Crude Oil Day Trade Strategies (Live Video from Oil Trading Room with Alerts) for EIA, Market Open, Model Resistance, Time Cycles.

This video does not have any high flying trades, what it does have is important lessons for day trading crude oil and understanding how to use the oil trading models to your advantage. It also discusses in detail the time cycles and what to expect in trade action.

#oil #trading #strategies

Voice broadcast starts at 13:30 on oil trading room video.

January 30, 2019 Oil Trading Room Live Session Summary Notes.

13:30 premarket for regular market open comments about important resistance on EPIC Algorithm model and where trade should settle intra-day (at top of quad or mid quad) in advance of EIA petroleum report at 10:30.

14:30 comment to not buying the “pop” in price as I expected crude oil trade to calm in advance of EIA report timing. The resistance hidden pivot (yellow horizontal line on chart) is discussed.

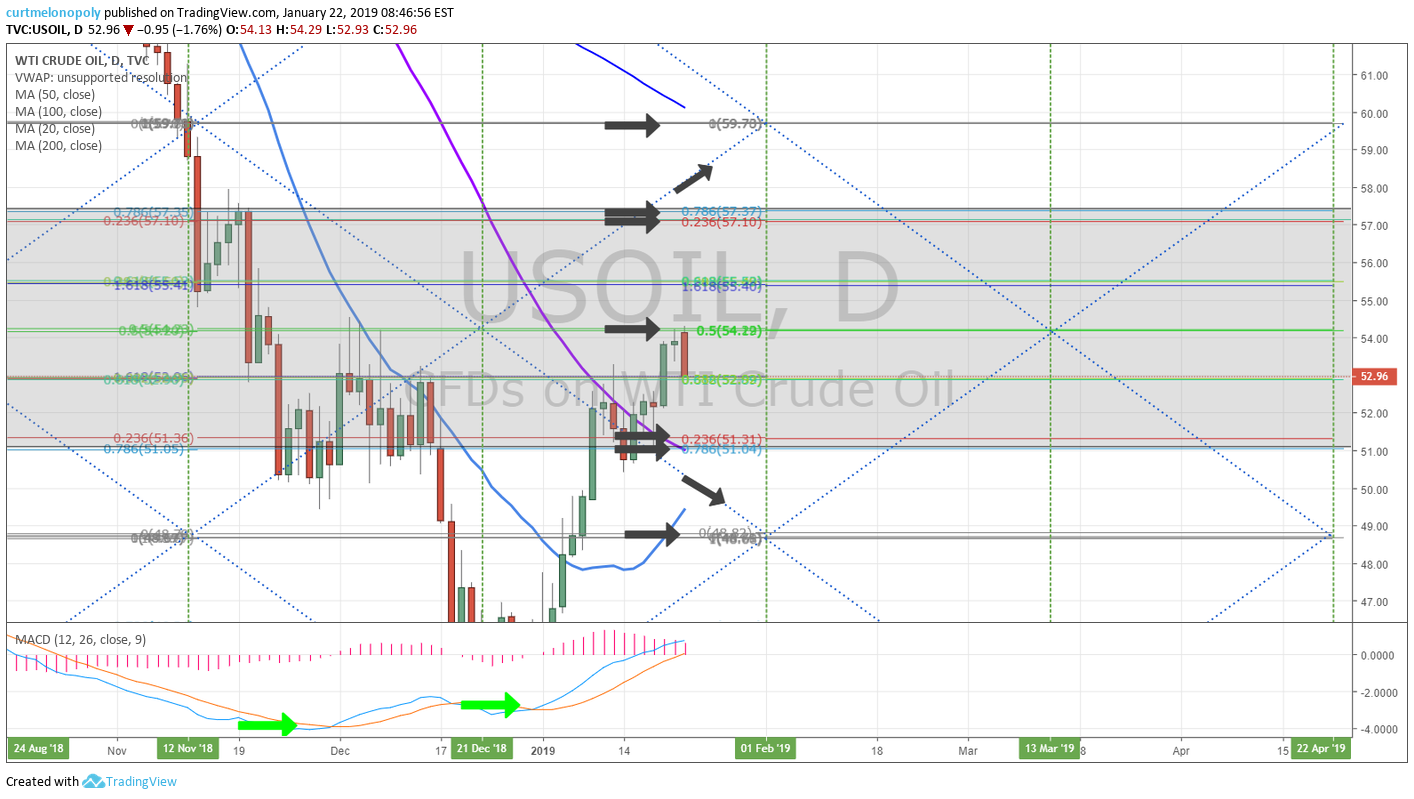

15:00 Comments toward time cycle inflection on global markets (including crude oil) over next 3 or 4 days is discussed. We could inflect up or down on other side of time cycle peak. 55s is very possible (even a blow off in to 56 is possible) as an inflection up over next few days and a double extension up could happen. Time cycle in to mid May 2019 is the main pocket of trade sizing timing. See special report guidance in to May 2019 for crude oil.

Time cycle from end of Dec to now was difficult to trade with swing trade sizing but the next time cycle I can’t miss (the one starting in next few days in to mid May).

18:40 looking for whether price trade can get above pivot and structure a base for a trade on the model.

At 37:37 I comment to stagnant trade not being a surprise in to EIA and that I was looking for a slight short 20 to 30 points in to EIA. Trading 54.00 intra-day.

By 1:13:37 on oil trading room video you can see price did come off as expected.

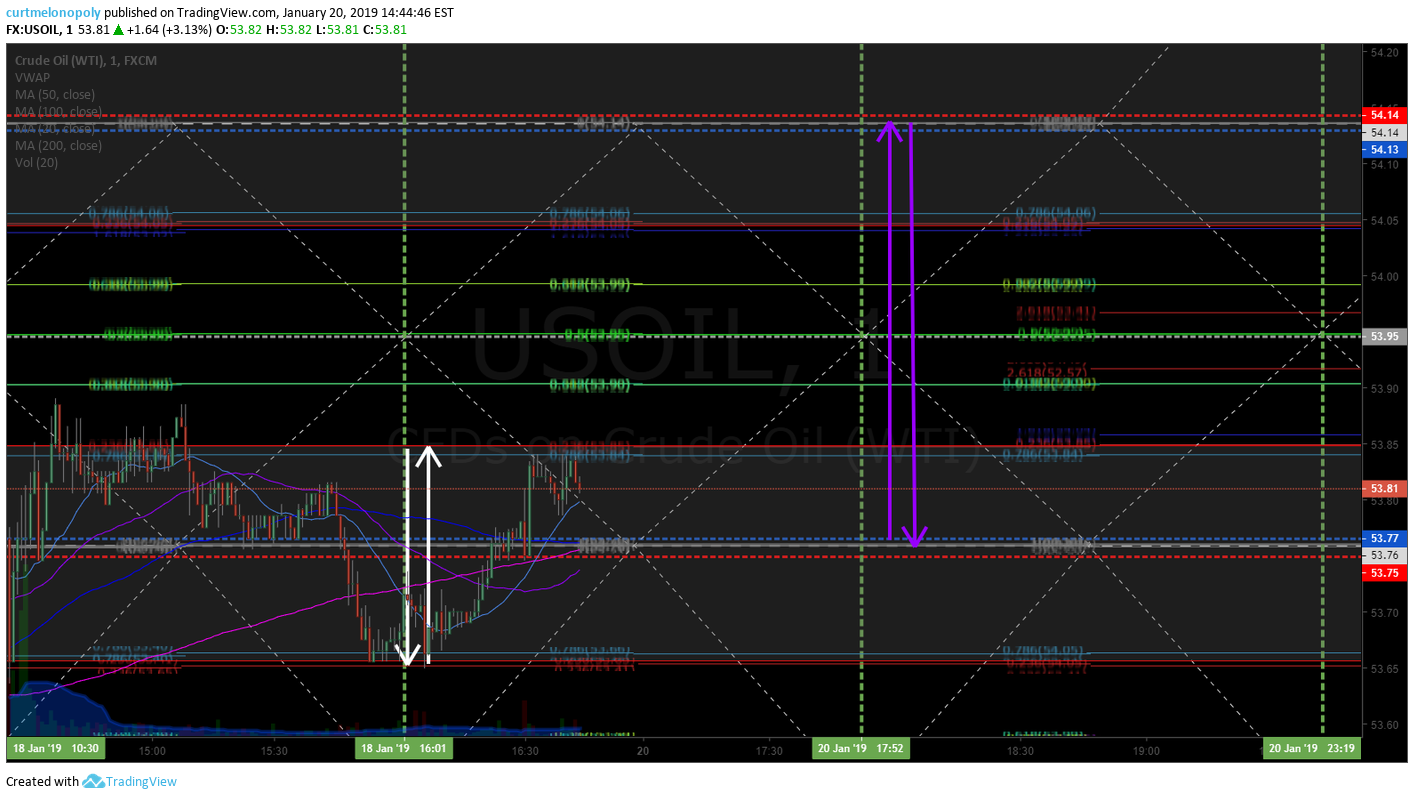

At 1:17:30 EIA is in just under a minute. The model support and resistance is explained.

1:18:40 the one minute model has resistance in trade just over-head (chart not shown).

1:19:20 I announce the EIA petroleum report results and comment that generally trade should be bullish. At 1:20:00 price hits near top of quad.

For a number of weeks we’ve been targeting 55s Jan 31 to Feb 3 so this could be what finishes the trajectory on that time cycle peak.

Screen capture of oil trading room… “could be final move in to 55s if open is strong.”

1:21:40 I am long at 54.24 for a trade above 1 minute support and EPIC model support. Test size trade long crude oil.

EPIC Crude Oil Trade Alert feed screen capture showing trade alerts for trade on the day. You can see that earlier in the day in overnight futures trade that I was actively trading for decent profit.

Resistance 54.32 is noted as key resistance for the trade and the top of the quad and a comment to not getting to excited because of the various resistance points nearby.

1:23:27 we get a touch to the resistance. The test of resistance is commented to. 54.59 upside price target discussed if resistance is breached. Price did in fact hit that on the day later.

Resistance at mid point of trading box on the 1 minute model is discussed. At 1:26:00 on video I close the trade for a small gain at 54.29. Wasn’t interested in dealing with the resistance.

Remember at this point I am still holding DWT short from a number of days ago. The entry short was 13.57 and it hit 8s intra-day. Hoping for 7s before closing.

1:28:15 I show on the model the upside scenario and channel resistance being likely.

1:28:40 I discuss the recent sell off in crude oil in to 41s and our call to 55s in to this time cycle peak is discussed and why this area of trade is low risk reward. Also discussed is the type of trade action to expect in to the peak of the cycle in to Jan 31 – Feb 3.

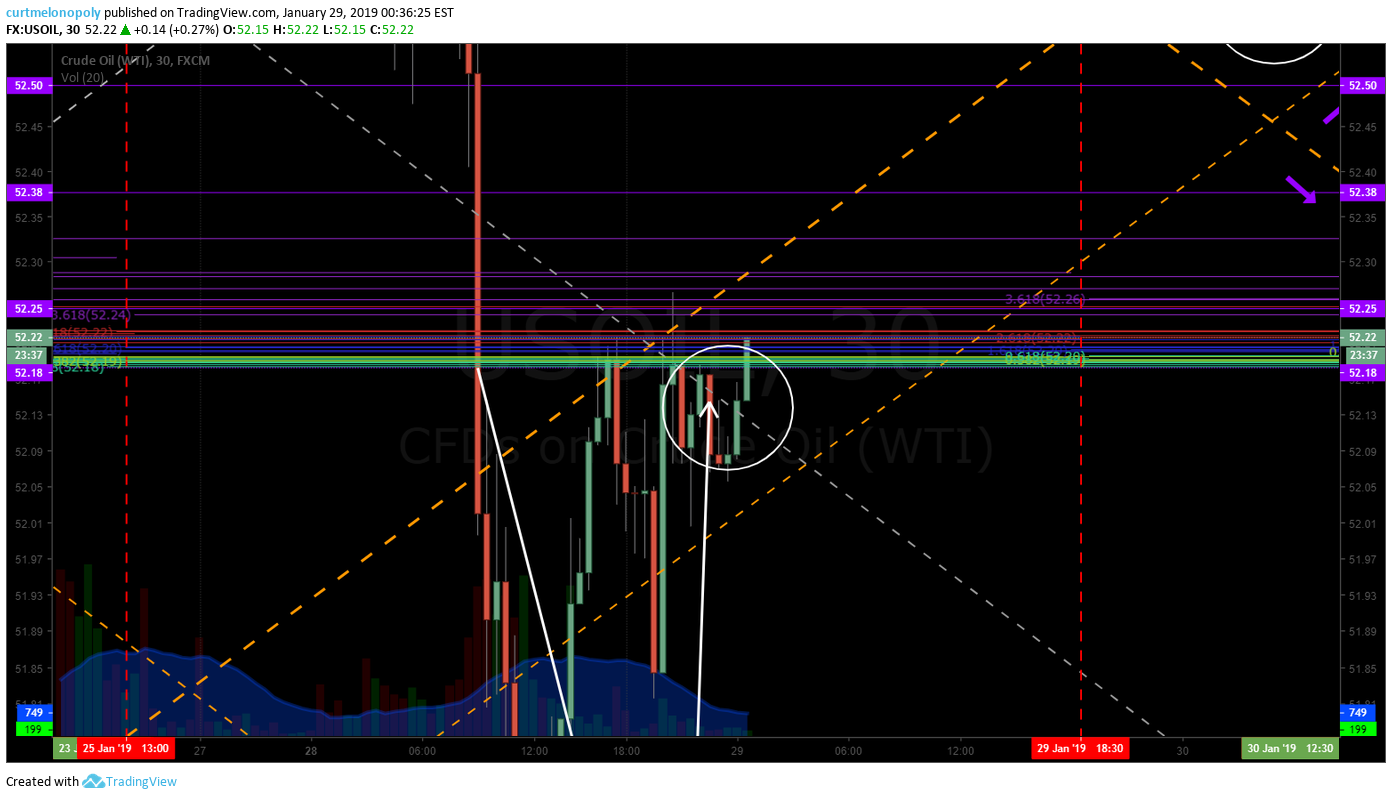

Later in day I reiterate the time cycle peak in crude oil with price target guidance and visual representation of the time cycle and price target on oil chart model for our member strategy.

Time cycle conclusion near term on oil is 55.40 price target from previous reports last number of weeks (could spike in to 56.00) expiring on about Jan 31 – Feb 3. HOD was 54.90. We expect at min a small pull back. FX USOIL WTI

Likely close short DWT (long oil) soon for short term only.

Curt Melonopoly Yesterday at 11:37 PM

Visual representation of the crude oil time cycle

Screen capture from oil trading chat room discussing trading strategies for time cycle peak and price target.

THE TAKEAWAYS – Main Oil Trading Strategies Learned on Video:

Just because oil was bullish in to the market open and normally that would mean a buy trigger – it doesn’t always mean buy.

– In this instance it was Wednesday and the timing of EIA coming in one hour after open had me hold off my long trade because trade normally softens in advance of EIA. Bulls and bears stand-off. Also, there was a key pivot resistance on the oil chart model in play. For these reasons and more the trade set-up was not ideal for risk reward. It wasn’t a high probability long trade.

– Know your resistance and support when trading and get out quick when resistance becomes real like with my EIA trade on this video.

It is highly recommended you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

Recent Learning Posts and Videos (most are premium member locked posts).

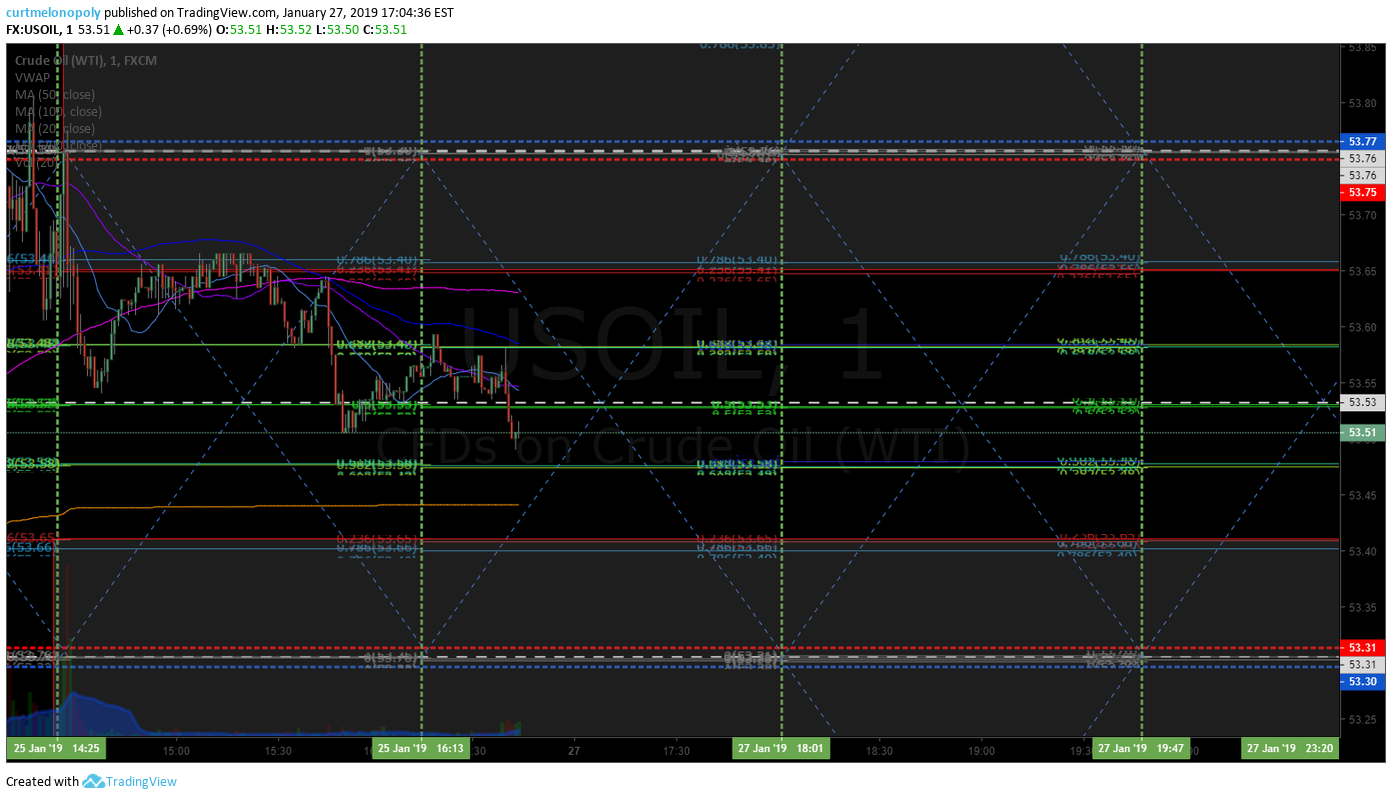

Jan 29 – Trading the Main Support and Resistance on EPIC Algorithm Model. How to Post.

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance.

Jan 27 – Premium Member Private Post (Weekly Reporting & Guidance).

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 22 – Compounding Gains Day trading Crude Oil.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Oil Trading Room, Strategy, Price Targets, Time Cycles, USOIL, WTI, CL_F, USO

Follow: