PreMarket Trading Report Fri Jan 11: Next Time Cycle VERY Near, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Friday Jan 11, 2019.

In this premarket trading edition: Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Reporting

- Jan 11 – We have been in deep with oil structures and swing trading structures we will complete them in next 24 hours (sorry for the delay) and then produce regular reporting in to weekend next week. It’s too early to swing yet anyway because oil hasn’t found its near term pull back ceiling yet (but its nearing a major resistance now).

- Main Trading Room

- Jan 11 – I am in session in main trading room today for market open, NO mid day review (we are using this time for getting reports out), during active trading.

- Development Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

15 RULES to TRADING (inspired via trade coaching session I just completed, there’s more, but here’s 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

15 RULES to TRADING (inspired via trade coaching session I just completed, there's more, but here's 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

— Melonopoly (@curtmelonopoly) January 11, 2019

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Jan 10 – DO NOT MISS THIS POST / VIDEO: How I Day Trade Crude Oil: 5 Trades 5 Wins 1.5 Hours 90 Ticks | Trading Room Video | Oil Trade Alerts

Jan 8 – A number of trading strategy posts were sent to members recently that are not listed here. Please review blog list – ask Jen for passwords if you require them.

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Friday Jan 11 –

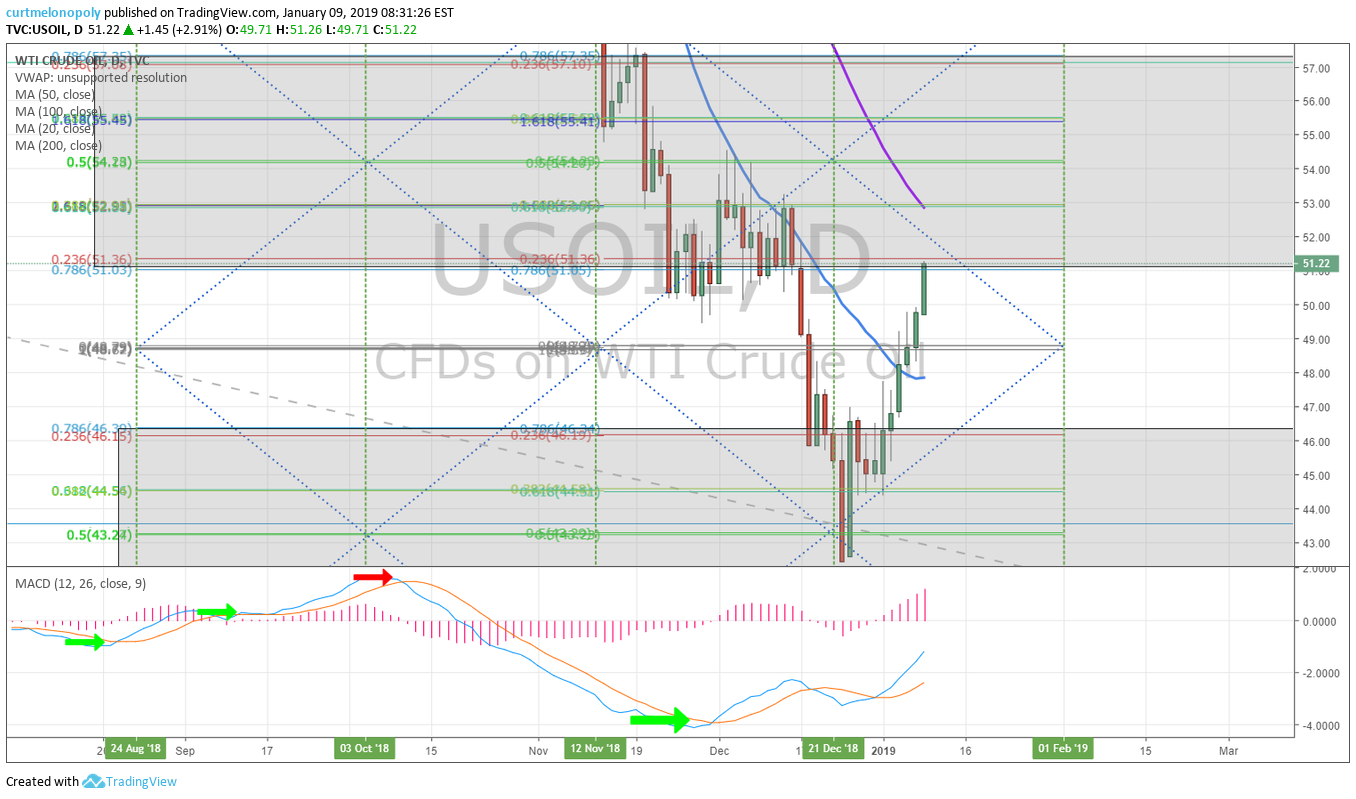

On watch: Looking for a buy side signal as close to 52.60 (in crude oil) as possible for a price target of 53.52 today. Bullish scenario on FX USOIL WTI traded on CL.

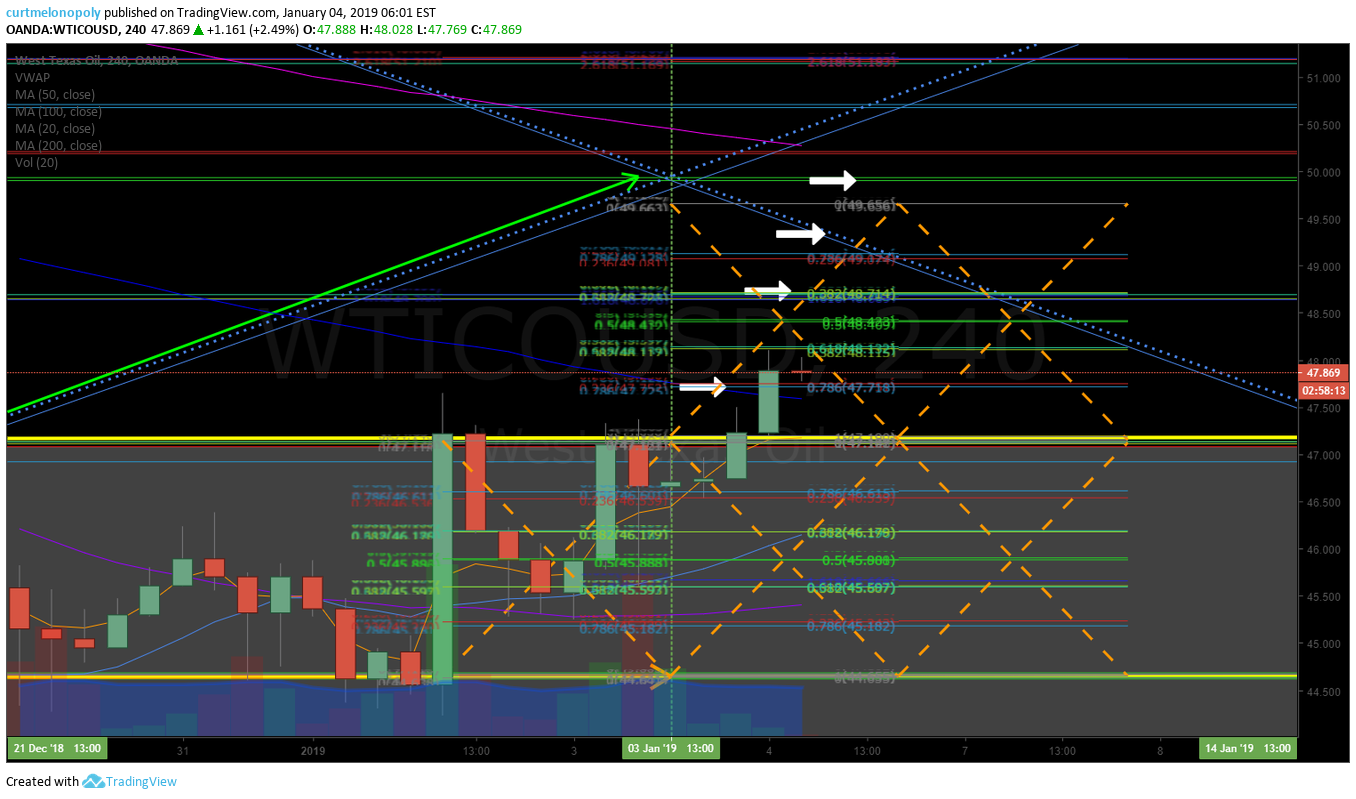

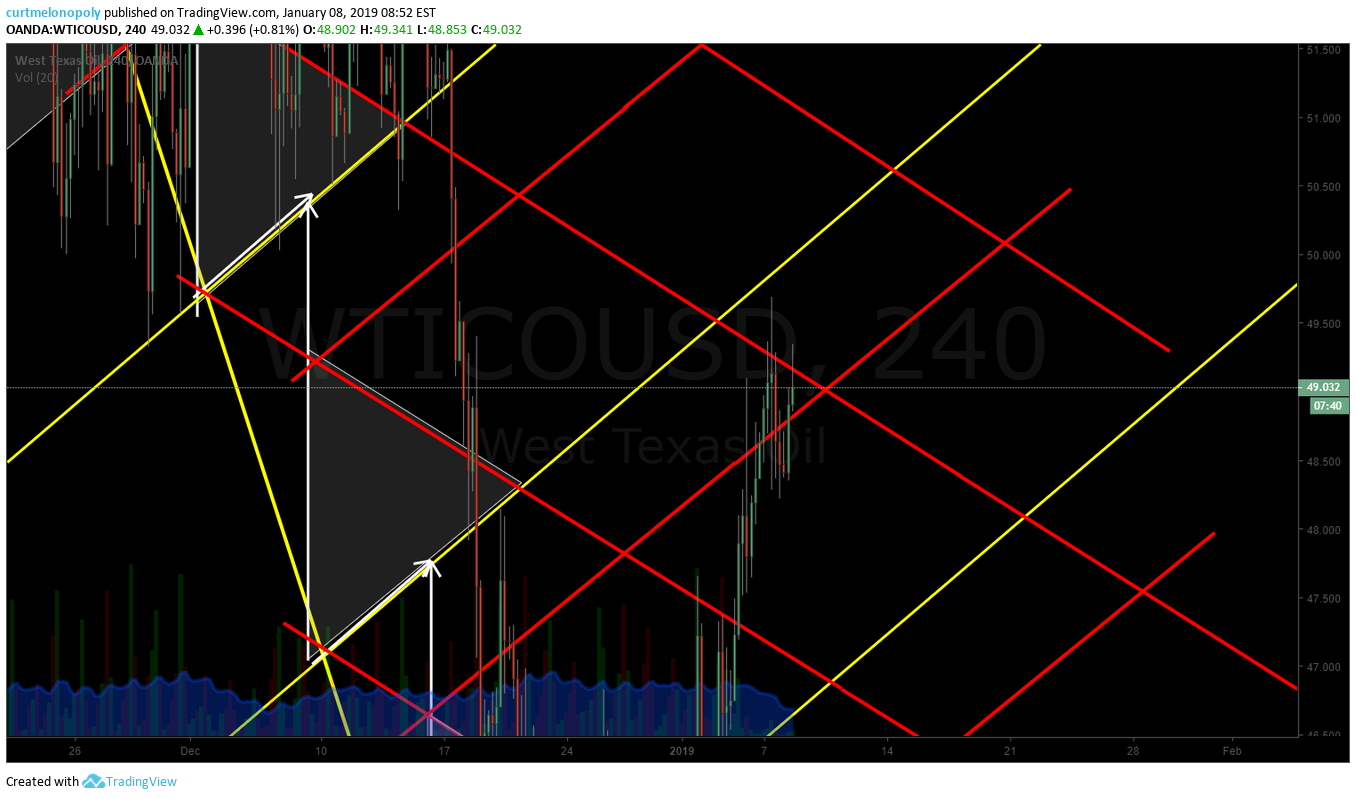

We have been looking for a pull back in oil for a number of reasons (watch mid vids and reporting)… anyway, in classic oil style we have not got much of any pull backs, HOWEVER, if you review the 240 minute model you will see a time cycle peak around Jan 14, 2019 that isn’t huge but big enough to potentially cause a pull back BETWEEN TODAY and next Wednesday. This would give me opportunity to add to the DWT short position (at oil support after pull back), at start of pull back take a long VIX, long Natural Gas, short SPY or QQQ, long dollar, long possibly Bitcoin, Gold, Silver and then when oil bounces reverse all those trades.

The machine trading will now get more aggressive as the EPIC oil model is finally normaliziing after holiday trade anomalies (the software triggers on the chart, so the structure of the chart s important).

Thanks for your patience with the reporting, we’re on it, we just got in deep with the oil anomalies and this possible turn. We need to have a structured oil plan for the rest of the trading in equities ad algorithms to find the core of the move.

Swing trading reports are near done and should be flowing out within 24 hours, EPIC report also and in to next week all the other algorithms.

$TSLA ON WATCH AS $GM’S CADILLAC TO INTRODUCE EV, TAKE REINS AS CO’S LEAD EV BRAND – SI

please, another opportunity to buy a dip $TSLA

… and the next B air https://t.co/Sf4T3ZmPB6— Melonopoly (@curtmelonopoly) January 11, 2019

Wednesday Jan 9 – EIA day, this will be interesting to see if the move in overnight oil futures is supported post EIA. We want a pull back to add to DWT short swing and establish structure for the daytrading of this possible reversal in trend. If you haven’t read the related reports for a possible reversal please do so. If you need access codes for historical posts on blog please email Jen a list that you require.

Would like to see small short term pull back in markets and then go in to May 2019 per my reporting in to end of December.

The reporting for this new time cycle will start tonight. Dig deep, you will thank yourself on the other side of this 6 months later.

Tuesday Jan 8 – Today in to EIA is the final watch on market structure that we need and we’ll start producing the structured trading range reports for the next 6 months. 24 hours of patience. Then its go time. I think we have it nailed down. Please watch those mid day review videos so you are in the know before we go. Really really important.

Monday Jan 7 – Two days to let market structure settle and the report flow for the next six month time cycles starts. #patience #caution.

Fri Jan 4 – If Fed pauses hikes and US-China trade relations improve oil should run in to May targets oil bundle members have (especially if OPEC cuts remain in play), the markets should run up in to May. Gold, Silver, VIX, DXY and Bitcoin may (are likely) to get soft and equities will be a stock pickers environment (traded properly within instrument structure) during that period (Q1 2019). Generally this is how it looks currently. But yet to be seen in to next week forward – this is one scenario. Reporting and alerts (either way) will become very active as next week rolls out and in to next 6 months. We will have the structure of trade for our coverage (the algorithm models and swing platform) so that we can trade either scenarios (up or down in each, including swing trading).

Market Observation:

Markets as of 7:19 AM: US Dollar $DXY trading 95.27, Oil FX $USOIL ($WTI) trading 52.79, Gold $GLD trading 1292.65, Silver $SLV trading 15.69, $SPY 258.15 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3630, $VIX 19.9 and NatGas 3.063.

Momentum Stocks / Gaps to Watch:

News:

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

Slack plans to public via rare direct listing in coming months–WSJ.

Earnings:

$APHA – Aphria FQ2 revenue up 63%; shares up 2% premarket

#earnings scheduled for the week

$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAA

#earnings scheduled for the week$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAAhttps://t.co/r57QUKKDXL https://t.co/CdQw0J0oUi

— Melonopoly (@curtmelonopoly) January 7, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

http://eps.sh/cal

A look at Jan #earnings calendar.$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN https://t.co/r57QUKKDXL https://t.co/rBfBzOCeAu

— Melonopoly (@curtmelonopoly) January 2, 2019

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

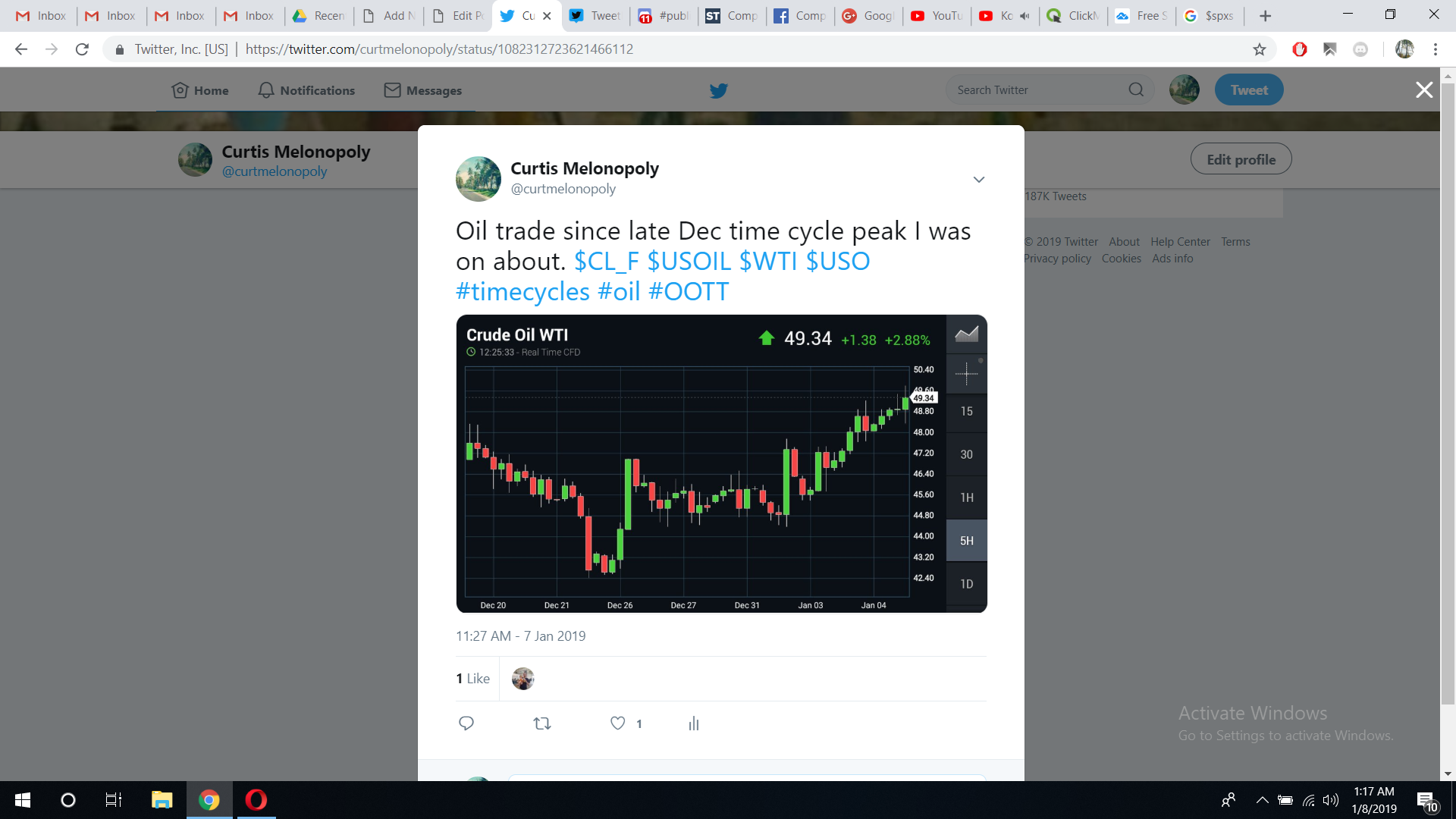

Structured trade in crude oil 240 min chart proving to be good model in addition to 30 Min EPIC and 1 Min daytrading model.

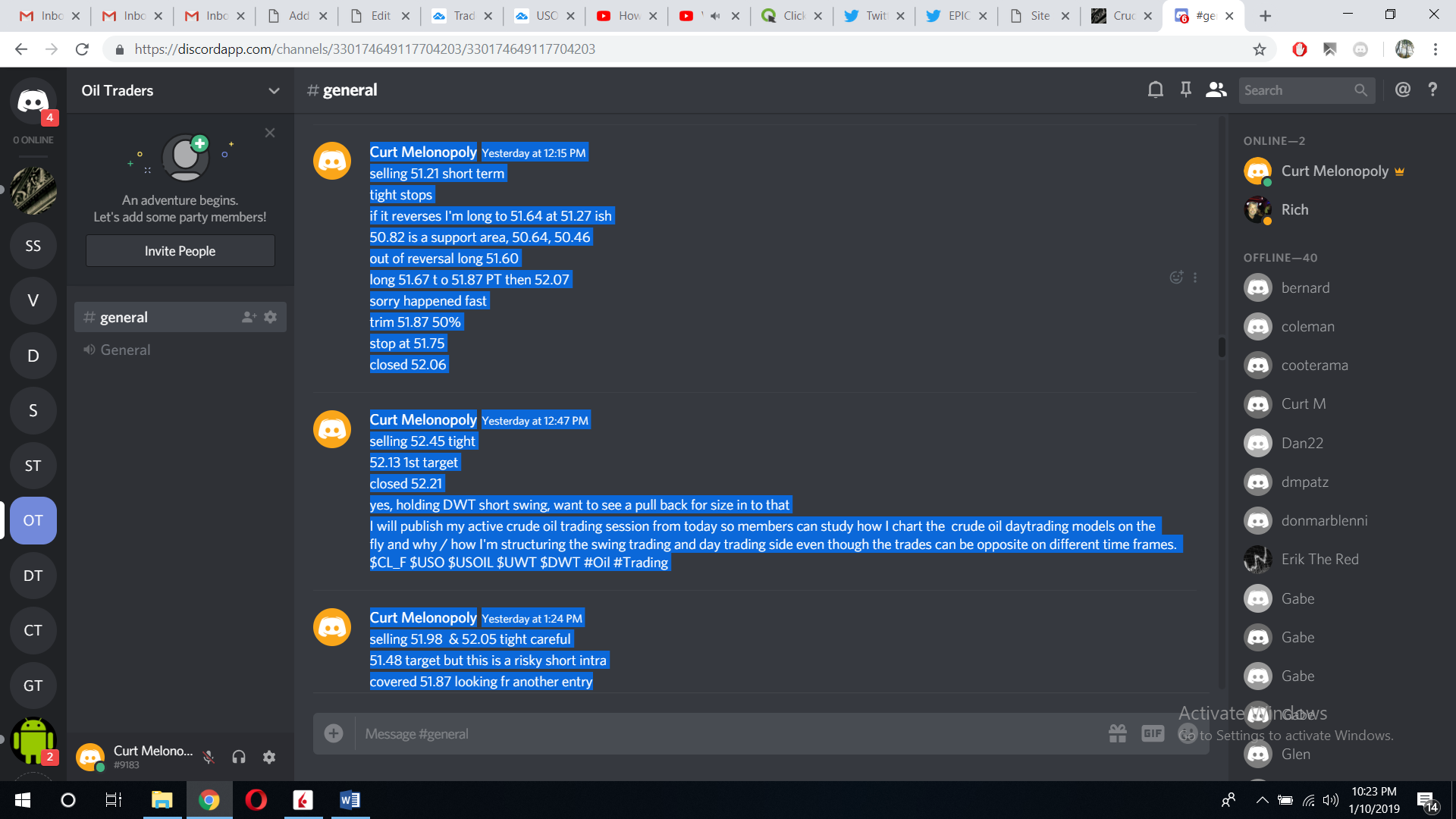

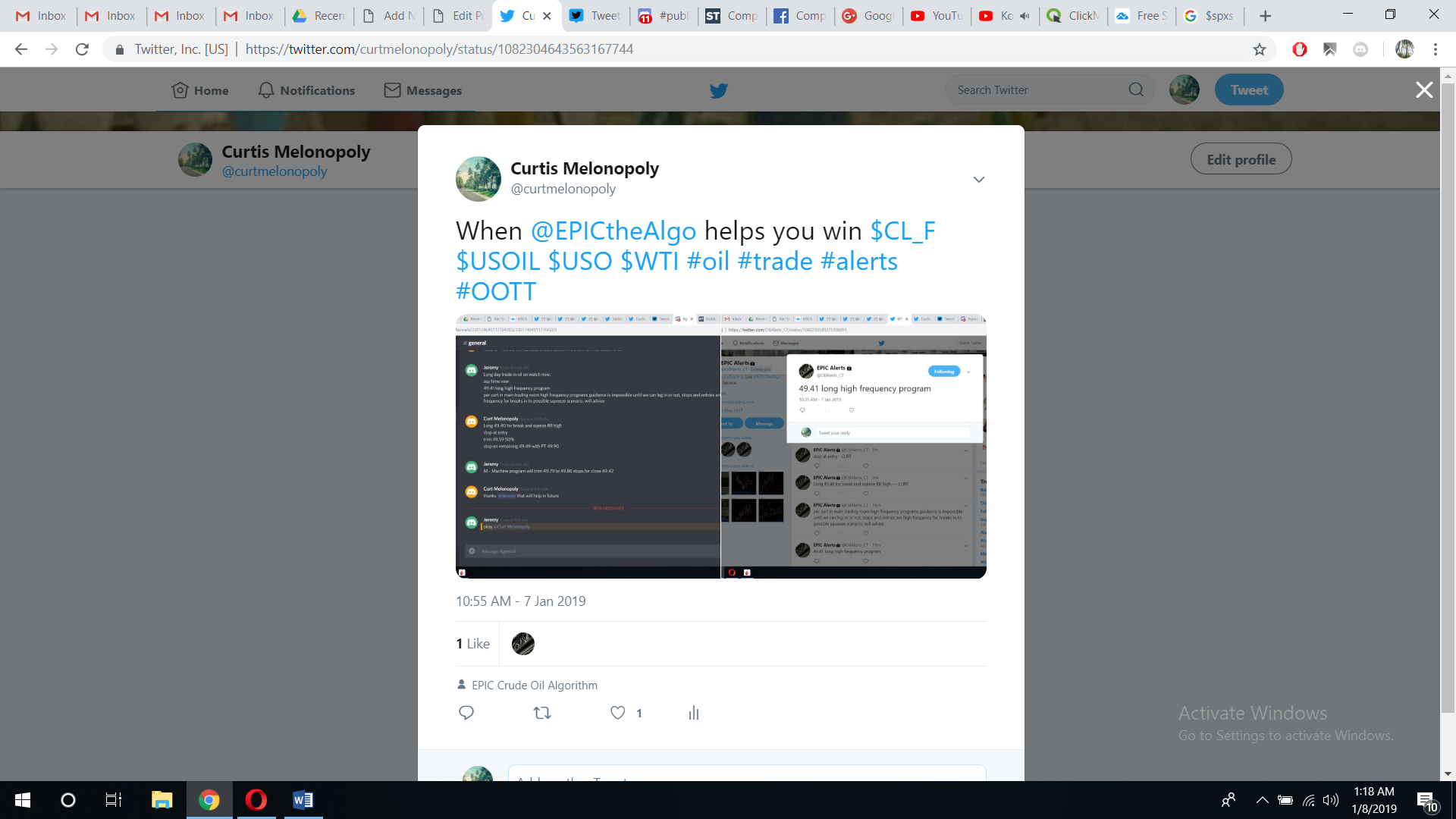

Screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Oil trade since late Dec time cycle peak I was on about. $CL_F $USOIL $WTI $USO #timecycles #oil #OOTT

When @EPICtheAlgo helps you win $CL_F $USOIL $USO $WTI #oil #trade #alerts #OOTT

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

#5Things

-Trump likely to invoke emergency powers for wall

-Dovish Fed

-Oil keeps ticking higher

-Markets mixed

-Coming up…

https://bloom.bg/2FuhqB4

Brent Crude Set for Longest-Ever Rally on OPEC, Economic Outlook

Top 75 weighted stocks – what Da Boyz buy to move the markets – Looks like a test of the 50 DMA next week, too. OE and possible breakout above the 50 DMA everywhere. Should make for some great DRAMA – Breakout Trump’s fault, too… LOL

https://twitter.com/ThinkTankCharts/status/1083658033207693312

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $FTK $TBLT $PRPO $TLRY $CRBP $PIXY $ERJ $TAK $UGAZ $BUD $HMY $JNUG $USLV $NUGT $NFLX $UXIN $SBGL $TVIX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$NFLX upgraded to Strong Buy from Outperform at Raymond James.

Cross Research Upgrades SYNNEX Corp. $SNX to Buy.

$TSLA – Wedbush positive on Tesla

(6) Recent Downgrades:

Netflix PT cuts at Morgan Stanley to $435 from $475 on ‘Modestly Lower’ Margins.

L Brands $LB Downside To $13 Possible – Jefferies.

Citi Downgrades Astra International Tbk PT (ASII:IJ) $PTAIY to Neutral.

Apple $AAPL Checks Indicate Weakness Should Continue – Longbow

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Oil, SPY, VIX, BTC, Gold, Silver, DXY,