Tag: $GE

PreMarket Trading Plan Mon Oct 1: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO more.

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday October 1, 2018.

In this premarket trading edition: NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Oct 1 – Lead trader booked for main trading room for market open, mid day review and futures trading this evening (as available and as market demands).

- Main live trading room is open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) live recorded trading with Lead Trader. Exceptions include; Trade Coaching Boot Camps, Special Trading Webinars or when Lead Trader is not available.

- Scheduled this week:

- New pricing published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Trading Boot Camp Event videos become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Oil Trading Bootcamp (online only)

- 1 day Swing Trading Bootcamp (online only)

- 3 day Trading Bootcamp November 2018 (online or in person)

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members.

- Sept 18 – Previously recorded Master Class Series were emailed to members.

- Sept 14-16 Cabarete Trade Coaching Boot Camp went well, there are a series of post links on this landing page that detail what our itinerary was each day etc.

- Machine Trade Coding Team Mandates: In current development and roll-out has commenced (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Operate 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the pre-market reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 17 – Protected: Trade Alerts (w/ video): $VIX $WTI $CL_F $PROQR $CARA $BOX $BABA $SSW $SPY $FB $SENS

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

SQUARE (SQ) swing trade is performing well in continuation of trajectory on chart – premarket trading 101.20 near 102.00 resistance from our 89.00 entry. Trim in to resistance add to trade above (if you are trimming at each resistance). The updated chart is below.

Per last week: The Square $SQ trade from yesterday is going well, trading 96.30 in premarket today with a swing trade entry at 89.00 and looking for more legs in this trade (see Square $SQ feature post and video).

Oil trading plan is similar to last week, I am looking for a trade at / near bottom channel support. Last week it did hit near lower channel support at 71.85 FX USOIL WTI at around 8:30 AM Sept 28 and then took off (no execution), currently trading near upper channel resistance. I will do more day trading again also with oil.

Per last week: Today is EIA Petroleum Report day at 10:30 AM. Looking for a large swing trade in oil (see feature report sent to members last night).

DISNEY (DIS) swing trade doing well, in to resistance area pre-market 117.17, trim in to add above $DIS. Good timing on this trade.

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO. Will only consider a smaller size but will consider another trade. This could be a bottoming pattern setting up. Yet to be seen though.

Bitcoin, the bottoming pattern continues, convinced that 5800 area is most probable bottom (alerted numerous times prior to it trading anywhere near there). Bottom line is that we’re expecting to trade it actively soon going in to Dec 24 time cycle peak and in to 1st Q 2019 aggressive.

Below are some trade position notes from recent weeks if you didn’t catch them;

Still watching the week set-up, I expect a significant oil size trade (swing and intra-day) very near, in a new Disney $DIS trade, the $XBIO set-up was awesome and there’s a number of others we are working on.

BTW the Bitcoin $BTC trade will be big soon, the charting is setting up, we will be updating members on the inflection move prior. We expect up, but we will be alerting the BTC set-up for both scenarios.

Have a swing trade in $CRON that is going well, trimming and adding per chart model that has been a great help.

Have a swing trade in $BABA under water on 1 1/10 sizing entry, watching for adds.

Really like $FB snap-back set-up here, watching the 50 MA overhead on the chart model, it keeps paying every time we trade it.

Also really like $NFLX set-up here, it has been a regular and consistent pay day with the simple chart model dialed in.

Oil I’ve missed a few sweet spots this week but continue to watch, not every trader can be on top of every instrument 100% of the time (I keep telling myself haha). Anyway, I’ll start hitting it out of the park again with patience. Hopefully today a set-up on the EPIC model allows some size.

SHOPIFY $SHOP has been a great set-up for a possible break upside the quad time cycle peak, support has held well for traders that have taken longs on the set-up. It could blow through the top of that quad on the time cycle peak coming, if it does it will be a significant extension up.

$NBEV trade has been fantastic, paying the bills for sure. Chart resistance and support areas worked well. Trade alert was good on NBEV.

$GTHX is a tad wild but managed well it has been a good trade for us.

And $AGN of course continues to pay on large sizing with trims and adds from the charting and trade plans published over last number of weeks.

Watching $BKRS for a long, looks decent for a swing trade.

Market Observation:

Markets as of 7:18 AM: US Dollar $DXY trading 95.13, Oil FX $USOIL ($WTI) trading 73.42, Gold $GLD trading 1186.12, Silver $SLV trading 14.53, $SPY 292.48 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 6573.00 and $VIX trading 11.8.

Momentum Stocks / Gaps to Watch:

New Ages Beverages bid up 17% https://seekingalpha.com/news/3393975-new-ages-beverages-bid-17-percent?source=feed_f … #premarket $NBEV

Your Monday morning Wake Up Call:

#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company’s update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

Your Monday morning Wake Up Call:#Tesla holders rejoice their CEO reached a settlement with the SEC, meanwhile, the company's update on Q3 deliveries is due sometime early this week.

Consensus estimates are for 80K deliveries, including about 52K Model 3s. $TSLA

— Benzinga (@Benzinga) October 1, 2018

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://bloom.bg/2DIinGQ $TSLA #premarket #swingtrading

Shares in Tesla rise more than $50, almost 19%, in pre-market trading https://t.co/dHZ2HFe5KU pic.twitter.com/4PyqE8FG8c

— Bloomberg Markets (@markets) October 1, 2018

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://bloom.bg/2DISeYz

Shares in GE continue to surge in pre-market treading following the announcement of a new CEO https://t.co/evehvFP8a8 pic.twitter.com/1iTdE24dGH

— Bloomberg Markets (@markets) October 1, 2018

News:

Viking Therapeutics stock jumps 4.8% premarket on news of positive trial results

$AGLE FDA Grants Rare Pediatric Disease Designation to Pegzilarginase for Arginase 1 Deficiency

$CORT Receives Orphan Drug Designation for Relacorilant as Treatment for Pancreatic Cancer.

Recent SEC Filings / Insiders:

Recent IPO’s:

$SVMK SurveyMonkey IPO is bigger than expected https://www.marketwatch.com/story/surveymonkey-ipo-is-bigger-than-expected-2018-09-25?mod=mw_share_twitter

Elastic sets IPO terms to raise up to $203 million, to be valued at up to $2 billion

$BNGO REMINDER: Analyst IPO Quiet Period Expiration Today for BioNano Genomics

Ticketing company Eventbrite prices IPO at $23 to raise $230 million

Earnings:

Cal-Maine misses profit and sales expectations, dividend drops from previous quarter

#earnings for the week

$COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN

#earnings for the week $COST $SFIX $PEP $STZ $SGH $PAYX $LEN $CALM $AYI $LW $SNX $RPM $PIR $ISCA $NG $LNDC $RECN https://t.co/r57QUKKDXL https://t.co/PJ2ABTMR7h

— Melonopoly (@curtmelonopoly) October 1, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis

The Cannabis Arbitrage Deal Of The Year $SCYB #pot #swingtrading #Cannabis https://t.co/SEASQ0kFJW

— Swing Trading (@swingtrading_ct) October 1, 2018

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://finance.yahoo.com/news/3-highest-growth-stocks-market-190200998.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

3 of the Highest Growth Stocks in the Market Today #swingtrading $SQ https://t.co/6OaZlugwOd via @YahooFinance

— Swing Trading (@swingtrading_ct) October 1, 2018

SQUARE (SQ) premarket trading 101.20 near 102.00 resistance. Trim in to resistance add to trade above. Updated chart. $SQ #tradealerts

DISNEY (DIS) swing trade doing well, in to resistance premarket 117.17, trim in to add above $DIS #swingtrading #tradealerts

XENETIC BIOSCIENCES (XBIO) held a key support area on Friday. On watch for a trade over 3.25 $XBIO #swingtrading #tradealerts

CRONOS (CRON) MACD cross up on 240 Min Chart with decision near on chart timing, on watch $CRON #tradealert #swingtrading

TESLA (TSLA) Upper and lower price targets in to next time cycle nearing $TSLA #tradealerts #swingtrading

– Tesla’s faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.

– Tesla's faithful flood showrooms as carmaker pushes for profit.

– Elon Musk told employees that hectic weekend would end in victory.https://t.co/42zskaCK7W— NDTV Profit (@NDTVProfitIndia) October 1, 2018

ADVANCED MICRO (AMD) hit key resistance at mid quad and came off now near a support, some members in this play toward price target #swingtrading #tradealerts

APPLE (AAPL) premarket bullish momentum with 20 MA test and 224.60 range buy sell trigger above $AAPL #swingtrading #tradealerts

FACEBOOK (FB) premarket up over 50 MA on 240 min chart, watch 167.60 resistance overhead $FB #swingtrade #tradealerts

ALIBABA (BABA) bullish up 2% intra day, holding support of trading range well. Trim in to resistance add above. $BABA #tradealerts #swingtrade

CARA THERAPEUTICS (CARA) Nice swing trade from trading bootcamp in to next leg at resistance intra day $CARA #swingtrade #tradealert

OSI SYSTEMS (OSIS) Trading 77.55 testing 50 MA and key Fib resistance, over targets 84.21 Dec 28, 18 $OSIS #tradealerts #swingtrading

BALLARD POWER (BLDP) Five out of five of the last major time cycles price reversed, Oct 10 is next time cycle peak. $BLDP #swingtrading #tradealerts

LEVEL BRANDS (LEVB) trading 6.54 premarket long in to 8.09 price target, 6.16 area support. $LEVB #daytrading #swingtrade

EDITAS MEDICINE (EDIT) Bounce at 50 MA over mid quad resistance 200 MA res next Sept 24 price target in sight. $EDIT #swingtrade #tradingalert

NETFLIX (NFLX) perfect turn at previous alerted trendline support 309.54, cleared 313.52 res (red blue) 338.66 mid quad bounce $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) Part 2 – past 361.91 key resistance, over 200 MA 380 mid quad resistance on deck trading 372.11 $NFLX #swingtrading #tradealerts

NETFLIX (NFLX) PT 3 over 380 mid quad resistance, targets 395.57 trendline (gray dotted) 398.20 red blue key resistance $NFLX #swingtrading #tradealert

ROKU INC (ROKU) At resistance 73.55 area, above 73.70 targets 77.80 next. Trim in add above. $ROKU #swingtrde #daytrading

SHOPIFY (SHOP) continues bullish pressing upper FIB trendline, trading 159.25 targeting 166 Oct 10 $SHOP #tradealerts #swingtrading

22nd Century Group (XXII) over 2.85 targets 3.09 then 3.53 Nov 19 time cycle. $XXII #tradealerts #swingtrading

MOMO Inc. from Trading BootCamp over 48.50 targets 49.66 50.46 51.42 65.57 Feb 5 #swingtrading #tradealerts

G1 THERAPEUTICS (GTHX) at intra day model support, could bounce here targets near 70 first if so $GTHX #tradealerts

US Dollar Index (DXY) Algorithm support area test 94.50, 94.04 break bounce area $DXY $UUP #USD #tradingalerts

BOX INC (BOX) Box testing support, short under red box support, down side targets at arrows in sell-off $BOX #Swingtrading #daytrade #tradealerts

PROQR THERAPEUTICS (PROQR) Bounced at support range (box) now at key res, over 22.70 targets 24.85 fast then 27.55 $PRQR #swingtrading #daytrade #tradealerts

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

Market Outlook, Market News and Social Bits From Around the Internet:

our Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA

Your Monday morning Speed Read:

– Stock futures 🚀higher on news the U.S., Canada & Mexico reached a trade deal $SPY $EWW $EWC

– U.S. purchasing managers index (PMI) data at 10am ET

– Elon Musk reportedly banned from tweeting Tesla news w/out an ok from the company lawyer $TSLA— Benzinga (@Benzinga) October 1, 2018

#5things

-North America trade deal

-Musk settles

-Italian risk

-Markets rise

-Coming up…

https://bloom.bg/2DSHs26

U.S. and Canada forge a last-gasp deal to salvage NAFTA as a trilateral pact with Mexico https://reut.rs/2N9Q1os

https://twitter.com/Reuters/status/1046727441354563584

Gerald Celente – Economic Meltdown Worse Than Great Depression Coming

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ACST $SYN $MTNB $TSLA $LEVB $NBEV $OGEN $IRDM $GE $IGC $CRMD $MTSL $ALT $AMRN $TLRY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $VIAV $BCS $ICPT $STOR $ALVR $BIIB $EWBC $MTB $UPS $LOGM $APO $TEVA $ENTG

BMO Capital Downgrades The Chefs’ Warehouse, Inc $CHEF to Market Perform

J.B. Hunt Transport Services $JBHT PT Raised to $151 at Credit Suisse

(6) Recent Downgrades: $INTC $TI $BUD $AMD $CIEN $ALV $MEI $TEL $CHEF $FFIV $REVG $WDC $LRCX $INFN $CMG $AMAT $SHLO $DLPH $VEEV $PAYC

RBC Capital Downgrades CAPREIT (CAR-U:CN) to Sector Perform

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, NAFTA, Cannabis, Elon SEC Deal, TSLA, NBEV, GE, SQ, DIS, XBIO, CRONO

PreMarket Trading Plan Mon June 25: Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV more.

Compound Trading Premarket Trading Plan & Watch List Monday June 25, 2018.

In this edition: Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete- Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

https://twitter.com/CompoundTrading/status/1004257179438866432

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Daytrading Room: As of today May 25, we are targeting this Wednesday.

- Target date for recommencement week of June 25. Main Link and password emailed to trading room members on a per session basis for daytrading and webinar events (per memorandum May 29, 2018). Applicable members will begin to receive notice as sessions commence.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Oil Algorithm EPIC Run: Winning continues for the EPIC Oil Algorithm. 100% live oil trade alert win rate for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts ⤵🎯

https://twitter.com/EPICtheAlgo/status/1010004212950843392

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

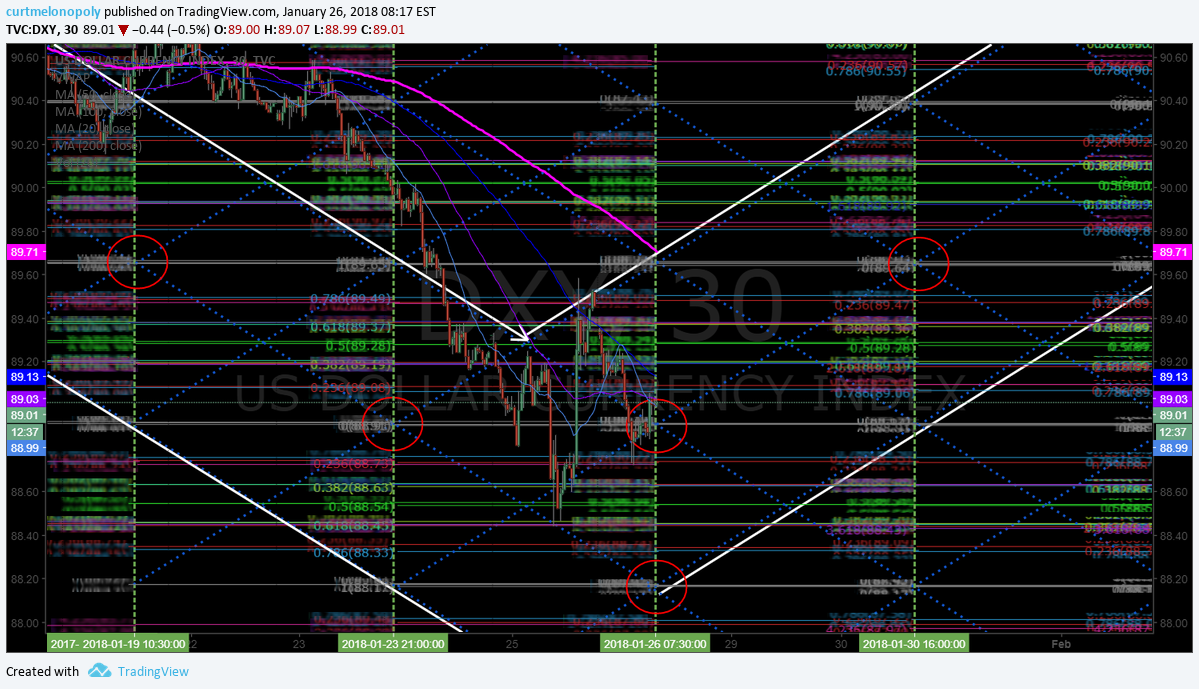

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

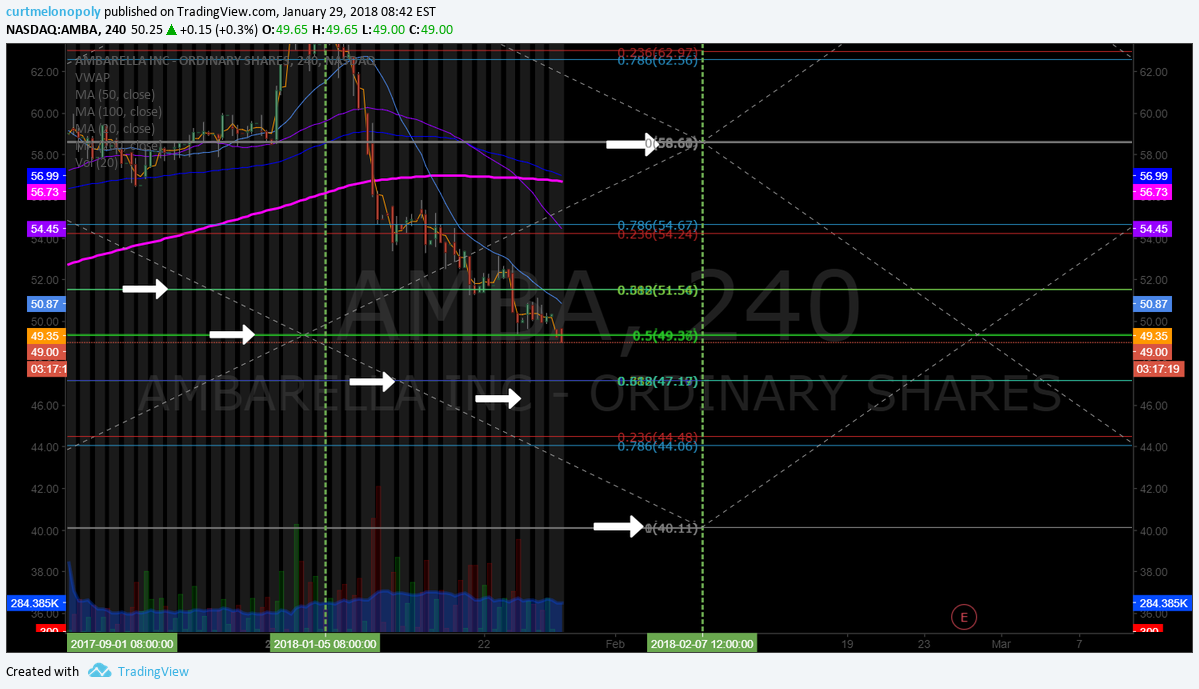

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: HOG, NFLX, GE, MSFT, AMZN & more –

https://twitter.com/CompoundTrading/status/1011216171998248961

25 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/11927273 $XRM $VLRX $CPB $ACHV $ZOM $TRXC $SOGO $IQ

25 Stocks Moving In Monday's Pre-Market Session https://t.co/HEoeTWwL52 $XRM $VLRX $CPB $ACHV $ZOM $TRXC $SOGO $IQ

— Benzinga (@Benzinga) June 25, 2018

Market Observation:

Markets as of 8:06 AM: US Dollar $DXY trading 94.37, Oil FX $USOIL ($WTI) trading 68.96, Gold $GLD trading 1268.55, Silver $SLV trading 16.39, $SPY 273.64, Bitcoin $BTC.X $BTCUSD $XBTUSD 6219.00 and $VIX trading 15.

Momentum Stocks to Watch: $XRM $VLRX $ACHV

News:

Oil falls below $75 in London after Saudis pledge to boost supply https://bloom.bg/2yHqAIS

The two most important oil benchmarks are behaving very differently after OPEC’s meeting https://bloom.bg/2yG3RNb

Merrimack Pharma says trial of pancreatic cancer treatment failed to meet main goals

Pluristem shares jump 2% on news of positive trial of treatment for radiation damage

Harley-Davidson’s stock sinks, sees EU tariffs adding $2,200 to average motorcycle cost

$MNKD Presents Positive Afrezza® Clinical Data from STAT and AFFINITY Studies at ADA 78th Scientific Sessions

$CTRV ContraVir Pharmaceuticals to hold a business news update conference call today at 4.30 pm

$GE WSJ: GE Nears Deal to Sell Industrial-Engines Unit to Private-Equity Firm Advent

Shopify to run B.C.’s online cannabis sales http://business.financialpost.com/wcm/757a5ebd-ba5d-42e6-8e55-0ae131d6c7b7 … via @nationalpost

Brunswick ends Sea Ray sale process and opts to retain and restructure the business

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$NKE $CCL $LEN $WBA $GIS $PAYX $STZ $RAD $FDS $JKS $ACN $KBH $BBBY $INFO $MKC $SCHN $UNF $CAG $APOG $CUK $SONC $GMS $AVAV $PIR $EROS $SNX $LNN $OMN $SJR $FUL $XPLR $CAMP $PRGS $NG $FC $DTRM $IRET $GBX $DAC

http://eps.sh/cal

https://twitter.com/CompoundTrading/status/1011220159246323713

upcoming #earnings releases with the highest #volatility

$PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL

http://eps.sh/cal

upcoming #earnings releases with the highest #volatility $PIR $AVAV $BBBY $EROS $CAMP $APOG $JKS $PRGS $SNX $RAD $SJR $KBH $SONC $INFO $LEN $OMN $SCHN $FUL https://t.co/lObOE0dgsr pic.twitter.com/kbjyr7perU

— Earnings Whispers (@eWhispers) June 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

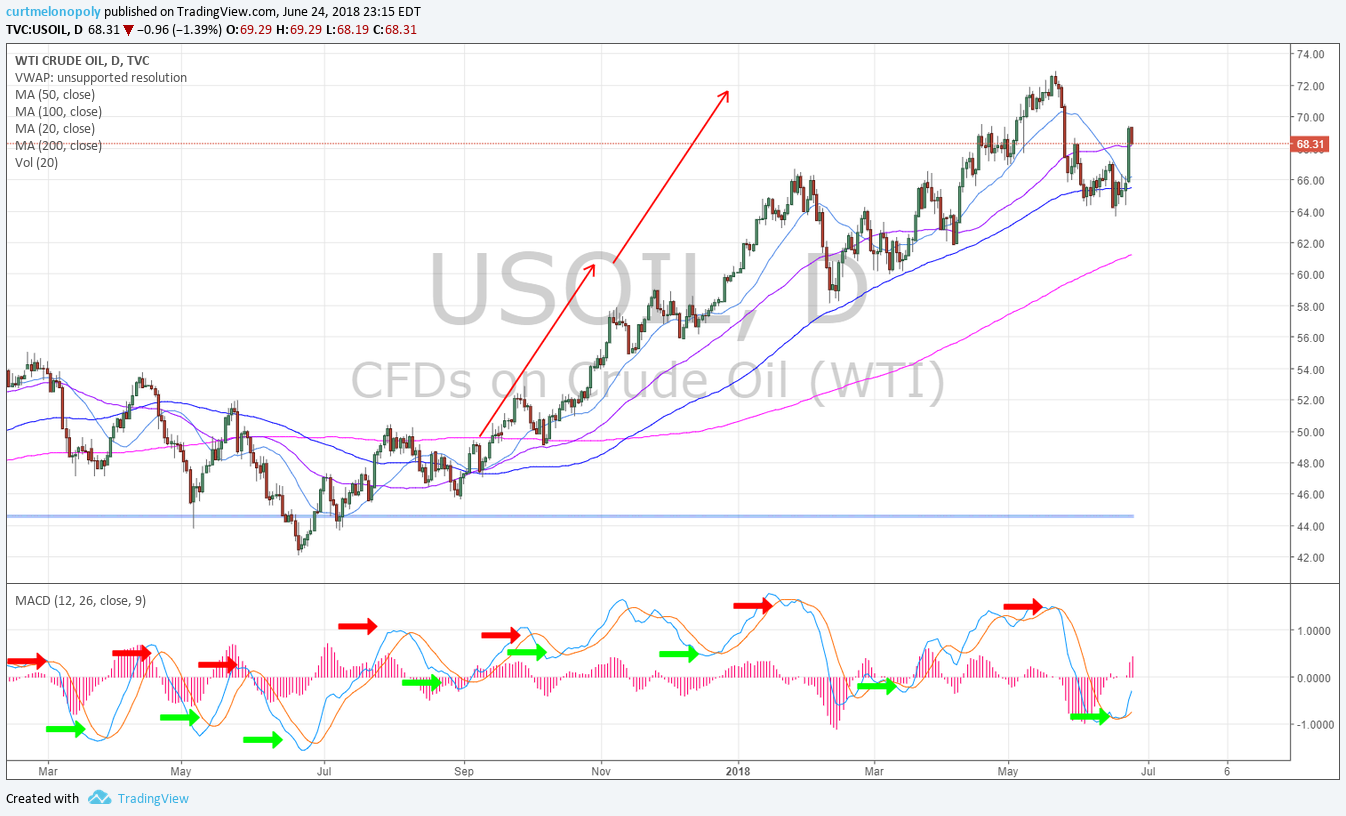

Oil Chart (Daily). K.I.S.S. chart MACD turned up and price above 50 MA (bullish). June 24 1115 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #OOTT

EPIC Oil Algorithm trade alert wins continue for many weeks now. Time stamped real time. FX $USOIL $WTI $CL_F $USO #OIL #OOTT #Oiltradealerts #algorithm

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

ALLERGAN (AGN) swing trade continues – trading 176.55, over 174.76 targets 180.28, then 184.62 main resistance Aug 13. $AGN #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

INTRA CELLULAR (ITCI) Trading at key support (mid quad Fib) watch for directional swing trade to next target $ITCI #swingtrading

3rd target hit. Trade thesis complete for #EIA. Next levels to follow. Oil Algorithm (EPIC). June 20 1148 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

1st & 2nd price target areas on trade alert hit early. most trimmed 65.90s. Oil Algorithm (EPIC). June 18 201 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

SENSEONICS (SENS) swing trade is targeting most bullish apex of quad, trim in to resistance add above. $SENS #swingtrading

BOX INC (BOX) Resistance trim in to 28.32 and add above to 30.00 area res. $BOX #Swingtrading

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

$GDX remains range bound but a tad divergent to bear side. $NUGT $DUST $JDST $JNUG

Gold failed 200 MA upside resistance test. #GOLD #CHART $GC_F $XAUUSD $GLD

Oil Chart (Weekly). Oil trendlines on weekly time-frame. June 18 146 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Oil Algorithm Simple Weekly Gen 1 Model. Trade failing 20 MA and Fibonacci support test. June 18 132 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #Algorithm #OOTT

US Dollar Index (DXY) Shorts MAY get some reprieve soon, but this move is structured – get out of its way until it isn’t. $DXY #algorithm

VOLATILITY S&P INDEX (VIX) Time cycle concludes approx July 16, 2018 on large weekly structure. Moves probable in to and out of that timing. $VIX #volatility

Market Outlook, Market News and Social Bits From Around the Internet:

Trade War Fears, Global Markets’ Decline, Stocks To Continue Lower? –

Trade War Fears, Global Markets' Decline, Stocks To Continue Lower? – https://t.co/ukliOJOrl9

— Investing.com Stocks (@InvestingStockz) June 25, 2018

Five Things You Need to Know to Start Your Day

Get caught up on what’s moving markets. https://www.bloomberg.com/news/articles/2018-06-25/five-things-you-need-to-know-to-start-your-day via @markets

#5things

-U.S. ups the pressure on China

-Erdogan wins in Turkey

-OPEC confusion

-Markets drop

-May, Merkel risks

https://bloom.bg/2yGVH7f

https://twitter.com/CompoundTrading/status/1011222547357106176

Economic Data Scheduled For Monday

Economic Data Scheduled For Monday pic.twitter.com/Go2ULBepv7

— Benzinga (@Benzinga) June 11, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $XRM $VLRX $ACHV $GTN $ZFGN $TVIX $CIG $CPB $CLPS $AKER $UVXY $SXE $FCEL $DGAZ $VXX $CIEN $FSLR $PSTI $AKAO $SQQQ $MBT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $HPR $SO $NSC $BSM $BWA $DGX $MSFT $CIEN $CRTO $FRT $FSLR $HPR $NTR $ALRM $NSC

$SRPT raised to a new street high of $275 by Liisa Bayko @ JMP

BofA/Merrill Lynch Upgrades First Solar $FSLR to Buy Citing Solar ITC Extension

Monness, Crespi, Hardt Reiterates Buy on MongoDB $MDB Ahead of MongoDB World and Investor Meeting

UPDATE: Zendesk $ZEN PT Raised to $67 at Cowen; ‘Moving Up-Market With A Long Runway Ahead’

(6) Recent Downgrades: $KR $KMX $YRD $EL $ATI $CRS $INTC $OHI $OGE $ORLY $MLVF

$OHI downgraded to Market Perform from Outperform at Wells Fargo.

Intel stock falls after Instinet downgrades to neutral

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Trade War Fears, Global Markets Lower, OIL, $HOG, $NFLX, $GE, $MSFT, $AMZN, $XRM, $VLRX, $ACHV

PreMarket Trading Fri Apr 20: $AGMH, Trump, OIL, Bitcoin Cash, Silver, Gold, Crypto, SP500, $GE, $HON, $RF, $WFC, $MAT, $SKX

Compound Trading Chat Room Stock Trading Plan and Watch List Friday April 20, 2018: SP500, $SPY, $BTC, Bitcoin, Gold, $GLD, $GDX, OIL, $WTI, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

EPIC (Oil) Members Note: Weekly EIA Oil Trade webinar 10:30 AM ET Wed in oil trading room. Also, weekly webinar Wed 11:00 AM ET specific for Oil trade chart analysis, algorithm model use (swing and intra) and cover questions as needed. The videos will be available to EPIC members as a library online. (Previously EIA was in main trading room, but for this purpose we will meet in the oil trading room. The private oil trading Discord channel can also be used for live two way voice question and answer).

April Sale On Now! 10 Promo Codes Per Select Items Only! Ends Apr 30 or if Promo Code limit for a specific item has been reached (10). If there is no sale price beside item listed it is sold out. Click here for available Promo Codes. https://compoundtrading.com/overview-features/ … #trading #stockmarket

April Sale On Now! 10 Promo Codes Per Select Items Only! Ends Apr 30 or if Promo Code limit for a specific item has been reached (10). If there is no sale price beside item listed it is sold out. Click here for available Promo Codes. https://t.co/TFgZFPzOBt #trading #stockmarket

— Melonopoly (@curtmelonopoly) April 16, 2018

New link on site for those that couldn’t access previous for Trade Coaching Boot Camp coming up. (hopefully this works for ya) “Only 2 Spots Left! May 2018 Trade Coaching Boot Camp in Dominican Republic” #tradecoaching

New link on site for those that couldn't access previous. (hopefully this works for ya) "Only 2 Spots Left! May 2018 Trade Coaching Boot Camp in Dominican Republic" #tradecoaching https://t.co/2OExe4N4vS

— Melonopoly (@curtmelonopoly) April 20, 2018

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts.

$FB Facebook Long Set-Up Testing Buy Sell Trigger

Twitter Trading Plan $TWTR (Part two)

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Cryptowatch: Bitcoin cash & Ripple both surging 13% today as the major cryptocurrencies continue their comeback this month $BCH $XRP $BTC $ETH

Stocks making the biggest moves premarket: GE, HON, RF, WFC, MAT, SKX & more https://www.cnbc.com/2018/04/20/stocks-making-the-biggest-moves-premarket-ge-hon-rf-wfc-mat-skx-more.html?__source=sharebar|twitter&par=sharebar

Stocks making the biggest moves premarket: GE, HON, RF, WFC, MAT, SKX & more https://t.co/8kDe9AQyi7

— Melonopoly (@curtmelonopoly) April 20, 2018

Here’s what Bitcoin Cash fans are doing right now…

Here’s what Bitcoin Cash fans are doing right now… pic.twitter.com/6j9d6n7nE5

— CNBC's Fast Money (@CNBCFastMoney) April 20, 2018

Crypto Board🔥$BTC $XRP $ETH $LTC $XBT #Crypto

Crypto Board🔥$BTC $XRP $ETH $LTC $XBT #Crypto pic.twitter.com/SaT6f1Rt3i

— Melonopoly (@curtmelonopoly) April 20, 2018

Per Apr 18 – Time to look at metals and crypto very closely… in prep for a short term retrace in our broad market bull move inflection that should peak soon and retrace for a rest. Crypto up or down has high ROE ROI #commodities #crypto #trading #algorithm #models $STUDY

Well that worked well… very profitable – after chart review I am bias some retrace is soon, I am short term trimming all positions here. We had over twenty long side alerted positions in this move. 100% winners. Timestamped. $STUDY #boomtown #premarket #trading #stockmarket https://t.co/HGHmFnnXsN

— Melonopoly (@curtmelonopoly) April 18, 2018

Market Observation:

As of 7:45 AM: US Dollar $DXY trading 89.95, Oil FX $USOIL ($WTI) trading 67.92, Gold $GLD trading 1342.31, Silver $SLV trading 17.16, $SPY trading 268.77, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 8539.00 , and $VIX trading 15.8.

Recent Momentum Stocks to Watch:

News: $CLDX, $AGHM, $SQ (raise), $ABEO, $HEAR, $IZEA, $LLNW, $VXRT

$ABEO Abeona Therapeutics Receives Orphan Drug Designation in the European Union for ABO-202 Gene Therapy Program in Batten Disease

Deutsche Bank Reiterates Buy on Square $SQ Ahead of 1Q Release

Recent SEC Filings:

Recent IPO’s: $AGMH

Earnings:

#earnings scheduled for the week

$NFLX $BAC $GE $LRCX $GS $UNH $IBM $JNJ $CLF $MTB $ABT $MS $ISRG $PGR $CMA $PG $AA $BX $AXP $ASML $MLNX $HON $UAL $FRED $NUE $SLB $PIR$DGX $URI $GSM $CE $CSX $GWW $WM $SEAC $NTRS $PNFP $KEY $WTC $USB $OMC $SKX $TXT $ETFC

http://eps.sh/cal

#earnings scheduled for the week$NFLX $BAC $GE $LRCX $GS $UNH $IBM $JNJ $CLF $MTB $ABT $MS $ISRG $PGR $CMA $PG $AA $BX $AXP $ASML $MLNX $HON $UAL $FRED $NUE $SLB $PIR$DGX $URI $GSM $CE $CSX $GWW $WM $SEAC $NTRS $PNFP $KEY $WTC $USB $OMC $SKX $TXT $ETFChttps://t.co/r57QUKKDXL https://t.co/9agjWeri4f

— Melonopoly (@curtmelonopoly) April 16, 2018

Trade Set-up Alerts & Reports. Recent / Current Holds, Open and Closed Trades:

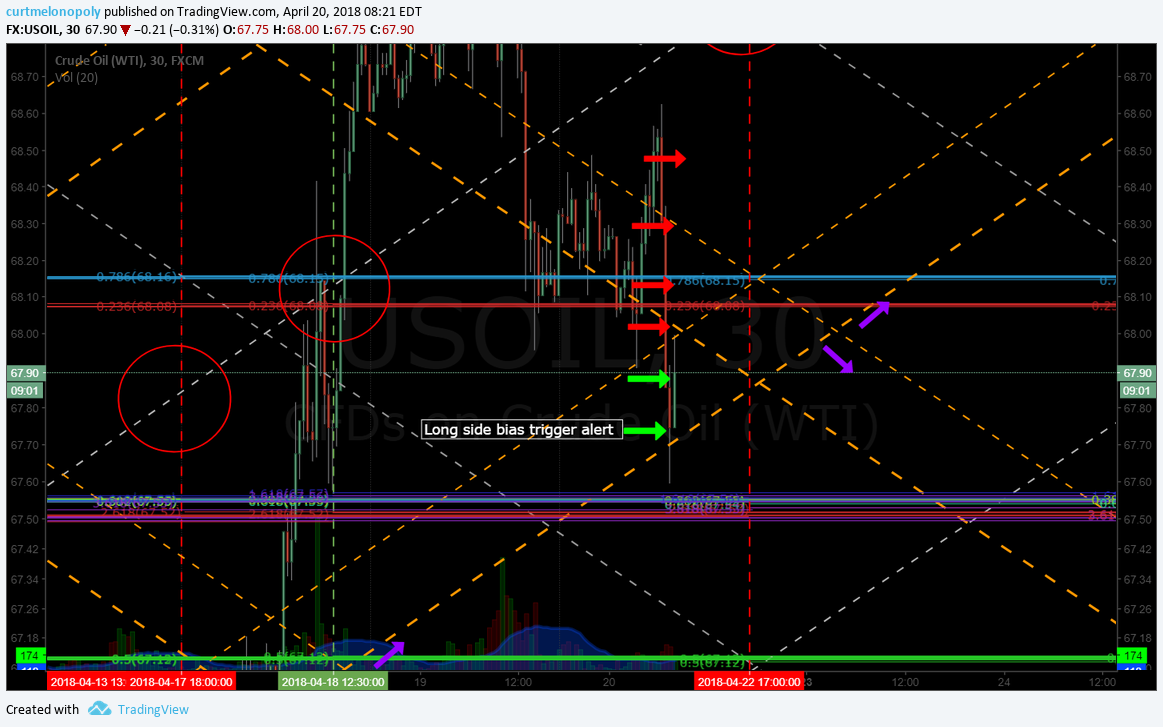

Premarket Oil Trade in Progress. Long side bias trade set up alert. Entry and price targets. Trim before resistance add above. FX $USOIL $WTI #OIL

April 12 – Special Swing Report – $FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

$FB Facebook long side trade from 153.40 Mar 28 buy side trigger now testing buy sell trigger 167.51. See chart notes. #swingtrading https://www.tradingview.com/chart/FB/968SzV2E-Facebook-New-Buy-Sell-Trigger-Here-Now-See-Chart-Notes/

April 11 – Swing Trading in Review. $DIS, $C, $TSLA, $FB, $SPY, $GDX, $CELG https://compoundtrading.com/swing-trading-review-dis-c-tsla-fb-spy-gdx-celg/ …

https://twitter.com/CompoundTrading/status/983045524839452672

Charts and Chart Set-ups on Watch:

Silver touch to 100 MA on Weekly. Not saying it will go… but I wouldn’t want to be short. $SLV, $USLV, $DSLV

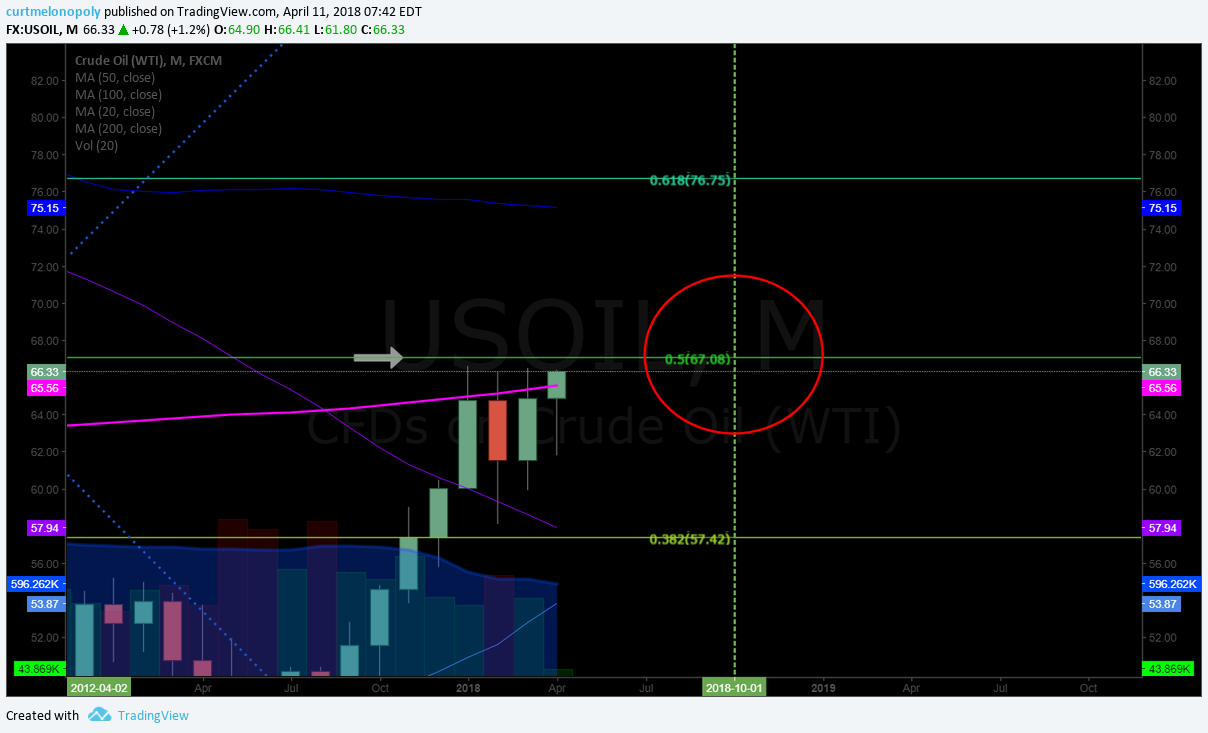

100 Day Moving Average on Monthly Oil Chart logical price target. $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT

Gold bulls continue to press the upper resistance points on daily chart model. #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

$GDX Gold miner trading near mid quad resistance test and perfectly on way to price target. $NUGT $DUST $JNUG $JDST

$FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.

Bitcoin: April 12 – Bullish indicator – price didn’t drop in to target this time. Not absolute indication of turn, but is a signal. $BTC

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://t.co/5AWSJCxqA5 pic.twitter.com/9SaQX01K5U

— Swing Trading (@swingtrading_ct) April 8, 2018

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://www.tradingview.com/chart/MXIM/l2JjyH3X-MXIM-under-55-94-short-side-looks-great-MACD-turn-Chart-notes/ …

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://t.co/nNQfOV6rMr pic.twitter.com/4241zYTpX0

— Swing Trading (@swingtrading_ct) April 8, 2018

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

$TSLA also blasting here from yesterday’s alert🔥 In it to win it. #swingtrading

$TSLA also blasting here from yesterday's alert🔥 In it to win it. #swingtrading pic.twitter.com/JEefAyUROL

— Melonopoly (@curtmelonopoly) April 5, 2018

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://twitter.com/SwingAlerts_CT/status/981914928528416768/photo/1pic.twitter.com/muDQaThxP2

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://t.co/muDQaThxP2 pic.twitter.com/UXpvTgLpuo

— Melonopoly (@curtmelonopoly) April 5, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5Things people in markets are talking about now:

-3 percent?

-OPEC finds reasons to keep cuts

-Dovish Carney

-Markets quiet

-Coming up…

https://bloom.bg/2HMXA3o

#5Things people in markets are talking about now:

-3 percent?

-OPEC finds reasons to keep cuts

-Dovish Carney

-Markets quiet

-Coming up…https://t.co/B02EltPY4b pic.twitter.com/XRorMDu36o— Bloomberg (@business) April 20, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AGMH, $ERIC $VXRT $IONS $LLNW $PF $DPW $GE $MSCC $XNET $EBIO $RIGL $NOK $OPGN $HEAR $INFY $SBGL $TWTR $DWT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $TSCO $PBCT $ADS $MAC $ASB $E $UGI $SBNY $SYNT $LFC $WLL $TWTR $NAP $MAC $OMF $JHG $ASB, $WWE. $STLD. $AMZN

(6) Recent Downgrades: $PG $CHD $TEAM $PM $DHT $NNA $SKX $MRTN $OLN, $NKE, $QVRO, $PIR, $SKX, $PM

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Trump, OIL, Bitcoin, Cash, SILVER, GOLD, Crypto, SP500, $GE, $HON, $RF, $WFC, $MAT, $SKX

PreMarket Trading Plan Wed Apr 11: #EIA, Oil, Syria, Zuckerberg, Fed, $SPY, $GE, $FB, $CBS, $FCAU, $NWL, $USG, $HLT

Compound Trading Chat Room Stock Trading Plan and Watch List Wednesday April 11, 2018: #EIA, Oil, Syria, Zuckerberg, Fed, $SPY, $GE, $FB, $CBS, $FCAU, $NWL, $USG, $HLT – SP500, $SPY, $BTC, Bitcoin, Gold, $GLD, $GDX, OIL, $WTI, $USOIL, Volatility, $VIX , Silver, $SLV, US Dollar Index, $DXY … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Details to our next Trading Boot Camp in May! We’re over 70% booked so don’t wait. 30% off on this session! And what a location! #tradecoaching #learntotrade

https://twitter.com/CompoundTrading/status/982706326454358017

Notes in red text below are new comments entered specifically today (or recently important).

Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Real-time Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM us!

Connect with us on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Recent Educational Videos:

Want to learn how to trade stocks for consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: GE, FB, CBS, FCAU, NWL, USG, HLT & more –

Stocks making the biggest moves premarket: GE, FB, CBS, FCAU, NWL, USG, HLT & more – https://t.co/Sz1hMw2rTH

— Melonopoly (@curtmelonopoly) April 11, 2018

Market Observation:

As of 8:28 AM: US Dollar $DXY trading 89.58, Oil FX $USOIL ($WTI) trading 66.07, Gold $GLD trading 1351.50, Silver $SLV trading 16.60, $SPY trading 264.5, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 6844.50, and $VIX trading 21.2.

Recent Momentum Stocks to Watch:

News:

$BIOL to explore strategic alternatives, CEO resigns.

$TSRO and Medison Enter Into Exclusive Distribution Agreement to Commercialize ZEJULA in Israel

Helius Medical Technologies announces uplisting to Nasdaq and pricing of Class A common stock an… https://seekingalpha.com/news/3344921-helius-medical-technologies-announces-uplisting-nasdaq-pricing-class-common-stock-warrants?source=feed_f … #premarket $HSDT

Loxo teams up with Veracyte to advance development of therapies for genetically defined ca… https://seekingalpha.com/news/3344923-loxo-teams-veracyte-advance-development-therapies-genetically-defined-cancers?source=feed_f … #premarket $VCYT $LOXO

$FB CEO exceeds expectations in congressional hearing, says Wells Fargo. Reiterates an outperform rating and $230 PT.

Oil surges after Donald Trump tells Russia in a tweet to “get ready” because missiles will be fired at Syria https://bloom.bg/2HpWz0M

Oil surges after Donald Trump tells Russia in a tweet to "get ready" because missiles will be fired at Syria https://t.co/2xLGehVfam pic.twitter.com/8vrZ6Yv7sG

— Bloomberg (@business) April 11, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings scheduled for the week

$JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY

http://eps.sh/cal

#earnings scheduled for the week $JPM $C $RAD $WFC $DAL $BLK $BBBY $FAST $MSM $PNC $OZRK $APOG $SMPL $FRC $FHN $INFY $SLP $CBSH $SJR $EXFO $LAYN $NTIC $TISA $DPW $HQCL $DGLY https://t.co/r57QUKKDXL https://t.co/BcGzJRjTUB

— Melonopoly (@curtmelonopoly) April 7, 2018

Trade Set-up Alerts – Recent / Current Holds, Open and Closed Trades:

Swing Trading in Review. $DIS, $C, $TSLA, $FB, $SPY, $GDX, $CELG https://compoundtrading.com/swing-trading-review-dis-c-tsla-fb-spy-gdx-celg/ …

https://twitter.com/CompoundTrading/status/983045524839452672

Charts and Chart Set-ups on Watch:

April 11 – Oil monthly. Near previous highs. Bias trim long to no hold and wait. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://www.tradingview.com/chart/GOLD/IcE7fVql-Historical-resistance-hit-again-Predictable-short-Chart-Notes/ …

Gold came off again at historical resistance for predictable short. Price target June 4 1320.00 area most probable. #Gold $GLD $GC_F https://t.co/1ic9v7LhsP pic.twitter.com/hZlfN8gjV9

— Rosie the Gold Algo (@ROSIEtheAlgo) April 9, 2018

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://www.tradingview.com/chart/CELG/gdKoFxEq-CELG-86s-to-91s-off-alert-buy-sell-trigger-now-Chart-Notes/ …

$CELG 86s to 91s off alert, buy sell trigger now. Chart Notes. https://t.co/5AWSJCxqA5 pic.twitter.com/9SaQX01K5U

— Swing Trading (@swingtrading_ct) April 8, 2018

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://www.tradingview.com/chart/GDX/xqvoPTby-50-MA-Test-Structure-in-Play-Top-10-Easiest-Trades-See-Notes/ …

$GDX 50 MA Test, Structure in Play – One of the Cleanest, Easiest Trades on the Market. See Chart Notes. $NUGT $DUST $JDST $JNUG $GLD #GOLD https://t.co/EX9GrJPGPK pic.twitter.com/uNM4IIwwCY

— Rosie the Gold Algo (@ROSIEtheAlgo) April 8, 2018

Oil Resistance One of Most Predictable Trades in Markets. See chart notes. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT https://www.tradingview.com/chart/USOIL/LFoaIZEq-Oil-Resistance-One-of-Most-Predictable-Trades-See-chart-notes/ …

https://twitter.com/EPICtheAlgo/status/982760354815053824

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://www.tradingview.com/chart/MXIM/l2JjyH3X-MXIM-under-55-94-short-side-looks-great-MACD-turn-Chart-notes/ …

$MXIM under 55.94 short side looks great. MACD turn. See Chart notes. #swingtrading https://t.co/nNQfOV6rMr pic.twitter.com/4241zYTpX0

— Swing Trading (@swingtrading_ct) April 8, 2018

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn’t bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.

https://www.tradingview.com/chart/LTCUSD/NAsEtGUs-Litecoin-likely-bounce-near-here-for-chart-structure-Chart-notes/ …

Litecoin will have to bounce near here if chart structure to remain in place. $LTC

If it doesn't bounce near up channel support (yellow diagonal line) it could run another trading quad area down very easily.

See chart notes.https://t.co/SMEVswx4ha pic.twitter.com/EHM5S9DmcC

— Crypto the BTC Algo (@CryptotheAlgo) April 7, 2018

$TSLA also blasting here from yesterday’s alert🔥 In it to win it. #swingtrading

$TSLA also blasting here from yesterday's alert🔥 In it to win it. #swingtrading pic.twitter.com/JEefAyUROL

— Melonopoly (@curtmelonopoly) April 5, 2018

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://twitter.com/SwingAlerts_CT/status/981914928528416768/photo/1pic.twitter.com/muDQaThxP2

$DIS swing trade set-up from swing trading report yesterday blasting here🔥 Nice set-up. In it to win it. #swingtrading https://t.co/muDQaThxP2 pic.twitter.com/UXpvTgLpuo

— Melonopoly (@curtmelonopoly) April 5, 2018

Trade in $C Citi on fire🔥In it to win it. #swingtrading

Trade in $C Citi on fire🔥In it to win it. #swingtrading pic.twitter.com/0HKG0jH9sb

— Melonopoly (@curtmelonopoly) April 5, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Trade tensions ease, Syria risk rises

-Zuckerberg, day two

-Fed minutes due

-Markets slip

-Russia crisotunity?

https://bloom.bg/2qm56dP

A bullish trend is emerging under the market’s surface. via @tradingnation

A bullish trend is emerging under the market’s surface. via @tradingnation pic.twitter.com/5opuGQSyYN

— CNBC (@CNBC) April 10, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $VHC, $RUSS, $INO $LEDS $CATB $DCIX $TVIX $ARWR $BTG $TOPS $APVO $AVEO $UVXY $NAK $SBGL $VXX $NUGT $DGAZ $JNUG $AREX $TXMD

(2) Pre-market Decliners Watch-List : $SPY $DWT $JDST $DUST $LABU $UGAZ $SOXL $MU $SQ $OSTK $CNET $PYPL $GOGO $NTEC $ALOG $LBCC $TSLA

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $WHF $C $WPX $AVAV $SYNA $HP

$MELI PT Raised to $450 at BofA/Merrill Lynch

$APVO initiated at Buy at Roth. PT $12

UPDATE: Harley-Davidson $HOG PT Lowered to $44 at Wedbush

(6) Recent Downgrades: $CGBD $AMG $MITL $FND $RSG $FTNT $VLO $PBF $CAR $AVXS $FTNT

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, #EIA, Oil, Syria, Zuckerberg, Fed, $SPY, $GE, $FB, $CBS, $FCAU, $NWL, $USG, $HLT

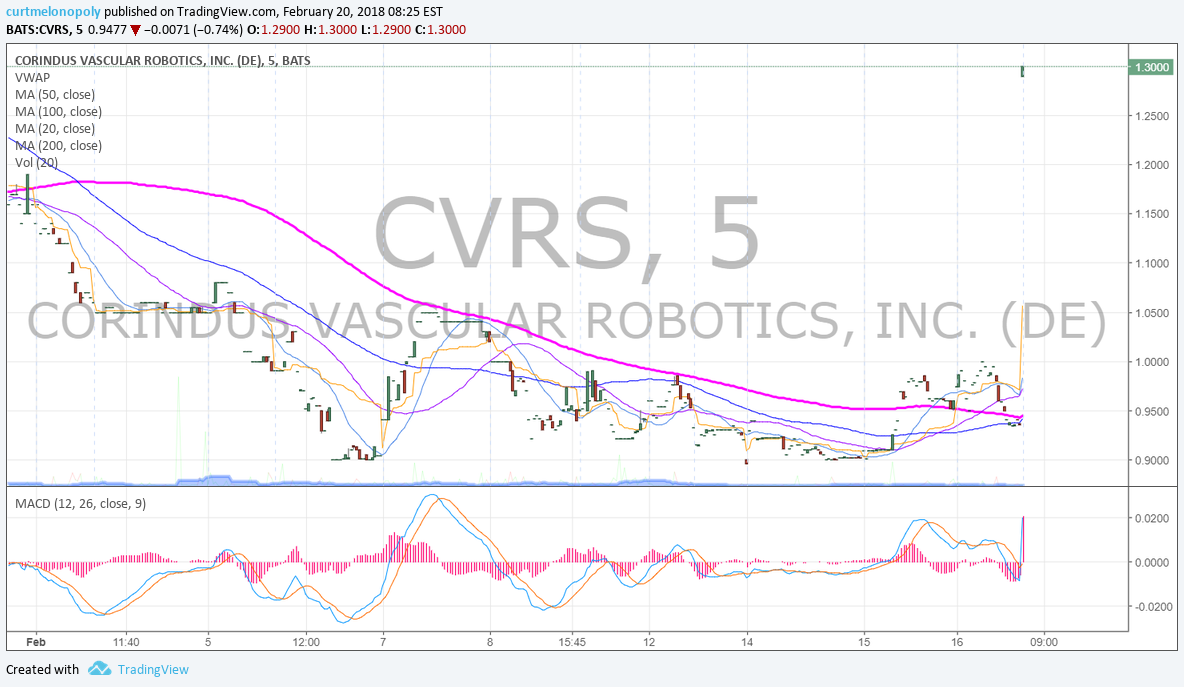

PreMarket Trading Plan Tues Feb 20 $CVRS, $WMT, $HD, $QCOM, $GE, $GM, $HSBC, $AAPL

Compound Trading Chat Room Stock Trading Plan and Watch List Tuesday Feb 20, 2018 $CVRS, $WMT, $HD, $QCOM, $GE, $GM, $HSBC, $AAPL – $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY – $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX , Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY, $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

Curtis is on annual holiday from Feb 13 – 23.

Reporting and trading rooms run per normal. Mid day reviews will recommence when he returns. Curtis will be intermittently in trading rooms only during that time.

Service(s) Memo Follow-Up re: Compliance and Service Offerings Going Forward

https://twitter.com/CompoundTrading/status/963218112668631041

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: WMT, HD, QCOM, GE, GM, HSBC, AAPL & more http://cnb.cx/2EG8N7D

Stocks making the biggest moves premarket: WMT, HD, QCOM, GE, GM, HSBC, AAPL & more https://t.co/mR75eopYUd pic.twitter.com/DuifmaIFne

— The Exchange (@CNBCTheExchange) February 20, 2018

30 Stocks Moving In Tuesday’s Pre-Market Session https://benzinga.com/z/11224640 $RAD $OAKS $DCAR $PTX $NXPI $ADMS $RIOT $BBL $SNAP $KIRK

30 Stocks Moving In Tuesday's Pre-Market Session https://t.co/7DZYlgTHLn $RAD $OAKS $DCAR $PTX $NXPI $ADMS $RIOT $BBL $SNAP $KIRK

— Benzinga (@Benzinga) February 20, 2018

Market Observation:

US Dollar $DXY trading 89.32, Oil FX $USOIL ($WTI) trading 61.98, Gold $GLD trading 1338.64, Silver $SLV trading 16.49, $SPY trading 271.89 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 11470.00, and $VIX trading 20.9.

Recent Momentum Stocks to Watch:

News:

Recent SEC Filings:

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CAR

#earnings for the week$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CARhttps://t.co/r57QUKKDXL https://t.co/5WENUDJCMO

— Melonopoly (@curtmelonopoly) February 20, 2018

Recent / Current Holds, Open and Closed Trades

This will commence when Curtis returns from holiday. “With new alert protocol buy / sell signals will be posted here as trade signals trigger along with specific thesis and chart set-ups”.

Per recent;

Yesterday the first oil trade went very well and with EIA I missed a large short opportunity, newer position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (event closing this derivative), $SPXL 1/10 size, small sizing holds include $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM (recently closed 1/3 at highs hold 2/3), $JP, $SLCA, $INSY (all small size) and very small sizing $AAOI, $SPPI and micro size $OMVS. On short side I am 1/10 Gold short.

New position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (per above awaiting news decision), $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM, $JP, $SLCA, $INSY (all small size) and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Holding $XIV 1.5/10 sizing, $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Closed $FB position yesterday for win, closed $XIV for win and re entered $XIV. Holding $XIV, $SPXL, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trimmed at highs and then added heavy $XIV yesterday, added $SPXL near lows, traded $WYNN for win and held some and some other minor trades (all wins). Holding $SPXL, $FB, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Added Monday 1/10 size $SPXL, 1/10 $GE, 1/10 $DUST. Traded short oil for a small win on swing from Friday to Monday early the traded again Monday morning for a loss 1/10 size. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding long $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trade short oil for a small win on swing from Friday to Monday early. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding new entries $WKHS, $GE. Holds on Bitcoin at 9700.00, trimmed 50% of $ROKU hold, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

Added $SPXL, new add $WKHS, $GE. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.