Tag: Silver

Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Swing Trade Alerts. #tradealerts #daytrading #swingtrading

Swing Trading Alerts with raw video footage from our Live Trading Room mid-day review webinar Oct 2, 2018. 12:12 PM.

Stocks Alerted for Trade: VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Be sure to check the date on each chart (I’ve included some from previous posts).

Some discussion at the beginning of this video about time cycles over next two quarters expected to provide significant trading opportunity.

Volatility $VIX – Mid July 2018 time cycle changed and it lasts in to mid December 2018, 15.9 was upside bringing 50% ish since lows, 21’s are even possible soon. A spike if very likely at minimum in to 15’s. The time cycle after the end of this one in to mid December is significantly more aggressive than this current time cycle. The current time cycle is the start of the inflection and the next in to Q1 2019 is the inflection.

We see some opportunities in equities coming to the long side and many to down side that will be specific to themes that will surface in the inflection period. Crypto, Gold, Silver, VIX, various metals / commodities and select equities will all be on watch. There will be a series of reports to members as themes surface through the timing.

Gold $GC_F $XAUUSD $GLD – Over 50 MA, MACD turning back up, price spiked today and it is on watch. Algorithm report on deck. Silver is in the same scenario (algorithm report also within next couple days).

Bitcoin $BTC $XBTUSD – Wedge chart reviewed, trading mid range in wedge, we expect this to turn up in to Christmas and next year. Algorithm report on deck.

$PYX – has been on watch, trade got aggressive today to upside, expecting a move to the 41’s as very probable, very aggressive chart structure. We are working on a structured model.

$EDIT – last trade wasn’t easy but we got out with a profit after being under water on the trade and we added at bottom of channel and closed at 200 MA resistance test.

$TSLA – sloppy chart, best way to trade it is to trade the range of the chart, enter long at bottom of range in 280s and close near top of range.

$SQ – trading 99.32, 97.55 I was going to take the trade intra-day and I didn’t, it’s on watch but watching to see if it proves out. Specific price targets and dates reviewed on video.

$OGEN – it may be a bottom play for good day traders.

$IGC – find a good entry on 5 minute intra-day, take a long, with a stop, close your eyes. Don’t follow it down.

$SYN – watch out, not an easy trade

$EBR – could go, tough

$GOL – same as $EBR

$PBRA – same, aggressive

$EBRB – same

$SBS – same

$BSBR – same, a tad farther ahead than others

$LEVB – been watching and bullish on

$SBGL – no

$LW – trending chart, off theme for the day, mid way through bounce, no play

$MSB – aggressive, never trade it, high probability for a full extension upside.

Subscribe:

Click here for Swing Trading Alerts.

Click here for a menu of Trading Alerts, Newsletters, Trading Rooms and Trade Coaching prices and options.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade, Alerts, Swing Trading, Trading Room, VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX

PreMarket Trading Plan Thurs Sept 13: $BABA, Inflections on Watch: Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps more.

Compound Trading Premarket Trading Plan & Watch List Thursday September 13, 2018.

In this edition: Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps, $AAPL, $FB, $GOOGL, $SNAP, $TLRY, $AMD, $VZ and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members.

- Thursday Sept 13 –

-

- I’ll be live on mic live broadcast trading in main trading room #premarket 9:25 #daytrade momos and mid-day #swingtrading chart set-up reviews at 12:00 noon (pending market / scheduling conditions). If room is full message me so I can make room. GL today! Trading room link.

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Currently have oil on watch for a quad decision up or down in premarket. Favor 69.83 for end of Friday at this point on FX $USOIL $WTI.

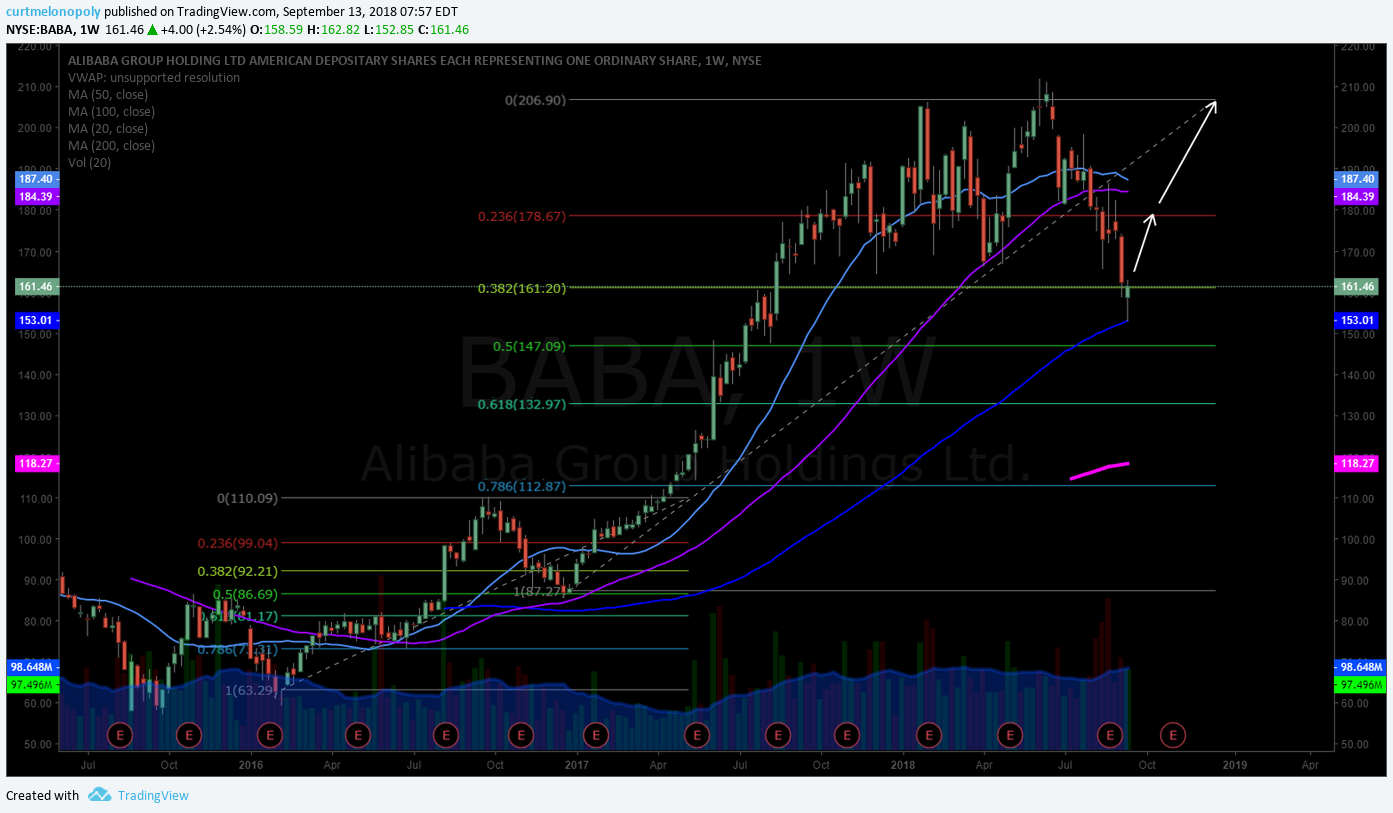

Long side trade alert in premarket for ALIBABA per below. Live chart link included for the trade alert. $BABA

Watching Gold and Silver for possible inflection point to bullish side. They still have some hurdles but it seems near. $GLD $SLV

Bitcoin recovering, so also watch that at this point. Trying to position for a run in to December. $BTC $XBT. Morgan Stanley’s Bitcoin swaps launch has me intrigued.

Watching financials for inflection $XLF, $BAC, $GS, $JPM, $C, $MS

If you missed yesterday’s premarket, there were a number of swing trade set ups in there that could inflect and become decent trades.

Market Observation:

Markets as of 7:27 AM: US Dollar $DXY trading 94.81, Oil FX $USOIL ($WTI) trading 69.41, Gold $GLD trading 1205.75, Silver $SLV trading 14.19, $SPY 289.88 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6437.00 and $VIX trading 12.8.

Momentum Stocks / Gaps to Watch: $PI $XBIT $BLIN $ATOS

Impinj’s stock rockets after internal audit completed, upbeat results and outlook

$AAPL is taking a hit ahead of Apple’s big product launch, and one trader is betting on more pain ahead. We’ll explain why https://www.cnbc.com/2018/09/12/ahead-of-apples-product-launch-trader-is-playing-for-a-pullback.html …

$AAPL is taking a hit ahead of Apple’s big product launch, and one trader is betting on more pain ahead. We’ll explain why https://t.co/MFdtDe3gNM Program sponsor: @Schwab4Traders pic.twitter.com/mV7bY0NchZ

— Trading Nation (@TradingNation) September 12, 2018

News:

$TLRY: Tilray receives necessary regulatory permits in Canada and Germany to export medical cannabis flower for… http://bit.ly/2OcguTr

Verizon in focus as former AOL chief Armstrong confirms exit $VZ $BABA $GOOG $GOOGL $FB http://dlvr.it/Qk3bFG

$FATE: Fate Therapeutics Enters into Exclusive License Agreement with Gladstone Institutes for CRISPR-based Cellular Reprogramming

$ATOS: Atossa Genetics Announces Preliminary Results from Male Phase 1 Study of Topical Endoxifen .. All Objectives Successfully Met

Stocks making the biggest move premarket: KR, TSLA, ADBE, HSY, WMT & more https://cnb.cx/2N9C0vO

Your Thursday morning Speed Read:

– Kroger reports mixed Q2, raises EPS guidance for the year $KR

– Pivotal ends its bear call on $SNAP, ups rating to Hold, seeing shares fairly valued

– The FCC 2 day begins a series of hearings related to Big Tech antitrust concerns $FB $GOOGL

Your Thursday morning Speed Read:

– Kroger reports mixed Q2, raises EPS guidance for the year $KR

– Pivotal ends its bear call on $SNAP, ups rating to Hold, seeing shares fairly valued

– The FCC 2day begins a series of hearings related to Big Tech antitrust concerns $FB $GOOGL— Benzinga (@Benzinga) September 13, 2018

Bitcoin Gains Traction as Morgan Stanley Prepares Bitcoin Swap Trading –

Bitcoin Gains Traction as Morgan Stanley Prepares Bitcoin Swap Trading – https://t.co/hj0E7o8Sa3

— Investing.com News (@newsinvesting) September 13, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

Kroger’s stock drops after earnings beat, but sales come up short

#earnings for the week

$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)

http://eps.sh/cal

#earnings for the week$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)https://t.co/r57QUKKDXL https://t.co/wHU5AlivAx

— Melonopoly (@curtmelonopoly) September 8, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

ALIBABA (BABA) from recent trade alert for weekly 100 MA bounce watch, up premarket trading 164.76. $BABA #tradealerts #premarket

NEMAURA (NMRD) Premarket trading 2.98 up 4.2%, up 32.7% yesterday hit daily 200 MA area and backed off in previous trade.$NMRD #daytrading.

FOMIX PHARMA (FOMX) premarket up 31.4% trading 7.78 on positive results, resistance 8.00 range $FOMX #daytrading #stocks

XENETIC BIOSCIENCES INC Premarket near 200 MA support test after sel;-off, near time cycle peak Sept 14, possible turn $XBIO #swingtrade #daytrade #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up scenario Number 2. $XBIO #swingtrading #tradealert

FREDS INC (FRED) On day two of gap and go continued to struggle with 200 MA wall. $FRED #daytrading #swingtrade #premarket

PROQ THERAPEUTICS (PRQR) ran another 15% yesterday near a buy sell trigger resistance, trim in to it add above. $PRQR #swingtrading #daytrade

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ALIBABA (BABA) If no bounce at 100 MA that is near it is most probable to bounce in 147 range. $BABA #swingtrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

PROQ THERAPEUTICS (PRQR) premarket resistance watch at diagonal Fib line overhead and 22.75, above sees 27.55 implied $PRQR #swingtrading #daytrade

FREDS INC (FRED) Cleared 200 MA on daily, premarket next major resistance 50 MA on weekly. $FRED #daytrading #swingtrade #premarket

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

CLOUDERA INC (CLDR) Premarket up 6.5% trading 18.75 with 22.00 target. $CLDR #daytrading #swingtrading

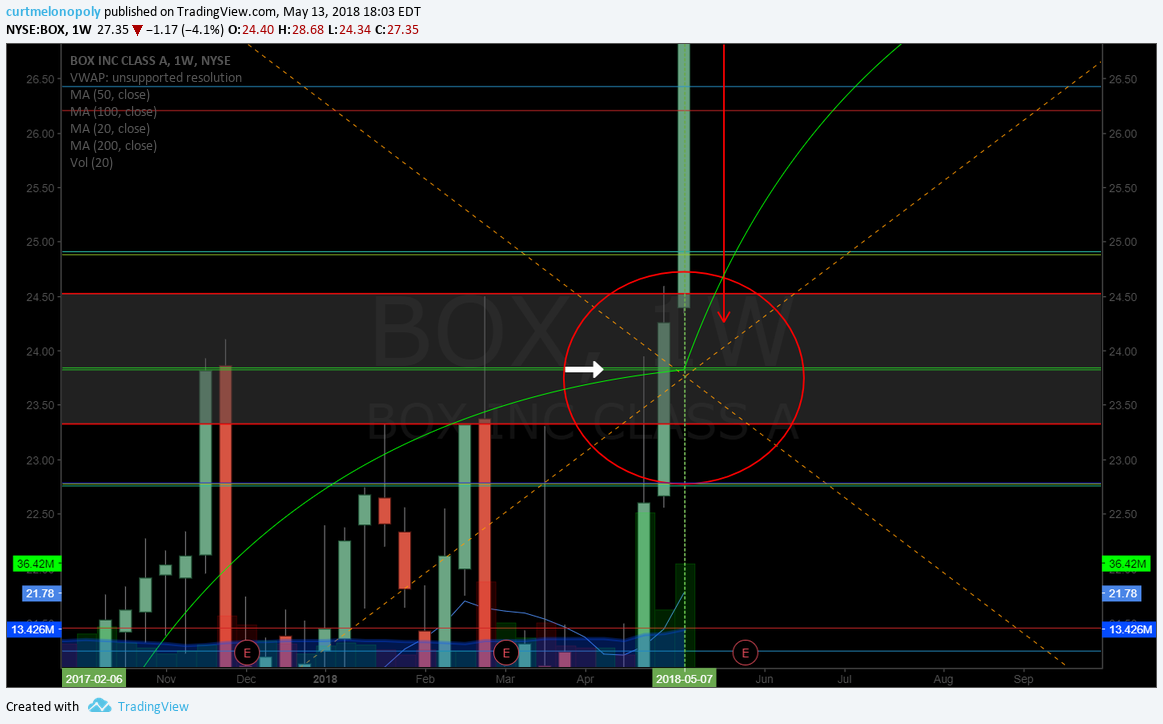

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Turkey, BOE and ECB decisions

-Trade talks

-Florence weakens

-Markets rise

-Data due

https://bloom.bg/2NHCngz

#5things

-Turkey, BOE and ECB decisions

-Trade talks

-Florence weakens

-Markets rise

-Data duehttps://t.co/TQr2TERlqM pic.twitter.com/b8yh9zmAgl— Bloomberg Markets (@markets) September 13, 2018

Oil prices fall, reversing some of the strong gains from the previous session, as economic concerns raises doubts about ongoing fuel demand growth https://reut.rs/2N83Mc1 by @hgloystein More from #ReutersEnergy: https://reut.rs/2CPVxfT

Oil prices fall, reversing some of the strong gains from the previous session, as economic concerns raises doubts about ongoing fuel demand growth https://t.co/rnWXstQpJl by @hgloystein More from #ReutersEnergy: https://t.co/lql35QNze4 pic.twitter.com/aJiUuFCI7a

— Reuters (@Reuters) September 13, 2018

Excess liquidity matters more than CB, but this is not a backdrop you want to be adding to risk from a macro level. Pick your spots.

https://twitter.com/RooseCapital/status/1040201823150387201

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PI $XBIT $BPMX $ATOS $TLRD $IGC $TLRY $NLST $SNGX $VTL $BLPH $PDD $YINN $CARA

(2) Pre-market Decliners Watch-List :

Pivotal Software stock plunges 27% after billings miss

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MGA $SNAP $DVA $BHC $TRI $MEOH $INTC $AVY

Intel stock gains after Northland Capital ends bearish call.

Analyst initiates AMD at 24% upside https://seekingalpha.com/news/3389955-analyst-initiates-amd-24-percent-upside?source=feed_f … #premarket $AMD

Apple target lifted to $260 at Needham after iPhone event

$AAPL Apple Inc: Maxim Raises Target Price To $221 From $200

(6) Recent Downgrades: $WAGE $VNTR $STI $FEDU $TAL $CIEN $FNSR $HOLX $W $TXRH

Morgan Stanley goes to Equal Weight on optical, downgrades Finisar and Ciena $FNSR $CIEN $LITE $IIVI $ACIA http://dlvr.it/Qk3bF9

Morgan Stanley Downgrades Finisar $FNSR to Equalweight

ServiceMaster $SERV PT Lowered to $61 at Morgan Stanley

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Alerts, Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps, $AAPL, $FB, $GOOGL, $SNAP, $TLRY, $AMD, $VZ

SILVER Algorithm Report Sun July 15 $SLV, $USLV, $DSLV #Silver #Algorithm

SuperNova Silver Algorithm Update Sunday July 15, 2018 $SLV, $USLV, $DSLV. Charting Model Observations

My name is SuperNova the Silver Algo. Welcome to my new Silver trade report. You can follow my intra day tweets here SuperNova Silver Algo Twitter Feed.

How My Algorithm Works and Availability:

I am an algorithm chart model in development at Compound Trading Group.

Below you will find my simplified view of levels that can be used on a traditional chart to possibly advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on (rooted in technical set-up).

My algorithmic charting will eventually transition to developer coding phase for our trader’s dashboard program. I am not an automated bot or high frequency type algorithm (HFT). Please review my algorithm development process.

Below you will find simple Generation I Level chart modeling with a goal toward generation 5 modeling as with EPIC the Oil Algorithm model (for example).

Silver Trading Observations.

Silver Buy Sell Triggers (wide range swing trading):

18.51

17.74

16.96

16.17

15.40

15.028

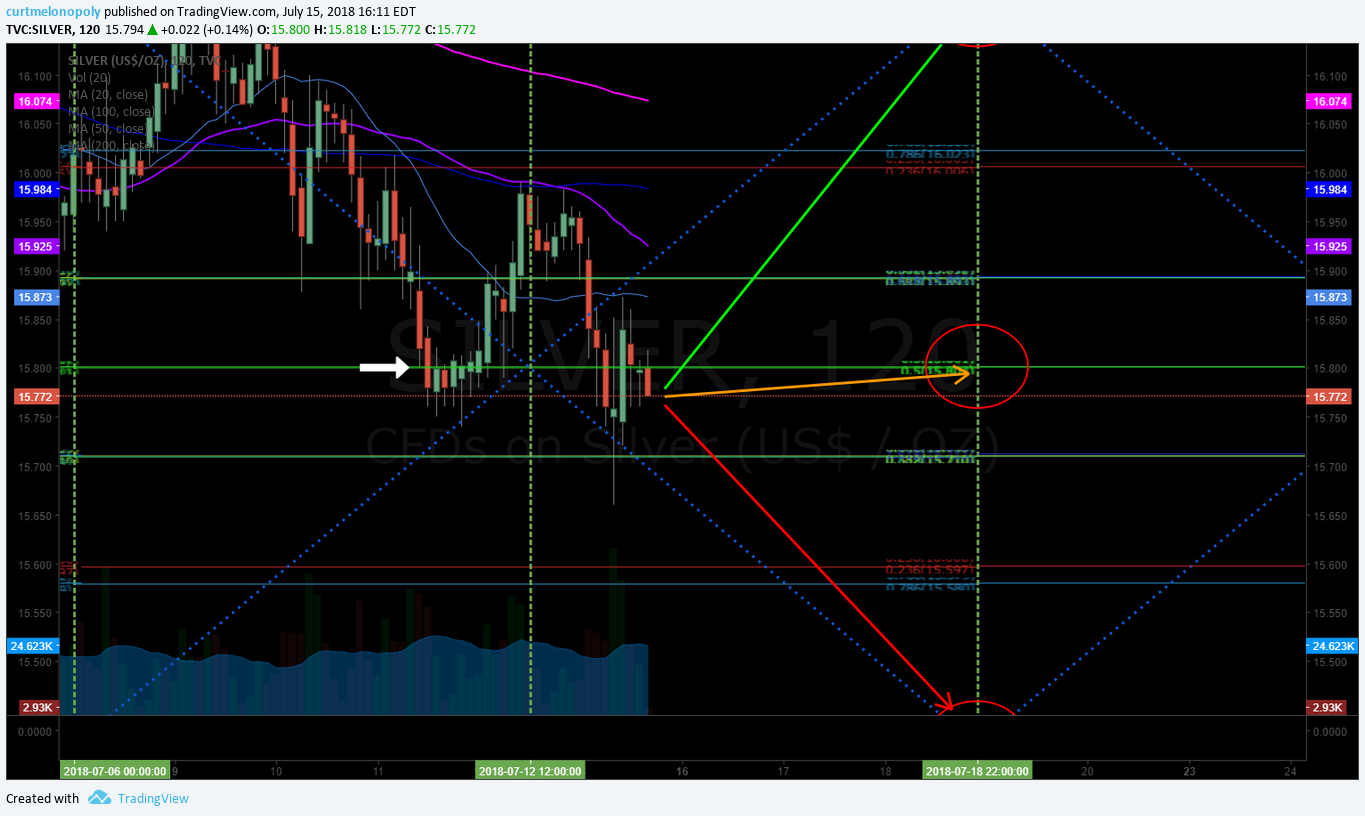

SILVER Daily chart watching previous lows 15.62s last Dec for a possible bounce or further break down. $SLV

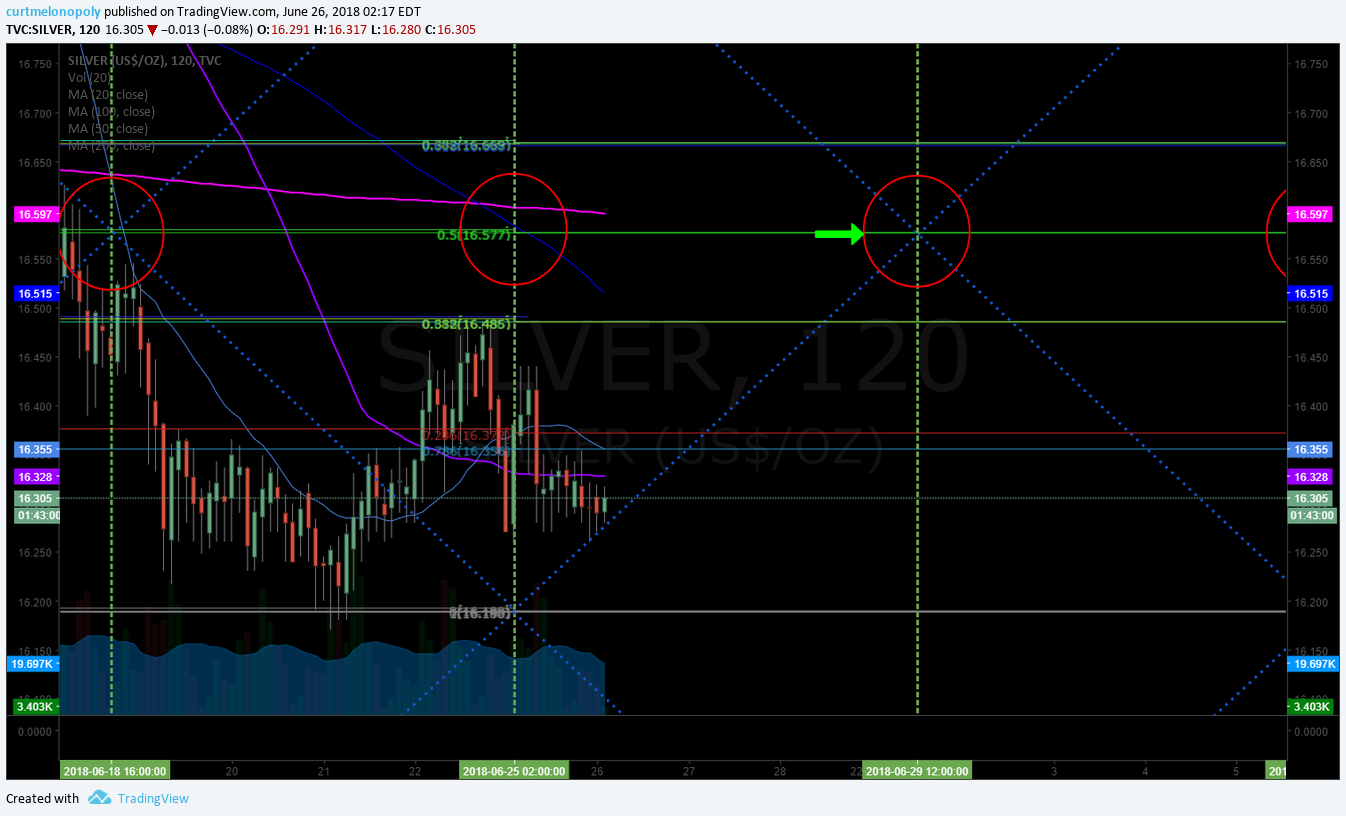

Silver Daily Model remains range bound. June 26 225 AM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

SILVER. Daily chart range bound trade continues. Limited guidance available. $SLV, $USLV, $DSLV #Algorithm #Chart

Silver 2 Hour Chart Model (daytrading)

SILVER 2 Hour Chart in Break Down – watching current pivot area 15.80s for a trajectory decision 412 PM July 15 #swingtrading $SLV #Silver

Silver 120 min model trade near support 8th time this year. June 25 218 AM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Markets are so machine controlled now 14 of 19 of these symmetrical targets in time cycles in Silver model have hit perfect. Five that missed barely did, trade was easily a win for 19 in 19. $SLV $USLV $DSLV #Silver #Chart #Symmetry #Algorithms #MachineTrading #Commodities

Per recent;

Silver 120 min daytrading chart range bound. May 24 1014 PM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Silver Conventional Charting

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Silver Weekly chart compression near end June 25 228 AM #SILVER $SLV, $USLV, $DSLV

Per below the structure continues, refer to previous link below;

Wedge in play with price under 200 MA with decision pending on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Recent Algorithm Price Target Hits

July 15 – Algorithm target report updates will be posted soon.

June 25 – Algorithm target report updates will be posted soon.

April 19 – Since the posts below the models have been hitting targets regularly. Looks like we have the models dialed in.

Silver Mar 2 300 PM target hit – not perfect but a hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver Mar 9 300 AM target hit – not perfect but it hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Good luck with your trades and look forward to seeing you in the room!

SuperNova Silver Algorithm

Article Topics: SuperNova, Silver, Algorithm, Trading, Chart, $SILVER, $SLV, $USLV, $DSLV

SILVER Algorithm Report Tues June 26 $SLV, $USLV, $DSLV #Silver #Algorithm

SuperNova Silver Algorithm Update Tuesday June 26, 2018 $SLV, $USLV, $DSLV. Charting Model Observations

My name is SuperNova the Silver Algo. Welcome to my new Silver trade report. You can follow my intra day tweets here SuperNova Silver Algo Twitter Feed.

How My Algorithm Works and Availability:

I am an algorithm chart model in development at Compound Trading Group.

Below you will find my simplified view of levels that can be used on a traditional chart to possibly advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on (rooted in technical set-up).

My algorithmic charting will eventually transition to developer coding phase for our trader’s dashboard program. I am not an automated bot or high frequency type algorithm (HFT). Please review my algorithm development process.

Below you will find simple Generation I Level chart modeling with a goal toward generation 5 modeling as with EPIC the Oil Algorithm model (for example).

Silver Trading Observations.

Silver Buy Sell Triggers (wide range swing trading):

18.51

17.74

16.96

16.17

15.40

Silver Daily Model remains range bound. June 26 225 AM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

https://www.tradingview.com/chart/SILVER/BsmDcmNz-Silver-Daily-Model-remains-range-bound-June-25-225-AM-SuperNova/

Per recent;

SILVER. Daily chart range bound trade continues. Limited guidance available. $SLV, $USLV, $DSLV #Algorithm #Chart

Per recent;

Silver range bound last month. Limited guidance available here. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Targets charted in play in to next time cycle. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Silver 2 Hour Chart Model (daytrading)

Silver 120 min model trade near support 8th time this year. June 25 218 AM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Markets are so machine controlled now 14 of 19 of these symmetrical targets in time cycles in Silver model have hit perfect. Five that missed barely did, trade was easily a win for 19 in 19. $SLV $USLV $DSLV #Silver #Chart #Symmetry #Algorithms #MachineTrading #Commodities

Per recent;

Silver 120 min daytrading chart range bound. May 24 1014 PM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Silver Conventional Charting

Silver Weekly chart compression near end June 25 228 AM #SILVER $SLV, $USLV, $DSLV

Per below the structure continues, refer to previous link below;

Wedge in play with price under 200 MA with decision pending on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Per recent;

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Also, take note of 200 MA on weekly chart just above current trade.

https://www.tradingview.com/chart/SILVER/Q2Nj70JG-There-s-a-decision-coming-on-Silver-Chart-notes/

Recent Algorithm Price Target Hits

June 25 – Algorithm target report updates will be posted soon.

April 19 – Since the posts below the models have been hitting targets regularly. Looks like we have the models dialed in.

Silver Mar 2 300 PM target hit – not perfect but a hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver Mar 9 300 AM target hit – not perfect but it hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Good luck with your trades and look forward to seeing you in the room!

SuperNova Silver Algorithm

Article Topics: SuperNova, Silver, Algorithm, Trading, Chart, $SILVER, $SLV, $USLV, $DSLV

SILVER Algorithm Report Tues June 5 $SLV, $USLV, $DSLV #Silver #Algorithm

SuperNova Silver Algorithm Update Tuesday June 5, 2018 $SLV, $USLV, $DSLV. Charting Model Observations

My name is SuperNova the Silver Algo. Welcome to my new Silver trade report. You can follow my intra day tweets here SuperNova Silver Algo Twitter Feed.

How My Algorithm Works and Availability:

I am an algorithm chart model in development.

Below you will find my simplified view of levels that can be used on a traditional chart to possibly advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on (rooted in technical set-up).

My algorithmic charting will eventually transition to developer coding phase for our trader’s dashboard program. I am not an automated bot or high frequency type algorithm (HFT). Please review my algorithm development process.

Below you will find simple Generation I Level chart modeling with a goal toward generation 5 modeling as with EPIC the Oil Algorithm model (for example).

Silver Trading Observations.

Silver Buy Sell Triggers (wide range swing trading):

18.51

17.74

16.96

16.17

15.40

SILVER. Daily chart range bound trade continues. Limited guidance available. $SLV, $USLV, $DSLV #Algorithm #Chart

Per recent;

Silver range bound last month. Limited guidance available here. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Targets charted in play in to next time cycle. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Per last report 16.95 as May 7 most probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver 2 Hour Chart Model (daytrading)

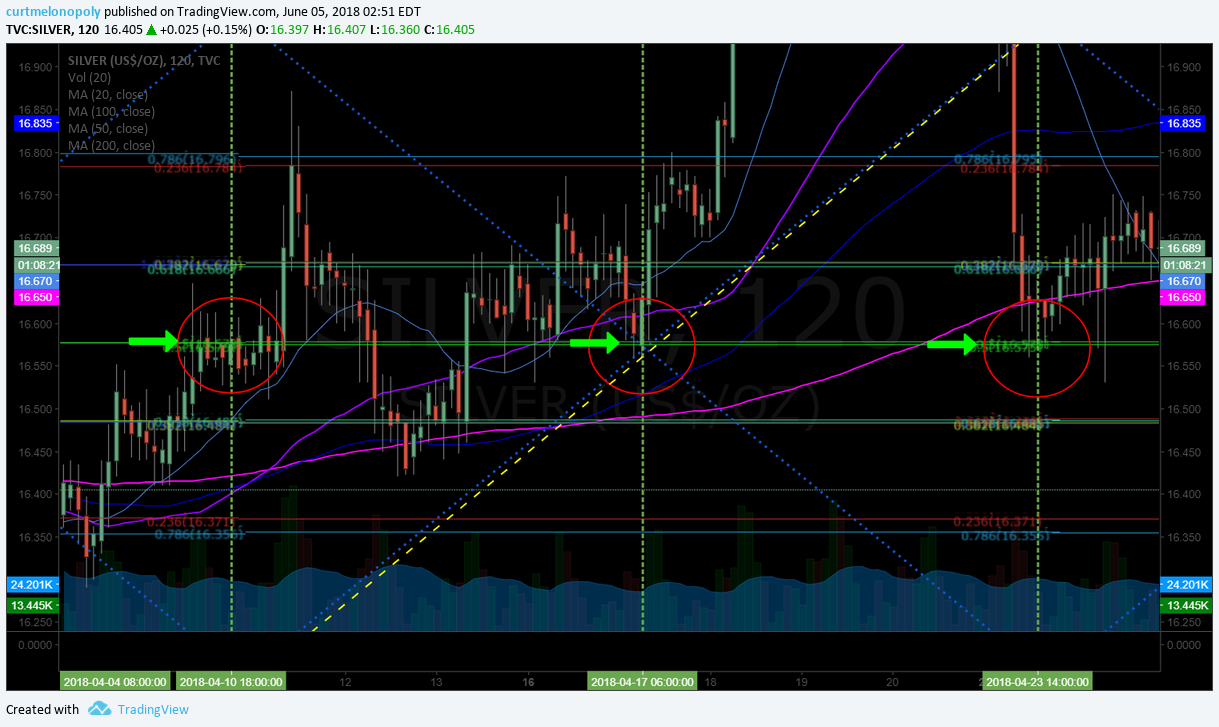

Markets are so machine controlled now 14 of 19 of these symmetrical targets in time cycles in Silver model have hit perfect. Five that missed barely did, trade was easily a win for 19 in 19. $SLV $USLV $DSLV #Silver #Chart #Symmetry #Algorithms #MachineTrading #Commodities

Per recent;

Silver 120 min daytrading chart range bound. May 24 1014 PM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Silver did not hit target this time – bought above. Bullish bias. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Silver Conventional Charting

Per below the structure continues, refer to previous link below;

Wedge in play with price under 200 MA with decision pending on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Per recent;

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Also, take note of 200 MA on weekly chart just above current trade.

https://www.tradingview.com/chart/SILVER/Q2Nj70JG-There-s-a-decision-coming-on-Silver-Chart-notes/

Per recent;

April 30 – SILVER conventional chart compression to end of triangle.

Recent Algorithm Price Target Hits

June 5 – I will update target hits soon.

May 24 – I will update target hits soon.

May 14 – I will update target hits soon.

April 19 – Since the posts below the models have been hitting targets regularly. Looks like we have the models dialed in.

Silver Mar 2 300 PM target hit – not perfect but a hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver Mar 9 300 AM target hit – not perfect but it hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Good luck with your trades and look forward to seeing you in the room!

SuperNova Silver Algo

Article Topics: SuperNova, Silver, Chart, Algorithm, $SILVER, $SLV, $USLV, $DSLV

SuperNova SILVER Algorithm Charting Update Thurs May 24 $SLV ($USLV, $DSLV)

Silver Trading Chart Update Thursday May 24, 2018 $SLV ($USLV, $DSLV) Chart and Algorithm Observations

My name is SuperNova the Silver Algo. Welcome to my new Silver trade report. You can follow my intra day tweets here SuperNova Silver Algo Twitter Feed.

How My Algorithm Works and Availability:

I am an algorithm chart model in development.

Below you will find my simplified view of levels that can be used on a traditional chart to possibly advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on (rooted in technical set-up).

My algorithmic charting will eventually transition to developer coding phase for our trader’s dashboard program. I am not an automated bot or high frequency type algorithm (HFT). Please review my algorithm development process.

Below you will find simple Generation I Level chart modeling with a goal toward generation 5 modeling as with EPIC the Oil Algorithm model (for example).

Silver Trading Observations

Silver range bound last month. Limited guidance available here. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Key Silver Buy Sell Triggers (wide range swing trading):

18.51

17.74

16.96

16.17

15.40

Per recent;

Targets charted in play in to next time cycle. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Per last report 16.95 as May 7 most probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Per recent;

April 24 – Silver retrace was deeper than expected. Revised 16.95 as May 7 most probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver 2 Hour Chart Model (daytrading)

Silver 120 min daytrading chart range bound. May 24 1014 PM SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Silver did not hit target this time – bought above. Bullish bias. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Silver daytrading model amazing – it keeps hitting mid quad target over and over again.

Silver Conventional Charting

Wedge in play with price under 200 MA with decision pending on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Per recent;

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Also, take note of 200 MA on weekly chart just above current trade.

https://www.tradingview.com/chart/SILVER/Q2Nj70JG-There-s-a-decision-coming-on-Silver-Chart-notes/

Per recent;

April 30 – SILVER conventional chart compression to end of triangle.

Recent Algorithm Price Target Hits

May 24 – I will update target hits soon.

May 14 – I will update target hits soon.

April 19 – Since the posts below the models have been hitting targets regularly. Looks like we have the models dialed in.

Silver Mar 2 300 PM target hit – not perfect but a hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver Mar 9 300 AM target hit – not perfect but it hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Good luck with your trades and look forward to seeing you in the room!

SuperNova Silver Algo

Article Topics: SuperNova, Silver, Chart, Algorithm, $SILVER, $SLV, $USLV, $DSLV

Trade Set-Ups (May 14 /15 Member Edition) $BOX, $ITCI, $SPY, $EEM, $PFE, $BTC, Bitcoin, SILVER, $SLV, $ETH, Ethereum, $EOG, $EDIT, $EXP more.

Swing Trading Report and Video for May 14 / 15, 2018.

In this Issue: $BOX, $ITCI, $SPY, $EEM, $PFE, $BTC, Bitcoin, SILVER, $SLV, $ETH, Ethereum, $EOG, $EDIT, $EXP more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

- Price increase platform wide May 15, 2018. Detailed announcement to follow. Current members unaffected.

- 24 Hour Crypto Trading Desk opens May 15, 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; $BOX, $ITCI, $SPY, $EEM, $PFE, $BTC, Bitcoin, SILVER, $SLV, $ETH, Ethereum, $EOG, $EDIT, $EXP more.

Mid Day Chart Trading Set-ups May 14 Summary:

Trade set-ups May 14 Mid Day Trade Review;

$ITCI – called it on way down for a turn, it’s turned and it’s been a great trade, cleared 50 MA, swing trade and intra day resistance points. Swing 23.78 above is important resistance. 21.22 22.30 intra. 30.63 is a swing resistance to watch.

$SPY – through price target, in to resistance today, up and over adding. May 18 273.40 target moderate, 283.00 bullish target. 274.50 next resistance. 272.10 support intra.

Bitcoin $BTC – up against resistance (mid quad) very important area. 8870.00 area. Upside target 9880.0 and moderate 8871.00 bearish 7894.00 May 19 approx.

Silver $SLV – buy side alert issued 16.67 area, I’m off a bit but it’s a small starter.

$GOOGL – great trade with it bullish through targets ,trading very technical. 1127.81 resistance 1148.04 1158.09 1166.00 area. Support 1078.58 1103.20.

$EOG – at resistance, trim 119.61 next 128.15 and support 108.91.

$EDIT – 36.45 pivot triggered long over and then came off. Over 50 MA is bullish. Mid quad 37.70 mid qaud resistance. 47.49 is bullish target late Sept.

$HTZ – over 50 MA on hourly we sent alert to trim longs in to the 50 MA, wash-out snap back trade,

$GDX is playing out according to model.

$EEM up against 50 MA on daily, 100 MA above bothers me, MACD is turned up. Soft. Price above all MA’s with 50 breaching the 100 MA and I’d be interested in a play. Moving averages are the issue. MACD looks good.

$PFE 20 MA above on weekly chart not great, stochastic RSI coming down on monthly, MACD not the best, against historical resistance. Very soft.

$EXP 107.90 buy trigger waiting on earnings before execution.

$BOX hit mid quad resistance and came off, excellent symmetry in model, there is a set up post on blog for mailing list subscribers. 20.39 resistance 33.20 bullish target 23.74 bearish target – trade price toward target.

Ethereum $ETH $ETHUSD – up over MA’s, 739.11 resistance 739.55, and main resistance at 825.43 and 906.97 top of channel. Algorithmic model chart resistance at channel.

$BTC Bitcoin under mid channel line. 17690.00 July 4 price target is the most bullish scenario (unlikely of course, but in a bull run that would be the most bullish target for Bitcoin). Trading the channel.

In Closing:

I will re-iterate that a few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Peace and best,

Curt

Recent Trading Set-Up Review Webinars / Posts:

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

PreMarket Trading Plan Mon May 14: $MYO, $PRPO, $ACIA, $KTOV, $BOX, $CALA, $SPY, GOLD, SILVER, OIL, $VIX, $DXY more.

Compound Trading Trading Plan and Watch List Monday May 14, 2018.

In this issue: $MYO $PRPO $ACIA $KTOV, $BOX, $CALA, $SPY, GOLD, SILVER, OIL, $VIX, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Quick Update: Reporting, Live Rooms, New Team Members, Pricing, Discounts, Trade Coaching, New Book https://compoundtrading.com/quick-update-reporting-live-rooms-new-team-members-pricing-discounts-trade-coaching-new-book/

What’s New at Compound Trading April / May 2018. https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

Price Increase: Platform wide price increase May 15, 2018. Does not affect existing members. Official announcement to follow.

Machine Trading: May 15, 2018 the new teams start. Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: XRX, F, WMT, JPM, HSBC, GOOGL & more

Stocks making the biggest moves premarket: XRX, F, WMT, JPM, HSBC, GOOGL & more https://t.co/QdxbYmyaaw

— Melonopoly (@curtmelonopoly) May 14, 2018

Premarket analyst action – healthcare https://seekingalpha.com/news/3356187-premarket-analyst-action-healthcare?source=feed_f … #premarket $BGNE $SURF $TNDM

Premarket analyst action – healthcare https://t.co/fc9mNqWRJ2 #premarket $BGNE $SURF $TNDM

— Seeking Alpha Market News (@MarketCurrents) May 14, 2018

26 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/11703065 $ACIA $OCLR $LITE $FNSR $KTOV $NXPI $QCOM $REGI $NHTC $ECYT $XRX

26 Stocks Moving In Monday's Pre-Market Session https://t.co/6XSI4dgemv $ACIA $OCLR $LITE $FNSR $KTOV $NXPI $QCOM $REGI $NHTC $ECYT $XRX

— Benzinga (@Benzinga) May 14, 2018

7 Stocks To Watch For May 14, 2018 https://benzinga.com/z/11701862 $A $HQCL $ITRI $NI $VIPS $YUMA $RXN

7 Stocks To Watch For May 14, 2018 https://t.co/u70P8n60c1 $A $HQCL $ITRI $NI $VIPS $YUMA $RXN

— Benzinga (@Benzinga) May 14, 2018

Market Observation:

As of 8:00 AM: US Dollar $DXY trading 92.55, Oil FX $USOIL ($WTI) trading 70.80, Gold $GLD trading 1318.41, Silver $SLV trading 16.63, $SPY 273.30, Bitcoin $BTC.X $BTCUSD $XBTUSD 8418.00 and $VIX trading 13.1.

Momentum Stocks to Watch: $MYO $PRPO $ACIA $KTOV

News:

$MYO Myomo® Application for Medicare Codes Receives Favorable Preliminary Decision

https://finance.yahoo.com/news/myomo-application-medicare-codes-receives-120000268.html?.tsrc=rss

$MYO Myomo® Application for Medicare Codes Receives Favorable Preliminary Decision https://t.co/ERTe4JGVan

— Melonopoly (@curtmelonopoly) May 14, 2018

OPEC says global oil glut nearly gone as output ticks up slightly https://seekingalpha.com/news/3356195-opec-says-global-oil-glut-nearly-gone-output-ticks-slightly?source=feed_f … #premarket $USO $OIL $UWT $UCO

Your questions about the crypto regulatory fight in the U.S.—answered https://bloom.bg/2L0jJfV

Your questions about the crypto regulatory fight in the U.S.—answered https://t.co/WK7belEi6p pic.twitter.com/svNtzrmcEO

— Bloomberg Crypto (@crypto) May 14, 2018

$COCP Completed successful uplisting to Nasdq Capital Market March 12,th 2018

$ELOX uplisted

Boston Scientific announces real-world data demonstrating success of SMART pass on the S-ICD system https://seekingalpha.com/news/3356173-boston-scientific-announces-real-world-data-demonstrating-success-smart-pass-s-icd-system?source=feed_f … #premarket $BSX

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$WMT $HD $AMAT $CSCO $M $JCP $DE $TTWO $BZUN $MZOR $NTES $KEM $A $VIPS $CSIQ $LONE $HQCL $MARK $SORL $JWN $DGLY $EXP $SWCH $AZN $CPB $NM $GDP $BCLI $MGIC $TGEN $KMDA $JACK $ATNX $HTHT $MANU $NINE $MTBC $VRTU $RXN $AMRS $FLO

#earnings for the week $WMT $HD $AMAT $CSCO $M $JCP $DE $TTWO $BZUN $MZOR $NTES $KEM $A $VIPS $CSIQ $LONE $HQCL $MARK $SORL $JWN $DGLY $EXP $SWCH $AZN $CPB $NM $GDP $BCLI $MGIC $TGEN $KMDA $JACK $ATNX $HTHT $MANU $NINE $MTBC $VRTU $RXN $AMRS $FLO https://t.co/r57QUKKDXL https://t.co/EFUpuZmWFi

— Melonopoly (@curtmelonopoly) May 14, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

$BOX Weekly Algorithmic Model Chart #earnings #trading

Gold. Monthly. $XAUUSD $GC_F $GLD $NUGT $DUST $JDST $JNUG #Gold

Simple symmetrical time cycle on weekly, Volatility reversal leading in to July 23 ish probable. $VIX $UVXY $TVIX

$VIX under moving averages on Daily Chart and under lower bollinger. Long bias RR setting in.

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Massive time cycle comes due late July on Gold Daily. Structure in place still. May 14 218 AM #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

With earnings on deck this week watch this one close. 118.00 upside 93.00 downside. Good range. $EXP

$CALA targeting 3.00 range July 6. Trending down quad wall near perfect. Watch for bounce. #swingtrading

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

$SPY Daily Chart, ending week bullish with a break above upper TL and 20 MA near breach 50 MA. $ES_F $SPXL $SPXS

Oil Monthly. Right at pivot, between 100 MA Resistance 200 MA Support. MACD SQZMOM trending up Stoch high. $USOIL $WTI $USO #OIL

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Monday

Economic Data Scheduled For Monday pic.twitter.com/2N84n9mCGd

— Benzinga (@Benzinga) May 14, 2018

#5things

-U.S.-China tensions ease

-Italy’s ambitious populists

-OPEC says has Iran buffer

-Markets mixed

-Jerusalem embassy

https://bloom.bg/2IcNAUh

#5things

-U.S.-China tensions ease

-Italy's ambitious populists

-OPEC says has Iran buffer

-Markets mixed

-Jerusalem embassyhttps://t.co/4axxsJ8Fmm pic.twitter.com/D3glqrO299— Bloomberg Markets (@markets) May 14, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MYO $PRPO $ACIA $KTOV $NXPI $CNET $PXLW $HMNY $OCLR $VLRX $HTBX $NPTN $TNDM $SYMC $LITE $RGSE $FNSR $AMDA $TRXC $EMIS $HUYA $MRVL $BLNK $QCOM

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $TLRD $WAB $DK $TRI $AMS $LB $LEA $FNHC $FBN $TNDM $TLRD $LGCY $UPS $MTH $MGA $OC $FMC $CSX $AG $TTD $CVX $AMAT $CMG

JPMorgan Remains Positive on Ormat Technologies $ORA, Issues Cautious Alert Regarding Lava Flow in …

(6) Recent Downgrades: $ANDV $XRX $OC $AOSL $UIHC $TWNK $DF $HTH $CHSP $FBHS $MAS $UNIT $DCT $JELD $BECN $CUB $IFF $EMES $IFF $CASY $CAT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $MYO $PRPO $ACIA $KTOV, $BOX, $CALA, $SPY, GOLD, SILVER, OIL, $VIX, $DXY

SuperNova $SILVER Algo Chart Model Update Mon May 14 $SLV ($USLV, $DSLV)

Silver Trading Chart Update Monday May 14, 2018 $SLV ($USLV, $DSLV) Chart and Algorithm Observations

My name is SuperNova the Silver Algo. Welcome to my new Silver trade report. You can follow my intra day tweets here SuperNova Silver Algo Twitter Feed.

How My Algorithm Works and Availability:

I am an algorithm chart model in development.

Below you will find my simplified view of levels that can be used on a traditional chart to possibly advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on (rooted in technical set-up).

My algorithmic charting will eventually transition to developer coding phase for our trader’s dashboard program. I am not an automated bot or high frequency type algorithm (HFT). Please review my algorithm development process.

Below you will find simple Generation I Level chart modeling with a goal toward generation 5 modeling as with EPIC the Oil Algorithm model (for example).

Silver Trading Observations

Targets charted in play in to next time cycle. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Key Silver Buy Sell Triggers (wide range swing trading):

18.51

17.74

16.96

16.17

15.40

Per recent;

Per last report 16.95 as May 7 most probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Per recent;

April 24 – Silver retrace was deeper than expected. Revised 16.95 as May 7 most probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Per recent;

Silver on fire through chart model. Retrace to 16.96 Apr 24 and uptrend to 17.72 May 7 probable PT. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver 2 Hour Chart Model (daytrading)

Silver did not hit target this time – bought above. Bullish bias. SuperNova $SILVER Algorithm Chart Model $SLV, $USLV, $DSLV

Per recent;

Silver daytrading model amazing – it keeps hitting mid quad target over and over again.

Per recent;

Silver confirming long side trade bias over 16.69 first target 16.78 then 16.95 on daytrading model. SILVER $SLV #trading

Silver Conventional Charting

Doesn’t really matter how you draw the lines – there’s a decision coming on Silver Weekly Chart. #Silver $SLV $USLV $DSLV

Also, take note of 200 MA on weekly chart just above current trade.

https://www.tradingview.com/chart/SILVER/Q2Nj70JG-There-s-a-decision-coming-on-Silver-Chart-notes/

Per recent;

April 30 – SILVER conventional chart compression to end of triangle.

Per recent;

April 24 – Silver touch to 100 MA and came off. Intra getting a bounce here.

Recent Algorithm Price Target Hits

May 14 – I will update target hits soon.

April 19 – Since the posts below the models have been hitting targets regularly. Looks like we have the models dialed in.

Silver Mar 2 300 PM target hit – not perfect but a hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Silver Mar 9 300 AM target hit – not perfect but it hit. Provided on weekend prior report. SuperNova $SILVER Algo Chart Model $SLV, $USLV, $DSLV

Good luck with your trades and look forward to seeing you in the room!

SuperNova Silver Algo

Article Topics: SuperNova, Silver, Chart, Algorithm, $SILVER, $SLV, $USLV, $DSLV