Tag: $MSFT

Stock Swing Trades On-Watch & Current Trades | AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT more …

Trade Set Ups / Current Swing Trade Positions March 19, 2019.

Stocks Covered in this Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, the first leg of the move from Dec 24, 2018 to now has been great and the next COULD BE better in to mid May 2019. Don’t miss out.

Trade Set Ups and Current Swing Trade Positions March 19, 2019.

Anadarko Petroleum (APC) –

Per March 5 Report “this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target”.

ALSO, the is a link to a special report below (at bottom of this post) that explains exactly how to trade Anadarko Petroleum.

ANADARKO PETROLEUM CORP (APC) MACD turning up on Weekly Chart, should be ready to go soon. #swingtrade $APC

TerraForm (TERP) –

Per March 5 report “trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year”.

THERE IS ALSO A LINK TO A SPECIAL REPORT BELOW FOR TERP AT BOTTOM OF THIS POST.

TerraForm Power Caps a Transformational Year With Solid Q4 Results #swingtrading $TERP https://finance.yahoo.com/news/terraform-power-caps-transformational-solid-173600840.html?soc_src=social-sh&soc_trk=tw

TERRAFORM POWER (TERP) This is about to test 200 MA on Weekly Chart, you will want to watch close now. #swingtrade $TERP

Home Depot (HD) –

Per March 5 Report, “240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video”.

Home Depot’s Solid 2018 in 3 Charts https://finance.yahoo.com/news/home-depot-solid-2018-3-210500199.html?soc_src=social-sh&soc_trk=tw #swingtrading $HD

HOME DEPOT (HD) holding top of trading box with indicators turning up, looking for a pop here $HD #swingtrading

Gold (XAUUSD, GLD, GC_F) –

Per March 5 report, “Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far”.

GOLD remains in structure on monthly chart. Watching. $GC_F $XAUUSD $GLD

EXXON (XOM) –

Per March 5 report, “this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM)”.

EXXON (XOM) This swing trade just keeps giving $XOM #swingtrade #energy

I will be trimming this position in to the red trading box (underside) resistance tomorrow and considering re-entering above the blue line when price is in trading box.

Nike (NKE) –

Per March 5 Report, “this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight”.

Breaking Down Nike’s Q3 Earnings Outlook Ahead of March Madness https://finance.yahoo.com/news/breaking-down-nikes-q3-earnings-192407481.html?soc_src=social-sh&soc_trk=tw #swingtrading $NKE #earnings

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

Alphabet / Google (GOOGL) –

Per March 5 Report, “algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video”.

Tech giants will have to be regulated in future – EU’s Timmermans https://finance.yahoo.com/news/tech-giants-regulated-future-eus-145838975.html?soc_src=social-sh&soc_trk=tw #swingtrading $GOOGL

Google (GOOGL) Exceptional trajectory (upper scenario) on this swing trade, no reason to liquidate any time soon. $GOOGL

This is another fantastic swing trade. If anything just remember to take profit along the way.

Advanced Micro (AMD) –

Per March 5 Report, “when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019”.

AI Stocks to Watch, Including One Under-The-Radar Gem https://finance.yahoo.com/news/ai-stocks-watch-including-one-120000581.html?soc_src=social-sh&soc_trk=tw Gopher Protocol Inc. (GOPH), Five9, Inc. (FIVN), Fortinet, Inc. (FTNT), Advanced Micro Systems (AMD), and Tesla, Inc. (TSLA) #swingtrading #AI

ADVANCED MICRO (AMD) does have symmetry in price targets hit with a channel, upper target may hit #swingtrade $AMD

I don’t like the way this stock trades, however, it has held the channel structure and the price targets are hitting on the model. The upper price target on the chart below could be in play.

https://www.tradingview.com/chart/AMD/w5sN14u2-ADVANCED-MICRO-AMD-does-have-symmetry-in-price-targets-hit-wit/

Twitter (TWTR) –

Per March 5 Report, “didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review”.

TWITTER (TWTR) continues to struggle in the cluster of support and resistance areas, no trade for me. #swingtrade $TWTR

Facebook (FB) –

Per March 5 Report, “the model has done really well, we will be updatnig the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past”.

For now I will leave this one alone considering the mosque attacks. A structured trade just isn’t possible at this point, I will re-look at it the near future.

BP –

Per March 5 Report, “bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best”.

BP I didn’t execute on this but it does look like a decent trade setting up. #swingtrading $BP #chart

FireEye (FEYE) –

Per March 5 Report, “tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it”.

FIREEYE (FEYE) Fireeye stuck in a range, watching for now. #swingtrade $FEYE

Arrowhead Pharma ARWR –

Per March 5 Report, “This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video”.

ARROWHEAD PHARMA (ARWR) Looking for top of trading box resistance to break for a move to next, great swing trade. $ARWR

TESLA (TSLA) –

Per March 5 Report, “I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video”.

TESLA (TSLA) hasn’t hit my 231.00 price target yet but it has come off really hard so far. $TSLA #stock

Alibaba (BABA) – the bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

ALIBABA (BABA) This couldn’t be a better swing trade, hasn’t hit 206.00 price target yet but it is in play $BABA #swingtrade

Microsoft (MSFT) –

Per March 5 Report, “per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch”.

This stock has done really well, but I missed taking the trade, so I won’t review the chart at this time.

Eagle Materials (EXP) –

Per March 5 Report, “was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

I missed my execution on this one so I won’t review the chart set-up at this time.

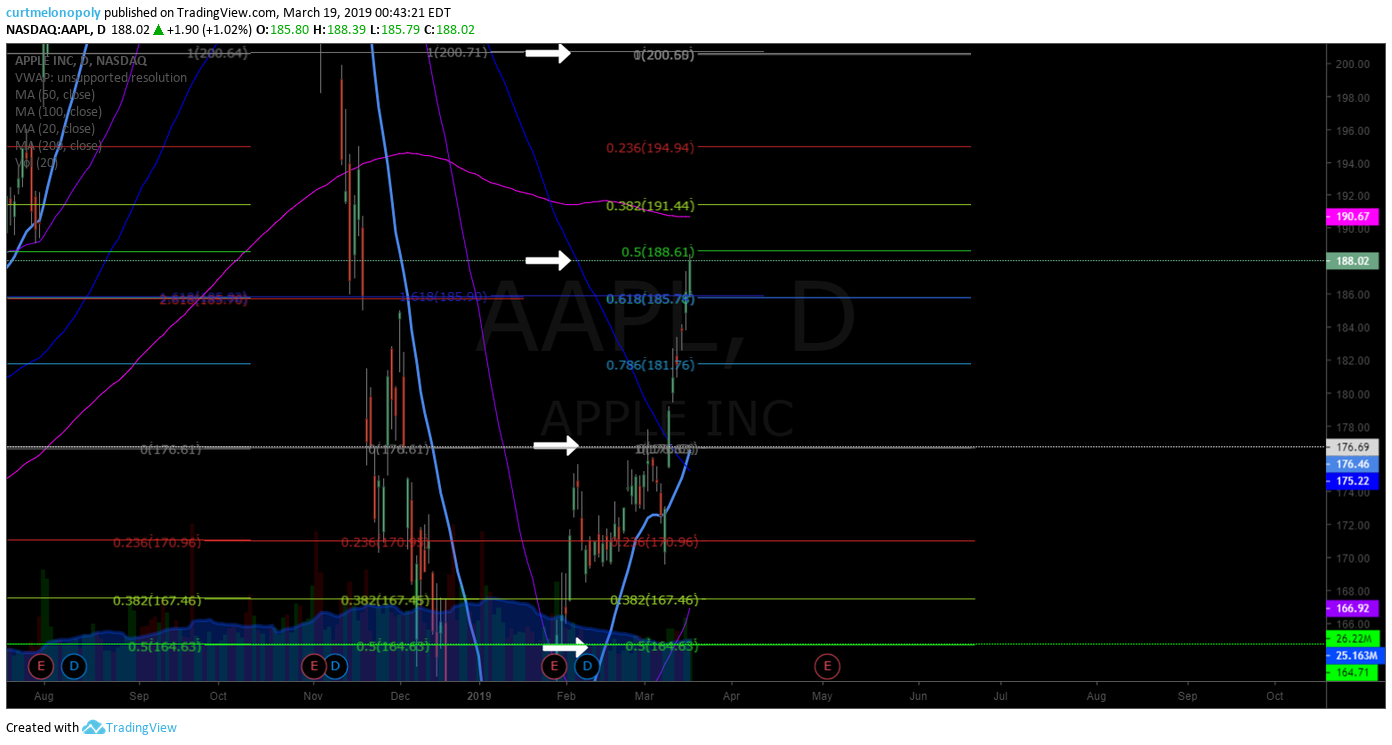

APPLE (AAPL) –

Per March 5 Report, “direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video”.

APPLE (AAPL) The gift that keeps giving, take profit at each gray and green and add above. Simple. $AAPL #swingtrading

Allergan (AGN) –

Per March 5 Report, “has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now”.

ALLERGAN (AGN) Bounce off key support after sell-off, working its way up channel. $AGN #swingtrade #chart

AK Steel (AKS) –

March 5 Report, “potential trajectory on video and it isn’t my favorite type of set-up. Just on watch”.

AKS isn’t doing much of anything, not trading it anytime soon.

Netflix (NFLX) –

March 5 Report, “very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video”.

NETFLIX (NFLX) Continues to trend towared price target for late May. Take profit along the way. $NFLX #stock #chart

American Express (AXP) –

Per March 5 Report, “great trade alert set up from swing trade service, hit price targets early, really strong trade structure”,

AMERICAN EXPRESS (AXP) great trade set-up and above current resistance it has lots of room to run $AXP

The 3 below I am not interested in trading any time soon.

Morgan Stanley (MS) – trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines – hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC) – really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Other Recent Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below (that may be locked) please email us at compoundtradingofficial@gmail.com for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT

Stock Swing Trades On Watch and Current Trade Positions (w/video) | AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and many more…

Trade Set Ups and Current Swing Trade Positions March 5, 2019.

Stocks Covered in this Special Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, this report reviews how great this time-cycle has been and is going to get better around the next corner. These trades have gone extremely well so please do study the video, go in to the previous reports, study the charts and time cycle price targets and BE READY FOR THE NEXT TRADE SET-UPS on deck!

Swing Trading Set-Up VIDEO:

#Swingtrading

Voice broadcast starts at 4:25 on video.

Trade Set Ups and Current Swing Trade Positions March 5, 2019.

The beginning of this video discusses the team work in progress, trade alert protocols, coding, alerts, machine trading developments, changes in my personal trading schedule etc.

This is an important trade set-up video for all stocks we have been swing trading in 2019 so far, so it is an important review for our clients prior to the next round of swing trade entries coming.

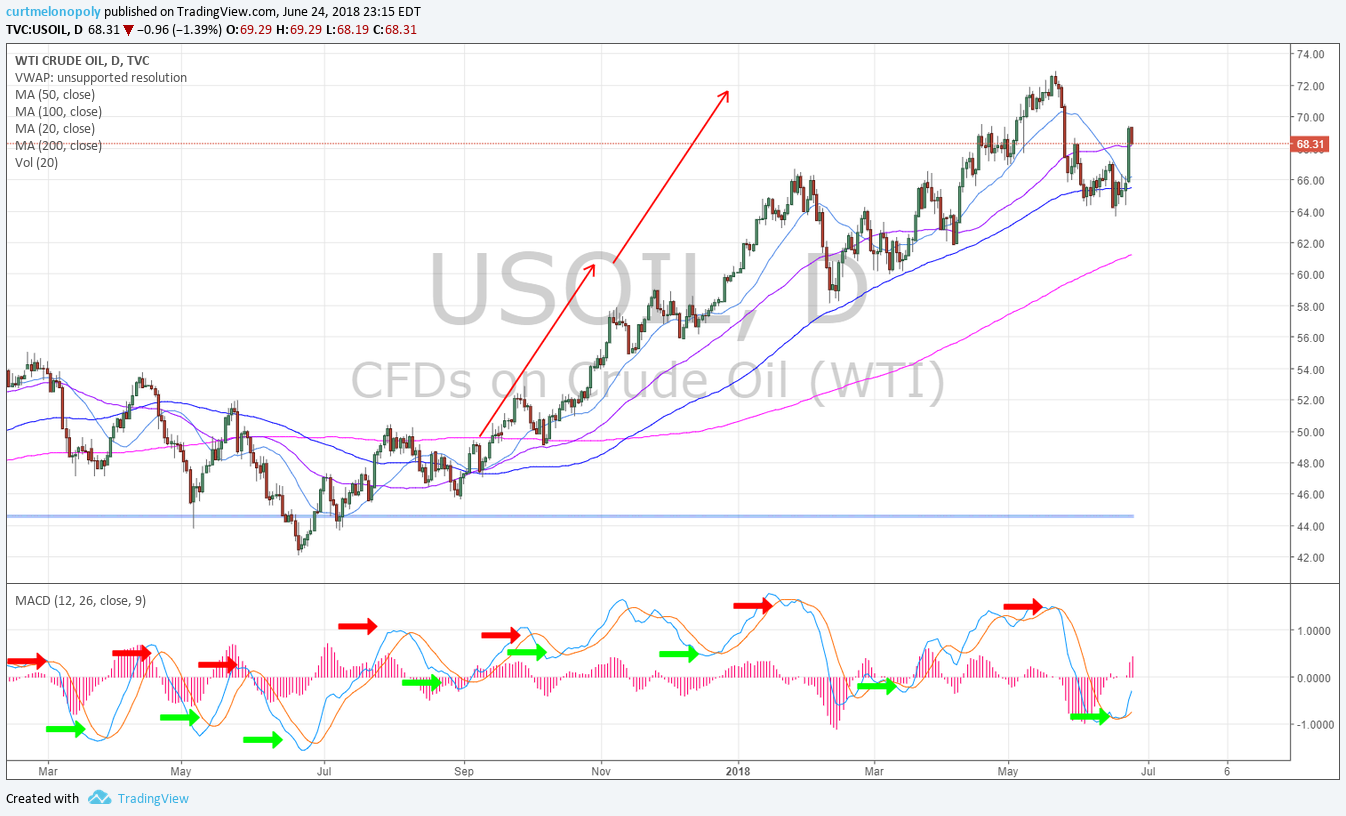

Crude Oil ($WTI, $USOIL, $USO) – Tonight the protocols for the alerts will be distributed to members so that our clients know which set up is in play when we send out alerts. The EIA down channel target 55.23 and top uptrend channel 57.25 – the mid pivot (mid quad) for indecisive trade is at 56.25 on FX USOIL WTI. Our bias is toward up channel and we are hoping to get up in to 58.07 range this week to top of swing area of the EPIC Algorithm model (30 minute). The video outlines a scenario for between API Tuesday afternoon at 4:30 and EIA report Wednesday at 10:30.

Anadarko Petroleum (APC) – this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target.

TerraForm (TERP) – trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year.

Home Depot (HOM) – 240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video.

Gold (XAUUSD, GLD, GC_F) – Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far.

EXXON (XOM) – this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM).

Nike (NKE) – this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight.

Alphabet / Google (GOOGL) – algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video.

Advanced Micro (AMD) – when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019.

Twitter (TWTR) – didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review.

Facebook (FB) – the model has done really well, we will be updated the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past.

BP – bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best.

FireEye (FEYE) – tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it.

Arrowhead Pharma ARWR – This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video.

TESLA (TSLA) – I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video.

Alibaba (BABA) – the bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

Microsoft (MSFT) – per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch.

Eagle Materials (EXP) – was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

APPLE (AAPL) – direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video.

Allergan (AGN) – has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now.

AK Steel (AKS) – potential trajectory on video and it isn’t my favorite type of set-up. Just on watch.

Netflix (NFLX) – very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video.

American Express (AXP) – great trade alert set up from swing trade service, hit price targets early, really strong trade structure,

Morgan Stanley (MS) – trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines – hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC) – really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Other Recent Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below (that may be locked) please email us at compoundtradingofficial@gmail.com for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT

Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C …

Video Review. Trade Set Ups for Swing Trading Earnings Tuesday January 29, 2019.

Swing Trading Stock Signals in this Video Report from Mid Day Review in Main Trading Room Jan 28: $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C and more…

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://t.co/XL7cEWGMce

— Swing Trading (@swingtrading_ct) January 27, 2019

Earnings Season Special Reports Thus Far:

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Video Review:

VIDEO TRANSCRIPT SUMMARY (there is much more detail on video itself):

#swingtrading #earnings

Jan 28, 2019 mid day report.

It’s earnings season, this is the big week with over one hundred companies are reporting. I am bias to a bullish run post earnings in to May 2019.

The following is my bias;

When oil bounces I will be long Oil adding to DWT short, long SPY, Dollar not sure, Volatility short, Silver and Gold slightly bias to short, BTC short, Natural Gas is a timing thing.

Oil is reviewed at various points in this video as it trades intra-day.

Refer to charting in the premium member special reporting issued recently (links above).

TESLA (TSLA) normally I would be looking for a long in this range on the charting but I am looking for short in this one instance. Looking for 231.00 and possibly more is my price target. If wrong first target upside for Tesla in 330s then 380s. March 26 timing.

In other words bullish the market and bearish TESLA.

ALIBABA (BABA) strong resistance just under trading box here. Price target 238.00 range (178.00 – 208.00 is reasonable bullish target area in trajectory of chart). I am really bullish Amazon.

FACEBOOK (FB) I don’t like but it could surprise and run here. Fundamental view and technically it is a bit of a mess. Nature of news flow could be setting up for a short squeeze. 150 MA in 166s is likely first price target, trading 147s intra-day. If sell-off happens refer to previous model in reports.

MICROSOFT (MSFT) not reviewing, not the same risk reward as Amazon here so I will likely trade Amazon and leave MSFT be.

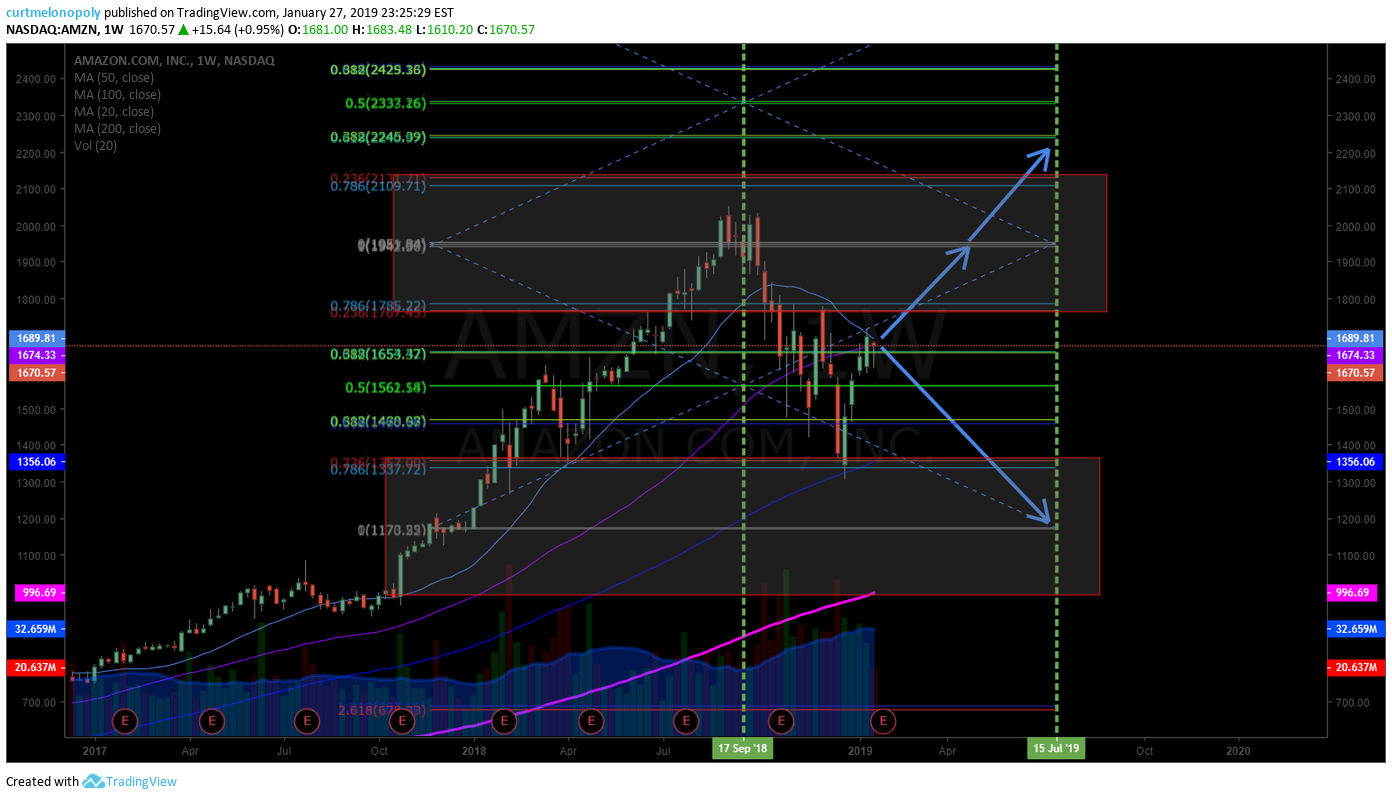

AMAZON (AMZN) price target 1946.00 and on a double extension is 2210.00 and even 2300s is possible in to July 2019. The price target timing is Feb 25 on the first area. 1173.00 is sell off target. The timing depends on the trajectory of trade post earnings.

EAGLE MATERIALS (EXP) trendline supports I am watching are the support areas I have as support, I’m looking for a bounce at the trend line with resistance at 73.00, 85.00, 91.00.

APPLE (AAPL) 152.98 is your main pivot and price is in that slot. Other side of earnings should bring a direction to the model and I’ll trade it.

ALLERGAN (AGN) Bounce at main pivot occurred in the sell off late 2018. Price target 155.9 support trading 157.13 (151.87 even possible then a rip). Bullish trend line to 202.00 is my price target. Other targets reviewed on video in trajectory up and support down noted. Mid May time cycle conclusion on AGN confirms on this and many charts.

ADVANCED MICRO (AMD) upside bullish trajectory is reviewed on the video. Other side of earnings 24s price target Mar 13 then 26.50 then 28s next reviewed on video.

AK STEEL (AKS) – has been in pivot trade on daily since Jan 8, upside target 4.03 and downside 1.63 trading 2.70. I have no bias.

NETFLIX (NFLX) support pivot 319.22 resistance 357.53 trading intra-day 331.80 off 1.85% on the day. Time cycle Jan 31 makes it difficult to take a trade here, trading in basket of trading quad here. Waiting for other side of Jan 31. 338.26 PT mid May 2019 as a bias.

AMERICAN EXPRESS (AXP) over 99.00 targets 112.00. Trading 99.76 down 1% on day. Model is very structured and following its trajectory When oil bounces this is one to take. 112.14 PT July which puts mid May in to play as PT timing if really bullish. Great example of post earnings structure. See vid.

Morgan Stanley (MS) more complicated chart, near bottom of trading channel, 42.81 intra day, long term 2021 Mar 76.50 is bullish target or in to Aug 55.21 is near term bullish price target.

DELTA AIRLINES (DAL) trading 48.13 intra day up .9% on day, 49.59 PT Feb 4 and then decision, other side of Feb 4 a trade entry can be taken.

BANK OF AMERICA (BAC) early in to earnings season I should have take this trade, the set-up on chart model is reviewed in detail on video, hoping for low 28s for entry. Decent set-up.

SHAW COMMUNICATIONS (SJR) getting in to early May 2019 there is a target zone and the trajectory and structure is explained, can’t trade it because of time cycles. Risk Reward not there for a trade.

CITIGROUP (C) – CITI is now in to its resistance area under its pivot, this is the 2nd I missed so far, 61.04 in sell off then 47.67, bias to 73.87 breach to upside price target early March then July and mid May time cycles reviewed.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, Video, $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C

Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA #swingtrading #earnings

Trade Set Ups Video for Swing Trading Earnings Season Monday January 28, 2019.

Swing Trading Stock Signals in this Report: $AMZN, $MSFT, $FB, $BABA, $TSLA …

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

https://twitter.com/swingtrading_ct/status/1089542580696694784

Our Earnings Season Special Reports Thus Far:

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

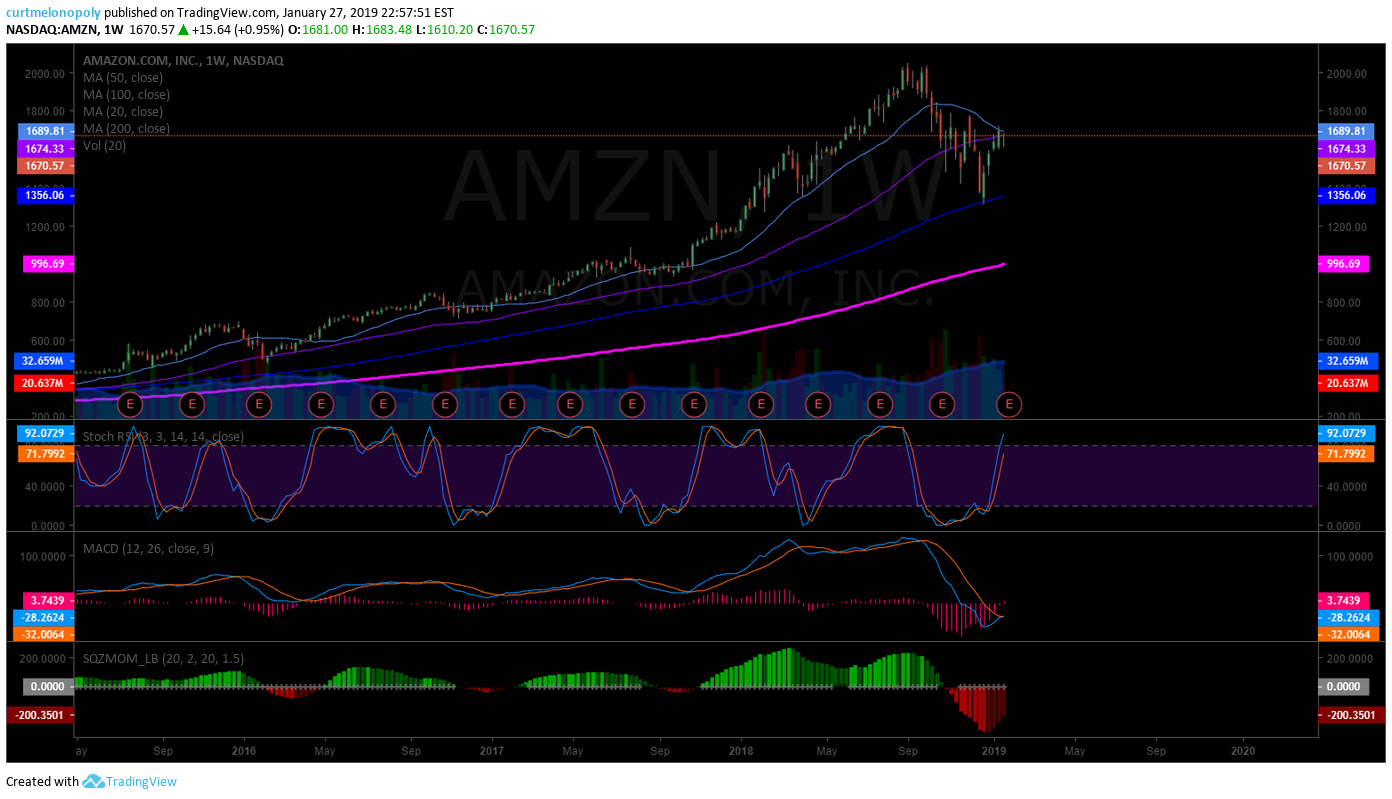

AMAZON (AMZN) Weekly chart says shorts better have it right in to earnings. MACD SQZMOM Price to MA’s say big move possible.

Jan 27 – The upside move here could be huge. Price on a launch pad right under 20 and 50 MA’s on weekly chart with SQZMOM and MACD supporting a possible move. Wouldn’t want to be short in to earnings. Risk reward very poor for shorts.

Amazon.com’s $4.5 Billion Retail Opportunity – 3,000 stores with 50% higher returns than conventional convenience stores. #swingtrading #earnings https://finance.yahoo.com/news/amazon-com-apos-4-5-220000638.html?soc_src=social-sh&soc_trk=tw

My Trading Plan for Amazon Earnings:

It’s simple, if price breaches the 20 and 50 MA it’s a long to test previous highs (the pivot of around 1950.00). And if previous highs are taken out, look for an equal extension to upside of previous highs (price target around 2200.00). If Amazon sells off, look to 200 MA (near) test and bounce.

AMAZON (AMZN) Earnings swing trade price targets for upside move or sell – off. $AMZN #swingtrading #earnings

MICROSOFT (MSFT) Similar to AMZN but I don’t like it as much. Retrace didn’t touch 100 MA and RR not the same imo. $MSFT #earnings #swingtrade

The set-up is very similar to Amazon, but the 20 and 50 MA’s aren’t pinching like on Amazon chart and price didn’t pull back enough. Also, the fundamental picture isn’t as strong. The Amazon chart trajectory holds much higher risk reward for the bullish trade bias.

However, if it sells-off I wouldn’t expect as much of pull back as with Amazon.

So it depends if you are considering a trade position in to earnings or not. I will wait until after earnings are announced for both, And likely not trade Microsoft. Yet to be seen.

Trading Plan for Microsoft Earnings:

In a bullish run you can expect previous highs, however, I wouldn’t expect much more near term.

In a sell-off I would target a touch to 100 MA (near to). Unlikely imo.

Forget IBM. Microsoft Is a Better Dividend Growth Stock $MSFT #swingtrading #earnings https://finance.yahoo.com/news/forget-ibm-microsoft-better-dividend-231200981.html?soc_src=social-sh&soc_trk=tw

FACEBOOK (FB) Price targets on 240 minute trading chart. $FB #earnings

We have used this model a number of times for win side trading on Facebook.

We will wait for earnings and then trade the price targets pending direction.

Facebook earnings: After a year of scandals, record profit still expected #swingtrading $FB https://on.mktw.net/2B2j9uw.

FACEBOOK (FB) Weekly chart. In a bullish move I will target 168.00 region for 50 MA test. In a sell-off there’s no saying. $FB

ALIBABA (BABA) I like the setup for the long side to 206.00 price target. Will wait for earning trade to confirm. $BABA.

TESLA (TSLA) My bias is down to 231.00 price target. Will wait for earnings, but that is my bias. $TSLA #earnings

Tesla’s first downgrade of the year comes down to this #swingtrading $TSLA #earnings https://on.mktw.net/2DteGCX

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AMZN, $MSFT, $FB, $BABA, $TSLA

PreMarket Trading Plan Mon June 25: Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV more.

Compound Trading Premarket Trading Plan & Watch List Monday June 25, 2018.

In this edition: Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete- Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room: As of today May 25, we are targeting this Wednesday.

- Target date for recommencement week of June 25. Main Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: HOG, NFLX, GE, MSFT, AMZN & more –

https://twitter.com/CompoundTrading/status/1011216171998248961

25 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/11927273 $XRM $VLRX $CPB $ACHV $ZOM $TRXC $SOGO $IQ

25 Stocks Moving In Monday's Pre-Market Session https://t.co/HEoeTWwL52 $XRM $VLRX $CPB $ACHV $ZOM $TRXC $SOGO $IQ

— Benzinga (@Benzinga) June 25, 2018

Market Observation:

Markets as of 8:06 AM: US Dollar $DXY trading 94.37, Oil FX $USOIL ($WTI) trading 68.96, Gold $GLD trading 1268.55, Silver $SLV trading 16.39, $SPY 273.64, Bitcoin $BTC.X $BTCUSD $XBTUSD 6219.00 and $VIX trading 15.

Momentum Stocks to Watch: $XRM $VLRX $ACHV

News:

Oil falls below $75 in London after Saudis pledge to boost supply https://bloom.bg/2yHqAIS

The two most important oil benchmarks are behaving very differently after OPEC’s meeting https://bloom.bg/2yG3RNb

Merrimack Pharma says trial of pancreatic cancer treatment failed to meet main goals

Pluristem shares jump 2% on news of positive trial of treatment for radiation damage

Harley-Davidson’s stock sinks, sees EU tariffs adding $2,200 to average motorcycle cost

$MNKD Presents Positive Afrezza® Clinical Data from STAT and AFFINITY Studies at ADA 78th Scientific Sessions

$CTRV ContraVir Pharmaceuticals to hold a business news update conference call today at 4.30 pm

$GE WSJ: GE Nears Deal to Sell Industrial-Engines Unit to Private-Equity Firm Advent

Shopify to run B.C.’s online cannabis sales http://business.financialpost.com/wcm/757a5ebd-ba5d-42e6-8e55-0ae131d6c7b7 … via @nationalpost

Brunswick ends Sea Ray sale process and opts to retain and restructure the business

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$NKE $CCL $LEN $WBA $GIS $PAYX $STZ $RAD $FDS $JKS $ACN $KBH $BBBY $INFO $MKC $SCHN $UNF $CAG $APOG $CUK $SONC $GMS $AVAV $PIR $EROS $SNX $LNN $OMN $SJR $FUL $XPLR $CAMP $PRGS $NG $FC $DTRM $IRET $GBX $DAC

http://eps.sh/cal

https://twitter.com/CompoundTrading/status/1011220159246323713

upcoming #earnings releases with the highest #volatility

$PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL

http://eps.sh/cal

upcoming #earnings releases with the highest #volatility $PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL https://t.co/lObOE0dgsr pic.twitter.com/kbjyr7perU

— Earnings Whispers (@eWhispers) June 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). June 24 1115 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Oil Chart (Weekly). Oil trendlines on weekly time-frame. June 18 146 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Algorithm Simple Weekly Gen 1 Model. Trade failing 20 MA and Fibonacci support test. June 18 132 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

Market Outlook, Market News and Social Bits From Around the Internet:

Trade War Fears, Global Markets’ Decline, Stocks To Continue Lower? –

Trade War Fears, Global Markets' Decline, Stocks To Continue Lower? – https://t.co/ukliOJOrl9

— Investing.com Stocks (@InvestingStockz) June 25, 2018

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets. https://www.bloomberg.com/news/articles/2018-06-25/five-things-you-need-to-know-to-start-your-day via @markets

#5things

-U.S. ups the pressure on China

-Erdogan wins in Turkey

-OPEC confusion

-Markets drop

-May, Merkel risks

https://bloom.bg/2yGVH7f

https://twitter.com/CompoundTrading/status/1011222547357106176

Economic Data Scheduled For Monday

Economic Data Scheduled For Monday pic.twitter.com/Go2ULBepv7

— Benzinga (@Benzinga) June 11, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $XRM $VLRX $ACHV $GTN $ZFGN $TVIX $CIG $CPB $CLPS $AKER $UVXY $SXE $FCEL $DGAZ $VXX $CIEN $FSLR $PSTI $AKAO $SQQQ $MBT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $HPR $SO $NSC $BSM $BWA $DGX $MSFT $CIEN $CRTO $FRT $FSLR $HPR $NTR $ALRM $NSC

$SRPT raised to a new street high of $275 by Liisa Bayko @ JMP

BofA/Merrill Lynch Upgrades First Solar $FSLR to Buy Citing Solar ITC Extension

Monness, Crespi, Hardt Reiterates Buy on MongoDB $MDB Ahead of MongoDB World and Investor Meeting

UPDATE: Zendesk $ZEN PT Raised to $67 at Cowen; ‘Moving Up-Market With A Long Runway Ahead’

(6) Recent Downgrades: $KR $KMX $YRD $EL $ATI $CRS $INTC $OHI $OGE $ORLY $MLVF

$OHI downgraded to Market Perform from Outperform at Wells Fargo.

Intel stock falls after Instinet downgrades to neutral

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV

Post-Market Thurs Jan 26 $GOOGL, $MSFT, $DUST, $INTC, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY and more.

Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Thursday Jan 26, 2017 $GOOGL, $MSFT, $DUST, $INTC, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY – $SPY, $GLD, $GDX, $SLV, $USDJPY, $DXY, $USOIL, $WTIC, $VIX, $NG_F…

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Per Yesterday;

New Member Processing: Because our promo expires at the end of the month we are processing more new members than normal and Sartaj is traveling in Europe so he is processing at each stop on his travels as he gets time – bear with us, we’re getting new members up and running with reports within 72 hours of check-out at this point! Thanks!

Two Week Account Double Challenge: It ended today (Monday) because there was a holiday last week (so ten trading days). I didn’t double, I think I was closer to 41% and our techs will do review vids and publish P&L soon for review. It started out really strong and as inauguration got closer market got less aggressive and has been since. The momo plays lacked follow through the last five or six trading days. Oh well! 41% ish isn’t bad. I’ll be looking to get my double up before the end of the month now and I’ll be targeting a double up per month going forward. Remember – all live in the room, recorded, transcript etc… no calling things after the fact – totally transparent room.

Daily Trading Results: I apologize, I haven’t had time to do last Wed, Thur and Fri yet – I will post them. To be honest they were so uneventful for me that I prioritized other work – but I’ll get them out soon.

Promo Code Discounts are Ending: The 38.2% inaugural opening discounts end Jan 31, 2017 and we won’t be a promo driven type room – so if you’re thinking of jumping do it now. Also, the promo codes are technically all used up (we were only going to offer discount for first 200) so if you get an error message when typing in your promo code that’s on the website then let us know and a tech will sort it for you.

https://twitter.com/CompoundTrading/status/823791504602710016

SMS / Email Alerts: Our system was upgraded so all members will now start receiving them for each trade (morning momo trades may not have time to process alerts outside room fyi).

New Service Option: We now also offer a stand-alone trading room option (vs. bundle w/ trading room, premarket newsletter and alerts) at 59.00 /mth and w/ promo code is 1.22 per day.

New Service Option: EPIC the Oil Algo now has an Oil Report only option (vs. bundle w/ 24 hr trading room launching early 2017) at 199.00 and w/promo code works out to just over 4.00 day.

New Service Option: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Feature Post: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are using our algorithms or charting it is a must read.

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

$GOOGL, $MSFT, $DUST, $INTC, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY

Google I entered with some of our swing service members after market trading (large entry), $MSFT and $INTC I scalped after market. $TRCH I entered doing regular trade as an add and $LGCY – holding both. Still hold $DUST, $JUNO, $ROKA, $CBMX and I’m bullish on all (have a plan and reasons for all that I won’t get in to here). Had a small papercut moomo trade for a 5 cent loss first thing in morning.

Momentum / Noteable Stocks Today:

| Ticker | Last | Change | Volume | Signal | |

| FFHL | 3.42 | 48.05% | 3732398 | Top Gainers | |

| GLF | 2.10 | 44.83% | 2029400 | Top Gainers | |

| MSDI | 2.16 | 35.85% | 2722800 | Top Gainers | |

| PULM | 2.22 | 35.37% | 20261451 | Top Gainers | |

| AVGR | 3.10 | 34.78% | 9900900 | Top Gainers | |

| BDMS | 12.75 | 34.21% | 14600 | Top Gainers | |

| GMO | 0.56 | 23.33% | 1387439 | New High | |

| LUNA | 2.27 | 14.07% | 1515973 | New High | |

| MGCD | 8.70 | 13.55% | 85867 | New High | |

| CFBK | 2.04 | 8.05% | 70259 | New High | |

| WOOF | 90.80 | 0.01% | 2005000 | Overbought | |

| UPLD | 11.62 | 1.93% | 15833 | Overbought | |

| FFHL | 3.42 | 48.05% | 3732398 | Unusual Volume | |

| MGI | 12.92 | 8.75% | 12625500 | Unusual Volume | |

| ENTL | 16.69 | -13.92% | 1891400 | Unusual Volume | |

| MGCD | 8.70 | 13.55% | 85867 | Unusual Volume | |

| ABB | 23.80 | 1.28% | 5779600 | Upgrades | |

| ABMD | 106.09 | -7.60% | 1243213 | Earnings Before | |

| COGT | 3.85 | -2.53% | 78400 | Insider Buying |

Holding:

New Swing Account Entry $GOOGL Scalped – $MSFT, $INTC Small size – $DUST, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY, $ESEA

Looking Forward:

I’m still bullish. We were right about Brexit, Trump winning, all time highs in markets, our algos have obviously been nailing it and I have no reason to stop. We are publishing my and the algo and swing trading P&L’s over next few days with obvious massive percentage gains over many hundreds of calls now dating back to last July. We’re also doing some webinars soon to help the market about our algos and to show members how to use them. And finally we have a series of documents and videos coming out that take a scientific approach to all our calls and the verdict on our success – fortunately we tracked the whole launch process. It has been upward and onward since we started developing the algos and I am very very pumped forward.

Judge me on my results not what I think.

— Melonopoly (@curtmelonopoly) January 27, 2017

https://twitter.com/EPICtheAlgo/status/824911771005693952

Price action since my alert. Algo modeling worksheet Jan 27 438 AM $GC_F $GLD $XAUUSD $GDX $GDXJ $NUGT $DUST $JNUG $JDST pic.twitter.com/93dRgH3NBM

— Rosie the Gold Algo (@ROSIEtheAlgo) January 27, 2017

Per last report on Tuesday;

I’m excited for trade now. Yesterday I pointed out that I was looking at a trade in inverse Gold and that worked out and that it looked like commodities were going to cool some. Also noted yesterday that the market would likely pop and $SPY got some lift. So no surprises at all – going per plan. Epic the Oil algo, Rosie the Gold Algo, SuperNova Silver Algo and the rest of them are all dialed in and hitting well.

I can’t complain – I’ve had a good run, Mathew is hitting it regularly and the members are having a great year so far so it’s all systems a go!

In overnight trade it looks like commodities are cooling a bit so I may look at inverse Gold or Miner’s ETN’s ETF’s Tuesday, also market has been calm since inauguration so I would expect a bit of a pop or drop here soon and I’m thinking a pop. So I’m looking forward to the last six days of trading in January.

Also looking at the Trump “wall” trade 🙂

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Trading Room:

09:00 am Curtis M : Premarket Momo: $AVGR, $MGI, $FFHL, $FNCX, $RLMD – also Gold and Natural Gas lots of range.

Stock Chat-room Trading Transcript:

Miscellaneous chatter may be removed.

08:57 am Curtis M : .

09:01 am OILK K : Gold looks awful

09:21 am OILQ K : $FNCX looks good for open

09:22 am Mathew Waterfall : looks like usd/jpy wante to test the top of the channel which is right about 114.4 and also lined up with previous support/res. I expect it to back off from there but watching closely

09:31 am Elyse N : Watchin $RADA here

09:31 am Elyse N : $FFHL long

09:35 am Roger S : $FFHL rocket power wow

09:35 am Mathew Waterfall : $AAPL call spread almost a double. Im out at 3 bags

09:36 am OILQ K : Crude is really close to break out territory

09:36 am Curtis M : Ya watching close

09:40 am Kari S : Short $FFHL

09:40 am Jon E : $PCLN momo

09:42 am Steve S : Good short Kari

09:53 am Mathew Waterfall : Seeing some messy options flow. Puts buying in a few names and on $SPY. Some large $TVIX darkpool prints as well

09:56 am Clive B : $GLBS on steriods

10:02 am Gurpreet S : $RGSE lol

10:06 am Steve S : $PULM popping a bit

10:18 am Kari S : Taking some $SEAX here for a start

10:18 am Kari S : $SAEX

10:19 am Kari S : Rails looking awesome too guys

10:19 am Elyse N : Yes to rails

10:26 am Curtis M : I was on top of $LGCY 2 days ago ugh and forgot

10:35 am Curtis M : Thanks Mat

10:36 am Curtis M : Starter in $PULM

10:39 am Kari S : $TRCH up 5% Curt

10:46 am Curtis M : Stopped out $PULM .5 cent loss

10:46 am Mathew Waterfall : $egle POPPIN

10:54 am Curtis M : Long $LGCY small for break out

10:54 am Curtis M : Still hunting break outs lol

10:55 am Mathew Waterfall : Scanners are empty. Im gonna take a break and do some deeper scanning to see if I can find anything positive out there. Be back in a bit

10:55 am Curtis M : kk

11:08 am Roger S : Covered $NAK short from open

11:09 am Clive B : What r u thinking with crude curt?

11:09 am Curtis M : Thinking theres a possible squeez coming above that yellow line if it gets there

11:10 am Clive B : ya thats what I figured

11:10 am Curtis M : It may get there if so I’ll hammer down on small small cap oil and UWT

11:10 am Curtis M : But it has to get there

11:12 am Curtis M : Long another 100 shares $LGCY 2.61 avg

11:18 am Kari S : $TRCH looks like its going to go soon Curt

11:19 am Kari S : $LGCY and $TRCH could be good so I am going to start small entries

11:29 am Jon E : $TRCH popping nice volume

11:31 am Mathew Waterfall : Interesting to me that $IWM is remaining weak against the other indexes. Watching this to see if it leads to the downside. It lead higher after the election so it should provide some direction

11:33 am Curtis M : If oil gets up over that white dotted algo line t will test the upside resistance break out area

11:35 am Mathew Waterfall : Small $JNUG tester against LODish

11:35 am Mathew Waterfall : USD/JPY chart looks like it wants to roll over a bit otherwise I wouldn’t take this trade

11:35 am Mathew Waterfall : $GDX chart looks UGLY so tight leash

11:35 am Mathew Waterfall : 7.93 entry

11:39 am Mathew Waterfall : Huge buy $GDX 22.83

11:40 am Roger S : Nice bottom $SCON bouncer

11:40 am Mathew Waterfall : Gonna set my stop to flat and move on for a bit. Will let it play out here

11:49 am Mathew Waterfall : No mojo for me today. Stopped flat on that $JNUG attempt. Not looking to take losses so I may just sit on my hands and see where this market goes

11:57 am Mathew Waterfall : Bought a bit of $SLW to add to the amount I bought yesterday averaging down. About half position here. and $JNUG is now moving north lol

11:57 am Mathew Waterfall : $SLW is a swing and I will hold for a while

12:03 pm Elyse N : Curt – when is that webinar?

12:04 pm Curtis M : We have one for Rosie the Gold algo coming – haven’t set on for Oil yet – soon

12:04 pm Elyse N : ok would like that

12:05 pm Curtis M : This weekend we’re announcing times for webinars for all algos

12:06 pm Curtis M : Machines pushing the edge of that algo line hard in crude

12:06 pm Curtis M : real aggressive

12:06 pm Curtis M : here it is

12:07 pm Curtis M : wouldnt want to be short but it could fail still but short is not good here

12:11 pm Mathew Waterfall : Rollover continuing in USD. $TLT also flashing green

12:15 pm Roger S : Long $UWT small and will add if we see a break out – short leash as Mathew says

12:16 pm Caide X : Good risk reward Roger – break out oil gets to 54.30 before res makes sense

12:17 pm Caide X : Looking at miners and not sure what to do

12:19 pm Mathew Waterfall : Have a coin to flip Caide? lol j/k

12:19 pm Mathew Waterfall : give me a second I’ll hop oin the mic and give my view

12:26 pm Curtis M : $BCEI halt

12:28 pm Mathew Waterfall : Hope between the mini tangets some of that made sense lol

12:42 pm Dean S : In $CLVS some

12:47 pm Steve S : $SSH jiggy

12:49 pm Elyse N : $AWH alive now

12:57 pm Steve S : $BCEI short cover pop and drop action?

01:00 pm Mathew Waterfall : Halt was for news but I can’t find out what the news was so not trading it

01:00 pm Mathew Waterfall : the 5′ bar it put in is crazy thought

01:01 pm Steve S : No news out there on $BCEI at all

01:02 pm Mathew Waterfall : The only news I could find was that it was halted for news lol so that’s great

01:02 pm Steve S : lol

01:02 pm Mathew Waterfall : Likely a bunch of people guessing at this point

01:04 pm Mathew Waterfall : Dollar getting smoked finally. $GDX running into a trendline over 22.96 will have legs if dollar keeps falling

01:04 pm Gurpreet S : $MYOS high of day

01:05 pm Mathew Waterfall : Problem with $MYOS is that it already had a large ramp to squeeze the shorts

01:06 pm Mathew Waterfall : Now inventory may be looking to exit if they bought up near those highs

01:08 pm Jon E : Low floats aren’t easy playz imho

01:12 pm Mathew Waterfall : You got that right Jon.

01:13 pm Jon E : pumpers there too

01:14 pm Curtis M : crude support test

01:15 pm Curtis M : blue line

01:16 pm Curtis M : Gold coming up to res at blue line

01:21 pm Steve S : $EGY dump

01:25 pm Mathew Waterfall : $gld call buying coming across here

02:15 pm Mathew Waterfall : still sitting on my hands over here. Gold so far with the 23.6 on the downside and bounced holding above it so far. Close over that at 1184.1 is constructive for a test to upsie at 1221 which is the 38.2 and basically the last swing high

02:26 pm Steve S : Watching your Twitter feed Curt 🙂 Just poking the nerves of bears over there

02:26 pm Steve S : $TRCH does look good though

02:27 pm Curtis M : ya

02:28 pm Curtis M : just havin fun

02:37 pm Curtis M : Here comes the test on $SPY

02:41 pm Steve S : Adding to $NVDA swing

02:43 pm Gurpreet S : Decent spot Steve

02:44 pm Gurpreet S : I was looking at it on its pullback but didn’t enter

02:46 pm Caide X : Wow $DELT action here

02:51 pm Mathew Waterfall : $DELT is flying. Sliced right through VWAP. Might take some on a pullback to that area

03:05 pm Mathew Waterfall : Vicious green bar the dollar just put in and basically got swatted as resistance.

03:26 pm Dean S : Adding to $LGCY swing in to close

03:29 pm Mathew Waterfall : What a do nothing day. I will spare you guys the useless ramblings into the close here sense we havne’t really moved all all sense my last check in. Looking for dollar back in the 99’s over the next day or two and gold abck north or 1200. Other than that nothing changed on my radar

03:30 pm Jon E : ya boring

03:31 pm Mathew Waterfall : Even as daytraders we don’t have to trade heavily every day. Over trading can be a good way to donate money, something I hate doing

03:32 pm Gurpreet S : 10 4

03:44 pm Steve S : $KerX lozer

03:50 pm Mathew Waterfall : $TLT wants HOD into the close. 119.29 and I will think of taking some calls

03:57 pm Kari S : $GOOGL , $MSFT, $SBUX , $INTC , $WYNN , $PYPL here we come

03:59 pm Mathew Waterfall : Big night for earnings. I don’t play earnings so I’ll be watching from the sidelines. Have a good night all, slight down day for me with my miners and metals plays, but looking for upside after some consolidation. See ya in the am

04:00 pm Curtis M : cya Mat

04:00 pm Curtis M : cya crew

Be safe out there!

Follow our lead trader on Twitter:

https://twitter.com/curtmelonopoly

Article Topics: $GOOGL, $MSFT, $DUST, $INTC, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500