Category: Day Trading Crude Oil

One of The Best Crude Oil Day Trading Strategies – 200 MA One Minute Chart Time Frame #OOTT $CL_F $USO $USOIL

How to Day Trade the 1 Minute Oil Chart Using the 200 MA for Support and Symmetry for Resistance.

A Simple Step by Step Intra Day Trading Guide from our Oil Trading Room and Alerts Service.

Below are my top trading rules (steps I take in my strategy) when daytrading crude oil on the one minute time-frame. It has worked for me over the years and I am sure you will find it a highly profitable way to day-trade oil.

1. The Price Trend of Trade is Your Friend.

- If you are going to day trade oil long be sure oil is in a rally. In this case oil has been rallying for a number of days and today oil price continued to rally. In this instance, the trend is on your side so it is obvious that your highest probability day trades scalping crude oil futures will be long buy entries.

- Today’s News – Stock market live updates: Dow up 400, oil rallies 18%, Norwegian dives 18% https://www.cnbc.com/2020/05/05/stock-market-today-live.html

2. Price Dropping in to The 200 MA on One Minute Oil Chart.

- Chart from the Oil Trading Room and Alerts feed shows the set-up intra day for the 200 MA scalp, “On the 1 minute time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts” The white arrow on the chart points to the 200 MA on the 1 minute time-frame (200 MA in pink).

On the 1 min time frame 25.15 200 MA is attractive test for a crude oil day trade pop up scalp – trading 25.68. #oiltradealerts

3. Execute Your Long Trade when Price Hits the 200 MA (Moving Average).

- The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play.

- “Nice 40 point move on that crude oil daytrade set up on the 1 minute time frame, I didn’t take it, first extension resistance here. #oiltradealerts”

The screen image capture of the oil trading alerts feed show oil price bouncing off the 200 MA signal, day trade is now in play. #oiltradingalerts

4. Take Profit as You – Go Based on Your Trading Plan.

- Oil trading room live image below shows first price target hit, symmetrical price extensions, and a point to trim profits in your long trade scalping crude oil #oiltradingroom

Oil trading room live image shows first price target hit, symmetrical extensions, and a point to trim long scalp #oiltradingroom

5. Technical Analysis Helps Plan Your Oil Trading Strategies.

- Below is a one minute oil chart with symmetrical price extension price targets so our oil traders know where to trim profits along the way while daytrading oil.

Your 3 steps of symmetrical extension resistance points for this day trade in oil #oiltradealerts

6. Use an Oil Trading Strategy – A Plan.

- The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

- At point of writing this article, the move on this oil trade alert intra-day is now 80 points, this is a fantastic day trade strategy for oil traders. Knowing where your price targets are and knowing how to measure the symmetry for price extension price targets will really help your strategy.

The image capture of oil trading room shows the 3 price targets for our trading strategy with this trade intraday #oiltradingstrategies

Technical indicators or signals really help retrieve more profit in each trade and also help with your winning percentage of trades.

There are many other signals that you can use for any oil day trade, including the trade outlined in this article. Some of the other indicators or trade signals include order flow, time of day, resistance and support on larger time frames such as the 5 minute, 15 minute or 30 minute chart time-frames and many more.

The price extensions in this article are part of a proprietary one minute oil trading grid model that our machine trading uses. There are many ways to set your price targets, some use conventional charting methods and some algorithmic (or proprietary models as in this instance).

Hopefully this tutorial on using the one minute oil chart 200 MA as a signal for day trading (scalping) trades has helped. It is an intra-day strategy that has worked for me in my trading time and time again.

You should find implementing this simple crude oil intra day trading strategy that your win rate and returns will excel.

If you liked this article there is another day trading oil strategy article I wrote here.

Oh, and by the way, while I am finishing up writing this article oil is getting near the upper price target for this day trade and I just alerted the oil trading room and our alert subscribers to take profits. Nice Trade!

My goal is to build the best oil trading room and oil trading alerts service in the world for oil traders – obviously a tall order, but we’re getting there one step at a time.

Any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; day trading, crude oil, 200 MA, 1 minute time frame, strategy, chart, symmetry, oil trading room, oil trading alerts, simple, intraday, trading strategy

The Power of Compounding Returns With a Winning Systematic Machine Trading Platform.

Machine Learning is Changing Our World and Compound Gains are Powerful. This is a Short Story About How Machine Trading is Changing Portfolio Return, Risk and Compound Trading Expectations.

The World is Changing Fast. The Landscape of Public Markets, Risk and Portfolio Return Along With It.

A brief search on Google brings many articles about the increase in automated machine trading and the possible future forward scenarios for public markets.

I was recently interviewed about this very topic – the future is unknown, but in my basic thinking machine learning is here to stay, I have tried to compete against it and I intend to be on the right side of the ROI trajectory.

- Per Trevor Noren (@trevornoren) “Passive now controls 60% of US equity assets while quant funds control 20%—staggering 80% combined. Blackrock & Vanguard oversee $12t, up from less than $8t 5 years ago. And algorithmic trading systems are now responsible for 75% of global trading volume.” https://latest.13d.com/risks-passive-algorithmic-transformation-equity-markets-crisis-6ea6f6e9e271

- JP Morgan doubles down on machine learning for FX algorithms https://www.thetradenews.com/jp-morgan-doubles-machine-learning-fx-algorithms/

- Google’s AI AlphaGo Is Beating Humanity At Its Own Games (HBO) https://www.youtube.com/watch?v=8dMFJpEGNLQ

First, A Snap-Shot of Our Brief History.

When we started our trading service we demonstrated how day trading and swing trading could net good day traders consistently 100% – 400% a year with a systematic rules-based process.

We video recorded every session live, alerted the trades to our clients and documented each trade.

The naysayer says “I seen this or that trade that didn’t work!” – the small cross-section analyst that didn’t do their homework that is. Sure, we had our losses. But what they don’t say is that over-all we proved the returns were not only possible but probable (live recorded, time stamped, live alerted) in a systematic manner if a day trader uses a sound rules-based process, has an appropriate account size to execute various trades and sizing to spread risk (as we alerted live) and protects his/her downside. Anyone can go through our live alerts and videos to determine this to be the case. And we’re not the only day trading service that has or continues to provide these results – some even more.

What’s the point?

The point is that if you take an isolated cross-section of time, or you kinda executed the processes or kind of protected your downside or didn’t start with an appropriate account size to spread your risk then your individual scenario may have been different. But over-all, an investigation in to our processes show over 100% returns over all per annum daytrading and / or swing trading.

More specifically to the point, the same principle applies to machine trade development and testing.

When a trader reaches this level of day trading (a winning process within an appropriate account size with protected risk), he/she can then start thinking about compounding his/her gains (the holy grail for a day trader).

Or, as we did, the successful trader may chose to turn their attention to algorithmic modeling and then on to machine trading.

In our case, we started with cracking the code to and building software for trading crude oil futures contracts.

Why go in to further risk? Because I knew what my potential returns were investing (I have over three decades of experience) and I now knew what my potential returns were day trading and swing trading. The last frontier for me was machine learning and whether we could achieve better returns in automated trade with less future forward risk and effort.

My retirement years will be as a trader, the only questions for me are; what kind of trader and what are the returns?

Day trading and swing trading equities (along with trading various ETF type instruments) is much easier to master than day trading crude oil and manifold times easier than building software to trade crude oil or any other instrument.

We knew that if we mastered the code / rule-set of machine trade that higher returns were obviously possible and that we could then build software for numerous other instruments (at will) and obviously leverage our time and compound return potential far in to the future.

The EPIC v1 machine software real-world trade test was returning a projected 20% per annum, v2 40%, v3 80% and the goal for EPIC’s version 4 was 160%.

Version 4 was too aggressive and exceeded our risk tolerance so we returned to EPIC v3 and it has been running with sound stability and very low downside risk for seven weeks at approximately 90% projected annual returns. We expect this percentage to consistently increase over time (as the software learns) with little to no additional down-side risk.

Stability of Software – downside risk vs. return is key. V4 EPIC I believe could hit 800% per year or more but the volatility and subsequent risk therein was too much for us to stomach in real-world testing (real-world is also key and required – paper-trading when testing the software doesn’t cut it).

Below is the Seven Week Real-World Trading Performance YTD for EPIC v3 Crude Oil Futures Machine Trading Software.

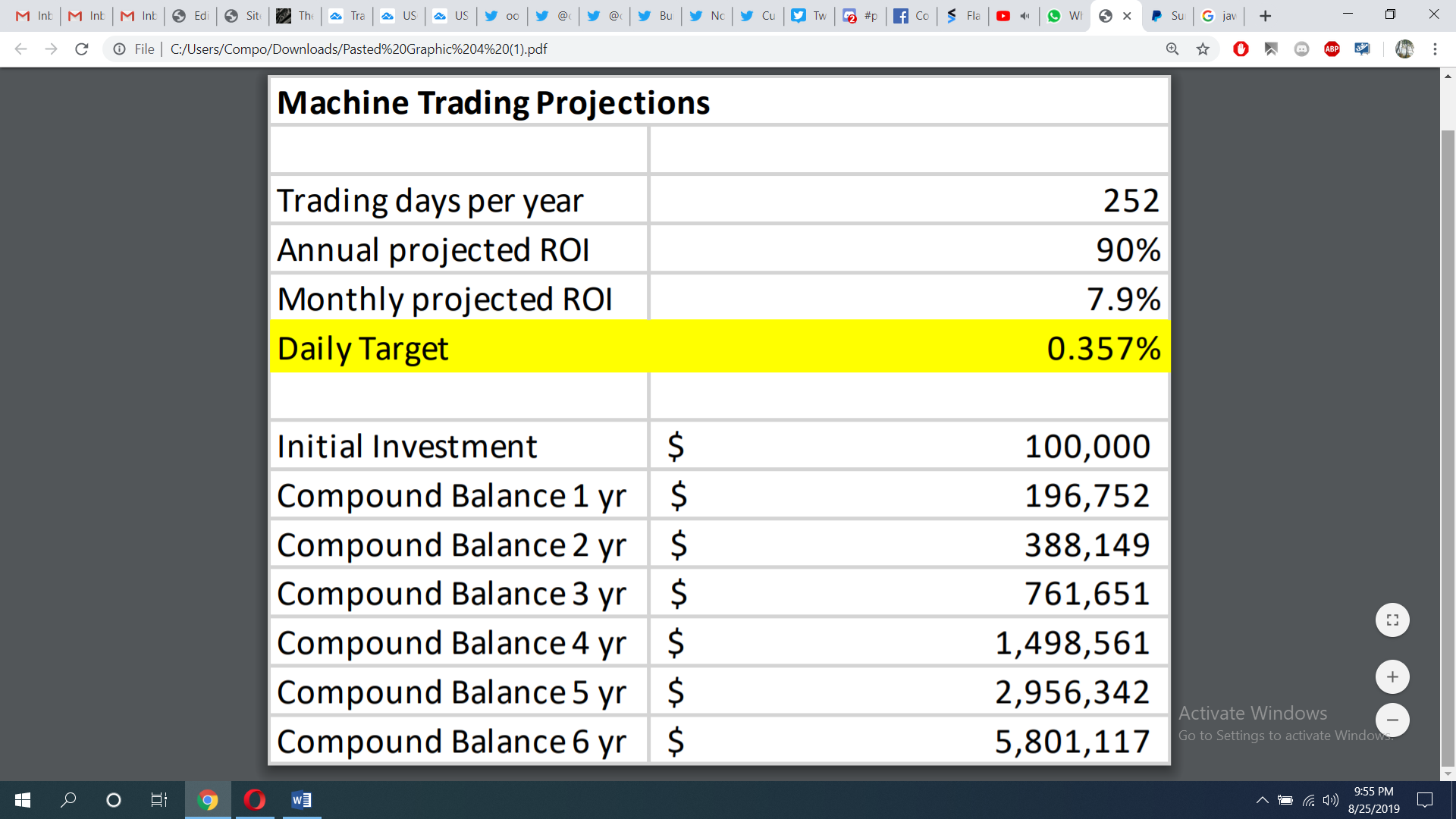

Below I provide the Compound Returns Based on our Current Oil Trading Results at 90% per annum Profit Compounded Over 3 Year Period.

The sample account starts with 100,000.00 and after 3 years has a balance of 761,651.00.

And below are the Compound Account Returns according to Current Oil Trading Results at 90% per annum profit Compounded Over a Six (6) Year Period.

The sample account starts with 100,000.00 and after 6 years has a balance of 5,801.117.00.

Will We Meet The Annual Return and Compound Trade Return Projection?

Only time will tell the story.

What I know for sure is that our v3 EPIC Crude Oil Machine Trade Software is extremely stable, has near zero down-side risk and has consistent gains.

It has been running for seven weeks as of this Tuesday, which in the machine trading world is a near life-time. At the eight week mark it is almost mathematically impossible for it to fail and at the twelve week point it is something like 99.99999% sure it will meet or exceed the expectations within current ROI trajectory.

My guess, v3 ends up performing at 100% – 150% and easily meets or exceeds the projections, I have zero doubt about its stability and ability to protect downside loss. But as I said, all return projections are yet to be seen, time will tell.

Relative to the Top Performing Hedge Funds of 2018 we are doing well, the Odey fund came out on top of the pack, generating about 53% in returns. Also relative to the best returns of all time we’re competing; The Renaissance Technologies Medallion fund is considered to be one of the most successful hedge funds ever. It has averaged a 71.8% annual return, before fees, from 1994 through mid-2014.

I always said we would never have taken this project on if we thought there was a considerable chance we would fail. We knew it would be one of the hardest things we’ll ever try and accomplish, but we believed we would get there.

In my best estimation, we have now successfully cracked the code.

Thanks for being part of and supporting our journey.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, machine trading, trading, compound, returns, ROI, $CL_F, $USOIL, $WTI, $USO, CL

How to Know & How We Alerted (In Advance) Crude Oil Intra-Day Bottom Price, Day High, Trend (PT 1)

A Reliable Method to Determine in Advance Intra-Day Bottom Price, Day High Price, Trading Trend and Timing for Your Crude Oil Day Trading Strategy (Part 1).

The systematic process below that includes actual time stamped oil trade alerts, live video from our oil trading room and charts from our oil trade chat room is easily identifiable when the right signals of trade are in play on any day that you are trading crude oil.

The method below can be learned and reproduced by any trader that studies the trading set-up and strategy explained.

When a trader knows with high probability the likely range of trade for the day then a trading strategy for daytrading can be put in to place.

If you know the likely high of day, low of day, reversal area, trend of trade for the day and the likely timing of the price target areas / reversals this goes a long way to help you with your day trade strategy for executing trades. You can then execute your trades in accordance to those signals until they are no longer relevant or in play.

Hopefully in sharing what happened today in our oil trading room this will help you with your oil daytrading strategy in future.

Part One of this Article will show you how trade transpired today, what we alerted, the charting as it happened, the models we used to determine the high price of day, low price of day, time cycle peak for price targets, the trend on day and more.

Part Two of this Article will explain how you can use this information (the charts, alerts, trading room, chat etc) to develop your own daytrading strategy for crude oil trade.

June 16 Update – Part Two of this Article is Now Complete and can be viewed by clicking here.

Today was the weekly EIA Report at 10:30 AM. There was a substantial build reported. Below is a copy of a tweet from ZeroHedge.

Crude oil +6.77MM, Exp. -0.5MM

Gasoline +3.21MM

Distillate +4.57MM

Cushing +1.79MM

Crude oil +6.77MM, Exp. -0.5MM

Gasoline +3.21MM

Distillate +4.57MM

Cushing +1.79MMOh that's why oil is plunging

— zerohedge (@zerohedge) June 5, 2019

Prior to the EIA report coming out I was concerned about it and let the trading room know right before it was announced (the live video is in this article). Even though I expected the oil price to collapse I didn’t trade it down because we were in the last part of our final coding of our machine trade – so I was doing double duty (I wanted to get done).

So the report comes out and oil starts to collapse (you can see all this on the video from the oil trading room for those learning about how oil trades and what to watch for).

At 10:54 AM I alert the oil trading room (with voice broadcast and charting), the oil chat room (see screen capture image below) and alert to the member Twitter feed (screen shot below) that we are looking at the 50.84 area of FX USOIL WTI for possible long trade (trend reversal) for a possible bottom price area on the day. We trade CL futures but alert on USOIL WTI for consistency between instruments of trade for crude oil.

Looking 50.84 area possible longs (bottom of quad) trading 51.26 intra. Shorting all pops thereafter in to quad area resistance.

Then at 11:54 the price of oil drops in to the area previously alerts, spikes down with a flash and trade reverses. In the oil chat room screen shot below you can see I alerted our long oil trade (machine trade in this instance) in the 50.70s and then the machine trade closed and fired a few other times. This ended up in fact being the low of day in trade. I had alerted that I was looking at the 50.84 area and price hit 50.70s and reversed.

Software fired in there 50.70 s to closing 50.90 s, I didn’t but we’ll see if it holds the range for a bounce.

You can also see in the screen shot that I was sharing various chart set-ups to help our traders with their trading strategies for the day so they knew where the structured areas of support, resistance etc were.

Then at 12:07 PM I alerted to the oil trading room by voice broadcast, chat room with charting and on live alert feed that the structure of trade had improved and that we expected that the low of day for trade had in fact been put in confirming a reversal.

improved structure, likely near term low in

Then shortly after 12:00 I alerted (to live trading room, chat room, alert feed) that there was a time cycle peak coming at 2:15 (in other words if you are long on the reversal from the day lows that 2:15 would be the area of time on the day for a high for your price targeting on the trade).

I also gave the resistance levels between where trade was at near the bottom of the trading quad (near the reversal area at bottom) and where we seen the top price target of trade. In other words, if you are long the trade watch for the 20 MA on the 5 minute chart above and the mid quad (mid channel) resistance on the 30 minute EPIC model chart.

2:15 time cycle should be the top on any retrace up on the day

20 MA on 5 min overhead

2:15 PM time cycle most bullish scenario we have is 51.90 (mid channel on EPIC quad) trading 51.32

body of 30 min candle at machine line

Then after the resistance areas are overcome in uptrend trade on the day at 1:20 PM (in advance of the 2:15 time cycle peak) I alert in more detail the various price target areas that represent various model charts on different time-frames so that our traders know exactly what levels to watch as price nears both time and region of trade for our trending price targets for the day trade.

Resistance we are watching intra 51.86 mid channel EPIC, 52.14 5 min, 52.10 on 1 min, 2:15 time cycle peak, just hit 51.81 intra. Nice reversal intra in the EPIC quad from just below support of area we had marked. Also watching for signals for longer term trend reversal possibilities.

Image capture below from oil trade chat room shows 1 min crude oil model trend and 5 min chart with oil trade trending in to time cycle peak as alerted.

Image below from oil trading room alerting that price reversal strong structure expect possible trend reversal and possible price targets. The first image is the 30 minute EPIC algorithm chart model showing a strong bounce off the bottom area of the quadrant (the alerted price reversal area).

Strong signal the trend on wider time frame is in reversal mode with action seen in this quad today really clean

And because the bounce is so strong and structured properly in the quad that traders could start possibly looking at larger time frame charting for a possible trend reversal and possible price targets in that scenario.

maybe one quad more down but that would be it if so imo

60.41 would be trend reversal target, trading 51.91, 850 ticks ish

sorry its 59.22

Image showing oil trade room signals on 1 minute chart for confirmation of intra day trend from HFT trade action. Normally we would explain or alert this as it was happening live, however, in today’s scenario I was doing double duty coding so I was sure to show our traders where / how they could confirm that the intra-day trend (for in future trading strategy) was still in play.

After two hits to the trend then the HFT programs set their confirmation pivot and continue trend. This confirms that a trade can continue looking in to the trend for the day, the price targets for day high and time cycle peak for the day.

this is where the HFTs hammered down today, after two hits to 1 min channel support and hit to 1 min range they hammered down

Two chart images below of crude oil trade from trading room comparing last week trade action and this week in 30 Minute EPIC model. This week the trade is much more structured confirming signals that I will include in Part 2 of this report.

Last weeks quad action

This week quad action

The final two images below show that price did in fact spike in to the time cycle peak for 2:15 PM and did reverse in this area of oil trade for a short opportunity as we had alerted much earlier in the day.

peaking in to time cycle intra

Next, in Part Two of this article (sent to premium members) I will explain exactly how you can use this information (the charts, alerts, trading room, chat etc) to develop your own day trading strategy for crude oil trade.

I will explain trade signals such as how to know where the time cycles are, what the expected high of day and low of day is most probable and what the trend on the day should be.

Below is the raw oil trading room video feed, if you are learning to trade oil you can correlate the time stamp you see on the images above to the time stamp on the video so you can scroll through the video to specifically what I was saying in the trading room during each alert period. The video below is only a raw feed and I am not broadcasting on mic all day – only when there are alerts and or trades in play (this is why I mention the time stamps). I only include the video because newer students of trade can utilize the live video (and associated comments and charting) to learn, but it is not packaged in short form so you have to dig a bit.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

At check-out use coupon code “epic30” for 30% off. Either Oil Trade Alerts Only or Oil Trade Bundle (Live Room, Reports, Alerts).

Standalone Oil Algorithm Newsletter (Member Charting Updates Distributed Weekly).

Real-Time Oil Trading Alerts (Oil Trade Alerts via Private Twitter Feed and Discord Private Chat Room).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (Weekly Newsletter, Trading Broadcast Room, Chat Room, Real-Time Trade Alerts).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Trading Room, Strategy, Signals, Reversals, Trend, Price Targets, Time Cycle

Follow: