Below are the updated crude oil trading chart models in for the week of April 28, 2019 to be used as signals for your trading strategy (day trading, intra-day swing trading or swing trading weekly and monthly time frames).

The charts are suitable for mechanically executed trading and are also the models our coding staff are using for our crude oil machine trade.

With each chart model there are trade strategy notes included for consideration.

For clarity, please review historical reporting on our blog and videos on YouTube for your study.

Much of the structured model discipline used is similar to concepts discussed in this video; Mathematician Who Cracked Wall Street.

Crude oil price moves within structured areas (or the range) of charting on various time frames at different times in trade. The structure oil price moves within (the range) can be one minute charting timing through to monthly charting time-frames and can be conventional charting set-ups or algorithmic chart set-ups (structures). Understanding and having each time frame at your disposal for both conventional and algorithmic charting will go a long way to increasing your probability of profitable trading.

Sizing your trades appropriate to your trading account and time frame for each set-up is also sound strategy.

Using the correct charting time-frame specifically for your trading strategy is critical. Generally, the lower (smaller) the time frame the less predictable the support and resistance areas of the charting will be. However, the larger time-frames (monthly, weekly, daily) can also have significant “slippage”.

Generally, the idea is to enter your positions based on the structure for the specific time frame you are wanting to trade referencing the other time frame support and resistance or range within the trend. The basic method is to understand the range of trade and execute trade long bias when price is near support for the appropriate time frame / structure and the opposite is true for short trades.

Our staff use the thirty minute model structures (range within trends) most often for primary areas of support and resistance trading signals referencing all other time-frames in their trading strategy.

Positioning should be significantly biased to the trending range of trade. For more information about trend identification for trading various time-frames refer to this article on Investopedia; Multiple Time Frames Can Multiply Returns.

If you have any questions about the models below please email us at [email protected].

Not all charts are updated every week and some concept or test charts are added or deleted on occasion.

Please note, the chart links are now distributed specific to each user or small group of users. If you are using more than one device to access the charting, to avoid disruption of service, please email us a simple / general description of those devices to assist in controlling dissemination.

EPIC Crude Oil Algorithm Model. 30 Minute Oil Chart Structure.

April 28 – Important note: Due to the Good Friday market holiday, the EPIC model will be divergent (or out) somewhat so please use the diagonal support and resistance lines cautiously until next week. This issue occurs after every market holiday and remains in effect for two weeks after each holiday.

The EPIC algorithm model chart below is a proprietary structure that has been back tested sixty months on thirteen time-frames. The model represents the most probable areas of support and resistance in oil trade on this specific time-frame.

Therefore, the levels noted on the EPIC model are to be used as important areas of consideration for support and resistance (trade signals) for your trading strategy when using conventional charting set-ups / structures and/or other algorithmic charting.

Resistance and support areas on the thirty minute charting oil trade structure are at each line on the algorithmic chart below. The primary areas of support and resistance are;

- Outer quadrant walls / also used as channel support and resistance (orange dotted diagonal), the half way point between each is often a buy or sell trigger in trade (not shown on model below),

- Mid channel line for uptrend and down trend (white dotted diagonal),

- Mid quad horizontal (not marked but is at the mid point of the quad),

- Fibonacci levels (various horizontal colored lines),

- Historical areas of support and resistance (purple horizontal).

- The intra-week swing trading range is from thick horizontal gray line to the next (commonly becomes a pivot area of trade).

- Also of note are the price targets for Tuesday 4:30 PM (API), Wednesday 10:30 AM (EIA) and Friday 1:00 PM (Rig Count). The Tuesday and Wednesday targets hit significantly more often than the Friday target (red circles with red or green vertical dotted lines intersecting).

This video explains How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, #OIL, #Trading, #Algorithm, #OOTT as does this video Oil Trading Room – How to Use EPIC the Oil Algorithm Model Chart June 21 #OIL #OOTT and this Webinar 1: EPIC the Oil Algorithm.

When the conventional crude oil charting set-up coincides (or agrees) with the EPIC algorithmic model support and resistance this is then considered a significant buy or sell trigger (signal) for crude oil trade.

Remember to be aware of (at minimum) the primary support and resistance areas on the larger time-frames (lower time frames are not as critical) – in this instance the 1 hour, 4 hour, daily, weekly and monthly charting should be considered when sizing your trades etc.

EPIC 30 Min Crude Oil Trading Algorithm Model April 28 946 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Per recent;

EPIC 30 Min Crude Oil Trading Algorithm Model April 20 817 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Algorithm

Crude Oil 30 Minute Simple Alternate Algorithm Model.

The simple alternate model below has Fibonacci support and resistance horizontal lines and diagonal Fib trend lines. However, trending channels and other conventional set-ups and the associated range of each should be a more primary consideration for your trading strategy.

Conventional trend lines and trending set-ups are noted in yellow on the chart.

Pay special attention to the relation between the intra-day price of crude oil and the 20 MA and 200 MA on the 30 minute chart. When price is above both the 20 and 200 moving averages (with 20 MA breaching through 200 MA upward) there is a significant probability of bullish continuance.

Also pay close attention to when the important support and resistance on the alternate model coincides with conventional chart signals and the EPIC Oil Algorithm model. This is key to your trading strategy and trade bias to bullish or bearish positioning should be relative to the structures agreeing.

30 Min Alternate Trend Lines (wide view) Crude Oil Trading Model 1042 PM April 28 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

https://www.tradingview.com/chart/USOIL/Y6ftxa1F-30-Min-Trend-Lines/

Per recent;

30 Min Alternate (wide view) Crude Oil Trading Model 902 PM April 20 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

30 Minute Oil Day Trading Structure.

Per recent;

Daytrading Fibonacci levels are added to the 30 minute chart structure below. There are also some timing notations (in white) that you can ignore, they are timing points of note I am watching.

30 Min Alternate Crude Oil Day Trading Model 1031 PM April 20 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

One Minute Oil Trading Model. Ideal for Intra-day Crude Oil Trade.

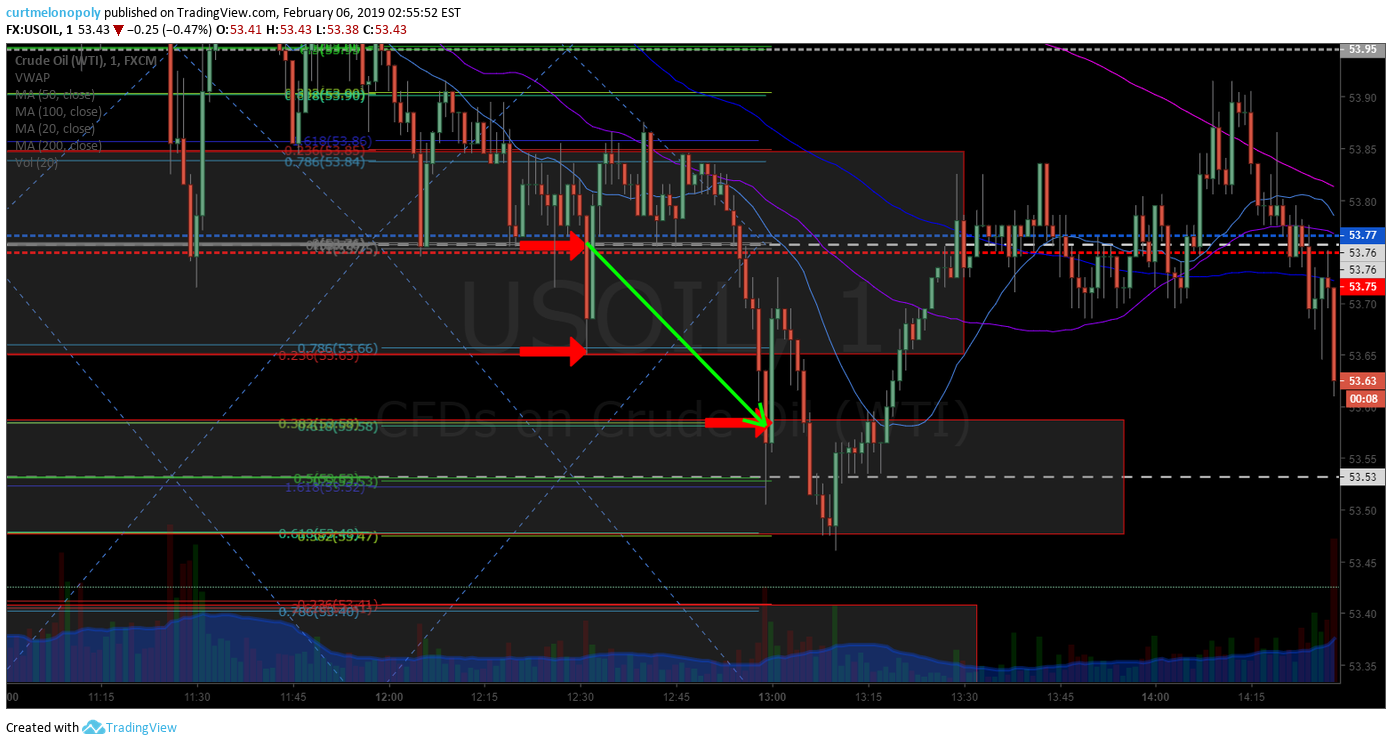

The one minute oil trading model provides for pinpoint trade entry, sizing and exit points for daytrading oil. It is also used for squeeze scenarios in oil day trading. The main range is between the red / blue areas with thicker dotted white lines. The range is considerably more predictable in a squeeze scenario.

Per recent;

One Min Crude Oil Trading Model (day trade) April 20 1120 PM FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Crude Oil Trade Setup Strategy When 20 MA Crosses up 200 MA with Price Above on One Minute Chart.

42 tick move when the 20 MA crossed up through 200 MA with price above on the one minute oil chart. There was some chop after price initially moved above 200 MA with 20 MA so you have to be prepared for this scenario. Often day traders will wait for price to get above the 200 MA and over the next level (the next Fib, the next MA or VWAP or previous / recent high in progression).

Crude Oil Trade Setup Short Strategy When 20 MA Crosses Down 200 MA with Price Below on One Minute Chart.

38 tick move when the 20 MA crossed down through 200 MA with price below on the one minute oil chart. There were a few pops up over 200 MA with price after initially coming under 200 MA so you have to consider that, quite often traders will wait for the confirmation when the 200 MA test fails to upside (which happened in the example below when the 50 MA then crossed down the 200 MA with price under).

Choppy intra day trade in crude oil on one minute chart. Wait for confirmation signals.

The example one minute oil chart below provides charting for choppy intra-day scenario. This is an example of why waiting for confirmation signals is prudent. Also note that this choppy intra-day trade was early in the evening in early futures trade, typically not the best time of day to trade crude oil. 3:00 AM to 3:00 PM Eastern Time is best for trading oil.

Also consider the trend line support and resistance and moving averages on both the 30 minute algorithm chart model and the conventional 30 minute oil charting.

5 Minute Crude Oil Chart Model.

The five minute oil trading strategy chart below includes a Elliot impulse 5 wave component for when oil is trading intra-day on this time frame. The horizontal / diagonal / sloping up-trending green lines can be used as support and resistance decision areas.

5 Min Crude Oil Trade Model 1055 PM April 28 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

5 Min Crude Oil Trade Model (concept chart) 1201 AM April 21 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

15 Minute Crude Oil Trading Structure.

Simple 15 min crude oil structured chart model April 28 1112 PM FX USOIL WTI CL_F USO

The previous structured test model from the previous report we are not updating this week, however, the support and resistance pivots are included below;

15 Min support and resistance marks on chart (without model structure). Crude Oil. April 28 1109 PM.

https://www.tradingview.com/chart/USOIL/tNVngoj8-15-Min-Support-and-Resistance-Marks/

Per recent;

Below is an untested and non back tested 15 minute chart for oil trade.

15 Min Crude Oil Trade Model (test concept chart) 1207 AM April 21 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

60 Minute Oil Charting.

60 Min Trend Channel Trade Box Fork (concept chart) 1117 PM April 28 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

Per recent;

60 minute simple crude oil trend-line, trending channel chart.

4 Hour Trending Channel Chart.

4 Hour Oil Trending Channel Chart with Trading Box 1121 PM April 28 FX USOIL WTI $USO $CL_F #Crude #Oil #Trading #Strategies

4 Hour Symmetry Chart Model.

April 28, 2019 – In recent trade the 4 hour symmetry price targets in oil trade have been divergent to the bullish side. At this point we are watching for a new symmetrical pattern to develop or the previous to re-continue.

See previous link below.

Per recent;

4 Hour Symmetry Chart, Previous Resistance Now Support 1220 AM April 21 FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

Trade in crude oil has recently jumped up over the channel resistance and now trades above the channel top (now support).

Per recent;

Crude oil has been trading in the channel on this algorithmic model since an 7, 2019. The white dotted lines at the top and bottom of this structure are support and resistance in the trending channel. The targets are historical hits.

Per previous;

The white targets are showing a possible divergence to trade either up or down in to either of the white targets in this time cycle.

4 Hour Oil Concept Trading Model.

The 4 hour crude oil concept model below has trend-lines, Fibonacci support and resistance horizontal lines (pay close attention to the gray horizontal lines) and diagonal algorithmic Fib trend lines (orange dotted).

4 Hour Concept Crude Oil Trading Model April 28 1113 AM FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

4 Hour Concept Crude Oil Trading Model April 21 1241 AM FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Daily Chart Trading Model.

The daily time frame provides a larger structure to consider. The diagonal Fib lines are important as are the mid quad horizontal lines. The moving averages (especially the 200 MA) should be considered in your trade strategy. The MACD is a common indicator on the daily oil chart for forward positioning and trend bias.

April 28, 2019 Trading Strategy / Set-Up Based on Symmetry in the Trend on the Daily Chart.

A sell off in exact place in structure of daily chart model did occur once previous in this trend (see two circled areas on daily chart below).

The two instances of selling pressure in the bullish daily trend in oil trade happens to be a perfect symmetrical measured extension in the progression.

IF crude oil trades up the same measured extension as the low to the first sell off in the symmetry, this would imply a high in this trend for crude oil on FX USOIL WTI to approximately 69.00 – if symmetry continues.

Before a pull back, or about 600 ticks from where oil is currently trading at 62.96.

See chart below;

Daily Crude Oil Chart with Symmetry of Previous Sell Off and Price Target of 69.00 if Symmetry Continues 1154 PM April 28 FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

Daily Chart Structure Crude Oil Trading Model. MACD turned down. 1248 AM April 21 FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Conventional Daily Crude Oil Chart with Support and Resistance 1157 PM April 28 FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Weekly Oil Trading Model.

The most important signals on the weekly chart model are the red historical trend lines. Pay very close attention to them. There are other common indicators included on the model also.

Weekly Trendline Crude Oil Trading Model April 29 1203 AM FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

Weekly Trend line Crude Oil Trading Model `155 AM April 21 FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

There is a potential price target of 74s in to early June on this Weekly Oil Chart Model on FX USOIL. Trading 62.95 intra-day.

Monthly Oil Trading Model.

Monthly Structure Crude Oil Trading Model April 29 1217 AM FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

Monthly Structure Crude Oil Trading Model April 21 100 AM FX USOIL WTI $USO $CL_F #Oil #Trading #Strategies

Per recent;

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Trading, Futures, Strategy, Signals, USOIL, WTI, CL_F, USO

Follow: