Tag: US Dollar

How to Trade US Dollar Index (DXY) Large Time Cycle in to Week of August 5 #USD $DXY $UUP #tradealerts #swingtrading

Trading Strategy for US Dollar Trade Alert Issued This Morning in Premarket for the Swing Trade Positioning in to Week of August 5, 2019 Time Cycle.

This a very important trading opportunity not just for the US Dollar, but many other instruments of trade on the equity, commodity and currency markets are affected by the price of the US Dollar. Below is your complete trading strategy for the time cycle peak coming in the Dollar.

On public facing Twitter feeds the alert reads;

“Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today’s premarket. #timecycles $DXY $UUP #USD #SwingTrading”

Member Alert: Large US Dollar Index (DXY) time cycle week of Aug 5, 2019 (extends 7 trading days either side). Trade Set Up detail to your email in today's premarket. #timecycles $DXY $UUP #USD #SwingTrading

— Melonopoly (@curtmelonopoly) August 1, 2019

On the private member alert feed the alert reads;

“US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD”

https://twitter.com/SwingAlerts_CT/status/1156872463273402369

Below is the chart and link for the US Dollar (DXY) time cycle alert;

US Dollar Index (DXY) Long trade likely to turn short other side of Aug 5 week, watch for report with all signals $DXY $UUP #swingtrade #USD

How to Trade the US Dollar (DXY) Time Cycle Peak.

The trading strategy for the US Dollar Index is simple if you use the model chart provided above.

In early 2018 we had alerted that the US Dollar was divergent to the downside and that a run in the dollar was imminent. The US Dollar traded up since that time from sub 90.00 to currently trading at 99.91.

When the US Dollar traded higher (after our alerts) it then reached the area of the main pivot (shown on chart above with horizontal red dotted line). The Dollar then traded around that pivot for some time. The trading pivot is important in your trading plan.

Simple Chart Symmetry and Price Targeting (price extensions) for this time cycle says to measure from the recent lows (trading just under 90.00) to the pivot area of 96.64 (about 7.00) and add the 7.00 approximately to 96.64 and you get about 103.50 ish. There are different ways to measure this – you can take the hard and fast support and resistance lines on the chart and measure from there or use exactly what price action said. In other words, the chart says support was 90.00, but the Dollar traded under 90.00 before it turned back up and got bullish. Depending on how you use those numbers this then determines your extension to the top. Lets call it 103.50 and use that for this example for your trading strategy.

The charting says the time cycle peak is the weak of Aug 5, 2019. This is a large time cycle so you have to allow for a week or so either side of the weak of the peak. Coming out of the other side of that peak the trade action (trading trajectory) will be key. You will either see a continuation of the current bullish trend or a turn to the bearish trade side. Probability says the price of the US Dollar will turn down. However, this is not always the case.

The chart says that 102.92 is your peak resistance price, but this can be extended up some for two reasons. One reason is the price extension you may measure from the previous lows, in this instance you would see the Dollar trade in to the 103s or 104s before turning. The other reason for a price higher than 102.92 is a simple over trade extension that happens at large time cycle tops and bottoms in trade – an over exaggerated move.

If the trade trajectory continues bullish then you simply extend the price up one structure above the current area of trade (see chart below). This is an unlikely scenario but it may occur. This bullish run would then peak in to the week of March 30, 2020 (this can change as we come near to the date, watch for charting updates). The price target in this scenario is 109.30 for March 30, 2020.

US Dollar Index (DXY) Bullish trading strategy for 109s in to Mar 30 2020 $DXY $UUP #swingtrade #USD

The Bear scenario to short the US Dollar is more likely, below is your trading strategy.

As noted above, simply wait for the week of August 5, 2019 and watch trade the week on the other side. Watch the key resistance areas on the chart. Early on in to the time cycle start to size your trade and continue sizing the trade (in my case it will be short $UUP likely) and then start to take profit at each support on the way back down as the US Dollar trades lower in to March 30 of 2020.

It is important to get your full size in early enough but not too early so you get caught on the wrong side.

If you need help with the trade let me know.

Watch the chart resistance close as we trade the markets over the coming few weeks, watch the apex of the quad the US Dollar is trading in currently on the chart. Watch for the inflection points. You can also bring your time down to a daily or 4 hour chart to get a better feel for what trade is doing.

Also, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Thanks,

Curt

Other Reading:

US Dollar Index on Market Watch https://www.marketwatch.com/investing/index/dxy

Dollar hits two-year high after Federal Reserve cuts interest rates by a quarter point as expected https://cnb.cx/2MsfQn1

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: US Dollar, USD, Trading, Strategy, Charts, Algorithm, Currencies, Alerts, $DXY, Swing Trade, $UUP, time cycles

Swing Trading Strategies | SP500 $SPY Volatility $VIX Gold $GLD Silver $SLV Bitcoin $BTC Oil $USO US Dollar $DXY | July 7 Premium #timecycles

Special Time Cycle Swing Trade Report With Set-Ups, Strategies, Alerts, Charts, News. July 7, 2019.

Below are Swing Trade Set-Ups Currently On Watch; S&P 500 $SPY Volatility $VIX Gold $GLD Silver $SLV Bitcoin $BTC Oil $USO US Dollar $DXY.

Review this Twitter thread as I commented some on each model below;

Working models tonight… that week of Oct 21, 19 time cycle peak… theres an inflection wk of Aug 5, 19 (but not near the size), Oct 21 is massive. Remember one I told u bout in to last Dec 24? This one has fire power potential 2B 2x size $SPY $VIX $USO $CL_F $DXY #timecycles

Working models tonight… that week of Oct 21, 19 time cycle peak… theres an inflection wk of Aug 5, 19 (but not near the size), Oct 21 is massive. Remember one I told u bout in to last Dec 24? This one has fire power potential 2B 2x size $SPY $VIX $USO $CL_F $DXY #timecycles

— Melonopoly (@curtmelonopoly) July 7, 2019

SP500 (SPY) Following our upper price target trajectory scenario near perfect since last SPY report, watch thick red line res test $SPY $ES_F $SPXL $SPXS #SwingTrade #Daytrade

The resistance overhead is key, if trade runs through it you can expect that to be possible support for continued run in to upper price target. This structured model has been quite consistent and is proving to be a decent swing trading guide for positioning of size through a move.

In this specific instance, the peak in to week of Oct 21 is broad global markets, SPY specifically is Sept 9 – Oct 4, so its a little earlier for some reason. VIX is Oct 21 week though.

A strong economy and Fed rate cuts: The stock market wants to ‘have its cake and eat it, too’ https://on.mktw.net/2YAQZk8

VIX The symmetry in previous time cycle peaks is amazing, watch Oct 21 2019 time cycle peak close. #volatility $VIX $TVIX $UVXY #swingtrading

Watch the first time cycle inflection in to Aug 5 week and then the large time cycle based on symmetry in to week of October 21, 2019.

ha one last note, its a wild card note, if $VIX got going it has a peak possible at 58.17 Oct 21, 2019 lol. Unlikely, but just saying, it has that in nitros available in the tank during that time frame, should a wild card scenario play out. #timecycles #volatility

Fed rate cut in question after June jobs report beat https://finance.yahoo.com/video/fed-rate-cut-june-jobs-183234715.html?.tsrc=rss

GOLD If you’re swing trading Gold use patience and trade the channel (red lines) it’s very clean $XAUUSD #Gold $GLD $GC_F

Of course if you’re using it as a hedge or store of value completely different story, but timing your entries in to Gold is well done with that channel between red lines on Monthly chart below.

Gold has time cycles peaking weeks of Aug 1 2019 (small), Feb 3 2020 (moderate), Aug 3 2020 (peak – large cycle peak). That far out however, you have to check back as we get closer as the timing can shift (a few months out we can nail it down exact) #Gold $GLD $XAUUSD #timecycles

Is The Debt Crisis About To Be Reborn In 2020? https://finance.yahoo.com/news/debt-crisis-reborn-2020-081448073.html?soc_src=social-sh&soc_trk=tw

SILVER Weekly chart seems to imply a break sometime in advance of Mar 2020 up or down, that’s all I have for you. #swingtrade $SLV $USLV $DSLV #Silver

Silver Sees Largest Daily ETF Inflow In A Year: BMO https://www.kitco.com/news/2019-07-04/Gold-Silver-Precious-Metals-Daily-News-Briefs.html

BITCOIN (BTC) One way to swing trade it (there are others in our report) is to long at the bowl trajectory on pull backs $XBT_F $XBTUSD #Bitcoin #Chart

Using other chart models on our Bitcoin report there are other not so static ways to swing trade the Bitcoin move, however, testing longs anytime price returns to that bowl trajectory seems moderately reasonable.

Oh, and Bitcoin’s time cycle peak is week of Dec 17, 2019. $BTC #timecycles

US Dominates Bitcoin Twitter Discussion, Sentiment Towards Facebook’s Libra is Sinking — Report $FB $BTC #Libra https://www.cryptoglobe.com/latest/2019/07/us-dominates-bitcoin-twitter-discussion-sentiment-towards-facebook-s-libra-is-sinking-report/#.XSKfJRyeeik.twitter

Crude Oil Weekly Chart is really interesting because 14 out of last 15 time cycles reversed (see previous report) Doing it again. #swingtrading

#Oil interesting because unlike recent time cycles where it was near same as market indices cycles (last Dec), it is off this cycle, Wk of Sept 23, 19 is an inflection with time cycle peak Jan 6, 20. Recent time cycle bottom June 10, 19 per our reports. #OOTT #timecycles $CL_F

US Dollar Index (DXY) Aug 5 2019 Mar 30 202 are the time cycles to watch, still trades around pivot $DXY $UUP #USD #swingtrading

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Signals, SP500, $SPY, Volatility, $VIX, Gold, $GLD, Silver, $SLV, Bitcoin, $BTC, Oil, $USO, US Dollar, $DXY, time cycles

PreMarket Trading Plan Thurs July 26: Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday July 26, 2018.

In this edition: Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trade Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Thursday July 26 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email info@compoundtrading.com

- July 25-27 – Weekly newsletter reporting and invoicing distributed to members (delayed this week due to next gen algorithms being integrated in to our trading platforms).

- July 23-July 31 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a complimentary version without algorithmic charting).

- End of July – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- End of July – New pricing structure published representing next generation algorithm models (existing members no change).

- End of July – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: selloff Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB #trading

Password: AR, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Password: WOW, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Unlisted Private Member Video – Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: CMCSA, LUV, FB, QCOM & more –

Stocks making the biggest moves premarket: CMCSA, LUV, FB, QCOM & more – https://t.co/Txh5AkjgVD

— Melonopoly (@curtmelonopoly) July 26, 2018

Market Observation:

Markets as of 8:14 AM: US Dollar $DXY trading 94.23, Oil FX $USOIL ($WTI) trading 689.23, Gold $GLD trading 1228.14, Silver $SLV trading 15.52, $SPY 283.34, Bitcoin $BTC.X $BTCUSD $XBTUSD 8210.00 and $VIX trading 12.3.

Momentum Stocks to Watch: $SVU $BPI $ARNC $XLNX

News:

$AGN Allergan’s stock set to rally after earnings beat and raise, new stock repurchase program

https://twitter.com/CompoundTrading/status/1022447396003958786

$DPW DPW Holdings’ Enertec Systems awarded $4.3M contract

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

IPOs expected to price/trade today*:

– Aurora Mobile $JG

– Berry Petroleum $BRY

– Cango $CANG

– Focus Financial Partners $FOCS

– Liquidia Technologies $LQDA

– Pinduoduo $PDD

– Tenable Holdings $TENB

Your Thursday morning Wake Up Call:

IPOs expected to price/trade today*:

– Aurora Mobile $JG

– Berry Petroleum $BRY

– Cango $CANG

– Focus Financial Partners $FOCS

– Liquidia Technologies $LQDA

– Pinduoduo $PDD

– Tenable Holdings $TENB*subject to change

— Benzinga (@Benzinga) July 26, 2018

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Mastercard stock falls after company reports in-line revenue, earnings beat

McDonald’s earnings and sales beat estimates

Bristol-Myers shares lift on Q2 profit, revenue beats

Xerox misses profit expectations but beats on revenue, sets $1 billion buyback plan

Raytheon shares rise after Q2 profit, revenue beats

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

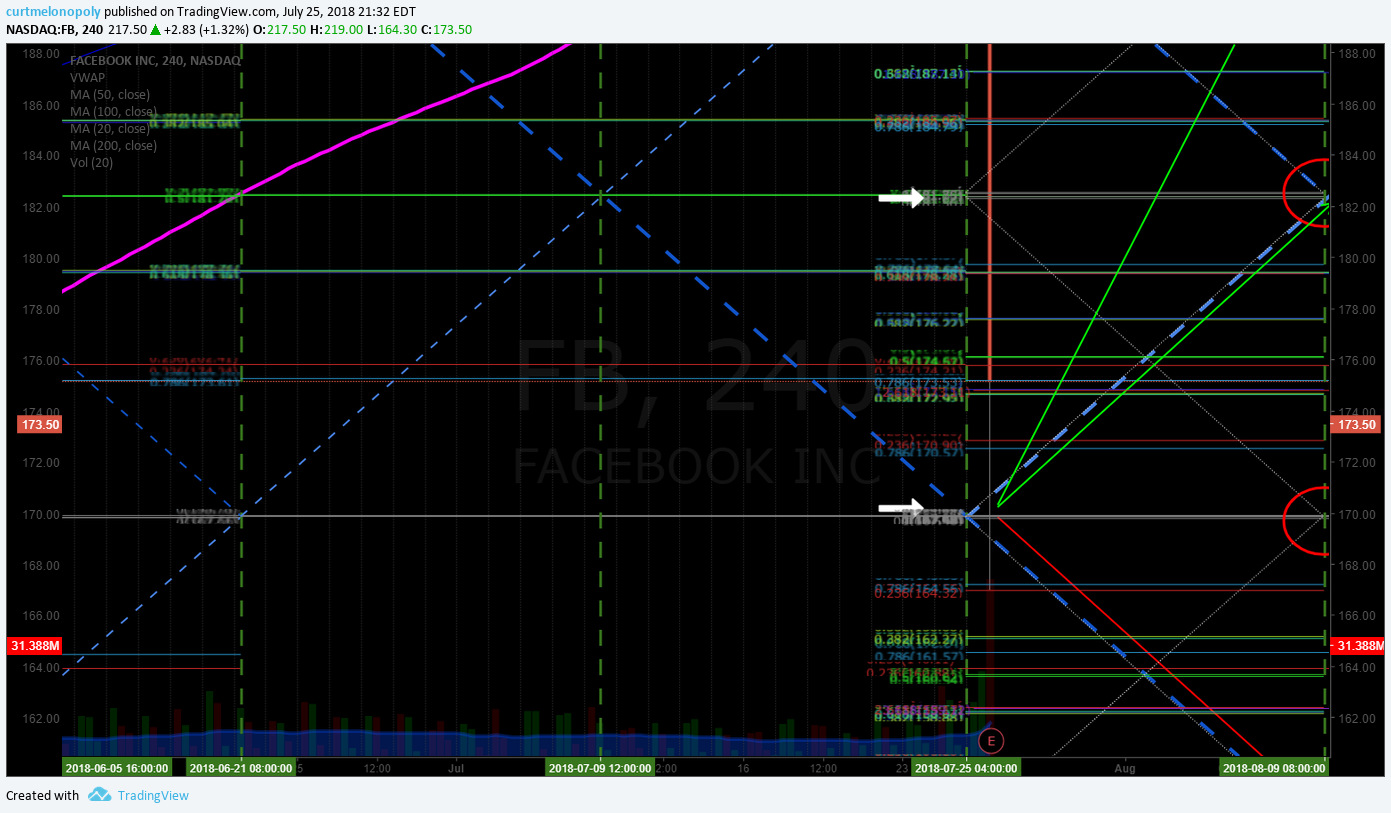

FACEBOOK (FB) Trading Facebook wash-out on earnings. Trading levels for daytrading and swingtrading. $FB #daytrade #swingtrade #chart

Scalp to start the day. EPIC the Oil Algorithm $USOIL $WTI $USO #Oil #trading

Scalp to start the day. EPIC the Oil Algorithm $USOIL $WTI $USO #Oil #trading pic.twitter.com/4foUVxkv3z

— Melonopoly (@curtmelonopoly) July 26, 2018

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

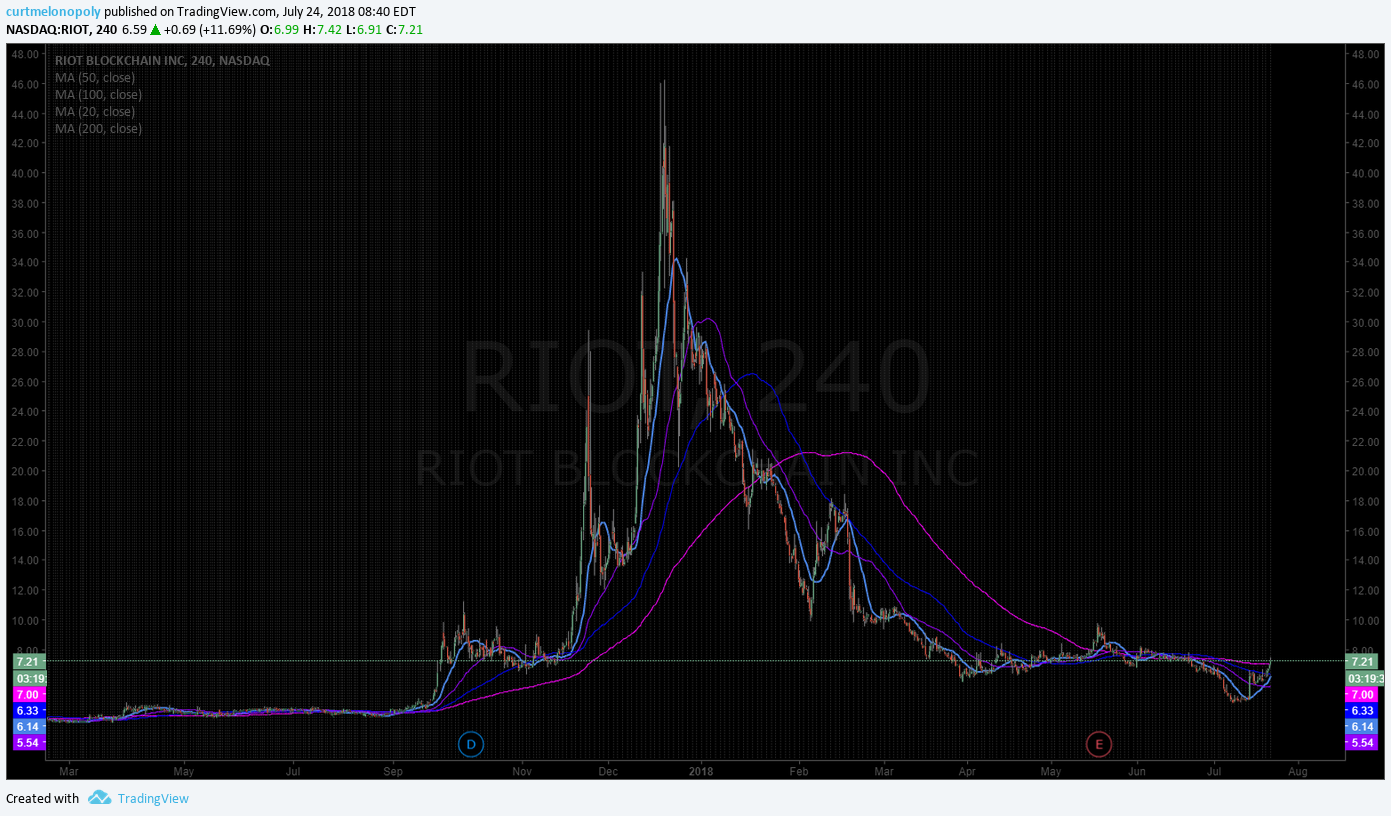

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

ALPHABET (GOOGLE) Trading over main resistance pivot 1211.60 intra 1262.34 on earnings 1318.52 price target. $GOOGL #swingtrading

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Celgene (CELG) trading 86.81 with earnings in one day at quad wall resistance over mid quad support $CELG

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Your Thursday morning Speed Read:

– Markets await Amazon’s afternoon Q2 report with bated breath – will it boost its market cap to $1T? $AMZN

– Dunkin Brands’ bakes up a Q2 beat, but cuts FY18 outlook 🍩 $DNKN

– Iran plans national cryptocurrency to circumvent US sanctions $SPY

Your Thursday morning Speed Read:

– Markets await Amazon's afternoon Q2 report with bated breath – will it boost its market cap to $1T? $AMZN

– Dunkin Brands' bakes up a Q2 beat, but cuts FY18 outlook 🍩 $DNKN

– Iran plans national cryptocurrency to circumvent US sanctions $SPY— Benzinga (@Benzinga) July 26, 2018

#5Things

-Trump, Juncker cool trade tensions

-Facebook plunges

-It’s ECB day

-Markets rise

-Another huge earnings day

https://bloom.bg/2LQ7DWC

#5Things

-Trump, Juncker cool trade tensions

-Facebook plunges

-It's ECB day

-Markets rise

-Another huge earnings dayhttps://t.co/4susNk7wYl pic.twitter.com/xQxuV9XCh5— Bloomberg Markets (@markets) July 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $SVU $TAOP $CRMD $ARNC $UAA $UA $AWX $XLNX $AMD $QCOM $BTI $TRCH $DPW $GNC $CNHI $SQQQ $CMCSA

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DAN $FCB $XLNX $NSC $IART $FFBC $FCX $EDU $CBRL

(6) Recent Downgrades: $DDD $HFWA $ROIC $FB $NGD $ELF $SNBR $OC $CHFC $CCJ $SKX

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Earnings, $FB, $AGN, OIL, $WTI, GOLD, Crypto, $BTC , US Dollar, $DXY

PreMarket Trading Plan Wed July 25: Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Wednesday July 25, 2018.

In this edition: Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trading Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Wednesday July 25 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 10:30 EIA Report Oil Trading – access limited to live trading room / EPIC Oil Algorithm members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email info@compoundtrading.com

- July 25-26 – Weekly newsletter reporting and invoicing distributed to members (delayed this week due to next gen algorithms being integrated in to our trading platforms).

- July 23-July 31 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a complimentary version without algorithmic charting).

- End of July – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- End of July – New pricing structure published representing next generation algorithm models (existing members no change).

- End of July – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: AR, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Password: WOW, Protected: Swing Trading Report (Members): Earnings Season Charting July 24 $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Unlisted Private Member Video – Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Unlisted Private Member Video – Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: KO, GM, BA, FCAU, UPS & more –

Stocks making the biggest moves premarket: KO, GM, BA, FCAU, UPS & more – https://t.co/NbxGklLWAH

— Melonopoly (@curtmelonopoly) July 25, 2018

Market Observation:

Markets as of 8:14 AM: US Dollar $DXY trading 94.49, Oil FX $USOIL ($WTI) trading 68.57, Gold $GLD trading 1232.14, Silver $SLV trading 15.59, $SPY 281.18, Bitcoin $BTC.X $BTCUSD $XBTUSD 8227.00 and $VIX trading 12.6.

Momentum Stocks to Watch: $RIOT, $TORC, $HMNY, $NVRO, $IRBT

$TORC ResTORbio’s stocks rockets on positive trial results, just as post-IPO lock up expires https://on.mktw.net/2JQ23Sh

$TORC Short % of Float (Jun 14, 2018) 419.52%

ResTORbio’s stocks rockets on positive trial results, just as post-IPO lock up expires

News:

MoviePass parent Helios and Matheson implements 1-to-250 reverse stock split, boosting share price

$RUBY Rubius Therapeutics (RUBY) Agrees to Acquire Manufacturing Facility in Smithfield, Rhode Island

$TEUM: Pareteum Awarded $3 Million 5-Year Contract in North Africa

$CYTR CytRx Announces Centurion BioPharma Corporation’s Filing of a Provisional Patent Application.

$CHFS Department of Veterans Affairs Awards a $6.5 million Blanket Purchase Agreement to CHF Solutions to Supply Aquadex FlexFlow System for Outpatient Services in Tampa, Fla.

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Freeport-McMoRan’s stock jumps after earnings and revenue rose above expectations

Hawaiian Holdings +5% after earnings, upgrade https://seekingalpha.com/news/3373389-hawaiian-holdings-plus-5-percent-earnings-upgrade?source=feed_f … #premarket $HA

Norfolk Southern rides higher after earnings https://seekingalpha.com/news/3373399-norfolk-southern-rides-higher-earnings?source=feed_f … #premarket $NSC

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

$TORC Premarket up 142% trading 21.79 on lock up exp, results, short interest. $TORC #daytrading

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

ALPHABET (GOOGLE) Trading over main resistance pivot 1211.60 intra 1262.34 on earnings 1318.52 price target. $GOOGL #swingtrading

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

Celgene (CELG) trading 86.81 with earnings in one day at quad wall resistance over mid quad support $CELG

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Your Wednesday morning Speed Read:

– Former Fiat Chrysler CEO Sergio Marchionne has died $FCAU

– Thermo Fisher’s Q2 earnings and revenues top estimates, as the consultant raises its FY18 overlook $TMO

– Bitcoin takes a breather after breaching $8K psychological level $BTC

https://twitter.com/Benzinga/status/1022065207198269440

Stunning correlation between the 10-year and S&P 500 could point to new highs for stocks https://cnb.cx/2NIFSQ8

Stunning correlation between the 10-year and S&P 500 could point to new highs for stocks https://t.co/e6eashKEIe pic.twitter.com/hg6KAg16Rz

— CNBC International (@CNBCi) July 25, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TORC $CRMD $NVRO $CODX $IRBT $VICR $AUDC $RETA $TRVN $HA $TVIX $TKC $UVXY $CEI $GLW $DTE $VXX $USLV

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

$NBIX PT raised to $122 from $100 at Baird.

W.R. Berkley $WRB PT Raised to $78 at RBC Capital

TD Ameritrade $AMTD PT Lowered to $60 at Morgan Stanley

Texas Instruments $TXN PT Raised to $113 at Morgan Stanley

$BIIB PT raised to $348 at Baird.

$RETA PT raised to $185 from $95 at Citi, added to US Focus List.

IQVIA Holdings $IQV PT Raised to $143 at Baird

Needham & Company Remains Bullish on G-III Apparel Group $GIII As Ivanka Trump Closes Fashion …

Rockwell Automation +3.5% on guidance boost https://seekingalpha.com/news/3373390-rockwell-automation-plus-3_5-percent-guidance-boost?source=feed_f … #premarket $ROK

Centene $CNC PT Raised to $152 at Piper Jaffray

Kimbell Royalty Partners LP $KRP PT Raised to $26 at RBC Capital

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Earnings, #EIA, OIL, $WTI, $RIOT, $TORC, $HMNY, $NVRO, $IRBT, GOLD, Crypto, $BTC , US Dollar, $DXY

PreMarket Trading Plan Tues July 24: $CELG, $RIOT, $ATI, $LLY, $GOOGL, $BIIB, $BRN, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY more.

Compound Trading Premarket Trading Plan & Watch List Tuesday July 24, 2018.

In this edition: $CELG, $RIOT, $ATI, $LLY, $GOOGL, $STLD, $BIIB, $CR, $BRN, $WHR, $SNV, $INFN, $DGX, $MMM, $UTX, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

July 24 Member Memo: Trading Coaching Boot Camp Prep, Machine Trading, Next Gen Models, Trade Alerts, Reporting, Swing Trading Earnings

Scheduled Events:

- Tuesday July 24 – Lead trader (and/or other team members) will be active in live trading room as follows and as available (as things can change fast in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email info@compoundtrading.com

- July 23 – July 27 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day reviews) and sent to our subscribers in lieu of the weekly swing trading report.

- https://twitter.com/swingtrading_ct/status/1021107913950212096

- End of July – Next generation algorithm models roll out in to August 2018 (machine trading Gen 1).

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

A Tidbit About our Structured Algorithmic Models

“The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn’t provide us with the model. We start at the end result and then confirm it with conventional math.

And yes, in our trading bootcamp we do teach this process. The process of how we get there – all steps except the black box final gen models (gen 5). But yes, generation 1 thru 4 models and the process therein I teach to our attendees and record it for home study thereafter.”

The thing about our algorithmic structured models is that we get the structure first, and then math can explain how to get there. The math confirms the model but doesn't provide us with the model. We start at the end result and then confirm it with conventional math.

— Melonopoly (@curtmelonopoly) July 18, 2018

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

25 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12063230 $ATI $LLY $GOOGL $STLD $BIIB $CR $BRN $RIOT $WHR $SNV $INFN $DGX

25 Stocks Moving In Tuesday's Pre-Market Session https://t.co/tzOneljgN7 $ATI $LLY $GOOGL $STLD $BIIB $CR $BRN $RIOT $WHR $SNV $INFN $DGX

— Benzinga (@Benzinga) July 24, 2018

Your Tuesday morning Speed Read:

– ‘COLOR US UNIMPRESSED’ Iran’s Foreign Minister, continuing Twitter beef w/U.S. President Trump $SPY $USO

– Harley-Davidson reports Q2 adj. EPS $1.52 vs $1.34 est, sales $1.7B vs $1.4B est $HOG

– Bitcoin regains $8K level, HODLers rejoice $BTC

Your Tuesday morning Speed Read:

– 'COLOR US UNIMPRESSED' Iran's Foreign Minister, continuing Twitter beef w/U.S. President Trump $SPY $USO

– Harley-Davidson reports Q2 adj. EPS $1.52 vs $1.34 est, sales $1.7B vs $1.4B est $HOG

– Bitcoin regains $8K level, HODLers rejoice $BTC— Benzinga (@Benzinga) July 24, 2018

Stocks making the biggest moves premarket: MMM, UTX, VZ, LLY & more –

https://www.cnbc.com/2018/07/24/stocks-making-the-biggest-moves-premarket-mmm-utx-vz-lly–more.html

Stocks making the biggest moves premarket: MMM, UTX, VZ, LLY & more – https://t.co/OyJJdIk3SI

— Melonopoly (@curtmelonopoly) July 24, 2018

Market Observation:

Markets as of 8:12 AM: US Dollar $DXY trading 94.50, Oil FX $USOIL ($WTI) trading 68.30, Gold $GLD trading 1227.14, Silver $SLV trading 15.51, $SPY 281.53, Bitcoin $BTC.X $BTCUSD $XBTUSD 8322.00 and $VIX trading 12.1.

Momentum Stocks to Watch: $RIOT

$ATI $HLX $BIIB $HOG $WERN $UTX $STLD, $VZ $LMT $GOOG

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT pic.twitter.com/zT665zD6PM

— Melonopoly (@curtmelonopoly) July 24, 2018

News:

$CELG #premarket Celgene shares lift on positive results for cancer drug trial https://on.mktw.net/2LlA7vd

Recent SEC Filings:

Insider Buys Of The Week: BlackRock, Dish Network, Walgreens https://benzinga.com/z/12054592 $BLK $DISH $WBA

Recent IPO’s:

Biotech Allakos prices IPO at $18, above price range

$RUBY 10.3M shares at $23 and $CRNX 6m shares at $17

$CRNX Crinetics Pharmaceuticals prices IPO at $17 a share

The IPO Outlook For The Week: Tech & International Exposure https://benzinga.com/z/12052697 $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA

The IPO Outlook For The Week: Tech & International Exposure https://t.co/A0rfpmunIn $AQST $BE $BRY $JG $CANG $FOCS $PDD $TENB $DAVA $OPRA https://t.co/Hrc0OwWq24

— Melonopoly (@curtmelonopoly) July 22, 2018

Earnings:

Biogen Q2 top line up 9%; non-GAAP EPS up 15%; shares up 6% premarket https://seekingalpha.com/news/3372775-biogen-q2-top-line-9-percent-non-gaap-eps-15-percent-shares-6-percent-premarket?source=feed_f … #premarket $BIIB

$VZ Premarket – Verizon shares rise 3% after company beats 2Q earnings and revenue expectations

Lockheed Martin +3% after strong Q2 beat, upsized full-year guidance https://seekingalpha.com/news/3372773-lockheed-martin-plus-3-percent-strong-q2-beat-upsized-full-year-guidance?source=feed_f … #premarket $LMT

StockTwits Earnings to Watch

Tue – $T $VZ $LMT $JBLU $BIIB $IRBT $MMM $LLY $TXN

Wed – $FB $AMD $F $GILD $PYPL $V $BA $HM $KO $ABX

Thu – $AMZN $INTC $SBUX $CMG $FSRL $SPOT $MCD

Fri – $TWTR $XOM $ABBV $CVX

Via @StockTwits

#earnings for the week

$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX

#earnings for the week$AMZN $AMD $FB $TWTR $GOOGL $BA $T $V $INTC $LRCX $HAL $LMT $PYPL $MA $VZ $MMM $CELG $MCD $HAS $F $ABBV $XOM $SBUX $BIIB $KO $AAL $PETS $ALGN $CMG $GRUB $RTN $UAA $GILD $NTGR $UTX $HOG $WDC $AMTD $NOK $DGX $UPS $JBLU $GM $CVX https://t.co/r57QUKKDXL https://t.co/rFjdIyBH0d

— Melonopoly (@curtmelonopoly) July 22, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

RIOT BLOCKCHAIN (RIOT) premarket trading up 9.71% 7.24 with resistance 9.70s #premarket #trading $RIOT

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://bloom.bg/2v1ggWS

Goldman warns of liquidity-fueled sell-off after ‘volmageddon’ https://t.co/qtnhhrvPmk pic.twitter.com/jWDcwkA9O6

— Bloomberg Markets (@markets) July 24, 2018

MACD still trending down on daily oil chart with price above 100 MA under 20 and 50. #OIL $USOIL $WTI

Bitcoin trading like a conventional equity now. Launched off 50 MA testing 100 MA resistance soon. $BTCUSD $BTC #Bitcoin #premarket https://twitter.com/CryptotheAlgo/status/1019561358600409088

US Dollar Index (DXY) Chart. Perfect move from structure to structure at resistance now to next possible. $DXY $UUP #USD #swingtrading #dollar

Gold chart (Daily) MACD may cross up here at previous December low support test. #GOLD #CHART $GC_F $XAUUSD $GLD

Gold chart monthly – trade sitting on 50 MA test and under bottom trendline. #Gold #Chart $GLD $XUAUSD $GC_F

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

Market Outlook, Market News and Social Bits From Around the Internet:

Economic Data Scheduled For Tuesday

Economic Data Scheduled For Tuesday pic.twitter.com/aKxskQDciJ

— Benzinga (@Benzinga) July 24, 2018

#5things

-Trump sets terms for Mueller interview

-It’s PMI day

-China stimulus

-Markets rise

-Coming up…

https://bloom.bg/2LmeMSt

#5things

-Trump sets terms for Mueller interview

-It's PMI day

-China stimulus

-Markets rise

-Coming up…https://t.co/IuLmwg9esS pic.twitter.com/GMfwu1Q3kF— Bloomberg Markets (@markets) July 24, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $LPNT $CTRV $BRN $DDE $HCLP $HAS $JMEI $MARA $NXTD $RIOT $CLF $CYH $TLRY $UWT $SLS $AEMD $TKC $VKTX $SESN $SYNT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Guggenheim Reiterates Buy on Grubhub $GRUB Ahead of 2Q Report

Turtle Beach +2.3% after Oppenheimer target boost https://seekingalpha.com/news/3372774-turtle-beach-plus-2_3-percent-oppenheimer-target-boost?source=feed_f … #premarket $HEAR

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CELG, $RIOT, $ATI, $LLY, $GOOGL, $STLD, $BIIB, $CR, $BRN, $WHR, $SNV, $INFN, $DGX, $MMM, $UTX, $VZ Earnings, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , US Dollar, $DXY