Tag: $TSLA

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Premarket Notes

We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

More swing set-ups / alerts on earnings to continue.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC, DXY and more than we will report on soon.

10:30 am

#EIA Crude Oil Trading Petroleum Inventories – Main Trading Room, I will be in attendance.

2:00 pm

FOMC Announcement

Thanks

Curt

Nice snap back trade $TSLA 4 Hour Chart pic.twitter.com/tkLzzNzUu4

— Melonopoly (@curtmelonopoly) July 31, 2019

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watch List, Stocks, Commodities, Alerts, Trading Room, Bitcoin, FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Swing Trading Strategies (Earnings) Part 4 : Premium | $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. July 31, 2019. …

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO, $AMZN, $GOOGL, $TWTR, $FB, $JBLU, $OAK, $INTC, $SQ, $BOX, $PXD, $TLRY, $EEM, $AGN, $XOP, $MGI, $PLUG, $BTC, $LYFT. $IOTS, $STNE, $TEUM, $AU, $OIH.

Earnings Trade Positions Reporting Special Notes:

July 31 – We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC and more than we will report on soon.

Per recent;

July 22 – Below are some equities in focus this week with earnings, the follow- up reports on deck deal with other earnings focus equities and time cycles for the indices and specific instruments we focus on (GOLD, SILVER, VIX, SPY, OIL, US DOLLAR, BITCOIN).

Per recent;

Over the coming days we will be re-visiting all recent swing trade set-ups, alerts and trades in progress to reconcile the trades in advance of earnings and prepare for the new on other side of each new set up from earnings reports. This will involve a significant number of posts, trade alerts, mid day reviews in the trading room and videos that our members will receive a copy of.

Executing your swing trading strategy with our charting reports and live alerts involves using the key support and resistance areas of the charting, time cycle peaks, trajectory of trade and conventional indicators such as MACD cross-over and Moving Averages.

Alerts are not always issued at each add or trim to positions because that is simply not possible so you do have to manage your trade.

In many instances a clear swing trade strategy is laid out in the newsletter and/or videos so that you can manage the swing trade according to your risk threshold and account size.

If you struggle to establish a trading strategy with the information provided on our reporting, videos and alerts then some trade coaching is recommended to get you started.

Part 4 Earnings Swing Trades:

Why National Oilwell Varco, Trex, and Chegg Jumped Today. $NOV National Oilwell Varco (NYSE: NOV), $TREX Trex (NYSE: TREX), and $CHEGG Chegg (NYSE: CHGG) #swingtrading #earnings #premarket https://finance.yahoo.com/news/why-national-oilwell-varco-trex-202900625.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1156489920032231424

Bigger-than-usual #earnings moves today from $FRAC $MDR $CNX $SLCA $IT $OMF $SSNC $AMKR $TREX $BERY $TBI $RIG $LGND $RNG $NOV $DORM $CVLT $CURO

(link: http://eps.sh/r) eps.sh/r

Bigger-than-usual #earnings moves today from $FRAC $MDR $CNX $SLCA $IT $OMF $SSNC $AMKR $TREX $BERY $TBI $RIG $LGND $RNG $NOV $DORM $CVLT $CURO https://t.co/1pgojKC5HH pic.twitter.com/isSoEbpQxR

— Earnings Whispers (@eWhispers) July 30, 2019

TESLA (TSLA).

Tesla trade alert had a great first day, 234.44 buys and it hit 243.36 high of day price. It is trading 242.18 in premarket as I write. Watching close for possible adds. It is a channel play on the swing trade side but could easily be a daytrader also.

Trade Alert Tuesday Morning 6:42 AM

TESLA (TSLA) Swing Trade Alert – Long starter 234.44, 270.00 price target, channel bounce trade within recent range, add at channel support $TSLA #earnings #swingtrading (link: https://www.tradingview.com/chart/TSLA/cxghrcYk-TESLA-TSLA-Swing-Trade-Alert-Long-starter-234-44-270-00-pri/) tradingview.com/chart/TSLA/cxg…

A German Banking Giant Doubles Down on Tesla Stock, Buys Uber #swingtrading $TSLA (link: https://www.barrons.com/articles/a-german-banking-giant-doubles-down-on-tesla-stock-buys-uber-51564398041) barrons.com/articles/a-ger… via

@BarronsOnline

A German Banking Giant Doubles Down on Tesla Stock, Buys Uber #swingtrading $TSLA https://t.co/1dGT8EcMkH via @BarronsOnline

— Swing Trading (@swingtrading_ct) July 30, 2019

Advanced Micro (AMD)

Trade Alert prior to close Tuesday in advance of earnings was timely considering the price drop after earnings were released;

https://twitter.com/SwingAlerts_CT/status/1156290250257420288

3:47 PM · Jul 30, 2019, ADVANCED MICRO (AMD) hitting highs with earnings on deck, good time to take profit and or close #swingtrade $AMD

And then this;

$AMD pic.twitter.com/DH4g4JUMvl

— Melonopoly (@curtmelonopoly) July 30, 2019

Crude Oil $USO $WTI $CL_F $UWT

When crude oil was trading 57.28 we alerted that 59.80 was in play, hit a high 58.55 yesterday and is still bullish.

Trade Alert, 2:01 PM · Jul 30, 2019, Crude Oil Daily Chart Suggests 59.80 in play, MACD turning up. 159 PM July 30 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Chart (link: https://www.tradingview.com/chart/USOIL/85jzeoEc-Crude-Oil-Daily-Chart-Suggests-59-80-in-play-MACD-turning-up-1/) tradingview.com/chart/USOIL/85…

https://twitter.com/SwingAlerts_CT/status/1156263539394404359

NATIONAL OILWELL VARCO (NOV)

NATIONAL OILWELL VARCO (NOV) Risk reward is high here with a possible channel trade (green). On Watch. $NOV #earnings #swingtrade https://twitter.com/SwingAlerts_CT/status/1156503027882307584

TREX COMPANY (TREX)

TREX COMPANY (TREX) Should easily see upside channel resistance and be a simple channel support trade long thereafter. $TREX #swingtrading #earnings

CHEGG INC (CHEGG)

CHEGG INC (CHEGG) Over 46.55 held this stock sees 52.70s, on watch, trading 45.77 #swingtrading #earnings $CHEGG (link: https://www.tradingview.com/chart/CHGG/nMqLWKYf-CHEGG-INC-CHEGG-Over-46-55-held-this-stock-sees-52-70s-on-wat/) tradingview.com/chart/CHGG/nMq…

https://twitter.com/SwingAlerts_CT/status/1156514261910339584

Below is Part 1, Part 2, Part 3 of the Earnings Season Swing Trade Reporting:

PIONEER NATURAL RESOURCES (PXD)

From the point of original swing trade entry 148.50 (see alert below) PXD then traded up to 157.22 (be sure you take profits on trades the go the right way) and has recently come off and closed trade Friday at 144.29. Earnings are in 23 days.

Your trading strategy (if long) may be to add at one or more of the white arrows and if trade doesn’t hold then close and repeat at the next arrow. Our swing trade strategy at this point would be this method pending price action, watch for alerts.

Which Energy Stocks Missed Oil’s Upside? #swingtrading #energy https://marketrealist.com/2019/07/which-energy-stocks-missed-oils-upside/

PIONEER NATURAL RESOURCES (PXD) three areas of support on 240 min chart for possible bounce (white arrows) Red is trading plan price trajectory. #swingtrading

Per recent;

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

There is a special premium member report for this trade set up here;

Password: timec

TILRAY (TLRY) Nice down trend channel from highs, looking for a bounce and another swing long #swingtrade.

When trade bounces out of the down trend channel below then the other chart models below will assist in your trading strategy for Tilray (TLRY).

U.S. CBD Sales to Grow an Average of 107% Annually Through 2023 https://finance.yahoo.com/news/u-cbd-sales-grow-average-130600799.html?soc_src=social-sh&soc_trk=tw #swingtrading #Cannabidiol #CBD $TLRY $CGC $KR $RAD $WBA $CVS

TLRY Earnings Date

Earnings announcement* for TLRY: Aug 27, 2019

https://www.nasdaq.com/earnings/report/tlry

TILRAY (TLRY) structured trading model for swing trading and day trading (expanded view) $TLRY #swingtrade #charting

TILRAY (TLRY) model with trading boxes, time cycles, algorithmic channel trend lines for swing trading and day trading (maginfied view) $TLRY #swingtrade #charting

Per recent;

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TSLA Earnings Date

Earnings announcement* for TSLA: Aug 07, 2019

Tesla, Inc. is estimated to report earnings on 08/07/2019. The upcoming earnings date is derived from an algorithm based on a company’s historical reporting dates.Our vendor, Zacks Investment Research, might revise this date in the future, once the company announces the actual earnings date. According to Zacks Investment Research, based on 4 analysts’ forecasts, the consensus EPS forecast for the quarter is $-1.55. The reported EPS for the same quarter last year was $-4.22.

Tesla is preparing to expand production at its electric-car factory in Fremont, California, according to an internal email #swingtrading $TSLA #earnings https://www.bloomberg.com/news/articles/2019-07-10/tesla-tells-staff-it-s-preparing-to-lift-output-at-fremont-plant

Tesla’s Leaked Email Is a Nightmare for Bears and Other Automakers #swingtrading $TSLA #earnings https://twitter.com/swingtrading_ct/status/1150558365703180288 https://marketrealist.com/2019/07/teslas-leaked-email-is-a-nightmare-for-bears-and-other-automakers/

TESLA (TSLA) Support and resistance areas are clearly marked (white arrows), long or short above or below trim at various res sup areas $TSLA #earnings #swingtrading

The trading strategy for swing trades in TESLA can be really simple.

The best way to swing trade TESLA is using the white arrows on the chart (these are primary support and resistance areas on the chart). When price breaches up through an arrow go long and the opposite for short. Set a stop that you are comfortable with in accordance to your risk threshold. If the trade goes your way simply trim profit at the fine detailed support and resistance areas on the chart.

If you are a more active swing trader then you can obviously look at each area of support and resistance for various sizing opportunities.

Alternatively to the above arrow trading strategy, you can also wait for a pull back to a key support or resistance and then enter (vs the brak out above or below key resistance).

The TESLA chart offers on of the best trading ranges and the key support and resistance areas work well. We have done well on numerous occasions swing trading TESLA. The most recent short wasn’t the best of the trades but focusing on the range of the trade, the general trend and the key support and resistance noted on this chart model provides for a really opportune swing trading environment given the range.

Per recent;

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

July 14 – The trading plan and price action has no significant change to the below.

Per recent;

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

This swing trade obviously went exceptionally well with Allergan (AGN). See screen image capture below of swing trade alert feed.

ALLERGAN (AGN) Up 36% premarket trading 168.00 from 116.00 buy alert, hitting all upside targets at key resistance, trim profits $AGN #swingtrade #alert

Allergan acquisition is ‘a major bailout’ for shareholders, according to analysts https://on.mktw.net/2X68Rqb

AGN Earnings Date

Earnings announcement* for AGN: Jul 25, 2019

Allergan plc. is estimated to report earnings on 07/25/2019. The upcoming earnings date is derived from an algorithm based on a company’s historical reporting dates.Our vendor, Zacks Investment Research, might revise this date in the future, once the company announces the actual earnings date. According to Zacks Investment Research, based on 11 analysts’ forecasts, the consensus EPS forecast for the quarter is $4.28. The reported EPS for the same quarter last year was $4.42.

ALLERGAN (AGN) Based on my best guess considering historical price action, going forward the yellow lines provide the upper and lower price range $AGN #swingtrade

Per recent;

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

What To Expect From AMD Earnings #swingtrading $AMD #earnings https://www.investopedia.com/what-to-expect-from-amd-earnings-4692801?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

How AMD Is Positioned in the US-China Trade War https://marketrealist.com/2019/06/how-amd-is-positioned-in-the-us-china-trade-war/

ADVANCED MICRO (AMD) this has been a great channel trade, however, with earnings in 12 days we will exit and continue after in channel #swingtrade $AMD #earnings

There have been a number of entries on this swing trade in the channel (see alerts feed for details) and the trade has gone extremely well. However, with earnings near we will be watching for continued swing trade through the channel support (long) and resistance (short).

Per recent;

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

INTC Earnings Date

Earnings announcement* for INTC: Jul 25, 2019

Intel Corporation is expected* to report earnings on 07/25/2019 after market close. The report will be for the fiscal Quarter ending Jun 2019. According to Zacks Investment Research, based on 15 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.88. The reported EPS for the same quarter last year was $1.04.

Tech earnings are a test amid tumultuous times, and all the chips are on the table #swingtrading #earnings $INTC $SPX, $ GOOGL, $FB, $MU, $DELL, $HPE, $NTAP, $AVGO, $MSFT https://on.mktw.net/2jUGA3u

INTEL CORP (INTC) from June 14 alert this swing trade set up has done well, time to exit before earnings and return thereafter #swingtrade $INTC #earnings

Per recent;

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

July 14 – No considerable change, see previous posts below.

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

July 14 – No considerable change, see previous posts below.

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per last report with video explaining trade set up, I am watching this at trading box support for a possible turn up, my bias is up but it hasn’t go moving yet so it remains on watch only.

3 Wild Card Stocks to Buy Now for Long-Term Gains https://finance.yahoo.com/news/3-wild-card-stocks-buy-160344516.html?soc_src=social-sh&soc_trk=tw

Per recent;

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

The stocks listed below (and others on various other reports and alerts) will be reported on in swing trade reports over the next number of days. All stocks that we have alerted and or have trade positions and / or expect to have trade positions will be covered in the near term reports.

Part 2: Swing Trading Earnings July 17, 2019.

In case you missed my ramblins’:

Mornin’ traders #premarket thoughts, HUGE time cycle next #itisdifferentthistime #timecycles Going to be a massive two cycle ride to Dec 2019 starts soon. $VIX $SPY $GLD $SLV $BTC $CL_F $USO $DXY I knew then, I know now. This one goes down in history. Watch the reports on deck.

Mornin' traders #premarket thoughts, HUGE time cycle next #itisdifferentthistime #timecycles Going to be a massive two cycle ride to Dec 2019 starts soon. $VIX $SPY $GLD $SLV $BTC $CL_F $USO $DXY I knew then, I know now. This one goes down in history. Watch the reports on deck. pic.twitter.com/GmI7kLiuYp

— Melonopoly (@curtmelonopoly) July 16, 2019

$GOOGL topped out in high 12s and we didn’t go back, and won’t except to short it when time is right #timecycles #premarket

$GOOGL topped out in high 12s and we didn't go back, and won't except to short it when time is right #timecycles #premarket pic.twitter.com/uzAvqCXE8d

— Melonopoly (@curtmelonopoly) July 16, 2019

Members: Do not miss this report, looking back on 2019 two of my largest size trades will be in to and out of the two time cycle peaks coming in Volatility. There is no more structured time cycles in global markets than the volatility trade.

Members: Do not miss this report, looking back on 2019 two of my largest size trades will be in to and out of the two time cycle peaks coming in Volatility. There is no more structured time cycles in global markets than the volatility trade. https://t.co/66swXxmkji

— Melonopoly (@curtmelonopoly) July 15, 2019

Are we running everything yet? So, so close. You can almost hear it. Man we’re close. Gotta run the CentralZuck coin too, add that in there.

run baby run https://t.co/FAyvroFKyn

— Melonopoly (@curtmelonopoly) July 10, 2019

Our focus #timecycles and how they fit with #Powell #Trump war plan. It’s been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

Our focus #timecycles and how they fit with #Powell #Trump war plan. It's been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

— Melonopoly (@curtmelonopoly) July 10, 2019

Okay, now that we got that out of the way…

FACEBOOK (FB) VS AMAZON (AMZN)

I don’t like the idea of long trades with $GOOGL, $FB, $AMZN or $TWTR (least of the concern is Twitter). At issue, they’re going to get wacked. When? No idea. My guess, generally speaking the time frame around earnings – ish will be a tough ride for longs in $GOOGL and $FB but that is yet to be seen. $AMZN likely comes off around earnings because it will likely be sell the news. But $GOOGL and $FB more so that I think Trump and friends are likely to wack them around earnings.

I could be wrong, but hey, lets get you ready both ways so if you’re trading long or short you know your chart levels for your trading strategy.

First FACEBOOK (FB) and then in tonight’s report I will cover AMAZON (AMZN) and many other;

“To set the stage, the following chart shows how the two stocks have performed over the last five years. Amazon is the clear winner, outperforming Facebook by more than 2-to-1,”

Better Buy: Amazon vs. Facebook @themotleyfool #stocks $AMZN $FB https://www.fool.com/investing/2019/07/13/better-buy-amazon-vs-facebook.aspx

UPDATE 1-France says Facebook’s Libra not yet viable as G7 minister meet #swingtrading $FB #Libra https://finance.yahoo.com/news/1-france-says-facebooks-libra-111732518.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

FB Earnings Date

Earnings announcement* for FB: Jul 24, 2019

Facebook, Inc. is expected* to report earnings on 07/24/2019 after market close. The report will be for the fiscal Quarter ending Jun 2019. According to Zacks Investment Research, based on 13 analysts’ forecasts, the consensus EPS forecast for the quarter is $1.9. The reported EPS for the same quarter last year was $1.74.

FACEBOOK (FB) trades in channels (yellow examples) with decisions around time cycles (green vertical) $FB #swingtrade #earnings #strategy

We have always done well trading Facebook because it is one of the most structured equities on the markets. Trade channels (yellow examples shown) and check the price action relative to the channel at the key time cycles (vertical green). Yes, it is that easy.

You can also consider the trading boxes (orange) – they provide a range, moving averages (not so much imo) and horizontal Fibonacci lines in the chart model below. The green and gray horizontal are key pivots. The diagonal Fibonacci trend lines (blue dotted) provide the framework for possible channels.

It doesn’t surprise me the upcoming time cycle peak in to July 22 is around FB earnings scheduled for July 24, 2019. If price spikes above current channel my advice is to be very cautious with long entries up and above the channel.

Anytime you are trading with a structured algorithmic chart model and trade leaves the structure you can be sure its divergent and very likely to correct back in to its natural structure.

Your best trading strategy for Facebook earnings?

Don’t rush, don’t hold in to earnings, there is no need. And don’t rush when its in its new channel whether up or down. Let the channel establish itself and then simply starting adding in to the trend within the channel according to direction. That’s it. That strategy will return excellent ROI, you will beat the market many times over because Facebook is that good of a trading vehicle.

Let me know how you do please.

Per recent;

June 24, 2019 – Review video for trading strategy in detail.

We will get in to Amazon and many of the others when I return to this reporting tonight (last night we got side tracked so we will resume this evening). For now, the chart below.

Part 3: Swing Trading Earnings July 22, 2019.

AMAZON (AMZN).

AMAZON (AMZN) should become a trajectory trade after earnings in to price target options show, Trade the trajectory. $AMZN #earnings #swingtrade

Per the previous post below, watch the top of the trading box resistance area on the chart just over 2100.00. As I noted prior, I am bearish Amazon but I can’t say when I think it will lose steam, I think its a geo political signalling event that could also have signals with earnings coming in short of expectations over the next number of quarters. But the timing is going to be the issue. For now, the top of the trading box is considerable resistance.

After earnings simply trade in the direction of the trajectory (see arrows on chart pointing toward price targets for April 2020). And then when the geo political issues start to ramp up and price responds then it is time to short this stock.

The upbeat picture painted by this past week’s blowout bank earnings heralded a promising earnings season. Too bad other industries didn’t get the memo https://www.bloomberg.com/news/articles/2019-07-21/from-tesla-to-twitter-a-guide-to-this-week-s-quarterly-reports

From Tesla to Twitter, a Guide to This Week’s Quarterly Reports https://t.co/h2yc2YwlYg

— Swing Trading (@swingtrading_ct) July 21, 2019

Per recent;

AMAZON (AMZN) Weekly structure on chart says there is big resistance coming at top of trading box $AMZN #swingtrading #earnings

ALPHABET (GOOGL).

Google ( GOOGL ) as with AMAZON is a price trajectory trade to price target after earnings report this week #swingtrading $GOOGL #earnings

As with Amazon, I think Google is going to be considerably challenged by the US government and other governments around the world. At this point I think Amazon is at most risk, with Google next, then Facebook and then Twitter. Twitter and Square may fair well, but Amazon I see at very high risk and Google at high risk. Google as with Amazon will be very good short positions when the time is right.

OK Google, tell us why your earnings growth is slowing down … hello? Anyone there? #swingtrading $GOOGL #earnings https://on.mktw.net/2XQsRgU

TWITTER (TWTR)

TWITTER (TWTR) will also likely become a trajectory trade. Trading in trading box now, on watch other side of earnings. $TWTR #swingtrading #earnings.

The Twitter chart structure is not nearly as good as Google, Facebook and Amazon but it may be less affected by the coming government anti-trust challenge I believe is on the horizon. Twitter is on watch for after earnings this week.

JETBLUE (JBLU).

JETBLUE (JBLU) Good price action post earnings suggests 22.00 then a move to 27.00 possible therafter. #swingtrading $JBLU #earnings

Is JetBlue Airways (JBLU) Stock Undervalued Right Now? #swingtrading $JBLU #earnings https://finance.yahoo.com/news/jetblue-airways-jblu-stock-undervalued-131001127.html?soc_src=social-sh&soc_trk=tw

OAKTREE (OAK).

OAKTREE (OAK) Hit primary price target from last reporting on this, now looking to 55’s earnings $OAK #swingtrade #earnings

Zacks.com featured highlights include: Guess?, Denny’s, FTI Consulting, Oaktree Capital… #swingtrading $OAK #earnings https://finance.yahoo.com/news/zacks-com-featured-highlights-guess-140102104.html?soc_src=social-sh&soc_trk=tw

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per June 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, Earnings, $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO, $AMZN, $GOOGL, $TWTR, $FB, $JBLU, $OAK, $PXD, $TLRY, $EEM, $AGN, $INTC, $XOP, $MGI, $BOX

Swing Trading Strategies, Charts, Alerts w/ Video | Premium $PXD $TLRY $TSLA $EEM $AGN $AMD $INTC $XOP $MGI $BOX $FB $PLUG $BTC $LYFT $IOTS $SQ $STNE $TEUM $AU …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. June 24, 2019.

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $TEUM, $AU, $OIH.

Live Trading Room Swing Trade Video Review From June 20, 2019 2:22 PM.

All the swing trading alerts, strategies, charts and various set-ups are reviewed in detail on the video below from the live trading room.

Crude Oil (USOIL WTI)

Near resistance (as of time of video) 57.66 uptrending trend-line above, updated signals and charting in the most recent oil report distributed to members.

PIONEER NATURAL RESOURCES (PXD)

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

FACEBOOK (FB)

June 24, 2019 – Review video for trading strategy in detail.

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per une 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, $PXD, $TLRY, $TSLA, $EEM, $AGN, $AMD, $INTC, $XOP, $MGI, $BOX, $FB, $PLUG, $BTC, $LYFT. $IOTS, $SQ, $STNE, $AU. $OIH, $WTI, $USOIL #Oil

Swing Trade Strategies, Set-Ups, Alerts, Current Trades, Earnings | GOOGL, AMD, BABA, AAPL, NFLX, TSLA, BTC, Oil, NBEV, GOLD, ARWR …

Swing Trading Premium Report: Strategies, Set-Ups, Alerts, Current Trades April 22, 2019.

Covered in this Report: Protected: Stock Swing Trades On-Watch, Trade Alerts & Current Trades | GOOGL, AMD, BABA, TSLA, AAPL, NFLX, BTC, NBEV, TERP, SQ, APC, GOLD, Oil, XOM, ARWR and more. .

We expect this earnings season to be very busy both on the alert / trading side and the reporting side of our platform. Most of the set-ups below deal with a clean-up of existing swing trades or recent trades in advance of the busy earnings season.

The newer set ups will start to come out in force as earnings are released. We expect it to be one of our busiest earnings seasons to date.

If there is no April 22 update for any specific stock listed below that signals that our position is the same as the April 9 reporting notes you will see as you read the report.

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this report. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Crude Oil (FX USOIL WTI, $CL_F, $WTI) –

April 22 – Below is the swing trade alert for crude oil to start the week from Sunday night futures that moved so quick it ended up being an intra-day trade but may yet return to a swing trade.

Crude oil trade alerts start week off right Long 64.60s .70s to 65.50s $CL_F $USOIL $WTI $USO $UWT $DWT #OilTradeAlerts #OOTT https://twitter.com/curtmelonopoly/status/1120167333862019073

Bitcoin (BTC) –

April 22 – Bitcoin is trading 5282.80 intra-day, up from our entries starting at 3449.50. Holding for now and will likely start charting in more detail as it develops structure and alerting positioning more frequently. For now watching the structure assemble per below (previous report).

April 9, 2019 –

The Jan 30, 2019 trade alert for Bitcoin is now proving out well…

Starting a swing trade BTC Bitcoin on XBTUSD long 3449.50 price target 4200.00. 20% sizing. When it confirms will add to 100% – see Bitcoin report due soon. #swingtrading $BTC $XBTUSD

At this point I am watching and holding only. Will re-assess as trade develops and advise.

Bitcoin trade going well, trade is nearing key resistance soon, if trade gets above the red TL then I will send new charting out.

New Age Beverages (NBEV)

April 22 – At this point I’m not as excited about this swing trade in $NBEV. I may close the position soon. The chart structure is not acting as well as I had hoped. It closed 5.27 on Friday and my starter positioning was 5.40s – .60s.

New Age Beverage Corporation (NBEV) Gains As Market Dips: What You Should Know #swingtrading $NBEV https://finance.yahoo.com/news/age-beverage-corporation-nbev-gains-214509793.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

New Age Beverage Corporation (NBEV) Gains As Market Dips: What You Should Know #swingtrading $NBEV https://t.co/wtO2LCSg0d via @YahooFinance

— Swing Trading (@swingtrading_ct) April 22, 2019

April 9, 2019 – NBEV trade is going well, will watch for more entry adds along way to target.

April 8, 2019 trade alert: Swing started 1/10 $NBEV 5.44 – 5.60 refer to previous charting for targets

Nice trade in $NBEV so far, it closed 6.63 with our entries 5.44 – 6.60 in premarket today. Expecting this one to be a big win. #swingtrading (typo in alert). pic.twitter.com/pt76v5WxwK

— Melonopoly (@curtmelonopoly) April 8, 2019

NBEV swing trade alert doing very well so far.

SQUARE (SQ) –

April 22 – Square closed 70.74 Friday, I am looking at an add to this position (longer term swing than most I alert). There is decent support for a range nearing 70.00. Square reports earnings in ten days and I will hold through earnings.

Can Square (SQ) Keep the Earnings Surprise Streak Alive? #swingtrading $SQ #earnings https://finance.yahoo.com/news/square-sq-keep-earnings-surprise-141002545.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

April 9, 2019 –

April 3 trade alert Long $SQ 76.01 1/5 sizing with 87.80 PT in to 6 month duration if needed. Details in swing report due out tonight. #swingtrading $SQ.

At this point I am watching. When the trade needs to be managed I will send out the alerts and provide updated charting.

Anadarko Petroleum (APC) –

April 22 – Anadarko was a great swing trade with the buy out. It certainly transpired faster than expected. We closed the trade at 60.61 from a 47.19 entry long. It closed 64.14 on Friday and looks like it will easily get to our original price target in the 76s. I am not considering an immediate position but with earnings coming up in ten days I am watching very close.

https://twitter.com/SwingAlerts_CT/status/1116665023374471168

ANADARKO PETROLEUM CORP (APC) swing trade went well, 47.19 – 60.61 fast. #swingtrading $APC #premarket pic.twitter.com/c2ErBludWG

— Melonopoly (@curtmelonopoly) April 12, 2019

Chevron Is Getting a Hidden Gem in the Anadarko Deal #swingtrading $APC https://finance.yahoo.com/news/chevron-getting-hidden-gem-anadarko-211700433.html?soc_src=social-sh&soc_trk=tw

April 9, 2019 Swing Trade Alert:

ANADARKO PETROLEUM CORP (APC) Has 20 MA now on weekly I will be long starter in premarket 47.19 range #swingtrading $APC

Per March 5 Report “this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target”.

ALSO, the is a link to a special report below (at bottom of this post) that explains exactly how to trade Anadarko Petroleum.

ANADARKO PETROLEUM CORP (APC) MACD turning up on Weekly Chart, should be ready to go soon. #swingtrade $APC

TerraForm (TERP) –

April 22 – TerraForm closed 13.50 on Friday, watching earnings in ten days for a possible entry long for the swing trade set-up.

April 9, 2019 –

TERRAFORM POWER (TERP) Swing trading set up doing well, considering a position soon. #swingtrading $TERP #earnings

Per March 5 report “trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year”.

THERE IS ALSO A LINK TO A SPECIAL REPORT BELOW FOR TERP AT BOTTOM OF THIS POST.

TerraForm Power Caps a Transformational Year With Solid Q4 Results #swingtrading $TERP https://finance.yahoo.com/news/terraform-power-caps-transformational-solid-173600840.html?soc_src=social-sh&soc_trk=tw

TERRAFORM POWER (TERP) This is about to test 200 MA on Weekly Chart, you will want to watch close now. #swingtrade $TERP

Home Depot (HD) –

April 22 – Home Depot closed 205.40 Friday and is right at range resistance. Above this area it could run but I am not chasing it, HD reports earnings in 29 days and I’ll be watching price action in to earnings for possible set up.

April 9 –

HOME DEPOT (HD) great swing trade if you took it, I didn’t get an entry, too extended now #earnings $HD #premarket

Per March 5 Report, “240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video”.

Home Depot’s Solid 2018 in 3 Charts https://finance.yahoo.com/news/home-depot-solid-2018-3-210500199.html?soc_src=social-sh&soc_trk=tw #swingtrading $HD

HOME DEPOT (HD) holding top of trading box with indicators turning up, looking for a pop here $HD #swingtrading

Gold (XAUUSD, GLD, GC_F) –

April 22 – At time of writing Gold is trading 1278.10 so we are on the right side of the trade. It is however a slow mover. Anyway, just watching for now.

April 9, 2019

GOLD remains in its structure, still short $XAUUSD #Gold $GLD $GC_F

From Feb 18 2019:

GOLD Swing Trade Chart Adds Short from 1319.78 20%, add 1350.14 10%, 1378.00 10%, 1484.63 60%. Price Target 1119.23 $XAUUSD $GC_F #Gold #SwingTrade

Per March 5 report, “Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far”.

GOLD remains in structure on monthly chart. Watching. $GC_F $XAUUSD $GLD

EXXON (XOM) –

April 22 – XOM is trading 81.50 in premarket, the set up for this swing trade is so structured (very clear support and resistance) that there is no need for me to alert this trade in more detail until there is significant change. The trajectory to the price target is near perfect at this point. Really good swing trade.

April 9, 2019 –

EXXON (XOM) nearing price target for swing trade, take profits in to 85s add above 85.69 $XOM #swingtrading #earnings #energy

Per March 5 report, “this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM)”.

EXXON (XOM) This swing trade just keeps giving $XOM #swingtrade #energy

I will be trimming this position in to the red trading box (underside) resistance tomorrow and considering re-entering above the blue line when price is in trading box.

Nike (NKE) –

April 22 – NIKE swing trade set up just keeps moving in a bullish structure trading 89.10 in premarket with the next significant resistance in the 93.31 area of the chart. I’m out per previous alerts but I am starting to think I may re-enter. On Watch.

Is Nike Stock A Buy Right Now? Here’s What Earnings, Charts Show https://www.investors.com/research/nike-stock-buy-now/ #swingtrading $NKE

April 9 –

Per March 19 swing trade alert we closed position long in NIKE;

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

https://twitter.com/SwingAlerts_CT/status/1107841552351678464

NIKE (NKE) this trade went well and did in fact break down after we alerted to close for profit #swingtrading $NKE

Per March 5 Report, “this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight”.

Breaking Down Nike’s Q3 Earnings Outlook Ahead of March Madness https://finance.yahoo.com/news/breaking-down-nikes-q3-earnings-192407481.html?soc_src=social-sh&soc_trk=tw #swingtrading $NKE #earnings

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

Alphabet / Google (GOOGL) –

April 22 – Alphabet reports earnings in seven days, trading 1241.10 up from 1135.56 entry now seems like a good time to close in advance of earnings, will watch earnings price action for other positions near term. $GOOGL

Will Alphabet Earnings Beat Expectations Again? #swingtrading $GOOGL #earnings https://finance.yahoo.com/news/alphabet-earnings-beat-expectations-again-203000924.html?soc_src=social-sh&soc_trk=tw

Swing trade in Alphabet (GOOGL) went well, closed 1241.10 up from 1135.56 entry. #swingtrading $GOOGL

April 9, 2019

The one highest price target from the original alert Feb 13, 2019 has not been met, but the rest have, caution forward.

Feb 13 swing trade alert “Google ( GOOGL ) swing long starter 1135.56 PT 1158 1210 1266 1319. Will add as trade improves. #swingtrading $GOOGL”

Google ( GOOGL ) swing trade went well with most price targets met, profits should be considered, adds over 1225.00 possible #swingtrading $GOOGL

Per March 5 Report, “algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video”.

Tech giants will have to be regulated in future – EU’s Timmermans https://finance.yahoo.com/news/tech-giants-regulated-future-eus-145838975.html?soc_src=social-sh&soc_trk=tw #swingtrading $GOOGL

Google (GOOGL) Exceptional trajectory (upper scenario) on this swing trade, no reason to liquidate any time soon. $GOOGL

This is another fantastic swing trade. If anything just remember to take profit along the way.

Advanced Micro (AMD) –

April 22 – ADVANCED MICRO (AMD) has not regained momo since alert went out to trim in to 30..00, watching #swingtrade #earnings $AMD

We are not holding any shares at this point and with earnings coming up in a week I will only watch at this point. I’ll watch post earnings price action closely for another position.

April 3 this alert went out: Trim $AMD in to 30.00 add above #swingtrading $AMD https://twitter.com/SwingAlerts_CT/status/1113469559229558790

5 Semiconductor Stocks to Buy for a Spring Charge #swingtrading $AMD $NXPI $MU $INTC $QCOM https://finance.yahoo.com/news/5-semiconductor-stocks-buy-spring-152914795.html?soc_src=social-sh&soc_trk=tw

April 9, 2019;

This trade keeps giving, the most recent trade alert for AMD is going well along with trim alerts to position etc.

At this point adds at each pull back make sense on the way to upper target.

Long $AMD 27.99 for 33.66 target 1/3 size add above 30.19. #swingtrading $AMD https://www.tradingview.com/chart/AMD/bUazvZHj-Long-AMD-27-99-for-33-66-target-1-3-size-add-above-30-19-swin/ …

ADVANCED MICRO (AMD) This swing trade keeps giving. Nice chart structure now. #swingtrading #traadealerts

Per March 5 Report, “when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019”.

AI Stocks to Watch, Including One Under-The-Radar Gem https://finance.yahoo.com/news/ai-stocks-watch-including-one-120000581.html?soc_src=social-sh&soc_trk=tw Gopher Protocol Inc. (GOPH), Five9, Inc. (FIVN), Fortinet, Inc. (FTNT), Advanced Micro Systems (AMD), and Tesla, Inc. (TSLA) #swingtrading #AI

ADVANCED MICRO (AMD) does have symmetry in price targets hit with a channel, upper target may hit #swingtrade $AMD

I don’t like the way this stock trades, however, it has held the channel structure and the price targets are hitting on the model. The upper price target on the chart below could be in play.

Twitter (TWTR) –

April 22 – Twitter trading 34.72 with earnings around the corner leaves me in a watch and see pattern. Not an easy stock to trade. But lets see how earnings price action looks.

Twitter’s Q1 Report Could Show Growth Amid Ongoing Transparency Effort #swingtrading $TWTR #earnings https://invst.ly/aldjw

April 9, 2019 –

As of now I am not looking at trading Twitter, I may revisit on the next round.

Per March 5 Report, “didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review”.

TWITTER (TWTR) continues to struggle in the cluster of support and resistance areas, no trade for me. #swingtrade $TWTR

Facebook (FB) –

April 22 – Facebook reports earnings in two days, I will wait for price action post earnings. We have always done well swing trading Facebook and the model we use is quite predictable, so I expect a position after they report.

Investors Shouldn’t Get Their Hopes Up When Facebook Reports Earnings #swingtrading $FB #earnings https://finance.yahoo.com/news/investors-shouldn-apos-t-hopes-130900069.html?soc_src=social-sh&soc_trk=tw

April 9, 2019 –

Same as Twitter, I am not considering a trade in Facebook but may do so on the next reporting round.

Per March 5 Report, “the model has done really well, we will be updating the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past”.

For now I will leave this one alone considering the mosque attacks. A structured trade just isn’t possible at this point, I will re-look at it the near future.

BP –

April 22 – BP reports in eight days. Will watch price action post earnings for possible position.

April 9, 2019 –

At this point I am not looking at trading BP but I will revisit it on the next report. If you took the original alert it has done moderately well.

Per March 5 Report, “bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best”.

BP I didn’t execute on this but it does look like a decent trade setting up. #swingtrading $BP #chart

FireEye (FEYE) –

April 9, 2019 –

FIREEYE (FEYE) has gone flat and until there is some sense of direction it is on watch #swingtrade $FEYE

Per March 5 Report, “tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it”.

FIREEYE (FEYE) Fireeye stuck in a range, watching for now. #swingtrade $FEYE

Arrowhead Pharma ARWR –

April 22 – Trading 18.17 with earnings in eighteen days there is no reason to add to this swing at this time. If it comes off enough prior to earnings I may add, otherwise I will continue to look for adds to the position on the other side of earnings near the support line on the chart below.

Arrowhead Pharmaceuticals Receives FDA Clearance to Begin Phase 2/3 Study of ARO-AAT for Treatmen… #swingtrading $ARWR https://finance.yahoo.com/news/arrowhead-pharmaceuticals-receives-fda-clearance-113000589.html?soc_src=social-sh&soc_trk=tw

April 9, 2019 –

ARROWHEAD PHARMA (ARWR) has been a great trade and we’re holding in the trajectory for now $ARWR #swingtrading

Per March 5 Report, “This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video”.

ARROWHEAD PHARMA (ARWR) Looking for top of trading box resistance to break for a move to next, great swing trade. $ARWR

TESLA (TSLA) –

April 22 – Trading 266.60 with earnings in two days has not completed the downside price target objectives I called some time back. I am eager to go long because I think the Tesla stock will get a good bounce other side of earnings, however, discipline is key so I will await price action post earnings and advise.

Tesla earnings: The big question is how big is the quarterly loss #swingtrading $TSLA #earnings https://on.mktw.net/2VPMG2N

April 9 – TESLA (TSLA) Although I was right about the down trend next and it is near a buy zone I am just watching for now $TSLA #daytrading #swingtrading

Per March 5 Report, “I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video”.

TESLA (TSLA) hasn’t hit my 231.00 price target yet but it has come off really hard so far. $TSLA #stock

Alibaba (BABA) –

April 22 – Trading 186.94 with top of trading box on chart 194s and earnings in 23 days it seems time to trim is prudent.

Alibaba Stock Has Several Catalysts to Drive Its Growth Story Further #swingtrading $BABA #earnings https://finance.yahoo.com/news/alibaba-stock-several-catalysts-drive-141032429.html?soc_src=social-sh&soc_trk=tw

April 9 – ALIBABA (BABA) Nearing resistance in to 194s, trims or profit taking should be considered soon. $BABA #swingtrade #tradealert

Per recent;

The bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

ALIBABA (BABA) This couldn’t be a better swing trade, hasn’t hit 206.00 price target yet but it is in play $BABA #swingtrade

Microsoft (MSFT) –

April 22 – With earnings in two days I will re look at the chart structure post earnings.

April 9, 2019 – I didn’t take the trade and am not looking at a trade in MSFT this round. Will revisit the charting next cycle.

Per March 5 Report, “per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch”.

This stock has done really well, but I missed taking the trade, so I won’t review the chart at this time.

Eagle Materials (EXP) –

April 22 – Trading 89.90 near key resistance with earnings in 3 weeks I will watch price action post earnings.

April 9, 2019 – Here also I didn’t take the trade and am not looking at a trade in EXP this round. Will revisit the charting next cycle.

Per March 5 Report, “was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

I missed my execution on this one so I won’t review the chart set-up at this time.

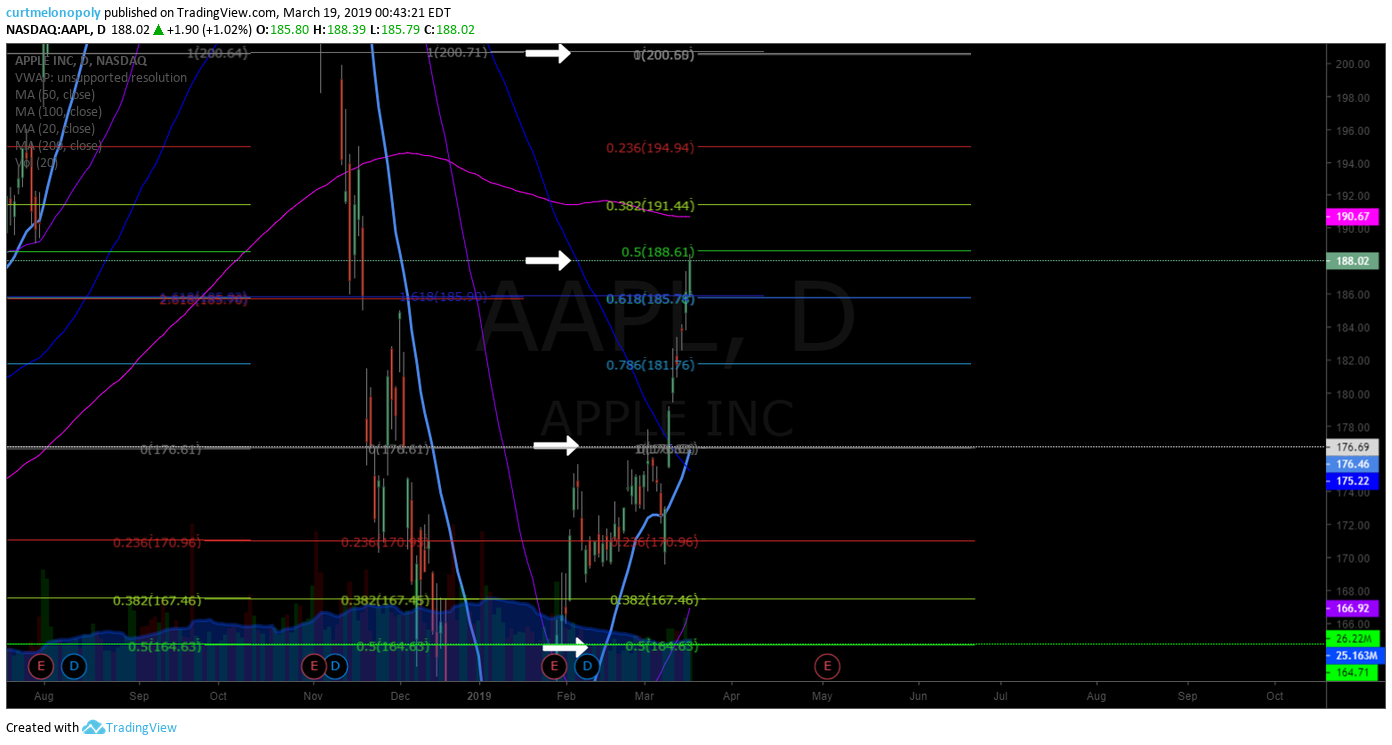

APPLE (AAPL) –

April 22 – I’m not really excited about Apple’s stock at this point, however, I will watch price action very close post earnings for a possible short term swing trade considering how structured this simple model has been to price movement.

APPLE (AAPL) Reports earnings in eight days, key signals are noted on the chart. $AAPL #swingtrading #earnings

April 9, 2019 –

APPLE (AAPL) If you’re long on this multi leg swing now is the time to trim in to resistance and add above $AAPL #swingtrading

Per March 5 Report, “direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video”.

APPLE (AAPL) The gift that keeps giving, take profit at each gray and green and add above. Simple. $AAPL #swingtrading

Allergan (AGN) –

April 9, 2019 – only watching AGN at this point.

Per March 5 Report, “has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now”.

ALLERGAN (AGN) Bounce off key support after sell-off, working its way up channel. $AGN #swingtrade #chart

Netflix (NFLX) –

April 22 – Trading 358.57 in premarket and not really excited about an entry here in Netflix, I will continue to watch the chart set up as earnings rolls on but I don’t expect an entry here anytime soon now.

April 9, 2019 – chart structure and price almost identical to last report with chart below.

March 5 Report, “very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video”.

NETFLIX (NFLX) Continues to trend toward price target for late May. Take profit along the way. $NFLX #stock #chart

American Express (AXP) –

April 9, 2019 – only watching AXP at this point.

Per March 5 Report, “great trade alert set up from swing trade service, hit price targets early, really strong trade structure”,

AMERICAN EXPRESS (AXP) great trade set-up and above current resistance it has lots of room to run $AXP

The 3 below I am not interested in trading any time soon.

Morgan Stanley (MS) –

April 9, 2019 – on watch only.

Per previous;

Trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines

April 9, 2019 – On watch only.

Per previous;

Hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC)

April 9, 2019 – On watch only.

Really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Recent Highlight Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below reports (that may be locked) please email us at [email protected] for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, GOOGL, AMD, BABA, AAPL, NFLX, BTC, NBEV, SQ, APC, GOLD, XOM, ARWR, OIL, TERP

Stock Swing Trades On-Watch & Current Trades | AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT more …

Trade Set Ups / Current Swing Trade Positions March 19, 2019.

Stocks Covered in this Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, the first leg of the move from Dec 24, 2018 to now has been great and the next COULD BE better in to mid May 2019. Don’t miss out.

Trade Set Ups and Current Swing Trade Positions March 19, 2019.

Anadarko Petroleum (APC) –

Per March 5 Report “this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target”.

ALSO, the is a link to a special report below (at bottom of this post) that explains exactly how to trade Anadarko Petroleum.

ANADARKO PETROLEUM CORP (APC) MACD turning up on Weekly Chart, should be ready to go soon. #swingtrade $APC

TerraForm (TERP) –

Per March 5 report “trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year”.

THERE IS ALSO A LINK TO A SPECIAL REPORT BELOW FOR TERP AT BOTTOM OF THIS POST.

TerraForm Power Caps a Transformational Year With Solid Q4 Results #swingtrading $TERP https://finance.yahoo.com/news/terraform-power-caps-transformational-solid-173600840.html?soc_src=social-sh&soc_trk=tw

TERRAFORM POWER (TERP) This is about to test 200 MA on Weekly Chart, you will want to watch close now. #swingtrade $TERP

Home Depot (HD) –

Per March 5 Report, “240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video”.

Home Depot’s Solid 2018 in 3 Charts https://finance.yahoo.com/news/home-depot-solid-2018-3-210500199.html?soc_src=social-sh&soc_trk=tw #swingtrading $HD

HOME DEPOT (HD) holding top of trading box with indicators turning up, looking for a pop here $HD #swingtrading

Gold (XAUUSD, GLD, GC_F) –

Per March 5 report, “Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far”.

GOLD remains in structure on monthly chart. Watching. $GC_F $XAUUSD $GLD

EXXON (XOM) –

Per March 5 report, “this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM)”.

EXXON (XOM) This swing trade just keeps giving $XOM #swingtrade #energy

I will be trimming this position in to the red trading box (underside) resistance tomorrow and considering re-entering above the blue line when price is in trading box.

Nike (NKE) –

Per March 5 Report, “this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight”.

Breaking Down Nike’s Q3 Earnings Outlook Ahead of March Madness https://finance.yahoo.com/news/breaking-down-nikes-q3-earnings-192407481.html?soc_src=social-sh&soc_trk=tw #swingtrading $NKE #earnings

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

Alphabet / Google (GOOGL) –

Per March 5 Report, “algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video”.

Tech giants will have to be regulated in future – EU’s Timmermans https://finance.yahoo.com/news/tech-giants-regulated-future-eus-145838975.html?soc_src=social-sh&soc_trk=tw #swingtrading $GOOGL

Google (GOOGL) Exceptional trajectory (upper scenario) on this swing trade, no reason to liquidate any time soon. $GOOGL

This is another fantastic swing trade. If anything just remember to take profit along the way.

Advanced Micro (AMD) –

Per March 5 Report, “when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019”.

AI Stocks to Watch, Including One Under-The-Radar Gem https://finance.yahoo.com/news/ai-stocks-watch-including-one-120000581.html?soc_src=social-sh&soc_trk=tw Gopher Protocol Inc. (GOPH), Five9, Inc. (FIVN), Fortinet, Inc. (FTNT), Advanced Micro Systems (AMD), and Tesla, Inc. (TSLA) #swingtrading #AI

ADVANCED MICRO (AMD) does have symmetry in price targets hit with a channel, upper target may hit #swingtrade $AMD

I don’t like the way this stock trades, however, it has held the channel structure and the price targets are hitting on the model. The upper price target on the chart below could be in play.

https://www.tradingview.com/chart/AMD/w5sN14u2-ADVANCED-MICRO-AMD-does-have-symmetry-in-price-targets-hit-wit/

Twitter (TWTR) –

Per March 5 Report, “didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review”.

TWITTER (TWTR) continues to struggle in the cluster of support and resistance areas, no trade for me. #swingtrade $TWTR

Facebook (FB) –

Per March 5 Report, “the model has done really well, we will be updatnig the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past”.

For now I will leave this one alone considering the mosque attacks. A structured trade just isn’t possible at this point, I will re-look at it the near future.

BP –

Per March 5 Report, “bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best”.

BP I didn’t execute on this but it does look like a decent trade setting up. #swingtrading $BP #chart

FireEye (FEYE) –

Per March 5 Report, “tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it”.

FIREEYE (FEYE) Fireeye stuck in a range, watching for now. #swingtrade $FEYE

Arrowhead Pharma ARWR –

Per March 5 Report, “This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video”.

ARROWHEAD PHARMA (ARWR) Looking for top of trading box resistance to break for a move to next, great swing trade. $ARWR

TESLA (TSLA) –

Per March 5 Report, “I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video”.

TESLA (TSLA) hasn’t hit my 231.00 price target yet but it has come off really hard so far. $TSLA #stock