Tag: $GTHX

Swing Trading Special Report Series (Part D) Sun Nov 18 NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ …

Compound Trading Swing Trade Report Sunday November 18, 2018 (Part D).

Swing Trading Signals and Stock Picks In this Issue: NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ … .

Email us at compoundtradingofficial@gmail.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part D of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were covered at the last Trade Coaching Boot Camp. Part A of this swing trading special series can be found here, Part B of the swing trade report here and Part C of the swing trading report here.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports..

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSIS, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 14 – Swing Trading Special Report Sun Oct 14 (Part A) FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Current Swing Trading Signals and Stock Charts.

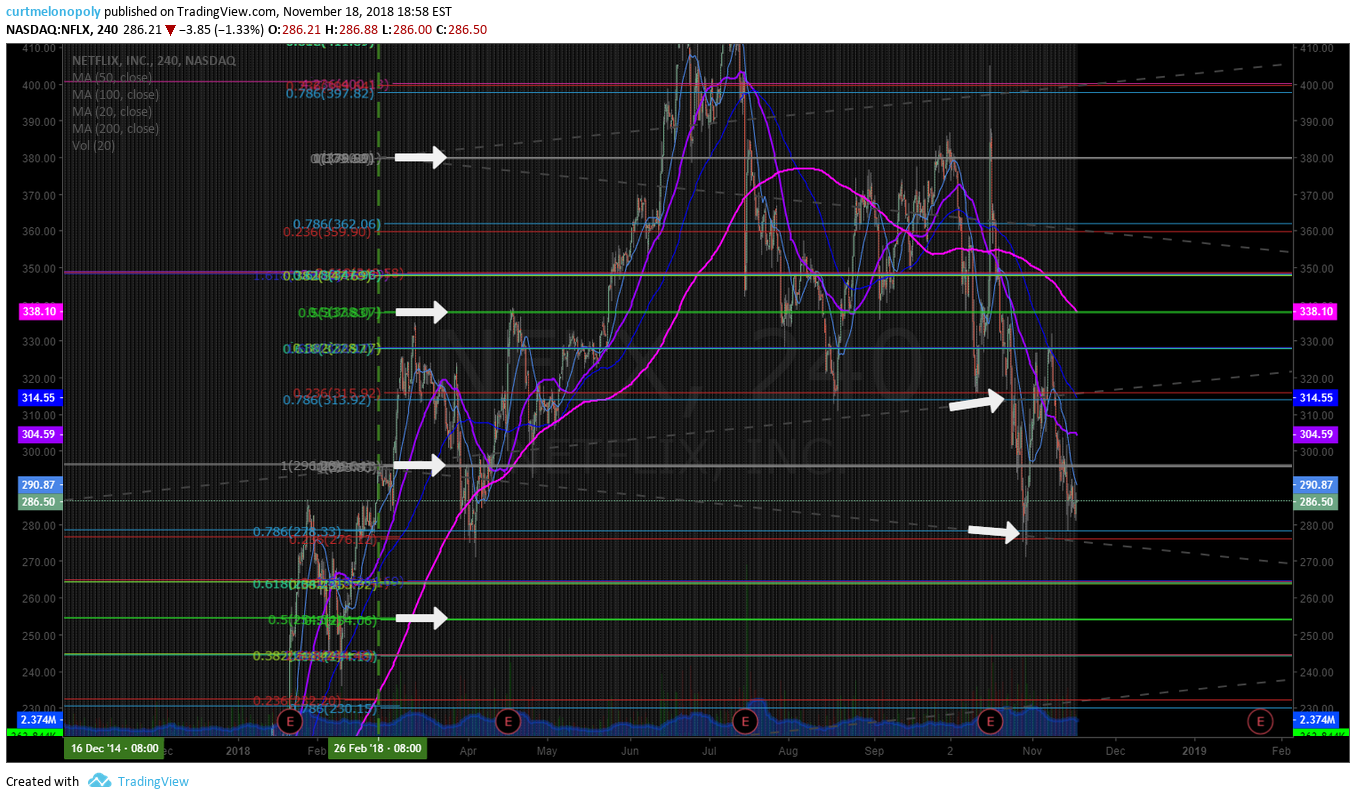

NETFLIX (NFLX) stock under pressure trading near Fibonacci Trend line support.

How to trade the Netflix stock move:

- Under trend line support (trending down) 275.00 targets 232.68 (trending up).

- Current area holds (closed 286.21 Friday) targets 315’s (upper trend line).

- Current bias is down to 232’s, on watch for Monday.

It’s time to stop lumping Netflix in with the other FAANG stocks, says analyst. #swingtrading $NFLX https://www.marketwatch.com/story/its-time-to-stop-lumping-netflix-in-with-the-other-faang-stocks-says-analyst-2018-11-16?siteid=yhoof2&yptr=yahoo

MOLECULAR TEMPLATES INC (MTEM) Bounced off previous support, over 5.50 targets 7.00 or 9.79 Mar 4, 2019.

Barron’s calculates that has been a total of nearly $46 million in recent stock purchases in Acadia Pharmaceuticals (ACAD), Molecular Templates (MTEM), Foamix Pharmaceuticals (FOMX), and Amicus Therapeutics (FOLD). https://www.barrons.com/articles/biotech-stocks-1538083965?siteid=yhoof2&yptr=yahoo

PYXUS $PYX bounced off previous low, last trade was near 3x return, targets for next swing on chart. Now on watch.

Pyxus Stock Dives On Tariffs, Marijuana Stocks Also Retreat https://www.investors.com/news/pyxus-stock-marijuana-stocks/

22nd CENTURY GROUP (XXII) over 2.85 targets 3.09, 3.53 then 4.39. On high watch. $XXII.

Analyzing 22nd Century Group’s Year-to-Date Performance. https://marketrealist.com/2018/11/analyzing-22nd-century-groups-year-to-date-performance?utm_source=yahoo&utm_medium=feed&yptr=yahoo

PROQR THERAPEUTICS (PRQR) Over 20.70 targets 22.65, 24.85, 27.55 Dec 10 time cycle $PRQR

ProQR (PRQR) Reports Q3 Loss, Misses Revenue Estimates https://finance.yahoo.com/news/proqr-prqr-reports-q3-loss-134501815.html?soc_src=social-sh&soc_trk=tw

BOX INC (BOX) Trading 17.90 forming bottom, upside targets 19.30, 23.85 July 2019 $BOX. Watching for the interim bottom to continue and a possible turn up in price.

G1 THERAPEUTICS (GTHX) could have bottomed, above trading box possibly sees price targets on chart $GTHX.

Seaspan (SSW) If this area holds price targets 10.20 perhaps 10.61 Nov 26 time cycle with symmetry $SSW.

Health Innovations (HIIQ) Watching for 200 MA test to hold and bounce with price targets on chart $HIIQ.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ

PreMarket Trading Plan Thurs Sept 20: Bull Market Dead? Trump #OPEC #OIL, $CRON, $NBEV, $NFLX, $FB, $SHOP more.

Compound Trading Premarket Trading Plan & Watch List Thursday September 20, 2018.

In this edition: $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $MTEM, $PYX, $ROKU, $CVM, $XXII, $MOMO, $SPY, $DIS, $SSW, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC, $BKRS and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 20 – Lead trader booked for main trading room for market open, mid day review and futures trading today (as available).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- The main live trading room going forward is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or if the lead trader is not available.

- Week of Sept 17 – New pricing published representing next generation algorithm models (existing members no change).

- Week of Sept 17 – Next generation algorithm models roll out (machine trading Gen 1).

- Week of Sept 17 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Week of Sept 17 – Trading Boot Camp Event videos become available on Compound Trading website.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Week of Sept 17 – The previously recorded Master Class Videos will become available on our website.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 19: Mid day review – currently in processing.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

As I wrote the last few days I expect trade set-ups from Trading Boot Camp to start alarming as they have, the markets have some really decent setups (see video reports the last few days).

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

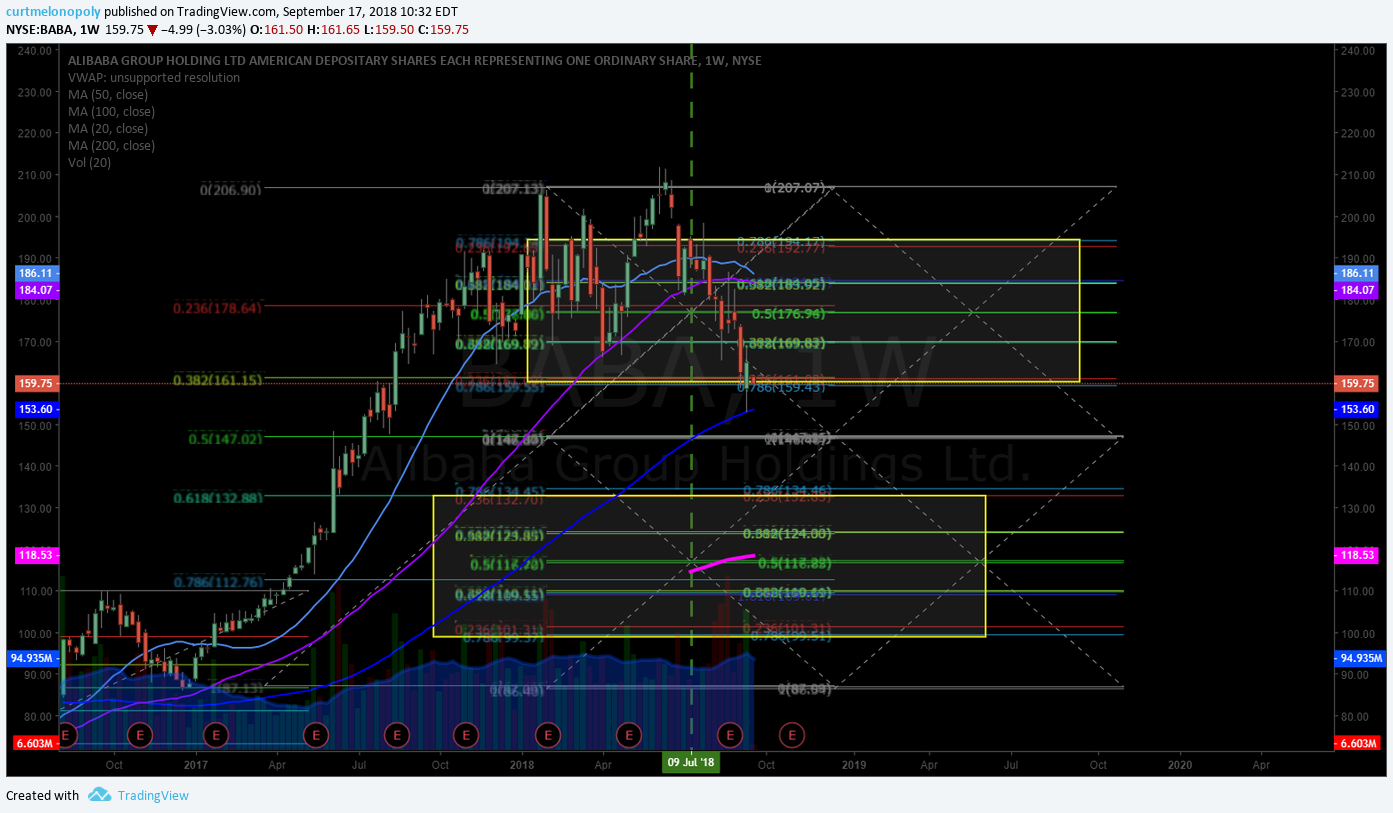

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

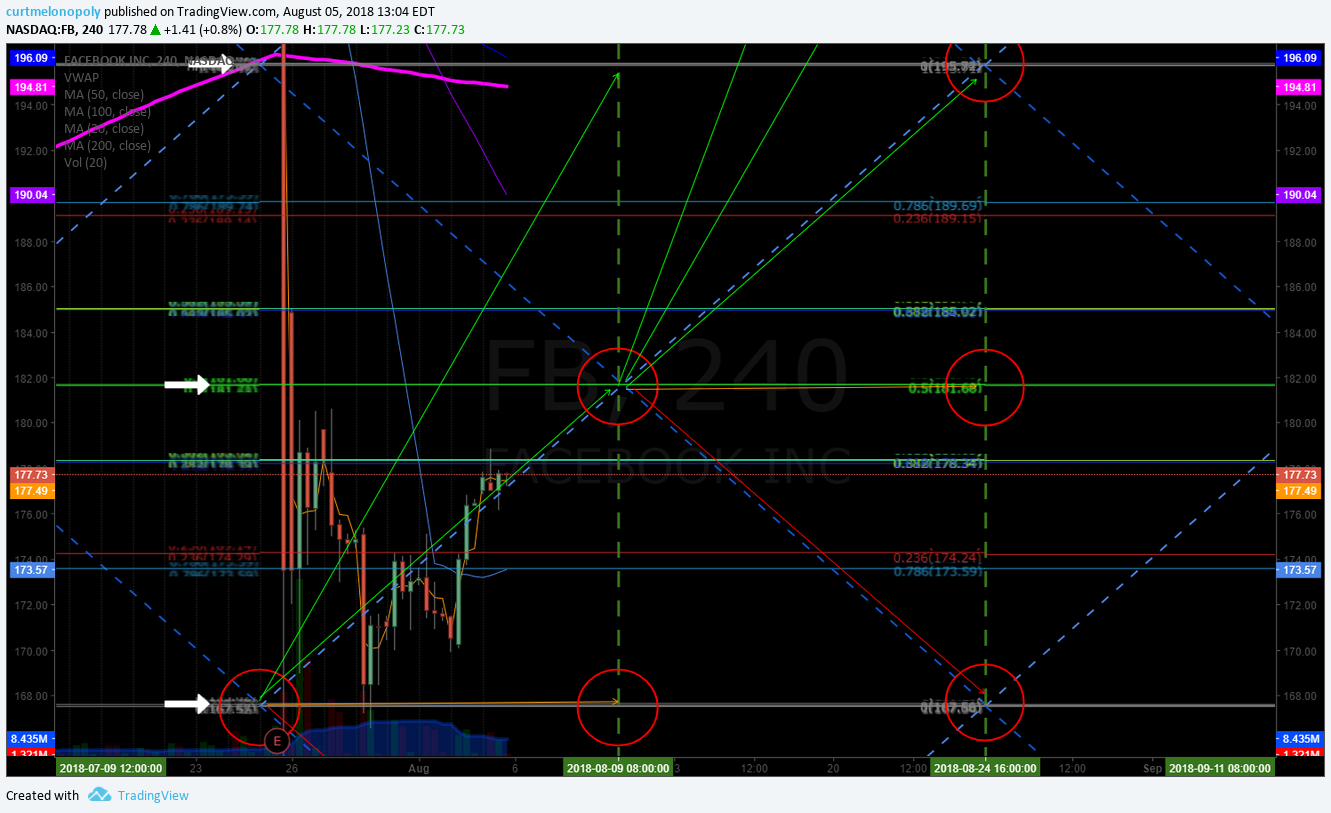

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 7:11 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 71.15, Gold $GLD trading 1203.48, Silver $SLV trading 14.20, $SPY 291.22 (previous close), Bitcoin $BTC.X $BTCUSD $XBTUSD 6412.00 and $VIX trading 11.7.

Momentum Stocks / Gaps to Watch:

Canadian cannabis company Cronos partners with Aleafia in study of medical marijuana for insomnia.

$CRON Canadian cannabis company Cronos partners with Aleafia in study of medical marijuana for insomnia https://t.co/xgfYMxYEG6

— Melonopoly (@curtmelonopoly) September 20, 2018

News:

The ‘Great Bull’ market is ‘dead,’ and here’s what’s next, Bank of America predicts.

The 'Great Bull' market is 'dead,' and here's what's next, Bank of America predicts https://t.co/nSiLM5qhV5

— Melonopoly (@curtmelonopoly) September 20, 2018

EU says Facebook must comply with EU consumer rules by end-2018 or face sanctions https://reut.rs/2Dcdiq5 $FB

$FB EU says Facebook must comply with EU consumer rules by end-2018 or face sanctions https://t.co/rne0sOalOZ $FB

— Swing Trading (@swingtrading_ct) September 20, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Under Armour’s stock jumps after profit outlook raised, restructuring costs increased

RV maker Thor Industries shares slide 10% premarket after profit miss

Olive Garden parent Darden’s stock jumps toward record after profit and sales beat, raised outlook

#earnings for the week

$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK

#earnings for the week$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK https://t.co/r57QUKKDXL https://t.co/cAnHRobuy5

— Melonopoly (@curtmelonopoly) September 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

FACEBOOK (FB) bounce off quad wall in to key resistance (red blue) upside test 20MA 50 MA – key test area $FB #swingtrading #tradealerts

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

MOLECULAR TEMPLATES INC (MTEM) Trading 6.99 over 6.20 alert targeting 6.88 resistance, next areas on chart #daytrade #tradealerts

PYXUS $PYX came off alert premarket – trading 23.52 at primary pivot on 240 min chart targets 26.00 area if it launches at this area at open #daytrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

OIL 1 Min Chart $USOIL $WTI $USO $CL_F

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

NEW AGE BEVERAGES (NBEV) Above 2.80, targets 3.27, 4.17, 4.89 $NBEV #tradealerts #swingtrading #daytrade

CRONOS (CRON) trading 11.93 testing diag TL over targets 13.04 14.62 14.80 15.88 16.75 Sept 27 $CRON #tradealert #swingtrading

Seaspan (SSW) over 9.50 intra should see lower 10s fast, trading 9.34 intraday. $SSW #daytrade #swingtrade #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

ALIBABA (BABA) got a bounce at 100 MA under rane support, watching close here now $BABA #tradealerts #swingtrading

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

CARA THERAPEUTICS (CARA) Testing break-out area intra-day. On watch. $CARA #tradingsetups #tradealert

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

Crude Oil Daily Chart, MACD turning back up with price above 50 MA Sept 17 623 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-China announces tariff cuts

-No Brexit breakthrough

-OPEC has a problem

-Markets rise

-New face for the Fed

https://bloom.bg/2NrtDvT

#5things

-China announces tariff cuts

-No Brexit breakthrough

-OPEC has a problem

-Markets rise

-New face for the Fedhttps://t.co/zOvIx4gGWK pic.twitter.com/aJvj9Clw9z— Bloomberg Markets (@markets) September 20, 2018

Tech disruption is deflationary, BofAML says. The supply of robots, artificial intelligence and big data putting downward pressure on the price of labor, goods, services & capital. Aging Demographics and Excess Debt adding to the deflationary pressure.

Tech disruption is deflationary, BofAML says. The supply of robots, artificial intelligence and big data putting downward pressure on the price of labor, goods, services & capital. Aging Demographics and Excess Debt adding to the deflationary pressure. pic.twitter.com/3M20lCHZtI

— Holger Zschaepitz (@Schuldensuehner) September 20, 2018

Per Trump: We protect the countries of the Middle East, they would not be safe for very long without us, and yet they continue to push for higher and higher oil prices! We will remember. The OPEC monopoly must get prices down now! #OOTT #OPEC #OIL

Per Trump: We protect the countries of the Middle East, they would not be safe for very long without us, and yet they continue to push for higher and higher oil prices! We will remember. The OPEC monopoly must get prices down now! #OOTT #OPEC #OIL https://t.co/SnXvBCKNQF

— Melonopoly (@curtmelonopoly) September 20, 2018

US crude #oil stocks at 3-1/2-year low on the back of unseasonally strong refinery demand and robust exports. #OOTT

US crude #oil stocks at 3-1/2-year low on the back of unseasonally strong refinery demand and robust exports. #OOTT pic.twitter.com/agoLXHQiBi

— Ole S Hansen (@Ole_S_Hansen) September 20, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $LIQT $NBEV $MTL $ABIL $TLRY $WPRT $MLHR $FOLD $IGC $BLDP $MYSZ $CRON $RUSL $NIO $DRI $VNE $CGC

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $NE $RIG $HP $RDC $DO $CAT $MTW $SNHY $IPG $CNI $FBP $RL $VIAB $NTR $ARCT

(6) Recent Downgrades: $CVIA $BRKR $SLCA $COP $CNQ $SFIX $SKX $FTNT $TPH $WLH

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $MTEM, $PYX, $ROKU, $CVM, $XXII, $MOMO, $SPY, $DIS, $SSW, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC, $BKRS

Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room for: $VIX Volatility $WTI $CL_F Oil $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 17, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Tickers reviewed: $VIX $WTI $CL_F $USO $PROQR $CARA $BOX $BABA $SSW $DXY $SPY $GTHX $FB $FF $SENS and more.

I apologize for the sound interference – at times it was just awful, we’ll re hard wire the set-up again soon here and get that fixed. In tomorrow’s mid day I will hard wire that one computer to modem and you can let me know if it is any better please.

Voice broadcast does not start until 3:18 on video.

Market discovery theme on day.

Volatility $VIX – time-cycles reviewed in to Dec 24 beyond and inflections in markets, market open, futures and account return expectations over next two trading quarters or so.

Crude oil trading $WTI $CL_F $USO – review of crude oil algorithm, machine trading model, charting, price targets for time cycles this week reviewed.

PROQR Therapeutics $PROQR – Excellent chart set-up, one of my favorite trades of late. Buy sell trading signals reviewed. Bounced at support at previous trade alert now at key resistance, trim in to resistance and over 22.70 targets 24.85 then 27.50. Watch the diagonal trend line (quad wall). Careful shorting this stock, 18.05 possible.

US Dollar $DXY – Review of US Dollar Algorithm charting. Lower support trend line and upper trend line, support and resistance areas to watch. Review of structure.

$CARA Therapeutics – testing previous highs, testing other side of bowl and a full extension is possible here, structured chart trading signals reviewed, Target Dec 10 30s or 38.00s if it breaks out. Pull back to 16.36 support, look for a bounce there if it sells-off. 19.70 is near term support for a test long also.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

BOX $BOX – previously provided upside targets, down side scenario on video 22.32 good support, 50 MA support is good, intra day in down trajectory lines, 10.36 is a downside sell-off target that is possible in a panic. Channel symmetry also reviewed.

SEASPAN $SSW – keeps hitting resistance, simple short at each, looking for a long over resistance in trajectory on video. Upside 10.18 first target, best scenario Nov 11.93 and 18.30 best best not probable.

G1 Therapeutics $GTHX – pullback in price here doesn’t surprise me, candle body is in current bullish trajectory lines on chart, review of downside supports and upside price targets. 76.00 – 80.00 (up over 69.62 is a trigger). All areas reviewed on video.

SHOPIFY $SHOP – chart pivot acting as support (red line) Oct 10 166.72 price target, holding key support, working up against a quad wall (diagonal Fib resistance), 154.35 buy side comes in at that area. Pull back support is 50 MA primary for a long side test trade.

SP500 $SPY – the box test area reviewed, above box is a long and under is a short. 283.93 278.47 Sept 1 are downside targets in a sell-off. Other trade signals and price targets reviewed on video.

ALIBABA $BABA – underwater a bit on this swing trade in BABA, I’m in 1/10 sizing now. Bounced off 100 MA, trading right at box support, Dec 17 trade price targets discussed to low side. Adds at each support is the trading plan for ALIBABA should sell-off continue.

https://www.tradingview.com/chart/BABA/gKTnmCkK-BABA/

FACEBOOK $FB – 20 MA upside resistance trade alarm set for possible turn on the snap-back trade I’m looking for. 240 min chart.

Top momentum stocks for the day reviewed;

$OTM 20 MA resistance on weekly, above will target the 50 MA. It respects the 50 MA and 200 MA on weekly chart. Trading plan reviewed on video.

$LEU – stay away from

$FF – Currently at support and resistance area, price extensions for a possible run are reviewed on video. Targets 23.67 in a bullish scenario, trading 17.63.

$TAHO – junk

$GHG – junk, no structure

$CEL – not a good chart

$CWH – terrible

$SPA – at previous lows, bounced there before…. but…. no structure

$SUPV – junk

$TGS – bounced off 200 MA support, good example of a bullish run out of the bowl for multiple extensions up on the chart.

$WAB – not interested

$AG – on 200 MA support, not interested.

$SENS – support 3.97 trading 4.16, looking for a bounce. The trade set-up will be on the upcoming swing trading report.

Others were also reviewed.

VIDEO Trade Alerts: $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Voice broadcast does not start until 3:18 on video.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, $VIX, $WTI, $CL_F, $USO, $PROQR, $CARA, $BOX, $BABA, $SSW, $DXY, $SPY, $GTHX, $FB, $FF, $SENS, swingtrading, daytrading

Swing Trading Earnings Special Report (Members) Mon Aug 6 $BABA, $BA, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $FB more.

Swing Trading Report. In this Special Earnings Season (Member Edition) Monday Aug 6, 2018: $SPY, $VIX, $DXY, $GTHX, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $BA, $BABA, $FB and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from July 31 mid day review, published August 6, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

June 27 Swing Trading Regular Report is referenced in this special earnings report. Members can reference that report for charts you may need (or review the video) as all the charting is not included in the report below due to weekly reporting time constraints.

Tickers covered; $SPY, $VIX, $DXY, $GTHX, $ARWR, $EDIT, $C, $DIS, $PSTG, $MXIM, $ATHM, $BWA, $LIT, $BA, $BABA, $FB

SP500 $SPY 278.71 support, 283.71 288.91 resistance.

Volatility $VIX – End of time cycle week, ish On watch.

US Dollar $DXY – 95.62 Aug 28 upside target and 93.50 Aug 28 in bearish scenario.

$GTHX – Price targets in bullish scenario 53.64 58.09 Aug 27, and downside scenario on same day 44.42 and 40.04.

$ARWR – Lost mid quad support, price target 16.00 ish Nov 26 23.88 in more bullish scenario or 8.93 in a sell-off.

$EDIT – 27.87 22.93 18.12 are downside targets and 48.00 ish is most bullish scenario with other targets on way up. Sept 21 time cycle completion. Trading plan detail on video.

CitiGroup $C – Hit support numerous times, at 200 MA on daily, 86.40 upside price target Oct 17, lower target is 73.80 60.37 Oct 17. Over 73.70 is long side trade alert pivot.

Disney $DIS – In to a resistance cluster. Excellent upside trade trajectory, very predictable in structure. Trade alerts from reports has been excellent – fantastic trade. 117.34 upside price target scenario 110.46 bearish same day Sept 6 time cycle peak. Video details the trading plan.

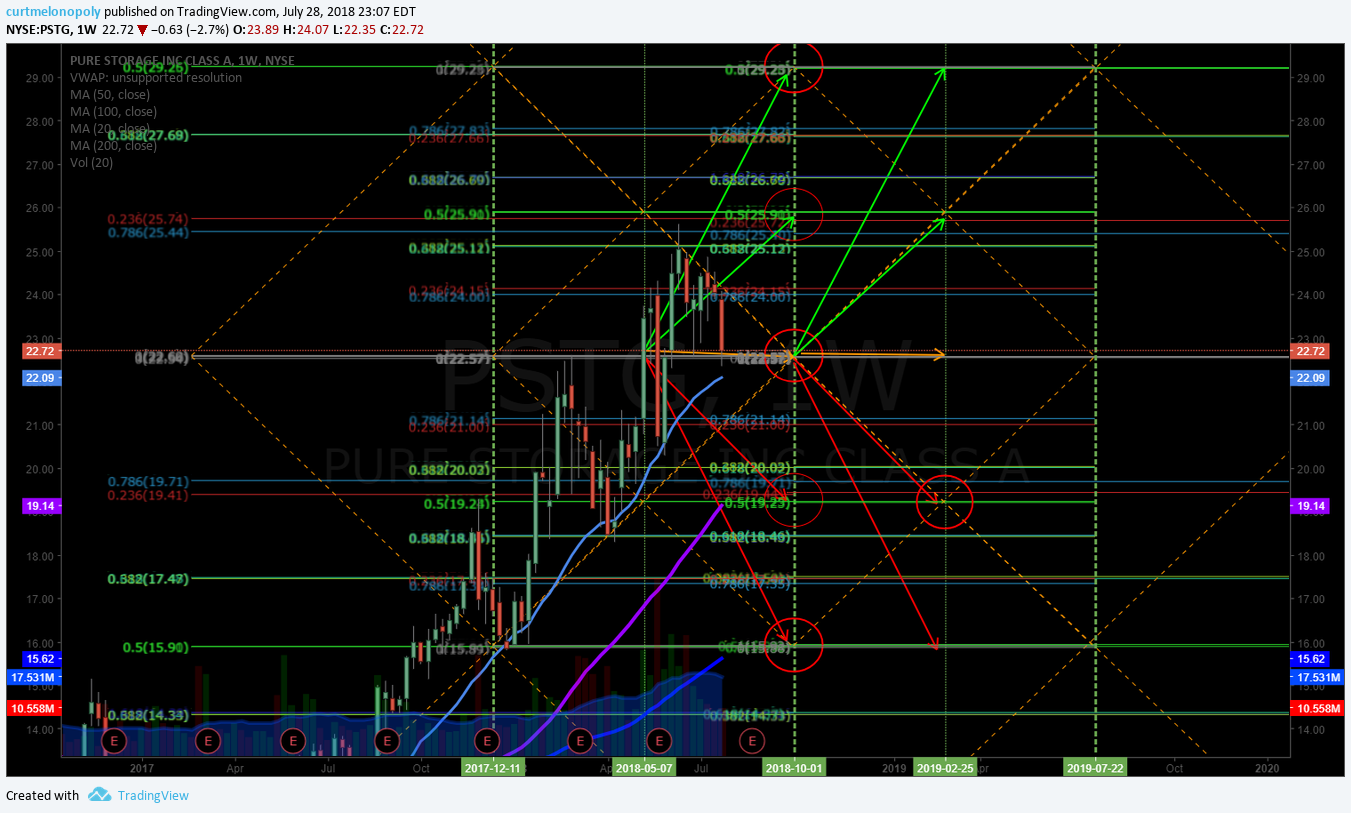

Pure Storage $PSTG – Earnings in 26 days, current trading structure explained on video. Price targets are 15.96, 19.23 in a sell-off 22.68 for Oct 1, bullish 25.85 and then 30.00 range same day. Over 22.58 is a long.

MAXIM $MXIM – Red lines on chart are historical support and resistance, over 65.00 long side trigger, main resistance 74.80, downside support 50 MA or 56.50 ish.

Autohome $ATHM – near support 92.20, time cycle just ending, careful with this one, not easy where it is, trading 96.44 intra 110.18 main resistance, downside sell off target scenario 74.25 area on chart and upside most bullish target possible is 110.50 and 128.40 Apr 2019 in large structure.

$BWA – Last report I alerted that the sell-off should be finished. Technically a perfect trade. Price target has been hit. Trading plan is other side of earnings a 46.60 trade alert alarm set for over 45.60 ish targeting 54.20 Jan 8, 2019 and to downside 42.81 is price target and 38.86 in a complete sell-off.

Global Lithium $LIT – Pinched between 20 MA and 100 MA and under main pivot. Possible sidewinder set up that is explained in video in large chart structure.

Boeing $BA – It is n the other side of earnings, threatening break-out but price is so far above 200 MA on weekly chart, so I don’t like it so much. However, Stochastic RSI is trending up again but MACD is not. Set alarm trade alert for when MACD turns for a review.

$BABA – Earnings in 23 days, price near structural pivot, SQZMOM green Stoch RSI trending down and a decision has to be made at 200 MA. 177 ish is downside price target in a sell-off scenario in advance of earnings which is very possible considering the last earnings dump (in to earnings). Trading plan details in video. No algorithmic model built for this yet however we are planning to when in next trade (when we get a retrace we will enter this trade). All equities we follow will get models in advance of machine trading for each.

Facebook $FB – Last sell-off earlier in year we nailed it, it is again doing the same thing it did last time. Trading plan reviewed on video. Personal target 181.63 Aug 9. Various support and resistance levels on chart discussed on video.

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

Swing Trading Earnings Special Report (Members) Sun Aug 5 $SNAP, $HIIQ, $FIT, $TWLO, $GOOGL, $FB, $CELG, $PSTG … #swingtrading #tradealerts #earnings

Swing Trading Report. In this detailed Special Earnings Season (Member Edition) Sunday Aug 5, 2018: $SPY, $DXY, $AGN, $ITCI, $PSTG, $GTHX, $SNAP, $ARWR, $GOOGL, $HIIQ, $FB, $TWLO, $HCLP, $MYND, $CELG, $FIT, $EXP, $OAK, $RSX, $BOFI, $SLCA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from July 30 mid day, published August 5, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

SP500 $SPY

Trading 280.14, 200 MA on 60 min under trade, support 278.60, target Aug 2 11:00 278.60 range, if it gets a bounce 283.75 Aug 13 is price target to upside. Volatility is up in the first day of new volatility time cycle. Next $VIX cycle ends Dec 24 approx. Resistance 283.70 on SPY.

Our trade alerts as they relate to market inflections are reviewed on video.

US Dollar $DXY

Still in structure respecting resistance. Up over resistance then there could be a significant move up to next structure resistance on chart reviewed.

OIL $WTI $USOIL – oil trade on the day is reviewed. Weekly price targets are reviewed from EPIC oil algorithmic model

ALLERGAN (AGN)

Trading channels on the AGN chart are reviewed as are various charts.

The Allergan trade alerts as they progressed, time cycles, and buy sell triggers on $AGN are discussed on the video. This type of charting (structured charting) is also discussed and may help students of the market – some trade coaching notes here.

How this relates to our algorithmic charting models, machine trading and the timing of our Sept 14-16 Cabarete Trade Coaching event is discussed.

Black box algorithmic charting is discussed at this point in the video.

Our specific trading services platform / roll-out schedule is also discussed.

The calls specific to our trade alerts and trading in AGN are reviewed in detail.

Quant funds, lies in the markets, media selling fear and what people (retail) want to hear and why retail loses are also discussed on the video for our trading students.

Click here for our previously published exclusive member report: Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Today’s Research Reports on Trending Tickers: Bristol-Myers Squibb and Allergan $AGN https://finance.yahoo.com/news/todays-research-reports-trending-tickers-122000758.html?soc_src=social-sh&soc_trk=tw

ALLERGAN (AGN) Closed Friday 185.93 over 184.62 support 189.07 is resistance test next. Trim in to add above. $AGN

INTRA CELLULAR (ITCI)

Structured charting is also reviewed on video here. Timing cycles, price targets to up and downside, buy sell triggers etc.

Intra-Cellular Therapies Provides Corporate Update and Reports Second Quarter 2018 Financial Results $ITCI https://finance.yahoo.com/news/intra-cellular-therapies-provides-corporate-110932713.html?soc_src=social-sh&soc_trk=tw

INTRA CELLULAR (ITCI) Closed Friday 20.90, main resistance 24.77, support 19.75, 24.60 price target Set 6 if bullish. $ITCI

PURE STORAGE (PSTG).

If you are using these charts and you want to get rid of the indicators at the bottom so that the chart model is easier left click twice on field area to get rid of indicators at bottom.

Pure storage earnings in 26 days (as of date of video). Indicators and support and resistance are reviewed on video.

Again, structure of charts is discussed on video.

The massive chart channel is reviewed.

Support / resistance levels and price targets are discussed in detail for Pure Storage on the video.

Previously published exclusive swing trading report can be found here for PSTG: How to Trade Pure Storage (PSTG) Earnings in Six Days (Member Edition) $PSTG

7 Tech Stocks That May Soar On Takeovers $PSTG $FSLR $CY $LOGM $ETSY $HUBS $OKTA http://www.investopedia.com/news/7-tech-stocks-may-soar-takeovers?

PURE STORAGE (PSTG) closed just above key support last Friday – important time of week for a stock to trade just above key support level $PSTG

G1 THERAPEUTICS (GTHX)

Our swing trade success in G1 is discussed on the video as well as the various support and resistance levels on the charting, trade alerts ad price targets.

Bullish trade trajectory on this equity is awesome (see trade between diagonal green target trajectory lines) and the channel trade is in is now noted on the charting (yellow).

G1 Therapeutics to Provide Second Quarter 2018 Corporate and Financial Update on August 8, 2018 $GTHX https://finance.yahoo.com/news/g1-therapeutics-second-quarter-2018-100000130.html?soc_src=social-sh&soc_trk=tw

G1 THERAPEUTICS (GTHX) Closed 51.38 Friday, 53.66 58.29 resistance, 49.01 44.41 support $GTHX.

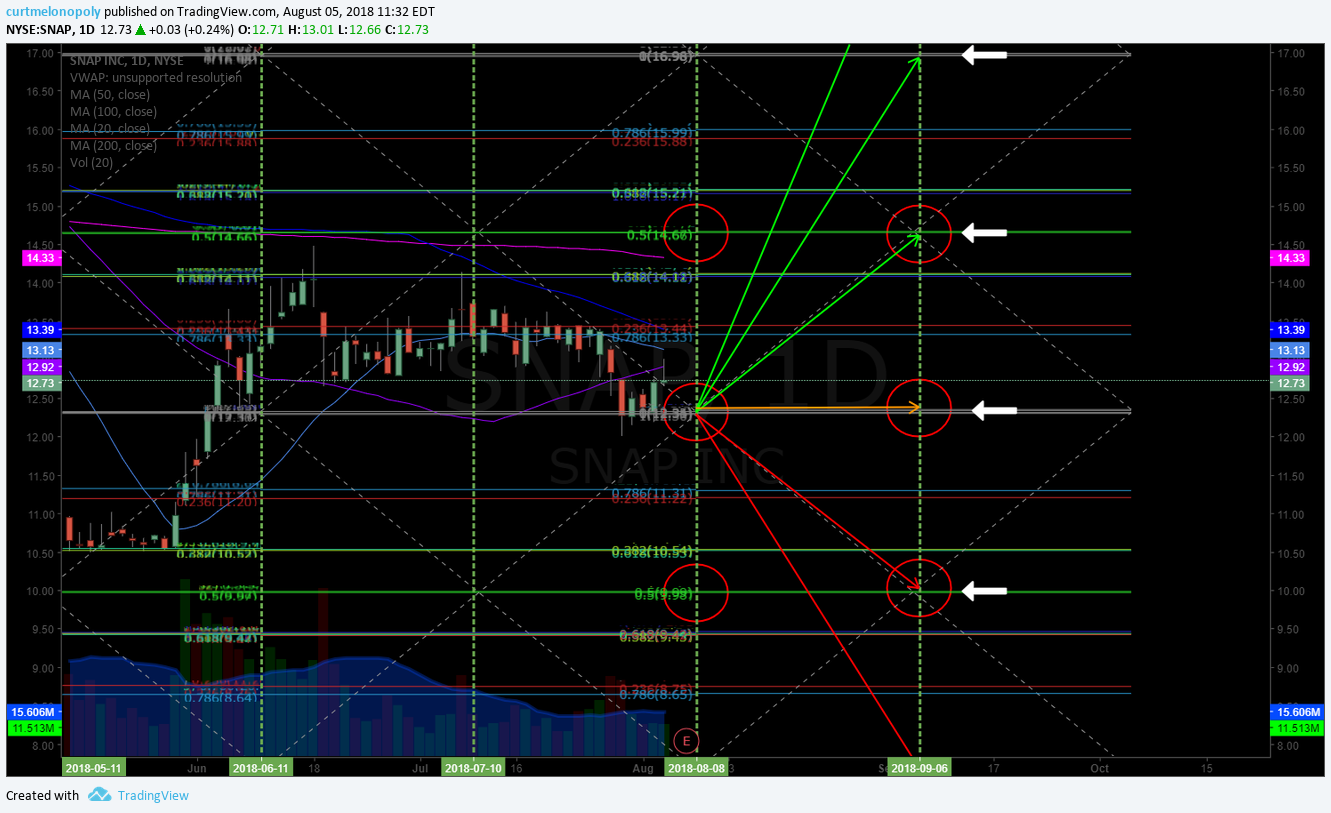

SNAP INC (SNAP) Earnings Trade Chart (Earnings in 2 days).

SNAP is not an easy stock to trade – we provide the specific levels to watch in earnings in two days.

The chart below is an updated version for earnings and is very detailed with all support, resistance, price targets, time cycles, trade trajectory lines and more.

SNAP closed Friday 12.73, it has supports at 12.33 and 9.99 in a sell-off. The SNAP chart has resistance at 14.66. Next time cycle ends Sept 6 on the chart with upside scenario 14.66 area and 9.99 area on the same day. In a total sell-off 7.64 is the next downside support.

3 Reasons Snap Investors Should Be Nervous Next Week $SNAP https://finance.yahoo.com/news/3-reasons-snap-investors-nervous-150000656.html?soc_src=social-sh&soc_trk=tw

SNAP INC (SNAP) How to trade SNAP earnings chart, support resistance price targets time cycles. $SNAP

ARROWHEAD PHARMA (ARWR)

My trading plan and trade alerts for ARWR are discussed in detail on the video. The trading channel, price targets, earnings plan, trade sizing, price support and resistance and moving averages are reviewed. The chart below highlights the current trading structure on ARWR with a highlighted triangle drawn on the chart (outlined in green).

How the market responds to earnings in two days will decide how I will trade ARWR post earnings.

Arrowhead Pharmaceuticals Earns $10 Million Milestone Payment from Amgen $ARWR https://finance.yahoo.com/news/arrowhead-pharmaceuticals-earns-10-million-113000479.html?soc_src=social-sh&soc_trk=tw

ARROWHEAD PHARMA (ARWR) Closed Friday 14.54 earnings in 2 days, main resistance 16.41 23.79 support 8.84 $ARWR

ALPHABET (GOOGL)

All the future forward price targets are discussed on video for Google post earnings. In addition to a swing trading chart for Google I have also included a daytrading chart below for daytraders.

There is a previously published exclusive member reports here: Protected: Trading Alphabet (GOOGL) Post Earnings. Swing Trading, Day Trades, Investing (Member Edition) $GOOGL

Report: Google working on a censored search engine for China $GOOGL https://www.yahoo.com/news/report-google-working-censored-search-004932360.html?soc_src=hl-viewer&soc_trk=tw

Google (GOOGL) Post earnings chart. Closed 1238.16 Friday. Main support 1211.86 resistance 1320.10. $GOOGL

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

Health Innovations (HIIQ)

Upside and downside price targets on the chart. Careful with resistance test in progress and the divergent trade possibilities. The upper channel is also being tested so an over bought retrace is very likely here. Congrats to longs on this swing trade alert. Hit bullish price targets early.

3 Stocks That Soared 20% or More This Week — Which Are Still Buys? $MOH, $DXCM, $HIIQ https://finance.yahoo.com/news/3-stocks-soared-20-more-123100958.html?soc_src=social-sh&soc_trk=tw

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart.

FACEBOOK (FB)

Facebook has got a bounce up since our alerts during the panic sell-off. The wash out trade set-up in the sell off is very similar to the last, and we killed the last swing trade set up in a sell off. We’re expecting another big trade here. All levels on chart and explained in video.

Click here for the previously published exclusive member reports for swing trading Facebook:

Protected: Trading Facebook (FB) Earnings Part 2 – Opportunity Knocks (Member Edition) $FB

Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB

Betting on a Smoother Ride for Tech Stocks https://www.barrons.com/articles/betting-on-a-smoother-ride-for-tech-stocks-1533330236

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB

TWILIO (TWLO)

Video reviews all levels going to earnings and chart below is an update since the mid day review. TWILIO has earnings this week and will be one of my main watches. MACD has been trending down on the daily chart and I am interested in a cell-off hopefully to 100 MA for a bounce play possibly. A significant wash-out snap back scenario would be best post earnings. We will see what happens.

3 Internet Stocks That Have a Killer Advantage $TWLO $NFLX $FB https://finance.yahoo.com/news/3-internet-stocks-killer-advantage-140600278.html?soc_src=social-sh&soc_trk=tw

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSI turned up, watching trend structure in to earnings in one day. $TWLO #chart #earnings

HI-Crush Partners (HCLP)

Hi crush has the potential to be a big trade. I’m watching the 200 MA slowly make its way down and I am hoping for a breach of it with price. I have it on watch and will produce a chart model should we engage a trade. Last week trade closed at the bottom of the weekly channel range in the 13.30 area. Hoping for a significant ROI on this one.

Hi-Crush Partners Telegraphs Major Changes to Its Business https://finance.yahoo.com/news/hi-crush-partners-telegraphs-major-191700714.html?soc_src=social-sh&soc_trk=tw

HI-Crush Partners (HCLP) Watching the 200 MA on weekly chart slowly work its way down. On close watch. $HCLP #chart #swingtrading

MYND ANALYTICS INC (MYND)

MYnd Analytics Partners with VisionQuest to Provide Telepsychiatry Services for its Community-Based Outpatient Mental Health Clinic in Pennsylvania https://finance.yahoo.com/news/mynd-analytics-partners-visionquest-telepsychiatry-142850638.html?.tsrc=rss

$MYND is reviewed on the video, it was one of the momentum stocks for last week. I am watching it for a daytrade going in to next week.

CELGENE (CELG)

There was a report on Celgene June 12 put out. We have had much success with this stock this year. Longs need to trim in to the Aug 8 price target resistance. Over its 200 MA currently.

Zacks.com featured highlights include: Celgene, Progressive, T. Rowe Price, AMC and Celanese https://finance.yahoo.com/news/zacks-com-featured-highlights-celgene-115511301.html?.tsrc=rss

CELGENE (CELG) Price target 95.90 Aug 10 in play. Main chart support at 86.28. Bullish formation. $CELG #swingtrading

EAGLE MATERIALS (EXP)

Eagle has been a very predictable chart. It is currently bouncing near recent bounce areas. Watching for a possible long trade, more likely after the time cycle on the chart expires but price will determine action. The trading quadrants on chart structure are discussed on video.

Eagle Materials Reports First Quarter EPS Up 22% On Record Revenues $EXP https://finance.yahoo.com/news/eagle-materials-reports-first-quarter-103000694.html?soc_src=social-sh&soc_trk=tw

EAGLE MATERIALS (EXP) Bounced near support, watching for a possible long as it has bounced here prior. $EXP

FITBIT (FIT)

If I had the time to publish another special trade report of FITBIT I would, but I don’t. The lats time we killed the wash out trade and it’s setting up again. Closed 5.46 Friday post earnings in a wash out sell off and this week over 5.61 with structure is a long to 6.66 etc. All levels are on the chart. All the price targets, time cycles, trade trajectories, support and resistance area etc are included on the swing trading chart below.

Click here for a previously published member exclusive report on trading FITBIT:

FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT

Unloved Fitbit Watches Shares Slide Despite Beat $FIT https://realmoney.thestreet.com/articles/08/03/2018/unloved-fitbit-watches-shares-slide-despite-beat

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

OAKTREE CAPITAL GROUP (OAK)

We are watching this very close here. The upside targets on OAK chart are very aggressive. We did well in it post election and are looking for another. The news article below does have some insight for investors.

Oaktree Capital Sees Solid Results in a Challenging Market

OAKTREE (OAK) Watching trade for a breach over 200 MA really close for a long side trade. $OAK

RUSSIA ETF (RSX) Under 200 MA on the daily with indecisive indicators. Watching. $RSX #chart

Why Russia’s Manufacturing PMI Is Gradually Contracting

https://marketrealist.com/2018/07/why-russias-manufacturing-pmi-is-gradually-contracting

BOFI HOLDING (BOFI) Bulls bought the dip near 200 MA prior to earnings. On watch for post earnings setup. $BOFI

BofI Federal Bank Signs Agreement to Acquire $3 Billion of Deposits from Nationwide Bank https://finance.yahoo.com/news/bofi-federal-bank-signs-agreement-113000968.html?soc_src=social-sh&soc_trk=tw

US SILICA HOLDINGS (SLCA) Under 200 MA post earnings near historical bounce area. On watch with MACD up. $SLCA #chart

U.S. Silica (SLCA) Misses Earnings & Sales Estimates in Q2 https://finance.yahoo.com/news/u-silica-slca-misses-earnings-134401463.html?soc_src=social-sh&soc_trk=tw

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

Swing Trading Special Earnings Report (Members) $TSLA, $FB, $HIIQ, $GTHX, $PSTG, $FIT, $ATHM, $FEYE … #swingtrading #tradealerts

Swing Trading Report. In this detailed Special Earnings Season (Member Edition) Aug 3, 2018: $TSLA, $FB, $HIIQ, $GTHX, $PSTG, $FIT, $ATHM, $FEYE, $RCL, $SPY, OIL and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 2 mid day, published August 3, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review session from August 2, 2018 that will become the premise for our next major entries for Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

Notices are reviewed in the first 5 mins of video FYI.

All quoted support and resistance are approximate.

Swing trades reviewed on this video: $TSLA, $FB, $HIIQ, OIL, $GTHX, $PSTG, $SPY, $FIT, $ATHM, $FEYE …

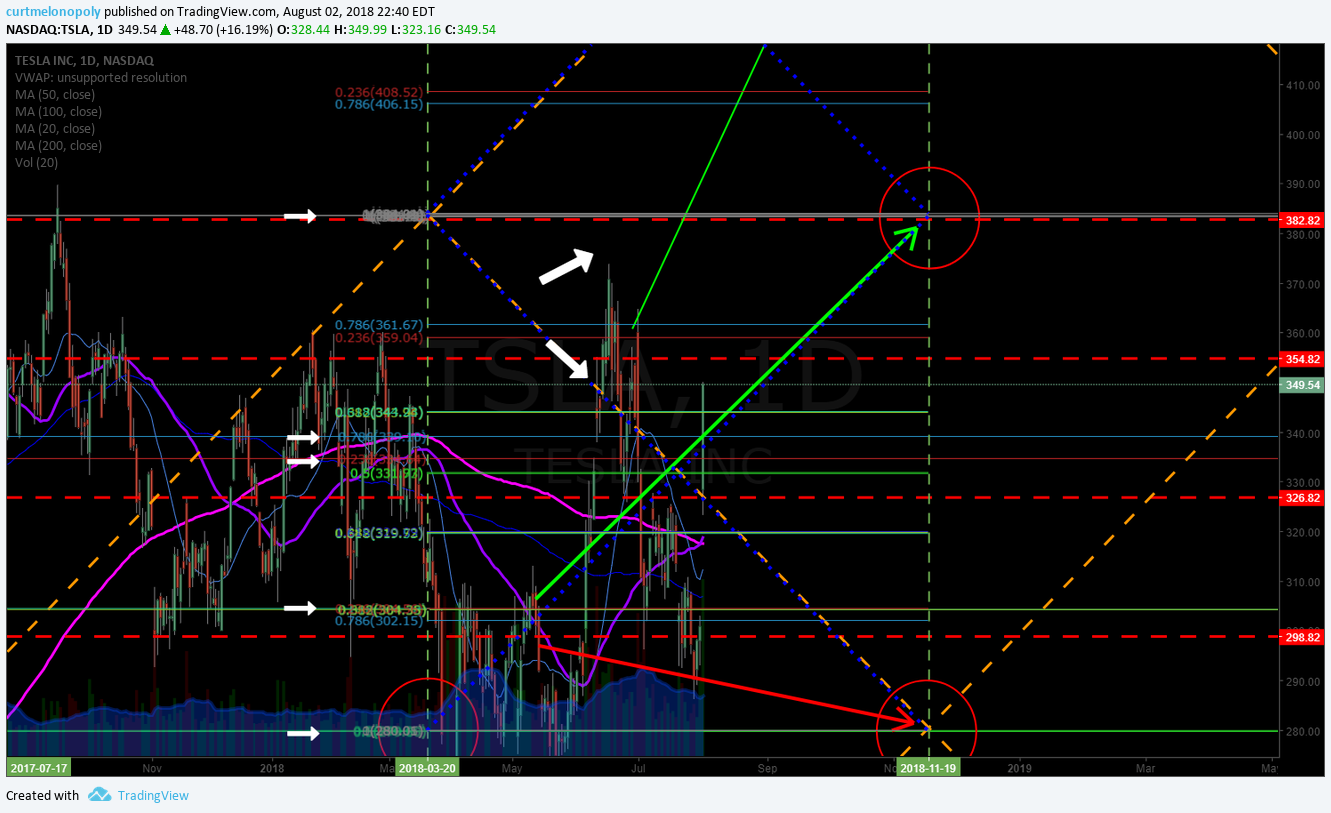

TESLA $TSLA – A review of the Tesla chart structure on video. Elon Musk fired up bulls on earnings conference call.

384.00 resistance and 435.38. Sell-off support 280.00 and 176.23 (main structural supports). But now at important resistance test area.

Nov 20 price target, upside trajectory 383.40. Trading range structure for trading TESLA with trims and adds is drawn by lead trader highlighted on video.

Significant resistance is shown on video at various points (Fibonacci quad walls – trendlines etc).

Recent Special TESLA Report is here: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles. https://compoundtrading.com/how-to-trade-the-tesla-move-price-targets-buy-sell-triggers-time-cycles-tsla-swingtrading-daytrading/

TESLA (TSLA) Closed 349.54 in regular trading Aug 2 in bullish formation here now. $TSLA #swingtrading

Live chart link for Tesla (shows all buy sell triggers and various other levels to watch for trade):

An example of our trading alerts feed on Twitter:

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

TESLA (TSLA) Tesla shares surge as investors embrace cash comments, Musk apology $TSLA #swingtrading https://finance.yahoo.com/news/tesla-shares-jump-cash-burn-144334101.html?soc_src=social-sh&soc_trk=tw

TESLA (TSLA) Tesla shares surge as investors embrace cash comments, Musk apology $TSLA #swingtrading https://t.co/hLrDQl4ceT

— Swing Trading (@swingtrading_ct) August 3, 2018

Health Insurance Innovations $HIIQ – Trading 42.75 price target 44.50 trade alert to trim went out today, next target 49.10 then 54.80 (divergent above channel), 40.20 support. Careful with trajectory noted on video.

Predictable charting trade structure. Channel is outlined. Symmetry shown in price targets hit. Trade alert entry long discussed. Trade trajectory is also discussed.

Health Innovations (HIIQ) Trade has hit our bullish price target early, trim longs here $HIIQ chart. #swingtrade #earnings

Live chart link for $HIIQ trade:https://www.tradingview.com/chart/HIIQ/zHy7T51l-Health-Innovations-HIIQ-Trade-has-hit-our-bullish-price-target/

Health Innovations (HIIQ) Health Insurers Fly As Trump Takes New Ax To ObamaCare $HIIQ #swingtrading https://www.investors.com/news/health-insurers-stocks-earnings-trump-rule-health-plans/

Health Innovations (HIIQ) Health Insurers Fly As Trump Takes New Ax To ObamaCare $HIIQ #swingtrading https://t.co/Ahqj7I0uRl

— Swing Trading (@swingtrading_ct) August 3, 2018

FITBIT $FIT – Buy sell triggers on our swing trading charts reviewed here. Recent special FITBIT swing trading report reviewed here on video.

FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT https://compoundtrading.com/fitbit-inc-class-a-nyse-fit-how-to-trade-fitbit-for-40-gain-member-exclusive-fit-swingtrading-daytrading-chart/

50 MA used as resistance on last sell off. Trading 5.48 down 7.5% today on other side of earnings. Likely over sold soon. Next time cycle completes Aug 14, 2018. Upside 5.60 6.67 7.72 are upside targets. Get ready for a turn. On watch here.

FITBIT (FIT) On close watch for an oversold bounce and trend reversal post earnings. $FIT

Live chart link with buy sell price targets and trade triggers for FITBIT https://www.tradingview.com/chart/FIT/Ni1fxuz4-FITBIT-FIT-On-close-watch-for-an-oversold-bounce-and-trend-rev/

FITBIT (FIT) The Versa Is Driving Fitbit’s Turnaround $FIT #swingtrading https://finance.yahoo.com/news/versa-driving-fitbit-apos-turnaround-213400971.html?soc_src=social-sh&soc_trk=tw

FITBIT (FIT) The Versa Is Driving Fitbit's Turnaround $FIT #swingtrading https://t.co/mEbX05UUJx

— Swing Trading (@swingtrading_ct) August 3, 2018

FIREEYE Inc. $FEYE – trading 15.09 on other side of earnings, downside 13.14 Sept 17 target, upside 16.24 19.29 Sept 17. Likely oversold soon also. Probability is for a turn. On watch closely for a trade. Main resistance 16.26.

Time cycles, machine trading liquidity, rule-set coding machine trading strategies and financial instrument chart trading structures on our algorithmic charting is discussed in detail here on the video. This explains how our win rate is so high.

FIREEYE (FEYE) Fireeye likely oversold soon also. Probability is for a turn. On watch closely for a trade. #swingtrade $FEYE

FIREYE (FEYE) FireEye Beats on New Customer Additions, Subscription Growth $FEYE #swingtrading https://finance.yahoo.com/news/fireeye-beats-customer-additions-subscription-000200148.html?soc_src=social-sh&soc_trk=tw

FIREYE (FEYE) FireEye Beats on New Customer Additions, Subscription Growth $FEYE #swingtrading https://t.co/Mz11yFLIjR

— Swing Trading (@swingtrading_ct) August 3, 2018

AutoHome $ATHM – Weekly chart, price target hit, mid quad support, earnings in 6 days, on high watch, 127.75 Apr 1 2019, large chart structure, Upside move target scenarios 110.87 , 128.70, 146.00.

AUTOHOME (ATHM) Weekly chart, price target hit, mid quad support, earnings in 6 days, on high watch $ATHM #swingtrading

Also discussed on the video is how to visualize the algorithmic charting horizontal instead of vertical and algorithmic charting channels.

Autohome (ATHM) Autohome Inc. to Announce Second Quarter 2018 Financial Results on August 8, 2018 $ATHM #swingtrading #earnings https://finance.yahoo.com/news/autohome-inc-announce-second-quarter-110000348.html?soc_src=social-sh&soc_trk=tw

Autohome (ATHM) Autohome Inc. to Announce Second Quarter 2018 Financial Results on August 8, 2018 $ATHM #swingtrading #earnings https://t.co/OAoa51LtmW

— Swing Trading (@swingtrading_ct) August 3, 2018

Facebook $FB – FaceBook has been an awesome trading instrument for our trading team and members this year.

How to check Wall Street calls is discussed.

While Facebook was in sell-off panic I was posting live on my Twitter feed where price would stop and rebuild in the chart structure.

Earlier in the year our Facebook trade in that sell-ff washout trade was one of our largest wins this year.

Review these recent special reports on swing trading Facebook (it will put the current trade set up in to perspective):

Protected: Trading Facebook (FB) Earnings Part 2 – Opportunity Knocks (Member Edition) $FB #trading #earnings

https://compoundtrading.com/trading-facebook-fb-earnings-part-2-opportunity-knocks-member-edition-fb-trading-earnings/

Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB #trading

https://compoundtrading.com/trading-facebook-fb-earnings-wash-out-on-revenue-growth-warning-member-edition-fb-trading/

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

https://compoundtrading.com/fb-facebook-long-set-testing-buy-sell-trigger-swingtrading-public-edition/

Buy sell triggers are discussed. Chart shows our structure that we have known for months.

Now trade in Facebook is following the trajectory in the charting send to members.

181.68 167.53 174.76 are buy sell triggers. 181.50 Sept 8 target and more above.

Review other recent reports for the larger view of chart structure in Facebook.

160.60 and 153.58 in a sell-off. The previous time we traded this in the year it did go one more floor down before it took off bullish.

FACEBOOK (FB) trade following trajectory in chart sent to members 181.68 167.53 174.76 buy sell triggers. $FB #swingtrade #chart

Example of what our trade alerts look like on our trading alert Twitter feed:

https://twitter.com/SwingAlerts_CT/status/1024658448942870528

FACEBOOK (FB) Facebook’s Faceplant a Buying Opportunity $FB #swingtrading https://www.barrons.com/articles/facebooks-faceplant-a-buying-opportunity-1533240359

FACEBOOK (FB) Facebook’s Faceplant a Buying Opportunity $FB #swingtrading https://t.co/LoLnAsx1zG

— Swing Trading (@swingtrading_ct) August 3, 2018

G1 Therapeutics $GTHX – Earnings in 6 days, wonderful swing trade in progress here, 58.14 upside price target (most bullish), this trades with large intra-day swings, also a good daytrading instrument, 58.21 resistance. Trims today at quad wall resistance.

A review of our trade alerts feed on Twitter is at this point in the video.

G1 THERAPEUTICS (GTHX) Trims today at quad wall resistance worked well.

Pure Storage $PSTG – trade alert triggered while doing video, closed just above key support last Friday – important time of week for a stock to trade just above key support level. Trading 22.53 earnings in 24 days, trading right at decision, price target Oct 1 25.78 29.20 (bullish). Downside 19.19 15.90 in event of sell-off.

A recent special report we published on trading Pure Storage:

How to Trade Pure Storage (PSTG) Earnings in Six Days (Member Edition) $PSTG

https://compoundtrading.com/how-to-trade-pure-storage-earnings-in-six-days-member-edition-pstg/

Royal Caribbean $RCL – up over its mid quad resistance, 200 MA is right above and up against a quad wall, not a buy until over 188.70 because it has a number of decisions.

Price increases going in to the fall are discussed.

$SPY SP500 – Trading 281.74, followed quad wall down, 200 MA under price where price bounced, 283.68 resistance, price target 299 Aug 2 (not happening), Aug 13 time cycle price targets 283.82 and bullish 294.20 support for a sell-off 278.56, 273.67 in sell off 267.88 and 262.00.

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY

OIL FX $USOIL $WTI – Price hit the Tues 4:30 target and Wed 10:30 AM EIA price target on the EPIC Algorithm model. Got a a serious bull side move off bottom channel support earlier today (the team was traveling so we missed it). Various levels discussed on video.

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

If you have any questions about this special earnings trading report message me anytime.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me:

Special Swing Trading Report (Members) #earnings Sun July 29 OIL, $RIOT, $SPY, $PSTG, $AMBA, $FSLR, $AAOI, $LITE, $CALA …

In this Special Earnings Season Swing Trading Report: OIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: Do not miss listening to the actual video for earnings trade levels on these charts. Reviewing just the notes below is not sufficient. Many of these set-ups will be traded and as was so the last earnings and times before significant ROI for the year is gained setting up positions during earnings season. Also, even if the video was recorded days earlier the trading structure of the charts is still in play for the earnings trade set-up.

Mid Day Member Webinar Chart Swing Trading Set-ups Summary (from July 25 mid day, published July 29):

Swing Trading Special Earnings Season Report (member version) that will become the premise for our next major entries.

Reviewed: Crude OIL, $WTI, $USOIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA.

This is the mid day review video from Wednesday July 25, 2018 of last week. The charting updates apply today as they are focused toward the swing trading platform. We didn’t have time to post the video and report until now.

We continue in this series to review the 100 equities on our swing trading platform in about ten days in lieu of the one regular weekly swing trading report (covering about 1/5 per week). The objective is to cover all the charting trade set-ups during earnings season. This doesn’t mean we can include new charting for each as each are reviewed on the video.

The equities on this report are in reference to our regular Swing Trading report that was last published June 20, 2018 on regular rotation (for referencing charts as you need).

Not reviewing the video details (trading plans) is not advised because there is detailed trading plan information in this video.

FX $USOIL $WTI #CL #OILTrading – A quick look at the oil algorithm charting. I had about ten trades today, our machine trading side had 30 – 40 oil trades. My personal monthly month oil trading win streak continues. See special report to follow, the report will also have an intra day chart for members (charting our machine trading thesis is formed via).

$RIOT – See special report (to follow) on the daytrade and how we did it.

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

US Dollar $DXY – Dollar is at main pivot in structure of chart.

$SPY – SPY is at pivot also. Review recent videos. Near buy trigger trim near 284.94.

$TORC – was the the premarket momo, we didn’t take a trade, it did nothing at open.

$TORC Premarket up 142% trading 21.79 on lock up exp, results, short interest. $TORC #daytrading

$EDIT – I am in 33.43 1/3 sizing. 34.86 resistance on model. Will add on pull backs at supports or channel. I think it will get near bottom of channel and then I’ll add. Earnings in 18 days. Video shows trading plan on EDIT chart.

EDITAS MEDICINE (EDIT) Sell-off nears key support 27.95 for an add to swing, trading 29.70 Friday $EDIT #swingtrade #alerts

$GTHX – Long swing trade entry 49.63 1/3 sizing. Total sizing is never more than 3% of account sizing. So at 1/3 there is no stress. Set a trim 50.99 alerted it and trade missed trim trigger by 2 cents. Details of GTHX trading plan shown on video.

G1 THERAPEUTICS (GTHX) Over mid quad key support in swing trade long here. Targets on chart. $GTHX #swingtrade

$ARWR – Long swing trade from yesterday 17.24 entry, over mid quad support, Resistance at 19.50 quad wall and Fib line, pivot 16.42, main support 12.84. Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

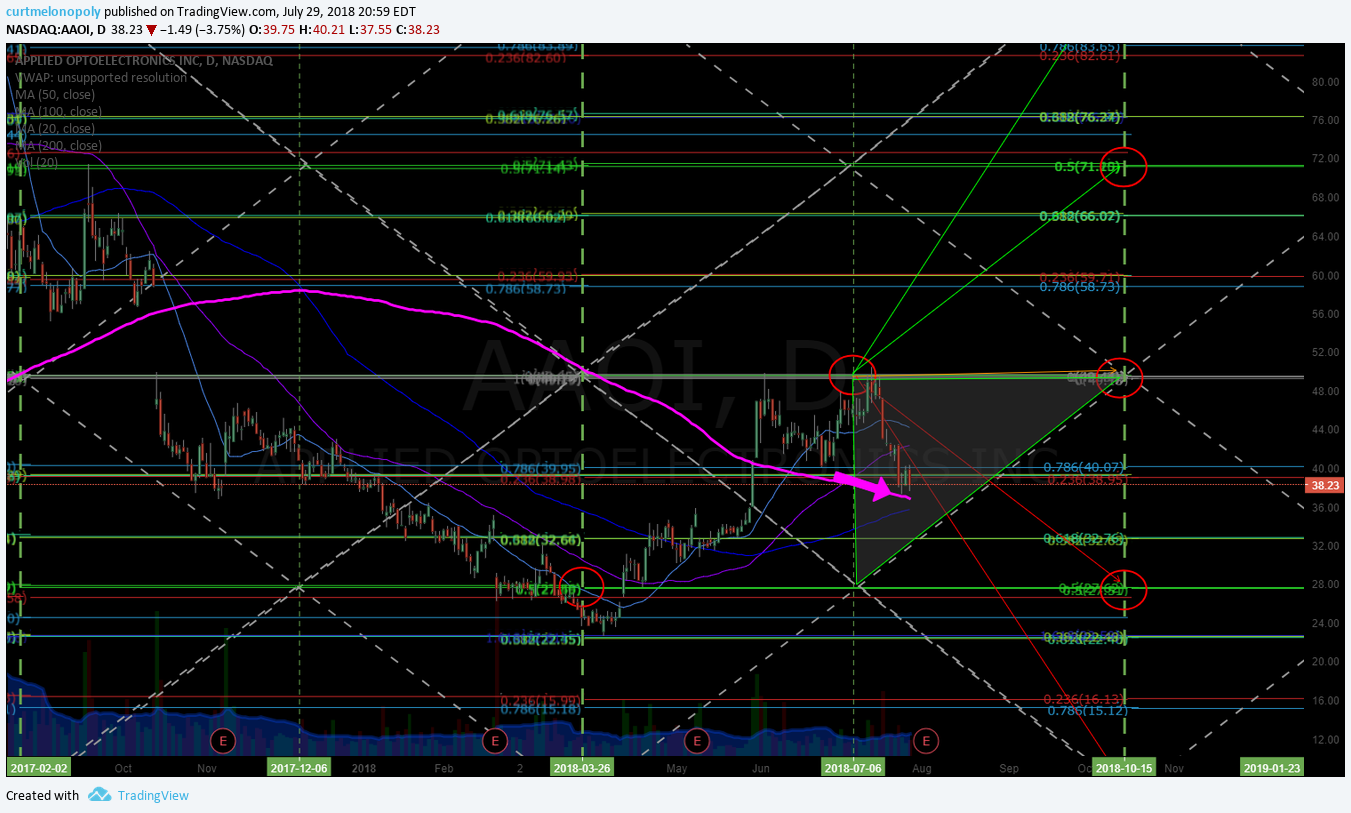

$PSTG Pure Storage – trading 23.84 earnings 32 days, in the pinch in the quad, looking for 25.90 in to Oct 1 in trading plan – looking for trade. 29.13 would be ideal price target Oct 1 top of algorithmic channel on chart.

PURE STORAGE (PSTG) Closed Friday just above key support. Below targets 19.25 Oct 1 above 25.92. $PSTG #swingtrading