Tag: $SENS

Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room for: $VIX Volatility $WTI $CL_F Oil $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 17, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Tickers reviewed: $VIX $WTI $CL_F $USO $PROQR $CARA $BOX $BABA $SSW $DXY $SPY $GTHX $FB $FF $SENS and more.

I apologize for the sound interference – at times it was just awful, we’ll re hard wire the set-up again soon here and get that fixed. In tomorrow’s mid day I will hard wire that one computer to modem and you can let me know if it is any better please.

Voice broadcast does not start until 3:18 on video.

Market discovery theme on day.

Volatility $VIX – time-cycles reviewed in to Dec 24 beyond and inflections in markets, market open, futures and account return expectations over next two trading quarters or so.

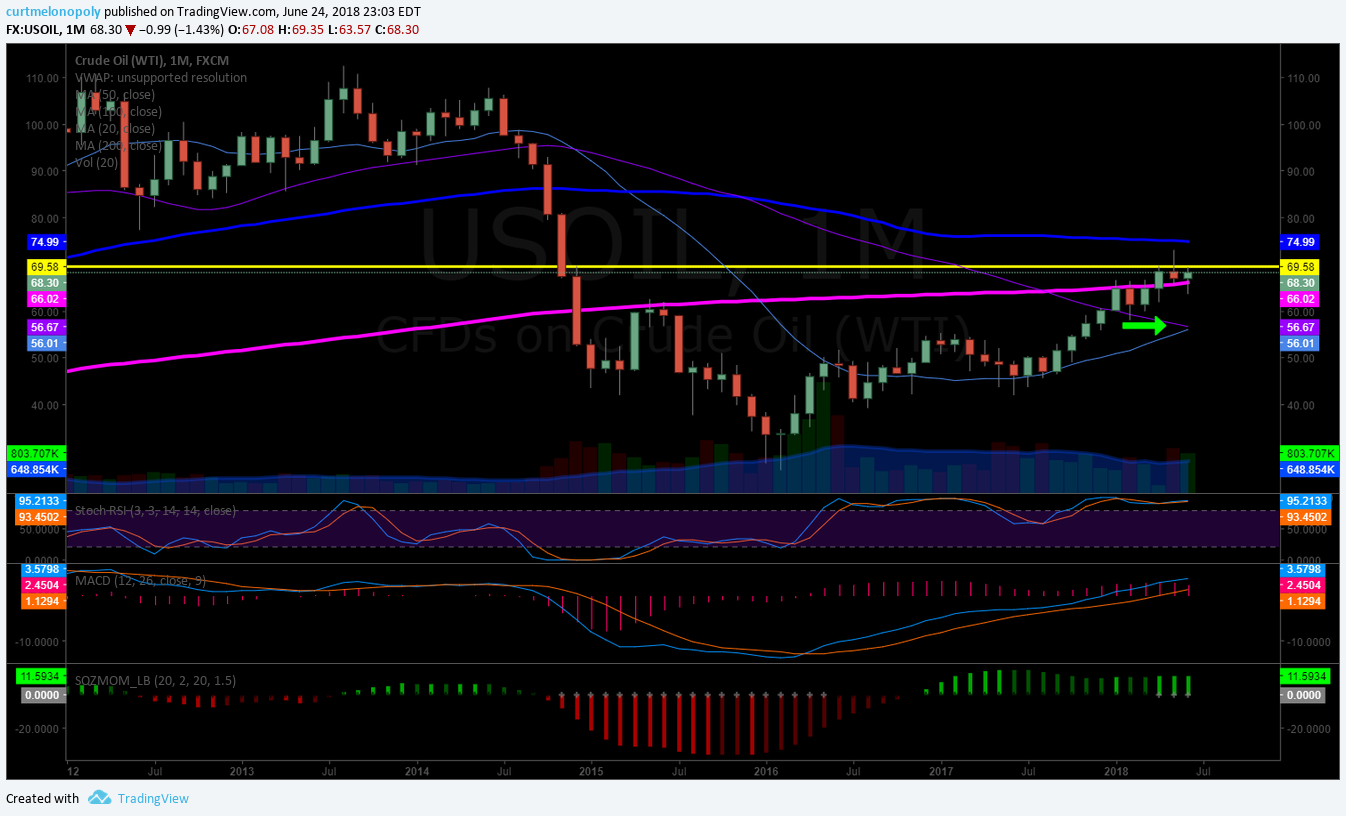

Crude oil trading $WTI $CL_F $USO – review of crude oil algorithm, machine trading model, charting, price targets for time cycles this week reviewed.

PROQR Therapeutics $PROQR – Excellent chart set-up, one of my favorite trades of late. Buy sell trading signals reviewed. Bounced at support at previous trade alert now at key resistance, trim in to resistance and over 22.70 targets 24.85 then 27.50. Watch the diagonal trend line (quad wall). Careful shorting this stock, 18.05 possible.

US Dollar $DXY – Review of US Dollar Algorithm charting. Lower support trend line and upper trend line, support and resistance areas to watch. Review of structure.

$CARA Therapeutics – testing previous highs, testing other side of bowl and a full extension is possible here, structured chart trading signals reviewed, Target Dec 10 30s or 38.00s if it breaks out. Pull back to 16.36 support, look for a bounce there if it sells-off. 19.70 is near term support for a test long also.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

BOX $BOX – previously provided upside targets, down side scenario on video 22.32 good support, 50 MA support is good, intra day in down trajectory lines, 10.36 is a downside sell-off target that is possible in a panic. Channel symmetry also reviewed.

SEASPAN $SSW – keeps hitting resistance, simple short at each, looking for a long over resistance in trajectory on video. Upside 10.18 first target, best scenario Nov 11.93 and 18.30 best best not probable.

G1 Therapeutics $GTHX – pullback in price here doesn’t surprise me, candle body is in current bullish trajectory lines on chart, review of downside supports and upside price targets. 76.00 – 80.00 (up over 69.62 is a trigger). All areas reviewed on video.

SHOPIFY $SHOP – chart pivot acting as support (red line) Oct 10 166.72 price target, holding key support, working up against a quad wall (diagonal Fib resistance), 154.35 buy side comes in at that area. Pull back support is 50 MA primary for a long side test trade.

SP500 $SPY – the box test area reviewed, above box is a long and under is a short. 283.93 278.47 Sept 1 are downside targets in a sell-off. Other trade signals and price targets reviewed on video.

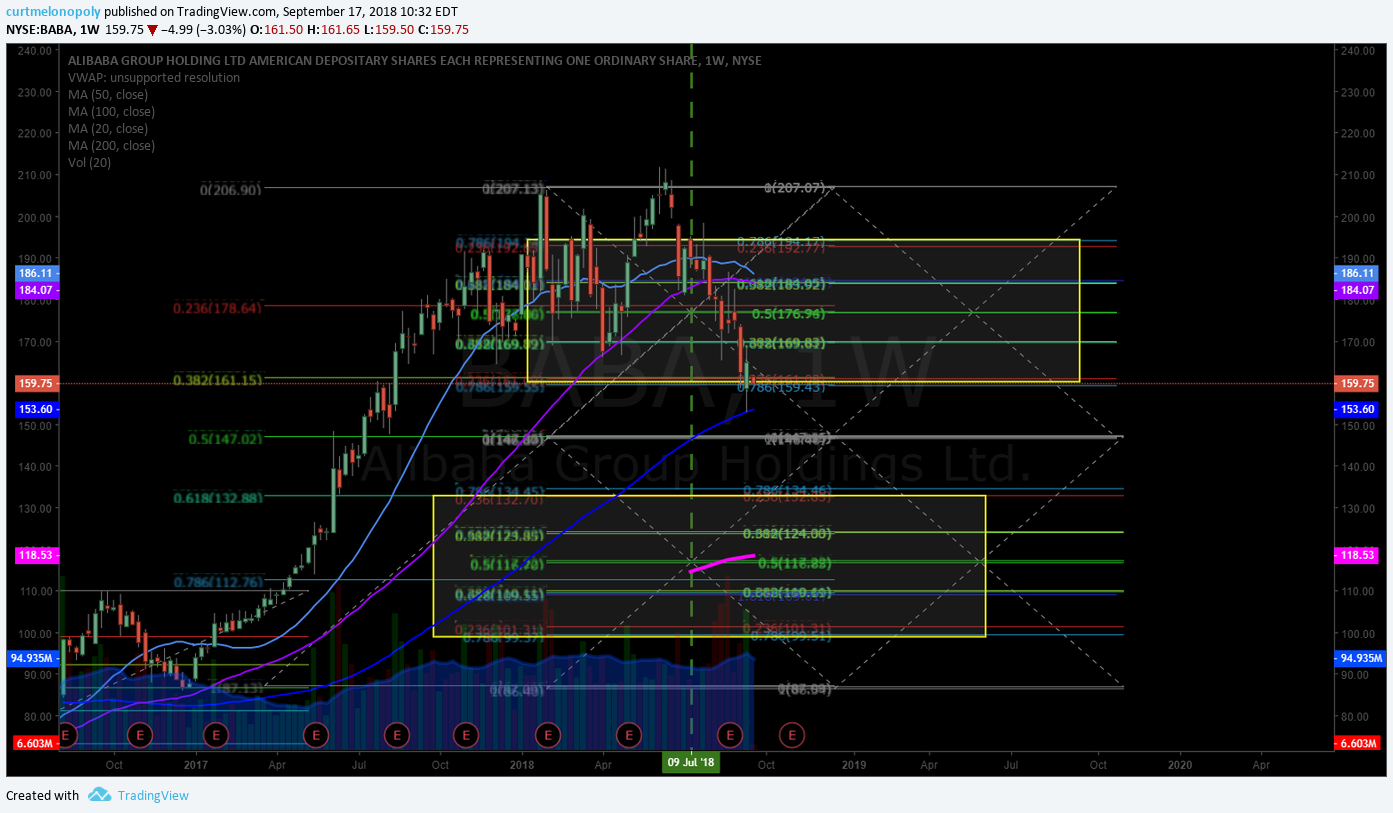

ALIBABA $BABA – underwater a bit on this swing trade in BABA, I’m in 1/10 sizing now. Bounced off 100 MA, trading right at box support, Dec 17 trade price targets discussed to low side. Adds at each support is the trading plan for ALIBABA should sell-off continue.

https://www.tradingview.com/chart/BABA/gKTnmCkK-BABA/

FACEBOOK $FB – 20 MA upside resistance trade alarm set for possible turn on the snap-back trade I’m looking for. 240 min chart.

Top momentum stocks for the day reviewed;

$OTM 20 MA resistance on weekly, above will target the 50 MA. It respects the 50 MA and 200 MA on weekly chart. Trading plan reviewed on video.

$LEU – stay away from

$FF – Currently at support and resistance area, price extensions for a possible run are reviewed on video. Targets 23.67 in a bullish scenario, trading 17.63.

$TAHO – junk

$GHG – junk, no structure

$CEL – not a good chart

$CWH – terrible

$SPA – at previous lows, bounced there before…. but…. no structure

$SUPV – junk

$TGS – bounced off 200 MA support, good example of a bullish run out of the bowl for multiple extensions up on the chart.

$WAB – not interested

$AG – on 200 MA support, not interested.

$SENS – support 3.97 trading 4.16, looking for a bounce. The trade set-up will be on the upcoming swing trading report.

Others were also reviewed.

VIDEO Trade Alerts: $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Voice broadcast does not start until 3:18 on video.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, $VIX, $WTI, $CL_F, $USO, $PROQR, $CARA, $BOX, $BABA, $SSW, $DXY, $SPY, $GTHX, $FB, $FF, $SENS, swingtrading, daytrading

PreMarket Trading Plan Tues June 26: OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $LEN, $JKS, $SENS more.

Compound Trading Premarket Trading Plan & Watch List Tuesday June 26, 2018.

In this edition: OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $FRSX, $LEN, $EXEL, $GE, $MU, $JKS, $GEVO, $SENS, $HRTX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete- Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room:

- Target date for recommencement week of June 25. Main Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

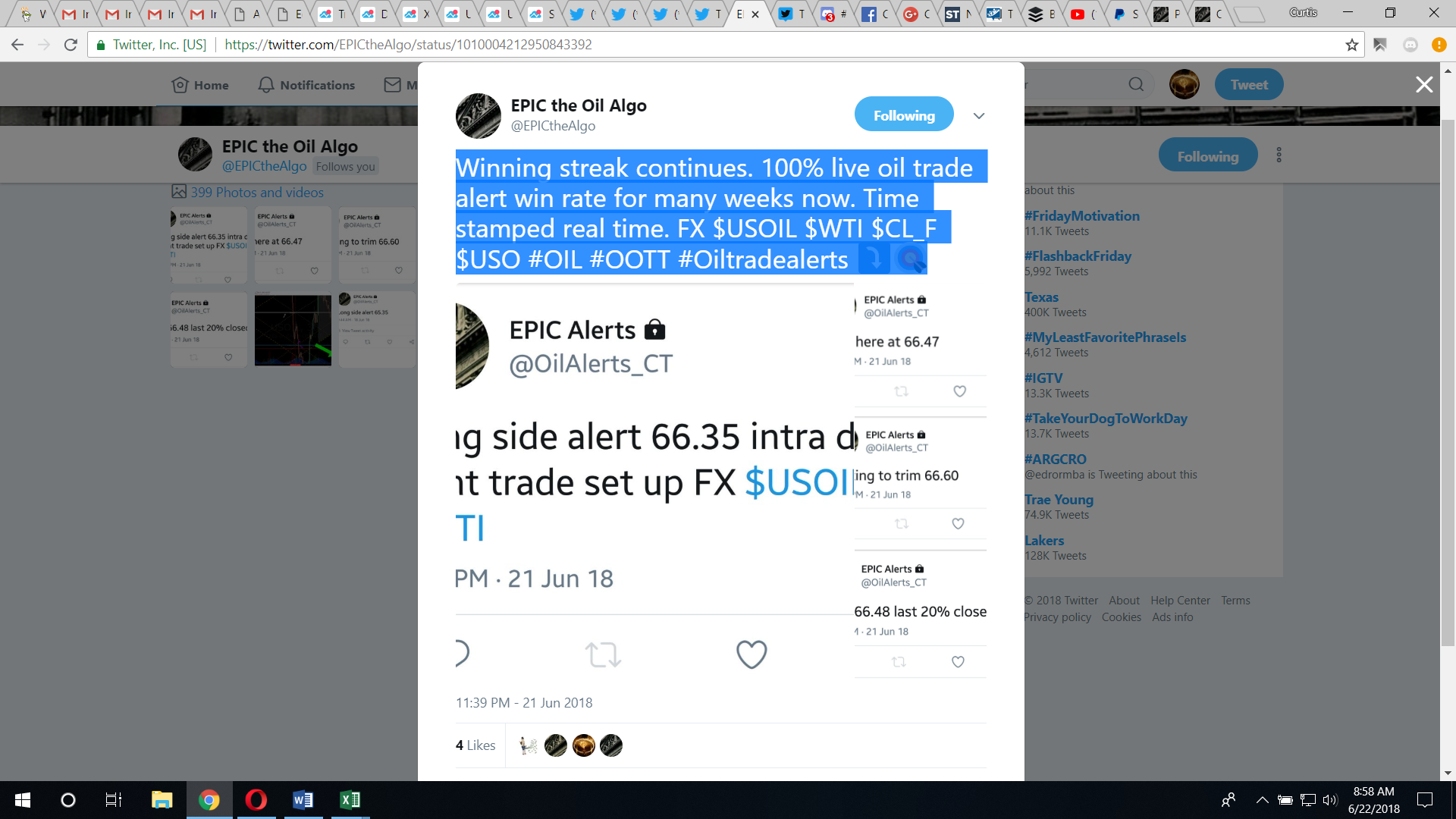

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

26 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11933869 $LEE $ACHV $SPPI $FRSX $LEN $EXEL $GE $MU $JKS $GEVO $SENS $HRTX

Market Observation:

Markets as of 7:52 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 68.31, Gold $GLD trading 1256.11, Silver $SLV trading 16.16, $SPY 271.00, Bitcoin $BTC.X $BTCUSD $XBTUSD 6059.00 and $VIX trading 17.4.

Momentum Stocks to Watch:

AbbVie shares rise on $1 bln investment in partnership with Alphabet-backed health company

Lee Enterprises rockets 23% premarket on news it will manage Berkshire’s newspapers

GE to maintain dividend for now, stock surges on first day ex-Dow

8 Stocks To Watch For June 26, 2018 https://benzinga.com/z/11932900 $AVAV $FDS $GEVO $LEN $HRTX $SENS $SONC $INFO

8 Stocks To Watch For June 26, 2018 https://t.co/1KmcpS6BEw $AVAV $FDS $GEVO $LEN $HRTX $SENS $SONC $INFO

— Benzinga (@Benzinga) June 26, 2018

News:

Netflix initiated at Outperform by Imperial Capital; firm sees potential 29% upside $NFLX

Energizer to acquire Nu Finish auto appearance brands for an undisclosed sum $ENR

Starbucks founder Howard Schultz steps down as Chairman today $SBUX

$VRX – Valeant’s (VRX) Salix And US WorldMeds Enter Into Exclusive Co-Promotion Agreement For Opioid Withdrawal Treatment LUCEMYRA @Street_Insider

$AKAO ZEMDRITM (plazomicin) Approved by FDA for the Treatment of Adults with Complicated Urinary Tract Infections (cUTI)

$XXII 22nd Century Announces New Non-GMO, Very Low Nicotine Flue-Cured and Burley Tobacco Varieties

$LEE Lee Enterprises will manage Berkshire Hathaway newspaper and digital operations in 30 markets

$ACHV Achieve Announces Positive Cytisine Data Demonstrating No Clinically Significant Drug-Drug Interaction

Recent SEC Filings:

Recent IPO’s:

$HRTX prices at $39.50

Earnings:

#earnings for the week

$NKE $CCL $LEN $WBA $GIS $PAYX $STZ $RAD $FDS $JKS $ACN $KBH $BBBY $INFO $MKC $SCHN $UNF $CAG $APOG $CUK $SONC $GMS $AVAV $PIR $EROS $SNX $LNN $OMN $SJR $FUL $XPLR $CAMP $PRGS $NG $FC $DTRM $IRET $GBX $DAC

http://eps.sh/cal

https://twitter.com/CompoundTrading/status/1011220159246323713

upcoming #earnings releases with the highest #volatility

$PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL

http://eps.sh/cal

upcoming #earnings releases with the highest #volatility $PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL https://t.co/lObOE0dgsr pic.twitter.com/kbjyr7perU

— Earnings Whispers (@eWhispers) June 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility

Volatility following perfect structure on lift off in to time-cycle peak on 60 min algorithm model. $VIX #volatility pic.twitter.com/Ire0fHoCNT

— Vexatious $VIX Algo (@VexatiousVIX) June 26, 2018

Silver Weekly chart compression near end June 25 228 AM #SILVER $SLV, $USLV, $DSLV

Volatility S&P 500 Index (VIX) Structured take-off on 60 minute model in to time-cycle peak. June 25 1108 PM $VIX #volatility $TVIX $UVXY

SPDR SP500 Monthly Chart (SPY) Elevated MACD pinch. On watch now. $SPY $ES_F $SPXL $SPXS

Oil Chart (Monthly). Trade touched pivot, 20 MA about to breach 50 MA (bullish if it happens) June 24 1103 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). June 24 1115 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

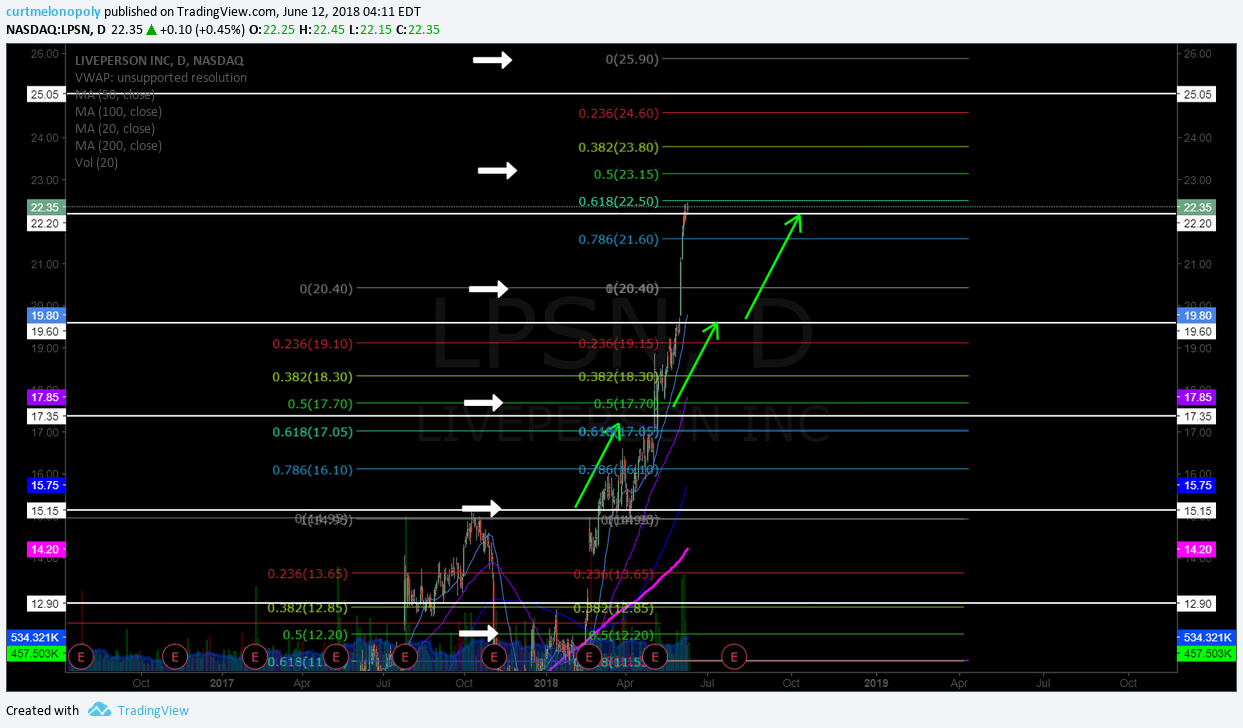

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Market Outlook, Market News and Social Bits From Around the Internet:

In markets today:

* Stocks bounce back

* Bonds fall

* Shanghai composite enters a bear market

* Harley Davidson, Jack Daniels hurt by trade war

https://www.bloomberg.com/news/articles/2018-06-25/asia-stocks-to-extend-global-slide-dollar-dips-markets-wrap …

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

#5things

-Navarro’s calming words

-China’s problems mount

-Immigration bill

-Markets quiet

-EM warnings

https://bloom.bg/2lAXSjF

#5things

-Navarro's calming words

-China's problems mount

-Immigration bill

-Markets quiet

-EM warningshttps://t.co/vCnAwucuN5 pic.twitter.com/nPiYiuhvTS— Bloomberg Markets (@markets) June 26, 2018

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/g6kMHMGWld

— Benzinga (@Benzinga) June 26, 2018

The biggest thing in oil last week wasn’t in Vienna, it was in Canada, says Goldman Sachs

https://twitter.com/EPICtheAlgo/status/1011334967836725249

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List:

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $CTL $MU $LRCX $CBOE $HOME $KMI $WH $MELI

Netflix stock up 1.7% premarket as Imperial Capital initiates coverage at outperform

$SPOT Barclays Starts Spotify (SPOT) at Overweight

Nvidia stock gains after Benchmark starts coverage with buy rating

$AXGN price target raised to $70 from $45 at Leerink – reiterates Outperform rating

Sandler O’Neill Upgrades Sandy Spring Bancorp $SASR to Buy

(6) Recent Downgrades: $INCY $UCBI $ABCP $SQ $AMCX $INTC $SO $TREE $SIRI $TTM $MGM $EDR $CAJ $ABCB

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, OIL, $SPY, $VIX, $NFLX, $LEE, $ACHV, $SPPI, $LEN, $JKS, $SENS

PreMarket Trading Plan Fri June 22: OPEC, OIL, Oil Algorithm EPIC Run, $BB, $MDT, $URI, $JPM, $BAC more.

Compound Trading Premarket Trading Plan & Watch List Friday June 22, 2018.

In this edition: OPEC, OIL, Oil Algorithm, EPIC Run, $BB, $MDT, $URI, $JPM, $BAC, $LITE, $GOOGL, $AGN, $FB, $EXP, $LPSN, $SENS, $BOX, $PCRX, GOLD, $GDX, $DXY, $SPY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete- Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Question and answer page has been updated for those asking about services and platform options (with recent inquiry example) here;

https://twitter.com/CompoundTrading/status/1004427758913679361

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room: Target date for recommencement week of June 25. Main Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: BB, MDT, URI, JPM, BAC & more –

Stocks making the biggest moves premarket: BB, MDT, URI, JPM, BAC & more – https://t.co/79UgkoWbE1

— Melonopoly (@curtmelonopoly) June 22, 2018

Market Observation:

Markets as of 8:37 AM: US Dollar $DXY trading 94.64, Oil FX $USOIL ($WTI) trading 67.08, Gold $GLD trading 1268.19, Silver $SLV trading 16.35, $SPY 275.55, Bitcoin $BTC.X $BTCUSD $XBTUSD 6345.50 and $VIX trading 13.5.

Momentum Stocks to Watch:

25 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/11920068 $ABIL $TNDM $SENS $IBIO $BB $TCS $GEVO $RHT $YTRA $SGH $OPK

News:

Benzinga:

– Blackberry reports Q1 top and bottom line beat, shares up a bit premarket $BB

– BTIG Research downgrades Red Hat to Neutral after the company Thurs. issued disappointing guidance $RHT

– Disney’s ABC plans ‘Roseanne’ spin-off, ‘The Connors’ $DIS

OPEC ministers strike deal on oil production levels

https://twitter.com/EPICtheAlgo/status/1010141288895795201

Live Webcast

174th (Ordinary) Meeting of the OPEC Conference – 22 June 2018

OPEC Secretariat – Vienna, Austria http://www.opec.org/opec_web/en/multimedia/349.htm …

https://twitter.com/EPICtheAlgo/status/1010140798254567424

Recent SEC Filings:

Recent IPO’s:

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://benzinga.com/z/11882630 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://t.co/VVKXywrt04 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

— Benzinga (@Benzinga) June 18, 2018

Earnings:

#earnings for the week

$MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS

#earnings for the week $MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS https://t.co/r57QUKKDXL pic.twitter.com/2CbnVqk0BA https://t.co/GIh1lTCH8Q

— Melonopoly (@curtmelonopoly) June 16, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Oil Chart (Weekly). Oil trendlines on weekly time-frame. June 18 146 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD still turned down price under 100 MA. June 18 143 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Trade failing 20 MA and Fibonacci support test. June 18 132 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

https://www.bloomberg.com/news/articles/2018-06-22/five-things-you-need-to-know-to-start-your-day

Economic Data Scheduled For Friday

Economic Data Scheduled For Friday pic.twitter.com/r3wFIXPBNw

— Benzinga (@Benzinga) June 22, 2018

– OPEC decides to hike oil supply

– J&K Governor holds all party meet

– Maharashtra #PlasticBan to come into effect tomorrow…

… & more. To know more about these stories, visit http://www.bloombergquint.com

– OPEC decides to hike oil supply

– J&K Governor holds all party meet

– Maharashtra #PlasticBan to come into effect tomorrow…… & more. To know more about these stories, visit https://t.co/FkiyCFV2LF pic.twitter.com/HwWcNSbKud

— NDTV Profit (@NDTVProfitIndia) June 22, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SBOT $CASI $YTEN $HRTX $DRI $PDCO $VYGR $KR $SUPV $HX $YPF $ARGT $LIFE $CTRV $LITE $MU $SFTBY $UGAZ $RYTM $WDC

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $URI $DG $DRI $VSLR $MOH $SO $ES $SO

(6) Recent Downgrades: $RHT $INGR $BKNG $ILPT $ECL $OLLI $HZN $ECL $VRX $SEMG $ZBH $NKE $KLAC $CAKE

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan,

PreMarket Trading Plan Tues June 19: $ASTC, OIL, $SENS, $BOX, $GEVO, $FMI, $NEPT, $PLM, $SPY, $DXY, $VIX more.

Compound Trading Premarket Trading Plan & Watch List Tuesday June 19, 2018.

In this edition: $ASTC, OIL, $SENS, $BOX, $GEVO, $FMI, $NEPT, $PLM, $SPY, $DXY, $VIX and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are newer comments recently important.

The rest of the weekly reports go out this evening, a number of swing reports, VIX, DXY and Silver are left for this week.

Our Question and Answer Page has been updated for those asking about our services and platform options (with a recent inquiry example) here

https://twitter.com/CompoundTrading/status/1004427758913679361

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Private Discord Server Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription (bundle subscription) as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

21 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11899774 $GEVO $FMI $ASTC $NEPT $VIVE $NVUS $SECO $CYAD $SE $TELL $GLMD $HMI

21 Stocks Moving In Tuesday's Pre-Market Session https://t.co/yrTbrMcnUk $GEVO $FMI $ASTC $NEPT $VIVE $NVUS $SECO $CYAD $SE $TELL $GLMD $HMI

— Benzinga (@Benzinga) June 19, 2018

Market Observation:

As of 8:03 AM: US Dollar $DXY trading 95.23, Oil FX $USOIL ($WTI) trading 64.72, Gold $GLD trading 1271.51, Silver $SLV trading 16.4, $SPY 274.00, Bitcoin $BTC.X $BTCUSD $XBTUSD 6722.50 and $VIX trading 14.3.

Momentum Stocks to Watch: $GEVO $FMI $NEPT $PLM

$ASTC premarket trading 4.20 up 120% on news 1st Detect Announces TRACER 1000 Accepted into European Evaluation Process for Security Screening… https://finance.yahoo.com/news/1st-detect-announces-tracer-1000-110500091.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

$ASTC premarket trading 4.20 up 120% on news 1st Detect Announces TRACER 1000 Accepted into European Evaluation Process for Security Screening… https://t.co/pADWECRCOi via @YahooFinance

— Melonopoly (@curtmelonopoly) June 19, 2018

News:

Novus shares rise 12% on FDA guidance for ear infection product

Veritas-backed Verscend to acquire health care payments company Cotiviti for $4.9 billion in cash

$NURO (+44.4% pre) NeuroMetrix Receives $3.8M Milestone Payment Under Pact with GSK Consumer Healthcare – SI

Recent SEC Filings:

Recent IPO’s:

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://benzinga.com/z/11882630 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://t.co/VVKXywrt04 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

— Benzinga (@Benzinga) June 18, 2018

Earnings:

#earnings for the week

$MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS

#earnings for the week $MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS https://t.co/r57QUKKDXL pic.twitter.com/2CbnVqk0BA https://t.co/GIh1lTCH8Q

— Melonopoly (@curtmelonopoly) June 16, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Oil Chart (Weekly). Oil trendlines on weekly time-frame. June 18 146 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD still turned down price under 100 MA. June 18 143 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Trade failing 20 MA and Fibonacci support test. June 18 132 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

#5things

-Trade war heats up

-Markets fall

-OPEC’s other problem

-Brexit vote(s)

-ZTE plunge

https://bloom.bg/2K1JL4C

#5things

-Trade war heats up

-Markets fall

-OPEC's other problem

-Brexit vote(s)

-ZTE plungehttps://t.co/eMLcba3sUJ pic.twitter.com/BPYn7p34KT— Bloomberg Markets (@markets) June 19, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ASTC $NURO $FMI $GEVO $NEPT $TVIX $CANF $VIVE $UVXY $RSLS $CNET $SECO $YANG $VXX $VIXY $RKDA

(2) Pre-market Decliners Watch-List : $EDGE $PAGS $TELL $HMI

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Premarket analyst action – healthcare https://seekingalpha.com/news/3364833-premarket-analyst-action-healthcare?source=feed_f … #premarket $ITRM $BLUE $CVS $HSDT

Premarket analyst action – healthcare https://t.co/q6LlYLQ3qB #premarket $ITRM $BLUE $CVS $HSDT

— Seeking Alpha Market News (@MarketCurrents) June 19, 2018

(6) Recent Downgrades:

RedHat stock falls after Raymond James downgrade

Snap stock falls after Cowen cuts estimates on daily active user, ad revenue concerns

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $ASTC, OIL, $SENS, $BOX, $GEVO, $FMI, $NEPT, $PLM, $SPY, $DXY, $VIX

Swing Trading Report Tues June 12 (Part B) $EDIT, $SENS, $LPSN, $ITCI, $GTHX, $EXTR, $ESPR, $PDLI, $IPI more.

Compound Trading Swing Trading Stock Report (with Buy Sell Signals on Select Chart Set-Ups) Tuesday June 12, 2018 (Part B).

In this Edition; $EDIT, $SENS, $LPSN, $ITCI, $GTHX, $EXTR, $ESPR, $PDLI, $IPI, $XOMA, $SOHU and more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This swing trading report is Part B of one in five on rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you form a swing trade plan that suites your time frame. If you need private coaching use our contact page and send me a note or email info@compoundtrading.com and we’ll contact you (sometimes there is a short waiting list).

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up (set-up) that signal a trade long entry or an exit. In our case we rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Using the real-time charts – as chart links are made available below, click on link and open viewer. To open a real-time chart beyond the basic “viewer” click on the share button at bottom right (near thumbs up) and then click “make it mine”. To remove indicators at bottom of chart (MACD, Stochastic RSI and SQZMOM) double click chart field area and double click again to return the indicators to the chart.

Newer updates below in red for ease.

Recent Compound Trading Videos and Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage

$ARRY – ARRY Biopharma

June 4 – ARRAY Biopharma (ARRY) Continues to trade between important buy sell triggers on model (Fib mid quads) $ARRY #swingtrading #chart

It did in fact get a bounce (per last report and I missed execution) and now is testing upside resistance at 17.29. 17.29 holds and 18.40 is the main price target / resistance.

The downside scenario is a support test at 15.76 then 15.54 and 13.44.

The range and predictability in this model is decent so I will try and get an entry on over 17.29 or a failure.

Also of importance, the MACD appears to be ready to turn (this is a weekly chart so it is significant structure so if MACD does turn then bias is clearly bullish). Also of note, the Stochastic RSI recently turned up from near bottom. My bias is long for now.

Key FDA Events in June Investors Need to Watch Out For $VRX $ARRY $GWPH $MERK #FDA https://finance.yahoo.com/news/key-fda-events-june-investors-195607348.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

ARRAY Biopharma (ARRY) Real-Time Chart Link:

April 25 – $ARRY down draft scenario from last report playing out almost exactly as charted, we will see if we get bounce here.

13.48 holds it targets 18.41 June 17. And if it doesn’t price targets 8.48 June 17.

My bias is to upside target.

$ARRY News: Is There An Opportunity With Array BioPharma Inc’s (NASDAQ:ARRY) 32% Undervaluation?

https://finance.yahoo.com/news/opportunity-array-biopharma-inc-nasdaq-123942473.html?.tsrc=rss

Mar 11 – $ARRY 18.39 mid quad resistance test has to pay out for direction prior to charting shorter time frames for trade – slightly bearish right now.

$ARWR – Arrowhead Pharmaceuticals

June 4 – Arrow Pharmaceuticals (ARWR) Chart. Monthly 200 MA resistance overhead at 17.17 trading 10.92. Bullish bias. $ARWR #swingtrading

It seems logical to me that trade will test the upside 200 MA on the monthly chart again. I refer to this resistance because a clear trading model isn’t established yet (working on it).

Arrowhead Pharmaceuticals to Present at Upcoming June 2018 Conferences

Arrow Pharmaceuticals (ARWR). Daily chart simple model seems to suggest over 10.63 targets 16.32 Nov 26 2018 $ARWR #swingtrading

April 25 – $ARWR trading 6.52 the chart structure is still in play. Watching for an upside move.

Arrowhead Pharmaceuticals to Webcast Fiscal 2018 Second Quarter Results https://finance.yahoo.com/news/arrowhead-pharmaceuticals-webcast-fiscal-2018-200100257.html?.tsrc=rss

Mar 11 – $ARWR testing a series of previous highs on weekly chart w Stoch RSI MACD SQZMOM trend up #swingtrading

This is one of those trades / charts that isn’t easy to set a specific rice target on – the chart history has many scenarios if previous / historical highs break to upside. One way to trade it is long on an uptrend day with a stop set and let it ride the test. The risk reward to bullish side is significant if it breaks the previous highs. All indicators suggest a significant sized move.

$CDA – CareDx

June 4 – CAREDX (CDNA). Trade did get the new all time highs expected. Extended now and entry very difficult. $CDNA #swingtrading

I did also go over this likely scenario on the mid day review videos but I did not execute as I was really busy at the time with other more structured trades. Will watch for a pull back to previous highs and see if we get a bounce near there for a swingtrade.

April 25 – $CDNA very bullish since last report and likely pull back to new all time high (most probable scenario)

Olerup QTYPE® Receives CE Mark Certification https://finance.yahoo.com/news/olerup-qtype-receives-ce-mark-120000842.html?.tsrc=rss

$NAK – Northern Dynasty Minerals

June 4 – Northern Dynasty Minerals (NAK) Chart – Trending toward lower price target .28 Jul 18, 2018. $NAK #swingtrading

April 25 – $NAK gone to sleep. Trading .94 above 96.73 targets 1.496, 1.862 July 18. Under targets .28 July 18. #trading #pricetargets

Why Northern Dynasty Minerals, Ltd. Could Be a Gold Mine for Growth Investors https://finance.yahoo.com/news/why-northern-dynasty-minerals-ltd-113200529.html?.tsrc=rss

Mar 11 – $NAK at buy sell trigger for pop or drop – on watch for swing either way. When price trades below line or above trade to next support or resistance line (swing) and test.

$XXII – 22nd Century Group

June 4 – 22nd Century Group (XXII) trade not giving clear bias on weekly chart. Watching downtrend MACD for possible turn. $XXII #chart

April 25 – $XXII trading 2.05 over 2.20 targets 270 then 3.50 and under targets 1.38 .88 .06 #trading #setup

Food and Drug Law Institute Publishes Public Policy Article by 22nd Century’s Dr. James Swauger https://finance.yahoo.com/news/food-drug-law-institute-publishes-125800933.html?.tsrc=rss

Mar 11 – $XXII on watch for a bounce at Fibonacci support with price targets in clear site. #swingtrading

This chart is really structural and the Fibonacci horizontal lines become excellent buy sell triggers. This is a great set-up for a swing at support and the upper target risk reward is significant if it bounces.

$SHOP – Shopify

June 4 – SHOPIFY (SHOP) Chart. This is a really aggresive structure that will either break out with a full extensions or retrace. $SHOP #swingtrading

I’m bias to an upside extension. Watching the MACD on daily and will watch a potential break to upside. Likely enter long in increments on the break. Yet to be seen.

April 25 – $SHOP trading 123.40 holding 200 MA. Over the MA’s I’m long and under 200 MA maybe short.

Shopify Inc’s (NYSE:SHOP) Earnings Dropped -13.12%, Did Its Industry Show Weakness Too? https://finance.yahoo.com/news/shopify-inc-nyse-shop-earnings-212230431.html?.tsrc=rss

March 18 – $SHOP trading 147.22 has done well since we signaled long 106s wash-out in Oct. MACD high – caution longs.

What a great trade signal long for our swing trading platform back in October when everyone panicked on the wash-out.

The problem is now that price on the daily chart is significantly higher than moving averages and the MACD is extended to be sure.

When the Stochastic RSI, MACD and Squeeze Momentum start to trend down this will likely be a decent short to at least the 50 MA.

Feb 11 – $SHOP with earnings around the corner this is a wait and see trade. Will be watching earnings very close.

$SSW – Seaspan

June 4 – Seaspan (SSW) Chart. MACD on weekly chart now in downtrend. Watching support and resistance for trade. $SSW #chart

That swing trade went really well – targets all achieved and now I have a moderate bias to some form of retrace as the MACD on weekly chart is trending down. But only watching at this point.

Seaspan (SSW) Chart. MACD on weekly chart now in downtrend. Watching support and resistance for trade. $SSW #chart

April 25 – $SSW trade going really well. Target in play 8.82. #swingtrading

Mar 18 – $SSW keeps failing at 7.73 w/Fib just regained 200 MA targeting 8.60s June 4 #swingtrading

Trading 6.86 this is a high probability trade to the 7.73 area and if it clears that 8.60’s are highly probable going in to early June.

This is a strong long signal.

$SSW also important is to watch the MACD – it recently crossed up signaling long. #swingtrading

$ITCI – Intra Cellular Therapies

June 12 – Intra-Cellular Therapies (ITCI) This swing trade went so clean through the model. On watch. $ITCI #swingtrading #chart

Watching the buy sell triggers for up or downside move (white arrows on chart).

Intra-Cellular Therapies Initiates Rolling Submission of New Drug Application for Lumateperone for Treatment of Schizophrenia

GlobeNewswire•June 6, 2018

https://finance.yahoo.com/news/intra-cellular-therapies-initiates-rolling-110000513.html?.tsrc=rss

April 26 – Watching for 200 MA support reversal t upside resistance 23 – 24’s. On watch and alarmed. $ITCI #swingtrading #setup

If it dumps the set-up is void and will have to be reconsidered.

There’s a very good chance that $ITCI sell-off was way overdone based on $ALKS FDA set-back. #swingtrading

Here’s Why Alkermes plc and Intra-Cellular Therapies, Inc. Are Crashing Today https://finance.yahoo.com/news/apos-why-alkermes-plc-intra-153500350.html?.tsrc=rss

Mar 18 – $ITCI trading 23.98 has done well since 17s signal… trade the gap with horizontal res line – long at each to resistance.

As price holds each diagonal resistance / support line trade to next level (resistance) line. All the better if it triggers a long off a moving average also. Watch the MACD to be sure it’s turned up and not down. MACD is currently trending up.

SENSEONICS HOLDINGS INC (AMEX: SENS)

June 12 – I missed my execution on the long even though last report I had it pin pointed perfect. So I am now watching the buy sell trigger areas on chart and indicators such as MACD. Looking for an entry up or down side a mid quad (buy sell trigger area). On watch. This is such a clean chart.

SENSEONICS HOLDINGS (SENS) Amazing symmetry on chart with last two price targets. I missed execution. On Watch. $SENS #swingtrading

Senseonics and Beta Bionics Partner on Development of the Bionic Pancreas System

Business Wire Business WireJune 7, 2018

https://finance.yahoo.com/news/senseonics-beta-bionics-partner-development-124400651.html?.tsrc=rss

April 26 – $SENS Amazing chart structure. The previous alert resolved to upside target. Trade decision now to upper or lower target again.

Above 3.09 is long to upper target and under 3.09 is down to lower target.

Mar 18 – $SENS trading technically perfect with MACD turn down, quad wall test, Fib test advantage shorts – at least for short term.

Under 3.17 is a short to 2.50s April 17 target and above 3.17 is a long to April 17 3.67 target.

Price above 200 MA (pink), price bounced off important mid Fib (grey), price hit target perfect at mid quad (green), and Fib test and quad wall resistance test (red). MACD turn down will give significant advantage shorts. Until at least SQZMOM and preferably other indicators turn up this is a short.

Feb 11 – $SENS perfect mid quad target hit Feb 9 – will watch for direction and then trade in direction of next target noted for April 16.

G1 THERAPEUTICS INC (NASDAQ: GTHX)

June 12 – G1 THERAPEUTICS (GTHX) Hard to believe I missed execution on this beautiful trade also after saying do not ignore. $GTHX #swingtrade

That’s at least two really strong trade set-ups I’ve missed executions on in this June 12 update so far. The coding team will help catch these now… but it still hurts. Those were really, really good set-ups.

So now I am watching for a breach of a buy sell trigger to go again.

Analysis: Positioning to Benefit within China Biologic Products, Merus N.V, Adient, G1 Therapeutics, Westport Fuel, and AppFolio — Research Highlights Growth, Revenue, and Consolidated Results

GlobeNewswire•June 6, 2018

https://finance.yahoo.com/news/analysis-positioning-benefit-within-china-122000834.html?.tsrc=rss

April 26 – $GTHX hits targets perfect. Trading 39.43, over 39.82 targets 44.36 May 10, 2018 as yet another double extension. #swingtrading

Don’t ignore this stock… the chart structure and ROI ROE is best of class and trades very structural and predictable

G1 Therapeutics Announces Initiation of Phase 1b/2 Clinical Trial of G1T38 in Combination with Tagrisso for EGFR-Mutant Non-Small Cell Lung Cancer https://finance.yahoo.com/news/g1-therapeutics-announces-initiation-phase-100000266.html?.tsrc=rss

Mar 18 – $GTHX very few stocks trade with this precision and return on equity. Near current target trade white arrow buy sell triggers.

Fantastic double extension to the long side, price is currently cradled in the target zone. From here it is a long through the horizontal Fibs if MACD, Stochastic RSI, and SQAMOM are turned up. If not wait for them all to turn and continue long. See next chart below also.

Also, for side note… if you review the historical reports below you will notice the “black box” component / comment to this charting…. it has played out perfectly technical and in line with “black box” targets. This is a super car trading vehicle if you dial in on its buy sell triggers along with its indicators etc.

EXTREME NETWORKS INC (NASDAQ:EXTR)

June 12 – $EXTR hit 8.11 on the short side from an alert in the last report trading 10.67. Another trade I didn’t execute on.

Now all I can really do is wait for a buy sell trigger to hit to either up or downside and restructure the trade plan at that time.

KodaCloud Announces Partnership with Extreme Networks to Bring the Power of Cloud-Based Artificial Intelligence to Enterprise WLANs

https://www.businesswire.com/news/home/20180605005119/en/

EXTREME NETWORKS (EXTR) Hit 8.11 on short from alert in last report trading 10.67. Another missed execution

$EXTR #short #trade

April 26 – $EXTR under significant pressure and the only trade I see with decent ROI is under 10.00 to 7s. Short.

Mar 18 – $EXTR over 12.80 is a long and under a short. Either way trade to triangle quad edge.

It’s a funky model chart but it works. Simply long over 12.80 and short under and then trim when near bright green lines. Consider also your MACD and Stochastic RSI on daily.

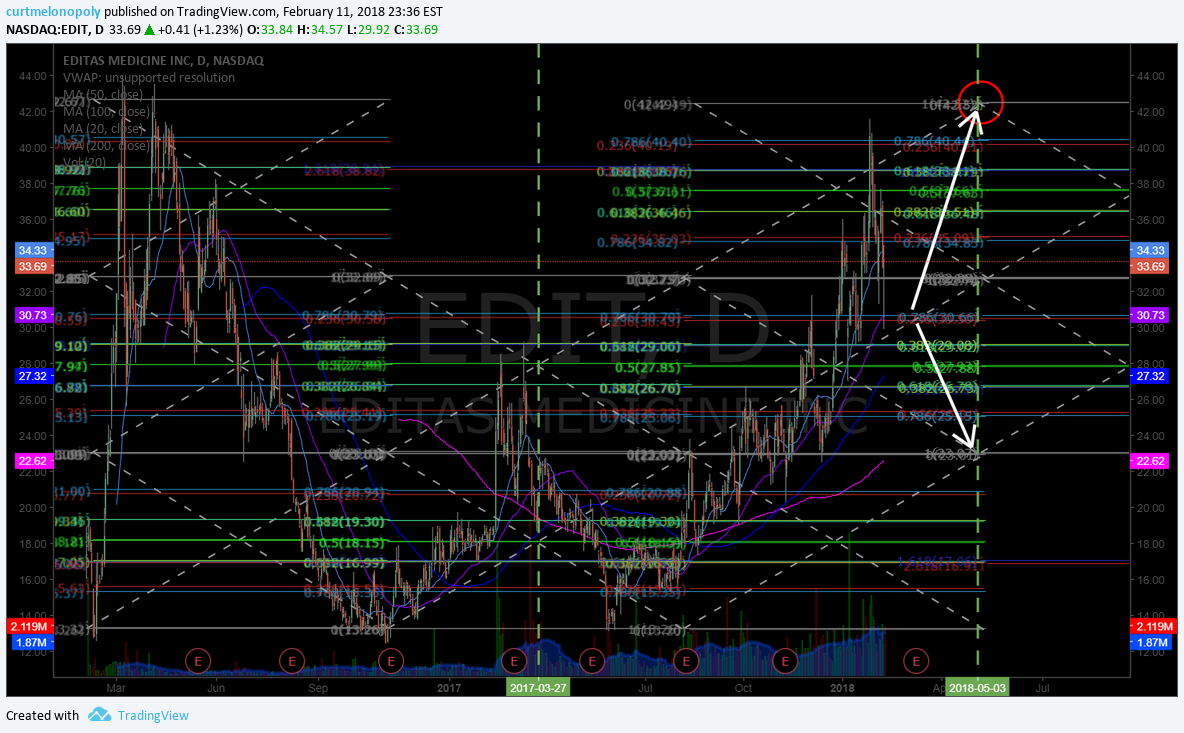

EDITAS MEDICINE INC (NASDAQ: EDIT)

June 12 – EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart with perfection $EDIT #price #tragets #chart

Gene-Editing Startups Downplay Potential of Cancer Side Effect By Robert Langreth and Bailey Lipschultz

June 11, 2018, 4:25 PM EDT

April 26 – $EDIT Clean chart structure channel and target hits, came off as warned, threatening retrace down channel next. Targets on chart.

This was a super clean predictable short from the alert on the last report.

Under 32.80 mid quad targets 27.79 Sept 19 and over 32.80 targets 37.58 Sept 19. Near decision now / mid quad.

Editas Medicine Inc (NASDAQ:EDIT): What Does The Future Look Like? https://finance.yahoo.com/news/editas-medicine-inc-nasdaq-edit-230627623.html?.tsrc=rss

March 18 – $EDIT caution longs as a clear channel has emerged and highs tested. Target from previous reports hit early. Watch 50 MA and indicators very close.

If price breaks above recent highs (which are similar to all time highs) then all bets are off.. but until then the channel wins – short at / near top of channel and long at bottom of channel is highest probability trade. Will review indicators below also (short time frame short bias).

INTREPID POTASH (IPI)

June 12 – INTREPID POTASH (IPI) 200 MA on weekly chart still looms overhead as resistance on upside $IPI #stock #chart

Is Intrepid Potash’s Turnaround Succeeding?

Motley Fool

Maxx Chatsko, The Motley Fool

Motley FoolJune 1, 2018

https://finance.yahoo.com/news/intrepid-potash-apos-turnaround-succeeding-113500395.html?.tsrc=rss

April 26 – $IPI You can keep this one simple, on the weekly it’s a long until the 200 MA test. Use lower time frame for entry.

Why Intrepid Potash Stock Just Popped 21% https://finance.yahoo.com/news/why-intrepid-potash-stock-just-180000862.html?.tsrc=rss

$MBRX – Moleculin Biotech

June 12 – Same status as last report, trading in same range also. Will leave on watch.

April 26 – $MBRX all vitals are flat. No trade until vitals come alive.

Moleculin Announces Patients Treated in FDA Approved Phase I/II Annamycin Clinical Trial https://finance.yahoo.com/news/moleculin-announces-patients-treated-fda-123000005.html?.tsrc=rss

Mar 18 – $MBRX has an obvious pivot region in the 2.43 area of the chart. Long above 2.43 if Stoch RSI turned up on daily.

I really like this set-up long over 2.43 as long as Stoch RSI on daily has also turned up.

$SOHU – SOHU.COM

June 12 – Trading 38.01 with not real trend bias in the chart. Will keep on watch.

April 26 – $SOHU Under pressure and RR on short side seems low so I’ll watch and see if chart reconstructs.

Sohu.com Hits 10-Year Low After Rough First Quarter https://finance.yahoo.com/news/sohu-com-hits-10-low-171000650.html?.tsrc=rss

Mar 18 – $SOHU testing historical lows. If all indicators turn up Stoch RSI MACD SQZMOM it is long, if not short.

$PDLI – PDL BIO Pharma

June 12 – PDL BIOPHARMA (PDLI) Over 200 MA and 3.22 I would consider a long side swing trade. $PDL #chart #setup

April 26 – $PDLI earnings in 9 days with MACD down riding the 200 MA on daily chart. Short bias but no trade.

ESPERION THERAPEUTICS (ESPR)

June 12 – ESPERION THERAPEUTICS (ESPR) Another execution on trade alert setup missed 65.20 to 33.02 wow big miss. $ESPR #trade

Here’s Why Esperion Therapeutics Dropped as Much as 36.9% Today

The development-stage biopharma’s top drug candidate could have a safety problem.

Maxx Chatsko (TMFBlacknGold)

May 2, 2018 at 3:15PM

https://www.fool.com/investing/2018/05/02/heres-why-esperion-therapeutics-dropped-as-much-as.aspx

April 26 – $ESPR Over 75.00 is a long and under 65.20 is a short. Coiling around main pivot. Indecisive.

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Biotech Investors Should Consider The Four Horsemen https://www.forbes.com/sites/moneyshow/2018/04/06/biotech-investors-should-consider-the-four-horsemen/?utm_source=yahoo&utm_medium=partner&utm_campaign=yahootix&partner=yahootix&yptr=yahoo#faf8f4ccfc62

$LPSN – LivePerson

June 12 – LIVEPERSON (LPSN) Live Person bullish targets keep getting hit. Over 23.15 is another long swing trade. $LPSN #chart

April 26 – $LPSN Trade played out almost exact as prescribed in last report. New upside and downside buy sell triggers and price targets on chart.

LivePerson to Announce First Quarter 2018 Financial Results on May 3, 2018 https://finance.yahoo.com/news/liveperson-announce-first-quarter-2018-133000537.html?.tsrc=rss

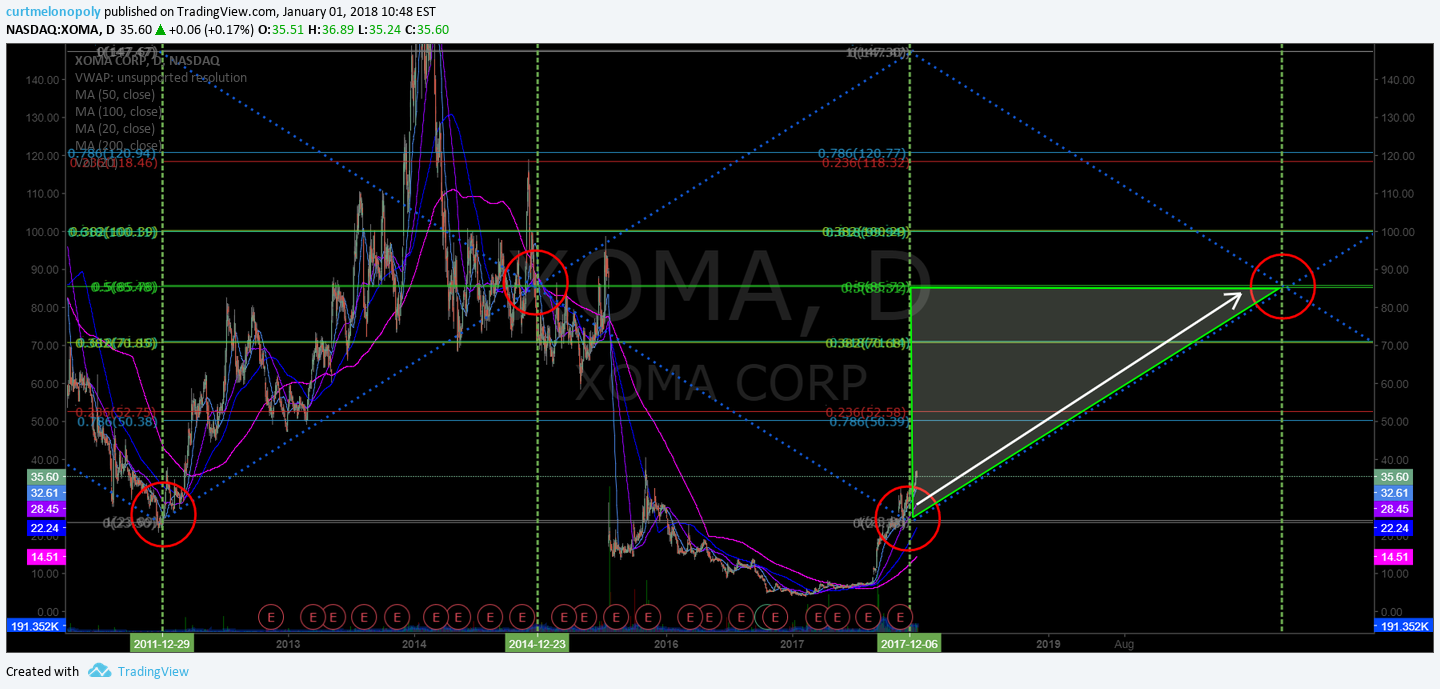

$XOMA – XOMA Corp

June 12 – Same as last report.

April 26 – Trading 24.21 with indecisive indicators. Will watch. No trade.

Mar 18 – $XOMA what an excellent short side trade under that structure and continues short under grey horizontal line.

Feb 11 – Trading 25.46 with chart structure in challenge. Will advise as it plays out. Watching.

Jan 1 – $XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats.

Jan 1 – $XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade.

In Closing:

I will re-iterate that a few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stocks, $EDIT, $SENS, $LPSN, $ITCI, $GTHX, $EXTR, $ESPR, $PDLI, $IPI, Picks, Signals, Buy, Sell, Triggers