Tag: Algorithm

Price Increase Mar 4: Oil Trade Services (Bundle, Newsletter, Alerts, Trading Room) w/ Promo Codes

RE: Price Increase Details w/ Promo Codes. EPIC Oil Trade Algorithm March 4, 2019. Applies to Bundle, Newsletter, Oil Trade Alerts and Oil Trading Room.

February 24, 2019

Compound Trading Group recently launched a first generation oil trading algorithm (CL) software with great initial success. January oil trade alerts seen a 63% account build increase. We expect results to continue to trend higher as the software is fine-tuned.

More recently, we distributed an advisory to detail software protocol updates that will execute oil trade alerts at a higher frequency with a mandate for 60 – 100 trade alerts per month with an objective of 80% or higher win rate (the current win rate is consistently higher than 90%). The objective is to provide a higher frequency of alerts to achieve a greater return on equity per month with a moderate decrease in win rate as the trade-off.

Also included on the advisory above is detail concerning our proprietary IDENT software update – IDENT is an order flow identifier that helps our software trigger trades with market leaders. The IDENT program update has provided our oil trading and alerts with an extremely high win rate since introduction.

Also recently announced, Compound Trading Group’s EPIC Oil Machine Trading Software has been selected for the SOVORON™ trading platform. SOVORON™ offers a unique trading service providing clients with technology application based Machine Trade of personal investment accounts along with a fund and robo-trade application in their pipeline. To explore their unique client service structure click here http://sovoron.com/ or call 1-849-861-0697.

And finally, Compound Trading Group will be closing to the general public as of April 30, 2019 and will only be available as a private service going forward – you can view the news release here.

Existing members will be included in the transition. Most of Compound Trading Group’s clientele are serious full time traders, private commercial trading services and institutional clients.

Price Increase Detail, Early Adopter Price Guarantee, Limited Promo Codes:

The main pricing menu on our website is found here.

Existing members (early adopter pricing) remains constant and are not affected by the price increases below as long as the member fees do not lapse.

Oil Trading Bundle – Weekly EPIC Algo Newsletter and Charting, Real Time Twitter Feed Alerts, Main Trading Room Access During Active Trade, Private Oil Trading Room / Chat Discord Server (not screen sharing live broadcast like the main trading room).

Current Pricing: 1 Month 399.00, 3 Months 1099.00, 6 Months 2199.00, 1 Year 3999.00.

New Mar 4, 2019 Prices: 1 Month 799.00, 3 Months 1999.00, 6 Months 3799.00, 1 Year 6999.00.

This works out to about 10.00 per alert but also includes the trading rooms and newsletter. If you calculated 60 – 100 trade alerts per month.

Standalone Oil Algorithm Newsletter – Weekly EPIC Algo Newsletter.

Current Pricing: 1 Month 299.00, 3 Months 807.30, 6 Months 1435.20, 1 Year 2511.60.

New Mar 4, 2019 Prices: 1 Month 399.00, 3 Months 999.00, 6 Months 1899.00, 1 Year 2999.00.

Crude Oil Trade Alerts – Distributed by way of private members Twitter feed and now includes access to private Discord oil chat / trade alert feed (with push notifications).

Current Pricing: 1 Month 199, 3 Months 537.3, 6 Months 955.2, 1 Year 1671.60.

New Mar 4, 2019 Prices: 1 Month 499.00, 3 Months 1399.00, 6 Months 2699.00, 1 Year 4999.00.

Promo Codes are in effect for a limited time “bundle30” at check-out. The promo codes remain in effect until Mar 3, 2019 only.

If you have any questions please email me direct at compoundtradingofficial@gmail.com.

Warm regards,

Jen

How I Day Trade Crude Oil +-90% Alert Win Rate | Friday’s 158 Tick Move | Strategy We Used To Trade It

Tools You Can Use to Day Trade Crude Oil for a Better Win Rate. 90%+- Is Within Reach.

How to Trade Oil Successfully with the Right Strategies: Trade Alerts, Chat Room Signals, Live Trading Room, Conventional Charts, Time Cycle Knowledge and Algorithmic Models.

My position in this post is simple; if you have the technical data needed to make the right trading decisions on all time frames (your oil trading strategy) provided to you (the oil day trader) in the most efficient manner, you can out trade the general market traders and compete with world class machine oil trading firms.

We endeavor to provide such a trading platform for our members. Below I explain how we are doing that.

But first, a trade coaching session for those learning to get on the winning side of their trading… if you are a pro that only needs the technical oil trading strategies included in this post… skip this rant and scroll down.

Why do I scream from the rooftops that my win oil trading rate is so high? Why do I scream transparency and documentation of my trading journey and the development of our oil trading systems?

I scream my win rate (that anyone can review our live recorded and time stamped documentation to verify) to drive home that you do not have to accept what the book selling circle jerk crew tries to sell you, “trade price, nobody knows the future and that a 60/40 win rate is acceptable” – this is a flawed process.

You do not have to accept what the book selling circle jerk crew tries to sell you.

Study our oil trading system development and you will find that trading price doesn’t work in oil and that thinking you can’t know the future (future decisions for up, down or sideways trade and the most probable price targets) is foolish thinking.

We know with high probability where price is going to be on any time frame (from a 1 minute chart to a monthly chart and all between) and we know with high probability how to trade the decisions a trader will face on the way to the possible price targets.

We know the natural trading structure of the financial instrument – in other words, we know the playing field. We play the game with the lights on while the majority of our competition is in the dark.

We know the natural trading structure of the financial instrument – in other words, we know the playing field.

A 60/40 win rate is painful, to accept and use that system you have to take a series of significant losing side cuts to only then take advantage of a winning swing trade trend pattern move. In other words, the problem with their process is that you win big when you win but you have to endure pain to get the big win. I do this myself, but only with 10% of my account.

For example I have been DWT short for a number of weeks in preparation for the reversal in oil trade we are now experiencing. But I do it so that I get the move even when I don’t have time to day trade it.

The problem with their process is that you win big when you win but you have to endure pain to get the big win.

Another problem with the 60/40 idea (and there are hundreds of problems with this thinking) is that oil can trade sideways for many weeks, in this scenario you get chopped up and this causes your brain to be confused and you begin questioning yourself.

The method we are developing, perfecting and teaching (that we have documented live in every fashion available for proof) has a much higher rate of return and win side rate, it allows you to be in cash daily, it is much less stressful (the draw downs when you do lose can be next to zero) and it is the equivalent of Wayne Gretzky on the ice (for example).

You can simply “out stick handle” your competition.

To be a 90%+ oil trading winner takes real work to learn, but on the other side you will have much less stress, you win more often, your ROI and ROE increase significantly, your lifestyle freedom increases and the most important part is it keeps your brain in the frame work of being a winner.

Worst case scenario – you add what you can or what you prefer to use of what we have learned and passed on to you so that your oil trading win rate increases.

The bottom line.

It is critical for your brain to know it wins. When it knows you are a winner it won’t accept losses. This is critical (you would have to do a serious psychological study to learn why this is so important – maybe someday I will write about what I’ve learned).

The bottom line is that your brain develops patterns of habit that manifest in reality. Your subconscious is the leader, and it needs to know when it trades crude oil, that you win.

The bottom line is that your brain develops patterns of habit that manifest in reality.

The only way this is possible (your brain knowing that you win so it won’t accept losing which causes your execution to be disciplined) is to be able to “out -trade” your competition.

Sure, you are competing with yourself – but in reality you are competing against the world’s best when you enter the markets everyday.

The only way to out-trade your competition is to have technical market information and tools they simply do not possess and / or do not have “as efficient” access to and they haven’t defined their trading process and skill-set to the same level you have.

This is what causes one to trade win-side at a rate of over 90%. And anyone can do it.

Lets Get on With The Technical Oil Trading Strategies You Can Use to Day Trade Crude Oil for a Better Win Rate.

Oil Trade Signals: The Strategy / Guidance I Provided to Members at Start of Week.

Crude Oil Time Cycles, Area of Trade, Support, Resistance, Trading Channels.

Note: The time stamps on the Private Member Discord Oil Chat Room Server is showing my time in the Dominican Republic (this time of year it is one hour later here in DR than Eastern Time in New York).

For this post (that focuses on examples from Friday Jan 18, 2019 in our oil trading room) I will start with trade signals I provided to our members at the beginning of the week (and some prior) to provide context for the guidance explained.

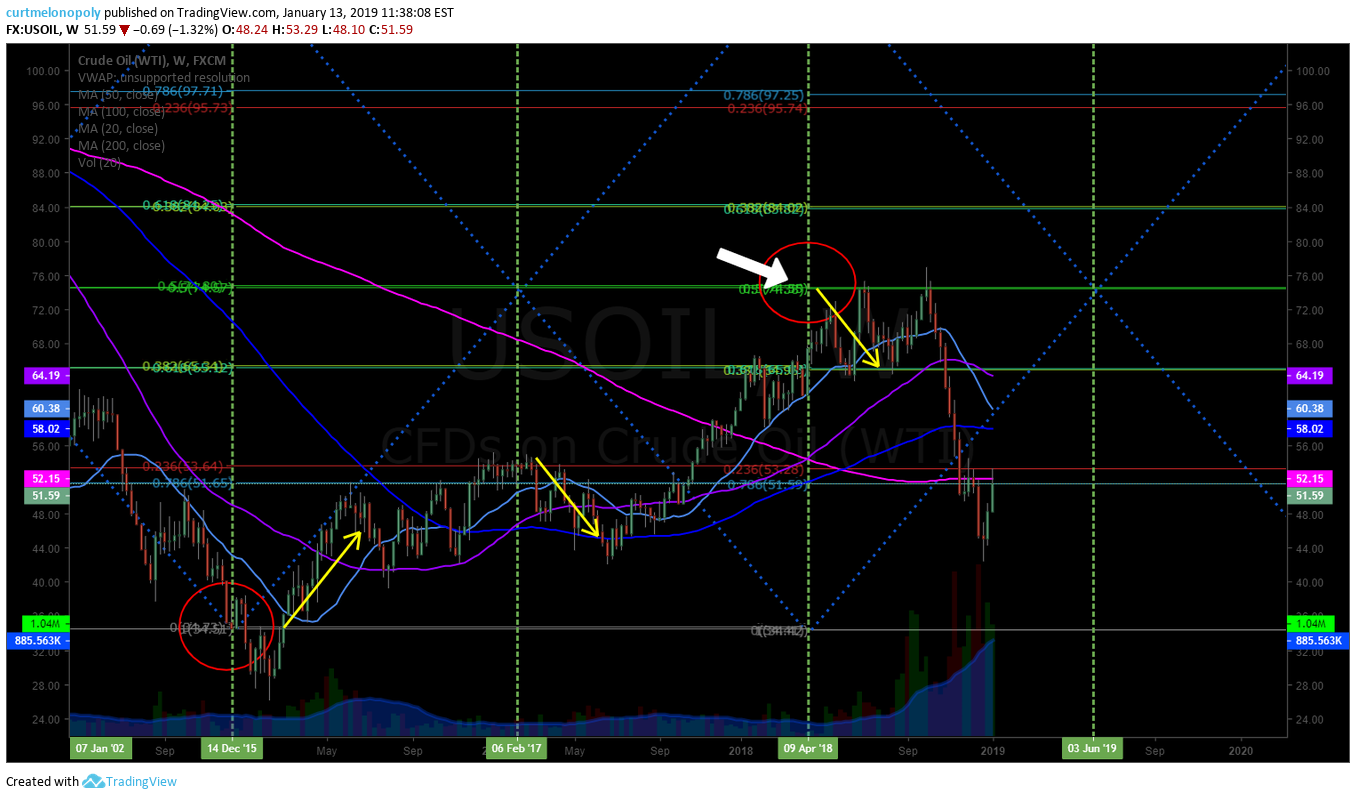

Below (3rd image down) you will find a private member server screen shot (to start the week of Jan 14, 2018) I shared with the chat room of a test chart our oil machine trade coding technicians are developing for sizing trades.

In addition to using our main oil charting (the EPIC Oil Algorithm model – a proprietary model based on a 30 minute oil chart) we use many other charts (conventional and algorithmic) on many time-frames to determine back tested and correlated probabilities for oil trade resistance, support, channels, reversals, time cycles and more.

In the instance below (at start of last week) I was signaling the possible channel oil would use for weekly trade – specifically if the scenario played out during weekly trade as it related to the previously provided signals to members (that we seen a time cycle ending in crude oil December 20, 2018).

Prior to this, we had provided members (many weeks in advance of Dec 20) that the time cycle peak / conclusion was for approximately Dec 20 (with allowance for a week either way of Dec 20 because the time cycle was so large as it was based on the weekly time cycle charting).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Between Dec 20 and Dec 26 there was one last “flash down” in oil trade which is typical at the end or peak of a time cycle on any time frame from the one minute charting to monthly charting (this is typical of the final stops being triggered and shorts covering positions).

Then on Dec 26, 2018 oil did in fact turn up in trade and hasn’t stopped trading upward since.

Oil hit a low of 42.38 on FX USOIL WTI on Dec 24, 2018 and closed Friday Jan 18, 2019 at 52.38 – less than one month later.

Also of note, we predicted the down turn in oil trade at the time cycle peak – the time cycle turn prior to the Dec 20, 2018 reversal.

See this tweet from EPIC Oil Algorithm Public Twitter feed and the post linked to our blog.

“Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/F8Z9UE66-Dating-back-to-2002-13-of-14-major-time-cycles-on-weekly-crude/ …

https://twitter.com/EPICtheAlgo/status/1084492522490155014

Back to Strategic Guidance Provided to Oil Chat Room Last Week:

The oil trade signals I alerted to members to assist in their oil trade strategy focused on the trading range our members could expect for oil the coming week. The alerted signals also gave our traders support and resistance areas on the charting and the most probable channel of trade (this is all in addition to the EPIC Oil Trading Weekly Report).

Curt Melonopoly Last Monday at 8:49 AM (7:49 AM EST)

“It’s a machine coding doodle chart for sizing etc so its a mess, but we are looking for channel highlighted in yellow to hold for trend reversal confirmation in crude oil – use proven EPIC model for confirmation for trading”.

Below is a screen shot of the live oil alert feed on Twitter providing the following signal to our members for the week:

“Under 52.16 FX USOIL WTI I am short term bearish, over 52.16 bullish to 53.34 and over to 55.65 – main test areas over head on weekly time frame.”

The examples above provide context to the guidance we provided our oil members at recent time cycle turns and at the beginning of the week…

Now lets jump to the specific point of this post that involves trade last Friday December 18, 2019 so we can learn how to day trade the opportunities in crude oil.

At 6:40 AM Friday Jan 19, 2019 I signaled the oil chat room that oil trade looked bullish and that our traders could expect a push toward the 53.40 resistance.

You can see on the chart / screen capture below how trade for the week had maintained the channel and that oil trade was following a trajectory (light blue vertical line) that I had outlined in the chat room earlier in the week as a probable upside strategy.

The strategy for the trajectory of the uptrending blue arrow was based on trajectory of time cycle targets on the short time frame assuming oil was bullish (price targets on our algorithmic charting can be assumed at where important trend lines cross, this is consistent through all time frames on all algorithmic models – this takes some time to learn).

The resistance I was alerting our members was at the top of the trading channel so they were aware of where to be aware of possibly trimming positions or at minimum being on watch for intra-day stall in trade.

“They’re pushing for that 53.40 area today (upside scenario), above could cause a significant squeeze”.

On this screen capture from the oil chat room I am showing our members that trade intra day was in the bullish scenario on a 4 hour test chart. Reconfirming the bullish scenario for day trading oil upward in Friday’s trade.

You will also notice at the bottom of the screen capture – the noted alert at the bottom of the screen, “53.50 is top of quad ton EPIC model resistance today, trading 52.83 intra” that this set-up coincided with our proprietary oil algorithm charting (the core oil algorithm charting – the core of our methodology, is not included in this post).

The core oil algorithm charting – the core of our methodology, is not included in this post.

Earlier that morning Jeremy has posted a link in the chat room to the article and video post covering trade from Thursday’s session and explanation of the one minute trading box set-up. You can study the set-up at the link below;

By far one of the most important crude oil trading articles we have posted since our inception.

Protected: How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video)

Password: ********

At 920 AM right before regular market open I provide chat room a crude oil position signal for preferred long entry point.

I also re-confirm my expectation that probability for the top of the quad area of the oil algorithm in trade gets hit and that my entry signal price target (preferred entry is 52.40) so that our traders could make their own decisions for execution.

Also mentioned here, the one minute trading model (the trading box area) as the preferred entry price so that our members know where I derived the 52.40 entry preference from.

Crude oil trade alert in chat room screen shot of long execution in to open and other alerts. Long oil at 52.67 with trims at 52.93 and 53.08.

Alert in oil chat room that I was closing the oil day trade at 53.03 due to internet issues and reiteration of price target 53.50 for day trade.

Then the price target for the day trade was hit. A 90 tick move so far on the day.

Below is screen shot capture of crude oil chat room of posted oil chart images of predictability of 1 minute oil day trading strategy in trading box model (as previously posted above – the Thursday featured blog post the day prior) when crude oil squeezes intra-day.

As the day trading session progressed I provided a number of alerts to impending resistance on all time frames in crude oil trade range expected for the day.

heavy resistance confirming on all time frames, but in a sqz u never know

Resistance areas of oil trade for guidance for day traders to consider trimming or closing positions.

Resistance had been hit on two 4 hour charts and the EPIC Oil Algorithm 30 Minute Model at this point of trade intra-day. Other charting time frames had resistance also.

240 Min Test Chart Scenarios posted to oil chat room revising the previous so that day trading signals for oil are updated.

LIVE OIL TRADING ROOM VIDEO | HOW TO DAY TRADE CRUDE OIL – STRATEGIES I USE.

#daytrade #crudeoil

Summary Notes for Video:

Note: Voice broadcast starts at 16:25 on video. When I am trading and on mic is noted below (the location times on video).

At 16:25 on video “I am triggering long 52.67 with tight stops because of test on 240 minute crude oil charting, so I may trigger in and out here, we’ll see. Will probably get in to pressure right in to open here but I didn’t want to miss the move. A little bit of FOMO.”

At 19:50 on video “The one minute candle turn in advance of market open is coming here, get ready for some pressure.”

Keep in mind the strategy guidance provided to members in the oil chat room specific to the preferred by trigger at 52.40 (in other words support on one minute day-trading model).

And Then The Internet Crashes! A Work Crew Down the Street Cut The Line.

At 23:00 mins on video I come on mic to announce the internet problem to the trading room (at which time I didn’t know what the specific problem with the internet was).

At 24:50 on video the pressure in oil trade comes (which made sense to me considering the resistance decision but I decided to hold because oil was so bullish through the time cycle). I could have cut and re-entered which may have yielded a better profit by 10 ticks or so.

And then the internet continues to crash intermittently. Had the internet not been crashing I would have been on mic providing our traders guidance.

At 56:40 I announce we are back up on a cellular network and that I am holding the position.

At 1:10:50 On video I announce I am trimming at 53.08 holding 25% – there was significant resistance on the EPIC Oil Algorithm so I trimmed.

In the trading chat room (not on video due to internet issues) I announce I am closing trade due to internet issues even though price wasn’t to the top of the algorithm quadrant and price target for the day, “closed 53.03 may re enter i had to close due to internet.”

Had the internet been restored timely I would have traded right top of quadrant and price target for the day.

At 1:18:00 on video you can see trade hitting the price target for the day (top of algorithm quadrant).

In a normal scenario I would have been trading the one minute trading chart model in the trading boxes and on mic in the trading room announces my trades. But on this day as fate would have it I couldn’t do it because I couldn’t risk the internet crashing while on the temporary cellular platform we were using.

Important note:

Much of the proprietary charting links, member oil reporting, and proprietary algorithmic charting is not included in this post. In 2019 we have started to limit dissemination of proprietary content due to copy cat trading firms.

Summary Thoughts for Context.

It is important to note that there were many many more trade alerts, charting updates, chat room trades / signals / guidance and trading room live trade coverage for the week.

Our members have much, much more information available to them for crude oil day trading decisions needed every day of the week on all time frames.

Having advanced technical know-how derived from a systematic scientific process that gets fed in to our various oil trading platform services to trading members allows for our members to “out stick handle” the everyday trading community and compete with world class machine trading firms.

My win rate and the oil machine trading win rate was well over 90% for the week and the reason is the combined tools available – available to myself, to our machine trading techs and thus the developed software and also made available to the members in our oil trading service.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Signals, Strategy, Alerts, Trade Room, Chat, Algorithm, USOIL, WTI, CL_F, USO

Follow:

Crude Oil Trading Algorithm Report (EPIC) Sun Jan 13 FX: USOIL WTI $CL_F $USO #Oil #Trading #Algorithm

Crude Oil Algorithm Trading Chart Report (EPIC) w/ Machine Trading Sunday Jan 13, 2019.

FX: $USOIL $WTI $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to the oil trading algorithm report. My name is EPIC the Oil Algorithm and I am one of seven primary Algorithmic Chart Models in development at Compound Trading Group (there are over one hundred in total in development at various stages in various markets).

NOTICES:

New members to our oil algorithm charting models, oil trade alerts and oil trading room are encouraged to on-board in a way that equips you as an oil trader for consistent profit.

Visit my public Twitter feed EPIC Oil Algorithm Twitter (@EPICtheAlgo) and review tweets over the last few months, visit our blog and review the recent crude oil trading algorithm blog posts, You Tube channel “how my oil algorithm works”, “how to use my charting”, weekly EIA oil report videos and our website explains how the oil algorithm was developed.

Invaluable are the crude oil trade alerts (available with or without the trading room / weekly report bundle) and the private member crude oil trading chat room on Discord (included in the bundle) and attendance to the live trading room.

The live alerts are important if you are not at your trading screens 24 hours a day and the chat room allows for interactive lead trader oil trade set-ups as each oil trade approaches. All bundle members can access the live oil trading room when active also.

Reviewing important points of reference and engaging the subscription resources will increase your probability of success considerably. This report also includes links to some recent example “how-to” videos.

Oil Trade Coaching – We strongly suggest users of this algorithmic crude oil trading strategy opt for some level of private one-on-one coaching with our lead trader. Our lead trader is maintaining a crude oil trading alert win-rate of over 90% as of Sept 2, 2018 (time-stamped, live alert, recorded).

On our website one-on-one online coaching packages are available (coaching via Skype) or you can request a custom package reflecting the time you wish to invest in learning. To request a custom package suited to your needs email info@compoundtrading.com or click here for standard private trade coaching packages. Other options for coaching include online webinars, trade coaching bootcamps and private on location (in person) coaching sessions.

Oil Trading Room – How to Use the Oil Algorithm

Oil Trading Room – How to Trade Intra-day with my Algorithmic Oil Charting

Oil Trading Alerts. Live Lead Trader Video Trading w EPIC Oil Algorithm

Recent articles / videos from our blog about how to trade crude oil with our oil trading algorithm (if you are a newer member that needs an unlock code for any of the posts below please email compoundtradingofficial@gmail.com):

Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Crude Oil Trading Strategy | Technical Analysis & Guidance.

Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video

Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Protected: Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Protected: Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

For the more articles / videos available visit our Crude Oil Trading Academy : Learn to Trade Oil page here.

MULTI-USERS: Institutional / commercial platform now available on our shop page.

SOFTWARE: My algorithmic charting is now also in the coding phase for our trader’s dashboard program. Please review my algorithm development process, about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on Twitter feed and/or this blog.

HOW MY ALGORITHM WORKS: I am an oil algorithmic model in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit – all not shown on chart at any given time) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI integration – only math as it relates to traditional indicators with the primary goal being probabilities. I am presented on (and used on) conventional trade charting as one would normally use.

The goal is to provide oil traders with signals for an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil – first with the reporting format as below, then with machine trading functions and an integrated intelligent assisted traders platform that will provide the user with various settings of automation and personal trade execution.

In the weekly report below you will find simplified levels represented on conventional and algorithmic charting for intra-day (day-trading crude oil), swing trading and investing.

This work (and associated trading) should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on with oil related financial instruments.

Forward questions to info@compoundtrading.com, private message our lead trader on Twitter or in the private Discord oil trading room.

For further information this link explains how our algorithmic charting is done, this YouTube video explains in summary how my algorithm works https://www.youtube.com/watch?v=LUNyxFoXJp8 this link for more information about our algorithmic stock charting models and what makes them different than most.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE SIGNAL (ON EVERY VENUE) IS VIDEO RECORDED, ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Oil Algorithm Observations:

Below is a link for the live algorithmic chart of EPIC the Crude Oil Trading Algorithm (Generation 1, Version 5 including black box modeling). The charting is a real-time trading chart represented on FX USOIL WTI published January 13, 2019.

Click on share button (bottom right beside flag) and when that screen opens click on “make it mine” to view real-time, make edits etc:

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Intra-day crude oil trade. Jan 12 1154 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Note: The holiday anomalies in the chart model are near totally worked through, some remain, but not significant enough to detail.

January 13, 2019

Generation 1 Model Oil Trading Signals

The first most predictable trade are the resistance and support cluster areas formed by long term chart trend lines (see charts that have trend-lines represented in red as made available below near bottom of this report – conventional charting trend-lines).

The second most predictable trade (wide trading range primary resistance and support that become predictable buy and sell triggers). Current algorithmic model wide trading range resistance (grey arrow – grey horizontal line) at approximately 54.45 in the current trading range. Current algorithmic model wide trading range support (grey arrow – grey horizontal line) at approximately 50.80 in the current trading range – these areas are general range support and resistance areas (our algorithm uses a .15 – .20 cent buffer on either side for these trades – if that is exceeded then trading price is likely to use the line as a pivot until a directional trending trade is established).

Trading between the resistance / support horizontal grey lines is extremely profitable risk – reward if one is disciplined to the patience required and follows the trend of trade.

More recently (as of September 2018) our back-testing has shown that the support and resistance areas noted are used in trade as a decision pivot – in other words, the price tends to pivot around these decision points on the chart and coil over a period of time and then spring out of the coil in an upward or downward trend.

The lower trading range is 47.14 – 50.79 and upper trading range 54.46 – 58.07.

Third most predictable trade (support and resistance of uptrend or down trend channels). On the chart an upward trending trade channel is presented and a downward option (channel support and resistance / trading range is represented as diagonal dotted orange lines and purple arrows – as made available, assist in displaying directional trade decision areas).

Fourth most predictable trade (support and resistance of 30 min quadrants). The diagonal lines make up quadrants (in this instance on a 30 min chart) and are represented as orange diagonal lines that make up geometric diamond shapes. These lines also assist in intra-day trade.

Fifth most predictable trade (support and resistance of most applicable Fibonacci) the Fib support and resistance lines are the horizontal lines in various colors with the exception of purple and yellow (see below). These horizontal lines become support and resistance for intra-day trade.

Sixth most predictable trade (support and resistance of historical support and resistance) Natural / historical support and resistance lines shown in purple or yellow – they represent historical support and resistance. The strongest of the historical support and resistance lines are shown in yellow horizontal and are typically accompanied by a yellow arrow marker.

Seventh most predictable trade signal we use are the time and price targets (red circles). When trade is in a significant uptrend or downtrend the targets become very precise and move up the indicator priority list quick.

Tues, Wed and Fri targets are most predictable in extended multi week up-trends or down-trends.

The Eighth most predictable trade is intra-day. You will notice on some of the charting geometric shapes in green on some of my charting (at times). They are charted live in the trading room and at times the lead trader will highlight these areas intra with white outlines (typically geometric shapes such as diamonds or triangles).

Intra-day Trading Bias

Intra day bias is up side trade as the MACD is turned up on the daily chart and this indicator is usually a leading indicator for oil trade on this time-frame. However, after the recent run up in price (since Christmas) and the pressure that came in to oil trade last week it is highly probable pressure continues in to this coming trading week.

Wide Trading Range – Buy and Sell Triggers for Swing Trading Crude Oil:

Swing trading bias / forward guidance as of Jan 13 12:01 AM EST is indecisive for the reasons noted above.

Review the charting and stay on top of the structures that play out in the different time frames. It has everything to do with the time frame you are trading.

Trade the ranges noted above between the thick grey lines (grey arrows) for the most predictable swing trades between 47.14 – 50.79, 50.80 – 54.44, 54.45 – 58.06, 58.07 to 61.69, 61.70 to 65.31, 65.32 to 68.92, 68.93 to 72.54, 72.55 to 76.14 and 76.15 to 79.74. This is a highly profitable risk-reward way to trade oil if you can be patient to trigger at only the break of the wide range charting areas and are disciplined to cut a losing trade that does not prove in your anticipated trend.

Or trade the range between the channel diagonal lines at support and resistance in up or down channel (orange dotted diagonals).

Significantly more advanced trading rules will be introduced over the coming weeks with the newer Machine Trading software development in full swing now.

Channel Trading Scenarios for this Week on the Model Shown on Algorithmic Model:

Follow the red circle targets up or down per the charts below.

THIS WEEK is more unclear than most in that channel trade could occur parallel to the channels noted on the charts below.

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Up channel scenario. Jan 13 1208 AM PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Dwon channel scenario. Jan 13 1210 AM PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Gen 1 and Gen 2 Algorithmic Oil Trading Machine Driven Model Development.

Per recent report example:

Crude Oil Trading Algorithm. Gen1.V5 (EPIC). Hidden pivot locations. Oct 25 831 PM FX $USOIL $WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Per recent example;

Crude Oil Trading Algorithm. Gen2.V2 (EPIC). Machine trading intra-day. Sept 17 552 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #Crude #Oil #Algorithm #OOTT

This is an alternate machine trading model currently in development.

Per recent example;

Crude Oil Trading Algorithm. Gen2.V1 (EPIC). Machine trading intra-day. Sept 11 1246 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #Crude #Oil #Algorithm #OOTT

Generation 1 Day-Trading Crude Oil 1 Minute Chart Signals

The trading box on the 1 min daytrading charting is key. Daytrading updates are often shared in the Discord Oil Chart Room.

Per recent example:

Crude Oil Day-Trading Chart Signals. 1 minute time.

Crude Oil Swing Trade Charting.

Monthly Oil Chart(s):

Crude Oil Monthly Structure Test Chart. Jan 13 859 AM FX USOIL WTI $USO $CL_F #OIL #trading #charting

On the widest time-frame this monthly crude oil chart seems to hold support and resistance zones at diagonal Fibonacci (outside quad) trend lines and horizontal Fibonacci (mid quad) lines. The timing cycle vertical lines (green dotted) seem to be in play especially when you fractal the time frames down.

Trade is currently testing upside of 50 MA on monthly chart.

Crude Oil Monthly Structure Test Chart – added support resistance markers and trading box. Jan 13 922 AM FX USOIL WTI $USO $CL_F #OIL #trading #charting

Lead Trader trading note: If I had this chart in recent trade I would have added to my DWT short when trade touched the lower TL line and trading box support area. I really like this monthly structured charting.

If you are swing trading crude oil I see no reason not to follow the support and resistance areas of this chart for swing trading using appropriate sizing flow at each decision.

Weekly Crude Oil Chart(s):

Dating back to 2002, 13 of 14 major time cycles on weekly crude oil chart structure seen trend reversal to some extent or another #Oil #OOTT #TimeCycles FX USOIL WTI $CL_F $USO $UWT $DWT

May 13, 2018 chart post with important notes:

Oil retrace probability high, historically #timecycle Notes.

Previous Crude Oil Time Cycle Special Report for Context:

Dating back to 2002, 12 of 13 major time cycles on weekly oil chart have seen trend reversal to some extent or another #OILChart

Crude Oil Weekly Trend Line Chart – Structured support bounce last two weeks. Jan 13 1110 AM FX USOIL WTI $USO $CL_F #OIL #trade #charting

Crude Oil Weekly Trend Line Charting – very busy chart Jan 13 958 AM FX USOIL WTI $USO $CL_F #OIL #trade #charting

Per recent for perspective:

Crude Oil. Weekly trend-line chart. Dec 17 403 AM FX USOIL WTI $CL_F $USO #OIL #trading

Daily Oil Chart(s):

Crude Oil Daily Chart MACD still up with price on support of trading box with 50 MA test above Jan 13 1057 AM FX USOIL WTI $USO $CL_F #OIL #chart

Lots going on with this daily oil charting. Price bounced near that large trend line down-trending from previous time cycle (dotted gray) and near bottom of trading quad. Now testing 50 MA with reconfirmation of MACD. Bullish with an overhead test is the bottom line.

Crude Oil Daily Symmetry Chart Jan 13 1127 AM FX USOIL WTI $CL_F $USO #crude #Oil #Symmetry

Per recent for perspective:

Crude Oil Daily Symmetry Chart Suggests 41 area possible. Dec 17 424 AM FX USOIL WTI CL_F

240 Minute Crude Oil Chart(s):

Crude Oil 2490 Min Test Chart Jan 13 1132 AM FX USOIL WTI CL_F $USO #algorithm #crude #oil

30 Minute Crude Oil Chart(s):

Per recent;

Crude Oil 30 Min Simple Algorithmic Chart Model Nov 19 434 AM FX USOIL WTI $USO $CL_F #OIL #trading

Diagonal Trend Lines:

Diagonal trend-lines are critical inflection points (currently represented in red below on our conventional charting).

Please review many of my recent posts so you can learn about how important these diagonal trend-lines are. If one is breached you can look to pull-back to next diagonal trend line about 90% of the time. Also pay attention to how thick the lines are – the thicker the line the more important because they represent extensions from previous time / price cycles.

Remember you can come in to the chat room to message the trader and REMEMBER I have posted a live chart link in this post so if you can’t see the lines well on this chart above you can go to the live chart link and watch for member live algo chart links through-out the day in your email inbox!

Fibonacci Levels:

Watch the lines for support and resistance. Careful using them as traditional retracement levels with crude because the algo lines etc are more dominant / predictable. But the Fib lines are excellent indicators for intra-day trade support and resistance.

The Fibonacci lines are marked on main chart above.

Horizontal Trend-Lines (purple):

Horizontal trend-lines are not as important as the other indicators reviewed above, however, they do serve as important resistance and support intra-day for tight trading and they are important if thick (in other words they come from previous time / price cycles). WE STARTED TO REPRESENT THE REALLY IMPORTANT LINES IN YELLOW FYI FOR EASE. Refer to chart for current applicable horizontal trend-lines.

Horizontal trend-lines are marked on charts above.

Oil Time / Price Cycles:

Watch your email and / or my Twitter feed for time price cycles they may start to terminate.

Time / price cycles are the single most important indicator and my record calling them is near 100% – since inception seven months ago. The reason they are so important is that a trader does not want to be holding a crude oil instrument at termination of a time cycle if not absolutely sure if price will go up or down. A trade may choose to enter a large position in advance of a time price cycle termination IF THERE IS A HIGH PROBABILITY OF A DIRECTION IN PRICE and if the market is trading at a really important pivot area. In other words, if the market is trading at the bottom of the upward trending channel at a support (yellow lines) and we knew there was a significant probability of a time cycle about to terminate a trader may enter with a long position. The price really spikes or drops significantly when these important time cycles terminate.

The problem with time / price cycle terminations is they change from minute to minute (depending on where price is on the chart) so you have to be in the trade room to get the alert. Our lead traders will do everything they can in future to send these on SMS but we have to be careful because it can be difficult with so much going on in the room. The reason they (time cycles) change is because they are actually represented by or are geometric shapes in the chart – I know it sounds odd but I have (as I mentioned) hit these calls just shy of 100%. The oil political people know the same algorithmic modeling principles and they ALWAYS TIME THEIR BIG ANNOUNCEMENTS AROUND THE TIME PRICE CYCLE TERMINATIONS.

So if you can picture a triangle on the chart – and price is trading in the triangle – and price is going to come to the edge of the triangle and there is a significant support or resistance or an algo line terminating there too or a target (those type of indications)… then we know there is a high probability of a time and price change. In other words, it is where there are clusters of algorithm points that cross and when price is going to cross over that cluster is where they are. And these are represented on all the different time frames – the larger the time frame – the larger the time price cycle termination – the larger the spike or downdraft. This is where we establish our intra-day quadrants from for sniping trades (which we will put in to the room soon because it looks like the geo political rhetoric is over for a while making them more predictable). Difficult to explain in short. So we will do our best to SMS alert these in future.

Also, the real large or important time / price cycle terminations we know far in advance and they can be put in these newsletters.

If you review my Epic the Oil Algo Twitter feed, my blog posts and my story on our website you will get a feel for how accurate these calls are.

Alpha Algo Trading Trend-Lines (Primary – Red dotted lines. Secondary – White dotted lines):

To determine which algo line is most alpha (or probable) intra day, it is the nearest line to price action. This can also help you determine the trend of trade. If the algo line is trending up the price will follow it up until price is tested at an algorithm indicator (the main tests are diagonal trendlines, horizontal trendlines, time / price cycles etc – as I have shared with you). This is why it is important to watch all the lines because they are all support and resistance. To keep it simple trade the range (yellow lines) as I’ve mentioned but keep an eye on these indicators.

Current Alpha Algo Targets (Red circles):

Your closest target that crude is trending toward is always the most probable.Then, your second most probable is the one that is up or down trend depending on whether general price is in an upward or downtrend for the most recent week or so and what your other indicators look like (such as the MA’s I explained above).

The other way to determine which targets are in play is actually quite simple, you will notice that crude trades between the channel lines up and down and up and down and there are various support and resistance along the way. If it hits a target at the top of the channel you can bet most times (unless the next day like today) that the next target hit will be at the bottom of the channel.

Wait for the price to trend toward a target and take your position and watch as price gets closer and closer to the target. Remember, that the machines trade from decision to decision – or in other words from support to next resistance or resistance to next support or when the times come each week on Tuesday Wednesday and Friday they will trend toward the target that market price action determines they go to.

Our lead trader will explain more in the room and do not hesitate to ask our lead trader in the room by private message or on twitter to explain intra day decisions.

Recent Live Crude Oil Trade Alerts (sample signals):

See recent special oil reports, private alert Twitter feed and/or Discord private member oil chat room for many more examples.

Jan 13 – Recent trade alerts will be updated soon in more detail.

Recent Oil Algorithm Price Target Hits:

Jan 13 – Price Target Reporting will be updated soon.

Oil Intra-Day Algo Trading Quadrants (white dotted lines):

Trading quadrants are simply support and resistance lines that can assist your intra-day trading – they are not alpha or primary support and resistance by any measure. Price action does however typically move more assertively when leaving a trading quadrant.

Indicator Methods:

As explained above, my algorithm is a consideration of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This is how we establish the probability of specific targets hitting (we call them alpha algo targets).

Alpha Algo Targets, Algo Trend-lines, Algo Timing, Quadrants for Intra Snipes

Algo targets are the red circles – they correspond with important times each week in oil reporting land. Tuesday 4:30 PM, Wednesday 10:30 AM and Friday at 1:00 PM. The red dotted diagonal lines are the algo trend-lines. And the vertical dotted (red or green) are marking the important times each week. You will find that the price of crude will hit one of the alpha algo targets about 90% of the time. In the absence of market direction the machines take price to the next algo line and/or target. Understanding how the price of crude reacts to the algos and how they move price from target to target is critical for intra-day and swing trading crude oil and associated instruments.

You will notice that price action of crude will use these algo trend-lines and act as support and resistance, and that price also often violently moves when an alpha algo line is breached either upward or downward.

We cover this in much more detail in the member updates, trading room. A review of my Twitter feed and previous blog posts will help you understand the relation of these indicators. We will start posting video blogs (for my subscribers) on YouTube (in addition to my daily blog posts) for swing traders that work during regular trading hours.

Also… we will cover how to establish algo trend-lines and price targets future forward (as you have seen me do on my Twitter feed for some time now).

Conclusion:

See you in the live trade room! And again, if you struggle to know how to use these indicators as a trader’s edge, it is recommended (if you have earnestly reviewed all of our documentation first) that you obtain private coaching prior to trading a real account with real money – we recommend you use a paper trading account at first.

You can also send specific questions to our email inbox at info@compoundtrading.com – if you do this be sure to ask a specific question so it can be answered specifically. When the 24 hour oil trading room opens you will have ample opportunity in that 24 hour room to ask questions also.

Watch my EPIC the Oil Algo Twitter feed for intra day notices and your email in box for member only material intra day also.

EPIC the Oil Algo

Subscribe to Service Here:

Standalone Crude Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Crude Oil Trading Alerts (Private Twitter feed).

Crude Oil Trading Room Bundle (includes weekly newsletter charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article topics: EPIC, Crude, Oil, Algorithm, Trade, Alerts, Trading Room, Chat, Charts, Signals, Time Cycles, $USOIL, $WTI, $USO, $CL_F