Compound Trading Premarket Trading Plan & Watch List Monday June 18, 2018.

In this edition: $CVX, $AAPL, $JD, $MLNX, $UL, Oil, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text below are newer comments recently important.

Note #1 – Some of the reporting will not be out until later Monday evening. On weeks that we have to allow for chart data resets (such as this week) it can take a day or two to get them all out. And as I noted in Discord, even though we have coding techs now processing, I still need to review and approve each entry on each report.

Note #2 – Everyone should have invoicing reconciliation from Jen (I’ve reviewed her work and sent back to her for execution). If you do not receive such be sure to contact her info@compoundtrading.com for uninterrupted service. Thanks.

Note #3 – If you’re participating on the public (free) side of chat room, rule 1 is one trade idea posted per month per attendee minimum (does not apply to current premium members)…. Jen will be asking folks politely to exit the room in non compliance beginning this week. It doesn’t do anyone any good to have squatters. Other rooms are more amenable to that.

Note #4 – Daytrading room, webinars etc will be much more active starting sometime this week (now that coding team is in the flow and know), and more so in to next week – watch for notices. Daytrading is under new protocols, so if you are unaware and wish to attend (as a premium paid member) you will receive email notice prior to each session. Webinars are different in that they will be various and will include both premium and free sessions. Watch for notices.

If you missed it…. here’s a summary of what I think is important to watch this week for any bias (except crypto) https://twitter.com/curtmelonopoly/status/1008402052337356800

Our Question and Answer Page has been updated for those asking about our services and platform options (with a recent inquiry example) here

https://twitter.com/CompoundTrading/status/1004427758913679361

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing. #IA #AI #Algorithms #Coding

Machine Trading – New Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Live Trading Room & Premarket Reporting:

Main Link and password is emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Next sessions recommence week of Monday June 4, 2018 as coding team is preparing new environment. Applicable members will begin to receive notice as sessions commence.

Premarket report is on a lead trader / trading team availability basis only (the premarket reports are not published every market day).

Real-time Alerts:

Real-time Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Disclaimer / Disclosure:

Every subscriber must read this disclaimer.

Private Discord Server Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription (bundle subscription) as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email us.

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

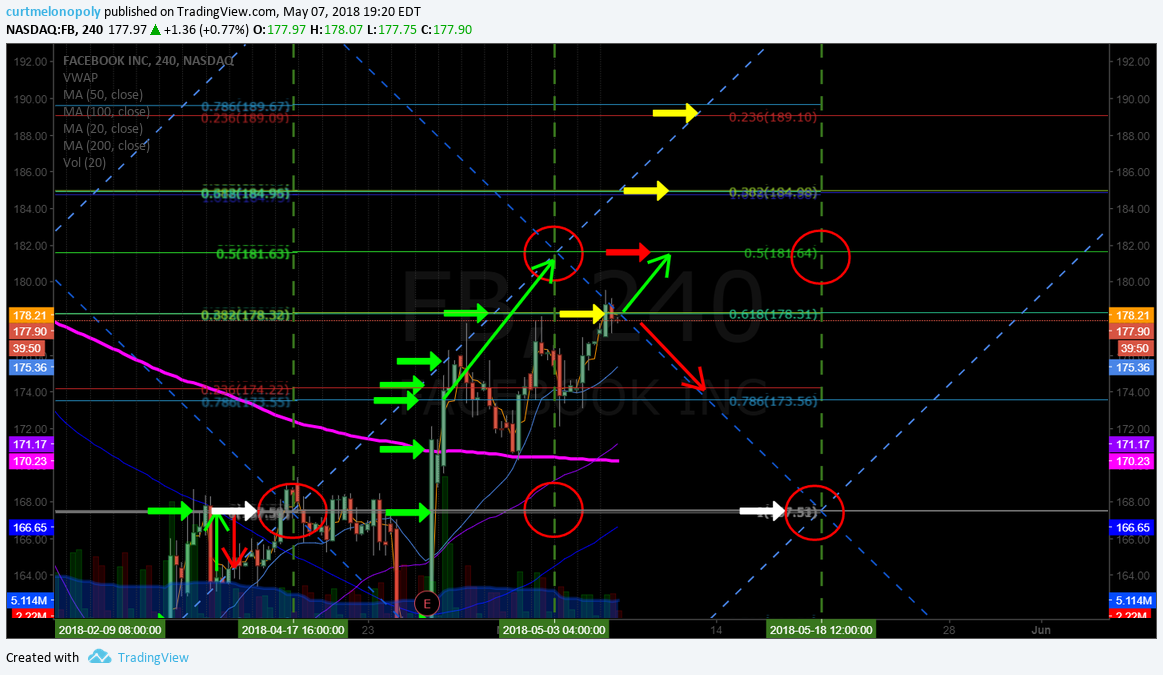

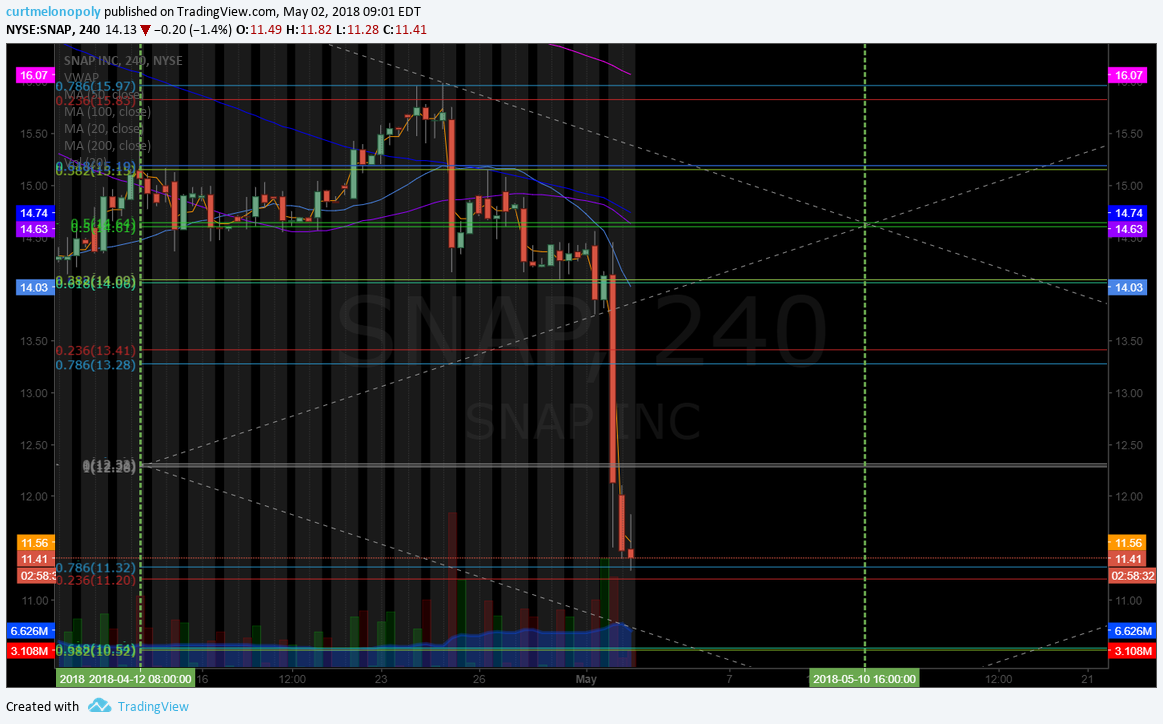

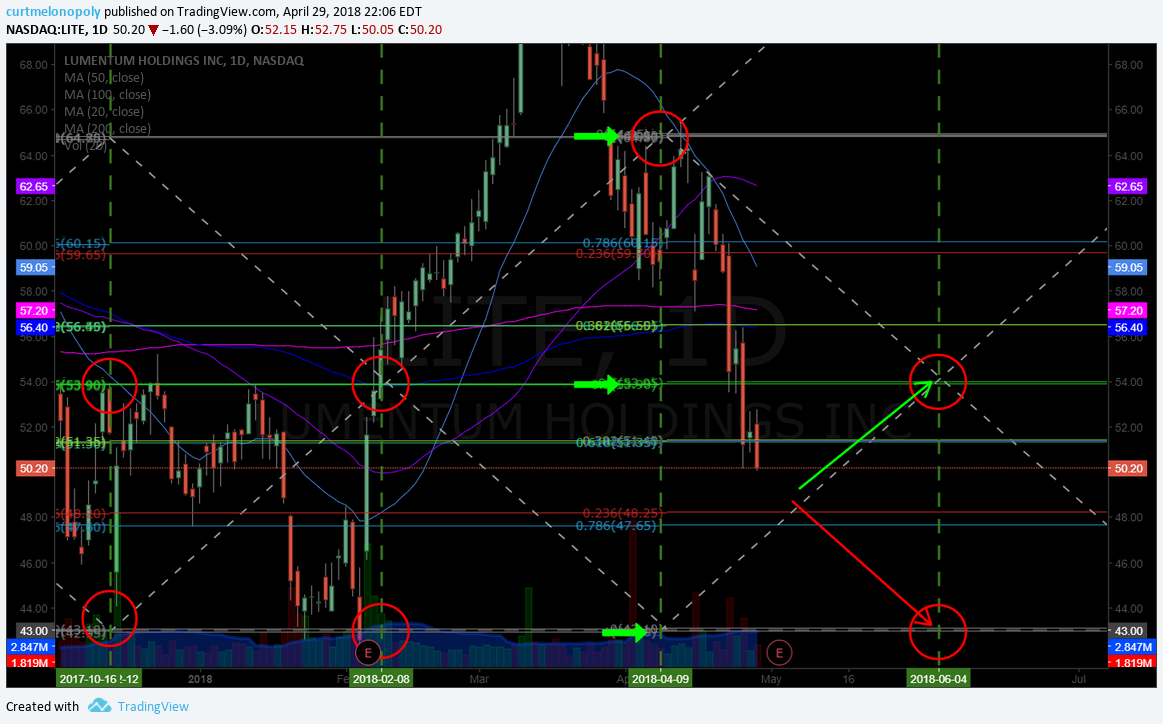

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: CVX, AAPL, JD, MLNX, UL & more –

Stocks making the biggest moves premarket: CVX, AAPL, JD, MLNX, UL & more – https://t.co/z32yFbki4X

— Melonopoly (@curtmelonopoly) June 18, 2018

26 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/11892964 $PTCT $NMM $CBPO $QTNT $VSTM $JD $GERN $CBIO $AMEH $KLIC

26 Stocks Moving In Monday's Pre-Market Session https://t.co/AUwlwGmM0t $PTCT $NMM $CBPO $QTNT $VSTM $JD $GERN $CBIO $AMEH $KLIC

— Benzinga (@Benzinga) June 18, 2018

5 Stocks To Watch For June 18, 2018 https://t.co/erJ0P9Kkh6 $DECK $DRYS $PERY $TDY $TWI

— Benzinga (@Benzinga) June 18, 2018

5 Stocks To Watch For June 18, 2018 https://benzinga.com/z/11891885 $DECK $DRYS $PERY $TDY $TWI

Market Observation:

As of 7:40 AM: US Dollar $DXY trading 94.77, Oil FX $USOIL ($WTI) trading 64.77, Gold $GLD trading 1279.51, Silver $SLV trading 16.54, $SPY 276.57, Bitcoin $BTC.X $BTCUSD $XBTUSD 6422.50 and $VIX trading 13.3.

Momentum Stocks to Watch: $PTCT $CBPO $VSTM $SLDP $NNM $QTNT $EVFM

News:

Google to invest $550 million in Chinese e-commerce giant JD.com

Rent-A-Center to be acquired by Vintage Capital for $15 per share in cash $RCII http://dlvr.it/QXgw95

Recent SEC Filings:

Recent IPO’s:

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://benzinga.com/z/11882630 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

IPO Outlook For The Week: Pharma, Pharma And More Pharma https://t.co/VVKXywrt04 $EIDX $APTX $AVRO $ECOR $EPRT $IIIV $MGTA $XERS $DDOC

— Benzinga (@Benzinga) June 18, 2018

Earnings:

#earnings for the week

$MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS

#earnings for the week $MU $ORCL $FDX $KR $RHT $SGH $BB $WGO $DRI $KMX $AOBC $LZB $BKS $MEI $SECO $ATU $PDCO $BNED $CMC $SOL $SCS $AMS https://t.co/r57QUKKDXL pic.twitter.com/2CbnVqk0BA https://t.co/GIh1lTCH8Q

— Melonopoly (@curtmelonopoly) June 16, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

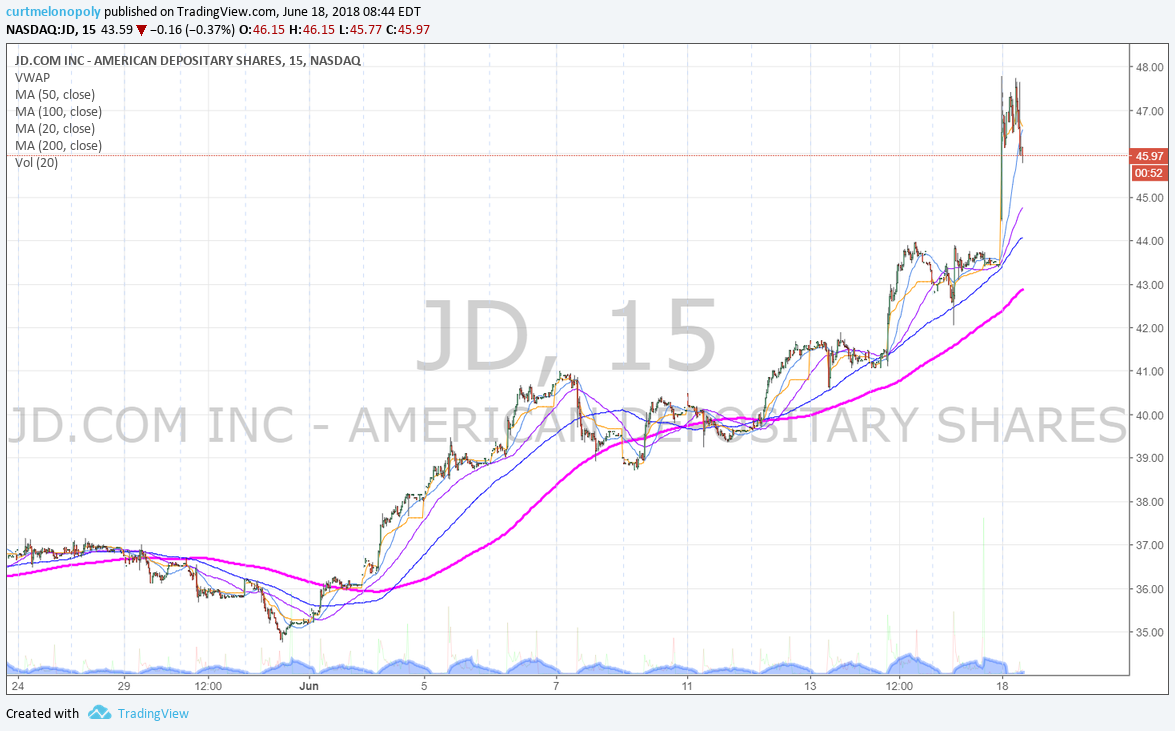

JD.COM (JD) Premarket up 5.46% trading 45.97 on Google investment $JD #premarket #trading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Oil Chart (Weekly). Oil trendlines on weekly time-frame. June 18 146 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Chart (Daily). K.I.S.S. chart MACD still turned down price under 100 MA. June 18 143 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

Oil Algorithm Simple Weekly Gen 1 Model. Trade failing 20 MA and Fibonacci support test. June 18 132 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

Market Outlook, Market News and Social Bits From Around the Internet:

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets.

U.S.-China trade worries take center stage!

Here are the top five things you need to know in financial markets today:

https://www.investing.com/news/economy-news/top-5-things-to-know-in-the-market-on-monday-1496278 …

#stockstowatch #Finance #Traders #StockMarket

U.S.-China trade worries take center stage!

Here are the top five things you need to know in financial markets today:https://t.co/BilhKjvJ1M#stockstowatch #Finance #Traders #StockMarket— Investing.com (@Investingcom) June 18, 2018

Economic Data Scheduled For Monday

Economic Data Scheduled For Monday pic.twitter.com/BJREllpA1j

— Benzinga (@Benzinga) June 18, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PTCT $CBPO $SLDB $RCII $QTNT $VSTM $NMM $EVFM $LYL $IMGN $XSPL $YANG $TVIX $JD $AUPH $GERN $FLT $CFRX $VIPS $GALT $NEW $HTBX $UVXY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $FRAN $ENIA $PTCT $KMI $TNK $FRO $DHT $RBS $CVX $IQV $ADS $GMK $RF $DEI $BLK $PE $CHMI $ADS

Valeant Pharmaceuticals $VRX PT Raised to $32 at Cantor Fitzgerald

$EVFM initiated at OUTPERFORM at Oppenheimer with $9 price target.

$EVOP William Blair initiates coverage on EVO Payments (NASDAQ: EVOP) with a Outperform rating

Oppenheimer Reiterates Outperform on Global Blood Therapeutics $GBT Following HOPE-KIDS Update

GreenSky stock rises after several analysts initiate coverage with bullish ratings

$GRUB GrubHub price target raised to $140 from $110 at Craig-Hallum

Micron Technology $MU PT Raised to $100 at Evercore ISI Ahead of Wednesday’s Print

(6) Recent Downgrades: $DISCA $DIS $GPN $CB $LDOS $RDFN $ZG $HIBB $DNB $HZO $RPD $ABEV $KOF $COUP $INTC $IMMR

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CVX, $AAPL, $JD, $MLNX, $UL, Oil, $DXY