Real Time Crude Oil Trade Alerts, How Time-Cycles Work – Crude Oil Day-Trading Strategies April 22, 2020.

Daytrading crude oil is not easy, having an edge helps. Time cycles are an edge and algorithmic models also help considerably.

Below is a documented real-time oil trade I took earlier this morning – alerting the trade, charting and guidance to our oil trading room members with a series of trade alerts.

The actual oil trade alerts, oil trading room discussion, guidance and charting is below.

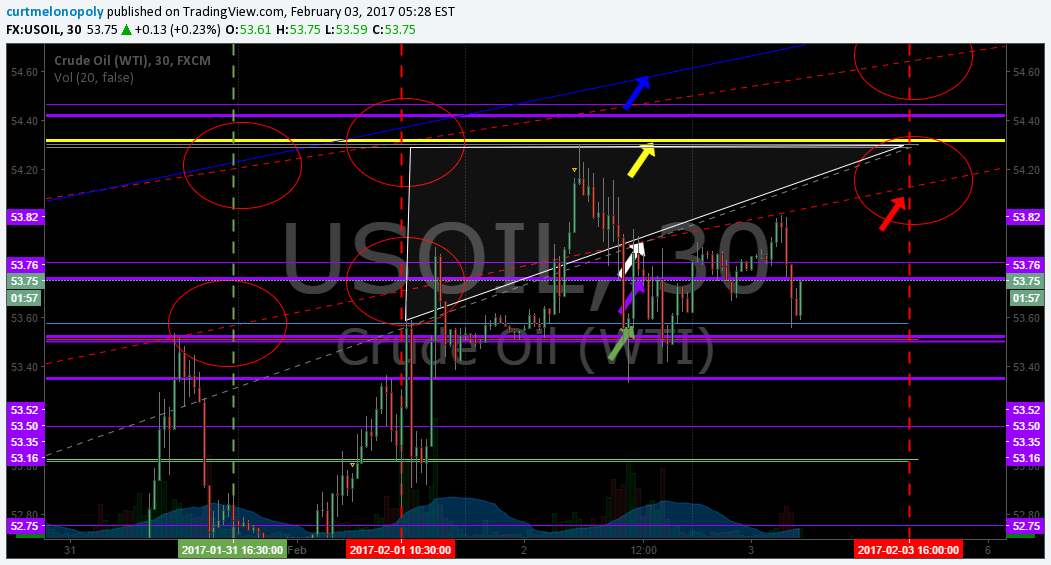

The charting includes our EPIC v3 Machine Trading 30 minute algorithmic model and the 1 minute daytrading chart model that our software uses.

In this instance this was a day trade intended to develop in to an intra-week swing trade.

This trading set-up and the strategy itself is in play live right now.

Oil traders may find this interesting for Wednesday April 22,2020 trade.

See below.

A real-time example of how time-cycles work in crude oil trade Direct hitFireBow and arrow

#OOTT $CL_F $USO $USOIL #timecycles

A real-time example of how time-cycles work in crude oil trade 🎯🔥🏹#OOTT $CL_F $USO $USOIL #timecycles 👇

— Melonopoly (@curtmelonopoly) April 22, 2020

Curt MelonopolyToday at 3:14 AM

Starting a swing long 1/10 size 11.00 with stop 10.39 (on FX USOIL WTI) traded on CL, entering other side of quad on EPIC 30 Min – Curt Personal intraday swing trade.

Will advise.

obviously a high risk trade

Curt MelonopolyToday at 3:14 AM

Starting a swing long 1/10 size 11.00 with stop 10.39 (on FX USOIL WTI) traded on CL, entering other side of quad on EPIC 30 Min – Curt Personal intrad day swing trade.

Will advise.

obviously a high risk trade pic.twitter.com/ccjdMukzym— Melonopoly (@curtmelonopoly) April 22, 2020

30 min quad, hoping to get turn up here

30 min quad, hoping to get turn up here pic.twitter.com/jyOUwmAOMi

— Melonopoly (@curtmelonopoly) April 22, 2020

If I actually get my way here I will trim 25% at 11.39, 11.62, 11.87 and have stop just above entry hoping the 25% remaining gets the turn up for more.

There, got my profit trims and holding 25% of position with stops above entry #oiltradealerts That worked well.

If I actually get my way here I will trim 25% at 11.39, 11.62, 11.87 and have stop just above entry hoping the 25% remaining gets the turn up for more.

There, got my profit trims and holding 25% of position with stops above entry #oiltradealerts That worked well. pic.twitter.com/DfucPyh9Kl— Melonopoly (@curtmelonopoly) April 22, 2020

Full move through the EPIC 30 min quad fast there and the swing trade in crude oil is well positioned in time cycle #oiltradealerts

Full move through the EPIC 30 min quad fast there and the swing trade in crude oil is well positioned in time cycle #oiltradealerts pic.twitter.com/LQIUQ1Ifjc

— Melonopoly (@curtmelonopoly) April 22, 2020

The power of time cycles and algorithmic trading. #OOTT $CL_F $USOIL $USO #machinetrading #oiltradealerts

The power of time cycles and algorithmic trading. #OOTT $CL_F $USOIL $USO #machinetrading #oiltradealerts

— Melonopoly (@curtmelonopoly) April 22, 2020

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Crude, Oil, Trading, Strategies, time-cycles, crude oil trade, oil trading room, #OOTT, $CL_F, $USO, $USOIL, $UCO, $SCO, tradealerts, Swing Trading, daytrading, FX, USOIL, WTI