Below You Will Find Proprietary Oil Trading Signals Not Available Elsewhere.

When Crude Oil Starts Selling Off Intra-Day Volatility Increases Fast. Knowing Where and Having the Signals for Support and Resistance On The One Minute Chart Will Help Your Trading Strategy.

If you day-trade crude oil futures contracts (or if you are learning how to day trade crude oil) the chart models and signals below will help you understand the structure of trade on intra-day charting (like using a GPS or a map).

The trade signals provided below will increase your trading win rate and ROI on each trade (as you learn to trade the set-ups or strategies).

We can also help you with confirming that the trend is actually bearish (selling in downtrend) and when price is likely to reverse intra-day and oil trade is likely to turn bullish.

This is part one of a two part post (part one is public and part two is premium member only).

How Oil Sells Off Intra-day on Stairs to Support Floors Down.

The structure of oil sell-offs is not the same as when oil trades up. When crude oil trade is bearish intra-day you will find that it has specific areas of support / floors (this is also true when price is bullish but the structure or steps of trade are different).

When oil is trading down the price will often quickly drop to the next support and will then hang around for sometime and possibly test resistance areas for a possible reversal. When the reversal doesn’t happen or work then price drops quickly to the next floor of support.

The price of oil drops quickly to support and then the bulls will try and trade price back up (along with a certain amount of the shorts covering short positions) for a snap back or price reversal trade. At each support you will find this process occurring.

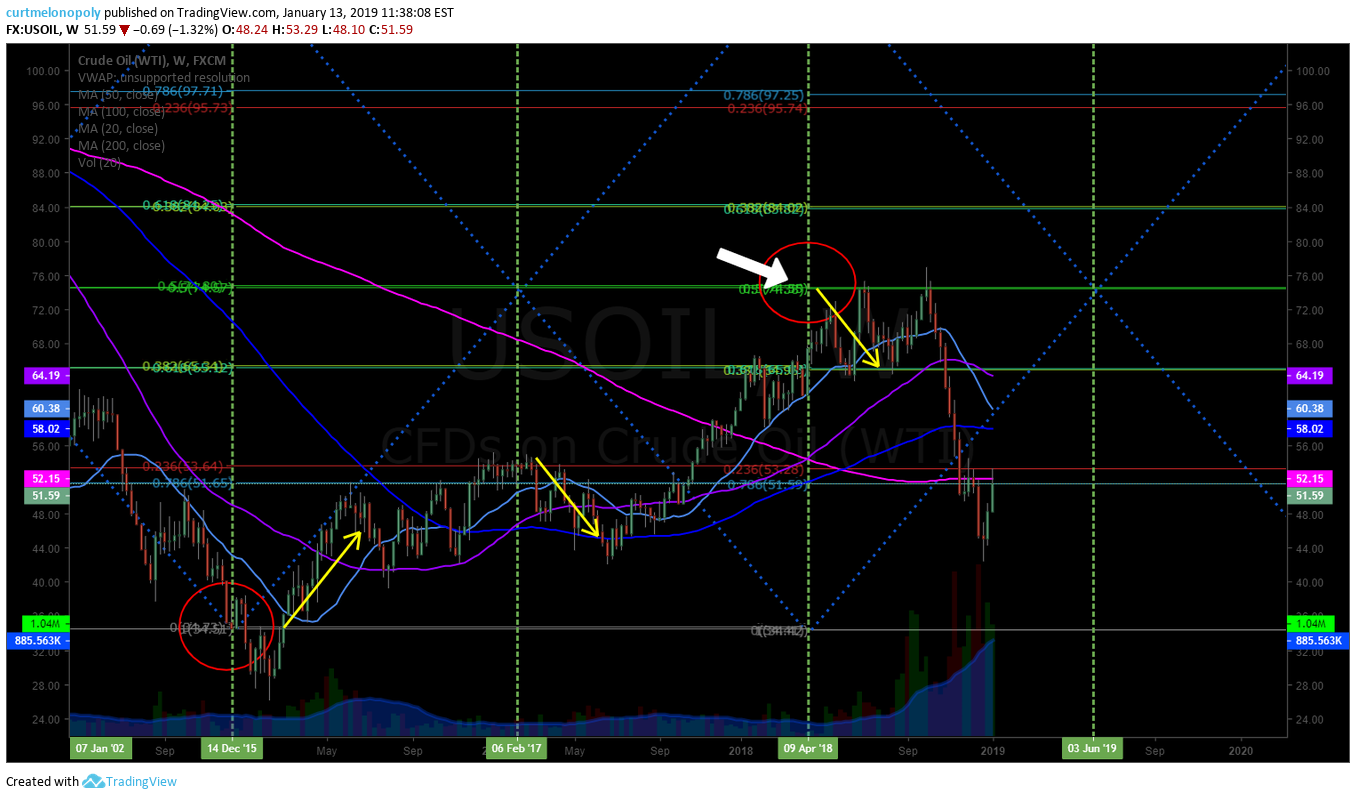

The more support there is on the charting (on various chart time-frames) the more likely a snap-back trade will occur (price reverses intra-day). This is why we have algorithmic models and conventional charting for all time frames that we use in the oil trading room, in member reporting and coded in to our machine trading software.

The goal is to know where each support and resistance point is on the charting so that you can develop a trading strategy for intra day moves in oil price.

When you know where the support and resistance is you can then day trade the price of oil with more perspective or clarity.

Before you can learn how to trade a financial instrument (such as crude oil futures contracts) it is important to know the structure of the instrument (as it applies to the charting on various time-frames).

Once you know the structure (the playing field or like I refer to it as a GPS or map) then you need to learn how to trade that specific structure (this is where your personal trading style and strategies come in to play).

Knowing where support and resistance is on the charting allows you to set stops properly, it also helps you with sizing the number of contracts you are trading (trimming and adding to your trade size) and more.

There are two reasons we know the chart structure in the trade of oil (every financial instrument has a structure – like your DNA or the rings on a tree).

One reason is that we construct algorithmic charting models and the other is that we are coding for machine trade of oil. Both reasons require us to back test our charting. It isn’t enough to chart conventional trend-lines (or whatever it is you are charting) and it isn’t enough to design an algorithmic chart model – the assumptions for consideration in trade, such as support and resistances areas, need to be back tested so that you have a quantifiable high probability of success.

You need to know that your assumptions provide highly probable set-ups (trade signals) to provide you a trading edge.

When we chart for the purpose of trading signals we first start with conventional charting (on all time frames) and then move to charting algorithmic models of highly probable areas of support and resistance of trade (visual representation of important structure points of the charting) and then we move to coding what we know to be most probable areas of support and resistance in trade. I should note for completeness that our models provide much more than support and resistance, there are other important trade signals such as time cycles, the structure of trade itself on various time-frames and much more.

We use the charting for crude oil on thirteen different time-frames (1 minute charting through to monthly charting), we chart it on conventional charts, work with algorithmic modelling and back test all the various indicators for up to 60 months (such as moving averages, VWAP, MACD, stochastic RSI and more).

When we back test our assumptions we are calculating the probability of that structure in trade re-occurring. When we find a structure with high probability of repeating then we model that structure and code it to our machine trade software.

In this specific area of day-trading (intra-day sell-offs and reversals) we can help you with what structure is in play on the one minute chart as oil sells off and what to watch for so that you know the sell-off is likely done and the price trend is about to change and turn bullish for price reversal.

Support And Resistance On The One Minute Oil Chart in Sell-Offs.

Specific to crude oil, sell-off support and resistance on the charting is VERY PREDICTABLE. You will find that the areas of support are very precise and price will step down in a very structured way on the chart – this is a near exact science.

Why is the trade of oil so precise on the one minute chart when oil sells off? The answer is very likely because the trade of oil is now mostly done by software programmed / coded for machine trade and this machine trade liquidity has caused very specific structures of trade to manifest.

Lets Look at Some Recent Crude Oil Trade From our Oil Trading Room.

Below is a screen shot from our oil trade chat room on Discord (which is not the same as the live broadcast oil trading room) of a comment and a chart of intra day trade in crude oil (this was posted at 1:03 PM last Thursday).

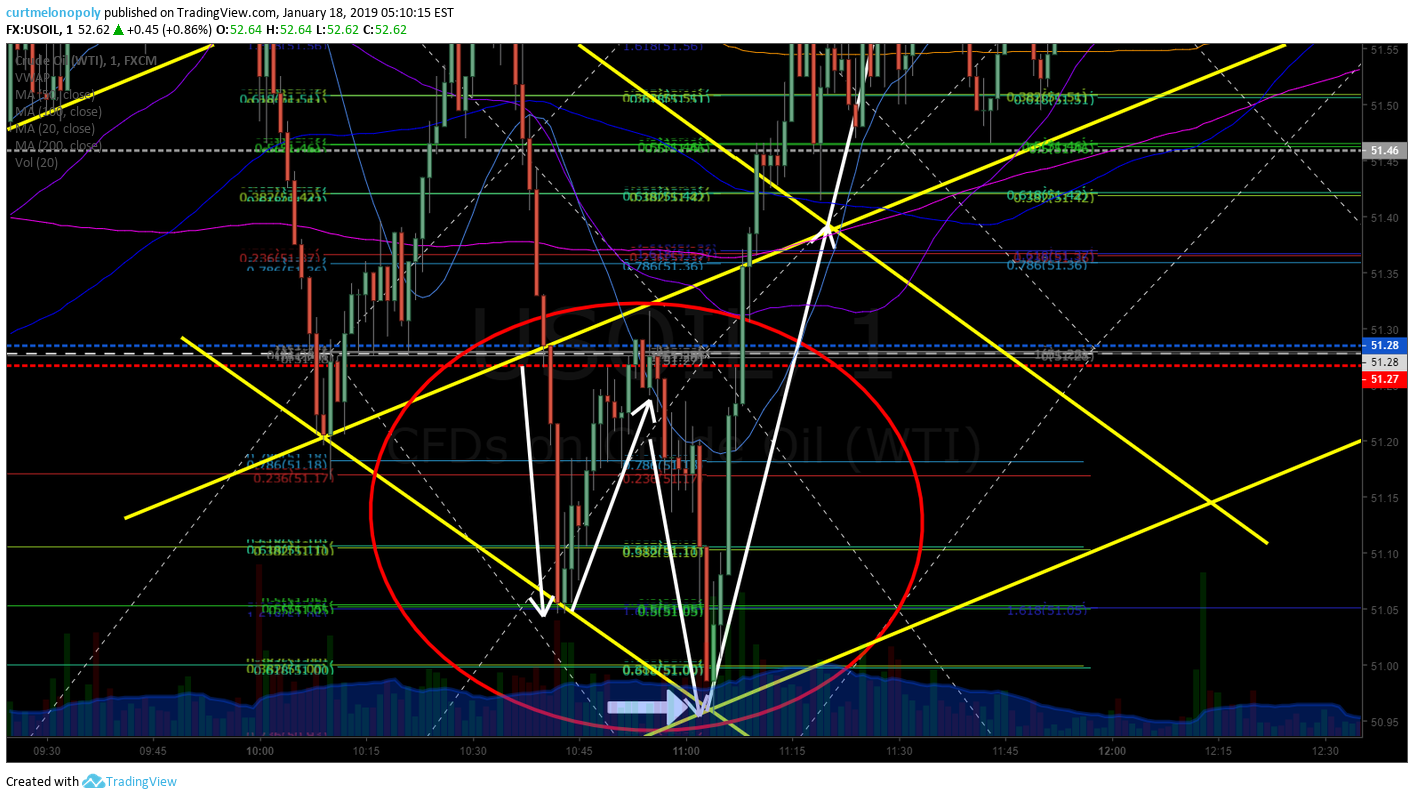

My comment in the trading room reads “perfect structured sell down out of support in to next buy trigger”. What this means is that crude oil sold off intra day, it lost its area of support (the yellow diagonal trend line on the one minute chart model) and then dropped perfectly to the next support decision line on the chart (yellow line again) and then price bounced to test resistance.

By the way, the crude oil trade alerts are both what you see below (the Discord private server screen images below) and alerted on a private member Twitter feed.

This structure (you see below) occurred over and over again daily this week during sell-offs. This is a very predictable structure for knowing where to short oil intra-day, where to trim (cover) size of your short position and where to possibly find support for a reversal trade in your intra-day trading strategy.

Click here for an article that explains what short selling is.

This is by far one of the most predictable signals available for day-trading crude oil you will find. It has one of the highest probabilities of success in oil trade model charting.

The key to success however is learning what the structure is (having the model at your disposal for when you trade) so that you can size your trades properly and set stop orders properly etc – learning how to use the signals for your strategy and knowing when trade is likely to stop selling off so that you can then begin planning for a trend reversal.

This is a very predictable structure for knowing where to short oil intra-day, where to trim (cover) size of your short position and where to possibly find support for a reversal trade in your intra-day trading strategy.

And then in the screen shot below from the oil trading room you will see on the next chart posted to the room that oil started to bounce (or trade up) from the support (or buy trigger signal) on the chart. I then asked our software developer Jeremy to note that the software did not trigger a long trade for our coding updates to be done later that night.

Look close at his answer / comment to my request, he knew why the software did not signal a trigger for a long trade (and also why there was no trade alert as such on our member feed to buy)… it was because the order flow program (our proprietary IDENT software) knew that the machine liquidity in the markets was not buying that support and that they were going to sell it off again.

the order flow program (our proprietary IDENT software) knew that the machine liquidity in the markets was not buying that support and that they were going to sell it off again.

And sure enough, if you look at the next image below you see that they sold oil off again shorting it down to the next step in the sequence to the next support on the chart structure (next yellow line down representing next support in a sell off). Again, it was precise trade action.

they sold oil off again shorting it down to the next step in the sequence to the next support on the chart structure

Then you will notice that I alerted the oil trading room (at 1:12 PM Thursday) that the bulls are starting to buy at each support area of the one minute chart (in other words, be aware that a price reversal in intra-day trade could occur soon).

There were buy programs and/or day-traders starting to buy at supports that are not support areas for a continued sell-off, they are areas of support for either indecision (or a decision is needed) or support for trading bullish (or in an uptrend).

This is key – the fact that buys were coming in at bullish support areas or decision areas on the model (this is an early sign or signal of an imminent reversal). These lines are at the white diagonal (signals a decision area of charting) and the blue diagonal (signals bullish support) on the chart model.

Oil was trading at 57.44 on FX USOIL WTI at the time.

This is key – the fact that buys were coming in at bullish support areas or decision areas on the model (this is an early sign or signal of an imminent reversal).

And then next trade in crude oil reversed with a bounce and was threatening a confirmation signal for trend reversal. I was explaining to our day traders in the room at the time (this screen shot is taken on the weekend so you don’t see who was in the oil trade room at the time in the image) what to watch for in intra-day trade action for a confirmation of trend reversal. In this example I highlighted an area of the chart model where machines are programmed for a price target.

In this example I highlighted an area of the chart model where machines are programmed for a price target.

And then in this image (screen shot from oil trading room) you see that trade hit the price target and got through resistance confirming more that the low of day in trade had been put in and that we were now alerting bias to uptrend trading signals going forward for oil trade on the day.

Note the low of day was in fact 57.33 and I has alerted at 57.44 that the bulls were starting to step in (during the extreme sell-off) at key bullish areas of the algorithm chart model – this is machine trade. Knowing what the large liquidity in machine trade is doing is key now when day trading crude oil. This is very important.

Note the low of day was in fact 57.33 and I has alerted at 57.44 that the bulls were starting to step in (during the extreme sell-off) at key bullish areas of the algorithm chart model.

Looking at the chart below you can see very clearly how precise the day trading signals are on the daytrading algorithmic crude oil model.

- The green arrows show three shorting opportunities from yellow diagonal support / resistance to the next yellow diagonal support / resistance (like stairs stepping trade down in the model).

- You will notice that the last stair down that trade over shot the yellow line a bit, this is a signal that an intra-day bottom is being put in.

- You can also notice (from the charts shown above) that as buying came in at the decision support / resistance lines (white diagonal lines on chart model) and at the blue decision diagonal support / resistance lines that I alerted a possible trend reversal in trade.

- Then you will notice (see chart below) that trade got through the yellow resistance after bouncing (yellow arrow on chart) – this is a bullish intra-day signal that a reversal is likely near.

- And then next in trade you will see that trade bounced at the blue diagonal trend-line (blue arrow) when it pulled back from resistance, a bounce at a blue line is further confirmation that trade is now bullish intra-day. The blue lines are used as support and resistance in an intra-day uptrend.

- And then the subsequent blue arrows on the chart show how trade breached in to the next bullish area, then pulled back and used the blue line as support (after confirming up after hitting a decision white line) for a bounce and then so on through the bullish trade reversal in the daytrading sequence.

- Blue is for trading in uptrend, yellow is trading a sell off, white is a reference point for a decision to go up or down in trend on the model.

- The trend-lines on this algorithm model are not conventional. The trend-lines are algorithmic calculations and therefore proprietary and not available elsewhere.

How powerful is that for an oil daytrader?

Knowing exactly where the support and resistance is during a sell-off and knowing with high probability where the turn is likely to happen for reversal in trade and then knowing exactly where to trade the uptrend.

Below is the video explanation that accompanies this post (live oil trading room footage included).

In part two (the premium member post) we will take a deeper look at strategies for trading the one minute model (such as trade sizing and seeing the reversals in advance) and I will provide chart links to the proprietary algorithmic models via email to our members.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Updates Distributed Weekly).

Real-Time Oil Trading Alerts (Oil Trade Alerts via Private Twitter Feed and Discord Private Chat Room).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (Weekly Newsletter, Trading Broadcast Room, Chat Room, Real-Time Trade Alerts).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trade Alerts, Trading, Oil Trading Room, Strategy, Signals, Shorting, Support, Resistance, Reversals, USOIL, WTI, CL_F, USO

Follow: