Blogs

Premarket Trade Report July 12 | Notes, Alerts, Watch List, Reporting Etc $SGBX, $AMD, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY, #OOTT

Friday July 12 Premarket Trading Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

Premarket Client Notes:

Morning traders,

All reporting will be out this weekend, any delays we credit to accounts – see this link for our policy on reporting cycles and fee credits.

My apologies, the algorithmic models sometimes take much longer to back test than expected. It has happened before. By all, I mean Swing Trading, Trading Results (missing days), Algorithmic reports SPY, VIX, OIL, Gold, Silver, US Dollar, Bitcoin and any other miscellaneous reporting.

It was a Fed speak week and with various other anomalies not only did the models take longer to work but we also didn’t want to take our next time cycle entries without being beyond this specific week. All entries for swinging this cycle and cleaning up the old we want in place between today and Tuesday (some may creep in to late next week, but few). ER will delay some also.

The new oil trade software version is performing well and we will continue to tweak its code toward the 151% per annum target, Bitcoin software is next and then likely Gold but we are undecided at this point:

Profit & Loss: Daily +$473 YTD+$5,412 Projected $85,891 or 86% Oil Machine Trade 100k Account. #Oil #TradeAlerts #MachineTrade #OOTT $CL_F $USO $WTI $USOIL

Profit & Loss: Daily +$473 YTD+$5,412 Projected $85,891 or 86% Oil Machine Trade 100k Account. #Oil #TradeAlerts #MachineTrade #OOTT $CL_F $USO $WTI $USOIL pic.twitter.com/7p2mfdgZNT

— Melonopoly (@curtmelonopoly) July 12, 2019

Near 4 weeks now, one red day (-0.2% draw-down) since new version launch Crude Oil Trading AI software. Current return trajectory 83% per annum. Target 151%. 3 yr history +90% trade alert win rate. Verified P&Ls. EPIC Oil Algorithm #tradealert #OOTT $USO $WTI $CL_F #machinetrade

Near 4 weeks now, one red day (-0.2% draw-down) since new version launch Crude Oil Trading AI software. Current return trajectory 83% per annum. Target 151%. 3 yr history +90% trade alert win rate. Verified P&Ls. EPIC Oil Algorithm #tradealert #OOTT $USO $WTI $CL_F #machinetrade pic.twitter.com/NpS2nBVri7

— Melonopoly (@curtmelonopoly) July 12, 2019

Watch List, Current Trades:

Current Trades – The AMD trade is going very well, we’re 2/3 trimmed on longs at this point but will likely add as we go through the sequence of buying support and selling resistance areas. The Bitcoin trade, first 3/4 were good and last 1/4 not as good, we’re completely out at this point however, we are going to be very active next week forward with new machine trade software development starting. All new swing trades (per above) and reporting on all existing swing trades will be very active over next week.

It’s Friday so don’t try and make up your week today, liquidity in daytrading equities can be weak on Friday’s.

$SGBX at 150%+ in premarket is the big mover, again, caution its Friday and it is a chat room pump, lots of caution.

Bitcoin, not sure at this point, watching the trade within the models close, may be looking at a short term swing entry this weekend, will advise. Still alerting on the swing private feed but new alert feed for BTC in works now.

CXO, DVN, FANG, ECA, EOG, HAL, PTEN, NBL, MRO etc all with down grades this morning, watching the sector close to say the least.

"All News Is Good News" As S&P Rises Above 3,000 While Bond Selloff Accelerates https://t.co/SvLI32fuGV

— zerohedge (@zerohedge) July 12, 2019

Here's a rundown of your top economic news today https://t.co/NAHUZQ5tiY

— Bloomberg (@business) July 12, 2019

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watch List, Stocks, Commodities, Alerts, Trading Room, Bitcoin, $SGBX, $AMD, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY, #OOTT

Trading Profit & Loss Report (Trades, Alerts) July 10 “MY ANGRY RANT – WHY MOST TRADERS LOSE”, $AMD, $CL_F, $USO, $BTC, $BTC.X, $XBT_F #OOTT

Wednesday July 10 Trading Profit and Loss Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

- Includes Live Trading Room Raw Video Feed Recording.

- Includes Trade Alert Links / Screen Shots.

Note: I am just getting back in to the routine of posting daily trade profit and loss reports. For now the reports will include basic information and over time we will provide more information for traders that are using this information for their study and /or trading plans. Near future we will include more formal P&L spreadsheets also.

Section 1: Trading Day Summary.

Good morning, I am writing this in premarket on Thursday, I’m doing July 10 trade results now and if time I will do July 9 (July 9 was only oil trades, all wins), but July 10 was more involved so I’m doing it first to be our traders are up to date.

Caution, there is quite an angry rant below about me not being surprised most people fail trading.

Wednesday was #EIA day for oil traders and Fed testimony day. I took a 1/3 off my $AMD long swing (going great), closed the final 25% of my Bitcoin $BTC short (final execution was not near as good as the first 75% of the trade), nailed a crude oil long trade along with our software machine trade (which is doing great).

Per recent note below in italics, reports are coming we were in it all last night and they will start going out this evening, we want all our new entries to be in place for all swing trades between today and Tuesday for this important time cycle.

Don’t go to sleep, we have a flurry of equity, commodity and indices trades coming very soon. It’s all about time cycles and the current reporting in process getting released.

Our focus #timecycles and how they fit with #Powell #Trump war plan. It's been clear since day one, only question is timing along the way. Report blast of the century in the works. Biggest opportunity in trading history next 5 years. $SPY $VIX $DXY $CL_F $SLV $GLD $BTC #premarket

— Melonopoly (@curtmelonopoly) July 10, 2019

Per above our machine software nailed an oil trade continuing its march to considerable gains if its trajectory continues since most recent version launched. For more information on the machine trading platform contact Rich at Sovoron direct www.sovoron.com.

Profit & Loss: Daily +$136 YTD+$4,643 Projected $80,694 or 81% Oil Machine Trade 100k Account. #OOTT #Oil #MachineTrading $CL_F $USOIL $WTI $USO

Profit & Loss: Daily +$136 YTD+$4,643 Projected $80,694 or 81% Oil Machine Trade 100k Account. #OOTT #Oil #MachineTrading $CL_F $USOIL $WTI $USO pic.twitter.com/DuWKl8fgDf

— Melonopoly (@curtmelonopoly) July 10, 2019

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI pic.twitter.com/bMP3Ods5TU

— Melonopoly (@curtmelonopoly) July 8, 2019

Top performing funds of 2018:

1. Odey European

Performance in 2018: 53%

Strategy: Macro

Top Performing Hedge Funds of 2018 https://t.co/INqmmzBTLn via @investopedia

— Melonopoly (@curtmelonopoly) July 10, 2019

Section 2: Specifics on Trades for the Day.

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert. As time allows I provide in the section below copies of charts, guidance from private member Discord server chat room, live trade room screen shots and screen shots of alerts.

Oil Trades / Alerts.

Below is a screen shot of the trade alert short side snipe technical trade 60.17 to 60.10. The earlier trade in futures is the one below this image.

Below, a screen capture from oil trading alert feed on Twitter, the first trade (early futures) both I and machine software traded long for a win. Entries from 58.40s & .50s and we closed the trade 58.72 area and alerted it.

Bitcoin Trades.

Note: We continue to alert Bitcoin on the swing alert feed for now (and by email), this will change soon however when our new Bitcoin trading chat Discord server opens and the new Bitcoin alert feed on Twitter is available to members.

I did get stopped out on the final 25% of this BTC trade when I was out in the evening at meetings Wed night, the first 75% was great and the last not so good. My BTC trading will get very regular in to next week as we’re launching our coding of the BTC algorithm now that we’re done the Oil trading algorithm. We have big plans for this area of trade / machine trading, alerts etc. The returns in our Bitcoin trading will be the largest returns we achieve, easily hands down. More on that very soon.

Swing Trades.

Note: Our swing trade chart models can be used for daytrading (converting them on the fly is easy – bringing the time-frame down to 30, 15, 5 and 1 minute time frames).

As mentioned above, I closed 1/3 of my AMD swing trade. This trade is an excellent example of the power behind algorithm models. We took the entry at the support of the channel (marked with arrow on chart in screen shot below of trade alert). The point is, there was no channel there as conventional charting would see it. That channel support is part of the model. Conventional charting provides a channel on the chart after the fact. If you look at any of the experts that were trading this (and I won’t mention names), they were talking up their AMD trade with entries long after ours, because they couldn’t see what we could see.

This is a critical lesson that 99% will over-look. It not only provide better returns for your swing trades, but more confidence in your trades and precise areas to exit.

Our new swing trade report due out soon has many of these excellent set ups. And our members can access many models from the 3 years we have been building models in equity markets, it is a significant advantage and the primary reason we post incredible swing trade returns (see our profit and loss master document).

Our swing trade returns (alerted) are top of class, you can’t get better, you just have to stop for more than a minute and look at the P&Ls and the alert feed. It’s quality over quantity, not casino mind trading. If you’re sensing emotion to this there is, check the alerts and try and find better. Those returns beat the best hedge fund returns in the world. Time stamped, alerted live, recorded in live trading room – the evidence is there and couldn’t be more clearly laid out, for near 3 years! The only thing I could do more is serve it McDonalds style with a nice cover image, drive thru style 2 min videos so that most would eat the sh*t that the market serves out, oh and put two lines on the chart. World class swing trading, best you can get. We know how many people open the charts, watch the videos, do their homework, its no wonder the majority fail. Totally disappointing.

And now we’re developing machine trade for oil that will (if I get my way) beat the best funds in the world with-out trying (in fact we’re targeting 3 x their best results and currently on track for 2 x) and soon Bitcoin machine trades. I mean really. Jeez. Do your homework and stop telling me everything is against you when I talk to you on DM or whatever. It’s your fault it ain’t the markets fault. VERY FEW do what it takes. All the videos are there, raw trading room feeds yes, that is what you need. You can look at the time stamp on the alerts and go to the raw trading room feed and hear everything I was thinking about the trade set-up and more.

THIS IS WHAT A TRADER NEEDS, YOU DON’T NEED DRIVE THRU CASINO MIND SH*T 2 MIN VIDEOS. THIS IS WHY YOU DON’T WIN.

THIS IS WHY THE MAJORITY OF TRADERS LOSE.

Section 3: Trading Room Raw Video Footage for the Day.

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is a raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts. I make this available for authenticity / documentation and also some learning traders use the raw feeds for study purpose. Also, as time allows I publish separate trade set-up reports with video snippets to our blog and YouTube.

Live Trading Room Raw Feed

The video below at time of posting is still uploading at YouTube so it may not be available yet when you try.

If you have any questions about my trading or need help with yours send me an email anytime [email protected] and I’ll do my best to help.

Thanks

Curt

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Profit and Loss, Trade Alerts, Trading, Day Trading, Swing Trading, Oil, Bitcoin, USO, CL_F, BTC, BTC.X, XBT_F, AMD

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Monday July 8 Trading Profit and Loss Report.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

- Includes Live Trading Room Raw Video Feed Recording.

- Includes Trade Alert Links / Screen Shots.

Note: I am just getting back in to the routine of posting daily trade profit and loss reports. For now the reports will include basic information and over time we will provide more information for traders that are using this information for their study and /or trading plans. Near future we will include more formal P&L spreadsheets also.

Section 1: Trading Day Summary.

Monday was moderately calm trading day.

Don’t go to sleep, we have a flurry of equity, commodity and indices trades coming very soon. It’s all about time cycles and the current reporting in process getting released.

Our machine software nailed an oil trade continuing its march to considerable gains if its trajectory continues since most recent version launched.

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI

New version of software 1 red day 0.2% draw down since launched over 2 weeks ago. Current rate of return (annual ROI compound) 82% but we know when #AI gets in to its groove 150% will be the mark. Verifiable P&Ls. #OOTT #machinetrade #oilalerts $CL_F $USO $USOIL $WTI pic.twitter.com/bMP3Ods5TU

— Melonopoly (@curtmelonopoly) July 8, 2019

On the stock (equity) trading front it was quiet for Day Trades and Swing Trades (as said previous, when new swing trade report is launched this will change, we expect it at latest Wed night this week). I am watching $AMD close as I am in 3/10 size, the other swing trades / updates will be on the report (I have a number of open trades that I will report on).

Still in the Bitcoin short 1/4 of the size of initial short, first 3/4 went well and final 1/4 a tad under water. Over all a decent trade.

Section 2: Specifics on Trades for the Day.

If you cannot see a chart below, a link is not available or not showing to the alert and/or chart or parts of the data is blocked with ******, this is because it is a premium member chart or alert. As time allows I provide in the section below copies of charts, guidance from private member Discord server chat room, live trade room screen shots and screen shots of alerts.

Oil Machine Trades / Alerts.

Since the new version of software was launched a few weeks ago it has a decent P&L rolling along (as noted above), here’s a quote from the machine P&L report I was reviewing this morning (soon you will get daily copies);

“Profit & Loss: Daily +$389 YTD+$4,500 Projected $82,120 or 82% Oil Machine Trade 100k Account.”

Below are the oil trade alert screen shots of the machine software alerting our members to the opening and closing of the trade.

Personal Oil Trades.

- I traded with the machine software as it traded only.

Machine Bitcoin Trades.

- N/A in development.

Personal Bitcoin Trades.

- None, watching current action to either re-short at resistance (see member report) or cover the final 25%. Decent trade so far but would like to see price targets 2 and 3 of 3 hit. Price target 1 hit.

Personal Swing Trades.

- No new positions, adds or trims (other than Bitcoin). This will get very active as soon as the new swing trade report is released.

Personal Day Trades.

- None on day. There were a few set-ups per the premarket report I was ready to trigger on but the equity markets slumped so I didn’t trigger a day trade in equities.

- As above, once the new swing report comes out my day trading will get much more active. Our swing trade chart models can be used for daytrading (converting them on the fly is easy – bringing the time-frame down to 30, 15, 5 and 1 minute time frames).

Section 3: Trading Room Raw Video Footage for the Day.

#OilTrading #BitcoinTrading #DayTrading #SwingTrading #MachineTrading #TradeAlerts

The video below is a raw feed only, to find live trading and trade alerts voice broadcast when lead trader is trading in the room reference the time of day on the alerts. I make this available for authenticity / documentation and also some learning traders use the raw feeds for study purpose. Also, as time allows I publish separate trade set-up reports with video snippets to our blog and YouTube.

Live Trading Room Raw Feed

If you have any questions about my trading or need help with yours send me an email anytime [email protected] and I’ll do my best to help.

Thanks

Curt

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Profit and Loss, Trade Alerts, Trading, Day Trading, Swing Trading, Oil, Bitcoin, USO, CL_F, BTC, BTC.X, XBT_F, AMD

Premarket Watch List July 8 $SGMO, $AMD, $OASM, $AYTU, $CBIO, $SYMC, $ORN, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Monday July 8 Premarket Watch List.

- Day Trade and Swing Trading.

- Equities, Commodity and Bitcoin Trading.

- Personal Trades and Machine Software Trades.

Watch List

24 Stocks Moving In Monday’s Pre-Market Session $OASM $SGMO $CBIO $AYTU $SYMC $ORN $NTAP $TYME $AAPL $LC $LPL

REVIEW – $AMD +1.3% premarket Ryzen 3000 Review: AMD’s 12-core Ryzen 9 3900X conquers all – PC World

https://www.pcworld.com/article/3405567/ryzen-3000-review-amds-12-core-ryzen-9-3900x.html

NEWS – $SYMC +4.0% pre – Broadcom $AVGO Makes Progress on Symantec Deal With Financing, Savings – BBG

GEOPOLITICAL – $USO Oil steadies as demand concern counters Middle East tensions – SI

ETF INFLOW – Silver $SLV – Silver Sees Largest Daily ETF Inflow In A Year: BMO $SLV #Silver

https://twitter.com/curtmelonopoly/status/1148041622472540160

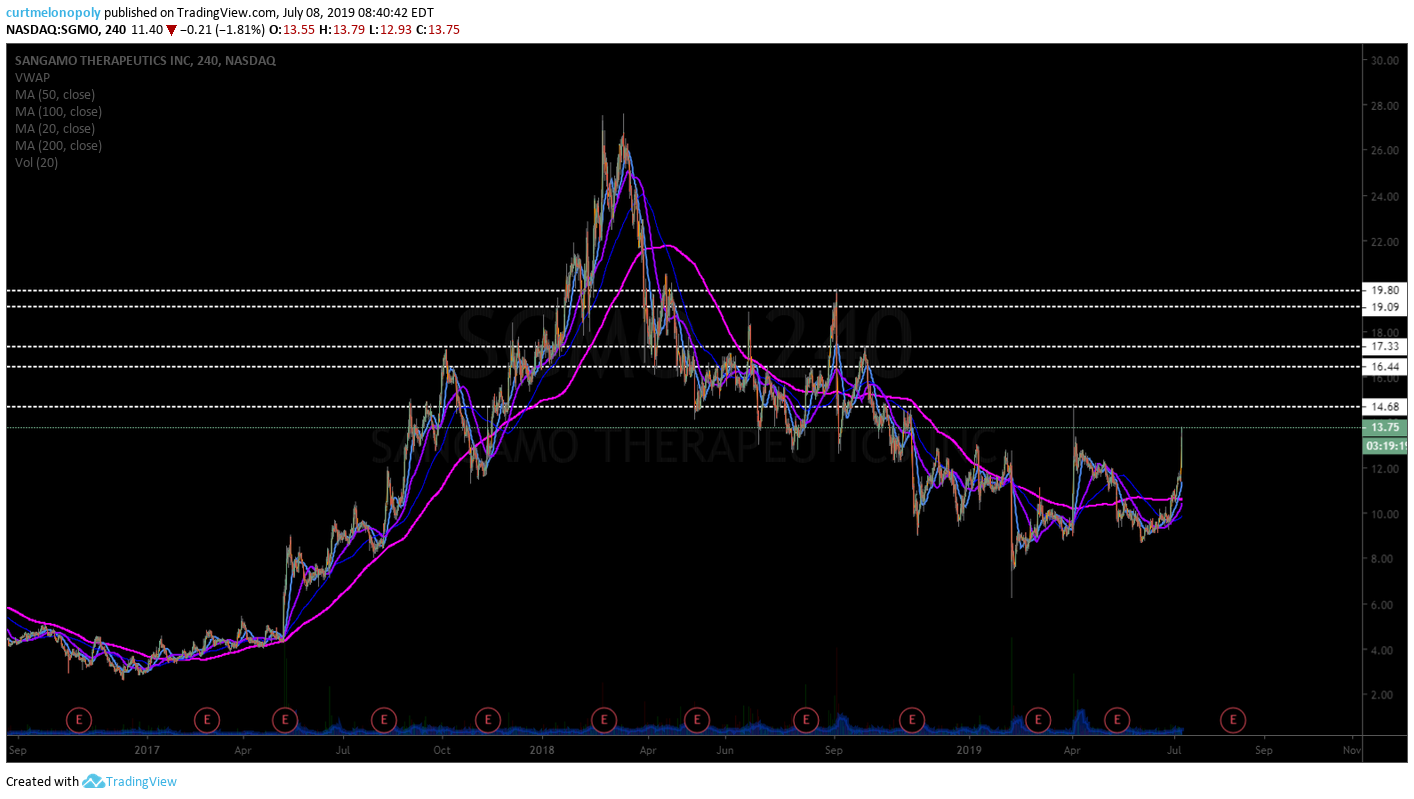

SGMO premarket up 20.53% trading 13.75 on results. Daytrading resistance points on chart $SGMO

Recent Swing Trading and Day Trading Reports (all charts can be brought down to Day Trading time frame):

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Premarket Notes (for more about what we’re up to with our trading):

Company News:

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Subscribe to Learn and Profit:

Click Here for Subscription Service Price Tables.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics: Premarket, Trading, Watchlist, Stocks, Commodities, Bitcoin, $GMO, $AMD, $OASM, $AYTU, $CBIO, $SYMC, $ORN, $USO, $GLD, $SLV, $SPY, $BTC.X, $VIX, $DXY

Swing Trading Strategies | SP500 $SPY Volatility $VIX Gold $GLD Silver $SLV Bitcoin $BTC Oil $USO US Dollar $DXY | July 7 Premium #timecycles

Special Time Cycle Swing Trade Report With Set-Ups, Strategies, Alerts, Charts, News. July 7, 2019.

Below are Swing Trade Set-Ups Currently On Watch; S&P 500 $SPY Volatility $VIX Gold $GLD Silver $SLV Bitcoin $BTC Oil $USO US Dollar $DXY.

Review this Twitter thread as I commented some on each model below;

Working models tonight… that week of Oct 21, 19 time cycle peak… theres an inflection wk of Aug 5, 19 (but not near the size), Oct 21 is massive. Remember one I told u bout in to last Dec 24? This one has fire power potential 2B 2x size $SPY $VIX $USO $CL_F $DXY #timecycles

Working models tonight… that week of Oct 21, 19 time cycle peak… theres an inflection wk of Aug 5, 19 (but not near the size), Oct 21 is massive. Remember one I told u bout in to last Dec 24? This one has fire power potential 2B 2x size $SPY $VIX $USO $CL_F $DXY #timecycles

— Melonopoly (@curtmelonopoly) July 7, 2019

SP500 (SPY) Following our upper price target trajectory scenario near perfect since last SPY report, watch thick red line res test $SPY $ES_F $SPXL $SPXS #SwingTrade #Daytrade

The resistance overhead is key, if trade runs through it you can expect that to be possible support for continued run in to upper price target. This structured model has been quite consistent and is proving to be a decent swing trading guide for positioning of size through a move.

In this specific instance, the peak in to week of Oct 21 is broad global markets, SPY specifically is Sept 9 – Oct 4, so its a little earlier for some reason. VIX is Oct 21 week though.

A strong economy and Fed rate cuts: The stock market wants to ‘have its cake and eat it, too’ https://on.mktw.net/2YAQZk8

VIX The symmetry in previous time cycle peaks is amazing, watch Oct 21 2019 time cycle peak close. #volatility $VIX $TVIX $UVXY #swingtrading

Watch the first time cycle inflection in to Aug 5 week and then the large time cycle based on symmetry in to week of October 21, 2019.

ha one last note, its a wild card note, if $VIX got going it has a peak possible at 58.17 Oct 21, 2019 lol. Unlikely, but just saying, it has that in nitros available in the tank during that time frame, should a wild card scenario play out. #timecycles #volatility

Fed rate cut in question after June jobs report beat https://finance.yahoo.com/video/fed-rate-cut-june-jobs-183234715.html?.tsrc=rss

GOLD If you’re swing trading Gold use patience and trade the channel (red lines) it’s very clean $XAUUSD #Gold $GLD $GC_F

Of course if you’re using it as a hedge or store of value completely different story, but timing your entries in to Gold is well done with that channel between red lines on Monthly chart below.

Gold has time cycles peaking weeks of Aug 1 2019 (small), Feb 3 2020 (moderate), Aug 3 2020 (peak – large cycle peak). That far out however, you have to check back as we get closer as the timing can shift (a few months out we can nail it down exact) #Gold $GLD $XAUUSD #timecycles

Is The Debt Crisis About To Be Reborn In 2020? https://finance.yahoo.com/news/debt-crisis-reborn-2020-081448073.html?soc_src=social-sh&soc_trk=tw

SILVER Weekly chart seems to imply a break sometime in advance of Mar 2020 up or down, that’s all I have for you. #swingtrade $SLV $USLV $DSLV #Silver

Silver Sees Largest Daily ETF Inflow In A Year: BMO https://www.kitco.com/news/2019-07-04/Gold-Silver-Precious-Metals-Daily-News-Briefs.html

BITCOIN (BTC) One way to swing trade it (there are others in our report) is to long at the bowl trajectory on pull backs $XBT_F $XBTUSD #Bitcoin #Chart

Using other chart models on our Bitcoin report there are other not so static ways to swing trade the Bitcoin move, however, testing longs anytime price returns to that bowl trajectory seems moderately reasonable.

Oh, and Bitcoin’s time cycle peak is week of Dec 17, 2019. $BTC #timecycles

US Dominates Bitcoin Twitter Discussion, Sentiment Towards Facebook’s Libra is Sinking — Report $FB $BTC #Libra https://www.cryptoglobe.com/latest/2019/07/us-dominates-bitcoin-twitter-discussion-sentiment-towards-facebook-s-libra-is-sinking-report/#.XSKfJRyeeik.twitter

Crude Oil Weekly Chart is really interesting because 14 out of last 15 time cycles reversed (see previous report) Doing it again. #swingtrading

#Oil interesting because unlike recent time cycles where it was near same as market indices cycles (last Dec), it is off this cycle, Wk of Sept 23, 19 is an inflection with time cycle peak Jan 6, 20. Recent time cycle bottom June 10, 19 per our reports. #OOTT #timecycles $CL_F

US Dollar Index (DXY) Aug 5 2019 Mar 30 202 are the time cycles to watch, still trades around pivot $DXY $UUP #USD #swingtrading

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, Signals, SP500, $SPY, Volatility, $VIX, Gold, $GLD, Silver, $SLV, Bitcoin, $BTC, Oil, $USO, US Dollar, $DXY, time cycles