Tag: VIX

PreMarket Trading Report Tues Jan 22: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday January 22, 2019.

In this premarket trading edition: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 22 – Per email sent to members in premarket.

- Main Trading Room

- Jan 22 – Per email sent to members in premarket.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 20 – Protected: Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 15 – Protected: Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Tuesday Jan 22 –

Voice Broadcast Starts at 2:50 on video.

This is mid day review from Friday Jan 18, 2019.

This video explains the upcoming pull back I was looking for in oil and the general markets.

I explain how I will time my Swing entries around that, trading Indices, algorithm models SPY VIX WTI BTC GLD SLV DXY etc.

It’s a much watch for trading this time period.

All the reports will be out over next 48 hours, most before market open tomorrow.

Today I am in trading room for market open, mid day and futures.

Have a great day!

Curt

Friday Jan 18 – Mid day review will be looking at Swing Trade entry points. Crude oil has been a great week, don’t miss the post from last night – important details for daytrading crude oil. Same guidance per below from recent.

Market Observation:

Markets as of 8:07 AM: US Dollar $DXY trading 96.32, Oil FX $USOIL ($WTI) trading 53.21, Gold $GLD trading 1282.04, Silver $SLV trading 15.26, $SPY 264.96 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3548.00, $VIX 18.5 and NatGas 3.25.

Momentum Stocks / Gaps to Watch:

$TSLA (+1.0% pre) Tesla is reportedly in talks with China’s Lishen over Shanghai battery contract – CNBC.

$EBAY (+12.3% pre) Elliott Sends Letter to Board of Directors of eBay; Seeks Separation of StubHub and Classifieds.

$NVCN up 55% at $1.27 – Neovasc announces dismissal of claim brought by Edwards Lifesciences.

$UQM (+45.1% pre) UQM Technologies Signs Definitive Agreement to be Acquired by Danfoss – SI.

$TGTX – TG Therapeutics up 11% on receiving Breakthrough Therapy Designation for umbralisib.

$AAPL WOES SHOULD BENEFIT TELECOMS $TMUS $T $VZ – MACQUARIE.

24 Stocks Moving In Tuesday’s Pre-Market Session http://benzinga.com/z/13015207 $MDWD $APHA $EDU $AABA $URI $LULU $AUPH $TI $UBS $GPS

News:

Stocks making the biggest moves premarket: Johnson & Johnson, Nike, FedEx & more –

https://twitter.com/CompoundTrading/status/1087694423557849088

PG&E secures $5.5 billion in DIP financing to fund operations through bankruptcy https://on.mktw.net/2FR7Qsg

ARCONIC TO NO LONGER PURSUE SALE OF THE COMPANY.

$NVCN just out: Neovasc Announces Dismissal of Claim brought by Edwards Lifesciences.

$LCI Lannett (LCI) Announces Distribution Agreement For Trientine Hydrochloride Capsules.

$TSLA: NEEDHAM CUTS MODEL 3 DELIVERIES ESTIMATES BY 15,000 IN 2019 TO 243,000.

UBS Tumbles On “Very Poor” Results As Clients Pull $13 Billion.

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Offerings, Mergers:

$TOPS Announces Completion of Senior Secured Post-Delivery Financing for M/T Eco California.

Tilray to buy Natura Naturals for about $26.3 billion in cash and stock.

$CHFS – CHF Solutions files for equity offering.

Earnings:

Travelers beats earnings estimates despite higher catastrophe losses.

Halliburton tops profit and revenue expectations, shares slip.

Johnson & Johnson tops estimates for fourth quarter.

Stanley Black & Decker shares fall nearly 7% after weak 2019 guidance.

#earnings for the week

$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNP

#earnings for the week$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNPhttps://t.co/lObOE0dgsr pic.twitter.com/ROwchUMNvx

— Earnings Whispers (@eWhispers) January 19, 2019

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

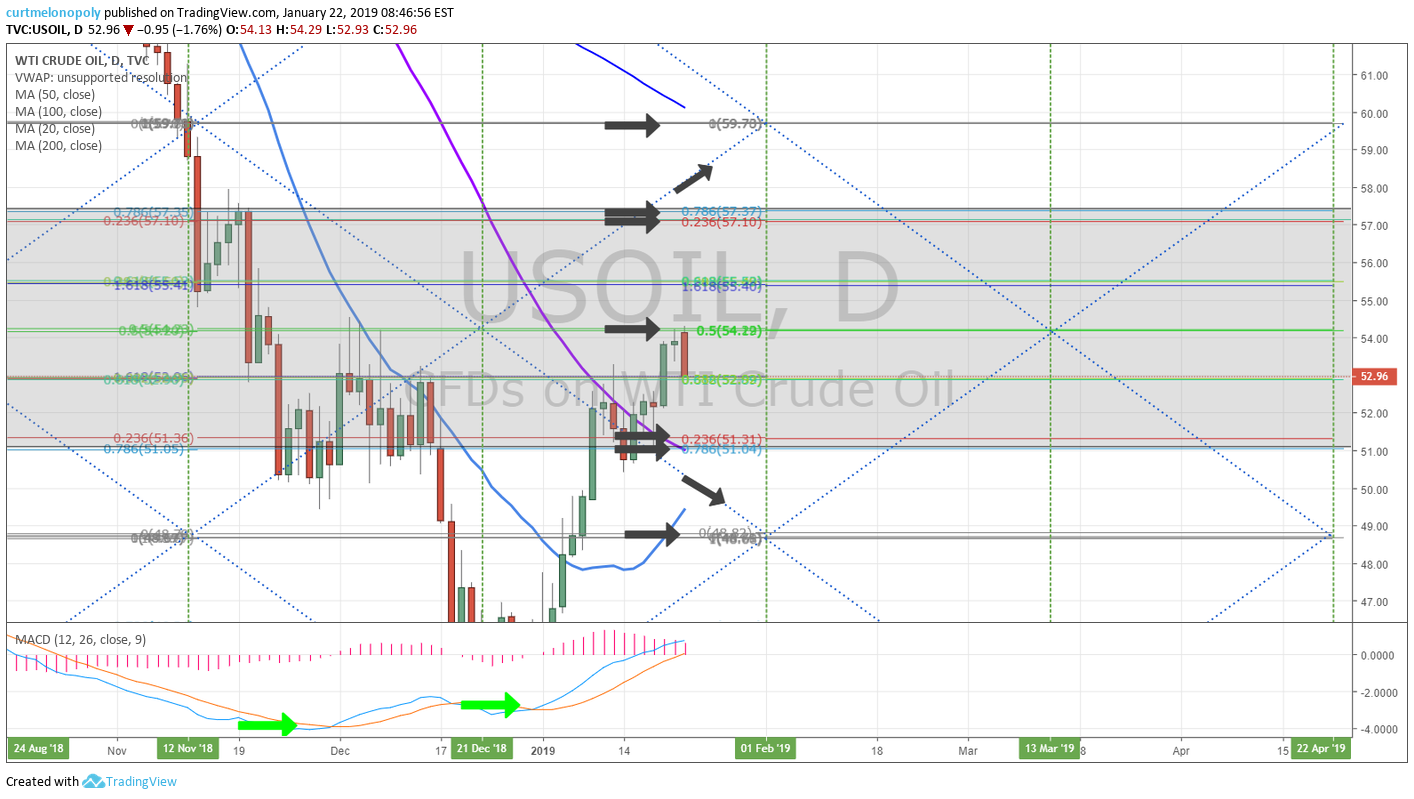

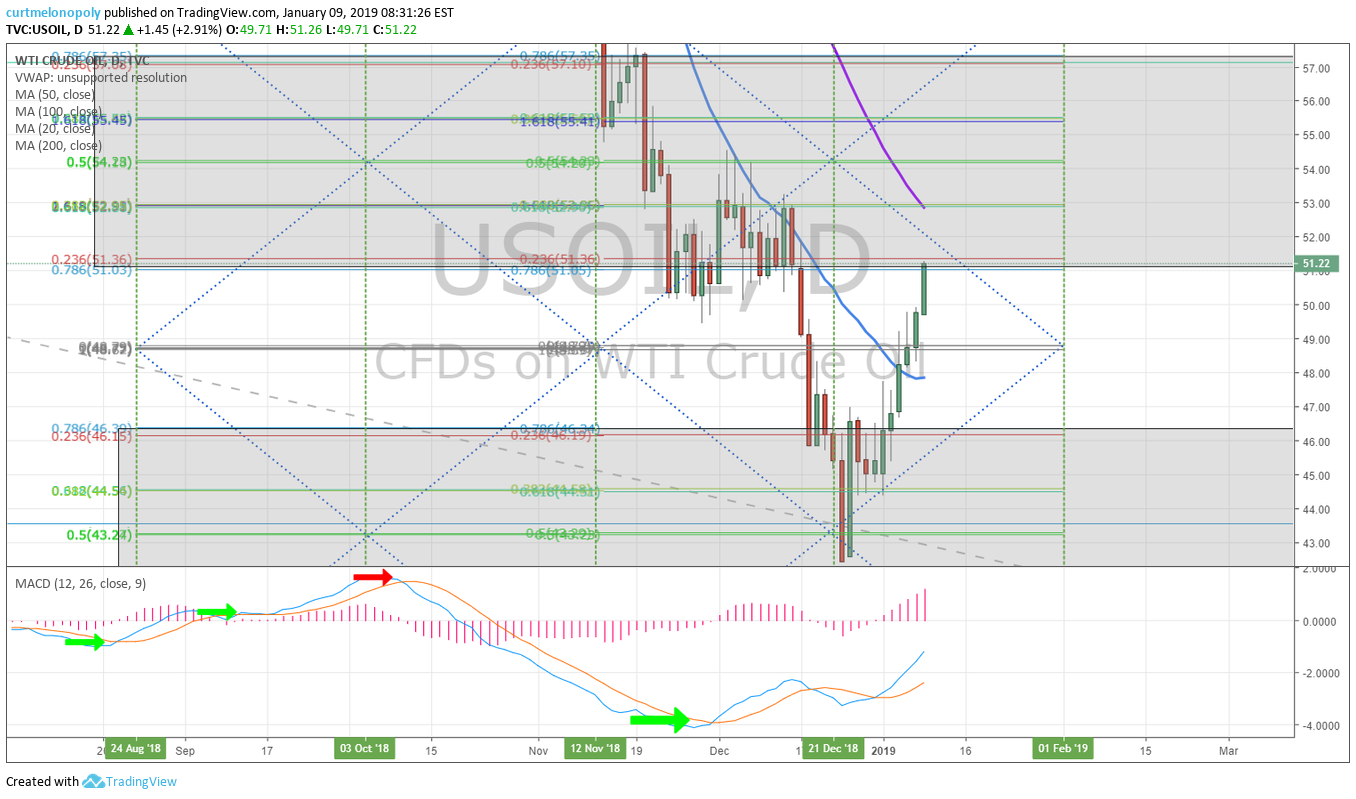

Crude oil perfect hit to mid quad on daily algorithmic model and backed off FX USOIL WTI $CL_F $USO #CrudeOil #Chart

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT pic.twitter.com/iqcDOtr7ri

— Melonopoly (@curtmelonopoly) January 21, 2019

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO pic.twitter.com/Fib1n1iMLG

— Melonopoly (@curtmelonopoly) January 18, 2019

Oil Trading Alerts Yesterday – Man vs. Machine, Both Winning.

Overnight futures crude oil trading alert Selling 51.07 will advise #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Overnight futures crude oil trading alert Covering 50.74 #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

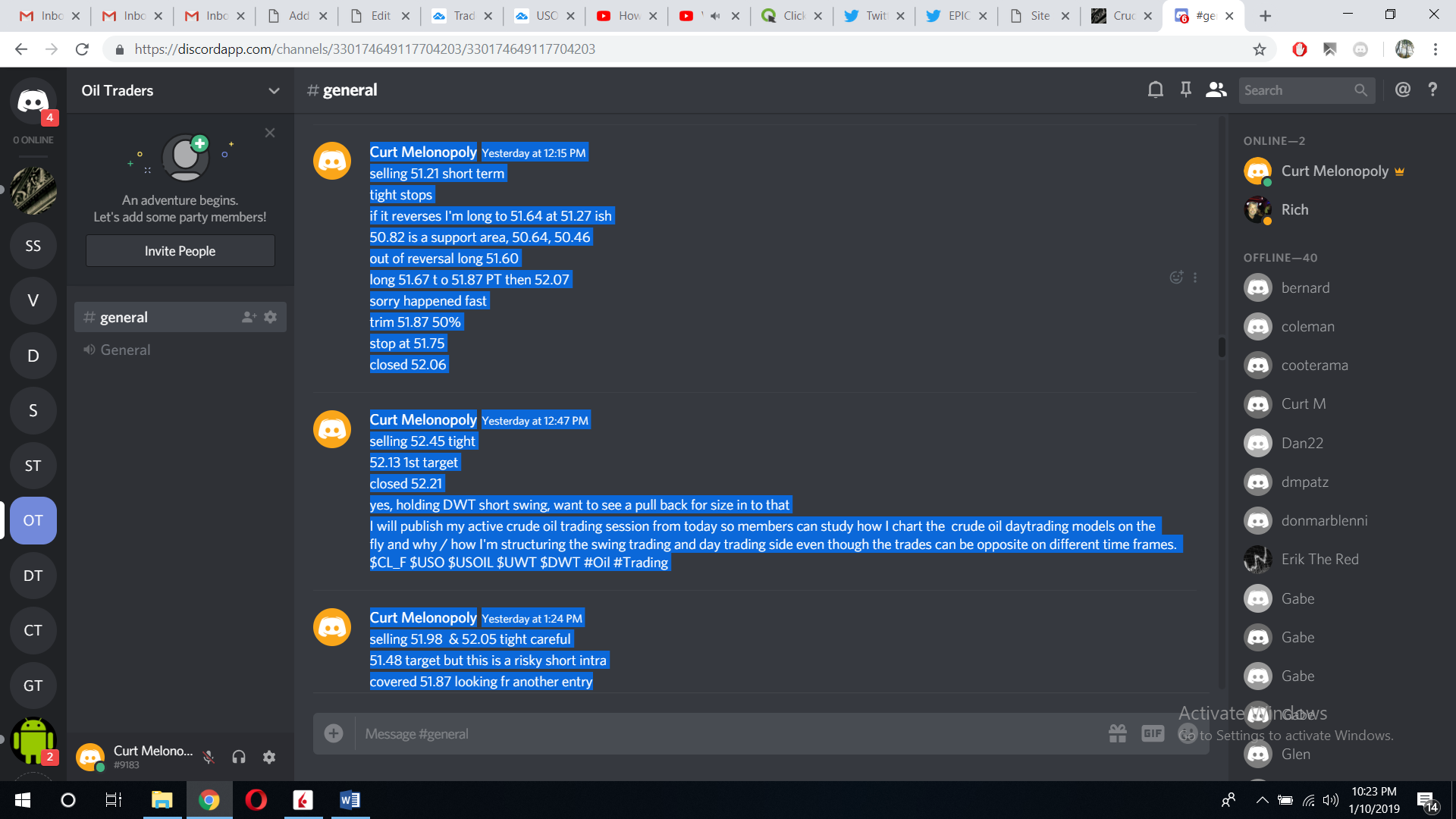

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

It’s A “Sea Of Red” As Global Stocks, S&P Futures Tumble

It's A "Sea Of Red" As Global Stocks, S&P Futures Tumble https://t.co/KavAmDyE9N

— zerohedge (@zerohedge) January 22, 2019

#5things

-No end in sight for shutdown

-Chances of second Brexit referendum rise

-Davos begins

-Markets slip

-Data, earnings due

https://bloom.bg/2AYQTcm

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://www.ft.com/content/49c9df22-19aa-11e9-9e64-d150b3105d21 …

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://t.co/a20LwlwF6k pic.twitter.com/JL6rAYR37X

— Lisa Abramowicz (@lisaabramowicz1) January 22, 2019

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $UAA $ICE $PANW $HIW $CABO $FTI $MIDD $BJ $CARS $SNV $NKE $CHU $TGP $BUD $IAG $AUY $FISV $AINV $DRNA

(6) Recent Downgrades: $BMTC $D $GPS $STT $PSEC $X $FTNT $BL $MO $ERJ $HTHT $FHN $PVH $REVG $GLOG $TIF $TOO $IMMU $LXFT $GPS $CRSP $LFC $WB $BTE $HBM

SCHLUMBERGER $SLB: SUSQUEHANNA CUTS TARGET PRICE TO $54 FROM $55

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY

PreMarket Trading Report Fri Jan 18: Earnings, $NFLX, $TSLA, $SQ, $UPL, $GEVO, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Friday January 18, 2019.

In this premarket trading edition: Earnings, $NFLX, $TSLA, $SQ, $UPL, $GEVO, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 18 – The swing trading articles / videos and the oil trading special reports should not be missed by our trading members this week.

- Jan 16 – New EPIC Oil Algorithm model was published (there is still minor anomalies from holiday but not significant enough to note). Swing reporting will be intensive in to earnings season with a series of mini reports (Post EIA in to Friday). The other model updates will flow and be released throughout the week.

- Trade Alerts

- Jan 18 – The trade alerts for oil are picking up (we’re winning) and the swing trade alerts will increase between this afternoon and through earnings.

- Jan 16 – You can expect swing trade alerts to start between Friday afternoon and Monday morning for this time cycle in to mid May 2019.

- Jan 16 – You can expect the machine trading in oil to pick up after EIA, the algorithm model is now past the anomalies from holiday.

- Main Trading Room

- Jan 18 – I am in session in main trading room today for open, mid day review, during actvie trade.

- Jan 16 – I am in session in main trading room today for market open, EAI, mid day review, during active trading, in futures.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

15 RULES to TRADING (inspired via trade coaching session I just completed, there’s more, but here’s 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

15 RULES to TRADING (inspired via trade coaching session I just completed, there's more, but here's 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

— Melonopoly (@curtmelonopoly) January 11, 2019

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 15 – Protected: Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Friday Jan 18 – Mid day review will be looking at Swing Trade entry points. Crude oil has been a great week, don’t miss the post from last night – important details for daytrading crude oil. Same guidance per below from recent.

Wednesday Jan 16 – Holding DWT short in to EIA today. Post EIA expect us to be in active in to time cycle peak mid May now. Positions in swings expected between Friday afternoon and Monday premarket to start. Oil still bullish, was looking for more of a pull back but in oil you never know. EIA report today should set the tone for that pullback or not decision. NatGas trade I seem to have missed executing on. Volatility on high watch here, if oil sells off I will be short OIL, TVIX short and SPY short will all be in play short term. Dollar could spike too so I may long it short term, it is holding its 200 MA. Per previous I would then expect to flip on all those positions. It would be ideal for this to happen now in this timing because entries in equities would be lower in this scenario. We shall see.

Monday Jan 14 – Earnings season starts, looking for my swing trade set-ups to develop as we get in to the season. Machine trade model for oil posted to Discord private member server that has a channel we are watching to confirm possible reversal in trend (up). VIX and $SPY on high watch with earnings season starting. May have missed my NatGas $UGAZ long I was talking about taking. $DXY US Dollar near 200 MA support test on daily, also on watch and VIX near lower Bollinger band, $TVIX on watch.

Citi $C up a bit premarket (reported earnings), but only .65% off in premarket. On watch today per swing trading report released this morning.

See more recent premarket reports for more of my possible set-ups.

Friday Jan 11 –

On watch: Looking for a buy side signal as close to 52.60 (in crude oil) as possible for a price target of 53.52 today. Bullish scenario on FX USOIL WTI traded on CL.

We have been looking for a pull back in oil for a number of reasons (watch mid vids and reporting)… anyway, in classic oil style we have not got much of any pull backs, HOWEVER, if you review the 240 minute model you will see a time cycle peak around Jan 14, 2019 that isn’t huge but big enough to potentially cause a pull back BETWEEN TODAY and next Wednesday. This would give me opportunity to add to the DWT short position (at oil support after pull back), at start of pull back take a long VIX, long Natural Gas, short SPY or QQQ, long dollar, long possibly Bitcoin, Gold, Silver and then when oil bounces reverse all those trades.

The machine trading will now get more aggressive as the EPIC oil model is finally normaliziing after holiday trade anomalies (the software triggers on the chart, so the structure of the chart s important).

Thanks for your patience with the reporting, we’re on it, we just got in deep with the oil anomalies and this possible turn. We need to have a structured oil plan for the rest of the trading in equities ad algorithms to find the core of the move.

Swing trading reports are near done and should be flowing out within 24 hours, EPIC report also and in to next week all the other algorithms.

$TSLA ON WATCH AS $GM’S CADILLAC TO INTRODUCE EV, TAKE REINS AS CO’S LEAD EV BRAND – SI

Market Observation:

Markets as of 7:15 AM: US Dollar $DXY trading 96.10, Oil FX $USOIL ($WTI) trading 52.57, Gold $GLD trading 1286.04, Silver $SLV trading 15.46, $SPY 264.06 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3597.00, $VIX 18.2 and NatGas 3.318.

Momentum Stocks / Gaps to Watch:

Top Most Active Stocks in #Premarket Trading $SQQQ $TSLA $SPY $UPL $NFLX $UGAZ $GLD $HMNY $QQQ $NOK $BIOC $UWT https://marketchameleon.com/Reports/PremarketTrading/ …

40 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/13005824 $UPL $OZK $GEVO $VFC $TEAM $GPOR $SPWH $JBHT $CVS $ACB $PCG $NLS $PRGS $TSLA $NFLX $TIF $AXP $LLY

https://twitter.com/CompoundTrading/status/1086252624138121217

News:

$TSLA Tesla to reduce full-time employee headcount by approximately 7%.

Square (SQ) Introduces Free Debit Card for Businesses $SQ https://www.streetinsider.com/dr/news.php?id=15017236 …

$GEVO (+41.7% pre) Gevo & Avfuel Partner to Supply Sustainable Jet Fuel for Business Jets Fuel Green Event at Van Nuys Airport.

CVS, Walmart reach agreement on pharmacy contract after impasse https://reut.rs/2TYvUx7.

$UPL (+58.4% pre) Ultra Petroleum Corp. Announces Favorable Opinion for Company on Make-Whole Litigation Appeal -GN

$TYME (-8.8% pre) Tyme Technologies misleads with cancer drug data release – STAT (2/2)

$IMMU (halted pre) Immunomedics’ cancer treatment fails to win accelerated approval from the FDA – Reuters

Eli Lilly shares slide premarket on news of failed trial for sarcoma treatment.

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Dish Network, Hartford Financial, Medtronic https://benzinga.com/z/12975164 $DISH $HIG $MDT

Recent IPO’s, Private Placements, Mergers:

Fiserv to acquire First Data in all-stock deal with equity value of $22 billion

Gannett’s stock soars after MNG’s unsolicited buyout bid, valuing the USA Today publisher at over $13 billion.

New Fortress Energy to offer 22.2 million shares in planned IPO, priced at $17 to $19 each.

Aurora Cannabis to buy Whistler Medical Marijuana in a $132 million stock deal.

Slack plans to public via rare direct listing in coming months–WSJ.

Earnings:

Netflix’s stock drop after results despite upbeat analyst calls.

CVS’s stock jumps after deal to keep Walmart participating in PBM networks.

Vans-parent VF’s stock soars after profit and sales beat, raised outlook.

Schlumberger shares rise premarket after revenue tops estimates.

$RYAAY – Ryanair lowers profit forecast

Tiffany & Co. $TIF sees FY EPS towards lower end of its previously-disclosed range https://www.streetinsider.com/dr/news.php?id=15019964 ….

#earnings for the week

$NFLX $C $BAC $JPM $UNH $DAL $WFC $GS $BLK $MS $AXP $AA $SJR $SLB $SNV $INFO $FRC $FAST $BK $PNC $USB $CSX $KMI $BBT $CMA $UAL $TEAM $KEY $CBSH $MTB $VFC $JBHT $SASR $STI $PRGS $FULT $HAFC $HOMB $PTE $RF $OZK $PBCT $WNS $PLXS

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

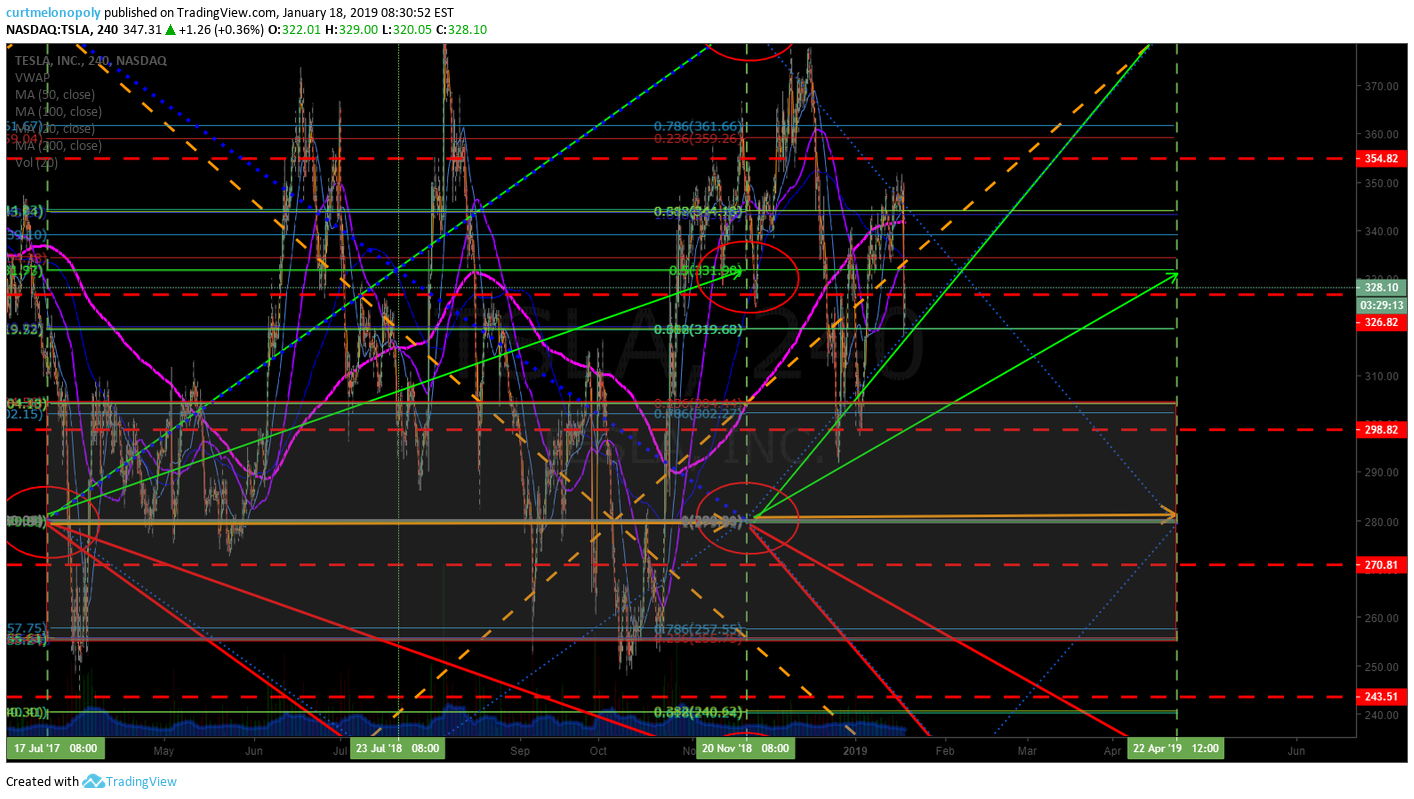

TESLA (TSLA) Watching close premarket as it sells off, would like to see lower for another swing trade #swingtrading $TSLA

Strong Bullish Structure in Oil Trade.

Oil Trading Alerts Yesterday – Man vs. Machine, Both Winning.

Overnight futures crude oil trading alert Selling 51.07 will advise #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Overnight futures crude oil trading alert Covering 50.74 #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Shutdown solution still seems distant

-Brexit impasse

-Investors get optimistic on trade

-Markets rise

-Tesla tumbles

https://bloom.bg/2FGDCYZ

Futures, Global Markets Surge On Renewed China Stimulus And Trade Optimism

Futures, Global Markets Surge On Renewed China Stimulus And Trade Optimism https://t.co/EGRFVsLcOS

— zerohedge (@zerohedge) January 18, 2019

Global oil demand is set to rise by 1.4m b/d in 2019 as a boost from lower fuel prices counters slowing economic activity, the IEA says https://bloom.bg/2FIqO4f #OOTT

https://twitter.com/EPICtheAlgo/status/1086246333365706757

Crude has held on to its rally above $50 a barrel for over a week. #Oil #OOTT $CL_F $WTI https://www.bloombergquint.com/business/oil-set-for-third-weekly-gain-as-opec-cuts-counter-u-s-output

BRENT’s front-month futures contract is back in backwardation, as OPEC output cuts and other supply disruptions start to remove the anticipated surplus in the oil market:

BRENT's front-month futures contract is back in backwardation, as OPEC output cuts and other supply disruptions start to remove the anticipated surplus in the oil market: pic.twitter.com/4P5GCRyuet

— John Kemp (@JKempEnergy) January 18, 2019

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $UPL $VFC $OZK $SPWW $EGAN $ACRX $TEAM $GPOR $DGAZ $STI $CLDX $TRQ $SE $PCG $CGC $SLB $VIPS $UXIN

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $SPB $KMB $CNP $EW $SPWH $VLO $CVX $CNP $CBSH $ACH $MDRX $ANET $FISV $IQV $E $TKC $LXFT

Cronos Group initiated with an Outperformer at CIBC $CRON $CGC http://dlvr.it/QwyZRY

Canopy Growth initiated with an Outperformer at CIBC $CGC http://dlvr.it/QwyZQT

Citi Upgrades Tenaris S.A. $TS to Buy http://streetinsider.com/r/15020283

$NFLX

BOFA reiterated BUY on $NFLX – PT $450

pt raised to $420 from $400 at Citi

pt raised to $415 from $400 @ Canaccord

pt raised to $400 from $380 at Stifel

pt raised to $425 from $410 at Oppenheimer

raised to $450 from $430 at Morgan Stanley

(6) Recent Downgrades: $BVN $KMX $IMMU $PPG $DK $IPG $LN $EEX $CASA $SIG $IAG $KEY $X $NLS $SASR $LKQ $LOXO $ED $KEY

$APTX PT lowered lowered to $18 from $32 at BMO. Maintains Outperform.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, $NFLX, $TSLA, $SQ, $UPL, $GEVO, Oil, SPY, VIX, BTC, Gold, Silver, DXY

PreMarket Trading Report Wed Jan 16: Earnings, $GS, $BAC, $F, EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday January 16, 2019.

In this premarket trading edition: Earnings, $GS, $BAC, $F, EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 16 – New EPIC Oil Algorithm model was published (there is still minor anomalies from holiday but not significant enough to note). Swing reporting will be intensive in to earnings season with a series of mini reports (Post EIA in to Friday). The other model updates will flow and be released throughout the week.

- Trade Alerts

- Jan 16 – You can expect swing trade alerts to start between Friday afternoon and Monday morning for this time cycle in to mid May 2019.

- Jan 16 – You can expect the machine trading in oil to pick up after EIA, the algorithm model is now past the anomalies from holiday.

- Main Trading Room

- Jan 16 – I am in session in main trading room today for market open, EAI, mid day review, during active trading, in futures.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

15 RULES to TRADING (inspired via trade coaching session I just completed, there’s more, but here’s 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

15 RULES to TRADING (inspired via trade coaching session I just completed, there's more, but here's 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

— Melonopoly (@curtmelonopoly) January 11, 2019

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 15 – Protected: Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Wednesday Jan 16 – Holding DWT short in to EIA today. Post EIA expect us to be in active in to time cycle peak mid May now. Positions in swings expected between Friday afternoon and Monday premarket to start. Oil still bullish, was looking for more of a pull back but in oil you never know. EIA report today should set the tone for that pullback or not decision. NatGas trade I seem to have missed executing on. Volatility on high watch here, if oil sells off I will be short OIL, TVIX short and SPY short will all be in play short term. Dollar could spike too so I may long it short term, it is holding its 200 MA. Per previous I would then expect to flip on all those positions. It would be ideal for this to happen now in this timing because entries in equities would be lower in this scenario. We shall see.

Monday Jan 14 – Earnings season starts, looking for my swing trade set-ups to develop as we get in to the season. Machine trade model for oil posted to Discord private member server that has a channel we are watching to confirm possible reversal in trend (up). VIX and $SPY on high watch with earnings season starting. May have missed my NatGas $UGAZ long I was talking about taking. $DXY US Dollar near 200 MA support test on daily, also on watch and VIX near lower Bollinger band, $TVIX on watch.

Citi $C up a bit premarket (reported earnings), but only .65% off in premarket. On watch today per swing trading report released this morning.

See more recent premarket reports for more of my possible set-ups.

Friday Jan 11 –

On watch: Looking for a buy side signal as close to 52.60 (in crude oil) as possible for a price target of 53.52 today. Bullish scenario on FX USOIL WTI traded on CL.

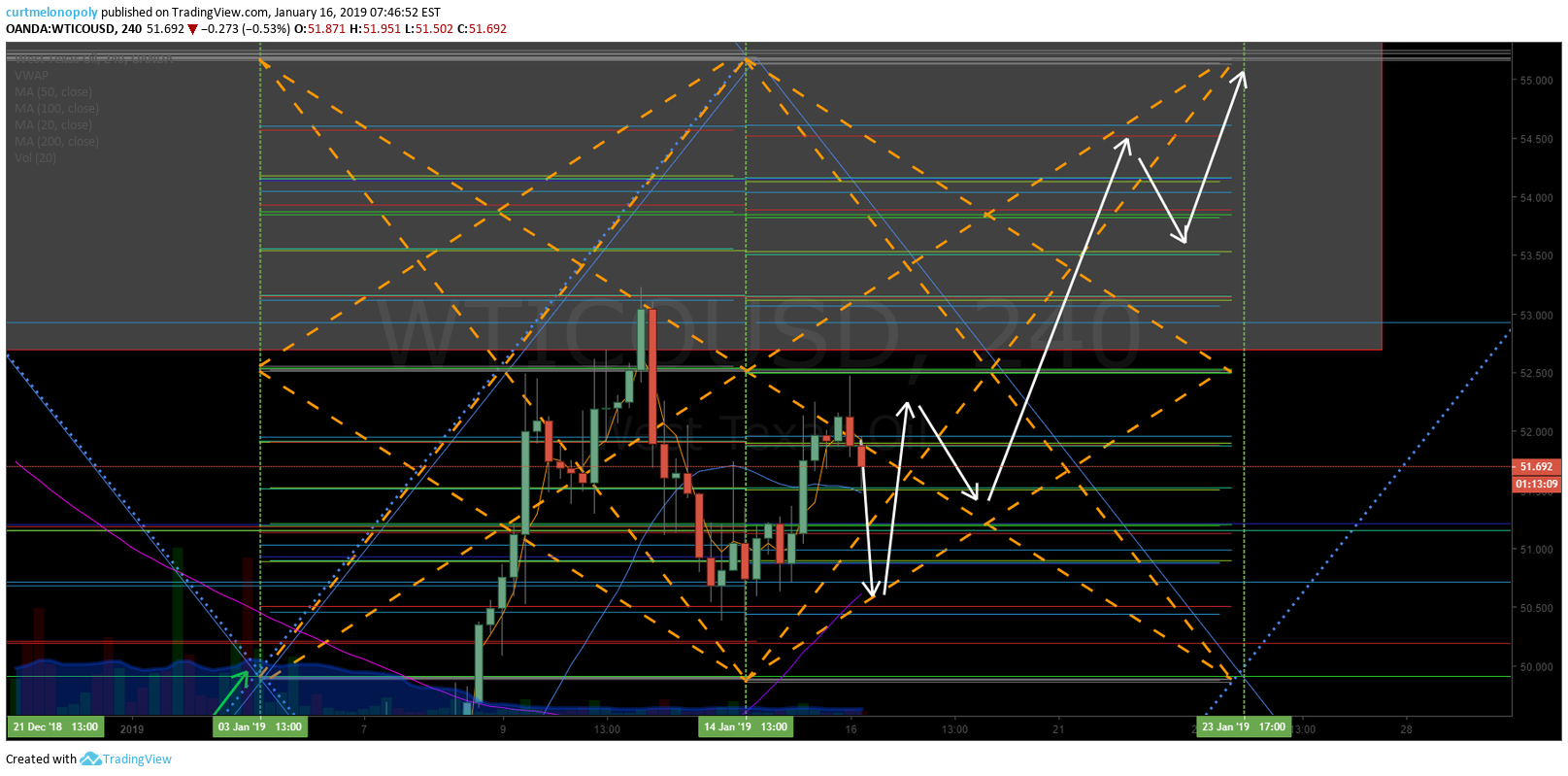

We have been looking for a pull back in oil for a number of reasons (watch mid vids and reporting)… anyway, in classic oil style we have not got much of any pull backs, HOWEVER, if you review the 240 minute model you will see a time cycle peak around Jan 14, 2019 that isn’t huge but big enough to potentially cause a pull back BETWEEN TODAY and next Wednesday. This would give me opportunity to add to the DWT short position (at oil support after pull back), at start of pull back take a long VIX, long Natural Gas, short SPY or QQQ, long dollar, long possibly Bitcoin, Gold, Silver and then when oil bounces reverse all those trades.

The machine trading will now get more aggressive as the EPIC oil model is finally normaliziing after holiday trade anomalies (the software triggers on the chart, so the structure of the chart s important).

Thanks for your patience with the reporting, we’re on it, we just got in deep with the oil anomalies and this possible turn. We need to have a structured oil plan for the rest of the trading in equities ad algorithms to find the core of the move.

Swing trading reports are near done and should be flowing out within 24 hours, EPIC report also and in to next week all the other algorithms.

$TSLA ON WATCH AS $GM’S CADILLAC TO INTRODUCE EV, TAKE REINS AS CO’S LEAD EV BRAND – SI

Market Observation:

Markets as of 7:15 AM: US Dollar $DXY trading 96.14, Oil FX $USOIL ($WTI) trading 51.68, Gold $GLD trading 1289.14, Silver $SLV trading 15.54, $SPY 260.13 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3642.00, $VIX 18.2 and NatGas 3.63.

Momentum Stocks / Gaps to Watch:

$FDC (+21.9% pre) Fiserv $FISV to buy First Data in $22 billion stock deal – CNBC

25 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12991811 $FDC $CCCL $MBOT $UAL $INPX $BAC $BK $EFII $ADNT $SNAP $PCG $JWN $STML $FISV

News:

Bank Of America Says Sees Nothing In Its Business That Suggests A Slow Down Is Imminent $BAC

Adient’s stock falls after mixed preliminary results.

$VCNX completes enrollment in SIGNAL Phase 2 study in subjects with early manifest and late prodromal Huntington’s disease.

Stocks making the biggest moves premarket: FDC, BAC, GS, BLK & more

Stock futures rise after BofA, Goldman earnings –

Stock futures rise after BofA, Goldman earnings – https://t.co/Nz8qyR7nte

— Investing.com Stocks (@InvestingStockz) January 16, 2019

#UPDATE: Ford said it expects to post a $112 million loss in the fourth quarter of 2018 as it restructures in the United States and Europe

#UPDATE: Ford said it expects to post a $112 million loss in the fourth quarter of 2018 as it restructures in the United States and Europe https://t.co/HoCUlgkjQg

— AFP News Agency (@AFP) January 16, 2019

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Dish Network, Hartford Financial, Medtronic https://benzinga.com/z/12975164 $DISH $HIG $MDT

Recent IPO’s, Private Placements, Mergers:

Fiserv to acquire First Data in all-stock deal with equity value of $22 billion

Gannett’s stock soars after MNG’s unsolicited buyout bid, valuing the USA Today publisher at over $13 billion.

New Fortress Energy to offer 22.2 million shares in planned IPO, priced at $17 to $19 each.

Aurora Cannabis to buy Whistler Medical Marijuana in a $132 million stock deal.

Slack plans to public via rare direct listing in coming months–WSJ.

Earnings:

$F SHARES DOWN ABOUT 1.6 PCT PREMARKET AFTER CO FORECASTS WEAKER-THAN-EXPECTED Q4 PROFIT

$UAL (+6.0% pre) United shares jump as airline’s fourth-quarter revenue, profit beat estimates – CNBC

Ford forecasts weaker-than-expected fourth quarter profit https://reut.rs/2TSGqWY

BlackRock Q4 Earnings:

-Adj EPS: $6.08 (est $6.28)

-IShares Net Inflows: $81.4B Vs $33.67B Q/Q

-FY EPS: $26.58 (Adj EPS: $26.93)

– GAAP Revenue: $3.434B (est $3.52B)

Goldman’s stock set to deliver a more than 40-point jolt to Dow after quarterly results top estimates

https://twitter.com/MarketsTicker/status/1085520302157778944

#earnings for the week

$NFLX $C $BAC $JPM $UNH $DAL $WFC $GS $BLK $MS $AXP $AA $SJR $SLB $SNV $INFO $FRC $FAST $BK $PNC $USB $CSX $KMI $BBT $CMA $UAL $TEAM $KEY $CBSH $MTB $VFC $JBHT $SASR $STI $PRGS $FULT $HAFC $HOMB $PTE $RF $OZK $PBCT $WNS $PLXS

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

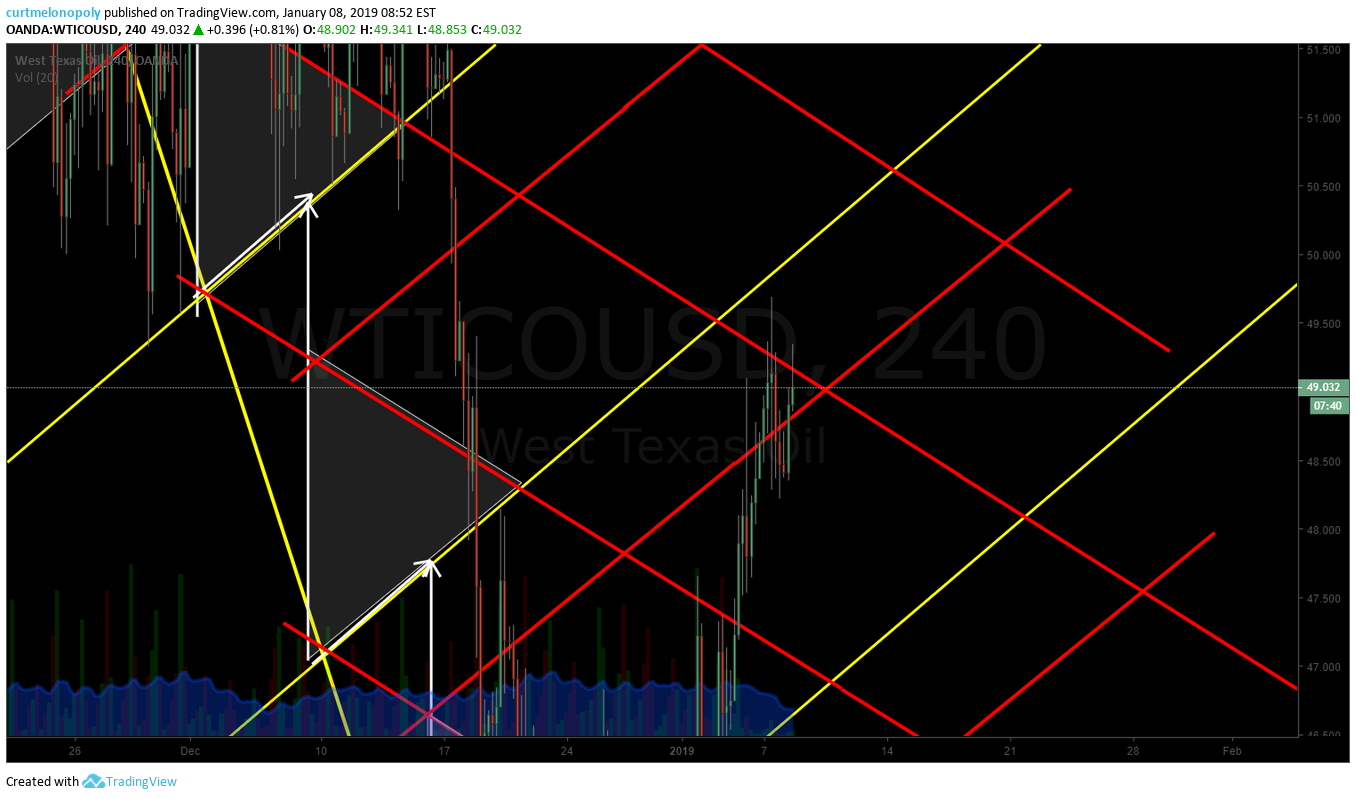

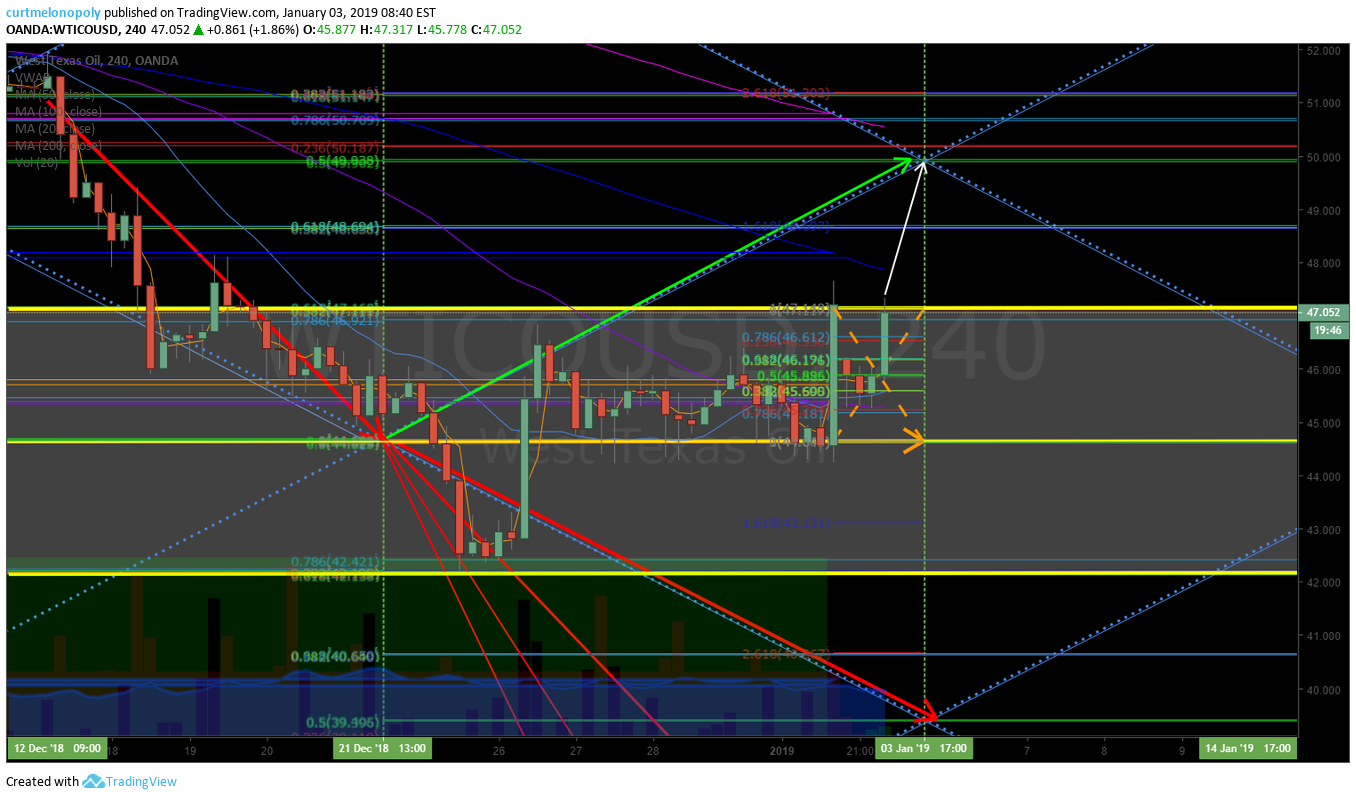

If I get pull back in oil, this is what it could look like.

Overnight futures crude oil trading alert Selling 51.07 will advise #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Overnight futures crude oil trading alert Covering 50.74 #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

Oil holds gain near $52 on hope that OPEC+ cuts will stabilize market.

Read: https://goo.gl/RTWE4c

Oil holds gain near $52 on hope that OPEC+ cuts will stabilize market.

Read: https://t.co/ENvgipwQU1 pic.twitter.com/yRbdMtOtij

— NDTV Profit (@NDTVProfitIndia) January 16, 2019

BlackRock CEO Fink: We Have Hit A Short Term Bottom For Stocks – RTRS $ES_F $YM_F $NQ_F

7:15 AM – 16 Jan 2019

BlackRock CEO Fink: We Have Hit A Short Term Bottom For Stocks – RTRS $ES_F $YM_F $NQ_F

— LiveSquawk (@LiveSquawk) January 16, 2019

. @BlackRock CEO Larry Fink on stock sell-off: "In the short run we probably hit a bottom" pic.twitter.com/OcYLCPEf7N

— Squawk Box (@SquawkCNBC) January 16, 2019

#5things

-British PM faces n-confidence vote

-Shutdown: Day 26

-Goldman, BofA earnings

-Markets quiet

-Coming up…

https://bloom.bg/2FvbpoI

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TBLT $FDC $MBOT $CLPS $VBIV $CCCL $CADC $ABIL $UGAZ $UAL $CREG $BAC $NTNX $UXIN $GS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $ACN $ARI $KREF $NAVI $OMF $NLY $CGBD $ING $DCP $BPL $WMB $CXO $CZZ $MET $SCCO

Clarksons Platou Starts Livent Corp. $LTHM at Buy

$CMG PT RAISED TO $485 FROM $430.00 AT COWEN

Lululemon Athletica Inc. $LULU PT Raised to $161 at Buckingham Research

(6) Recent Downgrades: $BUD $JWN $SC $WHF $BKCC $GPMT $PNNT $DVN $CDEV $CPE $IBP $INCY $ALSN $PCG $SNAP $CIG $AGRO $RNR $XELA $HUD $SYY $SBS $EFII $SYY

$JPM: BMO CUTS PRICE TARGET TO $123 FROM $124

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, $GS, $BAC, $F, EIA, Oil, SPY, VIX, BTC, Gold, Silver, DXY

PreMarket Trading Report Mon Jan 14: Earnings, $C, $MBOT, $GCI, $YGAZ, $DCAR, $YGTI, $YETI, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday January 14, 2019.

In this premarket trading edition: Earnings, $C, $MBOT, $GCI, $YGAZ, $DCAR, $YGTI, $YETI, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 14 – New EPIC Oil Algorithm model was published (there is still minor anomalies from holiday but not significant enough to note). Swing reporting will be intensive in to earnings season with a series of mini reports. The other model updates will flow and be released throughout the week.

- Main Trading Room

- Jan 14 – I am in session in main trading room today for market open, mid day review, during active trading, in futures.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

15 RULES to TRADING (inspired via trade coaching session I just completed, there’s more, but here’s 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

15 RULES to TRADING (inspired via trade coaching session I just completed, there's more, but here's 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

— Melonopoly (@curtmelonopoly) January 11, 2019

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Monday Jan 14 – Earnings season starts, looking for my swing trade set-ups to develop as we get in to the season. Machine trade model for oil posted to Discord private member server that has a channel we are watching to confirm possible reversal in trend (up). VIX and $SPY on high watch with earnings season starting. May have missed my NatGas $UGAZ long I was talking about taking. $DXY US Dollar near 200 MA support test on daily, also on watch and VIX near lower Bollinger band, $TVIX on watch.

Citi $Coff a bit premarket (reported earnings), but only .65% off in premarket. On watch today per swing trading report released this morning.

See more recent premarket reports for more of my possible set-ups.

Friday Jan 11 –

On watch: Looking for a buy side signal as close to 52.60 (in crude oil) as possible for a price target of 53.52 today. Bullish scenario on FX USOIL WTI traded on CL.

We have been looking for a pull back in oil for a number of reasons (watch mid vids and reporting)… anyway, in classic oil style we have not got much of any pull backs, HOWEVER, if you review the 240 minute model you will see a time cycle peak around Jan 14, 2019 that isn’t huge but big enough to potentially cause a pull back BETWEEN TODAY and next Wednesday. This would give me opportunity to add to the DWT short position (at oil support after pull back), at start of pull back take a long VIX, long Natural Gas, short SPY or QQQ, long dollar, long possibly Bitcoin, Gold, Silver and then when oil bounces reverse all those trades.

The machine trading will now get more aggressive as the EPIC oil model is finally normaliziing after holiday trade anomalies (the software triggers on the chart, so the structure of the chart s important).

Thanks for your patience with the reporting, we’re on it, we just got in deep with the oil anomalies and this possible turn. We need to have a structured oil plan for the rest of the trading in equities ad algorithms to find the core of the move.

Swing trading reports are near done and should be flowing out within 24 hours, EPIC report also and in to next week all the other algorithms.

$TSLA ON WATCH AS $GM’S CADILLAC TO INTRODUCE EV, TAKE REINS AS CO’S LEAD EV BRAND – SI

Wednesday Jan 9 – EIA day, this will be interesting to see if the move in overnight oil futures is supported post EIA. We want a pull back to add to DWT short swing and establish structure for the daytrading of this possible reversal in trend. If you haven’t read the related reports for a possible reversal please do so. If you need access codes for historical posts on blog please email Jen a list that you require.

Would like to see small short term pull back in markets and then go in to May 2019 per my reporting in to end of December.

The reporting for this new time cycle will start tonight. Dig deep, you will thank yourself on the other side of this 6 months later.

Tuesday Jan 8 – Today in to EIA is the final watch on market structure that we need and we’ll start producing the structured trading range reports for the next 6 months. 24 hours of patience. Then its go time. I think we have it nailed down. Please watch those mid day review videos so you are in the know before we go. Really really important.

Monday Jan 7 – Two days to let market structure settle and the report flow for the next six month time cycles starts. #patience #caution.

Fri Jan 4 – If Fed pauses hikes and US-China trade relations improve oil should run in to May targets oil bundle members have (especially if OPEC cuts remain in play), the markets should run up in to May. Gold, Silver, VIX, DXY and Bitcoin may (are likely) to get soft and equities will be a stock pickers environment (traded properly within instrument structure) during that period (Q1 2019). Generally this is how it looks currently. But yet to be seen in to next week forward – this is one scenario. Reporting and alerts (either way) will become very active as next week rolls out and in to next 6 months. We will have the structure of trade for our coverage (the algorithm models and swing platform) so that we can trade either scenarios (up or down in each, including swing trading).

Market Observation:

Markets as of 8:19 AM: US Dollar $DXY trading 95.62, Oil FX $USOIL ($WTI) trading 50.83, Gold $GLD trading 1294.65, Silver $SLV trading 15.60, $SPY 256.76 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3541.00, $VIX 19.9 and NatGas 3.382.

Momentum Stocks / Gaps to Watch: $MBOT $GCI $YGAZ $DCAR $YGTI $BOIL $YETI

$GCI (+20.0% pre) Hedge-Fund-Backed Media Group Makes Bid for Gannett – WSJ

$GG (+9.1% pre) Newmont Buys Goldcorp for $10 Billion to Be Top Gold Miner – BBG

$YGYI (+14.7% pre) Youngevity International Announces Exclusive Cross-Marketing Agreement with Icelandic Glacial.

$VLRX (+7.3% pre) Valeritas (VLRX) Announces V-Go Received Preferred Status on OptumRx Formularies – SI

28 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12977631 $MBOT $GCI $GG $YETI $BOOT $VAMT $YGYI $PCG $TLRD $VRNA $USAT $HUD $NEM $WDC $ASNA

News:

23 of 24 strategists expect the year to finish higher than Friday’s close — Cantor Fitzgerald’s Peter Cecchini is the lone dissenter at 2,390: BBG per @zerohedge

Stocks making the biggest moves premarket: GG, LULU, AAPL, PCG & more –

https://twitter.com/CompoundTrading/status/1084799581274161152

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Dish Network, Hartford Financial, Medtronic https://benzinga.com/z/12975164 $DISH $HIG $MDT

Recent IPO’s, Private Placements, Mergers:

Gannett’s stock soars after MNG’s unsolicited buyout bid, valuing the USA Today publisher at over $13 billion.

New Fortress Energy to offer 22.2 million shares in planned IPO, priced at $17 to $19 each.

Aurora Cannabis to buy Whistler Medical Marijuana in a $132 million stock deal.

Slack plans to public via rare direct listing in coming months–WSJ.

Earnings:

CITIGROUP BOUGHT BACK 74 MILLION SHARES IN 4Q $C per @deltaone

Ascena shares down 4.9% after updating Q2 guidance to loss of 23 to 28 cents per share.

Shares of airport retailer Hudson slide 7% premarket after sales guidance falls short.

Crocs raises Q4 revenue guidance after ‘best fourth quarter in years’.

Abercrombie & Fitch’s stock surges after Q4 sales outlook.

Tailored Brands lowers Q4 guidance as Jos. A. Bank sales fall short.

Cray shares slide 4% after company backs forecast for ‘substantial’ loss in 2018, 2019.

Citigroup misses fourth-quarter revenue expectations on much weaker-than-expected bond trading #swingtrading $C #earnings #premarket –

Citigroup misses fourth-quarter revenue expectations on much weaker-than-expected bond trading #swingtrading $C #earnings #premarket – https://t.co/0vgBx7yetm

— Swing Trading (@swingtrading_ct) January 14, 2019

#earnings for the week

$NFLX $C $BAC $JPM $UNH $DAL $WFC $GS $BLK $MS $AXP $AA $SJR $SLB $SNV $INFO $FRC $FAST $BK $PNC $USB $CSX $KMI $BBT $CMA $UAL $TEAM $KEY $CBSH $MTB $VFC $JBHT $SASR $STI $PRGS $FULT $HAFC $HOMB $PTE $RF $OZK $PBCT $WNS $PLXS

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades: