Tag: $SNAP

PreMarket Trading Plan Thurs Sept 13: $BABA, Inflections on Watch: Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps more.

Compound Trading Premarket Trading Plan & Watch List Thursday September 13, 2018.

In this edition: Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps, $AAPL, $FB, $GOOGL, $SNAP, $TLRY, $AMD, $VZ and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- September Live Trading Room Challenge, Coaching, News, Events, Q & A and More: information for existing members, those asking about our services and new on-boarding members.

- Thursday Sept 13 –

-

- I’ll be live on mic live broadcast trading in main trading room #premarket 9:25 #daytrade momos and mid-day #swingtrading chart set-up reviews at 12:00 noon (pending market / scheduling conditions). If room is full message me so I can make room. GL today! Trading room link.

- September 6 premarket through September 31 the main live trading room will be open 24 hours a day (regular sessions and futures, with 1 hour breaks every 10 hours for server reboots) for a month of live recorded trading with our Lead Trader Curtis.The exception will be during the Cabarete Boot Camp Sept 14 – 16 (live trading room will be reserved for coaching event).The month of trading will then be posted to YouTube accompanied with highlight posts.

-

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trade Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Sept 5 – Day Trading and Swing Trading CRONOS GROUP Inc. (CRON)

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Currently have oil on watch for a quad decision up or down in premarket. Favor 69.83 for end of Friday at this point on FX $USOIL $WTI.

Long side trade alert in premarket for ALIBABA per below. Live chart link included for the trade alert. $BABA

Watching Gold and Silver for possible inflection point to bullish side. They still have some hurdles but it seems near. $GLD $SLV

Bitcoin recovering, so also watch that at this point. Trying to position for a run in to December. $BTC $XBT. Morgan Stanley’s Bitcoin swaps launch has me intrigued.

Watching financials for inflection $XLF, $BAC, $GS, $JPM, $C, $MS

If you missed yesterday’s premarket, there were a number of swing trade set ups in there that could inflect and become decent trades.

Market Observation:

Markets as of 7:27 AM: US Dollar $DXY trading 94.81, Oil FX $USOIL ($WTI) trading 69.41, Gold $GLD trading 1205.75, Silver $SLV trading 14.19, $SPY 289.88 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6437.00 and $VIX trading 12.8.

Momentum Stocks / Gaps to Watch: $PI $XBIT $BLIN $ATOS

Impinj’s stock rockets after internal audit completed, upbeat results and outlook

$AAPL is taking a hit ahead of Apple’s big product launch, and one trader is betting on more pain ahead. We’ll explain why https://www.cnbc.com/2018/09/12/ahead-of-apples-product-launch-trader-is-playing-for-a-pullback.html …

$AAPL is taking a hit ahead of Apple’s big product launch, and one trader is betting on more pain ahead. We’ll explain why https://t.co/MFdtDe3gNM Program sponsor: @Schwab4Traders pic.twitter.com/mV7bY0NchZ

— Trading Nation (@TradingNation) September 12, 2018

News:

$TLRY: Tilray receives necessary regulatory permits in Canada and Germany to export medical cannabis flower for… http://bit.ly/2OcguTr

Verizon in focus as former AOL chief Armstrong confirms exit $VZ $BABA $GOOG $GOOGL $FB http://dlvr.it/Qk3bFG

$FATE: Fate Therapeutics Enters into Exclusive License Agreement with Gladstone Institutes for CRISPR-based Cellular Reprogramming

$ATOS: Atossa Genetics Announces Preliminary Results from Male Phase 1 Study of Topical Endoxifen .. All Objectives Successfully Met

Stocks making the biggest move premarket: KR, TSLA, ADBE, HSY, WMT & more https://cnb.cx/2N9C0vO

Your Thursday morning Speed Read:

– Kroger reports mixed Q2, raises EPS guidance for the year $KR

– Pivotal ends its bear call on $SNAP, ups rating to Hold, seeing shares fairly valued

– The FCC 2 day begins a series of hearings related to Big Tech antitrust concerns $FB $GOOGL

Your Thursday morning Speed Read:

– Kroger reports mixed Q2, raises EPS guidance for the year $KR

– Pivotal ends its bear call on $SNAP, ups rating to Hold, seeing shares fairly valued

– The FCC 2day begins a series of hearings related to Big Tech antitrust concerns $FB $GOOGL— Benzinga (@Benzinga) September 13, 2018

Bitcoin Gains Traction as Morgan Stanley Prepares Bitcoin Swap Trading –

Bitcoin Gains Traction as Morgan Stanley Prepares Bitcoin Swap Trading – https://t.co/hj0E7o8Sa3

— Investing.com News (@newsinvesting) September 13, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Tesla rival Nio to go public after pricing IPO at low end of expectations

Zekelman Industries to offer 41.8 million shares in IPO, priced at $17 to $19 each

Eventbrite to offer 10 million shares in IPO priced at $19 to $21 each

Cancer blood-testing company Guardant Health files for IPO.

Eli Lilly’s Elanco sets IPO terms to raise up to $1.45 billion before options

Earnings:

Kroger’s stock drops after earnings beat, but sales come up short

#earnings for the week

$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)

http://eps.sh/cal

#earnings for the week$ADBE $KR $PLAY $PVTL $SONO $FRAN $TLRD $SKIS $CASY $LMNR $BRC $MTRX $SAIC $EYPT $LAKE $CDMO $COOL $FARM $AGTC $IRET $OXM $PTN $ACET $RLGT $CSBR $PCYG $STRM $ERYP $LOVE (& $MAMS)https://t.co/r57QUKKDXL https://t.co/wHU5AlivAx

— Melonopoly (@curtmelonopoly) September 8, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

$BABA long side premarket 165s swing trade targets 178.67 then 207.50 Dec 17, 2018. #swingtrading #trade #alerts

ALIBABA (BABA) from recent trade alert for weekly 100 MA bounce watch, up premarket trading 164.76. $BABA #tradealerts #premarket

NEMAURA (NMRD) Premarket trading 2.98 up 4.2%, up 32.7% yesterday hit daily 200 MA area and backed off in previous trade.$NMRD #daytrading.

FOMIX PHARMA (FOMX) premarket up 31.4% trading 7.78 on positive results, resistance 8.00 range $FOMX #daytrading #stocks

XENETIC BIOSCIENCES INC Premarket near 200 MA support test after sel;-off, near time cycle peak Sept 14, possible turn $XBIO #swingtrade #daytrade #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up number 1. $XBIO #swingtrading #tradealert

XENETIC BIOSCIENCES INC How to trade XBIO charting set-up scenario Number 2. $XBIO #swingtrading #tradealert

FREDS INC (FRED) On day two of gap and go continued to struggle with 200 MA wall. $FRED #daytrading #swingtrade #premarket

PROQ THERAPEUTICS (PRQR) ran another 15% yesterday near a buy sell trigger resistance, trim in to it add above. $PRQR #swingtrading #daytrade

ALLERGAN (AGN) Chart structure reversal in to channel following call perfectly at this point. $AGN #swingtrading #chart

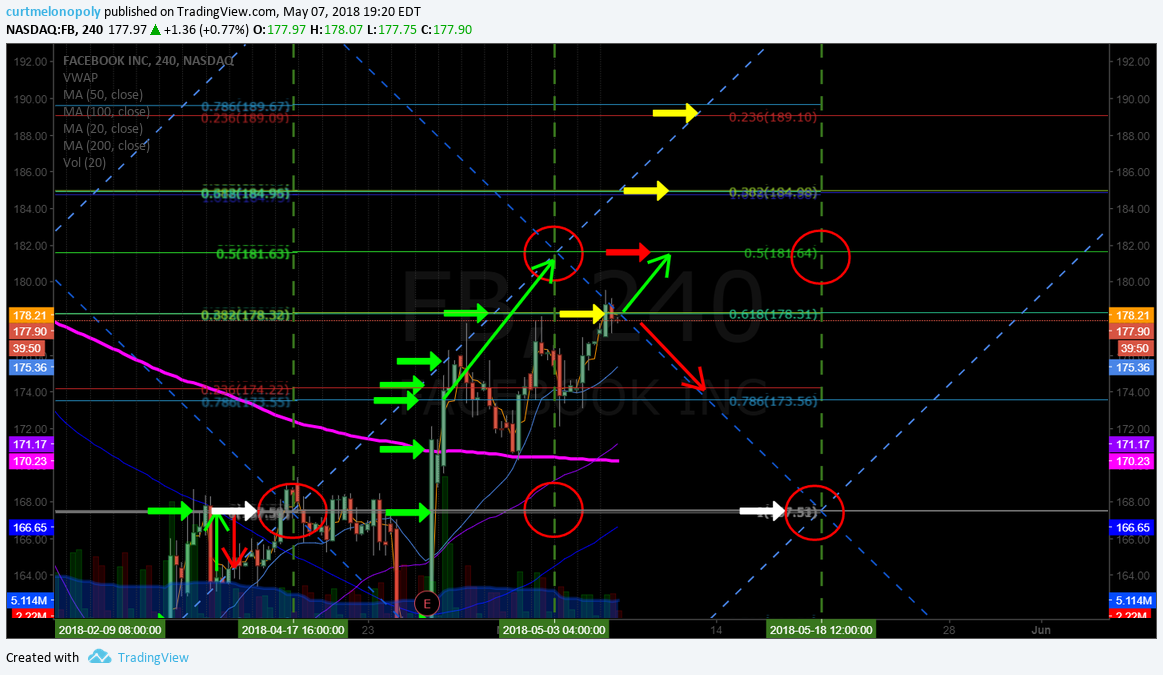

FACEBOOK (FB) On watch for wash-out snap-back trade now, main support and resistance marked on chart $FB #swingtrade #daytrade

DISNEY (DIS) From this target above 110.50 targets 118.00 area and below targets 103.00 area. $DIS #swingtrading #daytrading

APPLE (AAPL) If it doesn’t get a bounce here at 20 MA then 212.65 is the retracement point to try for a bounce. $AAPL #swingtrading #daytrading

ALIBABA (BABA) If no bounce at 100 MA that is near it is most probable to bounce in 147 range. $BABA #swingtrading

ARROWHEAD PHARMA (ARWR) Upper parallel trending channel per previoys clearly in play at this point. $ARWR #swingtrading #daytrading #chart

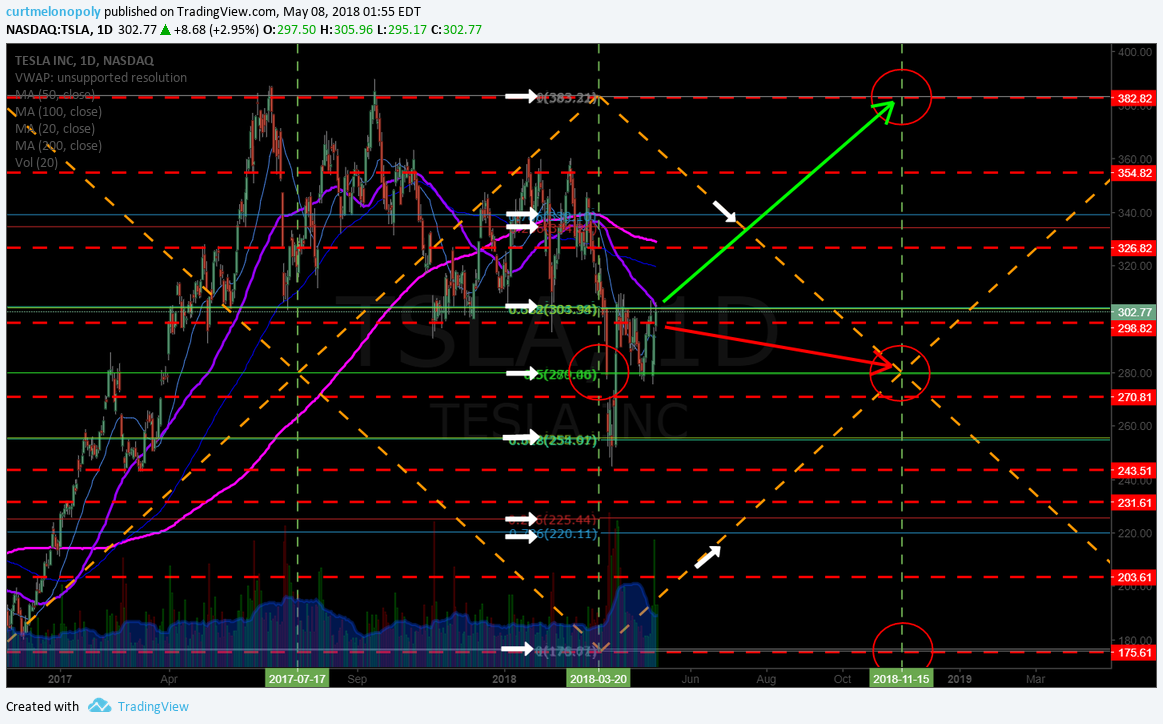

TESLA (TSLA) Wash out playing out as expected-alerted, watch Fri time cycle peak for trade of 280. $TSLA #daytrading #swingtrading

PROQ THERAPEUTICS (PRQR) premarket resistance watch at diagonal Fib line overhead and 22.75, above sees 27.55 implied $PRQR #swingtrading #daytrade

FREDS INC (FRED) Cleared 200 MA on daily, premarket next major resistance 50 MA on weekly. $FRED #daytrading #swingtrade #premarket

VOLATILITY (VIX) So we have a MACD turn up on weekly chart structure, Stoch RSI SQZMOM up, 20s possible Oct 1. $VIX $TVIX $UVXY #volatility #chart

BITCOIN (BTC) Wedge chart pattern on daily time-frame chart. $BTC $XBT $XBTUSD #Bitcoin #Chart

CLOUDERA INC (CLDR) Premarket up 6.5% trading 18.75 with 22.00 target. $CLDR #daytrading #swingtrading

$BOX weekly leap frog perfectly through targets. #earnings #premarket

$BOX weekly leap frog perfectly through targets. #earnings #premarket pic.twitter.com/1xTDdq2BdY

— Melonopoly (@curtmelonopoly) August 28, 2018

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

-Turkey, BOE and ECB decisions

-Trade talks

-Florence weakens

-Markets rise

-Data due

https://bloom.bg/2NHCngz

#5things

-Turkey, BOE and ECB decisions

-Trade talks

-Florence weakens

-Markets rise

-Data duehttps://t.co/TQr2TERlqM pic.twitter.com/b8yh9zmAgl— Bloomberg Markets (@markets) September 13, 2018

Oil prices fall, reversing some of the strong gains from the previous session, as economic concerns raises doubts about ongoing fuel demand growth https://reut.rs/2N83Mc1 by @hgloystein More from #ReutersEnergy: https://reut.rs/2CPVxfT

Oil prices fall, reversing some of the strong gains from the previous session, as economic concerns raises doubts about ongoing fuel demand growth https://t.co/rnWXstQpJl by @hgloystein More from #ReutersEnergy: https://t.co/lql35QNze4 pic.twitter.com/aJiUuFCI7a

— Reuters (@Reuters) September 13, 2018

Excess liquidity matters more than CB, but this is not a backdrop you want to be adding to risk from a macro level. Pick your spots.

https://twitter.com/RooseCapital/status/1040201823150387201

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $PI $XBIT $BPMX $ATOS $TLRD $IGC $TLRY $NLST $SNGX $VTL $BLPH $PDD $YINN $CARA

(2) Pre-market Decliners Watch-List :

Pivotal Software stock plunges 27% after billings miss

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $MGA $SNAP $DVA $BHC $TRI $MEOH $INTC $AVY

Intel stock gains after Northland Capital ends bearish call.

Analyst initiates AMD at 24% upside https://seekingalpha.com/news/3389955-analyst-initiates-amd-24-percent-upside?source=feed_f … #premarket $AMD

Apple target lifted to $260 at Needham after iPhone event

$AAPL Apple Inc: Maxim Raises Target Price To $221 From $200

(6) Recent Downgrades: $WAGE $VNTR $STI $FEDU $TAL $CIEN $FNSR $HOLX $W $TXRH

Morgan Stanley goes to Equal Weight on optical, downgrades Finisar and Ciena $FNSR $CIEN $LITE $IIVI $ACIA http://dlvr.it/Qk3bF9

Morgan Stanley Downgrades Finisar $FNSR to Equalweight

ServiceMaster $SERV PT Lowered to $61 at Morgan Stanley

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Alerts, Financials, Hurricane, $WTI, Oil, $GLD, Gold, $SLV, Silver, $BTC, $XBT, Bitcoin Swaps, $AAPL, $FB, $GOOGL, $SNAP, $TLRY, $AMD, $VZ

Swing Trading Earnings Special Report (Members) Sun Aug 5 $SNAP, $HIIQ, $FIT, $TWLO, $GOOGL, $FB, $CELG, $PSTG … #swingtrading #tradealerts #earnings

Swing Trading Report. In this detailed Special Earnings Season (Member Edition) Sunday Aug 5, 2018: $SPY, $DXY, $AGN, $ITCI, $PSTG, $GTHX, $SNAP, $ARWR, $GOOGL, $HIIQ, $FB, $TWLO, $HCLP, $MYND, $CELG, $FIT, $EXP, $OAK, $RSX, $BOFI, $SLCA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from July 30 mid day, published August 5, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

SP500 $SPY

Trading 280.14, 200 MA on 60 min under trade, support 278.60, target Aug 2 11:00 278.60 range, if it gets a bounce 283.75 Aug 13 is price target to upside. Volatility is up in the first day of new volatility time cycle. Next $VIX cycle ends Dec 24 approx. Resistance 283.70 on SPY.

Our trade alerts as they relate to market inflections are reviewed on video.

US Dollar $DXY

Still in structure respecting resistance. Up over resistance then there could be a significant move up to next structure resistance on chart reviewed.

OIL $WTI $USOIL – oil trade on the day is reviewed. Weekly price targets are reviewed from EPIC oil algorithmic model

ALLERGAN (AGN)

Trading channels on the AGN chart are reviewed as are various charts.

The Allergan trade alerts as they progressed, time cycles, and buy sell triggers on $AGN are discussed on the video. This type of charting (structured charting) is also discussed and may help students of the market – some trade coaching notes here.

How this relates to our algorithmic charting models, machine trading and the timing of our Sept 14-16 Cabarete Trade Coaching event is discussed.

Black box algorithmic charting is discussed at this point in the video.

Our specific trading services platform / roll-out schedule is also discussed.

The calls specific to our trade alerts and trading in AGN are reviewed in detail.

Quant funds, lies in the markets, media selling fear and what people (retail) want to hear and why retail loses are also discussed on the video for our trading students.

Click here for our previously published exclusive member report: Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Today’s Research Reports on Trending Tickers: Bristol-Myers Squibb and Allergan $AGN https://finance.yahoo.com/news/todays-research-reports-trending-tickers-122000758.html?soc_src=social-sh&soc_trk=tw

ALLERGAN (AGN) Closed Friday 185.93 over 184.62 support 189.07 is resistance test next. Trim in to add above. $AGN

INTRA CELLULAR (ITCI)

Structured charting is also reviewed on video here. Timing cycles, price targets to up and downside, buy sell triggers etc.

Intra-Cellular Therapies Provides Corporate Update and Reports Second Quarter 2018 Financial Results $ITCI https://finance.yahoo.com/news/intra-cellular-therapies-provides-corporate-110932713.html?soc_src=social-sh&soc_trk=tw

INTRA CELLULAR (ITCI) Closed Friday 20.90, main resistance 24.77, support 19.75, 24.60 price target Set 6 if bullish. $ITCI

PURE STORAGE (PSTG).

If you are using these charts and you want to get rid of the indicators at the bottom so that the chart model is easier left click twice on field area to get rid of indicators at bottom.

Pure storage earnings in 26 days (as of date of video). Indicators and support and resistance are reviewed on video.

Again, structure of charts is discussed on video.

The massive chart channel is reviewed.

Support / resistance levels and price targets are discussed in detail for Pure Storage on the video.

Previously published exclusive swing trading report can be found here for PSTG: How to Trade Pure Storage (PSTG) Earnings in Six Days (Member Edition) $PSTG

7 Tech Stocks That May Soar On Takeovers $PSTG $FSLR $CY $LOGM $ETSY $HUBS $OKTA http://www.investopedia.com/news/7-tech-stocks-may-soar-takeovers?

PURE STORAGE (PSTG) closed just above key support last Friday – important time of week for a stock to trade just above key support level $PSTG

G1 THERAPEUTICS (GTHX)

Our swing trade success in G1 is discussed on the video as well as the various support and resistance levels on the charting, trade alerts ad price targets.

Bullish trade trajectory on this equity is awesome (see trade between diagonal green target trajectory lines) and the channel trade is in is now noted on the charting (yellow).

G1 Therapeutics to Provide Second Quarter 2018 Corporate and Financial Update on August 8, 2018 $GTHX https://finance.yahoo.com/news/g1-therapeutics-second-quarter-2018-100000130.html?soc_src=social-sh&soc_trk=tw

G1 THERAPEUTICS (GTHX) Closed 51.38 Friday, 53.66 58.29 resistance, 49.01 44.41 support $GTHX.

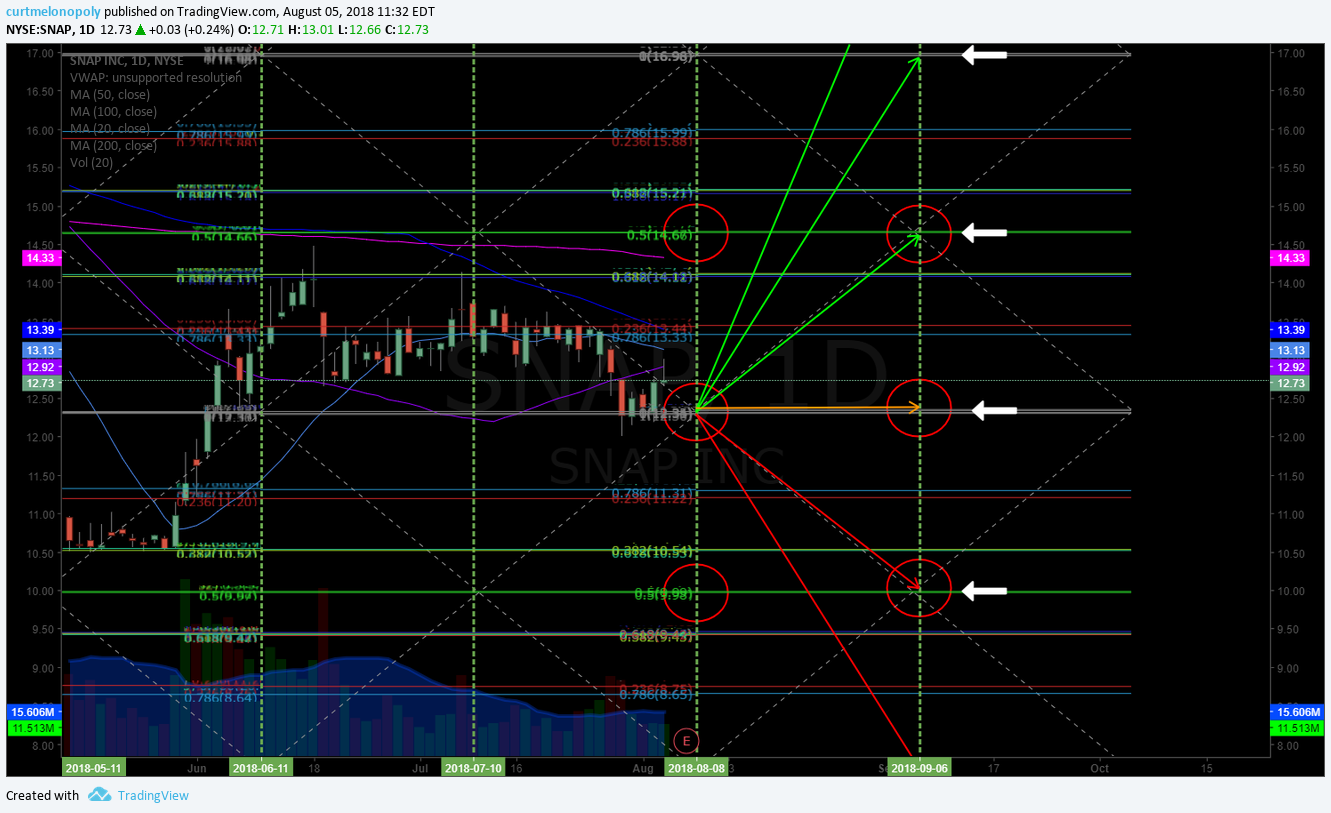

SNAP INC (SNAP) Earnings Trade Chart (Earnings in 2 days).

SNAP is not an easy stock to trade – we provide the specific levels to watch in earnings in two days.

The chart below is an updated version for earnings and is very detailed with all support, resistance, price targets, time cycles, trade trajectory lines and more.

SNAP closed Friday 12.73, it has supports at 12.33 and 9.99 in a sell-off. The SNAP chart has resistance at 14.66. Next time cycle ends Sept 6 on the chart with upside scenario 14.66 area and 9.99 area on the same day. In a total sell-off 7.64 is the next downside support.

3 Reasons Snap Investors Should Be Nervous Next Week $SNAP https://finance.yahoo.com/news/3-reasons-snap-investors-nervous-150000656.html?soc_src=social-sh&soc_trk=tw

SNAP INC (SNAP) How to trade SNAP earnings chart, support resistance price targets time cycles. $SNAP

ARROWHEAD PHARMA (ARWR)

My trading plan and trade alerts for ARWR are discussed in detail on the video. The trading channel, price targets, earnings plan, trade sizing, price support and resistance and moving averages are reviewed. The chart below highlights the current trading structure on ARWR with a highlighted triangle drawn on the chart (outlined in green).

How the market responds to earnings in two days will decide how I will trade ARWR post earnings.

Arrowhead Pharmaceuticals Earns $10 Million Milestone Payment from Amgen $ARWR https://finance.yahoo.com/news/arrowhead-pharmaceuticals-earns-10-million-113000479.html?soc_src=social-sh&soc_trk=tw

ARROWHEAD PHARMA (ARWR) Closed Friday 14.54 earnings in 2 days, main resistance 16.41 23.79 support 8.84 $ARWR

ALPHABET (GOOGL)

All the future forward price targets are discussed on video for Google post earnings. In addition to a swing trading chart for Google I have also included a daytrading chart below for daytraders.

There is a previously published exclusive member reports here: Protected: Trading Alphabet (GOOGL) Post Earnings. Swing Trading, Day Trades, Investing (Member Edition) $GOOGL

Report: Google working on a censored search engine for China $GOOGL https://www.yahoo.com/news/report-google-working-censored-search-004932360.html?soc_src=hl-viewer&soc_trk=tw

Google (GOOGL) Post earnings chart. Closed 1238.16 Friday. Main support 1211.86 resistance 1320.10. $GOOGL

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

Health Innovations (HIIQ)

Upside and downside price targets on the chart. Careful with resistance test in progress and the divergent trade possibilities. The upper channel is also being tested so an over bought retrace is very likely here. Congrats to longs on this swing trade alert. Hit bullish price targets early.

3 Stocks That Soared 20% or More This Week — Which Are Still Buys? $MOH, $DXCM, $HIIQ https://finance.yahoo.com/news/3-stocks-soared-20-more-123100958.html?soc_src=social-sh&soc_trk=tw

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart.

FACEBOOK (FB)

Facebook has got a bounce up since our alerts during the panic sell-off. The wash out trade set-up in the sell off is very similar to the last, and we killed the last swing trade set up in a sell off. We’re expecting another big trade here. All levels on chart and explained in video.

Click here for the previously published exclusive member reports for swing trading Facebook:

Protected: Trading Facebook (FB) Earnings Part 2 – Opportunity Knocks (Member Edition) $FB

Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB

Betting on a Smoother Ride for Tech Stocks https://www.barrons.com/articles/betting-on-a-smoother-ride-for-tech-stocks-1533330236

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB

TWILIO (TWLO)

Video reviews all levels going to earnings and chart below is an update since the mid day review. TWILIO has earnings this week and will be one of my main watches. MACD has been trending down on the daily chart and I am interested in a cell-off hopefully to 100 MA for a bounce play possibly. A significant wash-out snap back scenario would be best post earnings. We will see what happens.

3 Internet Stocks That Have a Killer Advantage $TWLO $NFLX $FB https://finance.yahoo.com/news/3-internet-stocks-killer-advantage-140600278.html?soc_src=social-sh&soc_trk=tw

TWILIO (TWLO) Over 20 MA on daily chart with stochastic RSI turned up, watching trend structure in to earnings in one day. $TWLO #chart #earnings

HI-Crush Partners (HCLP)

Hi crush has the potential to be a big trade. I’m watching the 200 MA slowly make its way down and I am hoping for a breach of it with price. I have it on watch and will produce a chart model should we engage a trade. Last week trade closed at the bottom of the weekly channel range in the 13.30 area. Hoping for a significant ROI on this one.

Hi-Crush Partners Telegraphs Major Changes to Its Business https://finance.yahoo.com/news/hi-crush-partners-telegraphs-major-191700714.html?soc_src=social-sh&soc_trk=tw

HI-Crush Partners (HCLP) Watching the 200 MA on weekly chart slowly work its way down. On close watch. $HCLP #chart #swingtrading

MYND ANALYTICS INC (MYND)

MYnd Analytics Partners with VisionQuest to Provide Telepsychiatry Services for its Community-Based Outpatient Mental Health Clinic in Pennsylvania https://finance.yahoo.com/news/mynd-analytics-partners-visionquest-telepsychiatry-142850638.html?.tsrc=rss

$MYND is reviewed on the video, it was one of the momentum stocks for last week. I am watching it for a daytrade going in to next week.

CELGENE (CELG)

There was a report on Celgene June 12 put out. We have had much success with this stock this year. Longs need to trim in to the Aug 8 price target resistance. Over its 200 MA currently.

Zacks.com featured highlights include: Celgene, Progressive, T. Rowe Price, AMC and Celanese https://finance.yahoo.com/news/zacks-com-featured-highlights-celgene-115511301.html?.tsrc=rss

CELGENE (CELG) Price target 95.90 Aug 10 in play. Main chart support at 86.28. Bullish formation. $CELG #swingtrading

EAGLE MATERIALS (EXP)

Eagle has been a very predictable chart. It is currently bouncing near recent bounce areas. Watching for a possible long trade, more likely after the time cycle on the chart expires but price will determine action. The trading quadrants on chart structure are discussed on video.

Eagle Materials Reports First Quarter EPS Up 22% On Record Revenues $EXP https://finance.yahoo.com/news/eagle-materials-reports-first-quarter-103000694.html?soc_src=social-sh&soc_trk=tw

EAGLE MATERIALS (EXP) Bounced near support, watching for a possible long as it has bounced here prior. $EXP

FITBIT (FIT)

If I had the time to publish another special trade report of FITBIT I would, but I don’t. The lats time we killed the wash out trade and it’s setting up again. Closed 5.46 Friday post earnings in a wash out sell off and this week over 5.61 with structure is a long to 6.66 etc. All levels are on the chart. All the price targets, time cycles, trade trajectories, support and resistance area etc are included on the swing trading chart below.

Click here for a previously published member exclusive report on trading FITBIT:

FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT

Unloved Fitbit Watches Shares Slide Despite Beat $FIT https://realmoney.thestreet.com/articles/08/03/2018/unloved-fitbit-watches-shares-slide-despite-beat

FITBIT (FIT) Earnings wash-out swing trade setting up here. Levels on chart and this post $FIT #swingtrading #earnings #chart

OAKTREE CAPITAL GROUP (OAK)

We are watching this very close here. The upside targets on OAK chart are very aggressive. We did well in it post election and are looking for another. The news article below does have some insight for investors.

Oaktree Capital Sees Solid Results in a Challenging Market

OAKTREE (OAK) Watching trade for a breach over 200 MA really close for a long side trade. $OAK

RUSSIA ETF (RSX) Under 200 MA on the daily with indecisive indicators. Watching. $RSX #chart

Why Russia’s Manufacturing PMI Is Gradually Contracting

https://marketrealist.com/2018/07/why-russias-manufacturing-pmi-is-gradually-contracting

BOFI HOLDING (BOFI) Bulls bought the dip near 200 MA prior to earnings. On watch for post earnings setup. $BOFI

BofI Federal Bank Signs Agreement to Acquire $3 Billion of Deposits from Nationwide Bank https://finance.yahoo.com/news/bofi-federal-bank-signs-agreement-113000968.html?soc_src=social-sh&soc_trk=tw

US SILICA HOLDINGS (SLCA) Under 200 MA post earnings near historical bounce area. On watch with MACD up. $SLCA #chart

U.S. Silica (SLCA) Misses Earnings & Sales Estimates in Q2 https://finance.yahoo.com/news/u-silica-slca-misses-earnings-134401463.html?soc_src=social-sh&soc_trk=tw

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me:

Swing Trading Report Sun July 15 (Part B) Earnings Season On-Deck. $TSLA, $IBB, $AGN, $SNAP, $NVO, $CTSH, $LAC, $VGZ, $AMMJ more.

Compound Trading Swing Trade Report Sunday July 15, 2018 (Part B).

Swing Trading Stock Picks In this Issue: $TSLA, $IBB, $AGN, $SNAP, $NVO, $CTSH, $LAC, $VGZ, $AMMJ more.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this report.

This report is 1 of 5 in rotation with our mandate being one report per week on average cycling the five reports that include over one hundred equities every five weeks (approximately).

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch List

$AAPL – Apple

July 12 – Decision area continues for Apple trade.

APPLE (AAPL) Continues to rotate around the primary 188.59 pivot, Use the fib lines to trade up or down. #swingtrading

May 29 – There is an exclusive member feature post here that reflects the report below:

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: TRADEAAPL

May 29 – Apple chart support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

Apple Real-Time Chart Link:

How to Trade Apple:

Either side of the main buy / sell trigger (pivot) in this range are the important levels to watch. The pivot is 188.61 and the important upside test Fib is at 199.44 and the important support is 185.78 area.

With the 20 MA moving up through the lower support and nearing intra-day trade this could get interesting here. If price loses the 20 MA watch for the support to break. If that breaks at 185.78 then price targets 181.75.

If price trends up with 20 MA then next resistance is the 199.44 and above that is a good upside swing risk reward.to next pivot at 200.66.

It seems with the news below (announcements on June 4, 2018 per CNBC) and how well Apple held up in today’s sell-off that the risk reward is still to the bullish side. But let the test of the upside resistance prove the bull thesis out.

Apple News:

$AAPL Apple will lay out its plans and priorities for the next year on Monday: Here’s what to expect

https://cnb.cx/2L63Bso https://www.cnbc.com/2018/05/29/apple-wwdc-2018-what-to-expect-ios-12-macos-tvos-watchos.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

Buy / sell triggers to watch for a swing trade with Apple stock (approximate):

176.62

181.75

185.78

188.61

191.44

194.94

200.66

205.79

209.81

Apple Static Chart:

April 16 – $AAPL Buy sell trigger 152.66 hit, then 164.92 testing 176.62. Over long to PT 188.61 with 181.75 and 185.78 res tests.

Apple has been a fantastic structured wash-out snap back swing trade set-up so far. The big test / major pivot in this trading structure is the upside test at 176.62. Longs should trim in to that and add over to next test at 181.75 and add over and so on.

The other scenario is a retrace to the Fibonacci support at 171.22 and on bounce long. If price does not bounce on a retrace to 171.22 then short in to 167.41 as first target.

Also, MACD on daily is turned up but Stochastic RSI is high and likely to cool lower with price and then watch for bounce.

$AMD Advanced Micro

July 12 – ADVANCED MICRO (AMD) Trading near previous highs struggling to hold up trend channel, trade main triggers. #swingtrading

News: Why AMD Stock Will Rally Before Its Earnings Announcement $AMD https://finance.yahoo.com/news/why-amd-stock-rally-earnings-035823418.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

April 29 – $AMD The close this gets to the key resistance in 14.60s the more short bias I am for a swing trade.

This surprised me since last report (I did some review on this surprise on a number of mid day review videos on YouTube channel).

Anyway, I don’t like the way it trades… it is manipulated by media, sentiment or otherwise and as it gets closer to previous highs overhead soon and near the key resistance in 14.60s I am yet again short bias to $AMD:) We’ll see, but I’ll likely pull the trigger this time.

$WMT – Walmart

WALMART (WMT) Continues down trend with 82.81 buy zone and 91 sell trigger, under 200 MA $WMT #chart

Walmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

Walmart is ‘dead money’ as the Dow stock sits in a bear market, says trader $WMT https://www.cnbc.com/2018/07/11/walmart-is-dead-money-as-the-dow-stock-sits-in-a-bear-market.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

May 29 – Wallmart stock continues its soft landing but indicators are flatening. Short side RR diminishing now.

I wouldn’t be surprised if that 82.61 pivot is gained to the upside again and we see a pop to upside resistance points on chart.

If that does not transpire in trade then the 74.54 is the bottom, bottom support in 2018 most probably. I really doubt trade will see 74.54. But keep an open mind and follow price per the chart support and resistance points.

$LTBR – Lightbridge Corp.

July 12 – LIGHTBRIDGE (LTBR) Continues range bound at main support area. Watching. $LTBR #Chart

See chart link below in previous post.

May 29 – Literally watching for the 200 MA not far above to be gained and then watch this for a pop. It has the 50 MA now and I expect the bottom players to step in here soon.

$LTBR has the 50 MA with 200 MA not far overhead. On watch for 200 MA and then boom. #swingtrading

$RCL – Royal Caribbean

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

July 12 – ROYAL CARIBBEAN (RCL) Range bound trade, waiting for a direction to swing trade. $RCL #stock #chart

May 29 – $RCL short side risk reward diminishing now and July 23 downside target 98.88 less likely. Trading 105.78.

I’m watching this support test area close now, this should turn up for a swing trade soon. As always follow price.

Royal Caribbean Cruises (RCL) Down 5.5% Since Earnings Report: Can It Rebound? https://finance.yahoo.com/news/royal-caribbean-cruises-rcl-down-072207247.html?.tsrc=rss

April 16 – $RCL Indecisive at this point and trading just under primary pivot resistance on chart. On watch. Buy sell triggers marked with white arrows.

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

$JKS – Jinko Solar

July 12 – JINKOSOLAR (JKS) Continues under pressure trading 14.20. Watching for a turn. $JKS #Stock #chart

May 29 – $JKS with earnings in 8 days is having trouble breaking range. Above 50 MA possible #swingtrade

April 16 – $JKS MACD on weekly may cross up here for long over 200 MA.

$PCRX – PacIra Pharma

July 12 – PACIRA PHARMA (PCRX) Testing underside of 200 MA for a break up to 42s possible. #swingtrading

May 25 – Trading 35.2 still under pressure and under 200 MA. On watch for over 200 MA for a swing.

April 16 – $PCRX under pressure. Over 200 MA long but on short side there isnt enough RR at this point.

$EWZ – I Shares Brazil ETF

July 12 – ISHARES BRAZIL ETF (EWZ) Trading 33.39 looking for confirmation bounce for run to 38.53. $EWZ #swing #trading #plan

The two downside price targets on the down trend swing trading scenario have been hit, so I’m thinking we may see a turn here soon. On watch really close.

Finding Opportunity in the Global Market Selloff $EWZ $EQJ $RSX $EZA $EWW https://www.barrons.com/articles/japan-stands-out-as-global-markets-falter-not-all-em-headed-for-slower-growth-1531332082

May 29 – $EWZ continued pressure likely until near quad wall diagonal Fib trend line for a bounce. On watch.

$FEYE – Fire Eye Inc.

July 12 – FIREEYE (FEYE) in to price target, other side of time cycle, 17.10 intra 17.64 targets 19.43 19.68 22.35 #swingtrade $FEYE

FireEye Stock Upgraded: What You Need to Know https://finance.yahoo.com/news/fireeye-stock-upgraded-know-153334694.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

May 29 – $FEYE near 50 MA support now. On watch for an upside swing trade if it bounces. #swingtrading

It is also very near key support. This is a significant watch area now for a trade.

April 16 – $FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.Over 19.70 long to 22.32 price target.

$LAC – Lithium Americas Corp

July 15 – LITHIUM AMERICAS CORP (LAC). Continues to rotate around mid quad pivot, waiting for a direction to trade to up or downside target. Bias to long, but waiting for confirmation here. $LAC #swingtrading #chart

Lithium Americas Announces Results of 2018 Annual General Meeting

CNW Group CNW Group June 22, 2018 https://finance.yahoo.com/news/lithium-americas-announces-results-2018-214600272.html?.tsrc=rss

May 30 – Sitting on mid quad support – big test here. Above is long to target and below short. $LAC #swingtrading #chart

Lithium Americas Corp (TSE:LAC): What Are The Future Prospects?

https://finance.yahoo.com/news/lithium-americas-corp-tse-lac-121406216.html?.tsrc=rss

Per recent’

April 22 – $LAC trading 5.59 bounced at quad wall support (blue diagonal line marked with green arrow- important) targets 7.81 Jan 30 2019. If it gets bullish I will chart shorter time frames.

I like the structure of this chart. Will be watching very close.

Also, note 200 MA overhead.

$IBB – BioTechnology Index Fund

July 15 – NASDAQ BIOTECHNOLOGY INDEX FUND (IBB) Per last swing report 108.51 to upside target of 112.81 hit. Last trading 118.35. Main resistance 122.12. Trim in add above to target.

Although the long side trade is going well, be aware that current trade is at previous high so cautious swing traders will want to trim some here and more as it nears mid quad primary resistance then add above incrementally to price target in trajectory.

May 30 – $IBB chart on daily above mid quad support and 200 ma targeting upside 112.81 next FIB resistance.

This is a decent set up with a decent risk reward and a decent structured chart. It’s not a great set-up, but decent.

Biotech ETFs Are the Best Way to Play the Recovering Sector

https://finance.yahoo.com/news/biotech-etfs-best-way-play-154314422.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

Per recent;

April 22 – $IBB daily chart with targets above pivot decision at 102.46 and below. #swingtrading

Above 102.46 tested targets 122.34 or 142.11 pending trade.

Under 102.46 targets 92.81 or 63.04 pending trade.

Time cycle peak completion Nov 27 2018.

As price proves above or under the main pivot I will alert the trade and chart the shorter time frames.

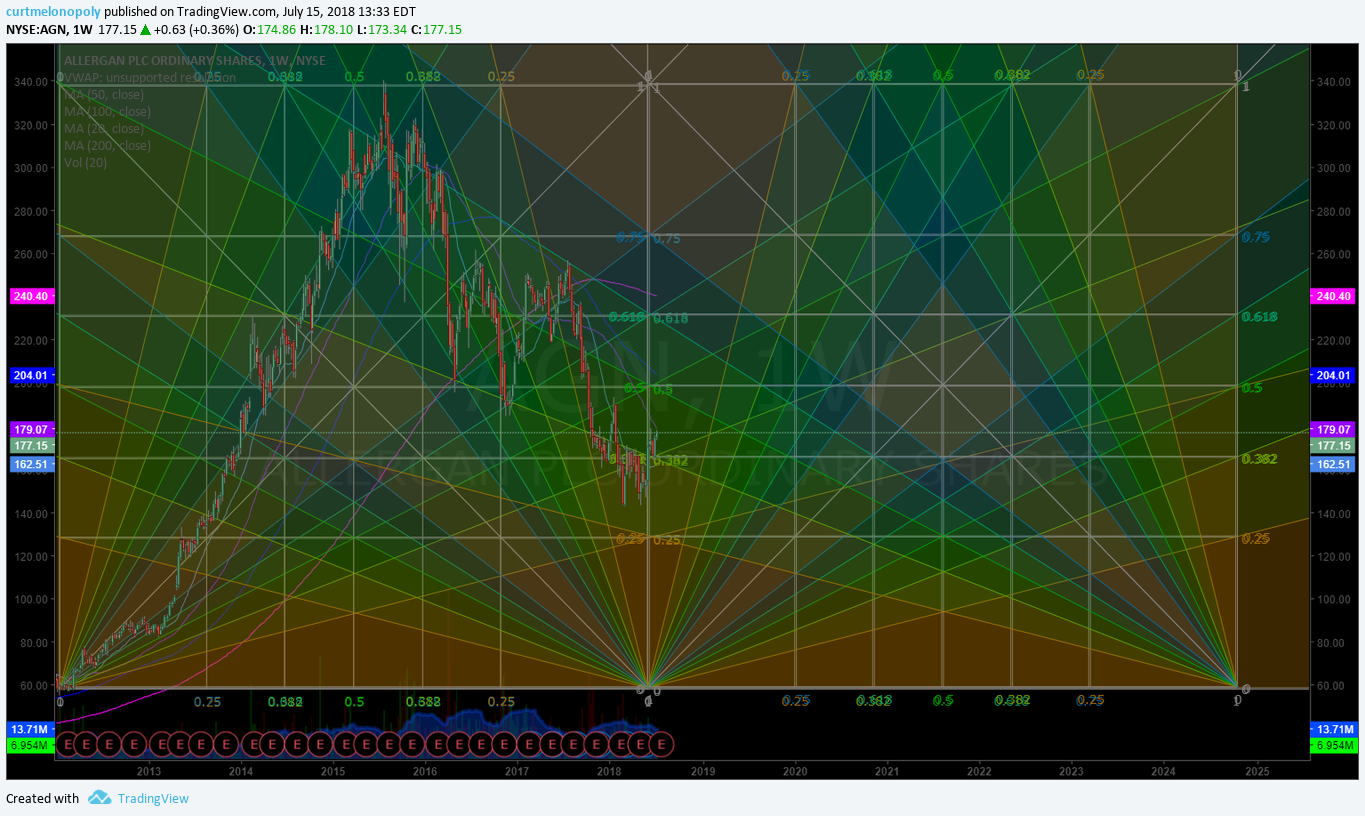

$AGN – Allergan

July 15 – The Allergan (AGN) trade couldn’t be going better. Here are some charts that help with areas to watch in this swing.

Notorious activist investor Carl Icahn buys small stake in Allergan

by brittany meiling — on June 7, 2018 08:04 AM EDT

ALLERGAN (AGN) Trading plan 4 hr chart previously published to swing trading private member chat room server June 7. $AGN #chart

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart https://www.tradingview.com/chart/AGN/001O0j7h-ALLERGAN-AGN-Excellent-swing-trade-in-progress-trading-177s-t/

ALLERGAN (AGN). Weekly chart displays time cycle conclusion and turn with key levels (every line) $AGN #chart

Per recent;

May 30 – Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. Career trade setting up imo. #swingtrading #swingtrading #setups https://www.tradingview.com/chart/AGN/iAaFQ6U5-Really-excited-for-the-huge-AGN-time-cycle-conclusion-on-or-abo/

$AGN Allergan to sell women’s health, infectious disease units https://finance.yahoo.com/m/919ae015-3199-352f-820a-3beef365d573/allergan-to-sell-women%26%2339%3Bs.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

If $AGN holds 147.00 as trade gets on other side of time cycle it should target upper price targets on this model. #swingtrading

Per recent;

April 22 – $AGN I know it’s psychedelic but I think the time cycle is over soon and it reverses. #swingtrading

June 4 165.48 is the first upside target if there is a reversal here. On watch. If we get a reversal near term I will model and alert it for a swing trade.

$CTSH – Cognizant Technology

July 15 – COGNIZANT TECHNOLOGY SOLUTIONS (CTSH) Continues to grind to previous highs. Watching Stoch RSI weekly. $CTHS #chart

I have been waiting for a 200 MA support test, however, I may try a turn up of Stochastic RSI in anticipation of an upside break. Stoch RSI is high now so I will look at a long when it returns to bottom and turns.

May 30 – $CTSH Bottom line is that I won’t trade it until it dumps the 200 MA again for a bounce on weekly chart. #swingtrading

Cognizant Interactive Among Top of Ad Age’s Agency Report 2018 Rankings

https://finance.yahoo.com/news/cognizant-interactive-among-top-ad-100000992.html?.tsrc=rss

April 22 – $CTSH Trading 81.71. Earnings in 14 days and very extended over moving averages on weekly. Watching.

$NVO – Novo – Nordisk

July 15 – NOVO NORDISK (NVO) Weekly chart very bullish with MACD near cross up price above MA’s testing main pivot area $NVO #swingtrading #chart

Earnings in 24 days and the weekly chart is very bullish BUT wait for price to breach the 200 MA on daily chart (see below).

NOVO NORDISK Earnings in 24 days and the weekly chart is very bullish BUT wait for price to breach the 200 MA on daily chart $NVO

May 30 – Best I can do for now with $NVO is watch for chart structure to form on monthly. Not there yet. Price on daily is way below 200 MA and MACD is turned down.

Novo Nordisk’s Oral Ozempic Positive in Diabetes Study https://finance.yahoo.com/news/novo-nordisk-apos-oral-ozempic-122812593.html?.tsrc=rss

$TSLA – Tesla

July 15 – The technical chart for Tesla (TSLA) as in May 30 report is structured the same with all buy sell triggers in effect per report below.

May 30 – The technical chart for Tesla (TSLA) is the same set-up as previously posted below.

April 23 – $TSLA trading 290.34. Over 280.00 is long and under 280.00 is a short. We have had some great trading in this one with recent wash-out.

278.00 needed as long side limited entry trigger. Less is short side. Simple on the fly daytrading model. $TSLA https://www.tradingview.com/chart/TSLA/2XQqKq0c-278-00-needed-as-long-side-limited-entry-trigger-Less-is-short/ …

https://twitter.com/SwingAlerts_CT/status/978995397594177537

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target..png

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$TSLA also blasting here from yesterday’s alert trade hit res at 299.84 area. Strong set-up..png

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

July 15 – SNAP INC (SNAP) Trading range-bound so I am now watching for a break up or down for possible swing trade. $SNAP

Cowen Previews Snap’s Q2 Earnings, Trims Price Target

Benzinga

Hannah Genig

Benzinga, July 13, 2018

May 30 – The SNAP chart is a disaster but it does look like a near term bottom area. Lots of caution of course.

$VGZ – Vista Gold

July 15 – VISTA GOLD (VGZ) Chart remains a mess and a strong sell. $VGZ

May 30 – Nothing yet. Trading .704

April 23 – Trading .78. $VGZ holding the 200 MA on weekly and testing 50 MA resistance. Long side advantage, but not great yet.

$AAU Almaden Minerals

July 15 – $AAU trading .713 still in no mans land.

May 30 – Trading .71 with terrible indicators.

April 23 – $AAU trading .849 with indicators indecisive.

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

$AMMJ – American Cannabis

July 15 – $AMMJ trading .69 it obviously dumped and continues to have poor indicators. There is no safe swing trade long or short here only daytrading. Waiting for structure to return.

May 30 – Trading .976 with flat indicators.

April 23 – $AMMJ trading 1.03 with buy sell triggers (white arrows), targeting Apr 26 .9911 May 24 1,21 (path of least resistance).

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $TSLA, $IBB, $AGN, $SNAP, $NVO, $CTSH, $LAC, $VGZ, $AMMJ

Swing Trading Report Thurs May 31 (Part B) $IBB, $AGN, $LAC, $TSLA, $SNAP, $CTSH, $NVO, $VGZ, $AAU, $AMMJ more.

Compound Trading Swing Trade Report Thursday May 31, 2018 (Part B).

Swing Trading Stock Picks In this Issue: $IBB, $AGN, $LAC, $TSLA, $SNAP, $CTSH, $NVO, $VGZ, $AAU, $AMMJ more.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this post.

This report is 1 of 5 in rotation.

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me ([email protected]) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates in red for ease.

Recent Compound Trading Videos and/ or Blog Posts for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch List

$AAPL – Apple

May 29 – There is an exclusive member feature post here that reflects the report below:

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: TRADEAAPL

May 29 – Apple chart support and upside move test on deck with 20 MA coming up to 185.78 support and current trade at 197.90 $AAPL #swingtrading

Apple Real-Time Chart Link:

How to Trade Apple:

Either side of the main buy / sell trigger (pivot) in this range are the important levels to watch. The pivot is 188.61 and the important upside test Fib is at 199.44 and the important support is 185.78 area.

With the 20 MA moving up through the lower support and nearing intra-day trade this could get interesting here. If price loses the 20 MA watch for the support to break. If that breaks at 185.78 then price targets 181.75.

If price trends up with 20 MA then next resistance is the 199.44 and above that is a good upside swing risk reward.to next pivot at 200.66.

It seems with the news below (announcements on June 4, 2018 per CNBC) and how well Apple held up in today’s sell-off that the risk reward is still to the bullish side. But let the test of the upside resistance prove the bull thesis out.

Apple News:

$AAPL Apple will lay out its plans and priorities for the next year on Monday: Here’s what to expect https://cnb.cx/2L63Bso https://www.cnbc.com/2018/05/29/apple-wwdc-2018-what-to-expect-ios-12-macos-tvos-watchos.html?__source=yahoo%7Cfinance%7Cheadline%7Cstory%7C&par=yahoo&yptr=yahoo

Buy / sell triggers to watch for a swing trade with Apple stock (approximate):

176.62

181.75

185.78

188.61

191.44

194.94

200.66

205.79

209.81

Apple Static Chart:

April 16 – $AAPL Buy sell trigger 152.66 hit, then 164.92 testing 176.62. Over long to PT 188.61 with 181.75 and 185.78 res tests.

Apple has been a fantastic structured wash-out snap back swing trade set-up so far. The big test / major pivot in this trading structure is the upside test at 176.62. Longs should trim in to that and add over to next test at 181.75 and add over and so on.

The other scenario is a retrace to the Fibonacci support at 171.22 and on bounce long. If price does not bounce on a retrace to 171.22 then short in to 167.41 as first target.

Also, MACD on daily is turned up but Stochastic RSI is high and likely to cool lower with price and then watch for bounce.

Mar 6 – $AAPL Price a magnet to the major pivot support resistance 176.67 – decision up or down in play. Go with price. #swingtrading

$AMD Advanced Micro

April 29 – $AMD The close this gets to the key resistance in 14.60s the more short bias I am for a swing trade.

This surprised me since last report (I did some review on this surprise on a number of mid day review videos on YouTube channel).

Anyway, I don’t like the way it trades… it is manipulated by media, sentiment or otherwise and as it gets closer to previous highs overhead soon and near the key resistance in 14.60s I am yet again short bias to $AMD:) We’ll see, but I’ll likely pull the trigger this time.

April 16 – $AMD Bias toward lower price target 7.49 May 3. Buy sell triggers marked in white arrows. However, this is not the easiest trade to execute. Watching.

$WMT – Wallmart

May 29 – Wallmart stock continues its soft landing but indicators are flatening. Short side RR diminishing now.

I wouldn’t be surprised if that 82.61 pivot is gained to the upside again and we see a pop to upside resistance points on chart.

If that does not transpire in trade then the 74.54 is the bottom, bottom support in 2018 most probably. I really doubt trade will see 74.54. But keep an open mind and follow price per the chart support and resistance points.

April 16 – $WMT Wallmart under pressure under 200 MA with 91.07 as primary resistance. Watching.

Wallmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

$LTBR – Lightbridge Corp.

May 29 – Literally watching for the 200 MA not far above to be gained and then watch this for a pop. It has the 50 MA now and I expect the bottom players to step in here soon.

$LTBR has the 50 MA with 200 MA not far overhead. On watch for 200 MA and then boom. #swingtrading

Apr 16 – $LTBR Trading 1.18 with all indicators and price action flat. Watching.

Mar 6 – $LTBR Lightbridge psychedelic chart structure with specific buy sell triggers at arrows. Big range likely.

Price is sitting above 200 MA with a significant risk reward scenario setting up if it starts an up move.

$RCL – Royal Caribbean

May 29 – $RCL short side risk reward diminishing now and July 23 downside target 98.88 less likely. Trading 105.78.

I’m watching this support test area close now, this should turn up for a swing trade soon. As always follow price.

Royal Caribbean Cruises (RCL) Down 5.5% Since Earnings Report: Can It Rebound? https://finance.yahoo.com/news/royal-caribbean-cruises-rcl-down-072207247.html?.tsrc=rss

April 16 – $RCL Indecisive at this point and trading just under primary pivot resistance on chart. On watch. Buy sell triggers marked with white arrows.

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

$JKS – Jinko Solar

May 29 – $JKS with earnings in 8 days is having trouble breaking range. Above 50 MA possible #swingtrade

April 16 – $JKS MACD on weekly may cross up here for long over 200 MA.

$PCRX – PacIra Pharma

May 25 – Trading 35.2 still under pressure and under 200 MA. On watch for over 200 MA for a swing.

April 16 – $PCRX under pressure. Over 200 MA long but on short side there isnt enough RR at this point.

Mar 10 – $PCRX trading 31.90 post earnings with MACD turned up. Long risk reward preferred. #swingtrading

Set-up isn’t strong enough to warrant a specific model, however, price is at historical support so odds are in favor in long here.

$EWZ – I Shares Brazil ETF

May 29 – $EWZ continued pressure likely until near quad wall diagonal Fib trendline afor a bounce. On watch.

April 16 – $EWZ short side scenario played out since last report. Watching now for bounce at support or pressure down target.

Mar 10 – $EWZ under 49.50 is a short to next test on chart and over is long to next test on chart.

$FEYE – Fire Eye Inc.

May 29 – $FEYE near 50 MA support now. On watch for an upside swing trade if it bounces. #swingtrading

It is also very near key support. This is a significant watch area now for a trade.

April 16 – $FEYE trade went as prescribed in last report – bias long to upside price target 22.32 June 27.Over 19.70 long to 22.32 price target.

$LAC – Lithium Americas Corp

May 30 – Sitting on mid quad support – big test here. Above is long to target and below short. $LAC #swingtrading #chart

Lithium Americas Corp (TSE:LAC): What Are The Future Prospects?

https://finance.yahoo.com/news/lithium-americas-corp-tse-lac-121406216.html?.tsrc=rss

Per recent’

April 22 – $LAC trading 5.59 bounced at quad wall support (blue diagonal line marked with green arrow- important) targets 7.81 Jan 30 2019. If it gets bullish I will chart shorter time frames.

I like the structure of this chart. Will be watching very close.

Also, note 200 MA overhead.

Mar 10 – $LAC trading 6.35, over 6.52 targets 7.21 and 7.77, under targets 5.40 #pricetargets

$IBB – BioTechnology Index Fund

May 30 – $IBB chart on daily above mid quad support and 200 ma targeting upside 112.81 next FIB resistance.

This is a decent set up with a decent risk reward and a decent structured chart. It’s not a great set-up, but decent.

Biotech ETFs Are the Best Way to Play the Recovering Sector https://finance.yahoo.com/news/biotech-etfs-best-way-play-154314422.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

Per recent;

April 22 – $IBB daily chart with targets above pivot decision at 102.46 and below. #swingtrading

Above 102.46 tested targets 122.34 or 142.11 pending trade.

Under 102.46 targets 92.81 or 63.04 pending trade.

Time cycle peak completion Nov 27 2018.

As price proves above or under the main pivot I will alert the trade and chart the shorter time frames.

Mar 10 – $IBB trading 114.36 triggered long at and if holds 113.78 for 118.88 and 124.70.

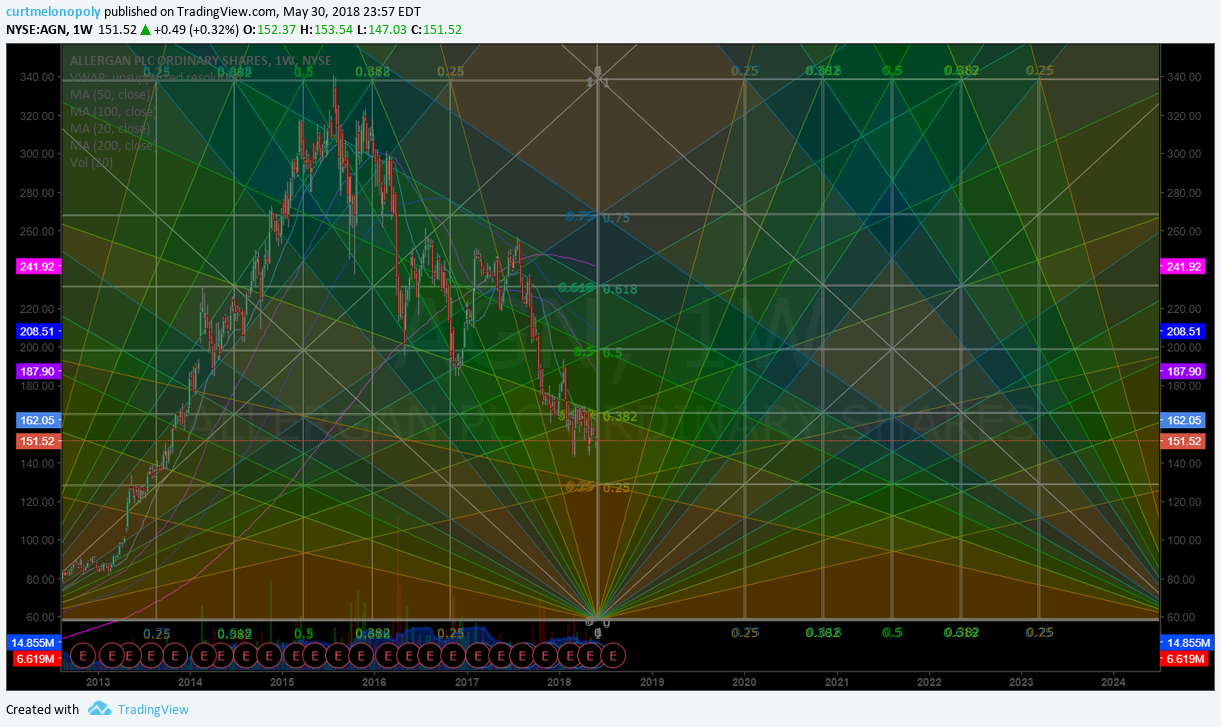

$AGN – Allergan

May 30 – Really excited for the huge $AGN time cycle conclusion on or about June 4, 2018. Career trade setting up imo. #swingtrading #swingtrading #setups https://www.tradingview.com/chart/AGN/iAaFQ6U5-Really-excited-for-the-huge-AGN-time-cycle-conclusion-on-or-abo/

$AGN Allergan to sell women’s health, infectious disease units https://finance.yahoo.com/m/919ae015-3199-352f-820a-3beef365d573/allergan-to-sell-women%26%2339%3Bs.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

If $AGN holds 147.00 as trade gets on other side of time cycle it should target upper price targets on this model. #swingtrading

Per recent;

April 22 – $AGN I know it’s psychedelic but I think the time cycle is over soon and it reverses. #swingtrading

June 4 165.48 is the first upside target if there is a reversal here. On watch. If we get a reversal near term I will model and alert it for a swing trade.

Mar 10 – Trading 157.28 so the previous post downside worked, however, indicators are now indecisive. Watching.

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

$CTSH – Cognizant Technology

May 30 – $CTSH Bottom line is that I won’t trade it until it dumps the 200 MA again for a bounce on weekly chart. #swingtrading

Cognizant Interactive Among Top of Ad Age’s Agency Report 2018 Rankings https://finance.yahoo.com/news/cognizant-interactive-among-top-ad-100000992.html?.tsrc=rss

April 22 – $CTSH Trading 81.71. Earnings in 14 days and very extended over moving averages on weekly. Watching.

$CTSH – Trading 84.71 still vertical move intact. Enter long, set stop, close eyes and hope or wait for pull back at MA’s for a bounce to long.

$NVO – Novo – Nordisk

May 30 – Best I can do for now with $NVO is watch for chart structure to form on monthly. Not there yet. Price on daily is way below 200 MA and MACD is turned down.

Novo Nordisk’s Oral Ozempic Positive in Diabetes Study https://finance.yahoo.com/news/novo-nordisk-apos-oral-ozempic-122812593.html?.tsrc=rss

April 22 – $NVO trading 47.23 below 200 MA on the weekly. Watching for further downside short.

April 22 – $NVO trading 47.23 looks like a short side trade on monthly to at least 44’s in to 20 MA if not further.

$TSLA – Tesla

May 30 – The technical chart for Tesla (TSLA) is the same set-up as previously posted below.

April 23 – $TSLA trading 290.34. Over 280.00 is long and under 280.00 is a short. We have had some great trading in this one with recent wash-out.

278.00 needed as long side limited entry trigger. Less is short side. Simple on the fly daytrading model. $TSLA https://www.tradingview.com/chart/TSLA/2XQqKq0c-278-00-needed-as-long-side-limited-entry-trigger-Less-is-short/ …

https://twitter.com/SwingAlerts_CT/status/978995397594177537

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target. https://www.tradingview.com/chart/TSLA/dn8THUSe-TSLA-long-confirming-here-over-280-55-with-304-17-next-resistan/ …

https://twitter.com/SwingAlerts_CT/status/981610107770429443

$TSLA long confirming here over 280.55 with 304.17 next resistance 382 Nov 15 price target..png

$TSLA also blasting here from yesterday’s alert trade hit intra resistance at 299.84 area. Strong set-up.

https://twitter.com/SwingAlerts_CT/status/981915345802973184

$TSLA also blasting here from yesterday’s alert trade hit res at 299.84 area. Strong set-up..png

Mar 10 – $TSLA monthly chart – trade range in triangle model and follow price to up or down target. #swingtrading

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

May 30 – The SNAP chart is a disaster but it does look like a near term bottom area. Lots of caution of course.

April 23 – $SNAP Just regained 200 MA. Trading 15.20. Over 15.18 targets 15.86, 15.99 then 17.00. Under targets 14.65. #swingtrading

$VGZ – Vista Gold

May 30 – Nothing yet. Trading .704

April 23 – Trading .78. $VGZ holding the 200 MA on weekly and testing 50 MA resistance. Long side advantage, but not great yet.

Mar 10 – Trading .76 under 20, 50, 200 MA’s with MACD trending down on daily – watching.

Jan 30 – $VGZ chart structure is slowly building – on watch now – waiting for structure to form and then I will model it.

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

May 30 – Trading .71 with terrible indicators.

April 23 – $AAU trading .849 with indicators indecisive.

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

$AMMJ – American Cannabis

May 30 – Trading .976 with flat indicators.

April 23 – $AMMJ trading 1.03 with buy sell triggers (white arrows), targeting Apr 26 .9911 May 24 1,21 (path of least resistance).

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.