Blogs

Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C …

Video Review. Trade Set Ups for Swing Trading Earnings Tuesday January 29, 2019.

Swing Trading Stock Signals in this Video Report from Mid Day Review in Main Trading Room Jan 28: $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C and more…

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://t.co/XL7cEWGMce

— Swing Trading (@swingtrading_ct) January 27, 2019

Earnings Season Special Reports Thus Far:

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Video Review:

VIDEO TRANSCRIPT SUMMARY (there is much more detail on video itself):

#swingtrading #earnings

Jan 28, 2019 mid day report.

It’s earnings season, this is the big week with over one hundred companies are reporting. I am bias to a bullish run post earnings in to May 2019.

The following is my bias;

When oil bounces I will be long Oil adding to DWT short, long SPY, Dollar not sure, Volatility short, Silver and Gold slightly bias to short, BTC short, Natural Gas is a timing thing.

Oil is reviewed at various points in this video as it trades intra-day.

Refer to charting in the premium member special reporting issued recently (links above).

TESLA (TSLA) normally I would be looking for a long in this range on the charting but I am looking for short in this one instance. Looking for 231.00 and possibly more is my price target. If wrong first target upside for Tesla in 330s then 380s. March 26 timing.

In other words bullish the market and bearish TESLA.

ALIBABA (BABA) strong resistance just under trading box here. Price target 238.00 range (178.00 – 208.00 is reasonable bullish target area in trajectory of chart). I am really bullish Amazon.

FACEBOOK (FB) I don’t like but it could surprise and run here. Fundamental view and technically it is a bit of a mess. Nature of news flow could be setting up for a short squeeze. 150 MA in 166s is likely first price target, trading 147s intra-day. If sell-off happens refer to previous model in reports.

MICROSOFT (MSFT) not reviewing, not the same risk reward as Amazon here so I will likely trade Amazon and leave MSFT be.

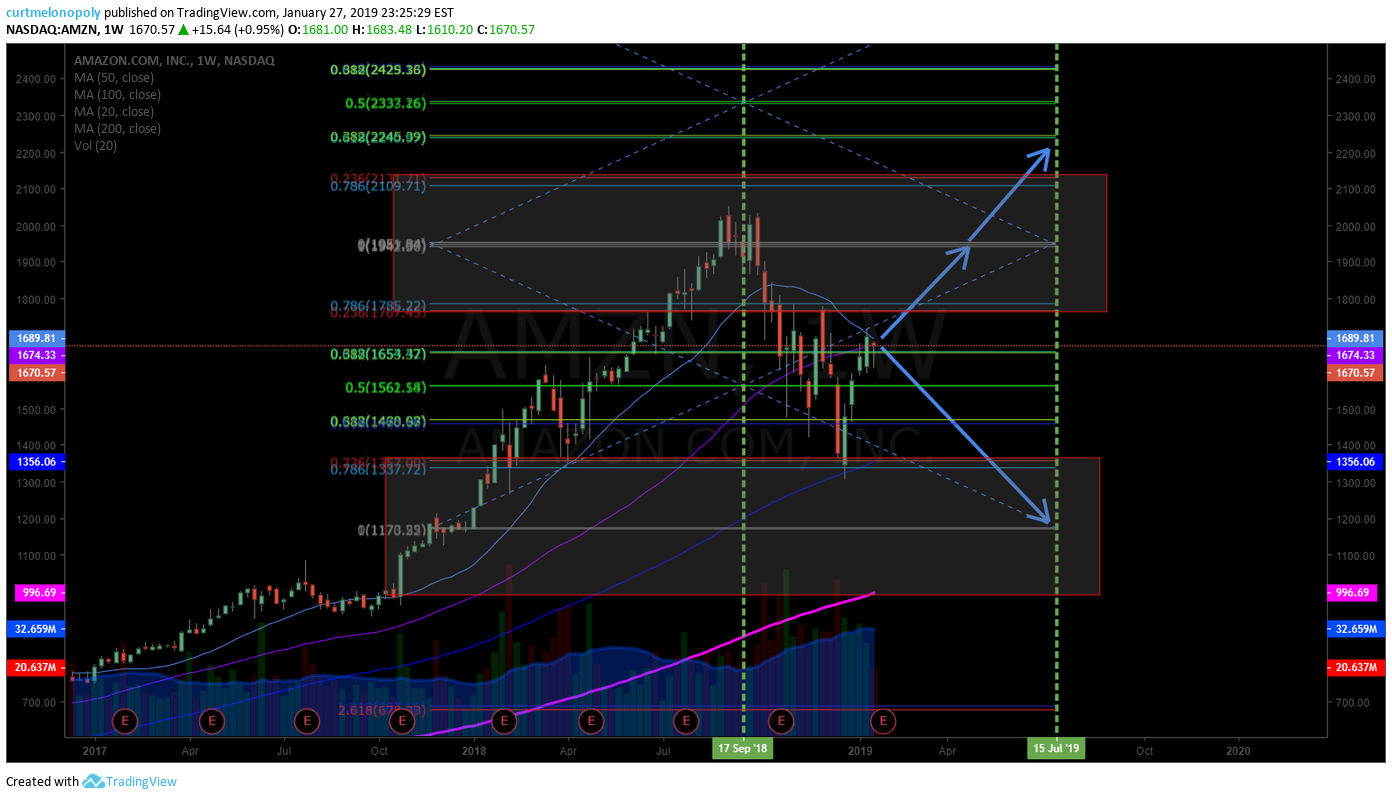

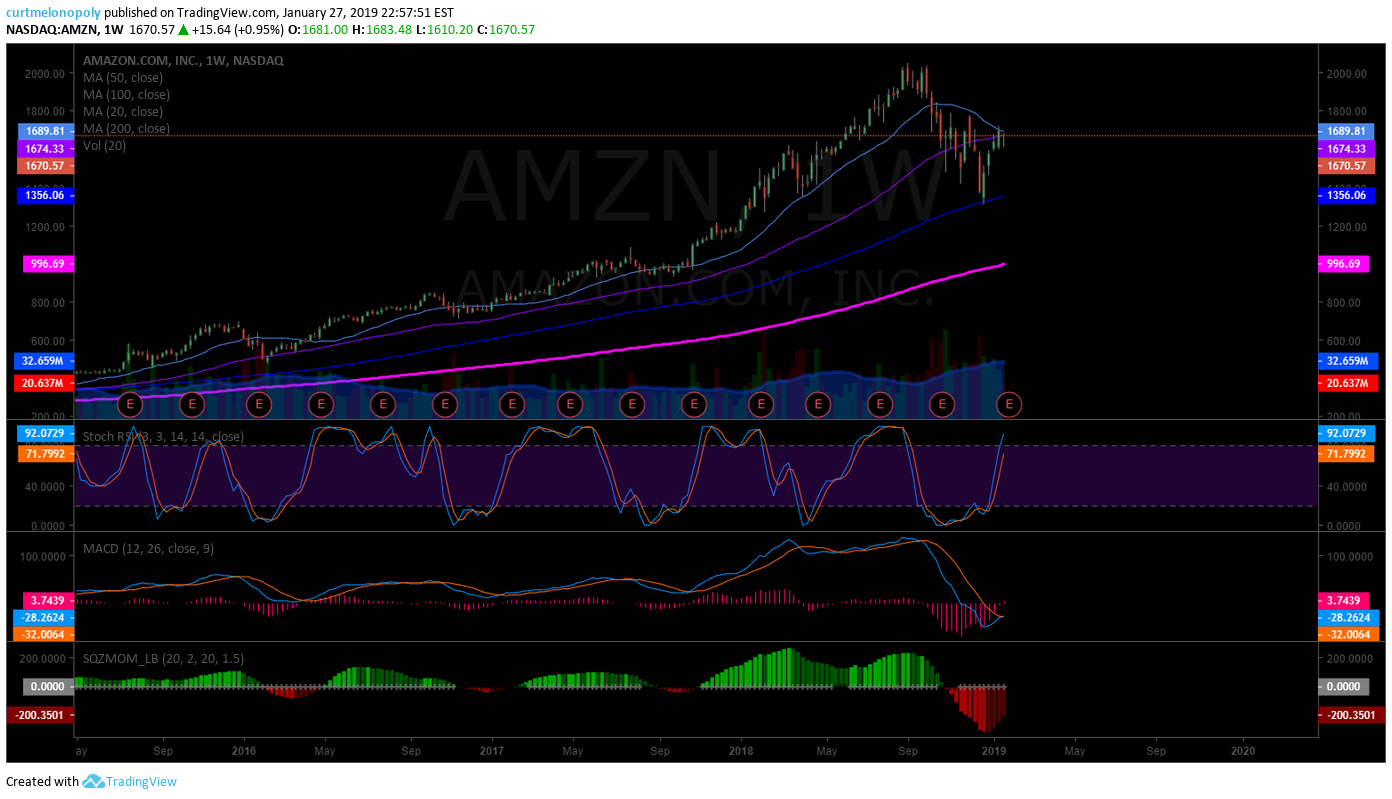

AMAZON (AMZN) price target 1946.00 and on a double extension is 2210.00 and even 2300s is possible in to July 2019. The price target timing is Feb 25 on the first area. 1173.00 is sell off target. The timing depends on the trajectory of trade post earnings.

EAGLE MATERIALS (EXP) trendline supports I am watching are the support areas I have as support, I’m looking for a bounce at the trend line with resistance at 73.00, 85.00, 91.00.

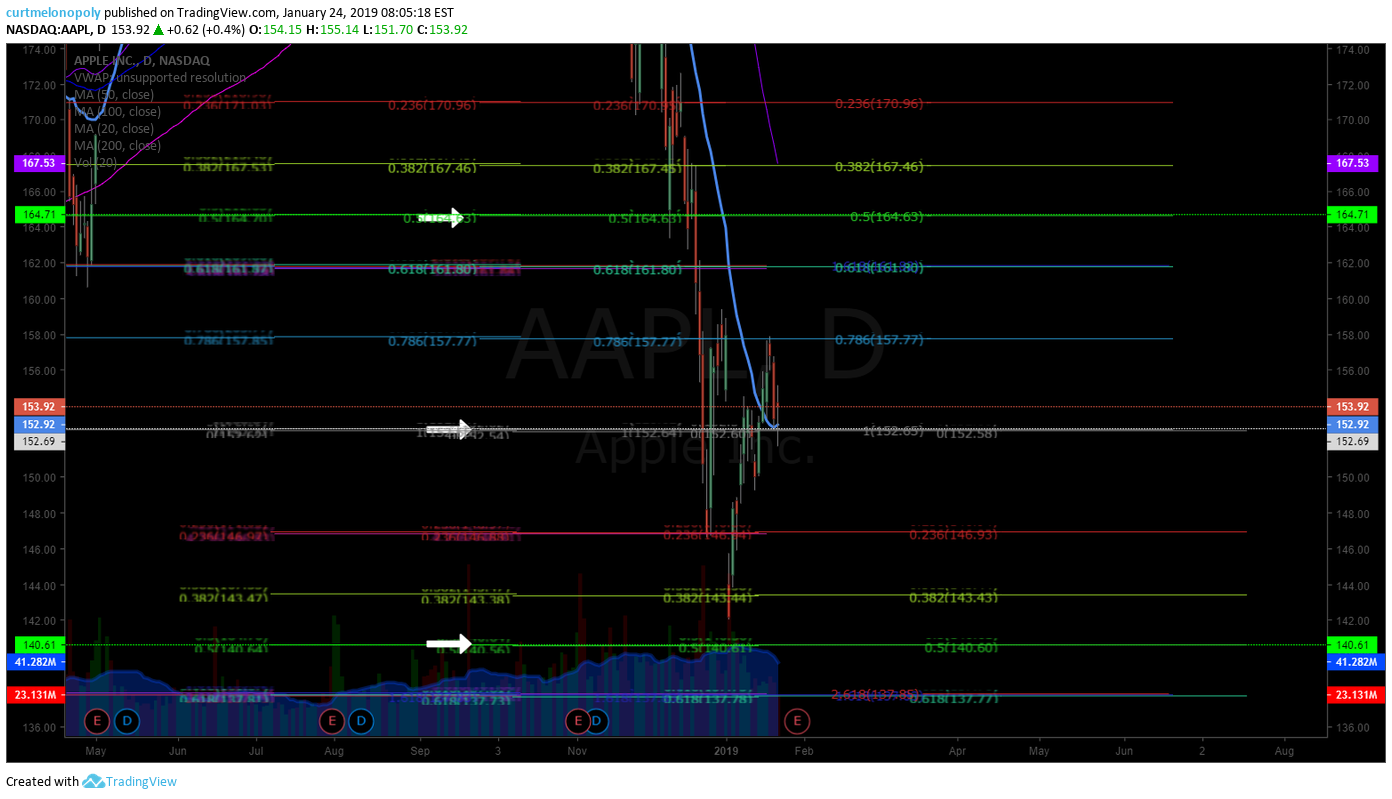

APPLE (AAPL) 152.98 is your main pivot and price is in that slot. Other side of earnings should bring a direction to the model and I’ll trade it.

ALLERGAN (AGN) Bounce at main pivot occurred in the sell off late 2018. Price target 155.9 support trading 157.13 (151.87 even possible then a rip). Bullish trend line to 202.00 is my price target. Other targets reviewed on video in trajectory up and support down noted. Mid May time cycle conclusion on AGN confirms on this and many charts.

ADVANCED MICRO (AMD) upside bullish trajectory is reviewed on the video. Other side of earnings 24s price target Mar 13 then 26.50 then 28s next reviewed on video.

AK STEEL (AKS) – has been in pivot trade on daily since Jan 8, upside target 4.03 and downside 1.63 trading 2.70. I have no bias.

NETFLIX (NFLX) support pivot 319.22 resistance 357.53 trading intra-day 331.80 off 1.85% on the day. Time cycle Jan 31 makes it difficult to take a trade here, trading in basket of trading quad here. Waiting for other side of Jan 31. 338.26 PT mid May 2019 as a bias.

AMERICAN EXPRESS (AXP) over 99.00 targets 112.00. Trading 99.76 down 1% on day. Model is very structured and following its trajectory When oil bounces this is one to take. 112.14 PT July which puts mid May in to play as PT timing if really bullish. Great example of post earnings structure. See vid.

Morgan Stanley (MS) more complicated chart, near bottom of trading channel, 42.81 intra day, long term 2021 Mar 76.50 is bullish target or in to Aug 55.21 is near term bullish price target.

DELTA AIRLINES (DAL) trading 48.13 intra day up .9% on day, 49.59 PT Feb 4 and then decision, other side of Feb 4 a trade entry can be taken.

BANK OF AMERICA (BAC) early in to earnings season I should have take this trade, the set-up on chart model is reviewed in detail on video, hoping for low 28s for entry. Decent set-up.

SHAW COMMUNICATIONS (SJR) getting in to early May 2019 there is a target zone and the trajectory and structure is explained, can’t trade it because of time cycles. Risk Reward not there for a trade.

CITIGROUP (C) – CITI is now in to its resistance area under its pivot, this is the 2nd I missed so far, 61.04 in sell off then 47.67, bias to 73.87 breach to upside price target early March then July and mid May time cycles reviewed.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, Video, $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance

Day Trading Crude Oil Strategy – Trading the Model Support and Resistance.

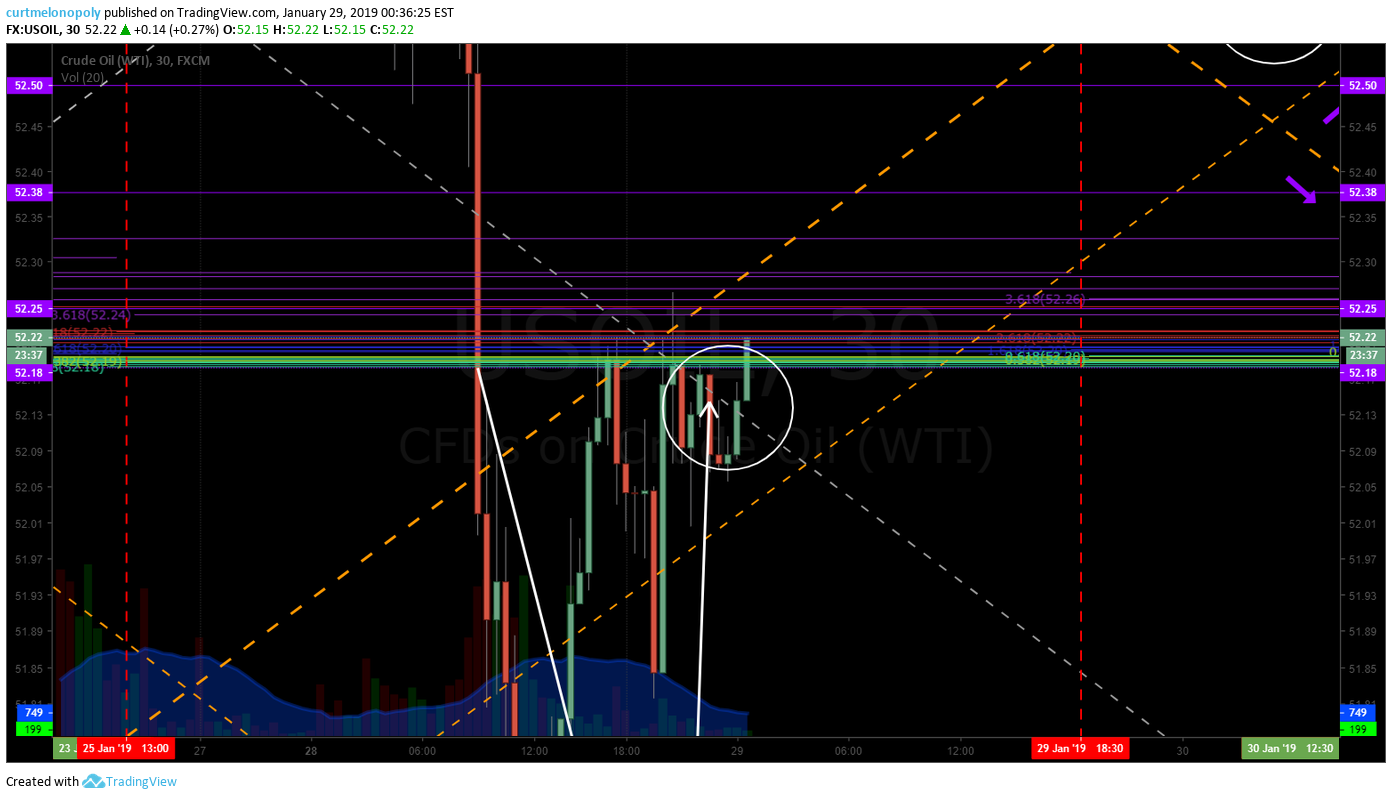

Monday we seen a one hundred point move in crude oil (a snap-back reversal intra-day) after a sell-off that started in futures Sunday night.

Below is a detailed description of how to trade the signals for this re-occurring pattern in crude oil intra-day trade.

Voice broadcast starts at 1:40 on video.

The Oil Day Trade Set-Up

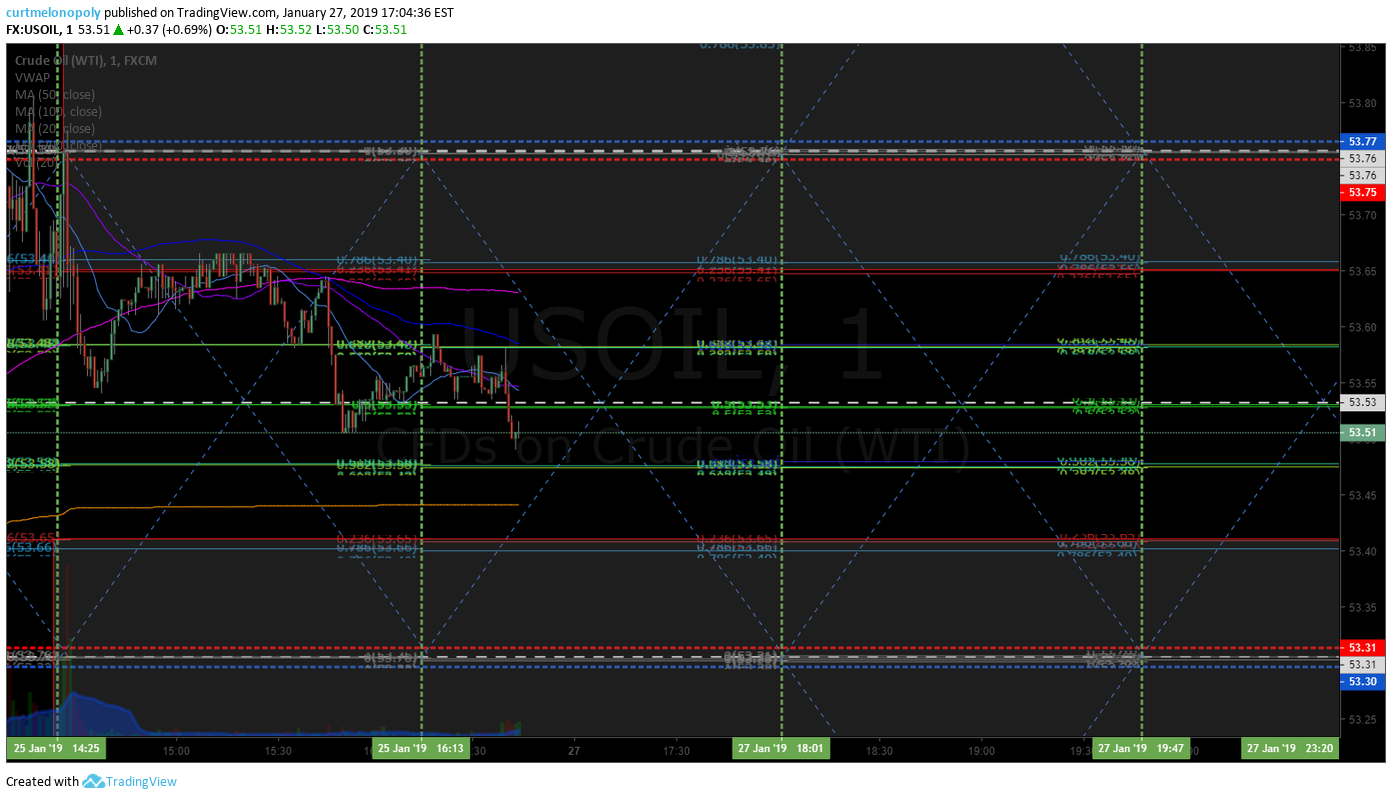

Oil was selling off through the day. Intra day price is very near a lower price target and has bounced.

We didn’t catch the sell-off because our team took a 5 hour break in futures.

The trading box example is reviewed at 3:00. Trade action on the 1 minute model (trading box). Trading patterns are reviewed.

Price targets on the EPIC Algorithm Model are reviewed at 4:35 on video. This is an important part of the video to watch. The upper and lower price targets on the model are reviewed. Twelve hours later as I write both targets (up and down price targets) have been in fact hit. The range of the trading quads are reviewed.

Price targets on the EPIC Algorithm Model are reviewed at 4:35 on video. This is an important part of the video to watch.

The price targets in the quad area of the crude oil trading model are shown below. The price target to lower support is shown (trade hit near the price target early) and then bounced to upper price target and resistance on the model.

At 6:20 on the video the 4 hour oil chart is reviewed. We were looking for a little lower on the day in this specific range, support was at 50.89 trading 51.57 on West Texas Oil. The timing at the time this video was recording looked short and it wasn’t likely it would hit (it didn’t). The symmetrical move to the upside and a sling shot move to the downside (opposite) is also reviewed as a scenario. In this down scenario that would bring price to down side of EPIC Algorithm quad trade is in (even lower to a point).

At 9:20 is the 4 hour oil test chart. Support 50.90 on West Texas or 51.10 on FX USOIL WTI.

At 10:20 on the video the weekly oil chart is reviewed. The weekly pivot at top and bottom of weekly candles previous are reviewed. Trade held the area intra-day and bounced.

At 19:00 on the video I review the one minute oil trading chart. A coil is in play which is usually a sign of an intra day turn. Price did in fact turn and run up to the top side quad resistance after this video ended through the rest of the afternoon.

Here, like the sell-off in overnight trade Sunday night, we didn’t catch the move because we were on break for the day. Two missed trades.

The four hour candle expiry is commented to also.

I explained that at the expiry of the 4 hour if it traded to upside that I would trade it, but I didn’t. Should have.

It is highly recommended you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

Jan 27 – Premium Member Private Post (Weekly Reporting & Guidance).

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 22 – Compounding Gains Day trading Crude Oil.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

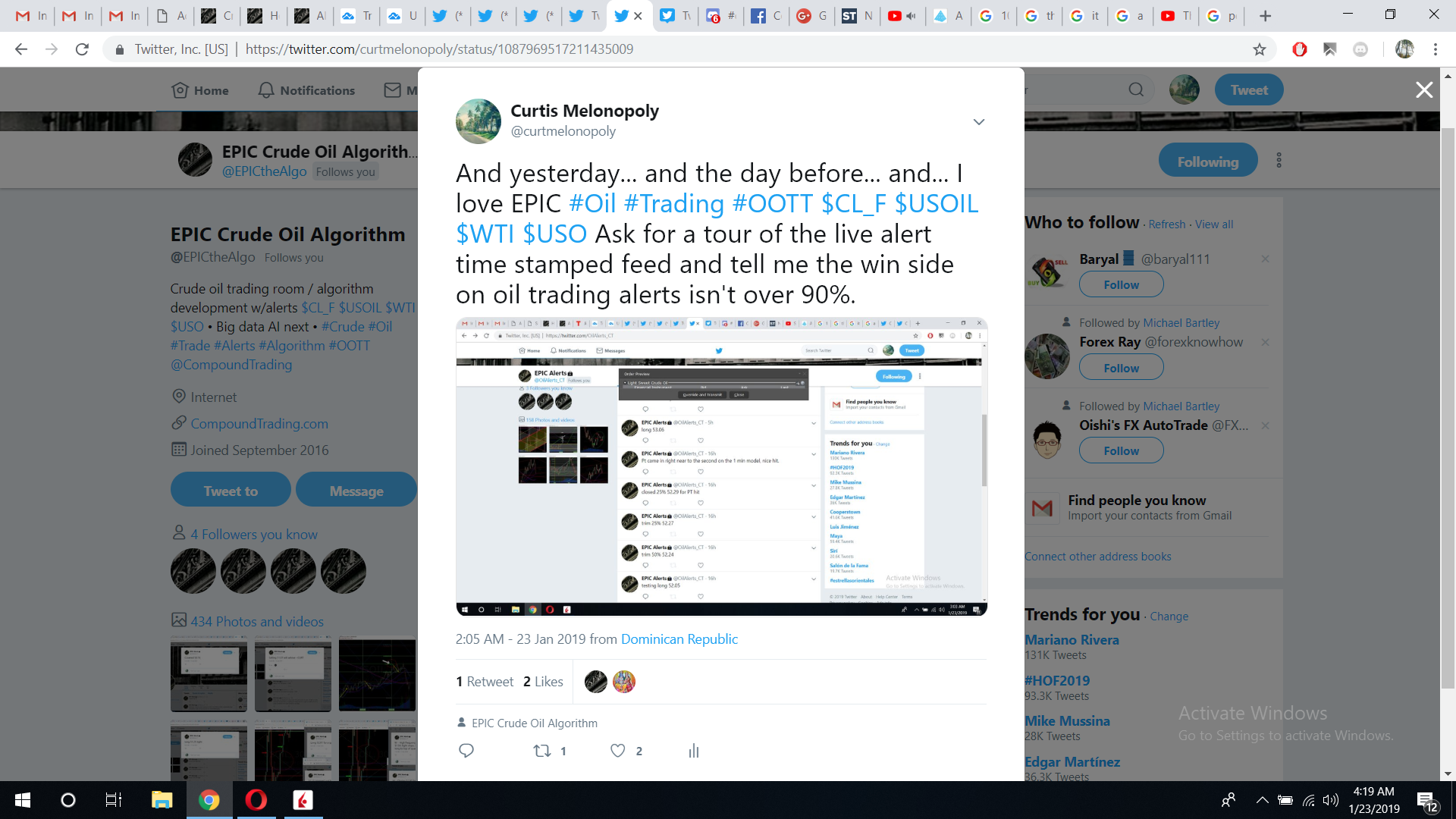

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow:

Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA #swingtrading #earnings

Trade Set Ups Video for Swing Trading Earnings Season Monday January 28, 2019.

Swing Trading Stock Signals in this Report: $AMZN, $MSFT, $FB, $BABA, $TSLA …

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://t.co/XL7cEWGMce

— Swing Trading (@swingtrading_ct) January 27, 2019

Our Earnings Season Special Reports Thus Far:

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

AMAZON (AMZN) Weekly chart says shorts better have it right in to earnings. MACD SQZMOM Price to MA’s say big move possible.

Jan 27 – The upside move here could be huge. Price on a launch pad right under 20 and 50 MA’s on weekly chart with SQZMOM and MACD supporting a possible move. Wouldn’t want to be short in to earnings. Risk reward very poor for shorts.

Amazon.com’s $4.5 Billion Retail Opportunity – 3,000 stores with 50% higher returns than conventional convenience stores. #swingtrading #earnings https://finance.yahoo.com/news/amazon-com-apos-4-5-220000638.html?soc_src=social-sh&soc_trk=tw

My Trading Plan for Amazon Earnings:

It’s simple, if price breaches the 20 and 50 MA it’s a long to test previous highs (the pivot of around 1950.00). And if previous highs are taken out, look for an equal extension to upside of previous highs (price target around 2200.00). If Amazon sells off, look to 200 MA (near) test and bounce.

AMAZON (AMZN) Earnings swing trade price targets for upside move or sell – off. $AMZN #swingtrading #earnings

MICROSOFT (MSFT) Similar to AMZN but I don’t like it as much. Retrace didn’t touch 100 MA and RR not the same imo. $MSFT #earnings #swingtrade

The set-up is very similar to Amazon, but the 20 and 50 MA’s aren’t pinching like on Amazon chart and price didn’t pull back enough. Also, the fundamental picture isn’t as strong. The Amazon chart trajectory holds much higher risk reward for the bullish trade bias.

However, if it sells-off I wouldn’t expect as much of pull back as with Amazon.

So it depends if you are considering a trade position in to earnings or not. I will wait until after earnings are announced for both, And likely not trade Microsoft. Yet to be seen.

Trading Plan for Microsoft Earnings:

In a bullish run you can expect previous highs, however, I wouldn’t expect much more near term.

In a sell-off I would target a touch to 100 MA (near to). Unlikely imo.

Forget IBM. Microsoft Is a Better Dividend Growth Stock $MSFT #swingtrading #earnings https://finance.yahoo.com/news/forget-ibm-microsoft-better-dividend-231200981.html?soc_src=social-sh&soc_trk=tw

FACEBOOK (FB) Price targets on 240 minute trading chart. $FB #earnings

We have used this model a number of times for win side trading on Facebook.

We will wait for earnings and then trade the price targets pending direction.

Facebook earnings: After a year of scandals, record profit still expected #swingtrading $FB https://on.mktw.net/2B2j9uw.

FACEBOOK (FB) Weekly chart. In a bullish move I will target 168.00 region for 50 MA test. In a sell-off there’s no saying. $FB

ALIBABA (BABA) I like the setup for the long side to 206.00 price target. Will wait for earning trade to confirm. $BABA.

TESLA (TSLA) My bias is down to 231.00 price target. Will wait for earnings, but that is my bias. $TSLA #earnings

Tesla’s first downgrade of the year comes down to this #swingtrading $TSLA #earnings https://on.mktw.net/2DteGCX

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AMZN, $MSFT, $FB, $BABA, $TSLA

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance

Day Trading Strategy for Crude Oil Futures Trade for Week of January 27, 2019.

Oil futures trade opens tonight at 6:00 Eastern, below is my battle plan for this week.

The regular EPIC Crude Oil Algorithm Weekly Reporting below is an alternate format to the regular format – we will be using alternate formats during a period of establishing simplified trading strategies for our members (the trade rule-set).

My strategy this week for my oil trading is primarily based on the EPIC Oil Algorithm charting model.

The EPIC Crude Oil Trading Algorithm Model below is by far the most predictable model we use for trade (30 Minute chart model).

The model is now normalized as we are past the charting anomalies from the holiday period.

The model link will be emailed direct to members of the bundle and / or newsletter separate from this report.

- Trading the Range of the Quadrants and Range of the Channels:

- Respecting the key resistance and support areas of the oil trading model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through middle of quad) and the mid channel lines (light gray dotted).

- We are finding that when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot (as it has the last eight or so trading days) that trade will often test the mid channel lines (gray dotted) of the model. This causes the predictability of the quadrant support and resistance to be less (trade at quad support and resistance can be “sloppy”). This trade action in the model makes logical sense as a trend is not in play for an up or down channel. Another way to describe it would be trade uses half quadrant support and resistance. While trade is in a sideways pattern on the daily your intra-day crude oil trading strategy should reflect this scenario. See examples from trade last week below:

-

“the predictability of the quadrant support and resistance to be less #crude #oil #trading #strategies” -

“when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot (as it has the last eight or so trading days) that trade will often test #oil #trade”.

-

- Trade Size –

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading oil in the model.

Per previous;

Screen capture of trade moving through EPIC Crude Oil Algorithm range a few weeks ago (Jan 16 – 20).

Timing of Trades is Based on the One Minute Oil Chart Model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend I will be bias to long positions and down trend intra-day I will be bias to short positions.

- Determine the trend on the daily chart, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm bias / trend.

- Check important timing for key global market open hours (inflections in day trend can occur here, especially with New York).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend.

- Trade Sizing and Positioning

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. On the EPIC algorithm model at key support and resistance I often test first and then add in size as the test proves itself and coincides with one minute chart.

- Trim positions at mid trading box and top of trading box for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult. Typically I trade the break upside at resistance or downside at support breached.

- Timing Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are), however, to pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

Day Trading Crude Oil Futures One Minute Strategy Model Jan 27 504 PM FX USOIL WTI $CL_F $WTI $USO #Crude #Oil #Daytrading

https://www.tradingview.com/chart/USOIL/dMZimFfV-1-min/

Per previous;

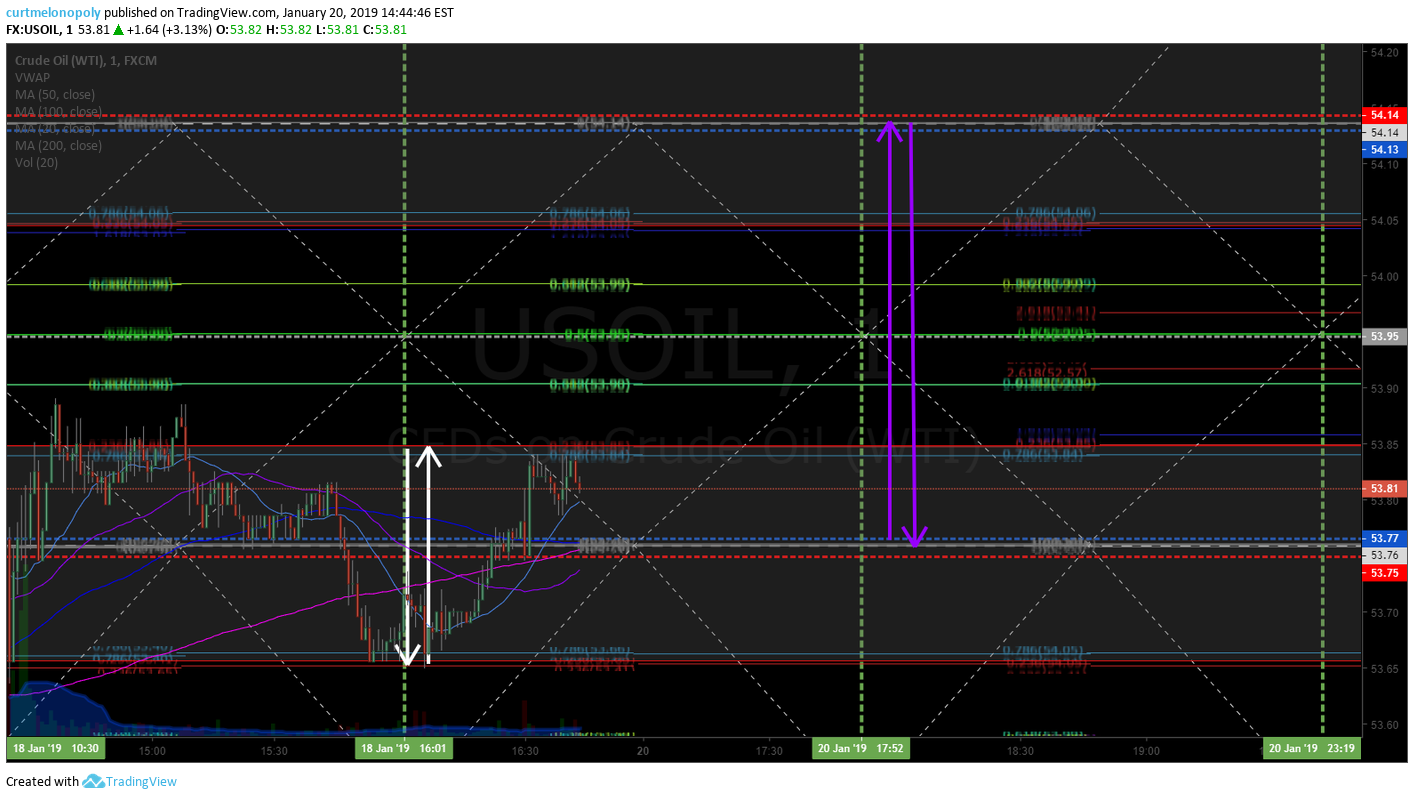

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

Also Monitor Oil Resistance and Support Levels on the 4 Hour, Daily, Weekly and Monthly Chart Models.

Beyond using the EPIC Oil Algorithm model for weekly / daily trading strategy / structure and the one minute chart model for timing day trades, use the daily, weekly and monthly chart models for important decisions in oil trade.

The longer the charting time-frame the more serious support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

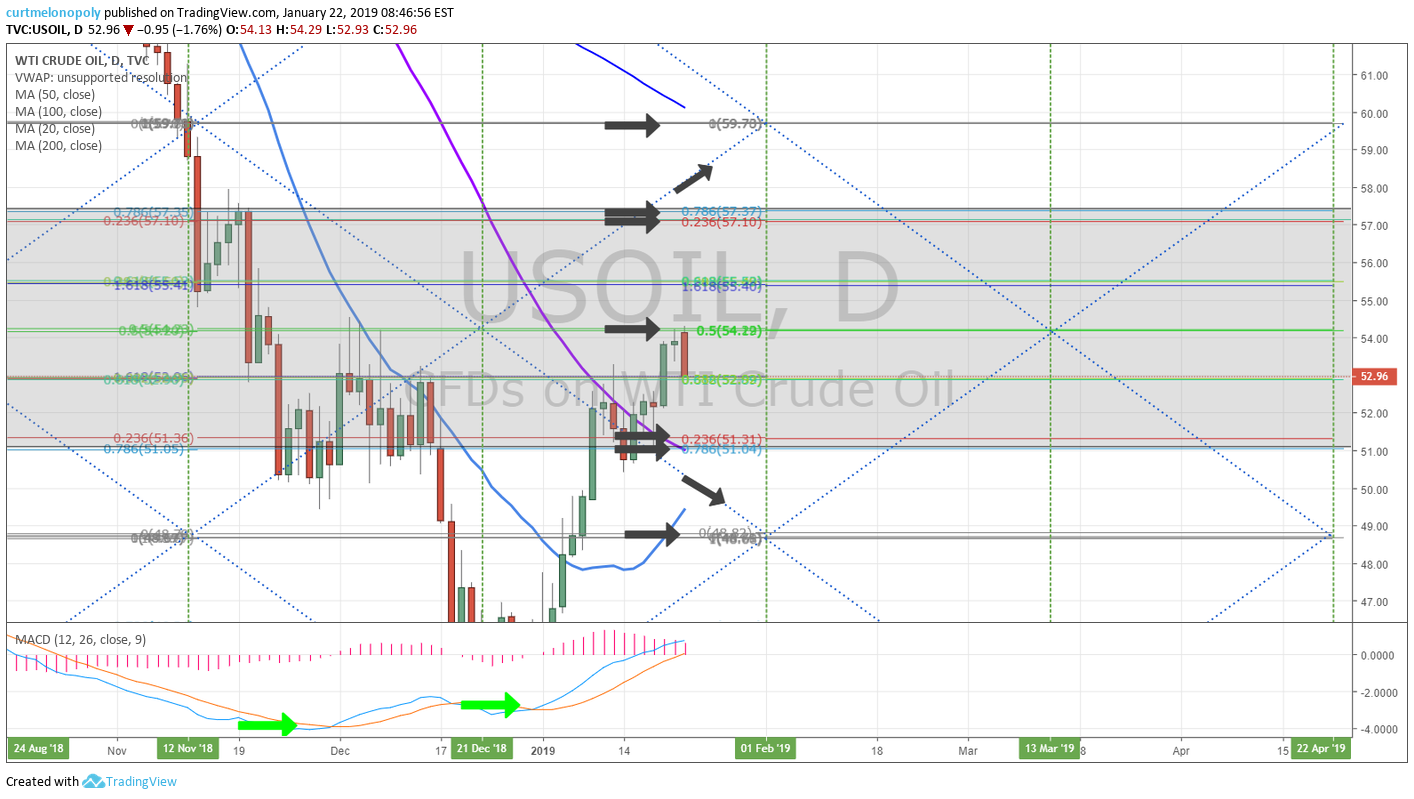

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), the 4 hour oil chart below has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

4 Hour Crude Oil Chart – 20 MA seems the most logical support test for a long trade entry test likely 52.90 area on West Texas.

The previously published chart shows primary support areas to watch (per below).

Per previous;

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

Symmetry on this chart structure says 55.30 on West Texas Crude is likely near Feb 1 and down to target. #oil #trading #strategy.

Per previous;

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

Daily FX USOIL WTI chart shows 54.14 Feb 1 price target still in play, look for spike or drop in to date. #crude #oil.

A pull back to 20 MA on daily chart is most probable.

Per previous;

Key support and resistance on daily crude oil chart is noted for day trading strategy.

Weekly FX USOIL WTI crude oil chart has been responding well also to market support and resistance areas for trade.

Per previous;

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, refer to the most recent Crude Oil Member EPIC Algorithm reporting and private member discord oil trading room for other charting and guidance.

It is also highly recommended that you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

Jan 22 – Compounding Gains Day trading Crude Oil.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow:

Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP #swingtrading #earnings

Trade Set Ups Video for Swing Trading Earnings Season Thursday January 24, 2019.

Swing Trading Stock Signals in this Report: $AAPL, $AKS, $AMD, $AGN, $EXP …

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Swing Trading Signals / Charts for Earnings Season.

Bloomberg Earnings Season Reporting Calendar List https://www.bloomberg.com/markets/earnings-calendar/us

AK STEEL (AKS) Swing Trading Earnings, Trade Set-Up with Support and Resistance Marked with White Arrows $AKS.

Jan 24 –

How Trump’s Steel Tariffs Could Play Out This Year https://marketrealist.com/2019/01/how-trumps-steel-tariffs-could-play-out-this-year?utm_source=yahoo&utm_medium=feed&yptr=yahoo

There are no clear price targets on the AKS chart, however, trading the range between key support and resistance post earnings could yeild result (key support and resistance at white arrows).

ADVANCED MICRO (AMD) swing trade long over 20.55 and short under 18.25 to price targets.

Jan 24 –

Big Chip Earnings Preview: Intel, AMD Set To Report Amid Changing Competitive Landscape, Cycle Risk #swingtrading $AMD https://finance.yahoo.com/news/big-chip-earnings-preview-intel-171733038.html?soc_src=social-sh&soc_trk=tw

ALLERGAN (AGN) Key areas of support and resistance noted on chart for post earnings swing $AGN.

Jan 24 –

Bouncing back from collapse: Old Republic International Corporation (ORI), Allergan plc (AGN) #swingtrading $AGN https://finbulletin.com/2019/01/23/bouncing-back-from-collapse-old-republic-international-corporation-ori-allergan-plc-agn/

APPLE (AAPL) Trade premarket 154.40, over 152.58 long to 164.63 under short to 140.60. $AAPL #swingtrading #earnings

Jan 24 –

Support and resistance areas of the Apple Stock chart should be in play for next quarter.

EAGLE MATERIALS (EXP) Nearing historical key diagonal Fib support areas for reversal trade set-up $EXP #swingtrading #earnings

Eagle Materials Schedules Third Quarter Fiscal 2019 Earnings Release and Conference Call with Senior Management

https://finance.yahoo.com/news/eagle-materials-schedules-third-quarter-211500013.html?.tsrc=rss

Jan 24 –

I will be looking for a reversal trade here to next resistance areas marked on chart. Trim in to them and add above according to rick tolerance and time frame.

A failure of key TL support is a divergent broken set-up and will be re-charted.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AAPL, $AKS, $AMD, $AGN, $EXP

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains)

Our Live Documented Journey to Compound Day Trading Crude Oil Futures for Gains That 99% Would Only Dream Possible…

And one of the best parts of our mad journey; we’re now beyond Concept and Theory…

and we’re proving it LIVE (well on our way to… Fact).

We are now Trading Crude Oil to Over 1% Per Day Returns, Live.

We have many other trades that are not live also because we are testing many models).

It’s been a bit of a petri dish. So far.

But as of late we’ve stopped the petri. It was unavoidable (the petri part).

Side thought – In all fairness, only we know what the petri part is (well not completely true because members do know the rules for the most part). The important point being… we’re done petri.

We are now trading crude oil in our process with consistency and ease, real-time live and we’re recording it, we are alerting the crude oil trades on a private Twitter member feed and sharing our work process (including all rules sets, thoughts, charts and more) in chat, and we’re even trading crude oil live in our oil trading room with screen share of our charts and voice broadcast from myself alerting the trades.

0.

The probabilities that our rule-set fails now after hundreds of trades, especially now that we are in minimal discovery and quickly moving to refinement and consolidation phases is… well, near 0.

Maybe.

Oh, and even more reason … our software runs trades near 24 hours a day now (non-alerted at this point), and nearly never loses. When it does, it’s for pennies. Soon we’ll unleash him/her (it) live.

Maybe.

For all intents and purpose, we don’t lose when manually executing trades either. Sure, we do lose sometimes, but very small if we do – very small. And even our manual executions are getting better all the time. And we (I) suck as traders.

Here’s an even better part; 3%, not 1% sees 10,000.00 to 2 Million Dollars in 180 days. And we’re going to do it.

Nobody knows the future! I know, I know.

1 – 3 Hours a Day.

A cool part… we do 1% or more with 1 – 3 hours a day of trade focus. Usually closer to an hour or so. We’re kind of busy with something I never thought I’d be doing…. code, machine learning, science, quantum thingys and other mind places.

Anybody Does Do It.

And better yet; anybody can do it. Why? Because we’re refining the process to its most simplest form. Quantum mind things to simple.

But there’s too many lines! I know, I know.

We have non traders (on staff) starting to use the rule-set and even starting to alert their trades. And the coolest part, they may be better at executing the trading rule-set than the experienced oil traders (initial indications are this could be very plausible).

We Like Tents… Almost as Much as We Love Beaches.

And the near best part (in my little world)… the money ain’t the motivator – I’d be equally happy living in a tent on a beach. Oh wait, I almost do. The shiny floors at the Hard Rock in Punta Cana were never my thing anyway.

And the best part; freedom is near (unless the world ends or something). Not only is freedom near for our staff (that have worked tirelessly day and night) but for our clients and members and their families and their families. Get the drift? This is why I’m so excited.

The Dream Realized. Next!

And we’re near done the first of many (instrument trading processes) we are developing. We’re in the final phases with our oil trading platform, soon it will simply be maintenance updates to the manual trading and machine trading parts of our oil trading services.

Yes, the other algorithm models and swing trading are next.

The Point?

Sharing our journey. I did promise when we started all this. That I would share.

Selling you on it. So you can join the movement to freedom. So you can help. So maybe you can be a part of it. Maybe you’ll take the next steps? Maybe anything is possible.

Maybe you will be our next donor when our software development needs a few million for the app.

Or maybe we’ll just boot strap that too.

Maybe I’ll inspire you. That would be novel.

Promises.

I also promised our sharing will end soon. It will be this year.

We’ll still be around to chat.

We’ll still have our enterprise.

We just won’t share.

It’s tiring. I just made a promise to share, to a point:)

How is it Done? … the trading up 1% gains or better in crude oil a day.

Members stay tuned for Part 2 of this post. Until then study the most recent report here:

Protected: Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Non members can visit our unlocked posts here:

Crude Oil Trading Academy : Learn to Trade Oil.

Non members could also get off their ass and subscribe and learn live. Just sayin.

How Does 10,000.00 turn in to over 1 Million at a Compound Rate in Less than Two Years?

When we first started this crazy venture I posted the post, it has a link to the calculator,

Come to think of it, I wrote it around the time that everyone told me I was nuts.

Fuel.

How $10,000 Turns in to 1 Million in 24 Mths @ 1% Per Day Compound Stock Trading.

Is There a Process in the Madness?

We have tried to explain it in the few moments of rest between days of no sleep and falling asleep in very strange places randomly the last two years.

We Weren’t Smart Enough to Think This Up.

We suspect we’re using similar ideas…

The mathematician who cracked Wall Street.

There’s my share of the month.

Now go spin it up.

And give EPIC Crude Oil Algorithm a follow.

Best and peace.

Curt

PS

Members stay tuned for Part 2 of this post.

Follow the Madness:

PreMarket Trading Report Tues Jan 22: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday January 22, 2019.

In this premarket trading edition: Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 22 – Per email sent to members in premarket.

- Main Trading Room

- Jan 22 – Per email sent to members in premarket.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 20 – Protected: Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 15 – Protected: Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Tuesday Jan 22 –

Voice Broadcast Starts at 2:50 on video.

This is mid day review from Friday Jan 18, 2019.

This video explains the upcoming pull back I was looking for in oil and the general markets.

I explain how I will time my Swing entries around that, trading Indices, algorithm models SPY VIX WTI BTC GLD SLV DXY etc.

It’s a much watch for trading this time period.

All the reports will be out over next 48 hours, most before market open tomorrow.

Today I am in trading room for market open, mid day and futures.

Have a great day!

Curt

Friday Jan 18 – Mid day review will be looking at Swing Trade entry points. Crude oil has been a great week, don’t miss the post from last night – important details for daytrading crude oil. Same guidance per below from recent.

Market Observation:

Markets as of 8:07 AM: US Dollar $DXY trading 96.32, Oil FX $USOIL ($WTI) trading 53.21, Gold $GLD trading 1282.04, Silver $SLV trading 15.26, $SPY 264.96 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3548.00, $VIX 18.5 and NatGas 3.25.

Momentum Stocks / Gaps to Watch:

$TSLA (+1.0% pre) Tesla is reportedly in talks with China’s Lishen over Shanghai battery contract – CNBC.

$EBAY (+12.3% pre) Elliott Sends Letter to Board of Directors of eBay; Seeks Separation of StubHub and Classifieds.

$NVCN up 55% at $1.27 – Neovasc announces dismissal of claim brought by Edwards Lifesciences.

$UQM (+45.1% pre) UQM Technologies Signs Definitive Agreement to be Acquired by Danfoss – SI.

$TGTX – TG Therapeutics up 11% on receiving Breakthrough Therapy Designation for umbralisib.

$AAPL WOES SHOULD BENEFIT TELECOMS $TMUS $T $VZ – MACQUARIE.

24 Stocks Moving In Tuesday’s Pre-Market Session http://benzinga.com/z/13015207 $MDWD $APHA $EDU $AABA $URI $LULU $AUPH $TI $UBS $GPS

News:

Stocks making the biggest moves premarket: Johnson & Johnson, Nike, FedEx & more –

https://twitter.com/CompoundTrading/status/1087694423557849088

PG&E secures $5.5 billion in DIP financing to fund operations through bankruptcy https://on.mktw.net/2FR7Qsg

ARCONIC TO NO LONGER PURSUE SALE OF THE COMPANY.

$NVCN just out: Neovasc Announces Dismissal of Claim brought by Edwards Lifesciences.

$LCI Lannett (LCI) Announces Distribution Agreement For Trientine Hydrochloride Capsules.

$TSLA: NEEDHAM CUTS MODEL 3 DELIVERIES ESTIMATES BY 15,000 IN 2019 TO 243,000.

UBS Tumbles On “Very Poor” Results As Clients Pull $13 Billion.

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Offerings, Mergers:

$TOPS Announces Completion of Senior Secured Post-Delivery Financing for M/T Eco California.

Tilray to buy Natura Naturals for about $26.3 billion in cash and stock.

$CHFS – CHF Solutions files for equity offering.

Earnings:

Travelers beats earnings estimates despite higher catastrophe losses.

Halliburton tops profit and revenue expectations, shares slip.

Johnson & Johnson tops estimates for fourth quarter.

Stanley Black & Decker shares fall nearly 7% after weak 2019 guidance.

#earnings for the week

$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNP

#earnings for the week$JNJ $IBM $HAL $INTC $F $AAL $PG $STLD $ATI $SWK $SBUX $ABT $TRV $PGR $PLD $UTX $FITB $LUV $BMY $CMCSA $UBSH $ABBV $LRCX $ISRG $KMB $MBWM $URI $EDU $AMTD $JBLU $FCX $WDC $GATX $FBC $ONB $PEBO $XLNX $FNB $OFG $UBS $MKC $ASML $UNPhttps://t.co/lObOE0dgsr pic.twitter.com/ROwchUMNvx

— Earnings Whispers (@eWhispers) January 19, 2019

#earnings season

$AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtrading

#earnings season $AAPL $NFLX $FB $BAC $C $JPM $GE $UNH $BA $DAL $CLF $T $GS $WFC $PYPL $GOOGL $INTC $F $TWTR $MA $V $JNJ $SLB $AA $MS $BLK $AXP $ATVI $ISRG $VZ $XOM $LRCX $PG $GM $CELG $MCD $FAST $SNV $PNC $ABBV $ABT $NOK $INFO $BMY $HAL #swingtradinghttps://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) January 12, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

Crude oil perfect hit to mid quad on daily algorithmic model and backed off FX USOIL WTI $CL_F $USO #CrudeOil #Chart

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT

4 micro trades 4 wins 39 ticks time for a break. 2019 winning streak still in play. #oil #Trading $CL_F $WTI $USO #OOTT pic.twitter.com/iqcDOtr7ri

— Melonopoly (@curtmelonopoly) January 21, 2019

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO

Crude oil trading alerts in to open today #crude #oil #trade #alerts #OOTT $CL_F $WTI $USO pic.twitter.com/Fib1n1iMLG

— Melonopoly (@curtmelonopoly) January 18, 2019

Oil Trading Alerts Yesterday – Man vs. Machine, Both Winning.

Overnight futures crude oil trading alert Selling 51.07 will advise #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Overnight futures crude oil trading alert Covering 50.74 #Oil #Trading #Alerts $CL_F $US FX USOIL WTI

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

It’s A “Sea Of Red” As Global Stocks, S&P Futures Tumble

It's A "Sea Of Red" As Global Stocks, S&P Futures Tumble https://t.co/KavAmDyE9N

— zerohedge (@zerohedge) January 22, 2019

#5things

-No end in sight for shutdown

-Chances of second Brexit referendum rise

-Davos begins

-Markets slip

-Data, earnings due

https://bloom.bg/2AYQTcm

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://www.ft.com/content/49c9df22-19aa-11e9-9e64-d150b3105d21 …

Leveraged buyout debt is riskier today than during the LBO boom of 2006 & 2007, at least based on debt-to-ebitda ratios. https://t.co/a20LwlwF6k pic.twitter.com/JL6rAYR37X

— Lisa Abramowicz (@lisaabramowicz1) January 22, 2019

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $UAA $ICE $PANW $HIW $CABO $FTI $MIDD $BJ $CARS $SNV $NKE $CHU $TGP $BUD $IAG $AUY $FISV $AINV $DRNA

(6) Recent Downgrades: $BMTC $D $GPS $STT $PSEC $X $FTNT $BL $MO $ERJ $HTHT $FHN $PVH $REVG $GLOG $TIF $TOO $IMMU $LXFT $GPS $CRSP $LFC $WB $BTE $HBM

SCHLUMBERGER $SLB: SUSQUEHANNA CUTS TARGET PRICE TO $54 FROM $55

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Time Cycles, TSLA, EBAY, NVCN, UQM, TGTX, Oil, SPY, VIX, BTC, Gold, Silver, DXY

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance

Day Trading Strategy for Crude Oil Futures Trade the Week of January 20, 2019.

Oil futures open tonight at 6:00 Eastern, below is my battle plan for this week. The regular EPIC Crude Oil Weekly Reporting is taking on a different format this week per below.

My strategy this week for my oil trading is primarily based on the EPIC Oil Algorithm charting model.

The EPIC model is by far the best model we use. This week the model will be completely normalized as we are past the charting anomalies from the holiday period. The updated EPIC charting will be emailed to members after futures open and after the techs have renewed the model to new data (post open).

- Trading the range of the quadrants and range of the channels.

- Respecting the key resistance and support areas of the model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through mid quad) and the mid channel lines (light gray dotted).

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading the model.

Screen capture of trade moving through EPIC Crude Oil Algorithm range in trade last week.

The timing of my trades will be based on the one minute chart model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend I will be bias to long positions and down trend intra-day I will be bias to short positions.

- Determine the trend on the daily chart, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm your bias.

- Check important timing for key global market open hours (inflections in day trend can occur here, especially with New York).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend.

- Trade Sizing and Positioning

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model.

- Trim positions at mid trading box and top of trading box for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult. Typically I trade the break upside at resistance or downside at support breached.

- Timing Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are), however, to pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

One Minute Model for Day Trading Crude Oil Futures Jan 20 236 PM FX USOIL WTI $CL_F $WTI $USO #CrudeOil #Daytrading

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

I will also watch resistance and support levels on the 4 hour, daily, weekly and monthly chart models.

Beyond using the EPIC Oil Algorithm model for your weekly / daily trading structure and the one minute chart model for timing day trades I also use the daily, weekly and monthly chart models.

The longer the charting time-frame the more seriously support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts should trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), this chart has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

Key support and resistance on daily crude oil chart is noted for day trading strategy.

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, refer to the most recent Crude Oil Member EPIC Algorithm reporting and private member discord oil trading room for other charting and guidance.

It is also highly recommended that you review recent reporting and videos released.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow: