Tag: Crude Oil

Lessons from Oil Trading Room (Part 1). Positioning 250 Tick Swing Trade Short Oil EIA & Day Trade Reversal.

How to Position Oil Trade Intra Week Swing Trading and Day Trading Strategies with Crude Oil Futures (Part 1 of 3)

#oiltradingroom #oiltradealerts #tradingstrategies

This three part article series deals with strategies for position trading crude oil intra-week. Positioning your size for events such as the EIA report Wednesday, API Tuesday, the Federal Reserve decision and more.

The live oil trading room video is an excellent supplement to the article as it provides a live raw feed insider’s look in to how our oil trading experts were trading crude oil this week both on swing trading and day trading time frames. Charting is reviewed along with key levels of support and resistance.

As the swing trade short starts to play out and oil sells off intra day 250 ticks the lead trader explains all strategies involved for the big win.

The automated software was also trading short and revered perfectly for an excellent intra week swing trade and day trade in this oil trading room video.

First the video below and then the charting and screen shots of alerts from oil trade alerts live feed.

Oil Trading Room Video (raw feed):

Video is live raw video feed from our oil trading room of a live positioning strategy short crude oil in to the EIA report 10:30 Wednesday and the reversal trade after a 250 tick CL_F crude oil sell off for a rally trade long.

‘Incredible day in our oil trading room on Thursday July 30, 2020.

Both our lead trader and EPIC V3.1.1 machine trading software were executing trades in this trading strategy master class. One of the best videos in our library for learning how to swing trade and day trade crude oil and how to position events such as EIA reporting.”

The oil trading strategy started with an alert to short oil 10% size 41.27 900 AM Wednesday morning in advance of EIA report.

And then alerts went out to buy and sell small positions in size in advance of the EIA report, in to EIA 1 futures contract was held.

At 1214 PM I started a personal swing trade short alerting it as 10% size at 41.35 on FX USOIL WTI traded on CL futures.

Image of guidance provided to oil trading room and alerts feed and overnight in to Thurs oil was selling off, strategy was working

Another screen shot of guidance I provided oil traders in oil trading room of strategy and what signals to watch for.

Screen capture image of oil trade room alerts my swing trade and software closing oil swing trade positions for nice win.

Image of oil trade alert feed for new position long crude oil intraday in oil trading room to 20% size.

Image capture of oil trading room alert feed alerts for a win as price reversal strategy intraday works selling contracts.

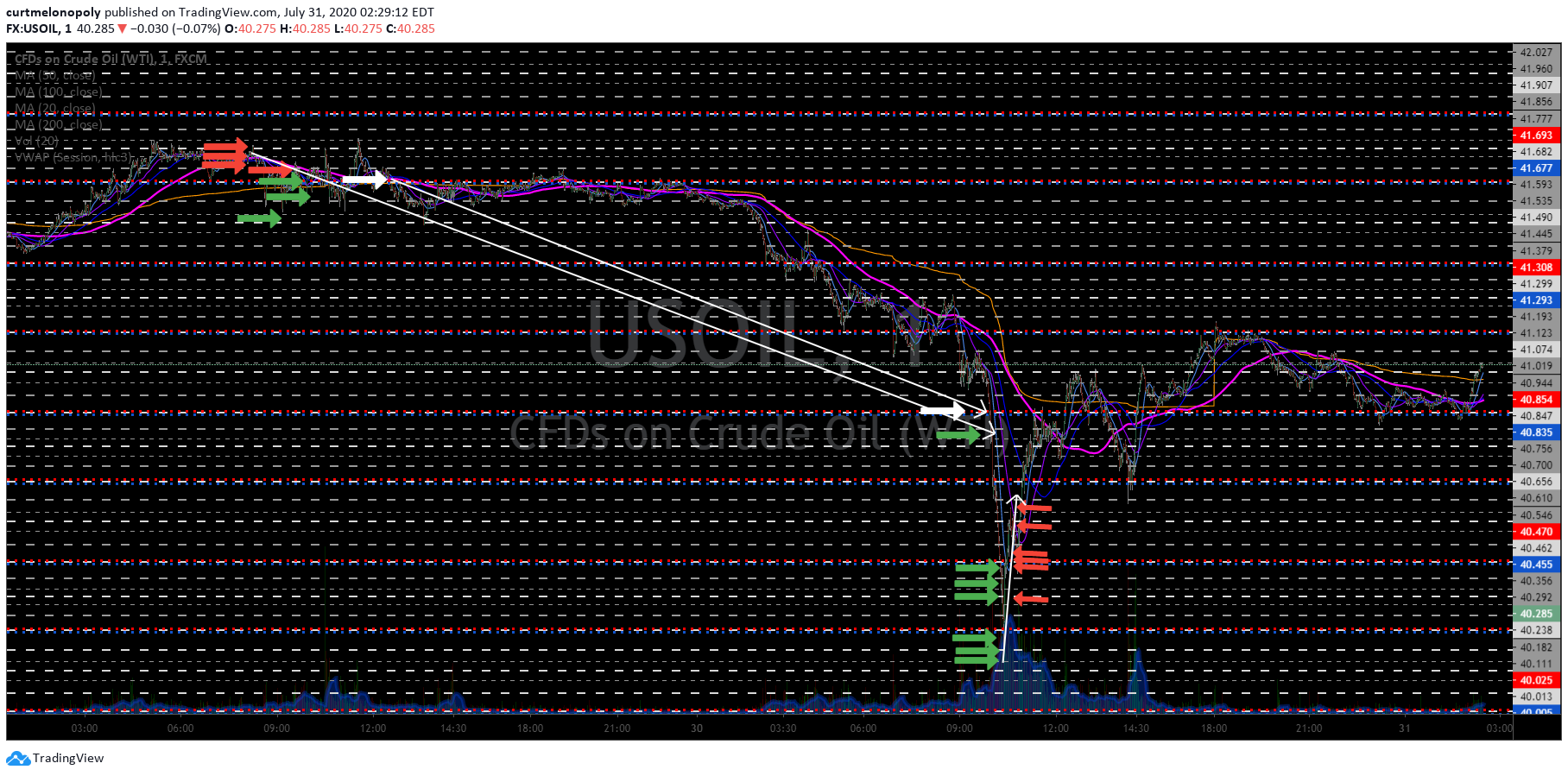

The chart below shows all the trade alerts – entries and exits of positions traded in oil trading room live, green arrows are buys and red arrows are sell CL contracts.

The red arrows are EPIC V3 selling futures contracts, green arrows are the buy alerts and the white arrows are my personal positions. You can see the start of the trade was an intra week short swing trade position in oil in advance of the Wed EIA report by the software and I entered my swing trade after EIA. Then the next series of trades on the chart below are the intra day trades the oil trading software took for a long position snap back trade as oil reversed.

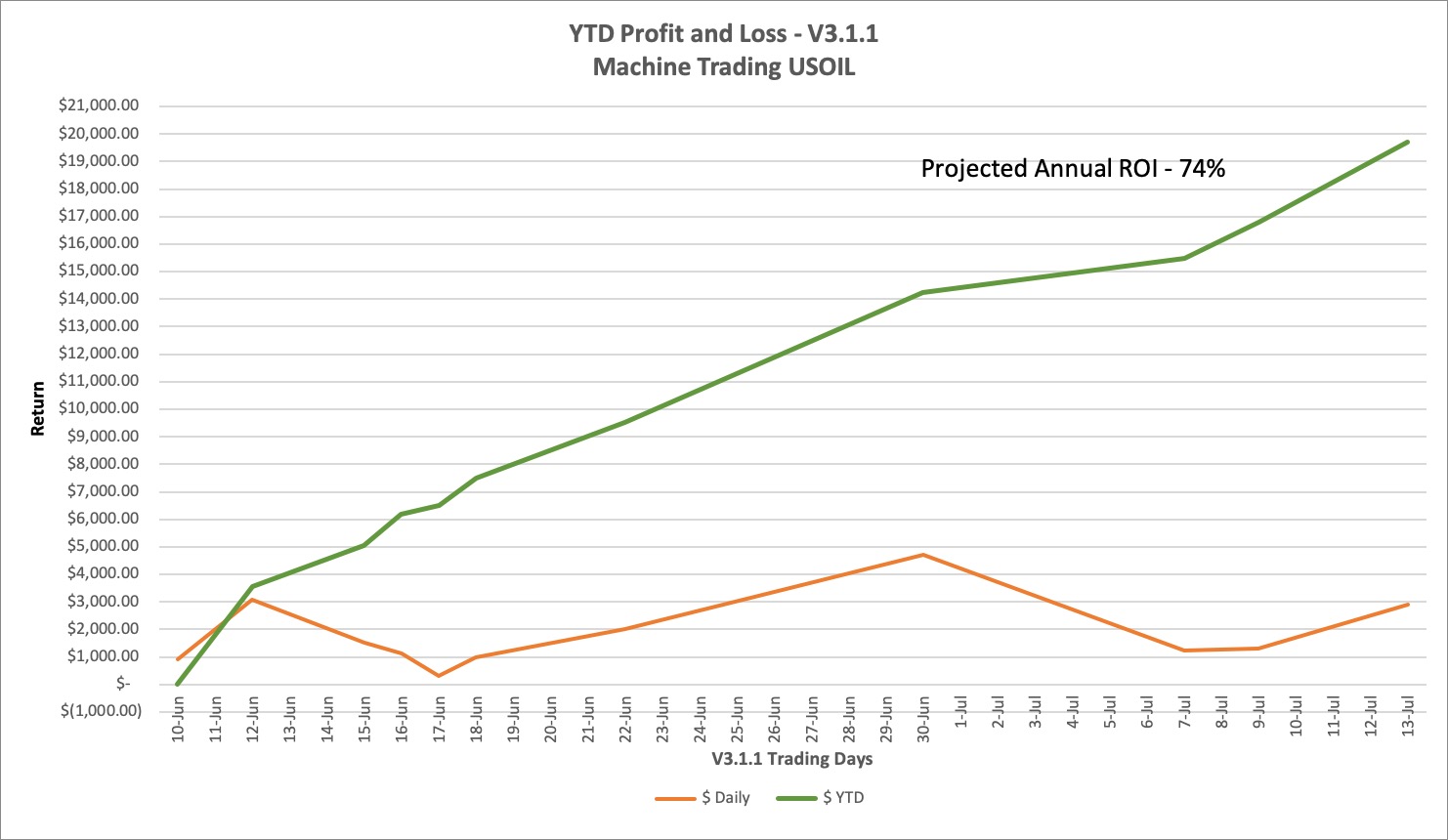

Black Swan Update, June 1-July 30 Profit & Loss YTD +$28,105 or $222,064 74% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 300k Account

In Part 1 above we show you exactly what happened in the oil trade (trading room video, chart that shows the trade execution positions, screen shots of the actual alerts) for the nice win.

In Part 2 I include charting for our Swing Trading subscribers and strategies used to position for the sell off in crude oil intra week. You can find the article here: Protected: Lessons from Oil Trading Room. Part 2 – Swing Trader Premium “5 Key Strategies”. How to Position Swing Trade Short Oil.

In Part 3 I explain in detail what strategies were used for such precise trade executions for day trading crude oil for our Oil Trading Service Subscribers. You can find the article here: Protected: Lessons from Oil Trading Room. Day Trading Strategies – Part 3 Premium. Positioning 250 Tick Trade Short Oil EIA & Day Trade Reversal.

Our goal is to develop the best oil trading room and alerts service available with the highest win rate % and the most repeatable strategies for consistent wins.

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

Tweets by EPICtheAlgoArticle Topics: Oil Trade Alerts, Oil Trading Room, Crude Oil, Trading, Trading Strategies, Swing Trading, Day Trading

Oil Trading Room Live Trade Alerts Video, Alerts Screen Shots, Charts Etc. Crude Oil Trading Strategy Short in to Settlement.

Oil Trading Room Live Trade Alerts Video.

Monday crude oil trade sequence. Short in to settlement at 2:30 EST.

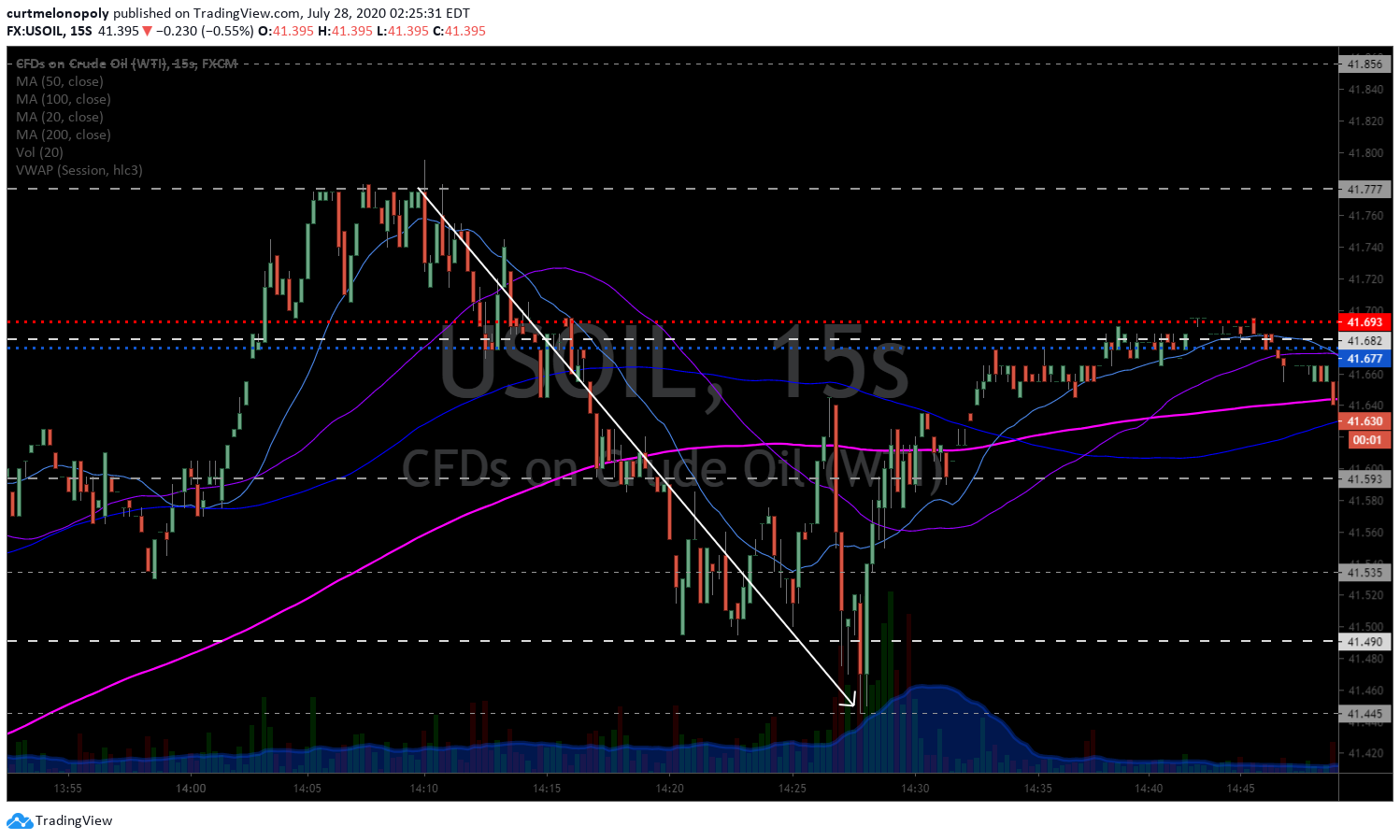

This oil day trading strategy is one of the best. In to settlement at 2:30 watch trade for over bought or over sold conditions on the day (VWAP helps for this as does having crude oil charting models, you will see examples in the video below).

In the example below crude oil had sold off early in the day and then a rally occurred. The day rally in crude oil had intra day trade sitting well over VWAP in to settlement at 2:30 EST.

When the order flow shifted just prior to settlement EPIC V3.1.1 kicked in to a short trade sequence intra day 6/30 size and the trade was caught live in the oil trading room on video.

The video below is a live broadcast as the trades are executed and the charting we use is also shown.

The chart below from the oil trading room shows the oil trade executed short for a win.

The next two images are from the oil trading alerts live feed on Twitter that show each trade alert as is it occurred.

Live oil trade alerts sequence image.

Oil trading room on Discord of discussion and alerts as they occurred for the short win in to settlement at 2:30 on Monday.

Black Swan Update, June 1-July 27 Profit & Loss YTD +$26,507 or $220,947 74% ROI Per Annum. #oiltradealerts #oiltradingroom

Black Swan Update, June 1-July 27 Profit & Loss YTD +$26,507 or $220,947 74% ROI Per Annum. EPIC V3.1.1 Oil Machine Trade 300k Account (time stamped alerts, audited P&L) #OOTT $CL_F $USOIL $USO #oiltradealerts #oiltradingroom

https://twitter.com/EPICtheAlgo/status/1287993958677831683

The bottom line is that having a solid repeatable trading strategy is important for any trader.

The EPIC V3.1.1 software is coded with our best oil trading strategies and the video in this report shows the results of trading with a plan.

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

https://twitter.com/

Article Topics: Oil trade alerts, Oil Trading Room, Crude Oil, Trading

Premarket Trader Market Note: Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting and more.

Morning Traders,

RE: Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting and more.

After fighting through Sunday night Study download issues with Click Meeting server capacity and WordPress Black Listing me keeping me from updating it looks like we’re good to go to get Swing Set Ups and the new Oil Report out tonight. Wow, technology makes your life easier.

Yesterday seen negative order flow in crude oil and in equities later in the day, it sure looked like de risking, not so much large machine sweeper programs – YET.

As I thought from yesterday we did get the negative side yesterday, we’ll see if they can run up in to EOD Tuesday (API) and then we have EIA Wed 10:30.

Watch these two crude oil chart levels for directional trading in crude oil and as a signal for the broader market swings:

**** private member link sent to your email

**** private member link sent to your email

EPIC V3.1.1 continues to win, post Black Swan updates:

https://twitter.com/EPICtheAlgo/status/1283014880111493121

https://twitter.com/EPICtheAlgo/status/1283014880111493121

Simple Oil Swing Trading Signals – Part 2 and 3 Schedule for Release Tonight:

#OOTT $CL_F $USO $USOIL $UCO $SCO

April Swing Trade Alert P&L is published. May & June to be published soon.

Swing Trade Alerts Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC … #swingtradealerts https://t.co/ChgjHxmOE0

— Swing Trading (@swingtrading_ct) July 12, 2020

ROKU, my miss of the week, don’t miss these TL break out set-ups when they’re alerted, this is a prime set-up for your swing trading returns.

ROKU, the one I missed. Had it lined up, alerted, alarmed and missed it.

No excuse, nice gains on that beauty TL break set-up.

Congrats longs!

#swingtrading $ROKU #tradingsetups

ROKU, the one I missed. Had it lined up, alerted, alarmed and missed it.

No excuse, nice gains on that beauty TL break set-up.

Congrats longs! #swingtrading $ROKU #tradingsetups pic.twitter.com/L44kuGq7Ag

— Melonopoly (@curtmelonopoly) July 13, 2020

For students of market instrument time cycles, this is a great starter $STUDY.

#timecycles

Previously alerted this Time Cycle trade set up in $FUV as a possible 3x hit and it got that and more!

Time cycles are powerful set-ups

#swingtrading #timecycleshttps://t.co/6p8tW12WX0https://t.co/z9lsyra9N5 pic.twitter.com/PRSxcGGTDO

— Swing Trading (@swingtrading_ct) July 12, 2020

Here’s a rundown of your top economic news today https://www.bloomberg.com/news/articles/2020-07-14/economic-lifeline-u-k-growth-struggle-china-nerves-eco-day

https://twitter.com/CompoundTrading/status/1283022759971495938

Articles this morning on our $RCUS and $TSCO swing trades:

$TSCO – Smashing quarter expected out of Tractor Supply https://t.co/miFa9r8d9I

— Swing Trading (@swingtrading_ct) July 14, 2020

$RCUS – Arcus Biosciences, Inc.: An Oncology Stock With Newfound Prominence. https://t.co/gbKXE79Owm

— Swing Trading (@swingtrading_ct) July 14, 2020

More as the day unfolds and look to alert feeds for set-ups.

Have a great day!

Thanks

Curt

Article Topics: premarket, traders, trading, crude oil, swing trading, oil trading room, Order Flow, Swing Trading Levels to Watch, P&L’s, $RCUS, $TSCO, Crude Oil, Machine Trading, Reporting