EPIC v4.1.1 Crude Oil Machine Trade Software

Project History & Objective.

Our team set out over six years ago to develop sophisticated software architecture for the trade of crude oil futures.

The objective: to provide a stable yet high performance product achieving an increasingly higher ROI over time as the software processes market data, structure of trade action and order-flow.

The software has undergone a number of updates over recent years (see links at end of this document for previous white paper updates), the most recent updates have provided for a stable trading entity that continues to excel in terms of ROI.

The most recent updates, noteably the Dec 8, 2022 EPIC v3.9 update and the most recent EPIC v4.1.1 version are providing stellar real world results both in terms of ROI and stability.

EPIC is used by the trading team at Compound Trading (for live trading alert feeds and the live trading room), also by Sovoron.com for private client trading executions and OilDefi.io to facilitate a decentralized (Defi) crypto tokenization platform.

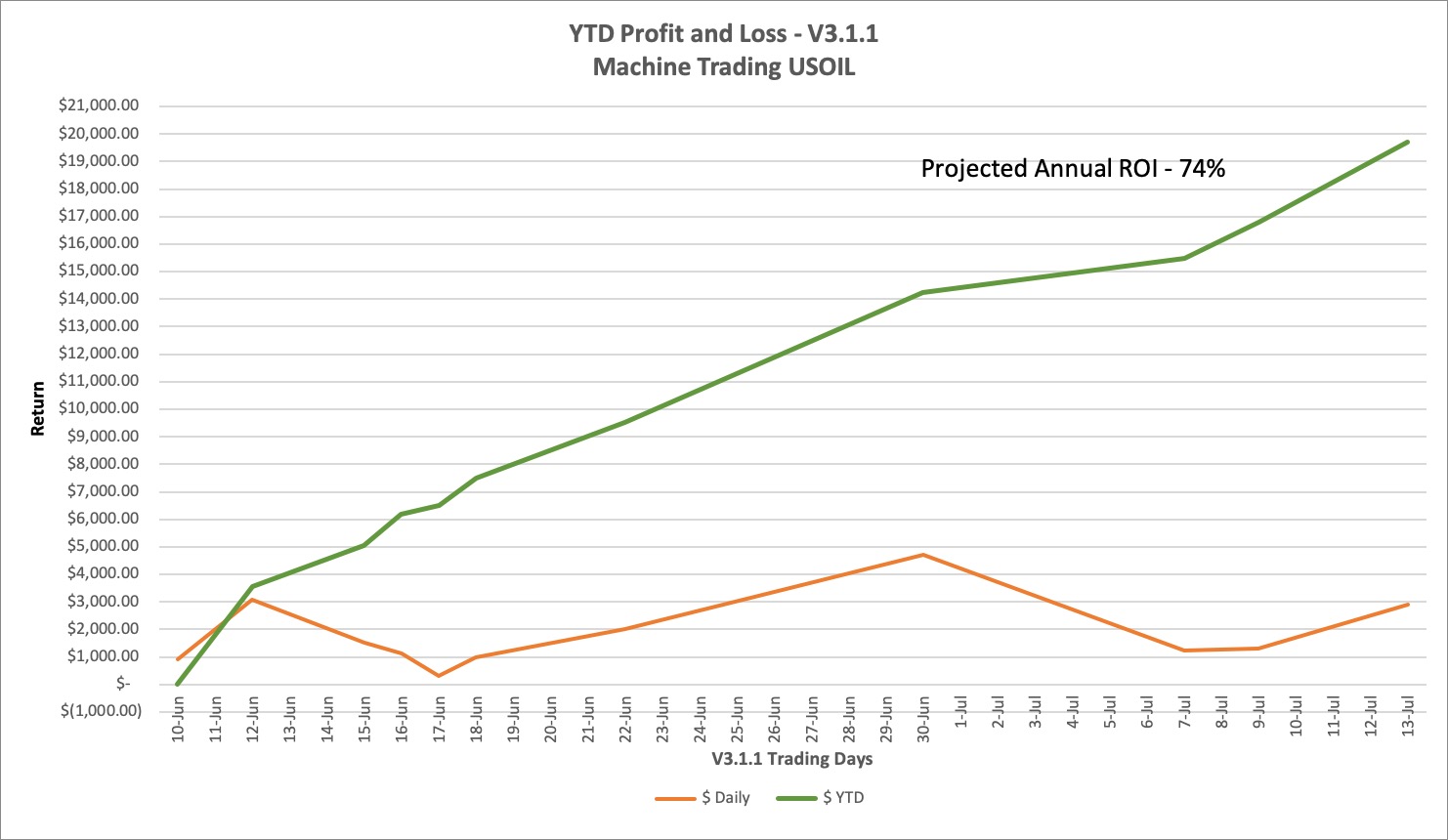

Below is a sample Sovoron real trade account performance.

SOVORON.com 58.69% Annualized ROI from previous update to EPIC v4.1.1 software update and forward Dec 8, 2022 – June 2, 2023 (audited financials or sample account broker statements available for SOVORON participants). As of June 2, 2023 software is in its first sequence of the new v4.1.1 update and escalates protocol to a total of maximum nine sequences. Estimated ROI for this version of software is well over 100% per annum but is difficult to determine full potential through the nine sequence escalations.

Calculated using a sample 300k account (real trades) per this calculation (click here).

Sample real 300k account ROI graph.

Note the consistent trajectory with low draw down and the increased trajectory of return.

The primary challenge until mid 2021 was “stability” vs. ROI objectives.

Until recently, some versions of the software achieved over 150% annual ROI and some as low as 20%. The size of the trade account was the most significant determining factor (the larger the account size the more stable the software is and the higher the return).

Over time the architecture of the software has been perfected, but the real game-changer has been the development of the EPIC IDENT™ Order Flow component of the code and more recently the Intra-Day High Frequency code that relies heavily on IDENT™.

In short, there are three primary protocols of code in the software;

- Swing Trading (average sequence duration is 11 weeks and has been as short as 1 week and as long as 16 weeks).

- Intra-Day High Frequency (average sequence duration is considerably less than 24 hours but can also be described at times as intra-week lasting up to 3 or 4 days).

- EPIC IDENT™ Order Flow (extremely high frequency for positioning alongside significant machine “entities” that have presented themselves in the intra-day order flow).

The software has proven to be very stable while consistently providing considerable returns.

To our knowledge the EPIC Oil Machine Trading Software is best in class.

EPIC Software Highlights.

- Lightning Fast Decisions. EPIC crude oil trading software executes trades through utilizing over 9300 weighted decisions instantly. The instructions provided within the architecture are growing daily. A human trader cannot make decisions as quickly, cannot process the data required for most intelligent trading probabilities and cannot execute trades as precisely.

- Algorithmic Chart Models. The EPIC software includes over thirty proprietary algorithmic chart models and the catalogue is growing. The algorithmic models have been designed, tested and refined in real-world trade for over 6 years by a team of day traders, each with over 20 years of experience. The oil trading models represent all time-frames from 15 second to monthly time-frames of trade. The algorithmic models have been back-tested to sixty months historically.

- Conventional Charting. The software includes conventional charting structures on all time-frames, also back-tested sixty months.

- Common Trade Set-Ups. Included in the software are common trade set-ups that oil day traders implement.

- Order Flow. EPIC IDENT™ is data-driven order flow intelligence in real-time to achieve best outcomes. The software includes and executes to a proprietary order flow identification system that tracks behavior (specifically isolating other market machine liquidity) and weighs identified entities and historical trade patterns to its trade decisions (instructions). EPIC IDENT™ increases its intelligence as it gathers data intra-day specific to liquidity flow, historical patterns, time of day, volatility, various preferences, latency, rejects and more. The method is similar to back-testing charting. However, the process occurs in real-time. In short, the software is looking for “fingerprints” within market liquidity. We cannot back-test 60 months as with charting, but back-testing from date of software deployment has been achieved.

- Time Cycles. Time cycles are within all algorithmic and conventional trading model structures. Order flow also has identified time cycles and other time cycle events such as weekly reporting in oil markets (API, EIA and rig counts). Additionally there are time-of day market time cycles around the world. All of these different time-cycles are included in the software architecture.

- Hard-Pivot Architecture. The risk threshold – management system within the EPIC architecture now has a hard pivot rule-set that has near ended substantial risk for accounts in the 300k range and completely ended risk for the 600k or larger accounts.

Combined, these advantages enable the EPIC Crude Oil Trading software to outperform conventional trading methods.

Introduction to Oil Market Trade and Machine Trading.

The world of public market trade is rapidly changing. It is estimated (depending on source) that over 80% of crude oil futures are not traded by humans and are now traded by machines.

Machine trade may be simple, bot style software, high-frequency software or more sophisticated architecture as with the EPIC class of algorithm.

Our team commenced the oil trading software development journey nearly seven years ago with algorithmic chart model development. From day one we employed computer scientists to work with us on a daily basis to build software that would emulate our trading methods.

Over time the software started to win more trades than our traders and today we rely almost solely on the software to execute trades. We simply “tweak” the software at each trade sequence to improve performance.

Account Size – ROI and Draw-Down Volatility.

The smaller the account size traded, the more difficult it is for the software to limit downside risk and provide optimal returns.

We have learned over time that a 100k account size will see volatility and has considerable associated risk. A 300k account size will rarely see volatility (draw-down risk) and a 600k account size is expected to almost never encounter volatility. As noted above, the risk threshold – management system within the EPIC architecture now has a hard pivot rule-set that has near ended substantial risk for accounts in the 300k range and completely ended risk for the 600k or larger accounts.

The software is designed to trade within a sequence of trade within structures or set-ups. As the oil market price changes, the software trading logic uses all the different data to update the decision tree utilizing the instruction rule-set.

You can imagine this as a dot plot process similar to the game “Go” – not exactly, but the concept helps to visualize how the software plots a sequence plan for trade.

The “ebb and flow” of regular oil market trade allows opportunity for the software to plot a plan of trade within a sequence. The larger the account, the more dots that can be plotted (trades can be “bite sized” entries within an “ebb and flow”).

To understand the trading methodology of the software in each “sequence” of trade requires a moderately in-depth conversation to review data with a member of our team.

In short, the software uses a positioning (swing trade) protocol for each sequence of trade and a high-frequency intra-day protocol via EPIC IDENT™ technology. On the positioning (swing trade) side of the architecture, this means that as crude oil price is rising the software is building a position short through-out the rally (and the opposite is true if the price of oil is falling). However, the average cost is off-set by the high-frequency component of trade via EPIC IDENT™ technology so that when the trend reverses the software achieves considerable returns.

API / Deployment Architecture.

EPIC v4 software is designed to be deployed remotely – accessing an account and executing trades. This provides the account holder with ultimate control. The account holder grants the software access and the software executes machine trades to the account. Architecture provides opportunity for decentralized platform integration.

Conclusion.

This paper outlines the opportunities that can be presented by the growing influence of machine trade on global financial markets.

Competitors within the machine trade industry are becoming more and more refined and successful – the best in class are assumed to be winning a larger portion of proceeds.

The most significant immediate challenge developers face in machine trade is building a product that will perform within a prescribed threshold of downside limiting stability while outperforming conventional trading methods.

Soon thereafter the challenge becomes competing against “like-kind” machine trade peers and being best in class.

It is our expectation that fewer and fewer competitors will achieve more of the proceeds (as a whole of trade in public markets) at an exponential rate, which does provide urgency to development and deployment.

The EPIC v4 trading software achieves consistent, predictable and very adaptable architecture that provides exceptional best in class ROI.

Business Inquiries.

For information about our subscription services that include; oil trade alerts, an oil trading room and oil trade newsletter reporting contact Compound Trading Group at compoundtradingofficial@gmail.com or www.compoundtrading.com.

Visit the official EPIC AI Trading Software website here for more information about our software: https://epicaihub.io/

Previous in this document series can be found here:

- June 27, 2025: EPIC AI White Paper

- December 10, 2023: EPIC Update: v6.1.1 Machine Learning Trade Software – Final Protocol Real World Results

- June 3, 2023: EPIC v4.1.1 Crude Oil Machine Trade Software White Paper

- March 28, 2022: EPIC v3.3 Crude Oil Machine Trade Software White Paper | March 28, 2022 Update

- January 7, 2021: EPIC v3.1.5 Crude Oil Machine Trade Software White Paper | Updated January 11, 2022 w/ Trade Execution Data

- June 4, 2020: EPIC V3.1.1 Crude Oil Machine Trade Software Update | June 4, 2020 White Paper #OOTT $CL_F $USO $USOIL

- April 19, 2020: EPIC V3.1 Crude Oil Machine Trade Software Update Details | White Paper #OOTT $CL_F $USO $USOIL

- December 29, 2019: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading