Tag: BOX

Swing Trading Strategies, Charts, Alerts w/ Video | Premium $PXD $TLRY $TSLA $EEM $AGN $AMD $INTC $XOP $MGI $BOX $FB $PLUG $BTC $LYFT $IOTS $SQ $STNE $TEUM $AU …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. June 24, 2019.

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $TEUM, $AU, $OIH.

Live Trading Room Swing Trade Video Review From June 20, 2019 2:22 PM.

All the swing trading alerts, strategies, charts and various set-ups are reviewed in detail on the video below from the live trading room.

Crude Oil (USOIL WTI)

Near resistance (as of time of video) 57.66 uptrending trend-line above, updated signals and charting in the most recent oil report distributed to members.

PIONEER NATURAL RESOURCES (PXD)

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

FACEBOOK (FB)

June 24, 2019 – Review video for trading strategy in detail.

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per une 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $AU. $OIH, $WTI, $USOIL #Oil

Swing Trading Special Report Series (Part D) Sun Nov 18 NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ …

Compound Trading Swing Trade Report Sunday November 18, 2018 (Part D).

Swing Trading Signals and Stock Picks In this Issue: NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ … .

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part D of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were covered at the last Trade Coaching Boot Camp. Part A of this swing trading special series can be found here, Part B of the swing trade report here and Part C of the swing trading report here.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports..

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSIS, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 14 – Swing Trading Special Report Sun Oct 14 (Part A) FEYE, ROKU, SHOP, ARWR, TSLA, AGN, CRON, SQ.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Current Swing Trading Signals and Stock Charts.

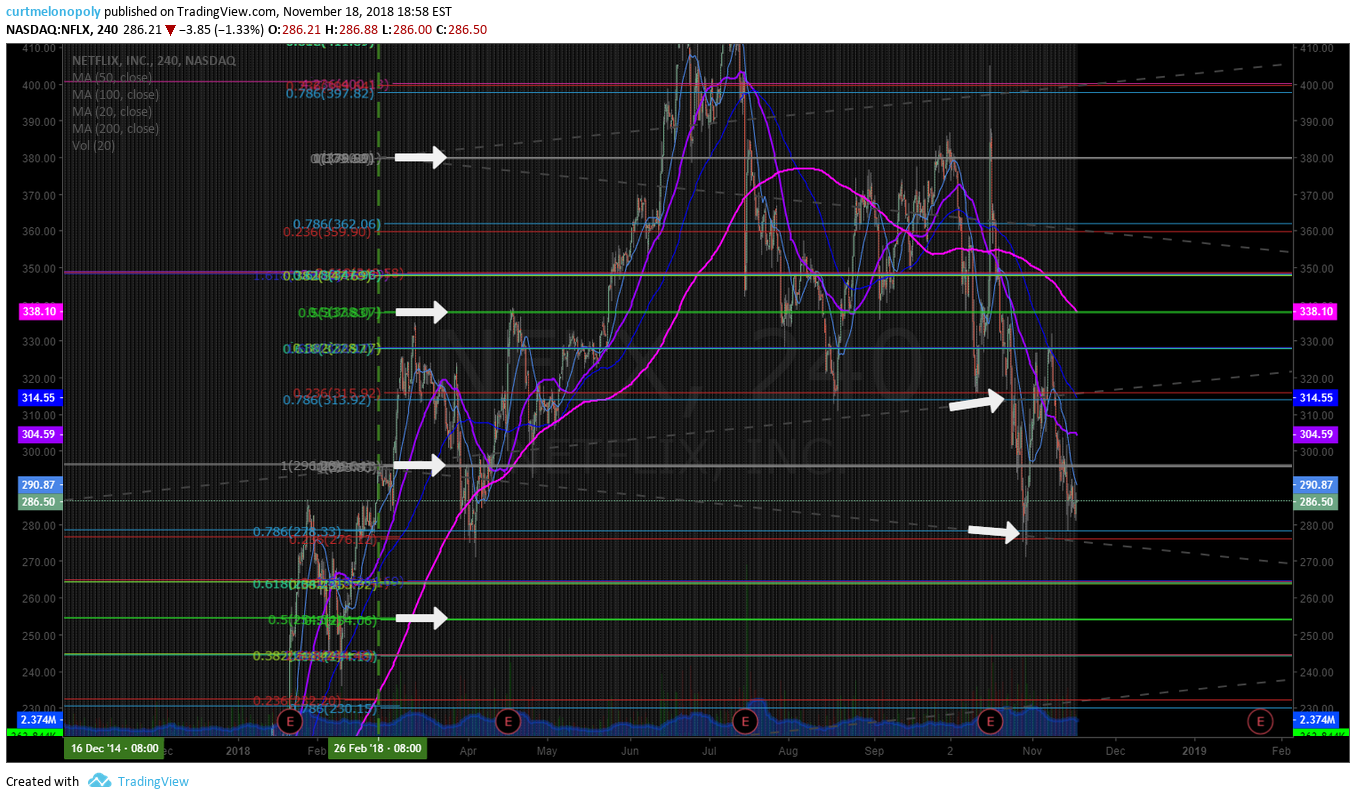

NETFLIX (NFLX) stock under pressure trading near Fibonacci Trend line support.

How to trade the Netflix stock move:

- Under trend line support (trending down) 275.00 targets 232.68 (trending up).

- Current area holds (closed 286.21 Friday) targets 315’s (upper trend line).

- Current bias is down to 232’s, on watch for Monday.

It’s time to stop lumping Netflix in with the other FAANG stocks, says analyst. #swingtrading $NFLX https://www.marketwatch.com/story/its-time-to-stop-lumping-netflix-in-with-the-other-faang-stocks-says-analyst-2018-11-16?siteid=yhoof2&yptr=yahoo

MOLECULAR TEMPLATES INC (MTEM) Bounced off previous support, over 5.50 targets 7.00 or 9.79 Mar 4, 2019.

Barron’s calculates that has been a total of nearly $46 million in recent stock purchases in Acadia Pharmaceuticals (ACAD), Molecular Templates (MTEM), Foamix Pharmaceuticals (FOMX), and Amicus Therapeutics (FOLD). https://www.barrons.com/articles/biotech-stocks-1538083965?siteid=yhoof2&yptr=yahoo

PYXUS $PYX bounced off previous low, last trade was near 3x return, targets for next swing on chart. Now on watch.

Pyxus Stock Dives On Tariffs, Marijuana Stocks Also Retreat https://www.investors.com/news/pyxus-stock-marijuana-stocks/

22nd CENTURY GROUP (XXII) over 2.85 targets 3.09, 3.53 then 4.39. On high watch. $XXII.

Analyzing 22nd Century Group’s Year-to-Date Performance. https://marketrealist.com/2018/11/analyzing-22nd-century-groups-year-to-date-performance?utm_source=yahoo&utm_medium=feed&yptr=yahoo

PROQR THERAPEUTICS (PRQR) Over 20.70 targets 22.65, 24.85, 27.55 Dec 10 time cycle $PRQR

ProQR (PRQR) Reports Q3 Loss, Misses Revenue Estimates https://finance.yahoo.com/news/proqr-prqr-reports-q3-loss-134501815.html?soc_src=social-sh&soc_trk=tw

BOX INC (BOX) Trading 17.90 forming bottom, upside targets 19.30, 23.85 July 2019 $BOX. Watching for the interim bottom to continue and a possible turn up in price.

G1 THERAPEUTICS (GTHX) could have bottomed, above trading box possibly sees price targets on chart $GTHX.

Seaspan (SSW) If this area holds price targets 10.20 perhaps 10.61 Nov 26 time cycle with symmetry $SSW.

Health Innovations (HIIQ) Watching for 200 MA test to hold and bounce with price targets on chart $HIIQ.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ

PreMarket Trading Plan Tues Oct 30: Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday October 30, 2018.

In this premarket trading edition: Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development Work in Progress:

- Ask for a tour of our member swing trading alert feed – we’ve done well through this and expect it to get better through Q1 2019. Been through many downturns over 30 years. Check the feed and tell me I’m wrong. #swingtrading #premarket https://twitter.com/curtmelonopoly/status/1057255452621324289

- Platform Expansion This Week – Nominal Intermittent Down Time Expected: 1. We are integrating web mail servers with machine trading api’s for our clients, this may cause intermittent downtime for email [email protected] – use [email protected] if you experience issues. 2. We are moving our main fiber line – expect full trading room platform downtime for up to 30 mins.

- Oct 30 – Lead trader booked for main trading room for market open 9:30 AM, 12:00 PM mid day review and futures trading this evening 6:00 PM (as available and as market demands).

- Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- https://twitter.com/curtmelonopoly/status/1054318666878238720

- Main live trading room – 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars and when Lead Trader is not available.

- What’s New / Work in Progress (week of Oct 29 we expect to clear this WIP list):

- Machine trading signals to be fed in to main trading room starting mid to late week of Oct 29.

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November for each of the seven trading models and swing and daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

October 30 Trading Plan: I published a swing trading report (Part B of the special series) last night – from that report and Part A of the series I have many stocks on watch that I think are decent candidates for long swings soon. I am watching a major support area on oil transpire in premarket, if it fails it may be another ladder down, if not it may be a decent long. Gold, Silver, BTC are under pressure and likely to be so now until Nov 11 ish. Sell-off should calm for a bit soon, other side of Nov 11 time cycle unclear at this point. VIX likely short set-up here. Those are my general bias near term but let price do the talking.

In equities also watching WMT, MCD, AAOI closely for long positions.

October 29 Trading Plan: Watching. Looks like a bounce in equity markets possible. Watching.

October 24 Trading Plan: It’s all about oil $WTI $CL_F today, then it will be about GOLD $GLD, SILVER $SLV, VIX $VIX and SP500 $SPY for me thereafter. Watching the TESLA $TSLA play and MCDONALDS $MCD very close. Everything else will be reviewed on swing trading report due out today.

October 23: Notes per below remain in play. New position long in Silver is working from 14.63’s as a swing trade, oil short in to open yesterday worked, watching for an intra-day bounce possible in to open in oil and then down likely. Gold has a bounce as does VIX as I expected in to this time cycle. Momentum daytrading is very dangerous right now. Watching some swing trades in equities (forming a report right now and I’ll release it today).

Considering a long term (6 months or more) swing trade in $MCD soon. Long.

$VIX up more than double since we were alerting time cycle run #premarket.

October 22: I have a new position in Silver in 14.63’s long that may get some pressure but there is a plan to add at support below. Earnings season may help equities some here near term – but it is dubious.

I will continue chewing around the edges of this crude oil sell-off at support areas for a reversal to the retracement and try and get a decent short position also when I can at upside resistance. Serious, serious pressure here in oil trade BUT support areas for possible reversal are starting to hit now on various charting time-frames and structures – BUT that doesn’t mean it will reverse. It reverses when it reverses, trade the indicators not bias.

Watching NFLX, SQ, ROKU, SHOP, FEYE very close right now and swinging them all. TSLA trade yesterday went great, still holding 25% on the swing side. Today is all about OIL with EIA.

PSTG has an upgrade I’m watching also.

I am leaning toward equity markets possibly holding up in to end of Oct early Nov, Gold Silver Crypto likely pressure in to that time frame, Oil likely pressure in to that time frame and VIX also. And then end of Oct early Nov that should switch.

This is a leaning bias – a general outlook. However, I do see significant risk that could trigger volatility at any time here. But generally equity markets should hold to that late Oct early Nov with VIX GOLD SILVER OIL under pressure and then the opposite should turn toward mid Dec time cycle peak. See the most recent oil trading strategies video.

I know I’ve been promising the remaining model reports for some time, last night we ran the machine trading tests on EPIC and it is working so I can leave the staff to that and now start getting the reporting out. The software development part of our biz I have to admit has been a challenge to our time.

It’s difficult to explain in short how complicated software development is with machine trading launch. But we’re learning to manage it. We’re in it to win it – we won’t give up and we’re making serious progress, that’s the bottom line.

Looking for possible short term sell off in oil with a spike in VIX, Gold, Silver and then markets should levitate for short term bringing VIX Gold Silver Crypto soft and then reversal again and again and rinse and repeat to mid December 2018 minimum.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

Markets as of 8:18 AM: US Dollar $DXY trading 96.68, Oil FX $USOIL ($WTI) trading 66.46, Gold $GLD trading 1222.56, Silver $SLV trading 14.43, $SPY 265.30 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6272.50 and $VIX trading 24.2.

Momentum Stocks / Gaps to Watch:

TTWO:RED DEAD LAUNCH GETS BIGGEST OPENING WEEKEND OF ALL TIME

Stocks making the biggest move premarket: KO, GE, PFE, TPR, UAA & more –

https://www.cnbc.com/2018/10/30/stocks-making-the-biggest-move-premarket-ko-ge-pfe-tpr-uaa–more.html

Stocks making the biggest move premarket: KO, GE, PFE, TPR, UAA & more – https://t.co/puluxQsJbH

— Melonopoly (@curtmelonopoly) October 30, 2018

News:

$URGN FDA Grants Breakthrough Therapy Designation UGN-101 For The Treatment Of Patients With Low-Grade Upper Tract Urothelial Cancer (LG UTUC)

Recent SEC Filings / Insiders:

Recent IPO’s:

Initial public offerings haven’t enriched investors so far this financial year amid volatility in the market.

Initial public offerings haven’t enriched investors so far this financial year amid volatility in the market.https://t.co/mYWuYAMqQK

— NDTV Profit (@NDTVProfitIndia) October 30, 2018

Earnings:

HCA shares up 3.1% premarket after earnings beat.

Mastercard stock rises after earnings beat.

#earnings for the week

$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNT

http://eps.sh/cal

#earnings for the week$FB $AAPL $BABA $GE $IQ $MA $BIDU $EBAY $CHK $XOM $EA $TEVA $GM $UAA $TNDM $BP $SPOT $ON $FDC $ADP $CVX $KO $AMRN $SBUX $X $ABBV $PFE $FIT $PAYC $YNDX $OLED $ABMD $WTW $ANET $WLL $LL $FEYE $DDD $RIG $SNE $KEM $NWL $STX $BAH $FTNThttps://t.co/r57QUKKDXL https://t.co/w6cD7uO3t7

— Melonopoly (@curtmelonopoly) October 29, 2018

#earningsseason calendar

$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAY

#earningsseason calendar$AMD $AMZN $FB $AAPL $TSLA $MSFT $NVDA $SQ $BABA $GE $SNAP $CLF $INTC $T $GOOGL $CGC $TWTR $BA $V $IQ $CAT $F $ROKU $SHOP $CRON $SLB $PG $BIDU $CELG $JD $HON $MA $DBX $HEAR $AMAT $TEVA $HAL $NOK $DIS $AAL $EA $TNDM $CMG $EBAYhttps://t.co/r57QUKKDXL https://t.co/exPTAW20yW

— Melonopoly (@curtmelonopoly) October 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

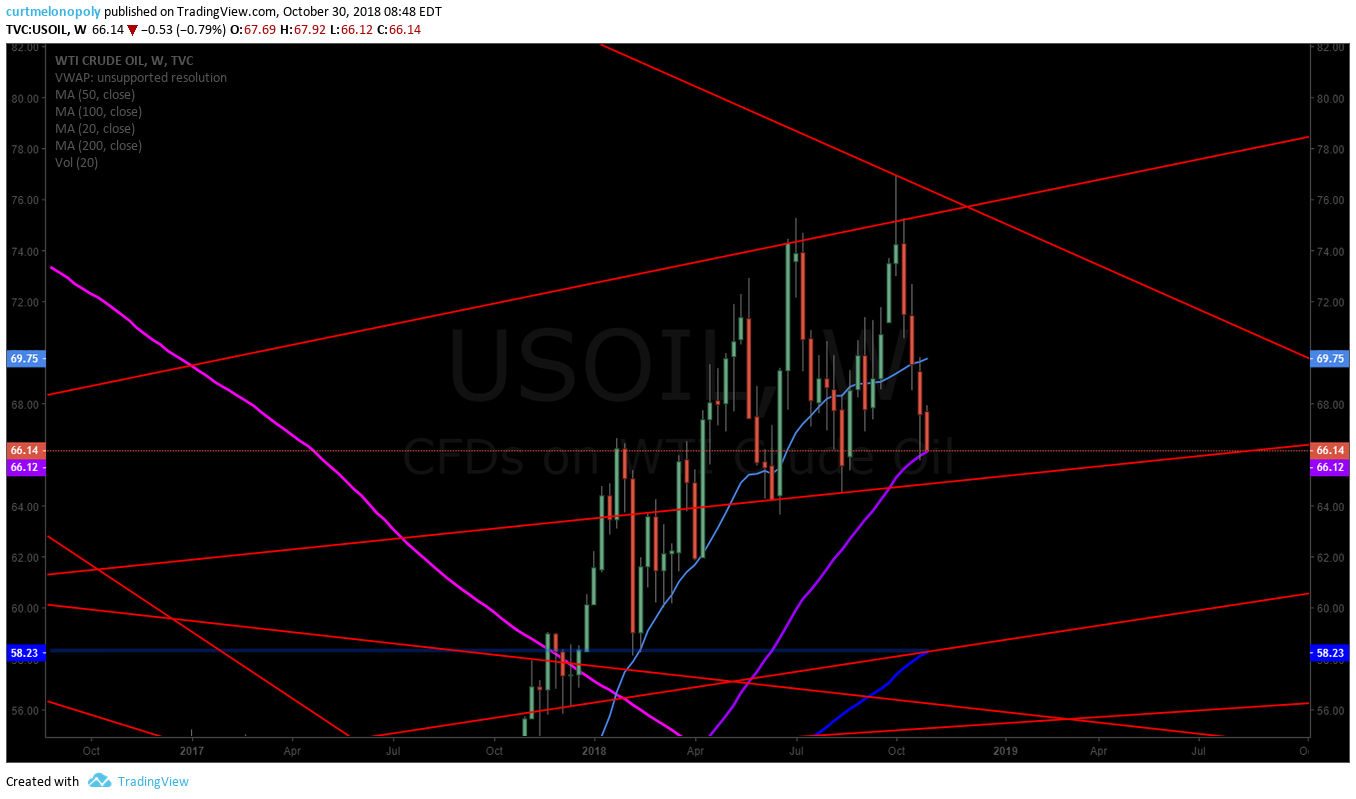

Crude Oil – The only chart that matters today (beyond EPIC Oil Algorithm) FX USOIL WTI CL_F USO #crudeoil

Swing trading with technical analysis $BLDP

Swing trading with technical analysis $BLDP #swingtrading #tradealerts pic.twitter.com/WURkhsEzCt

— Melonopoly (@curtmelonopoly) October 30, 2018

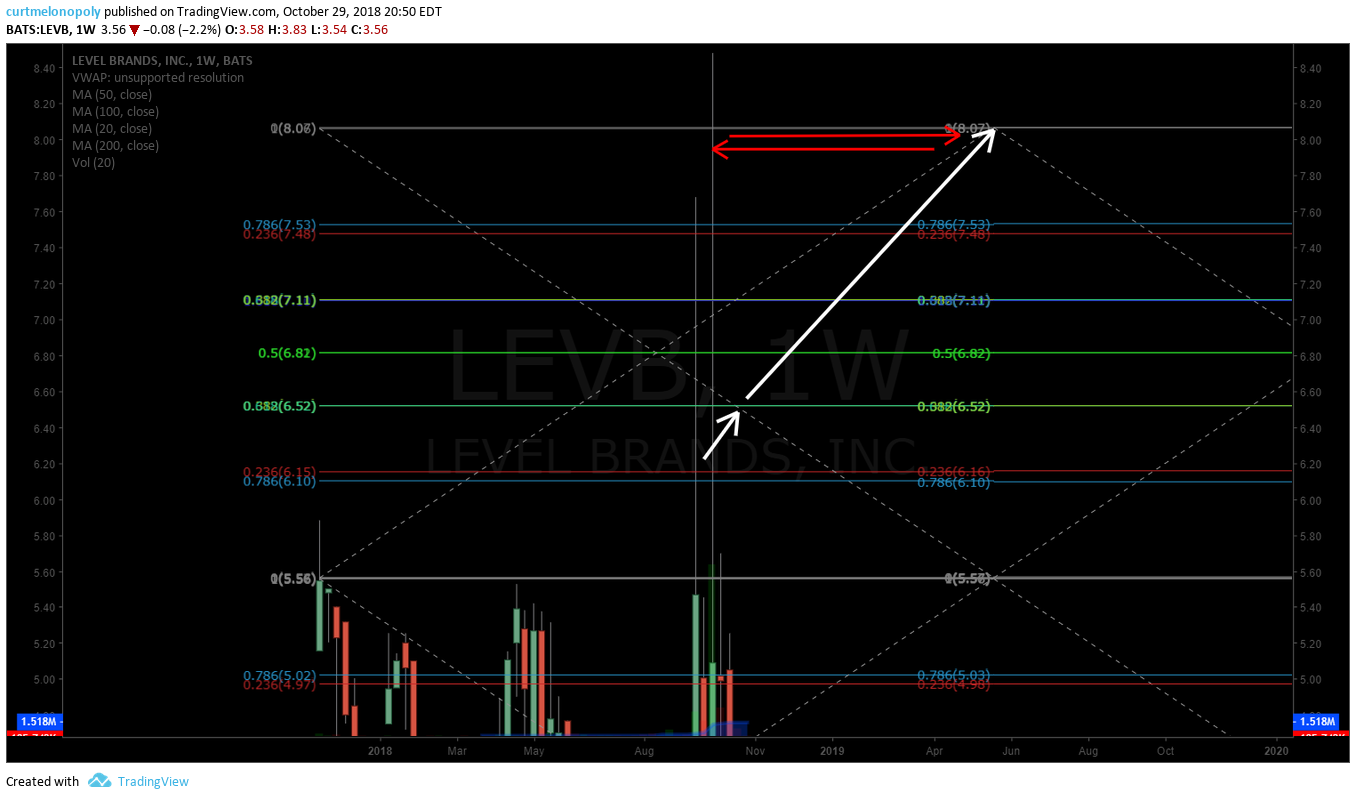

Swing trading with technical analysis $LEVB

Swing trading with technical analysis $LEVB #swingtrading #tradealerts pic.twitter.com/tnYe1Cj7iO

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis $PYX

Swing trading with technical analysis $PYX #swingtrading #tradealerts pic.twitter.com/36IfTDhB2Q

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis. $NBEV

Swing trading with technical analysis. $NBEV #swingtrading #tradealerts pic.twitter.com/IKvPhqzOtk

— Melonopoly (@curtmelonopoly) October 30, 2018

Swing trading with technical analysis. $BOX

Swing trading with technical analysis. $BOX #swingtrading #tradealerts pic.twitter.com/CCyhDBJ135

— Melonopoly (@curtmelonopoly) October 30, 2018

Crude oil 4 hour chart. Trendlines. FX USOIL WTI $CL_F $USO #Oil #trading #chart #OOTT https://twitter.com/EPICtheAlgo/status/1056884532408926208

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

On the daily oil chart price ended the week right above the 200 MA and above the primary pivot marked on the chart.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Silver Weekly Chart has a MACD turn up possible, watching for a possible run up Oct 21 756 PM #Silver #Algorithm $SLV $USLV $DSLV

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD

Gold (Daily) With MACD turn back up price above pivot near 200 MA resistance test – this trade is on high watch #GOLD $GC_F $XAUUSD $GLD pic.twitter.com/JNfF5U9u7L

— Rosie the Gold Algo (@ROSIEtheAlgo) October 21, 2018

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Crude Oil Trading Strategy with Trend-Lines on Weekly Chart.

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump wants a great deal

-Huge day for earnings

-Euro-area GDP misses

-Markets mixed

-Coming up…

https://bloom.bg/2PsZ7C0

The Stock Market is up massively since the Election, but is now taking a little pause – people want to see what happens with the Midterms. If you want your Stocks to go down, I strongly suggest voting Democrat. They like the Venezuela financial model, High Taxes & Open Borders!

The Stock Market is up massively since the Election, but is now taking a little pause – people want to see what happens with the Midterms. If you want your Stocks to go down, I strongly suggest voting Democrat. They like the Venezuela financial model, High Taxes & Open Borders!

— Donald J. Trump (@realDonaldTrump) October 30, 2018

holy shit

holy shit pic.twitter.com/OhlKe0oD9B

— Alastair (@StockBoardAsset) October 30, 2018

Smart Money Flow Index now at lowest since Jan. 1996…

https://twitter.com/epomboy/status/1057244599578755072

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ESIO $GSL $ACHV $DFBG $TTWO $AKAM $UA $UAA $CHGG $CCCL $KEM $DRYS $MYSZ $NSPR $UGAZ $BP

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $HES $WERN $CSTM $SCHW $CHGG $PSX $JBLU $COOP $SNDR $XPO $ODFL $CVE $GRFS $NVDA $POR $JWN $AMED $AKAM

$PRTO initiated at Buy at Maxim. PT $5

(6) Recent Downgrades: $ELVT $ETFC $UAL $SAVE $LUV $WFT $ARCB $GPC $UNFI $DDS $FLEX

AMD price target cut to $26 from $33 at Cowen

TriNet Group $TNET PT Lowered to $54 at Credit Suisse

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Earnings, Earnings, Crude Oil, TTWO, UAA, LEVB, PYX, BOX, NBEV, BLDP

Swing Trading Special Report Series (Part B) Mon Oct 29 SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

Compound Trading Swing Trade Report Monday October 29, 2018 (Part B).

Swing Trading Signals and Stock Picks In this Issue: SQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this special swing trading report series covering stocks that we have recently been trading or have been active stocks traded by our members and/or stocks that were recently covered at the Trade Coaching Boot Camp. Part A of this swing trading special series can be found here.

Basically we are consolidating all the most recent swing trade strategies in to a few reports prior to earnings season kicking in.

After this short series of reports we will return to the regular rotational reports and also introduce some themed swing trading reports (we have one for swing trading pot stocks, we are working on a financials report and an energy special report currently).

Swing trading set-ups in this short series of reports will provide charting and trade signals for the following equities; FEYE, ROU, SHOP, ARWR, TSLA, AGN, CRON, SQ, XBIO, FB, DIS, LEVB, NBEV, NIHD, BZUN, BLDP, AMD, OSI, CARA, BABA, EDIT, AAPL, NFLX, MTEM, PYX, XXII, PRQR, BOX, GTHX, SSW, HIIQ, ATHM, ESPR, CALA, APVO, MOMO, GSUM, CLDR, FIT among others. If you have any swing trading charting requests send them to us on email. The first of the trading set-ups in this series are included below.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service to also include special reports for earnings season, special trade set-ups, and swing trade alerts direct to your email inbox. Per above, soon we will also be producing themed reports.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red type for ease of review.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent. For newer members, if you need a password for a locked historical post please email us your request.

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Sept 25 – Crude Oil Trading Room – Member Oil Trade Signals / Alerts for Trading the EIA Report (w/ video)

Current Swing Trading Signals and Stock Charts.

SQUARE (SQ) Near key support on watch for a bounce. $SQ #swingtrade #tradealerts

ALLERGAN (AGN) Near support on watch for adds to swing trade. $AGN #swingtrading

BOX INC (BOX) Short PT hit – short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #tradealerts

PROQR THERAPEUTICS (PRQR) Hit price target from previous alert, on watch for support bounce – over 22.70 targets 24.85 fast $PRQR #swingtrading #tradealerts

DISNEY (DIS) Holding its structure in market downturn, looking for long 112 area $DIS #swingtrading

LEVEL BRANDS (LEVB) hit the 8.09 price target and then some, now nearing support watch again $LEVB #swingtrade

BALLARD POWER (BLDP) Turned down perfectly on time per alert, now it is a matter of where it turns. $BLDP #swingtrading #tradealerts

NEW AGE BEVERAGES (NBEV) Near support again on watch after near 4 x gains on last alert – above 2.80, targets 3.27, 4.17, 4.89 $NBEV #tradealerts #swingtrading

PYXUS $PYX near triple x since last alerted now nearing support and on watch for another run #swingtrade #tradealert

NETFLIX (NFLX) on watch for bounce at diagonal trendline support and possible MACD turn on 240 min chart. $NFLX #swingtrading

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Alerts, FSQ, AGN, BOX, PRQR, NBEV, PYX, NFLX, BLDP, LEVB, DIS

PreMarket Trading Plan Tues Sept 18: Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $FB, $AAPL, $TSLA, $WTI, $SPY, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday September 18, 2018.

In this edition: Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $BOX, $FB, $AGN, $AAPL, $DIS, $XBIO, $ARWR, $TSLA, $VIX, $WTI, $SPY, $DXY, $BTC and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 18 – Lead trader is in the main trading room for market open, mid day review and futures trading today.

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- The main live trading room going forward is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with our Lead Trader.The exceptions are; Trade Coaching Boot Camps, special Trading Webinars or if the lead trader is not available.

- Week of Sept 17 – New pricing published representing next generation algorithm models (existing members no change).

- Week of Sept 17 – Next generation algorithm models roll out (machine trading Gen 1).

- Week of Sept 17 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Week of Sept 17 – Trading Boot Camp Event videos become available on our website.

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Week of Sept 17 – The previously recorded Master Class Videos will become available on our website.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

As I wrote yesterday, many of the set ups that we charted and alerted during coaching boot camp are likely to alarm early week, so I’m expecting trades for those, we are also updating the complete platform equity list charting in the same way (re-charting them all and alarming them etc) – so this week and going forward should become very active in the trading room and on alert feeds.

Stocks – Oracle, FedEx Slide in Pre-market, Netflix, Apple Gain, Avon Surges –

Stocks – Oracle, FedEx Slide in Pre-market, Netflix, Apple Gain, Avon Surges – https://t.co/ssMbjoDBnP

— Investing.com Stocks (@InvestingStockz) September 18, 2018

Market Observation:

Markets as of 7:04 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 69.72, Gold $GLD trading 1200.48, Silver $SLV trading 14.22, $SPY 290.05 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6239.00 and $VIX trading 13.2.

Momentum Stocks / Gaps to Watch:

News:

Tilray receives approval from U.S. to import a medical cannabis study drug for a clinical trial … https://seekingalpha.com/news/3390989-tilray-receives-approval-u-s-import-medical-cannabis-study-drug-clinical-trial-uc-san-diego?source=feed_f … #premarket $TLRY

$VKTX Viking Therapeutics announces positive results in trial of non-alcoholic fatty liver treatment

Sempra Energy announces agreement with Elliott Management, Bluescape Energy $SRE http://dlvr.it/QkZ8b9

EMA accepts Bristol-Myers’ marketing application for expanded use of Empliciti https://seekingalpha.com/news/3390991-ema-accepts-bristol-myers-marketing-application-expanded-use-empliciti?source=feed_f … #premarket $BMY $CELG $ABBV

$FB Facebook Sought Access to Financial Firms’ Customer Data

https://www.wsj.com/articles/facebook-sought-access-to-financial-firms-customer-data-1537263000

Oil market safe despite trade tensions, Iran sanctions: Al-Falih http://bit.ly/2xoyaUI #OOTT $USOIL $WTI $CL_F $USO

https://twitter.com/EPICtheAlgo/status/1041980749736554498

Recent SEC Filings / Insiders:

Recent IPO’s:

Gritstone Oncology sets terms for IPO to raise up to $91.1 million

Qutoutiao prices IPO at $7 per ADS, raising $84 million

Navios ceases plan for IPO on Nasdaq

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

#earnings for the week

$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK

#earnings for the week$MU $ORCL $FDX $AZO $RHT $GIS $CBRL $DRI $APOG $THO $UNFI $CPRT $MLHR $SCS $SMMT $AMRK https://t.co/r57QUKKDXL https://t.co/cAnHRobuy5

— Melonopoly (@curtmelonopoly) September 17, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

VIKING THERAPEUTICS (VKTX) premarket up 140% on liver trial news. $VKTX #premarket #daytrading

$MYND needs that 50 MA on the weekly to get going above where it is IMO

Seaspan (SSW) over 9.50 intra should see lower 10s fast, trading 9.34 intraday. $SSW #daytrade #swingtrade #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

SHOPIFY (SHOP) is working the area between main pivot (red line) and upper price target $SHOP #tradealerts #swingtrading

SP500 (SPY) Chart – Came off at test area around pivot on 60 min chart, above box long below short $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade #Daytrade

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

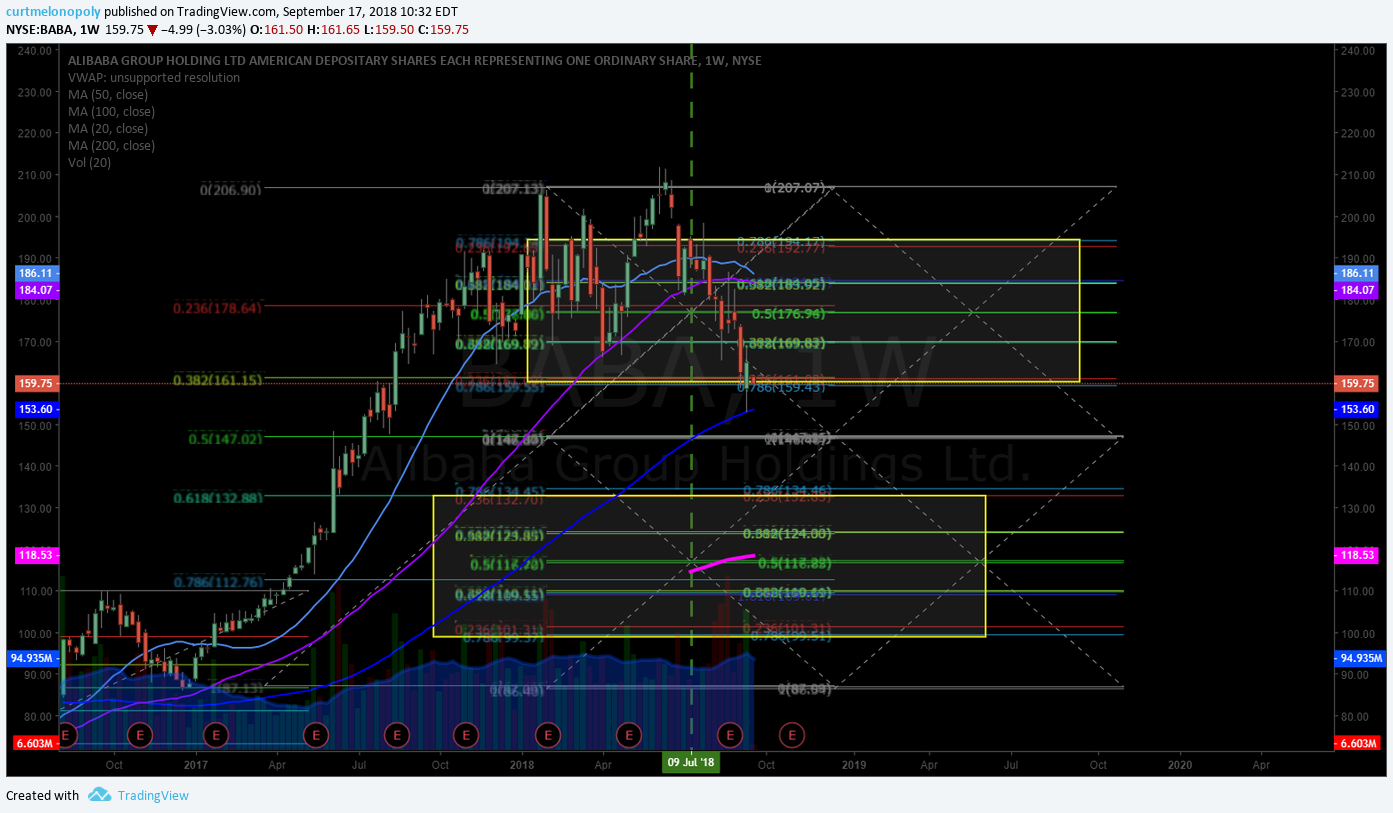

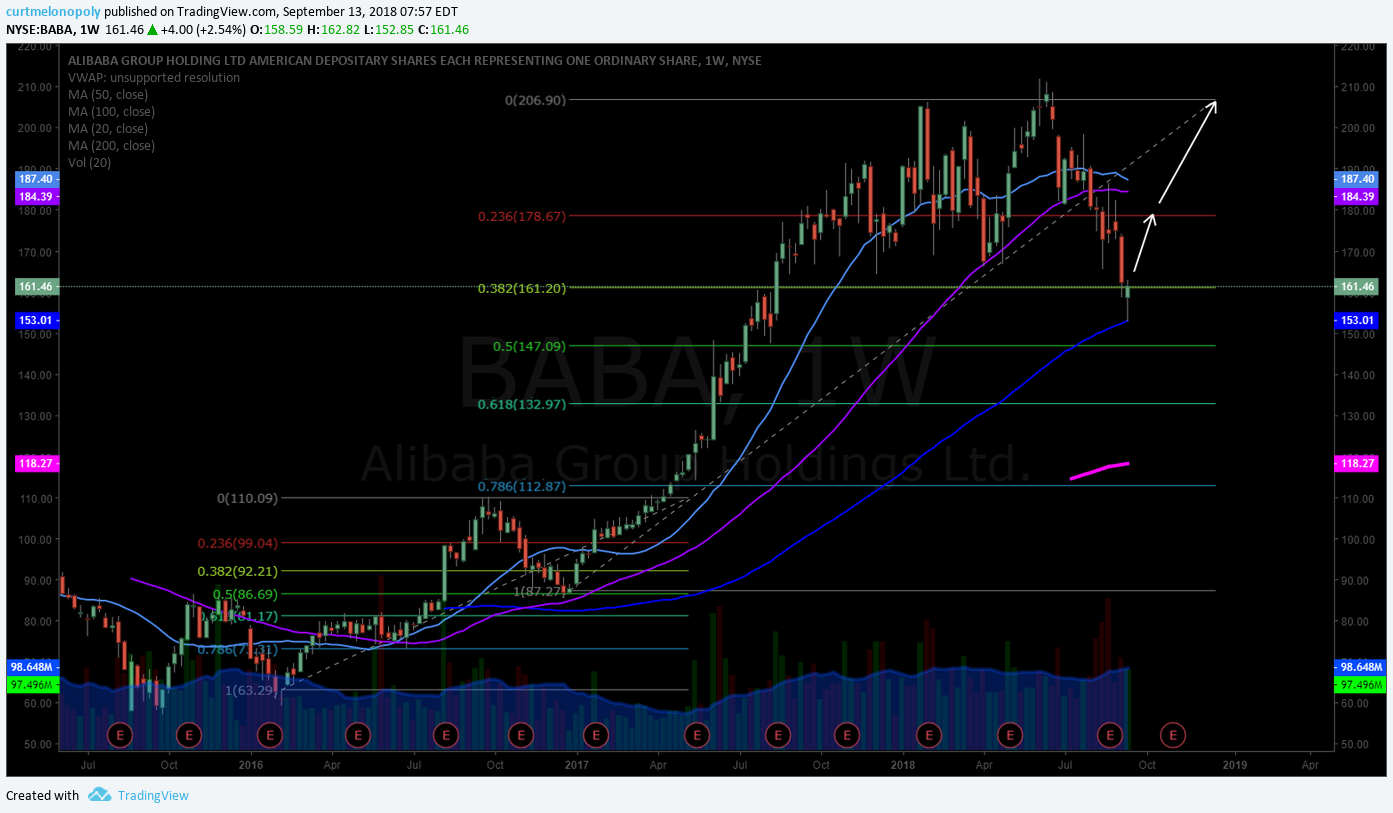

ALIBABA (BABA) got a bounce at 100 MA under rane support, watching close here now $BABA #tradealerts #swingtrading

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

CARA THERAPEUTICS (CARA) Testing break-out area intra-day. On watch. $CARA #tradingsetups #tradealert

PROQR THERAPEUTICS (PRQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

Crude Oil Daily Chart, MACD turning back up with price above 50 MA Sept 17 623 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

SHOPIFY (SHOP) Per Sean alert in live daytrading room yesterday $SHOP got over resistance today targeting 166s next #tradealerts #daytrade

BOX INC (BOX) Swing trading plan well in play with nice bounce off 50 MA on way to symmetrical price target. $BOX #Swingtrading #TradeAlerts

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trump tariffs

-China vows retaliation

-Markets rally

-Saudi happy with $80 Brent

-Confirmation delay

https://bloom.bg/2D8kjbh

Investors are going all in on the global divergence trade https://bloom.bg/2D7uKvU

Investors are going all in on the global divergence trade https://t.co/0n9qenMdbn

— Melonopoly (@curtmelonopoly) September 18, 2018

OPEC is warning of threats to #oil supply from large producers like Iran

https://bloom.bg/2NkagVj via @business #OOTT

OPEC is warning of threats to #oil supply from large producers like Iranhttps://t.co/9LQR0Dvh5I via @business #OOTT

— Bloomberg Energy (@BloombergNRG) September 18, 2018

Confidence in the global economy over the next 12 months has declined to the weakest in near 7 years, shows #MerrilLynch Global Fund Manager Survey.

Confidence in the global economy over the next 12 months has declined to the weakest in near 7 years, shows #MerrilLynch Global Fund Manager Survey. pic.twitter.com/EUALLJ2638

— YUAN TALKS (@YuanTalks) September 18, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $VKTX $APHB $TLRY $AVP $RDCM $EYES $NTNX $NBEV $QTT $OILU $UWT $UNP $ACBFF $ATRS $FTI $PDD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Providence Service $PRSC PT Raised to $107 at CJS Securities

Buy Nutanix $NTNX on ‘Unfounded Media Rumors’ – Needham & Company

$TRGP $VALE $UHS $SGRY $MD $LB $GFI $UNP

AMD, Nvidia stocks gain after Mizuho hikes target

(6) Recent Downgrades: $UAL $WK $BKU $FTNT $PLYA $DISCA $PRI $RHT $AU

Citi Downgrades Primerica $PRI to Sell

$FB-Facebook stock price target cut to $195 from $205 at J.P. Morgan

UBS downgrades Fortinet on “priced in” momentum https://seekingalpha.com/news/3391006-ubs-downgrades-fortinet-priced-momentum?source=feed_f … #premarket $FTNT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Saudi Oil, Tariffs, $TLRY, $VKTX, $CARA, $PROQR, $SSW, $BABA, $SHOP, $BOX, $FB, $AGN, $AAPL, $DIS, $XBIO, $ARWR, $TSLA, $VIX, $WTI, $SPY, $DXY, $BTC

Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Trade Alerts Report and Video from Live Day Trading Room for: $VIX Volatility $WTI $CL_F Oil $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

#TradeAlerts

Trading alerts and trading set-ups raw video from Live Trading Room mid-day review Sept 17, 2018. Some of the trade set-ups in this video are from the Trading Boot-Camp.

Tickers reviewed: $VIX $WTI $CL_F $USO $PROQR $CARA $BOX $BABA $SSW $DXY $SPY $GTHX $FB $FF $SENS and more.

I apologize for the sound interference – at times it was just awful, we’ll re hard wire the set-up again soon here and get that fixed. In tomorrow’s mid day I will hard wire that one computer to modem and you can let me know if it is any better please.

Voice broadcast does not start until 3:18 on video.

Market discovery theme on day.

Volatility $VIX – time-cycles reviewed in to Dec 24 beyond and inflections in markets, market open, futures and account return expectations over next two trading quarters or so.

Crude oil trading $WTI $CL_F $USO – review of crude oil algorithm, machine trading model, charting, price targets for time cycles this week reviewed.

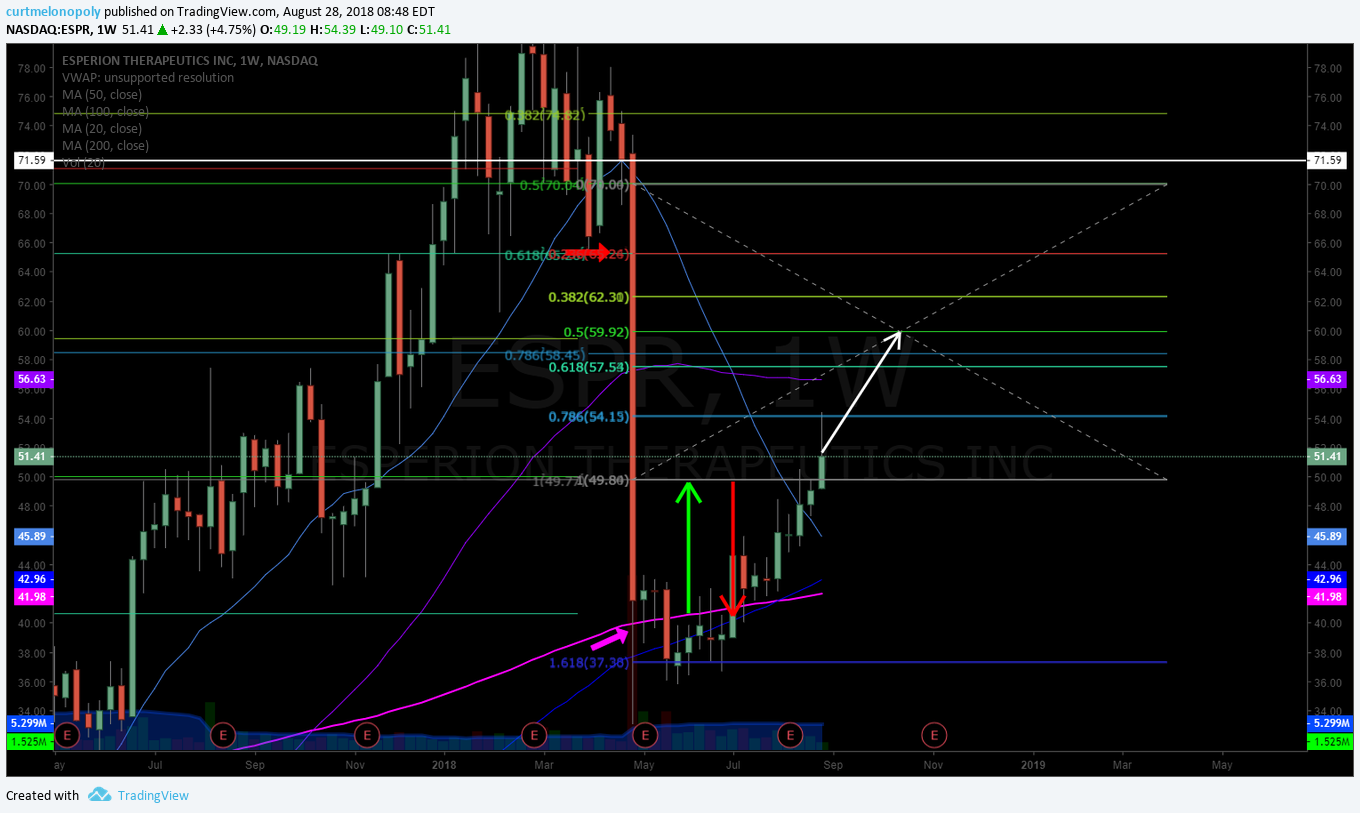

PROQR Therapeutics $PROQR – Excellent chart set-up, one of my favorite trades of late. Buy sell trading signals reviewed. Bounced at support at previous trade alert now at key resistance, trim in to resistance and over 22.70 targets 24.85 then 27.50. Watch the diagonal trend line (quad wall). Careful shorting this stock, 18.05 possible.

US Dollar $DXY – Review of US Dollar Algorithm charting. Lower support trend line and upper trend line, support and resistance areas to watch. Review of structure.

$CARA Therapeutics – testing previous highs, testing other side of bowl and a full extension is possible here, structured chart trading signals reviewed, Target Dec 10 30s or 38.00s if it breaks out. Pull back to 16.36 support, look for a bounce there if it sells-off. 19.70 is near term support for a test long also.

https://www.tradingview.com/chart/CARA/DtYzRa8p-CARA/

BOX $BOX – previously provided upside targets, down side scenario on video 22.32 good support, 50 MA support is good, intra day in down trajectory lines, 10.36 is a downside sell-off target that is possible in a panic. Channel symmetry also reviewed.

SEASPAN $SSW – keeps hitting resistance, simple short at each, looking for a long over resistance in trajectory on video. Upside 10.18 first target, best scenario Nov 11.93 and 18.30 best best not probable.

G1 Therapeutics $GTHX – pullback in price here doesn’t surprise me, candle body is in current bullish trajectory lines on chart, review of downside supports and upside price targets. 76.00 – 80.00 (up over 69.62 is a trigger). All areas reviewed on video.

SHOPIFY $SHOP – chart pivot acting as support (red line) Oct 10 166.72 price target, holding key support, working up against a quad wall (diagonal Fib resistance), 154.35 buy side comes in at that area. Pull back support is 50 MA primary for a long side test trade.

SP500 $SPY – the box test area reviewed, above box is a long and under is a short. 283.93 278.47 Sept 1 are downside targets in a sell-off. Other trade signals and price targets reviewed on video.

ALIBABA $BABA – underwater a bit on this swing trade in BABA, I’m in 1/10 sizing now. Bounced off 100 MA, trading right at box support, Dec 17 trade price targets discussed to low side. Adds at each support is the trading plan for ALIBABA should sell-off continue.

https://www.tradingview.com/chart/BABA/gKTnmCkK-BABA/

FACEBOOK $FB – 20 MA upside resistance trade alarm set for possible turn on the snap-back trade I’m looking for. 240 min chart.

Top momentum stocks for the day reviewed;

$OTM 20 MA resistance on weekly, above will target the 50 MA. It respects the 50 MA and 200 MA on weekly chart. Trading plan reviewed on video.

$LEU – stay away from

$FF – Currently at support and resistance area, price extensions for a possible run are reviewed on video. Targets 23.67 in a bullish scenario, trading 17.63.

$TAHO – junk

$GHG – junk, no structure

$CEL – not a good chart

$CWH – terrible

$SPA – at previous lows, bounced there before…. but…. no structure

$SUPV – junk

$TGS – bounced off 200 MA support, good example of a bullish run out of the bowl for multiple extensions up on the chart.

$WAB – not interested

$AG – on 200 MA support, not interested.

$SENS – support 3.97 trading 4.16, looking for a bounce. The trade set-up will be on the upcoming swing trading report.

Others were also reviewed.

VIDEO Trade Alerts: $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS #daytrading #swingtrading

Voice broadcast does not start until 3:18 on video.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

#tradealerts #swingtrading #daytrading

Article Topics; Trade Alerts, Trading, $VIX, $WTI, $CL_F, $USO, $PROQR, $CARA, $BOX, $BABA, $SSW, $DXY, $SPY, $GTHX, $FB, $FF, $SENS, swingtrading, daytrading

PreMarket Trading Plan Mon Sept 17: Tariffs, Pot, $CLRB, $TWTR, $AMZN, $BABA, $SHOP, $BOX, $DIS, $AAPL, $TSLA, $FB, $ARWR more.

Compound Trading Premarket Trading Plan & Watch List Monday September 17, 2018.

In this edition: Tariffs, Pot, $CLRB, $TWTR, $AMZN, $BABA, $SHOP, $BOX, $DIS, $AAPL, $TSLA, $FB, $ARWR and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Sept 17 – Lead trader is in the main trading room for market open and mid day review today.

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members

- The main live trading room going forward is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with our Lead Trader Curtis.The exceptions are; Trade Coaching Boot Camps, special trading webinars or if the lead trader is not available.

- Week of Sept 17 – New pricing published representing next generation algorithm models (existing members no change).

- Week of Sept 17 – Next generation algorithm models roll out (machine trading Gen 1).

- Week of Sept 17 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).