Tag: CL

Edited Sept 5, Draw-Down Oil Daytrading Session: Question and Answer Review | EPIC V3 Crude Oil Machine Trading Software

Summary Review – Answers For Questions Received About EPIC V3 Draw-Down in Oil Trading Room Today.

Please Note: There is an edit revision below that includes a question and answer session for Sept 5, 2019 that provides significantly more detail.

As the trading day progressed and we broadcast our trades in the live oil trading room today we received a number of questions by way of email and direct message. Below is an oil trading room review summary.

We did not have time to respond to the questions during the trading day as we were working with the machine trading software (coding).

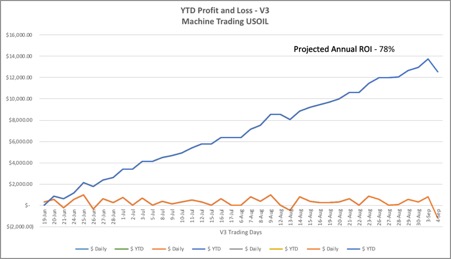

Today the software had a larger than normal draw-down shorting against a rally in crude oil trade. Below is the daily profit and loss chart.

For September 4, 2019 Profit & Loss Daily -$1,205 YTD +$12,559 Projected $77,696 or 78% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

The sequence the software was triggering trades to was a new sequence. When a new sequence activates the first go-round is often a loss, albeit normally less than today’s.

On the second or third go-round you will find that the software will win and continue to win better each time or it simply will not re-engage that same sequence.

The draw-down amount will normally be less as I mentioned, however, draw-downs will occur.

Nevertheless, the EPIC v3 crude oil trading software is extremely stable for a number of reasons, below are some of those reasons.

- If you look at the ROI trajectory for the software you will find that when draw-downs occur that the software will self-adjust its risk threshold to maintain the minimum trajectory.

- The software catalogs its trading set-ups, some set-ups it near never loses, some rarely, some not so rare. The point is, the software is coded to self adjust its minimum achieved ROI trajectory (correct it) as needed. In other words, it is coded to correct its minimum achieved trajectory by way of risk-threshold. To be more clear, it will be sure it self adjusts (wins) and how it is coded to do that is to bias its trade executions to its more probable set-ups.

- Its current ROI trajectory is between 80% – 90% approximately, you will see the software self-adjust its trade executions to more probable set-ups until that minimum trajectory is returned.

- Each time the trajectory is returned to the minimum average it will engage higher risk to learn trade set-ups. This process will continue and repeat over and over again. Over time the trajectory should increase on average as a result.

- The risk threshold of v3 vs v4 is much less aggressive (draw-downs and gains are considerably less volatile) and days like today will be few and far between because (as explained above) it will self-adjust back to the minimum ROI trajectory via the most probable trade set-ups of which it has some now that literally it very never loses if at all. It can rely on the catalog of those set-ups to adjust.

I can’t stress enough that the v3 software is not anywhere near similar in aggressiveness to the v4 version. This version is coded to avoid volatility, avoid large draw downs, and self adjust its risk threshold via high probable set-ups to snapiback to its minimum ROI trajectory as needed.

Watch the software over the next number of days and you will see it return to its minimum average trajectory and then you will see it take new sequence trade set-ups and the process will continue to repeat over and over.

If the software did not have trade set-ups (sequences) that it wins at near 100% of the time none of the above would apply.

Any questions about the detail of code architecture feel welcome to send us questions anytime so we can publish responses for our stakeholders to review as needed.

Below is an update. After the original blog post was released we had a few more questions come in that I would add answer to below. What I have done is copy and pasted the conversation below.

September 5 2019 Update: Oil Trading Room Review: Question and Answers EPIC V3 Software Protocol

[6:54 PM, 9/4/2019] Question: I still don’t understand that in some of the big moves the software fires opposite to the direction of the move but something we can talk about on Saturday

[7:22 PM, 9/4/2019] Answer: easy answer

[7:22 PM, 9/4/2019] Answer: if you look at the chart the price has come way off

[7:22 PM, 9/4/2019] Answer: software had order flow right

[7:23 PM, 9/4/2019] Answer: execution of sequence needs tweaking

[7:23 PM, 9/4/2019] Answer: same as when it gets the bottoms in sell offs, it used to struggle with that

[7:23 PM, 9/4/2019] Answer: as far as why it didn’t trigger with the rally….

[7:24 PM, 9/4/2019] Answer: thats simple too

[7:24 PM, 9/4/2019] Answer: order flow is random in a rally like that, it will near never trigger mid rally in rally’s induced by news, no predictable order flow data

[7:24 PM, 9/4/2019] Answer: short covering and retail daytrader trade causes the majority of the rally, no structure

[7:25 PM, 9/4/2019] Answer: so the key is it triggering on the predictable wins to maintain ROI trajectory and as time goes on slowly learning other set ups

[7:25 PM, 9/4/2019] Answer: i should have put this in the original blog post report

[7:26 PM, 9/4/2019] Answer: i will do an addendum / update report

[7:27 PM, 9/4/2019] Question: I understand why it would not fire in the big moves because of lack of structure and order flow

[7:27 PM, 9/4/2019] Question: I just don’t understand why when there is a big move down it is firing long and when there is a big move up it fires short

[7:27 PM, 9/4/2019] Answer: we tried to code a trajectory trade sequence for rally’s on news but we couldn’t get the code, too random

[7:28 PM, 9/4/2019] Question: Yes that makes sense to me

[7:28 PM, 9/4/2019] Answer: because its catching the end of the move to turn the other way, next in the code is to get it to hold some size through the reversal

[7:29 PM, 9/4/2019] Answer: the essence of the development right there, step one is code the reversal step two code the middle of the move, the middle is much more complicated to code

[7:30 PM, 9/4/2019] Question: Ahhh okay

[7:31 PM, 9/4/2019] Answer: the order-flow at the reversal is where the trading edge is…. seeing the order-flow pattern of the other machine liquidity on the IDENT program starting to turn for the reversal, thats why the machine trade software nails near 100% of the turns up in price on intraday trade after a sell off, but to get the sell-off you have to get the reversal like it was trying to do today and then you’re golden

[7:31 PM, 9/4/2019] Question: Okay yes I understand that now

[7:31 PM, 9/4/2019] Answer: its all about being able to get the reversal first, thats where the predictability is

[7:32 PM, 9/4/2019] Answer: once you have the sequence for the reversal then you can start on the middle core of the trade, we have the sell off reversal perfected and now we’re working on the middle of the move

[7:32 PM, 9/4/2019] Answer: the reversal after a rally to the short side still needs work, they’re different (reversal at top and reversal at bottom intraday)

[7:34 PM, 9/4/2019] Answer: without the reversal right its impossible to get the rest, the reversal is where you have to plant your trade, start your trade for high win rate probability, nothing else provides a high probability scenario that can be duplicated time after time

[7:34 PM, 9/4/2019] Answer: hope that helps

[7:34 PM, 9/4/2019] Question: Yes I get that now

[7:34 PM, 9/4/2019] Answer: good questions for the report update, doesn’t hurt to share

[7:35 PM, 9/4/2019] Question: You want to get the top of the rally

[7:35 PM, 9/4/2019] Answer: what happens in the middle is too random so if you get the top of a rally or the bottom of a sell off for the reversal and get your size in place then you have the trend to make the next turn

[7:36 PM, 9/4/2019] Question: But what is telling the software it is at the top when it really isnt and so it keeps firing short when the rally has not ended. That’s what I wanted to understand

[7:36 PM, 9/4/2019] Answer: its the bottoms and tops that have clear predictability, hence why we have the near 100% win rate on sell off reversals, but the rally tops are a different sequence that we’re working on

[7:37 PM, 9/4/2019] Answer: it was firing in to the top today, it nailed the top of the rally, it was firing 56.12 to 56.50, and then it came off to 55.90, its the same as the sell off bottoms, it trades them the same way, same concept, different sequence

[7:38 PM, 9/4/2019] Answer: that wasn’t the problem

[7:38 PM, 9/4/2019] Question: That makes sense. Because I remember you working on the bottoms of the sell off and now have that nailed

[7:38 PM, 9/4/2019] Answer: the problem is the sequence that it uses to gain size at the top and hold for the sell off reversal after the rally is the challenge we were working on

[7:38 PM, 9/4/2019] Answer: the sequence at tops is different than at bottoms

[7:39 PM, 9/4/2019] Question: Yes that makes sense to me

[7:39 PM, 9/4/2019] Answer: we have the bottom sequence perfected for the turn up after the sell-off, in that scenario we are now working on the sizing so that it holds some in the reversal rally

[7:39 PM, 9/4/2019] Answer: but the secret is this…

[7:40 PM, 9/4/2019] Answer: the only way the code wins near 100% of the time, the only way that is possible is at the reversals, reversal of a rally or reversal of the sell off

[7:40 PM, 9/4/2019] Answer: thats how the others that are winning have done it, we can see it in the order flow, its precise and repeatable over and over again

[7:41 PM, 9/4/2019] Answer: the middle of the move isn’t that way, it is random

[7:41 PM, 9/4/2019] Question: Okay I understand much better now

[7:42 PM, 9/4/2019] Answer: so if you have an ROI trajectory at say 85% and your code is nailing every bottom the only way to increase the ROI is to nail the tops or get your size better at bottoms for more profit in the move

[7:42 PM, 9/4/2019] Answer: so slowly we’ll work on nailing the tops for reversals and slowly work on holding more size when we’ve nailed the bottom reversals to increase ROI

[7:43 PM, 9/4/2019] Answer: when we lose as we develop those scenarios those trades won’t trigger (the software learning will stop) and the predictable set ups only will trigger to keep the 85% ROI at minimum (or whatever the ROI trajectory is at)

[7:44 PM, 9/4/2019] Answer: we have more than just the bottom reversals after a sell off in the ammo, but i think you get my point

[7:44 PM, 9/4/2019] Answer: there’s daytrading set ups it triggers to all the time, small wins intraday

[7:44 PM, 9/4/2019] Question: Makes sense

[7:45 PM, 9/4/2019] Answer: its just that today was a mathematically very large rally to which you see a larger than average loss, thats why i know that scenario will be very few and far between, very rare

[7:46 PM, 9/4/2019] Question: Yes that was an unusually large move in price

[7:46 PM, 9/4/2019] Answer: so its about risk management when it goes wrong and when it does the software / development team stopping the learning and software only trades what we know wins until trajectory of ROI is back in play (returned to its regular trajectory)

[7:46 PM, 9/4/2019] Answer: 3 days of trading and the previous ROI trajectory will be back at 85% – 90% and then as it learns the trajectory will turn up because the software now has more set-ups to trigger on that it wins consistently, at current level it is maxed out at about 90% ROI so it needs to add to its catalog of set-ups to increase ROI trajectory, the learning is where you will have short term draw-downs

[7:46 PM, 9/4/2019] Question: Yes that’s good

And remember, if you are struggling with your trading and need some trade coaching go to our website and register as needed.

Email me as needed compoundtradingofficial@gmail.com.

Best and Peace,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Oil Trading Newsletter (Member algorithmic and conventional charting).

Oil Trading Alerts (Private Twitter feed and Discord server).

Oil Trading Room (Bundle: newsletters, trading room, charting and real-time trading alerts).

Commercial / Institutional Multi User License (For professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, profit loss, coding, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL

Daytrading Crude Oil in Oil Trading Room: 6 Trades, 6 Wins. How We Did It | Alerts, Strategies, Video, Charts

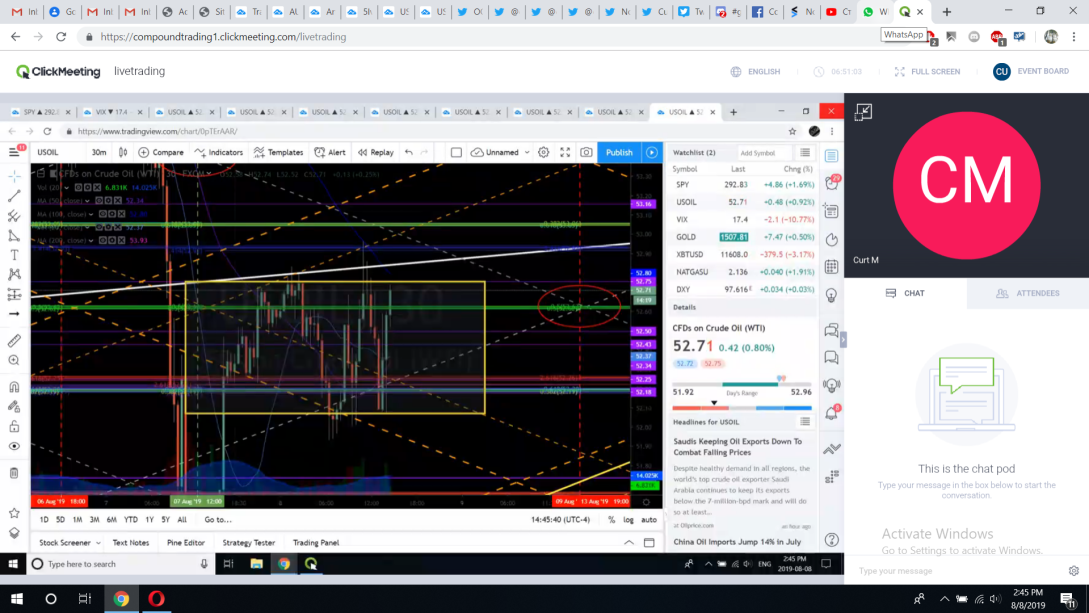

The Report Below Shows You Exactly How We Day Trade Crude Oil and Win Well Over 90% of Our Trades With EPIC V3.

The thing we have learned using the EPIC v3 Oil Trading Strategy (rule-set for daytrading crude oil) is that it is highly stable, predictable, maintains a high win rate and provides a low stress environment to achieve an excellent return on equity.

Below are the details from today’s trading session, hopefully this will help you improve your trading skill-set.

Included in this Article;

- Live Oil Trading Room raw video footage (I alert our day trades by voice over microphone),

- Technical Analysis (Charts) we used to establish the reversal area of trade in oil (most probable low of day price),

- Oil Trade Alert private feed (Twitter) and Discord private oil trade chat room where we share alerts, guidance, charting and more.

The EPIC v3 system for day-trading crude oil by far provides one of the best oil day-trading system results you will find. We have subscribed to many oil trading rooms and alert services out there (most) and have researched the returns the best funds are obtaining. EPIC’s v3 protocol is by far (as of today’s date) maintaining the best oil day-trading win rate percentage and best ROI we can find.

If you study the system and implement it as intended you will win.

You have to study the strategies, really know the methods, practice executing the trades and preferably be present in the oil trading room receiving guidance from us as you are trading or at minimum receiving the trade alerts via Discord and/or Twitter private member feed.

Private Member Discord Oil Trade Chat Server (used for alerts, charting, guidance, etc).

Below are screen capture images from the oil chat room server showing you what charts were shared with alert comments. The live oil trading room voice broadcast guidance provides our day-traders with significantly more strategy detail.

First the day-trades as they occurred today:

The trades you see below were executed because we knew that we were near the low of day and that a price reversal was very probable.

You will find that once we know the most probable area of trade on the day that is the low of day then we have a system of trading long in sequence on the 1 minute chart time frame using the other chart models as a guide also.

The five minute charting, 15 minute, 30 minute and 60 minute chart time-frames are all used.

Again, the video from the trading room footage will provide the most detail but the trade alerts, guidance and and charting revealed below will help you along some also.

The key is to not hold too much that you can’t correct your positioning through additional entries and / or surrendering a small loss if required to then enter another long position at the next support (when oil is selling off intra-day).

It is vital that you do not hold a long trade of any significant size in an intra-day sell-off, this will cause significant draw-downs to your account. You can always exit and take another trade if you protect your down-side.

Another key is holding enough in the reversal so that you can slowly release size as the reversal trade is occurring (something we are working on with the EPIC v3 software).

Curt MelonopolyToday at 7:50 AM

Preferred buys 53.76 trading 54.04 intra day.

Long 1/10 53.75 tight stops

Sell 1/10 53.93 hold 0

Curt MelonopolyToday at 9:50 AM

Long 1/10 53.18 and 1/10 53.35 from earlier test caution tight stops on structured range accumulation trade

Sold 1/10 53.30 holds 1/10

Curt MelonopolyToday at 10:02 AM

Long 1/10 53.08 add holds 2

Sold 1/10 53.21 holds 1/10

Curt MelonopolyToday at 10:13 AM

Software has a 52.92 add 1/10 long but won’t hold if this range breaks down. Holds 2/10 long.

Curt MelonopolyToday at 10:44 AM

Close 1/10 53.23 holds 1

Curt MelonopolyToday at 10:53 AM

Decent structure here

Close 53.42 hold 0/10 nice win

Exactly How We Established The Most Probable Low of Day Oil Price for The Reversal Trade To Win 6 out of 6 Day-trades Explained Below.

The technical analysis (charting) you see in the screen shots from the live trading room are oil trading models that are part of our system. Because crude oil is now widely traded by machines the models are highly predictable and structured, there is a system (rule-set) for planning your trade strategy.

In addition to the chart models (conventional and algorithmic) we also use our proprietary order flow software system (IDENT) which is simply a software code that identifies patterns in order flow much like we do as traders in charting.

Curt MelonopolyToday at 11:12 AM

Channel support machine line area on EPIC 30 Minute Algorithmic Model

10:30 time cycle inflection low on 5 minute model and quad wall support

Channel support hit on 30 minute model

How The Price Targets Are Established on the One Minute Oil Trading Time-Frame For Long Trades.

Once you have nailed the bottom area of intra-day trade (LOD) with your long trade positioning, the next challenge in daytrading crude oil is determining your price targets for trimming long positions and/or closing your positions all together.

One method we use (and our software is coded to) is symmetry as it relates to structured symmetry on the various algorithmic models on various time-frames. Below (and in more detail in the oil trading room video) I show our daytraders how to use the one minute oil chart time-frame symmetry to determine areas for price target upside extension for long trades.

Curt MelonopolyToday at 11:33 AM

software closed that sequence on 1 min symmetry (see arrow)

Curt MelonopolyToday at 12:02 PM

Video explains the reversal price target extensions based on 1 minute symmetry

Lead Trader Forward Oil Trade Guidance in Trading Room. Technical Analysis Suggests Further Downside Price Pressure Possible on Charting.

After the win it is important to know where you are going next, the trading strategy continues with forward looking support and resistance. Below is some of my technical analysis specific to the daily, weekly and monthly charting time frames.

Daily implies 51.45 low before decent bounce at TL

Weekly channel support 46.21 so lots of caution warranted

Monthly 47.00 area is support, again lots of caution trading 53.19

Miscellaneous other lead trader technical analysis in oil trading room and status of oil machine trading software development and alerts.

Curt MelonopolyToday at 1:14 PM

We’re watching 1:30 time cycle for possible mid intra-day time cycle inflection (possible high of day), trading 53.61 and we have possible HOD around 53.80 – .90 Time cycle on 5 min model runs 12:00 – 3:00 EST

Curt MelonopolyToday at 2:15 PM

Short 53.92 1/10 tight stops

Covered 53.87 1/10 still in HF mode, may re short it

Curt MelonopolyToday at 2:32 PM

Nice move through the quad on the daily reversal, slowly teaching the software to gain more of these moves, its a slow process one tweak at a time

developing a low risk trade sequence to gain accumulated size at the intra-day bottoms has been the priority, that was tricky enough, but slowly one step at a time we’ll get the full range coded, software up well today just on the bottom reversal trades so we’re happy, but the range will be a game changer

the larger the account the easier the sequence becomes to capture the whole move also

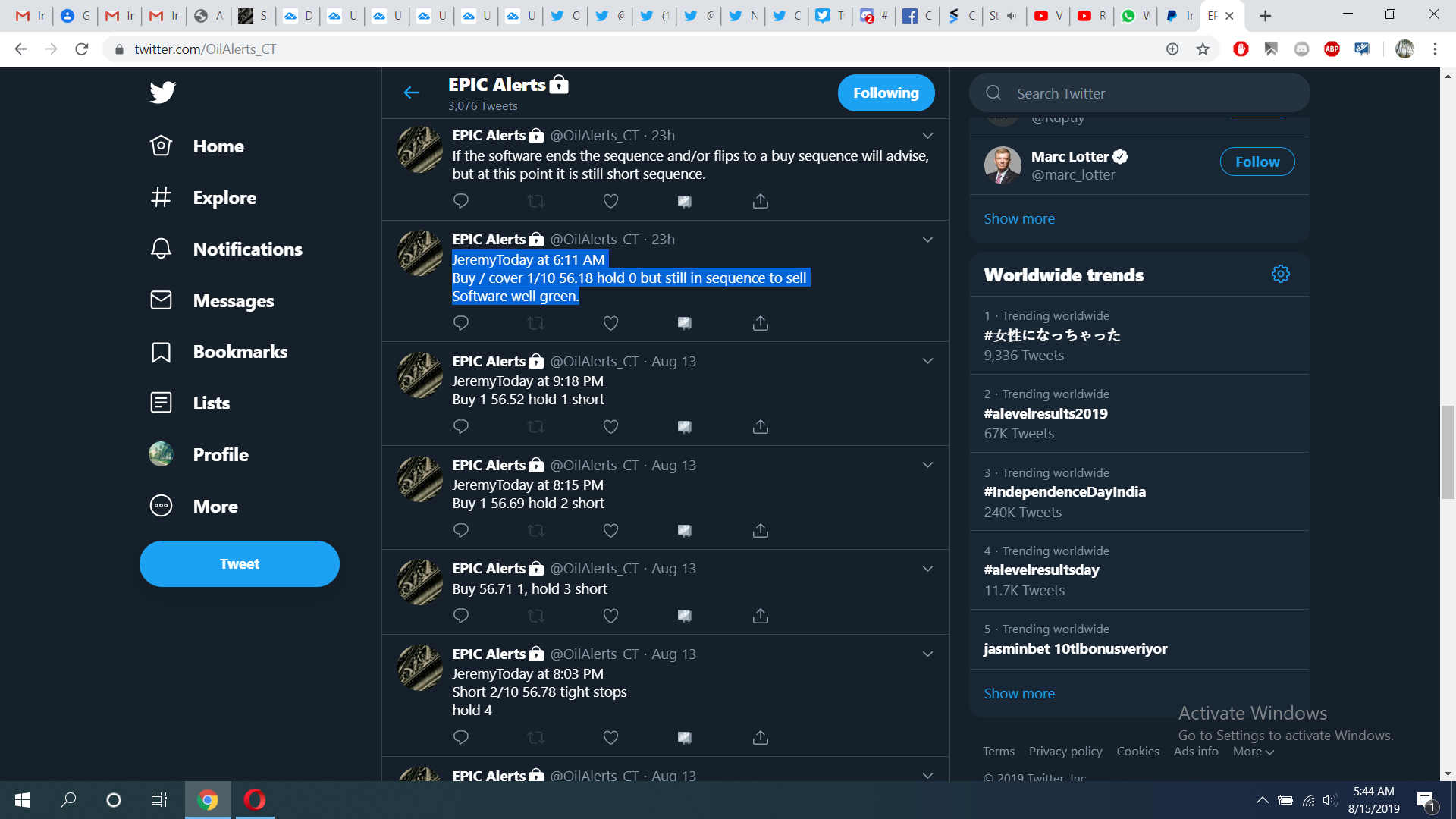

Screen image of private member private oil trading alert feed with trades as alerted through the day.

Below are the time stamped trade alerts from our private member oil trading alert feed and screen shots of the feed.

EPIC Alerts

@OilAlerts_CT

·

10h

Close 53.42 hold 0/10 nice win

EPIC Alerts

@OilAlerts_CT

·

10h

Curt MelonopolyToday at 10:44 AM

Close 1/10 53.23 holds 1

EPIC Alerts

@OilAlerts_CT

·

10h

Curt MelonopolyToday at 10:13 AM

Software has a 52.92 add 1/10 long but won’t hold if this range breaks down. Holds 2/10 long.

EPIC Alerts

@OilAlerts_CT

·

11h

Sold 1/10 53.21 holds 1/10

EPIC Alerts

@OilAlerts_CT

·

11h

Curt MelonopolyToday at 10:02 AM

Long 1/10 53.08 add holds 2

EPIC Alerts

@OilAlerts_CT

·

11h

Sold 1/10 53.30 holds 1/10

EPIC Alerts

@OilAlerts_CT

·

11h

Curt MelonopolyToday at 9:50 AM

Long 1/10 53.18 and 1/10 53.35 from earlier test caution tight stops on structured range accumulation trade

EPIC Alerts

@OilAlerts_CT

·

13h

Sell 1/10 53.93 hold 0

EPIC Alerts

@OilAlerts_CT

·

13h

Long 1/10 53.75 tight stops

EPIC Alerts

@OilAlerts_CT

·

13h

Curt MelonopolyToday at 7:50 AM

Preferred buys 53.76 trading 54.04 intra day.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from approximately 7:00am to 5:00pm EST). To listen to comments by the lead trader that contain specifics to his/her oil trade strategy / thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

Oil Trading Profit and Loss.

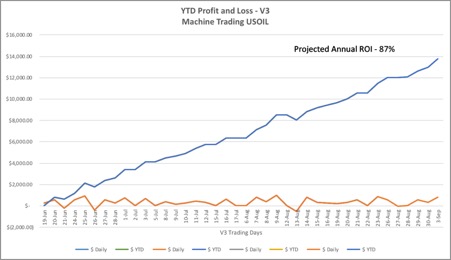

For September 3, 2019 Profit & Loss Daily +$796 YTD +$13,764 Projected $86,619 or 87% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

For September 3, 2019 Profit & Loss Daily +$796 YTD +$13,764 Projected $86,619 or 87% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/jrIEz8xxbk

— Melonopoly (@curtmelonopoly) September 3, 2019

How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

And if you’re really serious about learning how to trade crude oil to achieve our consistent v3 win rate and returns, review this particular oil trading room video from today.

Refer to the technical analysis charting and alerts time stamps and cross-reference the timing with the video time stamp and listen to the guidance in the oil trading room. Specifically the analysis of how we established the low range on the day is important. If a daytrader knows with confidence that intra-day trade is near a bottom then he/she can start to execute long trades in a systematic sequence to build size to garner better and better return on the day.

Email me as needed compoundtradingofficial@gmail.com.

Best and Peace,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Oil Trading Newsletter (Member algorithmic and conventional charting).

Oil Trading Alerts (Private Twitter feed and Discord server).

Oil Trading Room (Bundle: newsletters, trading room, charting and real-time trading alerts).

Commercial / Institutional Multi User License (For professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategy, alerts, trading room, technical analysis, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL

The Power of Compounding Returns With a Winning Systematic Machine Trading Platform.

Machine Learning is Changing Our World and Compound Gains are Powerful. This is a Short Story About How Machine Trading is Changing Portfolio Return, Risk and Compound Trading Expectations.

The World is Changing Fast. The Landscape of Public Markets, Risk and Portfolio Return Along With It.

A brief search on Google brings many articles about the increase in automated machine trading and the possible future forward scenarios for public markets.

I was recently interviewed about this very topic – the future is unknown, but in my basic thinking machine learning is here to stay, I have tried to compete against it and I intend to be on the right side of the ROI trajectory.

- Per Trevor Noren (@trevornoren) “Passive now controls 60% of US equity assets while quant funds control 20%—staggering 80% combined. Blackrock & Vanguard oversee $12t, up from less than $8t 5 years ago. And algorithmic trading systems are now responsible for 75% of global trading volume.” https://latest.13d.com/risks-passive-algorithmic-transformation-equity-markets-crisis-6ea6f6e9e271

- JP Morgan doubles down on machine learning for FX algorithms https://www.thetradenews.com/jp-morgan-doubles-machine-learning-fx-algorithms/

- Google’s AI AlphaGo Is Beating Humanity At Its Own Games (HBO) https://www.youtube.com/watch?v=8dMFJpEGNLQ

First, A Snap-Shot of Our Brief History.

When we started our trading service we demonstrated how day trading and swing trading could net good day traders consistently 100% – 400% a year with a systematic rules-based process.

We video recorded every session live, alerted the trades to our clients and documented each trade.

The naysayer says “I seen this or that trade that didn’t work!” – the small cross-section analyst that didn’t do their homework that is. Sure, we had our losses. But what they don’t say is that over-all we proved the returns were not only possible but probable (live recorded, time stamped, live alerted) in a systematic manner if a day trader uses a sound rules-based process, has an appropriate account size to execute various trades and sizing to spread risk (as we alerted live) and protects his/her downside. Anyone can go through our live alerts and videos to determine this to be the case. And we’re not the only day trading service that has or continues to provide these results – some even more.

What’s the point?

The point is that if you take an isolated cross-section of time, or you kinda executed the processes or kind of protected your downside or didn’t start with an appropriate account size to spread your risk then your individual scenario may have been different. But over-all, an investigation in to our processes show over 100% returns over all per annum daytrading and / or swing trading.

More specifically to the point, the same principle applies to machine trade development and testing.

When a trader reaches this level of day trading (a winning process within an appropriate account size with protected risk), he/she can then start thinking about compounding his/her gains (the holy grail for a day trader).

Or, as we did, the successful trader may chose to turn their attention to algorithmic modeling and then on to machine trading.

In our case, we started with cracking the code to and building software for trading crude oil futures contracts.

Why go in to further risk? Because I knew what my potential returns were investing (I have over three decades of experience) and I now knew what my potential returns were day trading and swing trading. The last frontier for me was machine learning and whether we could achieve better returns in automated trade with less future forward risk and effort.

My retirement years will be as a trader, the only questions for me are; what kind of trader and what are the returns?

Day trading and swing trading equities (along with trading various ETF type instruments) is much easier to master than day trading crude oil and manifold times easier than building software to trade crude oil or any other instrument.

We knew that if we mastered the code / rule-set of machine trade that higher returns were obviously possible and that we could then build software for numerous other instruments (at will) and obviously leverage our time and compound return potential far in to the future.

The EPIC v1 machine software real-world trade test was returning a projected 20% per annum, v2 40%, v3 80% and the goal for EPIC’s version 4 was 160%.

Version 4 was too aggressive and exceeded our risk tolerance so we returned to EPIC v3 and it has been running with sound stability and very low downside risk for seven weeks at approximately 90% projected annual returns. We expect this percentage to consistently increase over time (as the software learns) with little to no additional down-side risk.

Stability of Software – downside risk vs. return is key. V4 EPIC I believe could hit 800% per year or more but the volatility and subsequent risk therein was too much for us to stomach in real-world testing (real-world is also key and required – paper-trading when testing the software doesn’t cut it).

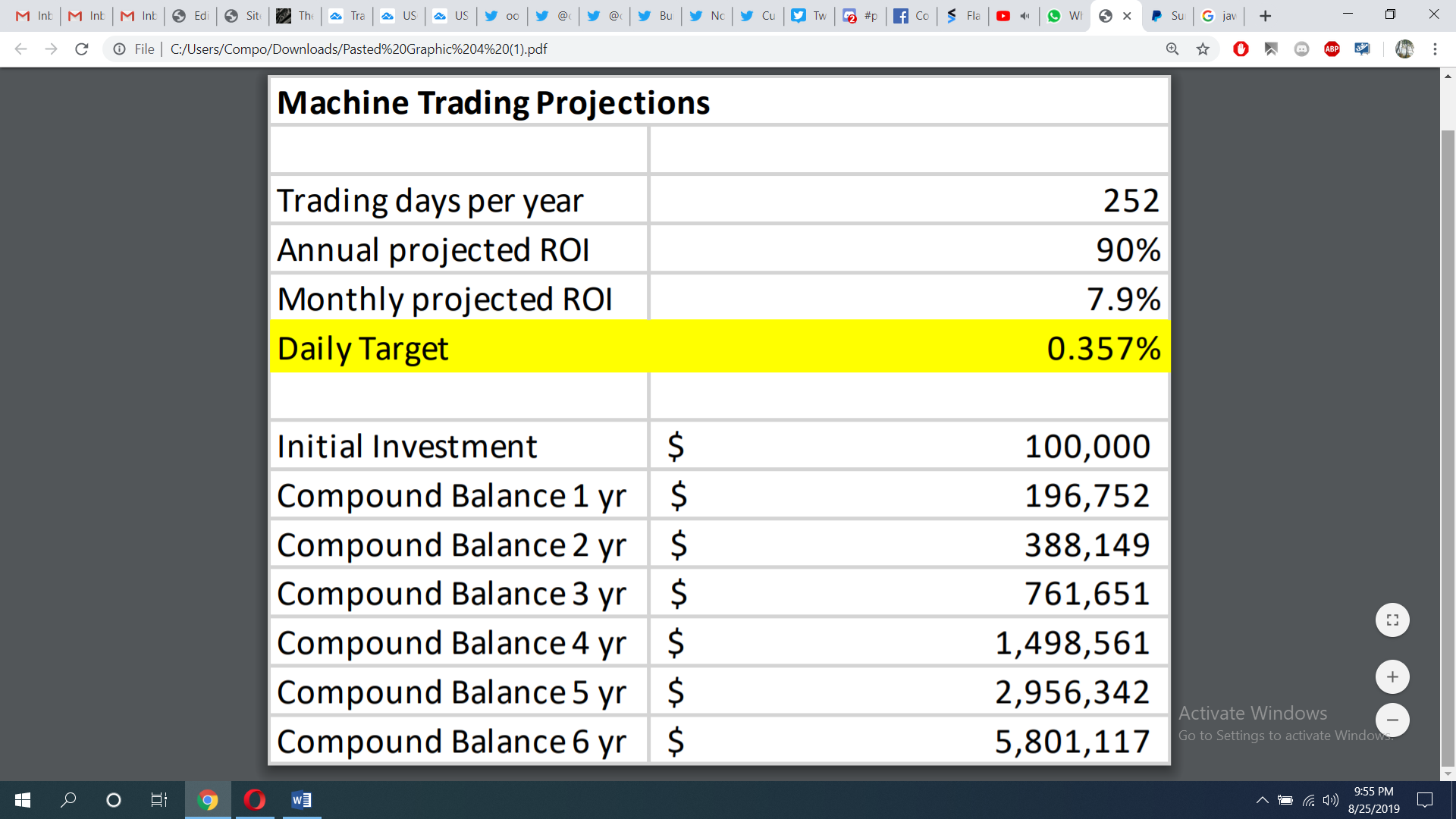

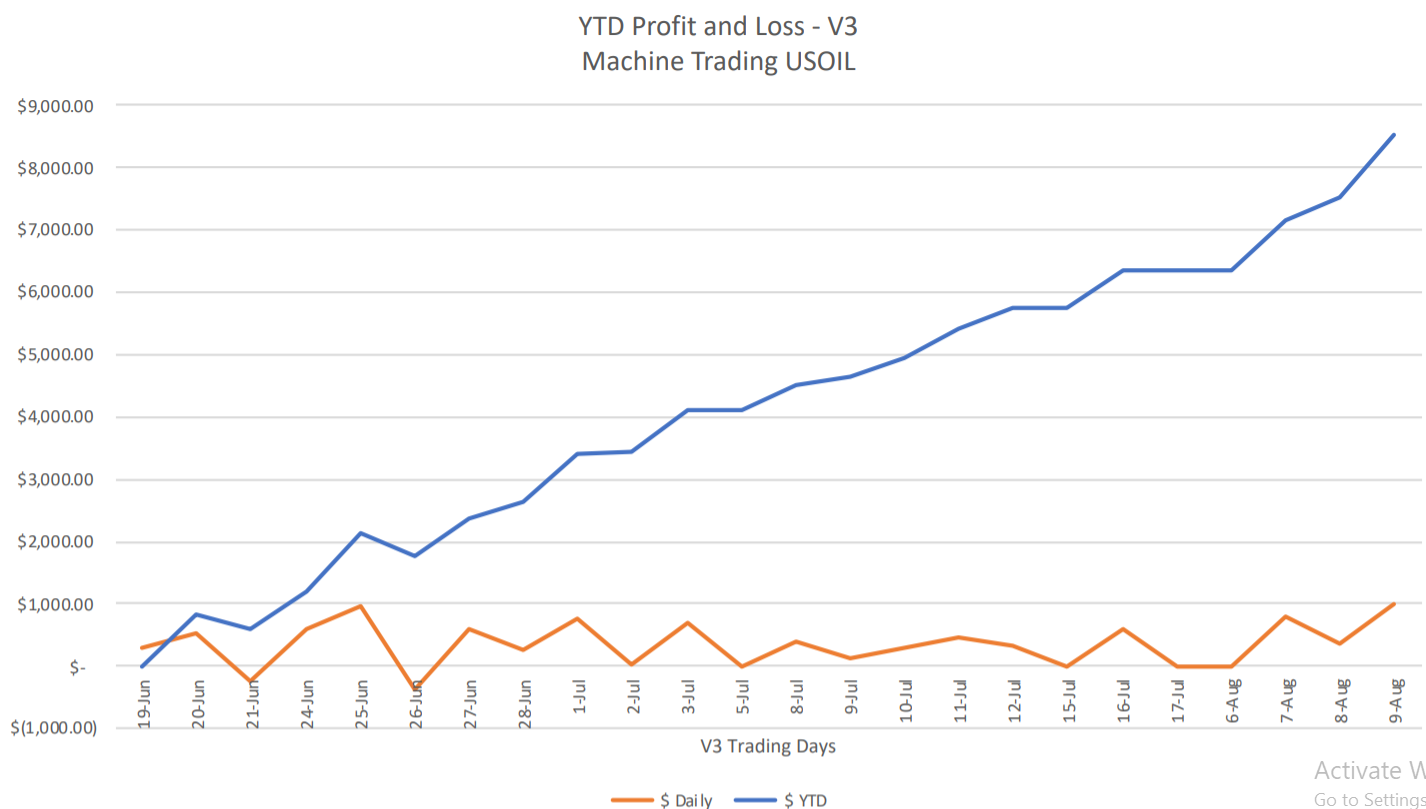

Below is the Seven Week Real-World Trading Performance YTD for EPIC v3 Crude Oil Futures Machine Trading Software.

Below I provide the Compound Returns Based on our Current Oil Trading Results at 90% per annum Profit Compounded Over 3 Year Period.

The sample account starts with 100,000.00 and after 3 years has a balance of 761,651.00.

And below are the Compound Account Returns according to Current Oil Trading Results at 90% per annum profit Compounded Over a Six (6) Year Period.

The sample account starts with 100,000.00 and after 6 years has a balance of 5,801.117.00.

Will We Meet The Annual Return and Compound Trade Return Projection?

Only time will tell the story.

What I know for sure is that our v3 EPIC Crude Oil Machine Trade Software is extremely stable, has near zero down-side risk and has consistent gains.

It has been running for seven weeks as of this Tuesday, which in the machine trading world is a near life-time. At the eight week mark it is almost mathematically impossible for it to fail and at the twelve week point it is something like 99.99999% sure it will meet or exceed the expectations within current ROI trajectory.

My guess, v3 ends up performing at 100% – 150% and easily meets or exceeds the projections, I have zero doubt about its stability and ability to protect downside loss. But as I said, all return projections are yet to be seen, time will tell.

Relative to the Top Performing Hedge Funds of 2018 we are doing well, the Odey fund came out on top of the pack, generating about 53% in returns. Also relative to the best returns of all time we’re competing; The Renaissance Technologies Medallion fund is considered to be one of the most successful hedge funds ever. It has averaged a 71.8% annual return, before fees, from 1994 through mid-2014.

I always said we would never have taken this project on if we thought there was a considerable chance we would fail. We knew it would be one of the hardest things we’ll ever try and accomplish, but we believed we would get there.

In my best estimation, we have now successfully cracked the code.

Thanks for being part of and supporting our journey.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, machine trading, trading, compound, returns, ROI, $CL_F, $USOIL, $WTI, $USO, CL

Buying Support in to the Plunge During Crude Oil Intra-Day Sell-Off | Oil Trading Room Video, Alerts, Strategy

7:49 AM EST Friday Crude Oil Started Sharp Intra-Day Sell-Off Dropping 200 Points in 40 minutes. We Went Long Live in Oil Trading Room and Alerting Buys in To Sell-Off and Nailed the Low Price and High Price of Day.

In the article below (one of the most important we have written) we detail the oil day trading strategy, trade positions (mapped on a chart) we executed short and long, screen capture images of oil trade alerts feed, technical charts, strategy comments, and live oil trading room raw video.

The Strategy Set-Up.

Thursday night going in to Friday morning (in CL futures trade) we alerted members by email and oil trade chat room (Discord server) there was a high probability of a significant sell-off coming in the over-night futures trading session (in to regular US market open). It was a channel resistance and symmetry set-up.

Oil did plunge in to the early morning on USA-China Trade War Escalation;

Oil plunged on trade-war escalation https://finance.yahoo.com/news/oil-plunges-trade-war-escalation-190000557.html?.tsrc=rss.

This set-up strategy we had been alerting to our members for some time as the trading channel resistance on the 30 minute chart time-frame was being challenged by oil bulls.

The key point is that there was also a significant algorithmic chart model symmetrical set-up developing, hence the alerts and trade guidance in the oil trade room (broadcast by voice).

You can see in the chart below the large red arrow and the green lighter arrows pointing down to a support area on the 30 minute chart. The red arrow is the area on the chart model to watch for the possible short selling set-up (as alerted) and the green arrows are the possible trajectory of the short trade.

The symmetry our models identified targeted this area of the chart model and time.

If you review the live oil trading room raw footage you will hear about the short set-up and strategy (which I know is cumbersome because we haven’t had time to splice short time frame snippets for you yet). But if you’re serious about wanting to become an expert oil trader the time is well invested.

Below is one alert to our members (screen shot capture) from the oil trading room. Our software did fire but this set-up is still being tweaked in the code (it was only a small win), but the subsequent long side oil futures buys were exceptional in that we nailed the low of day, each low of day and high of day thereafter.

Thursday night in to Friday (in CL futures trade) alerted members oil trade chat room high probability significant sell-off in over-night futures trade.

As mentioned, we executed a short position prior to the sell-off (see trade locations below) but closed the position shortly before the 200 point tumble in oil price (the v3 EPIC software IDENT program had also alerted us to the order-flow turning down).

The code in our software is slowly being tweaked to move with the sharp intra-day crude oil sell-offs, it won’t be long and we will be hitting most sell-offs (for those that are unaware we now nail near all low of day reversals so we are tweaking the code for the other side of the trade, the sell-offs).

In the article below we highlight how we hit the low of day trade during the sell-off, how we hit the low in each bounce thereafter and how we closed our final oil long position at the high of day.

Our most recent article to this deals with the opposite scenario, selling in to resistance during an intra-day crude oil rally, read it here.

Before reading this article, please read the introductory article (for context) to this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are emailed direct to our mailing list – click here to register.

Recent Trading Profit/Loss Results v3 EPIC Oil Machine Trade For 100K Sample Account:

For August 23, 2019 Profit & Loss Daily +$862 YTD+$11,463 Projected $89,020 or 89% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

For August 23, 2019 Profit & Loss Daily +$862 YTD+$11,463 Projected $89,020 or 89% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/g1l6TUbrpM

— Melonopoly (@curtmelonopoly) August 25, 2019

The Power of Compounding Returns With a Systematic Compound Trading Process.

Crude Oil Trading Compound Return Projection Based on Current Results 100K Sample Acct #OOTT $CL_F $USOIL $WTI $USO #OilTradeAlerts #MachineLearning

Crude Oil Trading Compound Return Projection Based on Current Results 100K Sample Acct #OOTT $CL_F $USOIL $WTI $USO #OilTradeAlerts #MachineLearning pic.twitter.com/DCSGkBAC6U

— Melonopoly (@curtmelonopoly) August 25, 2019

Friday Oil Trading Room Session.

Please note:

- When we alert 1/10 that means (for example) on an account of 100,000.00 that would normally execute a trade size of maximum 10 contracts, 1/10 size then represents 1 contract. We use a 100k account for our sample set for simplicity.

- Trades and the strategy therein are alerted to a live trade broadcast room by voice (by a leader trader) and published as time allows to an oil trading alert feed on Twitter and in a Discord private member server.

The Trade Strategy Set-Up – Buying Crude Oil in to the Intra-day Sell-Off.

As mentioned above, the real key to this oil trade strategy story (the set-up and trades on the day) wasn’t the short side but how we managed to nail the bottom on a vicious sell-off, then nail each subsequent bottom and high of day while buying oil in to the sell-off plunge.

Key take-away rules for trading long in to the sell-off:

- Know the technical support on all chart time-frames (conventional and algorithmic).

- Know which support areas are most probable areas for an intra-day reversal by way of historical back-tested data.

- When order flow and price action reverse (bulls are buying and shorts are covering during the sell-off) is a key indicator that the low-of-day in oil trade may be in place.

- When systematic market wide machine liquidity starts progressive buy programs, this is the low of day near 100% of the time (IDENT program). This is by far our best intra-day crude oil trading signal (proprietary and in development).

- Manage trade sizing and sequence – releasing size of trade, adds, closing position etc.

- Manage stops properly and know when to hold some or most of your trade size.

Below is a screen image capture of some oil chat room guidance alerts as the sell-off progressed in premarket and then the buying started at support (see other screen images below).

Curt MelonopolyLast Friday at 8:04 AM

Price target hit on that previous alert, we didn’t hold through the whole range as it was later than predicted, JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.

Example of algorithmic modeling (30 min doodle), symmetry alert at red arrow from earlier, follow green arrows down to bottom of channel.

nice move

What are the Probabilities of Trading The Low of Day, Each Low at Each Bounce and Closing High of Day?

Machine learning (as it applies to trading) is not like human learning and execution in that once the software begins to master a set-up it will rarely lose that similar set-up in future and it will increasingly extract more profit each time.

If you don’t want to use machine learning to enhance your trading (engaging a firm like our partners at Sovoron) then perhaps you can learn from the machine software (via alerts or oil trading room) to enhance your own oil day trading strategy.

Some of our clients do both – they have machine learning automation and mechanical human executed day trading in their over-all strategy.

Either way, below is a summary time-line with screen image shots of how it was done.

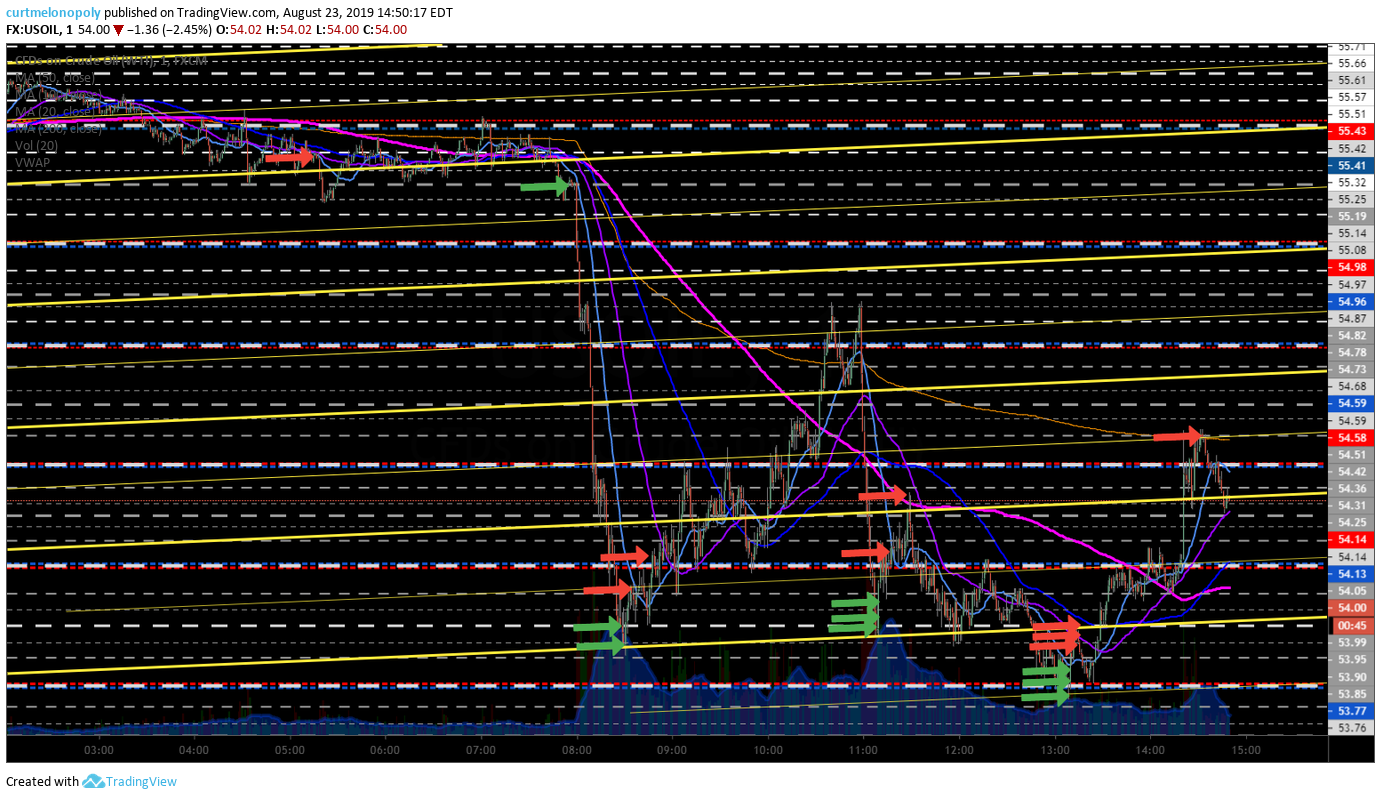

Below is a chart showing the oil trades for the day that were alerted to the feeds and broadcast live in the oil trading room.

Location (plotted on 1 minute chart) of EPIC v3 crude oil trade alerts. Green arrows on the chart are long entries and red are selling executions of trade #OOTT $CL_F $WTI $USOIL $USO #machinelearning #oiltradealerts

Oil Trade Alerts Feed Screen Capture Images for Friday Daytrading Sequence

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 8:39 AM

Sell 1/10 53.66 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Sell 1/10 53.65 hold 1

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 8:27 AM

Long 2/10 53.56 tight stops

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Price target hit on that previous alert, we didn’t hold through the whole range as it was later than predicted, “JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.”

EPIC Alerts

@OilAlerts_CT

·

Aug 23

JeremyToday at 7:50 AM

Cover 55.19 1/10 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.

As day trading oil continued Friday the image below shows a screen shot of the trade alerts sent out to members. Each low of day in trade was bought by our lead trader and software and profit trimmed and sold as price of oil went up.

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Long 2/10 53.53 sold 1/10 53.61

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 11:04 AM

Long 1/10 54.00

Screen shot of oil trade alerts in to the end of the day trading sequence on Friday from oil trading room. The last trade alerted was the high of day which concluded trade for the day in the oil trading room.

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 2:21 PM

Sold 54.11 1/10 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 1:11 PM

Sell 1/10 53.47 holds 1

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 1:04 PM

Long 53.32 3/10, sell 1/10 .37, sell 1/10 .40 , hold 1 add and 1 hold for 2/10 hold

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 11:19 AM

Sold 1/10 53.86 hold 1

Intra-Day Time Cycles Are Key for Oil Traders.

Curt MelonopolyLast Friday at 11:45 AM

Sell off cam in perfect at 11:00 mid time cycle inflection

So How Did We Nail the Short Oil Prediction in Over Night / Premarket Session, Nail The Low of Day Price Target Trade, Subsequent Low of Day Trades and High of Day Trade?

We have thousands of rules in our algorithmic models to which each rule is weighted against the others, so this is no short answer.

But if you read the article above closely, you look at the alerts and if you are a member look at all the other charting and information sent out prior to and during this trade set-up you will begin learning (or add to your oil day trading strategy too-kit) many excellent additions to help you increase your profits.

The live trading room videos also help, reviewing past articles will help you, having all the conventional and algorithmic charts available to you for immediate reference during intra-day trade, trade coaching helps (I’ve never had a complaint) and being in the live trading room is key if you are really serious about learning our rule-set.

The oil trading rule-set that our v3 EPIC machine learning software uses is one of the best in the world, we know this because we did the hard work in back-testing every trading rule it uses and designing a trading strategy that weighs the rules one against the other.

The win rate, the return rate, the stability and the precision of the oil trading software is evidence of this fact.

You now just have to put in your part of the work – we have already done the heavy lifting for you.

Welcome to the matrix.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from 7am to 5pm EST). To listen to comments by the lead trader that contain specifics to his/her oil trade strategy / thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Remember also that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

https://twitter.com/EPICtheAlgo/status/1163213528867770369

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategy,alerts, trading room, technical support, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL

Short Selling in to Resistance Area During Crude Oil Intra-Day Rally

Late Monday We Started A Crude Oil Short Sell Trade Sequence In To Technical Resistance in Advance of API Report Release Tuesday at 4:30.

Below are the trade positions we executed in this trade sequence (API report / resistance strategy) short and long, the charts, technical reasons and live oil trading room raw video.

As of the time of writing the strategy / sequence of trade is still in play.

Before reading this article, please read the introductory article to this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are emailed direct to our mailing list – click to register.

Recent Trading Profit/Loss Results v3 EPIC Oil Machine Trading Software Sample 100K Account:

For Aug 15, 2019 Profit & Loss: Daily +$355 YTD+$9,185 Projected $85,958 or 86% Per Annum. v3 Oil Machine Trade 100k Test Account (v4 period excluded) #OOTT $CL_F $WTI $USO #machinetrading #oiltradealerts

For Aug 15, 2019 Profit & Loss: Daily +$355 YTD+$9,185 Projected $85,958 or 86% Per Annum. v3 Oil Machine Trade 100k Test Account (v4 period excluded) #OOTT $CL_F $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/WlVVCbOlqZ

— Melonopoly (@curtmelonopoly) August 15, 2019

Monday Oil Trading Room Session.

Please note:

- When we alert 1/10 that means (for example) on an account of 100,000.00 that would normally execute a trade size of maximum 10 contracts, 1/10 size then represents 1 contract. We use a 100k account for our sample set for simplicity.

- Trades and the strategy therein are alerted to a live trade broadcast room by voice (by a leader trader) and published as time allows to an oil trading alert feed on Twitter and in a Discord private member server.

The Trade Strategy Set-Up – Selling Crude Oil Futures in To A Rally

Oil trade to start the week was/is bullish in some respects, the MACD on the daily is turned up and Trump seems to be softening a bit on the China trade war, and there was some news about a drone attack on Saudi Production Field also – so shorting in to a rally isn’t exactly going with the momentum. So this trade strategy does not have the momentum factor on our side.

Whenever possible trade with (in the direction of) momentum.

Oil ends higher after drone attack on Saudi production field

Published: Aug 19, 2019 4:09 p.m. ET

https://www.marketwatch.com/story/oil-climbs-after-drone-attack-on-saudi-production-field-2019-08-19

Nevertheless, technically oil trade intra-day was starting to get near resistance areas on various charting time frames, nearing resistance on important trend-lines on various time frame charts and was already up significantly on the day. At the time we started shorting oil intra-day our IDENT machine trade software was beginning to identify order flow selling pressure from other machine liquidity entities in intra-day markets.

Also, it was Monday trade -getting later in the day and Tuesday at 4:30 is the API report so any rally in price is likely to sell down somewhat (a retrace at minimum).

And finally, on days where crude oil has rallied it is often sold off in overnight futures trade session or in the following regular US regular session.

The price target on this short bias strategy is 55.22 (derived from the most probable price of oil per the EPIC Algorithm model) in to 4:30 Tuesday API report. We started shorting oil at 55.98 intra-day.

A crude oil day trade strategy such as this requires knowing where the technical resistance and support is on various time frame charting and the trader being able to size short trades in to resistance and cover various contract size at various supports. It requires technical know-how and strong risk management (trade size management, understanding technical range and emotional intelligence).

It isn’t an easy trade but comes with significant risk-reward if executed with proper discipline.

As mentioned above, at time of writing this trade sequence is still in play so I will update this article tomorrow with the conclusion of the trade results profit / loss etc. In the meantime I will share some charting, alerts, trading room video etc below so you can get a feel for how we are managing our execution of this particular strategy.

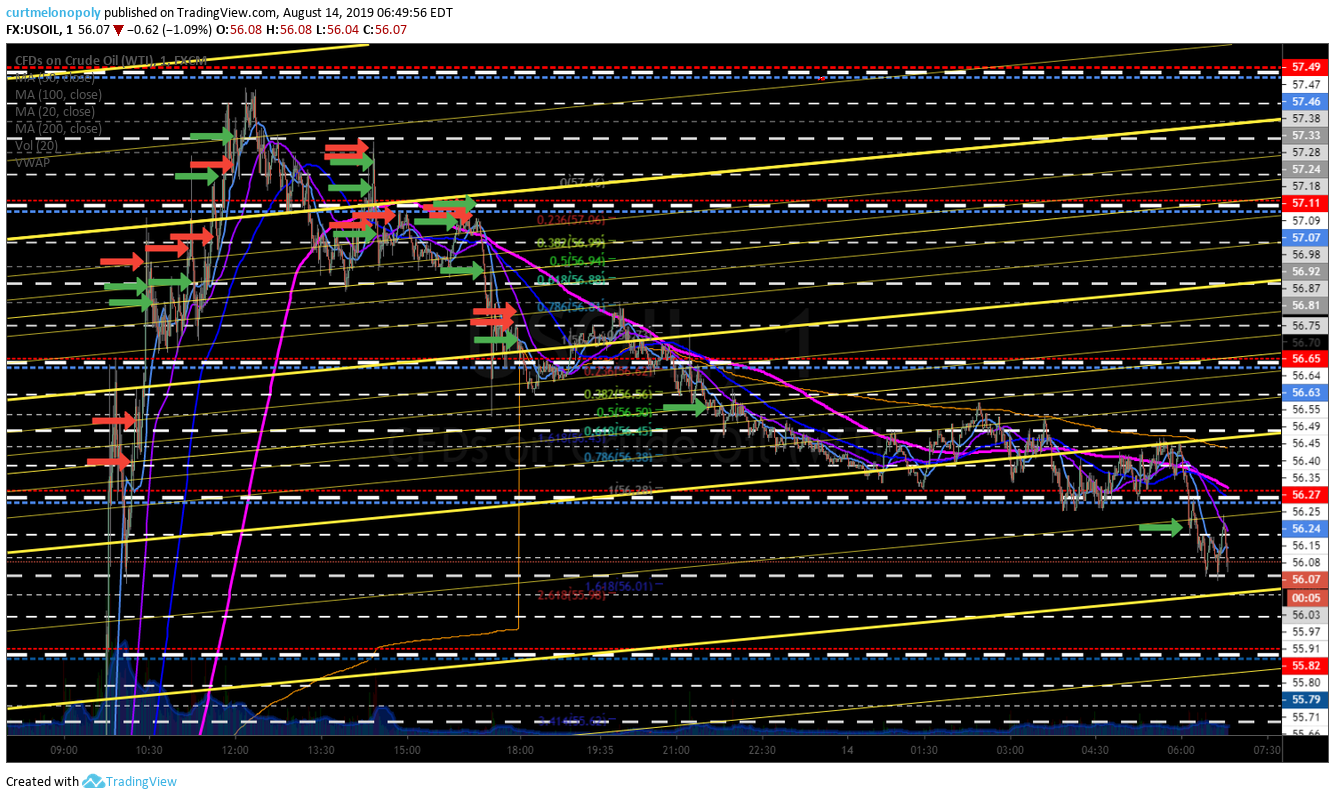

The oil chart below is a summary of all trades so far in the strategy.

Current sequence of all trades are mapped on the oil chart showing short trades (red) and buys to cover short positions (green). At this point we are 1/10 size short (at time of writing).

The first four positions in red at left of chart image is a 4/10 size short when order flow was showing significant selling pressure was starting. This was the battle ground for continued rally in price of oil intra-day or a retrace in price of some sort.

The bulls won the intra-day range battle so we covered 2/10 size for small scalps and held 2/10 size as price continued to rally in to resistance.

We added 2 more positions of size in to the next resistance area of the charting and the progression goes from there, covering wins when possible at support areas and re-shorting at resistance areas.

If price alternately continued bullish we would have covered at least one if not the two add size positions of the short. However, price did not continue to rally and this area of trade was the high of day for oil nearing the end of regular US market session.

This process (of shorting chart resistance areas and covering short positions at support areas) will continue in the strategy (trade sequence) until a strong intra-day sell-off occurs, at which time we will cover the remaining short positions for a win.

The Oil Trading Alerts (screen capture images and comments).

Curt MelonopolyToday at 2:00 PM

55.98 sold 4

bot 1 55.93 holds 3

Curt MelonopolyToday at 2:17 PM

boy .94 holds 2

Curt MelonopolyToday at 2:39 PM

Sell 1 56.18 holds 3, this sequence could run until 4:30 Tues API for a PT of 55.22

Curt MelonopolyToday at 3:47 PM

Sold 2 56.30 bot 1 56.23 holds 4 trading 56.22

Day trade alerts for oil trade strategy in chat room continue in to close of regular market session.

Curt MelonopolyToday at 4:10 PM

Cover 1 56.21 hold 3 short

Curt MelonopolyToday at 4:59 PM

See ya at 6 pm

Alerts continue in to the futures trading session and the trade sequence continues.

Curt MelonopolyToday at 6:02 PM

Buy 1 56.03 hold 2 short

Curt MelonopolyToday at 8:04 PM

Buy 1 55.89 hold 1 short

Trade strategy guidance posted to oil chat room about 15 minute chart model symmetry and sell off area intraday.

Its selling in to mid quad on 15 min model as we thought (trading plan from trading room earlier) Buy the day, sell over night

To clarify : Selling in to lower part of the 15 min quad at mid duration through the quad

Symmetry from 1 week earlier almost identical also

One of many examples of near resistance on oil chart models is the 30 min in picture (dark black trend line above price).

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from 7am to 5pm EST). To listen to comments by the lead trader that contain specifics to his/her oil trade strategy / thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

I did voice alert the trade executions in the live trading room on Monday (in video), however, there was not great detail as to the trade set-up / strategy, there is some guidance but not lengthy.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Remember also that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

https://twitter.com/EPICtheAlgo/status/1163213528867770369

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategies, API Report, Short Selling, Resistance, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL, alerts, trading room

134 Ticks in 1 Hour (Post EIA). Crude Oil Trading Tips: A Simple Intra-Day Reversal Strategy.

In One Hour of Crude Oil Trade Wednesday Afternoon (After EIA Reported Inventories) Price Ran Up 134 Ticks, And We Knew The Bottom.

A Simple Crude Oil Intraday Trading Strategy.

Below Are Tips for Intra-Day Reversal Trading Strategies and How To Determine Price Targets For Locating Bottom of Day Price.

Nail the bottoms in crude oil and you have the single most profitable strategy there is in trading crude oil. The intra-day reversals and subsequent run up in price move fast. Intra-day reversals can be precisely executed with an extremely high win rate (our v3 EPIC win rate is well over 90%) and you can build a profitable trading career with that one set-up.

The reversal trade in crude oil trade in this report and video is a real-world example from our oil trading room.

The intra-day oil futures short selling strategy / sequence from yesterday’s article concludes here also (see below).

We pick up the story in this article with us closing the winning oil short position / sequence from the Tuesday (selling in to the Trump news) and then on Wednesday (after the weekly EIA report) turning our focus toward pin-pointing likely oil trade reversal areas intra-day to possibly catch a bullish run-up trend intra-day after the sell-off.

The strategy worked. We caught the bottom near to the penny and we had the price target for the high of day within pennies also. Execution wasn’t perfect, but we are winning consistently and the v3 software is performing over expectation.

Exactly how we determined the most likely bottom area on the day and high of day price target is in the raw video feed from the live trading room (see below) and in this quick post.

With the limited time I have available to write this article in premarket, I will provide some of the tips you can use to locate bottoms for your daytrading strategies. For more on this subject, refer to the live trading room videos on YouTube and/or other articles we have published on this topic.

If there is one area of crude oil trade we know well, it is how to locate intra-day bottoms (low price of day) in advance to assist with a traders day trade strategy. The v3 EPIC Machine Trade Software has an extremely high success rate in this specific area of oil trade analysis.

Before digging in to this article, please read the introductory article for this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are sent direct to the mailing list – so be sure to register now, click here.

Recent Trading Profit/Loss Results v3 EPIC Oil Machine Trading Software Sample 100K Account:

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts pic.twitter.com/bPJVI49MIL

— Melonopoly (@curtmelonopoly) August 11, 2019

Wednesday’s Live Oil Trading Room Session.

Please note:

- When we alert 1/10 that means (for example) on an account of 100,000.00 that would normally execute a trade size of maximum 10 contracts, 1/10 size then represents 1 contract. We use a 100k account for our sample set for simplicity.

- Trades and the strategy therein are alerted to a live trading room by voice (by a leader trader) and published as time allows to an oil trading alert feed on Twitter and in Discord private member server.

First I will share the guidance from the oil trading room server, alert feeds etc and then I’ll give you some pointers on how to locate bottoms in trade.

The raw video from the oil trading room provides significantly more detailed guidance.

Chart from oil trading room below highlights the alerted close of last short sell position in crude oil for Tuesdays trading session.

Image of oil trading alert private member feed on Twitter that shows covering the last short sell on crude oil trade.

JeremyToday at 6:11 AM

Buy / cover 1/10 56.18 hold 0 but still in sequence to sell

Software well green.

The New Trading Day Starts: Oil trading room day trades alerted with price targets for reversal at intraday bottom and top.

Green arrows on chart are oil contract buys and red arrows sells, white are price targets for low and high alerted prior to trade.

Screen shot image of crude oil trading chat room alerting initial buys at reversal test area, time cycle, price targets for oil intra-day

Curt MelonopolyYesterday at 11:33 AM

Software started buying 54.32’s HF tests

It sold in to the 2/10 in to 54.50s, its in a range program now

Curt MelonopolyYesterday at 11:56 AM

At this point we’re looking for a 12:45 bottom, time cycle 11:15 – 2:15, trading 54.14

machines are here fyi

Preferred buys 53.93 for 54.93 PT bounce and 55.41 possible. Trading 54.29. Quoted as FX USOIL WTI

Preferred buy price target 12:42:30 EST at 53.93

Screen image from oil trading room of machine trade software nailing the bottom reversal intraday in crude oil trade and alerts.

Curt MelonopolyYesterday at 1:09 PM

Long 54.13 1/10 tight stops

Curt MelonopolyYesterday at 1:19 PM

Long 2/10 add 53.96, sell 1/10 54.01, hold 2

Sold in to 54.25 hold 0

Gotta teach it to hold some.

Screen image from oil trading room showing first price target previously alerted being hit.

two ticks away hit 53.95 – “Preferred buy price target 12:42:30 EST at 53.93”

2 ticks off price target in that first burst

“Preferred buys 53.93 for 54.93 PT bounce and 55.41 possible. “

Guidance in oil trading room lead trader alerting members to watch for a possible channel of trade coming.

Curt MelonopolyYesterday at 1:50 PM

possible channel

Curt MelonopolyYesterday at 2:25 PM

right in to top of channel beauty

Crude oil price then goes on to near the 2nd price target from previous alert. Image of trading room.

Curt MelonopolyYesterday at 2:36 PM

Hit 55.30 dangerously close now to 2nd price target, nice move today on that snap back reversal trade intraday

I will be on break until 6:00 PM, Jeremy will alert any trades, a tad overloaded with paperwork. Have a good one y’all.

So, The Question Then Is, How Did We Nail The Bottom Price On The Day? And How Is It That We Nail That Trade Day After Day With Well Over 90% Win Rate? Below Are My Tips:

What I Can’t Tell You (Top Secret):

- We are developing proprietary crude oil order flow AI software platform that is getting really accurate (IDENT). This software runs tandem to the EPIC Oil Trade Machine software that executes the trades. Sovoron then uses that data. Our trading service members and clients of SOVORON receive the benefit but I can’t tell you how it works, ever.

- We have been developing algorithmic chart models for crude oil trade on all time-frames for nearly three years now, this helps a lot in determining areas (range) of oil trade and turn-around (reversal, nap-back) trades. The oil algorithmic chart models are available to our trade service members in reports that are regularly distributed.

- We have taken the algorithmic chart models and coded them to machine trade software. The software then alerts myself (and team), our oil trading room traders, our trading service members and Sovoron to trades setting up and trade executions. I can’t tell you exactly how the software is coded beyond that, but I can say that it has over 4700 rules. The v3 software is executing a win rate well over 90%. You can learn how to trade on the information it uses by signing on to our newsletters, alerts and/or attend the live trading room.

What I Can Tell You:

Below are just a few tips I can provide with the limited time I have, but I can say that if you study our methods you can duplicate our win rate. We’re still learning and we’re teaching our trading service members and the recently launched AI software to trade oil (the software will obviously be much better than us soon enough), but I think you get the point. There is a process here, you just have to put in the work and learn.

- Conventional Crude Oil Charts are critical for your trading strategy. Our software uses them, I (our team) use them and you should be using them daily. All time frames are important so that you know the key areas of support and resistance for your day trading plan. Trend-lines on all times frames should be at your immediate access when trading oil.

- Algorithmic Crude Oil Chart Models refine and compliment conventional charting. They help you see what you wouldn’t otherwise be able to see. They also help you know better what the large machine liquidity in the oil markets are likely to do with each support and resistance area. Algorithmic models also provide you with a future forward GPS. For example, you will know where possible channels are before they appear from trade. In summary, algorithmic chart models provide you with the lay of the land – the structure of trade on various time-frames. It is this structure that wide market machine liquidity is programmed to compete within.

- When Sizing Your Intra-day Reversal Trade be sure you can release some size almost immediately so that if the trade then goes against you (after the initial spike) then you have some “room” for your stops. In other words, if price spikes 10 ticks after you enter a 3 contract trade then close 1 contract and then if price returns to your buy then decide if you want to release another and then if it goes 10 ticks under your buy release the last. In that scenario you have lost zero. So if you get good at this trade set up then you have a near zero risk trading edge IF YOU DON’T HOLD LOSERS. Where we are working with our software right now is with it holding some as price reversal continues. We have mastered the bottom reversals and now we’re training the software to hold some size and ride some profit. It’s complicated to explain but I’m sure you get the point.

- Technically watch for increasing volume at possible lows. Know your support and resistance on every time frame, your trend lines are key as are algorithmic chart model structures. Get to know your important times of day, times of week, time-cycles, events etc. Also, if you can enter after a flash down (a quick spike down in to your intended support) this is best. This allows for some range on the snap-back reversal and if the trade fails you can exit.

- And finally, DO NOT HOLD BAGS. Losing trades can be tough to recover. Our v3 software may hold some (very small) but only because it can locate the next bottom and hit it long and have a small loser right side up very quickly. If intra-day trade leaves the intra-day structure our v3 software will close the small position for a loss. This by the way is its edge and the primary reason the v3 EPIC Oil Trading Machine Software very rarely loses a trade.

Bottom Line:

- We obviously know how to locate intra-day bottoms in oil price and most often also tops (although top price of day targets are more difficult as is trading oil short from the top – bottom reversals are much easier to trade). The everyday oil trader can learn our methods and find a high win rate with an excellent ROI. Reviewing our videos on YouTube, reviewing our written blog posts and signing on with us will go a long way to you learning this trading edge. This becomes a really easy trading strategy when you have done your study, have the right indicators in front of you when trading, receive some experienced guidance when needed and have our alerts / guidance.

- As our software better learns how to hold profits and trail out of the intra-day reversal trades the win rate will remain the same but the ROI of the software graph will likely go parabolic from about 90% per annum (see chart) to a vertical ROI graph – we aren’t far away from this now.

- The majority (we estimate now to be close to 90%) of order flow in the oil markets is now machine traded, if you aren’t at least learning how they trade then you’re just not awake to the profitable world it offers.Between 2012 and 2016, almost two-thirds of crude oil contracts traded on CME’s futures exchange were automated, up from 54 per cent, according to a 2017 study by the US Commodity Futures Trading Commission. https://www.ft.com/content/8cc7f5d4-59ca-11e8-b8b2-d6ceb45fa9d0

- Dig in to the links below at the bottom of this article if you want to investigate how our development process can help you profit in the oil trading markets.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from 7am to 5pm EST). To listen to comments by the lead trader that contain specifics to his/her thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

On Wednesday I was fairly active on mic around trading times with trade set ups and execution of trades.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com and remember that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, tips, reversals, bottoms, trading, strategies, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL, how to trade, alerts, trading room, simple, intraday, strategy

Short Selling in to Crude Oil Bullish Break-Out on News | Day Trade Strategy | Oil Trading Room – PT 1

Selling Against An Intra-Day Bullish Break-out In Crude Oil Is Difficult. Here’s How We Day Short-Sold The Trump – China Break-Out News Yesterday.

The trade sequence in this report is a real-world example from our oil trading room. The intra-day oil futures short selling strategy / sequence as of the time of writing this report is not complete so there will be a Part 2 to this post.

Tuesday was a bullish break-out day for crude oil markets. Trump messaged to the world that some tariffs would be delayed and this sent oil soaring in price intra-day.

Oil prices continued to rally on Tuesday, this time on reports that the United States has decided to delay the next round of tariffs that were to be imposed on Chinese goods.

The delay gives hope to a skittish market that the trade war really won’t go on forever.

For WTI, oil prices had climbed 4.30% by 12:36pm EDT to trade at $57.29. Brent Crude was trading up even more at 4.70%, at $61.32—resuming its over $60 per barrel that it had fallen under during the first week of August as the trade war stoked fears of souring oil demand growth.

In addition to the tariff delay, which will now go into force on December 15, the United States will also be taking some of the items on that tariff list off completely, according to its newest policy document published on the Office of the United States Trade Representative website. While the list hasn’t been made public, it will include items that will be removed “based on health, safety, national security, and other factors”.

https://oilprice.com/Energy/Energy-General/Oil-Spikes-As-US-Delays-Tariffs-On-Chinese-Goods.html

When the intra-day price in the bullish break-out (on Trump news) was over-extended technically on charts and trade was starting to get in to overhead supply (order-flow), we began a short selling sequence.

Below is the first part of this article because (as I mentioned above) the short selling sequence is still in play and includes a significant number of trade executions.

So for today’s article I will include a chart that shows / maps out each trade execution as I and the v3 EPIC machine trading software executed the trades, the raw footage from the oil trading room and some miscellaneous charting. Then in Part 2 of this article (when the trade sequence is complete) I will explain each trade execution in detail so that it may help you with your crude oil day trading strategies.

Before digging in to this article, please read the introductory article for this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are sent direct to the mailing list – so be sure to register now, click here.

Also, The Most Recent Oil Trade Profit Loss Results For v3 Machine Trading (trade alerts) Sample Set;

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts