Tag: $APDN

Swing Trade Alert Profit Loss. Period ROI 127.23%. May 1-31, 2020. $200,000.00-$454,464.00 SPY, VIX, NATGAS, BTC, BABA, TWTR, AIKI, LUV, IWM, ZM, APDN…

Swing Trading Alert Profit Loss. Win 100% (of closed trades). ROI 127.33%. May 1-31, 2020. 200,000.00-.454,464.00 as Alerted to Time Stamped Member Private Feed, Trading Room and/or Newsletter Reporting. #swingtrading #tradealerts

Tickers Alerted on Swing Trade Feeds: $SPY, $VIX, $NATGAS, $BTC, $BABA, $TWTR, $AIKI, $LUV, $IWM, $SBUX, $APDN, $TSLA, $LK, $UAA, $TLRY, $SAVE, $GNRC, $AKBA, $SPWR, $TACO, $CAE, $CLVS, $IQ, $ZM, $IBB …

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 127.23% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=454464&investmenttime=date&investmentlength=2.5&beginbalanceday=05%2F01%2F2020&endbalanceday=05%2F31%2F2020&ctype=1&x=40&y=25

- Our goal is to provide the best swing trading alert and newsletter service available. The highest winning percentage with the most consistent returns.

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable may be announced on mic live, recorded live in live trading room, included in newsletter, alerted to private time stamped Twitter feed and.or emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Alert Profit Loss. Period ROI 127.23%. May 1-31, 2020. $200,000.00-$454,464.00 SPY, VIX, NATGAS, BTC, BABA, TWTR, AIKI, LUV, IWM, ZM, APDN…

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 100% Closed Trades. ROI 127.23%. May 1-31 , 2020. $200,000.00-$454,464.00 #swingtrading #tradealerts

Please Note: Although the win rate of closed trades is 100% for this period, there are a few trades underwater and a number of open trades at time of reporting.

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1tVbkHgVVVlZu2s3U9FBoT9LIgA3t6bQmbavJHlMUOwA/edit#gid=0

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | |||||||||

| 5/31/2020 | 9:30 | Short Semis Starter | $SMH | 300 | 140.7 | 0 | |||||||||||||

| 5/31/2020 | 18:24 | Add Bitcoin BTC short | $XBTUSD | 10 | 9490 | 0 | |||||||||||||

| 5/28/2020 | Long add 10% for 20% size (9.40+6.90 for 8.15 avg | $CLVS | 300 | 6.9 | 0 | ||||||||||||||

| 5/28/2020 | 9:33 AM | Trim profit 40 of 160 hold 120 | $CAE | 40 | 14.1 | 17.22 | 128 | 454464 | |||||||||||

| 5/28/2020 | Pre | Trim profit 50% of 320 hold 160 | $CAE | 160 | 14.1 | 15.71 | 257 | 454336 | |||||||||||

| 5/28/2020 | 7:47 AM | Trim to 95% 1420 of 1620 hold 200 | $TACO | 1420 | 4.4 | 6.4 | 2840 | 454079 | |||||||||||

| 5/28/2020 | Pre | Trim $SPY 304.05, 70 of 370 hold 300 | $SPXL | 70 | 33.8 | 40.6 | 476 | 451239 | |||||||||||

| 5/27/2020 | PM | Trim profit | $IWM | 50 | 127.31 | 143.47 | 808 | 450763 | |||||||||||

| 5/27/2020 | 3:54 PM | Trim Profit | $AXP | 10 | 84.5 | 101.2 | 1670 | 449955 | |||||||||||

| 5/27/2020 | 1:34 PM | Long | $ZSAN | 9000 | 1.029 | 0 | |||||||||||||

| 5/27/2020 | PM | Trim 25% 1500 of 6000 hold 4500 | $LK | 1500 | 2.67 | 2.97 | 450 | 448285 | |||||||||||

| 5/27/2020 | 8:36 AM | Trim profit hold 150 | $LUV | 100 | 30.78 | 34.88 | 410 | 447835 | |||||||||||

| 5/26/2020 | PM | Trim profit hold 250 | $LUV | 250 | 30.78 | 33.5 | 680 | 447425 | |||||||||||

| 5/26/2020 | 4:41 PM | Trim 25% | $IWM | 50 | 127.31 | 139 | 584.5 | 446745 | |||||||||||

| 5/26/2020 | 1:50 PM | Trim 25% of recent adds hold 775 | $TWTR | 125 | 26.9 | 34.1 | 900 | 446161 | |||||||||||

| 5/24/2020 | 7:56 PM | Trim 5% BTC short | $XBTUSD | 4 | 9130 | 8730 | 1600 | 445261 | |||||||||||

| 5/22/2020 | Long nat gas 20% 1.657 5% 2.25 for 25% long | $NG_F | 8000 | 1.657 | 0 | https://twitter.com/SwingAlerts_CT/status/1263859093443395585 | |||||||||||||

| 5/22/2020 | 10:22 | Adds 10% for 30% = 300 to long volatility | $VXX | 100 | 34.4 | 0 | |||||||||||||

| 5/22/2020 | 8:40 | Long | $CTXR | 2000 | 0.991 | 0 | https://twitter.com/SwingAlerts_CT/status/1263811044750827521 | https://twitter.com/SwingAlerts_CT/status/1263811995104673800 | |||||||||||

| 5/21/2020 | 18:04 | Short Bitcoin BTC | $XBTUSD | 200 | 9130 | 0 | |||||||||||||

| 5/21/2020 | 6:04 PM | Close Bitcoin BTC long | $XBTUSD | 70 | 5900 | 9130 | 226100 | 443661 | |||||||||||

| 5/21/2020 | 4:15 PM | Trim profits on 200 of 540, hold 340 | $TLRY | 200 | 8.04 | 10.29 | 450 | 217561 | https://twitter.com/SwingAlerts_CT/status/1263564137189294086 | https://twitter.com/SwingAlerts_CT/status/1263565839674101762 | |||||||||

| 5/21/2020 | 9:29 | Long | $SBUX | 100 | 78.5 | 0 | https://twitter.com/SwingAlerts_CT/status/1263461797727789060 | ||||||||||||

| 5/20/2020 | Trim profit 100 of 1000 from 26.90 avg buys hold 900 | $TWTR | 100 | 26.9 | 31.41 | 452 | |||||||||||||

| 5/20/20 | PM | Long adds | $LK | 4000 | 2.5 | 0 | |||||||||||||

| 5/20/20 | 9:56 | Long | $LK | 2000 | 3.08 | 0 | https://twitter.com/SwingAlerts_CT/status/1263106381864787969 | https://twitter.com/SwingAlerts_CT/status/1263111296356159488 | https://twitter.com/SwingAlerts_CT/status/1263111771503628289 | https://twitter.com/SwingAlerts_CT/status/1263121430138494977 | |||||||||

| 5/19/2020 | 11:49 AM | Trim profit | $BABA | 10 | 180.75 | 220.3 | 195 | 217198 | |||||||||||

| 5/19/2020 | 11:41 | Long | $UAA | 500 | 7.95 | 0 | |||||||||||||

| 5/18/2020 | PM | Trim profit 60/220, large exit June 5 w runner https://twitter.com/SwingAlerts_CT/status/1268909928216965121 | $DIS | 60 | 107.89 | 118 | 665 | 216914 | https://twitter.com/SwingAlerts_CT/status/1262395165257457666 | ||||||||||

| 5/19/2020 | 10:21 | Stop hit 30%, no swing only day trade | $SAVE | 300 | 9.19 | 9.43 | 72 | 216249 | |||||||||||

| 5/19/0202 | 9:58 | Trim 10% profit | $SAVE | 100 | 9.19 | 9.69 | 50 | 216177 | |||||||||||

| 5/19/2020 | 9:54 | Trim 50% profit | $SAVE | 500 | 9.19 | 9.49 | 150 | 216127 | |||||||||||

| 5/19/2020 | 9:35 | Trim 10% profit | $SAVE | 100 | 9.19 | 9.45 | 26 | 215977 | |||||||||||

| 5/18/2020 | 9:32 | Long $SAVE | $SAVE | 1000 | 9.19 | 0 | |||||||||||||

| 5/12/2020 | PRE | Add long 10% for 20% volatility | $VXX | 100 | 32.7 | 0 | |||||||||||||

| 5/15/2020 | 9:56 | Adds longs 10% 23.09 + 10% 29.10 to 20% size hold 1000 | $TWTR | 500 | 29.1 | 0 | |||||||||||||

| 5/14/2020 | PM | Trim profit on 110 of 120 | $APDN | 110 | 3.01 | 17.9 | 1628 | 215951 | https://twitter.com/SwingAlerts_CT/status/1260891113453432833 | ||||||||||

| 5/11/2020 | 10:07 AM | Trim 1/3 profit | $AKBA | 4000 | 12.1 | 12.9 | 3200 | 214323 | https://twitter.com/SwingAlerts_CT/status/1259847593305260041 | ||||||||||

| 5/11/2020 | 9:44 | Long | $AKBA | 12000 | 12.1 | 0 | https://twitter.com/SwingAlerts_CT/status/1259841838426488837 | ||||||||||||

| 5/11/2020 | 9:17 AM | Long | $GNRC | 300 | 103.86 | 0 | |||||||||||||

| 5/11/2020 | 12:46 PM | Take 1/3 profit per plan ten stopped | $IQ | 300 | 17.7 | 17.93 | 78 | ||||||||||||

| 5/11/2020 | 9:33 | Long w/ trade plan in tweets | $IQ | 900 | 17.7 | 0 | https://twitter.com/SwingAlerts_CT/status/1259580350193418240 | https://twitter.com/SwingAlerts_CT/status/1259588806455541761 | https://twitter.com/SwingAlerts_CT/status/1259839154185256961 | https://twitter.com/SwingAlerts_CT/status/1259840049941807106 | https://twitter.com/SwingAlerts_CT/status/1259855249856225281 | https://twitter.com/SwingAlerts_CT/status/1259878994310320130 | |||||||

| 5/11/2020 | pre | Short | $ABT | 96.4 | 0 | ||||||||||||||

| 5/8/2020 | 5:38 AM | Long | $DIS | 220 | 107.89 | 0 | https://twitter.com/SwingAlerts_CT/status/1258692826516332546 | ||||||||||||

| 5/7/2020 | 9:59 AM | Take profit on 90% | $ZM | 90 | 128.2 | 160.82 | 2935.8 | 211123 | https://twitter.com/SwingAlerts_CT/status/1258396035925278720 | https://twitter.com/SwingAlerts_CT/status/1253650760010784769 | |||||||||

| 5/7/2020 | PRE | Take profit on 50% of adds holding | $OSTK | 12 | 8.73 | 17.55 | 105.84 | 208188 | |||||||||||

| 5/6/2020 | 2:11 PM | Long 10000 | $AIKI | 10000 | 0.77 | 0 | https://twitter.com/SwingAlerts_CT/status/1258097052740923392 | ||||||||||||

| 5/7/2020 | 1:41 PM | Trim BTC | $XBTUSD | 70 | 5900 | 9889 | 3989 | 208083 | https://twitter.com/SwingAlerts_CT/status/1258014186736672768 | ||||||||||

| 5/6/2020 | 11:06 AM | Trim profit | $SQ | 40 | 43.62 | 69.15 | 1021.2 | 204094 | https://twitter.com/SwingAlerts_CT/status/1258050617370697731 | ||||||||||

| 5/5/2020 | PRE | Trim 50% long | $CUTR | 300 | 12.75 | 14.5 | 525 | 203073 | https://twitter.com/SwingAlerts_CT/status/1257651750456229894 | ||||||||||

| 5/5/2020 | PRE | Long | $SPWR | 800 | 7.63 | 0 | 202548 | https://twitter.com/SwingAlerts_CT/status/1257645316792365056 | https://twitter.com/SwingAlerts_CT/status/1257646130902568960 | https://twitter.com/SwingAlerts_CT/status/1257721739326488582 | https://twitter.com/SwingAlerts_CT/status/1258725098917433344 | https://twitter.com/SwingAlerts_CT/status/1280938925050257411 | |||||||

| 5/6/2020 | Numerous | Numerous | Trim 370 adds in stages see alerts, holds in place from orginal | $SPXL | 370 | 34.58 avg | 481 | 202548 | https://twitter.com/SwingAlerts_CT/status/1257641106390552583 | https://twitter.com/SwingAlerts_CT/status/1257669958059929600 | https://twitter.com/SwingAlerts_CT/status/1258028182810365955 | https://twitter.com/SwingAlerts_CT/status/1258028337152307200 | |||||||

| 5/5/2020 | PRE | Long adds $SPY 286.00, 370 held + 370 = 740 | $SPXL | 370 | 33.28 avg | 0 | 202067 | https://twitter.com/SwingAlerts_CT/status/1257641106390552583 | https://twitter.com/SwingAlerts_CT/status/1257669958059929600 | https://twitter.com/SwingAlerts_CT/status/1258028182810365955 | https://twitter.com/SwingAlerts_CT/status/1258028337152307200 | ||||||||

| 5/5/2020 | PRE | Profit trim to 90% 270 of 300 | $IBB | 270 | 123 | 124.3 | 351 | 202067 | |||||||||||

| 5/5/2020 | PRE | Long | $IWM | 200 | 127.31 | 0 | 201716 | https://twitter.com/SwingAlerts_CT/status/1257596110086049794 | https://twitter.com/SwingAlerts_CT/status/1257636882588073984 | ||||||||||

| 5/4/2020 | PRE | Trim 80 of 100 of 200 | $APDN | 80 | 3.01 | 11.46 | 676 | 201716 | https://twitter.com/SwingAlerts_CT/status/1257291032695386112 | ||||||||||

| Cover | $TSLA | 60 | 745 | 0 | 201040 | ||||||||||||||

| 12:42 PM | Cover | $TSLA | 20 | 693 | 1040 | 201040 | |||||||||||||

| 5/1/2020 | PRE | Short | $TSLA | 80 | 745 | 0 | 200000 | https://twitter.com/SwingAlerts_CT/status/1256134677359927302 | https://twitter.com/SwingAlerts_CT/status/1256247043510714368 | https://twitter.com/SwingAlerts_CT/status/1256247758752751617 | |||||||||

| 200000 | |||||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

|||||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

|||||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

|||||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

|||||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

|||||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

|||||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

|||||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

|||||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trader executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

|||||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at compoundtradingofficial@gmail.com or clients can Whatsapp Curt direct.

|

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Newsletter, Stocks, Commodities, Crypto, $SPY, $VIX, $NATGAS, $BTC, $BABA, $TWTR, $AIKI, $LUV, $IWM, $SBUX, $APDN

Swing Trade Alerts Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

Swing Trading Alert Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 as Alerted to Member Private Feed, Trading Room and/or Newsletter Reporting. #swingtrading #tradealerts

Tickers Alerted on Swing Trade Feeds: $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS,

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 131.26% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=462520&investmenttime=date&investmentlength=2.5&beginbalanceday=04%2F01%2F2020&endbalanceday=04%2F30%2F2020&ctype=1&x=62&y=20

- Our goal is to provide the best swing trading alert and newsletter service available. The highest winning percentage with the most consistent returns.

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 12, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 90% . ROI 131.26%. April 1 – 30, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1GVMx_8TcMuQglo4IN_oN03VwbcF2WVoG2mHd0gN4G9s/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

|

* Note: there are a series of oil trades that have to yet be moved to this ledger from lead trader.

|

||||||||||||||||

| 4/30/2020 | 12.05 PM | Long | $LUV | 500 | 30.78 | 0 | ||||||||||

| 4/30/2020 | PRE | Trim 50%: 25 hold 25 | $OSTK | 25 | 8.73 | 14.83 | 152.5 | 462520 | ||||||||

| 4/30/2020 | 8:05 AM | Trim 10% | $BTC | 70 | 5900 | 8878 | 20846 | 462368 | ||||||||

| 4/30/2020 | POST | Trim 25 hold 25 | $AAPL | 25 | 268.1 | 294 | 647.5 | 441522 | ||||||||

| 4/29/2020 | 12:49 PM | Trim 90 hold 370 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 37.15 | 310.5 | 440875 | ||||||||

| 4/29/2020 | 12:17 PM | Trim 90 hold 460 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.98 | 295 | 449565 | ||||||||

| 4/29/2020 | Trim 30% 30 of 150 hold 20 | $KBE | 30 | 28.23 | 35.21 | 209 | 440270 | |||||||||

| 4/29/2020 | 10:26 AM | Trim 90 hold 550 of 640 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.8 | 279 | 440061 | ||||||||

| 4/29/2020 | PRE | Trim 10% hold 320 | $CAE | 80 | 14.1 | 17.22 | 249.6 | 439782 | ||||||||

| 4/29/2020 | PRE | Take profit to 90% sell 180 hold 30 | $MA | 180 | 247 | 273.2 | 4716 | 438533 | ||||||||

| 4/28/2020 | 11:23 | Add 1/10 size long | $TECK | 300 | 7.71 | 0 | ||||||||||

| 4/28/2020 | PRE | Trim 10% | $IBB | 30 | 123 | 128.7 | 157 | 434817 | ||||||||

| 4/28/2020 | PRE | Trim 10% | $TACO | 240 | 4.4 | 5 | 144 | 434660 | ||||||||

| 4/28/2020 | 7:01 AM | Trim 10% | $AXP | 20 | 84.5 | 86.25 | 35 | 434516 | ||||||||

| 4/28/2020 | 6:57 AM | Trim 10% 20 of 140 hold 120 | $LVS | 20 | 44.5 | 47.8 | 66 | 434481 | ||||||||

| 4/28/2020 | 6:54 AM | Trim 10% 90 of 730 hold 640 | $MA | 90 | 247 | 269.5 | 2025 | 434415 | ||||||||

| 4/28/2020 | PRE | Trim 50% | $CAE | 400 | 14.1 | 17.2 | 1240 | 432390 | ||||||||

| 4/28/2020 | PRE | Trim 50% $KBE | $KBE | 150 | 28.23 | 31.5 | 490.5 | 421150 | ||||||||

| 4/28/2020 | 10:27 AM | Trim 270 of 900 hold 730 | $SPXL (SPY Bull ETF) | 270 | 33.7 | 36.3 | 648 | 430660 | ||||||||

| 4/27/2020 | 3:00 PM | Trim 90 of 300, hold 210 | $MA | 90 | 247 | 264.9 | 1611 | 430012 | ||||||||

| 4/27/2020 | 10:25 AM | Trim 30% 60 of 200 hold 140 | $LVS | 60 | 44.55 | 47.7 | 187 | 428401 | ||||||||

| 4/27/2020 | 9:56 AM | Close $INO | $INO | 20 | 11.03 | 15.22 | 88 | 428214 | ||||||||

| 4/27/2020 | 9:55 AM | Trim 10% 60 of 600 hold 540 | $TLRY | 60 | 8.04 | 9.26 | 70.8 | 428126 | ||||||||

| 4/27/2020 | PRE | Trim 40 hold 50 | $AAPL | 40 | 268.1 | 284.9 | 672 | 428055 | ||||||||

| 4/25/2020 | POST | Close 50 | $RCUS | 50 | 15.5 | 30 | 725 | 427383 | ||||||||

| 4/24/2020 | 3:40 PM | Starter long | $TLRY | 600 | 8.04 | 0 | ||||||||||

| 4/24/2020 | 3:03 PM | Starter long | $LVS | 200 | 44.55 | 0 | ||||||||||

| 4/24/2020 | PRE | Starter long | $CCJ | 600 | 9.83 | 0 | ||||||||||

| 4/24/2020 | PRE | Long | $AXP | 200 | 84.5 | 0 | ||||||||||

| 4/23/2020 | PRE | Trim to 90%, hold 20 | $INO | 130 | 11.03 | 12.49 | 189.8 | 426658 | https://twitter.com/SwingAlerts_CT/status/1253265769372286976 | |||||||

| 4/22/2020 | Trim 25% | $INO | 50 | 11.03 | 11.46 | 21.5 | 426469 | https://twitter.com/SwingAlerts_CT/status/1252974838672691200 | ||||||||

| 4/21/2020 | 11:54 AM | Short starter | $TSLA | 20 | 694.5 | https://twitter.com/SwingAlerts_CT/status/1252627996730707968 | ||||||||||

| 4/21/2020 | 10:00 | Add $APPL 268s per alert hold 90 | $APPL | 85 | 268.1 | 0 | ||||||||||

| 4/21/2020 | 11:00 | Trim $VXX 300 hold 100 | $VXX | 300 | 43 | 47.8 | 1440 | 426448 | ||||||||

| 4/21/2020 | PRE | Trim 50% of position | $OSTK | 50 | 8.73 | 11.89 | 158 | 425008 | https://twitter.com/SwingAlerts_CT/status/1225566766350393345 | https://twitter.com/SwingAlerts_CT/status/1252243687624622085 | https://twitter.com/SwingAlerts_CT/status/1255091263185059841 | |||||

| 4/20/2020 | 11:18 AM | Long Starter | $CLVS | 300 | 11.18 | 0 | https://twitter.com/SwingAlerts_CT/status/1252255241615130629 | |||||||||

| 4/20/2020 | 12:00 | Close | $BIIB | 30 | 335 | 350 | 450 | 424850 | ||||||||

| 4/20/2020 | 10:48 | Long starter | $ACB | 1200 | 0.71 | 0 | https://twitter.com/SwingAlerts_CT/status/1252247665758347264 | |||||||||

| 4/17/2020 | 4:03 PM | Sell 25% | $MA | 100 | 247 | 260 | 1300 | 424400 | ||||||||

| 4/17/2020 | Sell 25% | $TACO | 600 | 4.4 | 4.67 | 162 | 423100 | |||||||||

| 4/17/2020 | PRE | Long | $TACO | 2400 | 4.4 | 0 | ||||||||||

| 4/16/2020 | PRE | Long | $CAE | 800 | 14.1 | 0 | ||||||||||

| 4/16/2020 | POST | Long | $SPXL (SPY Bull ETF) | 900 | 33.7 | 0 | https://twitter.com/SwingAlerts_CT/status/1247072443723845638 | |||||||||

| 4/16/2020 | 1:39 PM | Trim profit to 90% 450 of 500 | $RCUS | 450 | 15.5 | 29.2 | 6165 | 422938 | ||||||||

| 4/16/2020 | 16:42 | Long in Size | $MA | 400 | 247 | 0 | https://twitter.com/SwingAlerts_CT/status/1250887337917243393 | https://twitter.com/SwingAlerts_CT/status/1250463929765187585 | https://twitter.com/SwingAlerts_CT/status/1250463036634251266 | https://twitter.com/SwingAlerts_CT/status/1250444010117726214 | ||||||

| 4/16/2020 | POST | Trim to 90% – 35 of 40 hold 5 | $AAPL | 35 | 261.9 | 296 | 1193.5 | 416773 | ||||||||

| 4/15/2020 | PRE | Trim 100 of 200 | $APDN | 100 | 3.01 | 8.51 | 550 | 415580 | ||||||||

| 4/14/2020 | PRE | Trim profit 25% 75 of 150 | $INTC | 75 | 48.42 | 58.7 | 771 | 415030 | ||||||||

| 4/14/2020 | PRE | Trim 25% profit | $PD | 150 | 17.2 | 19.12 | 288 | 414259 | https://twitter.com/SwingAlerts_CT/status/1249980190769496064 | |||||||

| 4/14/2020 | PRE | Trim 2 hold 2 | $GC_F | 2 | 1516.01 | 1725.77 | 41952 | 413971 | ||||||||

| 4/14/2020 | POST | Trim 90%, trim 180 old 20 | $BABA | 180 | 180.75 | 205 | 4365 | 372019 | https://twitter.com/SwingAlerts_CT/status/1249803532032716801 | |||||||

| 4/13/2020 | 4:14 PM | Trim 10% Long hold 40% | $AAPL | 10 | 261.9 | 272.9 | 110 | 367644 | ||||||||

| 4/9/2020 | Settlement | Close stop at entry | $CL_F | 1 | 24.07 | 24.07 | 0 | |||||||||

| 4/9/2020 | 9:31 AM | Cover short | $TSLA | 20 | 544,33 | 558.2 | -277.4 | 367544 | ||||||||

| 4/9/2020 | 7:14 AM | Trim 45% oil swing profit hold 5% | $CL_F | 5 | 24.07 | 27.3 | 16150 | 367822 | ||||||||

| 4/9/2020 | PRE | $VIX wknd ins adds to 30% $VXX | $VXX | 300 | 43 | 0 | https://twitter.com/SwingAlerts_CT/status/1248206283087503361 | |||||||||

| 4/9/2020 | 9:15 AM | Trim 50% Long hold 50% | $AAPL | 50 | 261.9 | 270 | 405 | 351672 | https://twitter.com/SwingAlerts_CT/status/1247880159010549765 | |||||||

| 4/8/2020 | 11:34 | Long | $KBE | 300 | 28.23 | 0 | https://twitter.com/SwingAlerts_CT/status/1247911880082980864 | https://twitter.com/SwingAlerts_CT/status/1247910820144648195 | ||||||||

| 4/8/2020 | 10:04 | Short (small) | $TSLA | 20 | 544.33 | 0 | https://twitter.com/SwingAlerts_CT/status/1247888116553142272 | https://twitter.com/SwingAlerts_CT/status/1247889336458022912 | ||||||||

| 4/8/2020 | PRE | Long | $AAPL | 100 | 261.9 | 0 | ||||||||||

| 4/7/2020 | 8:07 AM | Trim oil 50% swing profit | $CL_F | 6 | 24.07 | 24.97 | 5400 | 351267 | ||||||||

| 4/7/2020 | 15:06 | Long swing trade oil | $CL_F | 12 | 24.07 | 0 | ||||||||||

| 4/6/2020 | 1:14 PM | Trim profit on swaps 25% | $BTC | 75 | 5900 | 7147 | 1247 | 345867 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Gold Long (2 @ 100) hold 4 | $GC_F | 2 | 1516.01 | 1654 | 27598 | 344620 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Silver Long (2 @ 5000) hold 1 | $SI_F | 2 | 12.7 | 14.82 | 21200 | 317022 | ||||||||

| 4/6/2020 | PRE | Long | $ZM | 100 | 128.2 | 0 | ||||||||||

| 4/6/2020 | PRE | Long | $TWTR | 500 | 23.09 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds 100 hold 200 | $BABA | 100 | 187.11 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds | $STNE | 200 | 16 | 0 | ||||||||||

| 4/3/2020 | 2:23 PM | Close | $CL_F | 1 | 20.44 | 27.99 | 7550 | 295822 | ||||||||

| 4/3/2020 | 4:00 AM | Trim oil | $CL_F | 1 | 20.44 | 25.63 | 5190 | 288272 | ||||||||

| 4/2/2020 | 10:45 AM | Trim oil | $CL_F | 2 | 20.44 | 26.6 | 12320 | 283082 | ||||||||

| 4/2/2020 | 10:40 AM | Trim oil 50% of 50% approx | $CL_F | 4 | 20.44 | 26.4 | 23840 | 270762 | ||||||||

| 4/2/2020 | 1:43 AM | Trim oil trade 50% of total | $CL_F | 8 | 20.44 | 21.81 | 10960 | 246922 | ||||||||

| 4/2/2020 | 10:29 AM | Trim Silver Long (2 @ 5000) | $SI_F | 2 | 12.7 | 14.41 | 17100 | 235962 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 10:29 AM | Trim Gold Long (2 @ 100) hold 6 | $GC_F | 2 | 1516.01 | 1609 | 18598 | 218862 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 4:27 AM | Cover 25% | $APO | 75 | 34.4 | 30.87 | 264.75 | 200264 | ||||||||

| 3/31/2020 | 12:10 | Long oil swing in size | $CL_F | 16 | 20.44 | 200000 | ||||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at compoundtradingofficial@gmail.com or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Newsletter, Stocks, Commodities, Crypto, .$AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS

Swing Trading Alert Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 as Alerted to Member Private Feed, Trading Room and/or Reporting. #swingtrading #tradealerts

Tickers Alerted: $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 127.34% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=454676&investmenttime=date&investmentlength=2.5&beginbalanceday=03%2F01%2F2020&endbalanceday=03%2F31%2F2020&ctype=1&x=75&y=27

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 5, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1EOt1AkEdPchc-h_aijQ7EUzoF_uG186Uhta9Ri-9VPg/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

| 3/31/2020 | 12:19 | Long | $STNE | 400 | 22.96 | 0 | ||||||||||

| 3/31/2020 | 11:08 AM | Trim to 75% hold 25% | $NET | 400 | 17.75 | 26.2 | 3380 | 454676 | https://twitter.com/SwingAlerts_CT/status/1245005074260164609 | |||||||

| 3/31/2020 | 10:46 AM | Trim | $NET | 200 | 17.75 | 25.7 | 1600 | 451286 | ||||||||

| 3/31/2020 | 8:07 AM | Trim 25% | $HAS | 100 | 67.69 | 73.55 | 586 | 448696 | ||||||||

| 3/30/2020 | 2;47 PM | Trim 25% | $HAS | 100 | 67.69 | 70 | 231 | 449110 | ||||||||

| 3/30/2020 | 11:04 | Long | $HAS | 400 | 67.69 | 0 | ||||||||||

| 3/30/2020 | 9:43 | Short | $APO | 300 | 34.4 | 0 | ||||||||||

| 3/27/2020 | 12:51 | Long | $JETS | 800 | 15.8 | 0 | ||||||||||

| 3/26/2020 | 10:09 AM | Trim 100 of 400 | $SQ | 100 | 43.62 | 59 | 1530 | 448879 | ||||||||

| 3/25/2020 | 12:26 PM | Trim 50% 100 hold 100 | $BABA | 100 | 174.05 | 194.05 | 2000 | 447349 | ||||||||

| 3/25/2020 | 11:35 AM | Trim 12.5% hold 12.5% | $BA | 25 | 107.7 | 166.8 | 1477.5 | 445349 | ||||||||

| 3/24/2020 | 6:35 PM | Trim 25% hold 25% | $BA | 50 | 107.7 | 139.75 | 1602.5 | 443862 | ||||||||

| 3/24/2020 | 12:26 PM | Trim 50% | $INTC | 150 | 48.42 | 53.32 | 735 | 442260 | ||||||||

| 3/24/2020 | 12:25 PM | Trim 50% | $BA | 100 | 107.7 | 123.17 | 1547 | 441525 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% swaps | $BTC | 150 | 5900 | 6557 | 9855 | 4399778 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (5 x 5000 ounce contracts) | SI_V | *5 | 12.7 | 13.94 | 31000 | 430123 | ||||||||

| 3/24/2020 | 12:15 PM | Trim 50% (8 x 100 ounce contracts) | GC_F | 8 | 1516.01 | 1619.27 | 82608 | 399123 | ||||||||

| 3/23/2020 | 10:11 | Long | $INTC | 300 | 48.42 | 0 | ||||||||||

| 3/23/2020 | 9:59 | Long | $BABA | 200 | 174.05 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long BTC adds swaps | $BTC | 200 | 6200 | 0 | ||||||||||

| 3/23/2020 | 9:23 | Long Silver | SI_F | 10 | 12.7 | 0 | ||||||||||

| 3/23/2020 | 9:21 | Long Gold | $GC_F | 16 | 1516.01 | 0 | ||||||||||

| 3/20/2020 | PRE | Long | $SQ | 400 | 43.62 | 0 | ||||||||||

| 3/20/2020 | PRE | Long 200 | $BA | 200 | 107.7 | 0 | ||||||||||

| 3/19/2020 | Trim 200 for 400 held | $APDN | 200 | 3.01 | 9.48 | 12940 | 316515 | |||||||||

| 3/15/2020 | 5:13 PM | Adds swaps | $BTC | 100 | 5409 | 0 | ||||||||||

| 3/13/2020 | PRE | Cover 60, hold 40 | $NKE | 60 | 86.2 | 76 | 612 | 303575 | ||||||||

| 3/13/2020 | PRE | Cover 150 hold 50 | $WYNN | 150 | 100.52 | 71.08 | 4416 | 302973 | ||||||||

| 3/13/2020 | PRE | Long 100 | $COST | 100 | 277.6 | 0 | https://twitter.com/SwingAlerts_CT/status/1235724000808112128 | |||||||||

| 3/13/2020 | 14:30 | Add 400 for 600 held | $APDN | 400 | 2.3 | 0 | https://twitter.com/SwingAlerts_CT/status/1229993709732876290 | |||||||||

| 3/12/2020 | 10:26 | Long | $PD | 600 | 17.2 | 0 | ||||||||||

| 3/12/2020 | 9:54 AM | Cover 25% | $MA | 150 | 322.3 | 246 | 11445 | 298557 | ||||||||

| 3/12/2020 | 9:51 AM | Cover 25% | $WYNN | 150 | 100.52 | 69.78 | 4611 | 287112 | ||||||||

| 3/12/2020 | 8:51 AM | Cover 25% 100, hold 100 | $NKE | 100 | 86.2 | 76.9 | 9700 | 282501 | ||||||||

| 3/12/2020 | 10:32 AM | Trim 150 of 450 held | $VXX | 150 | 18.2 | 48.2 | 4500 | 272801 | ||||||||

| 3/11/2020 | 11:31 AM | Cover 50% 200 of 400 | $NKE | 200 | 86.2 | 82.17 | 860 | 268301 | ||||||||

| 3/11/2020 | PRE | Short 400 | $NKE | 400 | 86.2 | 0 | https://twitter.com/SwingAlerts_CT/status/1237697839129649152 | |||||||||

| 3/10/2020 | 3:44 PM | Trim 150 of 600 held | $VXX | 150 | 18.2 | 34.64 | 2466 | 267441 | ||||||||

| 3/9/2020 | 2:04 PM | Long 200 | $INO | 200 | 11.03 | 0 | https://twitter.com/SwingAlerts_CT/status/1237076932057075712 | |||||||||

| 3/9/2020 | 9:30 AM | Trim 150 of 500 | $WYNN | 150 | 100.52 | 84 | 2478 | 264975 | ||||||||

| 3/9/2020 | 10:19 AM | Sell 11/12 approx | $OVX | *11 / 12 | 35.8 | 139 | 55728 | 262497 | https://twitter.com/SwingAlerts_CT/status/1237018625191673856 | https://twitter.com/SwingAlerts_CT/status/1236994259607265281 | https://twitter.com/SwingAlerts_CT/status/1231427689703231488 | https://twitter.com/SwingAlerts_CT/status/1188897285385703424 | https://twitter.com/SwingAlerts_CT/status/1192794697569320966 | |||

| 3/5/2020 | 10:45 | Short 500 | $WYNN | 500 | 100.52 | 0 | ||||||||||

| 3/5/2020 | 10:31 | Long 200 | $GBTC | 200 | 10.72 | 0 | ||||||||||

| 3/3/2020 | 3:51 PM | Sell 200 of 200 | $HIIQ | 200 | 18.6 | 31 | 2480 | 206769 | ||||||||

| 3/3/2020 | PRE | Trim 100 of 600 | $RCUS | 100 | 15.5 | 17.59 | 209 | 204289 | https://twitter.com/SwingAlerts_CT/status/1234722519187435520 | https://twitter.com/SwingAlerts_CT/status/1230924666665078785 | https://twitter.com/SwingAlerts_CT/status/1250841232366088192 | |||||

| 3/2/2020 | PRE | Trim 100 of 300 | $APDN | 100 | 4.44 | 8.52 | 4080 | 204080 | ||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at compoundtradingofficial@gmail.com or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Stocks, Commodities, Crypto, $SQ, $MA, $APDN, $PD, $BA, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $VXX, $VIX, $OVX, $INO, $GLD, $GC_F, $SLV, $SI_F, $BTC, $STNE, $JETS, $APO, $HIIQ, $GBTC, $RCUS.

Premarket Trading Notes: $APDN, $CL_F, $USO, $DXY, US DOLLAR, CAD, Stocks on Watch, #DayTrading, #SwingTrading, #TradeAlerts, #Premarket

Good morning traders!

RE: Premarket Trading Notes

Good times, things are setting up exactly as we thought for the time cycles in to 2025. This time cycle in to end of August 2020 be safe at inflections, working on a time cycle within time cycle model for you now.

If you missed the beach side video last night I discussed the US Dollar / CAD and this morning on Swing Trade alert feed I sent out some thoughts on Gold trade.

What a day⚠️🗡️🎯🏹🐋💙🌴 https://t.co/jx9JUjXRVc

— Melonopoly (@curtmelonopoly) May 13, 2020

Day trades are setting up here, I may start a few today (I will alert to day trade alerts feed) and possibly transition them to the Swing Trading Alert platform if I can get on the right side.

A few day trades on watch: $APDN $BPMX $AIM $NVUS $IMUX $ALLO $TLSA $NBY $RIOT $CODX $WISA $ALT

Below is a list from Benzinga fyi

32 Stocks Moving in Thursday’s Pre-Market Session $APDN $BIOC $BPMX https://benzinga.com/z/16029951#.Xr04YFcqZvt.twitter #premarket #daytrading

32 Stocks Moving in Thursday's Pre-Market Session $APDN $BIOC $BPMX https://t.co/d6pNSUczeC #premarket #daytrading

— Day Trading Alerts (@DayTrade_Alert) May 14, 2020

The intense oil daytrading yesterday that continued in to the night and premarket today ended up on our side – a really nice trade for our oil trade alerts feed.

Since the black swan updates I don’t think EPIC has lost a trade, very little if any.

EPIC V3.1.1 was in deep at support at 24/30 size, that is deep for the software, anyway it worked out well for the oil trade alerts members (I got a number of Whatsapp messages and we were intensely working through member trades live on Whatsapp messaging).

I also got a nice win there too so that helped. If you’re a member and not connected to me on Whatsapp do so by emailing cmpoundtradingofficial.com so we can connect.

Power of trend line price breakouts from a trading structure support, crude oil intraday near 200 points from oil trade alert buys earlier #OOTT $CL_F $USO #oiltradealerts EPIC V3.1.1 software was in deep at 24/30 size in position trading, very large size. Lead trader was also.

https://twitter.com/EPICtheAlgo/status/1260875628502491143

The swing trade service got a big win this morning in $APDN on the news, really nice trade from lows, another multi bagger. I may do some daytrading in $APDN yet today also.

Another beauty of a trade on our swing trading alert platform $APDN #swingtradealerts

Applied DNA Receives FDA Emergency Use Authorization for COVID-19 Diagnostic Assay Kit

Another beauty of a trade on our swing trading alert platform $APDN #swingtradealerts

Applied DNA Receives FDA Emergency Use Authorization for COVID-19 Diagnostic Assay Kithttps://t.co/iyKCYoNjbQ pic.twitter.com/viyfI7Rpvl

— Swing Trading (@swingtrading_ct) May 14, 2020

Trump train trading will be awesome here forward, what an opportunity!

This is a strong signal imo. Inflection time. Looks like a man preoccupied with off-screen furback rats scurrying… no point for this public education – they've hit max opportunity of those that will get it, have it now and those that don't, oh well. Fireworks here fwd likely. https://t.co/490KOejSS5

— Melonopoly (@curtmelonopoly) May 11, 2020

I did say something about the tone represented the other day at the WH briefing – that I wouldn't want to be on the opposing team considering, here we go kids🪓⛓️🪝 https://t.co/YeVboLTSnj

— Melonopoly (@curtmelonopoly) May 14, 2020

While CNBC has been flashing

"MARKETS IN TURMOIL"

We been raising the dead and banking the living.

Couldn't have been a better time cycle and the next will be better than the last and the next and the next. Historic opportunity for traders.#premarket pic.twitter.com/QYgi57w5VX

— Melonopoly (@curtmelonopoly) May 14, 2020

Any questions let me know!

Curt

Previous Premarket Trading Notes for review on set-ups etc.

Article Topics; $APDN, $CL_F, $USO, $DXY, US DOLLAR, CAD, Stocks on Watch, #DayTrading, #SwingTrading, #TradeAlerts, #Premarket

PreMarket Trading Plan Tues Sept 25: Market Screams Epic Opportunity Near, $DIS, $APDN, $CLRB, $KORS, $NFLX, $BLDP, OIL, Bitcoin, more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday September 25, 2018.

In this premarket trading edition: $DIS, $APDN, $CLRB, $ARMN, $ACST, $XON, $OSIS, $BLDP, $LEBV, $CRON, $NBEV, $NFLX, $FB, $SHOP, OIL, $EDIT, $BABA, $GTHX, $AGN, $ROKU, $CVM, $XXII, $MOMO, $SPY, $SSW, $DXY, $BOX, $CARA, $PROQR, $XBIO, $AAPL, $ARWR, $VIX, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 25 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, special Trading Webinars or when the lead trader is not available.

- In final edits for release this week;

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced in part (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

See the general market news near bottom of this report – the are epic market trading opportunities on the near horizon.

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on. I don’t see any reason why we won’t be able to push these set-ups out this evening after the markets close. There is so much going on right now in the markets (the ground is moving) that we have to start pushing this stuff out and get ready.

Doing some charting in premarket for $CLRB and $APDN – both very interesting set-ups IMO.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Below are some trade position notes from late last week if you didn’t catch them;

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

The videos this week and the boot camp trade set-up reviews have been right in the flow of the market. We’re working on the rest of the equities we follow now and will have them all out over the next few days. Today in mid-day review I will tackle some more of the set-ups.

Market Observation:

Markets as of 7:43 AM: US Dollar $DXY trading 94.25, Oil FX $USOIL ($WTI) trading 72.40, Gold $GLD trading 1201.21, Silver $SLV trading 14.30, $SPY 291.83 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6378.00 and $VIX trading 11.9.

Momentum Stocks / Gaps to Watch: $JAGX $CEI $JONE $ASNA $TLRY $APDN $GNCA $HMNY

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12401306 $JAGX $ASNA $TLRY $MTNB $INFO $TGTX $OPNT $AINC $FDS $PETQ $KORS $CNP

https://twitter.com/CompoundTrading/status/1044562223388127232

News:

$APDN Applied DNA Expands Cannabis Tagging Portfolio to Address Large Growers https://finance.yahoo.com/news/applied-dna-expands-cannabis-tagging-090000755.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$CLRB: Cellectar’s CLR 131 Receives FDA Orphan Drug Designation for the Treatment of Pediatric Osteosarcoma

Michael Kors takes over fashion icon Versace in $2 billion deal

The Knot parent XO Group’s stock soars after $933 million buyout deal

$FCSC Awarded $1.4M FDA Orphan Grant for FCX-007 for Treatment of Recessive Dystrophic Epidermolysis Bullosa

Fiserv to buy U.S. Bancorp unit’s debt-card processing, ATM services and MoneyPass for $690 million

Aleafia to receive $10 million investment as part of deal to take majority stake in Serruya-led One Plant

$PSTI here is PR: FDA Orphan Drug Designation for PLX cell therapy for the Treatment of Graft Failure

Recent SEC Filings / Insiders:

Recent IPO’s:

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Earnings:

Jabil’s stock jumps after profit, revenue beat expectations

#earnings for the week

$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL

#earnings for the week$NKE $BB $KMX $RAD $KBH $JBL $ACET $FDS $MANU $BBBY $NEOG $ACN $CCL $INFO $ATU $MTN $WOR $CTAS $MKC $CAG $ASNA $AIR $OMN $CMD $FGP $PRGS $ESNC $ANGO $CAMP $FUL $DAC $ISR $SCHL https://t.co/r57QUKKDXL https://t.co/pVka1Ud3QD

— Melonopoly (@curtmelonopoly) September 24, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

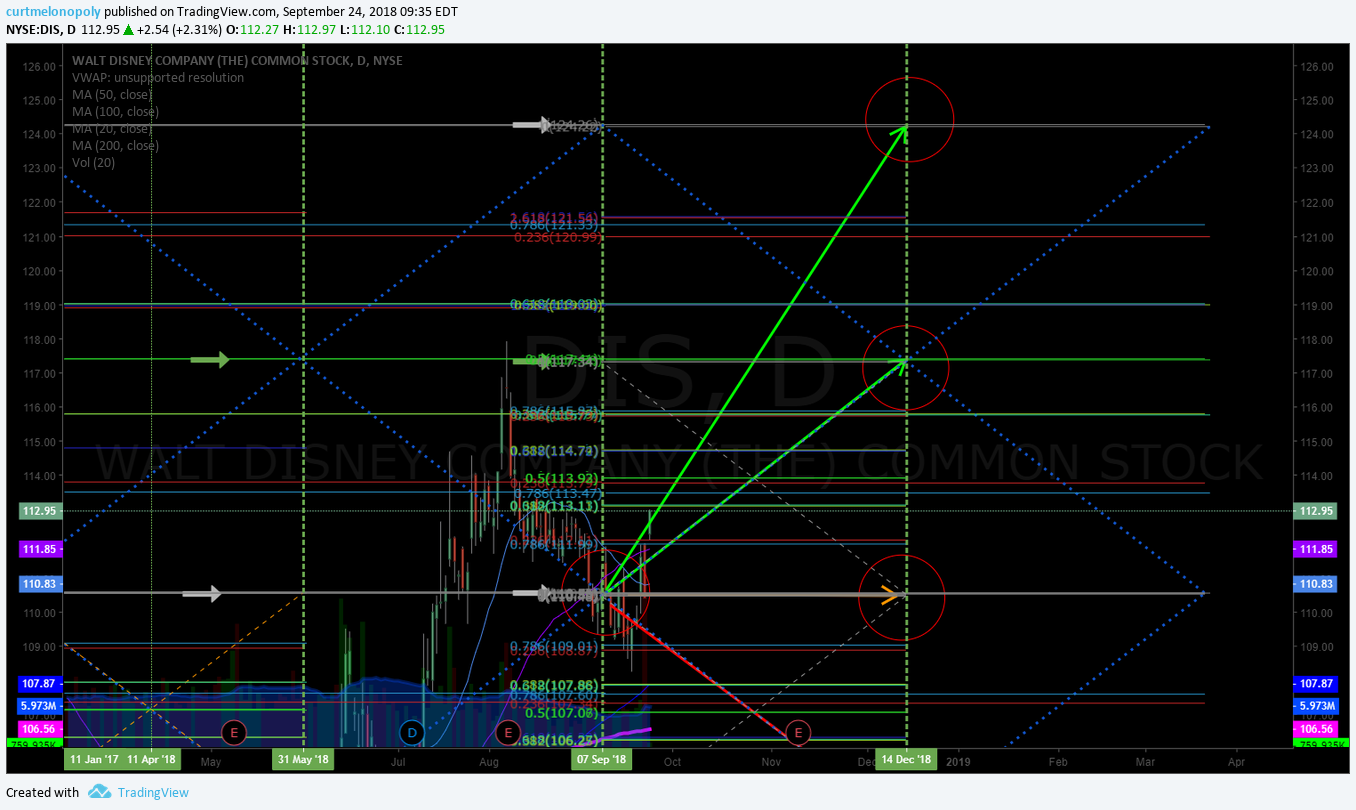

DISNEY (DIS) trade alert long 112.30, over 112.10 targets 117.38 or 124.27 Dec 14 pending trajectory of trade $DIS #swingtrading #tradealerts

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading

As the media wars heat up, Chart Master Carter Worth sees one company as a buy: Disney $DIS #swingtrading https://t.co/KiWbcjO7PO

— Swing Trading (@swingtrading_ct) September 25, 2018

Best Oil Stocks to Buy Now https://finance.yahoo.com/news/best-oil-stocks-buy-now-012433429.html?soc_src=social-sh&soc_trk=tw …

Best Oil Stocks to Buy Now https://t.co/mh3568k1o0 via @YahooFinance

— Melonopoly (@curtmelonopoly) September 24, 2018

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

ADVANCED MICRO (AMD) hit key support and bounced, targets 33.62 Oct 2 or sell off 28.87, watch structure uoutlined on chart #swingtrading #tradealerts

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

CRONOS – per yesterday’s trade alert and review video over trendline on way to resistance test in premarket $CRONO #tradealert #premarket

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

CVM Looking to break recent highs out of bullish bowl targets 5.00 then 6.00. $CVM #swingtrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

SP500 (SPY) near break upside test, above signals targets 293, 294.20, 295.50, 297 resistance Sept 21 ish $SPY $ES_F $SPXL $SPXS #SPY #Swingtrade #tradingalerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert