Tag: $NVDA

Swing Trade Set-Ups $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL …

Trade Set Ups for Swing Trading Tuesday February 26, 2019.

Swing Trading Signals in this Report: $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar: https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week:

#earnings for the week

$SQ $HD $CHK $ETSY $JD $M $MDR $PCG $FIT $AMRN $LOW $JCP $WTW $KOS $PANW $BKNG $ABB $BBY $SPLK $VEEV $AZO $TEX $TRXC $SHAK $NTNX $ECA $JT $WDAY $CRI $DNR $TNDM $AWI $DORM $GWPH $HTZ $TREE $PLAN $NSA $ICPT $FLXN $BNS $CROX $RRC

Earnings Season Special Reports Thus Far:

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Up VIDEO:

#Swingtrading

A Review of Current Swing Trades in First Section Below and Then Other Swing Trade Set Ups I Am Watching for Entries Reviewed Below:

GOLD (GC_F, XAUUSD, GLD) trading 1326.00, entry 1319.78 short 1/20 starter size per previous reporting (starter) looking for a pull-back at resistance levels on chart reviewed on video.

NIKE (NKE) is a break out swing trade play, trading 85.64 I am long 84.84. 99.65 first target then 91.39, 93.31, 101.35 for ultimate target. See chart.

ARROWHEAD (ARWR) swing trade is going well, looking for 27.59 early April 31.34 range after that for a double. Will add at channel support.

GOOGLE (GOOGL) starter position long 1135.00, trading 1117.32, 1158.00 first target then 1214.17 then 1317.72.

EXXON (XOM) Earnings play going well. Looking for a price target 85.61 area. Trim in to each resistance, add above or at pull backs.

SHORT OIL (DWT) Still in small starter, Trump tweet helps me a bit get more onside than I was.

RETAIL ETF (XRT) Trading 45.43. Price over 100 with 20 MA underneath. Looking for 47.48 upside at 200 MA.

STRYKER (SYK) Break out trade set-up, extension over trade break out is what I am watching. Trading 188.31 with price extension to 192.84 then a retrace – likely scenario.

NVIDIA (NVDA) Price target 208.00 ish possible. First price target 100 MA, 2nd traget 186.85, 188.81 is the third price target. 168.25 HOD and looking at a possible long over that. Video explains set-up in more detail.

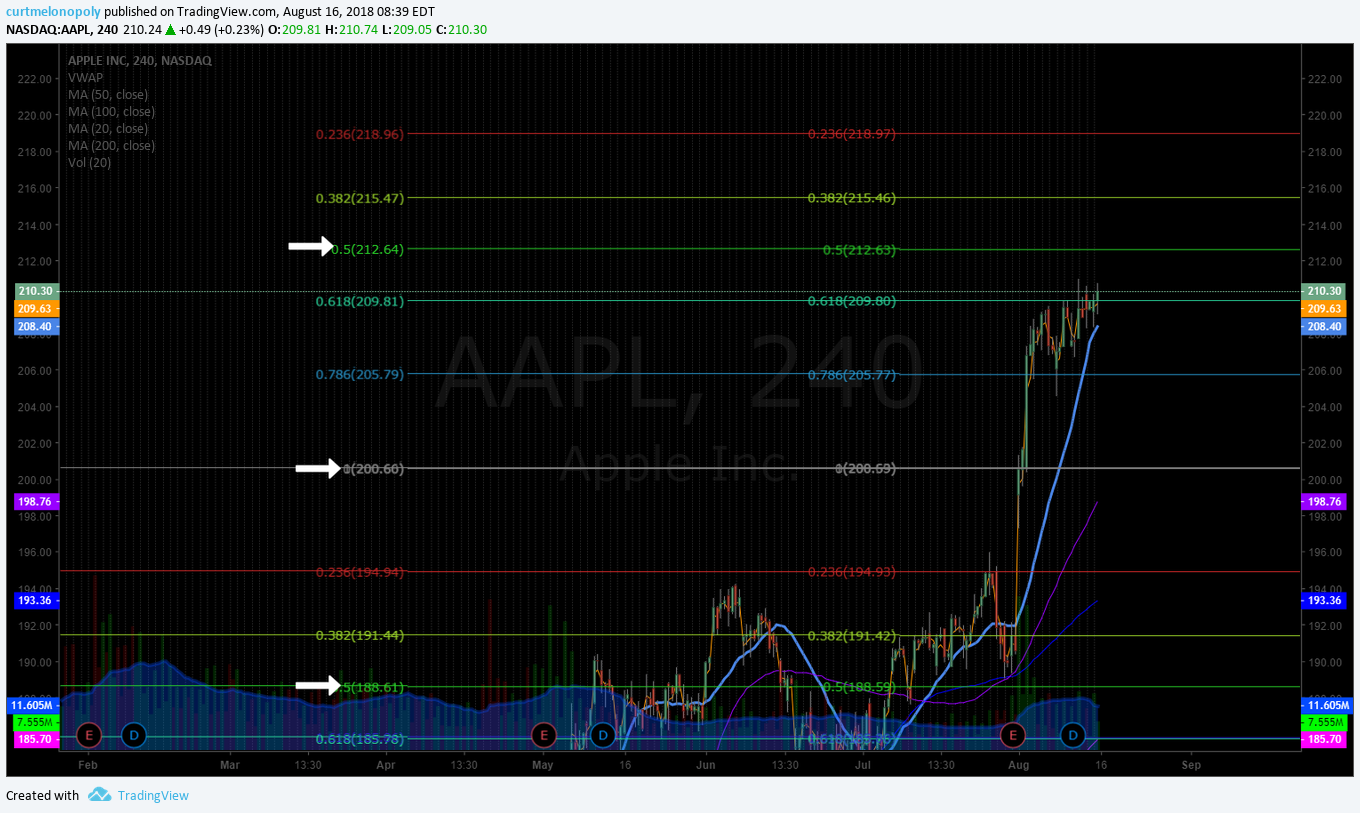

APPLE (AAPL) 181.66 is price target and 191.60 range is 200 MA as a possible price target above, trading 174.33 intra day, looking at it long – not the best trade set up of the bunch.

JOHNSON JOHNSON (JNJ) Price against a pivot on daily, over 138.00 is interesting for full extension, will re look at it at 138.00. Might be too late on this one. Was going to take trade a number of times and didn’t.

FINISAR (FNSR) Daily chart, another pivot play with full price extension up possible, over 25.37 I’m interested long for a price extension play long.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, Earnings, $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL

PreMarket Trading Report Wed Nov 28: #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRM …

Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Wednesday November 28, 2018.

In this premarket trading edition: #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRMand more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Nov 28 – Lead trader in attendance to live trading room at market open, EIA, mid day review and as required through the day and in futures trading.

- Jen (office)Yesterday at 6:08 PM

This week: Curtis, Jeremy (Sr. machine tech) and Katie (new machine tech) will be monitoring machine trades in oil on rotation near 24 hours a day (and going fwd). When trades are active the live trading room will be opened for EPIC and trading room members. During low liquidity hours trades will be nominal and more frequent in higher liquidity hours through each week. The first generation of the software is complete. There will be continuous updates. A rules based machine trade protocol will be published soon for members. The next to be coded is Bitcoin then SPY. Member reports are being processed now for the week also. Thank you — Jen. - Trade Coaching Boot Camp Cabarete Nov 30 – Dec 2, 2018 Winter Sessions Sell Out Fast (it is warm here after-all) so act fast if you plan to be here with us! https://compoundtrading.com/trade-coaching-boot-camp-cabarete-nov-30-dec-2-2018/.

- Team Work in Progress:

- Rules based machine trading protocol for oil to be published soon.

- Machine trading signals to be fed in to main trading room (initially manually then auto when api integration complete).

- New pricing to be published representing next generation algorithm models (existing members no change).

- Next generation algorithm models roll out (machine trading Gen 1).

- Trading Profit and Loss to be Published for Q1, Q2, Q3 2018 (a report detailing trading / alert performance of our team).

- Previously recorded Trading Boot Camp Event videos to become available on Compound Trading website.

- Previously recorded Master Class Videos will become available for download on website.

- New Trading Boot Camp Events to be announced

- 1 day Bootcamps in November / December 2019 for each of the seven trading models and swing / daytrading – 8 in total to be announced (online only).

- Sept 18 – Raw Trading Boot Camp Videos were emailed to members (new members inquire for copy).

- Sept 18 – Previously recorded Master Class Series were emailed to members (new members inquire for copy).

Premarket Report: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Watching time-cycle expiry / inflection for a direction in to next late Dec and then late Dec in to first quarter time cycle 2019.

There is a volatility time-cyle (monthly) coming in at Dec 5 so we are looking for a possible bounce in to that date and shortly thereafter.

Watching EIA closely today for structure in the current trading quad, it has been constructive of late.

Possible short $DWT on the day based on rise in premarket.

Per previous;

Nov 21 – Looking at possible retrace to .5 on oil (per last move), possible short in Natural Gas (DGAZ) and watching equities very close for supports to bounce and hold.

If you’re a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You’ll learn a lot and you’ll possibly catch a turn and change your financial life soon. You won’t get many opportunities like this. #premarket

If you're a newbie…. now is not the time to turn off…. now is the time to get in to your $STUDY sharpen your pencil and get to work. You'll learn a lot and you'll possibly catch a turn and change your financial life soon. You won't get many opportunities like this. #premarket

— Melonopoly (@curtmelonopoly) November 20, 2018

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It’s big, watch.

Further to that public Twitter post, over next two quarters I expect the equity markets to continue under serious pressure in to rates, after a technical retracement oil to skyrocket unless Trump can get a handle on the price somehow (trying with Saudi’s now), Dollar likely to spike hard for some time then fall off a cliff, volatility to increase, Gold and Silver get up and going soon and Crypto to fly. That’s my bias, thesis, trading plan in to next two quarters. Timing will be key. All of our reporting will reflect this near term and will also focus on key swing trading set-ups within themes.

Time cycle dates expiring in markets for big moves…. started end of July, next Oct 10, Nov 11, mid Dec big in to Q1 19. Distributing trading models starting tonight for time frames in expectation for #Oil, #Gold, #Silver, #Bitcoin, #SP500, #Volatility, #USD It's big, watch.

— Melonopoly (@curtmelonopoly) October 8, 2018

Market Observation:

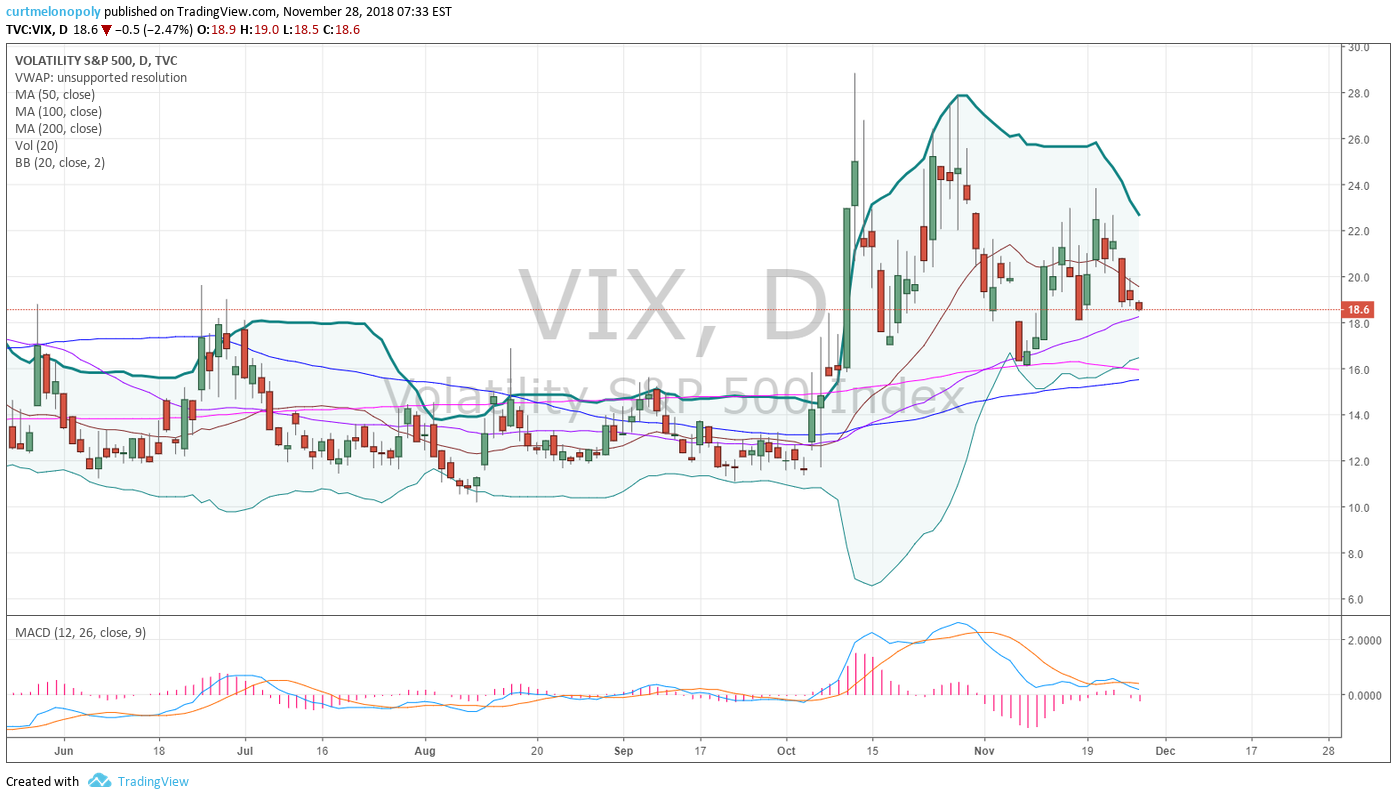

Markets as of 7:51 AM: US Dollar $DXY trading 97.36, Oil FX $USOIL ($WTI) trading 51.45, Gold $GLD trading 1214.15, Silver $SLV trading 14.15, $SPY 269.70 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4017.00 and $VIX trading 18.6.

Momentum Stocks / Gaps to Watch:

22 Stocks Moving In Wednesday’s Pre-Market Session https://benzinga.com/z/12763192 $GPIC $NTNX $CRM $BURL $SWPH $JILL $SINA $WB $CHS $SMRT $TIF $SJM $GWPH $GNL

News:

Wayfair shares soar premarket after company says direct retail sales rose 58% over holiday weekend.

AMD, Nvidia stocks rise after Mizuho says GPU prices are rebounding #swingtrading $AMD $NVDA

AMD, Nvidia stocks rise after Mizuho says GPU prices are rebounding #swingtrading $AMD $NVDA https://t.co/w5opqHarb8

— Swing Trading (@swingtrading_ct) November 28, 2018

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

$DKS Dick’s Sporting Goods’ stock surges after earnings beat, raised outlook https://on.mktw.net/2AuTNEz

Chico’s stock plummets toward 9 1/2-year low after earnings and sales miss, lowered outlook

#earnings for the week

$CRM $WB $SPLK $NTNX $DLTR $DKS $TIF $BURL $PANW $BOX $DSX $ZUO $BNS $JKS $SINA $GWPH $VEEV $ANF $CBRL $HIBB $KSHB $VMW $AMBA $HMLP $WDAY $DAVA $RY $SJM $GME $JILL $VJET $AMWD $ITRN $TD $PAGS $KNOP $TLYS $BKE $GSM $HPQ $TECD

#earnings for the week $CRM $WB $SPLK $NTNX $DLTR $DKS $TIF $BURL $PANW $BOX $DSX $ZUO $BNS $JKS $SINA $GWPH $VEEV $ANF $CBRL $HIBB $KSHB $VMW $AMBA $HMLP $WDAY $DAVA $RY $SJM $GME $JILL $VJET $AMWD $ITRN $TD $PAGS $KNOP $TLYS $BKE $GSM $HPQ $TECD https://t.co/r57QUKKDXL https://t.co/jLnh9OtyI6

— Melonopoly (@curtmelonopoly) November 26, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for some time). Trade alerts and stock chart set-ups should be traded as decision to decision process – when the trade set-up fails cut your position fast. Leg in to the winners at key resistance and support (at retracement or breach) and exit the losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide the framework for your trade (the chart structure enables the trader to set stops where a trade is a failed trade and leg in to winners and trim winners per the chart). The purpose of trade alerts is to bring awareness of the trade set-up in play but you have to execute the trade based on your trading strategy that should be harnessed in your rules based process.

There have been a few paper cuts executed on machine trading side in oil trade last few days – report will detail when released.

Volatility lower but we’re watching in to Dec 5 and lower supports near bollinger for possible bounce $VIX #volatility

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

TVIX premarket trading down. We are short Volatility from last Wednesday in 49s #premarket #volatility $VIX

SP500 (SPY) Daily Chart MACD turned up but structure under pressure. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrade

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

The crude oil trade on the 1 minute chart, continue to watch the support levels signaled earlier. #crude #oiltradealerts

if crude lets go here watch out…. yet again

if crude lets go here watch out…. yet again

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade

$TSLA #premarket jam. Closed 263.75 – 338.75 was a good one. Next! #swingtrade pic.twitter.com/M4NDXkdoMi

— Melonopoly (@curtmelonopoly) October 29, 2018

Machine trade in oil top tick hit perfect 67.62 to penny HOD, trimmed added numerous all win side and closed 90% 66.83. Nice trade.

Crude oil trade in to open yesterday: Nailed the Crude Oil Short in Trading Room at Open.

Trade alert this morning to trim Silver and add above: Trimming Silver 14.78 per price target will add above.

Trade alert yesterday : Long Silver 14.63 target 14.78 tight stops.

Daytrading Crude Oil – Screen Shot of Oil Trade Alerts Feed with signals for long oil trade and closing trade.

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading

TESLA (TSLA) daytrade with swing trade possible here to higher, we got some of that move at open. $TSLA #trading pic.twitter.com/6Kjglgconf

— Melonopoly (@curtmelonopoly) October 16, 2018

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT

That spike in Sunday night oil futures open was interesting (on Saudi Trump news flow), caught me off guard but I got a piece of it $USOIL $WTI $CL_F $USO #OilTradeAlerts #OOTT pic.twitter.com/vlOAl0ze6A

— Melonopoly (@curtmelonopoly) October 16, 2018

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts

Working the daytrade edges on SP500 $SPY #daytrading #tradealerts pic.twitter.com/tcbGIESXQF

— Melonopoly (@curtmelonopoly) October 9, 2018

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading

Working the edges of volatility on daytrading time-frames today also $VIX $TVIX $UVXY #tradealerts #daytrading pic.twitter.com/1on7qS3aYJ

— Melonopoly (@curtmelonopoly) October 9, 2018

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm

Example of knowing probability of time cycles (intra-day example). Look at the guidance in the oil trading room…. exact time of day and price of oil hit per guidance many hours earlier. Power of time cycles. FX $USOIL $WTI $CL_F $USO #oil #trading #algorithm pic.twitter.com/qa0HueviTl

— Melonopoly (@curtmelonopoly) October 9, 2018

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don’t. It is that simple.

This was an intra-day time cycle trade. I win when I respect time cycles, lose when I don't. It is that simple. https://t.co/k4HO2izAT7

— Melonopoly (@curtmelonopoly) October 9, 2018

$ROKU #daytrading #tradealerts

$ROKU #daytrading #tradealerts pic.twitter.com/RWXQcogTll

— Melonopoly (@curtmelonopoly) October 1, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

Futures higher on hopes of trade breakthrough; Powell speech in focus

Futures higher on hopes of trade breakthrough; Powell speech in focus https://t.co/IPZPh7IrIf

— Reuters (@Reuters) November 28, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $GPIC $IPCI $CMCM $MBRX $UGAZ $CRMD $NTNX $PXS $CRM $GSM $BURL $ANY $AFSI $WB $INFY $BITA $UNG

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DVA $SWKS $AZPN $SIVB $ZAYO $SAVE $OOMA $IMO $ONDK $ALK $AMX $TGP $SIVB $AZPN

Stifel upgrades $TGP from Hold to Buy

$AMZN: EVERCORE ISI RAISES PRICE TARGET TO $1990 FROM $1970

(6) Recent Downgrades: $BECN $WHR $EV $ECA $CME $TLP $TI $CBRL $CRNT $WHR

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, #EIA, WTI, OPEC, Volatility Trade Closed, $AMD, $NVDA, $GPIC, $NTNX, $CRM

PreMarket Trading Plan Thurs Aug 16: China US Talks, $AAPL, $NVDA, $SRPT, $WMT, $AMZN, OIL, $VIX, $DXY, $SPY more.

Compound Trading Premarket Trading Plan & Watch List Thursday August 16, 2018.

In this edition: China US Talks, $AAPL, $NVDA, $SRPT, $WMT, $AMZN, OIL, $VIX, $DXY, $SPY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Thursday Aug 15 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 1 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 1 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 1 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stock Futures Soar On Trade War Break: Walmart, Cisco Power The Dow http://dlvr.it/Qg4YLc

https://twitter.com/CompoundTrading/status/1030069763370889217

Market Observation:

Markets as of 7:40 AM: US Dollar $DXY trading 96.57, Oil FX $USOIL ($WTI) trading 65.11, Gold $GLD trading 1181.20, Silver $SLV trading 14.63, $SPY 281.78, Bitcoin $BTC.X $BTCUSD $XBTUSD 6427.00 and $VIX trading 13.7.

Momentum Stocks / GAPS to Watch:

28 Stocks Moving In Thursday’s Pre-Market Session https://benzinga.com/z/12217039 $GSM $WMT $SBBP $CSCO $VBLT $WUBA $HUYA $PTIE $PSTN $IIN $NTAP $RIOT $JD

News:

Your Thursday morning Speed Read:

– Amazon wants to acquire Mark Cuban’s Landmark Theaters, .@business reports $AMZN

– U.S., China will hold 1st trade talks since May later this month 🤞🏽$SPY $FXI

– Semi stock bellwether NVIDIA investors its Q2 print after the bell 2day $NVDA

Your Thursday morning Speed Read:

– Amazon wants to acquire Mark Cuban's Landmark Theaters, .@business reports $AMZN

– U.S., China will hold 1st trade talks since May later this month 🤞🏽$SPY $FXI

– Semi stock bellwether NVIDIA investors its Q2 print after the bell 2day $NVDA— Benzinga (@Benzinga) August 16, 2018

#5things

-China-U.S. talks

-Erdogan’s friends

-Retail health check

-Markets mixed

-Data due

https://bloom.bg/2vNjmiC

$WVE Receives Orphan Drug And Rare Pediatric Disease Designations For WVE-210201 #DMD Drug. $SRPT

After visiting Tesla’s Freemont facility, Evercore ISI says Model 3 ‘on track’ $TSLA http://dlvr.it/Qg4TVM

$REGN & $TEVA Announce Positive Topline Phase 3 Fasinumab Results in Patients With Chronic Pain From Osteoarthritis of the Knee or Hip

$SMMT Awarded Additional $12M by BARDA for Phase 3 Development Program of Ridinilazole

Recent SEC Filings / Insiders:

$SRPT CEO buys 16K shares @ avg price: $125.26/share

Weight Watchers 6M share Block Trade priced at $76.00 $WTW http://dlvr.it/QfyXKn

Recent IPO’s:

BioNano Genomics to offer 2.45 million shares in IPO priced at $6 to $7 each

GoDaddy’s stock falls after public offering of 10.4 million shares

Earnings:

J.C. Penney shares slump 16% after wider-than-expected loss, revenue decline

JD.com Earnings, Revenue Miss; Stock Falls

https://t.co/pMKAgHTGTY Earnings, Revenue Miss; Stock Falls https://t.co/B02mpLnbzL

— Investors.com (@IBDinvestors) August 16, 2018

So I hear Walmart earnings are “great”? 🙄

Well, have you seen a bigger disaster than this? This is like Enron/dot come level era bust

-90% net income before taxes

-130% net income per EPS

$WMT lost -30 cents per share in Q2. In a 4% f-ing economy!

https://twitter.com/vixcontango/status/1030049629457575936

#earnings for the week

$NVDA $JD $HD $AMAT $WMT $CSCO $JCP $M $YY $SYY $BZUN $DE $TSG $CGC $GWGH $SPCB $CRON $AAP $VIPS $JKS $NTAP $NINE $SWCH $CSIQ $HQCL $AG $BLRX $TPR $JWN $A $CREE $EAT $CNNE $ESES $ARRY $TGEN $CAE $GDS $ROSE $SNES $SORL $EAST $AVGR

#earnings for the week$NVDA $JD $HD $AMAT $WMT $CSCO $JCP $M $YY $SYY $BZUN $DE $TSG $CGC $GWGH $SPCB $CRON $AAP $VIPS $JKS $NTAP $NINE $SWCH $CSIQ $HQCL $AG $BLRX $TPR $JWN $A $CREE $EAT $CNNE $ESES $ARRY $TGEN $CAE $GDS $ROSE $SNES $SORL $EAST $AVGRhttps://t.co/r57QUKKDXL https://t.co/PfPzmWSmLy

— Melonopoly (@curtmelonopoly) August 12, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

OIL testing upside intra-day resistance in structure, possible move to 61.65 next intra day. #oil #trading #algorithm

APPLE (APPL) premarket nearing 212.65 range resistance trading 210.30, trim in to it add above. $AAPL #premarket #swingtrading

US Dollar Index (DXY) Did come off intra-day at resistance area testing 200 MA on 30 min chart $DXY $UUP #USD

Oil sell-off today, EPIC Oil Algorithm buy side oil trade alerts 64.50 buy side at day lows for members. #oil #trade #alerts FX $USOIL $WTI $CL_F $USO #OOTT #Algorithm

https://twitter.com/EPICtheAlgo/status/1029927566403100673

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

Oil Daily Chart. MACD cross up failed, trade under 50 MA. Bearish trend continues. Aug 12 947 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

— Melonopoly (@curtmelonopoly) August 9, 2018

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading pic.twitter.com/Y9MBk0hE7F

— Melonopoly (@curtmelonopoly) August 9, 2018

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

Market Outlook, Market News and Social Bits From Around the Internet:

Futures rebound on strong earnings, trade talk hopes –

Futures rebound on strong earnings, trade talk hopes – https://t.co/0EvVmHRgGz

— Investing.com Stocks (@InvestingStockz) August 16, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ANW $SMMT $GSM $NFX $CPST $WMT $WUBA $AVLR $HTGM $SYMC $CSCO $OSTK $HUYA $AVEO $SBBP $NUGT $IQ

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

Southwestern Energy $SWN PT Raised to $5 at Morgan Stanley

Oasis Petroleum $OAS PT Raised to $20 at Morgan Stanley

NetApp $NTAP PT Raised to $70 at Morgan Stanley

HCP $HCP PT Raised to $25 at Morgan Stanley

Harris Corp. $HRS PT Raised to $190 at Argus

Brixmor Property $BRX PT Raised to $22 at Wells Fargo

Patrick Industries $PATK PT Raised to $67 at Wells Fargo

Cisco $CSCO PT Raised to $53 at UBS

Morgan Stanley Resumes Williams Companies $WMB at Overweight

Independence Contract Drilling $ICD PT Raised to $6 at RBC Capital

Wolverine World Wide $WWW PT Raised to $38 at Buckingham Research

(6) Recent Downgrades:

Range Resources $RRC PT Lowered to $16 at Morgan Stanley

Noble Energy $NBL PT Lowered to $36 at Morgan Stanley

Devon Energy $DVN PT Lowered to $45 at Morgan Stanley

Cimarex Energy $XEC PT Lowered to $123 at Morgan Stanley

Constellation Brands $STZ PT Lowered to $235 at BofA/Merrill Lynch

U.S. Concrete $USCR PT Lowered to $68 at Stephens on 2Q Report; ‘Headwinds from Acquisitions’

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, China US Talks, $AAPL, $NVDA, $SRPT, $WMT, $AMZN, OIL, $VIX, $DXY, $SPY

PreMarket Trading Plan Mon Feb 12 $AMBR, $DARE, $BABA, $GD, $QSR, $FOXA, $QCOM, $AMZN, $F, $NVDA

Compound Trading Chat Room Stock Trading Plan and Watch List Monday Feb 12, 2018 $AMBR, $DARE, $BABA, $GD, $QSR, $FOXA, $QCOM, $AMZN, $F, $NVDA, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX – Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY, $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

Feb 11 Update – 2018 Plans, Clarifications, Compliance, Changes – Status of Data / Fund / Coaching

https://twitter.com/CompoundTrading/status/962748767282847744

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch: $AMBR, $DARE, $BABA, $GD, $QSR, $FOXA, $QCOM, $AMZN, $F, $NVDA

Caution with recent volatility $VIX and $DXY threatening continued upside.

$NVDA looks really strong after positive news flow last week.

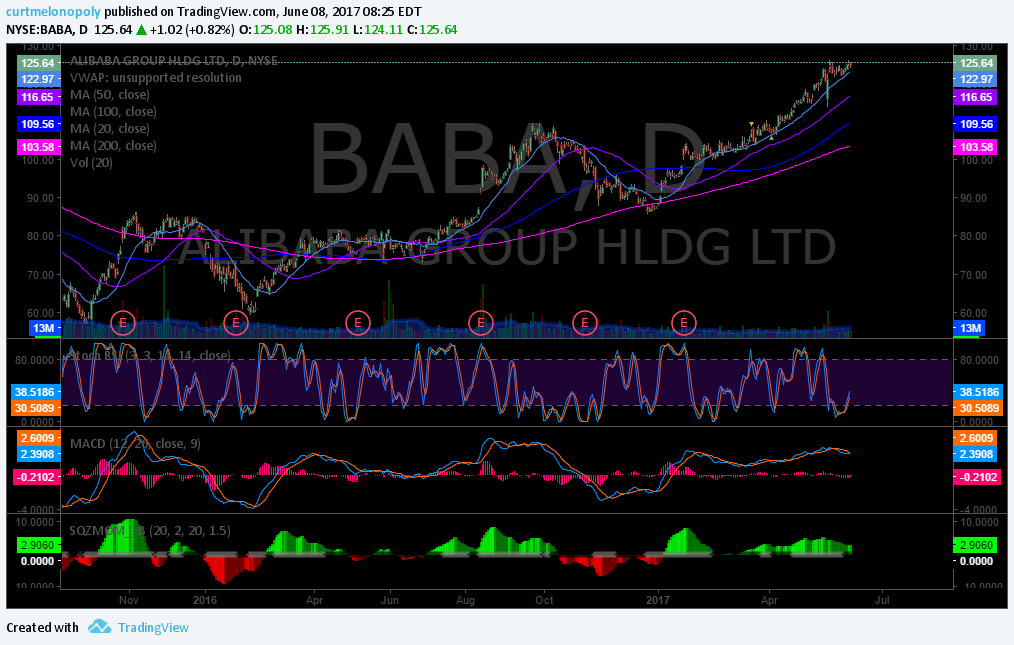

$BABA premarket trading up 2% 180.22 will be one to watch today “Alibaba signs deal to offer Disney shows on video platforms” https://finance.yahoo.com/news/alibaba-signs-deal-offer-disney-040247596.html?.tsrc=rss

Market Observation:

US Dollar $DXY trading 90.13, Oil FX $USOIL ($WTI) trading 60.33, Gold $GLD trading 1319.38, Silver $SLV trading 16.41, $SPY trading 261.68 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 8743.00, and $VIX trading 26.3.

Recent Momentum Stocks to Watch: $NVDA

News: $AMBR, $DARE, $BABA, GD, QSR, FOXA, QCOM, AMZN, F

Recent SEC Filings: CEO $CELG buys 4300 shares 91.90 Feb 8 FORM 4

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$AMAT $SHOP $BIDU $CSCO $UAA $ANET $WB $PEP $GRPN $FDC $KO $L $CGNX $DE $TWLO $SINA $APRN $IPGP $HIMX $MET $CYBR $ABX $MRO $CTL $WM $MZOR $INCY $ICPT $CNA $DO $FMC $TECK $QSR $PI $OHI $RPD $VIPS $NSP $KGC $CVE $FANG $CBS $SODA

#earnings for the week$AMAT $SHOP $BIDU $CSCO $UAA $ANET $WB $PEP $GRPN $FDC $KO $L $CGNX $DE $TWLO $SINA $APRN $IPGP $HIMX $MET $CYBR $ABX $MRO $CTL $WM $MZOR $INCY $ICPT $CNA $DO $FMC $TECK $QSR $PI $OHI $RPD $VIPS $NSP $KGC $CVE $FANG $CBS $SODA https://t.co/r57QUKKDXL https://t.co/KHR8FyApMX

— Melonopoly (@curtmelonopoly) February 12, 2018

Recent / Current Holds, Open and Closed Trades

No trades to report.

Per recent;

Yesterday the first oil trade went very well and with EIA I missed a large short opportunity, newer position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (event closing this derivative), $SPXL 1/10 size, small sizing holds include $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM (recently closed 1/3 at highs hold 2/3), $JP, $SLCA, $INSY (all small size) and very small sizing $AAOI, $SPPI and micro size $OMVS. On short side I am 1/10 Gold short.

New position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (per above awaiting news decision), $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM, $JP, $SLCA, $INSY (all small size) and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Holding $XIV 1.5/10 sizing, $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Closed $FB position yesterday for win, closed $XIV for win and re entered $XIV. Holding $XIV, $SPXL, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trimmed at highs and then added heavy $XIV yesterday, added $SPXL near lows, traded $WYNN for win and held some and some other minor trades (all wins). Holding $SPXL, $FB, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Added Monday 1/10 size $SPXL, 1/10 $GE, 1/10 $DUST. Traded short oil for a small win on swing from Friday to Monday early the traded again Monday morning for a loss 1/10 size. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding long $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trade short oil for a small win on swing from Friday to Monday early. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding new entries $WKHS, $GE. Holds on Bitcoin at 9700.00, trimmed 50% of $ROKU hold, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

Added $SPXL, new add $WKHS, $GE. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Trimmed $FB and $ROKU Tuesday and entered $DUST 1/10 starter size. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Charts and Chart Set-ups on Watch:

$BABA premarket trading up 2% 180.22 will be one to watch today “Alibaba signs deal to offer Disney shows on video platforms” https://finance.yahoo.com/news/alibaba-signs-deal-offer-disney-040247596.html?.tsrc=rss

Per recent;

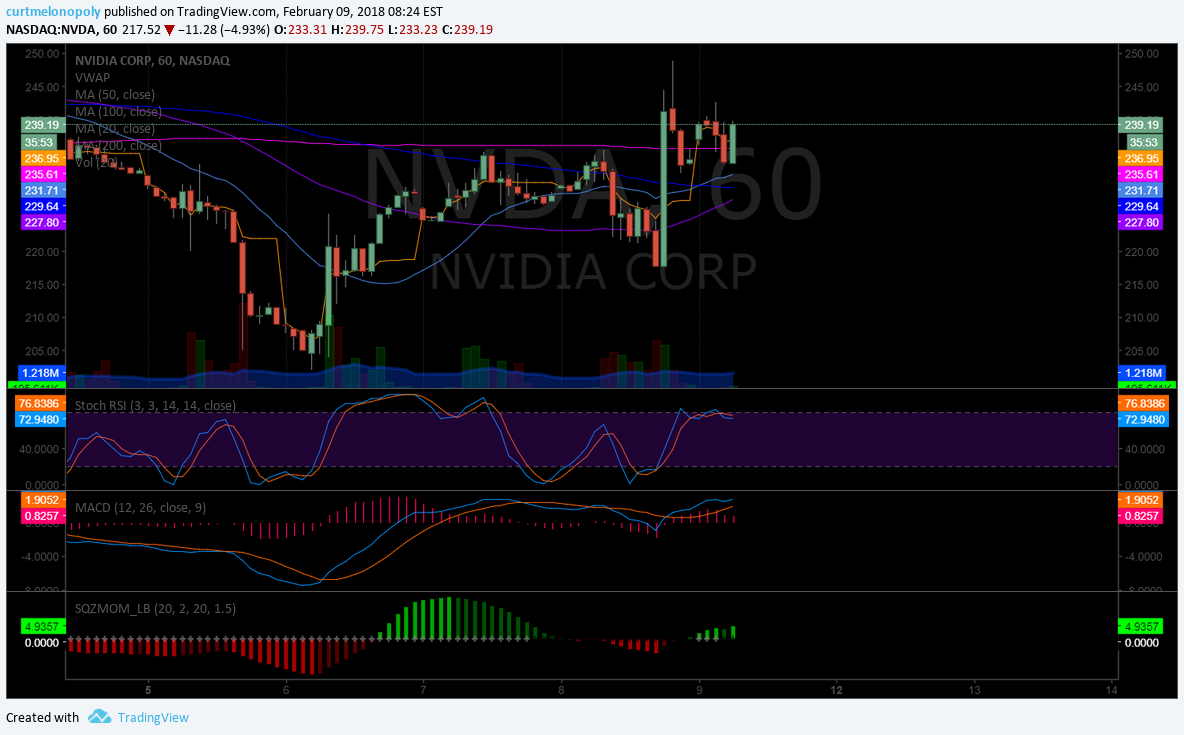

$NVDA Premarket up 9.96% trading 239.20 on cryptocurrency gaming demand and forward guidance. https://www.cnbc.com/2018/02/09/nvidia-shares-surge-after-big-cryptocurrency-gaming-demand.html?__source=Twitter

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. $TVIX $UVXY $XIV #volatility

Don’t look now but MACD turning up on $DXY US Dollar Index $UUP #swingtrading

$GDX in dangerous territory on 200 MA on Daily with MACD and SQMOM turned down. Bearish. $NUGT $DUST $JDST $JNUG

Gold hit mid quad resistance, broke thru, lost retest to downside, targets in play. MACD turn down. $GC_F $GLD $XAUUSD Feb 4, 2018

Oil resistance check. 50% Fibonacci, mid quad on monthly chart.. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://www.tradingview.com/chart/ARRY/EZbQb5F4-ARRY-Weekly-chart-suggests-long-term-structure-needs-price-over/ …

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://t.co/CA9E9zdGU0 pic.twitter.com/fkUJzMFe9Q

— Melonopoly (@curtmelonopoly) February 1, 2018

$AAOI The stock is trading 64% below last summer’s 52-week highs with earnings in 21 days I will be looking for a bounce. #earnings #trading

Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/ …

Market Outlook:

U.S. stock futures are holding their early gains https://bloom.bg/2nTDAU3

U.S. stock futures are holding their early gains https://t.co/i9GhF0euWB pic.twitter.com/o3XKoTlj7G

— Bloomberg Markets (@markets) February 12, 2018

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: GD, QSR, FOXA, QCOM, AMZN, F, BABA & more http://cnb.cx/2Bs536y

Stocks making the biggest moves premarket: GD, QSR, FOXA, QCOM, AMZN, F, BABA & more https://t.co/Ja1WJxSbfA https://t.co/UbIxl380vu

— Melonopoly (@curtmelonopoly) February 12, 2018

$BABA premarket trading up 2% 180.22 will be one to watch today “Alibaba signs deal to offer Disney shows on video platforms” https://finance.yahoo.com/news/alibaba-signs-deal-offer-disney-040247596.html?.tsrc=rss …

$BABA premarket trading up 2% 180.22 will be one to watch today "Alibaba signs deal to offer Disney shows on video platforms" https://t.co/tcjWLiN5HF pic.twitter.com/ERzcOrGA9a

— Melonopoly (@curtmelonopoly) February 12, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AMBR, $DARE, $CSRA $HGSH $EMAN $INPX $TEUM $VMIN $RIOT $NOG $NXTD $XIV $CARA $DGAZ $CDLX $DPW $UWT $RNN $CZR $GUSH $SVXY $AQMS $HMNY $ROKU

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $WDAY $NVGS $EQT $CPRT $PRU $HTBK $PFG $AVY $TOO $CAE $TEP $SLGN $PFG $CRC $PHG $WWE $BLL $TEVA $MOS $VFC $NDAQ $TAP $MHK $BZH $HES $EQT $TMST $BP $AXP $CSCO $CAE $DNKN $DHT $EURN $CARA

(6) Recent Downgrades: $LJPC $SMI $TEGP $RELX $SMI $EQGP $GLOG $SB $MTW

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $AMBR, $DARE, $BABA, $GD, $QSR, $FOXA, $QCOM, $AMZN, $F, $NVDA, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX

PreMarket Trading Plan Fri Feb 9 $UPS, $FDX, $AMZN, $QCOM, $NVDA, $ATVI, $AIG, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX

Compound Trading Chat Room Stock Trading Plan and Watch List Friday Feb 9, 2018 $UPS, $FDX, $AMZN, $QCOM, $NVDA, $ATVI, $AIG, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX – Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY, $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

A Quick Member Update – 2018 Plans and Current Status

https://twitter.com/CompoundTrading/status/951798787521089543

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch: $UPS, $FDX, $AMZN, $QCOM, $NVDA, $ATVI, $AIG

Caution with recent volatility $VIX and $DXY threatening continued upside.

$SRPT Sarepta premarket trading 51.510 down 9.9% on golodirsen study halt

$SRPT Sarepta premarket trading 51.510 down 9.9% on golodirsen study halt pic.twitter.com/3F9GF77ii6

— Melonopoly (@curtmelonopoly) February 9, 2018

$NVDA Premarket up 9.96% trading 239.20 on cryptocurrency gaming demand and forward guidance. https://www.cnbc.com/2018/02/09/nvidia-shares-surge-after-big-cryptocurrency-gaming-demand.html?

$NVDA Premarket up 9.96% trading 239.20 on cryptocurrency gaming demand and forward guidance. https://t.co/LzUmNse9yi pic.twitter.com/7UdOcEMFYv

— Melonopoly (@curtmelonopoly) February 9, 2018

Market Observation:

US Dollar $DXY trading 90.26, Oil FX $USOIL ($WTI) down trading 60.24, Gold $GLD trading 1315.88, Silver $SLV trading 16.33, $SPY trading 257.63 pressure from Thursday session and Friday futures morning suggests possible bounce, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 8230.00 down slightly from yesterday, and $VIX trading 33.6 up from yesterday.

Recent Momentum Stocks to Watch:

News:

$SRPT confirms UK golodirsen study halt. Scoop via @EPVantage http://www.epvantage.com/Universal/View.aspx?type=Story&id=764496&isEPVantage=yes …

$SRPT confirms UK golodirsen study halt. Scoop via @EPVantage https://t.co/i6wb2zW9df

— Jacob Plieth (@JacobPlieth) February 9, 2018

Recent SEC Filings: CEO $CELG buys 4300 shares 91.90 Feb 8 FORM 4

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$NVDA $TSLA $TWTR $SWKS $SNAP $DIS $ATVI $GILD $GM $CMG $BMY $AGN $TEVA $TTWO $BP $COHR $SYY $REGN $NTES $FEYE $ARNC $CVS $EXPE $SKX $HES $BAH $CMI $OCLR $GOLD $CHD $IRBT $LITE $GRUB $CTLT $GOOS $HAS $KORS $MCY $TRVG $ONVO $PM

#earnings for the week$NVDA $TSLA $TWTR $SWKS $SNAP $DIS $ATVI $GILD $GM $CMG $BMY $AGN $TEVA $TTWO $BP $COHR $SYY $REGN $NTES $FEYE $ARNC $CVS $EXPE $SKX $HES $BAH $CMI $OCLR $GOLD $CHD $IRBT $LITE $GRUB $CTLT $GOOS $HAS $KORS $MCY $TRVG $ONVO $PM https://t.co/lObOE0dgsr pic.twitter.com/SZzp8UrZ88

— Earnings Whispers (@eWhispers) February 3, 2018

Recent / Current Holds, Open and Closed Trades

No trades to report.

Per recent;

Yesterday the first oil trade went very well and with EIA I missed a large short opportunity, newer position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (event closing this derivative), $SPXL 1/10 size, small sizing holds include $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM (recently closed 1/3 at highs hold 2/3), $JP, $SLCA, $INSY (all small size) and very small sizing $AAOI, $SPPI and micro size $OMVS. On short side I am 1/10 Gold short.

New position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (per above awaiting news decision), $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM, $JP, $SLCA, $INSY (all small size) and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Holding $XIV 1.5/10 sizing, $SPXL 1/10 size, small sizing golds $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY and very small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Closed $FB position yesterday for win, closed $XIV for win and re entered $XIV. Holding $XIV, $SPXL, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trimmed at highs and then added heavy $XIV yesterday, added $SPXL near lows, traded $WYNN for win and held some and some other minor trades (all wins). Holding $SPXL, $FB, $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Added Monday 1/10 size $SPXL, 1/10 $GE, 1/10 $DUST. Traded short oil for a small win on swing from Friday to Monday early the traded again Monday morning for a loss 1/10 size. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding long $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00, $DUST, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI and micro size $OMVS. Short 1/10 Gold short.

Trade short oil for a small win on swing from Friday to Monday early. Friday trimmed $SPXL to 1/20 size hold, trimmed $FB to 1/20 size hold, holding new entries $WKHS, $GE. Holds on Bitcoin at 9700.00, trimmed 50% of $ROKU hold, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

Added $SPXL, new add $WKHS, $GE. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Trimmed $FB and $ROKU Tuesday and entered $DUST 1/10 starter size. Holds on Bitcoin at 9700.00, $ROKU, $FB, $GSUM, $SPXL, $JP, $SLCA, $INSY small on $AAOI, $SPPI, Gold short, $DUST and $OMVS micro size.

The USD Dollar is the most oversold since before the financial crash of 2008

Charts and Chart Set-ups on Watch:

$NVDA Premarket up 9.96% trading 239.20 on cryptocurrency gaming demand and forward guidance. https://www.cnbc.com/2018/02/09/nvidia-shares-surge-after-big-cryptocurrency-gaming-demand.html?__source=Twitter

$SRPT Sarepta premarket trading 51.510 down 9.9% on golodirsen study halt.

http://www.epvantage.com/Universal/View.aspx?type=Story&id=764496&isEPVantage=yes

$AMZN Amazon trading 1371.85 up Slightly Premarket – FedEx, UPS Shares Fall As Amazon Reportedly Will Launch Package Delivery Service https://www.investors.com/news/fedex-ups-shares-fall-as-amazon-reportedly-will-launch-mail-delivery-service/?src=A00220&yptr=yahoo

Per recent;

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. $TVIX $UVXY $XIV #volatility

Don’t look now but MACD turning up on $DXY US Dollar Index $UUP #swingtrading

$GDX in dangerous territory on 200 MA on Daily with MACD and SQMOM turned down. Bearish. $NUGT $DUST $JDST $JNUG

Gold hit mid quad resistance, broke thru, lost retest to downside, targets in play. MACD turn down. $GC_F $GLD $XAUUSD Feb 4, 2018

Oil resistance check. 50% Fibonacci, mid quad on monthly chart.. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://www.tradingview.com/chart/ARRY/EZbQb5F4-ARRY-Weekly-chart-suggests-long-term-structure-needs-price-over/ …

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://t.co/CA9E9zdGU0 pic.twitter.com/fkUJzMFe9Q

— Melonopoly (@curtmelonopoly) February 1, 2018

$AAOI The stock is trading 64% below last summer’s 52-week highs with earnings in 21 days I will be looking for a bounce. #earnings #trading

Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/ …

Market Outlook:

Economic Data Scheduled For Friday

Economic Data Scheduled For Friday pic.twitter.com/MAySIPQFcn

— Benzinga (@Benzinga) February 9, 2018

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: UPS, FDX, AMZN, QCOM, NVDA, ATVI, AIG & more –

Stocks making the biggest moves premarket: UPS, FDX, AMZN, QCOM, NVDA, ATVI, AIG & more – https://t.co/hWYoNdgIjt

— Melonopoly (@curtmelonopoly) February 9, 2018

European stock selloff intensifies https://bloom.bg/2BNTx6x https://twitter.com/markets/status/961943928273547264 …

European stock selloff intensifies https://t.co/4eUtOZlU2M pic.twitter.com/vr8VnyScuf https://t.co/FlsWkI4kJW

— Melonopoly (@curtmelonopoly) February 9, 2018

A rare market warning sign: People were finally investing in Dow right before it crashed

A rare market warning sign: People were finally investing in Dow right before it crashed https://t.co/FoMjntsO16

— Melonopoly (@curtmelonopoly) February 9, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $FEYE $NVDA $SVXY $NWL $DGAZ $HMY $XIV $IRBT $YANG $RAD $SNN $BHP $STM $FTI $RIG $EWZ $TSLA $SBGL $SPXL $AMD

(2) Pre-market Decliners Watch-List : $ELVT $EXPE $UVXY $TVIX $SRPT $VXX $UPS $NXTD $UGAZ $HMNY $YINN $GFI

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $BBT $CMA $GPP $SU $FEYE $UTX $PSDO $TWTR $TMUS $FFBC $CMA $CTRL $PNNT $FOXF $SWN $CRC $OSK $AIG $FISV $FMBH $APD $FUL $EMR $MTD $IMPV $EGAN $TEF $FHN $ESS $VIAB $AUY $BWA $REGN $CVX $SPH $AMWD

(6) Recent Downgrades: $KS $DDD $MCF $SWN $MNR $WYNN $CSS $EXPE $ELVT $WEB $CALD $HOLX $DO $CMFN $BLBD $HOLI

Regeneron Pharma $REGN PT Lowered to $430 at SunTrust Robinson Humphrey

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $UPS, $FDX, $AMZN, $QCOM, $NVDA, $ATVI, $AIG, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX

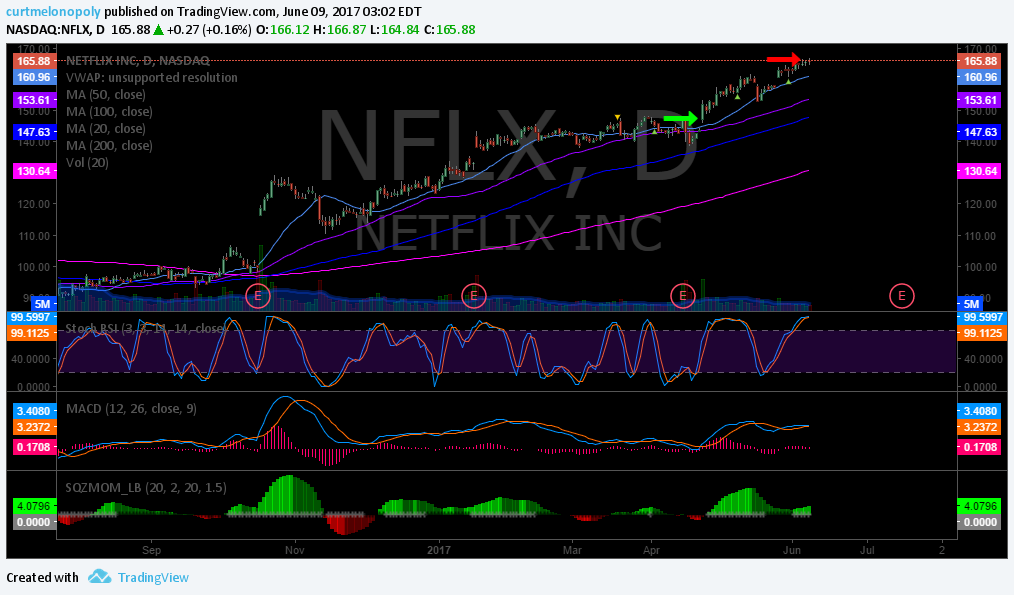

Post-Market Stock Trading Results Fri June 9 $UWT, $WTIC, $UUP, $DXY, $LIGA, $DCTH, $DXTR, $NFLX, $GS, $NVDA

Compound Trading Friday June 9, 2017 Review of Chat Room Day Trading, Swing Trading, Algorithm Charting, Videos and Live Alerts. $UWT, $WTIC, $UUP, $DXY, $LIGA, $DCTH, $DXTR, $NFLX, $GS, $NVDA – $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade).

Typically the lead trader is on mic and sharing charting pre-market right before open (9:00 AM ET), at market open (9:30 ET), for chart trade set-up and swing trading review during lunch hour (12:00 ET), during webinars (EIA Wed 10:00 and upcoming other regular webinars for SPY, Gold, Silver, VIX, and USD also – representing our algorithms). The trading room has in addition to live broadcast live chart screen sharing right from our monitors to yours. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

I will be traveling Monday after market through to late Tuesday and will be back in the main trading room for Wednesday.

The Oil trading room will open Wednesday night.

The regular reporting will be vacant between Monday market close and Tuesday evening. The most important reporting will be done Tuesday night as time allows (do not expect any at all Monday night) and regular newsletter reporting etc will recommence Wednesday evening.

Tuesday regular market Sartaj will open room. Any of our regular traders that can be in the room to keep things moving along and/or help newer traders that would be greatly appreciated.

This will happen from time to time with my travel.

Thanks

Curt

We are currently migrating our site (June 11). There may be intermittent downtime in the next 12 to 24 hours.

https://twitter.com/CompoundTrading/status/873947774370291712

Every Wednesday for now on 10:00 #EIA Report Oil Trade Charting Review hosted by Epic Oil Algo. $USOIL $WTI $CL_F #OIL #OOTT. This may or may not be made available to the public – check Twitter feed prior.

https://twitter.com/EPICtheAlgo/status/872131872742158336