Tag: Charting

Trading Facebook (FB) Earnings Part 2 – Opportunity Knocks (Member Edition) $FB #trading #earnings

How to Trade Facebook (FB) Earnings. Monday Trade in Facebook – Stock $STUDY Preparation. Technical Charting for Swing Trading and Day Trading. Member Edition of Report.

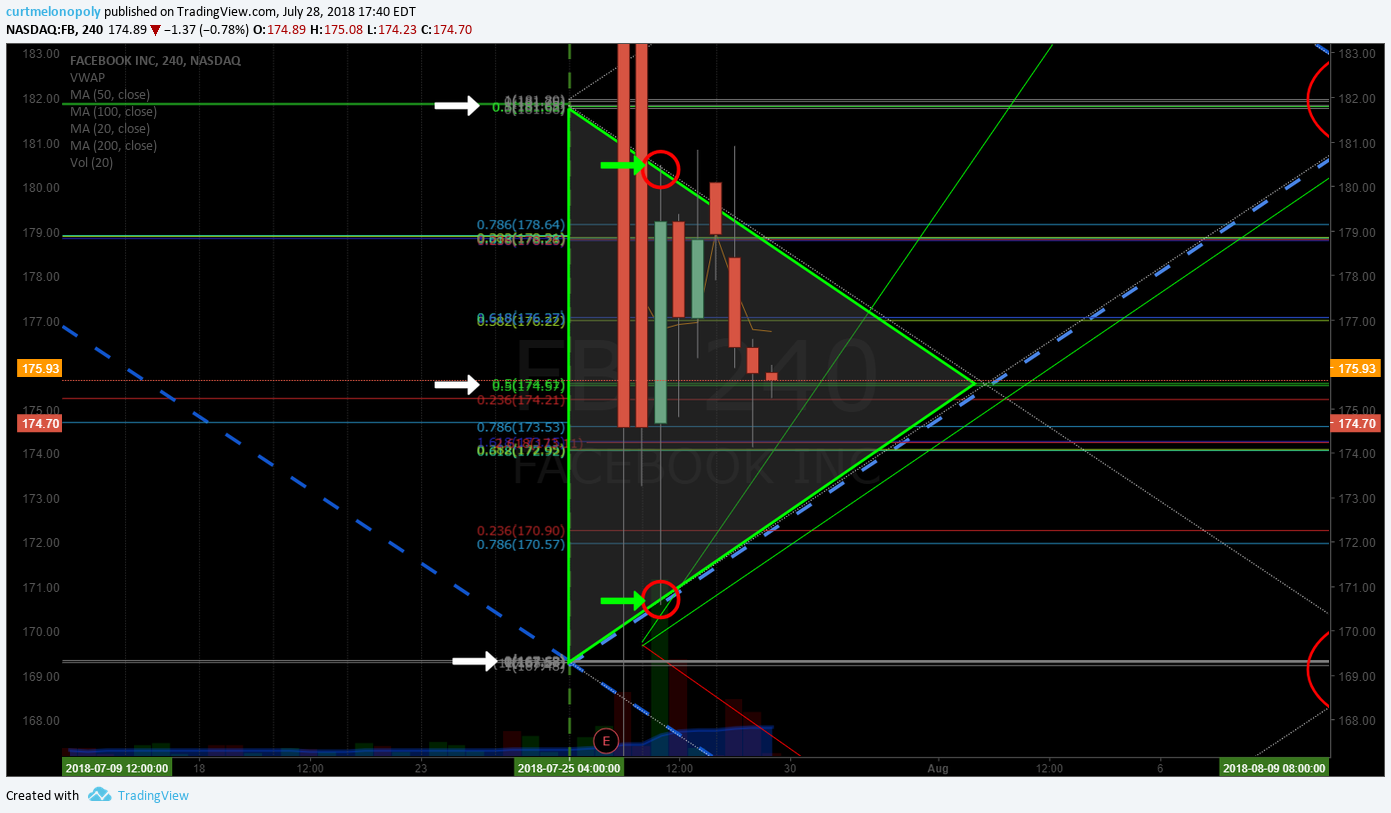

Trading Plan for Facebook, Inc. (FB), July 28 2018.

Monday I expect a big day for Facebook trade post earnings. What a fantastic opportunity to see some great day trading returns and possibly swing trade Facebook with large sizing.

In this follow-up report to the one published last week (Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning) are follow-up technical charting details for trading Facebook. The technical charts below will assist you on short time frame daytrading premarket and and market open and for entries toward swing trading possibilities.

If you are unaware of what occurred last week with Facebook earnings, this article explains:

Facebook has the WORST day in Wall Street history as shares plunge 19% and $119 billion is wiped off company’s value, as analyst predicts more misery to come for the social media giant.

As mentioned in part one of this special report;

The last time we traded a Facebook wash-out the trade was one of our biggest winners of 2018 (thus far). We nailed the bottom of the sell-off and we followed the trade through as it gained upside until today. We have been out of the trade for a few weeks now in anticipation for today’s earnings announcement.

Below is one of many alerts issued to members in the last Facebook sell-off, we were in nice and early and banked considerably as a result:

$FB Facebook long side trade from 153.40 Mar 28 buy side trigger now testing buy sell trigger 167.51. See chart notes. #swingtrading

https://twitter.com/SwingAlerts_CT/status/984194323192266752

You can find the April 11, 2018 Facebook trade article from our blog here:

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

Facebook Trading Plan:

Facebook (FB) “On the Fly” Charting Model – Daytrading Chart with buy sell triggers for Monday. $FB #facebook #chart

Member version of this report is distributed in real-time (not delayed) and includes (in addition to a static chart) a link below to a live interactive Facebook daytrading chart on Trading View (with all technical levels).

Buy / sell triggers on the short time frame per chart (intended for short term day-trading):

153.51

160.59

167.61

174.60

181.60

188.79

FACEBOOK (FB) Closed Friday just above 50% Fibonacci retrace pivot in trading structure alerted to members $FB #swingtrade #daytrade

My trading plan includes watching the Fibonacci retrace pivot noted at 174.60. Trade above is a long to diagonal down slope trendline that trade used as resistance last week. I won’t likely be shorting as the sell-off likely has the stock in an over-sold position (to be determined).

If trade loses the pivot then I will be looking to the lower uptrending Fibonacci trendline (bottom of quad) for long positions and then trimming (as above) at Fibonacci downtrending diagonal quad wall.

For ease the chart has the lines highlighted in green. When trade moves to the next part of the trading structure I will trade the next structure in a similar manner.

The time price targets are on the chart as red circles and are always at the main buy sell trigger points at the mid quad, top of quad, and lower quad. Trade the FB stock in the direction of trend in the trading structure toward the price targets (date for each price target is listed at the bottom of the chart).

I will be trading FB in premarket Monday and the live trading room will be open. I will also send alerts to our Swing Trading and Day Trading alert feeds as possible as trade develops.

If you have any questions about this special Facebook trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Winning Most Swing Trades Not Just Possible – It’s Probable, Here’s How.

Part 8 of the Freedom Traders Series. This section will provide tutorials on how to use our platform services and charting to win the majority of your trades. This is part one in this new section. #freedomtraders

Preface:

I work a lot, and today I had this article on “how to win most swing trades using our platforms” all figured out in my mind. Now that it’s 1:00 AM and I’ve processed hundreds of charts on swing trading, emails, helped other traders and more… I am experiencing writer’s block.

So what I will do is explain here quick the technical indicators we use in our trading to keep this as concise as possible. At a later date I will either do another more detailed article or revise this one.

This post will assist anyone to swing trade with a super high success / win rate that subscribes to our swing trading newsletters, swing trading alerts or trades using our algorithmic modeled charting in any way.

BUT! You have to trade using the rules. You won’t win unless you follow the rules.

“Look, I’m just mechanic. You want an engine in that car that’ll win? I’ll build you the best on the track. But you gotta turn the key and drive – I can’t do that for you.”

"Look, I'm just mechanic. You want an engine in that car that'll win? I'll build you the best on the track. But you gotta turn the key and drive – I can't do that for you." — DM convo. Okay gotta go. peace

— Melonopoly (@curtmelonopoly) June 5, 2018

This is Paint By Numbers Swing Trading. Trust the Process and Know the Rules.

We provide you the chart structure, with the instructions on how specifically to trade the move (paint by numbers trading). But you have to follow the plan and you have to know the rules of the game.

When you get to know our process for charting you will come to know that this is the best charting methodology on the markets. How do we know that? Because the biggest and best firms contract us to provide them with our charting data. This is the charting that the best of the best use for their traders and coding programmers for algorithms at hedge funds.

When you learn how to trade with a trading structure – a structured chart model, you will never return to trading the way you knew. I will guarantee that. It is like having a GPS when you travel. It’s totally different. We chart in advance the map of trade. This is much different than conventional charting methods that chart the trade after it has occurred (what you see in every day charting).

When you learn how to trade with a trading structure – a structured chart model, you will never return to trading the way you knew. I will guarantee that.

Proper charting structure allows you to be in a trade with confidence knowing that even if it fails you can get out with a win because you know the structure of the trade. You know that when it fails the next place on the chart where it should consolidate, restructure trade and you can then size in (exploit the next move) and get out with a win.

Conventional charting will not do this for you.

The video below should make understanding the charting easy for you and then later in this post I will show you some static chart examples.

Also you will learn more by watching swing trading educational and trade review videos on our You Tube Channel, reviewing trades on our swing trading alert feed and studying swing trading newsletters.

Video Explaining How to Use our Swing Trading Charts Properly.

“I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min – 6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.”

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 9, 2018

Trade set up reviews covered on this May 7 video are;

How to Trade the Chart Models:

– Fibonacci Diagonal Trend-lines

– Fibonacci Horizontal Trend-lines

– Diamonds make up trading structure / quads

– Price targets

– Main support and resistance (buy sell triggers)

– Time cycle peaks (time cycle completions)

– Moving averages (20 MA, 50 MA, 100 MA, 200 MA)

– Trading support and resistance (trims and adds)

Swing Trading Chart Example:

Below is a Google (GOOGL) chart, we can use this as an example chart for how simple it is to swing trade this system.

The Google chart below has the following indicators for your trade;

- Horizontal lines (Fibonacci related) are support and resistance on our charting. The ones marked with arrows are the key support and resistance areas for swing trading. The others not marked with arrows are intra-day support and resistance levels that you can use for adding to your position after you have entered long for example and trimming your position as trade nears your price target.

- Ideally you will take your initial long or short position at the main support or resistance line (the ones marked with arrows) and exit or considerably trim your position as trade gets to the next primary support or resistance (marked with an arrow).

- In this instance, using the chart below, you would enter long at 995.82 and trim that long at 1103.24 and continue to trim as you get closer to the next resistance at 1210.98. All figures are approximate.

- The diagonal lines (in this example they are grey dotted) are Fibonacci related trend-lines that form what we call trading quadrants (diamond shape trading areas). Why are these important? Because you use them like any other support and resistance. Trim your long positions in to them and add above. You don’t have to, but some traders want to optimize their return. It depends on your trading plan, sizing and time frame. This is just one chart example with one time frame.

- The red circles on our charts are price targets for not only the price but the actual exact time the target is most likely to get hit if trade hits it. Why do we provide these targets? Because if the machines are in the play that you are swing trading, you will find trade to be very predictable through the model and you will become very proficient at knowing which target will hit on the chart and exactly when.

- Time cycle peaks are the area of the chart structure that allows for the widest width of trade. The apex or upper of the diamond and it correlates with the lower inverse apex (the bottom of the diamond). When coding technicians program for trade in the structured chart model this is where the profit is made. You will find in many of the chart models that trade volatility will increase in to the time cycle peak. They are noted also with a vertical dotted line on our charts. In the example below a green vertical dotted line. Here again, you want to view the chart in your trading plan and if trade has previously shown wide swings historically on the chart model at these intervals then you can take advantage of that.

- Keep in mind that different trading instruments have different predictability in their chart models. This is directly influenced by liquidity in the market specific to the instrument and whether the machine liquidity is in the play. Some chart models for some instruments are incredibly predictable, and some are not. You will find our swing trading newsletters to explain this for various stocks we cover. The trading alerts feed does not cover this in great detail because it is an alert feed. The alert feeds do attempt to give clear entry and exit / trim points of reference for your trading plan however.

- Here is an example of a predictable structured trading model in Silver for example;

- Markets are so machine controlled now 14 of 19 of these symmetrical targets in time cycles in Silver model have hit perfect. Five that missed barely did, trade was easily a win for 19 in 19. $SLV $USLV $DSLV #Silver #Chart #Symmetry #Algorithms #MachineTrading #Commodities https://twitter.com/curtmelonopoly/status/1003893552961769473

Markets are so machine controlled now 15 of 19 of these symmetrical targets $SLV $USLV $DSLV #Silver #Chart #Symmetry

- Markets are so machine controlled now 14 of 19 of these symmetrical targets in time cycles in Silver model have hit perfect. Five that missed barely did, trade was easily a win for 19 in 19. $SLV $USLV $DSLV #Silver #Chart #Symmetry #Algorithms #MachineTrading #Commodities https://twitter.com/curtmelonopoly/status/1003893552961769473

- Here is an example of a predictable structured trading model in Silver for example;

- Also in our charting you will find conventional indicators like moving averages and other indicators that will vary from chart to chart.

- I don’t like the idea of a trader just following an alert feed and not subscribing to the newsletter service because just the alerts can do a disservice to a trader because the whole story is not there. But if that’s all a trader can afford to get going then okay I understand. But ideally you want to be trained in private coaching for at least a few hours, get the newsletters so you have the perspective and structure of the trades, get in to the trading private server for members so you can ask questions and then once you are running confident then you can take trade alerts with no problem. But I get it and I’m flexible to the plight of new traders.

- I highly encourage you to get at least a few hours of private trade coaching or attend a trading bootcamp to refine your skillset with sizing, cutting quickly and where if you are on the losing side of a trade, adding in to winners and trimming at the right locations in each trade. This is very important. So much so that I would venture to guess that knowing how the rules work and how to engage each trade will increase your win rate double, your losses to near zero and your return on each trade easily by 50%. It is critical.

Below is the Google chart I reference above.

Example of What our Swing Trading Alert feed looks like:

Initial Swing Trading Alert on Twitter Feed to Members:

FITBIT (FIT) Chart. Over 5.87 targets 6.16 6.22 6.67 PT June 28. Closed 5.86 bullish on news. $FIT #chart #swingtrading #daytrading https://www.tradingview.com/chart/FIT/1NNdYQxO-FITBIT-FIT-Chart-Over-5-87-targets-6-16-6-22-6-67-PT-June-28/ … 8:20 PM – 4 Jun 2018

The Follow-up Alert on this Specific Swing Trade the Next Day

Daytrading levels were added to the charting and alert because the trade was going the right direction. This updated charting allows for precise entry and exits for the swing traders and allows our daytraders to work in the trade chart structure as well.

FITBIT Class A (FIT). Intra over Fib TL, 6.17, 6.22 res targets 6.68 June 28, see daytrading levels added, trading 6.37 $FIT * See exclusive Member report. #chart #swingtrading #daytrading https://www.tradingview.com/chart/FIT/xrBqVqZF-FITBIT-Class-A-FIT-Intra-over-Fib-TL-6-17-6-22-res-

Example of Feature Reports our Swing Trading Members Receive.

This special edition emailed to our members the night before the alerts gave our members in detail exactly what the plan was in the trade – PRIOR TO THE ALERT BEING ISSUED THE NEXT DAY.

The report provided our traders detailed information on FitBit the Company, Fundamentals, the News applicable to theTrade Set-up, Technical Trade Set-up, and Charting details including Simple Algorithmic Chart Structure (model) with Price targets, Fibonacci support and resistance, trading quadrants (diagonal Fibonacci trend-lines).

Everything our traders needed to know was in that report, before the alert the next day was issued and it was processed as an extra to the service – a value add not required under the swing trading service offerings.

Unlocked: FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT #swingtrading #daytrading #chart Link:

Example of Private Discord Server Side Alerts our Members Have Access To with a Bundled Plan.

Here is a screen shot of what our private Discord servers look like (they are specific to the service you are subscribed to and there is no reason for a member not being in the chat room at anytime). It is vital to your success and many of our trading subscribers do not take advantage of this vital tool.

Example of our Swing Trading Newsletters:

We have five swing trading reports in rotation that cover over one hundred equities on a regular basis for our members. We also send regular feature reports out such as the trading plan above for FITBIT.

Below is a sample swing trading report:

Use password: AGN31

Example of How Confident I Am in Our Service.

Notice Not a Single Wall Street Trader Ever Argues. You know why? Because it’s true and they know it’s not arrogance, I’m stating a fact to scream through the noise. We’re dealing in data science, science is not sexy wall street casino. We’re fighting the casino mentality every day to help traders win.

When I call em’, I know I’m right (in advance) and I can even give you the road map of trade (instrument charting structure) winning high 90% since coding team arrived two months ago. Check the feeds for yourself. #boomtown

When I call em', I know I'm right (in advance) and I can even give you the road map of trade (instrument charting structure) winning high 90% since coding team arrived two months ago. Check the feeds for yourself. #boomtown

— Melonopoly (@curtmelonopoly) June 6, 2018

Hopefully that helps acquaint you with our swing trading services and how to use our swing trade charting to your advantage. Of course you can email me anytime or DM me on Twitter or on our Discord server. I’m here to help.

It takes time to learn what will prove to bring you to freedom for sure and to significant wealth if you become fluid in the mechanics of structured trading. There is no other better way to trade and I can prove that to you. But you have to invest some time in to it. When you become proficient at it you will see it as easy as paint by numbers. I guarantee you that.

Here’s how to get started with your new life at Compound Trading Group and Welcome Aboard!

Subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

After you have subscribed to specifically the swing trading alerts follow @SwingAlerts_CT on Twitter and then email info@compoundtrading with your telling us your Twitter handle so we can open the feed to you.

Follow this link for a follow-up swing trading article that provides a real-life technical trade set-up example:

Swing Trading. How to Swing Trade Using Technical Analysis. Our SQUARE $SQ Trade As Example.

Peace and best.

Curt

Freedom Traders Series:

Part 1 : My Personal Stock Trading Story. How I Blew up Two Accounts and then Learned How to Trade.

Part 2: Trading Checklist (Rules) I Follow Before Triggering a Stock Trade.

Part 3: Now I’m Inspired. A Struggling Trader That Inspired Change.

Part 4: We Want (Need) You! Apply to Nearest Recruiting Station.

Part 5: Learn How to Trade Stocks (Build a Small Account) Following my Journey.

Part 6 a: Trading Set-ups. How-To Develop a Systematic – Predictable Process.

Part 6 b: Trading Set-ups. Video Explains Predictable Winning Process.

Pat 7: How I Develop a Trading Plan Watchlist (Swing Trading and Day Trading).

Connect:

Register to free email list for periodical trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

About Curtis:

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

About our lead trader: https://compoundtrading.com/lead-trader/

Compound Trading Group Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for full-time daytraders. Private coaching and live alerts.

Article Topics; How to Swing Trade, Win Most Trades. Swing Trading, Alerts, Newsletters, Winning, Trades, Charting.

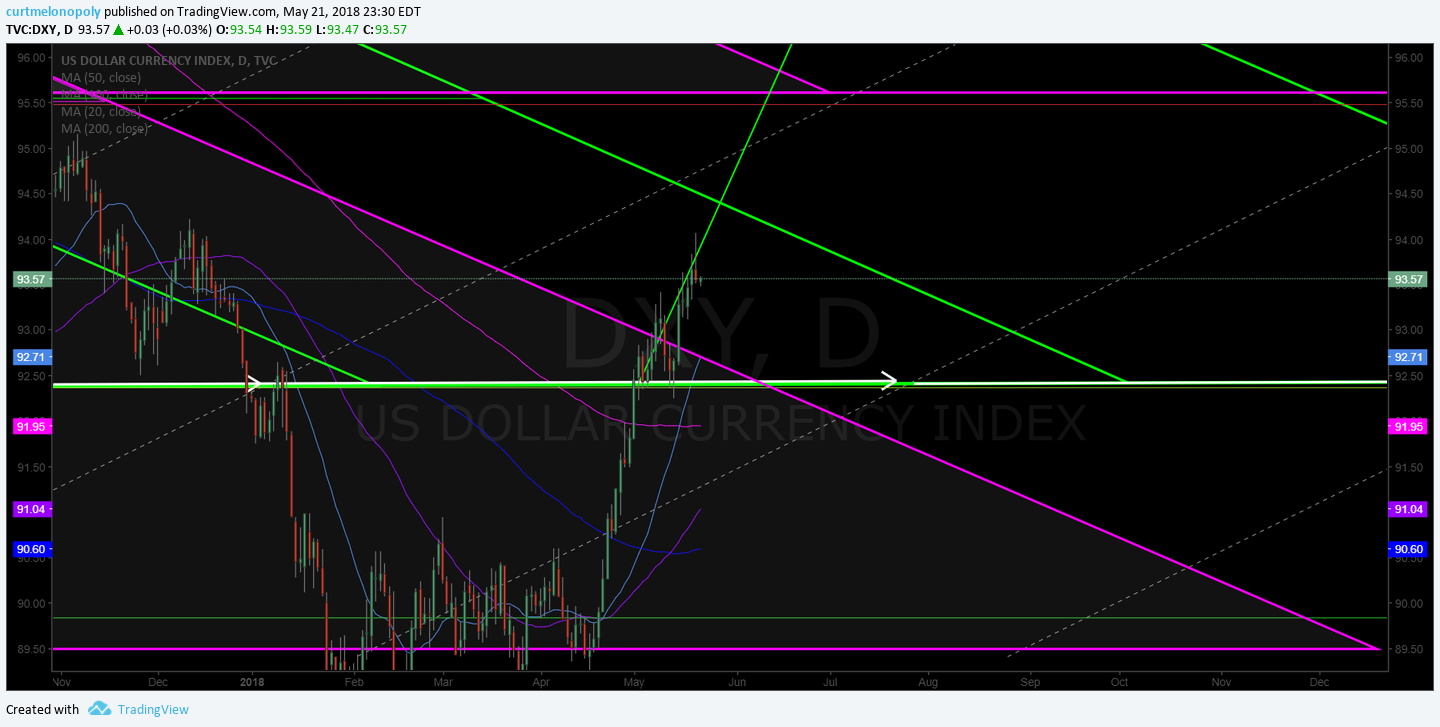

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm

Webinar Recorded Sunday May 20, 2018: How to Swing Trade the US Dollar Index Move $DXY $UUP

Feature post includes video, charting and summary of the webinar.

Video of How to Trade US Dollar Webinar:

Click here for a direct link to the How to Trade US Dollar Index $DXY Video.

Summary of Video:

When the dollar lost the 200 MA on daily it dumped in to Feb of the year and went sideways.

We sat quiet through the sideways period since because it was divergent to our algorithmic model.

As price started to get closer to 200 MA from underside again and MACD turned we started to alert clients and share some alerts on social media.

There is a pivot at 92.61 area on the daily chart where the set-up triggered a long side trade for us.

If trade loses that pivot all bets are off long side bias. Not stated on the video.

On the geometric charting (broad structure) there are some key areas of trade to watch for;

The video explains the chart structure to watch for.

The primary trendline to watch in the structure is shown on the video.

Important resistance 94.38 in 8 days 28th of May, 97.78 July 10, 100.5 – 100.76 Aug 20 (primary resistance), trading 93.78 intra,

Intraday on the hourly over 200 MA is a long and to trim I move to 15 min chart and when price loses the 20 MA, 50, 100, 200 MA I move out and wait for price to gain the 200 MA again on the hourly and I scale long again.

There is a part two to this video in progress, for a copy register to our mailing list.

Close up image of US dollar Index $DXY algorithmic chart shown in webinar video. #HowtoTrade #USD #Dollar #Algorithm

US Dollar Index Daily Chart MACD flat, price above main pivot (red line) over 200 MA. $DXY $UUP

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Subscribe to our Weekly $DXY US Dollar Index Newsletter Here

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.

Special Swing Trade Report: #OIL, #GOLD, $NFLX, $SPY, $DIS, $GDX, $TSLA, $AAOI, $ESPR, $ITCI, $TAN, $CELG, $C and more.

Exclusive Report for Email List Members and Swing Trading Members.

Some of the best trading set-ups and ROI we have had in some time. Wow.

Excellent set-ups in #OIL, #GOLD, $NFLX, $SPY, $DIS, $GDX, $TSLA, $EOG, $AAOI, $ESPR, $ITCI, $TAN, $CELG, $C and many more.

Written Summary Below of Trading Plan Set-Ups Reviewed in Video (Click on links in summary text below to be directed to specific charting from lead trader).

#EIA Oil Analysis / Charting Structure $USOIL $WTI: Oil trade is divergent to upside on the EPIC Algorithm Model. Trade is up near channel resistance area and our long bias is no longer in play until this resistance area is concluded to up or downside – there is a probable trade scenario going forward reviewed on video (EPIC members can review EPIC alerts, private Discord room, weekly newsletter and visit 24 hour oil room for more detail). The weekly simple oil model has a 74.50 upside chance for oil for week of April 9, 2018. And the third chart reviewed here is the Monthly oil model with a time cycle peak in October coming in around 67.00 on $USOIL $WTI. Doesn’t mean it won’t spike up in to weekly target range of 74.50 prior to returning to 67.00 area. Also of note is the 200 MA resistance and 50% retracement line on charting that is reviewed in this video.

Our weekly simple oil model posted originally months back has a 74.50 upside chance for oil for week of April 9, 2018 time cycle completion. Never thought price would get anywhere near that:) $USOIL $WTI #CL $UWT $DWT $USO #OOTT

Our weekly simple oil model posted originally months back has a 74.50 upside chance for oil for week of April 9, 2018 time cycle completion. Never thought price would get anywhere near that:) $USOIL $WTI #CL $UWT $DWT $USO #OOTT https://t.co/4EyE5Xajfv

— Melonopoly (@curtmelonopoly) April 11, 2018

And the simple monthly oil model with a time cycle peak in October is coming in around 67.00 on $USOIL $WTI (most probable) target. Video on deck explains other targets (trade price). $USO #CL #OOTT #OIL https://www.tradingview.com/chart/USOIL/LFoaIZEq-Oil-Resistance-One-of-Most-Predictable-Trades-See-chart-notes/ …

And the simple monthly oil model with a time cycle peak in October is coming in around 67.00 on $USOIL $WTI (most probable) target. Video on deck explains other targets (trade price). $USO #CL #OOTT #OIL https://t.co/utoQLL18ra pic.twitter.com/V3bkZVUpXR

— Melonopoly (@curtmelonopoly) April 11, 2018

Gold $GC_F $GLD – Weekly MACD pinching up with trade near previous high. This is a test area. Don’t forget the previous high test resistance with Gold that has caused it to back off.

$EOG EOG Resources – EOG trading above important buy trigger 108.76 intra trading 107.93. 115.29 diagonal resistance and one at 119.68 with 115 to 116 price target at earnings end of the month, if price holds the buy sell trigger area in around 109.00. Long over trigger.

$AAOI Applied OptoElectronics – Triggering buy long side trigger over mid quad on AAOI, is up over 12% on the day. More alert detail to follow for members as trade plays out.

$ESPR Esperion – ESPR trading perfect through the Fibs, hit important pivot resistance on 71.67 and triggered long side buy with first target 74.67 and hit today and backed off some. Looking for 80.60 – 80.80.

$ITCI Intra Cellular – ITCI with resistance 23.88 as intra important buy trigger with price above it. If it loses support 23.88 (when price is above) then cut each time until trade takes and hits the next price target area of 30.0 ish.

$DIS Disney – Disney dropped out bottom of model like $SPY model in recent volatility / panic. Structured buy side play targeting 103.73 June 30. Previously charted a number of times / alerted recently.

$NFLX Netflix – Netflix has been a fantastic trade set-up for members. We had a buy trigger 295.40. Buy side trigger confirmation was diagonal Fib / quad wall (explained on video).

$SPY SP500 – Same type of structure as Disney chart. This structure was modeled in advance of price. It is hitting exact day and time and price targets. This again has been an excellent SPY trade set-up for members. Upside 265.52 resistance, mid quad 267.96 and over targets over 265.62 targets 268 area April 18, 2018 as first buy side price target.

$TAN Solar ETF – TAN 25.08 intra with buy trigger at 25.50 on watch intra.

$GDX Gold Miners – Miner’s near mid quad resistance Fib line and then backed off on the day. Has been an excellent trade alert on long side for our members. 23.14 is the trim mark and it came very near today.

$CELG CELGENE – Celgene has price trending along diagonal Fib (quad wall) to first price target 91.37, 91.97, 96.00 price targets to upside off buy side long alert previously to members. Ultimate bullish target is 95.60 April 20 but unlikely.

$MXIM Maxim Integrated – We have a sell side bias on Maxim that has to play out. Watching. Resistance and support on chart in video.

$TSLA TESLA – Alerting TESLA in 260.00 range has been a great buy side trade structure. It got up over major resistance at mid quad horizontal Fib buy side confirmation trigger at 280.17 ish and straight to next resistance 304.60 with Nov 14 382.70 price target. Price targets (resistance) on its way upside are at 333.80 and 338.62 on its way up.

$C Citi – 73.68 next price target on Citi and all the resistance and more price targets explained on video.

$ATHM AutoHome – Fantastic break-out trade set-up previously alerted and now over previous highs. Trade price here forward. Will alert sell side when it triggers.

$VRX Valeant – Near 200 MA on daily as a massive test and then 50 MA on daily upside is the buy trigger. Model to follow if it sets up.

We also reviewed a few of the momentum stocks from the day.

For more detail on the time cycle peaks for your trade, price targets, and support / resistance points relating to your personal trading plan contact me with any questions you have.

Best and peace!

PS Remember to trade price – if the trade goes against you it is always better to take a small loss than be married to a bad chart / stock.

I am live broadcasting these trading set-up and other chart set-ups documenting my process in detail for review w/ daily PL’s, video, charting set-ups and alerts.

Subscribe: 1 month free trial and a $1.99 sign-up fee promo ends in 72 hours.

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Reach Out:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin 1.05% , $ETH, $LTC, $XRP,) $DXY -0.05% US Dollar -0.05% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 2.00% traders. Private coaching and live alerts.

Twitter Trading Plan $TWTR (Part two)

Twitter Trading Plan

Step 1. Chart Resistance. Know your upside resistance points.

My bias is long so I am charting upside only. IF it comes under pressure I will re-think a plan and publish separately. The chart below has the MAIN resistance points for upside trade (red dotted).

Step 2. Gap Fill. The gap area on the daily Twitter chart below (27.48 to 29.68) is my initial bias trading range.

Here is the real-time chart link https://www.tradingview.com/chart/TWTR/4kwf0zt1-Twitter-gap-fill-in-progress-on-daily-and-upside-resistance-poin/

Step 3. Chart Indicators. Twitter Long bias will be confirmed when SQZMOM, MACD, Stochastic RSI on daily all turn. $TWTR #charting

Additionally, I will watch the moving averages.

In all instances before taking the trade I will watch these indicators for trade timing on all time-frames first. 1, 15, 30 min, 1, 2, 4 hour charting etc.

When all those points line up, I check miscellaneous things such as time of day or time of week etc. I also refer to our $SPY algorithmic charting model for proper timing among a number of other details.

Here’s the real-time chart link for the indicators noted: https://www.tradingview.com/chart/TWTR/DCiW9xh2-Twitter-Indicators-I-am-watching/

If you need a hand with your trading plan let me know anytime.

Best of it with your trades!

Curt

———————–

Below is the first post in this series:

Twitter bounced near 200 MA on weekly support. $TWTR

With the recent pressure on related equities I am watching $TWTR $GOOGL $FB and a few others very closely at open on Monday.

Here’s the 4 hour chart post from Friday I alerted (200MA on 4 hour as intra-day resistance) – it did back off near that resistance intra-day.

Here’s a Friday news (Real Money) take on the issues facing Twitter and others: https://realmoney.thestreet.com/articles/03/30/2018/dont-buy-dip-facebook-twitter-and-alphabet?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

I love trading wash-out snap-backs because the returns can be fast and hard if you have the technical set-ups the pros use.

FOR PART II:

For the complete technical analysis / trading plan on this set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact

For those reasons, and of course the chart setup forming my trading plan I will go in to this week extremely bullish unless price action and or media / news tell me to back off.

For more detail on the time cycle peaks for your trade, price targets, and support and resistance points relating to your personal trading plan contact me with any questions you have.

Best and peace!

PS Remember to trade price – if the trade goes against you it is always better to take a small loss than be married to a bad chart / stock.

Monday I will be live broadcasting this trading set-up and other chart set-ups documenting my process in detail for review w/ daily PL’s, video, charting set-ups and alerts.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Twitter bounce near 200MA on wkly. Trade set-up w/ Chart Notes. by curtmelonopoly on TradingView.com

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin -0.37% , $ETH, $LTC, $XRP,) $DXY -0.13% US Dollar -0.13% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 0.82% traders. Private coaching and live alerts.

For the complete technical analysis on this swing trading set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact

Charting Re-balance Edits, Complimentary Publications, Email Distribution Lists

RE: Charting Re-balance Edits, Complimentary Publications, Email Distribution Lists

Good morning,

So when we opened the algorithm chart model files this morning, many (near all) shifted again and have to be reset. We’re working on that right now. This has to be completed for all charts before reports can be processed (because of course the chart time cycles and pricing affects reports).

This does occur on holidays with Trading View. Different holidays to different degree. Thanksgiving has been the worst we have experienced in the last year and this may have something to do with the half day – I am not sure.

Anyway, the shift in the charts this morning was less than yesterday so we expect today’s edits to be all that is needed and then we can process full reports. This may mean that reports are not out until tomorrow / b4 market open Thur and charts in completion would be out today / tonight at various points b4 market open tomorrow.

I apologize for the delay. I will ask Sartaj if he can credit some sub time for the gap in service.

It would be nice if we had another chart provider that didn’t have this issue surrounding holidays but Trading View is our only option (for our tech requirements). Perhaps in near future we can work with them toward a solution.

When you open the charts, to get past the viewer part to the live chart click on the share button bottom right and then “make it mine”. When in the chart if you only want the chart and not the indicators at the bottom double click on the chart and the bottom indicators will be removed.

So bottom line is that the charts will all be out today and the reports at latest tomorrow. And yes, in future surrounding holidays (at least until we find a solution) just know in advance this does occur.

Also, we are sending complimentary issues to members for various charting between now and Christmas (if you are wondering why you are receiving various updates).

And finally, I apologize if you are getting more than one email for an update (such as this memo), that means you are on more than one distribution list. This also we need to sort solutions for going forward.

Any questions let me know.

Thanks

Curt

Special Swing Trading Report: Chart Analysis (Member Edition) $SPY, $USOIL $WTI, $GLD, $GDX, $SLV, $VIX, $DXY

Good Morning Swing Traders and Welcome to the Compound Trading Special Swing Trading Report: Chart Analysis (Member Edition) $SPY, $USOIL $WTI, $GLD, $GDX, $SLV, $VIX, $DXY.

This report covers indicators on watch (in addition to the simple MACD) for S&P 500 $SPY, Gold $GLD, Gold Miners $GDX, Silver $SLV, Crude Oil $USOIL $WTI, US Dollar Index $DXY and Volatility $VIX.

We see a possible inflection very possible in many of the charts below so we thought we’d get ahead of the curve for our members and start charting these in advance of any move.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading #Gold KISS Keep it Simple MACD Nets Decent Annual ROI $GLD $GC_F $XAUUSD $NUGT $DUST $JDST $JNUG

Gold Daily 20 MA about to breach 50 MA price above 200 MA SQZMOM trend down MACD unknown Stoch RSI trend down $GLD $GC_F $XAUUSD $NUGT $DUST $JDST $JNUG #SwingTrading

In my opinion not a great place to enter. I will watch for price above 20 and 50 with breach and MACD clearly trending up and preferably SQZMOM trending up.

Live Gold chart with indicators (locked for members only) https://www.tradingview.com/chart/GOLD/jUFKBoSJ-Gold-Daily-20-MA-about-to-breach-50-MA-price-above-200-MA-SQZMOM/

Trading #Silver KISS Keep it Simple MACD Nets Decent Annual ROI $SLV $USLV $DSLV

Silver Daily Under 200 MA Price may loose all ma’s MACD looks to be crossing down SQZMOM trending down. Advantage bears. $SLV $USLV $DSLV

This is a messy chart. Advantage bears and may be a good short if 20 MA is lost and MACD turns down.

Silver Live Chart (locked for members only) https://www.tradingview.com/chart/SILVER/2psVv0zn-Silver-Daily-Under-200-MA-Price-may-loose-all-ma-s-MACD-looks-to/

Trading Crude #Oil KISS Keep it Simple MACD Nets Decent Annual ROI $USOIL $WTI $CL_F $USO $UCO $UWT $DWT

Crude Oil under 200 MA SQZMOM trending down MACD down under all ma’s $USOIL $WTI $CL_F $USO $UCO $UWT $DWT

This is advantage bears also. Not the best place to short or long. Long it if MACD turns up but watch for the 200 MA as resistance (not that it is critical). Also if long watch for MA cross over’s and price above to get you lift. Watch the SQZMOM.

Crude oil chart (locked for members only) https://www.tradingview.com/chart/USOIL/SNkC40tQ-Crude-Oil-under-200-MA-SQZMOM-trending-down-MACD-down-under-all/

Trading $SPY S&P 500 KISS Keep it Simple MACD Cross Provides Winning ROI Strategy $SPXL $SPXS $ES_F

$SPY on a short term looks like a sell with Stoch RSI trending down and MACD pinching. Managed markets hard to tell. $SPXL $SPXS $ES_F

$SPY is very difficult to trade short, it does however look like it is advantage bears short term while Stoch RSI is on its way down.

Live chart (locked for members) https://www.tradingview.com/chart/SPY/1AmCcPzX-SPY-on-a-short-term-looks-like-a-sell-with-Stoch-RSI-trending-d/

Trading $DXY #USD #Dollar KISS MACD Nets Decent Annual ROI $UUP

$DXY US Dollar Index Interesting on Daily with MACD turned up Stoch RSI trend up SQZ MOM trend up testing 20 MA. $UUP

Live chart (locked for members)

MACD on $VIX was dead for some time (red circle) but look! $UVXY $TVIX $XIV $VVX #volatility #swingtrading

$VIX Daily Stoch RSI trend up MACD crossed up and SQZMOM looks like it could turn up. $UVXY $TVIX $XIV $VVX

Live $VIX chart (locked for members) https://www.tradingview.com/chart/VIX/7tDjMwbB-VIX-Daily-Stoch-RSI-trend-up-MACD-crossed-up-and-SQZMOM-looks-l/

$VIX is not easy to trade. However, if it is extended it is a reliable short. Nevertheless, the MACD has come alive recently after being dormant for some time. You can also use Bollinger Bands quite successfully for shorting it – outside upper BB is almost always a quality short.

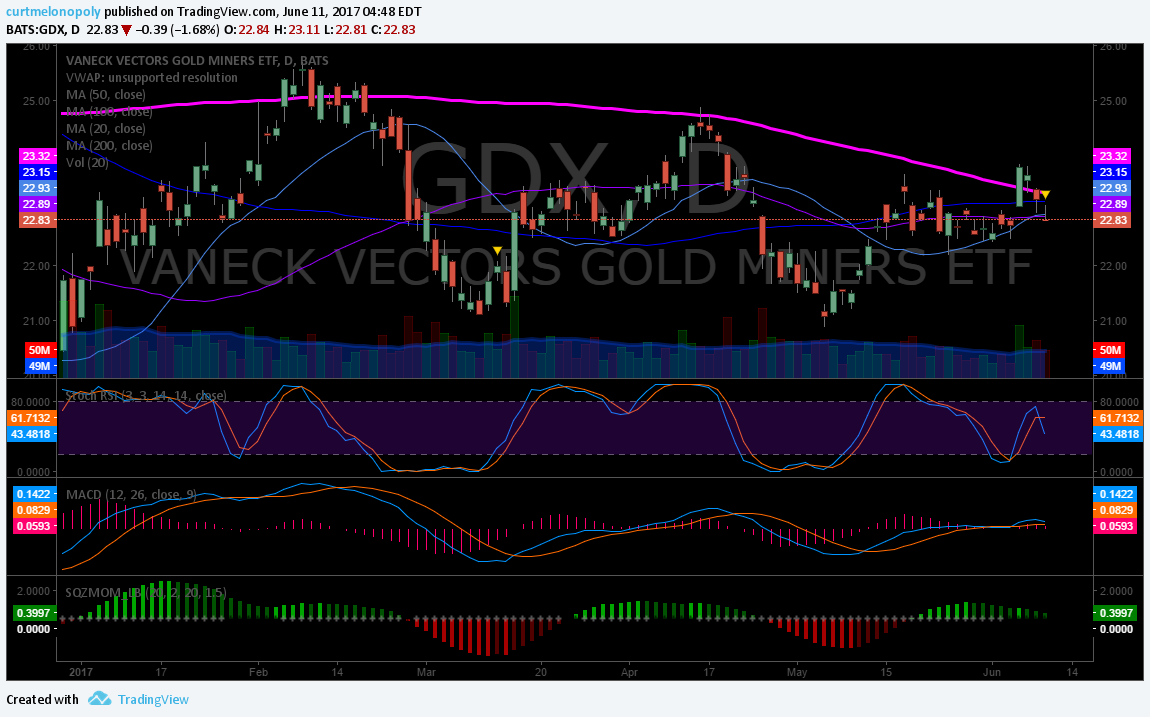

Trading $GDX #Gold Miners KISS Keep it Simple MACD Nets Decent Annual ROI $GDXJ $NUGT $DUST $JDST $JNUG #SwingTrading

$GDX Gold Miners on daily is in indecision with MACD and SQZMOM and moving averages. $GDXJ $NUGT $DUST $JDST $JNUG

$GDX Live Charting (locked for members) https://www.tradingview.com/chart/GDX/gRAeIT2y-GDX-Gold-Miners-on-daily-is-in-indecision-with-MACD-and-SQZMOM/

Thank you!

Best out there in the markets.

Follow us on Twitter

Article Topics; Compound Trading, Swing, Trading, Commodities, $SPY, $VIX, $USOIL $WTI, $GLD, $GDX, $SLV, $DXY, MACD, Charting, ROI, USD, Dollar, Volatility, Gold, Miner’s, Silver, Crude, Oil, S&P 500

Swing Trading Simple Chart Review (Public Edition) Mar 19 $SPY, $VIX, $USOIL $WTI, $GLD, $GDX, $SLV, $DXY

Good morning swing traders and welcome to the Compound Trading Swing Trading Keep It Simple K.I.S.S. Charting Review (Public Edition) for the week of March 19, 2017! This edition focuses on MACD, Stochastic RSI, Moving Averages and a few others.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Members please refer to the member publications for more detail.

Introduction:

My perspective of the markets can be summarized as go long when you can until it breaks (and I do believe there is a break on the horizon but it doesn’t do you any good to wait around for corrections).

Understanding what the simple indicators are for the entry and exit in your trading position in a swing trade is critical – proper entries and exits can not only increase your win rate but also significantly impact your personal investment portfolio return on investment, thus a critical discipline to at least become moderately familiar. The buy and hold concept has served investors moderately well for some time, but even so, they could have do so much better with very little time invested.

Click here also to review our most recent Swing Trading Quarterly Performance Report.

Thanking you in advance.

This Week’s Simple Charts include MACD, Moving Averages (MA), Stochastic RSI and a custom Squeeze Momentum Indicator for the US Dollar, Volatility, Gold, Miners, Silver, Crude Oil and the S&P 500. Daily charts with some 60 min perspectives.

Simple Charting $SPY MACD turned down (green buy, red sell), Stoch RSI Pinch, SQMOM turning down, under 20 MA. $SPXL $SPXS #SwingTrading

On the daily MACD says it’s on a sell but Stoch RSI on a buy. Wait for MACD to confirm.

Simple Charting $SPY 60 Min MACD turned down (green buy, red sell), Stoch RSI Pinch, SQMOM turned down, on 200 MA. $SPXL $SPXS #DayTrading

Hourly $SPY MACD is on sell, Stoch RSI looks confused and price is testing the 200 MA. #caution SQZMOM turned way down also.

Simple Charts $DXY MACD down (green buy, red sell), Stoch RSI down, SQMOM down, under 20 50 100 MA pinch. $UUP $USD #SwingTrading

Daily MACD on sell, Stoch RSI on sell, BUT the 50 MA is pinching 20 MA – wait for MACD to confirm long and price above MA’s.

Simple Charts $VIX MACD flat (green buy, red sell), Stoch RSI down, SQMOM flat, under 20 50 100 200 MA. $UVXY $TVIX $XIV

Daily says volatility is dead. Wait. Even the stochastic RSI is turned down.

Simple Charts $USOIL $WTIC Daily MACD down (green buy, red sell), Stoch RSI up, SQMOM down, on 200 MA. $CL_F $USO $SCO $UWT $DWT

Crude oil is back at the 200 MA on the daily – careful because it goes south of the 200 and springs sometimes – it catches shorts shorties. Wait for MACD to confirm. #patience

Simple Charts $USOIL $WTIC 60 Min MACD flat (green buy, red sell), Stoch RSI down, SQMOM flat, on 100 MA. $CL_F $USO $SCO $UWT $DWT

Even the hourly says wait. Lots of indecision. OPEC and company wouldn’t have anything to do with this I am sure.

Simple Charts #GOLD Daily MACD pinch (green buy, red sell), Stoch RSI up, SQMOM down, 100 50 MA cross. #SwingTrading $GLD $XAUUSD $GC_F

Indecision on the Gold daily with MACD pinch – so watch that close, but the stoch RSI is up and don’t forget about that bullish 100 50 MA cross. Let the MACD confirm on a swing to go long.

Simple Charts #GOLD 60 Min MACD down (green buy, red sell), Stoch RSI down, SQMOM green, above MA’s. #DayTrading $GLD $XAUUSD $GC_F

Hourly shows a little different picture, bulls are in it (price action) BUT they are not all in – the MACD and the Stoch RSI need to confirm.

Simple Charts #SILVER 60 Min MACD flat – up (green buy, red sell), Stoch RSI down, SQMOM green, 200 100 MA pinch. #DayTrading $SLV $USLV $DSLV

The Silver hourly is all about the 200 MA crossing the 100 MA – watch that close. Wait for MACD to confirm for good measure.

Simple Charts #SILVER Daily MACD down – up (green buy, red sell), Stoch RSI up, SQMOM red, below 20 50 200 MA. #SwingTrading $SLV $USLV $DSLV

Silver daily chart says MACD isn’t confirming yet, however, MACD is curling and Stoch RSI is turned up off the bottom. 50 MA could be an temporary glass ceiling also.

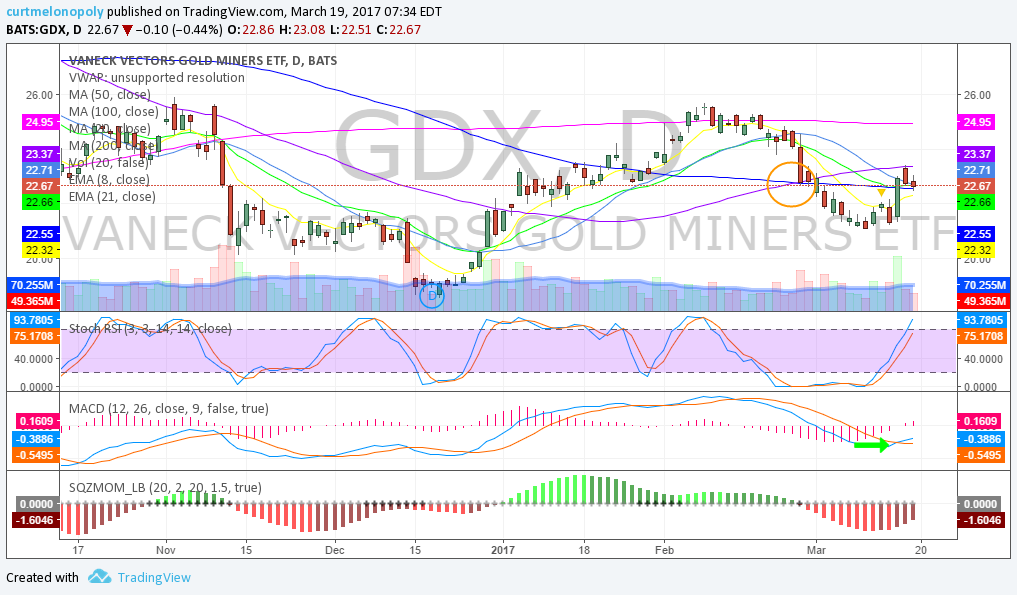

Simple Charts $GDX Miners Daily MACD up – up (green buy, red sell), Stoch RSI way up, SQMOM red – up, on 100 MA 20 MA test. #SwingTrading $GDXJ $NUGT $DUST $JNUG $JDST

Miner’s are always fun to review. They always front run – sometimes for the better and sometimes splat! Nonetheless the MACD on daily is turned up BUT the Stochastic RSI is revved – you may want to wait for that to cool before entering a swing.

Simple Charts $GDX Miners 60 Min MACD down (green buy, red sell), Stoch RSI up, SQMOM red, under 20 200 MA. #DayTrading $GDXJ $NUGT $DUST $JNUG $JDST

Miner’s on the 60 min actually show a MACD turned down – late week panic with the bulls? Weekend beer money maybe. I would go wider time-frame and allow the daily on $GDX to guide your way – wait for the simple indicators to all line up.

That’s my simple perspective for the week. Best to y’all this week.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

P.S.

The charts below may assist you in the endeavor of trade entry / exit and if you wish to become more serious (more profitable) with your entries refer to our swing trading for more insight (includes many equities also in the weekly reports).

The charting algorithm model Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Article Topics; Compound Trading, Swing, Trading, Stocks, Picks, $SPY, $VIX, $USOIL $WTI, $GLD, $GDX, $SLV, $DXY, MACD, Charting, ROI, USD, Dollar, Volatility, Gold, Miner’s, Silver, Crude, Oil, S&P 500, Stochastic, RSI, Moving Averages, MA, Commodities, Currencies

Swing Trading K.I.S.S. Chart Review (Public Edition) $SPY, $VIX, $USOIL $WTI, $GLD, $GDX, $SLV, $DXY

Good morning swing traders and welcome to the Compound Trading Swing Trading Keep It Simple K.I.S.S. MACD Charting Review (Public Edition) for the week of March 12, 2017!

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Members to our Swing Trading please refer to the member publications for more detail.

MACD Charting Annual ROI – US Dollar, Volatility, Gold, Miner’s, Silver, Crude Oil and the S&P 500.

$SPY S&P 500 KISS Keep it Simple MACD Cross Provides Winning Swing Trading Strategy $SPXL $SPXS $ES_F

$SPY S&P 500 KISS Keep it Simple MACD Cross Provides Winning Swing Trading Strategy $SPXL $SPXS $ES_F #swingtrading https://t.co/waVaTKz1f6 https://t.co/lKxEOQSTlW

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 12, 2017

Crude Oil Swing Trading KISS Keep it Simple MACD Wins FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/840802064515063808

Swing Trading $VIX KISS Keep it Simple MACD Provides Moderate Success $UVXY $TVIX $XIV $VXX

Swing Trading $VIX KISS Keep it Simple MACD Provides Only Moderate Success $UVXY $TVIX $XIV $VXX https://t.co/7QdKa5ZVhW #swingtrading https://t.co/5fWMo85ZYf

— Vexatious $VIX Algo (@VexatiousVIX) March 12, 2017

Swing Trading #Gold KISS Keep it Simple MACD Nets Decent Annual ROI $GLD $GC_F $NUGT $DUST $JDST $JNUG

Swing Trading #Gold KISS Keep it Simple MACD Nets Decent Annual ROI $GLD $GC_F $NUGT $DUST $JDST $JNUG #SwingTrading https://t.co/0otOU37O2i https://t.co/MZaPmnx646

— Rosie the Gold Algo (@ROSIEtheAlgo) March 12, 2017

Swing Trading $GDX #Gold Miners KISS Keep it Simple MACD Nets Decent Annual ROI. $GDXJ $NUGT $DUST $JDST $JNUG

Swing Trading $GDX #Gold Miners KISS MACD Nets Decent Annual ROI. $GDXJ $NUGT $DUST $JDST $JNUG #SwingTrading https://t.co/zTx3rLswIf https://t.co/GDgjgxgeYP

— Rosie the Gold Algo (@ROSIEtheAlgo) March 12, 2017

Swing Trading #Silver KISS Keep it Simple MACD Nets Decent Annual ROI $SLV $USLV $DSLV

Swing Trading #Silver KISS Keep it Simple MACD Nets Decent Annual ROI $SLV $USLV $DSLV #SwingTrading https://t.co/SSMkIDV5LE

— Supernova Silver (@SuperNovaAlgo) March 12, 2017

Swing Trading $DXY #USD #Dollar KISS Keep it Simple MACD Nets Decent Annual ROI – Note current status. $UUP

Swing Trading $DXY #USD #Dollar Keep it Simple MACD Nets Decent Annual ROI – Note current status. $UUP #SwingTrading https://t.co/DEzgoAOuA2 https://t.co/nnVGPW4ue7

— $DXY US Dollar Algo (@dxyusd_index) March 12, 2017

All in all the MACD used for swing trading is profitable – more or less so depending what you are trading. Your ROI will also obviously be affected by your ability to trade with conviction and discipline.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $SPY, $VIX, $USOIL $WTI, $GLD, $GDX, $SLV, $DXY, MACD, Charting, ROI, USD, Dollar, Volatility, Gold, Miner’s, Silver, Crude, Oil, S&P 500