Year: 2018

Trade Coaching Boot Camp Preparation Sept 14 – 16, 2018

Attending Trading Boot Camp.

Updated 10:25 PM Sept 13, 2018.

Hey Freedom Traders!

The next Trading Boot Camp is just around the corner! Class dates are Sept 14, 15 and 16. Below are some details in advance of your attendance.

Schedule:

Attend as you can through-out each day, come and go as you need and after the boot camp the video series will be available for you to access to catch up on parts you missed or need to review again.

Friday Sept 14 9 – 5 PM

- Sign in to the live trading room each day using the password “****”.

- We start broadcasting charting in pre-market at around 9:00 AM (this will give everyone a few mins to grab coffee and settle in for the day), the main trading room is booked off for us. We will run the first part of Friday like most other trading days – the regular premarket review at 9:25 ish, market open at 9:30, work with any trades for the day until about 11 am, do a mid day review at 12 noon and then class curriculum (per below) from 1 pm to 5 pm. After each break (which will be at various times through the day – unscheduled) I will answer all questions that were entered in to the chat room up to that point in the day.

Saturday Sept 15 9 – 5 PM

- Class curriculum (per below) from 9 am to 5 pm (previous notice was in error as 1-5).

- After each break (which will be at various times through the day – unscheduled) I will answer all questions that were entered in to the chat room up to that point in the day.

Sunday Sept 16 9 – 5 PM

- Class curriculum (per below) from 9 am to 5 pm (previous notice was in error as 1-5).

- After each break (which will be at various times through the day – unscheduled) I will answer all questions that were entered in to the chat room up to that point in the day.

After training;

- I have learned now with experience that many of the attendees need some final one-on-one trade coaching and that’s fine, just contact me as required and we’ll use a flexible arrangement to your needs.

- Our office will prepare the videos of the training and you will be provided with a copy (this copy will show the class environment vs. while you are an online attendee you will see a mirror image of my trading screen – which is needed to see the technical analysis).

- For about a month after training we send you (per below) much of our weekly newsletter data to be sure you can use what you learned in real life trading scenarios.

Curriculum and Your Preparation:

The curriculum is flexible and designed specifically for the attendees.

Below is a basic outline, however, the curriculum itself is formed around the questions the attendees bring to class. We also like to keep the training curriculum flexible to market conditions.

The following are things you can do to prepare:

- In advance of attending, list out all the questions you ever wanted to ask and be prepared to enter those questions at appropriate times while in training classes.

- When in class, enter your questions in the discussion box so that after each break the instructor(s) can answer your questions.

- All questions will be answered after each break through-out the day, this will keep the flow going vs. answering questions at any moment during class.

- The in person attendees will be entering questions in to the chat box on meeting trade room in the same fashion. The in person attendees will see the shared screen on the large screen and online attendees will see it on their computer monitors at home (essentially as if you were in a live webinar).

- Review as much of our material you have access to on You Tube (it is a lot and varied so we don’t expect you to review it all) and the weekly reports you may subscribe to.

Below is a basic course outline / structure (that will vary pending attendees):

What is a trading plan?

Trader Vocabulary

Risk Management: Sizing, Risk-Reward Calculations

Stock Evaluation: Fundamental versus Technical Analysis

Basic Technical Analysis Tools: Price Action, Catalysts, Indicators, Pre-Market/After-Market, Earnings, and others

Keyword and News Analysis

Putting a trading plan into action

Risk Management: Time dimensions, scaling in and out of trades

Technical Analysis: Time/Price Cycles, Fibonacci, Elliot Wave, Charting, and others

Bringing it all together: simulated trading

Real-time trade planning for intraday and swing traders

Technical Analysis: Combining multiple analytic tools, inverses, algorithmic and black box modeling, third-party scripting and widgets

Open Q/A. You trade your own account in a live environment

Availability of team trading pending on group sizes

Material for Review in Advance of Attendance:

For 30 days you will receive at no charge the “All Access Membership” from us. You will begin to receive emails from us a few days prior to training (this can vary depending on when you registered and more), during training and for approximately 20 – 30 days after completion. This material will connect you to most of our member trading services platform newsletters etc. This will allow for you to view in advance of course training much of what will be discussed in class and full access for up to a month after training class will enable you to put much of what you learned to work in real life trading.

What You Need to Bring:

A laptop suitable for trading and running charts is all you need for the class. I personally use six laptops for trading (I left my hard wired PC set-up behind), the class teaches to simplify your set-up not complicate it. One quick note here… we are starting to code our algorithms for machine trading and our office set-up where our coding techs are is a different story. But for the purposes of my personal trading and your trading bootcamp, you only need a laptop.

Attending in Future

We have also found that our class attendees wish to attend boot camp again, if this is something you wish to do then let the office know because you will receive a 50% discount code (or discounted invoice). Same applies if you are wanting to access just the video documentation from a future training.

That’s All!

That’s about all for now! About a week before you attend you will start to receive email notices linking you to our various platform services. As you have time please review the material and attend to trading rooms / webinars / read newsletters etc. If you don’t have time prior, there is no concern. In three days during class we will teach you what is needed. And remember, you have an all access pass to our services for about 3 weeks after training. If you need further coaching after the bootcamp we also have private trade coaching available.

Any questions send me an email anytime info@compoundtrading.com. And if you’re thinking of attending a future class (either in person or online) send me an email to let me know and I’ll provide you with future location plans.

Thanks

Curt

Other Links for the Trade Coaching Event:

Trade Coaching Boot Camp: Day 1 Review, Day 2 and 3 Schedule Updates, Post Boot Camp Plans.

PreMarket Trading Plan Fri Sept 7: Elon Smokes Weed, $ARWR, $CLDR, $CRON, $TSLA, $NVUS, $OKTA, $FIVE, $CYCC, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Friday September 7, 2018.

In this edition: Elon Smokes Weed, $ARWR, $CLDR, $CRON, $TSLA, $NVUS, $OKTA, $FIVE, $CYCC, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information is of value to existing members, those asking about our services and new on-boarding members.

- Friday Sept 7 –

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 6 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Yesterday I had a couple flats, but the trade plan was solid, just didn’t follow them through with enough room (Thursday and Friday day-trading not my favorite and I’m just getting back in saddle).

Hoping the oil pressure has been baked in to price to trade out of a pressured 2/10 size futures trade.

It is Friday. Do not try to make your week up today.

Per yesterday:

Thurs through Sunday will be getting my set-ups in order so it will likely be fairly quiet for me. There are some set-ups now, but it is end of week but I wanted to start live today to get set for Monday (so really I’ll be running a 30 day challenge starting Monday), anyway… you get the idea.

Also watching $CLDR range to targets sent out, $TSLA possible bounce to targets sent out, $CRON trading range and others of course that I’ll alert as we go.

Bitcoin $BTC has been hammered with manipulation lately so I’m sitting tight, trading small ranges.

Pot stocks $TLRY $CGC $CRON I am working on set-ups for pull backs in to next week.

And of course eyes on $VIX time-cycle smoldering now (see previous posts).

Market Observation:

Markets as of 8:05 AM: US Dollar $DXY trading 95.02, Oil FX $USOIL ($WTI) trading 67.86, Gold $GLD trading 1201.02, Silver $SLV trading 14.16, $SPY 287.64 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6380.00 and $VIX trading 15.1.

Momentum Stocks / Gaps to Watch: $NVUS $OKTA $FIVE $CYCC

25 Stocks Moving In Friday’s Pre-Market Session https://benzinga.com/z/12320872 $OKTA $ZEAL $FIVE $MRVL $PRQR $ARTX $PANW $FNSR $PSDO $GME $EGAN $XXII

25 Stocks Moving In Friday's Pre-Market Session https://t.co/QBdZ2RF0SZ $OKTA $ZEAL $FIVE $MRVL $PRQR $ARTX $PANW $FNSR $PSDO $GME $EGAN $XXII

— Benzinga (@Benzinga) September 7, 2018

News:

Tesla 8-K Shows Tesla’s Chief Accounting Officer, Dave Morton, Has Resigned $TSLA

Goldman Sachs CFO calls report the firm scrapped #bitcoin trading desk plans “fake news” $GS $BTC

Pres. Trump may decide as early as today 2 impose another $200B in tariffs on Chinese imports $SPY $FXI

GlaxoSmithKline has an FDA PDUFA decision date scheduled for today, for its Mepolizumab, a chronic obstructive pulmonary disease treatment $GSK

Alibaba stock gains after announcement of repurchase plan

USA Nonfarm Payrolls for Aug 201.0K vs 191.0K Est; Prior 157.0K

USA Private Payrolls for Aug 204.0K vs 190.0K Est; Prior 170.0K

USA Unemployment Rate for Aug 3.90% vs 3.80% Est; Prior 3.90%

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

#earnings for the week

$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI

#earnings for the week$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI https://t.co/r57QUKKDXL https://t.co/oiZ3V5Hc7S

— Melonopoly (@curtmelonopoly) September 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

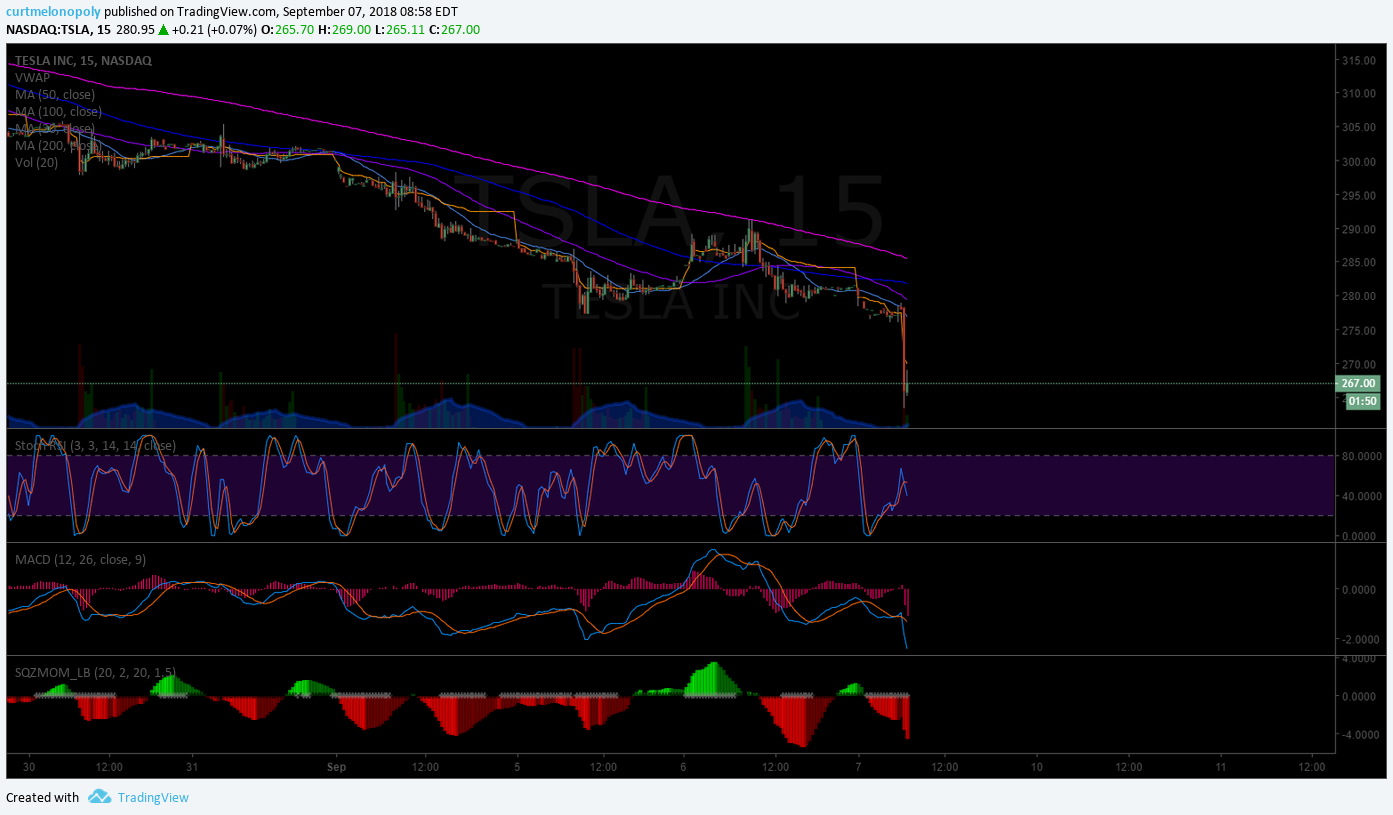

TESLA (TSLA) Premarket watching for a snap back wash out trade here, CFO steps down, ELON smokes weed $TSLA #daytrading #swingtrading

ARROWHEAD PHARMA (ARWR) Two options for swing trading channels. $ARWR #swingtrading #chart

Thurday Premarket – ARROWHEAD PHARMA (ARWR) premarket at top of swing structure, take some profit here at resistance $ARWR #swingtrading #chart

CLOUDERA INC (CLDR) Thursday played out precisely to trade alert, above 18.17 long below short. $CLDR #daytrading #swingtrading

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts

Gotta love stocks with perfect symmetry $CLDR #swingtrading #daytrade #tradealerts pic.twitter.com/J3ku1UKdVa

— Melonopoly (@curtmelonopoly) September 7, 2018

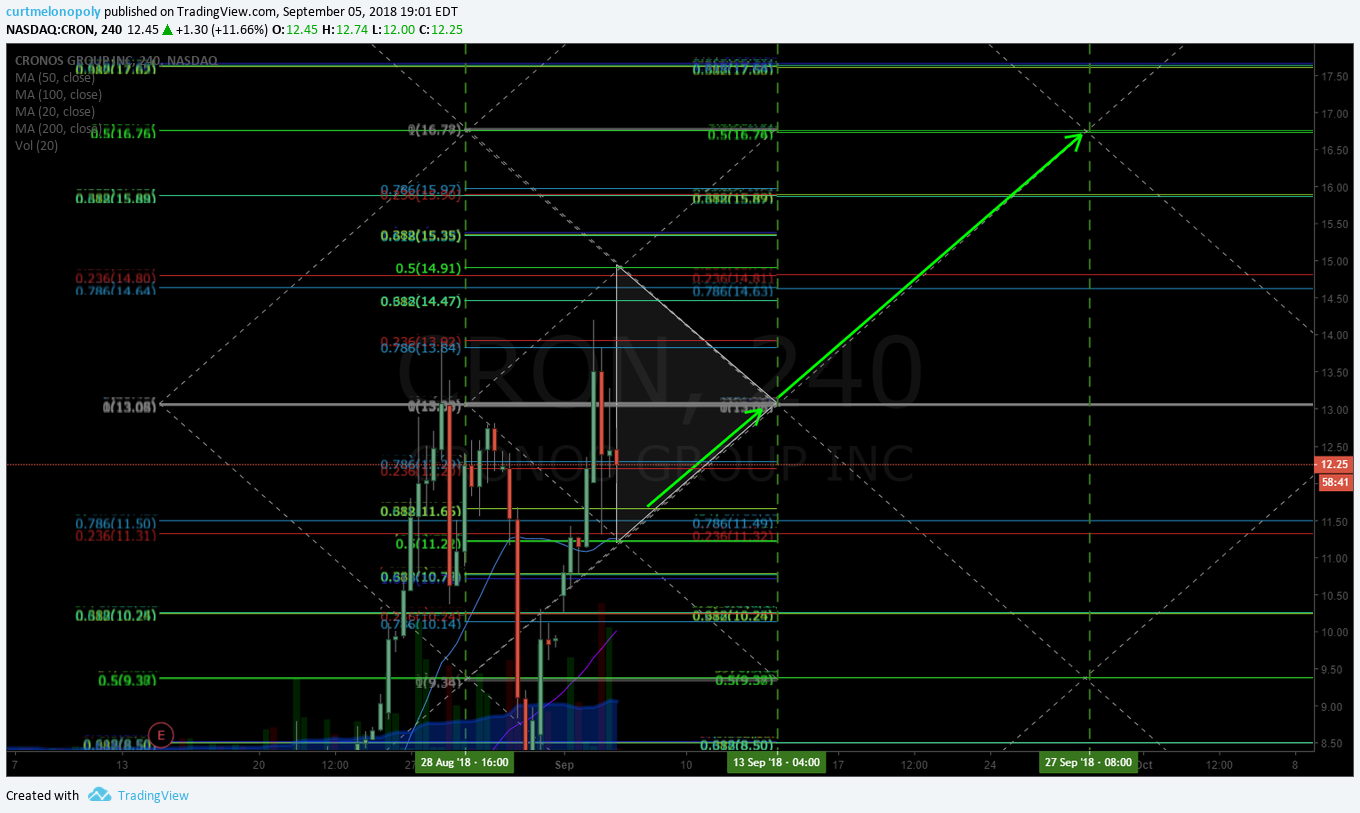

CRONOS GROUP (CRON) Holding the support area of swing trading – day trade structure. $CRONO #swingtrading #daytrading

CRONOS GROUP (CRON) Seems to me the buy side at green arrows is a great risk reward swing trade. Daytrade the levles. $CRONO #swingtrading #daytrading

TESLA (TSLA) At previous support, on watch for bounce in to 293s then 300s possible $TSLA #daytrading #swingtrading

On the back of excellent August sales estimates, $TSLA gapping-up in pre-market. Anticipating this, UBS issue a strategic downgrade on the stock.

What @UBS don’t tell anyone, is that have a massive short position with $TSLA and need the SP to fall to $185 or they loose $zillions

https://twitter.com/AskDrStupid/status/1037642153743278081

CLOUDERA INC (CLDR) Premarket up on earnings trading 16.51 looking for possible 18.17. $CLDR #daytrading #swingtrading

CRONOS (CRON) trading 13.23 up premarket and looks to be one of the few momos that may fly at open. $CRON #premarket

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they’ll get you.

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they'll get you.

— Melonopoly (@curtmelonopoly) September 4, 2018

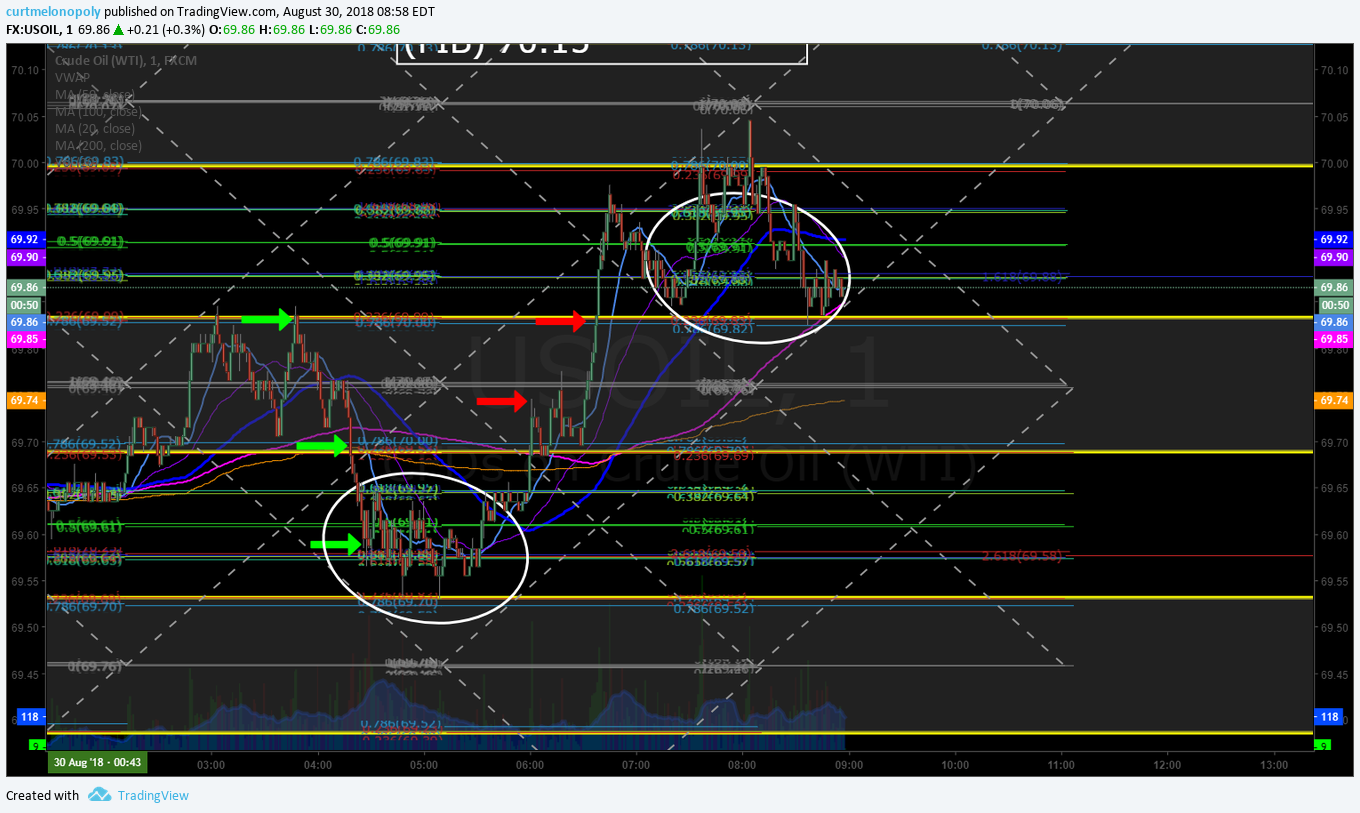

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/RvSwFejYxm

— Melonopoly (@curtmelonopoly) September 3, 2018

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/hpvrwLjWwx

— Melonopoly (@curtmelonopoly) September 4, 2018

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/JWCGQisxxU

— Melonopoly (@curtmelonopoly) September 4, 2018

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket pic.twitter.com/FAiPnf3tIK

— Melonopoly (@curtmelonopoly) September 4, 2018

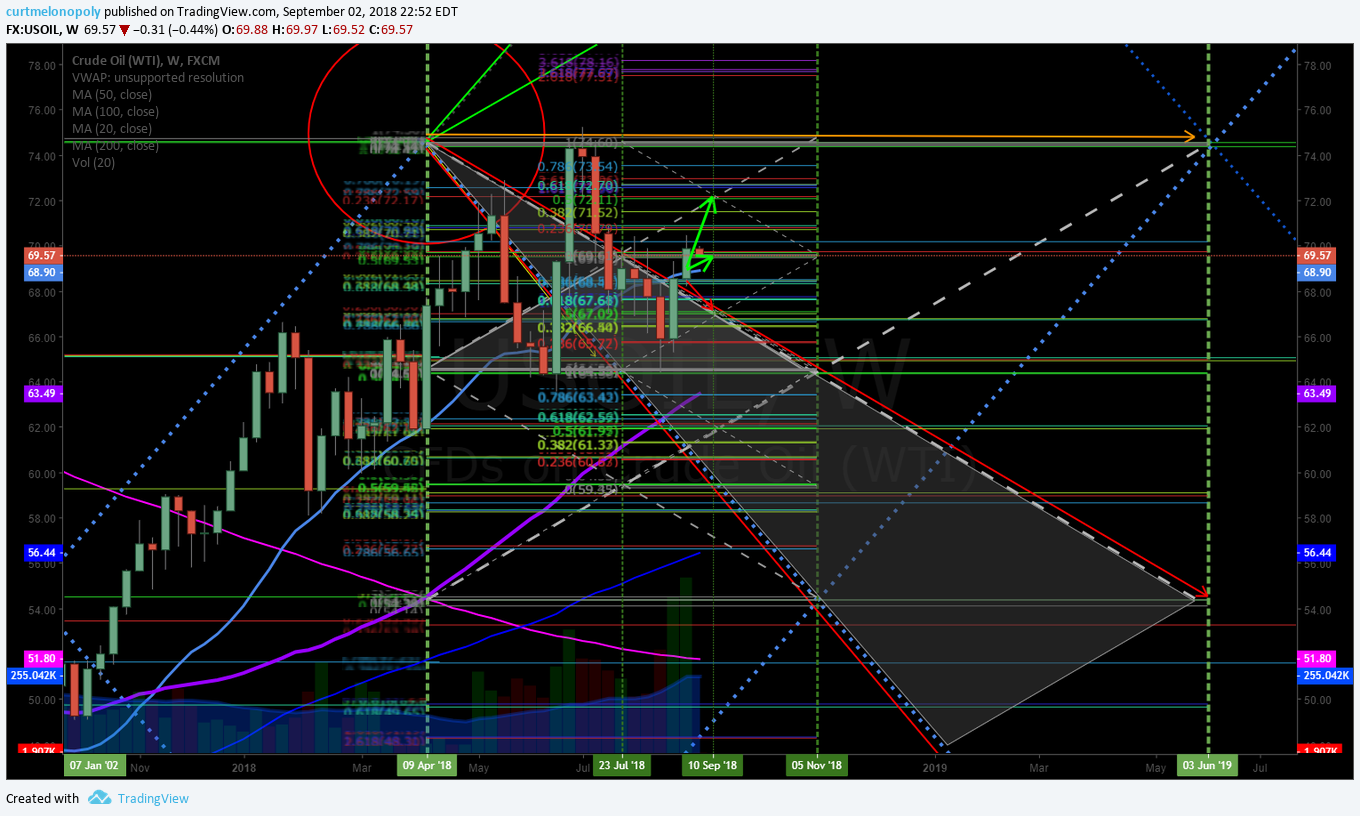

Oil Daily Chart. MACD still crossed up with price thru 50 MA and resting on it now. Sept 2 1108 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-It’s jobs day

-Trump’s China tariff decision

-Nafta talks

-Markets slip

-Coming up…

https://bloom.bg/2wOQLcp

#5things

-It's jobs day

-Trump's China tariff decision

-Nafta talks

-Markets slip

-Coming up…https://t.co/2VUILLixdD pic.twitter.com/4rCW0538nh— Bloomberg Markets (@markets) September 7, 2018

A recurring Goldman chart: Asset price inflation vs. ‘real’ economy inflation:

A recurring Goldman chart: Asset price inflation vs. 'real' economy inflation: pic.twitter.com/P1Xod6GvQF

— Tracy Alloway (@tracyalloway) September 6, 2018

Taking A Leap: Quantum Computing Arrives In ETF Form https://benzinga.com/z/12311541 $QTUM $AUGR $GOOG $IBM $INTC

Taking A Leap: Quantum Computing Arrives In ETF Form https://t.co/MPHyMT7pZ1 $QTUM $AUGR $GOOG $IBM $INTC https://t.co/FThdlGjpEG

— Melonopoly (@curtmelonopoly) September 6, 2018

JP Morgan’s top quant warns next crisis to have flash crashes and social unrest not seen in 50 years

JP Morgan's top quant warns next crisis to have flash crashes and social unrest not seen in 50 years https://t.co/T4mEHfH4sN

— Melonopoly (@curtmelonopoly) September 6, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $NLST $NVUS $DELT $OKTA $ZEAL $FIVE $MRVL $PRQR $PANW $ARWR $JG $AVGO $GEMP $TTM $DRNA $CRON $AKS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $PBF $CVI $COG $AYI $UFS $DOV $AKS $VALE $AVGO $CDEV $LION $NAV $HPR $RDC

Gladstone Land $LAND PT Raised to $14.50 at Ladenburg Thalmann

(6) Recent Downgrades: $MOR $SHPG $CVE $CVRR $IMH $WLK $OAS $WFC $CMA $CORE $ATKR $ZION $RS $XEC $WFC $TROW $VSI $NEXT $ESV $SSNC

UBS Downgrades Zions Bancorp $ZION to Neutral

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Elon Smokes Weed, $ARWR, $CLDR, $CRON, $TSLA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY

PreMarket Trading Plan Thurs Sept 6: $CRON, $CLDR, $TLRY, $CGC, $TSLA, #EIA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Thursday September 6, 2018.

In this edition: $CRON, $CLDR, $TLRY, $CGC, $TSLA, #EIA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information is of value to existing members, those asking about our services and new on-boarding members.

- Thur Sept 6-

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

First day of month’s trading challenge. Thurs through Sunday will be getting my set-ups in order so it will likely be fairly quiet for me. There are some set-ups now, but it is end of week but I wanted to start live today to get set for Monday (so really I’ll be running a 30 day challenge starting Monday), anyway… you get the idea.

It is #EIA report day at 11:00 and I’ve got an oil position a tad under water so that is on high watch today.

Also watching $CLDR range to targets sent out, $TSLA possible bounce to targets sent out, $CRON trading range and others of course that I’ll alert as we go.

Bitcoin $BTC has been hammered with manipulation lately so I’m sitting tight, trading small ranges.

Pot stocks $TLRY $CGC $CRON I am working on set-ups for pull backs in to next week.

And of course eyes on $VIX time-cycle smoldering now (see previous posts).

When u step in to arena for battle today remember it ain't ur regular job or biz… here u compete w best in world real-time, instant, w less tools. Top tier waiting to take ur $. Make sure you have the tools, training & emotional discipline to compete #premarket #wallstreet

— Melonopoly (@curtmelonopoly) September 6, 2018

Market Observation:

Markets as of 8:23 AM: US Dollar $DXY trading 95.10, Oil FX $USOIL ($WTI) trading 68.78, Gold $GLD trading 1205.91, Silver $SLV trading 14.27, $SPY 289.29 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6400.00 and $VIX trading 13.8.

Momentum Stocks / Gaps to Watch:

21 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12313623 $CLDR $VRNT $INSG $AVAV $CTRP $SECO $GIII $PRQR $DOCU $KALV $CGC $CRON

21 Stocks Moving In Thursday's Pre-Market Session https://t.co/ZPl8Z6a2ss $CLDR $VRNT $INSG $AVAV $CTRP $SECO $GIII $PRQR $DOCU $KALV $CGC $CRON

— Benzinga (@Benzinga) September 6, 2018

Stocks making the biggest move premarket: CBS, XOM, FB, DAL, NAV & more

https://twitter.com/CompoundTrading/status/1037670890857799680

News:

USA Continuing Claims for Aug 24 1.71M vs 1.71M Est; Prior 1.71M

USA Initial Jobless Claims for Aug 31 203.0K vs 214.0K Est; Prior 213.0K

BioCryst stock surges 6% premarket after winning $35 million CDC contract for flu therapy.

Hot pot stock Tilray presents at Barclays conference 7:30am ET $TLRY

Kapstone & Westrock shareholders vote on their proposed merger $KS $WRK

$CFRX completes enrollment in Phase 2 tiral Of CF-301 as a potential treatment for Staphylococcus aureus (Staph aureus) Top-Line data Q4

$ZSAN Zosano Pharma to Present Phase 3 Safety Study Update for ADAM™ Technology in the Delivery of Zolm… https://finance.yahoo.com/news/zosano-pharma-present-phase-3-123000859.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$CFRX ContraFect Completes Enrollment in Phase 2 Clinical Trial Evaluating CF-301 (exebacase) in Patien… https://finance.yahoo.com/news/contrafect-completes-enrollment-phase-2-123000857.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

$TMDI Abstract Featuring Titan Medical’s SPORT Surgical System Presented at the European Association of… https://finance.yahoo.com/news/abstract-featuring-titan-medical-sport-111500024.html?soc_src=hl-viewer&soc_trk=tw … via @YahooFinance

World stocks fall for fifth straight day on trade fears | Article [AMP] | Reuters

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

DKNY parent G-III Apparel shares soar 7% premarket after blowout earnings.

Lands’ End’s stock tumbles after wider loss, same-store sales decline

#earnings for the week

$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI

#earnings for the week$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI https://t.co/r57QUKKDXL https://t.co/oiZ3V5Hc7S

— Melonopoly (@curtmelonopoly) September 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

CRONOS GROUP (CRON) Seems to me the buy side at green arrows is a great risk reward swing trade. Daytrade the levles. $CRONO #swingtrading #daytrading

TESLA (TSLA) At previous support, on watch for bounce in to 293s then 300s possible $TSLA #daytrading #swingtrading

On the back of excellent August sales estimates, $TSLA gapping-up in pre-market. Anticipating this, UBS issue a strategic downgrade on the stock.

What @UBS don’t tell anyone, is that have a massive short position with $TSLA and need the SP to fall to $185 or they loose $zillions

https://twitter.com/AskDrStupid/status/1037642153743278081

CLOUDERA INC (CLDR) Premarket up on earnings trading 16.51 looking for possible 18.17. $CLDR #daytrading #swingtrading

CRONOS (CRON) trading 13.23 up premarket and looks to be one of the few momos that may fly at open. $CRON #premarket

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they’ll get you.

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they'll get you.

— Melonopoly (@curtmelonopoly) September 4, 2018

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/RvSwFejYxm

— Melonopoly (@curtmelonopoly) September 3, 2018

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/hpvrwLjWwx

— Melonopoly (@curtmelonopoly) September 4, 2018

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/JWCGQisxxU

— Melonopoly (@curtmelonopoly) September 4, 2018

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket pic.twitter.com/FAiPnf3tIK

— Melonopoly (@curtmelonopoly) September 4, 2018

Oil Daily Chart. MACD still crossed up with price thru 50 MA and resting on it now. Sept 2 1108 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

JP Morgan’s top quant warns next crisis to have flash crashes and social unrest not seen in 50 years

JP Morgan's top quant warns next crisis to have flash crashes and social unrest not seen in 50 years https://t.co/T4mEHfH4sN

— Melonopoly (@curtmelonopoly) September 6, 2018

#5things

-Bear market looms for EM stocks

-Cryptos plunge

-China tariff deadline day

-Developed markets mixed

-Data due…

https://bloom.bg/2NSGROk

Goldman Sachs is so scared of the SEC that it won’t sell Bitcoin on Wall Street

Goldman Sachs is so scared of the SEC that it won’t sell Bitcoin on Wall Street https://t.co/tPXsXrWVcB

— Crypto the BTC Algo (@CryptotheAlgo) September 6, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ABAC $CLDR $INSG $ARWR $SPPI $GIII $BCRX $NBEV $TRXC $FCSC $CTRP $JD $PDD $NUGT $JNUG $NFLX

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades: BEN COP CVX HQY HSGX SWN

Tilray downgraded to Market Perform after ‘massive’ move up at Northland $TLRY http://dlvr.it/QjJl10

Baird removing Micron $MU as Top Large Cap idea and cutting price tgt to $75 from $100.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CRON, $CLDR, $TLRY, $CGC, $TSLA, #EIA, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY

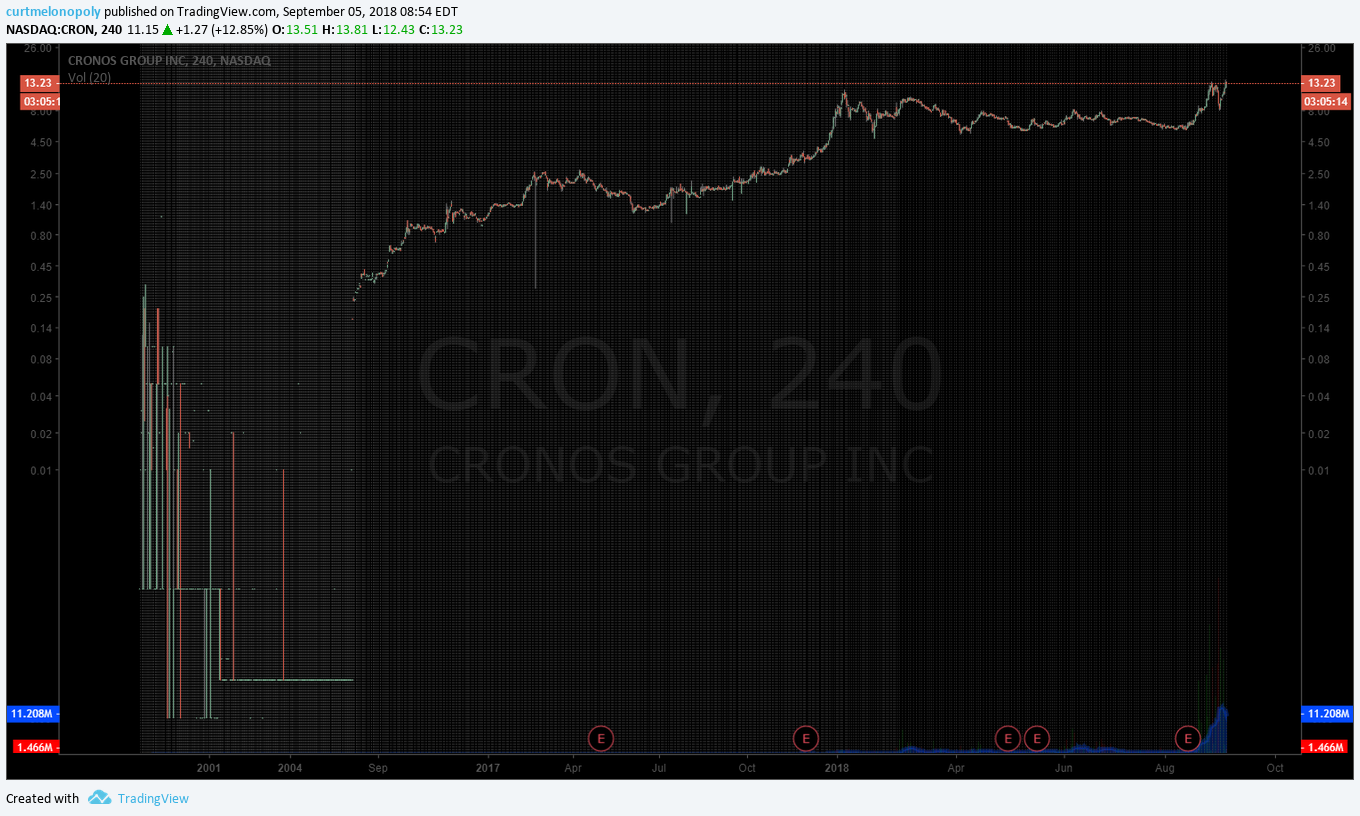

Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Trading Plan for Day Trading and Swing Trading CRONOS GROUP Inc. (CRON).

CRONOS GROUP (CRON) was one of the leading momentum stocks traded on today’s stock market.

See this news article:

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – http://markets.businessinsider.com/news/1027507302

Weed stocks are going nuts after one of the largest marijuana companies strikes a deal for lab-made THC (CRON) $CRON #swingtrading – https://t.co/QQ2iFdmRLy

— Swing Trading (@swingtrading_ct) September 5, 2018

Technical Trading Set-Up for CRONOS on the Chart.

The structure of the 4 hour chart implies a bullish move upside as long as levels at green arrows on chart are held.

I will be looking for long entries at green arrows for a swing trade.

On the day trading side I’ve also included levels for trade. Trade entries long near green arrow to upside of the triangle structure are the day-trading plan for me.

CRONOS GROUP (CRON) Seems to me the buy side at green arrows is a great risk reward swing trade. Daytrade the levels on the chart. $CRON #swingtrading #daytrading

Article Topics; CRONOS, $CRON, Daytrading, Swingtrading, Trading Plan, Chart

PreMarket Trading Plan Wed Sept 5: NAFTA, Emerging Markets, $PRQR, $CRON, $MNKD, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Wednesday September 5, 2018.

In this edition: NAFTA, Emerging Markets, $PRQR, $CRON, $MNKD, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information is of value to existing members, those asking about our services and new on-boarding members.

- Thur Sept 6-

-

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Plan on a calm day at my trading desk, many inflections in markets and getting ready for Sept Trading Challenge that starts tomorrow.

#Stocks – Facebook, Twitter Drop in Pre-market; SecureWorks, Coupa Surge –

#Stocks – Facebook, Twitter Drop in Pre-market; SecureWorks, Coupa Surge – https://t.co/gLo8icZSAs

— Investing.com News (@newsinvesting) September 5, 2018

Market Observation:

Markets as of 8:23 AM: US Dollar $DXY trading 95.41, Oil FX $USOIL ($WTI) trading 68.88, Gold $GLD trading 1194.51, Silver $SLV trading 14.14, $SPY 289.12 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 7015.00 and $VIX trading 13.7.

Momentum Stocks / Gaps to Watch: $PRQR $CRON $MNKD

26 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12305633 $PRQR $COUP $WATT $SMAR $HDS $TSRO $CGC $CRON $TLRY $CAL $RH $ADC $JD

26 Stocks Moving In Wednesday's Pre-Market Session https://t.co/5ab8NxWWRr $PRQR $COUP $WATT $SMAR $HDS $TSRO $CGC $CRON $TLRY $CAL $RH $ADC $JD

— Benzinga (@Benzinga) September 5, 2018

News:

$PFE $CHEK $YTEN $FCSC $WATT $CHFS $CRON $SBOT $XSPL $MNKD $PRQR

$YTEN (low float) Reports Promising Seed Yield Results for Novel Yield Trait C3004 in Growth Chamber Studies in Camelina

$FCSC Fibrocell Announces FDA Fast Track Designation of FCX-013 for Treatment of Moderate to Severe Localized Scleroderma

Blackstone’s EagleClaw to buy Caprock Midstream for $950 million in cash

Energous Reaches Milestone As It Secures Regulatory Approval For Its WattUp Wireless Charging Technology In 100 Countries Worldwide $WATT https://pro.benzinga.com @benzinga

$PFE Receives Breakthrough Therapy Designation From FDA For PF-06651600, An Oral JAK3 Inhibitor, For The Treatment Of Patients With Alopecia Areata

Your Wednesday morning Speed Read:

– Stock futures ⬇️ as specter of emerging-market concerns reaapears $SPY $VWO

– Morgan Stanley ups Anthem to Overweight, $368 price target $ANTM

– Blood-testing startup turned dumpster fire sh*t-show Theranos will officially dissolve itself

Your Wednesday morning Speed Read:

– Stock futures ⬇️ as specter of emerging-market concerns reaapears $SPY $VWO

– Morgan Stanley ups Anthem to Overweight, $368 price target $ANTM

– Blood-testing startup turned dumpster fire sh*t-show Theranos will officially dissolve itself— Benzinga (@Benzinga) September 5, 2018

LATEST: Bitcoin drops 3% in 10 minutes, Ethereum plunges 12%

LATEST: Bitcoin drops 3% in 10 minutes, Ethereum plunges 12% https://t.co/ufqwB3YBEA

— Bloomberg Crypto (@crypto) September 5, 2018

$GS reportedly ditches its bitcoin plans, and hodlers are left wondering…

$GS reportedly ditches its bitcoin plans, and hodlers are left wondering… pic.twitter.com/8DmJxVV5xO

— CNBC's Fast Money (@CNBCFastMoney) September 5, 2018

Recent SEC Filings / Insiders:

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive http://benzinga.com/z/12295014 $COTY $KDP $TTWO #swingtrading

Insider Buys Of The Week: Coty, Keurig Dr Pepper, Take-Two Interactive https://t.co/EFvNoBwwAr $COTY $KDP $TTWO #swingtrading

— Swing Trading (@swingtrading_ct) September 3, 2018

Recent IPO’s:

Earnings:

#earnings for the week

$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI

#earnings for the week$AVGO $RH $WDAY $CONN $FIVE $PANW $OKTA $DLTH $HDS $DOCU $GME $COUP $VRA $NAV $MRVL $KNOP $OLLI $FCEL $ZS $CLDR $HQY $FGN $AMS $CTRP $CSWX $BKS $SMAR $EGAN $MDB $CAL $MBUU $CBK $DVMT $AVAV $ZUMZ $GWRE $LE $FNSR $GIII $GCO $DCI https://t.co/r57QUKKDXL https://t.co/oiZ3V5Hc7S

— Melonopoly (@curtmelonopoly) September 4, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

CRONOS (CRON) trading 13.23 up premarket and looks to be one of the few momos that may fly at open. $CRON #premarket

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they’ll get you.

First red day in a long while in oil. Ended day with a flurry of trades in oil for a small cut. But took a size-able loss on the earlier sell-off. Will take 6 disciplined intra-day snipe trades to back-fill that day. Cut your losers fast or they'll get you.

— Melonopoly (@curtmelonopoly) September 4, 2018

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

Like this…. 3 contracts 30 mins 500.00 rinse and repeat 5 or 6 times a day $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/RvSwFejYxm

— Melonopoly (@curtmelonopoly) September 3, 2018

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/hpvrwLjWwx

— Melonopoly (@curtmelonopoly) September 4, 2018

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT

and again this… $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT pic.twitter.com/JWCGQisxxU

— Melonopoly (@curtmelonopoly) September 4, 2018

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket

and yes again…. at 3 contracts it is 500.00 ea rinse and repeat 5 or 6 times a day for 1500.00 a day etc $USOIL $WTI $CL_F $USO #Oil #Trading #alerts #OOTT #premarket pic.twitter.com/FAiPnf3tIK

— Melonopoly (@curtmelonopoly) September 4, 2018

Oil Daily Chart. MACD still crossed up with price thru 50 MA and resting on it now. Sept 2 1108 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Great wash-out trade in progress from our swing trading platform… ESPERION (ESPR) . Long ads from our previous 49.11 buy side alert. Target reached and now targets 59.90. $ESPR #swingtrading #daytrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Emerging market selloff

-Natfa talks resume

-Trump mulls shutdown

-Markets drop

-Coming up…

https://bloom.bg/2NnQWpC

Markets accustomed to buying the dips keep asking when can this EM sell-off end? But in reality until it gets big enough to impact the US, the pain will continue. In the 1997-98 EM crisis it took 15mths from the THB devaluation until LTCM's failure forced the Fed to act. pic.twitter.com/bwPYrpOogi

— Julian Brigden (@JulianMI2) September 5, 2018

Contagion or not, these emerging markets hold key to selloff

Contagion or not, these emerging markets hold key to selloff https://t.co/rynFQK8sKo

— Bloomberg Markets (@markets) September 5, 2018

Oil drops below $69 on U.S. supply concern as storm threat eases.

Read: https://goo.gl/eTjyrs

Oil drops below $69 on U.S. supply concern as storm threat eases.

Read: https://t.co/0mtNeDnxFy pic.twitter.com/ohIUKqHPWa

— NDTV Profit (@NDTVProfitIndia) September 5, 2018

We’ve got our first 2019 stock market forecast from Wall Street and it’s very bullish https://cnb.cx/2wGqNrC

https://twitter.com/CompoundTrading/status/1036952393441792000

Google will be broken up, warns ‘Cable Cowboy’ John Malone $GOOGL #swingtrading https://www.telegraph.co.uk/business/2018/09/01/google-will-broken-warns-industry-veteran/

Google will be broken up, warns 'Cable Cowboy' John Malone $GOOGL #swingtrading https://t.co/YFslnOvBFC

— Swing Trading (@swingtrading_ct) September 4, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PRQR $CRON $SBOT $NSU $IGC $VCEL $WATT $COUP $MNKD $TLRY $CGC $NEPT $HMY $AMD

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $GKOS $UNH $COST $COUP $GE $RH $GKOS $SYBX, $TNDM $PKI $BP $ANTM $CNP

$AMZN D.A. DAVIDSON RAISES AMZN PRICE TARGET TO $2,450 FROM $2,200

$RH Citi analyst Geoffrey Small raised the price target on Restoration Hardware (NYSE: RH) to $181.00 (from $176.00) while maintaining a Buy rating.

Exact Sciences (EXAS) PT Raised to $100 from $65 at Cowen Following Pfizer Deal Deep-Dive @Street_Insider

(6) Recent Downgrades: $RHI $HOLX $MYGN $CSX $MTN $CNI $HOLX $PDS $TSN

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Nafta, Emerging Markets, $PRQR, $CRON, $MNKD, Oil $WTI, SP500 $SPY, $BTC Bitcoin, $VIX, US Dollar $DXY more.

September Live Trading Room Challenge, Coaching, News, Events, Q & A and More.

September Live Trading Room Challenge, News, Events, Q & A and More information below will be of value to existing members, those asking about our services and new on-boarding members.

Good morning!

I responded to existing member questions and emailed a number of welcome letters to new members over the last 24 hours and as I’ve went along sending the email responses I’ve added and edited information.

To be sure you all have the information included in various emails to new trader members on-boarding to our services and various other questions, I have included a master new member on-boarding letter example below that you can review (it’s more efficient in these busy times at Compound Trading).

This letter also serves as important service updates to existing members to Compound Trading.

I will also publish this to our public facing blog and include a link to this document from our question and answer and home pages on our website (it has been some time since it has been updated).

Below is the new member on-boarding information example (actual new member email that was emailed – excluding private information):

Welcome to Compound Trading Group!

Your subscription for the main trading room (main trading room in this new member example) starts Sept __ and expires Oct __ – it does not automatically renew. If you wish to continue in future simply re-visit the shop page, you can cancel anytime.

Be sure to read our Disclosure and Terms and Conditions. There are a number of trading / alert platforms executed to and by our lead trader and/or trading team.

September Trading Challenge

Our lead trader (link to third-party Agilience Authority Index: “Curtis Melonopoly is rated Top 250 in world for stock exchanges, covering also Economy of the United States and Mathematical Finance“) will be in attendance to the main trading room the month of September, 2018 from Thurs Sept 6 pre-market through to Sept 31 recording his attempt for personal best. The video recordings of his September trading challenge will be available thereafter at our online trading academy link – many trading highlight / review videos and feature blog posts will also come from his attendance. You can find the Compound Trading You Tube channel here and our trading information blog is here (unlocked and member locked posts – many article posts are unlocked to public for study reasons over time also).

About Our Lead Trader / Trading Team at Compound Trading

Our lead trader is a thirty year veteran that services a wide swath of clients from beginning learning traders (in private trade coaching and trade boot camps) to significant institutional funds (conventional technical data services through to algorithmic structured data).

You will find the technical skill-set of our staff to be above average and at times perhaps even challenging. Keep in mind however, that we present trading set-ups in such a way that even the early learning trader to the world’s most sophisticated managed money firms have the data they need to execute trading plans.

We have many new traders that have on-boarded to our trading methodologies that have learned to trade from scratch that are now trading in the top 10% on the market (our minimum goal for our members).

Read the first post in the Freedom Traders series for an idea of where our lead trader started, his story that includes a painful learning process and how this may help you as a trader that needs to learn how to trade in the green.

When You Learn It You Are Free. My Personal Stock Trading Story. Part 1 of “Freedom Traders” Series.

In short, you will have access to very conventional charting through to advance structured algorithmic structured charting (including black box) – traders at all levels of growth find it advantageous.

The Trading Focus of Our Lead Trader / Trading Team

Our lead trader and/or trading team alerts trades in the following instrument categories; regular equity markets, futures and crypto currencies. His trading focus encompasses; the seven primary algorithm models in development at Compound Trading, day-trading momentum stocks (usually premarket and/or early in regular market hours) and swing trading conventional equities (as swing trades are triggering buy/sell areas of the charting models he will execute trade alerts at various levels). There are over one hundred equities that we are developing algorithm models for on our swing trading platform.

The financial instruments we trade and/or alert to our members include; regular equities and derivatives (day-trading and swing trading), commodity futures, commodity ETNs and ETFs, Crypto futures and swaps (mainly Bitcoin $BTC $XBT swaps). We also have an options platform add-on currently in development and is being used by our team now.

The seven Algorithmic Models and accompanied Newsletters are as follows; Crude Oil $WTI $CL_F $USO, Crypto $BTC $XBT, SP500 $SPY, Volatility $VIX, Gold $GLD $GC_F, Silver $SLV and the US Dollar $DXY. Each newsletter option provides (as available during development); announcements, video training, algorithm models, conventional charting, day-trade and swing-trade set-ups, buy-sell triggers, trade-alert & price-target re-caps, news and trading plans.

We also publish a morning pre-market report as time allows by our lead trader (subscription, but included with live trading room subscription) and after-market reports on occasion (free).

In summary, the algorithmic trading models developed at Compound Trading Group are conventional charts built out to include algorithmic charting (structured charting for deeper insight and knowledge of the instrument trade), through to coding for our near term digital trader platforms and machine trading).

You will witness in the trading room and on reports sent to members conventional charting on various time-frames to various forms of algorithmic charting models for the various trading instruments we trade in the markets. The structured algorithmic trade charting models are advantageous to traders learning, advanced traders, technical and fundamental traders, option traders and more.

September Trading Challenge

You may have seen this Tweet on the lead trader’s feed with respect to the September Live Trading Room Challenge;

Trading for my personal best for 1 month in September. Live in main trading room daily. Recording the whole month. 3 ways to watch live.

– Live Trading Room 999.00

– EPIC Oil Algorithm Bundle 399.00

– Trading Students 399.00

– Video set after 1499.00

https://twitter.com/curtmelonopoly/status/1036638335043809280

There are a number of ways to become involved and learn from the September Trading Challenge, they are as follows:

Live Trading Room 999.00.

- The link to subscribe to Main Trading Room is here.

- Main Trading Room subscription includes Premarket Newsletter, Real Time Twitter Alerts, Main Trading Room with broadcast and charting, Private Discord Daytrading Chat Server) *Requires application to acceptance and non disclosure execution prior to attendance.

EPIC Crude Oil Algorithm Trading Room Bundle 399.00.

- The link to subscribe to the bundle that includes the Crude Oil Trading Room, Crude Oil Trade Alerts and Oil Algorithm Reporting is here.

- EPIC is our first and as such most built out algorithmic model to date. Included in the EPIC oil trading bundle is access to the main trading room as needed because often our traders share (specific to crude oil trading) charting data and trading set-ups specific to the trade of crude oil.

Trading Students 399.00.

- Trading students can take advantage of the one month trading challenge for a special one time fee of 399.00. We want the new traders to learn and as such our existing students have been given a bit of a break here. Email Jen direct at info@compoundtrading.com for an invoice to be sent to you as there is no option for this special on our website store.

Videos: Learning to Trade Video Set (when Trading Challenge is complete) 1499.00.

- Email us to get on the list or simply download the series from our online store at the trading academy section of our website when the video set is posted for sale. Current members will receive 30% off.

- This video series will be advantageous for the beginning trader, intermediate and advanced.

Legacy Trading Membership 1499.00.

- The legacy membership is for serious full-time traders that want access to all of our services (some exclusions below) and direct 24 hour video feed access (web cam) to our lead trader’s trading desk.

- Includes all access to all Newsletters, Alerts, Trading Rooms, Algorithm Models, Online Coaching Events, Webinars and 24 hour live access to the Lead Traders personal trading desk (via webcam as available).

- Some services are excluded (that have limited space for example), such as Trading BootCamp in person attendance (virtual attendance is included) and one-on-one trade coaching is not included but all virtual coaching class events are included. Commercial licensing is not included.

- As more services are launched they are included. For example the machine trading platform (coding of algorithms) launching 2018 and all access to lead trader trading platform via webcam are included.

- Follow this link to register as an All Access Legacy Member.

Attendance of Lead Trader in September in the Main Trading Room is structured as follows (the trading in September will be open 24 hours a day):

Live Trading Room Schedule.

Sunday Futures Trading starting at 6 PM Eastern – Usually action does not start until later around 2 -3 AM Monday morning and in to premarket on regular markets. But he is typically in attendance at futures open Sunday around 6 PM. He usually alerts to his Twitter and/or in Discord when he is in session for futures.

He typically notifies clients in the premarket report and copied to his Twitter feed and / or Discord main channel lounge of his schedule for each trading day.

Premarket 9:15 – 9:30 (at times he does trade premarket also and will engage the room earlier than 9:15, he usually alerts members on email, Discord and or Twitter that he is in room in premarket trading when this occirs)

Market Open 9:30 – 11:30

Mid Day Review 12:00 – 12:30

Futures Markets 6:00 PM and through the night session.

Various other Attendance – he alerts to members as needed.

After the end of September he and the trading team will continue in the trading room, at intervals typically as noted above and perhaps not at as high of frequency at times (specific schedule pending travel and other professional obligations).

Trade Alerts

Trading set-ups / trades are alerted to various platforms (depending on the trade) as follows; regular reporting newsletters, special reports sent to members, various Twitter alert feeds, in the live trading room and to the trading chat rooms on Discord (there are private member servers and a public facing side of our Discord trading chat room channel). Click the link to attend to the public facing side of the channel and as / if you subscribe to specific services for specific instruments there are private side chat rooms and associated invite link(s) that will be made available to you (the private side servers are specific to the algorithmic models in development for oil, crypt etc and swing trading.

As a main day-trading room member your access is to the main trading room and public side Discord Server Chat Room (there is no private Discord server for the main trading room).

The Twitter alert feeds for the swing trading / day-trading are included in your membership for the main trading room (follow the Twitter account feed links below). The oil and crypto trade alerts are add-ons you may or may not wish to subscribe to in future.

As a member to the live trading room will provide you access to our team’s trades anyway but some members just find the alert feeds on Twitter to be additionally convenient. Many trades are discussed and/or alerted to main trading room that are not otherwise alerted to Twitter feeds.

Trade alert feeds are found here (please return an email to us so we know your Twitter feed and can open the trading alerts feed to you);

Swing Trading Alerts – Swing trade alerts are also now alerted by way of email to members (in addition to Twitter).

Crypto (Bitcoin, BTC, XBT) Trade Alerts

Newsletters Currently in Update (processing rotation flow).

We are updating our algorithmic and charting models on all of our services to be released to members prior to the September 14 -16 Cabarete Trade Coaching Event. The goal is to use the event as a time to have all services upgraded for members and bring our models another step forward.

At times you will find the newsletter rotations and / or lead trader attendance to the main trading room to be intermittent.