Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Tuesday October 2, 2018.

In this premarket trading edition: Italy, Tesla (TSLA), Square (SQ), Allergan (AGN), Oil WTI USOIL, Volatility VIX TVIX UVXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 1 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

The $ROKU daytrade yesterday at market open went well.

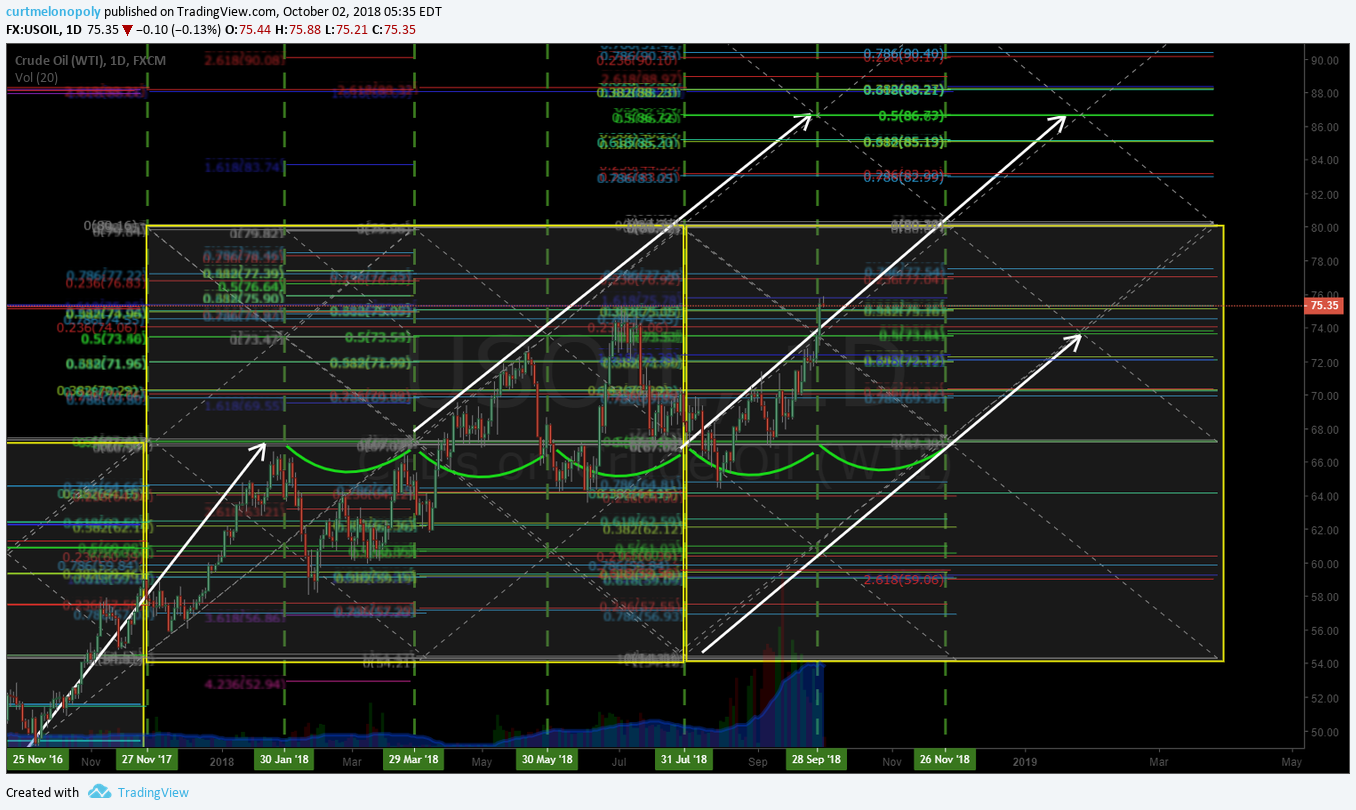

Looking for a large long side oil entry at support on algorithm model.

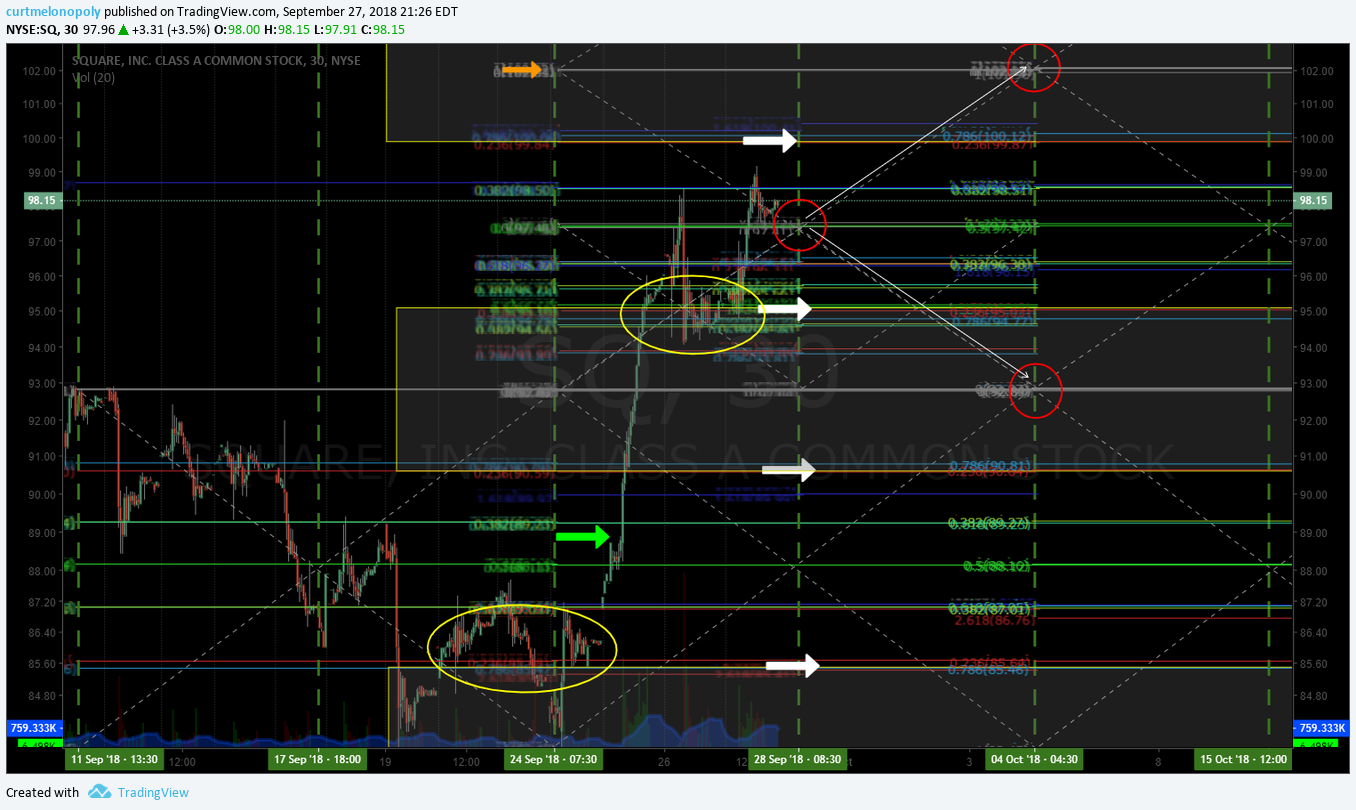

That Square alert from yesterday went well. Nice trim area. I have it on watch with upgrade.

Volatility in to end of week on watch.

Other trading plan notes below.

SQUARE (SQ) swing trade is performing well in continuation of trajectory on chart – premarket trading 101.20 near 102.00 resistance from our 89.00 entry. Trim in to resistance add to trade above (if you are trimming at each resistance). The updated chart is below.

Per last week: The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

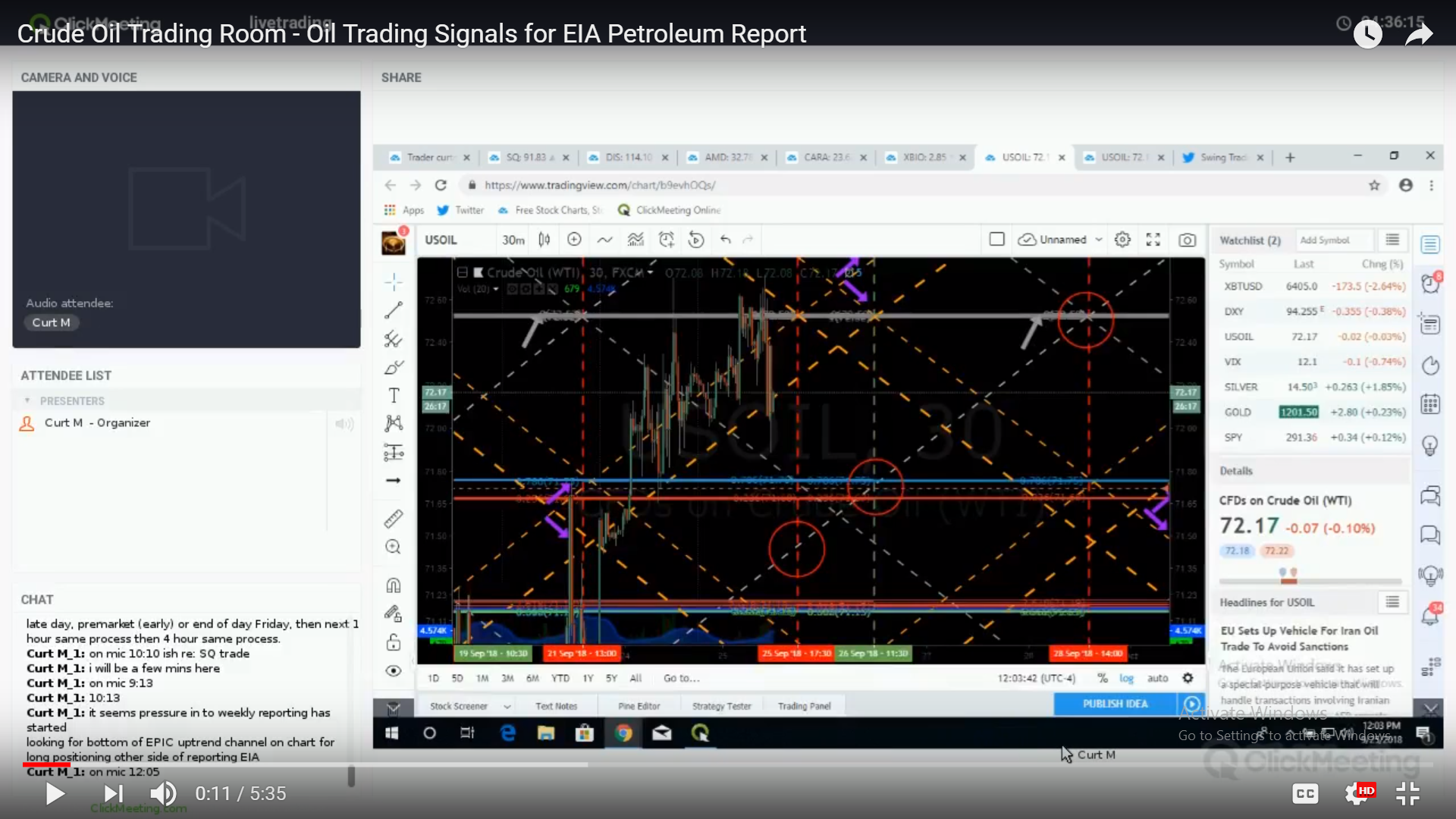

Oil trading plan is similar to last week, I am looking for a trade at / near bottom channel support. Last week it did hit near lower channel support at 71.85 FX USOIL WTI at around 8:30 AM Sept 28 and then took off (no execution), currently trading near upper channel resistance. I will do more day trading again also with oil.

Per last week: Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

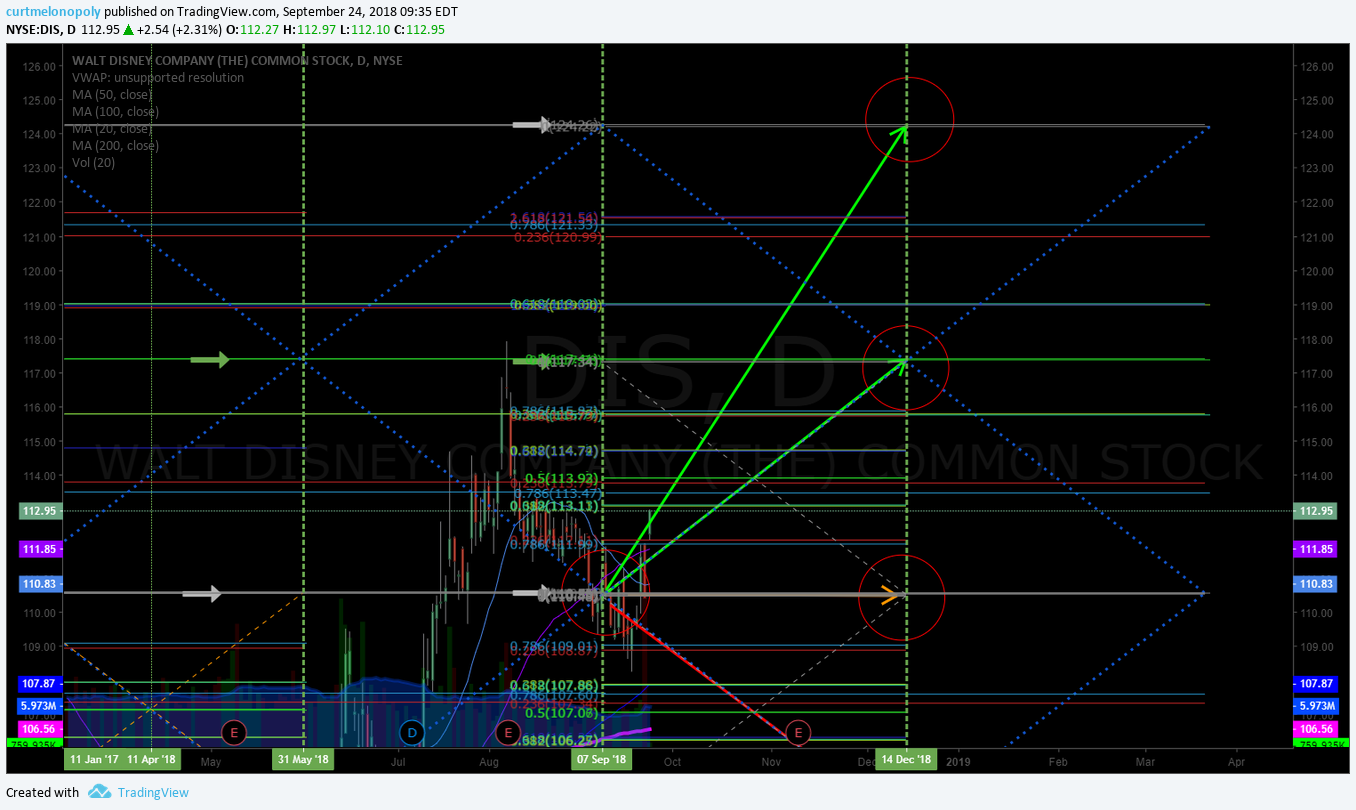

DISNEY (DIS) swing trade doing well, in to resistance area pre-market 117.17, trim in to add above $DIS. Good timing on this trade.

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO. Will only consider a smaller size but will consider another trade. This could be a bottoming pattern setting up. Yet to be seen though.

Bitcoin, the bottoming pattern continues, convinced that 5800 area is most probable bottom (alerted numerous times prior to it trading anywhere near there). Bottom line is that we’re expecting to trade it actively soon going in to Dec 24 time cycle peak and in to 1st Q 2019 aggressive.

Below are some trade position notes from recent weeks if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.30, Oil FX $USOIL ($WTI) trading 75.40, Gold $GLD trading 1192.12, Silver $SLV trading 14.55, $SPY 291.45 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6563.00 and $VIX trading 12.2.

Momentum Stocks / Gaps to Watch:

24 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/12440016 $DTEA $IGC $OMER $NNDM $EYEG $NBEV $TLRY $JAGX $SFIX $ACST $VNE

News:

Tesla $TSLA Q3 Total Vehicle Deliveries, 83,500 vs. 80,000 expected

Square stock gains after KeyBanc hikes target to $115

Canadian medical marijuana company Aleafia applies to list on Nasdaq

Clovis Oncology stock rises 10% premarket after ‘breakthrough’ designation from FDA

$PRTK FDA Approves SEYSARA™ (Sarecycline) for the Treatment of Moderate to Severe Acne

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Crude Oil Monthly Chart testing 100 MA resistance. Oct 2 517 AM FX $USOIL $WTI $USO $CL_F #OIL #chart

ALLERGAN (AGN) Looks like it may not be ready to retrace to bottom of channel in forecast, testing new highs.

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis https://t.co/SEASQ0kFJW

— Swing Trading (@swingtrading_ct) October 1, 2018

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://finance.yahoo.com/news/3-highest-growth-stocks-market-190200998.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://t.co/6OaZlugwOd via @YahooFinance

— Swing Trading (@swingtrading_ct) October 1, 2018

SQUARE (SQ) premarket trading 101.20 near 102.00 resistance. Trim in to resistance add to trade above. Updated chart. $SQ #tradealerts

DISNEY (DIS) swing trade doing well, in to resistance premarket 117.17, trim in to add above $DIS #swingtrading #tradealerts

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO #swingtrading #tradealerts

CRONOS (CRON) MACD cross up on 240 Min Chart with decision near on chart timing, on watch $CRON #tradealert #swingtrading

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PROQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

“U.S. stocks are extremely expensive — and were more expensive only twice in the last hundred-plus years.” https://on.mktw.net/2NVFt1y

https://twitter.com/MarketWatch/status/1046992145310191616

“In the modern era from 1988 to 2018, every single US recession was preceded by the strong relative performance of defensive stocks” https://www.businessinsider.com/next-stock-market-crash-unusual-trading-trend-could-be-signaling-meltdown-2018-9?utm_source=Sailthru&utm_medium=email&utm_content=biPrimeSelect&utm_campaign=BI%20Prime%20Weekend%202018-10-01&utm_term=BI%20Prime%20Select …

Jim Paulsen, @LeutholdGroup: "In the modern era from 1988 to 2018, every single US recession was preceded by the strong relative performance of defensive stocks" https://t.co/DkIBV2aHnp pic.twitter.com/UaVKBsamO3

— Trevor Noren (@trevornoren) October 1, 2018

The only time we’ve seen anything close to this many classic top features was the week of March 24, 2000 [Corrected chart]. Please also read recent tweet-storms, esp on importance of market internals in this half-cycle (overextended syndromes alone were strikingly useless).

The only time we've seen anything close to this many classic top features was the week of March 24, 2000 [Corrected chart]. Please also read recent tweet-storms, esp on importance of market internals in this half-cycle (overextended syndromes alone were strikingly useless). pic.twitter.com/qvD8DJ5Oj0

— John P. Hussman, Ph.D. (@hussmanjp) October 1, 2018

Through the first six months, corporate buybacks stand at $379.7 billion, a 50 percent increase from the same period in 2017.

Through the first six months, corporate buybacks stand at $379.7 billion, a 50 percent increase from the same period in 2017. https://t.co/7H7tNuXW5T

— Jesse Felder (@jessefelder) October 1, 2018

“Eight of the 9 years since 2008 has given us a rally in the 4th quarter…and the only down year (2012) only gave us a loss of 1%.” – Miller Tabak

“Eight of the 9 years since 2008 has given us a rally in the 4th quarter…and the only down year (2012) only gave us a loss of 1%.” – Miller Tabak@CNBC pic.twitter.com/kTuAozwBQ5

— Carl Quintanilla (@carlquintanilla) October 1, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $DTEA $OGEN $TRPX $IGC $OMER $CRMD $NNDM $LEVB $YANG $PYX $SBGL $UGAZ $GE $TRVN $TLRY

(2) Pre-market Decliners Watch-List : $SFIX $NBEV $ACST $YINN

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Wolfe Research Starts Visteon $VC at Peerperform

Wolfe Research Starts American Axle $AXL at Outperform

Johnson Rice Upgrades National-Oilwell Varco $NOV to Buy

(6) Recent Downgrades:

Nomura downgrades MongoDB to Reduce on ‘extreme valuation’ $MDB $MSFT http://dlvr.it/Qm3JTx

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, Italy, Tesla (TSLA), Square (SQ), Allergan (AGN), Oil WTI USOIL, Volatility VIX