Tag: Trading

Oil Trading Room 200 Tick Intra Day Trading Strategy – How It Was Traded and Alerted (Video) Part 1 #OOTT $CL_F $USO $USOIL

Part 1 – Crude Oil Day Trade Strategy For 200 Ticks Win From Our Oil Trading Room – Step by Step Tips on How We Traded It and Alerted it Live

The main question for oil traders reading this and /or watching the instructional video should be, “How did we know that oil intra-day would most likely reverse where it did on the chart?”

The oil trading alert went out at 6:37 AM EST and the one prior to that was at 4:09 PM the day prior (Monday June 8, 2020), so it isn’t that we send out many alerts every day, we send our alerts only out when it is the most highly probable area of intra day trade for a win.

So why then at that time of day? What was happening with intra-day trade, the charting, time of day and with other signals that caused us to trade in size long at 6:37 AM EST today?

In short it was the only trade entry alert of the day, the trade was in size and it happened to be at the low price of trade on the day also.

Below are the secrets of this time tested oil trading strategy.

Important Tips for this Simple Intra-Day Crude Oil Trading Strategy

- Time of Day is Important – Today’s 200 tick oil day trade was started in the morning prior to US regular market open and after many traders around the world in different time zones (and overnight Futures traders) have finished their trading day.

- Chart Trend Lines – I teach students to always have classical charting trend lines for support and resistance ready at all times on all time-frames.

- Key Algorithmic Charting Levels – Not all oil traders have this at their disposal, but this was one key reason for our trade success today..

Time of Day.

Time of day when day trading crude oil is very important. In this trade example it was the time of day where overnight futures traders (as far as USA traders are concerned) usually finish their day as well as some traders from around the world also (depending on time zone) and day traders in the U.S. start their day.

When traders start and stop their trading day is not the only time of day consideration.

There are other time of day considerations such as regular U.S. open premarket, regular U.S. market open at 9:30 AM EST, daily settlement at 2:30 PM EST, weekly inventory statistics from the American Petroleum Institute at 4:30 PM EST Tuesday’s and U.S. Energy Information Administration (EIA) at 10:30 AM EST on Wednesdays.

Specifically as it applies to this intra-day oil trading strategy, this trade was taken when the overnight futures traders were typically finished “taking profits or losses” on their day trade sessions and the new batch of day trader liquidity was entering the market. VERY KEY. Again, today’s oil trade was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture image from our Oil Trading Room with the day trade execution at 6:37 AM for 6 contracts entered – adding to existing 6 contracts in the long position sequence of trade.

Also in the image are some of the alerts in the trading room as the trade progressed (this is the private member oil trade chat room in Discord, there is a live charting and mic broadcast room also).

You can also see in the image the lead trader discussing another time of day coming at 9:00 AM and to be prepared to watch the possible signals of oil trade at that specific time. Time of day in oil trading is one of the best signals oil day traders can use in their strategies.

Oil trading alerts screen capture of today’s oil trade that was first entered and alerted at 6:37 AM EST, in size.

Below is a screen capture of the actual oil trading alerts feed showing the lead tech alerting the buy in crude oil.

The broker platform trade executions by our oil machine trading algorithm are shown (screen shots) in this tweet:

Crude oil trading alert feed today, deep dive early in premarket for a great 200 point rally through the day.

#OOTT $CL_F $USO $USOIL

#oiltradingalerts #machinetrading

https://twitter.com/EPICtheAlgo/status/1270435771615510531

Trading Trend Line Support and Break Outs.

In today’s trading action there was a trend line support signal on the charting for the long position at 6:37 AM and the a trend line break later in the day for a break out to continue the rally.

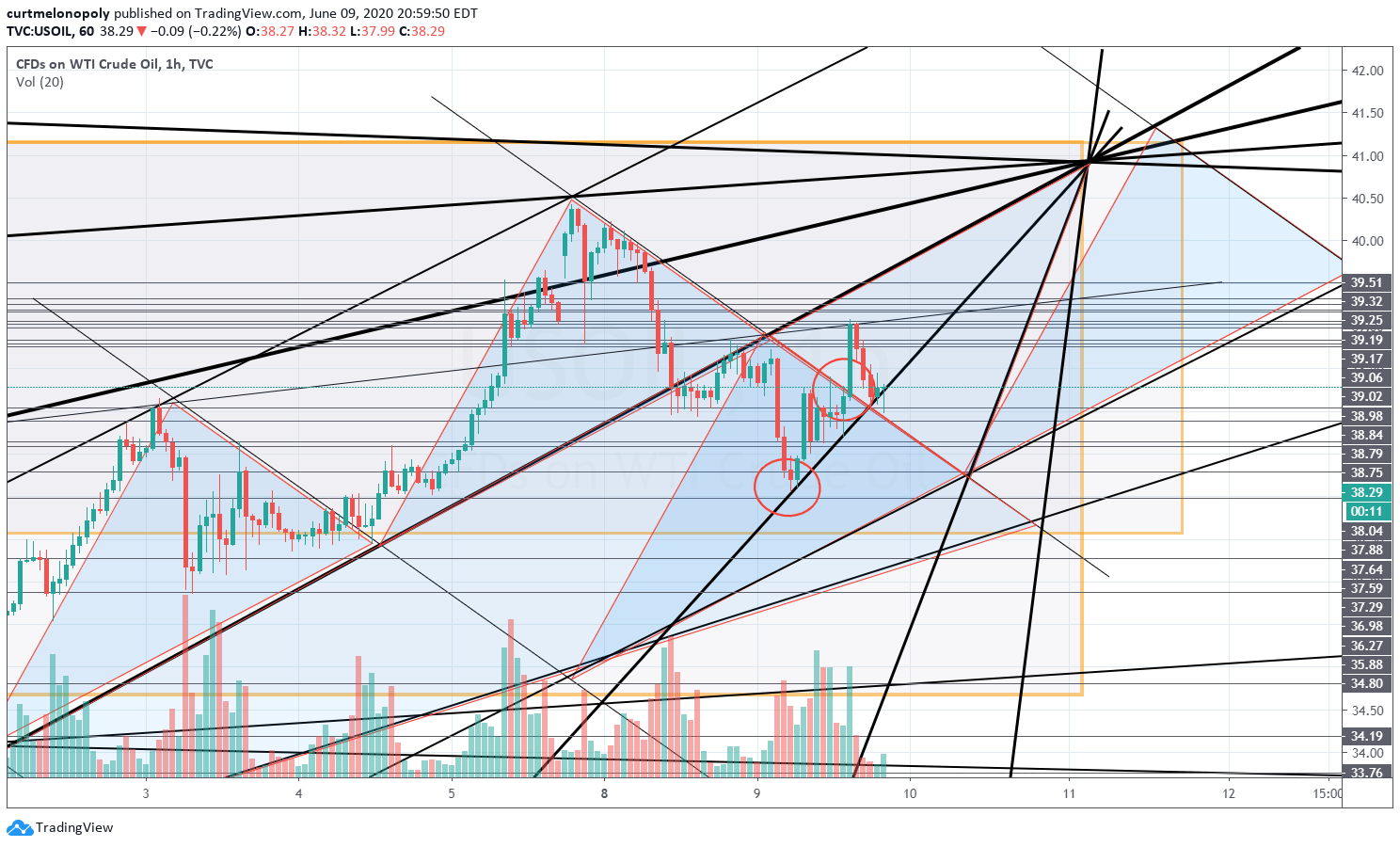

First, below see the initial support area of the trend line chart for the long trade entry. This signal is from a classical 1 hour oil chart with trend lines that included the mirrored fractal trading trend lines. This “mirrored fractal trend line” is where the signal was to enter the trade.

The one hour trading time frame is a significant oil trading signal because it is a larger than say a 1 minute, 5 minute, 15 or 30 minute chart timeline for daytrading. The one hour timing can be used also for intra-week trading signals.

The mirrored trend line fractal is a bit more than basic oil charting 101 in that it takes some technical analysis experience to learn, but not much and if you are an oil day trader it is a good skill to learn because the machine liquidity in the markets use mirrored fractals greatly.

You can see this technical charting skill helped garner a 200 point rally oil trade win today.

Crude Oil Trend line Chart, oil hit key support on the chart and this was one key signal for taking and alerting the trade.

And then later in the day came the trend Line resistance break out.

I marked the intra day oil trend line resistance break out area on the chart below with a second red circle.

I recently did a video instructional on oil trend line resistance break outs that explains the rules and tips for how to trade intraday break outs above a trend line resistance. It was identical to today’s set up and signals that produced this excellent win.

Here is an excerpt from that article:

Three Possible Trade Scenarios When Price Breaks Out;

1. The break out fails. This is possible so be sure to use stops or reverse your trade if the break out of resistance fails.

2. The break out succeeds and price keeps running without a retest of previous resistance (now support). If price does not come back to test support of the trend line then you have to be prepared to take the trade long and go with price action.

3. And finally, price breaks out of resistance and then comes back to retest the new support (which was previously the resistance of the trendline structure).

You can find Part 1 to the article with video tutorial here:

and

Part 2 for our premium members is here:

Trend line break outs, especially on larger time frame charting such as the one hour like with today’s trading are very powerful signals.

I even publicly gave my Twitter followers a bit of a heads up intra-day because I could see the trend line breach set up coming. My tweet went out at 11:30 AM and shortly after noon oil was in break out mode above the trend line resistance.

oil shorties could get wrecked here

oil shorties could get wrecked here

— Melonopoly (@curtmelonopoly) June 9, 2020

In Part 2 of this article we will take a look at how the swing trading strategies played in to this set up for our Swing Trade Alert service members.

In Part 3 for our Pro Oil Day Traders (Oil Trade Subscribers) we will look at the algorithmic charting structures that enabled this successful trade.

The video tutorial for this specific article (Part 1) is below.

As always, any questions please send me a note via email compoundtradingofficial@gmail.com.

Thank you.

Curt

< Updated June 10 7:41 AM EST >

There is another classical charting reason possible for crude oil’s 200 Point reversal rally intra-day, Fibonacci level 50% was hit perfectly.

Nonetheless, there were strong algorithmic charting reasons for the reversal rally intra-day that I will go in to in more detail for our oil trader members in Part 3. Considering the machine trading liquidity in the oil trading markets I would weigh those indicators / signals much more greatly than the chart below.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Oil, Trading, Alerts, Oil Trading Room, Strategies, Day Trading, Intra Day, Trend Lines, Break – Outs, Support, Time of Day

Market Report: Premarket $TSLA, $BA, $AAPL, $INTC, FOMC, API Crude Oil, EIA, Oil Trade Alerts, $CL_F, $USO, Swing Trading, Day Trading, Time Cycles

Market Update: Premarket Trading

Morning traders,

Monday was quiet for us, most of the portfolio rising, some trimming of profits of course, best swing run in our history.

The Boeing $BA trade below is an example of the time cycle we’ve had on the swing trading platform:

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥

#swingtrading

What a great trade, more than a double in Boeing $BA from 107s to 231s, holding some profit runner 🎯🏹🔥#swingtrading pic.twitter.com/mnsoSxstIY

— Melonopoly (@curtmelonopoly) June 8, 2020

Still have many profit runners and new positions start over the next 7 or 8 trading days for the cycle in to end of August – watch the swing trade alerts feed for new positions as we come out of this time cycle inflection.

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://seekingalpha.com/news/3581457-apple-announcing-mac-chips-wwdc-bloomberg?source=tweet #swingtrading

$AAPL $INTC – Apple announcing Mac chips at WWDC – Bloomberg https://t.co/RA5Kzcr8zy #swingtrading

— Swing Trading (@swingtrading_ct) June 9, 2020

Today is soft so far, except some highly speculative day trader stocks $IDEX $IZEA $EYES $AQMS etc wow. Watching close.

Going to short TESLA $TSLA to the moon and back when the time is right

“I would like to be able to get more money to buy more

@Tesla

actually,” says legendary investor Ron Baron. $TSLA

"I would like to be able to get more money to buy more @Tesla actually," says legendary investor Ron Baron. $TSLA pic.twitter.com/sCt9dr4mDu

— Squawk Box (@SquawkCNBC) June 9, 2020

We’re in live trading room, EPIC oil trading software active so the live oil trading alerts are also, likely some day trades firing in to open and swing trading reporting coming today with a number of set-ups, time cycle inflection last week this week so we’ll see how that goes.

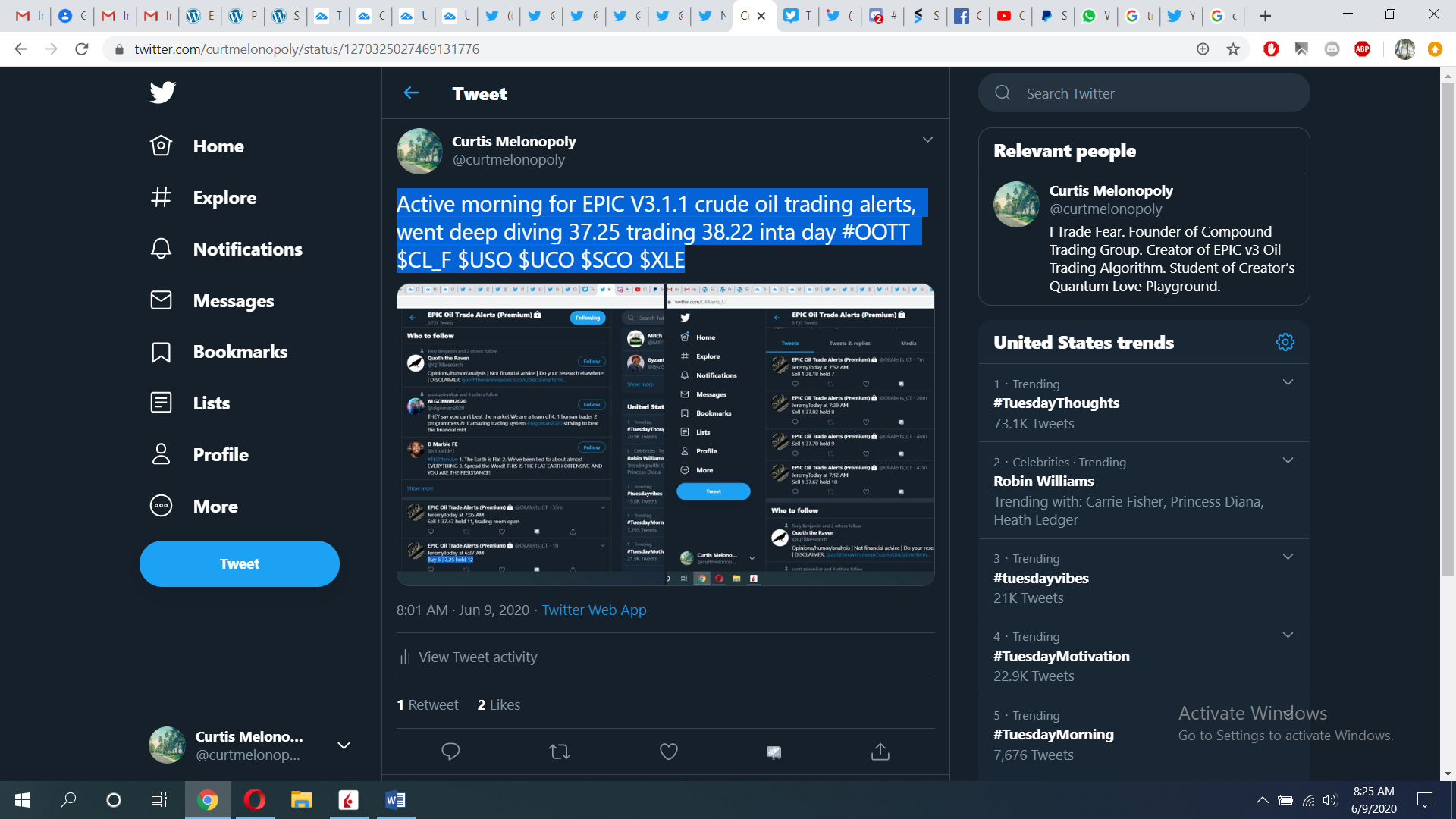

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE

Active morning for EPIC V3.1.1 crude oil trading alerts, went deep diving 37.25 trading 38.22 inta day #OOTT $CL_F $USO $UCO $SCO $XLE pic.twitter.com/CLLa0TseqW

— Melonopoly (@curtmelonopoly) June 9, 2020

Oil down on stronger dollar, oversupply concerns https://reut.rs/2Ygx7DV #OOTT $CL_F $USO $USOIL Thread https://twitter.com/davidgaffen/status/1270322515047481346

https://twitter.com/EPICtheAlgo/status/1270328242520670211

Some on schedule:

FOMC

FOMC decision: What to know in the week ahead

https://twitter.com/CompoundTrading/status/1270322725735804928

8:55

Redbook

10:00

Wholesale Trade

JOLTS

4:30

API Crude Oil Data with EIA 10:30 Wed

LIVE: President

@realDonaldTrump

holds a news conference

LIVE: President @realDonaldTrump holds a news conference https://t.co/qfXa9nMlTD

— The White House 45 Archived (@WhiteHouse45) June 5, 2020

Thanks

Curt

Algorithmic Trading Strategies for Crude Oil (CL) Day Trading, Swing Trading and Position Trading. Supplementary Article for Clients.

Algorithmic Trading Strategies for Crude Oil (CL) Day Trading, Trend and Swing Trading. Intra-Day, Daily, Weekly, Monthly Time-Frames.

This is a supplemental document for CL trade strategies for and as included in our algorithmic client oil reporting.

The various reporting included for our clients includes and is not limited to; live oil trade alerts (on Twitter, Discord, email and live in our Trading Room), conventional charting, algorithmic chart models, various trade signals, price targets, symmetry, time cycles and various other guidance.

We endeavor to assimilate the vast algorithmic data our computer scientists derive for our oil traders to action for a trader’s edge.

The algorithmic material is suitable for actionable mechanically executed trading and are also the models our coding team reference for our crude oil machine learning trade development.

You will find in the array of documentation and reporting we provide a well developed, time-tested proven rules based system for crude oil trading that is one of the best available. Oil traders should use all the models together as a structured system of trade for it to work to your best advantage.

With each chart model (in various reporting) we may include “best-use” trade strategy notes and/or “rules-based trade indications” for your consideration. The oil trading room and study of the Discord oil chat room is your best resource for real-time learning.

For perspective, review historical reporting on our blog and the various videos we have published to the Compound Trading YouTube channel.

Much of the structured model discipline developed in our system is similar in concept as discussed in this video; Mathematician Who Cracked Wall Street.

Our “How to Trade Crude Oil” Recommendations.

Crude oil price moves within structured areas (ranges) of trade represented on charting on various time frames (different time cycles of trade) often in symmetrical price extensions or mirrored fractals, historical price support and resistance, channels and simple price ranges.

The structure oil price moves within (the range of price) can be one minute charting (and more recently some machine trade is as low as 15 second time-frame) timing through to monthly charting.

Time-frame set-ups / strategies included in reporting are charted as conventional chart set-ups and/ or algorithmic chart set-ups (structures).

Understanding and having each chart time-frame at your immediate access (both conventional and algorithmic) will increase the probability of profitable trading.

You will find in reviewing the raw recorded video feed or in attending the live oil trading room that in the morning a lead trader will often review on mic the various levels of support and resistance on various oil trade time-frames on the charting to establish the most probable areas of trade for the strategy of trade.

The lead trader will also check with all the chart time-frames prior to entering a day trade at various times through the day.

When multiple time-frames agree to support or resistance (especially symmetrical) areas on the charting (with trend) this becomes your highest probability area of trade execution, we have found this to be one of the best oil trading strategies.

Sizing trades appropriate to your trading account, probability of support or resistance (multiple oil chart time-frames in agreement) and time frame for each set-up is a positive strategy.

Using the correct chart time-frame specific to your trading strategy is critical. Generally, the lower (smaller) the time frame the less predictable the support and resistance areas (or structure) of the chart will be. However, the larger time-frames (monthly, weekly, daily) may also have significant “slippage” but the primary structure will often remain intact.

Generally, the idea is to enter your positions based on the structure for the specific time frame you are wanting to trade referencing the other time frame support and resistance or range within the trend. The basic method is to understand the range of trade and execute trade long bias when price is near support for the appropriate time frame / structure and the opposite is true for short trades.

Our staff use the thirty minute model structures (range within trends) most often for primary areas of support and resistance trading signals referencing all other time-frames in their trading strategy. More recently the 60 minute and 120 minute time-frames are being used by our staff as it provides a wider view of the current structure of oil trade (post COVID black swan machine code updates).

Trade positions should be significantly biased to the trending range of trade.

Below are recent videos from webinars we recorded in our Oil Trading Room:

“How to Profit With EPIC v3 Crude Oil Machine Trades.”

“How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching”.

The recently released white paper(s) about EPIC v3 explains also its method of execution of trades and is a great supplemental piece of documentation for live human traders to reference for trading bias, see the report here;

EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

If you have questions about the models below please email us at compoundtradingofficial@gmail.com and if you are a client you can send your Whatsapp phone number to that email and connect direct to our lead trader for intra-day question(s).

Not all charts are updated every week and some concept or test charts are added or deleted on occasion.

Be sure to check the time-stamp of each chart in reporting as the preparation of charts and/or models can take days prior to publication and distribution of this report.

If you are a new client that would like to review historical reports that are still locked on the blog from public view please email the office with your request and we will send you recent report credentials for unlocking reports for review.

Please note, chart links that support the models and unlisted videos from live trade, for reporting set-ups and webinars are now distributed specific to each user or small group of users. If you are using more than one device to access these, to avoid disruption of service, please email us a simple / general description of those devices to assist in controlling dissemination.

EPIC Crude Oil Algorithm Model. 30 Minute Oil Chart Structure (see historical client reporting for the model).

The EPIC algorithm model chart is a proprietary structure that has been back tested sixty months on thirteen time-frames. The model represents the most probable areas of support and resistance in oil trade within this specific time-frame. During a black swan event adjust your trade bias to a larger 60 minute or 120 minute algorithmic model time-frame.

This (the EPIC 30 Minute Oil Algorithm Chart Model) is our most proven oil trading structure / strategy.

The levels noted on the EPIC model are to be used as important areas of consideration for support and resistance (trade signals) for your trading strategy when using conventional charting set-ups / structures and/or other algorithmic charting.

Resistance and support areas on the thirty minute oil trade structure chart are at each line on the algorithmic chart. The primary areas of support and resistance are;

- Outer quadrant walls / also used as channel support and resistance (orange dotted diagonal lines), the half way point between each is often an executable buy or sell trigger in trade,

- Mid channel line for uptrend and down trend (white dotted diagonal),

- Mid quad horizontal (not marked but is at the mid point of the quad),

- Fibonacci levels (various horizontal colored lines on model),

- Historical areas of support and resistance (purple horizontal lines on model).

- The intra-week swing trading range is from thick horizontal gray line to the next (commonly becomes a pivot area of trade). You will find on the larger time frame models of the one hour, two hour and four hour that these key horizontal swing range support and resistance levels are marked as green and gray alternating.

- The important historical diagonal trend-lines (conventional trend lines) are represented on the chart as thick white lines.

- Also of note are the price targets for Tuesday 4:30 PM (API), Wednesday 10:30 AM (EIA) and Friday 1:00 PM (Rig Count). The Tuesday and Wednesday targets hit significantly more often than the Friday target (red circles with red or green vertical dotted lines intersecting).

- At times other indicators are added to the chart such as important trend lines “in play”, moving averages and more.

The video at this link explains How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, #OIL, #Trading, #Algorithm, #OOTT as does this video Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #OIL #OOTT and this Webinar 1: EPIC the Oil Algorithm.

When conventional crude oil charting coincides (or agrees) with the EPIC algorithmic model support and resistance this is then considered a significant buy or sell trigger (signal) for crude oil trade.

Be aware (at minimum) of the primary support and resistance areas on the larger time-frames (lower time frames are not as critical) – in this instance (when trading the 30 min time frame) the 1 hour, 2 hour, 4 hour, daily, weekly and monthly charting should be considered when sizing your trades.

Also, more recently we have been adding models for the one hour and two hour time-frames (post COVID black swan event), please be sure to review these models as they are sent out.

This document is sent out to clients for the purpose of “supplemental” to the regular reporting to keep the regular reporting as short as possible. Also, ultimately it is the intra-day or intra-week information provided to our clients that also becomes key for trade bias.

I will also update this document extensively in the near future with a number of live trade video clips to show examples of intra-day trade, swing trade and position trading strategies we are using (for study guide purposes).

Thank you.

Curt

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Article Topics; Crude Oil, Day Trading, Swing Trading, Algorithm, Algorithmic, Trading, Trend, Position, Intra Day, Machine Trading, Supplement Article