Tag: $AMD

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Premarket Notes

We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

More swing set-ups / alerts on earnings to continue.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC, DXY and more than we will report on soon.

10:30 am

#EIA Crude Oil Trading Petroleum Inventories – Main Trading Room, I will be in attendance.

2:00 pm

FOMC Announcement

Thanks

Curt

Nice snap back trade $TSLA 4 Hour Chart pic.twitter.com/tkLzzNzUu4

— Melonopoly (@curtmelonopoly) July 31, 2019

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watch List, Stocks, Commodities, Alerts, Trading Room, Bitcoin, FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Swing Trading Strategies (Earnings) Part 4 : Premium | $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO …

Swing Trading Set-Ups, Strategies, Alerts, Charts, News. July 31, 2019. …

Below are Swing Trade Set-Ups Currently On Watch (in addition to the others in recent reporting) $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO, $AMZN, $GOOGL, $TWTR, $FB, $JBLU, $OAK, $INTC, $SQ, $BOX, $PXD, $TLRY, $EEM, $AGN, $XOP, $MGI, $PLUG, $BTC, $LYFT. $IOTS, $STNE, $TEUM, $AU, $OIH.

Earnings Trade Positions Reporting Special Notes:

July 31 – We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC and more than we will report on soon.

Per recent;

July 22 – Below are some equities in focus this week with earnings, the follow- up reports on deck deal with other earnings focus equities and time cycles for the indices and specific instruments we focus on (GOLD, SILVER, VIX, SPY, OIL, US DOLLAR, BITCOIN).

Per recent;

Over the coming days we will be re-visiting all recent swing trade set-ups, alerts and trades in progress to reconcile the trades in advance of earnings and prepare for the new on other side of each new set up from earnings reports. This will involve a significant number of posts, trade alerts, mid day reviews in the trading room and videos that our members will receive a copy of.

Executing your swing trading strategy with our charting reports and live alerts involves using the key support and resistance areas of the charting, time cycle peaks, trajectory of trade and conventional indicators such as MACD cross-over and Moving Averages.

Alerts are not always issued at each add or trim to positions because that is simply not possible so you do have to manage your trade.

In many instances a clear swing trade strategy is laid out in the newsletter and/or videos so that you can manage the swing trade according to your risk threshold and account size.

If you struggle to establish a trading strategy with the information provided on our reporting, videos and alerts then some trade coaching is recommended to get you started.

Part 4 Earnings Swing Trades:

Why National Oilwell Varco, Trex, and Chegg Jumped Today. $NOV National Oilwell Varco (NYSE: NOV), $TREX Trex (NYSE: TREX), and $CHEGG Chegg (NYSE: CHGG) #swingtrading #earnings #premarket https://finance.yahoo.com/news/why-national-oilwell-varco-trex-202900625.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1156489920032231424

Bigger-than-usual #earnings moves today from $FRAC $MDR $CNX $SLCA $IT $OMF $SSNC $AMKR $TREX $BERY $TBI $RIG $LGND $RNG $NOV $DORM $CVLT $CURO

(link: http://eps.sh/r) eps.sh/r

Bigger-than-usual #earnings moves today from $FRAC $MDR $CNX $SLCA $IT $OMF $SSNC $AMKR $TREX $BERY $TBI $RIG $LGND $RNG $NOV $DORM $CVLT $CURO https://t.co/1pgojKC5HH pic.twitter.com/isSoEbpQxR

— Earnings Whispers (@eWhispers) July 30, 2019

TESLA (TSLA).

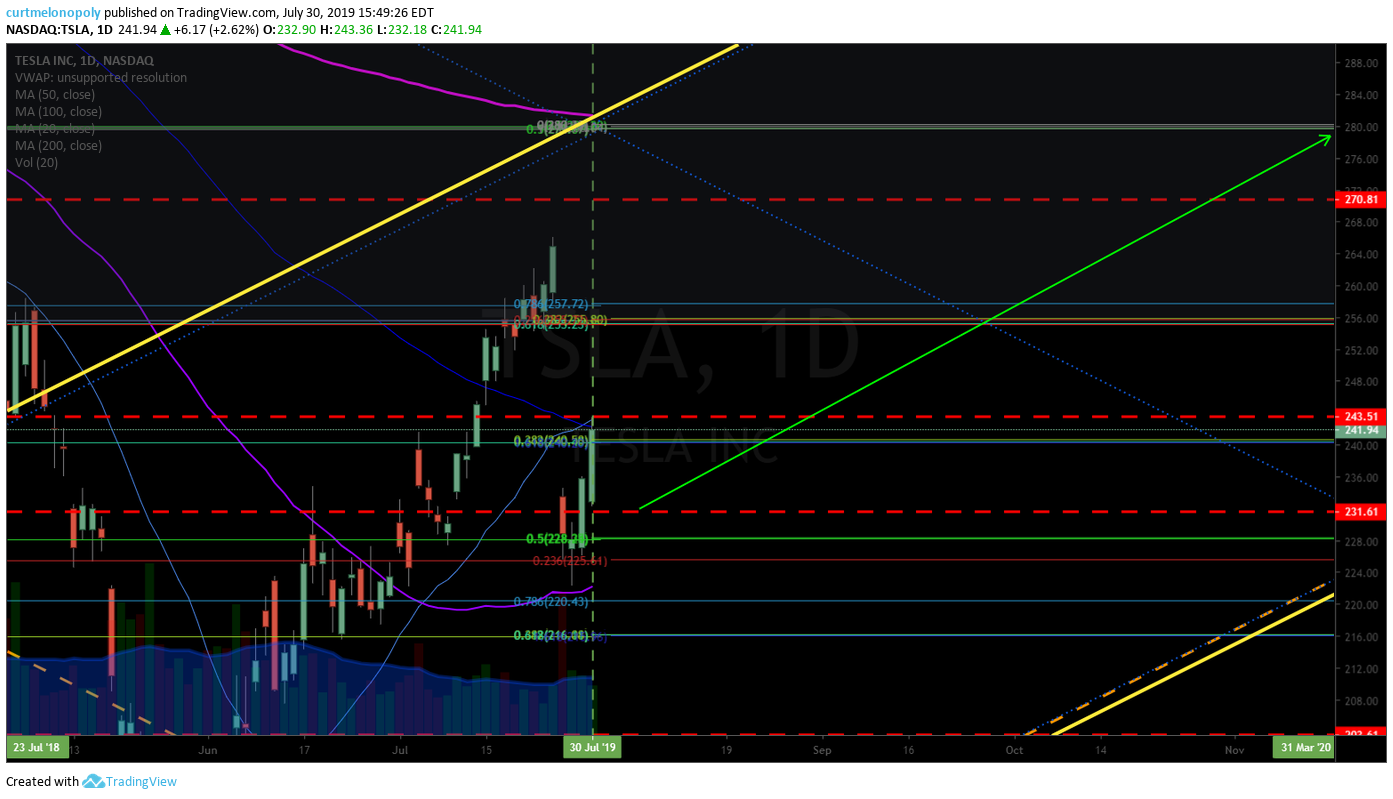

Tesla trade alert had a great first day, 234.44 buys and it hit 243.36 high of day price. It is trading 242.18 in premarket as I write. Watching close for possible adds. It is a channel play on the swing trade side but could easily be a daytrader also.

Trade Alert Tuesday Morning 6:42 AM

TESLA (TSLA) Swing Trade Alert – Long starter 234.44, 270.00 price target, channel bounce trade within recent range, add at channel support $TSLA #earnings #swingtrading (link: https://www.tradingview.com/chart/TSLA/cxghrcYk-TESLA-TSLA-Swing-Trade-Alert-Long-starter-234-44-270-00-pri/) tradingview.com/chart/TSLA/cxg…

A German Banking Giant Doubles Down on Tesla Stock, Buys Uber #swingtrading $TSLA (link: https://www.barrons.com/articles/a-german-banking-giant-doubles-down-on-tesla-stock-buys-uber-51564398041) barrons.com/articles/a-ger… via

@BarronsOnline

A German Banking Giant Doubles Down on Tesla Stock, Buys Uber #swingtrading $TSLA https://t.co/1dGT8EcMkH via @BarronsOnline

— Swing Trading (@swingtrading_ct) July 30, 2019

Advanced Micro (AMD)

Trade Alert prior to close Tuesday in advance of earnings was timely considering the price drop after earnings were released;

https://twitter.com/SwingAlerts_CT/status/1156290250257420288

3:47 PM · Jul 30, 2019, ADVANCED MICRO (AMD) hitting highs with earnings on deck, good time to take profit and or close #swingtrade $AMD

And then this;

$AMD pic.twitter.com/DH4g4JUMvl

— Melonopoly (@curtmelonopoly) July 30, 2019

Crude Oil $USO $WTI $CL_F $UWT

When crude oil was trading 57.28 we alerted that 59.80 was in play, hit a high 58.55 yesterday and is still bullish.

Trade Alert, 2:01 PM · Jul 30, 2019, Crude Oil Daily Chart Suggests 59.80 in play, MACD turning up. 159 PM July 30 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Chart (link: https://www.tradingview.com/chart/USOIL/85jzeoEc-Crude-Oil-Daily-Chart-Suggests-59-80-in-play-MACD-turning-up-1/) tradingview.com/chart/USOIL/85…

https://twitter.com/SwingAlerts_CT/status/1156263539394404359

NATIONAL OILWELL VARCO (NOV)

NATIONAL OILWELL VARCO (NOV) Risk reward is high here with a possible channel trade (green). On Watch. $NOV #earnings #swingtrade https://twitter.com/SwingAlerts_CT/status/1156503027882307584

TREX COMPANY (TREX)

TREX COMPANY (TREX) Should easily see upside channel resistance and be a simple channel support trade long thereafter. $TREX #swingtrading #earnings

CHEGG INC (CHEGG)

CHEGG INC (CHEGG) Over 46.55 held this stock sees 52.70s, on watch, trading 45.77 #swingtrading #earnings $CHEGG (link: https://www.tradingview.com/chart/CHGG/nMqLWKYf-CHEGG-INC-CHEGG-Over-46-55-held-this-stock-sees-52-70s-on-wat/) tradingview.com/chart/CHGG/nMq…

https://twitter.com/SwingAlerts_CT/status/1156514261910339584

Below is Part 1, Part 2, Part 3 of the Earnings Season Swing Trade Reporting:

PIONEER NATURAL RESOURCES (PXD)

From the point of original swing trade entry 148.50 (see alert below) PXD then traded up to 157.22 (be sure you take profits on trades the go the right way) and has recently come off and closed trade Friday at 144.29. Earnings are in 23 days.

Your trading strategy (if long) may be to add at one or more of the white arrows and if trade doesn’t hold then close and repeat at the next arrow. Our swing trade strategy at this point would be this method pending price action, watch for alerts.

Which Energy Stocks Missed Oil’s Upside? #swingtrading #energy https://marketrealist.com/2019/07/which-energy-stocks-missed-oils-upside/

PIONEER NATURAL RESOURCES (PXD) three areas of support on 240 min chart for possible bounce (white arrows) Red is trading plan price trajectory. #swingtrading

Per recent;

PIONEER NATURAL RESOURCES (PXD) through first Fib resistance target closed Friday 155.21 up from 148.50 swing trade alert with 161.00 area first Fibonacci resistance over-head.

From Swing Trade Alert 8:22 AM – 20 Jun 2019 (screen capture of alert below);

PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model. #swingtrading #tradealert https://www.tradingview.com/chart/PXD/pwpvHlyt-PIONEER-NAT-RES-PXD-Long-PXD-148-50-for-160-98-price-target/ …

Swing Trade Alert Screen Capture – PIONEER NAT RES (PXD) Long PXD 148.50 for 160.98 price target # 1. See model.

TILRAY (TLRY)

There is a special premium member report for this trade set up here;

Password: timec

TILRAY (TLRY) Nice down trend channel from highs, looking for a bounce and another swing long #swingtrade.

When trade bounces out of the down trend channel below then the other chart models below will assist in your trading strategy for Tilray (TLRY).

U.S. CBD Sales to Grow an Average of 107% Annually Through 2023 https://finance.yahoo.com/news/u-cbd-sales-grow-average-130600799.html?soc_src=social-sh&soc_trk=tw #swingtrading #Cannabidiol #CBD $TLRY $CGC $KR $RAD $WBA $CVS

TLRY Earnings Date

Earnings announcement* for TLRY: Aug 27, 2019

https://www.nasdaq.com/earnings/report/tlry

TILRAY (TLRY) structured trading model for swing trading and day trading (expanded view) $TLRY #swingtrade #charting

TILRAY (TLRY) model with trading boxes, time cycles, algorithmic channel trend lines for swing trading and day trading (maginfied view) $TLRY #swingtrade #charting

Per recent;

TILRAY (TLRY) Nice swing trade from 46.10 for 49.03 PT 1 and thru other resistance, trading 50.45 $TLRY #swingtrade #alert

Add in to each resistance and add above on trajectory or add on pull-backs.

It doesn’t get much easier than this – trade by numbers (lines).

From Swing Trade Alert to Trim in to Resistance 10:12 AM – 20 Jun 2019;

TILRAY (TLRY) in to key resistance, trim in to it add above to next #swingtrading #alerts $TLRY https://www.tradingview.com/chart/TLRY/cPAkfJnL-TILRAY-TLRY-in-to-key-resistance-trim-in-to-it-add-above-to-n/ …

From Swing Trade Alert Original Entry 8:04 AM – 20 Jun 2019;

Long $TLRY 46.10 for 49.03 PT # 1 details on report to follow, see previous charting.

TESLA (TSLA)

TSLA Earnings Date

Earnings announcement* for TSLA: Aug 07, 2019

Tesla, Inc. is estimated to report earnings on 08/07/2019. The upcoming earnings date is derived from an algorithm based on a company’s historical reporting dates.Our vendor, Zacks Investment Research, might revise this date in the future, once the company announces the actual earnings date. According to Zacks Investment Research, based on 4 analysts’ forecasts, the consensus EPS forecast for the quarter is $-1.55. The reported EPS for the same quarter last year was $-4.22.

Tesla is preparing to expand production at its electric-car factory in Fremont, California, according to an internal email #swingtrading $TSLA #earnings https://www.bloomberg.com/news/articles/2019-07-10/tesla-tells-staff-it-s-preparing-to-lift-output-at-fremont-plant

Tesla’s Leaked Email Is a Nightmare for Bears and Other Automakers #swingtrading $TSLA #earnings https://twitter.com/swingtrading_ct/status/1150558365703180288 https://marketrealist.com/2019/07/teslas-leaked-email-is-a-nightmare-for-bears-and-other-automakers/

TESLA (TSLA) Support and resistance areas are clearly marked (white arrows), long or short above or below trim at various res sup areas $TSLA #earnings #swingtrading

The trading strategy for swing trades in TESLA can be really simple.

The best way to swing trade TESLA is using the white arrows on the chart (these are primary support and resistance areas on the chart). When price breaches up through an arrow go long and the opposite for short. Set a stop that you are comfortable with in accordance to your risk threshold. If the trade goes your way simply trim profit at the fine detailed support and resistance areas on the chart.

If you are a more active swing trader then you can obviously look at each area of support and resistance for various sizing opportunities.

Alternatively to the above arrow trading strategy, you can also wait for a pull back to a key support or resistance and then enter (vs the brak out above or below key resistance).

The TESLA chart offers on of the best trading ranges and the key support and resistance areas work well. We have done well on numerous occasions swing trading TESLA. The most recent short wasn’t the best of the trades but focusing on the range of the trade, the general trend and the key support and resistance noted on this chart model provides for a really opportune swing trading environment given the range.

Per recent;

TESLA (TSLA) short, trade found support and bounced, stop at entry, resistance test above, could go either way. $TSLA

This trade started off well and as a daytrade it was excellent. On the swing it is still in play but trade did bounce at support below so be sure to exit before any loss as it is on the right side still. The trade is so close to the lower end of its trading range there’s no wisdom in holding if it turns against the original entry 225.05.

From Swing Trade Alert Feed 8:00 AM – 20 Jun 2019

Short $TSLA 225.05 for 203.42 1st PT, details in report upcoming. #swingtrading

EMERGING MARKETS ETF (EEM)

July 14 – The trading plan and price action has no significant change to the below.

Per recent;

EMERGING MARKETS ETF (EEM) Long term swing trade, add at bottom of channel long trim at top $EEM #swingtrade

MACD, Stochastic RSI, and Squeeze Momentum on daily time frame are all trending up.

From Swing Trade Alert Feed 8:07 AM – 20 Jun 2019 Long $EEM 43.06 with 45.50 Price target # 1, details in upcoming report

ALLERGAN (AGN)

This swing trade obviously went exceptionally well with Allergan (AGN). See screen image capture below of swing trade alert feed.

ALLERGAN (AGN) Up 36% premarket trading 168.00 from 116.00 buy alert, hitting all upside targets at key resistance, trim profits $AGN #swingtrade #alert

Allergan acquisition is ‘a major bailout’ for shareholders, according to analysts https://on.mktw.net/2X68Rqb

AGN Earnings Date

Earnings announcement* for AGN: Jul 25, 2019

Allergan plc. is estimated to report earnings on 07/25/2019. The upcoming earnings date is derived from an algorithm based on a company’s historical reporting dates.Our vendor, Zacks Investment Research, might revise this date in the future, once the company announces the actual earnings date. According to Zacks Investment Research, based on 11 analysts’ forecasts, the consensus EPS forecast for the quarter is $4.28. The reported EPS for the same quarter last year was $4.42.

ALLERGAN (AGN) Based on my best guess considering historical price action, going forward the yellow lines provide the upper and lower price range $AGN #swingtrade

Per recent;

ALLERGAN (AGN) Trading 130.75 up from 116.00 original alert, see video report from trading room for the trading strategy going forward on this one and / or follow support and resistance points on chart. $AGN #swingtrade

ALLERGAN (AGN) swing from 116.00 doing well trading 130.81, trim in to 136 area resistance add above $AGN #swingtrade #alert

From June 18 Report;

ALLERGAN (AGN) from yesterday Swing Trade Report up 4.24% today closing 120.64 trim in to 128.00 add above $AGN #swingtrade #alert

Ironwood and Allergan Report Positive Topline Data from Phase IIIb Trial of LINZESS® #swingtrading $AGN https://finance.yahoo.com/news/ironwood-allergan-report-positive-topline-200500616.html?soc_src=social-sh&soc_trk=tw https://twitter.com/swingtrading_ct/status/1141170424769896452

From June 17, 2019 Report:

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

ADVANCED MICRO DEVICES (AMD)

What To Expect From AMD Earnings #swingtrading $AMD #earnings https://www.investopedia.com/what-to-expect-from-amd-earnings-4692801?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

How AMD Is Positioned in the US-China Trade War https://marketrealist.com/2019/06/how-amd-is-positioned-in-the-us-china-trade-war/

ADVANCED MICRO (AMD) this has been a great channel trade, however, with earnings in 12 days we will exit and continue after in channel #swingtrade $AMD #earnings

There have been a number of entries on this swing trade in the channel (see alerts feed for details) and the trade has gone extremely well. However, with earnings near we will be watching for continued swing trade through the channel support (long) and resistance (short).

Per recent;

ADVANCED MICRO (AMD) has hit every upside price target (albeit some late) load at bottom of channel for 40.00 PT in trajectory #swingtrade $AMD – Of all the plays on radar between here and election, this is in top 10% imo. Load channel support. https://www.tradingview.com/chart/AMD/ngLZ4D1C-ADVANCED-MICRO-AMD-has-hit-every-upside-price-target-albeit-s/ …

Current trade pressure down in to time cycle peak, however, I expect it to turn very bullish in to October, 2019.

INTEL CORP (INTC)

INTC Earnings Date

Earnings announcement* for INTC: Jul 25, 2019

Intel Corporation is expected* to report earnings on 07/25/2019 after market close. The report will be for the fiscal Quarter ending Jun 2019. According to Zacks Investment Research, based on 15 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.88. The reported EPS for the same quarter last year was $1.04.

Tech earnings are a test amid tumultuous times, and all the chips are on the table #swingtrading #earnings $INTC $SPX, $ GOOGL, $FB, $MU, $DELL, $HPE, $NTAP, $AVGO, $MSFT https://on.mktw.net/2jUGA3u

INTEL CORP (INTC) from June 14 alert this swing trade set up has done well, time to exit before earnings and return thereafter #swingtrade $INTC #earnings

Per recent;

June 24 – See Video for swing trading strategy.

Per June 18 Report;

INTEL CORP (INTC) from June 14 alert up 2.69% trading 47.37 today with MACD and SQZMOM trend up, watch 200 MA above #swingtrade $INTC

Nvidia and Intel’s Mobileye Both Continue Racking Up Autonomous Driving Deals #swingtrading $INTC

S&P OIL and Gas ETF (XOP)

July 14 – No considerable change, see previous posts below.

June 24 – S&P OIL and Gas ETF (XOP) Swing trade doing well from 25.39 alert hit 27.09 trading 26.71. Add at each pull back and run the trend until MACD on 4 hour turns down. #swingtrade #tradealert

Per June 18 Report;

S&P OIL and Gas ETF (XOP). From yesterday’s alert bounced 2.69% today, MACD confirming, model to follow for trade strategy #swingtrading $XOP

ETFs & Stocks From Top-Ranked Sector to Buy #swingtrading $XOP

S&P OIL and Gas MACD cross up with double bottom, 20% move possible here. On watch for bounce. #swingtrading $XOP

MONEYGRAM INTERNATIONAL (MGI)

July 14 – No considerable change, see previous posts below.

June 24 – See Video for swing trading strategy.

Per previous;

MONEYGRAM INTERNATIONAL (MGI) Up 167% today, sure looks like a bottom pattern, 200 MA on weekly minimum price target in continuation scenario, on high watch for Wed premarket $MGI #swingtrade #daytrade #alert

MoneyGram Soars on $50M Investment From Blockchain Startup Ripple #swingtrading $XRP $MGI https://www.thestreet.com/investing/cryptocurrency/moneygram-soars-on-ripple-investment-14994298

BOX INC (BOX)

Per last report with video explaining trade set up, I am watching this at trading box support for a possible turn up, my bias is up but it hasn’t go moving yet so it remains on watch only.

3 Wild Card Stocks to Buy Now for Long-Term Gains https://finance.yahoo.com/news/3-wild-card-stocks-buy-160344516.html?soc_src=social-sh&soc_trk=tw

Per recent;

Per alert below this is on watch, review video for trading strategy.

BOX INC (BOX) Is revving up again for a big move, looking for a possible move to 23.00, fast $BOX #Swingtrading #tradealerts

The stocks listed below (and others on various other reports and alerts) will be reported on in swing trade reports over the next number of days. All stocks that we have alerted and or have trade positions and / or expect to have trade positions will be covered in the near term reports.

Part 2: Swing Trading Earnings July 17, 2019.

In case you missed my ramblins’:

Mornin’ traders #premarket thoughts, HUGE time cycle next #itisdifferentthistime #timecycles Going to be a massive two cycle ride to Dec 2019 starts soon. $VIX $SPY $GLD $SLV $BTC $CL_F $USO $DXY I knew then, I know now. This one goes down in history. Watch the reports on deck.

Mornin' traders #premarket thoughts, HUGE time cycle next #itisdifferentthistime #timecycles Going to be a massive two cycle ride to Dec 2019 starts soon. $VIX $SPY $GLD $SLV $BTC $CL_F $USO $DXY I knew then, I know now. This one goes down in history. Watch the reports on deck. pic.twitter.com/GmI7kLiuYp

— Melonopoly (@curtmelonopoly) July 16, 2019

$GOOGL topped out in high 12s and we didn’t go back, and won’t except to short it when time is right #timecycles #premarket

$GOOGL topped out in high 12s and we didn't go back, and won't except to short it when time is right #timecycles #premarket pic.twitter.com/uzAvqCXE8d

— Melonopoly (@curtmelonopoly) July 16, 2019

Members: Do not miss this report, looking back on 2019 two of my largest size trades will be in to and out of the two time cycle peaks coming in Volatility. There is no more structured time cycles in global markets than the volatility trade.

Members: Do not miss this report, looking back on 2019 two of my largest size trades will be in to and out of the two time cycle peaks coming in Volatility. There is no more structured time cycles in global markets than the volatility trade. https://t.co/66swXxmkji

— Melonopoly (@curtmelonopoly) July 15, 2019

Are we running everything yet? So, so close. You can almost hear it. Man we’re close. Gotta run the CentralZuck coin too, add that in there.

run baby run https://t.co/FAyvroFKyn

— Melonopoly (@curtmelonopoly) July 10, 2019

Our focus #timecycles and how they fit with #Powell #Trump war plan. It’s been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

Our focus #timecycles and how they fit with #Powell #Trump war plan. It's been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

— Melonopoly (@curtmelonopoly) July 10, 2019

Okay, now that we got that out of the way…

FACEBOOK (FB) VS AMAZON (AMZN)

I don’t like the idea of long trades with $GOOGL, $FB, $AMZN or $TWTR (least of the concern is Twitter). At issue, they’re going to get wacked. When? No idea. My guess, generally speaking the time frame around earnings – ish will be a tough ride for longs in $GOOGL and $FB but that is yet to be seen. $AMZN likely comes off around earnings because it will likely be sell the news. But $GOOGL and $FB more so that I think Trump and friends are likely to wack them around earnings.

I could be wrong, but hey, lets get you ready both ways so if you’re trading long or short you know your chart levels for your trading strategy.

First FACEBOOK (FB) and then in tonight’s report I will cover AMAZON (AMZN) and many other;

“To set the stage, the following chart shows how the two stocks have performed over the last five years. Amazon is the clear winner, outperforming Facebook by more than 2-to-1,”

Better Buy: Amazon vs. Facebook @themotleyfool #stocks $AMZN $FB https://www.fool.com/investing/2019/07/13/better-buy-amazon-vs-facebook.aspx

UPDATE 1-France says Facebook’s Libra not yet viable as G7 minister meet #swingtrading $FB #Libra https://finance.yahoo.com/news/1-france-says-facebooks-libra-111732518.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

FB Earnings Date

Earnings announcement* for FB: Jul 24, 2019

Facebook, Inc. is expected* to report earnings on 07/24/2019 after market close. The report will be for the fiscal Quarter ending Jun 2019. According to Zacks Investment Research, based on 13 analysts’ forecasts, the consensus EPS forecast for the quarter is $1.9. The reported EPS for the same quarter last year was $1.74.

FACEBOOK (FB) trades in channels (yellow examples) with decisions around time cycles (green vertical) $FB #swingtrade #earnings #strategy

We have always done well trading Facebook because it is one of the most structured equities on the markets. Trade channels (yellow examples shown) and check the price action relative to the channel at the key time cycles (vertical green). Yes, it is that easy.

You can also consider the trading boxes (orange) – they provide a range, moving averages (not so much imo) and horizontal Fibonacci lines in the chart model below. The green and gray horizontal are key pivots. The diagonal Fibonacci trend lines (blue dotted) provide the framework for possible channels.

It doesn’t surprise me the upcoming time cycle peak in to July 22 is around FB earnings scheduled for July 24, 2019. If price spikes above current channel my advice is to be very cautious with long entries up and above the channel.

Anytime you are trading with a structured algorithmic chart model and trade leaves the structure you can be sure its divergent and very likely to correct back in to its natural structure.

Your best trading strategy for Facebook earnings?

Don’t rush, don’t hold in to earnings, there is no need. And don’t rush when its in its new channel whether up or down. Let the channel establish itself and then simply starting adding in to the trend within the channel according to direction. That’s it. That strategy will return excellent ROI, you will beat the market many times over because Facebook is that good of a trading vehicle.

Let me know how you do please.

Per recent;

June 24, 2019 – Review video for trading strategy in detail.

We will get in to Amazon and many of the others when I return to this reporting tonight (last night we got side tracked so we will resume this evening). For now, the chart below.

Part 3: Swing Trading Earnings July 22, 2019.

AMAZON (AMZN).

AMAZON (AMZN) should become a trajectory trade after earnings in to price target options show, Trade the trajectory. $AMZN #earnings #swingtrade

Per the previous post below, watch the top of the trading box resistance area on the chart just over 2100.00. As I noted prior, I am bearish Amazon but I can’t say when I think it will lose steam, I think its a geo political signalling event that could also have signals with earnings coming in short of expectations over the next number of quarters. But the timing is going to be the issue. For now, the top of the trading box is considerable resistance.

After earnings simply trade in the direction of the trajectory (see arrows on chart pointing toward price targets for April 2020). And then when the geo political issues start to ramp up and price responds then it is time to short this stock.

The upbeat picture painted by this past week’s blowout bank earnings heralded a promising earnings season. Too bad other industries didn’t get the memo https://www.bloomberg.com/news/articles/2019-07-21/from-tesla-to-twitter-a-guide-to-this-week-s-quarterly-reports

From Tesla to Twitter, a Guide to This Week’s Quarterly Reports https://t.co/h2yc2YwlYg

— Swing Trading (@swingtrading_ct) July 21, 2019

Per recent;

AMAZON (AMZN) Weekly structure on chart says there is big resistance coming at top of trading box $AMZN #swingtrading #earnings

ALPHABET (GOOGL).

Google ( GOOGL ) as with AMAZON is a price trajectory trade to price target after earnings report this week #swingtrading $GOOGL #earnings

As with Amazon, I think Google is going to be considerably challenged by the US government and other governments around the world. At this point I think Amazon is at most risk, with Google next, then Facebook and then Twitter. Twitter and Square may fair well, but Amazon I see at very high risk and Google at high risk. Google as with Amazon will be very good short positions when the time is right.

OK Google, tell us why your earnings growth is slowing down … hello? Anyone there? #swingtrading $GOOGL #earnings https://on.mktw.net/2XQsRgU

TWITTER (TWTR)

TWITTER (TWTR) will also likely become a trajectory trade. Trading in trading box now, on watch other side of earnings. $TWTR #swingtrading #earnings.

The Twitter chart structure is not nearly as good as Google, Facebook and Amazon but it may be less affected by the coming government anti-trust challenge I believe is on the horizon. Twitter is on watch for after earnings this week.

JETBLUE (JBLU).

JETBLUE (JBLU) Good price action post earnings suggests 22.00 then a move to 27.00 possible therafter. #swingtrading $JBLU #earnings

Is JetBlue Airways (JBLU) Stock Undervalued Right Now? #swingtrading $JBLU #earnings https://finance.yahoo.com/news/jetblue-airways-jblu-stock-undervalued-131001127.html?soc_src=social-sh&soc_trk=tw

OAKTREE (OAK).

OAKTREE (OAK) Hit primary price target from last reporting on this, now looking to 55’s earnings $OAK #swingtrade #earnings

Zacks.com featured highlights include: Guess?, Denny’s, FTI Consulting, Oaktree Capital… #swingtrading $OAK #earnings https://finance.yahoo.com/news/zacks-com-featured-highlights-guess-140102104.html?soc_src=social-sh&soc_trk=tw

PLUG POWER (PLUG)

June 24, 2019 – Review video for trading strategy in detail.

BITCOIN (BTC)

June 24, 2019 – Review video for trading strategy in detail.

ADESTO TECHNOLOGIES (IOTS)

June 24, 2019 – Review video for trading strategy in detail.

SQUARE (SQ)

June 24, 2019 – Review video for trading strategy in detail.

STONECO (STNE)

June 24, 2019 – Review video for trading strategy in detail.

PATEUM (TEUM)

June 24, 2019 – Review video for trading strategy in detail.

ANGLO GOLD (AU)

June 24, 2019 – Review video for trading strategy in detail.

OIL SERVICE (OIH)

June 24, 2019 – Review video for trading strategy in detail.

LYFT INC (LYFT)

June 24, 2019 – Review video for trading strategy in detail.

Per June 18 report;

LYFT INC (LYFT) bullish chart trading 64.40 targets 75.44 Jul 5 with 68.82 resistance (trading box) #swingtrading $LYFT

Disney resorts get a Lyft with rideshare partnership #swingtrading $LYFT $DIS https://www.bizjournals.com/losangeles/news/2019/06/18/disney-resorts-get-a-lyft-with-rideshare.html

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, Earnings, $NOV, $TREX, $CHEGG, $TSLA, $AMD, $USO, $AMZN, $GOOGL, $TWTR, $FB, $JBLU, $OAK, $PXD, $TLRY, $EEM, $AGN, $INTC, $XOP, $MGI, $BOX

Premarket Trade Report July 12 | Notes, Alerts, Watch List, Reporting Etc $SGBX, $AMD, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY, #OOTT

Friday July 12 Premarket Trading Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

Premarket Client Notes:

Morning traders,

All reporting will be out this weekend, any delays we credit to accounts – see this link for our policy on reporting cycles and fee credits.

My apologies, the algorithmic models sometimes take much longer to back test than expected. It has happened before. By all, I mean Swing Trading, Trading Results (missing days), Algorithmic reports SPY, VIX, OIL, Gold, Silver, US Dollar, Bitcoin and any other miscellaneous reporting.

It was a Fed speak week and with various other anomalies not only did the models take longer to work but we also didn’t want to take our next time cycle entries without being beyond this specific week. All entries for swinging this cycle and cleaning up the old we want in place between today and Tuesday (some may creep in to late next week, but few). ER will delay some also.

The new oil trade software version is performing well and we will continue to tweak its code toward the 151% per annum target, Bitcoin software is next and then likely Gold but we are undecided at this point:

Profit & Loss: Daily +$473 YTD+$5,412 Projected $85,891 or 86% Oil Machine Trade 100k Account. #Oil #TradeAlerts #MachineTrade #OOTT $CL_F $USO $WTI $USOIL

Profit & Loss: Daily +$473 YTD+$5,412 Projected $85,891 or 86% Oil Machine Trade 100k Account. #Oil #TradeAlerts #MachineTrade #OOTT $CL_F $USO $WTI $USOIL pic.twitter.com/7p2mfdgZNT

— Melonopoly (@curtmelonopoly) July 12, 2019

Near 4 weeks now, one red day (-0.2% draw-down) since new version launch Crude Oil Trading AI software. Current return trajectory 83% per annum. Target 151%. 3 yr history +90% trade alert win rate. Verified P&Ls. EPIC Oil Algorithm #tradealert #OOTT $USO $WTI $CL_F #machinetrade

Near 4 weeks now, one red day (-0.2% draw-down) since new version launch Crude Oil Trading AI software. Current return trajectory 83% per annum. Target 151%. 3 yr history +90% trade alert win rate. Verified P&Ls. EPIC Oil Algorithm #tradealert #OOTT $USO $WTI $CL_F #machinetrade pic.twitter.com/NpS2nBVri7

— Melonopoly (@curtmelonopoly) July 12, 2019

Watch List, Current Trades:

Current Trades – The AMD trade is going very well, we’re 2/3 trimmed on longs at this point but will likely add as we go through the sequence of buying support and selling resistance areas. The Bitcoin trade, first 3/4 were good and last 1/4 not as good, we’re completely out at this point however, we are going to be very active next week forward with new machine trade software development starting. All new swing trades (per above) and reporting on all existing swing trades will be very active over next week.

It’s Friday so don’t try and make up your week today, liquidity in daytrading equities can be weak on Friday’s.

$SGBX at 150%+ in premarket is the big mover, again, caution its Friday and it is a chat room pump, lots of caution.

Bitcoin, not sure at this point, watching the trade within the models close, may be looking at a short term swing entry this weekend, will advise. Still alerting on the swing private feed but new alert feed for BTC in works now.

CXO, DVN, FANG, ECA, EOG, HAL, PTEN, NBL, MRO etc all with down grades this morning, watching the sector close to say the least.

"All News Is Good News" As S&P Rises Above 3,000 While Bond Selloff Accelerates https://t.co/SvLI32fuGV

— zerohedge (@zerohedge) July 12, 2019

Here's a rundown of your top economic news today https://t.co/NAHUZQ5tiY

— Bloomberg (@business) July 12, 2019

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watch List, Stocks, Commodities, Alerts, Trading Room, Bitcoin, $SGBX, $AMD, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY, #OOTT

Trading Profit & Loss Report (Trades, Alerts) July 10 “MY ANGRY RANT – WHY MOST TRADERS LOSE”, $AMD, $CL_F, $USO, $BTC, $BTC.X, $XBT_F #OOTT

Wednesday July 10 Trading Profit and Loss Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

- Includes Live Trading Room Raw Video Feed Recording.

- Includes Trade Alert Links / Screen Shots.

Note: I am just getting back in to the routine of posting daily trade profit and loss reports. For now the reports will include basic information and over time we will provide more information for traders that are using this information for their study and /or trading plans. Near future we will include more formal P&L spreadsheets also.

Section 1: Trading Day Summary.

Good morning, I am writing this in premarket on Thursday, I’m doing July 10 trade results now and if time I will do July 9 (July 9 was only oil trades, all wins), but July 10 was more involved so I’m doing it first to be our traders are up to date.

Caution, there is quite an angry rant below about me not being surprised most people fail trading.

Wednesday was #EIA day for oil traders and Fed testimony day. I took a 1/3 off my $AMD long swing (going great), closed the final 25% of my Bitcoin $BTC short (final execution was not near as good as the first 75% of the trade), nailed a crude oil long trade along with our software machine trade (which is doing great).

Per recent note below in italics, reports are coming we were in it all last night and they will start going out this evening, we want all our new entries to be in place for all swing trades between today and Tuesday for this important time cycle.

Don’t go to sleep, we have a flurry of equity, commodity and indices trades coming very soon. It’s all about time cycles and the current reporting in process getting released.

Our focus #timecycles and how they fit with #Powell #Trump war plan. It's been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

— Melonopoly (@curtmelonopoly) July 10, 2019

Per above our machine software nailed an oil trade continuing its march to considerable gains if its trajectory continues since most recent version launched. For more information on the machine trading platform contact Rich at Sovoron direct www.sovoron.com.

Profit & Loss: Daily +$136 YTD+$4,643 Projected $80,694 or 81% Oil Machine Trade 100k Account. #OOTT #Oil #MachineTrading $CL_F $USOIL $WTI $USO

Profit & Loss: Daily +$136 YTD+$4,643 Projected $80,694 or 81% Oil Machine Trade 100k Account. #OOTT #Oil #MachineTrading $CL_F $USOIL $WTI $USO pic.twitter.com/DuWKl8fgDf

— Melonopoly (@curtmelonopoly) July 10, 2019

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI pic.twitter.com/bMP3Ods5TU

— Melonopoly (@curtmelonopoly) July 8, 2019

Top performing funds of 2018:

1. Odey European

Performance in 2018: 53%

Strategy: Macro

Top Performing Hedge Funds of 2018 https://t.co/INqmmzBTLn via @investopedia

— Melonopoly (@curtmelonopoly) July 10, 2019

Section 2: Specifics on Trades for the Day.

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert. As time allows I provide in the section below copies of charts, guidance from private member Discord server chat room, live trade room screen shots and screen shots of alerts.

Oil Trades / Alerts.

Below is a screen shot of the trade alert short side snipe technical trade 60.17 to 60.10. The earlier trade in futures is the one below this image.

Below, a screen capture from oil trading alert feed on Twitter, the first trade (early futures) both I and machine software traded long for a win. Entries from 58.40s & .50s and we closed the trade 58.72 area and alerted it.

Bitcoin Trades.

Note: We continue to alert Bitcoin on the swing alert feed for now (and by email), this will change soon however when our new Bitcoin trading chat Discord server opens and the new Bitcoin alert feed on Twitter is available to members.

I did get stopped out on the final 25% of this BTC trade when I was out in the evening at meetings Wed night, the first 75% was great and the last not so good. My BTC trading will get very regular in to next week as we’re launching our coding of the BTC algorithm now that we’re done the Oil trading algorithm. We have big plans for this area of trade / machine trading, alerts etc. The returns in our Bitcoin trading will be the largest returns we achieve, easily hands down. More on that very soon.

Swing Trades.

Note: Our swing trade chart models can be used for daytrading (converting them on the fly is easy – bringing the time-frame down to 30, 15, 5 and 1 minute time frames).

As mentioned above, I closed 1/3 of my AMD swing trade. This trade is an excellent example of the power behind algorithm models. We took the entry at the support of the channel (marked with arrow on chart in screen shot below of trade alert). The point is, there was no channel there as conventional charting would see it. That channel support is part of the model. Conventional charting provides a channel on the chart after the fact. If you look at any of the experts that were trading this (and I won’t mention names), they were talking up their AMD trade with entries long after ours, because they couldn’t see what we could see.

This is a critical lesson that 99% will over-look. It not only provide better returns for your swing trades, but more confidence in your trades and precise areas to exit.

Our new swing trade report due out soon has many of these excellent set ups. And our members can access many models from the 3 years we have been building models in equity markets, it is a significant advantage and the primary reason we post incredible swing trade returns (see our profit and loss master document).

Our swing trade returns (alerted) are top of class, you can’t get better, you just have to stop for more than a minute and look at the P&Ls and the alert feed. It’s quality over quantity, not casino mind trading. If you’re sensing emotion to this there is, check the alerts and try and find better. Those returns beat the best hedge fund returns in the world. Time stamped, alerted live, recorded in live trading room – the evidence is there and couldn’t be more clearly laid out, for near 3 years! The only thing I could do more is serve it McDonalds style with a nice cover image, drive thru style 2 min videos so that most would eat the sh*t that the market serves out, oh and put two lines on the chart. World class swing trading, best you can get. We know how many people open the charts, watch the videos, do their homework, its no wonder the majority fail. Totally disappointing.

And now we’re developing machine trade for oil that will (if I get my way) beat the best funds in the world with-out trying (in fact we’re targeting 3 x their best results and currently on track for 2 x) and soon Bitcoin machine trades. I mean really. Jeez. Do your homework and stop telling me everything is against you when I talk to you on DM or whatever. It’s your fault it ain’t the markets fault. VERY FEW do what it takes. All the videos are there, raw trading room feeds yes, that is what you need. You can look at the time stamp on the alerts and go to the raw trading room feed and hear everything I was thinking about the trade set-up and more.

THIS IS WHAT A TRADER NEEDS, YOU DON’T NEED DRIVE THRU CASINO MIND SH*T 2 MIN VIDEOS. THIS IS WHY YOU DON’T WIN.

THIS IS WHY THE MAJORITY OF TRADERS LOSE.

Section 3: Trading Room Raw Video Footage for the Day.

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is a raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts. I make this available for authenticity / documentation and also some learning traders use the raw feeds for study purpose. Also, as time allows I publish separate trade set-up reports with video snippets to our blog and YouTube.

Live Trading Room Raw Feed

The video below at time of posting is still uploading at YouTube so it may not be available yet when you try.

If you have any questions about my trading or need help with yours send me an email anytime compoundtradingofficial@gmail.com and I’ll do my best to help.

Thanks

Curt

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Profit and Loss, Trade Alerts, Trading, Day Trading, Swing Trading, Oil, Bitcoin, USO, CL_F, BTC, BTC.X, XBT_F, AMD

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Monday July 8 Trading Profit and Loss Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

- Includes Live Trading Room Raw Video Feed Recording.

- Includes Trade Alert Links / Screen Shots.

Note: I am just getting back in to the routine of posting daily trade profit and loss reports. For now the reports will include basic information and over time we will provide more information for traders that are using this information for their study and /or trading plans. Near future we will include more formal P&L spreadsheets also.

Section 1: Trading Day Summary.

Monday was moderately calm trading day.

Don’t go to sleep, we have a flurry of equity, commodity and indices trades coming very soon. It’s all about time cycles and the current reporting in process getting released.

Our machine software nailed an oil trade continuing its march to considerable gains if its trajectory continues since most recent version launched.

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI pic.twitter.com/bMP3Ods5TU

— Melonopoly (@curtmelonopoly) July 8, 2019

On the stock (equity) trading front it was quiet for Day Trades and Swing Trades (as said previous, when new swing trade report is launched this will change, we expect it at latest Wed night this week). I am watching $AMD close as I am in 3/10 size, the other swing trades / updates will be on the report (I have a number of open trades that I will report on).

Still in the Bitcoin short 1/4 of the size of initial short, first 3/4 went well and final 1/4 a tad under water. Over all a decent trade.

Section 2: Specifics on Trades for the Day.

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert. As time allows I provide in the section below copies of charts, guidance from private member Discord server chat room, live trade room screen shots and screen shots of alerts.

Oil Machine Trades / Alerts.

Since the new version of software was launched a few weeks ago it has a decent P&L rolling along (as noted above), here’s a quote from the machine P&L report I was reviewing this morning (soon you will get daily copies);

“Profit & Loss: Daily +$389 YTD+$4,500 Projected $82,120 or 82% Oil Machine Trade 100k Account.”

Below are the oil trade alert screen shots of the machine software alerting our members to the opening and closing of the trade.

Personal Oil Trades.

- I traded with the machine software as it traded only.

Machine Bitcoin Trades.

- N/A in development.

Personal Bitcoin Trades.

- None, watching current action to either re-short at resistance (see member report) or cover the final 25%. Decent trade so far but would like to see price targets 2 and 3 of 3 hit. Price target 1 hit.

Personal Swing Trades.

- No new positions, adds or trims (other than Bitcoin). This will get very active as soon as the new swing trade report is released.

Personal Day Trades.

- None on day. There were a few set-ups per the premarket report I was ready to trigger on but the equity markets slumped so I didn’t trigger a day trade in equities.

- As above, once the new swing report comes out my day trading will get much more active. Our swing trade chart models can be used for daytrading (converting them on the fly is easy – bringing the time-frame down to 30, 15, 5 and 1 minute time frames).

Section 3: Trading Room Raw Video Footage for the Day.

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is a raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts. I make this available for authenticity / documentation and also some learning traders use the raw feeds for study purpose. Also, as time allows I publish separate trade set-up reports with video snippets to our blog and YouTube.

Live Trading Room Raw Feed

If you have any questions about my trading or need help with yours send me an email anytime compoundtradingofficial@gmail.com and I’ll do my best to help.

Thanks

Curt

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Profit and Loss, Trade Alerts, Trading, Day Trading, Swing Trading, Oil, Bitcoin, USO, CL_F, BTC, BTC.X, XBT_F, AMD

Premarket Watch List July 8 $SGMO, $AMD, $OASM, $AYTU, $CBIO, $SYMC, $ORN, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Monday July 8 Premarket Watch List.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

Watch List

24 Stocks Moving In Monday’s Pre-Market Session $OASM $SGMO $CBIO $AYTU $SYMC $ORN $NTAP $TYME $AAPL $LC $LPL

REVIEW – $AMD +1.3% premarket Ryzen 3000 Review: AMD’s 12-core Ryzen 9 3900X conquers all – PC World

https://www.pcworld.com/article/3405567/ryzen-3000-review-amds-12-core-ryzen-9-3900x.html

NEWS – $SYMC +4.0% pre – Broadcom $AVGO Makes Progress on Symantec Deal With Financing, Savings – BBG

GEOPOLITICAL – $USO Oil steadies as demand concern counters Middle East tensions – SI

ETF INFLOW – Silver $SLV – Silver Sees Largest Daily ETF Inflow In A Year: BMO $SLV #Silver

https://twitter.com/curtmelonopoly/status/1148041622472540160

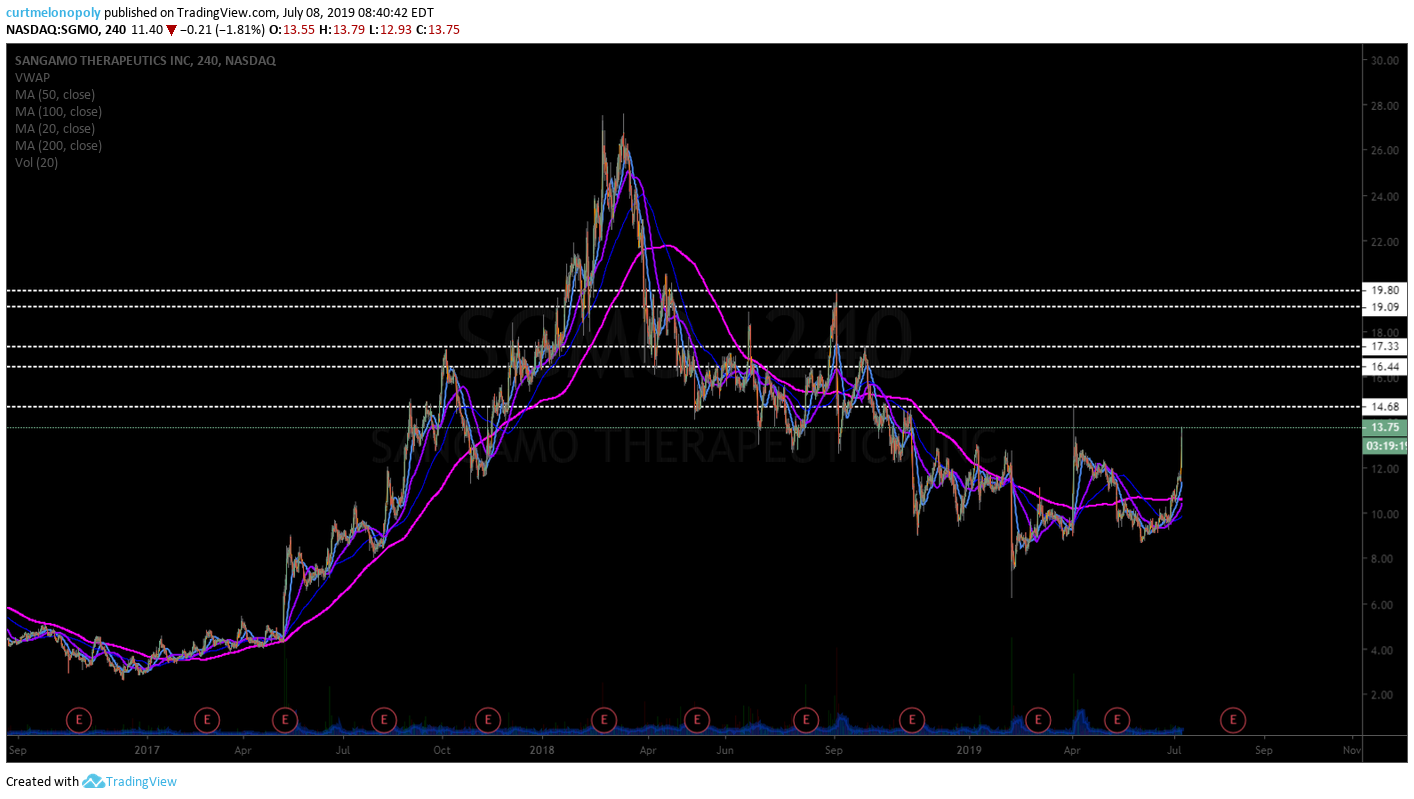

SGMO premarket up 20.53% trading 13.75 on results. Daytrading resistance points on chart $SGMO

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watchlist, Stocks, Commodities, Bitcoin, $GMO, $AMD, $OASM, $AYTU, $CBIO, $SYMC, $ORN, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Daily Trading Profit & Loss (Alerts) Report: July 1, 2019 $AMD, $KOOL, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Profit and Loss Summary for Personal Day and Swing Trades, Oil and Bitcoin Trades, Machine Trades and Alerts. Includes Live Trading Room Video and Alert Feed Screen Shots.

I recently posted to my Twitter feed that I would start providing daily trade profit and loss summaries and also posted some info on our goals for our machine trading / alert compound gains. Thread is below.

Compound Trading

100k at 0.6% gain day compound 23 mos= 1,000,000.00

Mon July 1, 19 100,000.00

Sun May 16, 21 1,000,737.00

Trading Days Yr 252

Annual ROI 151%

Monthly ROI 13.2%

Daily Target 0.6%#MachineTrade #Oil #Bitcoin #OOTT #Crypto $USOIL $WTI $CL_F $USO $BTC $XBT_F $XBTUSD— Melonopoly (@curtmelonopoly) June 30, 2019

This is the first profit and loss post, this will for now be basic and over time we’ll get more info and more formal (with proper P&L spreadsheets). Below is what time allows for today.

Oil Machine Trades / Alerts

There were four oil trades, all winners, the target (goal) for the day was exceeded by the machine trade.

3 of 4 of the trades were alerted. Alerts went to private Discord server, private member oil alert feed, were broadcast (my voice with charting) in the live trading room. 1 of 4 was only alerted live in trading room.

Personal Oil Trades.

None, however, I will be trading along side the machine trade alerts going forward now that our coding is mostly complete for oil.

Machine Bitcoin Trades.

N/A in development.

Personal Bitcoin Trades.

I shorted Bitcoin at 1/10 size, it went well and I covered 50% of the trade holding half at this point. Looking for a bounce to add to the short or if price gets to the price target I will close the short and re short after a bounce. Members can refer to the alert feed and / email sent out explaining the charting and trading plan for this short.

Personal Swing Trades.

The one swing trade was long AMD, which was a 2/10 size intended as an add to the current swing position (initial position at channel) and the other portion of the 2/10 size was to be a day trade, however, the day trade didn’t work so I am 3/10 long AMD.

Members can check to the private member swing trade alert feed on Twitter and recent reports for all current swing trades (there’s a new consolidation report on deck coming also).

Personal Day Trades.

As above the AMD day trade, it went against me and the only reason I held it is because I’m in an AMD swing trade and because my sizing is correct. When you have a swing trading plan and you’re also day trading a stock then this becomes an option for a trader. This is why we first start with the larger structure of the financial instrument and put together a trading plan for the swing trade and then perhaps also day trade the stock. You can take any of the swing trade charting in the reports and bring it down to a day trading time frame. If I day trade a stock that we do not have models for I would never hold the trade whether it goes well or not.

Historical Profit and Loss Trading Statements.

Jen is currently reconciling all the trading profit and loss statements for the purpose of review and study. The most recent working document update is available here:

Protected: Swing Trading Profit & Loss Report | Swing Trade Alerts Nov 2016 – June 26, 2019

Password: 4321 (if asked)

Take a look at recent premarket note for more about what we’re up to with our trading here:

Trading Room Raw Video Footage on Day:

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts.

Live Trading Room Raw Feed $AMD $USOIL $WTI $CL_F $BTC $XBT_F

Supporting Trade Alerts and Charting on Day:

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert.

Crude Oil Trade Alerts.

3 for 3 for machine trade alerts today. Exceeding .6% daily 151% per annum goal. #OOTT FX $USOIL $WTI $CL_F $UWT $DWT #OilTradeAlerts #machinetrading https://twitter.com/curtmelonopoly/status/1145164315726684161 …

3 for 3 for machine trade alerts today. Exceeding .6% daily 151% per annum goal. #OOTT FX $USOIL $WTI $CL_F $UWT $DWT #OilTradeAlerts #machinetrading https://t.co/sjrecbrb1p pic.twitter.com/ofpx0tP5mS

— Melonopoly (@curtmelonopoly) July 1, 2019

Machine trade caught the bottom turn today again. #OOTT FX $USOIL $WTI $CL_F $USO $UWT $DWT #OilTradeAlerts #MachineTrading

Machine trade caught the bottom turn today again. #OOTT FX $USOIL $WTI $CL_F $USO $UWT $DWT #OilTradeAlerts #MachineTrading pic.twitter.com/4jgRW2UoXp

— Melonopoly (@curtmelonopoly) July 1, 2019

Bitcoin Alerts.

Short Bitcoin 10640s for price target 1 at ****** area then possibly on to two other targets in trend noted $BTC #tradealerts

https://twitter.com/SwingAlerts_CT/status/1145671162950799362

50% profit trim 10319.00 $XBTSUSD $BTC #Bitcoin 20 ma support test on Daily #tradealerts

https://twitter.com/SwingAlerts_CT/status/1145708849728540672

BITCOIN (BTC) Short term trading plan, short or long at each arrow, timing on lower time frames $BTC #tradingplan

BITCOIN (BTC) We have met all targets now since buy alert (green arrow), trajectory early, what’s next on deck in new charting and report due later today. $BTC #Bitcoin

https://twitter.com/SwingAlerts_CT/status/1145610739991883777

DayTrade & Swing Trade Alerts.

Long $AMD 31.89 (already in swing, so partial is swing add and partial day trade), day trade partial. Resistance / price targets 32.58 trading box, 32.89 trendline diagonal, 33.64 mid quad, 34.29 trend line diagonal, 34.65 trading box final target. #daytrade #swingtrade #alerts

https://twitter.com/SwingAlerts_CT/status/1145668110147563520

ADVANCED MICRO (AMD) up nice from channel alert, trading 31.89 premarket, watch marked areas for resistance #swingtrade #daytrade $AMD

https://twitter.com/SwingAlerts_CT/status/1145665998453952513

ADVANCED MICRO (AMD) Nice bounce off channel support and above trading box res, trim in to key resistance add above in trajectory #swingtrade $AMD

https://twitter.com/SwingAlerts_CT/status/1143884167882727424

If you have any questions about my trading or need help with yours send me an email anytime compoundtradingpfficial@gmail.com and I’ll do my best to help.

Thanks

Curt

Additional Info:

Master Trade Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.