Tag: Oil

Swing Trade Set-Ups $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL …

Trade Set Ups for Swing Trading Tuesday February 26, 2019.

Swing Trading Signals in this Report: $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL and more. .

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar: https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week:

#earnings for the week

$SQ $HD $CHK $ETSY $JD $M $MDR $PCG $FIT $AMRN $LOW $JCP $WTW $KOS $PANW $BKNG $ABB $BBY $SPLK $VEEV $AZO $TEX $TRXC $SHAK $NTNX $ECA $JT $WDAY $CRI $DNR $TNDM $AWI $DORM $GWPH $HTZ $TREE $PLAN $NSA $ICPT $FLXN $BNS $CROX $RRC

Earnings Season Special Reports Thus Far:

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Up VIDEO:

#Swingtrading

A Review of Current Swing Trades in First Section Below and Then Other Swing Trade Set Ups I Am Watching for Entries Reviewed Below:

GOLD (GC_F, XAUUSD, GLD) trading 1326.00, entry 1319.78 short 1/20 starter size per previous reporting (starter) looking for a pull-back at resistance levels on chart reviewed on video.

NIKE (NKE) is a break out swing trade play, trading 85.64 I am long 84.84. 99.65 first target then 91.39, 93.31, 101.35 for ultimate target. See chart.

ARROWHEAD (ARWR) swing trade is going well, looking for 27.59 early April 31.34 range after that for a double. Will add at channel support.

GOOGLE (GOOGL) starter position long 1135.00, trading 1117.32, 1158.00 first target then 1214.17 then 1317.72.

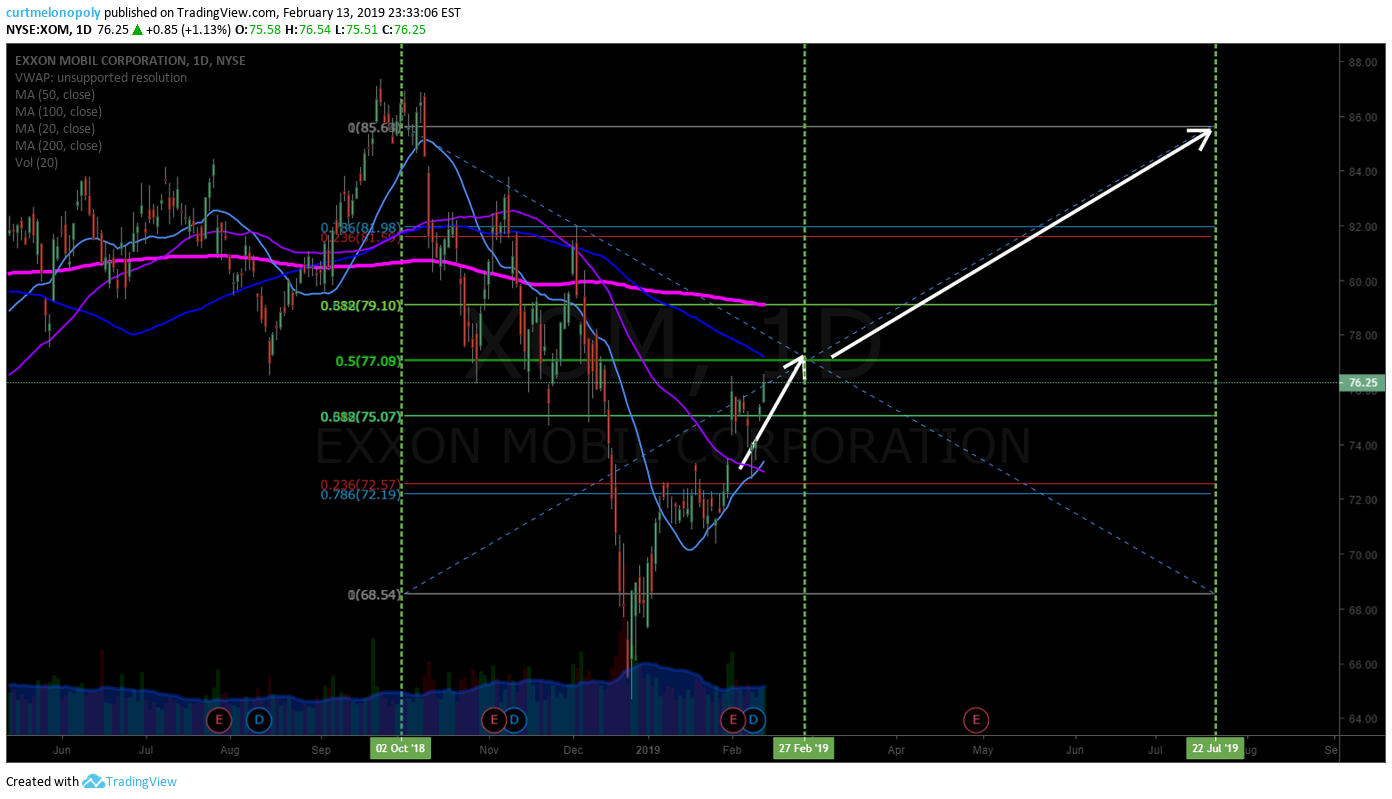

EXXON (XOM) Earnings play going well. Looking for a price target 85.61 area. Trim in to each resistance, add above or at pull backs.

SHORT OIL (DWT) Still in small starter, Trump tweet helps me a bit get more onside than I was.

RETAIL ETF (XRT) Trading 45.43. Price over 100 with 20 MA underneath. Looking for 47.48 upside at 200 MA.

STRYKER (SYK) Break out trade set-up, extension over trade break out is what I am watching. Trading 188.31 with price extension to 192.84 then a retrace – likely scenario.

NVIDIA (NVDA) Price target 208.00 ish possible. First price target 100 MA, 2nd traget 186.85, 188.81 is the third price target. 168.25 HOD and looking at a possible long over that. Video explains set-up in more detail.

APPLE (AAPL) 181.66 is price target and 191.60 range is 200 MA as a possible price target above, trading 174.33 intra day, looking at it long – not the best trade set up of the bunch.

JOHNSON JOHNSON (JNJ) Price against a pivot on daily, over 138.00 is interesting for full extension, will re look at it at 138.00. Might be too late on this one. Was going to take trade a number of times and didn’t.

FINISAR (FNSR) Daily chart, another pivot play with full price extension up possible, over 25.37 I’m interested long for a price extension play long.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, Earnings, $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL

Price Increase Mar 4: Oil Trade Services (Bundle, Newsletter, Alerts, Trading Room) w/ Promo Codes

RE: Price Increase Details w/ Promo Codes. EPIC Oil Trade Algorithm March 4, 2019. Applies to Bundle, Newsletter, Oil Trade Alerts and Oil Trading Room.

February 24, 2019

Compound Trading Group recently launched a first generation oil trading algorithm (CL) software with great initial success. January oil trade alerts seen a 63% account build increase. We expect results to continue to trend higher as the software is fine-tuned.

More recently, we distributed an advisory to detail software protocol updates that will execute oil trade alerts at a higher frequency with a mandate for 60 – 100 trade alerts per month with an objective of 80% or higher win rate (the current win rate is consistently higher than 90%). The objective is to provide a higher frequency of alerts to achieve a greater return on equity per month with a moderate decrease in win rate as the trade-off.

Also included on the advisory above is detail concerning our proprietary IDENT software update – IDENT is an order flow identifier that helps our software trigger trades with market leaders. The IDENT program update has provided our oil trading and alerts with an extremely high win rate since introduction.

Also recently announced, Compound Trading Group’s EPIC Oil Machine Trading Software has been selected for the SOVORON™ trading platform. SOVORON™ offers a unique trading service providing clients with technology application based Machine Trade of personal investment accounts along with a fund and robo-trade application in their pipeline. To explore their unique client service structure click here http://sovoron.com/ or call 1-849-861-0697.

And finally, Compound Trading Group will be closing to the general public as of April 30, 2019 and will only be available as a private service going forward – you can view the news release here.

Existing members will be included in the transition. Most of Compound Trading Group’s clientele are serious full time traders, private commercial trading services and institutional clients.

Price Increase Detail, Early Adopter Price Guarantee, Limited Promo Codes:

The main pricing menu on our website is found here.

Existing members (early adopter pricing) remains constant and are not affected by the price increases below as long as the member fees do not lapse.

Oil Trading Bundle – Weekly EPIC Algo Newsletter and Charting, Real Time Twitter Feed Alerts, Main Trading Room Access During Active Trade, Private Oil Trading Room / Chat Discord Server (not screen sharing live broadcast like the main trading room).

Current Pricing: 1 Month 399.00, 3 Months 1099.00, 6 Months 2199.00, 1 Year 3999.00.

New Mar 4, 2019 Prices: 1 Month 799.00, 3 Months 1999.00, 6 Months 3799.00, 1 Year 6999.00.

This works out to about 10.00 per alert but also includes the trading rooms and newsletter. If you calculated 60 – 100 trade alerts per month.

Standalone Oil Algorithm Newsletter – Weekly EPIC Algo Newsletter.

Current Pricing: 1 Month 299.00, 3 Months 807.30, 6 Months 1435.20, 1 Year 2511.60.

New Mar 4, 2019 Prices: 1 Month 399.00, 3 Months 999.00, 6 Months 1899.00, 1 Year 2999.00.

Crude Oil Trade Alerts – Distributed by way of private members Twitter feed and now includes access to private Discord oil chat / trade alert feed (with push notifications).

Current Pricing: 1 Month 199, 3 Months 537.3, 6 Months 955.2, 1 Year 1671.60.

New Mar 4, 2019 Prices: 1 Month 499.00, 3 Months 1399.00, 6 Months 2699.00, 1 Year 4999.00.

Promo Codes are in effect for a limited time “bundle30” at check-out. The promo codes remain in effect until Mar 3, 2019 only.

If you have any questions please email me direct at [email protected].

Warm regards,

Jen

Machine Learning Trade Software Advisory | Crude Oil: (1) Frequency (2) IDENT Program

February 22, 2019

RE: EPIC Crude Oil Algorithm Machine Trading Software Advisory Specific to Trade Frequency Protocol “Throttle” and IDENT Program Description.

We are now near two months of running the machine trading software for crude oil futures contracts (CL).

During the testing phase, which will continue for some time as we adjust code instructions, the execution of trades by the program is “throttled”. Meaning specifically that the frequency of trade was specifically limited to the highest and then was adjusted to a higher win probability threshold.

The result of the initial testing achieved near 100% win side trade accuracy, but less than optimum trade frequency. Increased frequency may (will in our estimation) return a higher ROI – assuming the win rate percentage achieved is high enough. This of course is a complicated calculation within the code that reflects the win side average per trade return vs. loss side average per trade. In short, the loss side is programmed to be less (limited by way of higher frequency executions – tight stop triggers) and when trade is on win side the trade profit is increased via trade size that is progressively trimmed as the trade is in progress. Refer to private Discord oil trade chat server for real-time discussion between developers and traders for more detail.

An article is available at this link that displays some of (actionable by a human trader executing trades manually) the oil machine trading results, much of which was throttled considerably and much of which had human intervention – in other words, had the software been released to execute totally autonomous the returns would have been considerably higher – but we are testing. The highlighted trades returned a 63% increase on the “large account” test for the one month duration. This achievement was specifically to the alerted trades, not the higher frequency machine trades.

The “alerted trades” meaning that which could be considered actionable alerts to our subscribers. The machine software executed many times more trades but our current alert system platform (Twitter private member feed, Discord private chat server, Oil trading room live broadcast) cannot for the most part distribute alerts fast enough for the higher frequency trades to be considered actionable by a human executing trades manually (a trader digital platform is on the team WIP to remedy this). In consideration also is that the higher frequency trade protocols could easily be reverse engineered to expose the proprietary protocols under our IDENT program – this remains a discussion point internally and how the higher frequency trades will be shared is in question (more on that at a later date).

The “throttle” was initially set to approximately 20 x and over the course of fifty days progressively lowered to function near 10 x with less and less human intervention along the way. 20 x for example would result in twenty times less trade frequency than would otherwise be if the software was not “throttled” at all.

Today (Feb 22 at 2:11 AM EST) the code was adjusted considerably to be “throttled” to be less than 10x and will be lowered progressively over the next 7 trade days. The win rate vs. return as it would be calculated over a month is the achievement bar (goal) in focus. More on this objective and other clarification in near future updates.

Market condition will also result in variance of execution frequency as will holiday weeks specific to the model(s) divergence.

The main takeaway: In to next week the frequency of trade will be considerably higher with an objective being to find the most optimum throttle setting to achieve the highest return. The win rate is expected to near 80% and not near 100% and the return on equity on a monthly basis to increase considerably.

The 63% monthly return (monthly return in this instance meaning account equity size increase as it relates to alerted trades only) is a favorable start, however, our team believes 100% + return per month is consistently attainable (on average over a year) and in a perfect machine executed world 300 – 500% being optimally possible. For now our objectives are to achieve consistent wins at higher than 80% with a frequency of about 60 to 120 trades per month with a return averaging 100% per month (the bar).

The IDENT program is a protocol specifically to order flow identification of market participants achieved by way of historical pattern recognition of between 20 – 40 entities that we consider largest and approximately 200 entities that we consider important enough to attempt to track. The entities are prioritized in what we describe as an “alpha” order. The IDENT program is in large part the topic of this recent article at this link that describes the influence of machine trade in the crude oil trade market as experienced by our lead trader and is in large part the reason for the “intuitive like” nature of our software protocol.

The IDENT program seeks to enter trade direction with prioritized alpha order flow and exit in the same fashion. It is a proprietary process and the instruction set within the code architecture will in large part remain private.

For more information on how our development has progressed, refer to this link that will immerse you in a series of articles written from first hand perspective of the day to day trading of our lead trader with crude oil futures.

Thank you.

Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Trade Set Up Reviews for Swing Trading Earnings Thursday Feb 14, 2019.

Swing Trading Signals in this Report: $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas.

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar: https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week:

#earnings for the week

$NVDA $CGC $SHOP $ATVI $TWLO $GOOS $UAA $AMAT $CSCO $TEVA $KO $L $KMPR $CTL $GRPN $CNA $MPAA $NGL $QSR $CHGG $DO $AVYA $WM $ANET $CYBR $PEP $EXEL $NSP $YELP $MCY $GOLD $MRO $RNG $DGX $NTAP $ICBK $DE $NRZ $YETI $JLL $MOH $AKAM $OHI

#earnings for the week$NVDA $CGC $SHOP $ATVI $TWLO $GOOS $UAA $AMAT $CSCO $TEVA $KO $L $KMPR $CTL $GRPN $CNA $MPAA $NGL $QSR $CHGG $DO $AVYA $WM $ANET $CYBR $PEP $EXEL $NSP $YELP $MCY $GOLD $MRO $RNG $DGX $NTAP $ICBK $DE $NRZ $YETI $JLL $MOH $AKAM $OHIhttps://t.co/lObOE0dgsr pic.twitter.com/cTAZxWC37n

— Earnings Whispers (@eWhispers) February 9, 2019

Earnings Season Special Reports Thus Far:

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

ALPHABET (GOOGL):

Google (GOOGL) swing long starter 1135.56 PT 1158 1210 1266 1319. Will add as trade improves. #swingtrading $GOOGL

I entered this trade early Wednesday because broad market conditions appear to be improving (geopolitical etc). It’s a probability play. My position is 1/5 size because I am not ready to leg in to swing trades yet. But I am close.

My downside tolerance is more on this trade than my other new entry in Nike long. Under 1078.00 would cause concern. It closed at 1128.63 and my entry was long 1135.56.

https://twitter.com/SwingAlerts_CT/status/1095697800023732224

NIKE (NKE):

NIKE (NKE) swing long 84.84 is a break-out play with tight stops price target 1 is 88.65 then 91.39 and so on. #swingtrading $NKE https://www.tradingview.com/chart/NKE/Ddrfhb9k-NIKE-NKE-swing-long-84-84-is-a-break-out-play-with-tight-stops/ …

Nike long early today is momentum trade for me with specific targets. My downside threshold is minimal. Trade is on the right side right now and I will watch this one close. I am in long 1/5 size and don’t expect to size in more but that is yet to be seen. It closed the day 85.40 and my entry was 84.84 long.

https://twitter.com/SwingAlerts_CT/status/1095699317887852544

ARROW PHARMACEUTICALS (ARWR):

Arrow Pharmaceuticals (ARWR) Long from mid 15s looking for adds long at channel support pull back $ARWR #swingtrading

I am long on a long term swing mid 15’s, trading 17’s and looking to add soon – preferably at channel support (or near).

https://twitter.com/SwingAlerts_CT/status/1048151441704214528

EXXON (XOM):

EXXON (XOM) holding initial position, near first price target, will trim in to that and add above #swingtrading #earnings

I am long from 72.60 as an earnings play. Close Wednesday 76.25. Long term swing in to late 2019.

https://twitter.com/SwingAlerts_CT/status/1090997581897961473

CRUDE OIL SHORT (DWT):

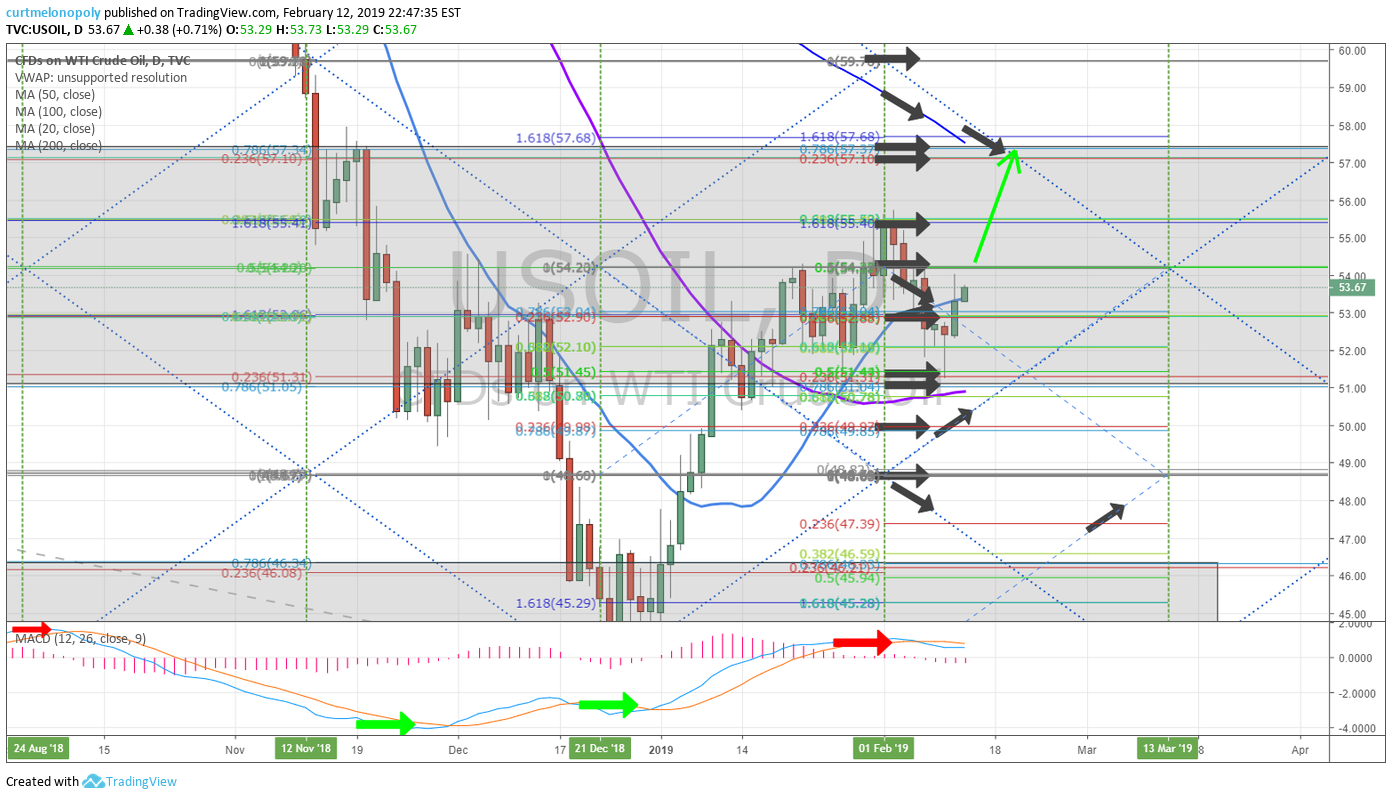

I’m holding this small starter swing trade position a bit longer, at minimum I’m thinking I close it for a small loss if oil swings down a bit. I’m watching a chart structure per below.

I’m long 10.59 1/20 size and it closed at 9.21 Wednesday.

Below is the original trade alert:

Long DWT 1/20 size 10.59, will build position as it develops. Moderately tight stops. Target 50.42 1st price target on FX USOIL WTI.

https://twitter.com/SwingAlerts_CT/status/1094969929974145025

DWT long (short oil) swing trade position needs to hold here, if it does follow the trendline up. #Oil #Short #swingtrade

Crude oil has two choices here, up and down trajectory shown with arrows on the daily chart.

GOLD (XAUUSD, GC_F):

Gold short trade 1/20 size 1319.78 entry holding and looking for adds. Gold trading 1308.55 intra-day at time of report.

Probability is for a pull back in Gold trade at resistance on this chart. If price gets above I will add short.

The original trade alert is below:

Starting Gold short position 1319.78 with initial price target 1186.00. 20 % sizing will add to 100% when it confirms. See Gold report for trading plan including dates and price targets due soon.

https://twitter.com/SwingAlerts_CT/status/1090810500001210368

BITCOIN (BTC):

Bitcoin has a decision to make soon at red trend line. Position long is assuming next is up in trade from base. BTC.

Long 1/5 size 3449.50 trading 3583.00 intra-day.

Original trade alert is below:

Starting a swing trade BTC Bitcoin on XBTUSD long 3449.50 price target 4200.00. 20% sizing. When it confirms will add to 100% – see Bitcoin report due soon. #swingtrading $BTC $XBTUSD

https://twitter.com/SwingAlerts_CT/status/1090809528633962496

NATURAL GAS (NG_F):

I am searching for a new trade in natural gas. The last one paid well.

Possible bounce on Natural Gas here. NATUSD NG_F $UGAZ

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas

Strategies for Day Trading and Swing Trading Crude Oil | Premium Member Newsletter

Strategies for Crude Oil Futures Trade February 12, 2019. Includes Rule-Set Instructions.

Below is the oil futures trading battle plan for day trading, swing trading intra-day and longer term swing trading.

This report includes a section that breaks out much of the rule-set for the 1 minute model with an actual trade progression as alerted in the oil trading room and on the Twitter alert feed. The report on whole provides key insight in to the rule-set we are using.

If you want to learn how we traded for over 63% gains last month, study this report and any recent reporting and videos closely. Our software techs believe 500% is not out of the question. I know it’s lofty, but when you consider the current win rate (over 90%) and that last months trading gains were only as a result of trading less than 10% of the time you can then begin to appreciate the power of a winning systematic oil trading rule-set.

The EPIC Crude Oil Algorithm Reporting below is an alternate format to the regular format – we will be using alternate formats during a period of establishing simplified trading strategies for our members (the trade rule-set).

Links for the 1 minute model and the 30 minute EPIC model are provided separate of this report to members as they are slightly different for different distribution lists (retail, commercial, institutional variations). If you need either please message us preferably at [email protected].

Oil Trading Strategies Below are in Large Part Based on the EPIC Oil Algorithm Charting Model.

We Weigh Trade Probabilities on all time-frames against the EPIC model. This is important to consider when assessing our trade alerts for your own trading plan.

The EPIC Crude Oil Trading Algorithm Model below is by far the most predictable model we use for trade (30 Minute chart model).

The 30 minute EPIC model provides a general trading structure for the day. Important areas of support and resistance should be considered. It is common for the outside quad walls to be tested on the upside and downside. Long trades at the bottom support and short trades at the top of each quad or channel should be considered. Specific points of trade execution should be considered on lower time frame charting models.

On the EPIC Algorithm model a trade in to top of quad range is probable if price is over mid quad.

Refer to historical EPIC reporting and videos on yYouTube for ways to structure trades in the model.

- Trading the Range of the Quadrants and Range of the Channels:

- Respecting the key resistance and support areas of the oil trading model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through middle of quad) and the mid channel lines (light gray dotted).

- We are finding that when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot that trade will often test the mid channel lines (gray dotted) of the model. This causes the predictability of the quadrant support and resistance to be less (trade at quad support and resistance can be “sloppy”). This trade action in the model makes logical sense as a trend is not in play for an up or down channel. Another way to describe it would be trade using half quadrant support and resistance. While trade is in a sideways pattern on the daily your intra-day crude oil trading strategy should reflect this scenario. See examples from trade below:

-

“the predictability of the quadrant support and resistance to be less #crude #oil #trading #strategies” -

“when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot (as it has the last eight or so trading days) that trade will often test #oil #trade”.

-

- Trade Size.

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading oil in the model.

Per previous;

Screen capture of trade moving through EPIC Crude Oil Algorithm range Jan 16 – 20. The quadrant walls and mid channel lines are support and resistance.

Timing Trades Using the One Minute Oil Chart Model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models. Often early in futures trade and after 2:30 oil settlement daily are commonly low volume periods of trade.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend bias to long positions and down trend intra-day bias to short positions.

- Determine the trend on the daily chart also, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm bias / trend.

- Check important timing for key global market open hours (inflections in intra-day trend can occur there, especially going in to New York regular market open).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend. Break-up or break-down trades are more risky but can return positive results as long as a trader closes losing positions quickly.

- Trade Size and Positioning.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- “M – Machine sell program initiated. Short 52.44. Stop 52.61 or buy program detected. 1 Min model price targets 52.29 52.11 51.88 51.66. Support 51.73 on recent 30 min model in trading room and 52.50 52.38 52.19 51.75 EPIC. Resistance 52.62 52.75 53.04 53.16 53.51 EPIC.”

-

Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Position size and trimming to take profits as you go should also reflect key resistance and support on the EPIC algorithm model.

- Trim positions at mid trading box and top of trading box on the one minute chart model for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult and typically a trader will have to trade the break upside at resistance or downside as support is breached because pull-backs are not as likely in a squeeze.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Using Trade Stops.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- From the oil trading room see also this comment “M – there is a directional move component of the code (that will be included on rule-set that is in final edit tonight). If a move starts and doesn’t directionally continue with prescribed velocity, program will close at entry or prior.”

- The screen capture of the one minute chart below shows you the determined location for the stop for the trade.

- The stop was set just above VWAP and the resistance on the pivot trading box. Above is important to allow for other stops. Your stop will be a total of about 13 – 19 ticks depending on exact entry point.

- You will also notice that I have drawn the Fibonacci retracements on the chart to determine where the trading box pivot resistance is on the one minute model. If you do not know how to do this, be sure to either watch the videos we have on our You Tube channel, read through recent reporting or obtain some private coaching. We do not include the Fibonacci levels on the model because it makes the chart difficult to load on many machines – especially laptops.

-

The stop for the oil trade was set just above the pivot resistance and just above VWAP.

- The stop was moved to the trade entry point in the example below, as trade proved itself below the pivot support. “M – Machine stop at entry”.

- The stop at entry now put us in a no loss position. It was not moved until trade was below the pivot support AND trade hit the first Fibonacci support. Oil trade then bid up to 1 tick under the stop and entry point a number of times before continuing down intra-day.

- To be even more precise about the trade short entry point and the location of the stop you would have to view a fractal of the Fibonacci levels one down. This is not required or reasonable for the day trader executing orders manually to do, it would be too cumbersome for most traders. However, if you want to learn how to do this you can either get in to some trade coaching or ask at our next webinar for oil trading that will be held late February. I am simply pointing out that the precise entry and stop was not coincidental and the fact that trade returned to just under by one tick and ran sideways for nearly 30 minutes was no coincidence. That is machines in the oil trading market.

-

Oil trade dropped below pivot trading box support and hit first Fib mark and stop was now set to trade entry point.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- Timing Trade Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- Trade was trending down in futures from open. Oil was now trading under support on 1 minute chart model, now resistance.

-

Crude oil trade short example chart shows intra-day trend, breach of support and execution of trade on chart.

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- To pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Using the Oil Trade Alerts.

- You can utilize our oil trade alerts in three main ways;

- The live trading room provides charting and voice broadcast from our lead trader. This is not a chat room – it is intended for traders to be able to hear our lead trader call trades live and view the charting he is using. Any chat is specifically kept to key signals from traders in attendance. This is primarily used by full time traders, institutional or private trading firms.

- The oil trade chat room (private Discord server) is for chat and oil trade signals etc. You can get push notifications to your phone for quick alerts. This is faster than the Twitter oil alert service provided but not as fast as being in the oil trading room with our lead trader. But the lead trader is not always in the live room so Discord provides fast alerts.

- The Twitter EPIC oil alert feed is also used by some of our traders.

- Trade alerts as shown in oil trading room (specifically the chat room private server on Discord) for trimming the short position as it proves out.

Trade alerts as shown in oil trading room for trimming the short position as it proves out. - Screen image of the oil trade alert feed on Twitter as the trade progressed.

-

Screen image of the oil trade alert feed on Twitter as the trade progressed.

- You can utilize our oil trade alerts in three main ways;

- Trimming Positions.

- In the example above (the screen shot of the Discord private member chat room), you see a series of trade alerts from our trader signalling position trimming.

- First Price Target Achieved. “M – first target hit 52.29 trim 10%.”

- The position was trimmed at 52.29 per the original alert signaled as follows “1 Min model price targets 52.29 52.11 51.88 51.66.”

- The amount or size of trim (cover) on the trade was determined to be 10% because this was only the first target in a highly probable trade. The probability rule-set encompasses about 5700 rules so we won’t go in to that here and is not needed for the oil trader to be highly successful using this trading system.

- The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Notice how trade reversed after the target was hit and was denied at the bottom of the pivot trading box and just under VWAP. Comment from lead trader in the chat room “when it dumped at 52.37 that was a VWAP touch at resistance – boom.”

The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Price Target 2 Hit. “M – Trim 20% 52.17 at target 2 @ 52.11 short time frame momo reversal”.

- When price misses a target and reverses, which is what it did in this instance (by a fraction), our rule-set in the strategy is to trim the position.

- The size of the trim was in accordance to price target 2 trim size in the rule-set, which is 20%.

- Below is the oil chart model showing the location of the alert to trim size and trade reversing intra-day after meeting price target objective.

Location of price target 2 was the trading box support on oil chart. Trade reversed a fraction before.

- At 30 minute candle expiring trade alert was sent to trim 10% because oil trade held support. In this case pivot trading box support. See chart below that coincides with alert “M – trim 10% 52.03 on timing”.

-

At 30 minute candle expiring trade trim 10% because oil trade held support. In this case pivot trading box support. - Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image is below.

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

M – Correction: target 3 at 51.88

M – trim 10% 51.88 target 3 hit

M – stop on remaining 52.13 or 51.67 if hit.”

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

-

Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image. - Trade alert to close oil trade position. “M – stop activated on remaining position 52.13″.

- Oil chart showing where to trim short trade at next Fibonacci support line.

-

Oil chart showing where to trim short trade at next Fibonacci support line. - Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

-

Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

Per previous;

Day Trading Crude Oil Futures One Minute Strategy Model Jan 27 504 PM FX USOIL WTI $CL_F $WTI $USO #Crude #Oil #Daytrading

Per previous;

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

Also Monitor Oil Resistance and Support Levels on the 4 Hour, Daily, Weekly and Monthly Chart Models.

Beyond using the EPIC Oil Algorithm model for weekly / daily trading strategy / structure and the one minute chart model for timing day trades, use the daily, weekly and monthly chart models for important decisions in oil trade.

The longer the charting time-frame the more serious support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), the 4 hour oil chart below has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

Symmetry on 4 hour oil chart model should be considered. Currently trading over 50 MA.

Oil trade met the price target on the 4 hour model perfect to timing. See charts below.

Per previous;

4 Hour Crude Oil Chart – 20 MA seems the most logical support test for a long trade entry test likely 52.90 area on West Texas.

The previously published chart shows primary support areas to watch (per below).

Per previous;

Symmetry on this 4 hour oil chart model should be considered also. There are 3 options for trade trajectory here.

Per previous;

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

Symmetry on this chart structure says 55.30 on West Texas Crude is likely near Feb 1 and down to target. #oil #trading #strategy.

Per previous;

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

Daily crude chart resistance 54.23, above that holds and 57.32 is in play for Feb 20, 2019 price target.

Per previous;

Daily FX USOIL WTI chart shows 54.14 Feb 1 price target still in play, look for spike or drop in to date. #crude #oil.

A pull back to 20 MA on daily chart is most probable.

Per previous;

Key support and resistance on daily crude oil chart is noted for day trading strategy.

Various points of resistance and support on weekly oil chart. Watch the red trend lines close.

Per previous;

Weekly FX USOIL WTI crude oil chart has been responding well also to market support and resistance areas for trade.

Per previous;

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, some are included below and for others visit the private oil chat room on Discord.

30 minute intra-day crude oil sketch chart from Curtis’ trading desk.

https://www.tradingview.com/chart/USOIL/etSPbOpT-30-minute-doodle-chart/

4 Hour chart structure shows sideways trade in crude oil of late. Also shows timing coming due this candle.

It is also highly recommended that you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

January 2019 Oil Trading Alert Profit / Loss.

Feb 6 – Day Trading Short for a Break to Downside Price Targets (How to with video).

How I Day Trade Crude Oil Short | Downside Break (Waterfall) | Oil Trading Strategies (w/video).

Jan 31 – Day Trade Timing Strategies for Crude Oil Trade Around Time Cycles and EIA.

Jan 28 – Day Trading the Support and Resistance of the Model. How to.

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance

Jan 27 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 23 – Day Trading Crude Oil Futures for Compound Gains.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow:

Swing Trading Earnings w/Video | Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL …

Trade Set Ups for Swing Trading Earnings Thursday Feb 7, 2019.

Swing Trading Signals in this Report: Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL and more…

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week

$GOOGL $TWTR $SNAP $CLF $TTWO $ALXN $DIS $BP $CLX $SYY $GM $GILD $CMG $GRUB $EA $STX $SPOT $AMG $SAIA $RL $CNC $EL $UFI $GLUU $MTSC $JOUT $PM $GPRO $LITE $FEYE $SWKS $LLY $MPC $BDX $REGN $VIAB $ONVO $HUM $ARRY $PBI $ADM $BSAC

#earnings for the week $GOOGL $TWTR $SNAP $CLF $TTWO $ALXN $DIS $BP $CLX $SYY $GM $GILD $CMG $GRUB $EA $STX $SPOT $AMG $SAIA $RL $CNC $EL $UFI $GLUU $MTSC $JOUT $PM $GPRO $LITE $FEYE $SWKS $LLY $MPC $BDX $REGN $VIAB $ONVO $HUM $ARRY $PBI $ADM $BSAC https://t.co/r57QUKKDXL https://t.co/Bm7PEKXynT

— Melonopoly (@curtmelonopoly) February 3, 2019

Earnings Season Special Reports Thus Far:

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

Feb 6 – Inflection? Mid day review tells you what to watch and when. #timecycles #swingtrading #daytrading https://www.youtube.com/watch?v=UCyiwmTDYno

Feb 7 – TWITTER (TWTR) over 34 targets 38.72 then 51, under targets 26.26. $TWTR #swingtrading #earnings

Feb 7 – FACEBOOK (FB) hitting first target from previous report, over 174.00 targets 181.50 then 195.00 $FB.

Feb 7 – ADVANCED MICRO (AMD) hit the upside price target early from last report, over 24.16 then 25.30 targets 29.

Feb 7 – BP Try and ignore chart noise and focus on price targets, over 44.30 targets 48, 57.50, 67 #swingtrading $BP

This is a really strong structure for a run in to Oct 2019 at minimum. 57.50 is my personal bias and I’ll be taking a long over 44.30. Price needs to hold 44.30 to make it work. Closed Wednesday 43.04.

Feb 7 – Crude Oil Swing Trade Set-Up. Try and ignore noise on chart, focus on upside downside price targets when oil price trades out of structure.

I really like this crude oil swing trade set-up. Will be watching very closely. Where price leaves the structure is still unknown and I will update the set-up at that point in time. If it runs up I’ll short $DWT again and if not I’ll long $DWT for the swing.

Feb 7 – EXXON (XOM) holding initial position, will trim in to target add above for continuation $XOM.

Feb 6 – ARROWHEAD PHARMA (ARWR) Holding this long term starter swing position in to earnings – on watch for adds $ARWR.

https://twitter.com/SwingAlerts_CT/status/1093191421048299521

Feb 6 – FIREEYE (FEYE) FireEye over 19.30 is a long to 22.50 test and under is a short to 17.59 then 16.20. $FEYE

https://twitter.com/SwingAlerts_CT/status/1093203230073503745

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, Video, Time Cycle, $TWTR, $FB, $AMD, $ARWR, $FEYE, $XOM, $BP, OIL

How I Day Trade Crude Oil Short | Downside Break (Waterfall) | Oil Trading Strategies (w/video)

Crude Oil Day Trading Session From Oil Trading Room – Trading Set-up Short Waterfall Strategy.

If you want to learn how to day trade crude oil, or if you want to win more often and already are an oil day trader this post with live video from our oil trading room will provide you with insight to how I day trade crude oil.

The planning and preparation I perform prior to every trade (such as reviewing support and resistance on all time frames and charting), the signals I watch for and what the water-fall short trade set-up looks like and specifically how to day trade the price action.

This is a very detailed video and I highly recommend oil traders study it for maximum consistency to your trading gains.

Voice broadcast starts at 1:23 on video.

At start of this video there are announcements about what we are doing (our staff work in progress) and general view of markets and how the trade of equities (swing trades) is affected by nearby resistance on oil charting.

Topics of announcements include the coding updates for the machine trading, status of algorithm reports, the huge month in our oil trading last month (up 63% in one month), trade alerts, digital platform for our clients to watch machine trade real-time, swing trade timing for equity and various algorithm model swing trade positioning in this time cycle, why the machine trading can beat my overall return performance by 10 times, coding of other algorithm models, the publishing of the rule-set modules for oil trading (mechanical human executed & machine traded, intra-day swings, longer term swings and daytrading).

The Pull Back In Oil Trade.

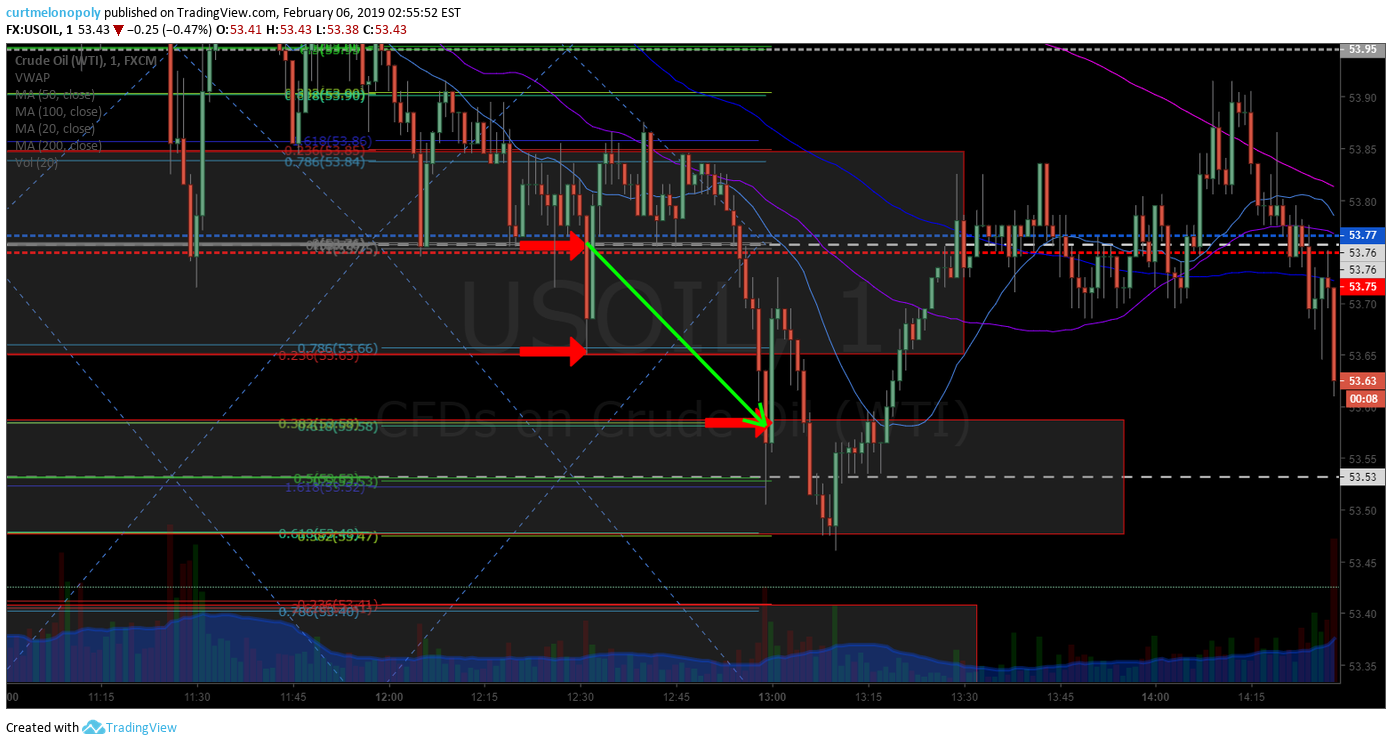

At 9:20 I discuss the trade action in oil as we trade near key resistance in oil. We should see 53 and possibly 52’s and even more down.

Trade Signals to Watch For Positioning Swing Trades, Intra-Day Swings and Day Trading..

When trade hits support for a proper bounce we know when machines are in trade because the trade action becomes really clean within the models. This predictable trade action provides a signal for when to start longer swing trade entries, helps us with intra day swing trades within the EPIC trading model and provides for precise day trading on the one minute model.

Trend Line Support on Watch.

At 10:30 on video the basing trend-line on the 4 hour chart is reviewed as support. Conclusion of this pull back in oil should come soon. I am expecting at latest Monday or Tuesday of next week.

Watch for violent trade up / down (stops taken out), most likely down first so I am positioning my bias for that scenario first. Likely a sharp down and then sharp up and then the mid point between the two points should be the decision area.

Tomorrow is EIA so this could be your timing or likely before end of week is likely for the spike up and down and then the pivot decision goes in to Sunday night futures.

https://www.tradingview.com/chart/WTICOUSD/kn9o1TRw-4-hr-concept/

One Minute Crude Oil Day Trading Model.

At 12:48 I discuss trade on the one minute day trading model. The problem in trade as we get close to key resistance decision is trade becomes sloppy. So I show you how to trade the model if you need to trade and you don’t want to wait for the decision on oil trade trend direction.

The indicators are late so you have to act on price prior.

How to Trade a Key Intra-Day Break to Down Side (Waterfall) or Upside. The Oil Day Trade Starts Live on Video Here.

At 14:00 the intra-day possible break to downside in trade is discussed.

Planning and Preparation for Your Day Trade – Know Your Key Support Area on Charting Prior to Entering a Trade.

- When trade on the one minute charting looks like a break to downside (or upside) is possible I first go to the EPIC model for key support or resistance. 53.52 is at mid quad on model, so that is support to watch.

- At 16:24 on video 53.00 is a support on the daily chart (a Fibonacci support on the oil daily chart and the 20 MA support).

- 51.13 is next support and 57.31 for Feb 20 is the upside scenario.

- My bias is pull back and then go again.

- 53.00 – 55.50 is a likely pivot area until a conclusion occurs in this trade area.

-

Oil trading room screen shot shows 53.00 support daily chart Fibonacci oil daily chart and 20 MA - At 18:00 on the video the weekly oil chart is reviewed.

- The price extension support and resistance, the 20 MA 57.00 and 200 MA 52.30 (as your broad trading range) and trend lines on the weekly charting is reviewed. 53.26 price extension is serious support and price under that is an obvious short.

Know Where the Price Targets Are for the Machines.

- Discussed is the end of week and EIA price targets on the EPIC algorithm model. The algorithmic channel and quad support and resistance areas.

Preparing My Short Order Day Trade in Oil Live on Trading Room Video.

- At 20:00 on video I get my trading execution ready.

The Trade Pattern Set-up (Signal).

At 20:30 on video – When you see this pattern (trade signal) on the one minute charting model be very careful to cut your trade fast if the machines kick in the other direction (long).

Trade When Signals Are Most Predictable.

I prefer trading oil when the trend is clear and the machines are in it. Reports say over 80% of oil traders lose. This is largely why. Trade gets sloppy and then frustrates the trader.

Money in crude oil trading is made in the trend. Near resistance trading can mind mess you.

This is why I close my DWT short swing trade when we got near key resistance.

Winning is Important.

Not only is losing bad for your account but it is even more important for your mind. Your subconscious needs to know it wins. The subconscious is powerful.

Day Trading Model.

Location of trading boxes around three pivot areas of the one minute crude oil day trading chart model.

24:00 on video pivot resistance is discussed.

I am short bias to 53, 52.75 then 51.20 is possible.

Indicator Signals.

At 24:45 on the one minute you have stochastic RSI increasing and price that is basing, typically that means down next or even a possible waterfall short trade set-up.

The Risk-Reward (the Math of the Trade) On a Down-Side Break Set-up.

At 25:20 I start to discuss the math of the trade. You can take the short side trade and if price turns on you then you take a maximum cut of 16 ticks on the trade, but if price gets you on the right side and continues to confirm short then your win will be much bigger return.

Short Trade Executed – Play by Play.

At 25:42 on the video at 53.77 my short trade execution is done live.

Location on crude oil chart of short trade entry for day trade on chart below.

Short crude oil trade alert screen shot of member Twitter alert feed is shown below at 53.77.

At 26.42 on video the buys came in at the Fibonacci support on the one minute model shown (red arrow).

At 26.50 buy side trades are testing the 20 MA resistance on 1 minute chart.

At 28:34 on video trade is over the 20 MA trading 53.83 hit resistance on the pivot on the 1 min just under 50 MA.

Indicators are turning up now. Started to look like a reversal trade but I stayed with the plan because trend on the day was down and I didn’t want to be chopped up.

Trade hit 53.87 before it turned back down (so I was 10 ticks off side at that point). Technically trade got a penny or two over trading box resistance but I held because the bulls needed to have big buys and momentum to kick in to fight the daily trend which was pressure in trade.

At 32.35 the 4 hour chart is reviewed and my target for the risk reward to down side. The reward potential was much better in my thinking.

The EPIC model confirms also.

At 33:40 the weekly chart shows a good risk reward also.

Protecting you capital is key and trading for risk reward on trend for the time frame.

30 minute candle turn timing is discussed.

The pivot test continues.

At 39:13 on the video the technical area of key support for the day trade is reviewed. 53.58 is the next Fib down so you want trade to break under that and hold under 53.58 and if it doesn’t you’re best closing the trade for a scalp. This is purely a math play. You will win 50% and win you do win you’ll either get a decent scalp or a larger 5 x risk reward win.

This is purely a math play. You will win 50% and win you do win you’ll either get a decent scalp or a larger 5 x risk reward win.

At 42:47 volatility VIX is reviewed and how I want volatility to start rising intra-day.

At 45:28 the importance of trading in a zen state vs. frustration is discussed.

At 46:00 trading on bias based on technical set-ups and protecting your capital (accepting it quickly when you are wrong) is key to trading success.

At 48.00 the inverse head and shoulders that technicians on Twitter were talking about is discussed relative to the risk reward on the 30 minute chart price target.

The price target for the short oil trade is shared in the oil trading chat room private server.

How I Knew Where to Close the Short Oil Trade for a Win.

At 53:15 on the video is top of the hour with price falling and trade was under the key support resistance 54.59 and we needed it to hold under for staying in the trade short.

The price action here on the video is important to watch close here if you want to learn how to do this.

At 57:00 on video I explain that you could short again here, I didn’t, but price did come off and it would have been a decent short trade.

Trade did not stay under resistance at pivot so I closed the oil short trade for a win.

If You Want a Win Rate 90%+ DayTrading Crude Oil – I Highly Recommend Listening to this Part of The Video – IT IS KEY.

I continue to comment on how the trade continues to set up discussing the technical areas to watch.

If you want to learn about specifically where your support and resistance areas are on the one middle model BE SURE TO WATCH THE VIDEO HERE (from 57:00 minutes on video forward).

If you watch the price action and my commentary you will see how precise the machines trade the one minute model – THIS WILL HELP YOU TIME YOUR ENTRIES AND WHEN TO CLOSE. VERY IMPORTANT.

Below is a screen shot of the oil trade alert feed – closing the trade for a win.

Below is the Trade Executed Live in Oil Trading Room.

Peace and best,

Curt

Email me with any questions you may have [email protected].

Recent Learning Posts and Videos (most are premium member locked posts).

Feb 4 – January 2019 Oil Trading Alert P/L.

Jan 31 – Day Trade Timing Strategies for Crude Oil Trade Around Time Cycles and EIA.

Jan 29 – Trading the Main Support and Resistance on EPIC Algorithm Model. How to Post.

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance.

Jan 27 – Premium Member Private Post (Weekly Reporting & Guidance).

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 22 – Compounding Gains Day Trading Crude Oil.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, How To, Trade, Oil Trading Room, Strategy, USOIL, WTI, CL_F, USO

Follow: