Tag: DXY

PreMarket Trading Report Wed Dec 19: EIA, FOMC, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday December 19, 2018.

In this premarket trading edition: EIA, FOMC, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading. - Lead Trader Premarket Note:

- Dec 19 – The Trading View data issue overnight slowed us down, however, reports will be approved and emailed out as soon as intermittent issues resolve (most are resolved it seems now, but some are not at time of writing). Also, all work in progress from 2018 is scheduled to be complete before Jan 1 so we will be quieter than usual with a final push to complete. Caution in to the time cycle peak and step on accelerator on the way out the other side.

- Dec 18 – We are updating all algorithm models and swing trade reporting. All will be distributed before start of new time cycle Friday. On other side of time cycle peak the reporting will be intense as the trends develop post time cycle peak. The associated private discord server and alert feeds will be more active as a result also. We nailed the time cycles before the election, post election and in to this peak we backed off considerably, out the other side of this peak we will be extremely active for 6 months.

- Dec 17 – This Friday is the time cycle peak in global markets. That makes this week and next the inflection. Member / client reporting over next two weeks will be intense. I will be in trading room most days over next 6 months. Public sharing of calls in this massive cycle next will be minimal. We’re locking down for the cycle. Explained on my Twitter account tonight. My goal is to back off front lines to back office when time cycle complete. Massive time cycle next and we intend to hit it. Hope y’all bank.

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December/ January for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- 3 day Cabarete trading boot camp to be announced for early Feb 2019.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Wednesday Dec 19 –

Still holding DGAZ (Natgas short) and will add to it if oil gets a leg up post EIA and FOMC.

Still holding the others per recent reports.

Time cycle completing and with FOMC and EIA today it makes sense.

Some of our favorite daytrading and swing trading equities are bullish premarket so that is a good sign and many market leaders have a jump in their step this morning, FB is an exception – it isn’t looking great at time of writing.

Machine trade in oil yesterday worked, small but it worked fine. Per dms, the reason it didn’t trade in to 230 EST when it was an obvious trade after giving guidance of price pressure in to the close is that the software is programmed not to trade between 210 – 230 EST in to close with oil. Same with post close until futures open, right before regular market open and around EIA or other special events. We will shorten this duration next updates and have a goal to completely eliminate the black out period for events and low volume periods – will advise.

Patience, we’re almost done this cycle.

Per Recent:

Tuesday Dec 18 –

DO NOT MISS the lead trader premarket note at start of this report.

I am watching GS, MCD, SBUX and SPY today, as well as Oil and obviously VIX with the two day Fed meetings. The other watches are in recent lists in premarket (equities etc). Also, Trump after Googl, FB, and TWTR again – watch your long bias.

If oil doesn’t regain yesterday’s price drop I will close my DGAZ long position soon.

Everything in recent reports remains in to time cycle peak. Use extreme caution.

We’re close to the other side of this cycle now. Lots of reporting on deck.

In to and out of this massive time cycle peak $STUDY and you’ll never regret it. Forget trading for a week.

Monday Dec 17 –

Global markets are calmer. Out of the VIX short trade last week but still in the others.

Equities on watch listed below all remain on my list.

Dec 13 – Markets are mixed (not surprising considering time cycle completion on 20 th ish). Extreme caution between here and 20th ish.

Current Trades:

Looking for a pull back on DGAZ to size next leg above starter.

Holding VIX starter short in TVIX – HIGH RISK TRADE, extreme caution. Likely reverse bias after Dec 20 ish.

Holding SPY long starter. Likely reverse to short after Dec 20 ish.

Holding DWT short starter (however, it looks like oil may take another leg down here, it will either hold here or down another floor). Will size in next leg after a pull back in oil.

Holding ARWR swing starter long (missed my next leg size).

Looking for a possible BTC long swing other side of Dec 20 ish.

Looking for a possible Silver and Gold long other side of Dec 20 ish.

Looking for a possible DXY short other side of Dec 20 ish.

Expect next 6 months to be trading career huge. Massive range. Equity swings will increase as we come out of this time cycle peak – it will be a stock pickers year in 2019 with technical analysis rooting the trade action. My goal is to retire off front lines in 6 months (still here, but off the front lines), to do that my personal trading and machine trading has to be massive to win side.

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. W

I will be in trading room for open, mid day and at other times when we are trading.

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas.

Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

Market Observation:

Markets as of 8:03 AM: US Dollar $DXY trading 96.98, Oil FX $USOIL ($WTI) trading 46.53, Gold $GLD trading 1247.43, Silver $SLV trading 14.64, $SPY 255.98 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3826.00 and $VIX trading 25.2.

Momentum Stocks / Gaps to Watch:

$WGO $DPW $AVGR $JBL $RIOT $AXON $ZIOP $RCII $TLRY $GSK $DGAZ $GOL $NGG $HMY $HIIQ $GUSH $RACE $APHA $GE

22 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12873168 $WGO $JBL $ZIOP $RCII $GSK $TLRY $ACB $MU $SRNE $FDX $EVFM

News:

$FDX $UPS – FedEx’s ‘jarring’ guidance cut

Rent-A-Center’s stock surges after B. Riley says termination of Vintage merger is ‘invalid’

$KRYS Completes Dosing in the GEM-Phase 2 Study in Pediatric Patients for the Treatment of Dystrophic Epidermolysis Bullosa. Topline Data 1H’19

$SVRA Announces Interim Results for OPTIMA Clinical Study of Molgradex for the Treatment of NTM

$EIGR Announces Breakthrough Therapy Designation For Lonafarnib In Progeria And Progeroid Laminopathies

Criminal justice bill puts prison stocks on watch

https://seekingalpha.com/news/3418068-criminal-justice-bill-puts-prison-stocks-watch

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

Cannabis company Aleafia to buy Emblem for 27% premium, in a C$173.2 million deal

Rent-A-Center’s stock surges after B. Riley says termination of Vintage merger is ‘invalid’

GE’s stock surges after report of IPO plans for health-care business #swingtrading #premarket #IPO

GE's stock surges after report of IPO plans for health-care business #swingtrading #premarket #IPO https://t.co/fD4Ab95gGP

— Swing Trading (@swingtrading_ct) December 19, 2018

DPW to pursue IPO of its technology and defense businesses

Olive Garden parent Darden Restaurants tops profit and same-store sales expectations

$AME – AMETEK completes private placement offering

$CGIX terminates merger

Earnings:

Micron downgraded to hold at Needham after earnings

Winnebago’s stock soars after profit and revenue rise above expectations

#earnings for the week

$MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST

#earnings for the week $MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST https://t.co/r57QUKKDXL https://t.co/VUgTdva6Tj

— Melonopoly (@curtmelonopoly) December 17, 2018

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

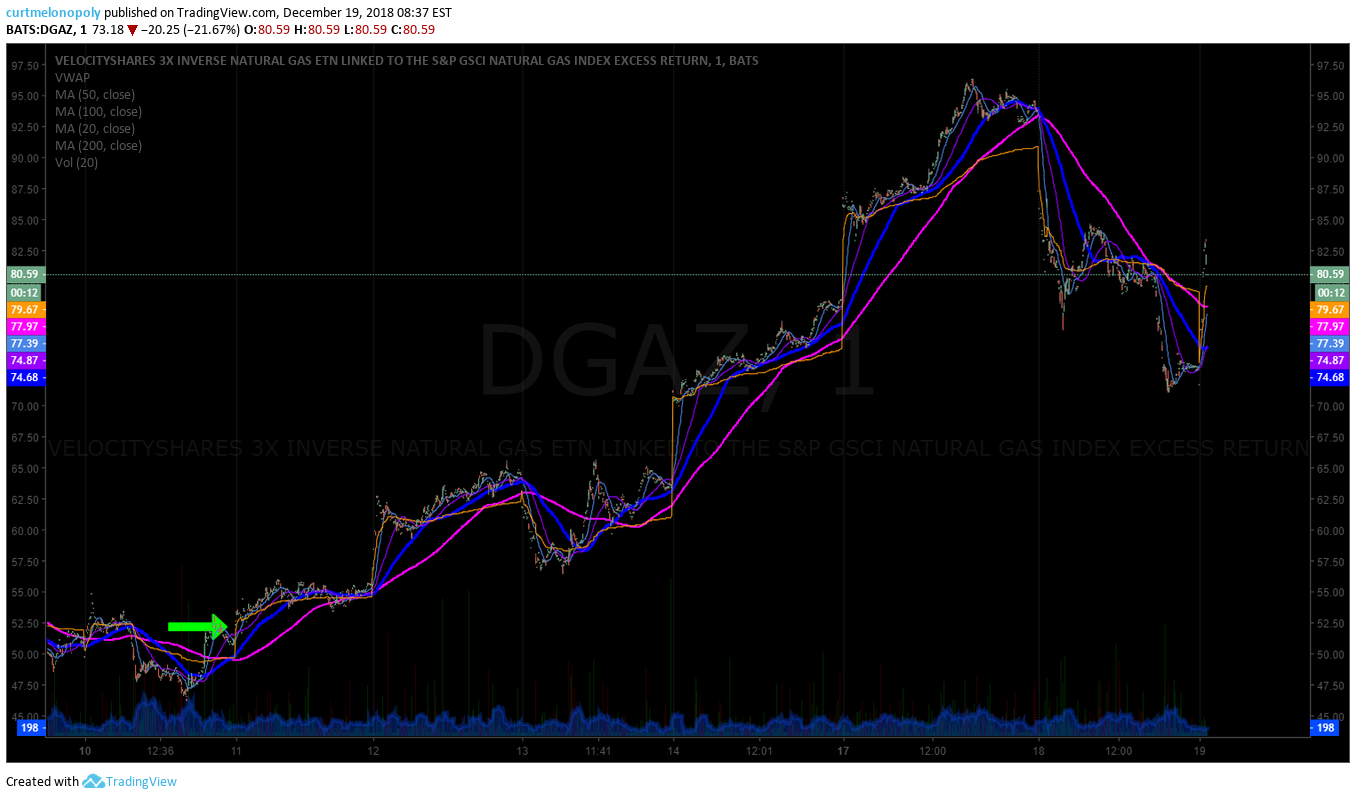

Short Natural Gas trade in DGAZ – looking for add today post EIA if oil jumps. #NaturalGas #trading #alerts

Lost a personal oil trade yesterday and late last week. Machine trading in oil doing well (t will outperform my returns now) so I will let our software handle the oil trading for now on. I’ll still trade oil but only based on machine trading alert signals.

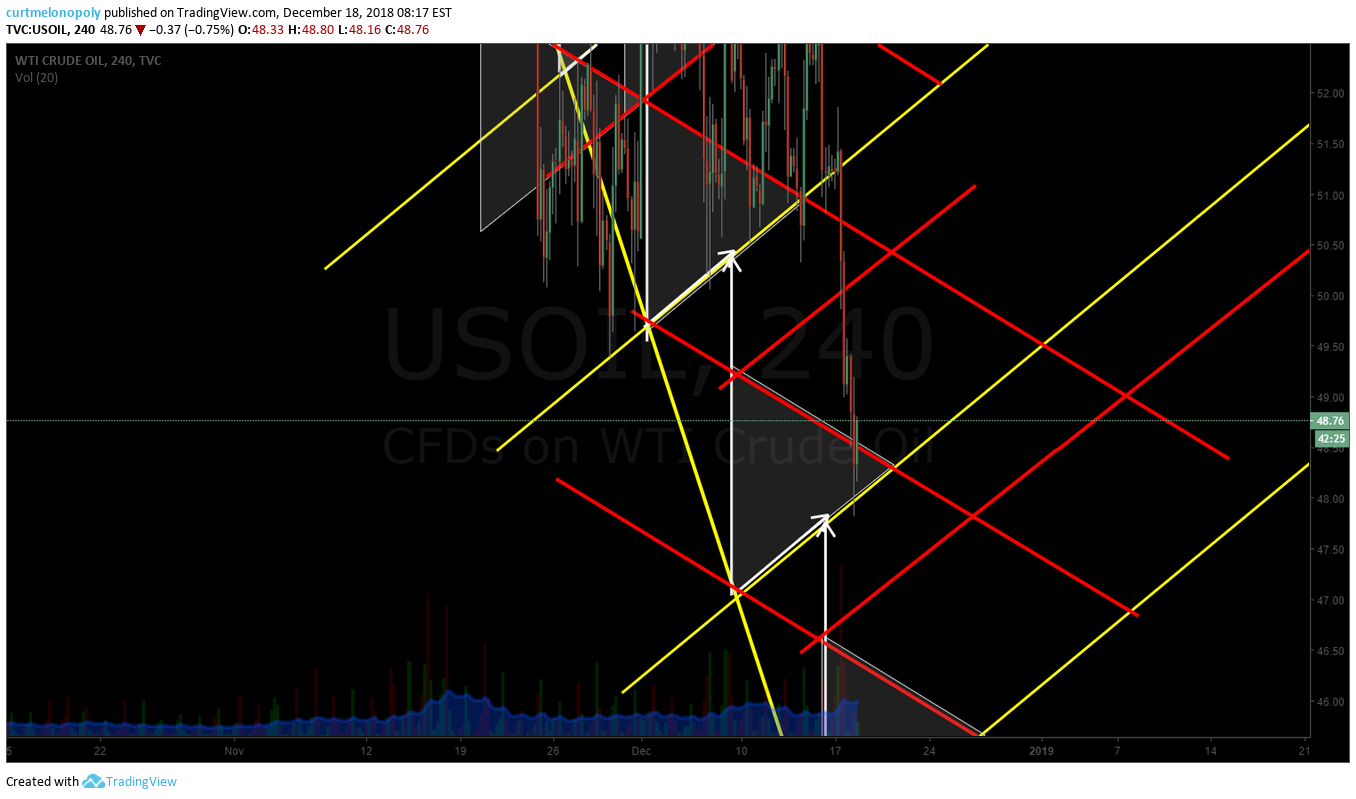

This simple structure our coders are using to code support resistance sizing remains in play #Oil #trading

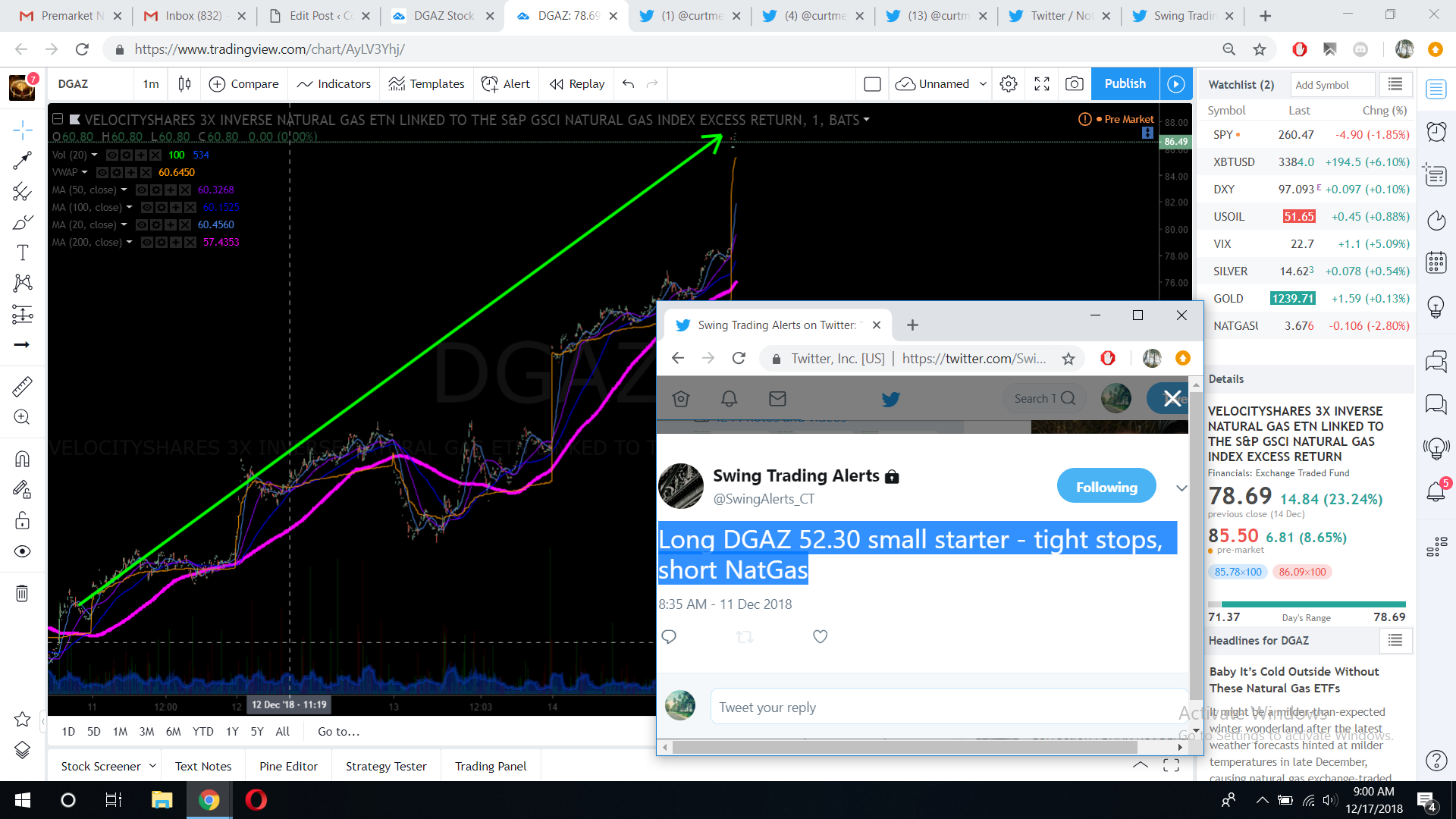

The $DGAZ trade. Short Natural Gas. #natgas $UGAZ $UNG

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

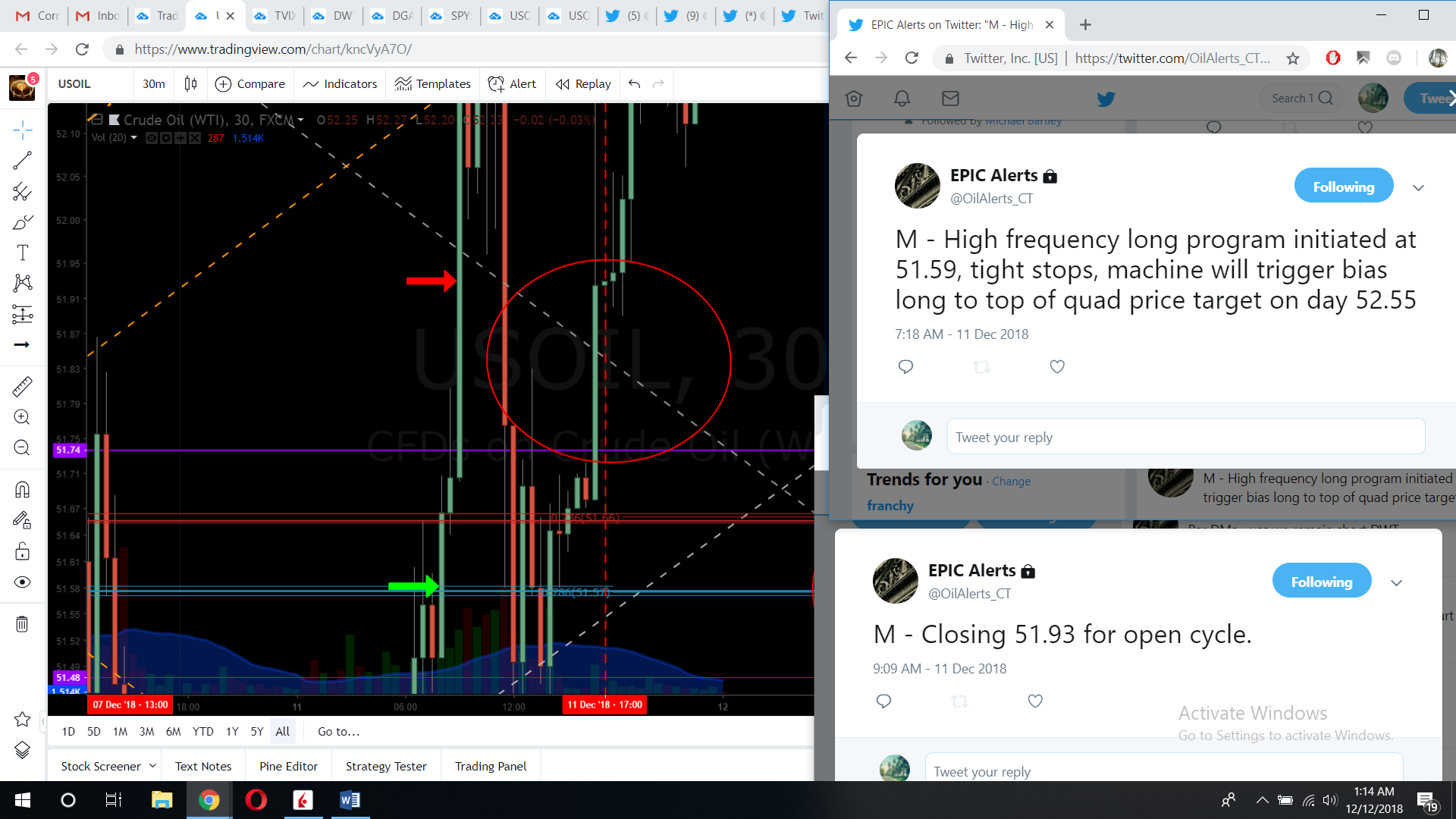

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

Futures Rise Ahead Of Fed; Europe Jumps On Italy Budget Deal

Futures Rise Ahead Of Fed; Europe Jumps On Italy Budget Deal https://t.co/8LFdHzKBDn

— zerohedge (@zerohedge) December 19, 2018

A ‘dirty’ rally is taking shape as the stock market is heavily oversold https://on.mktw.net/2Locu1C

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $WGO $DPW $AVGR $JBL $RIOT $AXON $ZIOP $RCII $TLRY $GSK $DGAZ $GOL $NGG $HMY $HIIQ $GUSH $RACE $APHA $GE

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$ULTA – Citi says Buy to Ulta

JPMorgan Upgrades Medtronic, Inc. $MDT to Overweight

(6) Recent Downgrades:

Antero Resources $AR PT Lowered to $20 at TD Securities

Schlumberger: Credit Suisse Cuts To Neutral From Outperform $SLB

-Cuts PT To $44 From $65

NCS Multistage Holdings $NCSM PT Lowered to $8 at Credit Suisse

Credit Suisse Downgrades Kinross Gold $KGC to Underperform

Bristow Group $BRS PT Lowered to $3.50 at Credit Suisse

Credit Suisse Downgrades Superior Energy Services $SPN to Neutral

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading,Time Cycles,

PreMarket Trading Report Tues Dec 18: Fed, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday December 18, 2018.

In this premarket trading edition: GS, SBUX, FB, GOOGL, TWTR, Analysts, Fed, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading. - Lead Trader Premarket Note:

- Dec 18 – We are updating all algorithm models and swing trade reporting. All will be distributed before start of new time cycle Friday. On other side of time cycle peak the reporting will be intense as the trends develop post time cycle peak. The associated private discord server and alert feeds will be more active as a result also. We nailed the time cycles before the election, post election and in to this peak we backed off considerably, out the other side of this peak we will be extremely active for 6 months.

- Dec 17 – This Friday is the time cycle peak in global markets. That makes this week and next the inflection. Member / client reporting over next two weeks will be intense. I will be in trading room most days over next 6 months. Public sharing of calls in this massive cycle next will be minimal. We’re locking down for the cycle. Explained on my Twitter account tonight. My goal is to back off front lines to back office when time cycle complete. Massive time cycle next and we intend to hit it. Hope y’all bank.

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December/ January for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- 3 day Cabarete trading boot camp to be announced for early Feb 2019.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Tuesday Dec 18 –

DO NOT MISS the lead trader premarket note at start of this report.

I am watching GS, MCD, SBUX and SPY today, as well as Oil and obviously VIX with the two day Fed meetings. The other watches are in recent lists in premarket (equities etc). Also, Trump after Googl, FB, and TWTR again – watch your long bias.

If oil doesn’t regain yesterday’s price drop I will close my DGAZ long position soon.

Everything in recent reports remains in to time cycle peak. Use extreme caution.

We’re close to the other side of this cycle now. Lots of reporting on deck.

In to and out of this massive time cycle peak $STUDY and you’ll never regret it. Forget trading for a week.

In to and out of this massive time cycle peak $STUDY and you'll never regret it. Forget trading for a week.

— Melonopoly (@curtmelonopoly) December 18, 2018

Per Recent:

Monday Dec 17 –

Global markets are calmer. Out of the VIX short trade last week but still in the others.

Equities on watch listed below all remain on my list.

Dec 13 – Markets are mixed (not surprising considering time cycle completion on 20 th ish). Extreme caution between here and 20th ish.

Current Trades:

Looking for a pull back on DGAZ to size next leg above starter.

Holding VIX starter short in TVIX – HIGH RISK TRADE, extreme caution. Likely reverse bias after Dec 20 ish.

Holding SPY long starter. Likely reverse to short after Dec 20 ish.

Holding DWT short starter (however, it looks like oil may take another leg down here, it will either hold here or down another floor). Will size in next leg after a pull back in oil.

Holding ARWR swing starter long (missed my next leg size).

Looking for a possible BTC long swing other side of Dec 20 ish.

Looking for a possible Silver and Gold long other side of Dec 20 ish.

Looking for a possible DXY short other side of Dec 20 ish.

Expect next 6 months to be trading career huge. Massive range. Equity swings will increase as we come out of this time cycle peak – it will be a stock pickers year in 2019 with technical analysis rooting the trade action. My goal is to retire off front lines in 6 months (still here, but off the front lines), to do that my personal trading and machine trading has to be massive to win side.

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. W

I will be in trading room for open, mid day and at other times when we are trading.

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas.

Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

Market Observation:

Markets as of 6:51 AM: US Dollar $DXY trading 97.12, Oil FX $USOIL ($WTI) trading 48.41, Gold $GLD trading 1249.43, Silver $SLV trading 14.67, $SPY 256.71 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3472.00 and $VIX trading 24.2.

Momentum Stocks / Gaps to Watch: $MRIN

$MRIN (+54.7% pre) Marin Software’s stock rockets 60% on Google revenue pact – MW

News:

$EIGR Announces PRIME Designation Granted by EMA for Lonafarnib for Treatment of Hepatitis Delta Virus Infection

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

DPW to pursue IPO of its technology and defense businesses

Olive Garden parent Darden Restaurants tops profit and same-store sales expectations

$AME – AMETEK completes private placement offering

$CGIX terminates merger

Earnings:

Navistar beats profit and revenue expectations, provides upbeat outlook

#earnings for the week

$MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST

#earnings for the week $MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST https://t.co/r57QUKKDXL https://t.co/VUgTdva6Tj

— Melonopoly (@curtmelonopoly) December 17, 2018

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

Lost a personal oil trade yesterday and late last week. Machine trading in oil doing well (t will outperform my returns now) so I will let our software handle the oil trading for now on. I’ll still trade oil but only based on machine trading alert signals.

This simple structure our coders are using to code support resistance sizing remains in play #Oil #trading

The $DGAZ trade. Short Natural Gas. #natgas $UGAZ $UNG

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Stock slump continues

-Oil plunges

-Xi stands his ground

-Fed meeting begins

-EU plays hardball on Brexit

https://bloom.bg/2S8FvBh

Facebook, Twitter and Google are so biased toward the Dems it is ridiculous! Twitter, in fact, has made it much more difficult for people to join @realDonaldTrump. They have removed many names & greatly slowed the level and speed of increase. They have acknowledged-done NOTHING!

Facebook, Twitter and Google are so biased toward the Dems it is ridiculous! Twitter, in fact, has made it much more difficult for people to join @realDonaldTrump. They have removed many names & greatly slowed the level and speed of increase. They have acknowledged-done NOTHING!

— Donald J. Trump (@realDonaldTrump) December 18, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MRIN $AETI $BIOC $UGAZ $ACHV $NAV $ACHN $SPRX $ACRX $ORCL $CRH $STM $SBGL $UNG $TLRY

(2) Pre-market Decliners Watch-List : $DGAZ $RCII $TVIX $UVXY $UWT $SQQQ $VXX $SPXU $SPXS $UCO $QID $SHPG $PM

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Desjardins Upgrades Shaw Communications (SJR/B:CN) $SJRWF to Buy

$TTWO – Buckingham starts Take-Two at Buy

$GILD initiated at Buy at Guggenheim. PT $86

$ORCL Raised @ RBC to $55.00 PT after Earnings

$AMD Reiterated Outperform @ RBC PT $34.00 Joins Nasdaq 100 on Dec 24th

(6) Recent Downgrades:

Inter Piperline Ltd. (IPL:CN) PT Lowered to Cdn$25 at Desjardins

H.C. Wainwright Downgrades Advaxis $ADXS to Neutral

$OSTK DA davidson lowers PT to $58 from $11

$DOVA Lowered @ Landenberg to $32.00 from $65.00 PT

$TSLA Maintained Sell @ GS $225.00 PT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Fed, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY

PreMarket Trading Report Mon Dec 17: Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday December 17, 2018.

In this premarket trading edition: Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading. - Lead Trader Premarket Note: This Friday is the time cycle peak in global markets. That makes this week and next the inflection. Member / client reporting over next two weeks will be intense. I will be in trading room most days over next 6 months. Public sharing of calls in this massive cycle next will be minimal. We’re locking down for the cycle. Explained on my Twitter account tonight. My goal is to back off front lines to back office when time cycle complete. Massive time cycle next and we intend to hit it. Hope y’all bank.

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Monday Dec 17 –

Global markets are calmer. Out of the VIX short trade last week but still in the others.

Equities on watch listed below all remain on my list.

Per Recent:

Dec 13 – Markets are mixed (not surprising considering time cycle completion on 20 th ish). Extreme caution between here and 20th ish.

Current Trades:

Looking for a pull back on DGAZ to size next leg above starter.

Holding VIX starter short in TVIX – HIGH RISK TRADE, extreme caution. Likely reverse bias after Dec 20 ish.

Holding SPY long starter. Likely reverse to short after Dec 20 ish.

Holding DWT short starter (however, it looks like oil may take another leg down here, it will either hold here or down another floor). Will size in next leg after a pull back in oil.

Holding ARWR swing starter long (missed my next leg size).

Looking for a possible BTC long swing other side of Dec 20 ish.

Looking for a possible Silver and Gold long other side of Dec 20 ish.

Looking for a possible DXY short other side of Dec 20 ish.

Expect next 6 months to be trading career huge. Massive range. Equity swings will increase as we come out of this time cycle peak – it will be a stock pickers year in 2019 with technical analysis rooting the trade action. My goal is to retire off front lines in 6 months (still here, but off the front lines), to do that my personal trading and machine trading has to be massive to win side.

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. W

I will be in trading room for open, mid day and at other times when we are trading.

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas.

Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

Market Observation:

Markets as of 7:30 AM: US Dollar $DXY trading 97.09, Oil FX $USOIL ($WTI) trading 51.73, Gold $GLD trading 1239.83, Silver $SLV trading 14.61, $SPY 260.34 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3361.00 and $VIX trading 22.6.

Momentum Stocks / Gaps to Watch:

Jack in the Box exploring potential sale of the company

Proteostasis’s stock jumps after license deal with Genentech

20 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12858013 $EVFM $PTI $PER $AXON $FRSX $ERJ $BBY $ALQA $QFIN $BZH

News:

Embraer: Deal With Boeing Expected To Be Concluded At End 2019 $BA

$INNT Plans to Commence the First Ever Phase 3 Registration Trial in Celiac Disease in 1H 2019 and Announce Top-line NASH Data with Drug Combinations by EASL 2019

EVIO Labs Receives Provisional License from Massachusetts Cannabis Control Commission

$RHHBY $PTCT $BIIB – EMA grants Prime status for Roche’s risdiplam for SMA

$TLC $ARGX $AXON – Jefferies sees three-bagger in Axovant Sciences in premarket analyst action

#5things

-Goldman 1MDB charges

-Shutdown standoff

-May to reject referendum calls

-Markets quiet

-Coming up…

https://bloom.bg/2S5Cz8r

Top 5 Things to Know in The Market on Monday –

Top 5 Things to Know in The Market on Monday – https://t.co/5cU75qXf70

— Investing.com News (@newsinvesting) December 17, 2018

The Charts Bulls And Bears Are Obsessing Over For 2019

The Charts Bulls And Bears Are Obsessing Over For 2019 https://t.co/BXkjapHzkg

— zerohedge (@zerohedge) December 16, 2018

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

$AME – AMETEK completes private placement offering

$CGIX terminates merger

Earnings:

#earnings for the week

$MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST

#earnings for the week $MU $FDX $NKE $BB $ORCL $RHT $GIS $DRI $RAD $PAYX $NCS $FDS $NAV $WOR $ACN $HEI $CSBR $WBA $KMX $SCS $LOVE $CAG $JBL $WGO $CCL $APOG $MLHR $NEOG $CTAS $PIR $SAFM $ABM $AIR $CAMP $ATU $REVG $SCHL $LAKE $TWST https://t.co/r57QUKKDXL https://t.co/VUgTdva6Tj

— Melonopoly (@curtmelonopoly) December 17, 2018

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

The $DGAZ trade. Short Natural Gas. #natgas $UGAZ $UNG

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

The speculative COMEX #gold position flipped to a net-long for the first time in five months. This after funds cut longs by 8k lots and shorts by 20k lots. In the two weeks to December 11 funds bought 62k lots, mostly above $1230/oz. S/t challenged on a break below.

The speculative COMEX #gold position flipped to a net-long for the first time in five months. This after funds cut longs by 8k lots and shorts by 20k lots. In the two weeks to December 11 funds bought 62k lots, mostly above $1230/oz. S/t challenged on a break below. pic.twitter.com/M41pZFNBDO

— Ole S Hansen (@Ole_S_Hansen) December 16, 2018

The combined net-long (+256k lots) in Brent and WTI crude #oil is now more than 20% below the previous two lows in Aug-16 and June-17 from where it rallied strongly on both occasions. #OOTT

The combined net-long (+256k lots) in Brent and WTI crude #oil is now more than 20% below the previous two lows in Aug-16 and June-17 from where it rallied strongly on both occasions. #OOTT pic.twitter.com/N2QOoMIcdh

— Ole S Hansen (@Ole_S_Hansen) December 16, 2018

“Bearish bets against the S&P 500 are at their second-highest levels all year”

"Bearish bets against the S&P 500 are at their second-highest levels all year" https://t.co/vllRACDNIt pic.twitter.com/tIFNlw68Vz

— Trevor Noren (@trevornoren) December 16, 2018

Low-Volatility Stocks Are Shining as Investors Search for More Certainty #swingtrading https://www.barrons.com/articles/low-volatility-stocks-shine-in-this-stock-market-51544702401 … via @BarronsOnline

Low-Volatility Stocks Are Shining as Investors Search for More Certainty #swingtrading https://t.co/NDo0uUAoeR via @BarronsOnline

— Melonopoly (@curtmelonopoly) December 17, 2018

JPM says that investors’ concerns about credit markets are justified. The net-debt-to-EBITDA ratio for the IG and HY universe has been rising steeply over past decade to levels that are much higher than those seen at the peaks of the previous two cycles.

JPM says that investors’ concerns about credit markets are justified. The net-debt-to-EBITDA ratio for the IG and HY universe has been rising steeply over past decade to levels that are much higher than those seen at the peaks of the previous two cycles. pic.twitter.com/xNuMlK6glK

— Holger Zschaepitz (@Schuldensuehner) December 16, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $LULU $AXON $MFA $CSL $SMG $TGI $LYB $ORTX $SHW $GIII $CLXT $CSL $BKS $G

Lululemon’s stock rallies after Stifel analyst says it’s time to buy

MCDONALD’S: JP MORGAN RAISES TARGET PRICE TO $182 FROM $180

$MCD

STARBUCKS CORP: JP MORGAN RAISES TARGET PRICE TO $70 FROM $69

$SBUX

(6) Recent Downgrades: $SCG $THC $EMR $ITW $BBY $EMR $MSEX $CPK $THC $BXMT

BEST BUY CO INC: BOFA MERRILL CUTS TO UNDERPERFORM FROM NEUTRAL

$BBY

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Time Cycles, NatGas, Oil, SPY, VIX, BTC, Gold, Silver, DXY

PreMarket Trading Report Wed Dec 12 : Firsts Far From Over, EIA, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, NatGas …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday December 12, 2018.

In this premarket trading edition: Firsts Far From Over, EIA, Time Cycles, Oil, SPY, VIX, BTC, Gold, Silver, DXY, NatGas and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Scheduled Events / Platform Development / Team Work in Progress:

- December Special 40% Discounts (limited promo discounts per):

Exclusive Member Christmas Discounts: Trade Alerts, Swing Reports, Algorithm Reporting, Trade Coaching, Live Trading. - Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps December / January 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Dec 12 – Per trade status video emailed last night; trades in oil going well (personal and machine trading did well yesterday), we’re short starter TVIX (VIX ETN), short starter DWT (short Oil ETN), long DWT (short NatGas ETN), long SPY. Looking at other equity, currency, indices trades per the video posted Dec 11 to YouTube and emailed. Unclear on Gold, Silver and BTC however, we are bias to a bullish run after Dec 20 time cycle peaks. Yet to be seen. Slightly bearish in to new year DXY. But everything is on the table and the trend after Dec 20 time cycle in to new year trading is key for positioning – KEEP AN OPEN MIND.

the firsts are far from over . careful with bias

the firsts are far from over . careful with bias

— Melonopoly (@curtmelonopoly) December 12, 2018

We’re watching for long SRRK, CMG, Yen, AES, KT, NEM, XLE, QQQ, DIA, IWM, IBB…

We’re watching for short XLK, WYNN, adding to DWT short, adding to long DGAZ (natgas short ETN)

Also on watch Gold, Silver, DXY, ARWR, …

Dec 10 – Good morning. Global markets continue under pressure. It is Monday, extreme caution at open. Let the trades come to you. We have majority of weekly reporting due out Mon – Wed evening.

I will be in trading room for open, mid day and at other times when we are trading.

Reminder: The live trading room is partitioned in to 25 attendees per room each viewing the same charting. If you are moved room to room you will be down for at most 20 secs at a time.

Reminder: The live trading room is attended by mostly full time traders and funds. We appreciate interaction to be as actionable as possible for attendees. Chatter can be directed to Discord server specific to instrument. If you need a link to private discord server for chat let us know [email protected].

Weekly guidance is pensive at this point, I am likely to let Monday open and will look toward the reporting. I am bias to oil turning up in to new year, VIX will be a considerable trading instrument for us also, Gold and Silver looking for advance bullish, US Dollar unsure, moderately bullish Yen, BTC should bottom near Dec 20, SPY and other indices I expect continued pressure. Moderately bearish NatGas. Swing trade guidance in reporting due out this week. Also moderately bullish NEM at this point. Moderately bearish Tech and Bio in to new year. All tentative in to turn of Dec 20 time-cycle. More in reports.

Some guidance / confluence contradictory at this juncture, those are our views at this point in to Dec 20 time cycle completion, all yet to be seen and positions to be determined.

Looking for significant moves over next 6 months (post Dec 20 time cycle).

I may be off on Friday for a vet hospital operation (bulldog) YTBD.

Market Observation:

Markets as of 8:00 AM: US Dollar $DXY trading 97.45, Oil FX $USOIL ($WTI) trading 52.61, Gold $GLD trading 1244.75, Silver $SLV trading 14.63, $SPY 266.77 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 3394.00 and $VIX trading 21.1.

Momentum Stocks / Gaps to Watch:$ABIL $LX $WPP $DBVT

Stocks – Nvidia, Apple, Amazon, Aphria Gain in Premarket; American Eagle Plunges – https://twitter.com/newsinvesting/status/1072847307484348416

News:

Dow set to jump 250 points as Wall Street’s wild swings in reaction to the trade battle continue https://www.cnbc.com/2018/12/12/stock-markets-dow-cheered-by-trumps-upbeat-trade-war-comments.html?__source=iosappshare%7Ccom.apple.UIKit.activity.PostToTwitter

Recent SEC Filings / Insiders:

Recent IPO’s:

Ride-hailing startup Lyft files confidentially for U.S. IPO.

Read: https://goo.gl/jxpnxi

Earnings:

#earnings for the week

$ADBE $AEO $SFIX $COST $DSW $PLAY $CIEN $PVTL $ASNA $INSE $FRAN $GTIM $CDMO $ASPU $ARWR $DLHC $CASY $PLAB $VRA $NCS $NX $TLRD $SEAC $ROAD $CHKE $IRET $OXM $NDSN $FTI $VERU $PHX $CIVI $SKIS $SMMT $PURE $STRM $MMMB $AXNX

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

USOIL MACD turned up on daily testing 20 MA resistance area. Holding after recent sell-off. #oil #Chart #crude

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility lower but we’re watching in to Dec 5 and lower supports near bollinger for possible bounce $VIX #volatility

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

TVIX premarket trading down. We are short Volatility from last Wednesday in 49s #premarket #volatility $VIX

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again