafect-completes-enrollment-phase-2-123000857.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$TMDI Abstract Featuring Titan Medical’s SPORT Surgical System Presented at the European Association of… https://finance.yahoo.com/news/abstract-featuring-titan-medical-sport-111500024.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

World stocks fall for fifth straight day on trade fears | Article [AMP] | Reuters

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

DKNY parent G-III Apparel shares soar 7% premarket after blowout earnings.

Lands’ End’s stock tumbles after wider loss, same-store sales decline

#earnings for the week

$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI

#earnings for the week$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI https://t.co/r57QUKKDXL https://t.co/oiZ3V5Hc7S

— Melonopoly (@curtmelonopoly) September 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

CRONOS GROUP (CRON) Seems to me the buy side at green arrows is a great risk reward swing trade. Daytrade the levles. $CRONO #swingtrading #daytrading

TESLA (TSLA) At previous support, on watch for bounce in to 293s then 300s possible $TSLA #daytrading #swingtrading

On the back of excellent August sales estimates, $TSLA gapping-up in pre-market. Anticipating this, UBS issue a strategic downgrade on the stock.

What @UBS don’t tell anyone, is that have a massive short position with $TSLA and need the SP to fall to $185 or they loose $zillions

https://twitter.com/AskDrStupid/status/1037642153743278081

CLOUDERA INC (CLDR) Premarket up on earnings trading 16.51 looking for possible 18.17. $CLDR #daytrading #swingtrading

CRONOS (CRON) trading 13.23 up premarket and looks to be one of the few momos that may fly at open. $CRON #premarket

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they’ll get you.

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they'll get you.

— Melonopoly (@curtmelonopoly) September 4, 2018

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/RvSwFejYxm